The role of technology in citrus farming: From drones to data analytics

SEED SUPPLIER TO THE WORLD

Starke Ayres invests significant resources into research, ensuring our farmers have access to a wide range of superior-quality seeds designed to improve yield, disease resistance, and adaptability in various growing conditions.

Scan this QR Code to view more.

Sweet Corn

Onion Tomato Squash Pumpkin

Pepper Cabbage

Green Bean

Edition 227 ISSN 1015-85 37 www.vegetablesandfruitmagazine.co.za

COVER

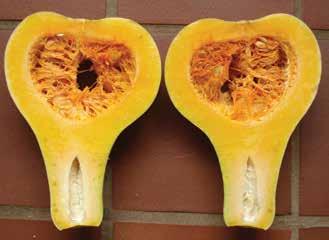

Butternut is one of the most popular vegetable crops for consumers and a reliable product for farmers.

EDITORIAL

Willie Louw (Group editor)

Carien Daffue (Editor) 082 927 8294 018 293 0622 info@mediakom.co.za PO BOX 20250, Noordbrug, 2522

ADVERTISING

Jana Greenall 082 780 9914 mediacom@lantic.net

DESIGN

Mercia Venter studio.chatnoir@gmail.com

Bly ingelig en volg ons op Facebook. Keep up to date and follow us on Facebook. Besoek ons webtuiste | Visit our website: Groente & Vrugte | Vegetables & Fruit www.facebook.com/SAGroenteenVrugte www.vegetablesandfruitmagazine.co.za

SUBSCRIPTIONS

Available on subscription only - visit website: Slegs met intekening beskikbaar - besoek webblad: www.vegetablesandfruitmagazine.co.za

1 Year @ R258.00 (6 issues)

2 Years @ R490.00 (12 issues)

In case of address change, please quote or attach previous address label Special rates for group subscriptions VAT included

Weens afleweringsprobleme met die gewone posdiens word intekenare en lesers versoek om hul e-posadresse aan info@mediakom.co.za te stuur vir die elektroniese versending van GROENTE & VRUGTE - VEGETABLES & FRUIT.

Due to delivery problems with traditional mailing services subscribers and readers are requested to send their e-mail address to info@mediakom.co.za for electronic delivery of VEGETABLES & FRUIT - GROENTE & VRUGTE.

NEWS

4 IFPA Southern Africa: navigating global challenges and embracing innovation

4 Gold and silver for avocado oils

5 Peritum Agri Institute stel akademie bekend

5 A family farm’s role in South Africa’s 155 000 tonne avocado industry

6 Three ARC young scientists walk away with awards

08

CUCURBITS

Breeding superior cucurbits with disease resistance and consumer appeal

10 Causes and prevention of thin necks in butternut squash

12 The powdery mildew threat to pumpkin growers

13 Cucurbits hold firm as prices rise on tighter supply

TOMATOES

14 Nitrate and iodine for improved crop growth through the use of potassium nitrate

16 Optimising pollination in tomatoes

18 The role of technology in citrus farming: From drones to data analytics

20 The future of South Africa’s citrus industry

23 SA citrus export estimates adjusted upward CITRUS

GENERAL

24 Consumer trends shaping the future of fresh produce

28 Inteligro and NWU form a strategic partnership

29 Makataan takes top honours in inaugural South African Preserve Championships

30 Agriculture lessons to be learnt from Clarkson’s farm

IFPA Southern Africa: navigating global challenges and embracing innovation

The International Fresh Produce Association (IFPA) recently hosted its Southern Africa Conference in Pretoria. This event gathered stakeholders from across the fresh produce supply chain, including growers, exporters, retailers, and global buyers, to engage in discussions and explore opportunities in the evolving agricultural landscape.

The main conference featured a programme addressing key topics such as global market trends, export logistics, consumer behaviour, and technological advancements in the fresh produce sector.

Ministerial address: state of the industry

The conference concluded with a keynote address by South Africa’s Minister of Agriculture, John Steenhuisen. He addressed

global trade pressures, including concerns about U.S. tariffs on South African exports, and emphasised the critical role of public-private partnerships in driving sustainable agricultural growth in South Africa. Minister Steenhuisen's remarks underscored the government's commitment to supporting the fresh produce sector amid evolving global challenges.

The IFPA Southern Africa Conference underscored the region's resilience and adaptability in the face of global challenges. By embracing innovation, understanding global market trends, and strengthening collaborations, the Southern African fresh produce sector is poised to enhance its competitiveness on the world stage. The insights and connections garnered during the conference will undoubtedly shape the industry's trajectory in the coming years.

Gold and silver for avocado oils

WESTFALIA FRUIT

Westfalia Fruit, a multinational supplier of avocados and fresh fruit, has emerged as a winner at the inaugural South African Food and Beverage Awards 2025, securing four major accolades for its avocado oil range.The company’s Lemon Flavoured Avocado Oil and Lemon Variant Oil claimed gold, while both the Garlic Flavoured and Plain Avocado Oils earned silver certificates.

The company’s oils not only boast award-winning quality but are also proudly endorsed by the Heart Foundation of South Africa, underscoring their health benefits. These awards reflect the high quality of ingredients as well as the skills and dedication of the producers. This recognition highlights ongoing commitment to food safety, excellence, health, and sustainability in every bottle.

Known as “avo-experts”, Westfalia Fruit continues to set the standard in the avocado industry. The company specialises in growing, sourcing, and processing avocados and related products for markets worldwide. Westfalia has a product range that includes avocado oil, low-preservative guacamole, frozen avocado, and dried fruit.

Hans Boyum, customer director at Westfalia Fruit, says, “This success reflects the passion and hard work of our entire team. It is a proud moment that validates our shared vision of bringing world-class

avocado products to our customers. It reaffirms our commitment to quality and innovation.”

The SA F&B Awards, held in partnership with the Aurora International Taste Challenge, were established to celebrate exceptional products within South Africa’s dynamic food and beverage industry. The awards not only honour excellence but also help guide consumers towards informed purchase decisions based on expert evaluations.

Silver, gold, and double gold certificates are awarded to products that excel in both taste and product quality. Winners are entitled to display the awards on their products as well as across print and digital platforms, as long as the product remains unchanged from the original sample and follows the terms of the non-exclusive license agreement.

“We are incredibly proud of our award-winning oils, which exemplify the quality and care that define our entire product range,” concludes Boyum. “This recognition strengthens our belief in the value we bring to our customers through consistent excellence. As a responsible corporate citizen, we remain committed to promoting sustainable agricultural practices and uplifting the communities we serve.”

The Lemon Flavoured Avocado Oil and Lemon Variant Oil claimed gold, while both the Garlic Flavoured and Plain Avocado Oils earned silver certificates.

PeritumAgriInstitutestelakademiebekend

Peritum Agri Institute het onlangs die Peritum Retail Academy bekendgestel, ‘n eiesoortige fakulteit vir landbou in Suid-Afrika. Die akademie het ten doel om kleinhandel in die landbousektor te transformeer deur professionele persone toe te rus met vaardighede wat aangepas is vir ’n vinnig veranderende mark.

Volgens Belinda Louw, stigtingsdirekteur van Peritum Agri Institute, gaan kleinhandel nie net oor transaksies nie, maar vereis dit ’n balans tussen mense, voorraad, prosesse en kliëntverwagings, alles binne ’n tegnologiese omgewing. Louw het beklemtoon dat die doel is om vaardige en passievolle kleinhandelaars te kweek wat ’n betekenisvolle bydrae tot Suid-Afrika se ekonomie kan lewer en terselfdertyd internasionale standaarde kan stel.

Die Retail Academy bied intensiewe opleidingsprogramme in kliëntervaring, digitale transformasie, uitstalling, winkel-

bedrywighede, finansiële bestuur, bemarking, belanghebberbestuur, leierskap en entrepreneurskap. Deur teorie met praktiese toepassing te kombineer, oorbrug die akademie die gaping tussen onderwys en die behoeftes van die bedryf.

Die akademie werk ook saam met bedryfsleiers en onderwyskundiges om mentorskap en praktiese insigte te bied. Kwalifikasies sluit in beroepsertifikate vir kleinhandeltoesighouers, takbestuurders en senior kleinhandelsbestuurders. Kort leerprogramme kan ook aangepas word vir besighede. Vir toeganklikheid bied Peritum ’n gemengde leerbenadering aan wat klaskamer-, aanlyn- en Teams-sessies insluit. Louw het verduidelik dat hierdie benadering ’n boeiende, bekostigbare en buigsame ervaring aan leerders regoor die land bied.

Besighede en individue wat inskrywings wil doen, kan Odette Shepperson kontak by marketing@peritumagri.com of 051 451 1120.

A family farm’s role in South Africa’s 155 000 tonne avocado industry

SAAGA

Avocado season has been in full swing and South Africans are scooping up the country’s favourite fruit in record volumes. With creamy texture, great health credentials, and versatile uses, it's easy to understand the obsession. According to the South African Avocado Growers’ Association (SAAGA), the country produces around 155 000 metric tonnes of avocados annually, and volumes continue to grow. Nearly 50% of this is exported primarily to the UK and EU, and the remainder meets the ever-growing demand from a South African population hooked on this popular fruit. That’s where farms like Springfield play a vital role.

Behind every avo is a farm, and behind every farm is a story. One of the most inspiring is that of Springfield Farms, nestled in Limpopo’s Levubu River Valley, where the Whyte family has been growing world-class avocados for nearly four decades.

Owned and run by Alan, Jill, Alex, Graeme and Cairine Whyte, the farm is a leading supplier to both the local market and global export destinations, including the UK and EU. Among its loyal local partners is Pick n Pay, where customers regularly fill their baskets with Springfield-grown fruit. “We’re proud to support local growers like Springfield Farms who prioritise quality, sustainability and community,” says Jacqui Peacock, Business Unit Head Produce & Horticulture at Pick n Pay. “Our customers care about where their food comes from, and partnerships like these help us deliver fresh, proudly South African produce from farm to shelf.”

A farming legacy, reimagined

The Whyte family bought Springfield in 1984, and gradually

expanded operations with a focus on avocados and macadamia nuts. Today, their 200 hectares of orchards produce key varieties like Hass, Pinkerton, Fuerte, Ryan and Reed.

Limpopo is the country’s largest avo-producing province, thanks to its high rainfall and rich red soils. “We’re fortunate to farm in an area that’s almost tailor-made for avocados,” says Graeme Whyte, who studied Global Food Business in the UK before returning home to help grow the family business. “But even with good land, successful farming takes intense planning, adaptability, and a commitment to doing things the right way.”

Growing the future, sustainably

Sustainability is central to Springfield’s success. The farm is GlobalGAP, SIZA and LEAF-certified, which requires rigorous practices around water conservation, reduced chemical usage, biodiversity preservation, and ethical labour.

In peak season, the farm employs over 370 people – 120 permanent and up to 250 seasonal workers – and also mentors young, aspiring farmers through hands-on training. “We believe in farming that not only feeds people, but also preserves the land for future generations,” says Graeme. “It’s why we invest in biological pest control, preserve indigenous bush, and manage our water use carefully.”

Harvesting avocados is a precision operation. Each day starts with maturity testing, orchard planning, and coordinating teams for picking and packing. The goal: deliver avocados in perfect condition with optimal shelf life. “There’s nothing more satisfying than seeing a cold truck filled with palletised avos, knowing it’s heading to a store – or a country – where people will enjoy the fruit we’ve worked so hard to grow,” says Graeme.

Three ARC young scientists walk away with awards

Three young scientists and Master's students from the Agricultural Research Council’s Infruitec campus proved that passion and dedication can open doors of recognition.

Anelisa Gusha ARC-SMALL GRAIN, BETHLEHEM

The multi-talented scientists from the Agricultural Research Council (ARC), including two women and a man, walked away with prestigious awards at a national summit held in Johannesburg, where hundreds of scientists gathered under one roof to share expertise and chart the way forward for the science fraternity.

The summit, Indigenous Plant Use Forum, aims to bridge ancestral wisdom with modern innovation, celebrate cultural heritage, and promote socio-economic and scientific benefits through the responsible use of indigenous plants.

It created a platform for role players to exchange ideas, showcase innovations, and present research that is shaping the future of science in South Africa. Among the many brilliant

Spotlight shines at ARC Master’s students for their role in research and agriculture. Bishop Ramagoma and Itumeleng Baloyi were awarded second place for best poster presentation by young scientists at a national summit, the Indigenous Plant Use Forum. Ramagoma also scooped the IPUF Oswald Innovation Award, sharing the spotlight in that category with Nompumelelo Mnisi, who also walked away with the same accolade.

minds, ARC’s very own stood tall.

Both Bishop Ramagoma and Itumeleng Baloyi were awarded second place for best poster presentation by young scientists. In addition, Ramagoma also scooped the IPUF Oswald Innovation Award, sharing the spotlight in that category with Nompumelelo Mnisi, who also walked away with the same accolade.

Bishop Ramagoma said the recognition means more than personal achievement.

“I feel deeply honoured to be recognised on a national platform. These awards are not just mine; they belong to the team and the institution that shaped me. Winning the Oswald Innovation Award motivates me to keep pushing boundaries in research that can make a tangible difference in agriculture. My goal has always been to ensure that our work benefits farmers and contributes to food security.”

Itumeleng Baloyi, who shone in the poster presentation category, expressed joy at the recognition of her research.

My motivation comes from knowing that science has the power to change lives, especially in rural communities where agriculture is a lifeline.

“Being awarded for the best poster presentation is a humbling moment. It tells me that the hard work, late nights, and sacrifices are worth it. My motivation comes from knowing that science has the power to change lives, especially in rural communities where agriculture is a lifeline. This award encourages me to keep pursuing excellence and to inspire other young women to step into science with confidence.”

For Nompumelelo Mnisi, winning the Oswald Innovation Award is a reminder of why she chose this path.

“This award is a symbol of perseverance. I am honoured because it validates the importance of our research and how it can impact real lives. What motivates me is the opportunity to contribute to solutions that address some of the pressing challenges in our sector. Science is not just about experiments - it’s about service, and I want to keep serving through research and innovation.”

Their research presentations, each unique in focus, are paving the way for innovation in the agricultural sector, an area critical for food security and economic growth in South Africa. The three young scientists are proof that South Africa’s research capacity is in capable hands. Their achievements not only spotlight individual brilliance but also affirm the ARC’s commitment to developing young talent that can lead innovation in agriculture.

Breeding superior cucurbits with disease resistance and consumer appeal

As global demand for premium fruits and vegetables continues to evolve, Syngenta Vegetable Seeds stands at the forefront of agricultural innovation, strategically adapting its breeding and cultivation approaches to meet contemporary market challenges. By balancing disease resistance and production efficiency with consumer preferences, the company has developed a comprehensive portfolio of cucurbit varieties that excel throughout the value chain.

SYNGENTA

Strategic cultivation requires premium genetics

Successful cultivation of melons, watermelons, and cucumbers demands meticulous planning and attention to detail from initial selection through the entire production cycle. Breeding varieties that address production challenges enables farmers to maximise their potential through the company’s network of trusted seed distributors.

“We have developed a diverse range of options allowing farmers to select varieties that deliver precisely what consumers desire,” explains Werner Wessels, area sales manager for vegetable seeds at Syngenta South Africa. “Our watermelon, melon, and cucumber varieties offer exceptional adaptability alongside industry-leading disease resistance packages.”

This strategic approach creates value throughout the distribution and retail channels. “Our extensive portfolio delivers meaningful consumer benefits such as superior fruit quality, exceptional texture, outstanding flavour profiles, and extended shelf life,” Wessels notes.

Premium melon varieties

Accolade

This eastern shipper variety features enhanced fruit quality with comprehensive disease resistance for early to main season plantings. Resistant to powdery mildew, Fusarium wilt, and cotton aphids, Accolade delivers consistent performance under challenging conditions. Distributed by Starke Ayres.

Athena

An early-season eastern shipper hybrid cantaloupe ideally suited for open-field production. Medium-sized yet vigorous plants produce abundant, high-quality fruit. The oval fruits feature minor sutures with distinctive coarse netting, weighing 1,5 to 2,5 kg. Distributed by InteliGro.

Sweet Spring

This early-maturing western shipper variety showcases deep orange flesh with a medium seed cavity - perfect for fresh

market applications. Sweet Spring produces uniform fruits weighing 1,9 - 2,5 kg with exceptional sweetness (average Brix: 14). Distributed by Starke Ayres.

Heidi

A robust variety renowned for uniform, visually appealing fruit with distinctively firm, sweet flesh. Its vigorous plant structure adapts seamlessly across diverse production regions and conditions, consistently delivering premium-quality fruit. Heidi offers comprehensive resistance to powdery mildew, Fusarium wilt, melon necrotic spot virus, and cotton aphid. Distributed by InteliGro.

Market-leading

Ariadne

hybrid watermelon varieties

Produces robust plants with excellent leaf coverage, protecting elongated fruits featuring medium green backgrounds with distinctive, wide dark green stripes. Exceptional flesh quality delivers outstanding flavour and elevated Brix levels. Resistant to fusarium and anthracnose. For grafted production, Vitalley or Carnivor rootstocks are recommended, though this may slightly delay maturity while increasing fruit size. Distributed by Starke Ayres.

Batukan

This adaptable variety performs consistently across diverse soil conditions, producing blocky, uniform fruits with medium-dark green rinds accented by lighter striping. Its crisp, bright red flesh offers pleasing texture and balanced sweetness, appealing to both retailers and consumers. Vigorous plants maintain strong leaf covers, protecting fruits while demonstrating reliable disease tolerance. Distributed by Starke Ayres.

Farao

This high-yielding, medium-early Crimson-type watermelon delivers an excellent, uniform fruit set. Strong plant vigour with optimal vine growth habits supports elongated sweet, seeded fruits with superior interior quality. Medium green exterior with broad, darker green stripes features medium-thick

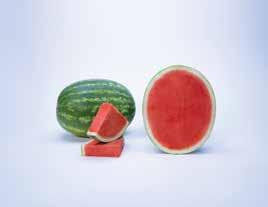

Successful cultivation of melons, watermelons, and cucumbers demands meticulous planning and attention to detail from initial selection through the entire production cycle.

rinds with excellent durability for long-distance shipping. Distributed by InteliGro.

Liverpool

This large Crimson Sweet-type hybrid features excellent flesh colour and quality. Vigorous growth with healthy leaf coverage protects fruits that mature just 65 days after planting. Medium-dark green rinds with broad, light green stripes contain deep red, firm-textured flesh with superior flavour and high Brix levels. Ideal for early-season and summer production in open fields. Distributed by Starke Ayres.

Fahari

An early-maturing Jubilee-type watermelon producing large fruits with exceptionally sweet red flesh. Thin yet durable rinds provide excellent shelf life and transportation quality for distant markets. Its shortened production cycle reduces costs while enabling precise market timing. Sufficient plant coverage protects fruits from heat damage, while each plant consistently produces two to three uniform, marketable fruits.

Captivation

A large oval-shaped seedless variety with exceptional fruit quality. Vigorous plants thrive in open-field conditions while demonstrating robust disease resistance. Distributed by InteliGro.

Fascination

An early-maturing Crimson Sweet-type triploid hybrid with exceptional yield potential. Produces uniformly blocky, mediumlarge fruits with shipping-durable rinds. Firm, dark red flesh delivers exceptional sweetness with minimal seeds - ideal for fresh-cut applications. Distributed by InteliGro.

Specialised cucumber varieties

Aegeas

This passive greenhouse hybrid produces long, dark green fruits with distinctive ribbing and superior quality. Early maturity combined with high yield potential makes Aegeas widely adaptable with an extended planting window. Exceptional heat tolerance and powdery mildew resistance make it ideal for South African summer production. Distributed by InteliGro.

Randall

A specialised winter cucumber variety developed for fresh produce markets. Long, dark green fruits (32 - 34 cm) deliver excellent quality from vigorous plants with strong powdery mildew resistance. Distributed by InteliGro.

Advanced rootstock solutions Carnivor

This easy-to-graft, vigorously growing interspecific rootstock offers exceptional cold tolerance for both melon and watermelon production. Superior fruit-setting ability while simultaneously promoting fruit weight makes Carnivor an ideal foundation for premium production. Distributed by InteliGro.

Vitalley

Versatile rootstock suitable for watermelon, melon, and cucumber grafting. Excellent vigour combined with superior low-temperature tolerance makes Vitalley adaptable to challenging conditions requiring enhanced plant performance. Compatible with all common grafting techniques. Distributed by Starke Ayres.

For area-specific recommendations, contact Syngenta South Africa offices: Tel: +27 (11) 541 4000 | www.syngenta. co.za | Facebook @SyngentaVegetableSeedsSouthAfrica .

Causes and prevention of thin necks in butternut squash

Butternut is one of the most popular vegetable crops for both producers and consumers. The consistent shape and rich orange flesh make it a reliable product that many farmers rely on. However, thin, underdeveloped necks are a frequent deformity that leaves farmers questioning what went wrong.

SAKATA

Athin-necked fruit is a clear indication that the plant experienced physiological or environmental stress during a critical stage of fruit development. This is not just a cosmetic concern, as it reduces quality, lowers yield, and ultimately affects profitability. By understanding the main causes and managing stress factors, farmers can reduce deformities and ensure a uniform harvest.

Water management

Inconsistent watering is one of the main reasons for thinnecked butternut fruit. Drought and intensive irrigation cycles disrupt regular cell formation, especially in the neck area of

the fruit, leading to thin or unevenly shaped produce. The best solution is to use mulch and drip irrigation to maintain constant soil moisture levels throughout the growing season.

Temperature extremes

Abrupt temperature changes during the early stages of fruit development can result in thin-necked fruit. Intense daytime heat or sudden cold nights stress the plants, disrupting hormone balance and cell division. Although the weather cannot be controlled, farmers can reduce risk by planting at the correct time and using shade nets and row covers when required.

Nutrient balance

Deficiencies in key nutrients, especially nitrogen and potassium,

Healthy uniform butternuts.

often result in uneven fruit growth during the early stages of production. Regular soil tests and the application of balanced fertilisers prior to flowering are essential to maintain correct nutrient levels for uniform tissue development.

Spacing, light and pest pressure

Overcrowded plantings block sunlight and limit photosynthesis, reducing the energy available for plant growth, particularly in the neck. Proper field layout and correct plant spacing ensure each plant receives sufficient light and resources. Diseases

Preventative strategies

By following a few practical steps, farmers can reduce the risk of deformities in butternut fruit:

• Maintain regular watering schedules

• Apply balanced fertilisers

• Ensure correct plant spacing

• Implement pest and insect control

• Use row covers and shade nets during extreme temperatures.

Thin necks in butternut squash are a clear indication that the plant has experienced stress during crucial growth phases. By maintaining consistent growing conditions, practising proactive pest control, managing nutrition, and protecting against weather extremes, farmers can improve yield and marketability to meet the quality standards consumers expect.

Disclaimer: This information is based on observations and data from other sources. As crop performance depends on the interaction between the genetic potential of the seed, its physiological characteristics, and the environment, including management, no warranty is expressed or implied for crop performance relative to the information given. No liability is accepted for any loss, direct or aphids also drain the plant’s energy, diverting resources away from the fruit. Correct spacing, good airflow, routine monitoring, and pest management are crucial to prevent stress.

An example of poor development in butternuts.

The powdery mildew threat to pumpkin growers

Powdery mildew continues to cause major problems for pumpkin growers in all growing areas. It is a fungal disease that thrives in warm, humid conditions and often appears where canopies are dense and airflow is restricted, typically the kind of environment found in late summer crops under irrigation.

STARKE AYRES

The causal agents of powdery mildew are Podosphaera xanthii and Golovinomyces cichoracearum. These are obligate parasites, meaning they need living plant tissue to survive. Once established, they can spread quickly. Airborne spores can be formed less than a week after initial infection, making early detection and control critical.

The first signs of the disease are white, powdery patches on the upper leaf surface, quickly spreading to petioles and vines. If uncontrolled, powdery mildew reduces photosynthetic area and weakens the plant. This leads to early leaf drop, lower fruit quality, and smaller yields, none of which is good news for growers trying to meet market standards.

Chemical control measures are available, but variety choice can minimise the impact of powdery mildew. STAR 7028 is a grey pumpkin with a vining growth habit, maturing early at approximately 85 days in summer and 95 -100 days in cooler winters. It produces deep, slightly ribbed fruits averaging 5 kg, with deep orange, firm flesh. The early maturity allows the plant to complete its growth cycle before peak periods of powdery mildew incidence, potentially reducing disease impact.

STAR 7026 is another grey pumpkin but with a semi-bush growth habit. It matures in about 90 days during summer and 100 -110 days in cooler winters. It yields large, uniform fruits averaging 6 kg, featuring deep orange, thick flesh with minimal under-skin greening. STAR 7026 has intermediate resistance to powdery mildew and Zucchini Yellow Mosaic Virus, enhancing its resilience against these common pathogens.

By cultivating both STAR 7028 and STAR 7026, farmers can capitalise on their complementary growth habits and disease resistance profiles, leading to robust harvests of high-quality

pumpkins suitable for various market demands.

Practical control tips

Managing powdery mildew takes a combined approach. Here’s what works:

• Start with hygiene: Remove old plant debris before planting and avoid planting in the same area season after season.

• Keep the air moving: Wider plant spacing and trellising (in suitable systems) can reduce humidity levels around leaves.

• Spray smart: A well-timed fungicide programme is your best line of defence. Contact fungicides (such as sulphur) should be rotated with systemic options to prevent resistance.

• Feed to resist: There is growing evidence that foliar feeds such as potassium silicate and potassium monophosphate can harden the plant against infection. They do not replace fungicides, but they can reduce disease pressure.

Local impact

In recent seasons, commercial growers have seen more aggressive outbreaks in dense plantings under tunnels or pivot systems, especially where cucurbits are grown back-to-back. Choosing varieties with strong leaf cover, but not excessive density, can help keep microclimates less favourable for fungal growth.

While powdery mildew is not new, its growing resistance to older fungicides and changing weather patterns make it a disease to keep top of mind. Monitor crops closely and do not skip sprays during the critical pre-fruit and early fruiting stages. As always, an integrated strategy beats a reactive one. Contact Norman McGuire at 082 808 0129 for more information.

Cucurbits hold firm as prices rise on tighter supply

Cucurbit growers and traders have navigated a period of tight supply and firmer prices recently, with fresh-produce market data pointing to month-on-month declines in volumes across several lines and notable price gains.

At the Cape Town fresh produce market, butternut squash volumes decreased while the average price per ton rose by nearly half. Pumpkin volumes fell, with a double-digit price increase. English cucumber supply eased, and prices climbed strongly. Gem squash volumes declined sharply compared to the previous month, with a marked price lift, although the longer-term trend shows volumes more than doubling and prices normalising from a higher base. These dynamics reflect seasonal shifts, regional weather recovery after prior dryness, and steady retail demand.

Recent figures illustrate the point. Butternut squash volumes decreased by 18,5%, with the average price rising to about R8 111 per ton. Pumpkin volumes fell by 29,2% and the price firmed to roughly R6 292 per ton. English cucumber volumes eased by 20,3%, while the average price increased by 60,6% to approximately R37 199 per ton. Gem squash volumes declined by 41,7% month-on-month, the average price rose by 62,2%, and the year-on-year comparison shows volumes up 103,8% with prices lower versus the previous high base. Baby marrow averaged 109,4 tons for the month with a modest volume dip and a softer price level.

The broader agricultural backdrop remains mixed but improving. National conditions improved with favourable rainfall supporting field crops after the previous season’s dryness, while pockets of stress and cost pressure persist. The horticultural subsector, including vegetables, continues to benefit from resilient consumer demand patterns and improved logistics stability.

Policy and plant health developments are also shaping the operating environment. South Africa has modernised its plant biosecurity framework with the Plant Health (Phytosanitary) Act, which replaces older pest legislation and aligns local systems with contemporary risk management and intellectual property protection for plant varieties. The update supports smoother trade, clearer compliance for seed and plant material, and more coordinated pest responses.

Regionally, efforts to strengthen surveillance and response capacity continue. The Africa phytosanitary programme entered a new phase recently, prioritising transboundary pest risks and practical capacity building for national plant protection organisations. While many vegetable pests remain manageable under integrated programmes, invasive fruit and cucurbit flies highlight the need for vigilant monitoring and rapid response to protect yields and marketable quality.

For cucurbit growers and marketers, three themes stand

out. First, supply discipline and timing matter. The recent price response to tighter volumes in butternut, pumpkin, English cucumber and gem squash shows the value of aligning harvest and logistics with market windows. Second, quality pays. Where weather variability has affected uniformity, graded supply has commanded premiums, especially in cucumbers and baby marrows sold into higher-end retail programmes. Third, biosecurity and compliance are non-negotiable. Updated plant health rules and import protocols underscore the importance of phytosanitary certification for seed and plant material, as well as proper record-keeping for treatments and pest control.

Practical steps for producers include close market tracking of volumes and prices for butternut, pumpkin, cucumbers and gem squash, tightening harvest-to-market lead times to preserve freshness, and review ing integrated pest management plans with a focus on cucurbit fruit flies and related threats. Growers should ensure that measurement units are standardised on labels and that traceability data is complete for audits.

Traders may consider flexible procurement to balance farm gate and market channel needs, particularly where weather can compress supply. Given the regulatory update, seed suppliers and nurseries should communicate clearly on varietal rights and phytosanitary documentation to avoid delays at inspection points.

In summary, cucurbit demand remains steady, the price outlook is constructive while supply is tight, and the policy environment has become clearer. With attentive crop management, disciplined market execution and strong compliance, the sector is positioned to capture value as the season progresses.

Sources

• Elsenburg, Western Cape Department of Agriculture. Full Vegetable Report, recent issue.

• National Department of Agriculture. New Plant Health (Phytosanitary) Act media release, recent.

• De Beer Attorneys. Commentary on the Plant Health Bill, recent.

• Africa Phytosanitary Programme. Overview of transboundary pest risks and capacity building, recent.

Nitrate and iodine for improved crop growth through the use of potassium nitrate

Nitrogen is crucial for plant growth and development, as it forms amino acids, proteins, and chlorophyll, which are essential for photosynthesis. Understanding the types of nitrogen in fertilisers is a powerful tool for farmers and agricultural professionals to make informed decisions. The three primary types of nitrogen in fertilisers are urea (CO(NH2)2), nitrate (NO3-) as Ultrasol® K Plus*, and ammonium (NH4+).

Suzette Smalberger SQM

Plants absorb both ammonium and nitrate, but the absorption rate depends on the ion’s prevalence in the solution. The negatively charged nitrate ion (NO3-) is easily absorbed by plants because it is dissolved in the soil solution in an ionised form. However, ammonium-nitrogen (NH4-N) competes with other essential cations, such as potassium (K+), calcium (Ca2+), and magnesium (Mg2+), for uptake. This competition can potentially cause nutritional imbalances that hinder plant growth.

Nutrient uptake directly affects the rhizosphere’s pH level. The amount of fertiliser and soil buffer capacity determines the extent of pH changes. Ammonium-nitrogen can lower pH from approximately 4,5 to 3,0, while nitrate-nitrogen can raise it to 6,0.

Light energy in plant leaves converts nitrate into nitrogen compounds, known as nitrate conservation energy. Ammonium is transformed into nitrogen compounds in the roots using sugars and carbohydrates. Excess ammonium-nitrogen can deplete carbohydrates, thereby reducing the plant’s energy availability.

Understanding the different forms of nitrogen in fertilisers - urea, nitrate, and ammonium - is essential for optimising plant growth and ensuring sustainable agricultural practices. Nitrate-nitrogen stands out due to its efficient absorption by plants, minimal competition with other essential nutrients, and ability to maintain a balanced rhizosphere pH. By leveraging nitrate-nitrogen, farmers can enhance crop yields, promote healthier plant development, and conserve energy within the plant system.

Iodine is currently recognised as a beneficial nutrient for plants. Ultrasol®ine K Plus** is a potassium nitrate fertiliser en-

riched with iodine. Adequate iodine promotes root and leaf development, as well as tolerance to abiotic stresses. Trials have shown that growers can achieve an average yield increase of 10% and produce export-quality fruits, thanks to improved fruit uniformity and development.

Tomatoes grown with Ultrasol®ine K Plus exhibited improved fruit quality, characterised by more uniform trusses and increased fruit weight. These fruits also contain higher levels of antioxidants, including phenolic compounds and vitamin C, which enhances their nutritional value.

The concentration of calcium in the fruit increases with the application of iodine, contributing to a firmer texture, longer shelf life, and a reduced risk of blossom-end rot.

By applying Ultrasol®ine K Plus farmers can correct iodine deficiency, maintain optimal iodine levels, prevent flowering delays, promote healthier plant development, and improve the yield and quality of tomato production. This knowledge empowers agricultural professionals to make informed decisions supporting productivity and environmental sustainability.

Suzette Smalberger, Senior Agronomist (PriSciNat 115259)., SQM Africa, Tel. 073 819 6076 sqmnutrition.com .

* Reg No. K5020 Act 36/1947. Registered holder: Sociedad Quimica y Minera (Africa) (Pty) Ltd SQM

**Reg No. K11316 Act 36/1947. Registered holder: Sociedad Quimica y Minera (Africa) (Pty) Ltd SQM

Disclaimer: The information contained herein is given to the best of SQM’s knowledge and is believed to be accurate. The conditions of use and application of the suggested formulae and recommendations are beyond our control. No warranty is made on the accuracy of any data or statements contained herein. SQM specifically disclaims any responsibility or liability relating to the use of the suggested formulae and recommendations and shall under no circumstances be liable for any special, incidental, or consequential damages arising from such use.

SQM AFRICA Registered by: Sociedad Quimica y Minera (Africa)(Pty)Ltd

Registration No: K11316 Act 36/1947

N=130g/kg; K=379g/kg; I=1003mg/kg Johan Fick: +27 76 658 0598 spn-safrica@sqm.com

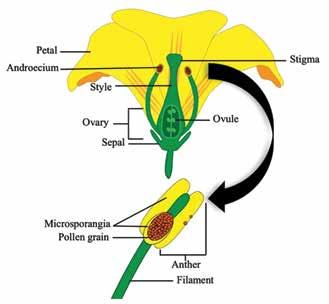

Optimising pollination in tomatoes

Tomatoes (Solanum lycopersicum) are one of the most widely produced vegetables in the world. They are naturally self-pollinating, but achieving consistently high yields and uniform, quality fruit will depend on how effectively the pollen is transferred from the anther onto the receptive stigma within each flower.

SAKATA

In open-field tomato production, natural wind and insect activity usually ensure pollination, but in protected environments like greenhouses or net houses, natural wind and wild insect activity are reduced, which means that pollination needs to be actively managed by the tomato producer.

How tomato pollination works

Each tomato flower encloses its pollen in an anther cone. Pollen is released through vibration, which can be provided by wind, buzzing insects, or mechanical shaking. In open fields, natural airflow and insect activity are usually sufficient, but in protected systems, vibration is often limited, making pollination management essential.

Pollination occurs within a short window around anthesis (flower opening). The number of ovules fertilised during this time determines the fruit size and shape. Poor or incomplete pollination can lead to small or irregularly shaped fruit or even flower abortion.

Climate constraints on pollen and stigma

Tomato pollen is highly sensitive to environmental stress:

• Temperature: The ideal temperature for pollen is between 21 °C and 24 °C, but pollen is still viable between 16 °C and 32 °C. When temperatures exceed this range, pollen viability drops and the chances for incomplete pollination increase.

• Humidity: Very high RH (>80-90%) causes pollen clumping and poor release, while low RH (<50-60%) dries the pollen out. Optimal performance occurs between 60 and 70% RH.

Strategies to increase the effectiveness of pollination

Mechanical intervention during pollination: In South Africa, where we are unable to use bumblebees, mechanical tools can be used effectively:

• Stick/pole/rod method: By hitting the trellising wire daily, a vibration is created to initiate pollen shed.

• Air pulses: Using air blowers to move air over flower trusses creates enough vibration to initiate pollen shed. Note that only a light breeze is necessary when using blowers to create vibration of the flower. Hard winds can damage flowers and lead to flower drop.

Mechanical pollination has been shown to be successful, but it is labour-intensive, and skilled labour is important.

Optimise microclimate:

The microclimate in greenhouses and temperature-regulated setups is critical for pollen release and fertilisation:

is consistent.

A stylised diagram of the tomato floral anatomy. This general morphology

Tomato flowers.

• Maintain 20-28 °C during bloom and avoid extended periods of heat and/or cold.

• Keep relative humidity between 60 and 70%, with horizontal airflow fans to reduce pollen clumping.

Nutrition and canopy management:

Balanced nutrition and crop architecture are equally important:

• Boron and calcium are essential for pollen germination and pollen tube growth. Avoid deficiencies during bloom.

• Nitrogen, phosphorus, and potassium must be carefully balanced to support healthy growth and optimal flower set. An excess or deficiency of any of these nutrients can disrupt plant physiology, causing either excessive vegetative

• Maintain an open canopy through pruning to expose flowers and promote airflow.

Why good pollination matters

Effective pollination leads to:

• Higher fruit set per truss: ensures more flowers develop into marketable fruit and reduces flower drop.

• Improved yield per plant: efficient pollination maximises production per square metre.

• Better uniformity of fruit shape and size: fewer misshapen fruit and increased pack-out quality.

• Enhanced marketability: uniform, quality fruit will meet grading standards and attract buyers.

• Economic efficiency: fewer losses and higher consistency increase profitability.

Effective pollination is key to high-yielding, uniform, and marketable tomato crops. In protected environments, mechanical vibration, climate control, and balanced nutrition ensure reliable fertilisation, reduce flower drop, and improve fruit quality, which ultimately results in better profitability. Therefore, pollination should be treated as a priority alongside irrigation and fertigation.

Disclaimer: This information is based on observations and data from other sources. As crop performance depends on the interaction between the genetic potential of the seed, its physiological characteristics, and the environment, including management, no warranty is expressed or implied for crop performance relative to the information given. No liability is accepted for any loss, direct or

Poorly pollinated tomatoes.

The role of technology in citrus farming: From drones to data analytics

The South African citrus industry, renowned for its high-quality fruit and significant contribution to both local and international markets, has faced numerous challenges in recent years, including labour shortages, unpredictable weather patterns, and evolving consumer demands. To overcome these hurdles and remain competitive in the global market, the industry is increasingly turning to advanced technologies.

From drones for crop health monitoring, to data analytics for predicting yields and automation for harvesting, these technologies are driving innovation and efficiency in citrus farming. This article explores the role of these technologies in optimising citrus farming practices, improving productivity, and ensuring sustainability.

Drones: aerial surveillance for precision farming

Drones, also known as unmanned aerial vehicles (UAVs), have become an indispensable tool for modern citrus farming. These aerial devices are equipped with multispectral, thermal, and high-definition cameras, enabling farmers to gather precise data on crop health, soil moisture, and other critical factors that affect orchard productivity. By flying over orchards and capturing detailed imagery, drones provide farmers with insights that were previously difficult to obtain through traditional means.

For instance, drones can detect early signs of pests, diseases, or nutrient deficiencies by capturing detailed images of trees and foliage. Multispectral imagery, which captures data in various light wavelengths, can highlight stressed areas in the orchard that may not be visible to the naked eye. Thermal imaging, on the other hand, is beneficial for detecting areas suffering from water stress or drought. These technologies allow for more precise and targeted interventions, such as applying fertilisers or pesticides only in the affected areas, rather than over-applying across the entire orchard. This not only reduces resource wastage but also contributes to more sustainable farming practices.

In addition to crop health monitoring, drones are increasingly being used for irrigation management. With water scarcity being a critical issue in South Africa, efficient water usage is essential for citrus farmers. Drones equipped with sensors can provide real-time data on soil moisture levels across vast orchards. This allows farmers to make informed irrigation decisions, ensuring that water is used efficiently and only where it’s needed. This is particularly important in areas where water is a limited resource, as it helps to conserve water while maintaining optimal crop health.

Drones also offer efficiency in crop scouting, where they

can cover large areas of land in a fraction of the time it would take a human worker. This helps farmers save on labour costs and time while collecting accurate data that can be analysed for further decision-making.

Data analytics: harnessing big data for better decision making

While drones provide valuable visual data, the true power of modern technology lies in data analytics. With the ability to process vast amounts of information, data analytics is revolutionising citrus farming by providing deeper insights into various aspects of production. This technology enables farmers to analyse historical data, weather patterns, soil conditions, and market trends to make more informed and precise decisions about their crops.

One of the key advantages of data analytics in citrus farming is its ability to predict yields. By incorporating historical yield data, weather forecasts, and soil conditions, predictive models can accurately estimate the amount of fruit that will be produced in a given season. This enables farmers to plan more effectively for the upcoming harvest, ensuring that the necessary resources, such as labour, storage, and transportation, are available when needed. Accurate yield predictions also help farmers adjust their marketing strategies, allowing them to meet consumer demand while avoiding overproduction or waste.

Beyond yield prediction, data analytics is also used to optimise resource allocation. By analysing the data from various sensors placed in the field, farmers can track soil health, water levels, and nutrient content in real-time. This information can then be used to create precision farming strategies, where inputs like water, fertilisers, and pesticides are applied only to areas that require them. This targeted approach reduces resource waste, lowers production costs, and contributes to environmental sustainability.

In addition, the use of data analytics can help farmers better understand market demand. By analysing trends in consumer behaviour, both locally and globally, farmers can adjust their production to align with market preferences. For example, if demand for a specific variety of citrus fruit is rising, farmers can adjust their crop planting schedules to ensure that they

can supply the market with the desired product. This flexibility is essential in a competitive industry where market conditions are constantly changing.

Automation: the future of harvesting

One of the biggest challenges faced by the citrus industry, both in South Africa and globally, is the high cost and limited availability of seasonal labour. During peak harvest periods, the demand for workers to pick fruit can outstrip supply, leading to increased labour costs and potential delays in harvesting. To address this issue, automation has become an increasingly important solution.

Automated harvesting machines, equipped with artificial intelligence (AI) and advanced sensors, are capable of picking citrus fruit with remarkable precision. These machines can detect the ripeness of fruit using visual and tactile sensors, allowing them to pick only the fruit that is ready for harvest. By operating around the clock, these robots can significantly reduce labour costs and increase harvesting efficiency, enabling farmers to complete the harvest faster and with less reliance on seasonal workers.

One such example is the AI-powered robotic harvesting machine developed by Israeli company Nanovel. This machine uses AI and vision systems to selectively pick citrus fruits from trees, even in dense orchards with complex tree structures. The robot’s multiple arms are able to delicately pick the fruit without causing damage, ensuring that the quality of the produce is maintained. As the technology continues to evolve, these machines are expected to become even more cost-effective and efficient, offering a viable solution to the labour challenges faced by citrus farmers.

While robotic harvesting systems are still in the early stages of adoption, they represent the future of citrus farming. By reducing labour dependency, improving harvest efficiency, and ensuring consistent fruit quality, automation is poised to become a standard practice in citrus orchards worldwide.

Integrated systems: combining technologies for maximum efficiency

The true power of technology in citrus farming lies not in individual tools, but in the integration of multiple technologies working together to optimise every aspect of the farming process. Integrated systems combine drone-collected imagery, data from ground-based sensors, and predictive analytics to create a comprehensive approach to orchard management. This system allows farmers to monitor and control all aspects of the orchard in real-time, from soil moisture levels to pest populations.

For example, farmers can use drones to capture high-resolution imagery of their orchards, which is then analysed using data analytics platforms to identify areas of concern, such as pest infestations or nutrient deficiencies. This information can be used to trigger automated systems, such as irrigation or fertiliser application, ensuring that the right resources are applied at the right time. This integrated approach not only improves farm efficiency but also reduces waste and enhances sustainability.

Challenges and considerations

While the benefits of technology in citrus farming are clear, the adoption of these innovations does come with challenges. One of the primary barriers is the high initial investment required to implement advanced technologies. For many small-

scale farmers, the cost of drones, automated systems, and data analytics platforms can be prohibitive. As a result, there is a need for financial support and training to help farmers embrace these technologies.

Another challenge is the technical expertise required to operate and maintain these systems. Many farmers may lack the necessary skills to use drones, interpret data analytics, or repair automated machinery. As technology becomes more integrated into farming practices, there is a growing need for education and support to ensure that farmers can maximise the potential of these tools.

The future of citrus farming

Despite these challenges, the future of citrus farming looks promising. As the industry continues to embrace new technologies, South African citrus growers will be better equipped to navigate the complexities of modern agriculture. Drones, data analytics, and automation are not only helping farmers improve efficiency and reduce costs, but they are also enabling them to produce higher-quality fruit that meets the growing demands of global markets.

The integration of these technologies will also play a crucial role in ensuring the sustainability of the citrus industry. By reducing resource wastage, improving water management, and optimising input use, technology is helping citrus farmers minimise their environmental impact while maintaining profitability.

As South Africa’s citrus industry continues to innovate, the adoption of these technologies will be key to ensuring its continued success on the global stage. The future of citrus farming is undoubtedly digital, and by embracing these advancements, farmers can secure a more sustainable and prosperous future for the industry.

Technology is no longer a luxury for South African citrus farmers – it is a necessity. As automated harvesting systems become more widespread, farmers will be able to address labour challenges and harvest more efficiently. While the adoption of these technologies comes with challenges, the benefits far outweigh the costs. As the industry moves towards more sustainable and productive practices, the role of technology in citrus farming will continue to grow.

References

Flyeye.io. (n.d.). Thermal Drone Services in Agriculture. Retrieved from https://www.flyeye.io/thermal-drone-services-in-agriculture/ ScienceDirect. (2023). Application of deep learning for citrus yield prediction. Retrieved from https://www.sciencedirect.com/science/ article/pii/S2199853123001774

Medium. (2021). The Growing Importance of Data Analytics in Agricultural Decision Making. Retrieved from https://medium. com/%40agribazaar/the-growing-importance-of-data-analyticsin-agricultural-decision-making-573323a999d4

FutureFarming.com. (2023). Nanovel Launches Cost-Competitive Robot for Citrus Harvesting. Retrieved from https://www.futurefarming.com/tech-in-focus/nanovel-launches-cost-competitiverobot-for-citrus-harvesting/ Pollensystems.com. (2021). Forrest Faszer Account Executive: Automation in Agricultural Processes. Retrieved from https://www. pollensystems.com/blog/forrest-faszer-account-executive-p8dfhryhzc-k9m3l-d7h2b

Israel21c. (2023). Meet the Farm Robot That Picks Citrus Fruit. Retrieved from https://www.israel21c.org/meet-the-farm-robot-thatpicks-citrus-fruit/

The future of South Africa’s citrus industry

South Africa's citrus industry has long been a key player in the country's agricultural sector, contributing significantly to both the local economy and global markets. The industry is renowned for its high-quality fruit, with exports reaching far corners of the globe, particularly Europe, Asia, and the Middle East.

As the citrus industry faces growing challenges such as climate change, fluctuating labour availability, and market competition, technology, sustainability practices, and market expansion are becoming increasingly critical to its success. This article explores the key trends and innovations shaping the future of South Africa’s citrus industry.

Technological advancements in citrus farming

One of the most prominent shifts in citrus farming in South Africa is the integration of precision agriculture technologies. These tools, including drones, satellite imagery, and soil sensors, are transforming the way farmers monitor and manage their orchards. Drones equipped with multispectral sensors capture high-resolution images of the trees, providing farmers with detailed insights into crop health, soil conditions, and even pest infestations. By using this real-time data, farmers can make more informed decisions about irrigation, fertilisation, and pest control, leading to more efficient and sustainable practices.

Automation in harvesting is another key technological development driving change in the industry. Due to increasing labour costs and the seasonal nature of the work, automation has become essential. Robotic harvesters, such as those developed by companies like Nanovel, are designed to work around the clock, picking fruit without damaging it. These robots use artificial intelligence and advanced sensors to identify ripe fruit, enabling farmers to maximise efficiency and reduce reliance on manual labour. With the global shortage of seasonal farmworkers, automation in citrus harvesting offers a promising solution to labour shortages while improving productivity.

Additionally, artificial intelligence (AI) and machine learning (ML) are being employed to predict pest outbreaks, monitor dis-

ease progression, and optimise harvest times. AI can analyse historical data combined with real-time inputs from the orchard, identifying patterns that help predict when pests are likely to appear or when conditions are ideal for harvest. This predictive capability not only helps farmers stay ahead of issues like pest infestations but also improves resource management by optimising input use.

Sustainability pactices: Balancing growth with environmental responsibility

Sustainability is increasingly becoming a priority in the citrus industry, with growers looking for ways to reduce their environmental impact while maintaining high production levels. One of the most pressing challenges facing the industry is water scarcity. South Africa, a water-stressed country, has prompted citrus farmers to adopt more efficient irrigation systems. Modern smart irrigation systems utilise data from soil moisture sensors, weather forecasts, and evapotranspiration models to deliver precise amounts of water only where and when it is needed. This approach significantly reduces water wastage, ensuring that orchards get the right amount of water for optimal fruit development while conserving precious resources.

Another key sustainability initiative is Integrated Pest Management (IPM). This holistic approach combines biological control agents, like predatory insects, with traditional farming techniques to reduce pesticide use. By focusing on the natural predators of pests and using pesticides only when necessary, the citrus industry can minimise its environmental footprint while ensuring that crops remain healthy. IPM not only reduces the reliance on chemical pesticides but also helps protect beneficial

Die Beste Wetenskap vir die Beste Uitkoms

STAATMAKER VALSKODLINGMOTBEHEER WAT SO SLIM SOOS JY WERK.

Vir die boer kom elke seisoen met ’n lys van uitdagings. Gewasbeskerming moet egter nie een van die bekommernisse wees nie. Dit is hoekom ons Coragen® insekbeheer ontwikkel het; een van die mees gevorderde produkte vir insekbeheer in die wêreld. Om slim te werk het nou baie makliker geword danksy die vinnige en lang nawerkende Valskodlingmotbeheer in sitrus. Coragen® insekbeheer bied ’n unieke metode van werking met ’n uitstekende toksikologiese- en omgewingsprofiel. Die nuwe wapen in die geïntegreerde beheer arsenaal teen Valskodlingmot en beter vrugkwaliteit verlaag die risiko van afkeurings vir uitvoervrugte na die meeste uitvoermarkte. Beter gewasbeskerming en bewaring van voordelige insekte –dit is mos wat elke sitrusboer wil hê.

Kontak jou naaste FMC-handelaar om meer uit te vind oor Coragen® insekbeheer.

The future of South Africa’s citrus industry

FROM PAGE 20

insects and pollinators, which are essential for the overall health of the ecosystem.

In addition to water and pest management, the industry is exploring ways to reduce its carbon footprint. Farmers are increasingly turning to renewable energy sources, such as solar and wind power, to operate irrigation systems and processing plants. The use of energy-efficient technologies and better waste management practices further contributes to reducing the industry's overall environmental impact. These efforts are aligned with global sustainability goals and position South African citrus growers as leaders in eco-friendly agricultural practices.

Market expansion: Reaching new consumers globally

For years, South African citrus exports have been concentrated in Europe, but the industry is now looking beyond traditional markets. Diversifying export markets has become a strategic focus to reduce dependence on a single region. As global demand for citrus grows, emerging markets in Asia, the Middle East, and Africa are becoming increasingly important. South Africa's strategic location and its participation in trade agreements like the African Continental Free Trade Area (AfCFTA) open up new opportunities for the citrus industry to expand its reach.

The expansion into Asian markets, particularly China and India, is a key growth area. These countries' growing middleclass populations are increasingly seeking healthy, fresh produce like citrus fruits, which are rich in vitamin C and other essential nutrients. South African citrus producers are positioning themselves to meet this rising demand by improving quality standards and ensuring the freshness of their exports through better supply chain management and logistics.

In addition to geographical diversification, there is also an increased emphasis on branding and consumer engagement. With the rise of social media and e-commerce platforms, consumers are more informed and discerning about the food they purchase. South African citrus growers are investing in branding strategies that highlight the quality, sustainability practices, and origins of their products. By telling the story behind the fruit, whether it’s the farm’s commitment to sustainable water management or its use of renewable energy, South African citrus producers are able to connect with consumers and build loyalty, particularly in premium markets.

Challenges and strategic responses

While the future of South Africa's citrus industry is bright, there are several challenges that need to be addressed to ensure continued growth and success. Climate change remains a significant threat, with unpredictable weather patterns such as extreme temperatures, droughts, and floods impacting crop yields. To combat these challenges, growers are increasingly investing in climate-resilient rootstocks, which are better equipped to withstand harsh environmental conditions. Additionally, farmers are adjusting planting schedules and using shade nets and windbreaks to protect crops from extreme weather.

Another challenge facing the industry is logistical constraints.

The freshness of citrus fruits is crucial for export markets, particularly those in Europe and Asia. Any delay in transportation can lead to spoilage and reduced quality. To address this, the industry is focusing on improving port infrastructure and cold storage facilities. With upgrades to existing infrastructure and better coordination in the logistics chain, South Africa can ensure that its citrus exports arrive at their destination in peak condition.

Lastly, South African citrus growers must stay vigilant in meeting international regulations. The industry is committed to adhering to the high standards required by the European Union, the United States, and other key markets. These standards cover everything from pesticide residue levels to quality assurance systems. In response, the industry is investing in certification programmes, quality assurance systems, and training for farmers to ensure compliance with these regulations.

The road ahead

The future of South Africa’s citrus industry lies in innovation, sustainability, and strategic market expansion. By adopting new technologies, such as drones, AI-powered harvesting robots, and smart irrigation systems, citrus farmers are optimising production and ensuring that they can meet the growing global demand for their products. At the same time, by focusing on sustainability, including efficient water management, integrated pest management, and carbon footprint reduction, the industry is contributing to the global goal of sustainable agriculture. Market expansion, particularly into emerging regions like Asia, offers significant growth potential for South African citrus producers. Through improved branding, strategic trade agreements, and the commitment to quality, South Africa is poised to strengthen its position as a leader in the global citrus market. While challenges such as climate change, labour shortages, and logistics remain, the industry's response through technology adoption and infrastructure improvements will ensure that South Africa’s citrus sector remains competitive and sustainable in the years to come.

References

1. Standard Bank. (2025). Driving Innovation and Sustainability in South Africa's Citrus Industry. Retrieved from https://www.standardbank.co.za/southafrica/news-and-media/newsroom/driving-innovation-and-sustainability-in-south-africas-citrus-industry

2. National Agricultural Marketing Council. (2024). Trade Probe Issue 99 | December 2024. Retrieved from https://www.namc.co.za/wpcontent/uploads/2025/01/Trade-Probe-Issue-99-December-2024. pdf

3. Citrus Growers' Association of Southern Africa. (2024). Annual Report 2024. Retrieved from https://www.cga.co.za/wp-content/uploads/2024/12/CGA-Annual-Report-2024-AW.pdf

4. Farmonaut. (2025). South African Farming: 2025 Agriculture Innovation. Retrieved from https://farmonaut.com/africa/south-africanfarming-2025-agriculture-innovation

5. ResearchGate. (2021). Innovation and Inclusion in South Africa's Citrus Industry. Retrieved from https://www.researchgate.net/publication/356391474_Innovation_and_inclusion_in_South_Africa%27s_ citrus_industry

SA citrus export estimates adjusted upward

The Citrus Growers’ Association of Southern Africa (CGA) has adjusted export projections for the current season upward, following the latest round of Variety Focus Group meetings. In August 2025, an estimated 188,2 million 15 kg cartons are expected to be packed for export.

This is a 10% increase from the 171 million cartons initially projected.

CITRUS GROWERS’ ASSOCIATION OF SOUTHERN AFRICA

Exceptional demand in overseas markets for processinggrade juicing oranges and juicing lemons accounts for a large part of the increase in exports. Favourable growing and weather conditions, as well as improved production efficiencies, also contributed. Stronger demand for fruit in the Northern hemisphere at the start of the season further boosted early lemon and orange exports.

“The sector continues to work closely with its partners to ensure steady and stable delivery to all markets. Industry leaders remain focused on delivering a successful season,” said Chief Executive Officer of the CGA, Dr Boitshoko Ntshabele. He explained that the Valencia orange figures are largely in line with the five-year average and that total volumes fit within the CGA’s long-term growth strategy.

The Southern African citrus industry could create 100 000 new jobs by increasing exports to 260 million 15 kg cartons by 2032. On this, Ntshabele said: “Volumes alone are of course just one metric with which to gauge an industry. Apart from trade turmoil, rising input costs and the EU’s continued unscientific and unfair plant health trade barriers are also impacting growers. With the projection of 188,2 million cartons this year, our industry is on course to achieve our targets. But for jobs to be created out of these volumes, the new citrus must find markets. Therefore, market retention and expansion are essential.

“Not improving market access across the board – including the US, China, India, Japan and others – will result in a missed opportunity for serious job creation. We are hopeful that the South African government will continue to assist with expanding market access in the future.”

It is estimated that 29,6 million 15 kg cartons of Navel oranges will be packed for export, an 11% increase from the original estimate of 26,1 million cartons. The projection for Valencia oranges has also been revised upward by 4%, from 52 million 15 kg cartons to 54,5 million cartons. The peak of the Navel season has passed, and Valencia packing is expected to con-

tinue before tapering off towards the end of the season.

In general, the sizing of oranges from the Northern regions is larger and those from the Southern regions smaller than usual. The sizes balance out in a complementary way, ensuring that all markets will be supplied with their preferred specification.

For mandarins, the original estimate earlier this year was 44,9 million 15 kg cartons. The latest projection stands at 49,3 million cartons, an increase of 9%. The late mandarin types are currently being packed, with the Satsuma and Clementine seasons completed. Better than average pack-out and favourable growing conditions have bolstered production.

The projection for lemons has also been increased to 39,6 million 15 kg cartons, supported by a larger third lemon set and strong demand across most markets.

The grapefruit export season is effectively over, with final volumes expected at 15 million 15 kg cartons, slightly below the original estimate of 15,3 million. It has been a stronger year than the previous one for grapefruit growers, with excellent demand in some markets.

“Growers and exporters should keep in touch with the markets to ensure the right quantities and quality product is arriving,” said Ntshabele. “The quality of the fruit is great. The whole season has been about two weeks earlier than the previous year, allowing for a smooth transition back to Northern hemisphere supply.”

“In general, the ports have been much more efficient this year, in part due to added equipment and new management strategies. This has helped get fruit out earlier than usual. However, with a larger projected crop, it will be important to keep the fruit moving swiftly through the ports over the next three weeks,” said Paul Hardman, chief operating officer of the CGA.

Regarding the 30% US tariff imposed on South African citrus recently, Ntshabele noted: “The Southern Hemisphere’s citrus is well past its peak, and local growers managed to accelerate shipments to the US ahead of the deadline. This has lessened some of the effects of the tariff on the current season’s exports. But should a mutually beneficial trade deal not be concluded, our next season will unfortunately feel the full effect of the tariff. Rural communities could then be hit hard.”

Consumer trends shaping the future of fresh produce

Global consumer preferences are shifting rapidly, driven by economic pressure, rising health awareness, digital acceleration, and growing environmental concern. At the recent IFPA Southern Africa Conference, Euromonitor International’s Relebohile Ramosoeu unpacked the top global consumer trends for 2025, providing valuable insights for businesses across the fresh produce value chain.

These consumer trends offer clear signals to stakeholders in the fruit and vegetables sector: from producers and retailers to exporters and marketers. Understanding them can shape innovation, marketing strategies and product positioning in ways that resonate with today’s evolving shopper.

Healthspan over lifespan

The concept of “healthspan”, living healthier for longer, is emerging as a key consumer aspiration. Consumers are not only investing more in health and wellness, but are increasingly seeking preventative and age-specific solutions that support longterm wellbeing.

More than half of global consumers believe they will be healthier in the future than they are now, with a growing number using apps to track health metrics. This trend presents a strong opportunity for the fresh produce sector to reinforce its role in preventative nutrition. Fresh fruit and vegetables, with their natural vitamins, antioxidants, and fibre, are uniquely positioned to be promoted as part of a long-term health strategy.

Ronald Whelan, CEO of Discovery Health, emphasised the significance of small, consistent healthy choices, stating they could have a substantial impact on both healthspan and lifespan. For fresh produce stakeholders, this underscores the importance of clear messaging around the nutritional value and health benefits of their products.

Strategic spending with 'wiser wallets'

Economic uncertainty continues to influence purchasing habits. Shoppers are more intentional, weighing both short- and longterm needs before spending. Three in four consumers report concern over rising daily costs, while nearly half are actively trying to save more money.

This trend, termed 'wiser wallets', signals a shift towards perceived value, not just in price but also in benefit. For the fresh produce industry, this highlights the importance of promoting affordability, versatility, and freshness. Pieter Engelbrecht, CEO of the Shoprite Group, reinforced this point, explaining that affordability is a non-negotiable aspect of their strategy.

Private-label retail brands, particularly in food staples, are also gaining traction. This presents opportunities for local growers and packers to collaborate with retailers on house-brand initiatives that meet budget-conscious consumer needs.

Eco logical: Green but grounded

While sustainability remains a core issue, today’s consumers take a more practical view of eco-conscious purchasing. Green attributes such as eco-friendly packaging, local sourcing, and minimal waste are appreciated, but they are often considered added benefits rather than sole motivators for purchase.

TO PAGE 26

Unieke chemie. Unieke voordele.

SumiPleo® word reeds wyd vertrou as effektiewe alternatiewe chemie vir weerstandsbestuur van Lepidoptera plae in Suid-Afrika. Beheer van Aartappelmot en Tuta absoluta in aartappels, Afrika bolwurm en Tuta absoluta in tamaties, Ruitrugmot in koolgewasse asook Afrika bolwurm in blaarslaaisoorte is geregistreer. Registrasie vir die beheer van Herfskommandowurm (Spodoptera frugiperda), ’n indringerplaag op mielies en suikermielies is ook nou beskikbaar. ‘n Afname in skade as gevolg van Liriomyza huidobrensis en Liriomyza trifolii op aartappels, asook Liriomyza trifolii en Chrysodeixis acuta op tamaties kan verwag word met die gebruik van SumiPleo®

VERSTANDIGE KEUSE

• Unieke chemiese molekuul (dichloropropeen-derivaat), met ’n nuut geïdentifiseerde metode van werking wat nie met enige ander bestaande aktiewe bestanddeel gedeel word nie. Geen kruisweerstand met ander chemiese groepe is tans bekend nie.

• ’n Kontak- en maaginsekdoder in ’n emulgeerbare konsentraat-formulasie.

• SumiPleo® is aktief teen alle larvale instars. Kort ná inname (3 tot 4 uur) hou teiken-larwes op met vreet.

• Dit het byna geen nadelige impak op voordelige organismes soos roofmyte, wespes, voordelige kewers, erdwurms of bestuiwers soos bye nie.

• SumiPleo® benodig nie bykomende bevorderings- of kleefmiddels nie. Dit het uitstekende reënvastheidvermoë sodra die spuitmengsel op die teikenplant droog geword het.

• SumiPleo® is ideaal vir gebruik in ‘n Geïntegreerde Plaagbestuur Strategie. DiPel® DF en Florbac® WG, Philagro SA se uitstaande Bacillus thuringiensis aanbiedings, maak uitstekende biologiese vennote met die gebruik van SumiPleo®

Vir meer inligting oor SumiPleo®, gesêls vandag nog met jou naaste Philagro-deskundige.

LEES DIE ETIKET VOOR GEBRUIK. DIPEL® DF (Reg. Nr. L6441, Wet Nr. 36 van 1947) bevat Bacillus thuringiensis, var kurstaki (Bakterië) (32 000 IE/mg). Hierdie produk is nie geklassifiseer as gevaarlik volgens GHS nie. FLORBAC® WG (Reg. Nr. L5531, Wet Nr. 36 van 1947) bevat Bacillus thuringiensis, var aizawai (Bakterië) (15 000 IE per mg). WAARSKUWING: Veroorsaak ernstige oogirritasie. Skadelik vir waterlewende organismes. SUMIPLEO® (Reg. Nr. L8377, Wet Nr. 36 van 1947) bevat Pyridaliel dichloropropeen derivaat (500 g/L). GEVAAR: Mag dodelik wees indien ingesluk en in lugweg beland (aspirasiegevaar). Mag allergiese velreaksie veroorsaak. Veroorsaak oogirritasie. Mag slaperigheid of duiseligheid veroorsaak. Baie giftig vir waterlewende organismes met langdurige gevolge. DiPel® en FlorBac® is geregistreerde handelsmerke van Valent Biosciences LLC, Libertyville, VSA. SumiPleo® is ‘n geregistreerde handelsmerk van Sumitomo Chemical Company, Tokyo, Japan.

Philagro Suid-Afrika (Edms) Bpk l Reg. Nr.: 98/10658/07

PostNet Suite #378, Privaatsak X025, Lynnwoodrif 0040

Pretoria: 012 348 8808 l Somerset Wes: 021 851 4163 www.philagro.co.za

Tindrum

Consumer trends shaping the future of fresh produce

FROM PAGE 24