ROHIT VOLETI International Management Institute, New Delhi

The technology giants of today have forayed into most if not all sectors of the economy and their entry Technology

Banking in the age of FinTech: Partner or Perish

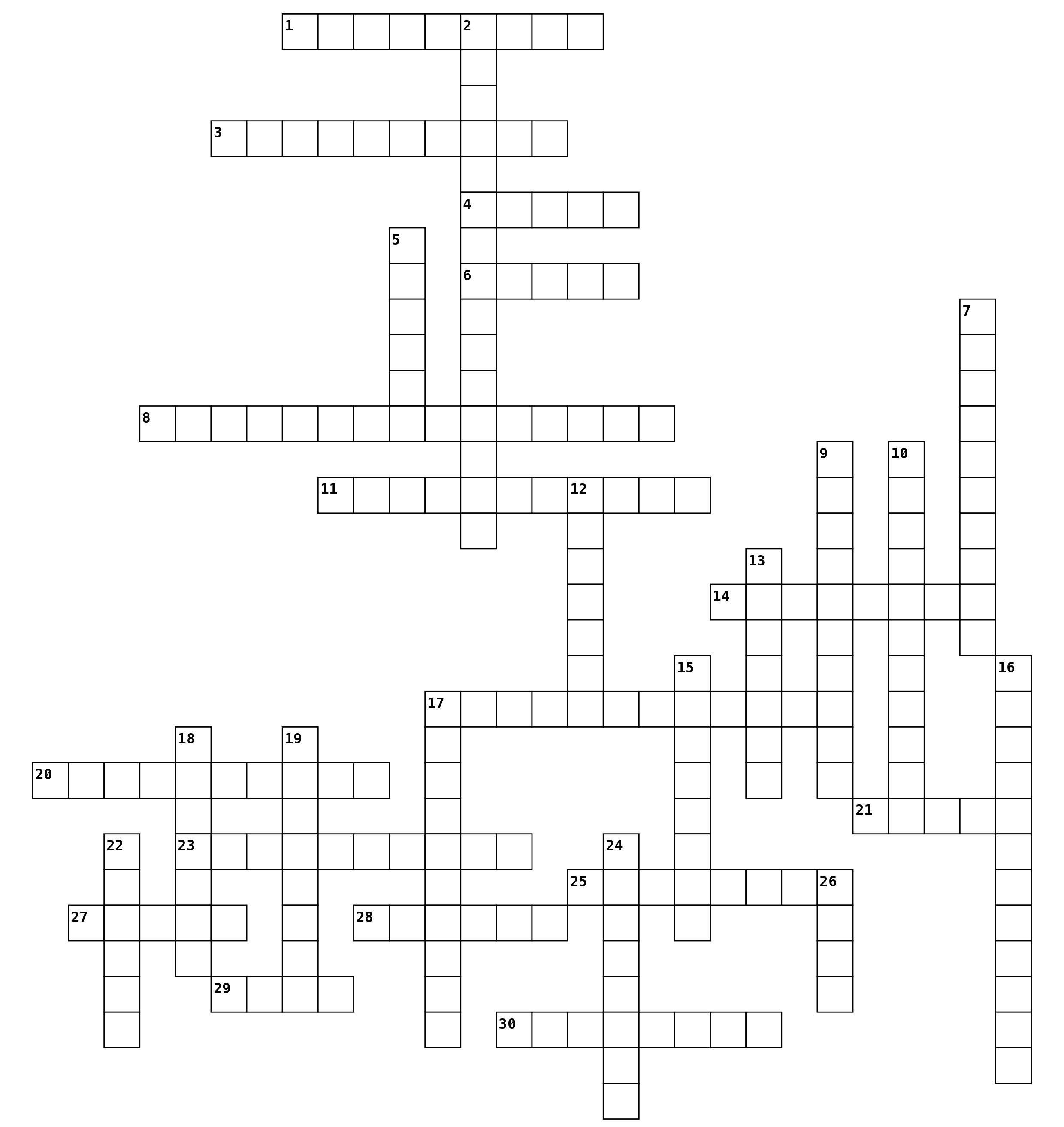

Artificial Intelligence & Machine Learning

“A crisis is a terrible thing to waste.” - Paul Romer Every crisis brings to us an opportunity to reimagine the way we operate in this dynamic world. The banking industry over the past few years has witnessed changing customer expectations and growing competition from fintech companies and technology leaders who have forayed into the banking space, leaving banks with no choice but to embrace digital technology. The COVID-19 pandemic has not only catalysed this change but has also depicted that inculcating technological practices is critical to continuity, consistency and resilience. For a world that is recovering from the adverse effects of the pandemic, banks which are at the nerve center of global economies must collaborate with technology providers such as fintechs in shaping the future of economic growth.

STUDENT ARTICLE

•

Leverage data to derive customer insights

•

Customer centricity through hyper personalisation

•

Smart pricing, product bundling

•

Data privacy and security

•

Fraud detection

•

Risk management

•

Cross-industry collaborations

•

Cutting-edge analytics

•

Seamless connectivity and services

•

Customer care automation

•

Voice support, language processing

•

Enhanced experience

Blockchain

5G

Internet of things (IoT)

Unveiling the potential of technology Banks have sustained desirable levels of stability and continue to command a high level of trust and confidence among customers. This advantage must be leveraged so that banks remain relevant to customers as financial intermediaries in a digital future that will be driven by personalisation, enhanced experience and transparency. It is under this context that technology plays a pivotal role in building upon the inherent strengths of banks in delivering value.

Potential

into the banking space has been a question of “when” rather than “if”. These companies have reset the standards of customer experience and offer lessons to traditional banks - to either adopt or collaborate. •

Tech giants command a high level of customer loyalty largely due to the frictionless ecosystems that they have created in effectively mapping sellers with customers and offering one-stop-

VITTA ARTHA | 23