ROAD TRANSPORT

Macfarlane electrifies Chinese challengers Hydro-electrics MAN on move

Macfarlane electrifies Chinese challengers Hydro-electrics MAN on move

Are you aiming for a smaller CO2 footprint, high performance and a long operating range? Then look no further... The Volvo FH Aero gas-powered is a long-haul truck shaped for aerodynamic efficiency. Running on bio-LNG and HVO, it reduces your CO2 footprint and let’s you cover long distances with high payloadscarbon neutral when calculated from tank to wheel. Your efficiency. Extended.

Contact your local Volvo Trucks dealer or visit volvotrucks.co.uk

Autumn brings the start of the political ‘season’ as a seemingly ever-growing number of political parties lay out their stalls at their national conferences.

While we can expect road freight transport to be widely ignored in the various policy launches, because it always is, energy policy will take a prominent part.

Conservative leader Kemi Badenoch has already made it plain that the all-party consensus over net zero by 2050 is no more: she now says it is unrealistic and is extolling the role of North Sea oil and gas as a cornerstone of the UK economy.

In the Labour corner, Ed Millibrand can be expected to stick to the script, while the rest of the left parties, including the LibDems and the Greens (who have elected a leader who isn’t currently an MP) are expected to demand even more of the same.

The real spanner in the works is Reform, which has a position aligned quite closely to that advanced by President Trump in the USA: that renewable energy is all part of some dastardly plot to destroy the country.

None of this is particularly helpful to the British logistics industry, which is currently faced with a variety of difficult choices when deciding future vehicle acquisitions.

Do you (literally, in some cases) bet the farm on electric vehicles and the associated infrastructure, go for a transition renewable fuel, or just stick to diesel reasoning that the engines are getting ever cleaner, and there are still at least two replacement cycles to go before they reach the end of the road?

Which horse to back?

The road to net zero is littered with good intentions. Back in 2013, Volvo was backing a now-forgotten renewable fuel called DME, which would be made from forestry waste. It actually got to the point of being listed as an option for the North American market, before the plug was pulled because of doubts whether there would ever be enough supply to make production of the vehicles viable. Then in this country we had LNG, which was going to be the fuel of the future, until it emerged that there was no infrastructure, making CNG superior in all aspects other than vehicle range.

Given this background, it will come as no surprise to learn that a recent industry-wide survey by the RHA revealed that 70 per cent of hauliers (and 75 per cent of coach operators) had made no plans at all for net zero.

Our own Government, and the EU, must shoulder some of the blame for this. They have forced the truck manufacturers to do the

most difficult part first, by electrifying trucks of over 12 tonnes. It’s a fact that batteryelectrics become more difficult and expensive the higher up the weight range you go.

The low-hanging fruit was in fact in the 7.5-12 tonne segment. Work patterns here are similar to those of citybuses, where electrification has been a success. The benefit to local air quality is also greater, as these trucks are mostly working in streets and not on the motorway.

Heavy battery-electrics are now at a stage where they could work, if suitable incentives and infrastructure were available. But they are not, and there’s no suggestion that any of our now many political parties intend to do anything about it. The difficult to pick and unripened fruit must now be harvested, and the politicians won’t even lend us a ladder to do it with.

Meanwhile, three Chinese truck manufacturers have responded to the opportunity that they can see, but our politicians cannot, and will launch 7.5-tonne battery electric trucks in the British market this year.

They will not only pick the low-hanging fruit now, they will also make hay in the years to come.

Matthew Eisenegger, Publisher

INFORMATION

EDITORIAL

Publisher: Matthew Eisenegger

Managing Editor: Richard Simpson

Designer: Harold Francis Callahan

Editorial Address: Commercial Vehicle

Media & Publishing Ltd, 4th Floor 19 Capesthorne Drive, Eaves Green, Chorley, Lancashire. PR7 3QQ

Telephone: 01257 231521

Email: matthew@cvdriver.com

ADVERTISING

Advertising Sales: David Johns

Telephone: 01388 517906 Mobile: 07590 547343

Email: sales@cvdriver.com

DESIGN

Art Editor: Harold Francis Callahan

Telephone: 01257 231521

Email: design@cvdriver.com

CONTRIBUTORS

Steve Banner

Benjamin Dovey

Grahame Neagus

Dougie Rankine

Harrison Thomas

PUBLISHED BY

Commercial Vehicle Media & Publishing Ltd, 4th Floor, 19 Capesthorne Drive, Eaves Green, Chorley, Lancashire. PR7 3QQ Telephone: 01257 231521

NOTE

The publisher makes every effort to ensure the magazine’s contents are correct. All material published in Destination Net Zero magazine is copyright and unauthorised reproduction is forbidden. The Editors and Publisher of this magazine give no warranties, guarantees or assurances and make no representations regarding any goods or services advertised in this edition. Destination Net Zero magazine is published under a licence from Commercial Vehicle Media & Publishing Ltd. All rights in the licensed material belong to Matthew Eisenegger or Commercial Vehicle Media and Publishing Ltd and may not be reproduced whether in whole or in part, without their prior written consent. Destination Net Zero Magazine is a registered trademark. © 2025

DP World offers HVO subsidy

If

Nikola hydrogen fuel-cell trucks are set to make a comeback on California’s roads after hydrogen ‘truck-as-aservice’ company Hyroad Energy acquired 103 brand new Nikola Tre tractor units together with parts, software and IP assets from the company’s bankruptcy auction.

“This acquisition significantly advances Hyroad’s mission to provide turnkey hydrogen trucking solutions that reduce the complexity and risk typically associated with adopting zero-emission technologies,” said Dmitry Serov, CEO and founder of Hyroad Energy.

“These trucks and the corresponding equipment and systems represent immediate capacity to put proven hydrogen fuel cell technology on the road to meet demand for zero-emission trucks.”

Hyroad said it would establish maintenance and parts facilities to support operations when the trucks are deployed, primarily in California where Hyroad continues to develop refuelling infrastructure.

In addition to deploying the new trucks, Hyroad pledged to support Nikola vehicles already in the hands of commercial operators.

Hyroad’s ‘truck-as-a-service’ business model is said to reduce the complexity and upfront costs of zero-emissions trucks.

The Nikola Tre is a forward-control tractor unit, unusual in the North American market, and is based on an Iveco S-Way ‘glider’ chassis-cab imported from Europe, with a fuel-cell electric driveline installed locally.

Four of the biggest players in the global truck market have u-turned on a 2023 agreement they made with the California Air Resources Board (CARB) to introduce low and no emissions heavy-duty vehicles to the state from 2027 onwards. They cite a disconnect between the state’s ambitions and federal opposition to expensive clean air initiatives following the election of Donald Trump as US president.

The Clean Trucks Partnership (CTP) was designed to secure infrastructure investment and support transition to production of zero-emission trucks. CTP gave the manufacturers some security in making the massive investments required in R&D, supply chain, and tooling to produce the next generations of ultra-low and zero emissions trucks, but the Trump administration’s efforts to remove California’s authority to set emissions standards has caused a collapse of confidence among them.

Multinational transport and logistics giant DSV has deployed the first four Volvo FH Aero Electric 4x2 tractor units in the UK as part of a commitment to acquire more than 300 zero-exhaust emission trucks from the manufacturer by 2026.

The Electrics are direct replacements for older diesel models in the DSV fleet. Based in Immingham, they cover routes previously served by diesel trucks, producing immediate carbon savings.

Keith Northen, manager, divisional, road, DSV, said: “When you’re introducing new technology into a working fleet, you need a partner that understands the operational challenges and can offer real-world solutions. Volvo gave us that confidence. Its approach to range, reliability, and infrastructure support aligns with our needs, and we know we can rely on its support network to keep us moving.

“The FH Aero Electric offers the right balance of range, payload capacity and aerodynamic efficiency for our operational needs. It’s a practical solution that supports both ours and our customers’ sustainability goals while keeping our service levels high.” Substantial energy consumption improvements are delivered by a refined design and new technologies. The cab’s improved aerodynamics are particularly beneficial for the electric model, with the design enabling better free-rolling properties, allowing for increased energy regeneration to recharge the battery under braking or while driving downhill, ready for use when needed in the next acceleration or uphill climb.

DSV’s new trucks are each equipped with the maximum six batteries, offering an approximate driving range of up to 300 km and a recharging time of just 2.5 hours while using a 250kW DC charger. They also feature three electric motors, generating up to 666 hp equivalent, and 2,400 Nm of continuous torque.

The electric model uses the standard I-Shift gearbox to deliver a smooth and comfortable driving experience. Volvo’s Camera Monitoring System (CMS) also contributes to aerodynamic performance but primarily boosts safety and visibility. Replacing traditional exterior mirrors, the solution increases the driver’s field of view and, when driving with a trailer, CMS deploys auto-panning functionality to follow the rear of the trailer as it turns. CMS also performs strongly in rainy and dark conditions, direct sunlight and even when driving in tunnels.

The Globetrotter cabs have leather upholstery and a suspended and heated driver’s seat with dual armrests. Also included is a premium 50mm mattress protector, a 33-litre fridge and additional cab storage.

DSV is guaranteed maximum uptime thanks to a comprehensive fiveyear Volvo Gold Contract covering all maintenance and repairs, including proactive monitoring of batteries and associated components.

Contract hire specialist Alltruck plc has introduced its first leased electric truck Designed for short and long-haul logistics, including urban and multi-drop deliveries, the DAF XD Electric has entered service with a long standing Alltruck customer in the London area.

The truck is fitted with Alltruck’s own built GRP box body with roller shutter, and has a tuck-away tail lift. Its 200-mile range makes it ideally suited for work in the capital’s Low Emission Zone.

Supplied and supported by DAF dealer Ford and Slater Leicester, the truck is powered by an EX permanent magnet e-motor and equipped with highcapacity, fast-charging lithium-ion batteries.

Josh Robinson, managing director, Alltruck plc, said: “The introduction of this, our first EV truck marks a significant step on our Alltruck Zero journey and a major leap forward in the transition to sustainable transport for our customers.”

The DAF is the latest step in the Alltruck Zero initiative, which aims not only to achieve sustainability goals but also to offer significant cost savings on fuel and maintenance. The initiative began in 2020 with the introduction of a Mercedes-Benz eSprinter van: the first of its kind to be fitted with a battery-powered cargo refrigeration unit. This vehicle still operates in London today.

“Our journey to net zero continues at pace,” says Josh. “Launching this new EV truck is a big milestone, but it’s only part of the picture. What makes this transition truly possible is the infrastructure behind the scenes. Our in-house bodyshop gives us the capability to build, adapt and maintain high-quality, future-ready bodies designed specifically for electric vehicles. This combination of cutting-edge trucks and real engineering expertise is helping to create a cleaner, more resilient future for logistics and freight.

“But we know the shift to electric isn’t just about doing the right thing for the planet. It’s also about the numbers. With electric trucks, the total cost of ownership picture looks very different – especially when you factor in lower maintenance, reduced energy costs and long-term operational gains. That’s why our new EV truck isn’t just a greener choice; it’s a smarter investment that delivers value over time, despite the challenges of residual value forecasting and higher upfront costs.’’

RE-Tech UK, a leader in AI-driven fleet technology, has just announced the launch of its revolutionary bebo Human Detection System

This innovative product is set to redefine safety standards for commercial fleet owners and local authorities nationwide, delivering on RE-Tech UK’s promise: “We’ve got the solution.”

Developed by an incredible team of experts at RE-Tech UK, the bebo Human Detection System is born from an unwavering commitment to Protecting Lives, Preventing Incidents, and Promoting Accountability in daily operations involving large vehicles.

This state-of-the-art solution is a monumental leap forward in mitigating the inherent risks of extensive vehicle blind spots.

“We are immensely excited and profoundly proud to introduce the bebo Human Detection System,” states Richard Edwards, Founder of RE-Tech UK. “Our dedicated team has poured their expertise into creating a technology that doesn’t just monitor, but actively intervenes to safeguard lives. This system embodies our core mission to drive safety innovation.”

it works

The bebo Human Detection System offers an advanced vehicle safety solution designed with one primary

goal: to significantly reduce the risk of serious injuries and fatalities. It achieves this by continuously monitoring a vehicle’s critical blind spots and high-risk zones. The system leverages sophisticated AI-enhanced cameras and precise fast detection capabilities. Should any individual enter these danger zones, the system provides immediate, audible warnings to deter unsafe behaviour.

Crucially, the innovation extends further with a built-in failsafe mechanism. If a serious safety threat is detected, this intelligent system can automatically shut down certain vehicle functions, adding an unparalleled layer of protection that goes beyond mere alerts. This proactive approach ensures a safer environment for both vehicle operators and pedestrians.

Experience the future of vehicle safety – watch the bebo Human Detection System in action: https:// re-techuk.co.uk/human-detectionsystem/

This groundbreaking addition to the highly valued bebo range solidifies RETech UK’s position at the forefront of AI-driven technology. It’s a testament to the dedication and foresight of their team, proving that safety and operational efficiency can evolve handin-hand. Keep compliant and protect lives on the road with the bebo Human Detection System.

Why Choose RE-Tech UK?

RE-Tech UK is at the forefront of innovation, delivering products that maximise safety and minimise risk. They are dedicated to providing comprehensive solutions, from data monitoring to fleet management. When you work with RE-Tech, their team of experts offer unparalleled expertise and personalised support, ensuring their clients feel confident and wellequipped.

About RE-Tech UK

Established over twenty years ago by Founder Richard Edwards, RE-Tech UK has expanded its offerings to deliver cutting-edge solutions that optimise data and safety management for businesses. Specialising in local authority and commercial vehicle fleets, RE-Tech UK is committed to providing advanced, AI-driven technology designed to solve complex operational challenges and enhance safety across the UK.

Contact Richard Edwards

redwards@re-techuk.co.uk

Tel: 0845 468 0812

Independent truck workshop chain Sapphire Vehicle Services is bringing its top-class 24/7 back-up to operators in South London – and offering job opportunities to ambitious technicians.

Sapphire’s new Charlton workshop offers a full range of inspection, maintenance and repair services for trucks and vans of all makes, around the clock. The purpose-built site is already staffed by a team of four but, says Regional Manager Patrick McGlynn, the plan is to add more as soon as possible.

“We’re actively recruiting for heavy vehicle technicians who are looking for a great place to work with clear career development pathways,” he said. “At Sapphire we place a great deal of emphasis on training and developing our people, so if you want to work your way up the ladder, get in touch soon.”

Sapphire boasts a network of 19 workshops across England and Scotland which together look after close to 30,000 vehicles, for a client list that includes some of the biggest fleets in the supermarket sector. The company is also an acknowledged leader in the fast-growing electric vehicle field.

The new Charlton site, at Riverside, just upstream of the Thames Barrier, sits next

to a distribution centre operated by one of Sapphire’s customers but is open to all comers.

“This is a brand new, purpose-designed facility and offers a complete range of services to everyone from large fleet operators to single vehicle owner-drivers,” said Patrick. “It’s fully kitted out with all the tooling required to work on any brand of truck, including Jaltest diagnostic equipment, and is a great place to work.”

The site also boasts a pair of mobile service vans and is home to an admin team as well as its current roster of four technicians. Among these is 28-year-old Nikhil Varsani, who is undergoing a training programme with a view to taking on the role of its first Depot Manager.

Nikhil has been with Sapphire for four years, having joined the team at the nearby Waltham Cross workshop after serving his apprenticeship and gaining experience with a main dealer outlet.

“This kind of career progression is one of the main reasons I was keen to join Sapphire,” he

said. “It’s a friendly company that really values its staff, and if you want to step up and take on more responsibility you’re backed all the way.”

Training up individuals like Nikhil is just one way Sapphire has demonstrated a determination to ‘grow its own’.

The company’s successful apprenticeship programme continues to take an input of eight or more candidates per year, for a two-year course culminating in a nationally recognised NVQ Level 3 qualification in Heavy Vehicle Maintenance and Repair. Meanwhile its Technician Upskilling courses have helped a raft of car mechanics learn the skills to enable them to switch to a career in heavy vehicle maintenance. Many of business’s current senior managers began their journeys on the workshop floor.

Anyone eager to join the programme should contact Sapphire’s Group Commercial Director Grant Tadman on 07880 264909 or grant. tadman@sapphirevs.com, or Regional Manager Patrick McGlynn on 07795 062111 or patrick. mcglynn@sapphirevs.com .

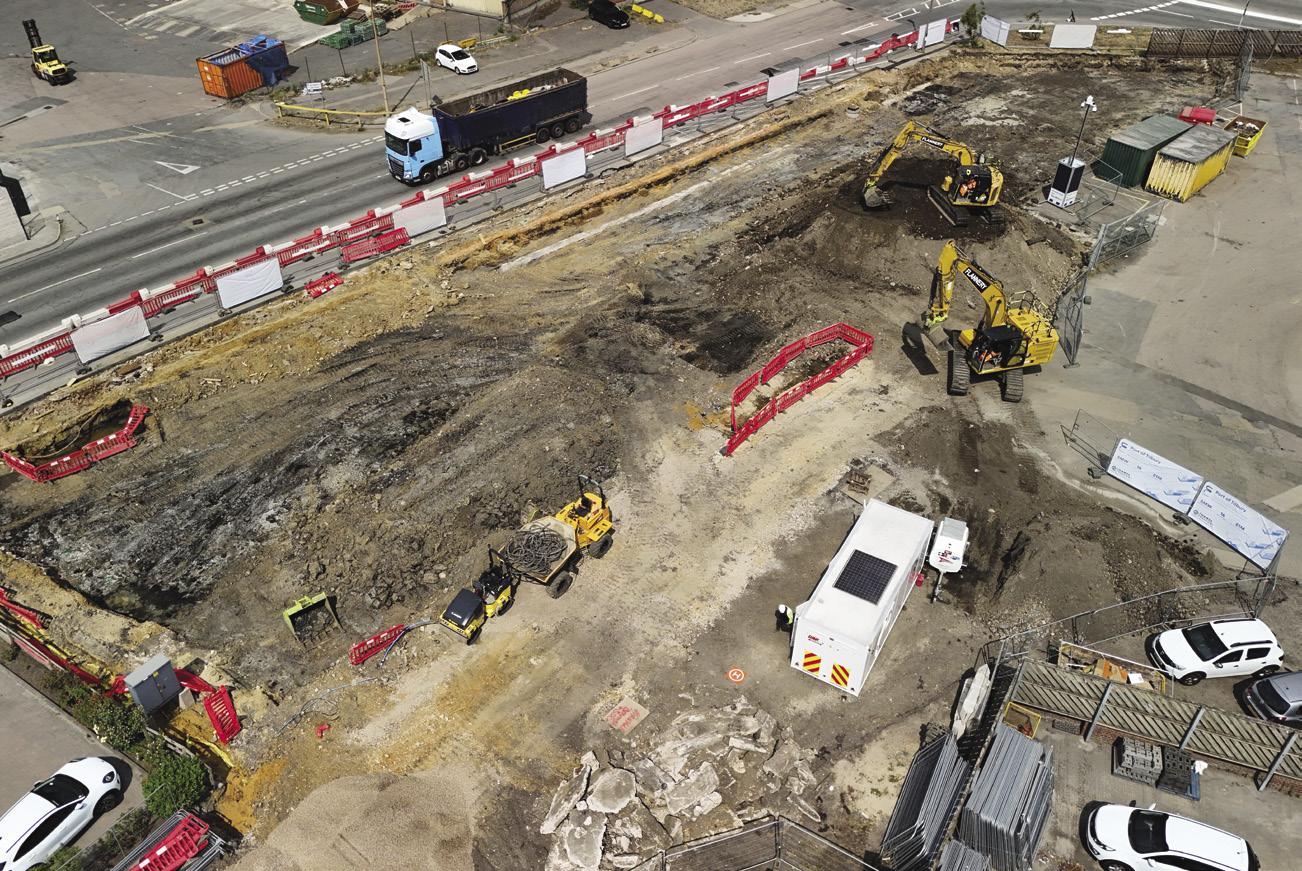

“That’s exactly why we’re building one of the UK’s largest dedicated commercial EV charging network starting with our first hub at the Port of Tilbury. Scheduled to go live in late December /early January, this site is a fleetfocused response to the growing structural barriers that are holding electrification back.”

Strategically located

As fleet operators across the UK begin the serious business of transitioning to electric HGVs, it’s becoming clear that charging infrastructure - not vehicle availability - is now the real bottleneck. And nowhere is that felt more acutely than in securing access to reliable, high-power charging, explains Benjamin Dovey, UK Sales Director, Fleete.

Operators know that zero-emission transport is coming, and many are ready to invest. But for most, installing private depot charging means navigating delays, high grid upgrade costs, and limited capacity. This is why Fleete is building a network of hubs at strategic port and logistics locations across the UK. Tilbury is the largest of the Thames ports and part of the Thames Freeport; it sees more than 10,000 vehicle movements each day and is home to over 60 businesses operating commercial fleets.

Standing charge can hit hard

Even where the grid is technically available, the economics can be difficult. Once a site increases its available supply capacity to support vehicle charging, it can be caught out by higher daily standing charges for businesses under the rules set out by Ofgem’s Targeted Charging Review (TCR). Set by the National Energy System Operator

• (L) to (R) Shaun Wood - Senior Asset Manager, Port of Tilbury; Chris Morrison – CEO, Fleete; Mayor of Thurrock- Cllr Sue Shinnick; Deputy Mayor of Thurrock -Cllr Steve Liddiard; Martin Whiteley -CEO, Thames Freeport; Giovanna BaffaPerformance & Risk Manager, Thames Freeport; Paul Middlemiss - Head of Sales UK & Ireland, Heliox; Stephen Millard – Site Manager, Envevo

(NESO) and your local Distribution Network Operator (DNO), these fixed charges are based on the connection size, not energy use. In practice, boosting grid capacity by 1–2 MW adds substantial fixed daily charges that vary hugely by region and voltage.

A 1 MW increase can mean roughly £35,000 extra per year in capacity fees in Scotland, £40,000 in London, or £50,000 in the Midlands or South West. For underutilised depot infrastructure, those costs can quickly erode the business case for going electric: a fleet of five electric trucks averaging 80,000 miles a year is expected to consume ~750 MWh electricity annually – at this level of utilisation, just these fixed connection charges can add up to 7p per kWh. This, along with

• Benjamin Dovey UK Sales Director, Fleete

the commodity cost, other non-commodity and supply costs, infrastructure costs and operational costs rapidly add up to an unsustainable total charging cost. But it doesn’t need to be that way.

Sharing the load

At Fleete, we believe shared charging hubs are the most commercially viable way to overcome that challenge. By pooling infrastructure across multiple users, we can dramatically improve utilisation, and that’s the key.

The Tilbury site will be capable of charging up to 16 vehicles simultaneously. It will feature 12 high-power chargers from Heliox, each delivering up to 360 kW, and four units from Voltempo’s Hypercharger Megawatt System, making it suitable for both heavyduty trucks and lighter commercial vehicles. The hub is located on the A13 corridor into London, giving it strategic relevance not just for port tenants and users, but for urban distribution and regional operators as well.

And with our transparent pricing model from 36p per kWh (base energy cost plus a simple service fee) , operators can budget with confidence. At these prices, many of our customers, find the total cost of ownership for electric trucks is already competitive with diesel and cheaper than building and operating their own depot.

Getting the funding right

Importantly, this isn’t just a private initiative. The Port of Tilbury hub is the first EV

“By pooling infrastructure across multiple users, we can dramatically improve utilisation, and that’s the key”

infrastructure project supported by seed capital from the Thames Freeport programme, a £1 million public investment that’s already unlocked over five times that amount from private partners. It’s a strong example of how targeted public funding can accelerate net-zero outcomes while delivering practical benefits to businesses on the ground.

Shared hubs make smarter charging

Shared charging hubs aren’t a compromise, they’re a strategic response to the limitations of depot charging, particularly for operators who don’t have the scale or location to justify a large grid upgrade. They offer a faster, fairer route to electrification and help ensure that infrastructure investment is used where it will have the most impact.

The Tilbury hub is just the beginning. At Fleete, we’re already developing future locations in Greater Manchester, Kent, Staffordshire, North Warwickshire and East Suffolk, as well as further locations in London, creating a national network designed around the real operational needs of fleet operators.

As more vehicles hit the road, infrastructure must keep pace. Shared hubs are how we get there, at speed and at scale.

Dynamon, a leading provider of fleet optimisation software, has joined forces with Webfleet, Bridgestone’s globally trusted fleet management solution, to deliver advanced, data-backed decarbonisation reports.

The new integration enables commercial fleets to access tailored reports that provide clear answers to key questions around vehicle replacement, EV rollout strategies, charger requirements and low-carbon fuel alternatives – without the need for costly external consultancy.

By combining Webfleet’s telematics insights with Dynamon’s advanced optimisation tool, ZERO, fleet operators can identify the most effective pathways to net zero and accelerate their transition to more sustainable operations.

Dynamon’s involvement as a service provider within the Webfleet EV Services Platform – an ecosystem that brings together leading energy and mobility services – laid the foundation for the integration.

Using Webfleet.connect, the solution enables seamless data exchange

between the two platforms, giving users the ability to make informed decisions on everything from vehicle suitability and infrastructure planning to total cost of ownership (TCO) analysis.

“Decarbonising a fleet can feel like stepping into the unknown and can be complex, costly and full of uncertainty,” said Dean Mahoney, Business Development Director at Dynamon.

“By combining Webfleet’s telematics data with Dynamon’s advanced simulation and insight tools, we take the guesswork out of the journey and give fleet operators the confidence to move forward.”

Beverley Wise, Regional Director for the UK and Ireland region at Webfleet, a Bridgestone company, added: “Our collaboration with Dynamon empowers fleets to transform their operational data into

practical steps toward decarbonisation.

“Together, we’re removing barriers to electrification by making data-driven decision-making more accessible and affordable.”

The Dynamon decarbonisation report is available to fleet operators at a fraction of the cost of traditional consultancy –delivering savings of up to 80% compared to typical assessments.

By making detailed carbon reduction analysis more accessible, the integration helps fleets meet growing regulatory and sustainability demands.

A thriving London-based taxi service business has successfully refinanced its fleet with backing through the Growth Guarantee Scheme.

The company was established by our customer after a former business was placed in administration, primarily because of issues caused by the pandemic.

Having worked with Close Brothers Asset Finance in 2021, our customer is confident of building on their strong history of providing exceptional taxi services to their customers in the UK’s capital city.

To get their services up and running, our customer needed to refinance the fleet from the previous business, and approached Alan Cardy, Senior Sales Manager in our National Accounts team, for a funding solution.

As a new venture, Alan suggested refinancing the taxis with the support of the Growth Guarantee Scheme.

The Growth Guarantee Scheme is backed by the British Business Bank and is designed to support UK SMEs access to finance as they look to invest and grow. The aim of the Growth Guarantee Scheme is to offer improved terms to the borrower which is what we were able to do in this case.

Alan Cardy, Senior Sales Manager, commented: “It has been a pleasure to work with our long-standing customer on the formation of their new business. By using the Growth Guarantee Scheme, we have facilitated the funding of their fleet, helping to meet their growing business demands.”

After reviewing the customer’s plans, Alan initially offered them a refinance agreement on 35 taxis, followed by a further 18 after two other lenders were unable to provide the necessary funding.

This new agreement was pivotal for the businesses growth because by refinancing the taxis with the backing of the Growth Guarantee Scheme they were able to secure the necessary funding and spread payments across a fixed period. This made budgeting more manageable and resulted in the company owning the assets outright at the end of the agreement term.

To get their services up and running, our customer needed to refinance the fleet from the previous business, and approached Alan Cardy, Senior Sales Manager in our National Accounts team, for a funding solution.

As a new venture, Alan suggested refinancing the taxis with the support of the Growth Guarantee Scheme.

The Growth Guarantee Scheme is backed by the British Business Bank and is designed to support UK SMEs access to finance as they look to invest and grow. The aim of the Growth Guarantee Scheme is to offer improved terms to the borrower which is what we were able to do in this case.

Our customer added: “We are delighted by the recent agreement for refinancing our fleet of taxis. As a taxi operator, it is crucial to have enough vehicles to serve our customers promptly. I found Alan and the team at Close Brothers Asset Finance incredibly helpful, and I wouldn’t hesitate to approach him again if we require finance in the future.”

This Summer has brought me three standout moments that reveal just how far the UK has come - and how far it still needs to go - in the transition to zero emission commercial transport. Each offers a different perspective on where we’re heading and what’s still getting in the way.

First, Road Transport Expo showcased fully productionised electric heavy goods vehicles (eHGVs) from every major OEM – trucks you can order now. That alone marks a milestone for the industry.

Second, the UK Government has released another round of EV grants, albeit aimed at the value end of the car market plus a little more funding for charging, all of which is welcome but will do little in accelerating the commercial EV sector.

Which brings me on to my third, and perhaps most enlightening moment – I’ve just returned from a trip to Norway. Thirteen days travelling the length of the country provided a clear picture of what an electrified transport future can look like when the stars align: long-term commitment, government backing, and, crucially, societal buy-in.

Norway’s transition away from internal combustion hasn’t happened overnight. It’s taken the best part of 30 years and still isn’t complete. Operators there continue to run diesel and gas trucks alongside battery-electric ones. Yet EVs are becoming dominant. And, unlike in the UK, there’s little resistance to change.

Now let’s be clear: the Norwegian experience isn’t a straightforward cut and paste guide

for the UK. A smaller population, abundant hydro and wind power, and a different political and social mindset all help. But it’s wrong to assume Norway’s terrain or climate makes the shift easier. Quite the opposite. It’s a large country with challenging mountains, extreme weather, and huge distances between major cities. If EVs can work there, they can work here too, if we tackle the right problems in the right way.

That starts with joined-up thinking. Norway’s progress has been powered by cross-party consensus. Not just about climate targets, but about how to get there. Laws get passed, incentives are long-term and predictable, and the public is taken along for the ride.

During my stay, I travelled by LNG cruise ship, electric trams, eBuses (single, double and

“Some 5 billion Krone (£334 million) is channelled into easing the transition”

articulated), EV taxis, efficient trains and saw widespread use of eScooters and eBikes, all operating in perfect harmony. International and regional transport operators run a mix of both ICE and electric trucks, but van fleets are overwhelmingly electric. Local EV charging infrastructure is extensive, simple to use and everyone has plenty of on-site infrastructure. Single-deck buses use opportunity pantograph charging at key stops.

In Norway, HGV charging is separate from car chargers for safety, with dedicated facilities that include driver rest areas and high-power chargers suited to the longer dwell times required for trucks.

Critically, in Norway, operators aren’t left to shoulder the burden alone. ENVORA, Norway’s incentive body, delivers government support in a coherent and practical way. Some 5 billion Krone (£334 million) is channelled into easing the transition. Up to 60% of the cost difference between an EV and a diesel truck is covered, electricity costs per kW are roughly one-third of UK rates, and infrastructure grants of up to 80% are available for shared charging installations of four or more high speed chargers, that are well spaced, running the length and breadth of the country. When you stack all that up, the business case for EVs in Norway becomes very hard to ignore.

Back in the UK, we’ve had 17 years since the first mass-produced EV van appeared, in the

form of the early Renault Kangoo and the Maxus EV80, and uptake of new vehicle sales is still below 10%. The ZEV mandate says we should already be at 16%. Something, clearly, isn’t working.

Despite government aims for 2030, a realistic timeframe is currently closer to 2040, so much has to change and at a much faster rate.

One advantage we do have is the accelerating pace of technology. Battery range is improving. Charging speeds are increasing. Vehicle designs are more refined, and TCO models are starting to favour electric. But it’s not enough to rely on market forces alone.

Our sheer weight of traffic, congested road networks, planning laws and infrastructure density are working against us. You can’t easily widen a 19th-century high street to fit modern eBuses, bikes and cargo vans all in harmony with trams, vans and trucks. Yet pedestrianising roads simply pushes congestion elsewhere. Cities like Oslo have been built – and rebuilt – with multimodal transport in mind. Ours haven’t.

So what’s the answer?

We need to look at this holistically, with a national master plan that is cross-party, longterm and all-encompassing. Not just grants for a few cars or piecemeal announcements, but a serious strategy that includes HGVs, LCVs, trams, ebikes, eScooters and even drones. And

we need to government incentives to drive the change, because the private sector alone can’t make this happen.

Operators will invest if the conditions are right. OEMs like Renault Trucks are already delivering capable electric models, from 3.1 to 42 tonnes. But penalising fleets for not hitting arbitrary targets – while failing to ease the cost and planning hurdles – isn’t leadership, it’s punishment.

The changes in legislation need to go far beyond the relatively straightforward fiscal incentives for vehicles and infrastructure. To make everything work we need to look: at reform of operating weights, when batteries are cutting into payload; increasing lengths, including drawbar combinations where battery packaging is easier than on a tractor unit; and proper facilities for commercial vehicles.

At the heart of this is education, and public understanding. The average pedestrian doesn’t see an eHGV as a clean, efficient logistics solution. They just see a “big juggernaut”, rather than the vital cog in the wheel of UK PLC that keeps our country moving.

Norway has shown what’s possible with vision, unity and support. The question now is whether the UK Government has the stomach to deliver radical, lasting, positive change?

Poor cold chain infrastructure could be responsible for up to 620 million tonnes of food loss, or 1.8 gigatonnes of carbon dioxide equivalent (CO2-eq) annually. Around 4% of global greenhouse gases (GHGs) are attributable to the cold chain highlighting the urgent need for a more sustainable approach to preserving and transporting perishable goods. While reducing food loss and waste is critical, the primary focus must be on decarbonising the cold chain itself. By prioritising the reduction of electricity, fuel, and refrigerant emissions, significant progress can be made towards creating a more sustainable food system.

The cold chain plays a vital role in ensuring the safety and quality of food products, but the energy consumption and resulting emissions pose a significant challenge. As the demand for fresh and frozen food products grows, it is imperative to find ways to minimise the environmental impact of the cold chain.

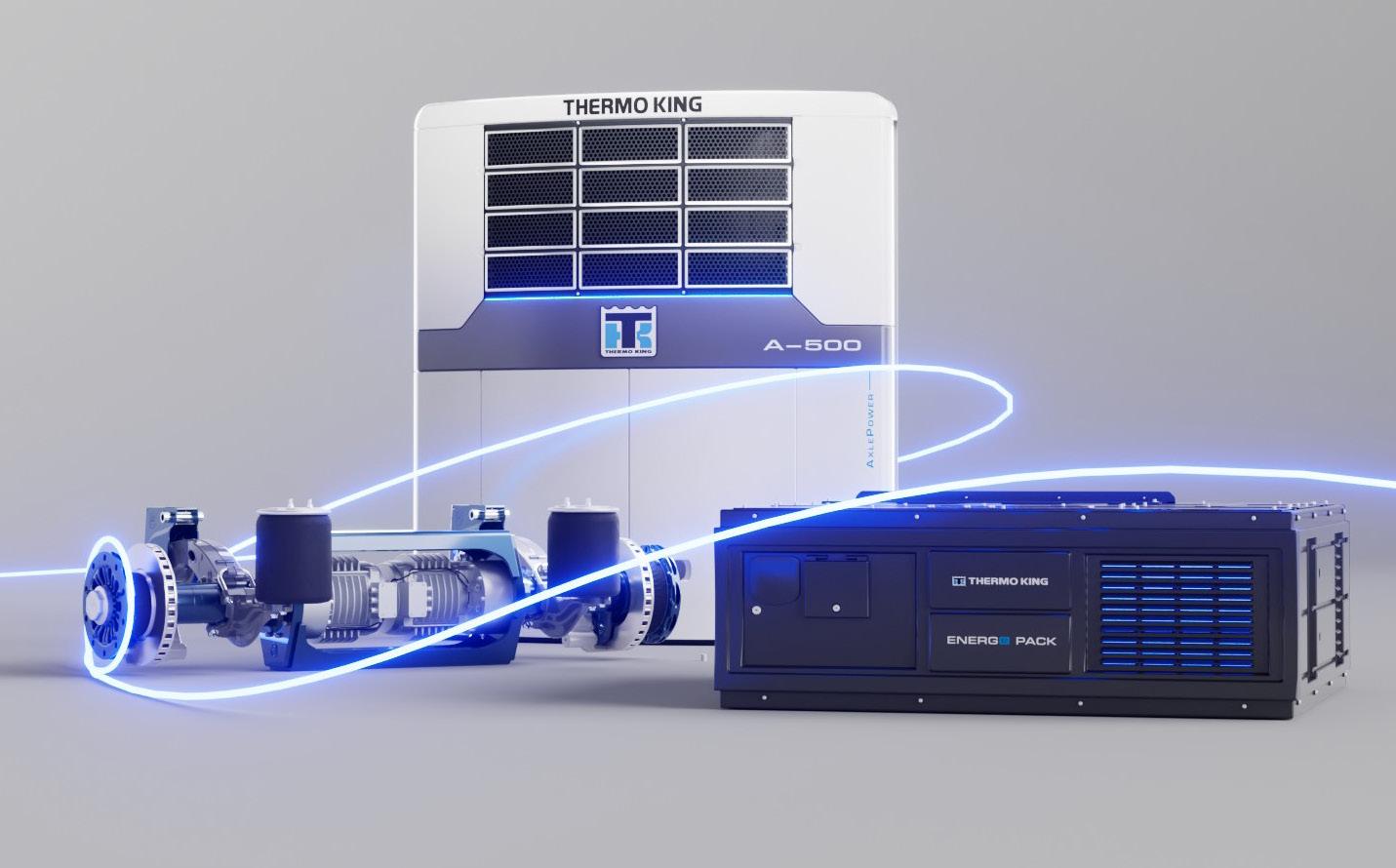

A key area of innovation is the development of electrified transport refrigeration solutions. Global climate innovator Trane Technologies and its brand Thermo King®, a leader in sustainable transport temperature control systems, have designed AxlePower. This innovative technology for trailer refrigeration units recovers energy from the vehicle during braking or going downhill, stores it in battery packs and reuses it to power the refrigeration unit, without impacting the truck’s fuel consumption. This technology is available now to be purchased or rented, saving on operating costs, while providing a sustainable cold chain solution.

Digital technologies also play a crucial role in optimising cold chain processes and reducing emissions. Advanced telematics and monitoring systems provide real-time visibility into the entire cold chain, enabling quick identification and resolution of issues that

can lead to energy waste. By leveraging datadriven insights, stakeholders can streamline processes, eliminate inefficiencies, and ultimately decrease the carbon footprint of the cold chain.

Trane Technologies is at the forefront addressing these challenges. We are committed to advancing our 2030 Sustainability Commitments, including the Gigaton Challenge, which aims to reduce customer GHGs by 1 billion metric tonnes by 2030. This reduction equates to 2% of the world’s annual emissions or the combined annual emissions of France, Italy and the United Kingdom. To achieve this goal, Trane Technologies focuses on the electrification and decarbonisation of the cold chain.

Policy Frameworks as a Catalyst Reducing food loss and waste, requires adequate policies. The European Union (EU) plays an important role in this regard: the revised Waste Framework Directive, for example, sets legally binding food waste reduction targets to be achieved by Member States by 2030.

Electrification of the cold chain and transport refrigeration also requires some policy adjustments to ensure the regulatory

framework provides the necessary incentives for zero-emission technologies. Additional weight from installing electrification equipment in vehicles, for example, should not be included in the overall vehicle weight. Doing so, only serves to penalise freight operators who would have to reduce their payload to compensate for the weight of the battery and other components.

Moreover, electrified refrigeration systems should be included in the scope of all incentive schemes made available by EU Member States for electric light and heavyduty vehicles. A favourable policy framework in this space could enable the EU to eliminate over 10 million tonnes of carbon dioxide emitted annually by transport refrigeration systems alone.

Measuring Progress and Driving Change

To gauge the impact of decarbonisation efforts effectively, it is important to measure progress in terms of emissions reduction. Key standardised metrics such as reduced emissions from electricity, fuel and refrigerants provide a clear picture of the improvements achieved. Regular monitoring and reporting on progress in reducing emissions are crucial for promoting accountability, benchmarking and continuous improvement.

Collaboration is also key to measuring progress and driving systemic change in the food cold chain. Governments, industry leaders, and consumers must work together to accelerate the transition to a lowemission system. Policy frameworks, financial incentives, and awareness campaigns can all help drive the adoption of sustainable technologies and practices. Cross-industry partnerships can foster the development of holistic solutions that cover the entire food supply chain from farm to fork.

The pursuit of a decarbonised cold chain is not only an ecological imperative but also an economically sound strategy. Energyefficient solutions can significantly reduce operating costs, improve performance, and enhance the competitiveness of businesses. However, the transition to a low-emission cold chain requires careful consideration of the economic implications. Policymakers and industry leaders must work together to develop strategies that balance sustainability goals with the need for more affordable and accessible food.

A promising approach is the introduction of circular economy principles in the food cold

chain. By developing products and processes that minimise waste, maximise resource efficiency, and enable the reuse and recycling of materials, the environmental impact of the cold chain can be reduced while creating new business opportunities.

Decarbonising the food cold chain is a complex but necessary step towards a sustainable food system. The goal is clear: a food system that is fair to both people and planet.

The path is paved with challenges, but with the right strategies, technologies, and partnerships, these can be overcome, and a resilient, sustainable future can be shaped. The transition to a low-carbon cold chain requires continuous improvement, adaptability, and the commitment to push boundaries.

It is a demanding journey, but one that is unavoidable. With determination, innovation, and collaboration, we can create a future in which food is not only safe and nutritious but also environmentally friendly. The time to act is now – this opportunity must be seized for a more sustainable future for all.

We are committed to advancing our 2030 Sustainability Commitments, including the Gigaton Challenge, which aims to reduce customer GHGs by 1 billion metric tonnes by 2030.

Macfarlane Packaging has expanded its fleet with the addition of five electric Volvos, marking a significant step in its ongoing decarbonisation strategy. Words: Harrison Thomas

For more than 75 years, Macfarlane Group has been a major player in the UK’s packaging industry. While its roots lie in the labels sector, the company has evolved into the country’s largest packaging distributor, with a growing footprint in bespoke manufacturing. But today, Macfarlane has far more on its plate than managing and distributing its product range – as is the case across the transport sector, it has a pressing responsibility to decarbonise.

“Sustainability is at the heart of our strategy,” says David Patton, head of sustainability at Macfarlane Packaging.

“It’s a key differentiator for us, not just in terms of improving our own operations, but also in helping our customers achieve their goals too.”

This commitment is more than a mission statement. Over the past five years, Macfarlane Packaging has achieved a 32% reduction in CO2 emissions, a milestone driven largely by operational efficiencies and smarter logistics. “Truck fuel accounts for about 80% of our

Scope 1 and 2 emissions,” Patton explains. “We’ve focused heavily on improving our fuel economy, investing in logistics planning software, incentivising smoother driving, and optimising our fleet usage.”

While progress can be made within Macfarlane Packaging’s existing fleet, like many other logistics companies, it is also starting to embrace the raft of alternative

• Martin Benning

fuel vehicles coming to market. Most recently, it has more than doubled its electric vehicle contingent through the acquisition of five Volvo trucks: four FE Electric rigids and one FM Electric tractor unit.

“We now have four vans, five rigids, and one electric tractor unit,” says Patton. “It is early days, but we are really happy with the performance so far across the board.”

As Patton details, Macfarlane Packaging’s local delivery model makes its operations particularly well-suited to electric mobility.

Packaging is, by its nature, lightweight and most of its sites serve their immediate areas, meaning it does not operate many trucks that are travelling long distances day-in and day-out. Its new rigids will typically cover up to 150 kilometres a day each, with the vehicles’ specification meaning they are well equipped to comfortably service their routes without any range concerns.

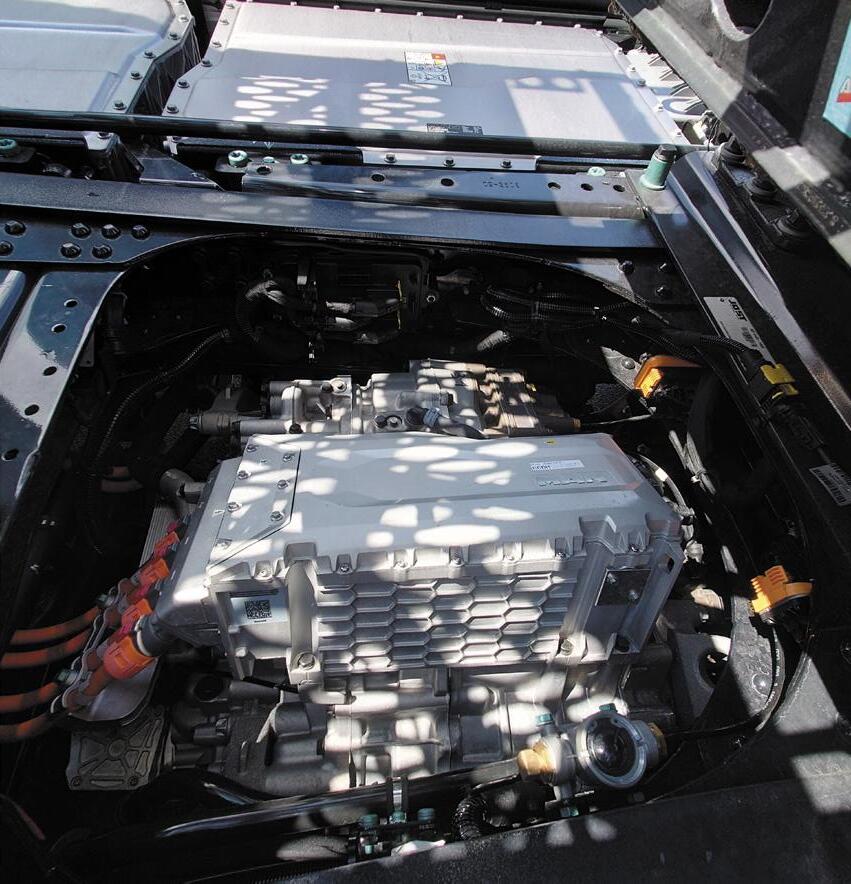

The FM Electric tractor unit is travelling further – up to roughly 240 kilometres per day – but this is still well within its capabilities. The 4x2 truck has been specified with the maximum six batteries, which offers a maximum range of approximately 300 kilometres. It also has a charging time of just 2.5 hours with a 250kW DC charger, or 9.5 hours on a 43 kW AC charger, while the battery can be charged more quickly up to 80% capacity mid-shift, in just the same way as a smartphone as the charger slows down towards the end of the process to protect the battery cells.

Diving further into the specification, the FM Electric is powered by three electrical motors, generating 2,400 Nm of continuous torque. These motors are paired with Volvo’s popular I-Shift gearbox, which delivers a smooth and ultra-quiet driving experience by constantly evaluating information about speed, weight, road grade and torque demand. cont.

“We now have four vans, five rigids, and one electric tractor unit”

“We are a packaging company, not a truck manufacturer. That is why having credible, experienced partners like Volvo Trucks is so critical to making this transition a success,” says Patton. “They have been a trusted partner, and we have been genuinely impressed with their approach –not just with regards to the vehicles’ performance but especially in their thinking around battery lifecycle, end-of-life use, and decarbonising manufacturing.

“The trucks have hit the ground running, which is significant. What has really impressed us is the pace of progress and the potential for even more improvements in the future.”

Inside the tractor unit’s Globetrotter cab, the customer’s chosen driver is treated to leather upholstery; DAB radio and satellite navigation; Volvo Dynamic Steering; and a suspended and heated driver’s seat with lumbar support. Combined with full air suspension, it delivers a comfortable working environment.

“We find that even those that are very attached to their diesel trucks tend to come around to electric once they understand the rationale and experience the quality of the vehicles,” says Patton. “These trucks really do sell themselves once they are in use.”

Still, the transition has not been without its challenges. “We can’t replace our entire diesel fleet just yet,” admits Patton. “There are still range limitations and infrastructure hurdles that limit a complete fleet overhaul. Planning is essential as you must use these vehicles smartly to get all the benefits.

“There are also definitely some sceptics as any major change brings resistance. Climate discussions have become more polarised recently, but the science is the science. People naturally resist change, and this is no different. And while we don’t yet have all the answers to many valid questions about sustainability, battery manufacturing, mining, and end-of-life processes, we see a clear path to finding them.”

Looking ahead, Macfarlane Packaging is keeping an open mind about other emerging technologies such as hydrogen and biofuels, but for now, electric is the most viable option. “We are not ruling anything out,” says Patton. “If there is a breakthrough in innovation or a major market shift, we will absolutely look beyond electric. But right now, we don’t see the other emerging options as being close to viable, at least not in the next year or two. It is hard to predict beyond that.”

The company’s decarbonisation strategy also continues to span multiple fronts. It has already electrified its forklift fleet within its distribution division and invested in solar panels, while it is also actively purchasing renewable electricity.

Efforts are also ongoing to help its customers reduce their own environmental impact through packaging optimisation tools and innovation labs. “Those efforts are not just about trying to use less cardboard or plastic but also maximising logistics efficiency, reducing product damage, and looking at the full life cycle. While reducing our own footprint is important, a big part of our mission is enabling our customers to do the same.”

Its commercial vehicle fleet though remains a key part of Macfarlane Packaging’s ambitious decarbonisation goals, with the business very grateful for the expert support and guidance it has received to-date.

“There is still uncertainty in this space and as a business we are navigating that, but we have been very impressed with what Volvo Trucks brings to the table, not just in terms of the vehicles, but also their efforts to influence government policy and support the broader transition,” says Patton. “And perhaps most importantly, these are really good trucks. Our drivers enjoy them, and they offer a great driving experience alongside the environmental benefits.”

“There are still range limitations and infrastructure hurdles that limit a complete fleet overhaul”

Scania has extended the Super range with the new 11-litre five-cylinder engine, featuring cutting-edge new technology to suit it for tightening VECTO and Euro 7 emissions standards. Words: Jack Sunderland.

The Scania Super 11

fills a gap in the Swedish manufacturer’s engine range which hasn’t been as noticeable as it would have been a few years ago as engine specification trends have shifted across various market segments.

Scania’s lightest trucks start at 18-tonnes gross weight, with seven and nine-litre engines on offer. The six-cylinder DC07 (actual capacity 6.7-litres, and derived from the Cummins ISB 6.7) weighs a healthy 360kg less than the 9-litre and offers outputs from 220 to 280bhp. The 9-litre (9.3-litre) DC09 is a five-cylinder rated from 280 to 360bhp, with the latter producing upto1700Nm of torque.

Prior to the arrival of the new 11-litre there was quite a gap between the DC09 and the 13-litre Super which was introduced three years ago with its entry level 420bhp and 2300Nm torque. Where payload is a priority, the Super 11 is likely to be of great interest: tipper, mixer and tanker operators would all welcome the 85kg payload advantage over the 13-litre as well as a claimed fuel consumption reduction of 7% over the 9-litre.

While the three-axle tractor unit market has moved toward 13-litre engines as standard, demand for a lighter option still exists. In addition to those seeking ultimate payload,

“The

lighter articulated operations which use twoaxle tractor units or shorter trailers may well see the Super 11 as a preferable choice.

Curiously, the eight-wheeler market has seen an increase in the use of 13-litres over 11s as well. The expected payload of an aggregate tipper is now widely considered to be 19.5 tonnes with anything over that a bonus. It’s common to see an eight-legger with just as much power as an artic (and an equally well-appointed cab) with operators citing the perceived improved longevity of the larger engine, residuals, driver retention and generally staying well on top of the job, with the latest 13-litres returning mpg figures running loaded which were unattainable when empty not too long ago.

With that in mind, the new Scania 11-litre has some work to do. The new Super 11 comes in three power ratings: 350bhp/1800Nm, 390bhp/2000Nm and 430bhp/2200Nm. All will run on HVO and the 430 can be prepared for FAME (Fatty Acid Methyl Ester). The 350 will make for a good 26 tonne option, while the 390 may tempt tipper and mixer operators in urban or relatively flat environments. The 430 will be the one the ultra-light 6x2 and 4x2 tractor unit users will be interested in and it would be no surprise if this option proves the most popular on four-axle rigids as well. The horsepower figure of 430 overlaps the entry level Super 13’s entry level unit, and while it’s less than some rivals, it’s important not to look only at the horsepower as the 2200Nm torque output isn’t far off a lot of 13-lites and betters most competitor 11-litre offerings.

Numbers on screen or paper are one thing, what really counts is how the vehicle performs in the real world. With the Super 13, every power rating we’ve tested so far has exceeded expectations. For instance, the 460 Super 13 feels every bit as capable as the old 500. Scania’s switchable performance modes give outstanding flexibility and allow the driver to get the best from the truck, depending on the load and road conditions.

Scania has opted not to simply downsize the 13-litre six, choosing instead to develop an allnew five-cylinder platform. The company has plenty of previous experience with five-cylinder engines: the 9-litre is also a five-cylinder although it bears little relation to the new unit, being based on the previous generation architecture. The thinking behind switching to five cylinders is that it allows the Super 11 to share 85% of its componentry with the 13-litre engine.

There are several new features making their debut with the Super 11, one of the most potentially beneficial for drivers is the powerful new variable valve brake (or engine compression brake), operated using the right-hand column stalk), rated at 233kW in standard configuration: there is also a high output version which produces 344kW. Those kw figures might not mean a lot here in the UK with our mash up of metric and imperial units, but if you look into what engine brakes on other models produce, they’re impressive figures.

The high output variant produces stopping power that’s not that far off what a separate transmission retarder will provide; that’s impressive on a lightweight engine and it comes without the weight penalty of a retarder. Such is its potency, care must be taken not to simply engage full power when empty on wet roads, the first two stages are plenty.

While the engine is 85kg lighter than the 13-litre, it also features ‘cam phasing’ for the first time: Variable Valve Timing, or VTEC as it’s become known colloquially, which has been offered on automotive petrol engines for decades. This not only increases performance under load, but the continual monitoring and optimisation of the valve timing means exhaust gas temperatures are closely controlled under low load situations which improves aftertreatment performance and subsequently fuel economy.

There’s further good news as the exhaust aftertreatment system is Adblue only, EGR (exhaust gas recirculation) which was always a compromise with undesirable side effects, is no more.

The aftertreatment system is all-new and is another feature which shows Scania has its eye on the forthcoming Euro 7 regulations which come in during 2027. A new single stage dosing system debuts on the Super 11, with all AdBlue being injected immediately downstream of the turbo, where temperatures are at their highest. This replaces the previous dual-dosing layout where additional AdBlue was injected immediately ahead of the SCR catalyst. This is not only much simpler, it is more efficient as AdBlue conversion rates are higher, particularly at cold start. As we approach the end of the Euro VI era, this is an engine built for Euro 7 and the enormous engineering challenges it brings.

“All will run on HVO and the 430 can be prepared for FAME (Fatty Acid Methyl Ester). ”

Although operators are increasingly looking to 13-litre engines for eight-wheeler applications and Scania buyers have had no alternative option up to now, if this new 11-litre, five-pot can deliver the same levels of performance and economy as its bigger brother it could tempt payload-conscious operators to give it a try.

The 430 will cope very well in eight-wheeler form and as a 40-tonne 4x2 artic, the real

test for it will be as a 44-tonne tractor unit. The entry level Super 13 is the 420 which was once a benchmark power rating for Scania tractors with the 124 420 and R420, but time has moved on, and even the perfectly capable Super 460 is being phased out of some big fleets in favour of 500s. This is partly due to residual values and partly due to driver perception and retention. There’s little doubt that 500bhp is a benchmark where a truck is considered to have an element of ‘performance’ and therefore desirability, but buyers of 11-litre tractor units have other priorities.

We drove a selection of Super 11-powered trucks at Scania’s test track. The first thing to note is that a straight-six engine is naturally balanced and other configurations either aren’t as smooth, so they need some internal assistance to smoothen things out. With the Super 11 running with five cylinders, Scania’s engineers have had to install balance shafts to eliminate vibration and ensure the smooth running we’ve become so accustomed to in modern trucks.

We drove a 390 three-axle rigid, a 390 four-axle artic and a 430 five-axle artic. All of them were R-series with the rigid having a neat day cab with a fold down rest bunk. The clever packaging even provided a little fridge which had a surprising amount of storage. All daycabs, where chassis configurations allow, could benefit from a set-up like this as it improves the working environment enormously for drivers who may often be

involved in physical multi-drop work: even if it’s not for a night out, that rest bed could provide much needed relief for drivers.

The engine note is surprisingly satisfying, the Opticruise gearshifts are seamless and the facility to engage eco-roll with a tap of the throttle can be utilised to great effect by drivers who are familiar with their truck and the roads. A near standstill pull away on a steep hill was completed without the gearbox getting into any state of confusion. The 390 artic did feel a tad lacking in power, but you’d likely only find these used in the UK with two-axle trailers on urban work.

Changing the 430 from Eco into Standard mode livened up the shifting, with more priority given to retaining momentum rather than lugging down to the bottom of the rev band before finally changing down, and at 35 tonnes gross it was perfectly happy. Over-egging the Eco-roll into a corner where we were going too fast was contained entirely by the new engine brake, our foot hovered over the brake as the corner approached, but it knocked off enough speed without the pedal being required – with some practice drivers should be able to make their brake pads last a very long time. Again, this may help with Euro 7, where dust from brakes will be counted as particulate emissions.

It pulled cleanly out the corner and up a hill with no fuss, there were no premature downshifts as the truck reads to topography ahead of it and factors in the weight, speed and whether it’ll make it over the top without needing a downshift.

Some of the new technology debuted here in the 11 will no doubt be installed in the 13

by the time Euro 7 rolls around. Considering how well the likes of the 460 Super has performed both with its surprising power and fuel economy, the expectation will be more of the same from the 11. This engine is a completely new option for existing Scania buyers, and may also make the marque more attractive to nonScania operators who regard the current offerings of 13-litre as overkill, and the 9-ltire as being not up to the job. If the fuel economy figures of the 13 are anything to go by, then a well specified Super 11 could be even more impressive. end.

“The aftertreatment system is all-new and is another feature which shows Scania has its eye on the forthcoming Euro 7 regulations which come in during 2027”

Alternatives to battery-electric trucks are being developed using technology from Johnson Matthey.

Producing little more by way of exhaust than non-toxic water vapour, hydrogen burnt in engines as an internal-combustion fuel – H2ICE – looks set to play a key role in truck propulsion. So says Dr Tauseef Salma, chief technology officer at automotive catalyst and filter specialist Johnson Matthey’s Clean Air division.

“I don’t believe that battery-electric or hydrogen fuel-cell technology can cater for the whole of the truck market,” she comments.

As an indication of its confidence in H2ICE’s advantages, Johnson Matthey (JM) plans to open a hydrogen internal-combustion engine test centre

in Sweden later this year. It will be able to accommodate power plants developing up to 800hp, just ahead of the most-powerful diesel engines currently fitted to production trucks in Europe.

“It’s a real show of our backing for this technology as we seek to unleash the potential of hydrogen mobility,” she continues. “We cannot rely on battery-electric vehicles alone to solve our challenges.”

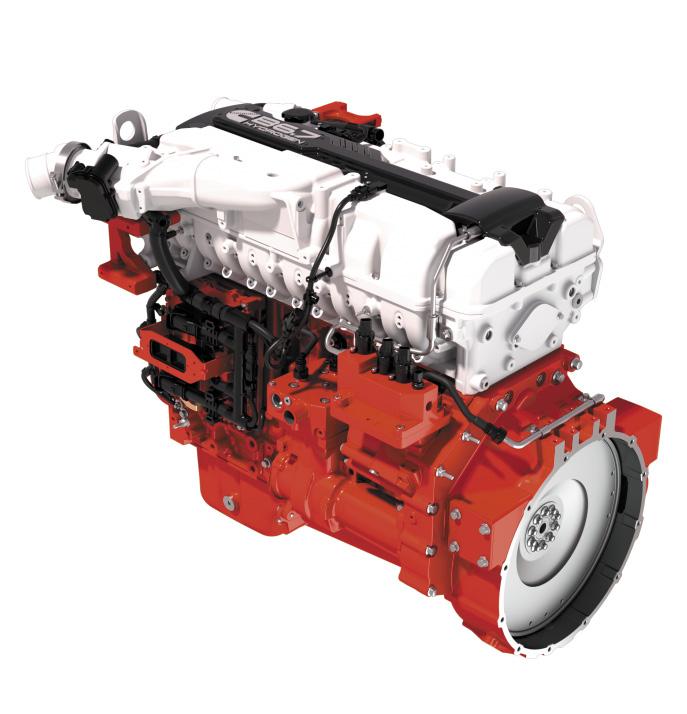

Under the Project Brunel banner JM has worked with Cummins to develop a 6.7-litre H2ICE truck and bus engine. It has achieved a tailpipe CO2 emission reduction in excess of 99% compared with a modern diesel engine, Cummins states.

MAN has rolled out small-series production of H2ICE trucks for use in sectors such as the construction industry. They may have to haul heavy loads in locations where battery charging points may not always be readily available. JM is a partner in the manufacturer’s hTGX initiative.

H2ICE presents a difficulty so far as emissions are concerned, however.

While the water vapour it generates is environmentally neutral, burning hydrogen in an engine also produces a small amount of NOx. This means that it requires aftertreatment using Selective Catalytic Reduction - technology which JM of course supplies – and that means relying on AdBlue.

The NOx level is so small that the European Union classes hydrogen combustion as zeroemission. The UK government does not, however.

JM is hoping it will change its tune. There may be good grounds for optimism given that London match-funded the Cummins project referred to earlier.

Burning hydrogen in an engine has some other drawbacks. Getting hold of the fuel remains problematic, it needs to be green hydrogen from sustainable sources if the environmental argument is to stack up, and price is a consideration.

All these considerations also apply to fuel cells, of course.

Fuel cell technology is more complicated than H2ICE however, pricier, and more vulnerable to failure if exposed to poor-quality hydrogen.

On the positive side, there is no denying that refuelling with hydrogen is far quicker than having to wait for a battery pack to charge up no matter whether you travel down the H2ICE or the cont.

“It’s a real show of our backing for this technology as we seek to unleash the potential of hydrogen mobility”

fuel cell route. That is likely to remain the case, even though battery-charging times are falling.

MAN says that its H2ICE trucks can be refuelled in less than a quarter of an hour and offer a range of up to 375 miles.

“The trouble with heavy trucks is that they are difficult to electrify,” says JM strategic projects director, Dr Chris Morgan.

The weight of the battery pack puts a squeeze on their potential payload, he points out, and charging opportunities may be difficult to come by if they are double- or triple-shifted. That said, batteries can be topped up during a driver’s statutory rest breaks and charging points specifically for heavy goods vehicles are slowly becoming more common.

Although they are not zero-emission, hybrids still have their place too, Morgan believes. Global demand for them looks set to stay healthy for the next ten years, he contends.

Nor should the environmental benefits of biofuels and fuels such as compressed natural gas be discounted, he adds. Like hybrids, they need aftertreatment but have the advantages of speed of refuelling and range as well as offering CO2 cuts.

Hydrotreated Vegetable Oil (HVO) can go straight into the majority of modern diesel engines as a so-called drop-in fuel without any

need for them to be modified. Synthesised from renewable raw materials such as used cooking oil and vegetable oils and fats, it can deliver a wellto-wheel cut in carbon emissions of up to 90%, say its advocates.

It should not be forgotten that the UK government plans to ban the sale of all new diesel trucks from 2040 onwards.

JM’s support for H2ICE does not mean that it is walking away from fuel cells. Earlier this year it inked a deal with Bosch which confirms the intention of both companies to develop and manufacture catalyst-coated membranes for use in fuel cell stacks.

JM has not long become a founder member of the Global Hydrogen Mobility Alliance. Embracing upwards of 30 companies including Bosch, Daimler Truck and Iveco (recently acquired by India’s Tata Motors), it is busy promoting fuel cells alongside H2ICE.

• Dr Tauseef Salma

• Dr Chris Morgan

“Hydrogen fuel cells are vital to Europe’s clean energy transition,” argues JM chief executive officer, Liam Condon. “They offer a practical solution for decarbonising transport, particularly in sectors where battery-electric options may not suffice.”

JM’s verdict is that all the aforementioned technologies can play a part in parallel with electrification, which cannot be seen as the sole zero-emission solution. “There are major opportunities for decarbonisation in road freight, but there is no silver bullet,” Morgan remarks.

JM is now helping to develop technology that meets the requirements of the new Euro 7 emission regulations, scheduled to apply to all newly-Type-Approved trucks from 29 May 2028. All new trucks will have to comply from 29 May 2029.

NOx will have to tumble by 62% and particulates by 20%, with the limit applying to smaller particles than was the case previously. It is going down from 23Nm to an evenmore-miniscule 10Nm.

A limit is also being slapped on the amount of N2O –nitrous oxide – and NMOG – non-methane organic gases – that can be produced, a new requirement.

The exhaust aftertreatment needed looks set to be more complex as a result of these changes says Morgan – with more emphasis being placed on in-service compliance with emission restrictions than was the case before.

“While the water vapour it generates is environmentally neutral, burning hydrogen in an engine also produces a small amount of NOx”

last 12 months, the UK car market has witnessed a huge influx of Chinese EV manufacturers, offering long ranges, high specs and competitive pricing. Up until this point, the van and truck sectors have remained relatively untouched by the east, but there are signs that is starting to change…

As part of its ‘Made in China 2025’ strategy, the Chinese government set out to dominate each stage of the EV supply chain; from raw material extration, through battery production to vehicle assembly; in order to control costs and reduce reliance on Western companies.

While we have already seen the fruits of this labour in the car sector, only Maxus has so far successfully penetrated the UK CV market but there is growing evidence that other Chinese OEMs are shifting their attention to our shores.

This year, Farizon was officially launched in the UK via middle-eastern distributor Jameel Motors, Wrightbus partnered with JAC to bring in the Rightech RT75 truck and Wakefield-based Pelican Engineering introduced the Yutong TE7 7.5-tonner, but there are many more gearing up for the move.

Arguably the most high-profile Chinese entrant to the car market has been BYD with its huge advertising campaigns and sports sponsorships. Not only is BYD China’s largest EV manufacturer, it is also the country’s second-largest battery manufacturer with its vertically-integrated model gives it a significant cost and supply advantage.

Currently commanding 1.8% of new car sales in the UK, BYD is set to enter the UK van market later this year with the 3.5t e-Vali and there are further vans and trucks scheduled for later in the decade.

GWM, or Great Wall Motors, may be a familiar name to some pickup owners after its ‘Steed’ onetonne pickup was on sale in the UK between 2012 and 2017. There was then a four-year hiatus before the ‘Funky Cat’ car was introduced in 2021 and, later this year, its UK importer IM Group look set to re-enter the pickup segment with the ‘Cannon’.

Compared to other OEMs on this list, GWM is a relatively small player but is highly-regarded for its 4x4 expertise. Surprisingly, GWM is taking a conservative approach with the Cannon, and rather an electrified powertrain, it will be powered by a 2.0-litre diesel engine and offers a one-tonne payload and 3.5t towing capacity.

While most manufacturers on this list are targeting the lighter end of the market, Windrose is focusing on heavy-duty and long-distance haulage. Windrose is still in its embryonic stage with only around 40 trucks in operation but last year the company established a satellite office in Belgium to assist with European type approval.

The 729kWh battery pack returns around 420 miles thanks to the truck’s aerodynamic design, and a 4x2 European prototype is expected to be ready for testing later this year.

“BYD is set to enter the UK van market later this year with the 3.5t e-Vali”

Owned by consumer electronics giant Skyworth (turnover £3.9bn), Skywell was originally a bus manufacturer and has been producing vans and trucks since 2014. Last year, it launched the BE11 SUV in the UK and unveiled the ‘233’ van at the Paris Motor Show –Skywell’s first product launch outside China.

The 233 will offer a generous payload of up to 1,755kg on the 4.25t GVW derivative and will be available with either an 88kWh or 105kWh LFP battery from CATL – the larger of which will return a range of over 200 miles.

Along with Dongfeng, FAW and SAIC, Changan is considered as one of the ‘Big 4’ of the Chinese automakers and recently set up an office in Birmingham to assist its expansion into the UK marketplace. Its team includes ex-Nissan UK director Nic Thomas and ex-Fiat Professional director Richard Chamberlain.

Changan is renowned for its vans and light trucks in China and the last year unveiled the innovative V919 panel van, which it claims is the world’s first electric rear-wheeldrive wide-body van and the first with brake-by-wire technology. At its launch in Beijing, Changan cited the European market as one of the key targets for the van.

“Sany is well-positioned to cater for the 8x4 market”

One of the surprise exhibitors at the IAA Commercial Vehicle show last year was Gecko with the Magicway mid-large size van, which uses a skateboard chassis design.

Gecko isn’t a subsidiary of a larger automotive company; instead, its shareholders include a range of component suppliers and potential customers like CATL batteries, telematics provider DST and delivery company JNT.

Gecko is a brand-new company and has yet to start production, but prototypes are already going through type approval for Europe. Sales are expected to start in Europe later this year followed by the UK next year, although the UK distributor is yet to be announced.

With its background in construction and material-handling equipment, Sany is well-positioned to cater for the 8x4 market. Distributed in Europe through its German bodybuilder subsidiary Putzmeister, Sany was officially launched in the UK at Road Transport Expo in 2023 but has kept a low-profile since, although Breedon’s recently took a Sany concrete mixer on trial in County Durham.

Maxus, owned by China’s largest vehicle manufacturer, has quickly established itself within the UK LCV sector, and it plans to expand into the truck segment next year with a 7.5-tonner. A prototype of the light truck, named the EH300 in China, is currently undergoing UK homologation testing and is expected to go on sale next year.

Maxus has, in the past, also touted a 4x2 electric tractor unit with a range of 350 miles.

While the length of this list may seem startling, it’s a drop in the ocean compared with the overall number of Chinese automakers – which is currently estimated to be around 150. While significant market consolidation is expected over the coming years, the survivors will be increasingly looking west once they have successfully rolled-out their domestic sales strategies. end.

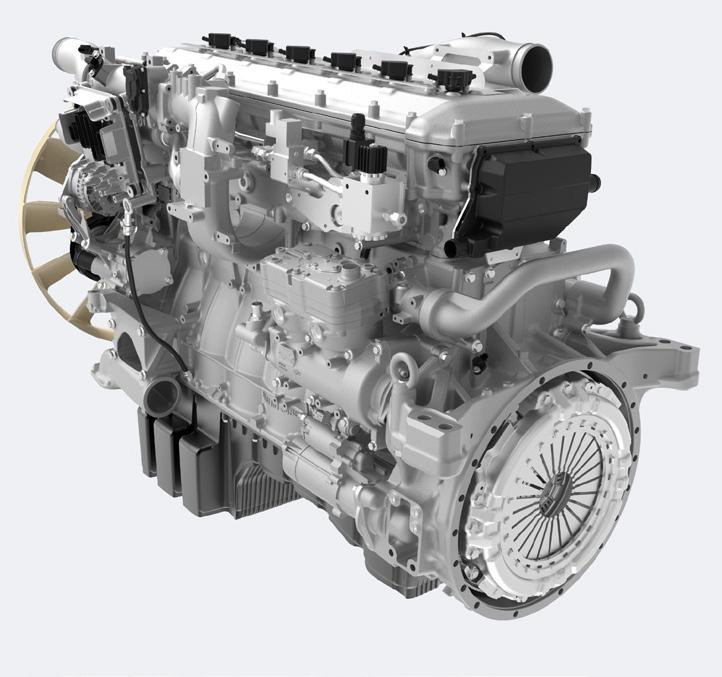

MAN’s new range of electric trucks show just how capable and flexible these vehicles can be. We went to Munich to drive three different models and found they do exactly what is required, with supreme refinement. Words: Jack Sunderland.

about electric trucks will inevitably extend to matters external to the truck itself.

Purchase price, charging infrastructure, axle configurations for British roads, battery life, resale values, driver acceptance and insurance all end up part of the discussion. But let’s focus on the truck itself. Manufacturers were set a challenge by governments and the EU; the future of road transport must be zeroemissions. At some point not too far from now we’re going to stop you from selling diesels, which by the way you still need to keep developing towards the near insane requirements of Euro 7 and if you sell too many and you exceed a CO2 target we may well fine you heavily for it.

While those who wield power have many responsibilities of their own to enable this to happen, if they don’t meet any of them they can just change the rules as they go along. Truck makers have no such luxury, but let’s make one thing clear; they have – quite

incredibly when you consider the uncertain circumstances and variety of propulsion systems they have to hedge their bets on (biomethane, hydrogen) – held up their end of the deal.

Cut away all the externals that surround the introduction of electric truck, and focus only on the vehicle, and they’ve done it! They’ve built fully electric trucks which can do the jobs that vast majority of dieselpowered ones do. Taking into consideration the almost exclusively adverse circumstances presented by the 2020s, it really is a phenomenal achievement.

MAN invited us to Munich to test drive the new generation of electric eTGX and eTGS trucks, in a variety of configurations, from a short wheelbase skip lorry, to a fully freighted artic with 45ft trailer. These are not work in progress pre-production models, but trucks rolling off the production line now, ready to haul loads.

The trucks can be specified with battery packs of four, five or six, depending on your

range requirements and at the top end there are two electric motor options for the largest variants, the ecd330 which has a minimum of four batteries and the ecd400 with a minimum of five, which give the equivalent of 449 or 544bhp. Both engines are mated to a MAN TipMatic four-speed gearbox, connected to a conventional propshaft and drive axle.

The 4x2 tractor unit has a 3750mm wheelbase, and with six batteries has 480kw of usable capacity, with charging times from 20 to 80% taking around 30 minutes, with smaller variants taking 20 minutes. The technical data sheets have a plethora of information about electronic PTOs, charging times and how many battery packs are ideal for various applications, For example on short-haul tipper work, where payload is an important consideration, you don’t need the full six batteries, assuming you can get some charge during the day if required.

For an operator that’s used to the simplicity of running diesels, it can seem very complicated, but MAN has worked out what specification is optimal for many different applications. Charging the truck

“The trucks can be specified with battery packs of four, five or six, depending on your range requirements”

is going to be one of the biggest questions UK operators have, and even if they can install the latest megawatt charging station back at base, they may still need to have access to charging on the road. But let’s not concern ourselves with external issues for now.

One thing you’re bound to note if you read posts by drivers on social media, is a deep-seated fear, or suspicion at least, of electric trucks. They’re worried about losing that traditional operation of mechanical machinery, as much as diesel trucks have advanced in refinement. Yet very few drivers will have sat in one, never mind driven one and they’ll almost certainly never have had the opportunity to do work in one. So what ARE they like to drive, and potentially work with?

The first truck we drove was the eTGS skip truck, which would equate to a typical 18-tonne rigid outfit in the UK, or 20 tonnes with the exemption granted to electric trucks due to their higher tare weight. Batteries are heavy. The first thing you’ll note when climbing behind the wheel is that, well, there’s nothing to note. It’s identical to the equivalent diesel. The control layout is the same as is the digital dash, with the tachometer replaced by power meter.

You engage drive using the right-hand stalk, the electronic handbrake will automatically disengage, and off you go. It’s quiet, but not silent, you

can hear the whirr of the electric motor as it sends power through the four-speed ‘box. The flexibility of an electric motor with its high revving capabilities and constant availability of full torque from take-off means far fewer ratios are required.

It can run at a max speed of 6500rpm, with full torque up to 3050rpm and an optimum