VITTA ARTHA

IN THIS ISSUE

Innovation, Sustainability and Finance

Dr. Nabendu Paul

Assistant Professor, IIM Amritsar

COVER INTERVIEW

Future Trends in the Indian Stock Market

Mr. Sanjiv Bhasin

Director, IIFL Securities

VOLUME 10

1. Foreword Prof. Nagarajan Ramamoorthy (Director, IIM Amritsar)………………….…………..….…...2 2. Cover Interview Mr. Sanjiv Bhasin (Director, IIFL Securities Ltd.)…………………..…………..……………3 3. Innovation, Sustainability and Finance Dr. Nabendu Paul (Assistant Professor, IIM Amritsar)………………………..………….......8 4. RBI's Digital Currency: Another Milestone for the Indian Economy Atharva Ramteke (MBAHR02, IIM Amritsar)……………………………………………..11 5. Central Bank Digital Currency Ravi Consul (MBA08, IIM Amritsar)………………………………...…………..………..13 6. Looming Threat of Global Recession in 2023 Agyeya Mishra (Delhi Technological University)…………………………..………..…………15 7. Sovereign Green Bonds in India–A Game Changer Vedant Gupta, Utkarsh Rai (IIM Lucknow)……………….…...……………...…….……..18 8. Insights into Forensic Auditing Rutu Jethva (Institute of Company Secretaries of India)………………….…….………...……22 9. Indian Banking Sector Report……………………………………….…………….25 10. CFA Preparation………………………………………..…………………………..28 11. Golden Investment Fund……………………………….………………………....30 12. Club Activities………………………………………………...…..………….…….32 13. Our Recommendations……………………………….…….……………………..35 14. Team FEC………………………………………………....……………………….40 15. Crossword……………………………………………...……..………………..…...41 CONTENTS CONTENTS VITTA ARTHA | 1

Dear All,

I am delighted to introduce the tenth edition of Vitta Artha, the bi-annual magazine published by the Finance and Economics Club (FEC) of IIM Amritsar. FEC works interminably at the college and industry levels to further the students' interests by exposing them to various aspects of the world of finance and economics. The club endeavours to harness talent and enhance the learning experience of our student community. Vitta Artha

The Finance and Economics magazine of IIM Amritsar is one such effort in the same direction. Varied views in the form of articles given by students from prominent B-schools across India, finance faculty, and the esteemed insights of industry professionals help the students and readers better understand the reallife implications and nuances in the fields of finance and economics.

In this edition of Vitta Artha, readers will gain an in-depth understanding of the projected performance of the Indian Markets and the key sectors to keep an eye on in the coming years. It sheds light on the pivotal role that retail investors will play in the Indian Markets in the coming times and provides an analysis of the recent IPO boom, where start-ups have offered equity to the public at hefty valuations. The report also talks about the pressing issue of a potential global recession and India's stance in the face of this threat. Additionally, it covers the hot topics of Cryptocurrency and Digital Currency, providing insights and perspectives on these emerging trends.

This issue features a comprehensive analysis of the interconnection between Innovation, Sustainability, and Finance. The article explores the perspectives of multiple stakeholders in companies regarding their sustainability efforts, including shareholders, lenders, customers, employees, suppliers, government, and society. Additionally, it delves into innovative engineering solutions that promote sustainability, such as Smog Free Towers, Seabin, Solar Glass, and more. The article also touches upon the Union Government's Nation Green Hydrogen Mission and the various technologies for producing hydrogen. Lastly, the article provides valuable insights into the concept of Sustainable Finance.

Alongside this, this edition also features CFA preparation strategies, Industry Analysis, and Insightful Articles from students from reputed institutes of the country on topics related to Finance and Economics. I hope that this issue of Vitta Artha, like the previous editions, adds value to its readers and thus augments their interest and inquisitiveness in the enriching domain of finance and economics.

–

FOREWORD VITTA ARTHA | 2

PROF. NAGARAJAN RAMAMOORTHY

FOREWORD

Mr. Sanjiv Bhasin Director IIFL Securities Ltd.

much interest in owning a SIP or equity in the last 30 years of my career as we are seeing now. We have four asset classes first gold/silver which is bought due to emotional reasons more than investment purposes, second is fixed income which just manages to beat inflation, third is real estate which takes a long time to build and fourth is equity where there are just ten crore Demat accounts out of one hundred thirty-five crore population. The SIP, the advent of mutual funds and participation from retail investors is here to stay, giving a number to it will be difficult but as the market matures, we will be among the top three or four economies in the world.

Question: Which themes do you anticipatewillbeprominentinthenearfuture?

Mr. Sanjiv Bhasin is currently associated with IIFL Securities Ltd. in the Director capacity. He has been associated with IIFL for 7 years. Here are some of the things we learnt from his work at IIFL on the topic of future trends in the Indian Stock Market.

Question:HowdoyouthinktheIndian EquityMarketswillperforminthecomingtwodecadesandwhatarethereasons behindit?

The next two decades belong to India as the demographic dividend is here to stay. I have never seen this

Since we are an outsourcing nation and IT is a reliable proxy for the rupee, it will continue to be one of the most tangible assets even as themes change. In the local economy, banks, construction, high-capex stocks, and automobiles are all doing very well. Consumer electronics, the entire consumer basket, consumer discretionary, and pharmaceuticals are other excellent sectors to trade against global cues. Sixtyfive percent of market capitalization is made up of twenty-three sectors that make up the nifty. Therefore, keeping an eye on the nifty itself will help us identify the themes that are being developed.

Question:Youtalkedaboutdomesticparticipation driving the markets. Can you elaboratealittlemoreonthat?

“Future trends in the Indian Stock Market”

INDUSTRY INSIGHT VITTA ARTHA | 3

Here’s what we learnt from this Cover Interview

Out of the four asset class discussed earlier peopleowned only three and equity was the missing link but people have now realised that equity will give the most return in the coming twenty to thirty years. Also, people can start a SIP even with Rs 2000 which is the amount they pay to buy a movie ticket with popcorn whereas owning the other three asset classes is much more expensive. The retail flows are as solid as a rock and they are not going to change or be deterred by any global chaos or volatility. The next twenty years belong to SIP which means it is an added burden on mutual fund managers, which will also oscillate government policies and it will be a time of performance for the fund managers. The bullishness that we are seeing now among retail investors has never been seen in my past 33 years of career.

Question:Overthepastfewyears,there hasbeenatrendwhereseveralstartup’s have launched initial public offerings (IPOs)and attracted significant interest fromretailinvestors.However,afterlisting, these startup’s have experienced a 70+% decline in value. What are your thoughtsonthesestocks?

A few years ago, there were hardly any startup’s; today, there are thousands of them. The unicorns are here to stay, but there will be pricing pressure because these are new-age businesses. Whether it is fintech, online, or distribution, these kinds of businesses take a while to mature because they require

capital to grow and returns are always back-ended. Businesses like Google, Amazon, Netflix, and others have demonstrated their success over time. As a result, while some of them will be swept away by the wave, others will build significant fortunes; however, this will take time. The initial pricing of these stocks occurred at a time when the index was at an all-time high and there was a craze to own equity, so the pricing would have been slightly erroneous. However, if someone has a long-term horizon, some of them could end up being very good prospective businesses. Additionally, it highlights the fact that young people are now prepared to act quickly, take entrepreneurship very seriously, and grab the bull by the horns, which is a very encouraging development for India. As we've seen in the United States, where the appearance of unicorns led to the creation of several multibaggers. The pricing will always be a little off due to volatility and outside influences. The decision of whether or not to invest in such businesses, however, depends on the investor's risk tolerance and time horizon. Zomato is a good play at Rs 50/share and as we know ordering food and doing away with domestic help has become a big business, we can give a similar credence to Paytm in the fintech space which is also trading at a discount but to make money here we need to give time rather than time the market.

Question:Everynewsoutletisdiscussing thepotentialforarecessionthatissoonto come.Whatdoyouthink?

Markets are forward-looking and anticipate recession

INDUSTRY INSIGHT VITTA ARTHA | 4

The Fed lost credibility for not acting upon inflation much before it became a problem and they had to come out to five consecutive rare hikes which is putting pressure on the US bond yields, as a result the dollar has been all over the place hurting primarily the euro and other currencies with it, but everything is now priced in. Europe has rebounded and even if there is a recession it is expected to be a mild one because of the upcoming US elections. They will implement enough convincing measures to address any issues with employment and the economy. Therefore, even if there is a recession, it will be mild and brief, as it is already being priced in. India stands out in the midst of all this chaos because, even though our expected growth rate is only 6-7 percent, it is still better than the majority of other global economies.

Question:ThereisaperceptioninIndia todaythatwhenwegrow,weoutperform theUSmarketandthatourstockmarket willdeclinelessthantheUSmarket.The IndianmarketisessentiallyoutperformingtheUSmarket.Doyoubelievethat this trend will last or that it was a onetimeeventbasedongeopoliticsorother factors?

Not only due to geopolitical reasons, but also because India is starting to stand out on the economic front. Our domestic demographic premium has performed brilliantly, and after the lockdown was lifted, businesses like hotels, restaurants, airlines, and airpor

-t have seen record business. Some IT majors, banks, cement, and also a number of other stocks have posted record numbers. Outflows totalling $30 billion have put pressure on the rupee and India's foreign exchange reserves. However, domestic investors have invested in the markets and are aiding us in getting out of this storm. We will be subject to global cues if the US market fall, it is not that we can stay completely aloof but our descent will be much less and when the markets turn, we will rise faster than them.and euphoria before they occur.

Question: On the Geopolitical front, we arestillundergoingawarinUkraine,and Chinaisstillunderstrictlockdown,how muchmoreitwillimpactthestockmarket inIndia?

A large part of this has already been played out, when the first bullet was fired the market bottomed out this is what has happened historically which we saw in February 2022. How much do we hear of Russia and Ukraine now? Where last year in March-April every day we used to get detailed updates on the conflict. Markets live up to everyone’s expectations and lightning doesn’t strike twice. Secondly, China itself has dug its hole given its demographics, covid handling, its domestic real estate problem and now they are on the verge of coming off. So the China opening will be a big threat as we have seen a lot of the ETF flows are going back to China and it will be one of the leading indicators of global growth and their market is at

INDUSTRY INSIGHT VITTA ARTHA | 5

helm of a bull run. Geopolitical risks will always realize that Europe's dependence on Russia is decreasing and that gas prices are now at a three-year low. Therefore, the markets factor in the actual event taking place much earlier than anticipated.

Question:Howwillcryptocurrencyaffect Indianequitymarkets?

If someone had entered the cryptocurrency market early, they would have made a lot of money, but if they had entered near the top, they would have lost money. Asset classes will always experience highs and lows, but because cryptocurrencies are so unpredictable, I don't track them. However, alternative asset classes and currencies are here to stay. China and Russia have already declared their disapproval of the dollar, and gold is not a viable alternative. As a result, the existence of cryptocurrencies will continue; however, they must be regulated in order to gain more legitimacy. It is worth looking into blockchain technology if one is familiar with the specifics, but because of its extreme volatility, only those with strong hearts should do so. However, most of the other major stock markets, with the exception of the US market, have outperformed cryptocurrencies since the start of the year.

Question:DigitalrupeewasrecentlyintroducedbyRBI.Whatkindof aneffect doyouthinkitwillhave?

The world is moving toward a digital age where everything, including banking, stock markets, and hotel

reservations, is done online. Because it offers a crypto alternative and is governed by the nation's central bank, the RBI proposal will be well received. The most transparent markets, the stock markets, won't be affected much at all. Our transition is very smooth, and I believe that the RBI is currently the most wellregulated central bank in the world. We have share settlements scheduled for two days. It will have hardly any impact on the stock markets, which are the most transparent. We have settlements of shares within two days, so our transition is very smooth and according to me RBI is the most well-regulated central bank in the world right now.

Question:HowdoyouseeNiftyat18000.

Overpriced,fairlypriceorunder-priced?

Due to the fact that retail flows are here to stay, our market will continue to be expensive. In the past two to three years, we have seen SIPs totalling 12,000 to 13,000 crores each month. As a result, some stocks and bluechips will always have an extended valuation. We are undoubtedly not a cheap market, but as a global outperformer, we are also not overly expensive. Despite the fact that we are a little more expensive than the majority of other emerging markets, 18000 seems like a reasonable price if someone has a medium to longer time horizon. exist, and stock markets are expected to climb the wall of worry once the event happens and it is discounted. It is out of anyone's control, but the escalations will now be subdued as both Russia and Ukraine

INDUSTRY INSIGHT VITTA ARTHA | 6

Question:Ourstockmarketshaveundergonemanychangessincediscountbrokersfirstappeared.Whattrendsdoyou seedevelopinginthissector?

Globally, discount brokerages have dominated the market; in India, Zerodha, 5paisa, etc. are dominating this sector, but profitability is still a problem. Other services, like asset management and other related ones, will now serve as a differentiator for traditional brokerage firms. In a time of transition, the strongest will survive. However, given that domestic inflows are expected to be strong for the foreseeable future, there is enough food for everyone to survive. This will ultimately be advantageous for the broking sector. The industry is just getting started, and I believe that all types of broking firms will coexist.

INDUSTRY INSIGHT VITTA ARTHA | 7

Dr. Nabendu Paul Assistant Professor IIM Amritsar

Innovation, Sustainability and Finance

2023 is an important year for India. As India holds the Presidency of the G20, this year provides an opportunity for India to usher into a new era of massive adoption of carbon neutral solutions and decarbonisation initiatives. This can be achieved through innovation and collaboration amongst firms, the government and the academia. Stakeholders of the firms care more now about sustainability-be it the shareholders, the lenders, the customers, the employees, the suppliers, the government and the society at large. Shareholders and lenders have started adopting policies which do not encourage and allow funding for projects that do not have environmental considerations. Customers want products and services which have lesser, if not zero, carbon emissions. Employees expect work environment which allows them to demonstrate their capabilities to make their work processes less energy dependent through innovation. Suppliers are under constant pressure to maintain less carbon emissions in the supplier chain. The government is determined to contribute towards the climate goals and has initiated mega projects. The society at

large would be a major contributor towards achieving the climate goal. It can take steps to gradually reduce reliance on conventional power and replace it with solar power, change of lifestyle, change of design and many more.

There are many exceptional engineering innovations which address the issues of sustainability. The first that comes to mind is the innovation of smog free towers. The smog free towers act as giant vacuum cleaners that suck up the polluted air in the big cities, clean them through a process of ionisation and release back into the atmosphere. The second impactful innovation is the safer cooking stoves. Almost 3 billion people worldwide rely on timber or animal dung for cooking. They have inefficient combustion rates and hence produce a lot of smoke which causes almost 4 million deaths every year due to smoke inhalation. Safer cooking stoves address this issue at a massive scale in the developing economies. The third innovation includes innovation of alternative plastic from carbon emissions. This alternative plastic is manufactured from naturally occurred polymer (Polyhydroxy butyrate (PHB)) which is produced by microorganisms in the ocean. Hence this plastic is fully biodegradable on land and water. The fourth innovation is the ‘Seabin’ which works by sucking sea water using a submersible pump where plastics are filtered out and clean water flows back to the ocean.

Another innovation that comes to mind is the solar glass that capture and store solar energy and this may be the way homes and commercial buildings are built

FACULTY ARTICLE VITTA ARTHA | 8

in future. This may reduce the energy requirements during the day and will replace traditional energy sources. Demetra, made from 100% plant extracts, is a natural treatment of fruit and vegetables preservation. They need not be stored in cold storage system during transit conserving a lot of energy. ‘Sundrop farms’ use concentrated solar power and thermal desalination for desalinating sea water before using the same for irrigation. Vegan bottle made from sugar cane extracts is yet another innovation. ‘CloudFisher’ converts fog into drinking water that can be even used for irrigation or for forestry efforts, and they are very useful for the population living in mountainous areas.

Sustainability can also be ensured with various simple innovations. Some of them include reuse, reduce and recycle of various electronic, plastic and metallic products, proper solid and liquid waste management, heat recovery systems, use of group technology in manufacturing, reliance on sharing economy, adoption of biodegradable packaging and so on. The government has given approval for going ahead with the National Green Hydrogen Mission. Hydrogen only emits water when burnt or oxidized. Hence, we may use this as a fuel without emission of CO2 (GHG). ‘Grey’, ‘Blue’, ‘Green’, ‘Pink’, ‘Yellow’ or ‘Turquoise’ are the various terms associated with hydrogen technologies which shows the way it is produced. ‘Green’ hydrogen is the only type produced in the climateneutral manner. Production of ‘Green’ hydrogen involves splitting water into hydrogen and oxygen using

renewable electricity. ‘Grey’ hydrogen is traditionally produced by reacting methane with steam which releases CO2 (the main culprit greenhouse gas) and hydrogen. ‘Blue’ hydrogen is traditionally produced in the same way as ‘Grey’ hydrogen with additional technology to hold CO2 and store it without releasing it in the environment, thereby lowering impact of hydrogen production on environment. ‘Turquoise’ hydrogen is produced through methane pyrolysis that holds 90-95% of CO2 in the solid form for long time.

The initial outlay of Rs 19744 crore for the National Green Hydrogen Mission will enable India to reduce its carbon footprint and also save substantial amount of foreign exchange on fossil fuel import bills. This will also help in abating approximately 50 million metric tonnes of greenhouse gas emissions, which amounts to 45% reduction of emission intensity by the year 2030 as compared to 2005. India will soon become the hub of production, utilisation and export of green hydrogen and contribute to sustainable development goal of addressing the issue of climate change.

Sustainable finance can play a great role in encouraging innovative projects and funding such projects which addresses environmental, social and governance concerns in an economic activity and project. While environmental concerns by the financial sector will ensure that there are no ‘private’ benefits at the expense of ‘public or social’ costs by using sustainable resources and ensuring actions that mitigate climate crisis to some extent, social concerns will ensure

FACULTY ARTICLE VITTA ARTHA | 9

that such financiers adhere to human and animal rights, focus on diverse hiring practices and focus on consumer protection. Governance concerns compensation practices, ensuring checks and balances in place for protection of shareholders’ wealth, reliable addressing the agency issues and so on. Sustainable finance may be important for two reasons. First, society is not going to accept the social costs when the firm (financiers and managers) are growing richer at the cost of society. Second, all stakeholders including investors are demanding higher transparency and accountability from the firm. Taking into cognizance the fact that the jobs in sustainable finance is on the rise and the world is approaching towards a climate crisis at a rapid speed, sustainable finance is there to stay and reorient on how we need to do business in future.

References:

1. Holmes, L. (2022, July 7). 5 examples of sustainable engineering for the future. British Engines. https:// www.britishengines.co.uk/blog/5-examples-ofsustainable-engineering-for-the-future/

2. Dominique, B. (2022, April 16). Solar Man of India

Chetan Singh Solanki advocates three steps to control global warming. The Times of India. https:// timesofindia.indiatimes.com/city/puducherry/solarman-of-india-chetan-singh-solanki-advocates-threesteps - to - control - global - warming/ articleshow/90875550.cms

3.What is green hydrogen? An expert explains its benefits. (2022, November 9). World Economic Fo-

rum. https://www.weforum.org/agenda/2021/12/ what-is-green-hydrogen-expert-explains-benefits/

4. Vishwa, Mohan. (2023, January 5). Eye on climate goals, govt OKs Nat’l Green Hydrogen Mission. The Times of India. Retrieved from http:// timesofindia.indiatimes.com/

5. Harvard Extension School. (2022, August 9). What Is Sustainable Finance and Why Is It Important? https:// extension.harvard.edu/blog/what-is-sustainablefinance-and-why-is-it-important/

FACULTY ARTICLE VITTA ARTHA | 10

Atharva Ramteke

IIM Amritsar

“RBI's Digital Currency: Another Milestone for the Indian Economy

” Probably, counterfeiting $100 bills is easier and cheaper than counterfeiting Digital Currency”. With this powerful and impactful thoughts, let’s begin our journey of gathering more and more information about digital currencies and specifically RBI’s digital currency and share new exciting knowledge about it to the whole world.

rencies available and used throughout the world notable examples include Bitcoin, Cryptocurrency, Stable coins, CBDCs and so on and so forth.

Now talking about our main topic i.e., RBIs digital currency then it should be noted that at an event titled "Digital Rupee: A Way Forward," hosted by the

First start with the actual meaning of Digital currencies. So, what is Digital Currency? We can define Digital currency as any form of electronic money that may be created, saved, and traded online. In todays globalizing world of business, it is very important to know the use of digital currency to make the transactions or any kind of work easier, smoother and efficient. There are various types of digital cur-

PHD Chambers of Commerce and Industry, Ajay Kumar Choudhary, executive director of the Reserve Bank of India, stated that the introduction of digital currency would increase operational efficiency and promote financial inclusion (PHDCCI).

With the introduction of the digital rupee, the robustness of the country's payment system will increase along with the efficiency of new payment methods. He also predicted that it would spur development in the field of international money transfers. In response to consumers' demands, more sophisticated, highcapacity use cases will be introduced to the market in the future. CBDC will provide the desired service to the public while protecting consumers from harm and preventing negative social and economic effects.

” STUDENT ARTICLE VITTA ARTHA | 11

The strategic void in this moment will be filled by digital currency. Additionally, it is supposed to work in tandem with the existing monetary systems rather than replace them. Users would have another option for making purchases with this feature.

According to the central bank digital currency (CBDC) tracker, approximately 105 countries accounting for 95% of global GDP have taken efforts to incorporate digital money into their respective economies.

There are approximately 50 nations that have reached a more advanced stage of preparation for the introduction of the digital currency, while only 10 nations have successfully launched the digital currency in its entirety.

To create a system that is accessible to all, robust enough to keep up with the rapid pace of technological advancement, and flexible enough to adapt to new circumstances, the Reserve Bank of India will

implement measures to ensure that CBDC is issued in accordance with a calibrated and nuanced methodology that includes adequate safeguards to tackle any potential difficulties and risks.

Digital currency issued by the Central Bank is based on the values of honesty, transparency, and accountability. The transition to digital currency will close the gaps and eventually eradicate all the black money in the system.

The Reserve Bank of India's (RBI) retail digital rupee (CBDC) pilot programme kicked off in Mumbai, New Delhi, Bengaluru, and Bhubaneswar on December 1.

Participants included State Bank of India, ICICI Bank, Yes Bank, and IDFC First Bank as well as customers and merchants in the initial stages of the retail digital rupee project, which was conducted in a closed user group.

In this case, the conversion of physical currency into digital currency is unrelated to the digital currency itself. This virtual currency would be stored in an electronic wallet much like paper bills are stored in a traditional wallet. Only the appearance is evolving; everything else remains the same.

STUDENT ARTICLE VITTA ARTHA | 12

Ravi Consul IIM Amritsar

Central Bank Digital Currency

Recently, there has been a buzz around the use of cryptocurrencies as a mode of payment worldwide, but their legitimacy is still ambiguous. With the use of emerging technologies in the financial sector, a major concern is safety. So, if this was such a big concern, why does the Indian government push to introduce its own digital currency into the system? Let’s find out.

Since the inception of modern money transfers, there have been multiple modes of payment like physical currency, wallets, and coupons, but only sovereignbacked fiat currencies have universal acceptability. Such currencies are debased by irresponsible monetary, fiscal, and inflation adjustments. With the advent of Bitcoin, the popularity of a decentralized transaction with no central authority is rapidly gaining momentum, with more and more people preferring it. Due to its rising popularity, India, along with 50 other countries, is planning to launch their own digital currency to address the latest technology while keeping national safety in mind. So, a "Central Bank Digital Currency (CBDC)" is a government-issued

token of currency that is not backed by a physical commodity like gold or silver. It aims to provide consumers with privacy, convenience, and accessibility. It aims to reduce the complexity of the current financial system by following a distributed ledger system. It will reduce cross-border transaction costs and provide higher security through its design.

Broadly, the government has launched two pilot CBDCs: wholesale and retail CBDCs.

The wholesale CBDCs are meant for financial institutions, similar to holding a reserve with the Central Bank. These banks use it to transfer funds and can use monetary policies to control interest rates, whereas retail CBDCs, an alternative to the physical currency, are meant for general consumers. The government is also trying to break the retail CBDC market into two parts based on its use case. . A token-based system allows for anonymous transactions, whereas an account-based system allows identification through an account. These classifications are still under scrutiny, as the more options a consumer has, the more loopholes are likely to be exploited. Currently, all these initiatives are running as pilot programs, where the government is assessing the use case and scalability of CBDC in Indian markets. If this technology becomes prevalent, it can make monetary policy more effective with better transmission and use for zero/negative interest rates. Through this, the government can also empower its citizens' spending in selected wallets to enhance its fiscal measures. Nonetheless, tax collec-

“

” STUDENT ARTICLE VITTA ARTHA | 13

-tion would be improved since all the transactions would be in real-time. Lastly, it is a boon for the environment as it would save a good percentage of printing paper otherwise used for physical currency.

With all these lucrative advantages, there are a few concerns that have yet to be addressed by the government. Firstly, since all transactions appear in realtime, you can no longer transact anonymously, unlike the case of physical currency. Secondly, there would be no provision to hold cash, as all these tokens would be in digital format and not convertible to a physical format. It also gives the government additional power to control the velocity of money with interest rates. Lastly, privacy and protection from notorious hackers are still a big concern, as these tokens, if used by an unauthorized user, can lead to severe damage to the economy.

With all these considerations, India has taken a brave leap into a new age, and only time will tell if these currencies prove to be a boon or bane for the country.

STUDENT ARTICLE VITTA ARTHA | 14

Agyeya Mishra Delhi Technological University

Looming Threat of Global Recession in 2023”

The COVID-19 pandemic has had a significant impact on the global economy, leading to high levels of unemployment and a decline in economic activity. While the vaccine rollout provided some hope for a recovery, there has still been a lot of uncertainty about the long-term impact of the pandemic. As the world slowly recovers from its devastating impact, many economists are warning of a potential global recession looming on the horizon. While the exact timing of a potential recession is difficult to predict, there are several indicators pointing to the possibility of a recession occurring in 2023.

One key factor contributing to the possibility of a global recession is the rising levels of debt worldwide. According to a report by the International Monetary Fund (IMF) [1], global debt levels reached a record high of $281 trillion in 2020, an increase of $15 trillion from the previous year. This increase was largely driven by government spending to combat the economic effects of the pandemic, as well as low-interest rates that have made borrowing more attractive for both governments and businesses.

The rising levels of debt are a cause for concern because they can make economies more vulnerable to economic downturns. When economies experience a recession, the value of assets such as stocks and real estate tend to decline, leading to a decrease in wealth for individuals and businesses. This, in turn, can lead to a reduction in consumer spending, which is a key driver of economic growth. Also, high levels of government debt can lead to a decline in investor confidence and make it more difficult for governments to borrow in the future. This could have negative impacts on economic growth, as governments may be unable to fund necessary infrastructure and other investments.

Another factor contributing to the potential for a global recession in 2023 is the uncertain state of the global trade environment. Trade tensions between major economic powers such as the United States and China have been a key source of uncertainty in recent years, and the COVID-19 pandemic has only exacerbated these tensions. They can turn into economic retaliation, which could disrupt global supply chains and lead to a slowdown in economic activity. The World Trade Organization (WTO) has reported that global trade is expected to decline by between 13% and 32% in 2020, depending on the severity of the pandemic.

This decline in trade can have significant impacts on the global economy, as trade is a key driver of economic growth. When countries reduce their imports

STUDENT ARTICLE VITTA ARTHA | 15

“

and exports, it can lead to a decrease in demand for goods and services, which can result in a slowdown in economic activity. Additionally, trade tensions can lead to an increase in the cost of goods and services, as tariffs and other trade barriers raise the price of imported goods. This can lead to a decrease in consumer spending and further contribute to the economic slowdown.

A third factor that could contribute to a global recession in 2023 is the potential for a financial crisis. The COVID-19 pandemic has already had a significant impact on financial markets, with many investors moving their money into safe havens such as gold and government bonds. While these asset classes have performed well in the short term, there is the potential for a longer-term financial crisis if economic conditions continue to deteriorate.

One potential trigger for a financial crisis is a rapid increase in interest rates. Low-interest rates have been a key factor in the economic recovery following the global financial crisis of 2008, but if rates were to rise significantly, it could lead to a decrease in demand for mortgages and other forms of borrowing, leading to a slowdown in economic activity. Additionally, a financial crisis could be triggered by a significant decline in asset values, such as a sudden drop in stock prices or a decline in real estate values.

A fourth factor that could contribute to a global recession in 2023 is a potential slowdown in the Chinese economy. China has been a major driver of

global economic growth in recent years, but the country is facing a number of challenges, including an ageing population, rising debt levels, and declining productivity. If the Chinese economy were to experience a significant downturn, it could have ripple effects on the global economy.

In addition to the potential for a global recession, there is also the risk of a deflationary spiral, where falling prices lead to a decrease in demand and a further decline in prices. This can be particularly damaging for economies that are already experiencing a downturn, as it can lead to a downward spiral of declining economic activity.

In conclusion, while it is difficult to predict with certainty whether or not a global recession will occur in 2023, several indicators are pointing to the possibility. The rising levels of debt worldwide, the uncertain global trade environment, and the potential for a financial crisis all contribute to the potential for a global recession in the coming years. It is important for governments, businesses, and individuals to be aware of these potential risks and to take steps to prepare for the possibility of an economic downturn. Governments must implement policies that promote economic stability and growth. This may include measures such as infrastructure investments, tax cuts, and monetary and fiscal policy measures to support economic activity. It is also important for businesses and individuals to be proactive in preparing for a potential economic downturn. This may include saving

STUDENT ARTICLE VITTA ARTHA | 16

more money, reducing debt, and diversifying investments to reduce risk.

References:

[1] International Monetary Fund. (2020). Global debt hits all-time high of $281tn, says IMF. Retrieved from https://www.theguardian.com/business/

STUDENT ARTICLE VITTA ARTHA | 17

Vedant Gupta | Utkarsh Rai

IIM Lucknow

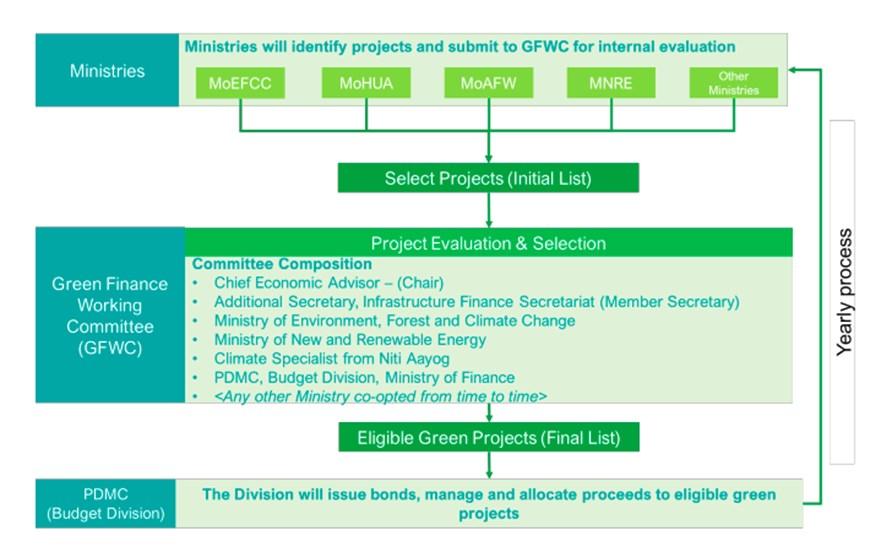

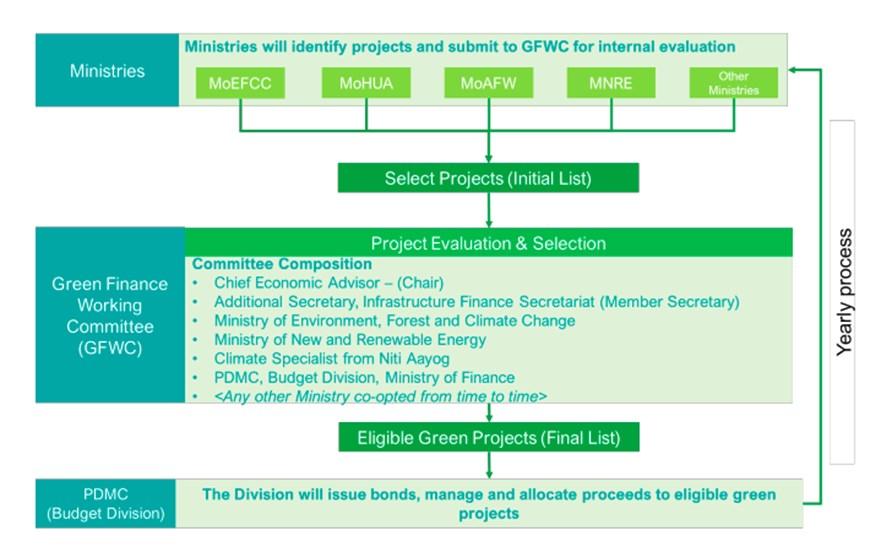

“Sovereign Green Bonds in India–A Game Changer

The recent Covid-19 pandemic has welldemonstrated the potential impact of large-scale disasters on the economy and society. One such natural disaster looming over our heads for decades is climate change. Erratic weather patterns, rising sea levels and melting glaciers are reshaping societies across the globe. Research by The Climate Impact Lab suggests that if prompt action is not taken to address climate change, 7.6% of the world's population will experience higher mortality rates, and 9.1 million people will die year until 2100. India is particularly vulnerable to climate change because of its distinctive geography, geology, and wide range of climatic conditions.

Though India is making fast progress towards a lowcarbon economy as part of its effort to achieve sustainable development goals, there's still a long way to go. These SDGs usually require significant capital funding. Although debt is the primary funding source for such projects, we must find more creative ways to accomplish development goals as the climate crisis worsens quickly.

With this increasing need for funding climate relief and adaptation activities, sovereign green bonds are now being leveraged worldwide. A sovereign green bond is fundamentally a debt instrument issued by the state or central government. It is used to borrow funds from investors with the obligation to spend the mobilized fund on climate or ecosystem-related activities. This article explores the impact that sovereign green bonds can generate in the Indian context.

The need for Sovereign Green Bonds in India

India first published its Nationally Determined Contributions (NDCs) in 2015. Back then, the primary goals were to cut the GDP emissions intensity by 3335% by 2030 compared to 2005 levels and to expand the total installed capacity of non-fossil fuel electric generation to 40%. These goals were well surpassed. For instance, compared to 2005 levels, India's carbon emissions had already decreased by 24% in 2016. Hence, India updated its NDC in 2022 with new objectives.

The key highlights of India's updated NDCs include:

Reducing India's GDP's emissions intensity by 45% by 2030

Achieving around 50% of installed electric power capacity from non-fossil fuel sources by 2030

Prime Minister Modi's worldwide climate change programme, the "Lifestyle for the Environment (LIFE) Movement."

STUDENT ARTICLE VITTA ARTHA | 18

”

These targets are significantly higher than before and consider the "Panchamrit" goals as well. They will be implemented over 2021

2030 through the plans and initiatives of the relevant Ministries/Departments and with the necessary assistance from the States and Union Territories. As promised under the UNFCCC and the Paris Agreement, India is now focusing on producing extra global financial resources and technology transfer. India's climate initiatives have thus far been funded mainly by domestic resources.

Sovereign Green Bonds will be issued in 2022–2023 as part of the government's overall market borrowings to raise money for green infrastructure. The funds will be used for government initiatives to lower the economy's carbon intensity.

Framework for the use of Green Bonds

India's Sovereign green bonds (SGrB) framework was released on November 9, 2022. The green bonds issuances under the framework will help the government tap funds from potential investors for public sector projects to reduce carbon intensity. The framework further underlines how the government plans to use this money. It outlines a strategy for green investments, including ways to ensure transparency when choosing green initiatives. It also describes how the administration will keep an eye on these investments. It lists green projects as renewable energy, energy efficiency, clean transportation, climate change adaptation, green building, sustainable land use and management of living resources, sus-

tainable management of water and waste, pollution prevention and control, and projects to conserve terrestrial and aquatic biodiversity.

The framework addresses each sector independently and provides a list of initiatives that must be prioritized to fulfil the greater goal of sovereign green bonds. The framework, for instance, contains renewable energy-related activities, including funding solar, wind, biomass, and hydropower energy projects that combine energy generation and storage. It also entails providing incentives for the use of renewable energy. The framework also includes a list of industries that SGrB should avoid at all costs. The government forbids the use of fossil fuels and the production of nuclear power, direct waste incineration, alcohol, firearms, tobacco, gaming, and palm oil, among other things. Similarly, the green funds will not invest in renewable energy projects that produce electricity from biomass using feedstock from landfills, hydropower plants bigger than 25 MW, or projects involving protected regions.

–

STUDENT ARTICLE VITTA ARTHA | 19

How good is the framework?

In our opinion, the strength of this framework lies in its reflection of India’s ambitions to expand renewable energy production and reduce its economy’s carbon intensity. However, it comes with its own set of drawbacks. The project categories are quite broad and create uncertainty about what kind of expenditures could be financed. They also lack any quantifiable thresholds which reduces the objectivity of the framework. Also, expenditures eligible under the framework may support substituting natural forests with monoculture plantations. These plantations are usually less biodiverse and less resilient to climate change.

Barriers to scaling up

Building a robust green bonds market in emerging economies such as India is hampered by many institutional and market hurdles. Given that having a technical understanding of current international standards in green bond transactions is a need for the issuing process, a lack of information has discouraged issuers and investors from using these instruments.

Along with institutional obstacles, market obstacles related to minimum transaction sizes, currency concerns, and high transaction costs have discouraged emerging economies from utilizing this instrument. As a result, small-scale green initiatives in underdeveloped nations have been unable to access the global financial green bond market.

Creating an effective green bonds market further requires harmonizing national and international regulations and standards for green bonds. The definition of green investments must also be homogeneous, as different taxonomies would be incompatible with a global market for green bonds.

Conclusion

The impact of COVID-19, along with the increased worldwide attention on climate change, has re-ignited interest in the Paris Agreement obligations. While India may be on track to meet its 2030 commitment, the road to becoming carbon-neutral by 2050 is long. It would require significant investment in infrastructure for renewable and sustainable energy sources. Globally, Green bonds are a profitable option for investors looking for sustainable investments. In India, incentives would also change investors' mindset from one primarily focused on yield to one more concerned about the environment. Government grants to issuers would enable them to appoint reputable international reviewers, which would snowball into raising the debt instrument's rating, allowing them to increase the number of issuances in the country. Direct financial incentives, such as tax breaks for corporate green bonds, must be evaluated to spur investor demand. With the substantial SDG commitments, the task at hand is enormous. And sovereign green bonds seem to have the potential to get this job done.

STUDENT ARTICLE VITTA ARTHA | 20

References:

1. Green Bonds: Key to fighting climate change?

(https://www.orfonline.org/research/green-bondskey-to-fighting-climate-change-56757/ #:~:text=According%20to%20the%20accepted% 20global,investment%20cycle%20for%20green% 20projects)

2. Framework for Sovereign Green Bonds

(https://dea.gov.in/sites/default/files/Framework% 20for%20Sovereign%20Green%20Bonds.pdf)

3. Green Bonds: Mobilising the debt capital markets for a low-carbon transition

(https://www.oecd.org/environment/cc/Green% 20bonds%20PP%20%5Bf3%5D%20%5Blr% 5D.pdf)

4. SEBI: Disclosure requirements for issuance and listing green bonds

(

https://www.sebi.gov.in/sebi_data/ meetingfiles/1453349548574-a.pdf)

5. A Study of Green Bond Market in India: A Critical Review

(https://iopscience.iop.org/article/10.1088/1757899X/804/1/012052)

STUDENT ARTICLE VITTA ARTHA | 21

Rutu Jethva Institute of Company Secretaries of India

Insights into Forensic Auditing”

Investments, personal finances, corporate finances, trading, taxation, and accounting are some familiar terms. Our analysis is based on the financial statements of the company and the reports issued by the respective regulatory authorities. The word "audit" has the potential to change everything. There is always a reliance on audited information and facts, but the public in general is not familiar with the auditing aspects of these issues. Let us look at the auditing aspects of the statements of financial position on which our investment decisions are based today.

In the modern era, India has emerged as one of the fastest-growing economies in terms of attainment, progress, and growth. To this end, we are pursuing a highly collaborative approach and addressing issues, such as fraud, deceit, financial misplacement, and the like, that are impeding India's inclusive growth. One of the problems is fraud. Sometimes temporarily, sometimes permanently, this has a negative impact on the organisation where it has been committed. Detecting, preventing, and regulating fraud has always been a top priority for developing economies, including India. By detecting, preventing, and over-

seeing corporate fraud, forensic auditing plays a crucial role in maintaining corporate effectiveness and merit.

There is a forensic audit that examines and evaluates the financial information of a company or individual for the purpose of using it as evidence in court. There are cases in which forensic audits can be conducted in order to prosecute an individual for fraud, misappropriation of funds, or other financial crimes perpetrated by him or her.

Corporate fraud has been established time and time again as one of the major obstacles to inclusive economic growth. An economy experiencing a decline in economic activity is characterised by corporate fraud. Employees' positions aren't the only factor in corporate fraud schemes. Organizations, employees, and clients are impacted by their complexity and high costs.

Several advantages can be gained from forensic auditing, including:

Corruption detection and responsibility

Misappropriation of assets detection

Fraud detection in financial statements:

Identifying and preventing fraud

Economic Policy Formulation

Providing valuable manpower resources

In light of the above advantages, it is clear that forensic audits provide a strategic means of detecting financial fraud in organisations and enhancing their , the

“

STUDENT ARTICLE VITTA ARTHA | 22

financial stability.

Fraud is without a doubt one of the most critical ills afflicting our society in the modern era there can be no denying this. Both short-term and long-term, fraud affects not only the organisations in which it occurs but also the economy and society of the entire country. A recent financial deception at Punjab National Bank (PNB) has frightened the government, the regulator, the stakeholders, and the corporate community, and even the public. We are also being prompted to critically examine the gaps that have contributed to bringing us to such a financial catastrophe, particularly regulators and governance professionals. Due to the discovery and subsequent investigation of this large fraud at PNB, the second largest state-run lender, the Financial Services Secretary was forced to mandate that "all non-performing loan cases affiliated with public sector banks exceeding INR 50 crores will be investigated for fraud." Moreover, all cases of bank fraud and consequential willful defaults should be reported to the CBI immediately.

India ranks 78th in the Global Corruption Perception Index, making forensic audits even more critical. The goal is to strengthen corporate culture and instil ethical governance. A forensic audit investigates financial fraud. Expert witnesses testify in court and analyse accounting records to establish or disprove financial fraud.

An investigation methodology for forensic audits:

In forensic investigation, specialised investigative skills are utilised to carry out an investigation so that the results can be used in court as evidence. In discussing the methodology to be used by fraud/forensic auditors/investigators, Umeraziz (2014) suggests approaching the examination both from the perspective of whether the fraud could have occurred as well as whether it could not have. His methodology is straightforward:

Analyzing the available data

Based on such data, develop a hypothesis.

Hypothesis testing

Developing and refining the hypothesis

As part of a forensic audit, the following techniques are often used to collect evidence:

Techniques pertaining to substance such as reconciliation, document review, etc.

Procedures for analysis: used to compare trends over a particular period of time or to obtain comparative data from different segments.

Techniques of computer-assisted auditing: software programmes used to detect fraud

Interview and interrogation: these are two major methods of investigation. Its goal is to elicit a response from the suspect or defendant.

STUDENT ARTICLE VITTA ARTHA | 23

The incidence of financial fraud in India: some insights

1. Sahara Group scam-

Subrata Roy, the chairman of Sahara Group, shares many similarities with Vijay Mallya. Sports are important to both businessmen. Sahara The Pune Warriors and Royal Challengers Bangalore are both IPL teams. Their Formula One team is Sahara Force India. A total of over 30 million small investors were allegedly not reimbursed by Sahara Group. Since the issue did not meet the criteria for public offerings, SEBI ordered Sahara to repay investors this amount with interest. Roy was arrested in February 2014, while he was on trial. The court and SEBI rejected the settlement proposal he submitted.

2. Satyam Computers

Satyam Computers' founder, B. Ramalinga Raju, confessed to boosting the company's revenue, profit, and profit margins each quarter between 2003 and 2008. In this case, an estimated Rs. 7,200 crore were misappropriated. Ramalinga Raju and his brothers were jailed for a total of seven years in prison and fined Rs. 5.5 crore in April 2015.

3. Saradha Chit Fund

Saradha Group, a company that operated a chit fund in West Bengal, collected approximately $200 billion to $300 billion from investors who were promised high returns on their investments. The company collapsed in April 2013. There was a loss for investors

of between Rs. 2060 and 2400 crores.

4. Ketan Parekh Scam

Several companies were involved in circular trading and stock manipulation by Parekh between 1999 and 2001. He obtained money from Global Trust Bank and Madhavpura Mercantile Co-operative Bank and manipulated K-10 stocks. Further, PNB and Satyam have been identified as clear audit failures. Satyam's matter was material, but a formal response from the bank was not sought. PNB should have traced Swift messages by serial number to the general ledger entry at least on a test-check basis. This should have been detected earlier.

Final thoughts

Information and communication technologies impact society profoundly. Technology and society evolve in harmony. Technological advancements lead to more development in society each day. Information and communication technology has impacted all aspects of human life, including education, health, entertainment, and communication. Thus, information technology is rightly called a boon. There is always a downside to every benefit. Information and communication technology are no different. Global cybercrime is one of the major challenges of this era of ICT. Corporations are not exempt from fraud. The increasing use of information technology in corporate fraud has led to the development of a new branch of forensic auditing called "cyber forensics."

STUDENT ARTICLE VITTA ARTHA | 24

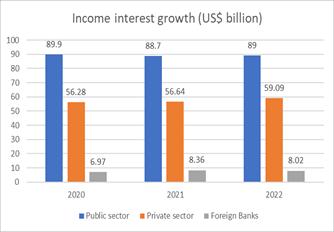

BANKING SECTOR REPORT

Introduction:

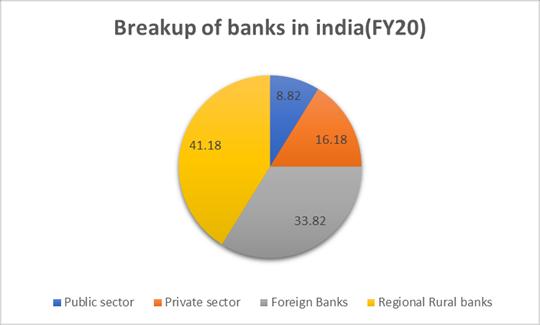

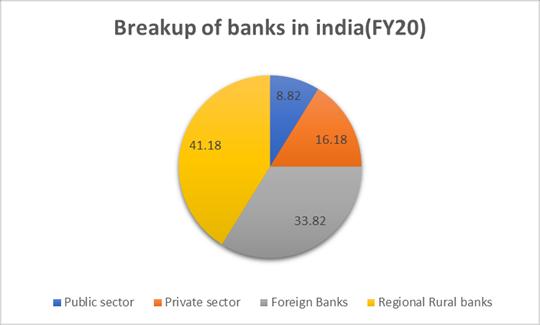

India is a developing country, and as more people live there, demand for banking services and associated goods rises. In addition to cooperative credit institutions, there are now 97621 banks in India which consist of commercial banks, PSU, foreign banks, regional rural banks, urban cooperative banks, and rural cooperative banks. There were 101243 ATMs located in rural and semi-urban and 111901 in urban regions in India. Although this number is far lower than in other developed countries, banks were nonetheless able to deal with liquidity issues since so many smaller banks were amalgamated into larger ones. The operational effectiveness of banks has risen as a result of the many amenities provided at ATMs, such as mobile, online banking, and facility development. According to RBI Indian banks have enough funds and are regulated.

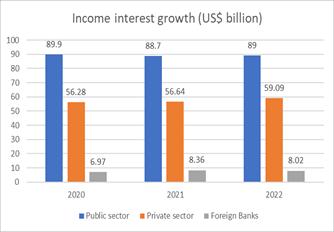

This level is due to recent bank mergers and acquisitions. Through increased liquidity and a reduction in the possibility of bad loans, mergers and acquisitions make both banks stronger and provide them the abil-

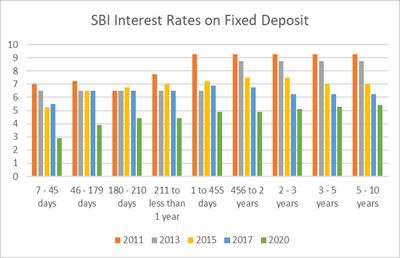

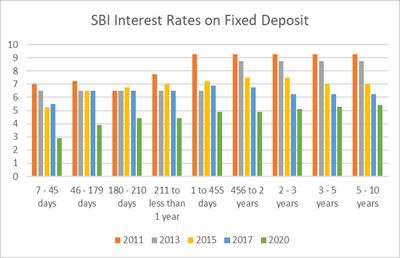

According to RBI Indian banks have enough funds and are regulated. The FD rates at SBI have been falling since 2011. This demonstrates that the banks have adequate liquidity, which has led to a decrease in the interest rates on FDs and other types of accounts.

ity to compete against big international banks.

Cutting-edge banking formats, such as payments and small financing banks have been developing in India. These kinds of programs have significantly improved financial inclusion in India and propelled the nation's credit cycle, along with significant changes to the banking industry including digital payments, neobanking, the expansion of Indian NBFCs, and fintech. India's banking industry is expanding thanks to a number of government initiatives, including the Pradhan Mantri Jan Dhan Yojana.

SECTOR REPORT VITTA ARTHA | 25

BANKING SECTOR REPORT

Market size:

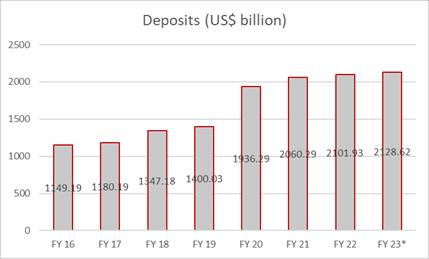

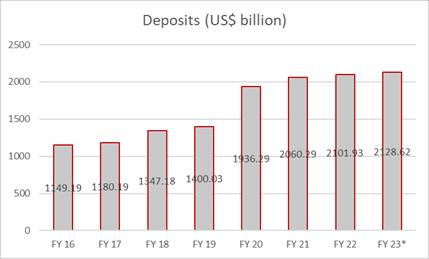

The total amount of deposits in Indian banks has likewise increased over time. A rise in bank deposits indicates that more loans are being issued.

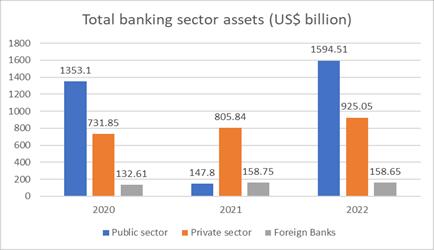

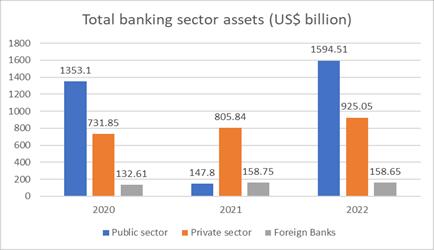

Bank assets have also expanded to US$2.67 trillion in 2022, in addition to bank deposits. The combined assets of commercial and public banks are 925.05 and 1594.51 billion dollars, respectively

downward in the Indian market. This shows that credit risk is decreasing in India and that consumers have increased faith in financial institutions. Following 2019, a large number of banks combined, which decreased the banks' NPAs and strengthen banking systems.

Increase in M&A and investment activities

Core banking and NBFC are into consolidated M&A activities recently.

After 2019 so many PSU and small banks merged into one big bank which started to improve the quality of services.

On April 1, 2019, Vijaya bank, Dena bank, and Bank of Baroda amalgamated into one entity.

According to India Ratings & Research, credit growth will hit 10% in 2022-2023, which would be the first time in eight years that it will approach double digits (Ind-Ra). On 4th November 2022, bank credit was US$ 1585.09 billion.

Kotak Mahindra banks acquired 9.98% of the share in KFin technology with Rs. 310 crores (US$41.62 million).

August 2019 was an important month for major mergers of public sector banks. During this month united Bank of India and the oriental bank of commerce merged with PNB. Allahabad bank and Indian bank also got merged, and Andhra bank and corporation bank merged with Union Bank of India.

US$ 100 million in green bonds was raised through private placement by India’s largest lender, the State bank of India in March 2020.

In April 2020, an Additional 29% share in Max life insurance was acquired by Axis bank.

Trust of people in the Indian credit system:

The buying of CDS derivatives has been trending

SECTOR REPORT VITTA ARTHA | 26

BANKING SECTOR REPORT

Way forward:

Since 2024 is an election year, the government's attention will be primarily on infrastructure development, which will need a large lending capacity. Due to the increased demand for financial services and infrastructure loans, this high capacity will accelerate the expansion of the banking industry. The usage of smart gadgets and the advancement of technology both raise public awareness of financial services. Increased awareness will spur demand for and expansion of the banking industry. On 3rd November 2022 government of India launched digital money which will help Indian currency to transfer immediately and thus improve the liquidity capacity.

India is increasingly engaging with fintech and microfinance. By FY23, it is expected that digital lending and distribution would total US$ 1 trillion. About 2084 investments were made in the Indian fintech sector, accounting for 14% of all global investments totaling US$29 billion. This puts India in second position globally for transaction volume. According to the Indian government, the fintech sector would generate US$ 83.48 billion (6.2 trillion rupees) by 2025.

References:

https://www.ibef.org/industry/banking-india

SECTOR REPORT VITTA ARTHA | 27

CFA PREPARATION

Ruchir Mundhra MBA08

IIM Amritsar

FRA (based on accounting) because being an engineer this was something I never had any know- how of. It's a vast subject and quite complex with so many things to remember. Through free content on YouTube especially that of IFT I was able to navigate through quite a few difficult subjects.

My father was the driving force behind my interest in finance. He is a mutual fund manager working at a private wealth management firm. Conversations with my father drew my attention towards finance and subsequently I began to read some books like ‘Mad money journey’ , ‘Rich Dad Poor Dad’ along with newspapers like Economic Times which increased my interest in reading about the economy and business affairs. During conversation with one of my friends who is a BCOM graduate he advised me to give CFA L1 a program designed to impart knowledge and test the fundamentals of financial concepts. He felt that it will help me develop more insights and help me switch fields into the BFSI sector.

So after my father's backing and friend's advice I enrolled for the CFA L1 exam for May 2022 in November 2021 itself to avail the early bird offer. That’s how my journey began. Initially I was quite confused what to start with. There were 10 subjects in all. I gave myself 5 months to prepare as I was relatively free & had nothing else to focus much on. Schweser notes which is a much more concise version of the CFA syllabus were the way to go. So first I touched upon

After that I touched upon Fixed Income which dealt with debt instruments like bonds, again a very vast subject which required a lot of detailed understanding. Then onto Economics, which again was challenging and a bit vast. Subjects like Corp Fin, Equity, Derivatives etc were not as difficult and with some reading can easily navigate through it. Last but not the least, a subject known as Ethics. This subject in terms of content is not as heavy as other subjects but has the potential to make or break your exam so it requires special attention and practice as well almost daily. It's quite tricky so one cannot neglect it as CFA institute pays special emphasis on this particular subject.

Then coming onto the practice part. There are exhaustive number of questions on CFA institute 's website for each and every subject and an aspirant should try to cover atleast 70% of it. These questions are the same type which comes in the exam so practicing it will acquaint you well for the exam. There are practice sets offered by Schweser as well which can also be covered.

CFA PREPARATION VITTA ARTHA | 28

CFA level 1 Cleared

After covering almost entire syllabus it's time for the mocks. There are two mocks on CFA 's website which I found to be even trickier compared to the actual exam. One should aim to score atleast 70% in them which is one of the major criteria to pass the exam. There are 180 questions in all & the aim should be to score atleast 126.

Finally, D- day arrives. A day before the exam other than some concepts of FRA I didn't touch upon any topic & made it a point to take ample amount of sleep & eat nutritious food. Other than your financial calculator & a bottle of water there is nothing much that needs to be taken as you will be provided with a pen & rough sheet. The exam is a long one having two parts & an optional half an hour break in between. My advice will be to opt for the same as a break is very necessary to recharge your batteries. The overall difficulty of the exam was moderate and with sufficient practice one can easily scale through it. Most of the subjects have been covered in our first year so there shouldn't be much difficulty one should face while preparing for L1. All the very best to all the future aspirants.

STUDENT ARTICLE VITTA ARTHA | 3 CFA PREPARATION VITTA ARTHA | 29

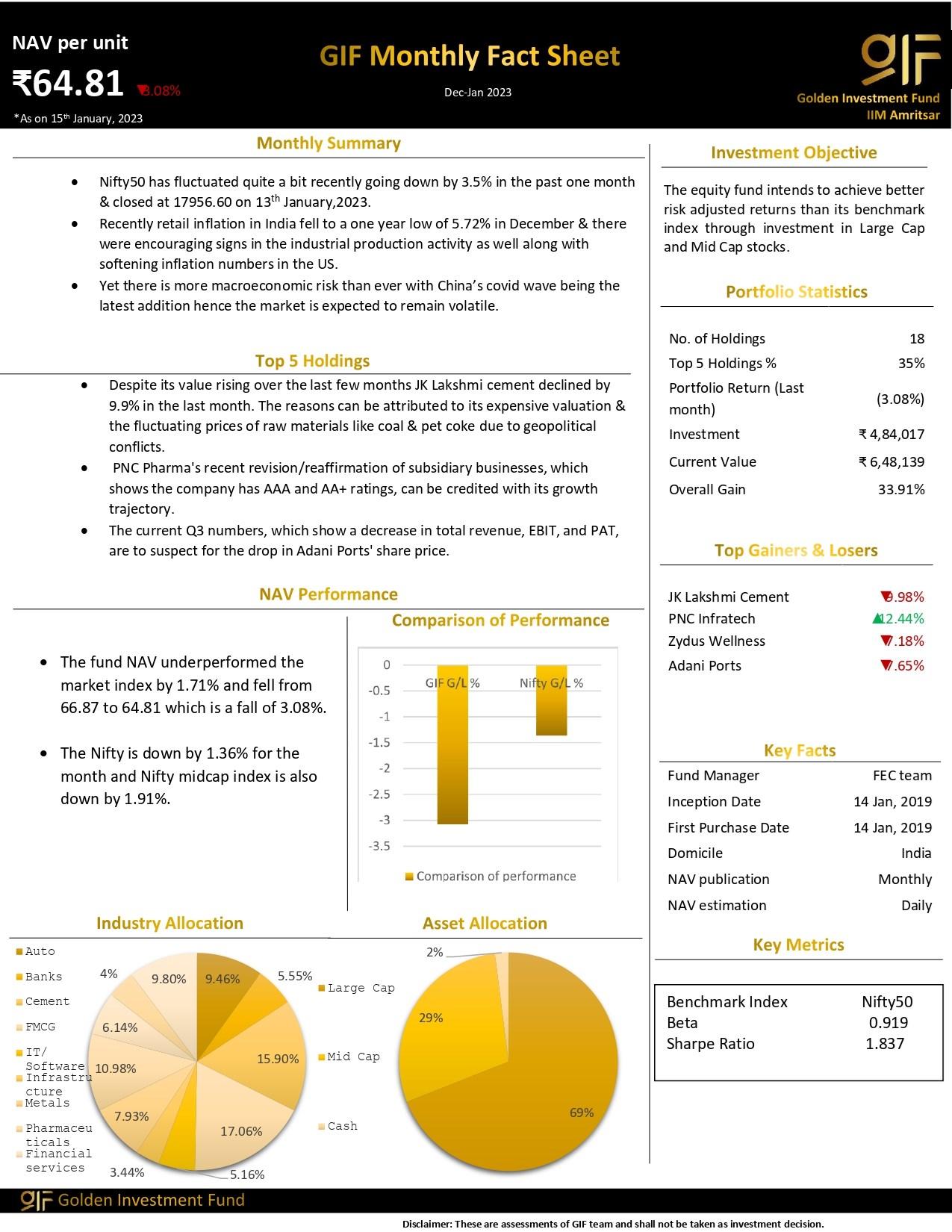

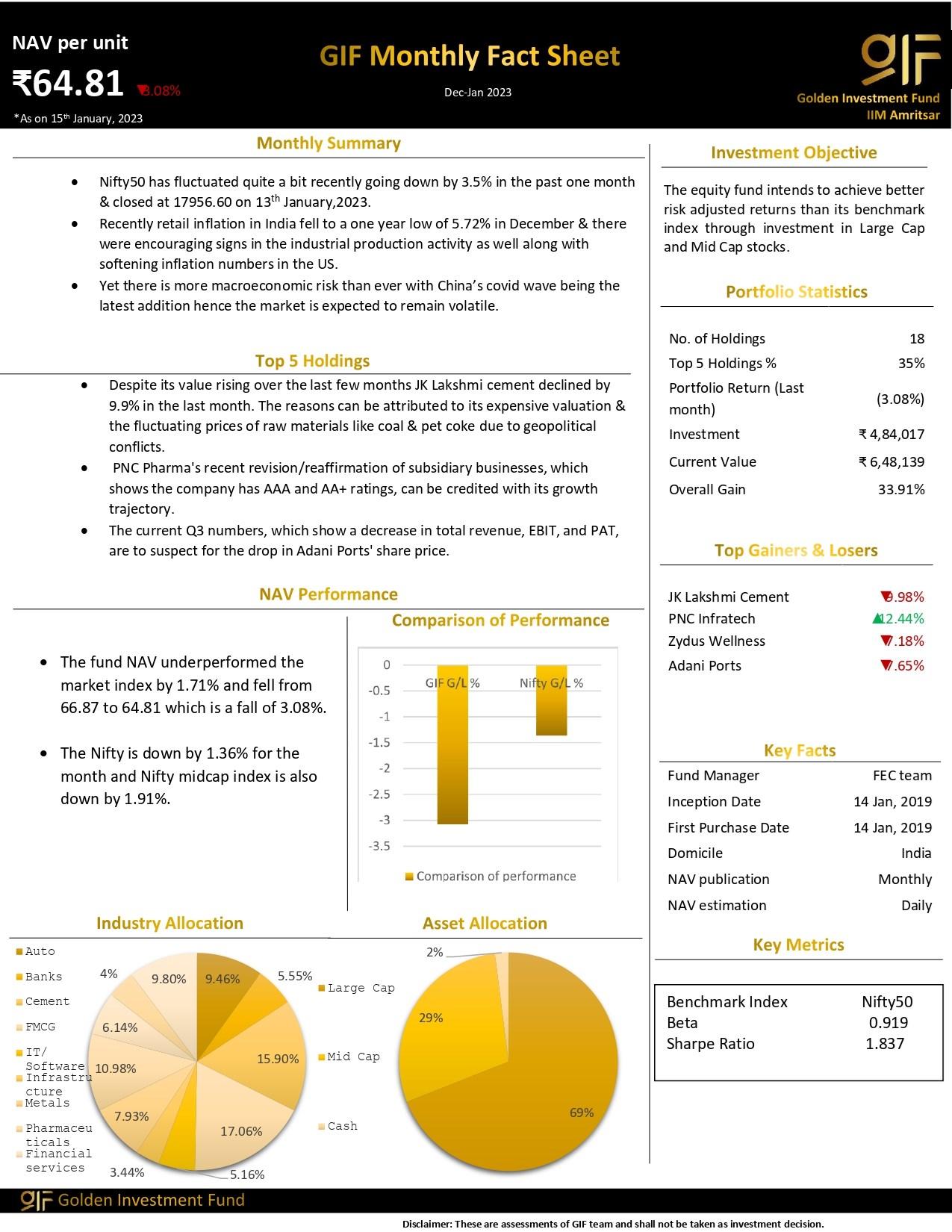

GOLDEN INVESTMENT FUND

The Finance and Economics Club, IIM Amritsar announced the launch of Golden Investment Fund (GIF), the student-run investment fund of IIM Amritsar, in February 2019. It was started with the aim to give hands-on experience to the students about investing and applying their research into the equity markets. Team GIF aims to create a culture of research, analysis, and investment among the members of FEC and Finance Enthusiasts of IIM Amritsar. The equity fund intends to achieve better riskadjusted returns than its benchmark index through investment in large-cap, mid-cap, and small-cap stocks.

GIF team releases weekly company reports and monthly fact sheets of its portfolio under management. The monthly report provides an outlook of the current market scenario as well as the companies in the portfolio of the fund. GIF team analyses the company’s fundamental and competitive. position in the market, investment risk, growth prospects, and investment decisions

STUDENT ARTICLE VITTA ARTHA | 3

GOLDEN INVESTMENT FUND VITTA ARTHA | 30

VITTA ARTHA | 3

STUDENT ARTICLE GOLDEN INVESTMENT FUND VITTA ARTHA | 31

GOLDEN INVESTMENT FUND

CLUB ACTIVITIES

Since its inception in 2017, FEC has been one of the most enthusiastic student interest groups of IIM Amritsar. The club organizes numerous interactive events throughout the year to provide students with an enriching learning experience in the world of finance. It supports students in their journey at IIM Amritsar, helping them harness their potential and enthusiasm and guiding them at every turn. From providing advice about additional certifications and online courses, like Bloomberg Market Certification, to helping them with subject choices and interview experiences, FEC facilitates outside-classroom training to upskill them, leading to brighter career opportunities.

Even in the months gone by, The club proudly upheld its tradition and delivered its finest efforts to ensure the students received the best experience and education possible.

Golden Investment Fund (GIF): It is a studentmanaged investment fund composed of experts in F&O and intraday trading. GIF team releases monthly fact sheets of its portfolio under management. Along with an overhaul of their reports, the GIF team also contributes to the IIM Amritsar's culture by conducting knowledge sessions and investment lectures to engage peers and motivate students to invest in capital markets and develop financial understanding among students.

Pariprekshya: Pariprekshya is IIM Amritsar's Annual Finance and Marketing Conclave, where eminent industry experts share their views and experience on

the big stage in front of IIM Amritsar faculty & students. Being conducted since 2017, the FEC has been pivotal in conceptualizing the event and helping students get relevant industry insights and familiarize themselves with industry trends. The Sixth Edition of Pariprekshya, organized in October 2022, had the Theme "ESG Trends in Financial Sector: The Prominence of ESG Today and Beyond" for its Finance Panel and witnessed several industry stalwarts sharing their valuable insights about this topic. It was a grand success and helped the students broaden their horizons of awareness.

Starry Nights: FEC is known for its trademark "Starry Nights" sessions, where members share their knowledge and experience in an informal setting. In Starry Nights, an informal discussion takes place on particular topics in which every attending student can share their point of view, hence contributing to a healthy conversation on important issues. Various Starry Nights sessions have been conducted since July 2021 on topics ranging from venture capital to the future of Hedge Funds in India. The latest session of Starry Nights was conducted in November 2022 and was based on the Theme of Portfolio Management. For the first time in the history of FEC, Starry Night was conducted along with a bonfire. Basking in the warmth of the fire, finance enthusiasts discussed various investment strategies and market trends, exchanging insights and ideas to further their understanding of the theme.

Fin-League: FEC's Fin-League quizzes put the

CLUB ACTIVITIES VITTA ARTHA | 32

CLUB ACTIVITIES

students' business acumen to the test and help them keep their minds sharp and ready while fostering a competitive environment. Winners of Fin-League quizzes were awarded prizes and certificates. The competition is organized in a league format, consisting of three progressively challenging rounds. The quizzes encompass a broad range of topics from the domain of Finance and Economics, providing a unique and enjoyable way to comprehend the relevant concepts and principles.

Activities on Social Media: FEC strives to keep students up-to-date with recent news in the financial world. It includes important events like budget, company mergers, bankruptcies, famous economics concepts, success stories of companies, and many more. FEC also release a series of posters under the name of "Fin-Bytes" to apprise the students of trending financial and economic terms floating around in the news.

Bridge the Gap: Bridge the Gap is an interactive discussion series conducted by FEC. It aims to connect students with our alums and other industry stalwarts through sessions and discussions on various relevant financial topics. FEC conducted the most recent "Bridge The Gap" session in January 2023, which had the topic - "How to prepare for CFA and the career opportunities it offers."

Guest Talks: FEC regularly organizes industry guest lectures and workshops to give students more practical exposure. In the past, FEC has hosted CFOs and senior management from prominent companies be-

longing to the financial sector.

Investment Awareness Session: As a part of Investor Awareness Week, FEC organized Investor Awareness Programme in association with BSE IPF. The speaker for the session enlightened the students about the risks associated with investing in the stock markets and guided them on safe investment habits.

AArunya: FEC organizes two events as a part of AArunya – IIM Amritsar's Annual Management, Cultural, and Sports Fest. The events for AArunya 7.0 are – InSight Out (1000+ registrations) and Impetus – A Case Competition (700+ registrations).

CLUB ACTIVITIES VITTA ARTHA | 33

. CLUB ACTIVITIES VITTA ARTHA | 34

CLUB ACTIVITIES

PARIPREKSHYA’22

STARRY NIGHTS

FINBYTES & GIF

FINLEAGUE

BRIDGE THE GAP

MOVIE REVIEW

stock market was breaking records. After that, one company after another went bankrupt, the country's economic structure was threatened, and Congress rolled out a massive bailout.

Director by

Director by

Distributed by - Lionsgate Roadside Attractions

Release Date - 21st Oct 2011

Running Time - 107mins

Country - USA

Language - English

SUMMARY

"Margin Call" follows a final night on Wall Street as fatal convictions climb the ladder of investment executives. A disastrous speculation in the mortgage market leads to the collapse of the company. At the time, America seemed to be enjoying prosperity and the

A "margin call" he starts in a day at an obscure investment firm. With his 80% of employees laid off, the investment firm must have surely guessed what was in store. One of the victims is Senior Risk Analyst Eric (Stanley Tucci). He, like many of his peers, did not understand that the real estate market was Trump's mansion. Writer-director J.C. Chandor sympathizes with most of his characters. It's important to remember that they all felt compelled to participate in deals that brought huge profits and bonuses to the company. On the way home, Eric hands his USB drive to Peter (Zachary Quinto). There is information about it that worries him. The office is empty and the survivors are glad they weren't laid off, but Peter realizes the company and the market are clearly on the verge. He contacts his supervisor, Will (Paul Bettany), who calls his boss, Sam (Kevin Spacey). Some are called for a late-night emergency meeting until dawn when a helicopter flies over to CEO John Taldo (Jeremy Irons).

You don't need to know much about markets to understand this movie. John is a cool, sophisticated Englishman, and he likes to say things like, "Speak up." Because his job requires him to run a company, but he doesn't necessarily understand his business. In fact, as we know it now, any young person fresh out

MOVIE REVIEW VITTA ARTHA | 35

of college could have looked at a balance sheet and realized clearly that Wall Street was doomed.

It's up to John to make the margin call. In other words, ordering a company to sell worthless inventory before word spreads about it is essentially betraying the customer. It has now been discovered that some companies can set up hedge funds of fortune to bet on them and make money. They knew they were worthless, so they sold these to customers . I think this movie is about how the characters are only concerned with the welfare of their own company. There is no greater sense of the common good. Corporations are immoral, exist and make human sacrifices to survive and thrive. This is troubling the demonstrators occupying Wall Street. They are not against capitalism; they are against Wall Street injustice and greed.

'Margin Call' employs an excellent cast capable of turning financial negotiations into compelling dialogue. They may also reflect the enormity of what is happening: Your business and life will be meaningless. This scenario was enacted by many Wall Street agencies in his fall of 2008, and radical financial reform is still opposed.

Irons is wise in the role, a man who knows his financial security is inviolable, sees his job as an immoral practice, and cares little about people. There must be a certain kind of ruthlessness in the leader of a great company. I also admired Kevin Spacey, who projects a sharp intellect in his own way, and Demi Moore as

an executive who knows how to climb just below the glass ceiling and stay there.

The physical world of the film itself is effective. It's all glass, steel, protocols, long black cars and executive perks, and a luxury lifestyle paid for by the inevitable scams.

MOVIE REVIEW VITTA ARTHA | 36

MOVIE REVIEW

BOOK REVIEW

At the start of the book the author points out that although the corporate sector is primarily the subject of discussions and reforms, the unincorporated or non-corporate sector of the Indian economy accounts for the majority of its output. He uses statistics from various surveys conducted by organizations like NSSO in an effort to highlight the significance and size of the non-corporate sector. In addition, the author disputes the conventional wisdom that India's economic expansion can be attributed to the 1991 reforms by arguing that the changes made to policy only affected the manufacturing and financial sectors, which are only related to activities carried out by the government and corporations and not by noncorporate sectors.

Author: Ramachandran Vaidyanathan

Author: Ramachandran Vaidyanathan

SUMMARY

India Uninc: is one of those books which not only educates readers but also alters how they view and understand the unorganized sector. It challenges several widely held beliefs and expertly refutes them with relevant facts and figures. It reveals the ignorance of the government, media, and policy experts toward the non-corporate sector and makes several recommendations that can be implemented for the benefit of everyone.

According to the author, we must acknowledge that India's growth over the past two decades has been fuelled by extraordinary national savings, a significant portion of which comes from the non-corporate sector rather than foreign inflows, which have been discussed at countless conferences but the noncorporate sector's role, which is a part of household savings in government data, is rarely discussed. The non-corporate sector also controls the vast majority of the service sector, which makes up almost two thirds of our economy Therefore, it is necessary, in the author's opinion, to revise or critically examine the hypothesis that links Central government reforms to the growth over the past 20 years. He also touches upon India’s fascination for FDI in retail trade, How

BOOK REVIEW VITTA ARTHA | 37

policy makers are biased against the self-employed group, importance of gold in our economy and our national demographic dividend and beautifully weaves all of these topics together.

India: Uninc educates us on various aspects of the Indian economy and makes readers aware of the value of the non-corporate sector. Prof. R. Vaidyanathan has clearly explained all the ideas, and even someone who is not familiar with the terminology can gain a lot from reading this book. He has supported his theories from a number of directions using pertinent data. Overall, this is a book that will undoubtedly teach readers something about our macroeconomic conditions and policy frameworks and serve as the go-to resource for understanding the unorganized or non-corporate sector.

BOOK REVIEW VITTA ARTHA | 38

BOOK REVIEW

COMIC CORNER VITTA ARTHA | 39 COMIC CORNER

SENIOR COORDINATORS

JUNIOR COORDINATORS

TEAM FEC VITTA ARTHA | 40

TEAM FEC

Vishesh Mehra

Vedant Mittal Ritvik Agarwal Madhav Tapadia

Rujuta Agrawalla

Atharva Pande Jagana Bharadwaj Somnil Dutta Utkarsh Jhawar

Anuradha Sahu

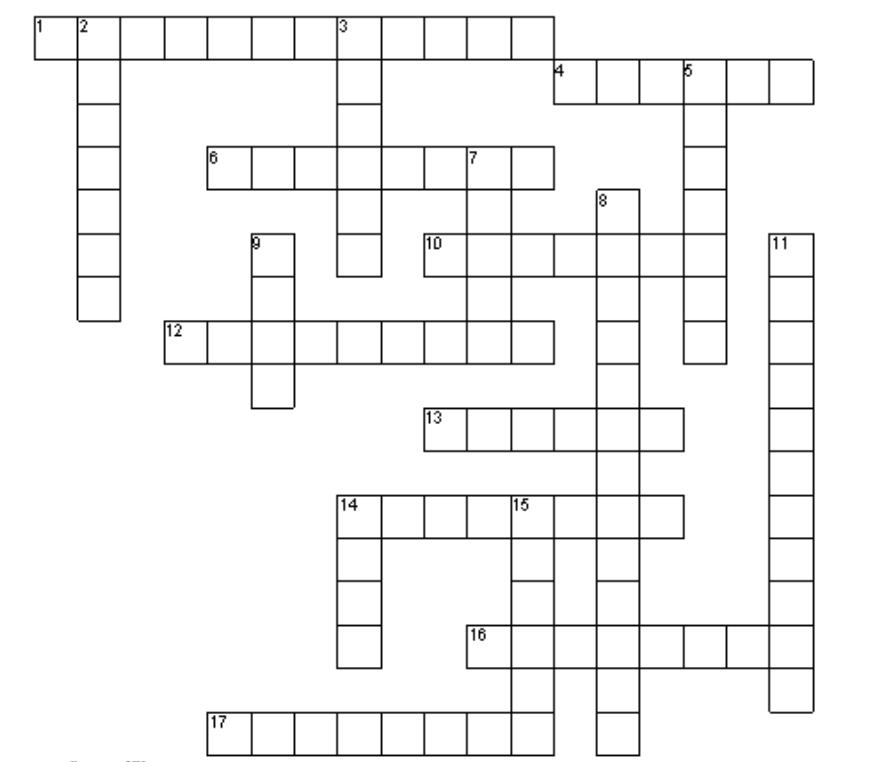

CROSSWORD VITTA ARTHA | 41 CROSSWORD

Note: There are no spaces between words.

ACROSS:

1. efficiency of work

4. ask bank to lend money

6. money paid for a loan

10. wealth of a business

12. agree to repair or replace

13. union of two companies

14. legal agreement

16. total sales of a company

17. paid to shareholders

DOWN:

2. proof of payment

3. put money into a company

5. paid to copyright owner

7. part of the capital

8. where to buy/sell shares

9. money lent

11. amount of money spent

14. notes and coins

15. money returned

CROSSWORD VITTA ARTHA | 42

CROSSWORD

Author: Ramachandran Vaidyanathan

Author: Ramachandran Vaidyanathan