South Africa's mango sector is at crossroads

WATERMELON RANGE

AMIN 29 (Diploid)

Ideal for early season

Large to extra-large, uniform fruit

Deep red flesh with high brix and excellent taste

Very high yielding with strong vines

Resistance: IR Fusarium (1) and Anthracnose (1)

Fruit weight of 11kg to 15kg

TALCA (Triploid)

Ideal for summer and early season

Large to medium, uniform, seedless fruit

Deep red, crisp flesh with long shelf life

High brix and excellent taste

Vigorous vines with high yield

Resistance: IR Anthracnose (1)

Fruit weight 8kg to 11kg

TURBO 840 (Diploid)

Early maturity

Very high yielding with uniform fruit

Deep red flesh colour, firm texture and high brix

Resistance: IR Fusarium (1) and Anthracnose (1)

Fruit weight of 11kg to 16kg

ARIADNE (Diploid)

Early maturity

Deep red, firm flesh with long shelf life

High yielding, with high brix and excellent taste

Resistance: IR Fusarium (1) and Anthracnose (1)

Fruit weight of 10kg to 13kg

CARINA (Diploid)

Attractive oval fruit with dark green rind and crimson red flesh

Very firm texture, good flavour and brix

Uniform, fruit weight of 10kg to 15kg

Very high yield potential

Resistance: IR Fusarium (0,1) and Anthracnose (1,3)

ESSENCE (Triploid)

Ideal for summer season

Large, uniform, seedless fruit

Deep red, very crisp flesh with long shelf life

High brix and excellent taste

Very vigorous vines with high yield

Fruit weight of 9kg to 10kg

Resistance: IR Powdery Mildew

LIVERPOOL (Diploid)

Very early maturity

Very strong vines with high yield

Deep red, firm flesh with good shelf life

High brix and good taste

Resistance: IR Fusarium (1), Anthracnose and Powdery Mildew (1)

Fruit weight of 11kg to 15kg

SANTA MATILDE (Diploid)

Ideal for summer and early season

Deep red, firm flesh with long shelf life

High yielding, with high brix and excellent taste

Resistance: IR Fusarium (1) and HR Anthracnose (1)

Fruit weight of 11kg to 14kg

Edition 228 ISSN 1015-85 37 www.vegetablesandfruitmagazine.co.za

COVER

The South African mango industry is mainly focused on the domestic market, with only a small portion of production being exported.

EDITORIAL

Willie Louw (Group editor)

Carien Daffue (Editor) 082 927 8294 018 293 0622 info@mediakom.co.za PO BOX 20250, Noordbrug, 2522

ADVERTISING

Jana Greenall 082 780 9914 mediacom@lantic.net

DESIGN

Mercia Venter studio.chatnoir@gmail.com

Bly ingelig en volg ons op Facebook. Keep up to date and follow us on Facebook. Besoek ons webtuiste | Visit our website: Groente & Vrugte | Vegetables & Fruit www.facebook.com/SAGroenteenVrugte www.vegetablesandfruitmagazine.co.za

SUBSCRIPTIONS

Available on subscription only - visit website: Slegs met intekening beskikbaar - besoek webblad: www.vegetablesandfruitmagazine.co.za

1 Year @ R258.00 (6 issues) 2 Years @ R490.00 (12 issues)

In case of address change, please quote or attach previous address label Special rates for group subscriptions VAT included

Weens afleweringsprobleme met die gewone posdiens word intekenare en lesers versoek om hul e-posadresse aan info@mediakom.co.za te stuur vir die elektroniese versending van GROENTE & VRUGTE - VEGETABLES & FRUIT.

Due to delivery problems with traditional mailing services subscribers and readers are requested to send their e-mail address to info@mediakom.co.za for electronic delivery of VEGETABLES & FRUIT - GROENTE & VRUGTE.

NEWS

4 Smart farming drives record Pink Lady packouts

4 Reopening preserves jobs and strengthens regional growth

5 Capespan’s managing director steps down

5 Minister signs stone fruit trade protocol with China

6 Corteva celebrates women in agriculture at a women’s brunch

7 2025 Absa Top 10 Olive Oil Awards winners

SUBTROPICAL FRUIT & NUTS

08 Macadamia growth with headwinds

9 Amber Macs Macadamia Expo strengthens collaborations

12 Climate-smart production and new market openings for avocado

13 Litchi orchards need adjustments to survive in hotter and drier conditions

15 South Africa’s mango sector is at crossroads

18 Guide to practical gains for avocado orchards

20 Peppers under protection: light quality and photoperiod

22 Continued professional development is a cornerstone and commitment 24 Mitigating FROST efficiently

26 Tamatieboerdery sonder KNO3 sal nie deug nie

28 Agricultural Writers SA North celebrates the champions of agriculture

Smart farming drives record Pink Lady packouts

Years of strategic investment and collaboration have paid off for Tru-Cape growers, who recently achieved their best Pink Lady® packouts to date. At Ceres Fruit Growers, packouts reached nearly 75%, the highest in the company’s history, while the Two-a-Day packhouse reported an eightpercentage-point improvement over the previous season.

The achievement reflects a coordinated, long-term effort among growers to improve colour development, fruit quality, and yield consistency. A key insight was that increasing the share of fruit meeting the Pink Lady standard, rather than being sold as generic Cripps Pink, could meaningfully improve profitability.

In warmer regions, growers such as Kootjie Viljoen of Oewerzicht near Greyton have introduced techniques to enhance light penetration and fruit colouring. These include summer pruning, breaking leaves around fruit clusters, and placing reflective mulch under trees to direct sunlight into shaded areas. Viljoen reports that the mulch system has boosted Pink Lady yield by around 20%.

In cooler areas like the Witzenberg Valley, overhead irrigation is used during ripening to encourage deeper red blush without affecting firmness or internal quality. Shade nets are also widely applied to reduce sunburn and promote uniform colour.

At Laastedrif, Rossouw Cillié has revisited planting layouts, trellis systems and rootstock choices to improve airflow, light distribution and microclimate control.

Tru-Cape’s progress is underpinned by precision management. Tools such as GPS-guided fertiliser spreaders, smart irrigation systems, and advanced weather forecasting platforms are now common. Knowledge sharing among growers has

also strengthened, helping align strategies and outcomes across regions.

Thanks to greater consistency and quality, export markets have responded strongly. Tru-Cape reports a 30% year-onyear increase in Pink Lady demand from Europe. Exports to Russia, the Middle East, and India have also risen, with more than 100 000 cartons shipped to Russia this season, a record.

Although Pink Lady remains a freely plantable cultivar in South Africa, Tru-Cape stresses that disciplined quality management is essential to protect the brand’s value. Ongoing trials with colour-enhanced strains, precision technologies, and system upgrades aim to sustain this positive momentum.

Reopening of fruit facility preserves jobs

Westfalia Tiger Brands has confirmed that the Ashton canned fruit facility will resume operations under new ownership. The new operating company, Langeberg Foods (Pty) Ltd, is backed by a consortium that includes local fruit producers through the Ashton Fruit Producers Agricultural Co-operative, Norfund and the Langeberg Community Trust, which holds a 10% stake.

The transition will preserve more than 3 000 permanent and seasonal jobs in the Breede River Valley and surrounding areas. In terms of the sale agreement, no retrenchments will occur for at least three years, offering stability to workers and communities that depend on the factory. The deal is viewed as a crucial boost to the region’s agricultural economy, particularly for deciduous fruit producers supplying Ashton.

Tiger Brands’ withdrawal from the deciduous fruit business was first announced several years ago, and this transaction concludes a lengthy process to find a buyer aligned with longterm sustainability objectives. As part of the agreement, Tiger Brands will invest R150 million in a community trust to fund socio-economic development projects in the Langeberg region.

The Ashton facility produces canned fruit, purées and processed products, with over 80% destined for export to Europe, China, Australia, and Japan. It will also continue supplying Tiger Brands’ KOO brand for the domestic market. The factory’s role as a processing hub remains vital for growers across Robertson, Ceres, Breede River, and the Klein Karoo, many of whom rely on the facility for access to processing and export markets.

The improvement in packouts reflects a coordinated, long-term effort among growers to improve colour development, fruit quality, and yield consistency.

Capespan’s managing director steps down

Capespan’s managing director, Tonie Fuchs, resigned as part of a planned leadership transition. No successor has yet been confirmed.

In its statement, the company expressed appreciation for Fuchs’ leadership and his contributions to both Capespan and the broader fruit industry. The board reaffirmed its commitment to maintaining stability and continuity during the transition period.

Capespan plays a central role in South Africa’s fruit export chain, providing marketing, logistics, and quality assurance services for a wide range of produce. Under Fuchs’ leadership, the company expanded its export footprint and improved operational efficiency.

Capespan confirmed that the process to appoint a new managing director is underway. In the interim, senior execu-

tives will oversee operations to ensure business continuity. Growers, supply partners, and clients have been assured that the transition is being managed carefully and without disruption.

Given Capespan’s importance in the export landscape, the appointment of a successor will be significant for growers whose fruit moves through the company’s network. The new managing director will take on responsibilities including market expansion, logistics optimisation, compliance, and quality management.

Cold chain performance, value-add packaging, and cultivar diversification will remain key focus areas. The company has reiterated its long-term commitment to supporting growers, improving export competitiveness, and expanding access to emerging markets.

Minister signs stone fruit trade protocol with China

South Africa and China signed a fruit trade protocol, the first time China has negotiated access for multiple stone fruit varieties from a single country under one agreement. The Minister of Agriculture, John Steenhuisen, and his Chinese counterpart, Sun Meijun, have signed the protocol in Shanghai.

According to a statement from the Department of Agriculture, Land Reform and Rural Development, the agreement officially opens the Chinese market to five South African stone fruit types: apricots, peaches, nectarines, plums, and prunes.

Minister Steenhuisen described the protocol as a breakthrough for local fruit producers and exporters at a time when diversification is essential for agricultural resilience. He said that the expanded access to China’s market has the potential to partially offset the impact of recent tariff increases, particularly those affecting plums.

According to the Department, the new trade opportunity could unlock about R400 million over the next five years, with that figure potentially doubling over ten years. The first export season under this agreement is expected to generate approximately R28 million, rising to R54 million in the following season.

China’s annual imports of peaches, nectarines, and plums already exceed South Africa’s entire seasonal export volume. The Department estimates that by 2032, stone fruit exports to China could represent around five percent of total national export volume.

Minister Steenhuisen said the agreement will encourage sustainable pricing and investment in new orchards. Over

the next decade, the initiative could support about 350 new direct jobs on farms and in packhouses, and approximately 600 additional jobs in related sectors such as transport and packaging.

During discussions in Shanghai, the minister also addressed the reopening of beef exports from selected regions in South Africa and progress on foot-and-mouth disease regionalisation. He invited a Chinese technical team to visit the country to inspect cherry and blueberry orchards and packhouses during the current harvest. If this visit proceeds successfully, South Africa may secure cherry market access during the next harvest cycle, further expanding trade opportunities.

The Department highlighted that investments linked to China’s belt and road initiative are already improving logistics infrastructure, including railways, ports, and highways. These developments are expected to enhance South Africa’s ability to move produce efficiently to global markets.

Minister Steenhuisen said that China has been South Africa’s largest trading partner for more than a decade, and this agreement strengthens a partnership that benefits both nations.

“The signing of this protocol reflects the shared commitment between South Africa and China to strengthen agricultural trade, create employment, and drive inclusive growth,” he said.

Corteva celebrates women in agriculture at a women’s brunch

Corteva Agriscience recently hosted a women’s brunch celebration, honouring women in agriculture and highlighting the company’s commitment to female empowerment. The event gathered women farmers, agritech professionals, community leaders, and industry stakeholders to connect, share experiences, and reaffirm their shared purpose of inclusive agricultural growth.

The celebration formed part of Corteva’s SoilSistas initiative, an empowerment programme that provides mentorship, training, and technical support to women in farming communities. Through this initiative, more than one hundred women across South Africa have been trained in agricultural and business skills, giving them practical tools to expand and formalise their enterprises.

At the brunch, participants reflected on their journeys in agriculture, sharing both their challenges and their successes. Speakers emphasised that women often carry multiple roles within their families and communities, while also managing farms and agribusinesses. Many spoke about how critical access to mentorship, modern technology, and market opportunities is for sustainable growth.

Corteva representatives announced plans to further expand the SoilSistas programme by introducing additional technical modules on digital agronomy, business scaling, and climatesmart farming. These new elements aim to equip women with the skills and confidence to navigate a changing agricultural landscape.

An awards segment formed part of the event, recognising exceptional SoilSistas participants who had demonstrated innovation, resilience, and measurable business growth. Recipients were celebrated for transforming their farms into thriving enterprises and for serving as role models in their local communities.

Partnerships featured strongly throughout the celebration.

Mirriam Mashego, Programme Manager at GIBS, and Guinivere Pedro, Head of Entrepreneurship Development Academy - GIBS, enjoying the day with Corteva.

Representatives from agricultural finance institutions, technology providers, and community development agencies shared their commitment to supporting women-led agricultural ventures. Several new collaborations were announced to provide improved access to finance, mechanisation, and value chains.

Panel discussions explored critical issues facing women in the sector, including land access, credit barriers, and limited visibility within mainstream agribusiness. Panellists stressed that gender inclusivity is not only a social goal but also an economic necessity, as women play a key role in food production and rural job creation.

Participants also engaged in hands-on workshops that covered soil health, irrigation management, pest control, and record keeping. The sessions emphasised how practical knowledge can drive profitability and resilience on small and medium-

Sindira

Chetty, Digital editor of Farmer’s Weekly, Nono Sekhoto, Co-Founder Circle Generation, Dr Tracy Davis, Executive Director, Commodity Markets & Foresight BFAP, and Linda van der Merwe, Seed marketing & Portfolio Lead, Corteva Agriscience, led the panel discussions that explored critical issues facing women in the sector.

TO PAGE 7

2025 Absa Top 10 Olive Oil Awards winners

South Africa’s finest extra virgin olive oils (EVOOs) were celebrated at the 12th annual Absa Top 10 Olive Oil Awards, hosted at Mynhardt’s Kitchen at Cathedral Cellar in Paarl.

Widely regarded as the highlight of South Africa’s olive oil industry calendar, the Absa Top 10 Olive Oil Awards recognise the most exceptional producers and products in the country. The awards follow the annual SA Olive Awards, where gold medal-winning EVOOs undergo a further round of blind tasting by an expert judging panel. From this elite group, the ten most outstanding EVOOs are selected to receive the accolade.

2025 Absa Top 10 Olive Oil Award winners (in no particular order)

• Mardouw Investments ZA (Pty) Ltd – Mardouw Premium Delicate – Delicate

• De Rustica Estate – De Rustica Delicate – Delicate

• Lions Creek Estate (Pty) Ltd – Picual Extra Virgin Olive Oil –Medium

• Morgenster Estate – Morgenster Extra Virgin Olive Oil –Medium

• W illow Creek Products (Pty) Ltd – Estate Blend – Medium

• Tokara – Tokara Woolworth Estate EVOO – Medium

• Babylonstoren – Babylonstoren Coratina – Medium

• Oudewerfskloof Olive Farm – Picual – Medium

• Andanté Olives Porterville – Andanté Intenso – Intense

• Rio Largo Olive Estate – Rio Largo Premium – Intense.

Now in its 12th year, the awards reflect the continued partnership between Absa and the SA Olive Industry Association, a collaboration that promotes quality, innovation, and sustainability in South Africa’s olive oil sector.

Yolisa Mlungwana, Regional Segment Head at Absa Private Banking, said each bottle of locally produced EVOO tells a story of passion, hard work, and connection to the land, setting

a global benchmark for quality. Absa is proud to once again be part of these awards, which celebrate excellence while supporting producers in building lasting relationships with retailers, distributors, and buyers.

Wendy Petersen, Chief Executive Officer of SA Olive, added that the awards remain the pinnacle of recognition for local producers.

“It is a moment to celebrate the extraordinary talent, skill, and commitment that define this industry. Producers continue to deliver world-class EVOOs that rival the best globally, and their pursuit of excellence is truly inspiring.”

Guests at the ceremony enjoyed an afternoon hosted by chef Mynhardt Joubert, whose bespoke olive-inspired menu showcased the diversity, flavour, and versatility of South African olives and EVOOs. Each course paid tribute to the expertise of the producers with dishes such as black olive roosterkoek, roasted lamb with green olives, and olive oil ice cream, each offering a sensory celebration.

Corteva celebrates women in agriculture at a women's brunch

FROM PAGE 6

sized farms. For many attendees, these sessions provided immediate, actionable insights to apply on their farms.

The atmosphere of the brunch was one of solidarity, optimism, and forward thinking. Participants expressed a renewed sense of motivation to continue expanding their businesses while mentoring other women entering the field. Corteva’s leadership reinforced this energy, stating that the company will continue investing in women’s development and measuring the long-term outcomes of its empowerment initiatives.

The event reinforced the message that women are not

merely participants in agriculture but central agents of change. By empowering them with education, networks, and resources, the agricultural sector strengthens its foundation for sustainability and innovation.

This gathering served as more than a celebration. It was a declaration that women’s inclusion and leadership are essential to the success and resilience of South African agriculture. The stories shared, partnerships formed, and commitments made will continue to inspire progress long after the final toast was raised.

Macadamia growth with headwinds

South Africa’s macadamia industry has evolved from a niche crop into one of the most advanced tree-nut sectors in the world. Plantings continue to expand, new orchards are maturing, and processors are investing in increased capacity.

Yet the landscape is changing. Export markets are becoming more competitive, quality standards are rising, and trade disruptions have created uncertainty around prices and access. Success now depends on aligning agronomy with market demands, embedding compliance in production systems, and investing in people, water, and postharvest efficiency.

Recent analyses confirm that South Africa remains among the top global producers of macadamias, with planted area continuing to rise as orchards reach full bearing. Although weather patterns and crop variability have influenced output expectations, the long-term outlook remains positive as young hectares come into production.

The industry’s knowledge network is strong. Technical days and annual events provide a shared platform for growers and processors to compare practices, discuss new research, and align on market signals. Recent forums have focused on mechanisation, moisture control, cracking efficiency, and the development of new markets.

Cultivar mix and orchard design

Varietal selection remains one of the main levers of profitability. Beaumont remains a preferred cultivar for in-shell markets, while Nelmac and 816 are favoured for kernel recovery and grade quality. Experience has shown that no single cultivar performs best across all sites. Many producers mix cultivars to balance flowering windows, pollination, vigour, and market preference.

High-density orchards are becoming more common as land and water costs increase. These layouts require disciplined canopy management to ensure light penetration and consistent yields. Trials combining reduced-vigour selections with targeted pruning strategies have produced earlier and more stable yields. Processors report that uniform nut size from well-managed blocks improves kernel grade distribution and reduces rework.

Irrigation management is moving from fixed schedules to sensor-based systems. With energy costs and water use under scrutiny, many farms have adopted soil-moisture probes and weather-linked evapotranspiration models. The goal is to apply water precisely when it supports growth and nut fill, then reduce volumes at the right time to maintain quality.

Precision fertigation, guided by regular tissue testing, ensures that nitrogen, potassium, calcium, and boron remain in balance. This reduces husk stick, improves shell strength, and enhances kernel recovery. Many growers note that the timing of nutrient application, rather than total volume, often determines crop performance across seasons.

Pests and biosecurity

Cover crops and mulches are increasingly used to stabilise soil moisture, build organic matter, and encourage beneficial organisms. In high-rainfall regions, growers shape beds and im-

TO PAGE 10

South Africa remains among the top global producers of macadamias, with planted area continuing to rise as orchards reach full bearing.

Amber Macs Macadamia Expo strengthens collaborations

The Amber Macs Macadamia Expo, held annually in White River, runs for two days every February to serve the macadamia farming community. The event features more than 160 exhibitors and 20 guest speakers who showcase the latest technology and ideas shaping the industry. It has become one of the most significant gatherings for macadamia producers in South Africa.

The expo attracts approximately 3 000 visitors each year.

The organising team focuses on presenting the latest macadamia-related innovations and ensuring a valuable and informative experience for attendees.

Amber Macs continues to improve its processing efficiency to deliver the best possible value to its growers. The processing facility team remains committed to supporting producers and refining operations daily. The macadamia industry is still young, and its growth depends on collaboration across the value chain. This spirit of partnership underpins the continued success of the Amber Macs Macadamia Expo.

As part of its strategy to strengthen international market reach, Amber Macs has launched its own retail brand, Giraf. The Giraf range of macadamia milks has, within a year, received three gold awards and one silver at the Food & Home Awards. The products are sold throughout South Africa via Dis-Chem, Spar, Pick n Pay, Wellness Warehouse, Faithful to Nature, and Takealot, and in the United Kingdom through Amazon. Expansion into European and the United States markets is planned for the near future.

The company aims to be recognised for quality and reliability in the eyes of its growers and customers. The company remains committed to hosting industry events that unite producers, processors, and service providers to share knowledge, promote growth, and strengthen community relationships.

Through its value-added brand, Giraf, the company offers global consumers premium macadamia nuts, milks, and

spreads. The brand aims to raise awareness of macadamias while connecting consumers directly with farmers.

The long-term vision is to build a responsive international macadamia brand that aligns the entire value chain, from what producers grow to what consumers demand, under the concept Soil to Soul. This integrated approach reflects the company’s respect for the skill and dedication of South Africa’s macadamia farmers.

The Amber Macs Macadamia Expo takes place on 5 and 6 February 2026 in White River, and tickets are available on Quicket.

5th & 6th February 2026

Please join us for our Fifth Annual Macadamia Expo At Amber Macs, Plot 88 Old Plaston Road, White River.

Come and explore the most cutting-edge technologies to optimize your farming, connect with the industry’s most renowned agronomists and participate in presentations from a wide range of industry experts to help grow your macadamia business.

Tickets will be available on Quicket from 1 November 2025 and will be valid for both days. This expo gets bigger and better every year, not to be missed!

The Amber Macs team.

Macadamia growth with headwinds

FROM PAGE 8

prove drainage to prevent root stress. Integrated pest management focuses on monitoring, sanitation, and threshold-based treatment, with growing attention to residue compliance for export markets. Industry organisations continue to support growers with technical training and biosecurity guidance to ensure compliance across the value chain.

Postharvest discipline is now a major factor in competitiveness. Processors emphasise the importance of rapid dehusking, staged drying, and accurate moisture measurement before cracking. Investment in optical sorting and inline nearinfrared systems has improved efficiency and reduced defects.

Some estates have introduced small-scale on-farm pre-drying units to manage peak inflows during harvest. The overall focus is better coordination between orchard operations and processor intake capacity to minimise grade losses.

Market

Market dynamics have grown more complex. Global supply is increasing as more orchards mature in southern Africa, Australia, and Latin America. Demand remains strong in Asia, particularly China, although buyers are becoming more selective and price sensitive. Trade disruptions in key markets have encouraged exporters to diversify into new regions, such as India and other parts of Asia, to safeguard volume and pricing. This diversification has brought greater contract flexibility and improved risk management.

Independent market observers have trimmed national crop estimates following field checks, which has shifted attention from chasing higher volumes to improving quality and timing. This change reinforces the importance of building market value on traceability, consistency, and service reliability.

International buyers now expect measurable progress in environmental and social performance. Efficient water use, reduced energy intensity, and fair labour practices are no longer optional extras but basic entry requirements. Many macadamia farms have reduced irrigation per kilogram of kernel through better scheduling, while processors have adopted energy-saving dryers and heat-recovery systems.

On the social side, training in first aid, safe handling, and machine operation improves safety and retention. Transformation and enterprise development remain key priorities, ensuring that growth in the sector is inclusive and sustainable.

Important aspects to manage:

• Protect quality through effective moisture management and careful drying.

• Coordinate orchard harvests with processor capacity to avoid bottlenecks.

• Diversify export markets, hedge currency exposure, and use forward sales strategically.

• Keep nutrition balanced through crop-specific fertigation and tissue analysis.

• Design systems that support worker safety and operational reliability.

• Invest in data and measurement tools to improve efficiency in water, power, and compliance.

The outlook for South Africa’s macadamia industry remains positive. With disciplined management, patient investment, and a focus on measurable quality, the sector is well positioned to maintain its reputation for excellence. The producers who succeed will be those who apply consistent standards, manage uncertainty with precision, and treat sustainability as a foundation rather than an aspiration.

The competitive, quality demands are higher, and recent trade tensions have introduced pricing and access uncertainty. Growers who succeed are the ones who match agronomy to market reality, treat compliance as part of production, and invest in people, water, and postharvest systems.

Recent industry and government analyses confirm that South Africa remains a top global producer by volume, with planted area still trending upward as earlier orchards reach full bearing. Output expectations for the current cycle have been adjusted after weather and crop load variability, yet the long-run trajectory stays positive as young hectares come on stream.

The industry’s knowledge network is dense. Macadamias South Africa (SAMAC’s) technical days and the annual MacDay forum give growers and processors a common platform to compare practices, discuss research, and align on market signals. The most recent MacDay programme emphasised mechanisation, moisture management, cracking efficiency, and new market development.

Sources:

• SAMAC Macadamia Day 2025 event page (samac.org.za)

• MacDay 2025 programme information (macday.samac.org. za)

Kry meer as net beskerming vir jou gewas

VIR ‘N PRODUSENT KOM ELKE SEISOEN MET’ N LYS BEKOMMERNISSE. Die beskerming van jou grond en gewasse behoort nie onder dié bekommernisse te tel nie. Daarom het ons Coragen® insekbeheer ontwikkel, een van die mees gevorderde insekbestrydingsprodukte ter wêreld. Coragen® bied doeltreffende gewasbeskerming, terwyl dit nie voordelige geleedpotiges skaad nie. Maak vandag doeltreffende insekbeheer ‘n werklikheid en verseker ‘n volhoubare besigheid vir môre. Kontak jou naaste FMC-handelaar om meer uit te vind oor Coragen® insekbeheer.

Climate-smart production and new market openings for avocado

Avocados remain one of South Africa’s headline subtropical crops. Domestic demand is firm, export interest is widening, and the industry continues to refine production systems for warmer, drier, and more erratic seasons.

The recent opening of Asian markets has added strategic options, while Europe and the United Kingdom remain core. Producers are adjusting cultivar portfolios, water and canopy practices, and postharvest routines to keep pace with quality and compliance demands.

The planted area is expanding, with the Southern and Western Cape gaining share as new orchards reach bearing age. Industry commentary expects a noticeable rise in those regions’ output, which helps to spread climatic risk beyond the traditional northern belts. The shift brings its own challenges, including wind, salt exposure in some coastal zones, and cooler spring conditions that can affect set, yet it improves the national supply balance and timing.

The South African Avocado Growers’ Association (SAAGA) and trade trackers project exports on a rising path, with European programmes still dominant and Asia growing from a low base. Recent logistics notes suggested steady weekly arrivals into Europe through the main shipping window, with quality holding where harvest maturity and cold chain were consistent.

South Africa’s access to China moved from paperwork to shipments recently, with early consignments handled by established exporters. The development followed a phytosanitary agreement and has been reinforced by further promotional activity. Officials and industry leaders frame the opening as a long-term play, where quality and consistent arrivals build trust. Japan has also been highlighted as a strategic opportunity under specific cold-treatment protocols.

Early trade coverage reported the first lots arriving in Shanghai, carried by brands with ripening and distribution capability. Analysts point out that smaller volumes at first are normal, since exporters and receivers refine protocols before scale. The immediate benefit is option value, where exporters can shift a portion of fruit away from saturated weeks in Europe.

The Hass cultivar remains the commercial anchor, yet the local breeding and evaluation pipeline continues to test options for heat tolerance, cropping regularity, and taste.

Companies have publicly showcased a large variety of libraries to accelerate the selection of future cultivars. Symposiums and field days emphasise that a cultivar choice should be made with site, market window, and polliniser mix in mind, rather than only chasing yield.

Orchard architecture is evolving. Trellised avocados, open V and spindle concepts borrowed from pome fruit, and systematic summer pruning are gaining traction, particularly on windy or high-radiation sites. Field demonstrations at the Allesbeste group’s events repeatedly highlight the gains in light distribution, earlier bearing, and picking efficiency from structured

canopies, while cautioning about cost and training needs.

Water scarcity and cost have turned irrigation into a precision discipline. Producers use probes, weather data, and blockspecific evapotranspiration to determine pulse length and frequency. The aim is to support flower initiation and fruit set, then keep trees in balance to control vegetative surges that shade fruit. Nutrition is linked to phenology, with attention to nitrogen restraint during sensitive stages, potassium and calcium management for firmness and disorders, and boron for set. These practices align with messages shared at SAAGA and regional technical forums.

Microclimate tools such as shade cloth, reflective mulches, and windbreak design help reduce sunburn, manage chill events, and stabilise fruit finish. In new coastal blocks, wind protection and salt drift mitigation are non-negotiable establishment costs.

Export programmes demand uniform dry matter and robust postharvest handling. Consistent maturity testing, careful picking to avoid pedicel damage, rapid field heat removal, and controlled ripening for programmes are the basics. Receivers report fewer claims when fruit is harvested at the correct dry matter and kept within tight temperature bands from the orchard to the ripening centre. Weekly market notes in Europe during the current season have reinforced that message.

South Africa enjoys a voyage-time advantage to parts of Asia relative to some competitors. Exporters are using that edge to target windows when supply from Pacific producers softens. The strategy only works when ports, container availability, and ripening capacity are aligned. Coverage of early-season China programmes pointed to mixed channel strategies, with fruit placed across modern retail, e-commerce, and wholesale to build awareness while hedging demand variability.

Industry strategy is shifting from promoting South Africa as an origin to growing category demand in priority countries through the World Avocado Association and local partners. That approach supports all origins in the short term, but creates space for South African programmes if quality is reliable. It also reduces the risk of origin fatigue in mature markets. The risk profile is familiar but evolving.

• Climate variability affects flowering, set, and sunburn.

• Input costs for energy and fertiliser pressure margins.

• Residues and phytosanitary compliance demand exact record-keeping and process control.

• Logistics disruptions can erase programme value if arrivals miss retail windows.

• Market competition from Morocco and countries is real, TO PAGE 14

Litchi orchards need adjustments to survive in hotter and drier conditions

South Africa’s litchi belt is getting warmer and drier. Producers in the Mpumalanga and Limpopo areas have observed that the spring and early summer heat waves start earlier, and rainfall has become unpredictable, with longer dry periods and brief, heavy rainfalls.

The direct effects of climate change on litchi farms include irregular flower production, reduced early-season fruit development, sun damage to fruit, and increased postharvest browning when cold chain management fails. The industry has responded rapidly in recent years, transforming how growers select cultivars and manage their canopies and irrigation systems throughout the production chain, from nurseries to packhouses.

Cultivars for a new climate

The market shows rising interest in materials that can handle hot and dry environmental conditions. The South African Litchi Growers’ Association (SALGA) technical forum hosted Israeli researchers who demonstrated tree management systems for hot and dry environments.

This generated strong interest from producers in how different cultivars would perform under South African conditions. The findings showed that farmers can achieve stable yields by choosing the right cultivars and using controlled light exposure for canopies, along with timed irrigation during severe weather.

A subtropical nursery has recently obtained a dedicated cultivar block, enabling scientists to research rooting success among different cultivars for improved litchi production. Nursery operations need expansion because orchardists now select planting blocks and rootstocks that combine heat tolerance with peri-

odic water resistance and vigour management. This nursery development represents a recent shift, indicating that climate-fit material will continue to gain momentum in the long run.

Industry planting data indicate that Mpumalanga continues to be the mainstay of production, while Onderberg remains the largest production area in the region. Limpopo is expanding its territory through block replacement and infill planting of cultivars that perform well in hot weather. The national litchi area has expanded because farmers believe that their adaptation investments will generate returns.

Canopy architecture

Farmers dedicate significant attention to the leaf development process of their crops. The objective for producers is to maintain equal light distribution across the canopy to promote flowering, colour development, and internal quality, while preventing direct sunlight from damaging fruits through sunburn and cracking.

The methods require strict summer pruning to develop light entry points in the mid-canopy area, selective leaf removal near fruiting clusters, and renewal pruning to maintain young, productive fruiting wood. In hotter locations, reflective mulches and the use of overhead micro-sprinklers during heat spikes help lower canopy temperature while preserving the fruit.

The use of netting is becoming more popular as a structural

PAGE 14

The principles developed for citrus and other crops apply to litchi cultivation, as moderate radiation exposure and reduced wind stress improve orchard climate conditions.

Litchi orchards need adjustments to survive in hotter and drier conditions

FROM PAGE 13

intervention. The principles developed for citrus and other crops apply to litchi cultivation, as moderate radiation exposure and reduced wind stress improve orchard climate conditions.

Implementing nets reduces sunburn damage and improves colour uniformity, making the packing process more efficient. Researchers note the need for additional crop-specific studies to determine trade-offs between different net specifications that the litchi industry can use to guide expanded trial operations.

Current water shortages at dams, along with rising pumping costs, require irrigation operations to adopt flexible and responsive management approaches. The agricultural sector is adopting more precise scheduling through a combination of soil moisture probes, weather data, and plant development tracking. The emphasis is on early-season water management to support flowering and fruit set, followed by carefully managed stress to improve colour without reducing size.

Recent research on tree crop transpiration and evapotranspiration has begun to appear in advisory systems that enable farmers to convert weather data into specific irrigation schedules.

Over-tree sprinkling during extreme events is used as an emergency heat-mitigation tool in some districts. The process requires significant water use but operates for short periods that safeguard packouts. Testing of antitranspirants and filmforming products continues, but most farmers prefer physical microclimate tools that can be operated with precise control.

Higher temperatures mean a tighter postharvest window. Packhouses require rapid field heat extraction and controlled sulphur dioxide exposure to preserve the pericarp’s colour quality.

Scientific literature provides detailed insight into enzymatic browning, which becomes more pronounced with increased temperature and time. Any delay between harvesting and cooling increases browning. The industry applies three main solutions: enhanced field bin shading, planned harvests, and faster packline processing.

Pests

Climate stress creates conditions that favour pest population growth. The industry depends on fruit fly management programmes conducted with regional partners to ensure market access. Area-wide sterile release and baiting methods follow national guidelines that align with trading partner requirements.

The false codling moth receives close monitoring in mixed subtropical systems because it attacks multiple hosts, and detection in one crop can harm the reputation of all.

The industry consistently emphasises that export access depends on strict orchard sanitation, pest density monitoring, and postharvest compliance.

Agricultural adaptation requires methods that extend beyond conventional farming. The industry promotes transformation through capacity-building programmes, enterprise development, and inclusive market participation across all fruit sectors.

Technical training for litchi producers includes canopy management, irrigation, and postharvest handling to achieve consistent standards among new entrants and smaller growers who face the same climatic challenges as large estates.

Producers remain realistic. The early planting season will face periodic heat waves and storms that damage crops, while rising production costs will reduce profit margins. The organisation’s strategy remains based on functional, data-driven practices. Improved cultivar matching, smarter canopy management, precision irrigation systems, and disciplined postharvest handling have already led to more stable packouts.

Nursery expansion continues, and regional knowledgesharing networks are strengthening. These systems support South Africa’s ability to deliver fruit that meets market expectations despite challenging weather.

Sources

• South African Litchi Growers’ Association, “SALGA Industry Census 2024,” and website pages (industry updates, symposium). (Litchisa).

Climate-smart production and new market openings for avocado

FROM PAGE 12

which keeps price discipline tight.

• The counter to these risks is system design. Choose sites and cultivars for resilience, design canopies for light and labour efficiency, run irrigation from data, not habit, and build a compliance culture that treats paperwork as part of production.

The near-term themes are clear. New hectares in the South and West will scale, exporters will shape Asia programmes methodically, and technical networks will continue to spread trellising, microclimate, and precision irrigation practices. The target is not only more fruit, but it is better fruit, arriving in the right week, with paperwork and ripeness that meet specifications.

With that lens, South Africa’s avocado sector remains well placed. The combination of agronomic innovation, market access, and collaborative technical culture is a durable platform for growth.

Sources:

• SA Government and trade press on China access and early consignments. Government of South Africa+1

• Westfalia company statements on Asian market development and Japan protocol context, plus variety library announcement. westfaliafruit.com+1

• SAAGA Research Symposium agenda and technical themes. avocado.co.za

South Africa’s mango sector is at crossroads

South Africa’s mango industry has long maintained a dual identity, supplying both local consumers and select export markets.

Recently, however, the sector has faced shifting conditions: fluctuating prices, tighter quality standards, climate pressures, and evolving varietal strategies. The challenge now lies in finding a sustainable balance that rewards growers, attracts investment, and develops markets without exposing the sector to unnecessary export risk.

According to the most recent industry census, South Africa’s commercial mango plantings cover about 5 775 hectares, excluding informal home gardens. Limpopo dominates the sector with approximately 74% of all orchards (around 4 280 hectares). Within Limpopo, the Hoedspruit area alone accounts for nearly half of the national total. Mpumalanga contributes around 22% (about 1 360 hectares), concentrated largely in the Onderberg region. Smaller plantings exist in KwaZulu-Natal, the Western Cape, Gauteng, and North West.

Historically, mango cultivation has been centred in the northeast, where climate conditions are most favourable. More recently, later-season plantings in warmer, drier areas such as Clanwilliam in the Western Cape have extended harvests into April and May. This has helped stabilise national supply and reduce seasonal bottlenecks.

The recent harvest season produced roughly 70 000 tonnes across both commercial and informal sectors, though many

smaller trees remain outside official records. Only around 9% of this volume, approximately 6 400 tonnes, was exported.

The Middle East remains the leading destination, absorbing nearly all exported mangoes. Other regions, including Africa, Europe, and Asia, have seen declining volumes in recent years. Domestically, most fruit is sold through informal channels such as roadside and farmgate trade, or via national fresh produce markets. Around a quarter of total production moves through formal market channels, with the remainder processed into dried, juiced, or pickled products.

This structure highlights a defining feature of the industry: South Africa’s mango sector remains primarily anchored in domestic and processing markets rather than large-scale export trade.

The past season underscored just how volatile mango markets can be. After several months of tight supply and strong prices, demand weakened abruptly. Scheduled promotions were cancelled, planned volumes reduced, and prices dropped below production cost in some regions.

Producers attribute this reversal to inconsistent fruit quality, stronger competition from other origins, and overestimation of demand. While supply itself was not excessive, markets

TO PAGE 16

The recent mango harvest season produced roughly 70 000 tonnes across both commercial and informal sectors.

South Africa’s mango sector is at crossroads

FROM PAGE 15

were unable to absorb available fruit. The experience serves as a reminder that volume expansion without demand alignment can quickly lead to financial strain. For most growers, a sharper focus on quality, consistency, and market responsiveness will prove more sustainable than expansion alone.

South Africa grows a range of cultivars, though varietal renewal has been limited in recent years. Established names such as Tommy Atkins, Kent, Keitt, and Sensation continue to dominate, while newer cultivars are being evaluated for their potential to improve yield, flavour and postharvest life.

Producers are increasingly interested in varieties that balance productivity with shelf life and export resilience. Orchard renewal programmes are underway to replace ageing trees and introduce better rootstocks, higher-density plantings, and improved irrigation systems. Managing alternate bearing through canopy control, pruning, and light management is becoming central to maintaining consistent yields and fruit quality.

Climate variability remains a key constraint. Heat stress, erratic rainfall, and drought have affected flowering, fruit set, and size development. Precision irrigation, supported by soil probes and evapotranspiration models, is helping farmers manage water more efficiently while protecting quality.

Pest pressure continues to limit export potential. Fruit flies and mango seed weevils remain major quarantine concerns that require area-wide trapping, baiting, and strict postharvest protocols. In addition, physiological disorders and handling damage can compromise quality and lead to market rejections. Consistent orchard management and careful handling are therefore critical for maintaining access to high-value markets.

With exports representing a small fraction of total production, processing remains vital to the industry’s stability. A large portion of the crop is channelled into dried products, juice, and pickled mango (achar), providing a market for fruit that does not meet fresh-export specifications.

Processing helps absorb surpluses and reduce price pres-

South Africa’s mango sector is unlikely to become a major bulk exporter, yet it holds strong potential in premium fresh markets and value-added processing.

sure during years of high yield, though margins remain tight, and infrastructure investment can be challenging. Niche freshmarket opportunities, particularly in premium and branded segments, show potential if producers can maintain traceability, consistent supply, and quality assurance systems.

Key challenges for the sector include:

• Variability in fruit quality, colour, and internal condition.

• Export compliance issues and phytosanitary risks.

• Price pressure when multiple producing regions overlap.

• Rising input and energy costs are reducing profitability.

• Logistics and cold chain inefficiencies leading to losses.

• Limited access to capital for upgrading production and processing systems.

Addressing these requires better coordination between growers and markets, renewed investment in orchard modernisation, stronger pest and disease management, and targeted support to help smaller producers meet compliance and market standards.

South Africa’s mango sector is unlikely to become a major bulk exporter, yet it holds strong potential in premium fresh markets and value-added processing. By focusing on orchard renewal, improved irrigation efficiency, and quality-driven marketing, the industry can achieve sustainable growth.

Future success will depend less on scale and more on precision, producing the right fruit for the right market. Growers who invest in quality management, trial new varieties, and build resilient market relationships will be best positioned to thrive in the years ahead.

Sources:

• SAMGA Census, “SAMGA Industry Census 2024” SA Mango Growers' Association

• SouthAfrica.co.za, “Mango production in South Africa” South Africa Online

Guide to practical gains for avocado orchards

South Africa’s subtropical belt produces some of the most dynamic, quality-driven avocados in the world, but it is also exposed to heat spikes, dry spells, salinity pressure in irrigation water, and the perennial challenge of converting flowers into packable fruit.

Linda Greyling and Nico Engelbrecht KELPAK

In this context, growers have steadily adopted Kelpak® Liquid Seaweed Concentrate (Reg. No. M437 Act No. 36 of 1947) as a management tool to support tree performance and improve marketable yield, while staying within label-based, fieldproven practice.

Across multiple trials, Kelpak has been shown to help trees cope with abiotic stress and to lift total marketable yield without compromising fruit size or weight. These outcomes are particularly relevant in alternate-bearing cultivars and in hotter, drier production zones.

Published summaries highlight improvements in the growth of young trees, fruit set and retention, and harvest numbers, with the net effect being more fruit reaching pack-out standards.

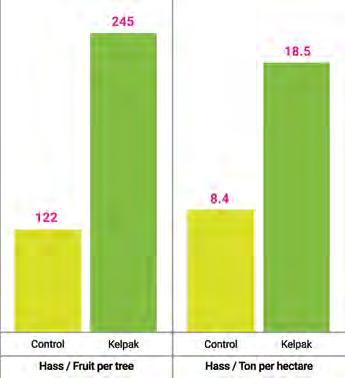

For growers, the most telling metric is delivered yield. In South African and international datasets, Kelpak programmes have produced notable gains:

• In a yearbook summary of commercial and independent trials, two foliar applications at 0,4% delivered a 24% yield increase (from 10,34 t/ha to 12,83 t/ha), alongside a 34,7% value increase (about USD 6 084/ ha in that trial set).

• In broader avocado brochures and case studies, improved pack-out due to larger fruit translated into an average income increase of 57% where blocks received two foliar sprays at 4 L/ha.

While absolute figures will vary by cultivar, season and management, the direction of progress is consistent with more marketable cartons per hectare and fewer borderline fruit.

The Company’s strength lies in simple, targeted timing at key physiological moments. A practical programme used in trials and aligned with grower practice includes:

• 50% flower: Foliar spray at 0,4% (minimum 3 L/ha).

• 14-21 days later (fruit set): Repeat foliar spray at 0,4% (minimum 3 L/ha).

• Optional fertigation pulse: 15 L/ha with the first root flush. Under saline irrigation conditions, a 30 L/ha pulse at the first and second root flush has been used with good effect. Maintain pH < 7 and rinse lines after pulsing.

These timings align with the orchard’s highest hormonal and carbohydrate demand, supporting fruit set and retention and

stabilising the on-tree crop for better alternation control. For foliar applications at spray volumes above 1 000 L/ha, maintain a minimum dilution of 0,4% and follow standard tankmix compatibility guidelines.

Subtropical blocks often grapple with variable water quality or heat events that compromise set and summer sizing. Trial summaries point to increased tolerance to abiotic stress (including heat and drought) and improved performance even where irrigation water salinity is elevated, conditions under which the fertigation option becomes especially relevant.

For packhouses and marketers, small changes in class distribution make a large difference. In Hass datasets, pack-out increased and fruit per 4 kg box decreased, a proxy for larger average fruit, following two foliar sprays at 4 L/ha in South African trials, and complementary fertigation in Chilean work.

Expect a little extra.

The headline benefit for growers is clearer grade profiles and better returns per hectare.

Implementation checklist for the 2025/26 season:

• Baseline first: pull the last two seasons’ block-level yield and class breakdowns to benchmark pack-out volumes.

• Start with a pilot: apply the two-spray 0,4% programme (with optional fertigation pulse) on representative Hass or Maluma blocks; retain a matched control.

• Watch set and drop: record fruit set counts and early drop after both sprays to capture where the differences start.

• Track stress windows: log heat spikes or irrigation EC fluctuations. If salinity is consistently high, consider the 30 L/ha fertigation pulses at the first and second root flush.

• Measure at pack-out: compare fruit per 4 kg box and class distribution; look for the expected reduction in fruit per carton and the shift to higher pack-out.

The bottom line for subtropical fruits?

In a market that rewards reliability and quality, tools that stabilise fruit set and convert flowers to cartons are invaluable. The collective evidence shows that Kelpak can contribute to that outcome in avocados by supporting stress tolerance and increasing the proportion of fruit that make it into marketable classes, translating into improved t/ha and stronger returns per hectare.

For more information, visit the Kelpak website.

Linda Greyling is Head of Technical Support at Kelpak. Nico Engelbrecht is Regional Head of Sub-Saharan Africa at Kelpak.

Peppers under protection: light quality and photoperiod

The influence of light quality and photoperiod on vegetative growth, flowering, and fruit set of peppers under protection

Jaco Erasmus SAKATA

In undercover production systems like greenhouses and shade nets, the quantity, quality, and duration of natural light are altered by structural materials and shading intensity. These changes can influence plant morphology, flowering behaviour, and fruit set.

Production of peppers (Capsicum annuum L.) under protection has become an essential method to ensure fruit quality and high yields under fluctuating outdoor conditions. However, one of the most critical challenges for production in greenhouses and under shade nets is the modification of the natural light environment.

The transmission properties of plastic film, nets, and structural materials reduce the total radiation and alter the spectral composition of light that reaches the crop canopy. Because pepper plants rely heavily on light for both physiological and structural development, understanding how light quality and photoperiod interact under protection is critical for achieving optimal vegetative growth, balanced flowering, and consistent fruit set.

LIGHT QUALITY AND ITS PHYSIOLOGICAL INFLUENCE

Light quality describes the spectrum of wavelengths perceived by plant photoreceptors, including red (R), blue (B), far-red (FR), and ultraviolet (UV) light. Each spectral region triggers specific developmental and physiological responses.

Red and blue light balance

Red and blue wavelengths are most important for photosynthesis and morphogenesis.

• Red light, primarily absorbed by phytochromes, stimulates

stem elongation, leaf expansion, and flowering initiation.

• Blue light, sensed by cryptochromes and phototropins, enhances chlorophyll formation, stomatal regulation, and compact canopy structure. In protected conditions where covering materials often reduce blue light, plants may exhibit elongated internodes and thinner leaves.

A balanced proportion of red and blue wavelengths promotes healthy vegetative architecture, improved photosynthetic activity, and uniform flower initiation. Shade nets that allow moderate blue transmission generally result in sturdier plants and better fruit set.

Far-red light and the red to far-red (R:FR) ratio

The (R:FR) regulates the plants’ perception of canopy density. Low R:FR ratios (common under dense foliage or shaded conditions) trigger shade-avoidance responses such as stem elongation, reduced leaf thickness, and earlier flowering. In peppers, excessive elongation can weaken plant structure and reduce flower retention.

In contrast, an adequate R:FR balance maintains compact growth and supports a favourable balance between vegetative and reproductive development. The choice of covering material strongly affects this ratio. Clear polyethylene films transmit more red light, while green or black nets reduce it, thereby influencing plant stature and flowering time.

Ultraviolet radiation (UV-A and UV-B)

UV radiation, though limited under plastic or net covers, plays a role in pigment synthesis and stress tolerance. Moderate UV exposure increases flavonoid and carotenoid accumulation, enhancing fruit colour and nutritional quality. However, excessive UV filtration, common under dense shade nets, may lead

to softer tissues and reduced disease resistance. Selecting covers that allow partial UV transmission can therefore improve fruit firmness and colour.

PHOTOPERIOD AND FLOWERING REGULATION

Peppers are generally considered day-neutral plants, but photoperiod still influences the timing of flowering, fruit set, and vegetative balance. Variations in day length alter the hormonal and photosynthetic signals that regulate reproductive transitions.

Short vs. long photoperiods

Shorter days favour vegetative growth, resulting in compact canopies and delayed flowering. Longer days stimulate flowering and faster fruit set. In protected environments, structural shading can shorten the effective photoperiod perceived by

ity in flowering across the canopy. Choosing an appropriate shading intensity (20% - 30%) helps maintain a natural photoperiodic rhythm while preventing excessive heat buildup.

Interaction with temperature and light intensity

Photoperiodic effects are closely linked with temperature and overall light intensity. Under low light and cool temperatures, peppers allocate more resources to vegetative growth, while reproductive development slows down. Under bright and warm conditions, flowering accelerates and fruit set improves. Hence, managing ventilation and shading to maintain moderate temperatures (22% - 28°C) while maximising light transmission is crucial for synchronized flowering and balanced fruit load.

In the production of peppers under protection, the light environment strongly influences vegetative growth, flowering, and fruit set. Spectral composition, especially red, blue, and far-red balance, shapes plant structure and reproductive timing, while photoperiod interacts with these effects. Optimising natural light through cover selection, shading, and canopy management enhances photosynthesis, promotes uniform flowering, and supports consistent fruit development in greenhouses and shade nets.

DISCLAIMER: This information is based on observations and/or information from other sources. As crop performance depends on the interaction between the genetic potential of the seed, its physiological characteristics, and the environment, including management, the company gives no warranty, express or implied, for the performance of crops relative to the information given, nor does the company accept any liability for any loss, direct or consequential, that may

Pepper production under shade nets.

Continued professional development is a cornerstone and commitment

Crop advisors at distributor companies take part in a continuous professional development (CPD) programme, designed to enhance professionalism, improve the quality of advice, and maintain standards in crop protection service for producers.

Jacques Fouché, Head of Technical

Fanie van der Merwe, co-writer NEXUSAG

Regular training and participation in technical transfer opportunities keep crop advisors up to speed in an ever-changing environment. The crop protection industry is dynamic: invasive pests and weeds regularly establish themselves; new products are researched and introduced; market and consumer requirements are constantly changing. New information is therefore generated all the time. Decision-makers should actively absorb and apply this knowledge to make the best-informed decisions. This also ensures the avoidance or mitigation of potential negative impacts of inappropriate recommendations and strategies.

Although continuous professional development (CPD) accreditation is not a statutory requirement, NexusAG crop advisors place a high premium on knowledge and skills development. This requires a significant investment in time, which speaks volumes about their attitude towards professionalism.

Proud member

CropLife South Africa (CropLife SA) is the crop protection industry association and champion for responsible production, distribution, and application of crop protection solutions. A CPD programme for accrediting technical and commercial representatives has been in place for decades, with ongoing changes, including transitioning to a digital format, in 2020.

The CPD programme is the industry standard and results in an industry-driven accreditation. It aims to promote crop advisors as specialists who uphold competence and ethical standards, and act in the best interests of the environment, community, and clients.

CPD programmes are widely used across industries like healthcare, education, finance, and engineering to enhance skills, ensure compliance, and foster innovation. These programmes promote lifelong learning, improve job performance, and maintain professional standards, giving individuals and organizations a competitive edge in rapidly evolving markets.

What it takes to be accredited.

Participants must accumulate a set number of CPD points over twelve months, in three areas: technical and product training

for crop protection, integrated crop management, and meeting industry responsibility standards. Training activities are documented in structured formats with assessments included. Upon completion of each CPD cycle, participants who satisfy compliance requirements are issued a digital CPD-compliance card, valid for one year. This card includes a QR code for information verification and can be emailed as proof.

Eligible training topics cover a range from technical subjects and product information to safety, legal matters, good agricultural practices, and stewardship. Examples of key and topical categories are technical themes like insect, disease, and weed knowledge, application methods; integrated crop management topics like soil health, cultivation, beneficial insects, pollinator safety, resistance management; and compliance topics like responsible use, container management, storage requirements, and transport of dangerous goods.

In addition to training sessions provided by member companies, industry experts, educational institutions, and approved partners, CropLife SA offers several online modules to help participants meet compliance requirements.

Value to the grower

All NexusAG crop advisors are accredited for 2025, as they have been every season since the initiation of the CropLife SA CPD programme. The company’s customer focus and internal priorities enable this consistent achievement.

Buying from a CropLife SA-accredited distributor supports responsible practices and ongoing improvement. An accredited advisor is recognizsed as meeting qualification requirements, staying updated with current standards, and adhering to defined codes of conduct. For export producers, this process is relevant for audit systems such as GlobalG.A.P.

It is recommended to check the crop advisor’s CPD-compliance card. Verification should include correct identification of the crop advisor, confirmation that “compliant” appears next to the NexusAG company name, and ensuring the card is valid for the current cycle.

Contact the NexusAG CropLife accredited crop advisor to design a tailored crop management strategy.

GROWING RESPONSIB LY. LEADING PROFESSIONAL LY.

NEXUSAG AND CROPLIFE – PROTECTING CROPS, THE ENVIRONMENT, AND OUR FUTURE.

When it comes to your crops, who you trust for advice ma ers.

That’s why every NexusAG crop advisor is proudly accredited through CropLife South Africa’s Continuous Professional Development (CPD) programme – the gold standard in our industry.

Why choose a NexusAG CropLife SA-accredited advisor?

The accreditation process ensures:

•Expe ise you can trust – we continuously keep informed of the latest knowledge on pests, diseases, nutrition, soil health, and resistance management.

•Responsible practices – our advice protects your crops, the environment, and our communities.

•Global compliance – the accreditation suppo s audits essential for expo markets.

•Proven professionalism – every NexusAG crop advisor carries a digital CPD card with verifiable credentials.

What it means for you?

With NexusAG, you get more than a crop advisor – you get a pa ner commi ed to integrity, competence, and continuous learning. We invest in professional development so you can invest with confidence in your farm’s future.

CONTACT US FOR MORE INFORMATION

Mitigating FROST efficiently

Key risk management principles stipulate identifying, quantifying, limiting, hedging against, and continuously monitoring relevant risks. It is about taking away all risk variables under the producer’s control and reducing it to an acceptable level. One of the risks in crop production is frost.

Marike Brits

NETAFIM SOUTHERN & EAST AFRICA

According to Charl van Reenen, Agronomy Manager at Netafim Southern & East Africa, long-term weather models are increasingly supporting the reality of climate change and the increased incidence of extreme weather events.

“Models are predicting increased frost amongst other risks. These events often occur later in winter and summer, typically when orchards are in very sensitive phenological stages. When these events are allowed to wreak havoc on crops, it has huge economic consequences in the form of failed harvests.”

When relevant, investing in frost mitigation tools is one of the most important investments a producer can make to protect potential income and long-term sustainability. According to Marco Appel, Agricultural Economist at Netafim Southern & East Africa, it may seem unnecessary or like an expense one can save on. “It is, however, like buying an umbrella before it rains. Seemingly unnecessary at times, but worth it when it rains.”

Appel adds that, as is the case with any investment, it is important to collect all the necessary information and make an informed decision.

“Most importantly, one needs to know the risk of frost in the particular area. Determine the probability of an adverse event. If there is a high probability, the expected value of avoided losses will be large enough to justify the investment.”

He reminds producers that mitigation systems are not tools you buy with the hope that it does its job every season. “You buy it knowing that the one time it is really needed, it will save an entire crop.”

Appel explains the difference in calculating return on investment for mitigation tools versus other crop management tools.

“It lies in how you define returns. For normal crop management tools, such as irrigation systems, the return will be the added income gained through increased yields or reduced costs as a result of the investment. In the case of risk mitigation tools, it is not about added income, but returns are defined by losses avoided.”

There are several mitigation tools against frost in the orchard. Each tool will offer different advantages and disadvantages, depending on the given circumstances. Netafim supports water sprinklers as a viable mitigation tool.

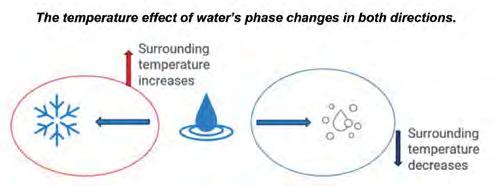

Latent heat and evaporative cooling

To understand the potential of using sprinkled water for risk mitigation, one have to look at the science behind it. “We need to understand the concept of latent heat and evaporative cooling. This is the heat or energy released or absorbed when substances change from one phase to another,” says

When water freezes and changes from liquid form to ice, its temperature will remain the same. Energy is released, which means that the surrounding temperature increases. This is latent heat, the basis of frost mitigation. When water evaporates, moving from liquid form to water vapour, energy is required and therefore taken from the environment. The surrounding temperature decreases as heat is taken from the environment. This is evaporative cooling used in heat mitigation.

The ins and outs of frost mitigation

To discuss frost mitigation, frost has to be defined. Van Reenen explains that frost is the deposit of ice crystals on surfaces that occurs when the dew point is below the freezing point. This occurs due to two main types of frost, namely, advection frost and radiation frost. The former occurs when cold air moves into an area, bringing with it freezing temperatures, and cannot be mitigated. The latter occurs when surfaces lose heat by radiation on clear, calm nights, and these surfaces become colder than the surrounding air. This type of frost can be mitigated. According to a 1999 report on frost mitigation by Dr Robert G. Evans from Australia, sprinklers have been used in the fight against frost since the 1940s.

Moving into the discussion of suitable products for sprinkler-based mitigation, it is important to understand how much water will be required for effective frost mitigation. Neethling: “If the ambient air temperature in the orchard remains above -5 °C, it will be sufficient to apply water at a rate of 3 mm/ hour to maintain continuous sprinkler coverage. This coverage will ensure ongoing ice formation and keep plant tissue temperatures above 0 °C.

“When designing a frost protection system with irrigation sprinklers, we set the application rate at 3 mm/hour. Yes, this is a high delivery rate. Although this can pose a challenge in making frost mitigation viable, it is a challenge that can be overcome with well-designed technologies.”

Neethling lists four general approaches to frost mitigation with sprinklers placed above the canopy:

• full coverage

• localised coverage

Dexter Neethling, Product Manager at Netafim Southern & East Africa.

• high efficiency (circle) and

• high efficiency (strip).

Key factors when selecting a sprinkler-based frost mitigation approach include:

• The distance between trees and the diameter of the trees.

• Orchard infrastructure, such as the presence of nets and the space between the canopy top and the netting.

• The tree's top diameter during the frost season.

• The total size of the area to be protected.

• Water and energy availability, including storage and pumping capacity.

• Site topography, considering its micro-climate areas.

• The meteorological properties of the site.

• The expected duration of a typical frost event in the area.

Don the right cap

The most important fact to remember, says Neethling, is that a frost mitigation sprinkler system cannot double as an irrigation system. “It is important to take off the irrigation cap and put on a frost mitigation cap during system planning and design. This will allow the producer to choose the correct products and approach. The most important goal is to ensure that the system can do the job required when it is go time. The system must be able to continuously sprinkle enough water for as long as required when conditions demand it.”

As efficiency is the name of the game when using any natural resources, it must also guide the design of a frost mitigation system. This is why Netafim offers solutions, such as Pulsar™, StripNet™ X, and other micro-sprinklers, that assist producers in mitigating frost efficiently to make it viable in terms of both costs and resource use. Netafim’s technologies are designed to deliver the required application rate while using low flow rates, lower pressures, and finally less water and electricity.

Involve experts and choose quality

“Be sure to involve the necessary experts to assist you in turning the environmental and infrastructure considerations of the farm into decision guidance when selecting a frost mitigation or cooling system. Risk mitigation tools are a significant investment, so it is important to do all the necessary groundwork to ensure the system can do the job required when frost strikes.”

When water freezes and changes from liquid form to ice, its temperature will remain the same.

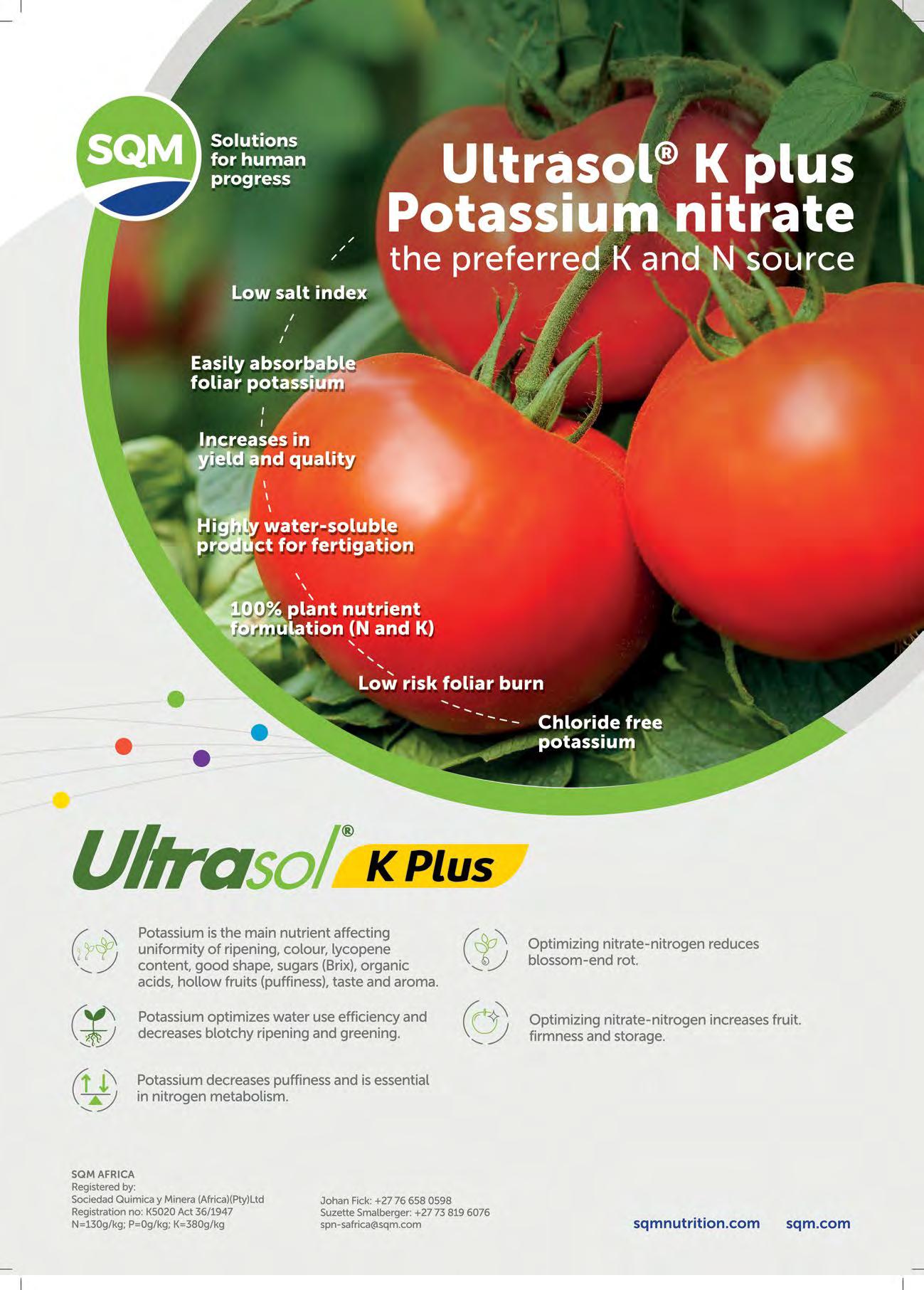

Tamatieboerdery sonder KNO3 sal nie deug nie

Tamaties is ’n intensiewe hortologiese gewas wat in Suid-Afrika onder verskillende toestande soos oop land, onder skadunet en in hidroponiese stelsels verbou word.

Johan Fick

SQM

Met verskillende kultivars vir die verbruiker en die produsent se behoeftes beskikbaar, moet elke stelsel en elke seisoen anders benader word. Die een voedingskomponent wat alle tamaties nodig het is kaliumnitraat.

Kalium se rol in die tamatieplant se groei moet uitgesonder word omdat dit die element is wat die meeste in enige verbouingspraktyk verbruik word. ’n Tamatieplant verbruik ongeveer 2,6 tot 3,6 kg kalium vir elke ton vrugte wat geoes word. Dit is baie algemeen dat 300 tot 400 kg/ha kalium toegedien word waar die opbrengs tussen 65-90 ton/ha is.

Kalium is belangrik vir die produksie en vervoer van plantsuiker en proteïnsintese. Kwaliteit is sinoniem met die gebruik van kalium omdat dit vrugrypwording en rakleeftyd bevoordeel. Oneweredige rypwording, hol vrugte en vrugte wat nie ferm is nie, is net ’n paar voorbeelde van kaliumtekorte in die vrug.

Kaliumnitraat is die beste opsie om kalium aan tamaties toe te dien. Dit bestaan uit 13% nitraat en 38% kalium. Daar is twee alternatiewe: Ultrasol K Plus* wat die wateroplosbare vorm is, en Qrop K** wat in korrelvorm is.