7 minute read

Swapneel Verma (Xavier Institute of Social Service, Ranchi

SWAPNEEL VERMA

Xavier Institute of Social Service, Ranchi

Advertisement

As the world sped out of pandemic, the rise in level of activity invigorated the global economy. The rebound resulted in a strong post pandemic recovery but it was unevenly spread across the globe. The sharp decline in consumption, government stimulus packages and increased savings placed huge disposable incomes in the hands of people. As a result, the demand sky rocketed, challenging the global supply chain.

This mismatch of demand and supply coupled with labor shortages and energy crisis fanned inflation all around the globe. The inflation in the US hit a four decade high in January 2022 when the U.S. Bureau of Labor Statistics reported that Consumer Price Index (CPI) rose 7.5% over the last 12 months. In Europe, the inflation rose to record level of 5.1% in January 2022, up from 0.9% a year earlier. Inflation in UK climbed to its highest level in 30 years where the CPI in January 2022 rose by 5.5% in the 12 months period. It was at such level in March 1992, when it stood at 7.1%. A similar story came from Canada as well where Canada's CPI rose 4.8 per cent on a year-onyear basis in December 2021, the highest since September 1991.

In such time where inflation already plagues major economies, it becomes crucial to examine the impact of the changing geopolitical equation on the global economy. The text book concepts of Economics can be better understood by analyzing its inextricable linkage with geo-political events Any geo-political crisis carries grave and widely impacting economic implications. In the context of constantly changing trade partners, every economy affects the other. Thus, a conflict between two countries affects not only them but also the bystanders. After being battered brutally by the pandemic, persisting supply chain chokeholds and leaps in prices, the global economy is set to be sent on yet another bumpy ride as Russia and Ukraine engage in an armed conflict. When Russia on 24th February 2022, announced commencement of military operation in Ukraine, the global markets sank. Investors sprinted for the safe havens, fleeing equities after the news of the invasion came out. RTSI, which is a dollar denominated Index on Moscow Exchange nosedived, breaking the covid low of around 830 points. It sank 49.93% to a low of 614.19 that day. The MOEX Russia Index, the main ruble denominated benchmark index of the Russian stock market, closed at a 33% lower level, erasing $189 billion in a day. The FTSE 100 Index of the London Stock Exchange, dropped 2.5% as the markets opened, the French CAC 40 fell 4% and the Germany’s Dax faced worst day on 24th February 2022 since Covid 19 crash when it lost over 4%. The European STOXX 600 lost around 3% as well.

The brutal effects of the invasion crossed the European borders and reached Asia. Hong Kong's Hang Seng Index declined 3%. Korea's Kospi tanked 2.6%. Japan's Nikkei 225 lost nearly 2% and China's Shanghai Composite moved 1.7% down. The scene was no different in domestic market. It became the worst performer in Asia where Sensex clocked a decline of over 2700 points (4.72 percent) and Nifty settled 815.30 points below (4.78 percent). The global stock market on 24th February bled and ended in red. It indicated market’s concerns about

serious economic repercussions including trade restrictions and further supply disruptions. Russia is a transcontinental country which is a key supplier of Oil, gas and raw materials. Compared to China however, which is world’s factory, Russia is comparatively less capable of crippling the world economy. Hence, the impacts of the conflict will be unevenly spread across the globe, intense for those who rely heavily on it and unnoticed in others.

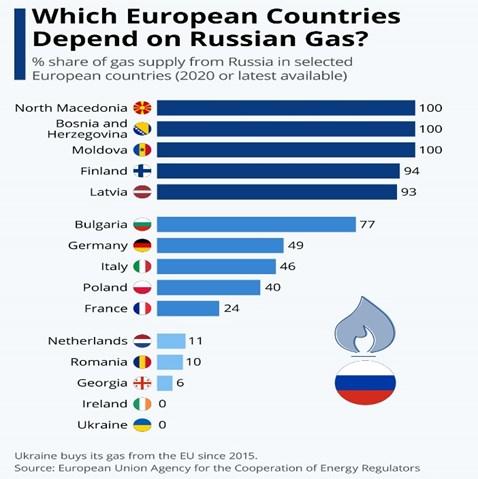

Russia is the second largest producer of Natural gas globally after the United States. The European Union relies heavily on Russia as it imports 40% of its Natural gas requirements and about 25% of its oil from Russia. Europe’s gas markets are linked to Russia via a network of pipelines. Currently, Europe’s gas reserves stand close to 30 percent. Europe’s dependence on Russia to heat its homes has driven the prices of natural gas up as the supplies from Russia has been lower this year. Any further disruption in supplies will make the Europeans pay top dollar to keep their homes warm in the winter. Households spending greater portion of their incomes on fuel and heating will leave less cash for other goods and services, ultimately affecting the growth. to enhance the capital base of the PSUs being monetized. The funds received may also be used to upgrade

PSUs' technology, reducing their need for government aid and financial support. Involvement of private entities will expose the PSUs to extra resources for reinvestment, reorganization and expansion. It can

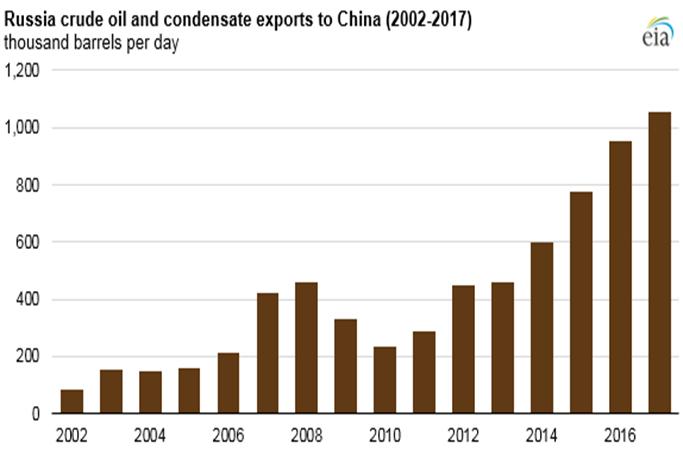

Source: U.S. Energy Information Administration, based on Russian export and country import statistics from Global Trade Tracker

Russia is third largest oil producer in the world. Apart from Europe, China is a destination for its oil exports. Its oil exports to China has gone up since 2010. The oil prices spiked, with Brent crossing the $100 per barrel for the first time since 2014 after Russia engaged in direct military confrontation with Ukraine. The rise in fuel price affects everything. It not only places greater negotiation power in the hands of OPEC but also adds to the cost of production. Economies like India which import about 84% of its crude oil requirement is staring at an increased oil import bill. This will ultimately cost heavier on the pockets of domestic consumers.

Unfortunately, the ramifications of this conflict are not limited to oil and gas. Russia is world’s top wheat exporter and Ukraine is called the “breadbasket of Europe”. Together, they make up about a quarter of global wheat exports. Countries like Egypt whose consume more wheat than global average, get 85% of their wheat demand from Russia-Ukraine. Ukraine exports more than 40% of its wheat and corn exports to Africa and Middle East. A Country like Lebanon, which is already in the middle of an economic crisis gets more than half of its wheat from Ukraine. Wheat and corn prices were already soaring. A further surge in prices can create social unrest. China has also recently become big recipient of Ukrainian corn. Furthermore, Ukraine also happens to be the largest

exporter of Sunflower oil. India will suffer the most as it is the largest importer of Sunflower-seed or safflower oil, crude followed by China. Russia is top producer of precious metals like Palladium which is a key component in emission reducing devices in automobiles and is also widely used in electronics, dentistry and jewelry. Palladium prices rose by 25% just even before the conflict escalated into a war. The severe sanctions imposed on Russia including its exclusion from Swift Network carry grave consequences for the transcontinental behemoth. Nonetheless, the impacts of war are far reaching owing to how intimately economies are woven together. While it’s too early to gauge the full impact of this conflict on the global economy, this major geo-political event raises serious questions about self-sufficiency of major economies.

References

1.https://www.bls.gov/news.release/cpi.nr0.htm 2.h t t p s : / / e c . e u r o p a . e u / e u r o s t a t / documents/2995521/14245727/2-23022022-APE N . p d f / 1 b d 1 f 7 8 c - b 6 1 5 - 7 0 5 2 - 7 3 7 9 3129551900eb#:~:text=The%20euro%20area% 20annual%20inflation,up%20from%205.3%25% 20in%20December.

3.h t t p s : / / w w w . o n s . g o v . u k / e c o n o m y / i n f l a t i o n a n d p r i c e i n d i c e s / b u l l e t i n s / consumerpriceinflation/january2022 4.h t t p s : / / w w w 1 5 0 . s t a t c a n . g c . c a / n 1 / d a i l y quotidien/220119/dq220119a-eng.htm 5.h t t p s : / / e c o n o m i c t i m e s . i n d i a t i m e s . c o m / markets/stocks/news/russian-stocks-nosedive-20 -a s-t r a d i n g-r e s u m e s-o n-m o s c o w-e x c h a n g e / articleshow/89794446.cms

6.h t t p s : / / w w w . b l o o m b e r g . c o m / n e w s / articles/2022-02-24/russian-stocks-suffer-thirdworst-rout-in-history-of-markets 7.https://edition.cnn.com/europe/live-news/ ukraine-russia-news-02-23-22/index.html

8.https://indianexpress.com/article/business/ market/equity-markets-live-updates-stocks-shares -bse-sensex-nse-nifty-russia-ukraine-war-february -24-7787490/

9.https://www.eia.gov/international/overview/ country/RUS 10.h t t p s : / / w w w . e i a . g o v / t o d a y i n e n e r g y / detail.php?id=33732 11.https://www.wsj.com/articles/russian-attack-