VITTA ARTHA VITTA ARTHA

Cover Interview

Navigating Market Cycles

Mr Sankaran Naren

CIO, ICICI Prudential AMC

Faculty Article: The Great Indian IPO Boom

Dr Pavneet Singh Asst. Prof, IIM Amritsar

1.

2.

3.

Dr

6.

7.

FOREWORD

DR. NAGARAJAN RAMAMOORTHY Director IIM Amritsar

DR. NAGARAJAN RAMAMOORTHY Director IIM Amritsar

DearAll,

I am pleased to introduce the twelfth edition of VittaArtha, the bi-annual magazine published by the Finance and Economics Club (FEC) of IIM Amritsar. FEC works interminably at the collegeandindustrylevelstofurtherthestudents'interestsbyexposingthemtovariousaspects of the world of finance and economics the club endeavours to harness talent and enhance the learning experience of our student community. Vitta Artha – The Finance and Economics magazine of IIMAmritsar is one such effort in the same direction. Varied views in the form of articles given by students from prominent B-schools across India, finance and economics faculties, and the deep insights provided by the industry professionals and leaders help the readersbetterunderstand thereal-lifeimplications andnitty-grittiesinthefields offinance and economics.

In the latest issue of VittaArtha, readers will delve deep into the dynamics of financial market cycles. The edition sheds light on the key elements to consider in an investment framework, exploring market cycles, identifying factors influencing them and the prospective trajectory of investments in different asset classes as a response to varying market cycles. It also explores the influence of domestic and international flows into the Indian markets and possible areas of sustainable growth. Furthermore, it explores the hurdles and prospects in the Portfolio Management Services (PMS) and Alternative Investment Fund (AIF) sectors, and offers guidance on forging a successful career inAsset Management.

This issue features a comprehensive analysis of the recent IPO boom in Indian markets. The article explores the various factors enabling and facilitating this sudden boom and the challenges faced by the investors in assessing the IPOs. It highlights multiple implications of the IPO boom to the Indian Economy and assesses future shape and outlooks of IPOs in India.

Alongside this, this edition also features articles across various domains in Finance and Economics from students across various reputed institutions, CFA preparation strategies and RealEstateSectorAnalysis.Moreover,thisissuebringsoutbooksandmovierecommendations to generate interest and enthusiasm amongst its readers. Like the previous editions, I hope that this issue of Vitta Artha adds value to its readers and thus augments their interest and inquisitiveness in the enriching domain of finance and economics.

INDUSTRY INSIGHTS

Mr Sankaran Naren Chief Investment Officer ICICI Prudential AMC

Mr Sankaran Naren Chief Investment Officer ICICI Prudential AMC

Navigating Market Cycles

Sankaran Naren has been associated with the ICICI PrudentialAMC, one of India’s leading Investment Manager’s since October 2004. He oversees the entire investment function across the Mutual Fund and the International Advisory Business of the Company.

Naren joined the AMC in 2004 as fund manager andhasworked invariouscapacities in the investment function culminating in his taking over as the Chief Investment Officer. Under his leadership, theAMC has been able to build strong processes in investments resulting in strong and sustainable performance across product categories. He currently manages some of flagship schemes of the ICICI Prudential Mutual Fund.

Naren has rich experience of three decades in almost all spectrum of the financial services industry ranging from investment banking, fund management, equity research, and stock broking operations.

Naren was also a member of the esteemed panel of invitees for the Honorable Prime Minister’s Pre-Budget consultation meet for 2020. In recognition of his work, various leading investment authors have featured him throughdedicatedchaptersintheirinvestment

books. He is widely recognized as India’s leading Mutual Fund and Capital Market Investment Guru. Mr. Naren has been honored with CIO of the Year award at the Asia Asset Management - Best of the Best Awards – 2023. Mr. Sankaran Naren is also a member of the Committee on Equity matters atAMFI.

During his career, he has also worked with organizations such as Refco Sify Securities India Pvt. Ltd, HDFC Securities Ltd, and Yoha Securities in various capacities.

Q &Awith S Naren:

How do you prioritize between psychological and economic indicators when assessing market cycles? Could you outline the key factors you consider most crucial for identifying changes in market cycles?

Both these factors are important from an equity investment perspective and also to assess the market cycle. When it comes to psychological factor, one be reactive; i.e. one can be risk averse when market participant’s interest is euphoric and greedy with participants are fearful. For economic indicatorsit’snotonlyimportanttoaccessthe currentsituationbutalsotoforecasthowthese indicators will pan out in the future.

Are there specific market cycles where company valuations become less critical, making investment in certain companies appealing due to the certainty in their cash flows?

Adoptingacountercyclicalapproach,thebest time to invest is generally when both psychological and economic indicators are weak. Certain examples from Indian equity market history is years such H2 CY 2013 or H1 CY2020. During the onset of the

pandemic,therewasfearamonginvestorsand the economic outlook was severely impact. Similarly, during 2013 India was under pressure in terms of macros as both inflation and current account deficit was high.At such times, equity in general was not the preferred asset class among investors.

Currently, which asset class do you find most attractive, and what methodologies do you employ to analyze individual asset classes?

In the current environment, there are no clear winners within the asset classes. However, our preference is towards large caps in equities and gold. Different methodologies are used to assess different asset classes. For Equities, we tend to use valuation plus identifying where are we in the business cycle. For Gold, what matters most is the US real rates. Gold tends to do well when real rates in US come off.

In your view, which sectors are currently experiencing a structural growth phase, characterized by sustained growth independent of macro cycles? What indicators differentiate structural growth from cyclical growth?

Consumption in India is a structural growth story. However, with fast changing consumer preferences, it is getting incrementally difficult to invest structurally for a long term. The way we approach it is to identify market share gainers within structural growth sector because we feel market share gain strategy is more durable and can sustain for long.

While the asset quality in Public Sector Banks (PSBs) has notably improved, do you anticipate this trend to be sustainable, or could their non-performing assets (NPAs) increase during a recessionary cycle?

The Indian banking sector's asset quality, we believe, in the near to medium term will continue to improve on account of tighter underwriting standards, improved riskmanagement practices and robust corporate balance sheets.

Some startups, initially listed at high valuations, have shown recent signs of recovery. What factors do you believe contribute to this recovery, and do you consider it to be sustainable?

Among the names which have seen a bounce back, few of the business has bounced back towards expected growth trajectory. Also, globally there is a view that rates will not see a spike from hereon.This has fueled a rally in global digital stocks and the same can be seen in Nasdaq. So, a similar sentiment is plating out in Indian names as well.

With India VIX at historical lows and currently lower than S&P VIX, do you attribute this to higher macro stability in India or to continuous domestic inflows into the markets?

Both – the macro stability and increasing domestic inflows – have played a role in ensuring that India VIX is hovering close to historic lows.

Domestic flows have significantly influenced the strength of Indian markets. Do you foresee a potential reversal of these flows if the markets experience a substantial downturn in the future?

The equity culture is gaining ground in India since the pandemic. While it is difficult to predict investor behavior, the recent trends show that during short spurts of market correction, investors have largely stayed put, which is an encouraging trend. At the same time, the new set of investors who have come into the market over the past three years have notseenasustainedbearmarket.Asandwhen

such a time were to come, how the new set of investors will react, is yet to be seen.

Whatwereyourkeyinsightsfromthelatest earnings season? Do you perceive better earningsprospectsforlargecapscompared to small caps?

The earnings season was largely in line with expectations and the commentary from corporates gave an indication that the outlook for festive season is a robust one. Thus, we believeQ3is likelyto registergoodgrowthin earnings. Currently, the large caps earnings forecastlooksrelativelymoreachievablethan the small cap companies.

What advice would you offer to someone aspiring to build a career in the asset management industry? Additionally, do you anticipate significant job disruptions in the industry due to technological advancements?

There are several roles one can aspire to be a part of within the asset management industry. But when it comes to fund management, what is most essential is temperament. There will begoodandbad calls.Whileframeworkswill keep you away from blunders, still mistakes/ not so optimal investment decisions are inevitable. How one learns from such episodes and ensures that it is never repeated is one’s career is what matters the most. The other quality is integrity. Since we deal with public money, integrity is of absolute importance.

We believe technological advancements cannot replace the human element that is required in investments. While automation can help address menial and repetitive tasks, theroleofexperienceandjudgmentincaseof steps like taking a counter cyclical view cannot be done by a machine.

Dr Pavneet Singh Assistant Professor IIM Amritsar

Dr Pavneet Singh Assistant Professor IIM Amritsar

The Great Indian IPO Boom

The strong growth in Initial Public Offerings (IPO) in the Indian market has been welldocumented in recent years. In the aftermath of Covid in 2021, a record-breaking 63 IPOs helped Indian companies raise an eyecatching INR 1,18,723.17 crore, setting a strong benchmark. This momentum has continued into the following years, with 40 IPOs in 2022 raising INR 59,302 crore. In 2023, the Indian markets witnessed another 57 IPOs, raising INR 49,434 crore in the process. This trend marks a sharp contrast to the uncertain and slightly pessimistic global markets, and India ranks first in number of IPOs in the world in 2023. From technology start-ups and e-commerce unicorns to traditional businesses and infrastructure firms, a diverse array of companies are tapping into the public markets to raise capital, unlock value, and provide liquidity to existing shareholders.

As per standard economic theory, firms can raise capital through three avenues- equity, debt and reinvestment of own profits. An economically rational firm would choose the avenuewherecapitalisavailableatthelowest cost.

Inthepost-Covidera,thecentralbanksacross the world have infused liquidity in the markets in an attempt to counter the effects of economic slowdown, and to revive the global economy. As the global economy has recovered, the excess money supply in the economy has implied that inflation rates in countries across the world have shot up. To counter this effect, central banks in subsequent years have raised the interest rates. In India as well, the repo rate has shot up from 4% in April 2022 to 6.5% currently. Higher interest rates imply that the cost of debt has gone up, thus making debt less attractive as an avenue for raising capital. Further, for most start-ups looking to raise capital through IPOs, the profits (in absolute terms) are not sufficient to enable them to use profits as the sole avenue for raising capital.

At the same time, the Indian equity markets are witnessing an interesting shift.The Indian economy has witnessed a sustained period of strong growth led by domestic consumer demand over the past decade. The average annual growth rate in real GDP over the past decade is over 6%, even accounting for the Covid years. For most normal years, the growth rate has hovered between 7% and 8%. Increasing urbanization and rising disposable incomes, especially among the middle class, have further fuelled this consumption-led growth. At the same time, sustained government investments in infrastructure development, such as roads, railways, and urban infrastructure, have stimulated economic activity.

As disposable incomes have grown, the rising Indian middle-class investor is seeking better and more sophisticated avenues for higher returns. This trend is evident on two levels. First, the number of retail investors in the Indian markets has seen exponential growth. The number of Demat accounts in India has grown from 54 lakh in2006-07 to 2.1 crore in

2013 to 13.9 crore accounts as of December 2023.Asperthelatestfigures,retailinvestors own stocks worth INR 30 lakh crores, about 7.7% of the total value of all listed companies in India and there is a strong uptrend in this direction.

Along with direct retail investment, the newage investor in India is also diversifying their risk while seeking higher returns through mutual fund investments. The Indian mutual fund industry has grown from INR 9 lakh crores in 2014 to INR 54 lakh crores in 2024 ,asix-foldincreaseinthespanof10years.As perthelatestnumbers,57.4%ofmutualfunds inIndiaareequity-oriented,whileonly16.5% are debt-oriented schemes, and a further 12.7% are ETFs. These numbers clearly highlight the increasing demand for equity among the new-age Indian investors. In the last two years, while foreign institutional demand for Indian equities has been somewhat sluggish, the rise of the domestic retail investor has more than made up for this sluggishness, and kept the markets in a buoyant mood. This has added to the attractive valuations of new stocks. These higher valuations imply a higher value of Tobin’s q. Hence the cost of raising capital through equity is relatively low, making it a rational choice for firms to sell equity to raise capital.

Aided by government schemes like Make in India, Startup India and Digital India, the country has seen an exponential rise in the number of startups in the last decade. As of October 2023, the DPIIT recognized 112718 startups in the country. Since 2017-18, the number of unicorns in India has grown at a whopping 66% annually. Currently, India is hometo111 unicorns withatotalvaluationof USD 359 billion. Of these, 67 unicorns were born in 2021 and 2022 alone. IPOs also serve as liquidity events for early investors in these startups. Forinstance,PayTM’sIPOprovided

an exit opportunity for investors including Alibaba Group, SoftBank, and Berkshire Hathaway, while also raising capital for the company's expansion and growth initiatives. The upcoming IPO of Flipkart, one of India's largest e-commercecompanies,is expectedto provide liquidity to early investors such as SoftBank, Tiger Global, and Accel Partners, who have invested billions of dollars in the company. Nykaa’s IPO allowed early investors, including private equity firm TPG and founder Falguni Nayar, to partially exit their investments, while also attracting new investors keen on the company's growth prospects in the beauty and personal care segment.

SEBI’s strong focus on improving its regulatory framework, the listing requirements of stock exchanges including a focus on corporate governance and transparency, and stringent disclosure norms have further helped reduced information asymmetriesforpotentialinvestorslookingto invest in IPOs in India.

The strong economic conditions, booming startups and rising number of unicorns, attractive valuations in the equity markets, innovativebusinessmodelsindiversesectors, rising demand for equity products among new-age investors, and the attractive exit options available to early investors in startups all provide strong underlying fundamentals driving the Indian IPO boom in recent years, which looks set to continue in the next few years.

References:

• https://www.businessstandard.com/finance/personalfinance/india-emerges-as-global-leaderin-the-number-of-ipos-year-to-date-in2023-124021900406_1.html

• https://economictimes.indiatimes.com/ma rkets/stocks/news/stock-market-rally-yet-

to-entice-retail-investors-only-12-9-lakhnew-demat-accounts-opened-infy15/articleshow/46126299.cms?from=m dr

• https://www.businessstandard.com/finance/personalfinance/record-4-2-mn-demat-accountsopened-in-dec-2023-total-touches-139million-

124011600300_1.html#:~:text=The%20to tal%20number%20of%20demat,around% 202.1%20million%20in%20FY23.

• https://www.livemint.com/market/stockmarket-news/reliance-hdfc-bank-tcs-topholdings-of-retail-investors-in-indianstock-market-nikhil-kamath-of-zerodhasays-11709271442270.html

• https://www.amfiindia.com/investorcorner/knowledge-center/history-of-MFindia.html#:~:text=The%20AUM%20size %20crossed%20%E2%82%B9,a%20span %20of%2010%20years.

• https://www.amfiindia.com/Themes/Them e1/downloads/home/Industry-Trends.pdf

• https://www.investindia.gov.in/indianunicorn-landscape

STUDENTS ARTICLES

Sriman Agrawal and Yatharth Shah

IIM AmritsarDemystifying the Numbers’ Game: An Introduction to Quantitative Finance

Nowadays, quantitative finance, which is more popularly known as quant finance, serves as the basis of the modern finance industry. It utilizes the magnificent capabilities of numbers, probability, and computer science used to understand the market intricacies, manage risk, and create customized investment strategies. Fundamentally, the discipline quant finance utilizes rigorous mathematical analysis to track the financial market movements and make informed decisions while the market conditions keep changing.

The goal of quantitative finance is to derive mathematical models and algorithms that predict asset prices correctly, determine the losses and gains, and value the investment returns. Models here run from the mere simplicity of regression analyses to very tough stochastic processes, depending on the levelofintricacyneeded fora rightmodelling of market dynamics. Through implementing historical markets data and advanced statistical tools, quant analysts seek to unveil more insights about market behaviour and find ways to make a profit with these new discoveries.

Today’s financial market witnesses an accelerated rate of technological progress, enormous volumes of data and, primarily, the importance of quant finance as a tool. As an instance, machine learning algorithms have radically changed those quantitative analysis areas, bringing to light numerous hidden insights in huge data sets and developing precise models more accurate than before. In addition these trends that is born of high-

frequency trading and the new algorithmic trading strategies have aesthetically altered the shape of the financial markets with now the new data driven approaches taking the most part of trading volume.

The prefix "quant" in the term, "quant finance" stands for quantitative and that it tends to use mathematical and computational methods to analyse the financial data for making informed decisions. Quanta mental analysts which are often referred to as quants are experts in mathematics, statistics, programming, and finance, they are able to develop more complex models that can give you a lot better then traditional approach.

The devastation of quant finance is not just limited to the trading desks and funds which engage in investments. It flows through different facets of the financial world: risk management, portfolio making, and regulatory compliance. Risk models are one of the critical tools of financial institutions to assess and respond to different types of risks for instance, market risk, credit risk, and operational risk. Quantifying the portfolios exposure to adverse events and identifying exposures allows institutions to build resilience and ensures continuity and stability of financial markets.

The future of quant finance will be characterized by both the hurdles and the boundless opportunities. On the other hand, the growing complexity and interdependence nature of financial markets create a place

where the ability and skills of quantitative analysts assume paramount importance. They have to design sophisticated tools and models to straightforwardly beat uncertainty. However, the positive side of this is that advancements in technology such as artificial intelligence and quantum computing is a step towardsunlockingarealmwithinquantitative analysis, consequently enhancing the ability of analysts to deal so far with complex problems and get more meaningful insights from data.

However, the end result, quantum finance stands as a powerful tool that is employed in the arsenal of modern finance to drive innovations, improve market efficiency, and shapethefinancialmarketframeofthefuture.

The employment of mathematical models, algorithms, and data analytic tools by quantitative analysts leads to in-depth understandingofthedynamicsofthemarkets, good risk management and enable the generation of better investment returns. As technology continues to build and data becomes more adequate the segment of quantitative finance will preserve its role as a major district of the financial business, and will more than maintain its position in the financial industry.

References:

• Hull, J. C. (2015). Options, Futures, and Other Derivatives. Pearson.

• Lipton, A. (2016). Mathematical Methods for Foreign Exchange: A Financial Engineer'sApproach. World Scientific.

• 3.Wilmott, P. (2006). Paul Wilmott Introduces Quantitative Finance. Wiley.

• 4.https://www.statista.com/outlook/dmo/fi ntech/digital-investment/roboadvisors/worldwide

• 5.https://corporatefinanceinstitute.com/res ources/data-science/quantitative-finance/

Pranit Mahajan and Laxmi Lokhande

Neville Wadia Institute of Management Studies & Research, Pune

Demystifying Forensic Accounting: Unveiling its Role in Modern Finance

Abstract:

This article examines the importance of forensic accounting in uncovering financial fraud and misconduct. It discusses the growingdemandforforensicaccountantsdue to increasing cybercrimes and corporate fraud.Real-worldexamplesdemonstratehow forensic accountants assist in investigations and legal proceedings, maintaining transparency and accountability in financial systems. Despite challenges, forensic accounting plays a crucial role in ensuring integrity and justice prevail in modern finance.

Introduction:

In the maze of modern finance, where transactions are complex and deception lurks in the shadows, the role of forensic accounting emerges as a beacon of truth. As financial systems become increasingly sophisticated, the need for vigilant oversight anddetectionoffraudulentactivitiesbecomes evermorecrucial.Forensicaccountingstands at the forefront of this endeavour, blending the precision of accounting with the investigative prowess of forensic science. In this article, we delve into the depths of forensic accounting, exploring its methodologies, real-world applications, and its pivotal significance in maintaining the integrityoffinancialsystems.

UnderstandingForensicAccounting:

Forensic accounting is a multifaceted field that transcends traditional accounting practices. It encompassesaspectrumofskills and methodologies aimed at uncovering financialirregularities,fraud,andotherforms of financial misconduct. Beyond the realm of balancesheetsandincomestatements,

forensic accountants meticulously dissect financial transactions, scrutinize documents, and analyse data trails to reconstruct a comprehensive picture of financial activities. This intricate process often involves the application of advanced investigative techniques and collaboration with legal authoritiestoensurethe pursuitofjustice.

Needforforensicaccountant:

Theneedforforensicaccountingisincreasing day by day. The rising need for forensic accounting worldwide is attributed to several keyfactors:

Growing cybercrimes & their vibrant effects canbeunderstoodbythefactthatinyear2012 the number of Cyber Crimes showed an increase of 61 % during the year. With these increase in percentages, wecannot ignore the needforforensic accountinginour country.

The Association of Certified fraud examiner also known as ACFE report indicates that approximately five percent of revenues of organizationsaresubjecttofraud.Thismeans that for every Rs. 500 billion of public spending in India there is potential fraud in organizationsamountingtoapproximately25 billion yearly. However, in India the fraud casesaremuchmoreaswerankIndiaas88th mostcorruptnation.

Thecurrentregulatorymeasuresarenotupto the mark as per requirement. The infamous scams of Harshad Mehta, Ketan Parekh, Sanjay Seth and recent India Bulls Scam and Kingfisher Airlines credit Card fraud are still fresh in our minds. Whether it is a stock market fraud or bank fraud or a cyber fraud, forensic accounting has become an indispensable tool for investigations. With India being ranked as the 88th most corrupt nation, needs for forensic accountants has become more profound. As per the survey conductedbyErnstand Young:

In respect to employees – About 20 % of almost3500respondentssaidthattheyhave

seen financial manipulation of some kind occurringintheirown companies.

In respect to Board of Directors and top managers – about 42% of Board of Directors and Top Managers said they were aware of some type of irregularity in financial reporting.

Withthesepoorstatisticsandbecauseofthese kinds of shortfall value of corporate disclosurearediminishing thereby increasing valueofforensicaccounting.

Example:

Following are some of the case studies of Kessler International forensic accountant team which is a famous forensic Accounting team worldwide, which clearly shows the need for forensic accountant in today’s world:-

1. An investment bank was considering providing finance to a plastic manufacturer overseas. The bank heard rumours of faulty operations and overestimated profits and thought accurate business intelligence could help them make a decision. The Kessler International team specializing in forensic accounting was enlisted to perform a comprehensive inquiry into the plastic manufacturer. Their objective was to verify the accuracy of the information presented to the investment bank. Their researchers and investigators scrutinized the company’s revenues, their books, and projections to assure they were fair and accurate. They also assessed the potential risks involved in the deal and provided the investment bank with valuable information to help them make the rightdecisionbeforeitwastoolate.

2.Amultinationalcorporation,rankedamong the Fortune 500, had suspicions regarding financial mismanagement within a recently acquiredsubsidiary.TheKesslerInternational team approached this investigation in stages andbeganbyconductingasurveillanceofthe plant. Investigators immediately observed employeesstealinglarge amountsofraw

materials. The next step was to conduct a forensic audit of the plant’s business records. They discovered that 75 of the plant’s employees were illegal aliens. There were other irregularities, such as three employees listedonthepayrollas"ghosts,"yettheywere found to be serving prison sentences at the time. After receiving this information, the Fortune 500 company took appropriate legal action.

Methodologies Employed in Forensic Accounting:

Forensic accountants employ a diverse array of methodologies and tools to unravel complex financial schemes and expose fraudulentactivities.Itincludes:

1. Forensic accountants conduct a comprehensive analysis of financial statements,scrutinizingkeyindicatorssuchas cash flows, revenue recognition, and expense patterns to identify anomalies or irregularities.

2. Leveraging advanced data analytics techniquesandsoftware,forensicaccountants sift through vast volumes of financial data to uncoverpatterns,trends,andcorrelationsthat mayindicatefraudulent behavior.

3. Forensic accountants meticulously examine financial documents, contracts, invoices, and other records to detect forged signatures, altered figures, or fictitious transactions.

4. Forensic accountants conduct interviews with relevant parties, including employees, clients, and stakeholders, to gather information, elicit confessions, and uncover crucialinsightsintofraudulentactivities.

Real-World Applications of Forensic Accounting:

The applications of forensic accounting span a wide range of industries and sectors, including:

1. Forensic accountants assist corporations in investigating suspected fraud, embezzlement, or corruption within their organizations, helping to identify perpetrators and mitigate financiallosses.

2. Forensic accountants provide expert testimony and analysis in legal proceedings, offering insights into complex financial matters and assisting in securing favourable outcomesfortheir clients.

3. In cases of asset misappropriation or financial misconduct, forensic accountants assist in tracing and recovering stolen assets, using their investigative skills to follow the money trail and hold wrongdoers accountable.

ChallengesandFutureTrends:

Despite its invaluable contributions to the field of finance, forensic accounting faces several challenges,Such as:

1.TechnologicalAdvancements

2.Cross-border complexities

3. The ever-evolving nature of financial crimes.

However, as new technologies such as blockchainandartificialintelligencecontinue to reshape the financial landscape, forensic accountants must adapt and innovate to stay aheadof emergingthreats.

Conclusion:

Inconclusion,forensicaccountingservesasa vital tool in the fight against financial crime, providing a critical line of defence in an increasingly complex and interconnected world. By employing rigorous methodologies, advanced technologies, and unwavering ethical standards, forensic accountants uphold the principles of transparency, integrity, and accountability, ensuring that justice prevails and financial marketsremain fairand efficient.

References:

• https://www.cpajournal.com/tag/forensicaccounting/

• https://sciendo.com/journal/JFAP

• https://inquesta.co.uk/blog/importance-offorensic-accounting/

• https://www.accaglobal.com/gb/en/studen t/exam-support-resources/professionalexams-study-resources/p7/technicalarticles/forensic-accounting0.html

Shivani Gupta

Shivani Gupta

Dr Ambedkar Institute of Management Studies and Research, Nagpur

Behavioral Finance: Understanding Investor Psychology

Abstract:

Behavioral finance is a field that examines how investors are not always rational but rather are influenced by cognitive biases and emotional biases. The paper emphasizes the importance of understanding an investor's psychology through behavioral finance. By understanding these psychological traits and biases, market efficiency can be improved.

Introduction:

Behavioral finance is an emerging discipline that aims to explain an individual’s economic decision-making process by combining behavioral and cognitive psychology with traditional finance and economics. This is based on the assumption that rational behavior by investors in the context of efficient markets accounts for various observed empirical phenomena. This looks at the contradictions provided in human behavior, both at the individual and group levels. This field provides insights into the potential inefficiencies in the financial market. This also focuses on the investors who are not always making rational decisions and are influenced by their own biases or information structure.

Key Biases and Behavior:

What is Bias? Bias is the “inclination or prejudice for or against one person or group, especially in a way considered to be unfair.”

Cognitive Bias refers to consistent diversion fromtherationalityorestablishednormsused intheprocessofjudgment.Cognitivebiashas great potential to influence the decisionmaking, problem-solving, and information processing that ultimately results in humans making distinct conclusions, and being irrational. By understanding and acknowledging cognitive bias, humans as well as groups can enhance their decisionmaking process by reducing the errors and influence of the information structure.

“Most people, probably, are in doubt about certain matters ascribed to their past. They may have seen them, may have said them, done them, or they may only have dreamed or imagined they did so.”

- William JamesSome real-world examples of investors under the influence of cognitive bias:

The Housing Bubble Crisis:

• The housing bubble crisis is also known as the house price boom or the 2000s housing cycle.

• It affected more than half of the states in the United States. It was a sudden spike in home asset values followed by a collapse. And it catalyzed the subprime mortgage crisis.

• Thehousingbubblewas aresult ofanother bubble in the technology sector, related to the financial crisis of 2007-08.

• The investors were pouring money into internet and technology stocks, driving their valuations to unsustainable levels. It was similar to other technology-inspired booms.

• Investors started buying homes as speculative investments as the bull market in housing continued.

• The complete crisis led to the U.S. Great Recession.

Implications:

• It has highlighted the role of behavioral factors, such as “Herd Mentality”. Observing profit from the rising housing market as a sound investment.

• Fear of Missing Out (FOMO) drove the investors to join the rally of speculation and investment, leading to impulsive investment decisions.

• Optimism Bias leads to exhibiting unwarranted optimism about the housing market’s future while underestimating the risks associated with this.

• Regret Aversion leads to investors staying invested in the market contributing to delayed decision-making in selling or divesting from overvalued assets.

Dot-com Bubble:

• It is known as the dot-com boom, it was a stock market bubble during the late 1990s and peaked on March 10, 2000.

• The bubble began deflating in March 2000 as the interest rates and investor confidence wavered. Dot-coms failed, includingPets.com and Webvan. Tech firms saw shares rise to 80-90%.

• The burst led to the 2001 recession.

Implications:

• Thedot-combubblehighlightedtheroleof behavioral factors, such as “herd mentality” and “irrational exuberance”.

• Investors during the dot-com bust crisis were gripped by fear and panic leading to rapid sell-offs without considering the long-term impacts, resulting in investors being under the influence of emotional bias.

• Overconfidence Bias leads to many investors overestimating the potential of internet-based companies, and underestimating the potential risks.

• In the dot-com burst, the fear of missing out (FOMO) led to Herding Bias. Where investors rushed themselves to buy shares in internet-based companies, fearing that they would be left behind in high returns.

• Both biases led to the creation of the speculative bubble and the subsequent market correction.

Interpretation:

It states that before investing, investors most of the time are under the influence of Herding Bias i.e. following the crowd. It is leading to impulsive decisions with short-hand and lessstructured knowledge.

The second bias that influences investors is Fear of Missing Out (FOMO). This is where investors rushed to do the same thing i.e. buy and sell shares. This is where they are under the emotional response where they think others are living better than them and have a satisfied life, and they are missing this opportunity.

Understanding Behavioral Bias:

• Tax benefits

• Return on Investment, etc.

Ways Investors Can Overcome Biases:

There can be various ways for an investor or a group of investors to avoid all kinds of emotional and cognitive bias.

• Formula Investing: In brief, a simple way where the investors rely on investment strategies i.e. a set of predetermined rules to make any investment decisions. This approach removes the emotional and cognitive bias touch from the decisionmaking process.

• Usually, investors make irrational decisions due to mental accounting bias, but the rational approach would make the investors make more viable decisions for present and future investments. Where investorsusuallyselltheirstockatthetime of a fall in stock prices, the rational investor would prefer to buy at the time of low price of stocks.

Impacts on Investment Decisions:

It is rightly stated in the Japanese Proverb, “If you want to know what’s happening in the market, ask the market.”

What is an Investment Decision? Investment

Decision refers to the analysis of the investment opportunities for an individual to gain profit, and manage the risk profiles, investment objectives, and rate of return on investment.As an individual and a firm have limited financial resources the proper evaluation of funds and capital budgeting of the funds is important, therefore, the proper need for investment decisions is important.

• Excessive Risk Taking

• Overtrading

• Under diversification

• According to my study, it is always advisabletohaveawell-educatedfinancial advisor, as they would provide a clear and detailed outside perspective, working in this industry for decades.

• Beat the Market, is a buzzword word that needs a clear understanding that cannot be possible by just investing the investor's investment in one portfolio only, to beat the market in the current era can be possible through Portfolio Diversification.

Conclusion:

• Behavioral Finance shows that investors are not fully rational-being, they are consumed under the influence of cognitive and emotional biases.

• This shows that they get influenced by newsletters and unstructured information presented before them.

References:

1. Fama, E.F. (1965). The behavior of stock prices. Journal of Business

2. Fama, E.F., & French, K.R. (1987). Dividend yields and expected stock returns.

3. https://en.m.wikipedia.org/wiki/2000s_ United_States_housing_bubble

4. https://fastercapital.com/content/Behavi oral-finance Overcoming-BehavioralBiases-with-FormulaInvesting.html#:~:text=For%20example %2C%20we%20can%20seek,achieving %20long%2Dterm%20financial%20succ ess.com

Antorika Chakraborty

Antorika Chakraborty

Indian Institute of Management, Kashipur

Investing in Blue Economy 2.0

Background:

The term "Blue Economy" describes the sustainable use of ocean resources to support employment, economic expansion, and better livelihoods while protecting the health of coastal and marine ecosystems. It includes variousindustries,suchasoffshoreoilandgas exploration, tourism, shipping, and fishing. Blue Economy 2.0 is the next stage of the ocean's sustainable business. It's not just aboutconservation;it'salsoaboutusingocean resources creatively and sustainably to providejobs,betterlivelihoods,andeconomic progress. The promotion of "Blue Economy 2.0," which emphasizes sustainable development of oceans, seas, and coasts, was noted in the Indian Interim Budget 2024.At

present, the Blue Economy is experiencing substantial expansion and growth. It provides transportationfor95%ofthenation'sbusiness in India, accounting for approximately 4% of the GDP. According to estimates, the global ocean economy is worth US$1.5 trillion annually.

Investments in Blue Economy 2.0:

Investing in the Blue Economy 2.0 entails making financial investments in industries related to the sustainable marine sector, such as waste management, renewable energy, and sustainable seafood. Public-private partnerships can attract investment from the business sector in Blue Economy industries. Governments and organizations frequently

offer incentives and financial support to promote investment in the Blue Economy. Small and medium-sized businesses (SMEs) can be wise investments in the blue economy. Encouraging them to obtain financing and credit can help them flourish. Publicly traded businesses engaged in the Blue Economy's sustainable seafood, tourism, wave and tidal renewable energy, marine biotechnology, and ocean waste management are among the industries in which one can invest. Certain investment funds concentrate on various companiesinvolvedintheBlueEconomy2.0. Investing in cutting-edge aquaculture techniques like offshore finfish systems and recirculating aquaculture systems (RAS) can also be brilliant. Businesses that adhere to sustainablecertificationstandardsforseafood frequently make safer investments. It is recommended to make investments in businesses that produce various renewable energy, such as solar, wind, hydropower, bioenergy, and geothermal power. Putting money into cutting-edge renewable energy initiatives like hydrogen, offshore wind, and improved batteries can also be wise. Companies that offer environmental services and trash management are directly investable. Investing in cutting-edge waste management techniqueslikewaste-to-energyprogramsand recycling systems can also be a bright idea.

Risks and Challenges:

The Blue Economy 2.0 presents a unique combination of risks and difficulties for investors. The fragmented nature of the fishing sector and its limited access to capital and modern technologies can impede the development of the Blue Economy. Among the dangers of climate change are rising sea levelsandmoreacidityinthewater.Activities depending on the sea can potentially be

disrupted by natural catastrophes.Three main problems are untreated sewage, chemical pollution, and marine trash. They harm the Blue Economy sectors that depend on the health of these ecosystems and the marine ecology. Modifications to laws governing maritime activity may impact investments. Forexample,companiesoperatingintheBlue Economy may face higher expenses due to increased environmental requirements. The Blue Economy is still in its infancy in many areas, including renewable energy derived from ocean resources. The technologies are not fully developed yet, and it is unclear if they will be viable. Long-term investment sustainability may be impacted by the depletion of marine resources caused by overfishing and other overexploitation practices.

Impact on Economy:

India's economy and the future of the global economy are expected to be significantly shaped by Blue Economy 2.0. The Blue Economy accounts for approximately 4% of India's GDP and facilitates 95% of the country's transportation-related activities. The Elite Consortium for a Sustainable Maritime Economy commissioned research that shows that investing $1 in important ocean activities generates a return five times, ifnotmore.TheBlueEconomy2.0program's Pradhan Mantri Matsya Sampada Yojana (PMMSY) is anticipated tocreate55lakh job opportunities. Over the next ten years, 100 million new jobs are predicted to be created globally by the blue economy. From the current three to five tons per hectare, aquaculture production is to be increased through the PMMSY, which can further increase exports to Rs 1 lakh crore. There are plans to build five integrated aqua parks in

India, improving the country's nautical infrastructure even more. Thus, to maintain theoceanenvironment'shealthandencourage sustainable growth in coastal regions, the BlueEconomy2.0encouragesthesustainable use of ocean resources for economic development, better livelihoods, and jobs. It also aims to increase resilience against the effects of climate change.

How can an individual contribute to Blue Economy 2.0?

Select goods created or obtained ethically, such as seafood, that have earned sustainable certifications. Acquire knowledge about the significance of the oceans and impart it to others. This may encourage a sustainable and conservation-minded culture. Take part in neighborhood projects that conserve and maintain marine and coastal habitats. Encourage companies engaged in the Blue Economy 2.0, like those involved in ecofriendly travel or sustainable aquaculture. Think about pursuing jobs in ocean engineering, marine biology, or sustainable tourism associated with the Blue Economy 2.0. Promote laws that encourage the wise use of marine resources.

Future of Blue Economy 2.0:

Implementing adaptation techniques to lessen the consequences of increasing sea levels and extreme weather events, as well as steps to restoredamagedcoastalecosystems,areatthe heart of the plan. To supply the increasing demand for seafood and alleviate pressure on wildfishsupplies,theBlueEconomy2.0plan would prioritize the growth of coastal aquaculture and mariculture.The next several years should rapidly expand the Blue Economy 2.0. Ecological utilization of the seas will grow significantly as the globe

struggles with the dual issues of rising populationandchangingweatherpatterns.We can sum up by saying that investing in the Blue Economy 2.0 will benefit the environment and present significant economic prospects to the best possible extent.

References:

• https://www.drishtiias.com/dailyupdates/daily-newseditorials/maximising-the-benefits-ofindia-s-blue-economy

• https://www.worldbank.org/en/news/info graphic/2017/06/06/blue-economy

• https://en.wikipedia.org/wiki/Blue_econ omy

• https://www.moes.gov.in/sites/default/fil es/202107/Blue%20Economy%20Policy_Englis h.pdf

• https://www.businessstandard.com/budget/news/budget-2024what-is-blue-economy-2-0-announcedto-boost-aquaculture124020100977_1.html

• https://www.lse.ac.uk/granthaminstitute/ explainers/what-is-the-role-of-the-blueeconomy-in-a-sustainable-future/

• https://www.pmfias.com/blue-economy2-0/

• https://pwonlyias.com/currentaffairs/interim-budget-blue-economy-2/

• https://enveurope.springeropen.com/artic les/10.1186/s12302-021-00502-1

• https://www.idhsustainabletrade.com/pu blication/investment-guide-forsustainable-aquaculture/

• https://sustainablefisheries-uw.org/buysustainable-seafood-grocery-store/

• ://www.investindia.gov.in/sector/renewa ble-energy

• https://www.exportgenius.in/blog/budget -2024-blue-economy-coastalaquaculture-mariculture-expansion757.php

• https://www.bluegrowth.org/Economics_Blue_Economy. htm

Introduction:

REAL ESTATE SECTOR

The real estate industry stands out as one of the most universally acknowledged sectors worldwide. It encompasses four distinct areas: residential, retail, hospitality, and commercial.Itsexpansionisintricatelytiedto corporateadvancementandtheneedforoffice spaces, alongside the increasing demand for both urban and semi-urban housing. Within theeconomy,theconstructionsectorholdsthe thirdpositionamongthe14primarysectorsin terms of its broad impact, including direct, indirect, and induced effects.

In India, the real estate industry ranks as the

is expected to reach USD 1.04 trillion by 2029, growing at a CAGR of 25.60% during the forecast period (2024-2029)1.

India's real estate market is highly fragmented, with multiple players operating in the market. Higher competition among market players is impacting selling prices and land prices, further leading to oversupply in the market. Furthermore, the market is dominated by a few pan-India branded players and multiple local players. Some of the major developers in the country are Prestige Estates Projects, DLF, Prestige Group, Lodha Group, Oberoi Realty, etc

second-largest job creator, trailing only the agriculture sector. Forecasts also anticipated an increase in investment from non-resident Indians (NRIs) in both the immediate and distant future. Bengaluru was projected to be the primary choice for NRI property investments, with Ahmedabad, Pune, Chennai,Goa,Delhi,andDehradunfollowing closely behind.

Indian Real Estate MarketAnalysis:

The Real Estate Industry in India Market size is estimated at USD 0.33 trillion in 2024, and

The COVID-19 pandemic had an impact on the nation's real estate market, particularly affecting the residential sector. Stringent lockdown measures in major Indian cities led to a decline in housing sales, with home registrations halted and home loan disbursements delayed. Despite these challenges, the sector experienced a revival marked by rising house sales, the initiation of new projects, and growing demand for office and commercial spaces.

Savills India forecasts a surge in demand for data centre real estate, projected to increase by 15-18 million square feet by 2025. The

demand for residential properties has also seen a notable uptick, driven by urbanization and escalating household incomes. India ranks among the top 10 housing markets globally in terms of price appreciation. According to the India Brand Equity Foundation (IBEF), foreign direct investment (FDI) in the real estate sector, encompassing construction development and related activities, totalled USD 55.18 billion from April 2000 to September 2022.

Market Trends:

• The housing market is predominantly driven by a significant demand for affordablehousing.Accordingtoestimates by the India Brand Equity Foundation, there is currently a shortage of approximately 10 million housing units in urban areas. To accommodate the expanding urban population, an additional 25 million units of affordable housing are projectedtobenecessaryby2030.Thereal estate sector has experienced favorable outcomes due to policy initiatives such as the implementation of the Real Estate Regulatory Authority (RERA), the introduction of Real Estate Investment Trusts (REITs), and government housing schemes like PMAY (Pradhan-Mantri Awas Yojana) and SWAMIH (Special Window for Completion of Construction

of Affordable and Mid-Income Housing Projects).

• As of May 2, 2022, the state of Uttar Pradesh in northern India had completed over one million housing units as part of the Housing for All (HFA) program initiatedin2014.KnightFrankreportsthat in 2022, more than 328 thousand housing units were introduced to the residential market nationwide. Despite substantial demand for housing in the country, there has been a consistent level of residential launches in recent years. Under the Pradhan MantriAwasYojana (PMAY), the Prime Minister's Housing Plan, the total numberofcompletedhousesinurbanareas of India reached 6.5 million in 2022.

• Housing affordability in India remained at 3.2 in the financial year 2022, unchanged from the previous year, as per data from HDFC Bank. According to the Reserve Bank of India, during the financial year 2022, Indian banks disbursed nearly two trillion Indian rupees (USD 24.44 billion) in housing loans, nearly reaching preCOVID levels. This reflected a resurgence in homebuyer confidence, with a growing number of Indians investing in residential properties.

• The Indian office real estate market has driven the growth of the commercial real

estate sector in the past decades. Office realestatehasbeenattheforefrontofthese developments. Once dominated by information technology, office spaces are being increasingly leased by other sectors such as BFSI (banking, financial services, and insurance), engineering, manufacturing, e-commerce, and coworking sectors. The sector has demonstrated consistently low vacancy and high absorption rates.

• Commercial real estate investments have seen a rise, attributed to the implementation of the Real Estate Regulation & Development Act (RERA) and the establishment of Real Estate Investment Trusts (REITs). REITs, which own, manage, and finance incomegenerating real estate, have played a significant role in this uptick. Among investors, office properties have become particularly favored for investment, especially among high-net-worth individuals (HNI) in India and international private equity (PE) investors. Together, they constitute the majority of equity investments in the Indian real estate sector. The allure of high rental rates and better profits draws investors from various backgrounds to this industry.Additionally, thetrendtowardssmallerhomesandlarger families has contributed to the growing popularity of flexible and co-working spaces across the country.

Growth Drivers:

• Corporate Expansion: The rapid growth of businesses is spurring the demand for officespaces,drivingbothurbanandsemiurban residential needs. Construction remains a vital sector for the economy, ranking third in terms of employment generation and economic contribution.

• Employment Hub: Real estate stands as a major employment generator, second only to agriculture, attracting substantial investment from Non-Resident Indians (NRIs). Bengaluru leads as the preferred destination for NRI investments, followed by Ahmedabad, Pune, Chennai, Goa, Delhi, and Dehradun.

• Diversification Beyond Residential: The retail, hospitality, and commercial sectors are experiencing notable expansion, providing essential infrastructure to meet India'sevolvingrequirements.Demandfor data centers is also projected to surge by 15-18 million square feet by 2025.

• Rising Living Standards: Increasing urbanizationandrisinghouseholdincomes are driving the demand for residential properties. India ranks among the top 10 countries globally in terms of housing price appreciation.

• Foreign Investment Confidence: The real estate sector has attracted significant foreign direct investment (FDI), totaling $55.18 billion from April 2000 to September 2022, showcasing investor confidence in its potential.

• Government Boosts Real Estate with Pro-Growth Policies: Government initiatives such as townships and settlement development projects, open to 100% FDI, have attracted global investment and development. The 'Housing for All' program targets the construction of 20 million homes by 2022 with a reduced 5% GST, enhancing accessibility. The PM Awas Yojana receives a substantial boost in Budget 2023-24, with a 66% increase to Rs. 79,000crore,underliningthegovernment's dedication to affordable housing.

Investment and Mergers &Acquisitions:

• To expand its footprint in Indian real estate, Blackstone in May 2021, acquired the Embassy Industrial Park portfolio at INR 5,250 crore (US$ 716.49 million).

• InJune2021,GICacquiredasmallportion of Phoenix Mills’ portfolio (worth US$ 733 million) across all the asset classes with a primary focus on the retail sector

• In November 2021, in the largest deal of the standalone commercial tower; Ascendas India Property Fund trustee manager a wholly owned subsidiary of Singapore-listed Capital and Investment, bought Aurum Ventures’ 16-storey commercial tower in Navi Mumbai for INR 353 crore (US$ 47 million)

• Marriott International enter a joint venture pact with Prestige Group and DB Realty for new two hotels in November, 2021.

• Lodha Group and Morgan Stanley Real EstateInvestingenterapactfordeveloping an industrial and logistics Park near Mumbai in December, 2021.

• Axis Bank and Square Yards partner to launch a co-branded home buyer ecosystem in September, 2022

• Godrej Properties and Neelkamal Realtors enter a joint venture for a project in Mumbai in December, 2022

• Brookfield India REIT bought Noida office park from Seaview Developers Pvt Ltd in December, 2021.

• Abu Dhabi Investment Authority buys Blackstone Group stake in Mindspace REIT in January, 2022

• Birla Estates acquired 28.6-acre land in Bengaluru in May, 2023

• BrookfieldAsset Management to acquired 51% stake in Bharti Enterprises’ 4 commercial properties and formed a JV in May, 2023.

• Bombay Dyeing sold its Worli land to Goisu Realty for Rs 5,200 crore in September, 2023

• Morgan Stanley Real Estate Investing enter a JVpact with Prakhhyat Group for a warehousing project inAugust, 2023.

Challenges:

• Thegovernmentcanhelpeasethefinancial burden on struggling developers and improve the real estate market by utilizing under-utilized or vacant land. This could be achieved through revising land regulations and implementing policies like land readjustment and pooling. To make this a reality, changes or revisions to the Land Acquisition Resettlement and Rehabilitation Act of 2013 might be necessary.

• Therearealotofimpendingprojectsinthe Indian real estate market starting from public sector projects to private sector housing colonies. There is a delay happening in the completion of these projects and the reason for this is that the project does not get enough funding or there is a lack of technology to complete these projects on time.

• Another big challenge in the Indian real estate sector is the protracted approval process because project approvals in India takeaboutdaystoyearsbecausethereisno option of a single-window clearance and it often results in time and cost escalations.

References:

• www.mordorintelligence.com/industryreports/real-estate-industry-in-india

• www.ibef.org/industry/real-estate-india

• www.greenscapegroup.co.in/blog/indianreal-estate-sector-and-the-currentchallenges/

• www.livemint.com/companies/news/godrejproperties-neelkamal-realtors-ink-jointventure-for-a-project-in-mumbai11672021689476.html

• www.squareyards.com/blog/square-yardslaunches-unique-ecosystem-forhomebuyers-with-axis-bank

• Marriott International signs agreement with Prestige Group, Hospitality News, ET HospitalityWorld (indiatimes.com)

• www.business-standard.com/article/ptistories/phoenix-mills-gic-to-set-upinvestment-platform-in-india-with-733-mn121060200362_1.html

• www.financialexpress.com/business/industr y-blackstone-acquires-embassy-industrialparks-for-rs-5200-crore-2249486/

CFA PREPARATION

Cleared CFA Level 1

There are many different approaches to CFA preparation; however, choosing the one that suits one’s personality is essential. Before beginning the discussion regarding the prep, let's first understand the exam pattern. The CFAexam is conducted in 2 sessions, namely AM (Ante meridiem or before noon)

and PM (post-meridiem or afternoon) slots, each lasting 2hrs 15 minsand consisting of 90 MCQs (all carrying equal weightage with no negativemarking)with30minsofanoptional break in between.

FunctionalArea shows the order in which the questions appear in the exam. Hence in AM exam first questions from Ethics and Professional Standards will appear, followed byTools in which the 3 topics will appear in a random order.

Note: A passport is necessary to register for the exam. So, apply if one intends to take the exam and need one. Check the passport's validity before applying.

Without much ado, let's dive into the preparation part of the exam. The prep can be broken down into 3 significant parts: Concepts, Practice, and Mocks.

Concepts: The 1st year of the MBA program playsapivotalroleineasingyourpathwayfor the CFA prep. Hence, focusing on these subjects,namelyStatistics,BusinessResearch Methods, Economics, Financial Accounting, Foundations of Finance, and Corporate Finance, during the 1st year will significantly help reduce the effort required for CFA.

The CFA Level-1 exam assesses understanding across various financial topics rather than in-depth analysis. Hence, remembering and recalling concepts across the vast syllabus is very important.Therefore, following a concise yet complete source like Kaplan Schweser notes can dramatically enhance your preparation.

However,ifoneneedsamoreelaboratesource (for reference), CFA Institute materials are available as a soft copy on the Learning Ecosystem-LES, CFA website. Hard Copies are available at library.

The IFT channel on YouTube can also aid one’s preparation as it explains concepts concisely and relevant to the exam.

Practice: Practicing Concepts is more important than reading them over and over again. CFA LES provides 2500+ questions; therefore, rather than waiting to complete the syllabus, one should start practicing questions on topics already covered in the MBA program or even one’s undergraduate degree. This will help him/her identify the strengths and areas he/she need to focus on. Therefore one should reduce the time and effort of studying the topics he/she might already know. The questions are broadly on 4

levels: Easy,Moderate, Hard,andExpert.The final exam consists mainly of Moderate and Hard-level questions with few Easy and Expert ones. Additionally, the explanation of the questions is concise and helpful.

The LES contains a significant chunk of lengthy numerals. These help increase one’s conceptual clarity; however, the final exam's numerals are comparatively shorter. So one don't need to worry about the time taken. 2hr 15 mins are plenty to complete the exam.

Mocks: CFA Institute provides 2 free mock examsavailableontheLES,whichareusually more challenging than the exam. However, one might also find some similar or even identical questions in the Final Exam. Hence, practicing these 2 mocks will help him/her identify and be comfortable with the pattern and level of the exam, but it might also provide him/her with some questions for the final exam.

Time Required: The 300-hour phrase is commonly used to properly convey the time needed to prepare for the CFA exam. However, if one can leverage the concepts studied in the MBA 1st year, 180-200 Hours is also more than enough, i.e., studying 6 hours a day for 1 month.

Lastly,CFALevel1is atestofone’smemory; hence, last week's revision before the exam plays the most crucial role in recalling the concepts. The preparation journey for CFA is arduousandtedious;ifonefeelsdown,talking with your friends preparing for CFA or even people on the subreddit r/CFA can help shake off this wayfarer’s woe

GOLDEN INVESTMENT FUND

The Finance and Economics Club, IIM Amritsar announced the launch of Golden Investment Fund (GIF), the student-run investment fund of IIM Amritsar, in February 2019. It was started with the aim to give hands-on experience to the students about investing and applying their research into the equity markets. Team GIF aims to create a culture of research, analysis, and investment among the members of FEC and Finance enthusiasts of IIM Amritsar. The equity fundintendstoachievebetterrisk-adjustedreturnsthanitsbenchmarkindexthroughinvestment in large-cap, mid-cap, and small-cap stocks.

GIF team monthly fact sheets of its portfolio under management. The monthly report provides an outlook of the current market scenario as well as the companies in the portfolio of the fund. GIF team analyses the company’s fundamental and competitive position in the market, investment risk, growth prospects, and investment decisions.

CLUB ACTIVITIES

Sinceitsinceptionin2017,FEChasbeenone of the most enthusiastic student interest groups of IIM Amritsar. The club organises numerous interactive events throughout the year to provide students with an enriching learning experience in finance. It supports students in their journey at IIM Amritsar, helping them harness their potential and enthusiasm and guiding them at every turn. From providing advice about additional certifications and online courses, like Bloomberg Market Certification, to helping them with subject choices and interview experiences, FEC facilitates outside classroom training to upskill them, leading to brighter career opportunities. The club has keptupitstraditionoverthemonthsthathave passed, working very hard to provide students with the best possible education and experience.

Golden Investment Fund (GIF): It is a student-managed investment fund composed of experts in F&O and intraday trading. GIF team releases monthly fact sheets of its portfolio under management. Along with an overhaul of their reports, the GIF team also contributes to the IIM Amritsar's culture by conducting knowledge sessions and investment lectures to engage peers and motivate students to invest in capital markets and develop financial understanding among students.

Pariprekshya: Pariprekshya is IIM Amritsar's Annual Finance and Marketing Conclave, where eminent industry experts share their views and experience on the big stage before IIM Amritsar faculty and students. Being conducted since 2017, the FEC has been pivotal in conceptualising the event and helping students get relevant industry insights and familiarise themselves

with industry trends. The Seventh Edition of Pariprekshya, organised in November 2023, had the theme "Digital Transformation in Finance: Exploring the Intersection of Finance and Technology" for its Finance Panel. Several prominent industry leaders have shared valuable insight into the subject. It has been a great success, helping to broaden the students' horizons of knowledge.

Starry Nights: FEC is known for its trademark "Starry Nights" sessions, where members share their knowledge and experience in an informal setting. In Starry Nights, an informal discussion occurs on topics in which every attending student can share their point of view, contributing to a healthy conversation on important issues. Various Starry Nights sessions have been conducted since July 2021 on topics ranging from venture capital to the future of Hedge Funds in India.

Fin-League: FEC's Fin-League quizzes put the students' business acumen to the test and help them keep their minds sharp and ready while fostering a competitive environment. Winners of Fin-League quizzes were awarded prizes and certificates. The competition is organised in a league format with three progressively challenging online rounds and a final Offline round. The examinations encompass various topics from Finance and Economics, providing a unique and enjoyable way to comprehend the relevant concepts and principles.

Arthaat: The FEC is pleased to present its monthly newsletter 'Arthaat'. Updates and significant events related to finance and economics is included in the newsletter, ensuring that all the essential global information is immediately available. The

November Edition of our newsletter covers centralnewsfromIndiaandaroundtheWorld

- from India’s Q2 GDP Growth Rate to BSE hitting the $4 Trillion Market Cap.

Activities on Social Media: The FEC is committed to ensuring that students are updated with the latest news from the world of finance. It includes important events like budget, company mergers, bankruptcies, famous economics concepts, success stories of companies, and many more. FEC has begunsendinginformationaboutrecentIPOs on the Indian market. For more detailed information, IPO Alerts are sent over social handles. FEC has also published a series of posters called "FinBytes" to inform students about the trends in financial and economic terms that are appearing in the news. Moreover,FECpresentedabriefsummaryof the Interim Union Budget tabled by the Honorable Finance Minister Nirmala Sitharaman on 1st February 2024.

Samvad:Samvadisaninteractivediscussion series conducted by FEC. It aims to connect students with our alumni and other industry stalwartsthroughsessionsanddiscussionson various relevant financial topics. FEC conducted the most recent "Samvad" session in October 2023 on "Financial Planning and RiskAnalysis”.

Guest Lectures: FEC regularly organises industryguestlecturesandworkshopstogive students more practical exposure. In the past, FEC has hosted CFOs and senior management from prominent companies belonging to the financial sector. FEC organized the most recent guest lecture in March 2024 on the topic- “ESG: Enriching 3Ps- People, Profitability and Prosperity.”

AArunya: FEC organised three events as a part of Aarunya 8.0 – IIMAmritsar'sAnnual Management, Cultural, and Sports Fest. The events for AArunya 8.0 were– InSight Out (600+ registrations), Impetus – A Case Competition (600+ registrations), and EcoBate- an Economics Debate.

MOVIE REVIEW

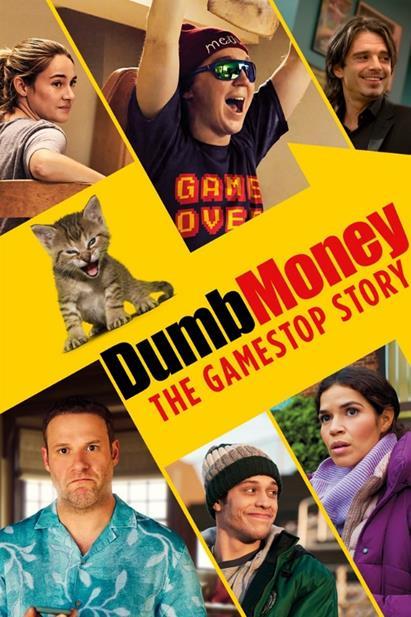

Directed by: Craig Gillespie

Produced by:Aaron Ryder,Andrew Swett

Release Date: 29th September 2023

Running Time: 104 minutes

Country: USA

Language: English Summary

Craig Gillespie's film Dumb Money is a David vs. Goliath story that stunned Wall Street with its cinematic examination of the 2021 GameStop stock trading craze. Great performances from Paul Dano as Keith Gill (Roaring Kitty) and Pete Davidson as his brother Kevin help the movie depict this intricate financial story in an approachable and captivating way. Even for those unfamiliar with financial lingo, Gillespie

skillfully distils complex stock market concepts into an entertaining story. His direction is quick, bringing life to a usually dull subject. Dano captures Gill's geeky fervor and underdog mentality with remarkableeffectinhis characterportrayal.

Andthereisthesupportingcast:acharming lesbian couple, a retail worker, and a nurse who knows as much about stocks as I know about quantum physics, which is to say, little at all. It's as if they are a strange version of the Avengers of finance, navigating the stock market boom with their superpower being unwavering optimism. The head honchos of hedge funds are so flawlessly naive and confused that you would believe they were trying out for a cartoon character. Their million-loss moments are a jumbled mix of schadenfreude and asoberingreminderthat your bank account is more Sesame Street than Wall Street.

Thefilmiscommendablefordemonstrating the internet's ability to inspire collective action and emphasizing the role of social media in modern financial movements. While the film tends toward a triumph-ofthe-underdog narrative, it is unafraid to address society's persisting economic imbalances. This choice makes the narrativemoreaccessiblebutlessusefulfor individuals who want a detailed understanding of the events. More detailed knowledge of financial institutions and behaviors would add dimension to the video. This might contain more sequences investigatingshort-sellingandstocktrading mechanics.

The climax is a jumble of panic-selling Reddit drama, with Robinhood playing the role of that friend who says they are five minutes away but has not even left the

house. The icing on the cake is the congressional hearing, where a symphony of suits and ties tries to explain the internet to other suits and ties. Dumb Money turns a challenging financial event into an engaging and captivating story.Whileit excels inmanyaspects, there isstillroomforimprovementincomplexity andrealism.Thefilm is abeautifuladdition to Gillespie's collection, offering a colourful, albeit shallow, look at a watershed moment in financial history.

BOOK REVIEW

Author:

Author:

Bryan Burrough & John Helyar

Publisher: Harper Collins

Pages: 624

Summary

"Barbarians at the Gate: The Fall of RJR Nabisco" by Bryan Burrough and John Helyar is not just a business book; it's a painstakingly written story that engulfs the reader in the enthralling whirlwind of RJR Nabisco's leveraged buyout (LBO) in the 1980s. This is not a lifeless recital of financial statistics, but rather a Shakespearean drama set on the glitzyWall Street stage, a morality tale in which ambition and avarice collide spectacularly.

The story revolves around F. Ross Johnson, the colourful CEO of RJR Nabisco, the business that produced well-known products including Winston cigarettes and Oreo cookies. Johnson, a man with lavish

tastes and dubious business judgements, comes up with a scheme to use an LBO to take the company private. Let us introduce Henry Kravis and his dynamic company, Kohlberg Kravis Roberts & Co. (KKR). Johnson's plans are thrown off when KKR, which is infamous for its cunning strategies and dependence on "junk bonds" highrisk, high-yield debt instruments sees an opportunity in RJR Nabisco. This starts a bidding battle that becomes a national curiosity, a media spectacle, and a feeding frenzy for hungry investors.

Burrough and Helyar are masters at telling a gripping story. They depict the financial scene of the 1980s vividly, a period of nrestrained optimism and unfettered ambitiononWallStreet.Thereaderistaken to the lavish boardrooms of KKR and RJR Nabisco, where they are able to observe the heated discussions, behind-the-scenes transactions, and calculated moves driven by enormous egos and the desire for unfathomable wealth.

The characters in this book are very well written. With his flashy charisma and blatantly inadequate leadership, F. Ross Johnson turns into a tragic figure who is finally destroyed by his own conceit and greed. Henry Kravis shows up as an intriguing anti-hero, a cunning but brutal tactician who personifies Wall Street's vicious culture. The devoted RJR Nabisco executives caught in the crossfire and the cunning investment bankers like Ted Forstmann make up an equally captivating supportingcharacterthatgivesthenarrative depth and complexity.

"Barbarians at the Gate" is more than just a funmovie.Itexploresthecomplexworldof leveraged buyouts, a financial instrument with substantial risks but the potential to generate enormous profit. Even a reader

with no background in finance may understand the intricacies of the deal because to the writers' straightforward and understandable explanations of difficult financial topics like hostile takeovers, junk bonds, and LBOs. More significantly, they highlight the negative aspects of these tactics, such as the possibility of asset theft, employment losses, and the dissolution of formerlystablebusinessestoproducequick profits for a small number of people.

There are a few small issues with the book. The financial lingo can get complicated at times, which could be difficult for readers who don't grasp the fundamentals. Furthermore, the attention paid to the legendary figures sometimes obscures the 1980s'greaterhistoricalbackground,which includedfinancialinnovation,deregulation, and a final market disaster.

Even with these small flaws, "Barbarians at the Gate" is still a fascinating and classic novel. Even in modern times, the themes of unbridledgreed,theviciouschaseofwealth at any costs, and the fallout from choosing short-term rewards above long-term worth remain powerfully relevant.The tale serves as a sobering reminder of both the human cost that can result from unchecked ambitionandthecyclicalnatureoffinancial markets.

The book is still relevanttoday, and not just in the finance industry. It's a warning story for anyone navigating a society that values success above everything else. It forces readers to consider the reasons behind business actions as well as the possible fallout for workers, customers, and society at large. Are these choices made with the intention of building long term value or manipulatingthesituationtobenefitasmall group of people?

In addition to being a business book, "Barbarians at the Gate" is also a historical account, anengrossingstory,anda timeless morality tale. Long after you've turned the last page, the book continues to haunt you, making you consider the real price of ambition and the seduction of gilded cages that can lead to them. More significantly, it forces you to think about the moral ramifications of unbridled financial manipulation and the personal tales that follow

TEAM FEC

SENIOR COORDINATORS

JUNIOR COORDINATORS

INSTRUCTIONS:

Use the clues to fill in the words above.

Words can go across or down.

NOTE: There are no spaces between words.

ACROSS:

2. What's the commonly used acronym for a marketable security that tracks a stock?

5. What kind of funds does a hedge fund use to earn alpha for its investors?

6. What do you call a legal entity created by an individual in which one person or institution holds the right to manage property or assets for the benefit of someone else?

7.What is the abbreviation of a type of retirement account in which contributions are deductible from earned income in the calculation of federal and state income taxes if the taxpayer meets certain requirements?

8. What do you call evidence of an investment, either in direct ownership (as with stocks), creditorship (as with bonds), or indirect ownership (as with options)?

10. What financial products value is based on an underlying security, commodity or other financial instrument?

11. What do you call evidence of a debt in which the issuer promises to pay the holders of this financial product a specified amount of interest and to repay the principal at maturity?

DOWN:

1. What is the amount of current income provided by an investment?

3.Whatkindofcontractisstandardized,transferable,andexchange-tradedandrequiresdelivery of a commodity, bond, currency, or stock index, at a specified price, on a specified future date?

4. What term is used to describe the range of price swings of a security or market over time?

9. What is a type of trust created by a person during his or her lifetime?