Prof. Nagarajan Ramamoorthy (Director, IIM Amritsar)

Ms. Seema Nayak (Chief Compliance Officer, NCDEX)

De (MBA07, IIM Amritsar)

(MBA07, IIM Amritsar)

Prof. Nagarajan Ramamoorthy (Director, IIM Amritsar)

Ms. Seema Nayak (Chief Compliance Officer, NCDEX)

De (MBA07, IIM Amritsar)

(MBA07, IIM Amritsar)

Dear All,

It gives me great pleasure to introduce the ninth edition of its bi annual magazine Vitta Artha of the Finance and Economics Club (FEC) at IIM Amritsar. FEC works interminably both at the college and industry level to further the interests of the students by exposing them to various aspects in the world of finance and economics. It is the endeavour of the club to harness talent and enhance the learning experience of our student community. Vitta Artha The Finance and Economics magazine of IIM Amritsar is one such effort in the same direction. Varied views in the form of articles given by students from prominent B schools across India and the esteemed insights of the industry professionals help the students and our readers to better understand the real life implications and nuances in the fields of finance and economics. This edition of Vitta Artha attempts to provide a glimpse into the potential of Agri commodity derivatives in India. It discusses the shortcomings of the current market scenario and addresses the reasons for a declining trend seen in the trade volumes of such derivatives. It also highlights the recent ban on derivatives of certain agricultural commodities and summarizes its implications. It further provides a detailed analysis on how Agri commodity trading can be boosted, thereby acting as a boon to both farmers as well as the country.

This issue also includes an article on the stance of MSME financing in India. Highlighting the decline in credit provided to MSMEs, it emphasizes on the need for more financial assistance and initiatives to be taken up to cater to these entities despite the existence of multiple government schemes. The article discusses the issues that hamper access to finance from formal sources, and what must be done to mitigate these problems. Alongside this, CFA preparation strategies and the internship experiences of various students of IIM Amritsar in the domain of finance is also articulated. I hope that this issue of Vitta Artha, like the previous editions, adds value to its readers and thus augments their interest and inquisitiveness in the enriching domain of finance and economics.

Ms. Seema Nayak is currently associated with NCDEX in the Chief Compliance Officer (CCO) capacity. She has been associated with NCDEX for 5 years. Here are some of the things we learnt from her work at NCDEX on the topic of the potential of Agri commodity derivates in India.

Question:WhatareAgri-Commodityderivatives,andwhatisthecurrentscenario of thatmarketinIndia?

I will take a different approach to answer this question; the answer you would be expecting is that the value of derivates is derived from an underlying commodity, and these would be traded on a regulated platform called an exchange, but let's look at a different perspective that will help us understand this bet-

ter. Let's look at the purpose of an exchange. Price discovery is at the heart of any exchange, which refers to determining a common price for an asset. In our case, it happens to be an Agri commodity derivative. Price discovery happens every time a seller and a buyer interact in a regulated exchange space, so because of the efficiency of the futures market and the ability for instant dissemination of information, bid and ask prices are available to all participants and are instantly updated across the country. This makes it fair and transparent, and it is a vital function of an exchange. Another key function of the commodity market is risk management. Since derivates are contracts for the future you enter into today, to buy or sell at a future date, this helps at least one party to free itself of a specific risk.

Let's understand this with an example of McDonald's: they need a constant supply of raw materials like potatoes for its fries. The price of the French fires is more or less fixed throughout different seasons irrespective of the cost of the potatoes, which keeps fluctuating. This can have an impact on the profits of the company, which makes it a risk. But if McDonald’s was to enter into a futures contract to buy potatoes at a fixed price decided today, it would be freed from the risk of change in the price of potatoes and assured of the supply. Similarly, the farmer who is the seller in the contract is assured of a fixed price, so when the harvest is ready, both the parties' risk is addressed by one transaction, which is a win win. That is the derivatives market for you in a nutshell

Now coming to the second part of the question; clearly, there is a huge potential for the Agri commodities market in India, and we are not even scrapping the bottom of the proverbial barrel as of now. There are multiple reasons for that, but I will majorly focus on a couple of issues as of now. The first is the lack of awareness amongst the policymakers and even stakeholders about the economic utility of the exchange. The second one is the inherent state of Indi-

an agriculture which is quite different from other countries. There is a lot of fragmentation and poor peripheral infrastructure, so this becomes a significant hurdle for the farmers to produce in massive quantities keeping the same quality, which would be a prerequisite to using the exchange platform. But given the agrarian economy we are, it is only a matter of time before we see the boom that it deserved to have.

Question:Couldyoushedsomelighton whytherehasbeenadecliningtrendin thetradevolumesofAgricommodityderivativessincethe201113periodwhenit wasatitspeak?

Turnover is a function of participants and the products. The exchange saw a considerable decline in members post the SEBI FMC merger. This was because of the misconceptions people had with SEBI as a regulator; so, post the merger we saw that 40% of the members surrendered their membership. After this also the exchange was hit with demonetization which had a large impact on physical markets. We saw the lowest turnover around that time. Also lockdown took everyone by surprise, which impacted the market severely. Another factor is the repetitive product bans which have been imposed which have shattered the confidence and lowered the turnover significantly of the physical markets in India. This impacts the ability to introduce new products to the exchange, yet as compared to 2011 13 we now have a wider product basket. We have added options, index based products and also added products in the non Agri space. These products do hold a lot of promise and with time these markets will grow. An economy like India, whose Agri sector has perceptible global impact with it being the largest exporter for a certain commodities, the Agri derivatives market has a major role to play to unleash the latent potential of Indian Agri markets. The Agri market is critical for financial

inclusion, this is important since it helps to reach out to the last mile stakeholder which is the farmer

Question:Whataresomeof thetriggers inyouropinionwhichwillresultinanincrease inAgri- commoditytradinginIndia?

In India, the policy related matters are considered from a very subjective perception. Clearly, one of the foremost objectives and perhaps an ongoing objective is to equip the policy makers to give them deeper understanding and data driven quality research on Agri commodity market such that it can support a regulatory regime which will help the Agri Commodities derivatives space to develop and prove its utility. If you have a look at models of other countries, say China, the Agri markets witnessed a flip in growth post the government mandated the public sector units to participate in the commodity exchange platform. The government also started making its purchases through the commodity markets. In India, we have the public distribution systems which acquire a lot of Agri commodities, and we have the government agencies procuring at MSP. All that procurement could be done through the exchange space. Not only would that add transparency, but it would also help monitor and regulate the purchases, which is a win win. When government buys at MSP they store the commodities at huge government warehouses and then there is a surplus of the product and if not stored properly, it can lead to a lot of wastage. All this could be avoided if done through an exchange platform, which could give a huge boost to the commodities market. Finally, enhancing the institutional and even foreign participation will help broaden the reach. In fact, agriculture is the backbone of Indian economy, and the commodities exchange can play a huge role in unshackling the farmers, ensuring social and economic prosperity to the country

Question:Istheinformationasymmetry oneof thekeyfactorsandarethereapprehensionsthatthegovernmentcurrentlyhas?Isthereaneedtoeducatepolicy markersmoreaboutthis?

Agri Commodities is a very sensitive space, that is the reason why regulators tread with caution, which is understandable. But you have to open up the markets a little bit to let it come to its own potential. We have to reduce the artificial interferences. If you impose a price, then there is hardly any price discovery. Then there is no purpose of having a price discovery at all. When I talk about the regulatory regime I divide it into two parts, the first being at the ministry level and second at the SEBI level. Where we are talking about allowing participation of different kinds of stakeholders, it’s important that all stakeholders are allowed to participate because you are replicating the physical markets. There have been efforts regarding this. We have started “eligible foreign entity” but the rules around this are a little cumbersome and it’s not incentivising the foreign exchange to participate on the Indian platform. In fact, the irony is that many of the Indian institutions will hedge their currency risk if there are into exports, but you will rarely see any corporation hedging the commodity price risk. RBI has issued a circular advising bankers lend in order to encourage the corporation to hedge the commodity price risk. Similarly, SEBI has also issued a circular to its listed companies requiring them to disclose their hedge positions in their annual reports. While these are small steps, we need to take large steps. In other countries, it is seen that they use hedging as a form of risk management which is so logical, and it breaks me that corporates in India are not using it. Some corporates in India which hedge, do it on international exchanges because the participation process in Indian exchange is tough and has its limits: you can’t

take a position beyond a certain limit because you can impact the price movements. We call it as OI limits or Open Interest limits. These problems need to be addressed, and that is the area which needs to be worked on.

With an abrupt disruption of the contracts, the hedged positions were rendered negate and they were fully exposed to the price volatility suddenly. With the loss of the price protection that was ensured to the farmer, they were again at the mercy of the middlemen in the form of traders, money lenders etc and the situation was further aggravated because now they didn’t have an efficient price discovery mechanism, nor did they have a risk reference price Action price is used as a reference price; so they use it for decisions like crop sowing or pricing of the produce. Even people who do not participate in the exchange will use it as a reference for these purposes. This was completely taken away, and if you look at other market participants the value chain participants, the institutional participants, the legal participants, the banks all were adversely impacted. Let’s look at the rationale. We do have any official confirmation behind this, but the media indicated that it was an attempt to control food inflation. The hypothesis that the future market price drives the prices up itself is vexatious, and you don’t have to believe me or take me at the face value when I am saying this. There are reports from multiple notable economists who have conclusively established that price rise cannot be attributed to futures trading. Let’s look at a real life example. Channa futures were suspended in August 2021. The prices of Channa dal and its related products in the retail markets were ac-

Question:Wesawarecentbanonderivativesof certainagriculturalcommodities suchaswheat,chana,mustardseeds,and theirderivatives,soyabean,etcamidfood inflation.Whatisyourtakeonthis?

tually higher in the following weeks. Clearly, if the purpose was containing prices, it was not served. Similarly, another example, Mustad was suspended in October 2021. The retail price of mustard remained at the higher levels. We know that price is a function of multiple economic factors and has no correlation with futures trading. The futures platform is at best a messenger, not the price setter. Let me give you a coronary: so if you point that if the prices are rising and you go and close a physical mandi, then there is no point. Similarly, we are an electronic market a place for price discovery. We cannot contribute to the price rise; so suspending the futures trading to control price rise is totally illogical. I hope people understand that what they are trying to achieve they are not going to get by suspending future trading. They are only causing more and more harm; what it does is that it shatters the confidence of existing market participants. We can see that in equity markets when there are issues pertaining to the market, certain individuals are banned. Have you ever seen that a company is banned from trading? Hardly. How can it be any different in commodities market? So, if you find questions related to market integrity, you take actions accordingly, and banning the commodity is not the solution.

Question:NCDEXalongwithitsInvestor Protection Fund Trust has recently launched thefirstcallcentreforfarmers andfarmerproducerorganizationstoimpartcompleteknowledgeaboutagriculturalderivativesandrelatedmarketinfrastructure services. What impact do you foreseethisbringinginthenear-andlong termfutureandhowreceptivedoyoubelievethefarmersandtheirorganizations wouldbetothisservice?

I will answer the question in two parts. First, why we started this. NCDEX has always been committed to the cause of bringing the futures to the farmers, one of the gaps that we identified in bringing the farmer participations was that the famers would have queries and they would not know whom to contact for immediate resolution, and if the query remains unresolved for long then they would put the thought of using an exchange on the back burner. So, it had to be a one stop solution for all queries, which means only the exchange was in the position to do it. That was the reason to introduce the NIKCC or NCDEX ITF Kissan Call Centre, it is our attempt to address this gap. NIKCC addresses queries in real time, and also tells them about the benefits, like price discovery. This is also an opportunity to build deeper connections with the farmers which is clearly our objective of reaching the last mile stakeholder.

Coming to the second part, we have many ambitious plans for the future. It may be too early, but we want to be a one stop solution to all farmer queries for which we will have to do some backward and forward integration. When I say backward, we want to collaborate with Krishi Vigyan Kendra to provide information about the pre sowing part to the farmer. Similarly, we extend our reach within the financial ecosystem to provide lending. So, these are the two things we want to build on. We also have put in lot effort to increase our ground presence given the fragmented nature of the Indian agriculture system which will help further familiarise the farmer about the exchange.

IIM Amritsar

IIM Amritsar

ment. The survey further highlights the fact that as many as 84% of such enterprises are ‘Own Account Enterprises’ i.e. individual entrepreneur driven businesses not employing any hired labour.

The COVID 19 pandemic was particularly hard for the MSME sector. According to a survey by SIDBI 67% of MSMEs had to temporarily shut down in FY 2020 21. The situation could have been a lot worse had the government not stepped in with aggressive relief measures for the sector. As the post pandemic recovery is underway, the sector is once again faced with old questions of stagnation, low productivity, and market access. Lack of access to formal sources of finance continues to be the most important impediment to growth While the slew of policy measures by the government and the RBI in the past decade and a half have most certainly given a boost to the sector, a lot more needs to be done to expand the reach of the formal financial institutions while at the same time maintaining the asset quality.

The 73rd round of the NSS survey of ‘Unincorporated Non Agricultural Enterprises’ carried out in 2014 15 is by far the most comprehensive data on MSMEs in India. According to the survey, there are 63.4 million enterprises in the country with 63.05 million units in the ‘Micro’ segment, 0.33 million in the ‘Small’ segment, and another about 5,000 in the ‘Medium’ seg-

At the upper end of the spectrum i.e. the larger firms within the MSME sector, one sees a similar story of stagnation. The Economic Survey 2018 19 in its discussion about the MSMEs had drawn attention to the ‘dwarfs’ in the Indian Economy i.e. firms that are more than 10 years old but have not grown beyond 100 employees. According to the survey, while such ‘dwarfs’ account for more than 50% of total manufacturing firms in the organised sector, their contribution to the Net Value Added is a meagre 7.6% and their contribution to total employment is only 14.1%. The average number of workers employed by 40 year old plants in India is the same as those in 5 year old plants. As a comparison, in the USA an average 40 year old plant employs 8 times the number of workers as compared to a 5 year old plant, and in Mexico, the employment in 40 year old plants is twice that of an average 5 year old plant.

Weak legal and financial institutions may be one reason for the stunted growth of the MSME sector. A World Bank project appraisal memorandum for funding of the RAMP (Raising and Accelerating Micro, Small and Medium Enterprise Performance) Program of the Government of India notes that financial institutions are wary of lending to the MSME sector primarily on account of lack of adequate collateral and information asymmetries in assessing creditworthiness.

An IFC Report on Financing India’s MSMEs dated November 2018 had estimated that between 2010 and 2017 the demand for debt from the MSME sector had grown from Rs. 9.9 trillion to Rs. 36.7 trillion.

However, despite several measures by the Government of India and the RBI for improving financial access to the MSME sector, the supply of credit from formal financial institutions continues to fall short of demand. Total credit supply has increased from Rs. 7.0 trillion to Rs. 10.9 trillion between 2010 and 2017, thus leaving a credit gap of Rs. 25.8 trillion.

Over the last few years, the government of India has taken up a wide array of policy measures to improve access to finance for MSMEs. The MSME Act 2006 has been major enabling legislation around which several regulatory and institutional facilitation of MSMEs has become possible. At the last count, the website of the Ministry of MSMEs listed 28 direct government support schemes for the sector. The RBI has been trying to increase the supply of credit to the sector through several measures such as the classification of MSME loans under the category of priority sector lending, the introduction of TReDS (Trade Receivables Discounting System) platforms, strengthening the reach of Credit Information Companies and launching the Credit Line Guarantee Scheme for the MSMEs. The MUDRA (Micro Units Development and Refinance Agency) loan scheme has tried to address the credit needs of the micro and small spectrum of the MSME sector. Streamlining the debt recovery mechanism through various amendments in the IBC (Insolvency and Bankruptcy Code) 2016, the creation of CRESAI (Central Registry of Securitisation Asset Reconstruction and Security Interest of India) are steps to increase the confidence level of banks and NBFCs while lending to potentially high risk MSME businesses.

Some of these schemes have been well received by the MSME sector. For example, the Udyam Portal has registrations from 8.4 million MSME units. This

promises to be one of the largest sources of data on MSMEs in the times to come. The MUDRA loan scheme has extended cumulative support of Rs. 15.52 trillion to 295.5 million loan accounts over 6 years of operation. Through TReDS platforms in FY 2021 22 MSMEs were able to discount invoices worth Rs. 360 billion at a borrowing cost of 4 9% as against the cost of 12 15% they would have usually paid to the banks.

While the numbers are impressive, a lot more needs to be done. The total credit to Micro and Small enterprises has steadily declined from 13% of total non food credit in January 2016 to 11.78% in January 2022. In the case of TReDS, only 36% of the identified buyers have so far registered on the platform since 2017 despite persistent efforts from the government.

Most of these policy initiatives require MSMEs to be familiar with the filing of applications, compliance reports, and other procedures in online mode. The Fintech firms are leading the spurt in designing innovative financial products, outreach to customers, appraisal methods, and quick and low cost processing of applications. However, not all MSMEs, especially in the micro and small segment are equipped to and comfortable with the digital mode of operation.

The language of these digital access platforms being predominantly English also poses a challenge to the

Stagnation in Credit flow to the Micro and Small Enterprises Source: RBI Monthly BulletinMSME promoters. There is an urgent need to make these digital interfaces available in all the major regional languages in the country.

While technology can help in reducing transaction costs and speed up the processes, it can also act as a barrier in many ways. An RBI Working Group study on digital lending puts the total lending through digital channels at a mere 6.04% of the total number of loans and 2.07% of the amount disbursed for Scheduled Commercial Banks (SCBs). NBFCs have done better on this front by disbursing 10.87% of amount using digital channels to 53.05% of loan accounts. However, the share of NBFCs in total loans to the MSME sector is a mere 10%.

The second issue that hampers access of MSMEs to formal sources of finance is the information asymmetry that persists in the credit market for MSMEs. MSMEs often function in hyper local geographies, information about which is either not available or costly to acquire. Governance mechanisms in MSMEs and reporting and compliance standards are often found wanting. Promoters are often first time entrepreneurs and do not have any track record of past businesses. Shortage of capital would also mean that an asset light model of operation is preferred. All these factors make appraisal and lending to MSME projects a challenge. Banks, NBFCs, and especially the Fintech companies in their pursuit of speed, volumes, and reduction in transaction costs have been following some innovative methods of appraising project viability and credit worthiness of promoters:

1. Apart from traditional analysis of financial statements, lenders are using bank statements, POS devices, and data from other digital modes of payment to understand the profitability of enterprises. Thanks to the evolving digital payments eco system lenders can have more reliable and high frequency information

on the business to structure cash flow based lending products.

2. Personality traits of promoters can be used as indicators of their ability to make business profits and willingness to pay. Psychometric tests of promoters are being used for assessing these aspects as part of the appraisal process.

3. Some fintech companies are combining the social media footprint of the promoter with data analytics to understand the character of the promoter.

4. Appraisal can also include an analysis of the social network of the promoter such as family members, friends, neighbours, and their businesses. Lenders also get feedback from customers and suppliers of the business to get information on the dealings of the promoter.

5. Traditional lenders such as banks and NBFCs need to explore new distribution channels. Fintech companies and informal money lenders have a deeper reach and are more flexible in terms of the structuring of the products, documentation, and compliance requirements relying more on social pressures for the recovery of loans. Such channels can be formally used by the banking sector. Some structures analogous to the SHG Bank Linkage Program can be explored especially for meeting the credit requirements of the micro and small sector.

However, while doing this, it is important to heed the warning given by an article by William Magnuson that the next crisis may not originate from the Wall Street but from the Fintech firms in the Silicon Valley. The report of the RBI Working Group on Digital Lending notes that currently the fintech companies are being governed under the existing laws and rules such as the Banking Regulation Act (1949), RBI Act (1934), Companies Act (2013), Chit Funds Act (1932) and a host of state level acts for money lending. The report stresses the need to strengthen the legal and regulato-

regulatory framework keeping in mind the specific nature of the Fintech business such as enforceability of supervision, the risk to financial stability on account of the Fintech sector, and its need for continuous innovation, both in technology and ways of doing business. The report also emphasises the need for looking into issues such as technology standards, consumer protection, data privacy and security, and the extent of transparency in the algorithms used by the Fintech companies without affecting their competitive advantage.

The challenges faced by the MSMEs are multi dimensional. Lack of access to finance is an important factor. Diversity among the MSMEs is seen not just in terms of size but also in the sectors, product lines, geographical areas, and structure of businesses. The interstices of the economy in which MSMEs operate are spaces replete with contextual richness. If formal financial institutions are to make themselves more accessible to MSMEs, they will have to look beyond standard financial products and traditional delivery mechanisms. A judicious mix of flexibility and speed, with innovative ways of keeping a check on the quality of assets being created, will be the key to success. The financial sector, while retaining its prudence, will have to get as ‘jugadu’ as the MSMEs they hope to target.

1.The Indian Express, February 8, 2022

2.Hsieh, C. T., & Klenow, P. J. (2014). The life cycle of plants in India and Mexico. The Quarterly Journal of Economics, 129(3), 1035 1084.

3.Ayyagari, M., Demirguc Kunt, A., & Maksimovic, V. (2017). SME finance (No. 8241). The World Bank. 4.International Bank for Reconstruction and Development. (2021). Program Appraisal Document on a Proposed Loan in the Amount of US$500 million to India for a Raising and Accelerating Micro, Small and Medium Enterprise Performance (Report No. PAD4243). The World Bank

5.International Finance Corporation (2018) Financing India’s MSMEs: Estimation of Debt Requirement of MSMEs in India. The World Bank

6.The Financial Express, March 22, 2022

7.RBI Bulletin

8.The Financial Express, May 4, 2022

9.RBI (2021). Report of the Working Group on Digital Lending Including Lending Through Online Platforms and Mobile Apps

10.RBI (2019). Report of the Expert Committee on Micro, Small, and Medium Enterprises

11.International Finance Corporation (2018) Financing India’s MSMEs: Estimation of Debt Requirement of MSMEs in India. The World Bank

12.The Economic Times, September 19, 2017

A continuous economic crisis that started in 2019 is now affecting the island nation of Sri Lanka. Since the nation's independence in 1948, this has been the most significant economic catastrophe. As a result, there was never before seen inflation, almost no foreign exchange reserves, a shortage of medicines, and higher prices for necessities. The calamity is thought to have been exacerbated by tax cuts, money printing, national plans for organic farming or conversion to organic agriculture, the 2019 Easter Bomb, the COVID 19 Pandemic, and several other amplifying events. The ensuing economic situation in Sri Lanka in 2022 catalyzed the protest.

As said by an Asian Development Bank working paper in 2019, “Sri Lanka is a classic twin deficits economy; twin deficits signal that a country’ s national expenditure exceeds its national income, and that its production of tradable goods and services is inadequate.”

The country has been grappling with political instability for ages. The COVID 19 Pandemic decimated the Sri Lankan economy, but the massive tax cuts Rajapaksa promised during the 2019 election campaign and executed months earlier hastened the current issue. Due to the virus' destruction of the country's prosperous tourism economy and remittances from

foreign employees, rating agencies have pushed Sri Lanka downgrades, virtually cutting off Sri Lanka from the global financial markets. Foreign exchange reserves were decreased by almost 70% in just two years due to the collapse of Sri Lanka's debt management program, which depended on access to these markets. The Rajapaksa administration's proposal to outlaw all chemical fertilizers starting in 2021 a decision that was later overturned also hurt the nation's agricultural industry and caused a decline in the crucial rice crop.

As of February, the nation's reserve was at just $ 2.31 billion, but its debt, including the $ 1 billion International Government Bond (ISB) due in July, must be paid off by 2022. It costs $4 billion. The majority of Sri Lanka's external debt, worth $ 12.55 billion, is represented by ISB. The Asian Development Bank, Japan, and China are additional significant lenders. According to the IMF, government debt has "unsustainable levels," which states that the nation's foreign exchange reserves are insufficient to cover short term debt obligations.

Despite mounting concerns, the Rajapaksa regime and the Central Bank of Sri Lanka (CBSL) have consistently declined calls for IMF assistance from experts and opposition leaders. The administration did, however, ultimately come up with plans to approach the IMF in April after Russia invaded Ukraine in late February and the rise in oil prices. IMF representatives announced on Thursday that talks with Sri Lankan authorities on a potential credit package will start "in the coming few days." Before approaching the IMF, Sri Lanka drastically depreciated its currency, encouraged inflation, and worsened things for those who already experienced challenges and long line ups.

Rajapaksa is additionally looking for assistance in China and India, particularly for oil. As part of the $ 500 million credit line negotiated with India in Feb-

ruary, fuel shipments are planned. Sri Lanka and India have already agreed to import necessities like food and medication with a US $ 1 billion credit line. The Rajapaksa administration has asked New Delhi to contribute at least US $ 1 billion.

China agreed to swap the US $ 1.5 billion with CBSL, gives the government a US $ 1.3 billion syndicated loan, and then offered the island nation a US $ 1.5 billion credit line and a second loan of up to the US $ 1 billion.

Due to a severe economic crisis, Sri Lanka, a significant player in the global tea market, could not export tea, which provided India's tea industry with an opening to enter the market. North Bengal tea traders claim that India may have new market opportunities due to the current circumstances in Sri Lanka, where tea cannot be sold. If the situation in Sri Lanka persists, the Indian tea market will prosper.

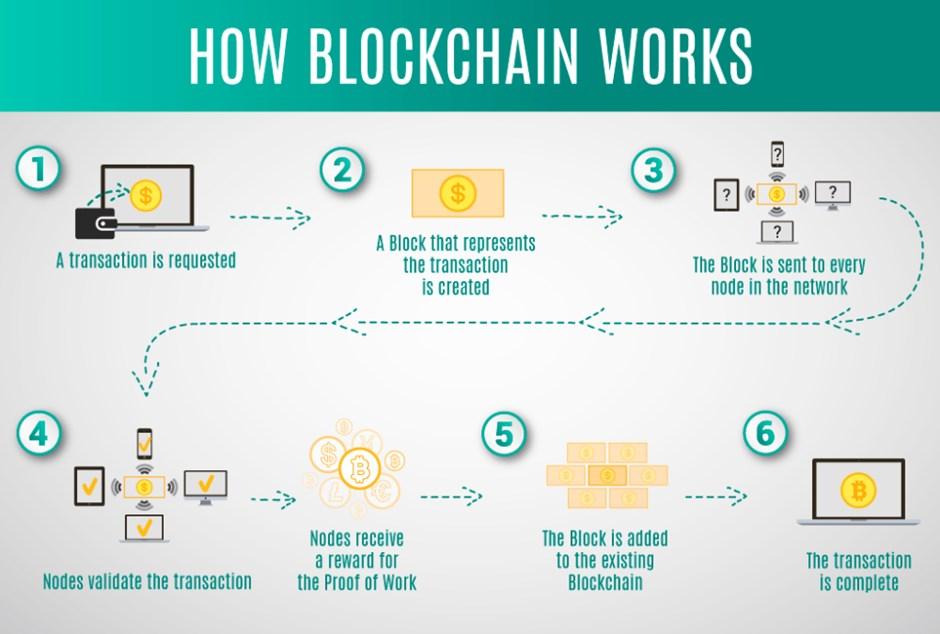

The process of encrypting and decrypting a piece of data is known as cryptography. In simple terms, the process of coding and decoding the information. This simple procedure, which has been utilized for hundreds of years, is suddenly transforming the globe in ways we can't even fathom. The blockchain was created due to this simple encoding and decoding procedure, and Crypto currency is based on blockchain technology. It will be myopic to conceive of Crypto only in monetary terms while discussing it. The blockchain has numerous dimensions in its applications due to the technology involved. You're probably wondering what the blockchain is? I will briefly summarize this. A blockchain is a chain of blocks that contains information, and this way of storing information is why everyone in the tech world is crazy about it. It was introduced in 1991 by two researchers, Stuart Haber and W. Scott Stornetta. But why is it so crazy? It's one of the safest ways to store information in a world where cybercrime is rampant, but it's decentralized. That is, one user or group has no control over the information and cannot be hacked at this time. So, where do you think you can put this elegant technology? The application is only bound to your imagination.

There are plenty of advantages that a cryptocurrency provides…... let's discuss some of them.

Decentralization means that no single entity or a group can control the blockchain network and, in our case the cryptocurrency network. So, there can't be frauds and scams which were being consistently done in our financial systems, especially the banking system, as the power is distributed throughout the system. Due to this decentralized nature, people don't have to ask for permission from the financial authorities to become part of this cryptocurrency network.

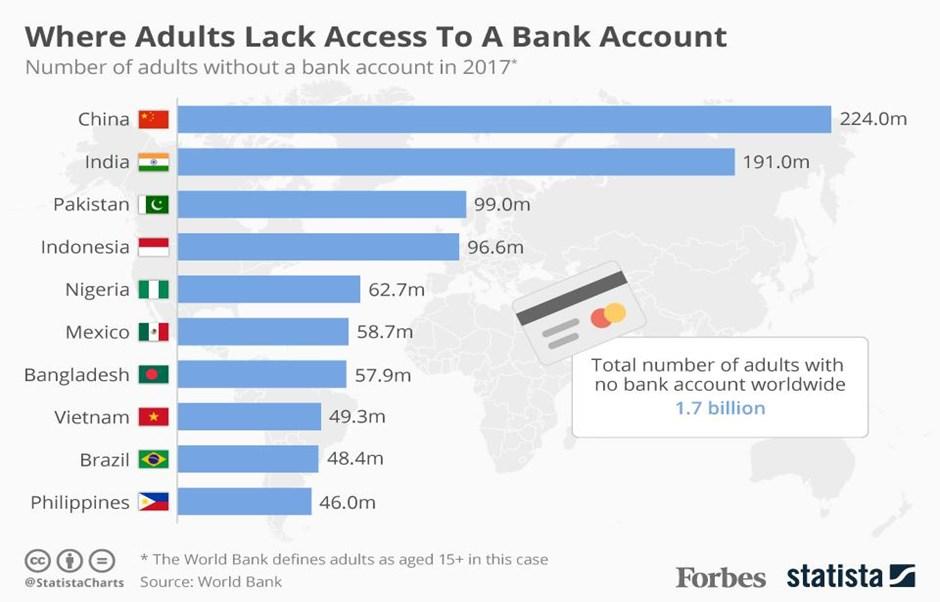

There are many people in the world who don't possess bank accounts or don't have sound financial services available in their region. But with Cryptocurrency, you don't require any of these things. All you need is a smartphone with internet connectivity, and you can use this technology for financial transactions.

Each block in the blockchain possesses a unique private key that can be verified by utilizing a public key. If someone tries to hack or change the data in the blockchain, the unique key of the block becomes invalid.

ecosystem is expanding, the ease of transactions will increase exponentially.

Metaverse is a virtual reality environment in which users can interact with digital objects and with one another. In terms of Gen Z and Millennials, it's similar to GTA Vice City (Grand Theft Auto) but far more serious. Because the Metaverse is decentralized and infinite, Cryptocurrency could be extremely useful in purchasing and selling assets in the Metaverse. People will be investing more in the Metaverse as its market capitalization grows, as shown in the below bar chart, and Cryptocurrency could be its primary mode of transaction due to the decentralized nature of both the Metaverse and the Cryptocurrency, as they complement each other.

So, in general, terms, if some tries to tamper with the transaction related data in the cryptocurrency network, the individual has to hack the entire blockchain or the exchange itself, and it is really difficult to do that compared to the current financial platforms we are using.

Crypto transactions are simpler, less expensive, and more private than most other types of transactions. Anyone can send and receive cryptocurrencies using a simple smartphone app or digital Crypto wallet. The cost of transaction is negligible to none in some cases. It is not always necessary to have a bank account in order to use Cryptocurrency but let's say you have a bank account; then you can use cash to buy bitcoin at an ATM and then send the coins to someone's phone. It is as simple as that, and as the

Cryptocurrency is decentralized and unregulated, it makes its nature anonymous, and the crime syndicates and other criminals can use it to fund their criminal activities and money laundering. There is a high chance that it will pose threats to national security and the government agencies need to be proactive to counter these threats

(Image Source: https://blog.chainalysis.com)

The price discovery of Cryptocurrency is still a big issue. The real value of the Cryptocurrency cannot be determined on the exchanges and is subjected to get highly influenced in the early phases; for example, one tweet of a celebrity (in our case Elon Musk) can influence the entire exchange. The cryptocurrency market is highly volatile, and if you trade in Cryptocurrency, then you probably understand that in the current scenario, the value of Cryptocurrency keeps on changing on an average of 5% on a daily basis which is not suitable for any currency. There should be some stability attached to any currency, and the bid/ask spread shouldn't be high.

As the financial authorities do not regulate the Cryptocurrency market, there is no shield or front line of defense to protect you and your business in case things go south. No central authority enforces its value, which also leads to price volatility, as discussed in the earlier case. Even Warren Buffet made a statement "It doesn't make sense. This thing is not regulated. It's not under control. It's not under the supervision [of] any…United States Federal Reserve or any other central bank. I don't believe in this whole thing at all. I think it's going to implode." When the "Oracle of Omaha" (arguably the greatest investor of all time) makes a statement like that, then things need to be taken seriously.

A huge chunk of government revenue comes from taxation, and in the case of Cryptocurrency, almost all the countries are unable to get tax gains from Cryptocurrency as they are unable to tax them so, if we move away from using conventional banking services to using Cryptocurrency than governments will lose a massive source of tax revenue. As shown in the below mentioned table, there are multiple flows or sources of tax revenue for the Government, and if the people or any corporate legal entity starts using Cryptocurrency for financial transactions, then the revenue gain that the Government earns through these sources will start diminishing.

(Tax collection by the Indian Government in crores, imagine the Government's losses after Cryptocurrency is in the mainstream) (Image Source: https://www.financialexpress.com)

It is pretty much clear that Cryptocurrency is here to stay, but which Cryptocurrency will survive in the long run; we don't know. In the late 90s, people used to talk about the "internet" in the same way. Then the "dot com bubble burst' happened, and there was a huge correction in the market. But the "internet" is still here with us along with really spectacular internet based companies. Cryptocurrencies are heading in a similar direction. With any new opportunity, the threats and risks are always involved, and it is upon us how to utilize and tackle those risks to our advantage.

"When it's done right, ESG investing is good business."

Environmental, Social and Governance investing has taken the financial world by storm, and it has received a fillip in the pandemic years. Pandemics and environmental challenges have come to be viewed similarly by investors in terms of impact. As Covid 19 presents the first major sustainability challenge of the 21st century, the corporate world has awoken to its increased relevance in the upcoming years. The pandemic has proved to be a catalyst for ESG concerns worldwide, in terms of where investors want their funds to be parked and how companies adapt to be more ESH investment friendly. Thereby, it becomes important to understand the relevance of this trend on the investment as well as the corporate world, its impact on how companies go about their businesses, and what the future beholds for the ESG way of investing.

But the pandemic has not been the only thing going forward for ESG investors or corporates. A host of other factors have been at play silently for years, further validating the spotlight that the trend is currently

enjoying. Some of these factors are: GDP, and in Sri

Mounting empirical evidence is driving the speed at which ESG concerns become material to corporates. A host of industry 4.0 technologies such as artificial intelligence, blockchain, and virtual reality are creating unprecedented levels of transparency. These shifts, along with changing regulations in some form or the other across countries, have enabled investors and other stakeholders to look beyond just publicly reported ESG data.

Emphasizing Freeman's stakeholder theory, key organizational influencers such as the media, public figures, or NGOs can increase the materiality of a sustainability issue to businesses. Given the hyper informational transparency that exists today, when these stakeholders disseminate evidence, they create narratives that change societal expectations from corporates and prompt action by regulators or investors. For example, the world's largest wealth fund Norway's Sovereign Wealth Fund with assets over one trillion dollars, declared that it's working on a strategy to ensure that its investments live up to the carbon neutrality goals set by the Paris Agreement.

Now that we have established the relevance of ESG let's take a look at its impact across various facets of the business world. As expected, the phenomenon is not limited just to investors or companies, but the entire value chain has become much more aware of these issues, including suppliers, employees and of course, consumers. The following points validate the same:

As per a BCG analysis, nearly 72% of European consumers reported choosing products that came in environmentally friendly packaging. Another 46% of consumers worldwide said that they would choose eco friendly products over a preferred brand if given a choice.

this. In its aftermath, the Investor Mining and Tailings Safety Initiative, formed by investors representing a cumulative $13 trillion in assets, called on nearly 700+ companies active in the mining extraction industry to routinely disclose information on their tailings storage facilities. This prompted the creation of the first global database of tailings dams.

Another BCG research revealed that nearly 67% of millennials expect their next employer's organization to be purpose driven and their jobs to have a societal impact. More importantly, such employees are also more willing to publicly criticize their employers' climate policies. Many such employees are forming ESG advocacy groups or submitting shareholder proposals to drive change on the ground.

In the investing world, investors perform two core functions with respect to the ESG trend. The first one is decisional. Investors have increasingly started to evaluate companies from an ESG perspective, apart from the usual standard financial metrics. These concerns now weigh heavily on portfolio construction and asset allocation. Which, in turn, determines where capital flows.

The second function is influential. Investors shape the market and the workings of organizations by pushing for greater transparency. Their control over capital flows gives them the leverage to do so. The Brumadinho dam disaster serves as a good example of

Going ahead, ESG investing seems to have a bright future and is set to fundamentally redefine how investments will be made in the future. We can expect more and more MNCs to adapt their practices in order to be ESG compliant. As mentioned above, this shift would not only be from an investor oriented push but due to pressure from all stakeholders, including employees, consumers, governments etc. ESG investing is set to play an important role in how the world as a whole, delivers on its sustainability promise.

But there are a few hiccups along the way. ESG funds tout their relatively strong returns. Yet, they don't make clear that the real drivers are sectoral characteristics, riding on global business cycles. For example, a heavy emphasis toward technology companies that have seen above average rates of growth can partially explain the above normal returns and not just ESG practices alone.

Procedure to create wealth management for Asset Managers, integrating the customized ESG mandate

However, the ESG trend will allow leading asset managers to carve out a differentiating niche for

themselves in the domain of portfolio construction In the upcoming years, the ability to create a portfolio that reflects how a client thinks about sustainable investing will transform the ESG product landscape. Personalized investment portfolios will be the way to go for many climate conscious HNIs, who wish to invest responsibly. Institutions, advisors, and individual investors will increasingly be able to express their views on what they want to own and act accordingly. This level of thematic customization would generally require an expensive and complex separately managed account (SMA) structure and the associated tracking and operationalization costs. But emerging mechanisms such as direct indexing and fractional ownership have broken down that barrier, granting such investors the weapon of "choice" at a very low price. The future will behold an era where asset managers will be able to build deeply personalized portfolios involving small sums and do so at scale while representing the client's preferences.

In our opinion, strong performance with regard to ESG factors such as carbon reduction & enhanced gender equality can unlock a significant positive impact for society, companies, and investors. We believe that consumers, activists, and employees all play a role in determining which ESG issues become material to the business, but companies & investors can become influencers in this materiality process. Adopting an 'always on' approach towards such aspired materiality allows investors to develop a competitive advantage by optimising performance with respect to issues that are material, both currently & in the future.

There is simply no denying that sustainable investing is indeed both messy & confusing as well as an exciting topic for asset managers, with the potential to stir

up the industry & develop new sources of competitive advantage. The scale will continue to matter, performance will always matter, and so will fees. But now, sustainability will matter as well. At its roots, the best investor has a deep desire in understanding how the world works. Markets, economies, & people are all connected, as they always have and only now can we put a name to it ESG.

We think that integrating these concepts will be key to how successful they become, while acknowledging that there is grave confusion regarding the integration of material ESG info into the investment decision making process. The translation of data in the form of ESG scores to meaningful cashflow impact is a rather new line of thought for many, and the lack of empirically established links doesn't help the cause either.

In the end, we believe that in order to effectively integrate, investors need to acknowledge ESG info for what it is a highly flawed yet meaningful source of data that operates alongside the traditional investment criterion. Much like other data sources be it credit scores or investment notes, ESG data is not be taken at face value; rather, it is imperative that asset managers should engage in doing their own homework aided with the triangulation of numerous sources of internal & external information, allowing for increased confidence in their decision making process as well sift the credible information from noise.

1.https://www.bcg.com/en in/publications/2020/ esg commitments are here to stay

2.https://www.bcg.com/en in/capabilities/social impact sustainability/how sustainable finance is shifting future of investing

3.https://www.mckinsey.com/~/media/McKinsey/ Business%20Functions/Strategy%20and% 20Corporate%20Finance/Our%20Insights/Five% 20ways%20that%20ESG%20creates%20value/Five ways that ESG creates value.ashx

4.Formankovaа, S., Trenz, O., Faldik, O., Kolomaznik, J., & Vanek, P. (2018). The future of investing sustainable and responsible investing. Маркетинг і менеджмент інновацій, (2), 94 102.

5.Blank, H., Sgambati, G., & Truelson, Z. (2016). Best Practices in ESG Investing. The Journal of Investing, 25(2), 103 112.

6.Van Duuren, E., Plantinga, A., & Scholtens, B. (2016). ESG integration and the investment management process: Fundamental investing reinvented. Journal of Business Ethics, 138(3), 525 533.

7.Kotsantonis, S., & Serafeim, G. (2020). Human Capital and the Future of Work: implications for investors and ESG integration. Journal of Financial Transformation, 51, 115 130.

8.https://m.economictimes.com/small biz/money/ the need for esg pluralising development through environmental social and corporate governance investing/articleshow/81360222.cms

be better understood by analyzing its inextricable linkage with geo political events Any geo political crisis carries grave and widely impacting economic implications. In the context of constantly changing trade partners, every economy affects the other. Thus, a conflict between two countries affects not only them but also the bystanders.

As the world sped out of pandemic, the rise in level of activity invigorated the global economy. The rebound resulted in a strong post pandemic recovery but it was unevenly spread across the globe. The sharp decline in consumption, government stimulus packages and increased savings placed huge disposable incomes in the hands of people. As a result, the demand sky rocketed, challenging the global supply chain.

This mismatch of demand and supply coupled with labor shortages and energy crisis fanned inflation all around the globe. The inflation in the US hit a four decade high in January 2022 when the U.S. Bureau of Labor Statistics reported that Consumer Price Index (CPI) rose 7.5% over the last 12 months. In Europe, the inflation rose to record level of 5.1% in January 2022, up from 0.9% a year earlier. Inflation in UK climbed to its highest level in 30 years where the CPI in January 2022 rose by 5.5% in the 12 months period. It was at such level in March 1992, when it stood at 7.1%. A similar story came from Canada as well where Canada's CPI rose 4.8 per cent on a year on year basis in December 2021, the highest since September 1991.

In such time where inflation already plagues major economies, it becomes crucial to examine the impact of the changing geopolitical equation on the global economy. The text book concepts of Economics can

After being battered brutally by the pandemic, persisting supply chain chokeholds and leaps in prices, the global economy is set to be sent on yet another bumpy ride as Russia and Ukraine engage in an armed conflict. When Russia on 24th February 2022, announced commencement of military operation in Ukraine, the global markets sank. Investors sprinted for the safe havens, fleeing equities after the news of the invasion came out. RTSI, which is a dollar denominated Index on Moscow Exchange nosedived, breaking the covid low of around 830 points. It sank 49.93% to a low of 614.19 that day. The MOEX Russia Index, the main ruble denominated benchmark index of the Russian stock market, closed at a 33% lower level, erasing $189 billion in a day. The FTSE 100 Index of the London Stock Exchange, dropped 2.5% as the markets opened, the French CAC 40 fell 4% and the Germany’s Dax faced worst day on 24th February 2022 since Covid 19 crash when it lost over 4%. The European STOXX 600 lost around 3% as well.

The brutal effects of the invasion crossed the European borders and reached Asia. Hong Kong's Hang Seng Index declined 3%. Korea's Kospi tanked 2.6%. Japan's Nikkei 225 lost nearly 2% and China's Shanghai Composite moved 1.7% down. The scene was no different in domestic market. It became the worst performer in Asia where Sensex clocked a decline of over 2700 points (4.72 percent) and Nifty settled 815.30 points below (4.78 percent).

The global stock market on 24th February bled and ended in red. It indicated market’s concerns about

serious economic repercussions including trade restrictions and further supply disruptions. Russia is a transcontinental country which is a key supplier of Oil, gas and raw materials. Compared to China however, which is world’s factory, Russia is comparatively less capable of crippling the world economy. Hence, the impacts of the conflict will be unevenly spread across the globe, intense for those who rely heavily on it and unnoticed in others.

Russia is the second largest producer of Natural gas globally after the United States. The European Union relies heavily on Russia as it imports 40% of its Natural gas requirements and about 25% of its oil from Russia. Europe’s gas markets are linked to Russia via a network of pipelines. Currently, Europe’s gas reserves stand close to 30 percent. Europe’s dependence on Russia to heat its homes has driven the prices of natural gas up as the supplies from Russia has been lower this year. Any further disruption in supplies will make the Europeans pay top dollar to keep their homes warm in the winter. Households spending greater portion of their incomes on fuel and heating will leave less cash for other goods and services, ultimately affecting the growth.

to enhance the capital base of the PSUs being monetized. The funds received may also be used to upgrade PSUs' technology, reducing their need for government aid and financial support. Involvement of private entities will expose the PSUs to extra resources for reinvestment, reorganization and expansion. It can

Russia is third largest oil producer in the world. Apart from Europe, China is a destination for its oil exports. Its oil exports to China has gone up since 2010. The oil prices spiked, with Brent crossing the $100 per barrel for the first time since 2014 after Russia engaged in direct military confrontation with Ukraine. The rise in fuel price affects everything. It not only places greater negotiation power in the hands of OPEC but also adds to the cost of production. Economies like India which import about 84% of its crude oil requirement is staring at an increased oil import bill. This will ultimately cost heavier on the pockets of domestic consumers.

Unfortunately, the ramifications of this conflict are not limited to oil and gas. Russia is world’s top wheat exporter and Ukraine is called the “breadbasket of Europe”. Together, they make up about a quarter of global wheat exports. Countries like Egypt whose consume more wheat than global average, get 85% of their wheat demand from Russia Ukraine. Ukraine exports more than 40% of its wheat and corn exports to Africa and Middle East. A Country like Lebanon, which is already in the middle of an economic crisis gets more than half of its wheat from Ukraine. Wheat and corn prices were already soaring. A further surge in prices can create social unrest. China has also recently become big recipient of Ukrainian corn.

Furthermore, Ukraine also happens to be the largest

Source: U.S. Energy Information Administration, based on Russian export and country import statistics from Global Trade Trackerexporter of Sunflower oil. India will suffer the most as it is the largest importer of Sunflower seed or safflower oil, crude followed by China.

Russia is top producer of precious metals like Palladium which is a key component in emission reducing devices in automobiles and is also widely used in electronics, dentistry and jewelry. Palladium prices rose by 25% just even before the conflict escalated into a war. The severe sanctions imposed on Russia including its exclusion from Swift Network carry grave consequences for the transcontinental behemoth. Nonetheless, the impacts of war are far reaching owing to how intimately economies are woven together. While it’s too early to gauge the full impact of this conflict on the global economy, this major geo political event raises serious questions about self sufficiency of major economies.

1.https://www.bls.gov/news.release/cpi.nr0.htm

2.https://ec.europa.eu/eurostat/ documents/2995521/14245727/2 23022022 AP EN.pdf/1bd1f78c b615 7052 7379 3129551900eb#:~:text=The%20euro%20area% 20annual%20inflation,up%20from%205.3%25% 20in%20December.

3.https://www.ons.gov.uk/economy/ inflationandpriceindices/bulletins/ consumerpriceinflation/january2022

4.https://www150.statcan.gc.ca/n1/daily quotidien/220119/dq220119a eng.htm

5.https://economictimes.indiatimes.com/ markets/stocks/news/russian stocks nosedive 20 as trading resumes on moscow exchange/ articleshow/89794446.cms

6.https://www.bloomberg.com/news/ articles/2022 02 24/russian stocks suffer third worst rout in history of markets

7.https://edition.cnn.com/europe/live news/ ukraine russia news 02 23 22/index.html

8.https://indianexpress.com/article/business/ market/equity markets live updates stocks shares bse sensex nse nifty russia ukraine war february 24 7787490/

9.https://www.eia.gov/international/overview/ country/RUS

10.https://www.eia.gov/todayinenergy/ detail.php?id=33732

11.https://www.wsj.com/articles/russian attack

“Double, treble, quadruple bubble, watch the stock market get into trouble...”

This famous adage by Garth Nix appropriately warns about the anatomy of a stock market bubble staring India and the prospects of this excessive valuation to end in tears.

The domestic stock markets have touched record high levels and generated high double digit returns during 2020 21 even as the country’s economy continued to face disruptions on the back of unparalleled levels of monetary and fiscal stimulus. Between 6th February to 30th September 2020, the Reserve Bank of India (RBI) had announced a total liquidity support of ₹11.1 trillion. Expansionary monetary policies had been adopted worldwide with an aim to bring down interest rates to near zero levels, drive economic activities through provision of cheap debts and massively scale up the purchase of assets resulting in a rise in direct participation of retail investors and witnessing an opening of over 1.43 crore Demat accounts during 2020 21.The availability of cheap money encouraged increased speculation from novice retail investors and high Foreign portfolio investment (FPI) inflow ,thus, contributing to the rising stock prices. With the temptation to make hay while the sun shines, Initial Public Offers (IPOs), Follow On Public Offers (FPOs) and rights issues increased manifold by 43.1% during 2020 21. According to RBI, the high amount of liquidity that has been injected into the economy to aid eco-

nomic recovery has had “unintended consequences” in the form of inflationary asset prices. India’s equity prices continued to surge, with the benchmark Sensex crossing 50,000 in January,2021 and on February 15,2021 Sensex touched a peak of 52154, a 100.7% increase from the slump just before the beginning of the nationwide lockdown on March 23, 2020. The BSE Sensex surged by 68% to close at 49,509 while the Nifty 50 increased by 70.9% to close at 14,691 on March 31, 2021.[1] This continuous rise in asset prices has been in stark contrast to the estimated 8% contraction in GDP in 2020 21, thus, posing the risk of a bubble formation.

A stock market bubble refers to an economic bubble wherein market participants inflate share prices to levels exceeding the company’s fundamental value including earnings and assets by a significant margin. It is created on the basis of speculative optimism or increased demand, rather than the real value of the financial assets. The central bank of India noted that the deviation of the actual Price/Equity (P/E) ratio from its long run trend reflects that the ratio has been overvalued, while measures of dividend yield also signal that markets are getting “overpriced”. According to the annual report prepared by RBI, Sensex is currently trading at a P/E ratio of 31.6 against a 5 year average P/E of 24.53. The turn in market sentiments “following positive news on the development of and access to vaccines and the end of uncertainty surrounding US election results” have also led to increased valuation of equities.[2]

This newfound liquidity fueling the stock prices in an environment where the real economy is collapsing has left little scope of doubt to examine whether the current stock market rally is rational or not. In India, with the unemployment rates sky rocketing, Debt to GDP ratio spiking and budget deficits broadening while the stock markets are still presenting a buoyant image, the country’s economy is threatened with the

VACHI St. Xavier’s College. Kolkatapossibility of a bubble burst. Sooner or later, these bloated asset prices shall exert inflationary pressures on the economy causing central banks to hike interest rates, lower the circulation of money and thus, dampen expectations of future bubble price appreciation. Massive sell offs causing decline in prices shall lead to greater negative effects on equity return. The stock market shall be in a state of mayhem, derailing any hope of recovery. The financial stability of the economy shall be brutally sabotaged with no significant improvements in economic growth.

To avoid wealth erosion and better navigate the bubble, an understanding of the five stages of a financial bubble i.e., displacement, boom, euphoria, profit taking and panic is essential. Displacement is the first stage that occurs when investors are captivated by a new paradigm, such as historically low interest rates. In 2020, RBI announced a repo rate cut of 40 basis points to 4% which is the lowest benchmark interest rate India has had since 2000 to mitigate the impact of Covid 19. Following a displacement, prices rise slowly but eventually gain momentum as more and more participants enter the market leading to a spur in speculation activities. During this boom phase, escalating market prices grab the eyeballs of many individuals. Cheap credit and quantitative easing program fuel the boom to levels such that in March 2021, the overall debt held by Indian households were valued at ₹43.5 trillion approximately. With valuations going through a roof and too many people itching to jump onto the bandwagon, the investors are lulled into false sense of security that should they wish to sell, they will easily find someone who would be willing to pay more. The euphoria stage is characterised by this conviction which leads to investments that are disproportionately higher than an individual’s risk appetites. As prices reach Utopian levels, some investors who are receptive to the warning signs of a possible bubble burst in near future start selling positions to lock in gains at the profit taking stage. With passage

of time, the bubble perforates which acts as the catalyst for economic recession. In the panic stage, asset prices descend rapidly as supply overwhelms demand. Investors and speculators faced with plunging values of their holdings become willing to liquidate it at any price.

As RBI flags risk of a bubble in Indian equity markets, the question that requires addressal is how should retail investors manoeuvre their way in a market that seems to disregard the turmoil on the economic front? While it is impossible for investors to insulate themselves completely from volatility, it is advisable to not let exuberance get the better of investment fundamentals i.e., diversification, asset allocation and rebalancing of portfolios. Another important strategy to safeguard investment from fluctuations is through staggered investments over time and Systematic Investment Plans (SIP) in a mutual fund spread with low correlation, in accordance to the speculator’s risk taking abilities. In the long run, SIP investments in mutual funds due to the benefit of rupee cost averaging can wipe out the creases left by the bubbles. At the moment, the Indian stock market seems to be rising rapidly after a period of hesitation during the second wave. Minor corrections are expected throughout the year, depending on the evolving Covid 19 situation, the pace of recovery of global and domestic economies and developments in global financial and liquidity conditions.

Thus, the efforts undertaken by the central bank to keep interest rates lower and engage in unconventional monetary policy to curb the economic downturn has emerged as a global policy concern. Given the evident disconnect between the glooming economy and booming markets, it is certain that the bloated asset prices may be coming to an end, leaving a trickier future impending on the horizon. With frothy markets sparking worries of bubbles in Indian assets, the only question that remains unanswered is, when?

1.India Today, 2021, RBI warns of stock market bubble: Should investors be worried?, viewed 25 July 2021, <https://www.indiatoday.in/business/story/rbi warns of stock market bubble should investors be worried 1809096 2021 05 31>.

2.Modak, S 2021, Rising stock markets amid GDP contraction pose risk of a bubble, says RBI, viewed 26 July 2021,<https://www.business standard.com/article/ markets/rising stock markets amid gdp contraction poses risk of a bubble says rbi 121052701358_1.html>.

3.Curran, E 2021, Pandemic Era Central Banking Is Creating Bubbles Everywhere, viewed 27 July 2021, <https://www.bloomberg.com/news/features/2021 01 24/central banks are creating bubbles everywhere in the pandemic>.

4.Khan, A 2021, Beware the equity market bubble: Experts raise the red flag, viewed 27 July 2021, <https:// www.newindianexpress.com/business/2021/jun/16/ beware the equity market bubble experts raise the red flag 2316821.html>.

.

different databases. I was also taught about how my work aligns with the Adobe global goals.

Ritikesh Kashyap MBA07 IIM Amritsar

I also got to meet with the Adobe director of International Accounting, for my final project presentation. It was a very rich experience working in such a big MNC and understanding its internal working and processes.

I interned at Adobe Systems India Pvt. Ltd. The tenure for the internship was 8 weeks (11th Apr’ 22 to 3rd June 22). I was selected as a Financial Analyst Intern at Adobe. I was working with the team ACE (Accounting Centre of Excellence), on the Global Fixed Asset management side. My role was to aid the team in their work and learn more about the company.

For the first week, I was just having an introduction session with the team. The real work started in the second week when I was granted access to different databases of the company. My mentor explained to me the working process of the company and what was the role of the global fixed account side in the organization.

My role during the internship period was in Global Fixed Assets management. I used the different databases to manage and maintain the fixed assets of the company. I used SAP, ARIBA, and SNOW database present in the company to manage the database. I was also assigned the task of dashboard maintenance for the company.

A few of the activities that I performed at the firm were P&L Analysis for the identification of fixed assets, safety stock capitalization, correcting the records of the assets, and reconciliation of assets from

My summer internship at Drewry maritime consulting Pvt ltd. has been one of the most gratifying and motivating experiences of my MBA at the IIM Amritsar. I interned in the Financial research arm of Drewry, where I worked as an equity research analyst. My project was to prepare the financial model and write an equity research report.

The company on which I had to work on was an LNG shipping company, and I had very little prior knowledge about this industry, so Drewry provided me with industry reports to help me out. I was given 3 weeks for understanding the company, prepare a story for the company, and project its future cash flows. I had to prepare the financial model for the company in these 3 weeks and then I had to write the equity research report. I was again provided 2 weeks to prepare the first draft after which my manager gave me some pointers on how to improve the report and what mistakes I was doing. The next 2 weeks were filled with small revisions and changes after which it went for publishing and the report was published within my internship tenure.

Apart from this report, I was also provided with the duty to track the LNG industry and report all the changes in the industry in the weekly meetings. As my project was over early I was also given the

opportunity to work on an update report for a company under the coverage of Drewry. My mentors, other employees, and staff members with whom I communicated were supported and helpful in my development as I was able to develop and maintain a genuinely positive and compassionate learning environment. Throughout the internship, there was an excellent blend of support and freedom. I’ve learned both the tangibles, such as technical aspects of the job and the intangibles, such as the importance of a strong work ethic and high work standards. It was a privilege to intern at Drewry and connect with well informed individuals with extensive expertise

I have been really interested in equities investing and trading since the last year of my engineering. I opted to do the CFA Course in order to have a better understanding and more extensive knowledge about the financial markets. After completing a year at a prestigious institute, I knew I would face challenges juggling ten subjects along with a rigorous MBA curriculum. Because it takes around 300 hours to study for the CFA Level 1 Exam and I started preparation in the month of April, I chose November as the best month for scheduling my exam. Here is how I prepared for my CFA Level 1 Exam. The first is Schweser's notes. They were really useful since they were much more concise and straightforward than CFA textbooks. Do not fall into the trap of referring to too many materials. I went back over the notes three times and completed all of the practice questions at the end of each topic. Because I wasn't familiar with the material, it took me the longest (around three months) to get through the first time. But it became faster the second and third times.

I am from an engineering background; hence, I know I have to give extra time and effort, especially to subjects like Financial Reporting and Analysis and Economics. Reading topics like Corporate Finance, Derivatives, Equity Investments was never a challenge to me because of my interests. However, Fixed Income Securities and Ethics are not difficult but bit tricky subjects. Ethics has significant weightage in the CFA

Level 1 exam, so a low score in this subject would significantly impact your score. Practicing ethics questions from the book 'Ethics in practice' would have an additional advantage. The second category includes all of the multiple choice practice questions included in CFA textbooks. The majority of these questions are extremely close to those on the actual exam. I went through all of the questions multiple times, so when I took the actual exam, everything felt quite familiar to me.

Talking about the CFA L1 exam pattern, it is not a speed based test like CAT. It tests your understanding, and sometimes spending time on questions is more beneficial than directly jumping on to answers to save time. Also, CFA L1 tests more concept based questions than real world calculations, so don't squander the last few days of your study time on lengthy calculation intensive problems. The third point to mention is the mock tests supplied by CFA to candidates. A month before my actual CFA exam, I took the simulated examinations to gauge my readiness. Mock examinations, in my opinion, are more complicated than genuine exams. I also practiced all the practice tests from Schweser's notes. Practicing test and analyzing it is more time consuming and exhausting, but it will prepare you for the D Day as there would be only one optional break between the exam. Getting used to exam patterns is essential because the second session can be challenging.

Examine the curriculum and depth of each subject, and carefully plan out your study schedule. It is preferable to get a financial calculator at the start of the preparation process in order to become acquainted with it. Learn as many functions as you can because just a handful of them are effective in solving complex Fixed Income Security questions. My summer internship was initially begun in offline mode, but after a couple of weeks, it converted into an online mode, allowing me to devote a significant time to

prepare for the next 40 50 days. A head start in the beginning has significantly helped in my preparation. I have dedicated a whole day for the preparation in the last month before the exam. Schweser's Secret Sauce is beneficial in the last month of preparation because it almost summarises every topic of the curriculum. It would Be ok to leave one or two really tough topics with lower weightage rather than wasting time on them and failing to revise commonly questioned topics during the final days of preparation. This phase is critical since most subjects must be reviewed, which considerably improves exam performance. During the critical phase I devoted most of my time revising important concepts and giving analyzing the mock test. Mistakes in the mock test and learning from those mistakes have significantly helped me in improving my exam performance.

Finally, I'd like to highlight that you shouldn't be concerned about CFA examinations; most ideas are already taught in MBA curriculum; you simply need to brush up on certain of them depending on the test format and your current level of preparation.

country.

Until a few years ago, I was a bright eyed engineering graduate with a knack for number crunching. Indulging in the CFA curriculum opened a Pandora's box of knowledge and a window into the world of finance where I could use my quantitative abilities and critical thinking to good use. Now, having gone through the rigors of the CFA exams twice, there are a lot of things I wish I knew before registering for the CFA Program. The article aims at providing a comprehensive guide for all CFA Program candidates and potential applicants, taking the reader through the journey of a CFA Exam.

Once a potential candidate meets the basic eligibility requirements, they can register for the CFA Program and enroll for the Level 1 Exam. The CFA Institute provides a downloadable version of their curriculum for registered candidates. Although the CFA Exams were branded as the world’s hardest exams by Financial Times, the bar is pretty low with regards to pre requisites for the Level 1 Exam. Candidates just need the knowledge of basic math, one of the two recommended calculators and a willingness to learn. An understanding of capital markets would help candidates relate better to the concepts in the curriculum. Better yet, relating the concepts learned to real life examples would help cement the learnings. For example, after learning about private equity, candidates can check the recent activities of private equity firms in the

The CFA Institute Candidate Resources includes the PDF version of the curriculum and the Learning Ecosystem, which is an online learning tool that consists of the curriculum, end of reading questions, mock exams, flash cards and much more. I would advice candidates to use these resources to good use. For example, the practice questions are a great way to get a feel for the exams and test exam readiness. Third party prep providers and study materials are available which are concise and save reading time as compared to the extensive CFA Institute curriculum.

The CFA exams, for most parts, don’t check your speed, but conceptual understanding. Candidates are tested on concepts from every nook and cranny of the curriculum, (even the obscure niches). Hence, it is important to learn and understand (not mug up!) the entire expanse of the curriculum. The institute study material is vast and full of examples, but candidates can study through the much concise study materials provided by third party prep providers like Kaplan Schweser. Personally, I feel these study materials explain the whole curriculum in a simpler manner. Candidates can also purchase video lectures by authorized prep providers which save a lot of time in terms of understanding the concepts, but are not inexpensive. Regardless of the study method, it is paramount to solve the institute questions provided at the end of each reading or accessed through the practice questions in the learning eco system. As they say, “Practice makes perfect.” I would recommend candidates to make notes of important points and formulae which would help in revision later. CFA Institute offers two mock exams. Mocks should be taken one month before the exams as it is a good tool to assess candidates’ exam preparedness and

gives time to brush up on long visited concepts. There is an arbitrary consensus that it takes 300 hours of prep time to pass any CFA Exam. This includes studying readings, solving questions, countless revisions and mocks.

Hence…

The CFA Exams are not easy and Level 1 is just the start. I have found that allocating roughly 300 study hours over six month period gives optimum results. There is enough time to cover the entire curriculum and offers flexibility to shuffle around with study time. However, candidates must choose a timeline better suited to their study habits and work schedule. Note that consistency is the key and small consistent study hours are more impactful in learning than long infrequent ones. Weekends give a much needed break from stressful workdays and are perfect time to study. Candidates might need to kiss their weekends goodbye! The CFA Program is very demanding and is a test of your commitment and determination more than anything else.