28 minute read

RAISE OF AGRI FINTECH Inherent Sustainable Development in awakening

products is still below the pre-pandemic levels.

As per the Retailers Association of India, the demand for retail products was about 93% of pre-pandemic levels in February 2021.5 A sud-

Advertisement

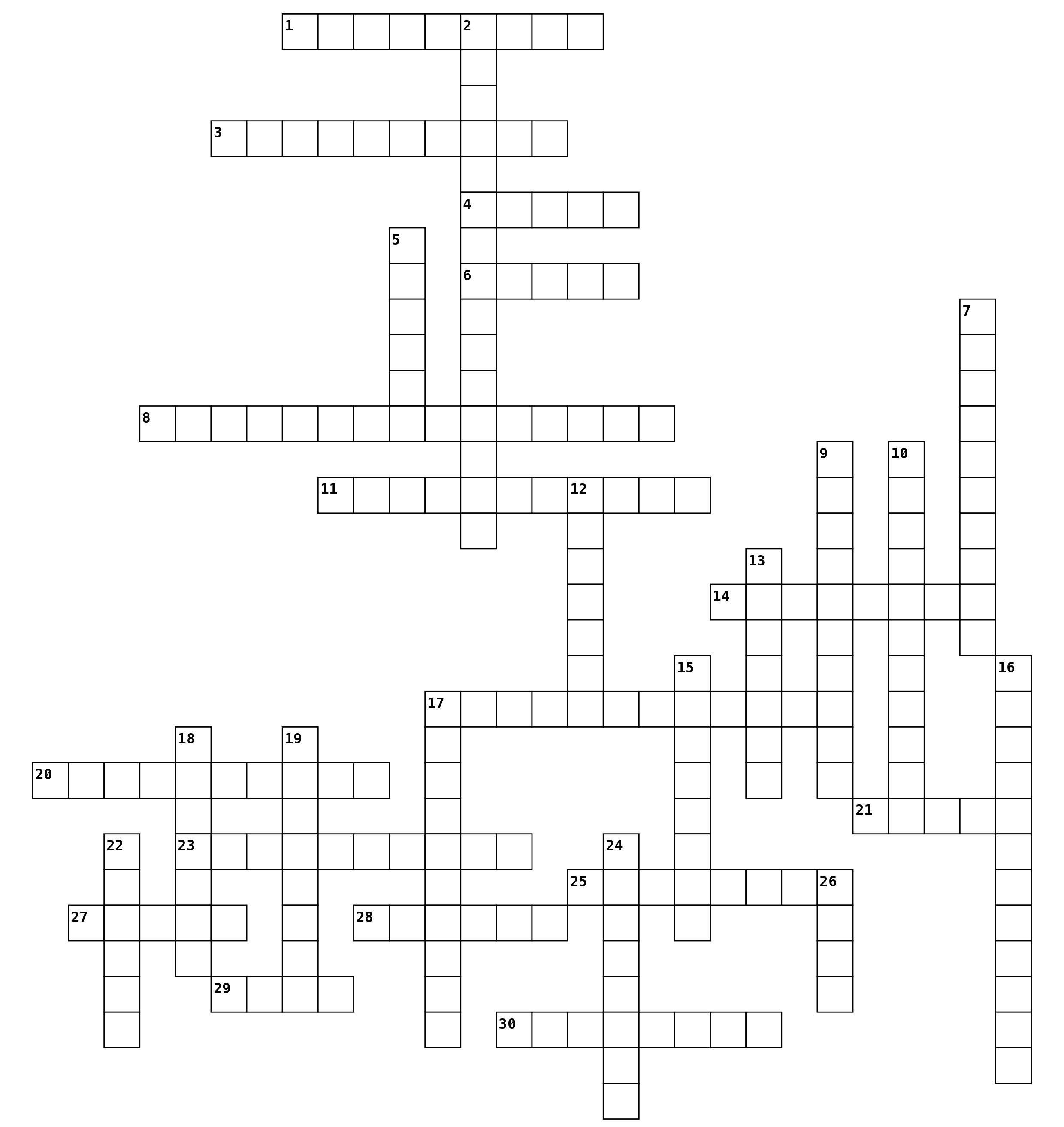

(a) Z-Shaped Recovery

(b) V-Shaped Recovery

Figure 1: Types of Recovery

Table 1: Pre-COVID GDP Growth Projections for India den surge in pent-up demand almost a year after the recession seems an unlikely scenario Thus, the Z-shaped recovery is not a feasible scenario for the Indian economy. 2. The V-shaped recovery- In this scenario, the pent-up demand is lost forever, but the GDP rebounds quickly to the pre-recession projections. (Figure 1b). This is the ”V-shaped recovery” that the Finance Minister talked about in her recent budget speech. Is the V-shaped recovery actually feasible?

To understand this, we need to analyze India’s growth projections before the Covid crisis hit the economy. In 2019-20, India had a GDP of 145.66 lakh crore INR (at constant 2011-12 prices)6. Table 1 on the left presents a summary of India’s growth projections for 2020 and 2021 as per various international agencies before the recession hit the Indian economy.7

Let’s take the IMF projection as the benchmark growth projection for FY 2020-21 and 2021-22. At growth rates of 5.8% and 6.5% from a base of 145.66 lakh crores, India’s real GDP was projected to hit 164.13 lakh crore INR by the end of 2021-22. For a complete recovery from the recession by the end of 2021-22, we would need the GDP to hit the same benchmark. Due to the recession, the Economic Survey forecasts the GDP in 2020-21 to decline by 7.7%. Thus, the GDP for 2020-21 is forecast to be 134.44 lakh crores. The Economic survey also projects a growth rate of 11% for FY 2021-22. This means that real GDP is expected to reach 149.22 lakh crores in 2021-22, which is some way off the earlier projections. To reach the pre - Covid target levels, the Indian economy would need a herculean 22% growth in real GDP in FY 2021-22! Thus, while an 11% growth, if achieved, would be an impressive feat in itself for an economy still reeling from the effects of

the pandemic, the recovery would not be sufficient to classify it as a short-run V-shaped growth.

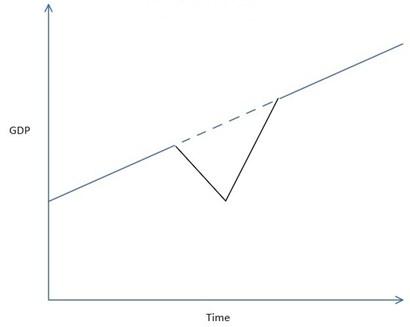

3. The U-shaped recovery- In this recovery, the economy slowly recovers to the baseline after an immediate slump (Figure 2a). Given the pace at which the economy has bounced back already since the lockdowns were eased, this pattern is already out of question. 4. The W-shaped recovery- This is also known as a double-dip recession. In this scenario, the economy would immediately bounce back from an initial recession much like a V-shaped recovery, as pent-up demand is satisfied, only to be hit by another negative growth shock after showing false signs of recovery. This type of a recession can be extremely painful for investors who invest in the market after the initial downturn in anticipation of a full recovery. The recent rise in Covid cases and the reimposition of lockdowns and night curfews might hurt consumer sentiment. Thus, we cannot discount the possibility of another dip in economic activity in the coming months, if the virus again starts to spread at a faster rate.

(a) U-Shaped Recovery

(b) W-Shaped Recovery

Figure 2: Types of Recovery

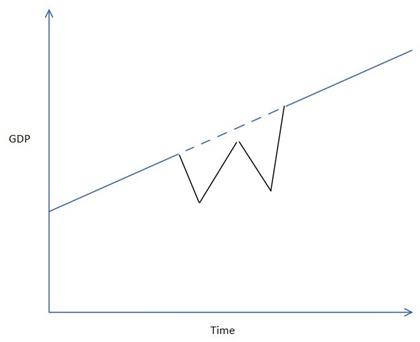

(a) L-Shaped Recovery

(b) Nike swoosh-Shaped Recovery

Figure 3: Types of Recovery

5. The L-shaped recovery- Of all the scenarios

described in this section, this is the most pessimistic scenario. As shown in Figure 3a, the Lshape recovery happens when the recession leaves a permanent mark on GDP, and the demand lost due to the recession is lost forever. The US recession of 2009 is a prime example of the L-shaped recovery. If the 11% growth forecast in the next financial year actually transpires, we would have avoided the L-shaped recovery. 6. The Nike Swoosh-shaped recovery- This is the most likely scenario for the Indian economy. In this pattern of recovery, the recession is immediately followed by a bounce back (which is being predicted), but the bounce back is not sufficient to bring the economy back immediately to the pre-recession growth path. After the immediate bounce back, the economy slowly recovers over the next few years to the original growth trajectory. In this case, the economy continues to outperform the pre-recession growth projections for a few years, albeit not by much (Figure 3b). India seems to be primed for such a recovery. First, the relief measures announced by the government in May 2020 focused on both demand-side and supply-side measures. This is in contrast with the massive use of fiscal policy for large demand stimuli as announced by many other countries. This approach is better suited for achieving medium to long run growth. Second, the fiscal measures were announced to be carried out in a phased manner, unlike the onetime stimuli announced by many countries. This calibrated response in dealing with the pandemic leaves the government with room for more fiscal measures in the future.

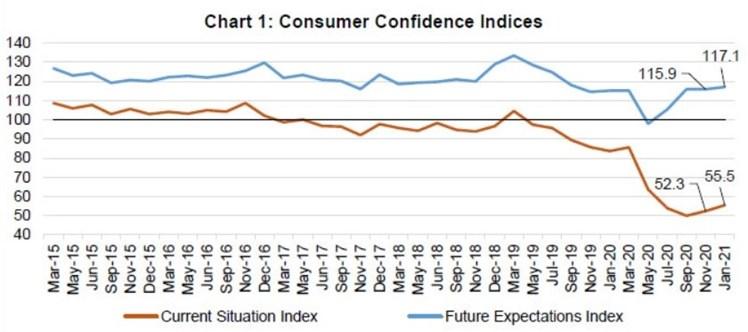

Figure 4: RBI Consumer Sentiment Index Source: RBI Website9

How to find the correct shape

Some leading indicators can help us in predicting the shape of the economic recovery. 1. Consumer sentiment- Consumer sentiment is an important leading indicator of aggregate demand. A high consumer sentiment typically leads to higher consumer spending. The RBI periodically conducts surveys to gauge consumer sentiment in the economy.8 This survey measures consumer confidence on a variety of parameters, including the economic situation, employment, and prices. Figure 4 above shows the sharp decline in consumer confidence since March 2020. However, as can be seen, the future expectations index started recovering in July 2020, while the current situation index has been improving again since November 2020. Improvements in these indices point to a recovery in aggregate demand, even though the confidence indices are still some way off the precrisis levels.

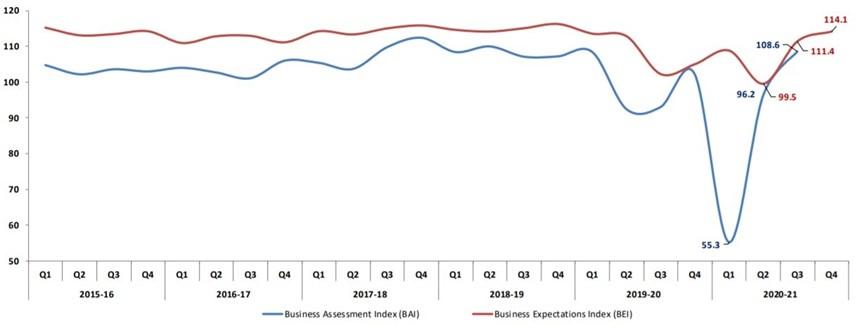

2. Business sentiment indicators- This is an important leading indicator of the supply conditions in the economy. The RBI publishes the Industrial Outlook Survey every quarter. This survey measures the qualitative assessment of

the business environment by Indian manufacturing companies. As can be seen from Figure 5 before, business expectations seem to have recovered after suffering a sharp decline in the first two quarters of 2020-21.

3. Bank lending- The credit taken by businesses from banks is a leading indicator of future investment into productive activity. As per the latest RBI data, bank credit growth improved to 6.2% (y-o-y) in the quarter ending in December 2020, from 5.8% in the previous quarter. The bank credit growth in December 2019 was at 7.4%11. The increase in credit growth points to returning business confidence among new businesses.

4. Stock market- The stock market is usually considered as the most important leading indicator of future economic activity. At first sight, the surge in the stock markets over the last 9 months, since the steep decline in the initial months of the lockdown, might point to the prevalent positive sentiment among investors. However, this must be taken with a pinch of salt, since the recent jump in stock markets seems to be driven by the excess liquidity available with financial institutions due to the central

Figure 5: RBI Industrial Outlook Survey Source: RBI Website10

banks’ infusion of liquidity into markets across the world.

Economic Recover y in India

Indicators like consumer confidence, investor outlook, bank credit growth and the stock markets all point to the advent of the recovery phase of the economic cycle in India. The growth projections by various national and international organizations for 202122 also point to an expectation of a sharp recovery. While the growth rates may not be sharp enough to complete a V-shaped recovery in 2021-22, the signs for future economic growth in the medium and long run seem to be positive. The government’s calibrated policy response to the pandemic (both fiscal and monetary policy) and focus on both supply and demand-side measures in its stimulus, could provide impetus to economic growth in the coming years. However, a few challenges could derail these expectations. First, and most important, is the recent resurgence in the Covid cases across the country. This has led to the re-imposition of stringent measures in many States already, and lockdowns have returned to various districts. This could once again dent consumer confidence and halt economic activity. The government needs to ensure that the vaccination should reach the citizens of the country in a smooth and efficient manner over the next few months. Second, the economic growth in the post-Covid era has so far been driven by large business houses, while the small and medium businesses have lost out. The government needs to provide adequate measures to ensure that these businesses, which employ a large fraction of the workforce, do not go down. Third, as the economy continues to recover, core inflation has started to rise again, along with rising fuel prices. This could again hurt consumer sentiment. Finally, as the developed countries start to rein in their liquidity measures, there is a danger of a ’new taper-tantrum’, one very much in the spirit of 2013, where foreign investors start pulling money out of emerging markets like India12. This could lead to a devaluation of the Indian rupee and

further raise the price of commodities, especially oil. At the same time, as economic growth comes back on track, the government would need to refocus on the larger reform agenda by improving the Ease of Doing Business, introducing structural reform in the banking system, and boosting domestic production through the Atmanirbhar Bharat mission, while ensuring that future growth is environmentally, socially and politically sustainable.

Footnotes

1. IMF World Economic Outlook database available at - https://www.imf.org/external/datamapper/ N G D P R P C H @ W E O / O E M D C / A D V E C / WEOWORLD

2. World Bank Global Economic Prospects report available at- https://www.worldbank.org/en/ publication/global-economic-prospects 3. h t t p s : / / s c r o l l . i n / a r t i c l e / 9 8 8 0 1 6 / h o u s e h o l d incomes-in-india-are-yet-to-recover-from-the-covid19-lockdown-shock

4. h t t p s : / / w w w . h i n d u s t a n t i m e s . c o m / b u s i n e s s / m i s s i n g-m i d d l e-i n-i n d i a-s-eco n o m i c-r e co v er y101615347987440.html

5. https://www.businesstoday.in/current/economypolitics/retail-sales-at-93-of-pre-covid-levels-in-febindustry-expects-revival-by-june/story/434019.html 6. MOSPI National Accounts Statistics- http:// m o s p i . n i c . i n / p u b l i c a t i o n / n a t i o n a l -a c c o u n t sstatistics-2020x

7. h t t p s : / / f a c t l y . i n / r e v i e w-i n d i a s-g d p-g r o w t hprojections-made-by-different-agencies/ 8. h t t p s : / / w w w . r b i . o r g . i n / S c r i p t s / PublicationsView.aspx?id=20320 9. h t t p s : / / w w w . r b i . o r g . i n / S c r i p t s / PublicationsView.aspx?id=20320#CH1 10. h t t p s : / / w w w . r b i . o r g . i n / S c r i p t s / PublicationsView.aspx?id=20323#C1 11. https://rbidocs.rbi.org.in/rdocs/PressRelease/ P D F s / PR1152CDAD5DFFE13F4AD8A1803071A35D4F 09.PDF

12. h t t p s : / / w w w. b l o o m b e r g q u i n t . c o m / e c o n o m yf i n an c e/ r a g h u r am-r a j a n-s ays-a-t ap er-t an t r u mmoment-possible

References

• h t t p s : / / w w w . b r o o k i n g s . e d u / b l o g / u p front/2020/05/0 4/the-a bcs-of-the-post-covideconomic-recovery/ https://www.indiatoday.in/ b u s i n e s s / b u d g e t-2 0 2 1 / s t o r y / i n d i a-v-s h a p e drecovery-and-a-once-in-a-century-crisis-economicsurvey-in-10-points-1763994-2021-01-29 • h t t p s : / / w w w . b u s i n e s s-s t a n d a r d . c o m / a r t i c l e / economy-policy/un-expects-india-s-economy-torecover-by-7-3-post-covid-19-impact-121012600144 1.html

• https://www.livemint.com/industry/energy/indiafuel-demand-return-to-pre-covid-levels-indian- oilchairman-11615900576075.html

• https://scroll.in/article/989096/indian-economy-to -be-hardest-hit-due-to-covid-19-despite-recoverypredicts-new-oecd-report • https://www.livemint.com/news/india/india-ontrack-for-economic-recovery-to-grow-10-in- fy22-sp -11613457362187.html

• https://www.indiatoday.in/business/story/despiteindia-s-economic-recovery-many-households- arenot-happy-here-s-why-1778243-2021-03-11 • h t t p s : / / w w w . i n v e s t o p e d i a . c o m / f i n a n c i a l e d g e / 0 8 1 0 / t h e - 6 - s i g n s - o f - a n - e c o n o m i c recovery.aspx https://www.investopedia.com/ terms/e/economic-recovery.asp: :text=Indicators% 20of%20Recovery,-

• E c o n o m i s t s % 2 0 o f t e n % 2 0 p l a y t e x t = L e a d i n g % 20indicators%20can%20be%20things, somewhat% 20of%20a%20lagging%20indicator. • h t t p s : / / eco n o m i ct i m es . in d i at i m es . co m / n ews / economy/policy/calibrated-response-to-deal-with% 2 0 p a n d e m i c-l e a v e s-r o o m-f o r-m o r e-f i s c a lm e a s u r e s - e c o n o m i c - s u r v e y / articleshow/80586453.cms?from=mdr

Aman Hedau

PGP 05 IIM Amritsar

Akshay Rajgire

PGP 05 IIM Amritsar

Exchange Rates are not that complex…. What’s next for Rupee

What is Exchange rate and how does it work?

An Exchange rate is a rate at which one nation's currency will be exchanged with the currency's value in another nation. Exchange rates are determined in the foreign exchange market, available to a wide range of buyers and sellers. The trading is continuous for 24 hours except for the weekends. As the exchange rate is a specific price, -can be explained through the demand and supply of foreign currency. However, in the long run, the foreign exchange rate between the two currencies is determined by the purchasing powers of the two currencies in domestic economies. In a short time, the demand for the import and export of goods and services (which are both visible and invisible goods) as well as the amount of capital flows between countries affects the supply and demand of foreign exchange, and thus the exchange rate decides currencies. A system of the exchange rate in which the value of a currency is allowed to freely adjust or float according to the demand for the supply of foreign exchange is called a flexible exchange rate system. A flexible exchange rate system is also called a floating exchange system. Presently, in most countries of the world (including India), flexible exchange rate systems prevail.

Major factors affecting change in Exchange rate:

Inflation: As the inflation rate of a country increases, the purchasing power of money decreases, also

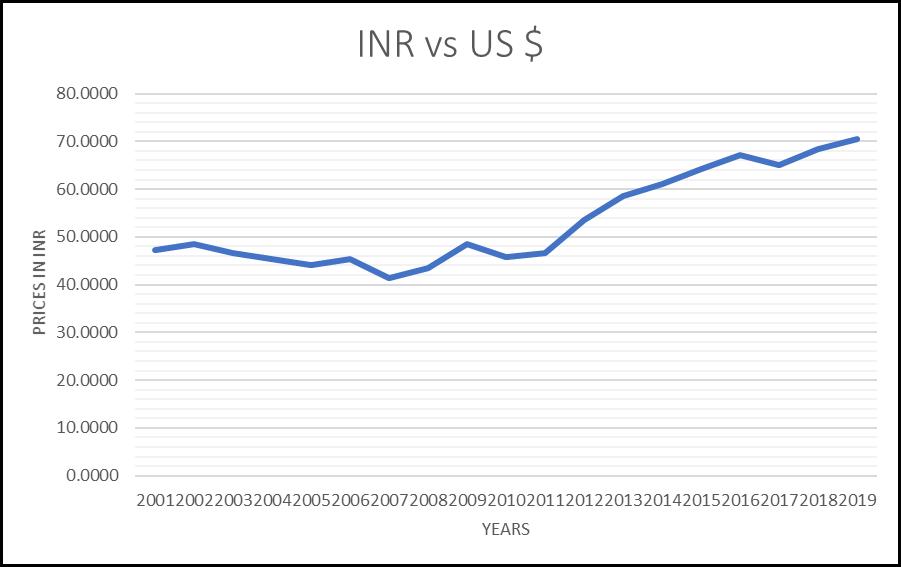

Figure 1: Exchange rate INR vs USD

the paper currency internally depreciates which in turn appreciates the foreign currency. If both countries have inflation, then the currencies of the countries with high inflation will depreciate against those with low inflation.

Economic Growth: Generally, in the short run, high economic growth rates are not conducive to the local currency's performance in the foreign exchange market; however, in the long run, they strongly support the strong momentum of the local currency. Net Foreign institutional investors (FII): It is the total amount invested in a country with the help of Foreign Direct Investment (FDI) and Foreign Portfolio Investor (FPI). Interest rate: It is merely the rate of borrowing capital from another country. When a country increases its interest rate, or its domestic interest rate is higher than the foreign interest rate, it will increase capital inflow, increasing domestic currency demand resulting in domestic currency appreciation and foreign currency depreciation.

Foreign Exchange Reserves: When exchange rate fluctuates in the foreign exchange market adversely affect either the nation's economy or the government objective to achieve some policy goals through exchange rate adjustments; the monetary authority can participate in buying/selling foreign currencies in the market. For this purpose, the central bank, or the RBI, uses foreign exchange reserves to control exchange rates fluctuates owing to foreign exchange supply and demand. Current Account deficit: When a country has an extensive international trade deficit, it means that the country has lesser foreign exchange earnings as compared to its foreign exchange expenditure. Also, as the demand for forex reserves exceeds its supply, the foreign exchange rate increases. Crude oil: India is an oil importing country, and its imports are around 30% of the total imports. India requires about 4.4% of the total production of oil. This indicates that small fluctuation in crude oil prices can directly affect the imports, which increases the current account deficit, thereby increasing the exchange rate.

Statistical Obser vations

The major parameters such as GDP, interest rate, inflation, crude oil, current account deficit, FII and Foreign exchange reserves can be considered as independent variables along with exchange rate as a dependent variable. The data for all the variables has been taken from RBI website.

The table given above shows the correlation analysis (calculated) which is used to find out the impact of each independent variable on the dependent variable i.e., exchange rate

Table 1: Correlation coefficients of exchange rates w.r.t major macro-economic variables

Forex Reser ves: The underrated factor

After analysing data for the past 20 years from 2001 to 2020, it is found that the foreign exchange reserves accumulated by the central bank are very high compared to other developing economies. The correlation calculated by comparing exchange rate

and Forex reserves is close to 0.773, which shows a strong relationship between the two variables. If we look at this theoretically, the forex reserves don't exhibit a long-run or short-run correlation with the exchange rate in the case of the Indian economy. Yet, it can be seen that the accumulation of forex reserves is relatively high.

Does increase in forex reser ves

indicate healthy India’s economy?

We can imply that the recent increase in reserves gives India a much-needed cushion to overcome external shocks. India is one of the few countries where our forex reserves are more than forex debt. The increase in FDI indicates trust in our economy's future rather than a commentary on its present state. During the pandemic period, there has been lower domestic demand compared to previous years. So, India's case remains a dilemma and challenging to comment that piling up of forex reserves indicates a healthy economy.

During April 2012 to May 2020, India’s forex reserves showed drastic increase inflows which climbed from INR 14.96 trillion to INR 37.32 trillion2 .

So, what’s next for exchange rate?

The RBI has been accumulating forex reserves for the past few years, which indicated there is confidence in the future of the Indian economy. Nonetheless, the accommodative stance of RBI to act upon any major roadblock may also hit the economy. The optimistic aspect that we can take from the pandemic is that our fiscal deficit has reduced, which positively impacted the exchange rate due to fewer imports. Recently, various rating agencies like Nomura and Goldman Sachs have given an overweight to the Indian economy as they believe that our economy will outperform compared to other major economies worldwide. So, we feel that India’s currency is in a decent position to hold for the near future, and probably it may appreciate as people will invest in India. We are also safe to assume that any significant event would not hamper India's exchange rate as RBI will use Forex reserves and its accommodative stance in controlling the depreciation of the Indian Rupee.

Source

1. RBI Database

2. Database on Indian Economy, RBI h t t p s : / / d b i e . r b i . o r g . i n / D B I E / d b i e . r b i ? site=home

Abhimanyu Sadh

PGP 05 IIM Amritsar

Why oil prices became negative, or did they?

First of all, no, we didn’t get paid at the petrol pumps for ‘buying’ oil. Not in India, not in the USA. And yes, the impact of falling prices was more concentrated in the USA and related economic parties (not countries) and had very little to no impact on oil prices (not the futures price) in India. (Indian oil companies had a healthy buffer stock at the time to deal with fluctuations in both oil production and prices.)

2 things:

1. Fall in oil prices meant fall in the price of crude oil (West Texas Intermediate to be specific) and not petrol or diesel. Though logic dictates that these prices should also decline, it didn’t happen because it takes some time for that ‘benefit’ to reach the consumers, primarily because of the time taken in refining and transporting the oil.

2. Price of oil didn’t fall (it did to some extent, but didn’t go negative) but the price of futures contracts which had WTI (West Texas Intermediate) as the underlying asset. Specifically, the prices of May Futures saw a steep decline into the negative territory upto -$37.63 per barrel whereas June Futures held on to the positive price tag. When would prices fall? Common sense says prices fall when supply exceeds demand. Yes, but in this case the actual commodity was not involved but derivative contracts of the same, and they (prices) fell due to fears of supply exceeding demand. (Remember salt rumours in India when people flocked to ration shops to buy salt due to utterly baseless rumours of salt being wiped off the face of the earth.)

Where’d the excess supply come from? This is a no brainer, there was no excess supply per se (although OPEC production could be a factor, but not a trigger), but COVID pandemic effectuated lockdowns in many countries which saw industrial and household demand for oil crumble. So, there was excess supply only in comparison to severely weak demand. This observation is important as it restricts the negative prices to the derivatives markets and not physical markets where the prices were more or less stabilised.

What happened then? 1. WTI May futures were going to expire on Tuesday, April 21. The implication being those who had taken long position on such contracts (bought these contracts and through these contracts the right to be delivered oil) had 2 options: square off their positions or take delivery of oil. 2. As most of the traders were more or less speculators, delivery wasn’t really an option for them. No one wanted 1 barrel (let alone 1000, the standard size of a WTI Future) of black and thick crude oil outside their home or garage. And those who did deal in physical delivery of oil already had pent up supply and could take no more. Why? Because the cost of storage exceeded the cost of oil itself. 3. So, the law of demand prevailed. As traders began selling the contracts to square off the long positions so as not take delivery, prices slumped, became negative and kept going down before closing at -$37.63.

What remained?

• With May futures giving in to the pressures of supply, the last man standing was June Futures of WTI. These also a steep decline in price but didn’t go negative which shows traders were more or less optimistic about COVID, lockdown restrictions and the level of economic activity and expected the same to improve after a month.

• Brent Crude futures also endured (didn’t go negative), primarily because the physical Brent was more accessible than WTI which was landlocked as compared to Brent which could be easily transported through sea routes to assuage demand pangs in parts of the world.

Notes:

• In India, the April contract of crude oil on MCX (Multi Commodity Exchange) saw a steep decline in prices (they didn’t turn negative though), the reason simply being these futures are also based on WTI.

Shubham Shukla

MBA 06 IIM Amritsar

India on its way to a blue and green economy

India has seen a growth rate from around 1% in 1991 to more than 8% in 2016. From $266 billion economy in 1991 to more than $2 trillion economy now. However, the climate has significantly suffered as a result of this economic growth. From 1990 to 2019, India's GDP per capita increased by 470 percent, resulting in a significant reduction in its natural resources. Now, this indeed tells a different story because it means that the population's demand for resources from the environment exceeds the ecosystem's ability to restore those resources. Therefore, it becomes vital to change the course of development so that the environment doesn’t suffer at the cost of economic growth, which will only be temporary once we start losing natural resources. For such changes, the concept of Green Economy and Blue economy has been introduced.

Understanding Green and Blue economy

United Nations Environment Programme (UNEP) defines Green Economy as one that results in ‘improved human well-being and social equity, while significantly reducing environmental risks and ecological scarcities. ’ A green economy boosts pro-poor economic growth by increasing natural resources and securing poor people's livelihood choices. A Green economy does not replace the idea of sustainable development; instead, it emphasizes the implementation of a holistic approach that takes into account issues such as social marginalization, intergenerational equity, job growth, poverty eradication, and other pressing environmental concerns. Professor Gunter Pauli of the United Nations University (UNU) first presented the Blue Economy theory in 1994 to reflect the needs of future growth and prosperity, as well as the challenges posed by global warming. It is the long-term use of ocean resources for economic development, better livelihoods & employment, and ocean ecosystems' health. The value addition from the Blue Economy includes :

Renewable Energy: Sustainable marine energy has the potential to contribute significantly to social and economic growth. Fisheries: Sustainable fisheries will bring in more income, produce more fish, and assist in the recovery of fish stocks. Maritime Transport: Sea transport accounts for more than 90% of all foreign trade. Tourism: Ocean and coastal tourism have the ability to create employment and economic growth. Climate Change: Oceans act as a carbon sink (blue carbon) and help mitigate climate change. Waste Management: Better waste management on land will aid in the recovery of oceans.

Opportunities for India

India has expressed its commitment to climate action on numerous occasions, especially in promoting renewable energy. It is, for example, a founding member of the International Solar Alliance and recently proposed the OSOWOG (One Sun One World One Grid) plan for a phased global electricity grid. India has also taken a pragmatic approach to carbon taxation, imposing an INR 400 per tonne coal

tax and the world's highest motor fuel duties. Subsidies for fossil fuels have been gradually phased out in recent years. However, the pandemic has exacerbated India's already precarious financial situation, making it more difficult for the country to follow a green transition. The challenge is to concentrate resources on critical sectors such as mobility, storage, agriculture, and solar energy, which can all help achieve economic recovery, social regeneration, and carbon transition goals. In the next 20 years, India's energy demand will skyrocket. Using renewable energy to fuel this growth would improve India's competitiveness and provide clean electricity to millions of households.

India is in a unique role in terms of its maritime position. There are nine coastal states and 1382 islands along its 7517-kilometer-long coastline. As around 95 percent of India's trade by volume transits by sea, the country has 12 major ports and 187 minor ports that handle about 1400 million tonnes of cargo per year. India's Exclusive Economic Zone, which spans over two million square kilometers and is rich in both living and non-living resources, includes substantial recoverable crude oil and natural gas resources. Over 4 million fishermen and other coastal communities rely on the coastal economy. With such extensive maritime interests, India's Blue Economy plays a critical role in the country's economic growth. It is more than just an economic and environmental proposition for India. It provides India with an unprecedented opportunity to achieve national goals, improve relations with neighbours, and exert power in the region. The inaugural Maritime India Summit 2016 in Mumbai saw nearly INR 83,000 crore (US$ 13 billion) in investment commitments in the shipping, ports, and related sectors. Over the next ten years, the government aims to invest INR 12 lakh crore in developing 27 industrial clusters and improving port connectivity through new rail and road projects. These are projected to generate "immense employment opportunities" in the ports, highways, and shipping sectors and above the 10 million potential jobs (four million direct and six million indirect jobs) under the Sagarmala Project over the next ten years. These are projected to generate "immense employment opportunities" in the ports, highways, and shipping sectors. There are different schemes and projects initiated by the government. The Sagarmala project is a strategic initiative for port-led growth, using a broad range of IT-enabled services to modernize ports. OSMART is an umbrella scheme in India that seeks to control oceans and marine resources for sustainable growth. Integrated Coastal Zone Management focuses on coastal and aquatic resource protection and enhances livelihood opportunities for coastal residents, among other things. Coastal Economic Zones (CEZ) will be developed as a microcosm of the blue economy under Sagarmala, with factories and townships that depend on the sea contributing to global trade. India has a national fisheries policy to support the "Blue Growth Initiative," which focuses on the sustainable use of marine and other aquatic resources. Shipping, ports, Container Freight Stations (CFS)/Inland Container Depots (ICD) and Coastal Economic Zones (CEZ), road, rail, and coastal connectivity, shipbuilding, investments, advisory, technology, training, and leisure, including cruise and lighthouse tourism, are all priority sectors for India's maritime ecosystem. If India wants to advance its blue economy policy, it needs to focus on improving connectivity. This is just one of the reasons why sea-route and inland water connectivity are crucial for India's efforts to develop its blue economy. Other significant advantages include creating jobs and boosting the country's economic growth by offering a more fuelefficient, less costly, and dependable transpor-

tation mode.

Conclusion

Though India battles COVID-19, it must also embark on a new course of economic revival— one that will alleviate the adverse effects of climate change while also fostering long-term sustainable and inclusive growth. Prioritizing investments in industries that can aid the transition to a greener economy is critical. With concerns about defense, regional attention has shifted to the Indian Ocean as the new frontier for sustainable economic growth. India should build on its current momentum and assume a more significant role in developing and protecting the Indian Ocean by developing concepts, norms, and road maps for a more inclusive and collaborative ocean governance society.

References

1. h t t p s : / / w w w . d e v a l t . o r g / i m a g e s / L2_ProjectPdfs/GTR-Final.pdf 2. https://www.gatewayhouse.in/wp-content/ u p l o a d s / 2 0 1 7 / 0 6 / F I C C I _ B l u e-E c o n o m yVision-2025.pdf 3. h t tp s:/ /ww w. dri sh t iia s.c om / to-the-po in t s/ paper3/blue-economy 4. h ttp s: / / w w w . o r fo n l i n e . o rg / re se a rc h / b l u eeconomy-beyond-an-economic-proposition/ 5. h t t p s : / / i n c o i s . g o v . i n / d o c u m e n t s / Blue_Economy_policy.pdf 6. h t t p s : / / u p d a t e c o l l e c t i v e . f i l e s . w o r d p r e s s . c o m / 2 0 1 8 / 0 1 / o c c u p a t i o n o f t h e c o a s t _trc2017.pdf 7. https://www.orfonline.org/research/greenrecovery-opportunities-for-india/