1. Foreword Prof. Nagarajan Ramamoorthy (Director, IIM Amritsar)………………….…………………..2 2. Cover Interview Mr. Rahul Bajoria (Chief Economist, Barclays)…………………..…………………….…….3 3. A Note on Family Firms Dr. Surender Rao Komera (Assistant Professor, IIM Amritsar)………………………………...7 4. Financial Crisis of 2008 Shivansh Khattri (MBA06, IIM Amritsar)……………………………………………...….10 5. 5 Trillion Economy Pratik Sanjay Avasarmol (PGP07, IIM Amritsar)………………………………………....13 6. Sri Lanka’s Economic Crisis: A lesson for policy makers Prajjwal Singh (SCMS, Noida)…………………………………………..….……………16 7. National Monetization Pipeline and its Impact on India Urvee Baweja (Shaheed Sukhdev College of Business Studies, DU)……………...……….…….19 8.Glass Ceiling Effect: Application of Game Theory and Economic Ramifications Mahima Agarwal (NMIMS, Mumbai)………………………………..…….………...…...22 9. Internship Experiences……………………………………….…………………...25 10. CFA Preparation………………………………………..………………………….27 11. Golden Investment Fund……………………………….………………………...28 12. Club Activities………………………………………………...…..………….……34 13. Our Recommendations……………………………….…….…………………….37 14. Comic Corner……………………………………………..……………………….39 15. Team FEC………………………………………………....………………………40 16. Crossword……………………………………………...……..…………………….41 CONTENTS VITTA ARTHA | 1 CONTENTS

PROF. NAGARAJAN RAMAMOORTHY Director, IIM Amritsar

Dear All,

It is with great pleasure I announce that the Finance and Economics Club (FEC) at IIM Amritsar is ready with the eighth edition of its bi-annual magazine - Vitta Artha. FEC works interminably both at the college level and industry level to further the interests of the students by exposing them to various aspects in the world of finance and economics. It is the endeavor of the club to harness talent and enhance the learning experience of our student community. Vitta Artha – The Finance and Economics magazine of IIM Amritsar is one such maneuver in the same direction. Varied views in the form of articles given by students from prominent B-schools across India and the esteemed insights of the industry professionals help the students and our readers to better understand the real-life implications and nuances in the fields of finance and economics.

This issue of Vitta Artha provides a glimpse into the stance of central banks on the monetary policy and whether they are underestimating the risk of inflation. It further addresses the possibility of occurrence of a Taper Tantrum, like the one we were caught in, in 2013. It also discusses the economic recovery across the world post the pandemic, and if the reappearance of cases in certain countries and the lockdowns imposed are a cause of concern for the global economy.

The edition also includes an article on family firms, highlighting the fact that family firms outperform comparable non-family firms of the same sector. This is a consequence of the long-term focus of the controlling family which happens to be a salient feature when it comes to family firms. While this is true, such firms have also underperformed when economic conditions have been overtly positive, owing to another characteristic of family firms being conservative in nature. The article goes on to provide a detailed analysis on the drivers of such an excellent financial performance of family businesses.

Alongside this, CFA preparation strategies and the internship experiences of various students of IIM Amritsar in the domain of finance is also articulated. I hope that this issue of Vitta Artha, like the previous editions, adds value to its readers and thus augments their interest and inquisitiveness in the enriching domain of finance and economics.

FOREWORD VITTA ARTHA | 2 FOREWORD

Mr. Rahul Bajoria Chief Economist Barclays

But given the unprecedented nature of monetary and fiscal stimulus that was provided, recovery has been strong. And given the combination of household savings, very strong demand particularly in the electronics sector, we've had a bounce that's a lot stronger in the goods space than it was in services. We are definitely over pre-COVID levels of output, including India. From here on, the question will be, "What is the element of scarring that we end up seeing as more and more sectors open up?” And given the supply bottlenecks that we are seeing operating in various areas - whether it is logistics, energy, or IT - it is a direct consequence of scarring. But it certainly shows the lack of investing growth in the last couple of years as the outlook for global economy was not very clear. So, investment rates have been very weak and that has had an impact on the supply side, leading to more inflationary pressures. These are some of the characteristics of the recovery.

Here are some of the things we learned, from his work at the Barclays and a look through his knowledge lens at the monetary policy and its adaptation during and after the pandemic on the world stage as well as in the Indian context.

Question:Howdoyouperceivethecurrent economic recovery throughout the worldanddoyouthinkbarringsomesupply side issues, things are back to preCOVIDlevels?

Recovery has been a bit asynchronous because the nature of health crisis in different countries has determined what kind of recovery they had experienced.

Question: Your thoughts on the current stance of central banks of the world on themonetarypolicy?Also,thereporate has remained at a constant 4% since March2020.DoyouseeRBIchangingits accommodativestanceanytimesoon?

Like the asynchronous nature of recovery everywhere, there has been a fair amount of heterogeneity in the monetary policy behaviour. In countries which are large exporters of commodities, say China, where the health crisis was not as problematic, they were able to have a much earlier normalization, given their economic conditions improved a lot faster.

Whereas in the other countries, we've had Bank of England indicate that they'll be hiking rates and the Reserve Bank of Australia abandoning its Yield Curve Control Policy and they think of hiking sometime later next year. So more Central Banks joining in the

INDUSTRY INSIGHT VITTA ARTHA | 3

“Stance of central banks currently throughout the world on monetary policy” Here’s what we learnt from this Cover Interview

normalization cycle. Question is, where does that put India? Given the nature of the health shock in India, we've had a start-stop sort of recovery, which did poorly in the first COVID lockdown. When we had a lockdown for the second wave, the impact of the pandemic was less, economically speaking. In such an environment, the biggest source of uncertainty for the RBI is the health crisis, even though the vaccinations have improved there is greater certainty on that front. India's inflation is mostly because of higher imported prices and not so much because of what's happening domestically.

That gives up a little bit more room to continue with accommodative policies but then we will start seeing modest policies coming through most likely in the next meeting. So, the RBI has already announced that it will not buy any more bonds, and I think they will start raising the Reverse Repo Rates from the next meeting in December and maybe sometime by the middle of next year, we'll have Repo Rates hikes also. But the entire Monetary Policy normalization cycle in India will be a function of India's growth performance, and not India's inflation. We've had high inflation for some time and that is not something that has led to the tightening of the policy.

Question:Manufacturing&consumption companiesarefacingtheheatofinflation duetorisingrawmaterialprices.Doyou seeitcontinuing?

Down to the fact that important commodities have become more expensive, if you have a larger exposure metal products and things like that, you will find your margins getting eroded. We have seen that in the data as well; if you've seen the PMI numbers, they clearly show that the input prices are rising at a much faster pace than output prices. It's the same thing with WPI inflation being a lot higher than CPI

inflation. But this is coming at a time when profits are actually quite high. The profitability and performance of major companies have been high, so clearly there is top line revenue growth in the system. And so companies are able to absorb some of these higher costs. It depends on the relative industries and their ability to pass on higher costs to consumers. In sectors where there is greater competition between different companies you will see that price increases will not take place and margin squeezes will be much more common. In areas where it is common for these price increases to be pushed through, those prices will go up. So, we've seen a bit of a differential performance across the sectors based on what is the nature of the pricing power that they enjoy.

Question: Crude oil prices are above 80 levels.Doyouseetheuptrendcontinuing anddoyouhavealevelinmindwherethe pricesmightconsolidateforawhile?

Prices have consolidated around $80 a barrel but it is a very volatile market. In my 14 years of working in markets, I've never seen anybody convincingly talk about where oil prices are going to go. It is a very difficult one to predict. But looking at the recent price dynamics, it does not feel like prices are going to come up any time soon, especially going into the winter cycle, when LNG shortages are there and there's a possible winter snap.

Question:Arethecentralbanksunderestimatingtheriskofinflation?

We are a low inflation economy if you really think about it. That is directly a function of the fact that India's per capita income is generally on the lower side, so inflation tends to eat into your income very quickly. Is there underestimation of inflation risks? Well, the data says yes. Most Central Banks were not

INDUSTRY INSIGHT VITTA ARTHA | 4

forecasting inflation to be this high last year. Purely looking at their numbers you'd think that they're underestimating inflation. For example, if you ask whoever cooks at your home, they'll tell you cooking oil prices have gone up a lot. But that is a function of our imported commodities. Like palm oil has become expensive, and partly that is because there are not enough people in Malaysia to harness it, so labour costs have gone up. The moment the borders open, they'll be able to import more labour, and the cost arithmetic of palm oil will go down, and you will see prices correcting down.

So, you do have mean reversion in inflation so I won’t necessarily say that this inflationary trend will be there with us for the next two years. Nothing like that. But there was a clear underappreciation of the bottlenecks that we have. And on the demand side, the labour markets have tightened, wage growth is picking up in certain places. But a real demand led inflation bout is something we haven't seen in a long time. If that comes, the challenges of monetary policy will compound. But at the moment it seems very supply centric.

Question: Do you foresee a Taper Tantrum2.0?

Taper Tantrum is the name given to the episode back in 2013, when the FED suddenly announced that they will be tapering their purchases of government securities. As part of the stimulus program in 2008 the US Federal reserve had announced that they will be doing quantitative easing, which in modern day parlance is the Central Bank keeping rates at record lows and once you've run out of rates to cut, you start buying assets to make sure the long end yields come down as well. So they did QE 1, 2 and 3 over five years between 2008 to 2013, and in May 2013 the FED announced that they'd be tapering, which

was implicitly a signal to the markets that they are now fine with long end yields increasing. This was a period when countries like India, Mexico, Turkey, Brazil, Indonesia were part of the fragile pipeline and they had very high Current Account Deficits to finance. They were consuming and investing too much compared to their total savings, so they were borrowing quite a bit from the world to finance their consumption and investment. So Current Accounts tend to be very sticky. So at that time when tapering happened, the uncovered interest parity meant that the US Dollar started to appreciate because the interest rates were rising in the US relative to other emerging markets. And as a result of that, money started flowing out of bond and equity markets from these countries, with the expectation that rates in US are going higher, it's more profitable to be investing in US markets. As a result of that, we had very large-scale value loss both in terms of currency and fixed income space for these countries. That was the Taper Tantrum and that was the period when India saw the rupee going from around 54 to 68 and it appreciated back to 62 in a very short span.

Is there a possibility of a Taper Tantrum 2? Well, even if there is, the Central Banks are better prepared because they have larger foreign reserves, and they are a lot more aware of not making the same mistakes. The good thing from an Indian perspective is that our Current Account financing requirements are very low at the moment. So, while our trade deficit is widening, we are also getting a lot of inflows. There's a lot of capital inflow coming in, companies are raising funds and that makes the supply of dollars in the system quite high. So the probability of the rupee having a similar, say 10%-20% depreciation in a short period of time is miniscule. That should prevent India from getting materially impacted in a Taper like scenario, but yes, you can never completely rule it out.

INDUSTRY INSIGHT VITTA ARTHA | 5

Question: How are foreign investors viewingIndiaasamarketcurrently?Indiahasoutperformedotherstockindices sinceCOVID,sodotheforeigninvestors believethatthistrendwillcontinueoris therecautionbecausetheyfeelthemarkethasrunuptoomuch?

So obviously you have such large inflows in the system and foreigners are bullish about India's prospects. I think what is interesting about India at the moment is that not only you have this IPO cycle, which is leading to a lot of inflows, but also the quality of foreign inflows has improved. It is slightly more longer-term money that is coming in and that naturally makes people look at India more seriously as an investment destination. Also, we've had very little impact from a growth perspective. While we did suffer quite a bit in the pandemic but the recovery in activity levels has been very quick. There's general optimism because of improved profitability. If you look at the PE Ratios, there are 2 ways in which high PE Ratios can be sustained - you have wildly optimistic assumptions that your prices are going to stay high but ultimately it is a call on your earnings as well. If earnings are increasing, then that can sustain higher valuations for a longer period of time. So profitability, as I said earlier, is improving despite all the challenges of high inflation. As long as that dynamic remains in place, I don't think one can really say that the markets are overvalued. If earnings are there, there is a reason why people would take that bet.

Question:Doyouthinkthatthecurrent valueinthemarketsissimilartotheone wehadinthe2005to2008phase,oris thisdifferent?

I would say this is quite different because this time around, although optimism levels are there but the growth momentum is missing. There is a lot of anticipation of growth, but the growth is not there in actual. You need to come out of the pandemic and then reassess whether the growth momentum is sustaining itself. I think if that comes in, maybe we will be more lengths higher to market valuations than where we are already.

Question:Doyouthinktheresurgenceof casesinChina&UKandlockdownsimposedincertaincitiesareacauseofconcernfortheglobaleconomy?

I would say it is a cause of concern in the sense that it can create these micro-air pockets in which supply bottlenecks can increase. Like if China shuts down a major port or you have a major congestion happening because there are no people to clear items, that does create a problem. Is it something that is affecting growth in a material way? Actually, the impact of these lockdowns is becoming less and less relevant and people have kind of figured out a way of working around them. So, we see a declining marginal impact of lockdowns on activity, but yes, it can create some issues now and then, depending on where and who is doing it. So if it happens in a major economy like China, it does create problems. But if it is happening in places which are economically not so relevant, then its impact is very miniscule.

INDUSTRY INSIGHT VITTA ARTHA | 6

Dr. Surender Rao Komera Assistant Professor IIM Amritsar

A Note on Family Firms

In this note I aim to provide an overview of family businesses in terms of their business perspective, corporate governance, share price performance, capacity to weather adverse market conditions, and ESG compliance. To support my arguments in this note, I generously make use of the statistics published by Credit Suisse in its annual research reports on family businesses.

INTRODUCTION

Family owned and managed firms are one of the dominant forms of business organization in the world. They play a crucial role in generating employment and creating innovative technology. A number of studies have attempted to understand various dimensions of family firms including their performance, business strategy, investment decisions, financing choices, and corporate governance. Most of these studies define the family firms - organizations where founders or descendants control the direction of business operations through their top management roles and/or controlling voting rights. They document some of the salient features of family firms. They are:

1. The presence of controlling shareholder in the upper echelon mitigates the agency problems.

2. Long term focus of the controlling family allows the management to pursue wider growth opportunities.

3.Visible management and agility/consistency in business decisions – help the family firms to build reputational capital with their prominent stakeholders.

The studies also highlight few notable concerns with family firms. They are:

1.Family’s desire to maintain control may disincentivize the entrepreneurial risk-taking activities.

2.As value of ownership interest accounts for the significant portion of family’s wealth, family managers may adapt very conservative approach in their business decisions.

3.Given the unavoidable nepotism in family firms may make them prone to the maladies of strategic simplicity.

Market Performance:

Do family firms offer good investment opportunities for external investors? To answer this question, family firms have been identified as those in which founder or extended family owns at least 20% of equity. With this definition, around 1000 firms across the world have been identified as family firms. I note that more than 51% of these firms are from Asia, followed by Europe (25%), North America (14%) and so on. They are widespread across the world. To understand the relative performance of these family firms, a comparable sample of non-family firms were selected and sector adjusted return have been calculated. The reported findings suggest that family firms outperformed the comparable non-family firms by more than 370 basis points over the period of 2006 to 2020. The Asian family firms stood out for their significant performance followed by the European

FACULTY ARTICLE VITTA ARTHA | 7

family firms, while the North American family firms outperformed their sector peers by an average of 130 basis points per year during the same study period. This consistent long-term performance of family firms may be attributable to their superior financial performance driven by their long-term orientation. However, it is noted that family firms seem to underperform their sector peers over short periods (e.g., second half of 2008, second half of 2013) in which overall economic and market conditions are overtly positive. Such an underperformance of the family firms when the market sentiments are highly positive may be attributable to the conservative/defensive corporate policies they adapt compared to their nonfamily peers. These defensive policies include maintaining conservative balance sheets (higher profit margins and lower gearing ratios).

Operating and financial performance:

What are the drivers of family firms’ superior performance? During 2006 – 2020 period, the sample family firms report superior revenue growth led by their management’s long-term investment horizon. They report greater revenue growth rates, superior operating profit margins, and more consistent emphasis on innovation activities than their non-family counterparts. On the sector adjusted basis, family firms across the regions generate consistent top-line growth, laying the foundation for superior overall financial performance. In addition to their higher topline growth, family firms generated greater operating margins. Their sector adjusted EBITDA margin has been on an average 190 basis points (per year) higher than their non-family counterparts. An average family firm also reports to use lower debt financing than an average non-family firm. The evidence suggests that family owned firms have significantly lower gearing

ratios in all the regions except North America in 2017. At the same time, I note that the credit quality of family firms is observed to be better than the nonfamily firms. This has been the case throughout the study period. I argue that such a lower gearing ratio provided the greater insulation for the family firms during all the recent adverse market conditions. Further, the lower prevailing debt financing helped these family firms to reduce the gearing quickly during the early years of post-crises periods.

The underlying questions still remains. Why do family firms report better revenue growth and profitability than their non-family peers? The data suggest that family firms annually spend significantly higher than their annual depreciation expense on their capital expenditure. This ratio of capital expenditure as percentage of depreciation continues to be higher throughout the study period in the case of family firms. Further, family firms report to spend more of their sales revenue on innovation activities. This seems to be the situation across all the regions and industries. The available evidence clearly supports the long-standing argument of family firms’ longer-term investment philosophy. Such an investment focus, offers the family firms with greater flexibility to focus on long term growth instead of short-term quarter-to -quarter earnings growth.

Corporate Governance:

As I mentioned earlier, the presence of controlling shareholder in the firm’s upper echelon better aligns the managers’ and shareholders interests. At the same time, available literature on family firms also suggest that controlling shareholder may either directly indulge in the expropriation of corporate resources or embark on the suboptimal corporate decisions to safeguard their control. These activities of controlling shareholders are detrimental to the minority shareholders’ interests. Such ‘principal-principal agency problems’ can be more pronounced if the founder or

FACULTY ARTICLE VITTA ARTHA | 8

the extended family owns special voting rights in the corporate decisions. In other words, the presence of special voting rights for the family may adversely affect the minority shareholders’ interests. The recently published statistics by the Credit Suisse help me to comment on the potential impact of family’s special voting rights on the wealth of the ordinary shareholders.

The available evidence suggest that the concerns raised by the earlier studies about the ill effects of family firms with the special voting rights are visibly misplaced. It is reported that the family firms with special voting rights have outperformed the family firms where the family’s shares rank the same as that of the ordinary shareholders. This evidence seems to be true across all the jurisdictions with the provision of different classes of equity securities. With the support of this evidence, I tend to argue that families with the special voting rights have greater long-term focus than the families with controlling ordinary share holding. This is because shares with the special voting rights across the world have lower liquidity in the financial markets leading to their custodians to have a long-term perspective on the growth of their investments.

ESG Compliance:

Across the world, there is an increasing focus on environmental, social, and governance investing. The Credit Suisse’s study notes that an average family firm reports better overall ESG compliance than an otherwise similar non-family firm. Overall, European family firms report better ESG scores than the Asian and North American family firms. It is also observed that family owned firms, despite their better overall ESG score, underperform their peers in the governance aspects. This observation complements the perception in the financial markets that controlling shareholders may exploit the minority shareholders in the family firms.

For the further details, I direct the reader to the below mentioned references.

References

1.The Family Business Model – 2015: Credit Suisse Research Institute

2.The CS Family 1000 - 2017: Credit Suisse Research Institute

3.The CS Family 1000 - 2018: Credit Suisse Research Institute

4.The Family 1000: Post the Pandemic – 2020: -

FACULTY ARTICLE VITTA ARTHA | 9

Shivansh Khattri MBA 06 IIM Amritsar

The Financial Crisis of 2008

"Money in the bank is like toothpaste in the tube. Easy to take out, hard to put back."

This quotation by Earl Wilson highlights one of the most pervasive issues around the globe inundating even the smartest individual with the inevitable debt.

Banking Sector is devoted to holding and investing of financial assets. Commercial Banks engage themselves in loan-making and deposit-taking providing services to individuals and businesses. Investment Banks offer services to institutional investors and large companies acting as an intermediary between investors in securities and issuers of securities. There also exists a third category of banks, the infamous Universal Banks which offer services of both, Commercial and Investment Banks. Going back in time to 1933 when The Glass-Steagall Act was passed as a response to the crisis of the 1920's. The purpose of the act was to prevent fraud. The precursor to today's Citibank, The National City Bank failed to reveal negative information pertaining to bad Latin American loans which it sold to investors. There was a widespread condemnation. An act was passed to curb a number of abuses including the investment of their own assets in securities by banks which consequently risked their deposits. However, the act is remembered primarily for forcing banks to choose between commercial banking

and investment banking.

Fast forward to 1999 when the increasingly competitive financial environment led to relaxations in the provision of the act that inhibited the mingling of commercial and investment banks. A midnight deal was struck to promote the soundness of US banks and to ensure the protection of consumers' rights. Consequently, many commercial banks merged with investment banks and many investment banks diversified their financial services. The very purpose of enactment of the Glass-Steagall Act became the purpose of its repeal allowing banks to become "too big to fail".

The financial crisis that occurred in 2008 illustrated the delicate ties that exist between the financial side and the real side of the economy. The collapse of the 'dot-com bubble' in the early years of the century led to macroeconomic threat and emergent recession. The bubble that was created as a result of growing speculation-based investments based on faulty assumptions in Internet-based companies in the late 1990s ultimately burst when the capital dried up. Investors were overlooking the traditional valuation fundamentals. The consequent stock market crash forced many companies to shut down. The Federal Reserve responded by reducing interest rates aggressively. The LIBOR rate fell. The economy was healthy again.

This combination of drastically reduced interest rates and a stable economy led to an unprecedented boom in the housing market. The housing prices in the US rose noticeably and accelerated dramatically as rates of interest plummeted. This made investors hungry for higher-yielding alternatives. These hungry investors preyed upon the bright macroeconomic prospects and enhanced their risk tolerance levels.

STUDENT ARTICLE VITTA ARTHA | 10

A growing tendency of mortgage-backed securities began to develop. The homeowner would get made a conforming loan by the loan originator who would sell the mortgage to Fannie Mae and Freddie Mac to recover the cost of the loan. The agency would pool the loan into mortgage-backed securities and sell the securities to investors such as pension or mutual funds. However, these subprime loans had higher default risk. Thus emerged a strong trend towards lowor no-documentation loans that called for little verification of the borrower's credit ability. These subprime borrowers began to purchase houses by borrowing as much as the entire purchase price. Adjustable Rate Mortgages was another trend which would offer low initial interest rates but would eventually reset to the ongoing market interest yield.

With the deregulation of the derivative market by the US Government, investment banks carved out Collateralized Debt Obligations with AAA-rating. CDOs contained a number of debt obligations. Their design concentrated the risk on one class of investors leaving the other set relatively protected. The demand for CDOs increased manifolds which was the result of the introduction of Credit Default Swaps by American Insurance Groups. CDS was an insurance against default. This further encouraged the investors to buy subprime loans because CDS helped in credit enhancement by insuring their safety. This led to unsupportable exposure to default risk as most investors did not have sufficient capital to back the obligations. Despite the risk the financial product was AAA-rated. This was a result of the rating agencies being paid by investors to dramatically underestimate the risks.

By 2007, the systematic risk had grown tremendously. Many large financial institutions would borrow shortterm funds at low interests in order to finance highyielding long-term illiquid holdings gaining from the interest rate differences. This not only necessitated

their need to refinance their positions constantly but also made them highly leveraged with little capital as a buffer against losses. Besides, there was a rising trend of CDOs and over-the-counter exchange of CDS contracts with limited information of the trading partners' credit exposure.

Such new financial models were brimming with systematic risk. The problems of the financial system were ready to spill over and disrupt the real side of the economy. Unfortunately, in 2006, the Federal Reserve increased the interest rates. This left lenders with a limited capital which they chose to hoard instead of lending out to customers thus aggravating funding problems in the country.

By the fall of 2007, housing prices fell and the highly leveraged loans drowned. The property was worth less than the loan balance forcing many homeowners to abandon their homes as well as loans. The mortgage default rates surged and the crisis shifted into higher gear. CDOs provided far less protection than was anticipated. As the housing prices fell, defaults further increased and the much hoped-for benefits could never be materialized. Many investment banks began to totter.

The crisis peaked in 2008 with Fannie Mae and Freddie Mac being put into conservatorship. Merrill Lynch was sold to Bank of America. Lehman Brothers announced bankruptcy. The government, however, reluctantly lent to AIG on the grounds that AIG held massive amounts of CDS contracts and that its failure would destabilize the banking industry. The US Treasury proposed to purchase mortgage-backed securities.

Lehman had borrowed significantly by issuing commercial papers. The customers withdrew their funds and the short-term financing market eventually got shut down. This made banks unable to extend loans

STUDENT ARTICLE VITTA ARTHA | 11

to customers that included small businesses. Their operations were scaled back and the unemployment rate rose.

This Financial Crisis ultimately led to the Dodd-Frank Reform Act, 2010, which proposed stricter rules for banks by limiting the risky activities they could engage in. The Volcker Rule restricts a bank from trading for its own account and investing in hedge or private equity funds. The act mandates increased transparency in derivative markets by standardizing the trade of CDS contracts and attempts to unify the number of financial regulators clarifying their lines of regulatory authority. The Office of Credit Ratings was created to regulate the credit rating agencies.

Though over a decade old now, the crisis of 2008 is still fresh in the minds of investors and institutions. The entire series of events can act as an important case study for aspiring financiers for the crisis accurately depicted the delicate relation that exists between financial systems and the economy.

STUDENT ARTICLE VITTA ARTHA | 12

Pratik Sanjay Avasarmol

PGP 07

IIM Amritsar

5 Trillion Economy

5 Trillion Economy: Vision, Government Initiatives and Road Map

Prime Minister Narendra Modi, on 15th August 2019, while giving his 6th Independence speech, expressed the confidence that India would be a $5 trillion economy by 2024 More recently, On 20 12 2019, to mark the 100th year of ASSOCHAM Prime minister said, "The country has developed so fast in the last five years that we can aim for such big and worthy goals."

The Economic survey 2019 laid the foundation for achieving a $5 trillion economy by 2024 presented by Chief Economic Adviser (CEA) Krishnamurthy Subramanian.

The Context:

India set an ambitious goal to achieve a $5 trillion economy by 2024, and if completed, India will be the third-largest economy.

The Government wants to boost the service sector to contribute $3 trillion, Industry to $1, and Agriculture to $1 trillion.

The recent Slowdown due to pandemics has raised a question on an ambitious goal.

What is a $5-Trillion economy?

The $ 5 trillion economy is the total size of the country as a whole. Simply it shows the entire GDP of that country in the same year.

What is GDP?

The GDP is the total money value of all the goods and services produced within the boundary of a country within a given period, generally for one year.

The total size of Indian GDP in 2014 was $1.85 trillion, whereas in 2018, it was $2.7 Trillion, and India is the sixth-largest economy in the world and the third-largest in terms of purchase power parity.

Government Initiatives:

#National Pipeline Project

On the occasion of Independence Day 2019, Prime Minister Narendra Modi announced an Rs. 102 Lakh Crore infrastructure pipeline under the national infrastructure project has been laid down by considering achieving a $5 Trillion Economy goal by 2024.

STUDENT ARTICLE VITTA ARTHA | 13

Why is it required?

Robust infrastructure is the number one requirement for any economy to grow with an equally strong supply chain. To become more competitive in this area, India needs to boost the service and industry sector. In addition to that, it will also create opportunities for employment and upgrade the well-being of people.

The following are essential observations:

1. Investment needed: ₹111 lakh crore over the next five years (2020-2025) to build infrastructure projects and drive economic growth.

2. Energy, roads, railways, and urban projects are estimated to account for the bulk of projects (around 70%).

3. The monetization of infrastructure assets. Setting up of development finance institutions.

Strengthening the municipal bond market.

#Make in India:

How "Make in India will awake India."

As Government has already planned to boost all sectors and their contribution to total GDP following are the highlights of essential in India's dream to achieve a $5 Trillion economy.

"Make in India" aims to increase the contribution of manufacturing in GDP to 25% from 16%.

With the launch of the 'Make in India' campaign, India has already marked its presence as one of the world's fastest-growing economies.

India has good demographic dividends for the next 2 -3 decades, and the workforce's cost is less than the other developed countries.

India is a house of solid and responsible business houses operating with credibility and professionalism. These business houses have made enormous contributions to the development of the Indian economy.

NITI AAYOG:

In the future, Niti Aayog CEO Amitabh Kant recently outlined these steps.

#Incrase Ease of Business and Ease of Living to promote private investments

Over the last few years, the Government has taken some steps in this regard like they have scrapped more than 1300 antiquated law that creates an obstacle while making FDI's

By adopting these reforms, India has jumped up to 65 positions in the world Bank Ease of Doing Business. But, India's challenge is to be in the top 25 countries in the next four years.

#Urbanization - Can't Ignore at any cost

If we compare the total land area, which is less than 5% globally, it contributes to more than 75% of real GDP. We will see more urbanization in the next five decades than India could ever see from the last 500 years.

# Women Participation is the key

Unfortunately, Indian women's contribution to work is only 26%, whereas the world's average stands at 48%. If we left out such a vast mass, then we could not grow at a set pace. Eventually, it won't be easy to achieve a target of a $5 trillion economy.

STUDENT ARTICLE VITTA ARTHA | 14

#Agriculture Reforms is vital

We all know that India is an agriculture-based country where 48% of the population work in farms and businesses related to farming, poultry, etc. Indian farmers can't grow on subsidies. They need better technology, infrastructure, roads, water supply, and essential agriculture tools, and if they are not growing, we must not think about this ambitious dream.

References:

1.https://indbiz.gov.in/atmanirbhar-bharat-tofacilitate-indias-dream-to-be-a-us-5-trillioneconomy/

2.https://economictimes.indiatimes.com/news/ economy/indicators/indian-economy-to-grow-at-9 -5-in-2021-8-5-in-2022-imf/ videoshow/86968477.cms

3.https://www.thehindu.com/news/cities/ Hyderabad/indias-us-5-trillion-economy-dreamshattered-for-now-due-to-pandemic-rangarajan/ article36899010.ece

STUDENT ARTICLE VITTA ARTHA | 15

PRAJJWAL SINGH SCMS, Noida

Sri Lanka’s Economic Crisis: A Lesson For Policy Makers

Context

On 1st September 2020, the Sri Lankan government declared a state of economic emergency, empowering the administration to seize food inventories and fix their prices, in order to contain the spiralling inflation. As the economy battles out a food shortage, long queues were seen outside shops in Colombo selling essential items such as rice, sugar, potato, kerosene and onions. Apart from food shortage, many reasons have contributed to this crisis.

Sri Lanka’s economy

Sri Lanka is a frontier economy i.e., an economy that is more developed than the least developed economies but too risky or small to be deemed as a developing economy. The principal characteristic of this type of economies is that they depend on a few sectors for their GDP, and in Sri Lanka’s case these areas are tea & agricultural products, textiles and tourism. Domestically, services (tourism, banking and finance) and manufacturing (mainly apparel & textile and tea) contribute to almost 74% of its GDP. In case of merchandise exports, Sri Lanka earns majority of its foreign exchange from textile and tea exports, accounting for 52% and 12% of its exports respectively. When talking about service exports, Sri Lanka earns almost 1/3rd of its foreign exchange

from the tourism sector, which in addition contributes to 10% of its GDP. It also heavily relies on foreign aid from other countries for infrastructure development projects.

Countries like these do not have the financial strength or resources like those of bigger economies like India or China to endure economic shocks without any foreign assistance because of their small size.

The intertwined factors leading to a crisis

Inflation in August rose to 6% from 5.7% in July this year. The main driver for this was the rapidly depreciating Sri Lankan Rupee. The exchange rate has dropped by 9% this year till date. The drop in the exchange rate has been a result of the fast-depleting foreign exchange reserves. Banks having run out of foreign currencies, are unable to finance imports of essential items (food and medicine) causing their shortage. US Dollars have dried up wreaking a havoc as USA is Sri Lanka’s biggest trading partner and paying import bills in Dollars has got extremely costly. In August, a Dollar was being sold in black markets for 230 Sri Lankan Rupees.

STUDENT ARTICLE VITTA ARTHA | 16

Tourism sector, the third largest foreign exchange contributor, took a hit due to the pandemic and hurt the local economy causing drops in employment rate. Tourism attributable revenues fell from $455.5 million to under $3 million a month between December 2019 and July 2021.

it could lead to a widespread crop failure, inevitably pushing crop prices even further.

The foreign exchange reserve upheaval was aggravated by the government’s policy push to go ‘100% organic’. Subsequently in April, they banned imports of all types of chemical fertilizers; a bold step towards going environment friendly taken at a wrong time. The tea industry (a driving force for its economy) heavily depends on chemical fertilizers and the market for organic tea produce is very small and it is not cost effective to switch to an all-organic produce due to a lower crop yield. This gave another blow to the already troubled economy with predictions that it

Additionally, owing to the increasing borrowings of billions of Dollars during the past years especially from China, its debt to GDP ratio increased to a concerning all time high of 101% in 2020. After repayment of a $1 billion bond in July this year, Sri Lanka’s foreign exchange reserves fell further to $2.8 billion, leaving them with just enough reserves to cover 1.8 months’ worth of imports.

STUDENT ARTICLE VITTA ARTHA | 17

Lastly, Covid-impelled pent-up demand has put up a lot of stress on the already damaged supply chains, which is causing a delay in import of commodities. Sri Lanka being a net importer of food, has not been able to substitute its import demand for essential commodities, fuelling the economic crisis. Hoarding of essential food items also gained traction as traders looked for quick gains, contributing to the goods shortage.

The government’s course of action

The Central Bank of Sri Lanka (CBSL) has raised its deposit and lending rates by 50 basis points to 5% and 6% respectively, in a bid to ease inflationary pressures. In order to control foreign currency shortage, the government has banned the imports of cars, industrial raw materials and machinery, oils and spices and also plans to introduce fuel rationing later this year. Moreover, in an attempt to restrict foreign currency moving out of the country, it imposed capital controls in July for six months. Government officials have also been raiding food hoarders in a bid to relieve stressed supply. Furthermore, to address the outcry of farmers, the government reversed the fertilizer import ban in August – a much needed relief brought in too late. Lastly, it recently ended price controls on essential foods to curb black market trading.

Outlook for its economy

In August, Sri Lanka received $787 million from IMF’s special drawing rights (SDR) allocation and a $150 million currency swap agreement from Bangladesh. It had earlier received a $500 million loan from South Korea, and a $1.5 billion currency swap agreement from China. While this has given a temporary relief to the government, it has heavy debt obligations to look out for till next few years.

required by Sri Lanka annually between 2021 and 2025 to meet its foreign debt obligations. This is too large of a debt burden for Sri Lanka to pay because it runs not only a massive budget deficit but also a vast balance of payments deficit as it has been expending its foreign currency at a greater pace than it is earning.

The deteriorating reserves position induced rating agencies to downgrade Sri Lanka’s sovereign rating, indicating that it could soon default on its debt obligations, amounting to $1.5 billion next year. Due to the ratings cut, the cost of borrowing money will increase for Sri Lanka and will likely lead to a cautious approach while borrowing more. Nonetheless, its debt to GDP ratio is forecasted to hit 108% by next year. It also cannot print more currency in exchange for Dollars (an argument of the Modern Monetary Theory) because it would only lead to a further fall in Sri Lanka’s Rupee value. It would really take a ‘miracle’ to get out of this situation.

That being said, unless it receives help from its creditor countries (especially from China, its biggest lender) in forms of loan moratoriums, funding lines or currency swap agreements, the best solution would be to seek help of IMF, albeit with strict loan utilization conditions.

Conclusion

Being an import dependent country, Sri Lanka instead of banning imports, should focus on increasing its export revenues and developing tourism industry to cater to high volume tourism, as it would bring in much needed foreign earnings. It must also establish control over its debt obligations and work on its budget deficit. These measures would ensure a better position while handling any future economic shocks.

STUDENT ARTICLE VITTA ARTHA | 18

URVEE BAWEJA

Shaheed Sukhdev College of Business Studies, University Of Delhi

National Monetization Pipeline and its Impact on India

Recently, the Government of India launched the National Asset Monetization Pipeline (NMP) which estimates a monetization potential of $6 trillion through key public assets over the next four years from FY2022-25. The initiative has been planned to run concurrently with the concluding four years of the National Infrastructure Pipeline (NIP). It is in line with Prime Minister Narendra Modi’s deliberate disinvestment strategy in which the government will maintain presence and control in a few areas while the rest will be tapped by the private sector.

The pie chart below shows the sectoral proportion of NMP for the next four years. It can be seen that the top 5 sectors, accounting for around 80% of the total projected value of the assets being monetized include Roads (27%), Railways (25%), Power (15%), Oil & Gas pipelines (8%) and Telecom (6%). Mining, aviation, ports, warehouses, and stadiums are among the remaining up-and-coming industries. In terms of yearly phasing by value, this fiscal year is projected to

see 15 percent of assets with an indicative value of Rs 0.88 lakh crore handed out.

Oftentimes, it has been observed that asset monetization and privatization have been perceived to be the same. However, the two terms are significantly different from each other. The permanent transfer of ownership to private persons or corporations is known as privatization. The private entity becomes in charge of all activities and subsequent management choices. Asset monetization, on the other hand, entails leasing public assets to private companies in order to generate money. However, it involves the transfer of revenue rights rather than ownership. Once the transaction life comes to an end, the assets are returned to the government.

This initiative is highly welcome in a time when the economy is facing a pandemic-led economic crisis like no other. With India’s GDP sinking by 7.3% for the year 2020, primarily attributable to the pandemic, coupled with the hike in direct taxes. Owing to this, low and middle income customers reduce their expenditure, which further drags down the GDP. The large number of unutilized or underutilized public assets was also a compelling reason for the government to undertake this measure so as to ensure the efficient utilization of these resources to bolster economic

STUDENT ARTICLE VITTA ARTHA | 19

development. Additionally, with the government’s fiscal deficit nearing 9.3% of the country’s GDP and government debt at 90% of the same in the current fiscal year, the need for monetizing public assets has become critical. The situation is further highlight in the following graphs

Through the National Monetization Policy, the government aims to engage the private sector to unlock the potential in brownfield projects and use it to fund creation of infrastructure nationwide. A brownfield project is one, where development to rebuild, modify or upgrade is carried out in a now unused or underutilized resources, where work was once carried out. NMP will also help in maintaining fiscal prudence and contribute immensely in achieving the goals of $5 trillion economy and Atma Nirbhar Bharat. Moreover, the modernization of the existing public assets will assist in economic development.

Despite the objectives that the NMP may achieve, there is general apprehension of certain challenges that it may encounter. Loss of jobs of the workers of state-owned industries is one of the key concerns being raised. There is also the risk of corruption or blockages by opposition over asset allocation. Some assets may be undervalued during value estimation owing to a lack of distinct or identifiable revenue

streams which can result in huge losses for the nation.

Since only a few private individuals will actually invest in the Public Sector Undertakings (PSUs), there is a risk of growing concentration of power in the hands of a few, especially in some of the major areas of the economy. The absence of a quick and unbiased dispute resolution body raises many concerns over the smooth functioning of the project. Another key challenge that the government may face is resistance from individuals with vested interests who are illegally occupying government land or property, often overlooked owing to strong political backing.

The NMP, if implemented effectively, can play a pivotal role in transforming the economy. The PSUs that had hitherto been idle will now be put to productive use, resulting in a balanced regional growth. With respect to employment, the NMP will create opportunities for unskilled and skilled labor in maintenance of assets, asset creation, and other avenues. As a result, new career opportunities will emerge across the ecosystem. Another impact the NMP will have is the reduction in the amount of financial assistance required to enhance the capital base of the PSUs being monetized. The funds received may also be used to upgrade PSUs' technology, reducing their need for government aid and financial support. Involvement of private entities will expose the PSUs to extra resources for reinvestment, reorganization and expansion. It can

STUDENT ARTICLE VITTA ARTHA | 20

also assist public sector entities in lowering their market borrowings and interest payments. Lower interest rates will encourage private investment and enhance asset use efficiency. Since the pipeline would speed up infrastructure development and service modernization, this will lead to a multiplier effect in the economy. Economies of scale, improved asset utilisation, synergies, and the building of new infrastructure will all contribute to enhanced productivity and efficiency. The synergy premium which will be paid by the private entity will contribute to the nation’s gross savings and enable the government to support future capital expenditure without placing more burden on the economy.

The year-by-year estimated values of the monetization pipeline are shown in Rs. Crore in the bar chart below. These are projected values, subject to the invest Although the NMP looks very promising on paper, the real key to the development and success of this step lies in its effective implementation. To ensure better execution of the project, the government can set up a dispute redressal mechanism to monitor and safeguard the interests of all the stakeholders including the general public. It is also crucial to conduct a sensitization campaign to demystify the pipeline for the common man and debunk any misconceptions or preconceived notions. The government should give tax benefits to attract retail investors into monetization instruments like Infrastructure Investment Trusts (InvITs), as proposed by NITI Aayog. Setting up an independent regulatory body to ensure proper accountability and transparency of the transactions will also go a long way in gaining public confidence.

Thus, asset monetization, if implemented correctly, has the potential to extract unlimited value from infrastructure assets, which will not only have a large budgetary impact but will also help in the construction of world-class infrastructure in India. However, it is critical to guarantee that the revenues generated as a consequence of this effort are put to the same use for which they were intended. Subjecting all transactions under NMP to a competitive and transparent procedure is the only way through which utilities will emerge.

STUDENT ARTICLE VITTA ARTHA | 21

MAHIMA AGARWAL NMIMS, Mumbai

Glass Ceiling Effect: Application of Game Theory and Economic Ramifications

The gender-based wage discrimination encountered by women in various industries and fields of study is called the Glass Ceiling effect (GCE). The term explains prevalent gender biases in various sectors, which give rise to barriers of entry and lack of subsequent growth opportunities for working women.

Some of the instances are as follows:

In the corporate world, women continue to be underrepresented at every level, especially at the top levels of management, even though there is a rise in the absolute number of women in senior leadership position.

Despite having similar rate of return on investment, female directors are allotted a small budget as compared to male directors.

sign depicts outlier)

Candlesticks Depicting Male and Female Directorial Budget Allocations (*

Source: Miller (2018)

The percentage of female professors teaching top tier management in India is 6.67%, while it is 17%, 18% and 21% in the UK, US and Australia respectively. When female researchers are absent from work, they are assumed to be attending to their children whereas their male counterparts when absent, are assumed to be researching.

Source: Mckinsey & Company

STUDENT ARTICLE VITTA ARTHA | 22

Quantifying GCE through Game Theory

Here's a nascent model utilizing game theory to quantify the trade-off between household work and professional work faced by women at the point of marriage.

The model is non-zero in nature; Marriages aren’t situations of absolute victory or absolute defeat, hence it is impractical to assume that one person will win it all and the other will lose it all.

Additionally, another key assumption required is that the income levels of both the prospective husband and wife are equal. Had she been earning less, there is a loss in bargaining power which may result in the husband influencing this decision to a large extent. Hence, at equal income level, the basket of goods that can be reached when the husband works and the wife doesn’t, is the same as the one reached if the wife works and the husband doesn’t.

Given below is a basic payoff matrix using arbitrary payoffs to demonstrate the possible strategies and preferences of each agent:

Here, Player 1 is the woman and player 2 is the man. The two strategies at their disposal are to either work (W) or to not work (DW) post marriage. Hence, the two strategies lend us 4 possible outcomes namely,

1.(DW,DW): This strategy is not a rational possibility, since it will result in zero income for the family

and hence, no utility will be generated- (0,0).

2.(W,W): In this case, the man’s payoff is slightly lower relative to the woman’s, since the man derives certain utility in his work from the notion of providing for his partner, which is a very deeply rooted traditionalist perception in the male psyche – (4,3).

3.(W,DW): Here, the man’s payoff falls drastically, due to traditionalist notions leading him to consider housework as ‘unproductive’, or ‘disgraceful’ to him in some ways. The woman’s payoff falls slightly, since she too may fall prey to traditionalist notions and feel socially worse off for having a stay-at-home husband. However, the fall in her payoff is lesser relative to the man’s, since she’s getting utility from being able to work- (3,1).

4.(DW,W): Here, the woman’s payoff is seen to fall since she isn’t working, but it does not fall to the extent that the man’s does when he stays at home, because women value domestic work as important and productive to a greater extent than men do, so she’ll get some added utility from the traditionalist element of a matriarch tending to her home. The man’s payoff rises substantially due to the traditionalist notion of being the sole breadwinner for his family- (2,5).

Nash Equilibrium: When we apply Nash equilibrium to the above model, even after factoring in each and every possible orthodox mindset that the prospective husband and wife may harbour, we find that the equilibrium that we arrive at can is (W,W), implying that even under the most traditional notions, it is most rational for both husband as well as the wife to continue working post-marriage. While the payoffs mentioned are arbitrary, the numbers reflect the relative relationship between each choice, and real payoff values can easily be calculated by defining utility functions for each agent in the game.

STUDENT ARTICLE VITTA ARTHA | 23

GCE and Economic Development

Gender Equality is an essential parameter for measuring the development of an economy. By breaking the barriers that hinder women from getting– the same way as men – human capital endowments, economic opportunities and human rights, the recognition of gender equality affords economies better economic growth and accelerates development.

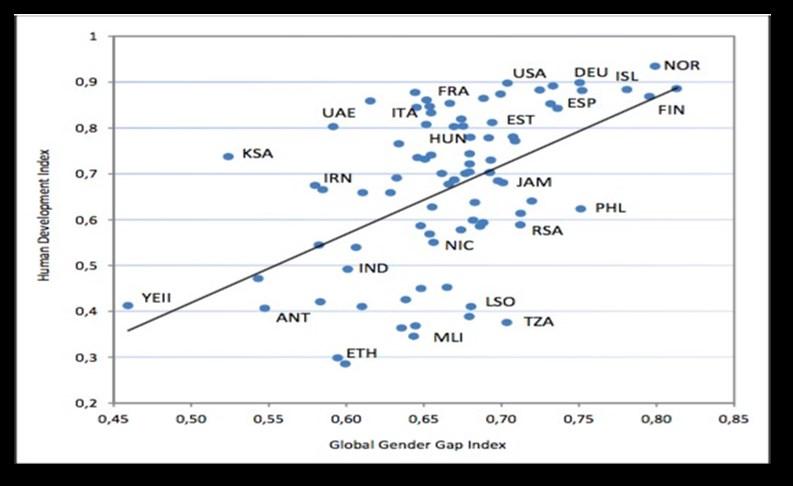

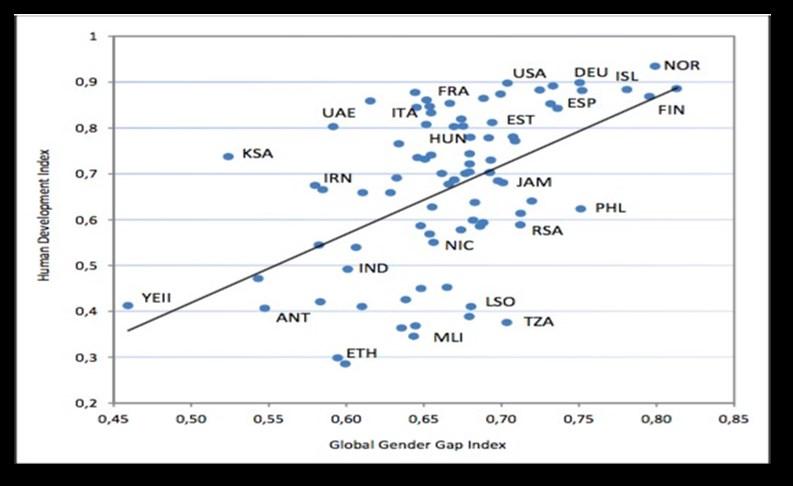

The figure below depicts the association between the GGI (Gender Gap Index) and the HDI (Human Development Index-). The GGI illustrates disparities between the two genders, where zero denotes inequality and one denotes perfect equality. The HDI, on the other hand, is the most widely accepted economic development index in use today.

stan)

One thing is clear: There is no way a country can achieve its economic and social development goals without first addressing the issue of GCE.

The Indian Context

As per the Economic Survey (2020-2021) by the Government of India, the Labour Force Participation Rate of women belonging to the productive age of 15-45 years is a low 26.50% in contrast to 80.30% for males. Women here earn roughly 65% of the wages of their male colleagues for performing the same job In the year 2019 (World Economic Forum Report, 2020). Only 3.7% of CEOs and Managing Directors of NSE -listed companies were females, a marginal increment from 3.2% five years ago ( Economic Times, 2019).

Just by increasing the Women Labour Participation Rate by 10% India can add upto $770 bn to its GDP by 2025 (McKinsey Global Institute, 2018). Hence, it needs to shatter the Glass Ceiling and promote nondiscriminatory practices at the workplace so as to embark on a growth trajectory and maintain its status of being one of the fastest growing economies of the world.

References:

1.https://www.investopedia.com/terms/g/glassceiling.asp

(Source: Global Gender Gap Report, World Bank)

The above plot depicts a cross-country analysis with the help of data available from 114 different countries. There is a relatively strong positive correlation of 0.55 between the HDI and the GGI which means countries whose level of equality between men and women is high tend to have a high level of human development as well (for example, Finland). At the same time, countries having huge gender inequalities have a low development index (for example, Afghani-

2.https://www.indiabudget.gov.in/economicsurvey/ doc/vol1chapter/echap04_vol1.pdf

3.World Economic Forum, The Global Gender Gap Report 2020 (2019)

4.https://economictimes.indiatimes.com/news/ company/corporate-trends/at-only-3-corporate-indiais-still-struggling-to-bring-women-to-the-top/ articleshow/68589499.cms?from=mdr

STUDENT ARTICLE VITTA ARTHA | 24

INTERNSHIP EXPERIENCE

Akshat Maheshwari

Akshat Maheshwari

PGP06

IIM Amritsar

Financial Analyst Intern - Synergy Consulting

My internship as Financial Analyst Intern at Synergy Consulting has allowed me to see so much more about the project finance domain than I can learn in the classroom. Getting a chance to work on the live project was the best part of my internship. It showed me a glimpse of a typical day in Synergy Associate's life.

Speaking about work, as interns, we got to work on live projects and not dummy assignments, and during the internship, I got the chance to see my work has gone to the clients, which feels great, as not many companies do that. The training and development sessions, organized into various modules, helped me get an in-depth understanding and hands-on experience of the fundamentals behind the work done by Synergy, like Valuation of the project, Various Risk Allocation and Mitigation strategies, Tariff Structure analysis, and Financial Models. Both the theoretical and practical applications are thoroughly incorporated into the modules, which in turn helped me directly get started with the real-time projects like designing Information Memorandum, Teasers and pitch book for both Government (Offtakers) and Bidders for construction or Maintenance Contracts, analyzing all Bidders Financial Models and comparing them with the help of different ratios like DSCR, LLCR, Cash Rati-

os, etc. I focused on the fundamentals of financial disciplines, including Corporate Finance, Financial Accounting, and Business Computing (Excel), when preparing for the interview. While studying financial subjects, attempt to understand why you're studying the concepts and how you may apply what you've learned in the classroom to real-life situations. Pick a firm at random from the list and review its financial statements, annual reports, and other documents. Apart from that, read the Job Description and business information thoroughly before filling out the form, and then mold your CV to match their wants and specifications. You can also include academic projects if you believe they will provide you an advantage throughout the Resume screening process.

INTERNSHIP EXPERIENCE VITTA ARTHA | 25

INTERNSHIP EXPERIENCE

Rishabh Nair

PGP06

IIM Amritsar

Treasury Intern — Kotak Mahindra Bank

Getting to work for Kotak Mahindra bank that too in the treasury department had been a very surreal experience for the finance enthusiast in me. The one aspect that I had grasped on right from the beginning was to be as inquisitive as possible trying to grasp each and every nuance of the treasury department as this was the golden opportunity I was waiting for and as conveyed by many seniors, that summer internships gives you the real flavor of the industry which you won’t be able to get in the confines of your classroom. Trying to advance in your project at a good pace can be advantageous as the more you accomplish within the project the more you will be able to learn. Going past the deadlines should be the motto.

At Kotak, each and every superior under whom I worked with were very helpful in terms of clearing my doubts and they also kept a regular track of my progress throughout the tenure of my internship be it weekly progress meeting with the senior vice president of treasury, or month end presentations with my mentors who used to give me constructive feedbacks and then used to decide the course of my following project work. I worked in the international banking unit of Kotak Mahindra bank in the IFSC of GIFT

City which is the first of its kind branch operating in a SEZ (Special Economic Zone). My project work revolved around the proprietary currency trading which Kotak does as a part of its daily operations. I was exposed to how the real time currency trading happens using the Bloomberg terminals and got to know its working. This project mainly used the concepts of risk management, derivatives, hedging, financial markets, macroeconomics etc. Thus being able to correlate the concepts learnt in the class with your projects is one of the key aspects of learning in an internship. Lastly finishing off the project on a high note was the cherry on the top. I was able to generate profits worth 10 lakhs within the 2 months of my internship with my formulated trading techniques which ultimately helped me to gain a letter of recommendation from the Senior Vice President at Kotak. So leaving a long lasting impression at the organization at which you do your internship should be a top priority and the success would follow.

INTERNSHIP EXPERIENCE VITTA ARTHA | 26

Aakash Gala

IIM Amritsar

CFA level 3 Cleared

I was working at my family's business when I decided to pursue CFA due to my interest in the finance domain. This distinguishes my experience from the majority of people who seek CFA while working or pursuing further education. I was enthused from the start, so studying was never a chore for me.

Coming from a commerce background gave me a slight edge as some basic concepts were already in place. I really enjoyed reading new subjects like Fixed Income securities and Derivatives. Quantitative Methods was one where I faced some difficulty. Ethics, in my opinion, is a highly significant subject in terms of both exams and everyday life. It's a bit tricky, and a low score in this subject can significantly affect your result. Many candidates have a question as to which topic or subject is important. All the subjects and topics are vital, in my opinion, but if any of them are challenging, you can skim over them but not entirely skip them. This is especially important in levels 2 and 3 because the questions are case-based sets rather than individual MCQ. It will significantly impact your score if you skip topics and receive a case set based on the same.

I studied from Schweser notes and watched recorded videos to prepare for all of the levels. The Schweser notes are a condensed version of the curriculum book. Resort to the curriculum whenever a topic or chapter is tough to understand. The blue box examples from the curriculum are critical, so always go

through them with each topic or chapter. Also, practice the questions from the curriculum book at the end of each chapter. Give all the mock tests available, i.e., in Schweser and mock on the CFA website. There's also a Schweser question bank with around 3 to 4 thousand questions that helped me revise concepts and build confidence. Get used to the exam pattern as the second session can be really challenging.

Go through the curriculum and depth of each subject and plan out the study schedule well. Remember to buy the financial calculator at the very beginning and practice sufficiently to get comfortable using it. After each exam, I would scarcely study for the next 4-6 months, but then I would put in daily 2-3 hours for the next 4-6 months. Working for my family also offered me the freedom to dedicate a whole day prepping for the last 15-20 days. This period is very crucial because most concepts must be revised, and this greatly aids exam performance. But you might not have that leverage, so dedicate some time daily.

After a term at premium B-school, I would say stay on schedule because juggling ten subjects is difficult. Lastly, take up the course only if you are passionate about finance as it would drive you to put in that extra mile with the hectic schedule of a b-school.

PGP07

CFA PREPARATION VITTA ARTHA | 27

CFA PREPARATION

GOLDEN INVESTMENT FUND

The Finance and Economics Club, IIM Amritsar announced the launch of Golden Investment Fund (GIF), the student-run investment fund of IIM Amritsar, in February 2019. It was started with the aim to give hands-on experience to the students about investing and applying their research into the equity markets. Team GIF aims to create a culture of research, analysis, and investment among the members of FEC and Finance Enthusiasts of IIM Amritsar. The equity fund intends to achieve better risk-adjusted returns than its benchmark index through investment in large-cap, mid-cap, and small-cap stocks.

GIF team releases weekly company reports and monthly fact sheets of its portfolio under management. The monthly report provides an outlook of the current market scenario as well as the companies in the portfolio of the fund. GIF team analyses the company’s fundamental and competitive. position in the market, investment risk, growth prospects, and investment decisions.

GOLDEN INVESTMENT FUND VITTA ARTHA | 28

46.59 49.55 55.02 57.89 60.206 62.011 63.25 65.78 66.86 70.29 73.33 40 45 50 55 60 65 70 75 Nov'20 Dec'20 Jan'21 Feb'21 Mar'21 Apr'21 May'21 Jun'21 July'21 Sept'21 Oct'21

NAV performance of our Golden Investment Fund during the past

NAV Performance

GOLDEN INVESTMENT FUND VITTA ARTHA | 30

GOLDEN INVESTMENT FUND VITTA ARTHA | 31

GOLDEN INVESTMENT FUND VITTA ARTHA | 32

GOLDEN INVESTMENT FUND VITTA ARTHA | 33

CLUB ACTIVITIES

Since its inception in 2017, FEC has been one of the most important student interest groups of IIM Amritsar. To provide students, an enriching learning experience in the world of Finance, the club organizes numerous interactive events throughout the year. It supports students in their journey at IIM Amritsar, helping them harness their potential and enthusiasm and guiding them at every turn. From providing advice about additional certifications and online courses, like Bloomberg Market Certification, to helping them with subject choices and interview experiences, FEC facilitates outside-classroom training to upskill them leading to brighter career opportunities.

This year, with sessions being both online and offline has brought its own set of challenges but the impact was not high enough to mar the spirit of the club that conducted the following events:

Golden Investment Fund (GIF): It is a student managed investment fund composed of experts in the field of F&O and intraday trading. GIF team releases weekly company reports and monthly fact sheets of its portfolio under management. Along with an overhaul of their reports, the GIF team also contributes to the IIM Amritsar’s culture by conducting knowledge sessions and investment lectures to engage peers and motivate students to invest in capital markets and develop financial acumen among students.

Pariprekshya: From 2017, FEC, in collaboration with the Industry Interaction Cell, has been successfully organizing IIM Amritsar's maiden Finance and Marketing Conclave where eminent industry experts share their view and experience on the big stage in front of IIM Amritsar faculty & students. It has helped the students get relevant industry insights

and get acquainted with the industry trends. The guest list included several industry stalwarts who helped us broaden the horizon of awareness.

Starry Nights: FEC is known for its trademark "Starry Nights" sessions where members share their knowledge and experience in an informal setting. In Starry Nights an informal discussion takes place on particular topics in which every attending student can participate in the discussion sharing their point of view, hence contributing to a healthy discussion on important issues. Various Starry Nights sessions have been conducted since July 2021 on topics ranging from venture capital to the future of Hedge Funds in India.

Fin-League: FEC’s Fin-League quizzes put the students’ business acumen to test and help them keep their minds sharp and ready while fostering a competitive environment. Winners of Fin-League quizzes were awarded prizes and certificates. It was a series of quizzes with each quiz focusing on a particular field of finance and economics and involved learning in a fun way about the concepts relating to the field.

Activities on Social Media: FEC members released a small post every week to keep students upto-date with recent news in the financial world. It included crucial events like budget, company mergers, bankruptcies, famous economics concepts, success stories of companies, and many more. A new series of posters under the name of “FinBytes” was also started by FEC to apprise the students of financial terms like ratio analysis, hedge funds, and many more.

CLUB ACTIVITIES VITTA ARTHA | 34

CLUB ACTIVITIES

Bridge the Gap: Bridge the Gap is a newly launched interactive discussion series. It aims to connect students with our alumni and other industry stalwarts through sessions and discussions on various relevant financial topics.

Guest Talks: FEC regularly organizes industry guest lectures and workshops to give students more practical exposure. In the past, FEC has hosted CFOs and senior management from prominent companies belonging to the financial sector.

AArunya 5.0: FEC organizes two events as a part of AArunya, the annual college fest. Insight Out, a valuation competition, and Barter-It-Out, a barter based competition.

. CLUB ACTIVITIES VITTA ARTHA | 35

STARRY NIGHTS

FINBYTES & GIF FIN-LEAGUE

PARIPREKSHYA’21

MOVIE REVIEW

uently made a large wager on it.

The film starts with Michael Burry (Christian Bale), a glassy-eyed, socially awkward hedge fund manager at Scion. He looks into mortgage-backed securities and discovers that the ostensibly safe housing industry is based on faulty loans. He wagers $1.3 billion against them, and the odds are stacked against him.

Directed by: Adam Klay

Directed by: Adam Klay

Distributed by: Paramount Picture Studio

Release date: Jan 22, 2016

Running time: 130 minutes

Country: United States of America

Language: English

SUMMARY

Big short is based on the book written by Michael Lewis, which has a star-studded cast of Christian Bale, Steve Carrell, Ryan Gosling, John Magaro, Finn Wittrock, and Brad Pitt. The movie is successful, if not entirely, in explaining the economic collapse of 2008 and how four different groups of people were able to predict the housing market crash and subseq-

The bet was discovered by Deutsche Bank's Jared Vennett (Ryan Gosling). Despite the fact that his bank was the first to take the risk, he agrees with Burry and works to recruit investors. Mark Baum (Steve Carell) has been a skeptic his entire life. Vennett recruits him and his crew to bet against the system after an incorrect number phone call. Vennett's prospectus was discovered by Charlie Geller and Jamie Shipley. They invest their tiny amount with the help of their next-door neighbor, Ben Rickert, a retired banker and doomsayer (Brad Pitt). There is some Financial jargon used in the film, but it is explained eloquently with the help of celebrity cameos. When you read about the craziness of bundling subprime mortgages into highly rated investment products, you might think to yourself, "Well, of course, it was a formula for disaster." Of course, if the home market tanked, the whole structure would come crumbling down like a Jenga tower. It was clear. we'd suspected it all along.

Almost none of us did, in reality. Certainly not the government leaders and financial CEOs who continue to enjoy freedom and power today. Or, if they were aware, they were unconcerned. Only a few people were mindful of the reality of what the banks and their facilitators were doing. In the end, no punishment was given to any major player, with thousands of people becoming homeless.

MOVIE REVIEW VITTA ARTHA | 37

Author: Robert T. Kiyosaki

Publisher: Warner Books

Pages: 336

BOOK REVIEW

In Rich Dad Poor Dad, Kiyosaki outlines the key lessons he learnt from his rich dad so he could avoid his poor dad’s financial fate. The book has become one of the best-selling personal finance books in history.

The Key Ideas

#1: The rich don’t work for money.

Working for a company is a short-term solution to a long-term problem. The rich recognize that by investing in income-generating assets, we can have money work for us instead of working for money.

#2: Your home isn’t an asset.

An asset creates income, and a liability creates expenses. Your home is therefore not an asset. The rich recognise this early on, building a portfolio of real assets rather than committing all their income to the trap of increasing mortgages on a home.

#3: The rich outsmart the government.

While the aim is often for the richest to support the poorest through taxes, this is rarely realised. The middle class absorb the biggest tax burden while the richest use corporations to outsmart the government on taxes.

#4: The rich invent money.

SUMMARY

Growing up, Robert Kiyosaki had a rich dad (his best friend’s dad) and a poor dad (his real dad). His poor dad did everything the way most of us are taught to do it. He got an education at university, he secured a stable, well-paid job, worked hard, got a mortgage, and so on. His rich dad, on the other hand, didn’t follow the usual path. He started small and focused on building income-generating assets, he used legal corporations to reduce his tax liability, he paid himself first.

In the real world, self-confidence matters far more than university grades. The rich combine financial IQ and courage to take advantage of the latest opportunities in the world.

#5: The rich use fear and desire to their advantage.

But even the financially literate can stop themselves from getting rich. The rich overcome fear, laziness, cynicism, bad habits and arrogance on their way to wealth.

BOOK REVIEW VITTA ARTHA | 38