By Joe Lam

COPYWRITER / ACRREDITED EDITOR

Are you our next Copywriter? ?

PLANNER

Are you our next Wedding Planner? ? ?

Are you our next Marketing Consultant

Are you our next Bookkeeper?

By Warren Strybosch

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

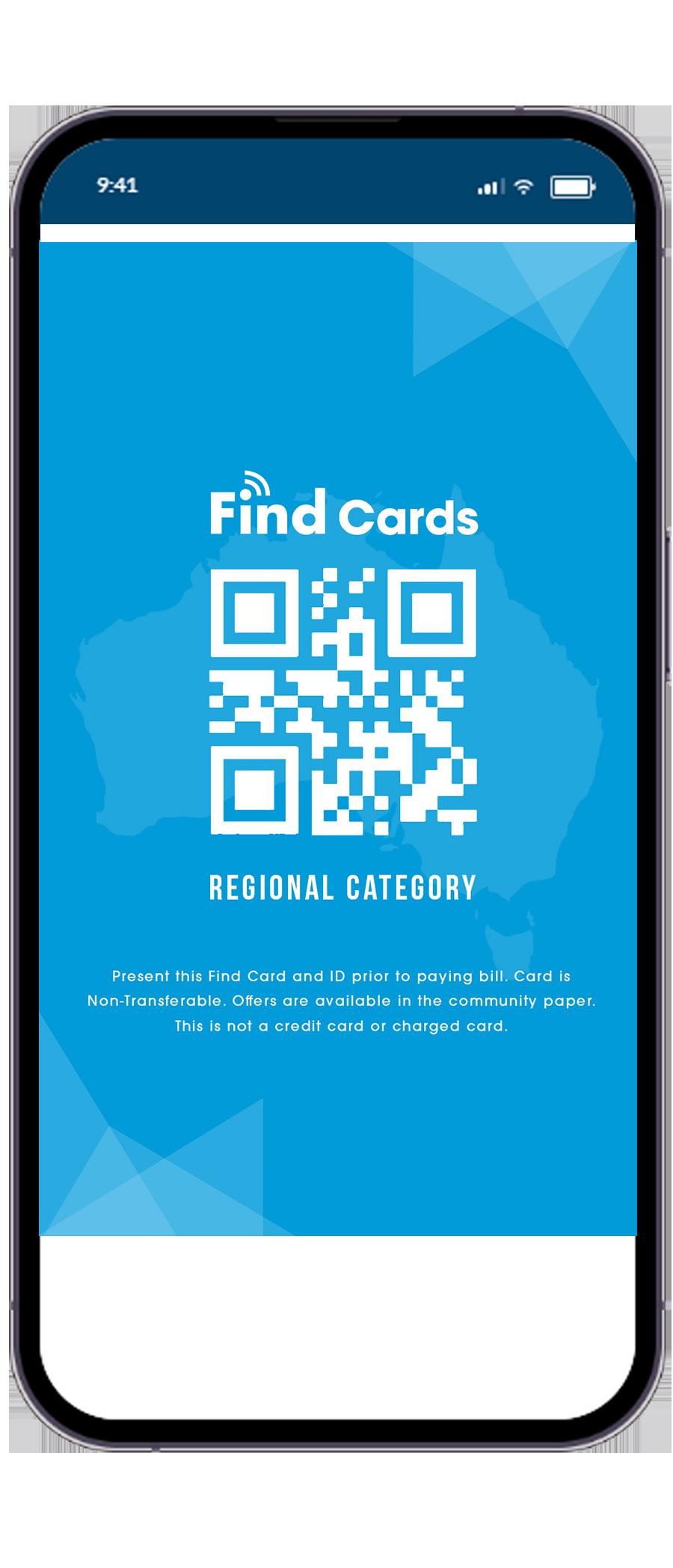

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in

By Joe Lam

Every winter, Melbourne transforms into the beating heart of Australian cinema through the Melbourne International Film Festival (MIFF), one of the oldest and most iconic film festivals in the world. In 2025, MIFF continues its proud tradition, celebrating its 73rd year as a beacon of cultural excellence, creativity, and community engagement.

A Festival with a Storied Legacy Established in 1952, MIFF has evolved into Australia’s largest and most prestigious film festival. What began as a modest gathering of cinephiles has grown into a globally recognised platform that showcases the best of international cinema while championing Australian filmmakers. The festival’s enduring success can be attributed to its steadfast commitment to innovation, diversity, and artistic integrity.

Over the decades, MIFF has screened thousands of films from around the world and has become a key date on the global film calendar. It is a founding member of the Melbourne-based Film Festivals Australia and one of the few festivals accredited by the Academy Awards®, the BAFTAs, and the AACTAs.

The People Behind the Magic Behind the scenes of MIFF is a passionate team of programmers, curators, artists, and executives who make the festival a resounding success year after year. One of the most influential figures in MIFF’s recent history is Artistic Director Al

Cossar, whose tenure brought a renewed focus on emerging talent and bold storytelling.

Past programmers and advocates such as Michelle Carey and Richard Moore helped shape MIFF’s voice as a fearless presenter of cutting-edge and often provocative cinema. The festival has also gained international attention thanks to the participation of luminaries such as Cate Blanchett, David Michôd, Gillian Armstrong, and Rolf de Heer—Australian icons whose works have featured prominently at MIFF over the years.

The 2025 edition promises an extraordinary lineup of over 300 films, special events, forums, and immersive experiences. This year’s festival includes a vibrant focus on Indigenous storytelling, environmental documentaries, and a spotlight on Southeast Asian cinema. World premieres from both acclaimed directors and rising stars ensure that MIFF remains a place of discovery and dialogue.

MIFF XR (Extended Reality), the festival’s digital innovation arm, returns with boundary-pushing VR and AR installations. The MIFF Schools program and industry initiatives like the Accelerator Lab and MIFF Premiere Fund continue to nurture young creatives and independent producers across the country.

A Catalyst for Culture and Commerce

Beyond its cinematic prestige, MIFF is

a cultural cornerstone with a profound economic and social impact. Each year, the festival attracts tens of thousands of local and international visitors to Melbourne’s CBD and surrounding suburbs, generating millions in tourism revenue and stimulating the hospitality, retail, and arts sectors.

MIFF also serves as an incubator for Australian film talent. Through programs like the MIFF Premiere Fund, the festival supports the production and international release of homegrown films, several of which have gone on to critical acclaim at Cannes, Berlin, and Sundance.

For the local community, MIFF is more than just a film festival—it’s a shared experience. From red carpet premieres at the iconic Regent Theatre to popup screenings in laneways and rooftop cinemas, MIFF brings people together to celebrate storytelling in all its forms.

As MIFF 2025 unfolds, it remains a vital thread in Melbourne’s cultural fabric. It honours its rich history while boldly embracing the future of film. More than a festival, MIFF is a movement—one that continues to inspire, provoke, and unite audiences across generations.

In a world constantly in flux, MIFF stands as a testament to the enduring power of cinema to illuminate, challenge, and connect us all.

By Liz Sanzaro

Any hope for the future lies with the young people. It is exciting to know that a local school plans for its grounds to become a vital habitat and refuge. The children understand how important it is for the creatures that are losing homes due to the significant number of native trees and native plants removed due to land clearing for development.

With the new developments being streamlined, without Council approval, there is no room for trees. This is wreaking havoc on the percentage tree cover for municipalities, which should achieve 30% cover.

A primary school in Croydon is taking on a substantial project with the help of a teacher who has put in a significant amount of work to obtain $5000 grant from the Education Department’s Sustainability grant, supported by Sustainability Victoria. https:// www.sustainability.vic.gov.au/

This project requires several resources to get underway. Maroondah Council will provide mulch and some plants. Croydon Conservation Society is supporting this through the tiny forest project. This school has chosen to re-invigorate part of the school land to become a significant future habitat and wildlife refuge.

The school hopes to create nature trails and corridors within the school grounds. The small grant will not go far, so they are looking for donations such as

• hardwood sleepers and posts to make bench seats

• large granite rocks for lizard sunbaking

• rio-steel mesh sheets for screens to grow native creepers and provide shade

• marine grade stainless steel rope for arbours.

If you think you have anything to donate that would help them with their project, you can contact Croydon Conservation Society and we will pass on your information to the teacher who is coordinating this amazing project. We are all looking forward to seeing this revegetation learning space created where children will be immersed in Nature.

No treated pine to be used, since the chemicals it is treated with are unsuitable for children. Originally Chromium Copper Arsenate. CCS was first in the world to get these tests done and found the wood to be toxic. Now treated with Alkaline Copper Quaternary, which is a skin irritant.

CCS contact…. President@croydonconservation.org.au

By Reece Droscher

Did you know that 7 out of 10 borrowers use a mortgage broker?

During the December 2024 quarter, mortgage brokers wrote 76% of all new home loans in Australia – the highest result on record.

When it comes to refinancing, many borrowers choose to use a mortgage broker for peace of mind that switching is the right move for them.

Here’s why many borrowers are using a mortgage broker to refinance, rather than going direct to a lender.

Australians are in the midst of a cost-ofliving crisis and money is tight for many. When it comes to your home loan, you want to know that it’s competitive and has the features you need.

A mortgage broker is a trained finance specialist who can offer support and guidance about whether refinancing is suitable for you. We understand the different home loans and can narrow down your options to find one that marries with your specific financial situation and goals.

Mortgage brokers are bound by a best interests duty. What that means is we are governed to always act in the best interests of our clients, so you can rest assured we’re on your team.

Do you remember when you took out your existing home loan?

Maybe you had to jump through a few hoops to get to the finish line? Perhaps it felt like there was A LOT of paperwork to wade through and it all seemed overwhelming at times?

Mortgage brokers streamline the refinancing process. We liaise with the lender, oversee the paperwork and provide ongoing assistance.

Bottom line: you’ll have someone to support you throughout the entire refinancing journey.

There’s no one-size-fits-all mortgage. Everyone’s financial situation and goals are different, which is why you need tailored finance solutions.

A mortgage broker will take the time to understand your financial circumstances and goals. If we think you could benefit from an offset account or redraw facility, we’ll explain why, but we won’t push extras on you that you don’t actually need.

If you go directly to a lender, they’ll try to sell you their home loans. Naturally.

We have access to a full panel of lenders, so we can compare the market and find a mortgage that’s suitable for you. Borrowers are spoilt for choice these days, and we will help you pick your home loan from the hundreds of options out there.

What about commissions? The commissions we receive are pretty similar across lenders. This ensures there’s no incentive for a broker to recommend one lender over another. Our job is to act with our clients’ best interests at heart.

Banks are generally focused on the here and now. Their primary goal is to secure your business and lock you in.

Mortgage brokers, on the other hand, take a holistic approach to your finances. We’ll take into account your current financial situation and future financial aspirations, then line you up with finance to support those goals.

If you haven’t reassessed your mortgage recently, now is the time to do it. Refinancing could help you to:

• Secure a more competitive interest rate

• Benefit from interest-saving features like offset accounts or redraw facilities

• Access equity for renovations, additional properties or other financial goals

• Consolidate debt.

Like to explore your options? Interest rates may be on the move again in early 2025, so it makes sense to shop around now to see what lenders are offering. Contact Reece on 0478021757 for more information.

Please call Reece Droscher on 0478 021 757 to discuss all of your Home Loan needs.

reece@shlfinance.com.au www.shlfinance.com.au

By Warren Strybosch

I have been working in the accounting and financial planning profession for nearly 25 years and it still amazes me that people think they can commit fraud or set up a scheme believing they will not get caught.

The Australian Taxation Office (ATO) continues to rely on sophisticated data matching tools to help safeguard the integrity of the tax system. Updated in June 2025, ATO data-matching programs draw on over 600 million third party transactions annually—from banks, employers, property records, online platforms, health funds, cryptocurrency providers, and more—to prefill tax returns, identify discrepancies, and spark compliance reviews or investigations, while also helping honest taxpayers lodge returns more easily.

A standout use of data-matching is in uncovering GST refund fraud. Under the ATO’s Operation Protego, individuals masquerading as fake businesses lodged bogus Business Activity Statements (BAS) to claim fraudulent GST refunds. The fraud was often promoted on social media and facilitated by easy ABN registration via myGov. As of mid2025 more than 57,000 alleged offenders had been flagged; the ATO recovered or blocked billions in refunds and secured dozens of prosecutions—with jail terms up to three years, convicted individuals ordered to repay funds, and heavy penalties imposed by the ATO.

Taxpayer alerts and the new GST fraud warning

In July 2025 the ATO issued Taxpayer Alert TA 2025/2, targeting arrangements where related party companies collude to inflate or invent invoices and claim improper GST refunds. Though these schemes differ from social-media driven rorts, they still pose serious risk— especially in property, construction and closely held corporate groups.

Directors and advisers involved may face personal, promoter or criminal liability Australian Taxation Office.

Monday night’s Four Corners GST fraud exposé

A recent Four Corners episode (aired Monday night) revisited the Plutus Payroll tax fraud—the largest such scheme in Australian history—where an operator diverted GST and PAYG funds held on behalf of clients, depositing only part of them to the ATO. The program detailed how intercepted communications and documents exposed a sophisticated network of dummy directors and shell entities, raising fresh scrutiny on ATO enforcement and regulatory oversight.

This ATO approach—blending largescale data matching, targeted alerts and robust enforcement—reflects a sharpened strategy to deter GST abuse and uphold trust in the system.

When it comes to money, the best approach is the black and white approach. If you feel you are unsure about a situation or that it might seem a bit of a grey area or if it sounds too good to be true…then stay well, clear of it. Only deal with those situations where you know it is all in the ‘white’ so to speak.

If you are still not sure, then please pick up the phone and ring your accountant or financial planner as well as a couple of other people before making any large money commitments. A couple of phone calls could save you thousands.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies, graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document. This information contained does not constitute legal or tax advice.

By Erryn Langley

Planner

As they age, many Australians begin reassessing their retirement lifestyle. One option that often comes up is downsizing the family home in order to reduce costs, freeing up equity and simplifying life. Beyond lifestyle benefits, there’s a valuable financial planning strategy that could help strengthen your retirement income: downsizer contributions to super.

If you're aged 55 or over, you may be eligible to contribute up to $300,000 per person (or $600,000 per couple) into your superannuation from the proceeds of selling your home. This contribution doesn’t count toward your standard contribution caps and doesn’t require you to meet the work test.

• You must be 55 years or older at the time of making the contribution.

• The property must have been owned by you or your spouse for at least 10 years, and it must be your main residence.

• You only have 90 days from the date of settlement to make your downsizer contribution into super. Missing this deadline may mean you lose the opportunity entirely.

• You must submit the ATO downsizer contribution form before or when the contribution is made.

Why Consider It?

• Boost Retirement Savings: It’s a one-off opportunity to significantly grow your super balance, especially if you’ve reached other contribution limits.

• Tax-Effective Income: Once contributed, the funds can be used to start a tax-free income stream via an accountbased pension.

• Downsizer contributions do count towards the transfer balance cap (currently $1.9 million).

• Selling your home may affect your Age Pension entitlements due to the asset and income tests.

• You cannot use this rule multiple times, it’s a once-perlifetime strategy.

• Don’t miss the 90 day window.

As you can see timing and making sure that you meet the requirements is critical, if you are considering downsizing, before you do so is a great time to speak with a Financial Adviser. Feel free to give us a call on 1300 557 144 to make an appointment to discuss how the use of a downsizer contribution could assist your overall retirement strategy.

Director and Financial Adviser - GradDipFinPlan Authorised Representative No 1269525

T:1300 557 144 Email: erryn@cherrywealth.com.au

Website: www.cherrywealth.com.au

Office Address: Suite 4 / 4 - 6 Croydon Road, Croydon 3136

Postal Address: PO Box 657, Croydon VIC 3136

Financial Planning is offered via Cherry Wealth Pty Ltd Ltd ABN 14 653 375 458

Cherry Wealth is a Corporate Authorised Representative (No. 1314769) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the Centrepoint Alliance group https://www.centrepointalliance. com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice.We may not have considered your financial circumstances, need or objectives. You should consider the appropriateness of the advice.You should obtain and consider the Product Disclosure Statement (PDS) and seek assistance from an authorised financial adviser before making any decisions regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material. It is based on our understanding of current regulatory requirements and laws as at the publication dates. As these laws are subject to change you should talk to an authorised adviser for the most up to date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

By Jodie Moore

When it comes to managing finances, one of the most important decisions a small or medium-sized business (SME) in Australia must make is whether to use cash accounting or accrual accounting. Each method has its advantages and is better suited to different types of businesses. Understanding the pros and cons of each can help you make an informed decision and ensure compliance with Australian Taxation Office (ATO) requirements.

Understanding the Basics

Cash accounting records income and expenses only when money changes hands. For example, you record a sale when the customer pays, not when the invoice is issued. Similarly, expenses are recorded only when you actually pay a bill.

Accrual accounting, on the other hand, records income and expenses when they are earned or incurred, regardless of when the money is actually received or paid. So, if you invoice a client in June but they don’t pay until July, the income is still recorded in June.

Why This Decision Matters

The method you choose impacts more than just bookkeeping. It affects how you manage cash flow, report income, pay taxes, and make business decisions. The ATO allows most small businesses with a turnover of less than $10 million to choose between cash and accrual

accounting, giving you some flexibility to pick the best fit.

Pros and Cons of Cash Accounting

Advantages:

• Simplicity: It’s straightforward and easier to manage, especially for sole traders or micro businesses.

• Better cash flow tracking: Since transactions are recorded only when money is received or paid, you have a clearer picture of your actual cash on hand.

• Tax timing benefits: You may defer paying tax on income until it's actually received, which can be helpful for cash flow.

Disadvantages:

• Limited financial insight: It doesn't show money you’re owed or owe to others, which can make it hard to plan ahead.

• Not ideal for growing businesses: As your operations become more complex, this method may not provide sufficient financial visibility.

Advantages:

• More accurate financial picture: It reflects earned income and incurred expenses, even if cash hasn't changed hands.

• Better for long-term planning: It shows outstanding invoices and bills, which helps in forecasting and managing obligations.

• Required for some businesses: Larger businesses or those that carry inventory may be required by the ATO to use accrual accounting.

Disadvantages:

• More complex: You may need a professional accountant or accounting software to manage it properly.

• Cash flow disconnect: Because income is recorded when earned, not received, you may appear profitable even if you’re low on cash.

Here are a few guiding questions to help you decide:

• Do you operate on a small scale with straightforward transactions? If so, cash accounting may be the simpler and more manageable option.

• Do you offer credit terms to customers or deal with inventory? Accrual accounting is better suited to businesses with delayed payments and stock management.

• Do you need a more accurate financial picture for investors, banks, or strategic planning? Accrual accounting provides a more complete view of your business performance.

• Are you close to the $10 million turnover threshold? You may need to switch to accrual accounting as your business grows, so it’s worth planning ahead.

The ATO permits small businesses to choose their accounting method, but once you select a method, consistency is key. You must apply it across your financial year and for GST reporting if you’re registered.

For GST purposes:

• Cash accounting allows you to pay GST only when you receive payment.

• Accrual accounting requires you to pay GST when you issue the invoice.

The choice can affect your GST liability, especially if customers pay late or early.

Choosing between cash and accrual accounting isn’t just about compliance — it’s a strategic decision that can impact your business’s cash flow, tax obligations, and growth potential. If you're unsure which method suits your SME, it's wise to consult a qualified accountant who understands both your industry and ATO requirements.

Whether you’re a start-up sole trader or a growing enterprise, understanding these accounting methods helps you take control of your finances and make more informed decisions.

By Kathryn Messenger

I thought I’d share 2 examples of how working with a naturopath can make a difference in your health. I have chosen 2 very different examples from my clinic in the last 12 months. Sometimes the journey is very straightforward, other times, there can be a few bumps in the road (names have been changed).

Emma, late 30’s, works, school aged kids.

She presented with anxiety (with panic attacks), fatigue, insomnia, and frequent colds.

Upon questioning:

• Energy 2/10

• Stress 7/10

• Too tired to exercise

• Daily nausea and bloating

• Poor concentration and memory

• Sleep waking 3x/night

I first prescribed an individual herbal medicine formula, a specific homeopathic, a mineral supplement, and a few foods to add to her diet.

2nd appointment (2 weeks later)

• Anxiety has improved – no panic attacks

• Energy was a little better

• Sleep, waking just once/night

• Stress 5/10

• No cold/flu

Added an additional nutritional supplement

3rd appointment (4 weeks later)

• Anxiety – not a problem anymore

• Energy – feeling a lot better

• Sleep – wakes very occasionally, falls straight back to sleep

• Stress no longer a problem

• Still no cold/flu

4 weeks later – Feeling really good, took products for another 4 weeks, and takes some of the products ongoing as she needs them.

Rob, early 60’s semi-retired

He presented with constant nausea with bloating and constant indigestion.

He had eliminated many foods to try and find the cause and had an extremely limited diet for 18 months.

History of stomach ulcers, and bowel disease.

Upon questioning:

• Loss of appetite

• loss of weight

• Frequent bowel movements (6/day)

• Energy 4/10

• Diet: Low fodmap, extremely limited variety of food, 1 meal and 1 snack each day

I prescribed an individual herbal medicine, 1 nutritional product, 1 homeopathic.

2nd and 3rd appointments (each 2 weeks later)

• Nausea – decreased

• Bowel movements – decreased

• Appetite improved, able to increase food intake

We worked at slowly introducing a greater variety of foods

4th and 5th appointments (each 2 weeks later)

• Tolerated new foods and enjoyed them

• Appetite - feels hungry, but very full after eating

• No longer losing weight.

• Bowel motions down to 3/day

2 additional homeopathics were introduced

6th and 7th appointments (each 1 month later)

• Feeling so good that he worked with his doctor to reduce medications.

• Nausea gone, very slight gut pain

• looks forward to eating

• Able to eat a wide variety of foods without any symptoms

• Learnt that there are 2 foods to avoid that exacerbate his symptoms

• Energy is much higher and able to function well Kathryn Messenger

We had our Annual General Meeting on Saturday, July 26 at Nick McGowan MP’s office and are happy to announce the newly elected members of the Committee:

President: Leah

Vice President: Corina

Secretary: Catherine

Treasurer: Irene

Uniform/Equipment/Merchandise Officer: Johnny

Social Media Officer:

Victoria Newsletter Officer: Renata

General Member: Ning

Youth athlete, Addy, attended the Youth National Team training camp held at the Australian Institute of Sport during July. Addy is preparing to attend the Youth World Championships in Greece. If you are a swimmer interested in high performance, please speak to our coaches so we can make a plan tov reach these goals.

Meet Andrea - one of our newest swimmers who combined her love of calisthenics and swimming in artistic swimming.

Flexibility training and lap swimming were easy to break into, but the challenges were there with breathwork and sculling technique. Andrea has been steadily progressing each week in class and soon enough will be swimming in the higher levels.

We are looking forward to seeing where Andrea's synchro journey takes her with her hardworking and focused mindset allowing her to work through every new skill with precision!

By Ethan Strybosch

When we started Good Cause, our goal was simple:

Help charities and not-for-profits grow through great marketing, and make it as affordable as possible.

We knew the sector was full of passionate teams doing world-changing work on tight budgets. So we set our prices low, not because we undervalued ourselves, but because we genuinely wanted to make a difference.

And for a while, that worked. But over time, we realised something important: Staying affordable shouldn't come at the cost of impact, for our clients or for us. Our hearts were in the right place. But we were often juggling too much, taking on more than we realistically had capacity for, all to try and “do the right thing.”

We weren’t cutting corners, but we were stretched thin, and that meant we couldn’t always be as strategic, fast, or proactive as we wanted to be.

It became clear that if we wanted to serve notforprofits well, we needed to give ourselves the time and space to do the job properly, not just affordably.

So we made a change, We restructured our pricing model to better reflect the value we provide, and to give every project the time, care, and strategic thinking it deserves.

We’re still far more affordable than most commercial agencies. But now we’re also sustainable, which means we can:

• Be more hands-on and available

• Focus on long-term success, not short-term fixes

• Deliver high-quality work, on time, every time

• Support our clients like a true extension of their team

The outcome? Better results for everyone. Since making the shift, we’ve had some of the best feedback we’ve ever received. Clients have noticed the difference, in the quality of our work, the speed of delivery, and the level of strategic guidance we’re able to bring to the table.

And for our team, it’s made a massive difference. We’re more focused, more energised, and more committed than ever to helping NFPs grow their reach, donations, and impact.

We still believe in making great marketing accessible for charities. That hasn’t changed, and it never will. But we’ve learned that accessibility doesn’t mean “as cheap as possible.” It means pricing fairly, working sustainably, and delivering work that actually moves the needle for the causes we care about.

If you're a not-for-profit looking to grow, fundraise, or reach new audiences, we'd love to help. Let’s make something meaningful together.

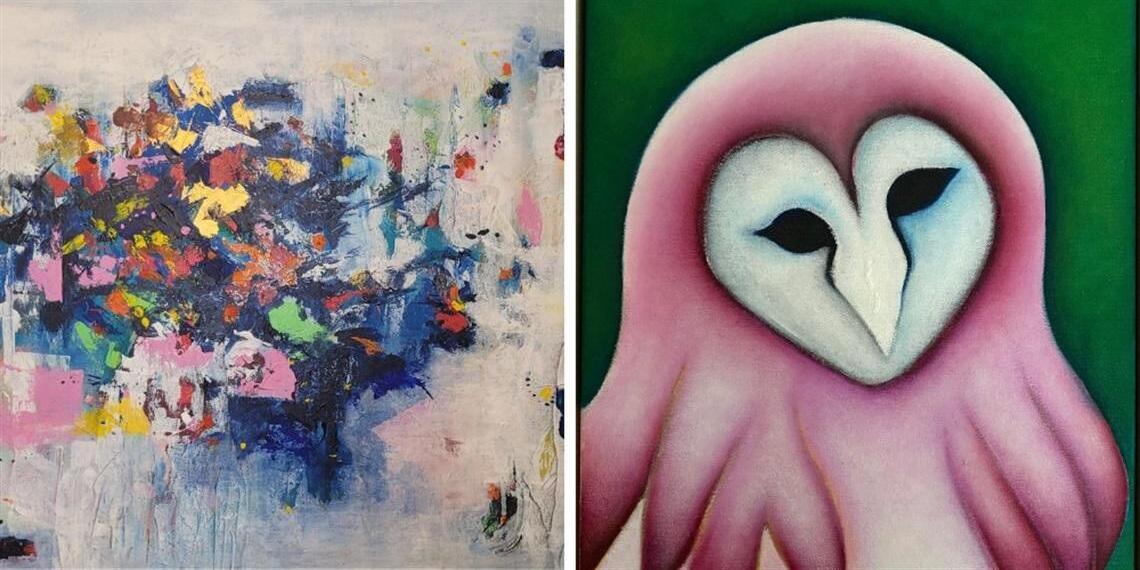

During July through to September, Wyreena’s Arts Lounge will feature two new exhibitions from Wi Sook Kim and Tanya Loh.

About the artist s

Wi Sook Kim - Harmony from diversity

Kim's journey as an elderly migrant, who left her home country later in life at the age of 65, has deeply influenced her artistic exploration of 'harmony from diversity'. Through her artworks, she seeks to express the profound belief that embracing diversity and differences can bring a vibrant, warm and dynamic energy to our lives, rather than leaving them monotonous and static.

Tanya Loh - Somewhere down in the south of Spain

Tanya is a self-taught artist for whom artistic practice equals catharsis. Inspired by a search for meaning, painting gives permission to reflect upon, release and ultimately come to terms with challenges imposed by life. Tanya's paintings are deeply personal.

Join Elana from Cloth Nappy Workshops Melbourne from the comfort of your home to discover the world of modern cloth nappies.

Elana will take you through everything you need to know to get started with reusable nappies. Learn how to wash them, where to buy them and what to look for.

They'll cover washing tips, dispel myths, show the different styles of modern cloth and most importantly an opportunity to ask questions to get you confi dent with cloth. Maroondah residents may receive a free nappy pack on completion of a survey.

Event details

• Date: Tuesday 12 August 2025

• Time: 7:30pm to 9:00pm

• Venue: Online Webinar

• Cost: Free

• Bookings are essential

Maroondah City Council has again received strong results in this year’s Local Government Community Satisfaction Survey.

The 2025 survey results indicate that Council continues to excel in core performance areas compared to the average ratings across Victoria. These areas include:

• Overall performance

• Value for money

• Community consultation

• Waste management

• Customer service

• Overall Council direction

• Making decisions in the interest of the community

• Sealed local roads

A total of 56 out of 79 Councils took part in the survey, which was conducted quarterly between June 2024 and March 2025 by an independent market research fi rm on behalf of the Victorian Government.

Survey respondents were asked to provide feedback on Council’s performance over the past 12 months.

Maroondah City Council’s overall performance was rated 12 points higher than the state-wide average for Councils, and scored higher than the average rating for Councils in metropolitan Melbourne. Maroondah also rated 11 points higher (58) in ‘value for money’, when compared with the statewide average (47).

Join Maroondah’s Waste Education Team for an interactive and eco-friendly workshop where we will explore the art of repurposing kitchen scraps and waste to make your own cleaning and beauty products. From citrus peels to coffee grounds, we'll show you how to harness the power of these kitchen scraps to make effective cleaning solutions and beauty products. You'll leave with a newfound knowledge of sustainable living and a personalized bath salt product that you can enjoy in your own relaxing bath.

Don't miss this opportunity to reduce waste, save money, and indulge in self-care, all while making a positive impact on the planet. Join us for an inspiring and practical workshop that will empower you to repurpose kitchen scraps and transform them into beautiful, eco-friendly products.

• Date: Tuesday 21 August 2025

• Time: 2:00pm to 3:00pm

• Venue: Realm Library, Ringwood

• Cost: Free

• Bookings are essential

Ringwood Art Society is a vibrant active art society whose studios are based at the Maroondah Federation Estate in Ringwood. Next year is our 60th Anniversary year – and we will have various events including an exhibition at Maroondah Federation Estate Gallery. Details will be available via our Website and Social Media.

We run classes in different mediums, offer workshops during the year with professional artists and every month we have an art demonstration given by different professional artists from all over Melbourne in different styles and mediums. These are open to non-members with just a $5 donation at the door (Meeting Room 1 – Second Monday of the Month – see our website for details).

We have a very active Plein Air (Paint out-doors) group who set up at various local pre-organised settings and paint the landscape. Nonmembers are welcome to come along and there is no cost. If you are thinking of becoming a member this is a good way of seeing who we are. As part of a Membership you get to see the art demonstrations for free, a discount for workshops, join tutored classes (not free), and also receive our professional quality full-colour magazine produced three times a year with information about art and artists and showcasing member’s paintings. You can also enter our many exhibitions.

The society is run completely by volunteers. A committee oversees and organises all the running of the society and other

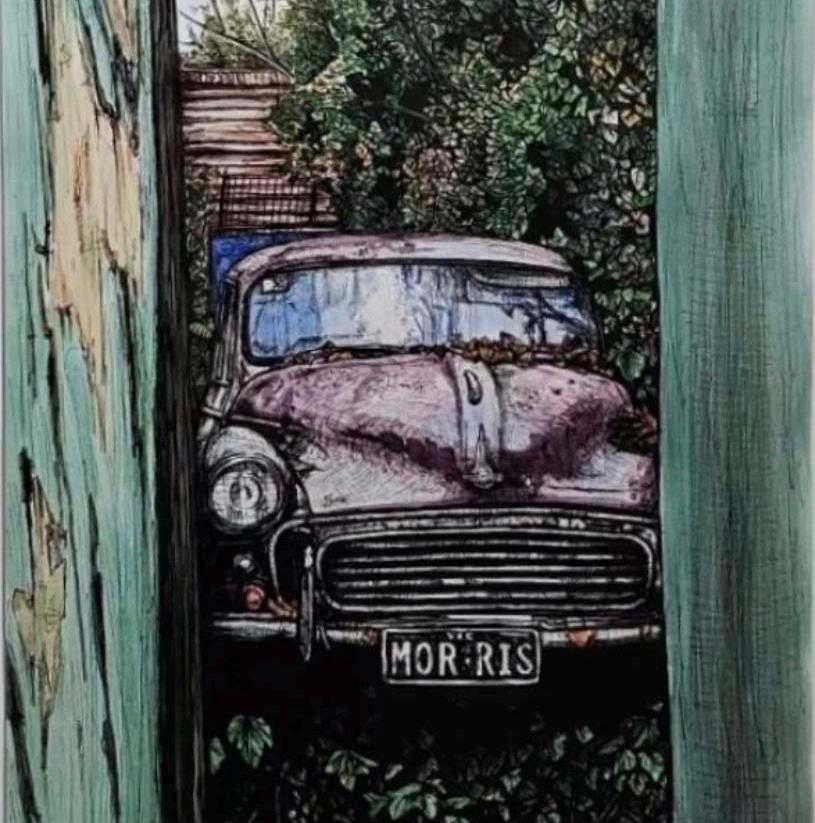

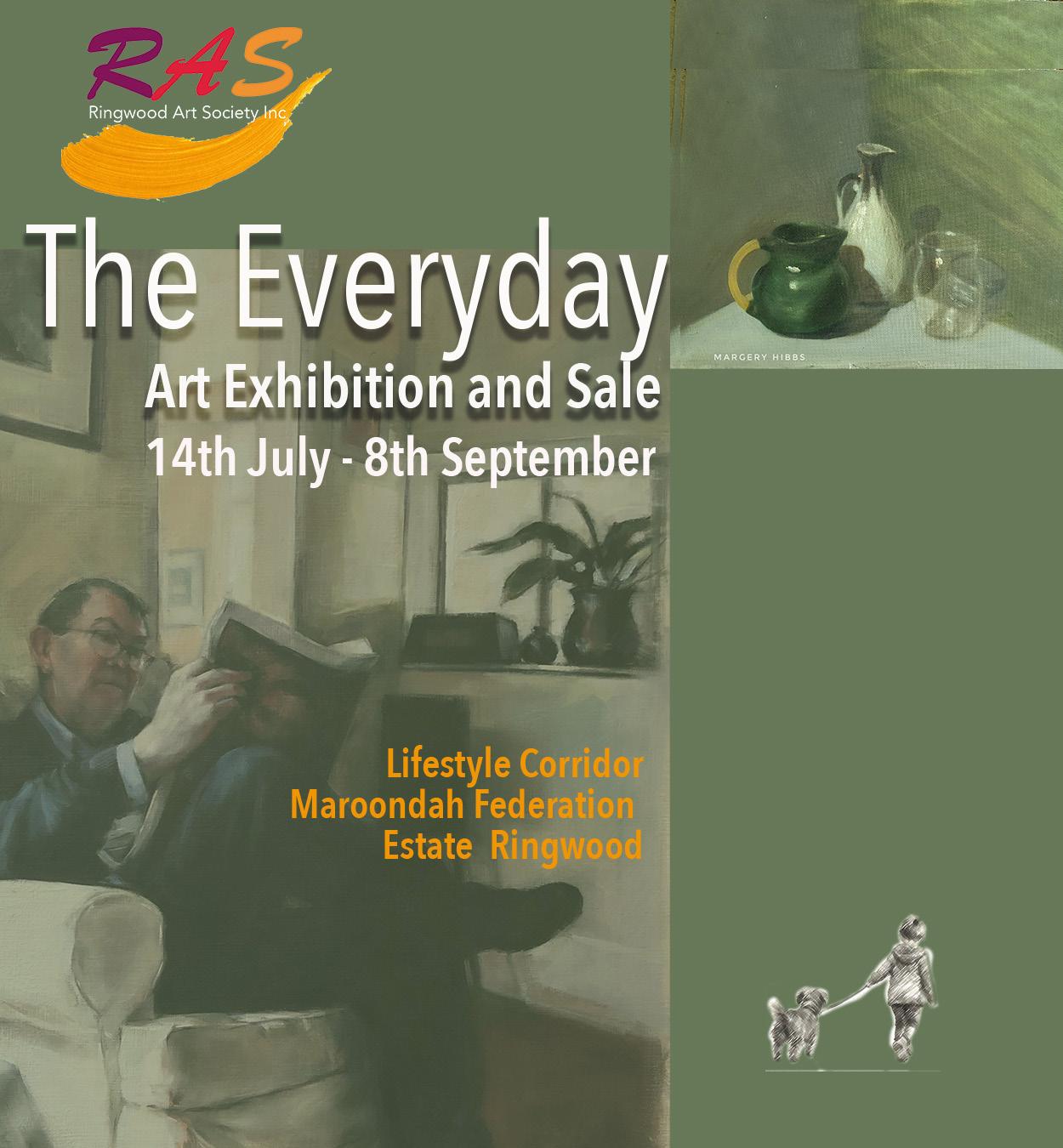

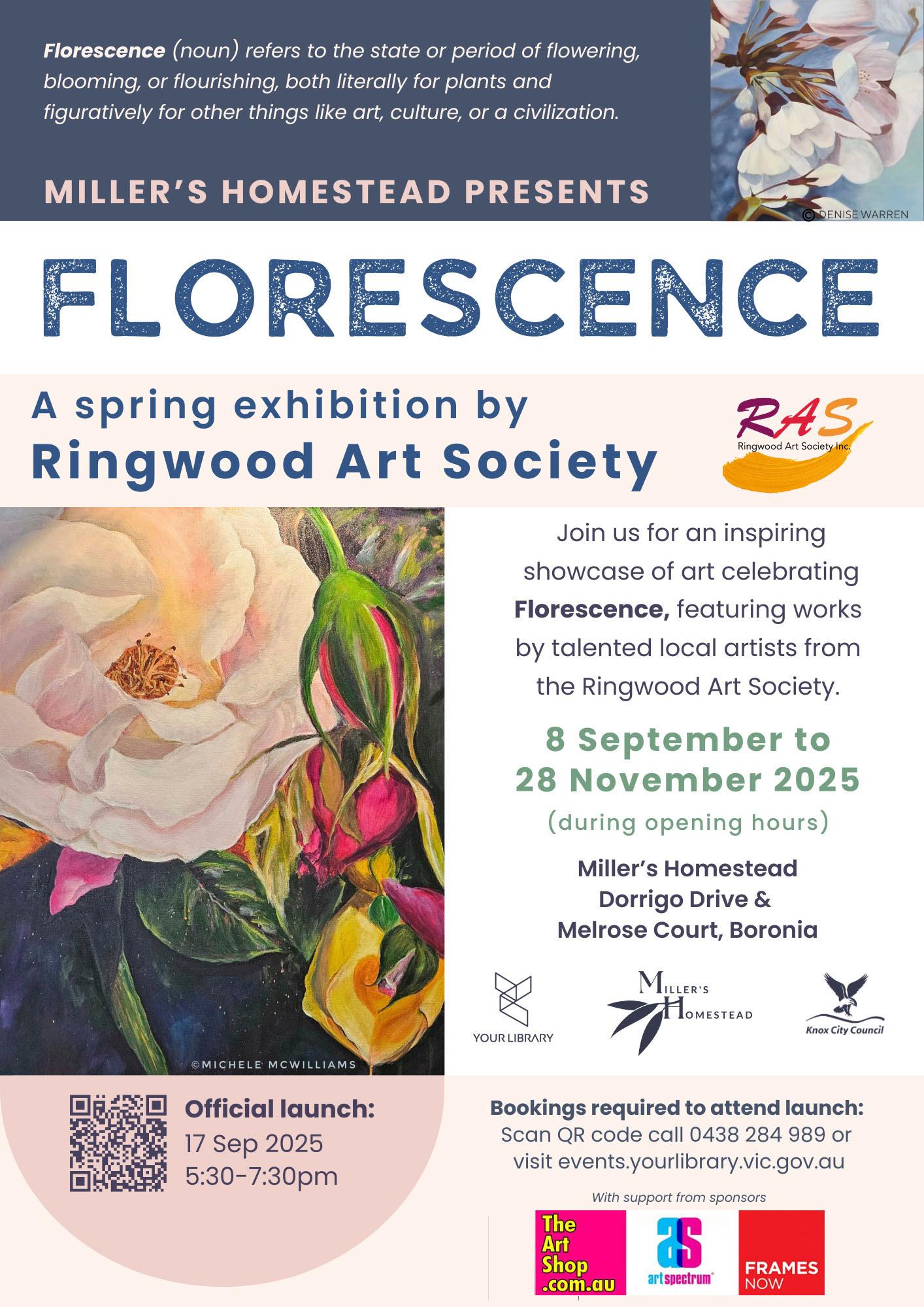

The current exhibition is called ‘The Everyday’ which runs until the 8th of September, and the previous exhibition invited artists to use predominantly blue in the ‘Blue By You’ exhibition. Ringwood Art Society also aims for one or two major exhibitions each year and this year we return to Miller’s exhibition entitled ‘Florescence’ see page 8th of September to the 28th of November, September. Go along and have a look for sale) and also admire the wonderful Council in conjunction with Knox Library will also be workshops offered as part days you can spot our Plein Air group painting big exhibition we take part in is the Melbourne Garden Show. We sell a lot of paintings other community art groups upstairs in the

Ringwood Art Society dates back to 1966 artists formed a group, using their homes later offered the use of a large barn at ‘Baileu’ in Canterbury Road, Vermont, group, known then simply as the Ringwood numbered about twenty. It grew steadily available, they had to find other venues, the now Heathmont Uniting Church. By grown to about 75 and during this time the and known as Ringwood Art Society – a more permanent venue was Senior Citizens Centre. With was able to offer classes, the society was approached Estate to join their Arts an art gallery, meeting facilities. The group now has around 125

Our society also presents (past member) Award student at Ringwood

To find out more follow us on Facebook: @ringwoodartsocietyaus ringwoodartsociety.org.au our studios membership in the Lifestyle Maroondah

Miller’s Homestead page

November, with the Opening on the 17th at the exhibition (all artworks are wonderful homestead which is run by Knox Library and Your Library services. There of this exhibition and on specific painting in the grounds. Another Melbourne International Flower and paintings at the exhibition where we join the Exhibition Buildings.

when a group of local enthusiastic homes as a meeting venue. They were the rear of a property known as becoming the first home of the Ringwood Artists. In those days, the group and when the Barn was no longer venues, including Ringwood Library and the mid 1980s, the numbers had the society became incorporated Society Inc. With increasing numbers was found at the North Ringwood With a permanent studio, the society workshops and paint-outs. In 2015, approached by Maroondah Federation Arts Precinct with dedicated studios, meeting rooms and more modern group is continually expanding and 125 members.

presents the Graeme Hildebrand Award and Prize to a nominated art Ringwood Secondary College each year.

more about our society you can Instagram @ringtwoodartsociety, @ringwoodartsocietyaus website: ringwoodartsociety.org.au or drop by and pick up a pamphlet and form and check out the artworks Lifestyle Gallery in the Corridor behind Federation Estate Office.

https://ringwoodartsociety.org.au/contact/

https://www.instagram.com/ringwoodartsociety/

Saturday 23 August

9.30 am – 3.30 pm

Lilydale Bunnings

Corner John & Hutchinson Streets, Lilydale

Sausages $3.50 (with bread & onions)

Cold drinks $2

Candlebark Community Nursery, a not-for-profit run by passionate volunteers, is firing up the BBQ for our monthly fundraiser at Bunnings. All proceeds support our efforts to grow local indigenous plants, share gardening expertise, and promote a more sustainable future.

Sizzle on Saturday, Visit the Nursery on Sunday!

See where your support goes. Drop into the nursery on Sunday to browse our plants, get advice, or just say hello.

Candlebark Community Nursery Incorporated 308 Hull Road, Mooroolbark 3138

Open to the public: Tuesdays, Wednesdays, Thursdays, Fridays and Sundays between 9:00 am and 3:00 pm.

Email: info@candlebark.org.au

Phone: (03) 9727 0594 or 0494 088 804

Website: www.candlebark.org.au

Facebook: https://www.facebook.com/profile. php?id=61557484754633

By Warren Strybosch

Income received from a superannuation “account based” or “allocated” pension is often favourably assessed under the income test used by Centrelink and the Department of Veterans Affairs to determine a person’s entitlement to government income support benefits. Such benefits might include the Age Pension, Disability Support Pension, Newstart Allowance, and the like. This means that a person currently receiving income support benefits may often be able to draw a reasonably significant amount of income from their account based pension without it having a detrimental effect on their government income benefit.

Legislation was passed in March 2014 that changed the way in which account based pensions are assessed for income test purposes. The change took effect from 31 December 2014. Account based pensions were brought into line with other “financial Investments”.

There are two groups of people who are affected by this change:

1. People who commenced receiving government income support benefits after 31 December 2014, whether or not they had an account based pension is place before January 2015; and

2. Those receiving government income support benefits before 1 January 2015, and they transfer their existing account based pension to a new superannuation provider, or commence a new account based pension after 31 December 2014.

Those people receiving income support as at 31 December 2014 and had an account based pension in place as at that date, will not be affected by the changes unless:

• Their income support benefit ceases for any reason, and is then recommenced, or

• they change pension providers, or

• stop and recommence an account based pension with their current provider.

There are no changes currently being made to the way the assets test applies to account based pensions.

Financial investment

Financial investments include money on deposit with banks, building societies, and credit unions, shares, managed funds and unit trusts, and money held in superannuation funds by a person of age pension age, where they have not yet commenced an account based pension.

When applying the income test, Centrelink or Department of Veterans Affairs will total up the value of a person’s financial investments and then “deem” an amount of income to be applied to those investments. The deeming rates change from time to time and are reflective of current interest rates. There are two deeming rates that apply depending on the amount of a person’s financial investments. The current deeming rates are:

Put simply, a pensioner couple have financial investments of $150,000, their deemed income, for income test purposes will be:

Deemed income is used when applying the income test. The actual income earned on financial investments, whether it is above or below the deemed income, is ignored when assessing eligibility for income support benefits.

However, income received from account based pensions under the pre 1 January 2015 rules are assessed on a different basis.

Income assessment of account based pensions –grandfathering provisions

When an account based pension commences, the amount of capital used to commence the pension is divided by the life expectancy of the pension recipient (or the longer of the two pension recipient’s life expectancies, where a reversionary pensioner is nominated). The resultant amount is referred to as the “deductible amount”. This amount remains constant for the life of the account based pension unless a lump sum withdrawal is made from the pension account, at which time the deductible amount is recalculated.

The amount of account based pension income assessed under the income test is the actual income drawn from the account based pension, after subtracting the deductible amount.

Let’s further consider the example of our pensioner couple mentioned previously. They also have an account based pension with a value at commencement of (say) $200,000. For the sake of the example we will assume the account based pension is held in the name of the wife who is 65. Her husband is 67. Her life expectancy is 21.62 years, and his is 16.99 years. In this example, it is irrelevant whether the husband was nominated as a reversionary pensioner or not, as his life expectancy is the lesser of the two. The deductible amount, in this example, is $9,250 ($200,000 ÷ 21.62). If this couple were to draw $10,000 income from their account based pension, only $750 of that will be counted under the income test ($10,000 - $9,250).

If we now extrapolate the income assessable under the income test for our pensioner couple, their assessable income under the income test will be:

Applying the January 2015 rule

If our pensioner couple were:

• not to commence receiving their age pension until after 31 December 2014; or

• to move their existing account based pension from one pension provider to another after that date; or

• to stop their existing account based pension, perhaps to add more superannuation savings, and then start a new account based pension after 31 December 2014;

Then their new account based pension will be treated as a financial investment and will be subject to deeming. If this were to occur, their financial investments will now total $350,000 and their deemed income will now be:

Whether a person will be better or worse off if their account based pension falls under the deeming rules or grandfathering provisions will depend on personal circumstances. For example, anyone drawing an account based income stream that is significantly more than their deductible amount may actually benefit by having their account based pension treated as a financial investment and subject to deeming.

In addition to the income test,government income support entitlements may also be affected by the assets test. The test that results in the lower income support benefit is the test that is used.We have not taken the potential assets test implications into account for the purposes of this review.

Strybosch Award winning Financial Adviser and Accountant

Based on deemed income of $221 per fortnight, this couples assessable income is still below the income free amount available under the income test, so their pension is unaffected, based on current deeming rates. However, as deeming rates increase over time, and given that they are currently at historically low levels, this couple may see a reduction in the amount of age pension they receive in the future.

When legislation to have account based pensions included as financial investments for deeming purposes was enacted, the income test treatment of existing account based pensions was grandfathered. That is, provided the following conditions are met, the former income test treatment of account based pensions (i.e. actual income received, less the deductible amount) will continue to apply.

To qualify for grandfathering, the pensioner receiving government income support must:

1. Be in receipt of a continuous government income support benefit as at 31 December 2014; and

2. Be receiving income payments from a continuing account based pension as at 31 December 2014.

Where a person holding a grandfathered account based pension passes away, and their account based pension was structured to automatically revert (transfer) on their death to a surviving spouse, then the original account based pension will continue to be grandfathered provided the reversionary pensioner was also in receipt of a government income support benefit at the time the pension transferred.

Financial Planning, SMSF, Super, Insurance, Pre-Retirement & Retirement Planning (Financial Planning) are offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth, Find Insurance and Find Retirement. Find Wealth Pty Ltd is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the

Centrepoint Alliance group (www.centrepointalliance.com.au/fsg/aw).

Warren Strybosch

Authorised Representative (No. 468091) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-todate information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

•

We

Here are the steps involved:

1. Email to info@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address

2. A Tax engagement letter will be emailed to you for signing via your mobile (no

3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes.

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.

•

We specialise in the following:

• Biz Pack Insurance

• Landlord Insurance

• Public Liability Insurance

• Professional Indemnity Insurance.

We DO NOT provide advice or quotes for the following (you need to go direct and save):

• Car Insurance

• Home & Contents

• Caravan

• eBikes

We work with only the most reputable insurers to bring you a range of insurance options for you to choose from:

At Find we can help you find the ‘right’ personal insurance. Our aim is to help you obtain and retain the personal insurances that are appropriate for you and at cost that you can afford.

• Income Protection (IP)

• Life Insurances or Death Cover

• Total and Permanent Disability (TPD) Personal Insurances Include:

When your insurance are in place, our services do not stop there. We will provide you with an after care service that includes policy notifications, insurance report, help desk, reviews and help at claim time. We provide ourselves in providing honest advice that you can rely on.

warren@findinsurance.com.au

www.findinsurance.com.au

•

• Lactation Consultant ----------- 39

• Swen Pouches ---------------------- 40

• Hair Dresser --------------------------- 00

• Chiropractor ------------------------- 00

• Beauty Therapy -------------------- 00

• Gym --------------------------------------- 00

• Massage Therapy ---------------- 00

Osteopathy in Australia is a government registered, allied health profession. Osteopaths focus on improving the function of the neuro-musculoskeletal system (bones, muscles, nerves and connective tissues) to optimise health and well-being.

Joanna is highly qualified and experienced in the osteopathic assessment and treatment of babies and infants.

She can assist with the following assessments:

• Gross motor development (milestones)

• Primitive reflexes

• Tongue function and it’s relation to sucking skills

• Biomechanics of the jaw and mouth

IBCLC lactation consultants are recognised around the world as the experts in lactation care. They provide evidencebased knowledge to assist mothers to establish and maintain breastfeeding. As professionals, they are charged with promoting, protecting and supporting breastfeeding.

Joanna can help with a broad range of lactation consulting services, including:

• Teaching a new mum how to hold and position her baby to breastfeed

• Assess the suck, swallow and breathing of an infant

• Assess for tongue function and determine any evidence of restriction (tongue tie)

• Pre and post-frenectomy breastfeeding support

• Help increase or decrease milk supply

20% off Express Customised Facial & Massage

feel renewed at endota Eastland in 60mins for $180*

feel renewed at endota Eastland in 60mins for $180*

Restore balance and de-stress with an express relax massage and facial customised to your needs.

Use the code H-EXPR at checkout under the local spa offers tab when booking online.

Grab a Shake'n'Dog combo and claim a free 'Ace' sticker sheet!

The original and still the best - our iconic Shake’n’Dog combo is serving up major throwback feels… and now comes with a bonus treat!

Snag your FREE Ace Sticker Sheet when you grab a Regular Shake’n’Dog Deal - but be quick, this gift is only available until it’s DOGGONE! Discover more

The Coffee Club's winter menu has arrived, and you need to visit ASAP!

It's that time of year - when the evenings get colder and the mornings are brisk.

But never fear! The Coffee Club's new winter menu has launched nationally, and now is the time to visit.

Win a Family Trip to Paris with Sharetea

Buy 2 Sharetea x Smurfs Drinks to enter the draw!

Sharetea

Get ready for a Smurfs adventure! Sharetea is thrilled to announce our exciting collaboration with the Smurfs Movie! Indulge in our two delicious drinks, both served in exclusive, limited edition Smurfs themed cups and seals.

In-Kind Sponsorship with Find Maroondah Community Paper

We invite a representative from each sporting club to submit team selections, results and any interesting stories relating to your club/sports.

For more information contact: Warren on 1300 88 38 30 or Email: editor@findmaroondah.com.au

The Norwood FNC is excited to announce that Tyler Benda will return as our Women’s Program Head Coach for the 2026 season.

Tyler has been nothing short of instrumental in relaunching our women’s program — taking the team from just 9 players before the season to 39 women pulling on the jumper throughout the year.

His leadership has brought a level of professionalism and care that has set a new standard for the program. Despite personal setbacks, Tyler's passion for the group and the club has never wavered.

With Tyler at the helm, we’re building something special — and we can’t wait to see what 2026 brings.

– Norwood FNC Committee

The Norwood FNC is proud to confirm that Brett Moyle will continue as senior coach for the 2026 season — marking his third consecutive year in the role.

Brett’s leadership has been pivotal in defining our club’s identity, fostering growth both on and off the field, and laying the groundwork for long-term success.

As we continue to add experience to our list and push forward in our rebuild, Brett is the right leader to guide us into 2026 and beyond.

Under his continued guidance, the club remains dedicated to developing homegrown talent and building a program that reflects the values, pride, and ambition of the Norwood community.

– Norwood FNC Committee

In a pretty uninspiring round 13 against Bayswater, Jackson Winter was one of our highlights. In addition to the stats shown here, Jacko had 10 contested possessions, 3 tackles and 4 clearances. It was his competitiveness that most stood out.

Jos was also great with 21 touches (15 contested), 5 tackles, 8 clearances and 126 FP. Kempy had 14 contested and 5 clearances. Liam had 12 contested, 29 Hit Outs and 5 clearances.

2 sleeps until Pre Season begins!

Get down Tuesday night at 6:45pm for a 7pm start as we begin preparations for the upcoming season.

All are welcome returning or new!

Introducing our 2025/26 Eastfield Senior Leadership Team!

With a wealth of experience in all aspects of cricket we are very excited with how the leadership group can lead our club into this season.

The team will be getting around training to talk through the season ahead and how they can help you get the most out of cricket. More details to follow on everyone's roles in the team.

Get excited for the season ahead and see everyone at training tomorrow!

Taking orders now for the Eastfield branded cricket bag again this season.

These bags have looked great around the club last season and here is your chance to order one for the start of this season.

$210 each but customised with your number and name on them.

Contact Matt Barnard if you are interested.

Simply upload your ad at www.findmaroondah.com.au/nfp-free-advertising or you can email the ad to the editor@findmaroondah.com.au and we will do the rest for you.

Senior

Karen

NextGen

Worship

Transform

Community

Children's