10 minute read

Crossword……………………………………………...……..………………..….42

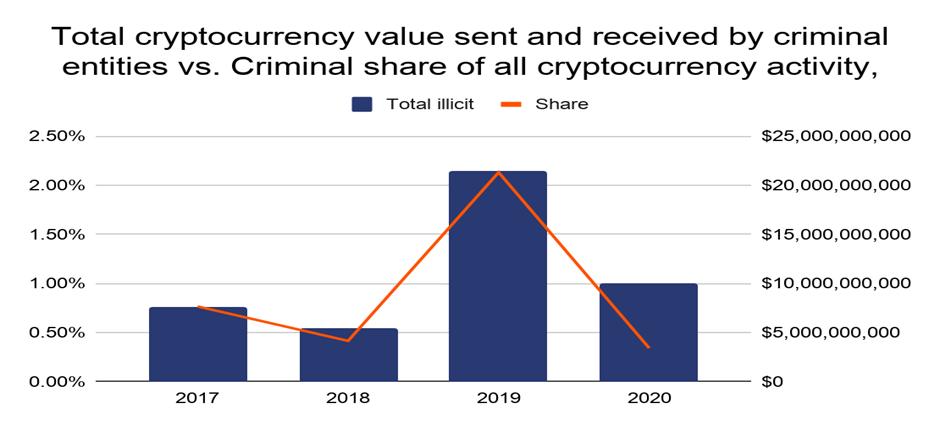

(Image Source: https://blog.chainalysis.com)

Value Volatility

Advertisement

The price discovery of Cryptocurrency is still a big issue. The real value of the Cryptocurrency cannot be determined on the exchanges and is subjected to get highly influenced in the early phases; for example, one tweet of a celebrity (in our case Elon Musk) can influence the entire exchange. The cryptocurrency market is highly volatile, and if you trade in Cryptocurrency, then you probably understand that in the current scenario, the value of Cryptocurrency keeps on changing on an average of 5% on a daily basis –which is not suitable for any currency. There should be some stability attached to any currency, and the bid/ask spread shouldn't be high.

Loss to Gover nment Revenue

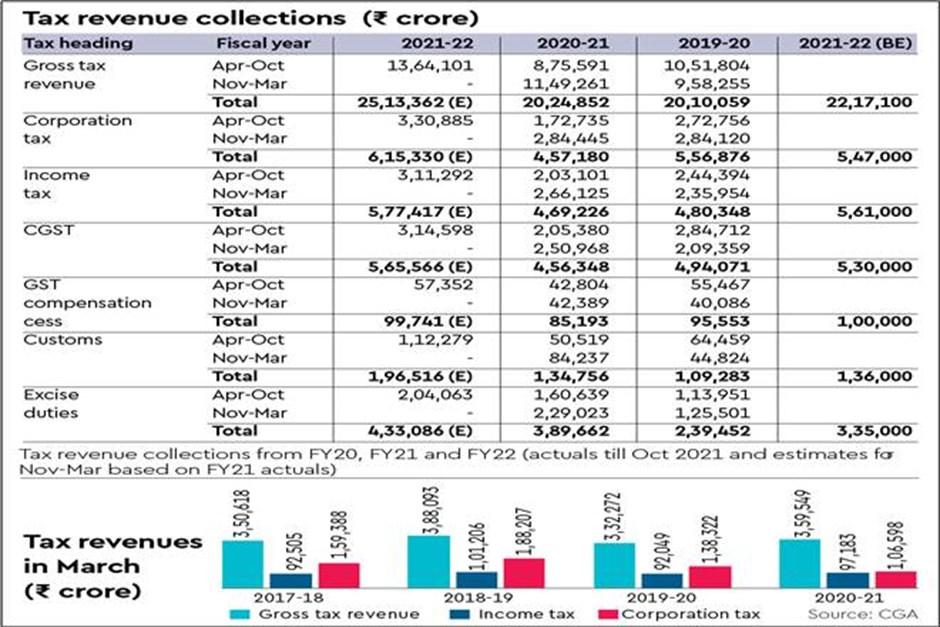

A huge chunk of government revenue comes from taxation, and in the case of Cryptocurrency, almost all the countries are unable to get tax gains from Cryptocurrency as they are unable to tax them so, if we move away from using conventional banking services to using Cryptocurrency than governments will lose a massive source of tax revenue. As shown in the below-mentioned table, there are multiple flows or sources of tax revenue for the Government, and if the people or any corporate legal entity starts using Cryptocurrency for financial transactions, then the revenue gain that the Government earns through these sources will start diminishing.

Regulation

As the financial authorities do not regulate the Cryptocurrency market, there is no shield or front line of defense to protect you and your business in case things go south. No central authority enforces its value, which also leads to price volatility, as discussed in the earlier case. Even Warren Buffet made a statement – "It doesn't make sense. This thing is not regulated. It's not under control. It's not under the supervision [of] any…United States Federal Reserve or any other central bank. I don't believe in this whole thing at all. I think it's going to implode." When the "Oracle of Omaha" (arguably the greatest investor of all time) makes a statement like that, then things need to be taken seriously.

(Tax collection by the Indian Government in crores, imagine the Government's losses after Cryptocurrency is in the mainstream) (Image Source: https://www.financialexpress.com)

Conclusion

It is pretty much clear that Cryptocurrency is here to stay, but which Cryptocurrency will survive in the long run; we don't know. In the late 90s, people used to talk about the "internet" in the same way. Then the "dot-com bubble burst' happened, and there was a huge correction in the market. But the "internet" is still here with us along with really spectacular internet-based companies. Cryptocurrencies are heading in a similar direction. With any new opportunity, the threats and risks are always involved, and it is upon us how to utilize and tackle those risks to our advantage.

NISHANT KUMAR SATYAM

IIM Indore

• HYPER-TRANSPARENCY

ESG Investing: Putting

The Environmental, Social & Governance in Profitable

"When it's done right, ESG investing is good business."

Introduction

Environmental, Social and Governance investing has taken the financial world by storm, and it has received a fillip in the pandemic years. Pandemics and environmental challenges have come to be viewed similarly by investors in terms of impact. As Covid19 presents the first major sustainability challenge of the 21st century, the corporate world has awoken to its increased relevance in the upcoming years. The pandemic has proved to be a catalyst for ESG concerns worldwide, in terms of where investors want their funds to be parked and how companies adapt to be more ESH-investment friendly. Thereby, it becomes important to understand the relevance of this trend on the investment as well as the corporate world, its impact on how companies go about their businesses, and what the future beholds for the ESG way of investing.

ESG: Present-Day Relevance and Drivers

But the pandemic has not been the only thing going forward for ESG investors or corporates. A host of other factors have been at play silently for years, further validating the spotlight that the trend is currently enjoying. Some of these factors are: GDP, and in Sri

Mounting empirical evidence is driving the speed at which ESG concerns become material to corporates. A host of industry 4.0 technologies such as artificial intelligence, blockchain, and virtual reality are creating unprecedented levels of transparency. These shifts, along with changing regulations in some form or the other across countries, have enabled investors and other stakeholders to look beyond just publicly reported ESG data. • Stakeholder Activism Emphasizing Freeman's stakeholder theory, key organizational influencers—such as the media, public figures, or NGOs—can increase the materiality of a sustainability issue to businesses. Given the hyper informational transparency that exists today, when these stakeholders disseminate evidence, they create narratives that change societal expectations from corporates and prompt action by regulators or investors. For example, the world's largest wealth fund - Norway's Sovereign Wealth Fund with assets over one trillion dollars, declared that it's working on a strategy to ensure that its investments live up to the carbon neutrality goals set by the Paris Agreement.

ESG: The Investor Impact

Now that we have established the relevance of ESG let's take a look at its impact across various facets of the business world. As expected, the phenomenon is not limited just to investors or companies, but the entire value-chain has become much more aware of these issues, including suppliers, employees and of course, consumers. The following points validate the same:

• Consumer Attitude

As per a BCG analysis, nearly 72% of European consumers reported choosing products that came in environmentally friendly packaging. Another 46% of consumers worldwide said that they would choose ecofriendly products over a preferred brand if given a choice.

Increasing Importance of ESG Adoption for Customers, Employees & Corporates Alike

• Employees Another BCG research revealed that nearly 67% of millennials expect their next employer's organization to be purpose-driven and their jobs to have a societal impact. More importantly, such employees are also more willing to publicly criticize their employers' climate policies. Many such employees are forming ESG-advocacy groups or submitting shareholder proposals to drive change on the ground. In the investing world, investors perform two core functions with respect to the ESG trend. The first one is decisional. Investors have increasingly started to evaluate companies from an ESG perspective, apart from the usual standard financial metrics. These concerns now weigh heavily on portfolio construction and asset allocation. Which, in turn, determines where capital flows. The second function is influential. Investors shape the market and the workings of organizations by pushing for greater transparency. Their control over capital flows gives them the leverage to do so. The Brumadinho dam disaster serves as a good example of this. In its aftermath, the Investor Mining and Tailings Safety Initiative, formed by investors representing a cumulative $13 trillion in assets, called on nearly 700+ companies active in the mining-extraction industry to routinely disclose information on their tailings storage facilities. This prompted the creation of the first global database of tailings dams.

ESG Integration For Efficient Implementation

Going ahead, ESG investing seems to have a bright future and is set to fundamentally redefine how investments will be made in the future. We can expect more and more MNCs to adapt their practices in order to be ESG compliant. As mentioned above, this shift would not only be from an investor-oriented push but due to pressure from all stakeholders, including employees, consumers, governments etc. ESG investing is set to play an important role in how the world as a whole, delivers on its sustainability promise. But there are a few hiccups along the way. ESG funds tout their relatively strong returns. Yet, they don't make clear that the real drivers are sectoral characteristics, riding on global business cycles. For example, a heavy emphasis toward technology companies that have seen above-average rates of growth can partially explain the above-normal returns and not just ESG practices alone.

Procedure to create wealth management for Asset Managers, integrating the customized ESG mandate

However, the ESG trend will allow leading asset managers to carve out a differentiating niche for

themselves in the domain of portfolio construction In the upcoming years, the ability to create a portfolio that reflects how a client thinks about sustainable investing will transform the ESG product landscape. Personalized investment portfolios will be the way to go for many climate-conscious HNIs, who wish to invest responsibly. Institutions, advisors, and individual investors will increasingly be able to express their views on what they want to own and act accordingly. This level of thematic customization would generally require an expensive and complex separately managed account (SMA) structure and the associated tracking and operationalization costs. But emerging mechanisms such as direct indexing and fractional ownership have broken down that barrier, granting such investors the weapon of "choice" at a very low price. The future will behold an era where asset managers will be able to build deeply personalized portfolios involving small sums and do so at scale while representing the client's preferences.

Concluding Opinion & The Way Forward

In our opinion, strong performance with regard to ESG factors such as carbon reduction & enhanced gender equality can unlock a significant positive impact for society, companies, and investors. We believe that consumers, activists, and employees all play a role in determining which ESG issues become material to the business, but companies & investors can become influencers in this materiality process. Adopting an 'always-on' approach towards such aspired materiality allows investors to develop a competitive advantage by optimising performance with respect to issues that are material, both currently & in the future.

There is simply no denying that sustainable investing is indeed both messy & confusing as well as an exciting topic for asset managers, with the potential to stir up the industry & develop new sources of competitive advantage. The scale will continue to matter, performance will always matter, and so will fees. But now, sustainability will matter as well. At its roots, the best investor has a deep desire in understanding how the world works. Markets, economies, & people are all connected, as they always have and only now can we put a name to it—ESG.

A Framework for ESG Integration at the Investor's Level

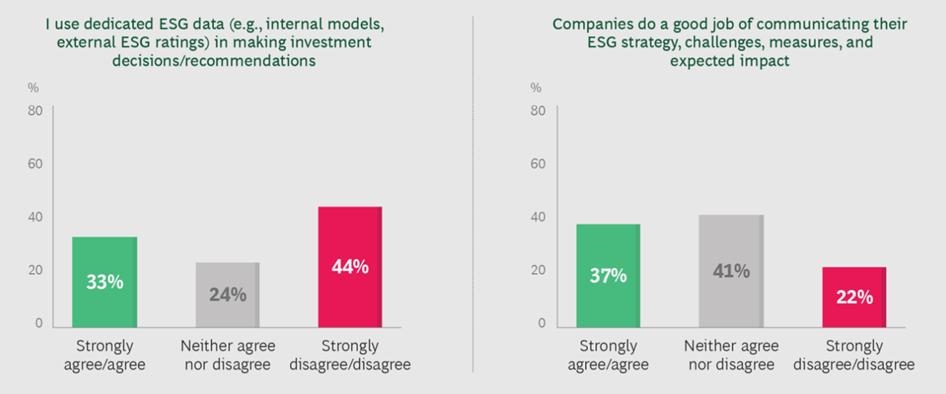

We think that integrating these concepts will be key to how successful they become, while acknowledging that there is grave confusion regarding the integration of material ESG-info into the investment decision-making process. The translation of data in the form of ESG scores to meaningful cashflow impact is a rather new line of thought for many, and the lack of empirically-established links doesn't help the cause either.

In the end, we believe that in order to effectively integrate, investors need to acknowledge ESG info for what it is—a highly flawed yet meaningful source of data that operates alongside the traditional investment criterion. Much like other data sources—be it credit scores or investment notes, ESG data is not be taken at face value; rather, it is imperative that asset managers should engage in doing their own homework aided with the triangulation of numerous sources of internal & external information, allowing for increased confidence in their decision-making process as well sift the credible information from noise.

References

1.https://www.bcg.com/en-in/publications/2020/ esg-commitments-are-here-to-stay 2.https://www.bcg.com/en-in/capabilities/socialimpact-sustainability/how-sustainable-finance-isshifting-future-of-investing 3.https://www.mckinsey.com/~/media/McKinsey/ B u s i n e s s % 2 0 F u n c t i o n s / S t r a t e g y % 2 0 a n d % 20Corporate%20Finance/Our%20Insights/Five% 20ways%20that%20ESG%20creates%20value/Fiveways-that-ESG-creates-value.ashx 4.Formankovaа, S., Trenz, O., Faldik, O., Kolomaznik, J., & Vanek, P. (2018). The future of investing–sustainable and responsible investing. Маркетинг і менеджмент інновацій, (2), 94-102.

5.Blank, H., Sgambati, G., & Truelson, Z. (2016). Best Practices in ESG Investing. The Journal of Investing, 25(2), 103-112. 6.Van Duuren, E., Plantinga, A., & Scholtens, B. (2016). ESG integration and the investment management process: Fundamental investing reinvented. Journal of Business Ethics, 138(3), 525-533. 7.Kotsantonis, S., & Serafeim, G. (2020). Human Capital and the Future of Work: implications for investors and ESG integration. Journal of Financial Transformation, 51, 115-130. 8.https://m.economictimes.com/small-biz/money/ the-need-for-esg-pluralising-development-throughenvi ro nme nta l-social-a nd-co rp ora te-go vernan ceinvesting/articleshow/81360222.cms