Serving Installers, Dealers and Integrators Across Canada

What is RSPNDR and how does it work?

Toronto-based guard dispatch service is working with major telcos and central stations p. 6

GardaWorld grows its monitoring business Industry vet Daniel Demers explains the Quebec company’s alarm plans p. 8

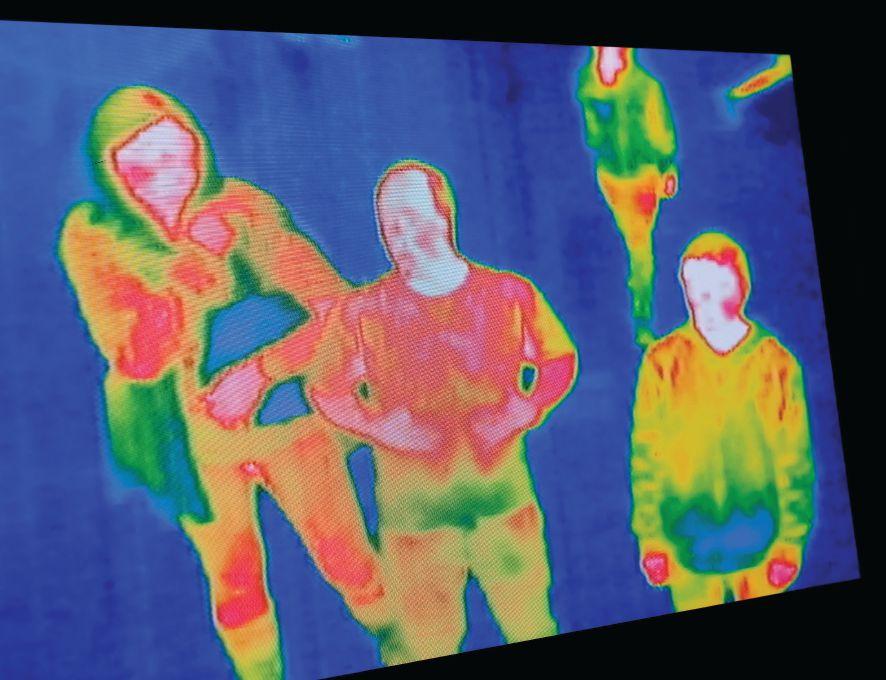

Why thermal is so hot

Expect to see this surveillance technology in more places as costs continue to come down p. 14

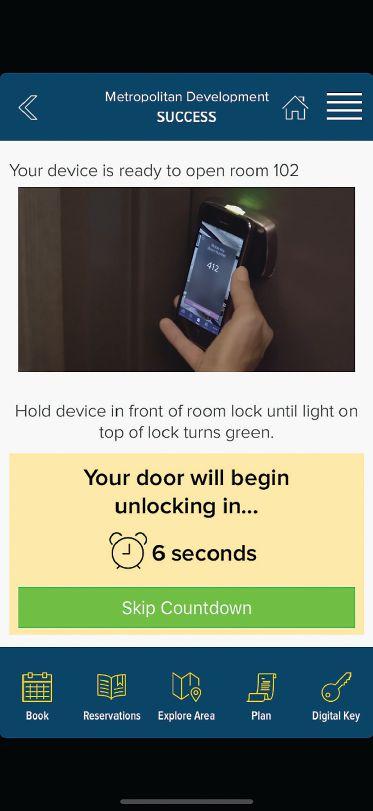

16 Phone it in Smartphones should be the next frontier in identity management and access control, but there are still a few inhibitors to mass adoption.

By Will Mazgay

20 Going places

Travel, transportation and cargo hubs have unique security surveillance requirements. By

Paul Laughton

4 Editor’s Letter

6 Line Card

• RSPNDR ramping up guard dispatch service

• Armstrong’s Monitoring grows through CML acquisition

• GardaWorld expanding alarm monitoring business

• Quebec firm invests in Allied Universal

12 Lessons Learned

Trend-spotting at Barnes Buchanan By Victor Harding

13 CANASA Update

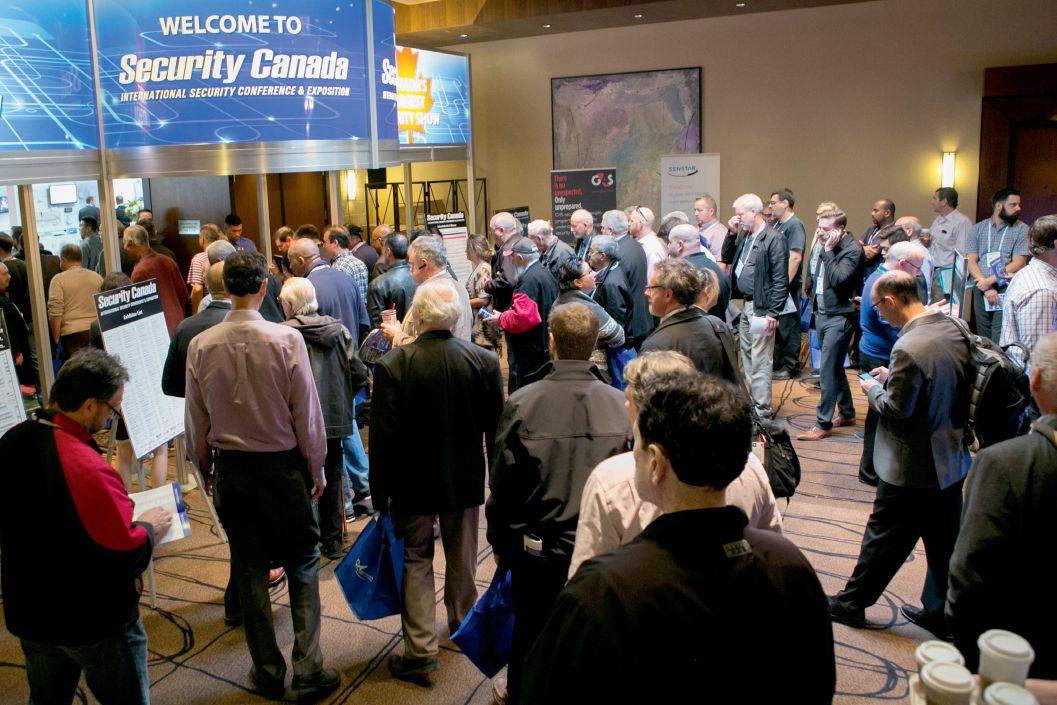

Security Canada season about to begin By Patrick Straw

14 Camera Corner Seeing in the dark By Colin Bodbyl

Eco-friendly magnalock

The Securitron M680E Series Magnalock with EcoMag technology from ASSA ABLOY has an increased holding strength of 1,200 lbs. The unit is eco-friendly, with an average power draw as low as 60mA at 24V, allowing for use of smaller backup batteries and longer wire runs of thinner wire.

24 Flexible storage

Wavestore’s high-density massive storage solution PetaBlok is available in various sizes from 48 HDD bays (480TB) taking up 8U of space, to 204 HDD bays (2.04PB) accommodated within 16U.

TBy Neil Sutton

elus recently launched a new smartphone health-care service with partner Babylon, offering users the ability to check their symptoms, connect with a doctor virtually, and receive referrals and prescriptions.

A series of rhetorical questions on the Babylon by Telus website suggests reasons why many people might find it a useful option: Don’t have a family doctor? Need a doctor after-hours? Can’t take time off work?

Convenience is clearly a driving factor here and it’s not hard to imagine it will be popular. There are more details available on the website, including who the doctors are, what they can do for prospective patients, and how Babylon by Telus manages issues like patient privacy. (By the way, the service recommends you continue to see your own doctor if you already have one.)

Remote medicine has been available in one form or another for many years. Communities in the remotest parts of Canada, for example, are able to communicate with a physician in a different part of the country via a video-conferencing link.

And any parent can likely identify with the scenario of trying to diagnose a screaming infant’s potential illness at 2 a.m. A quick call to a provincial telehealth organization may help with some of that anxiety, even if the recommendation is to visit your nearest emergency room, just in case.

I haven’t used Telus’s new service, but the promotional material suggests it will take telehealth to the next level, requiring little more than an app and a phone.

More and more, we’re seeing mobile devices (phones, smart watches) also marketed as health devices, whether as a heart-rate monitor or simple step-counter. Today, they are probably more closely aligned with exercise programs than they are with true medical apps, but as device sophistication improves, so will their link to health-care and role in patient treatment.

I think services like this could really be a boon to the security industry. Much as DIY home security systems, made affordable by popular retailers, can help to bring awareness to the value and importance of monitored security systems, medical apps and services can help draw more attention to PERS options.

When I asked Daniel Demers, now in charge of GardaWorld’s monitoring division, what he thought about Google and Amazon appliances in the home, he said he hopes they sell “tons.” His rationale being, those devices could help bring other service options, like security, into homes that may not have considered them before. (See p.8 for the full story.)

If smartphones and carriers can help put more medical apps into the hands of consumers, it follows that monitored health-care options should benefit too. Dealers just need to be savvy with their marketing and capitalize on the opportunity. The health of the PERS industry may depend on it one day.

Your Partner in Securing Canada Security Products & Technology News is published 8 times in 2019 by Annex Business Media. Its primary purpose is to serve as an information resource to installers, resellers and integrators working within the security and/or related industries. Editorial information is reported in a concise, accurate and unbiased manner on security products, systems and services, as well as on product areas related to the security industry.

Group Publisher, Paul Grossinger 416-510-5240 pgrossinger@annexbusinessmedia.com

Account Manager, Adnan Khan 416-510-5117 akhan@annexbusinessmedia.com

Editor, Neil Sutton 416-510-6788 nsutton@annexbusinessmedia.com

Associate Editor, Will Mazgay wmazgay@annexbusinessmedia.com

Media Designer, Graham Jeffrey gjeffrey@annexbusinessmedia.com

Account Coordinator, Kim Rossiter 416-510-6794 krossiter@annexbusinessmedia.com

Circulation Manager, Aashish Sharma asharma@annexbusinessmedia.com Tel: 416-442-5600 ext. 5206

President & CEO, Mike Fredericks

EDITORIAL ADVISORY BOARD

Colin Doe, Veridin Systems Canada Anna Duplicki, Lanvac Victor Harding, Harding Security Services Carl Jorgensen, Titan Products Group Antoinette Modica, Tech Systems of Canada Bob Moore, Axis Communications Roger Miller, Northeastern Protection Service Sam Shalaby, Feenics Inc. 111 Gordon Baker Rd, Suite 400, Toronto, ON M2H 3R1 T: 416-442-5600 F: 416-442-2230

Printed in Canada ISSN 1482-3217

CIRCULATION

e-mail: asingh@annexbusinessmedia.com

Tel: 416-510-5189 • Fax: 416-510-6875 or 416-442-2191

Mail: 111 Gordon Baker Rd, Suite 400, Toronto, ON M2H 3R1

SUBSCRIPTION RATES:

Canada: $42.00 + HST/yr, USA: $74.00/yr and International: $84.50/yr

Published 8 times a year

Occasionally, SP&T News will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Privacy Officer privacy@annexbusinessmedia.com

Tel: 800-668-2374

No part of the editorial content of this publication may be reprinted without the publisher’s written permission. ©2019 Annex Publishing & Printing Inc. All rights reserved.

Annex Publishing & Printing Inc. disclaims any warranty as to the accuracy, completeness or currency of the contents of this publication and disclaims all liability in respect of the results of any action taken or not taken in reliance upon information in this publication.

125 years of experience in putting the security of others first.

We understand you need to protect more than brick-and-mortar, which is why ADT does more than monitor. ADT has a wide range of alarm and security options for organizations of any size to help protect people, goods, and data. With 24/7 surveillance, solutions against intrusion and fire, remote monitoring, interactive services and more, ADT has a security solution for your organization. Join those who trust ADT with their livelihoods and protect your business.

Why choose ADT canada?

We are an integrator, meaning we can take over nearly any of the existing security equipment you have on-site.

We are customer-service oriented, innovative and technology savy. With over 125 years of experience and 15 branches in Canada alone, including four monitoring stations, you can trust the experts.

Anew security service aims to be the connective tissue that puts central stations in touch with guard services with the ultimate goal of responding to alarms more quickly and making end users happier in the process.

Toronto-based RSPNDR launched a pilot program for its service in 2017 and now works with two of Canada’s largest telcos as well as multiple monitoring companies, including API, Graham Alarm Monitoring, Global Link, Central Security BPG and Lanvac, according to the company’s management.

RSPNDR’s software is a cloudbased guard dispatching service that can be utilized by central stations as well as the guard companies that RSPNDR has partnered with. When an intrusion alarm is set off and recognized by a moni-

toring station, the software locates the guards close enough to respond and sends out an alert received by an app on guards’ phones. When one guard responds, all other guard notifications are cancelled. The responding guard then attends the scene and files a report based on a series of criteria laid out in the RSPNDR app.

Any guard, regardless of which guard company he or she works for, could potentially respond to alarm as long as the guard works for a company that is currently partnered with RSPNDR and is in close enough vicinity to the alarm to receive the app notification in the first place.

According to RSPNDR, everyone wins in this scenario. The monitoring station can dispatch more quickly; the responding guard companies collect revenue; both the

Armstrong’s National Alarm Monitoring announced in March it has acquired the monitoring assets of Consolidated Monitoring Ltd. (CML Security), based in Edmonton, Alta.

CML is a wholesale monitoring company that has been in business for more than 25 years. CML is privately-owned and operates a ULC-approved monitoring station in Edmonton. According to Armstrong’s, all of CML’s monitoring station management and staff will become part of the Armstrong’s compa-

ny. CML monitoring operations will also be rebranded under the Armstrong’s umbrella.

CML also operates a security services and installation division. That business was not part of the deal with Armstrong’s and will continue as an independent operation under the leadership of CML president Ed Pringle. “With the fast pace evolving world of alarm monitoring, we were looking for a quality company that would help take our company into the next phase of monitoring services, and we have found this with Armstrong’s,” said Pringle in a prepared statement.

station and the alarm dealer receive detailed reports from the guards; and the end user is assured of a swift response in the event of an alarm. The app will also track total response time (RSPNDR calls it Total Time for Service) in addi-

According to Armstrong’s, CML represents the company’s first major acquisition in more than a decade. Terms of the deal were not disclosed.

“This has been a great acquisition for us,” Gary Armstrong, president, Armstrong’s, told SP&T News, “[including] tens of thousands of accounts. We have known Ed for a long, long time. We have retained all of his employees…. They’re all very excited and they all signed on.”

Armstrong said that adding a property in Western Canada expands the company’s ability to offer service and technical support across all of Canada’s time zones.

The company operates three central stations in Dartmouth, N.S., Moncton, N.B. and now Edmonton. With the acquisition, Armstrong’s now serves approximately 175,000 accounts and 800 alarm dealers.

— Neil Sutton

tion to written reports and photos. Video from a guard’s phone cannot be integrated yet, but that may be an option in the future.

“We’re trying to change the habits and provide a new bar for what we call customer experience and transparency,” said Frank Pietrobono, RSPNDR’s vice-president of sales.

“People love the fact that they know where the guard is, when he’s there. [When] the report goes live, they have it at their fingertips. We’ve had a few incidents where the dealer has been able to use that report right away and can share it with their customer. It’s different from what we’ve had for the last 25to 30 years.”

This type of on-demand model has worked well in other industries — RSPNDR compares their service to similar innovations in the ride-sharing industry — and the company sees avenues outside of security and alarm response where their software could be a good fit.

According to the company, RSPNDR currently offers service in the Greater Toronto Area, lower mainland B.C., Montreal and Ottawa with more Canadian cities coming on board. RSPNDR also has plans to expand into the U.S. later this year.

— Neil Sutton

Since joining GardaWorld just over a year ago, alarm industry veteran Daniel Demers has helped the company significantly expand its base in the monitoring world.

When he was hired by GardaWorld in the fall of 2017, Demers held the title of strategic advisor to the CEO. More recently, he has been appointed as president of alarm and technical services for the company.

Demers, who was the CEO of Quebec-based monitoring firm Protectron (now part of ADT) for almost 20 years before joining GardaWorld, has overseen several acquisitions on behalf of his new employer. In 2018, GardaWorld acquired Alarme Microcom, an alarm monitoring firm founded in 1985 with locations in Quebec City and Montreal, and Centrale Ashton, a wholesale monitoring firm also in Montreal. GardaWorld also owns the assets of Alarme Prudential, a Montreal firm that was bought by Microcom before it became a GardaWorld company. The acquisitions provide the company two central stations — one in Montreal and one in Quebec City.

Demers says this trend will continue — with more acquisitions planned in the alarm monitoring space as GardaWorld expands that side of its operation. “We are actively seeking… acquisitions out-

“The goal is clearly to realize synergies with guard patrol and the other divisions.”

— Daniel Demers, GardaWorld

side of Quebec,” he notes.

But these acquisitions are not only to plant a stake in the monitoring market. The vision for GardaWorld, says Demers, is to integrate monitoring services into GardaWorld’s other operations, including the one it is still best known for, guarding. “The goal is clearly to realize synergies with the guard patrol and the other divisions. GardaWorld is a very, very well-known brand. It is extremely well recognized and we see great opportunities to capitalize on that,” explains Demers.

With these recent acquisitions, GardaWorld has fully entered the alarm business, monitoring premises for both residential and commercial customers. At the moment, it offers monitoring on a wholesale basis and also plans to offer a retail service as well. For Demers, these are not mutually exclusive or even competing notions. As GardaWorld brings additional services on board like billing services or interactive services, it will offer them to all of the dealers it serves, suggests Demers. Wholesale dealers “make the overall family stronger,” he says.

“We are looking to go to market with a formula [where] the small guys are happy with the big guys… What we want to offer goes beyond monitoring. We want to expand the services on the residential [side]. One of our visions is very B2C. Up to now, GardaWorld was mostly B2B, but with the acquisitions and the plan that we’re putting forward — [both] residential and commercial — it clearly is a B2C venture.”

Both Alarme Prudential and Alarme Microcom are labelled as GardaWorld companies on their websites. Centrale Ashton, which offered wholesale monitoring prior

to acquisition, will continue to do so, says Demers, and there are no immediate plans to change or update the name.

Demers notes that the monitoring market has changed significantly in recent years, but he does not view companies like Amazon or Google as his new competitors. More likely, they will enable the established security industry to access untapped markets by enabling homeowners to add security options to their homes more easily. “I do hope they are successful in selling tons” of devices like

Amazon Echo and Google Home, notes Demers. “Because the more they do, the more we are likely going to pick up potential customers who have components in their houses that can be integrated into our solutions.”

He also doesn’t see professional monitoring being under threat from newer providers on the scene. Life safety monitoring, like fire or panic alarms, “really has a requirement to have someone external available 24x7 to dispatch properly. That need will not go away.”

Demers also remarked that the monitoring market still has plenty of room to grow, with current estimates of overall market penetration still hovering around the 20 per cent mark. “It’s still a blue ocean out there,” he says.

— Neil Sutton

INSTALLED IN FACILITIES GLOBALLY, STRIKEIT INTEGRATES WITH HIGH IN-RUSH PANIC BARS, LOW CURRENT MLR EXIT DEVICES, ELECTRIC STRIKES AND MAG LOCKS. PROVEN POWER AND PRECISE FUNCTIONALITY COUPLED WITH AN UNPARALLELED WARRANTY, EQUALS RELIABLE ACCESS 24/7.

ALTRONIX SECURES YOUR MOST CRITICAL INS AND OUTS.

Alaska airport upgrades surveillance, storage

Rasilient Systems says it has completed Phase 2 of a video surveillance upgrade at Fairbanks International Airport (FIA) in Alaska.

According to the company, Phase 2 includes server and storage technology deployments, helping to facilitate IP megapixel camera distribution, live viewing and playback, and intelligent processing of archived video.

FIA’s building and security representative Dana Bowen said the facility’s decision to upgrade its security infrastructure was based on a desire to enhance both visibility and storage capabilities. In a statement, Bowen said the new equipment allows FIA to meet current requirements and “provide scalability for our future needs.”

FIA averages more than 328 aircraft operations each day. Phase 1 of the airport’s security upgrade was completed in the summer of 2018.

• Open Options (which was acquired by ACRE in December 2018) has appointed Steve Wagner as the company’s new president. Wagner began his career in 1986 at Checkpoint Systems.

• TOA Canada Corp. has appointed Ibrahim Chehade as its new product development engineer.

• The Security Industry

St. Louis community shares video with police

South Grand Community Improvement District (CID) in St. Louis, Mo., is using Genetec’s Stratocast video monitoring tool to reduce licence plate theft and share information with police.

The CID offers free parking to allow for easy access to nearby residences and businesses. Unfortunately, licence plate theft became a concern. CID added video surveillance to the 90-space parking lot in order to deter crime, utilizing three cameras to survey the area. With Genetec’s cloud-based monitoring technology, these images can be shared wirelessly with the CID’s head office.

“Using the cloud video system, I am able to find and view the video in seconds. I can narrow down my search based on dates and time and watch the event unfold with all camera feeds up on the monitor,” said Rachel Witt, executive director, CID, in a statement.

Association (SIA) has named Elizabeth (Elli) Voorhees as its new director of education and training. Voorhees will drive all education and certification program activity for SIA and through SIA’s partners.

• Ottawa-based Feenics has appointed Blair Cox as chief financial officer. Cox specializes in financial reporting,

The facility’s doors, including building entrances, public access areas, offices and residential apartment units, are secured using ASSA ABLOY’s Aperio wireless locksets with PDK’s cloud access control software. Administrators can remotely lock and unlock doors, set hours for maintenance access, monitor door use and retrieve reports.

The system is expected to expand to electrical rooms, storage rooms, mechanical rooms and closets, bringing the total to approximately 650 doors, as well as another 190 apartments and 40 assisted living units. The PDK software can be managed via a mobile device or browser.

forecasting and modeling, and corporate taxes.

• Arcules has named Cody Flood as senior director of sales for the United States and Canada.

• The Monitoring Association has announced the appointment of Steve Walker, vice-president of customer service for Stanley Convergent Security Solutions, to the executive committee of its board of directors.

April 24, 2019

Security Canada East Laval, Que. www.securitycanada.com

May 7, 2019 ADI Expo Edmonton, Alta. www.adiglobal.com

May 8, 2019

Security Canada Ottawa Ottawa, Ont. www.securitycanada.com

May 10, 2019 ADI Expo Calgary, Alta. www.adiglobal.com

May 29, 2019

Security Canada Alberta Edmonton, Alta. www.securitycanada.com

June 3-6, 2019

Electronic Security Expo Indianapolis, Ind. www.esxweb.com

June 6, 2019 ADI Expo Winnipeg, Man. www.adiglobal.com

June 13, 2019

Security Summit Canada Toronto, Ont. www.securitysummitcanada.com

June 18-19, 2019 Grower Day St. Catherines, Ont. www.growerday.com

June 19, 2019

Security Canada West Richmond, B.C. www.securitycanada.com

September 8-12, 2019 GSX Chicago, Ill. www.gsx.org

September 11, 2019

Security Canada Atlantic Moncton, N.B. www.securitycanada.com

October 23-24, 2019

Security Canada Central Toronto, Ont. www.securitycanada.com

Allied Universal, based in Conshohocken, Penn., recently announced a strategic investment from Caisse de dépôt et placement du Québec (CDPQ), making the organization the largest single shareholder in the security firm at about 40 per cent. CDPQ is a Quebec City-based institutional investor that manages funds for 41 organizations, including pension and insurance funds.

According to Allied, the investment will support long-term growth and includes US$400 million of primary capital which will be used towards potential merger and acquisition opportunities.

“We were having discussions

with several different groups who had expressed interest in Allied Universal. We were talking about potentially bringing in another equity partner and our current equity partners selling down in their ownership stakes,” explained Allied Universal president Steve Jones. Allied’s other major shareholders include Warburg Pincus and Wendel.

Jones described the relationship with CDPQ as positive from the outset. “We hit it off with CDPQ. They really liked our long-term plan and strategy. They came in and said, this is something we believe in and we really like the management team, the company and the industry and we

want to be part of this.”

Talks with CDPQ began last December and a deal was announced this February.

Last summer, Allied Universal acquired U.S. Security Associates (USSA), which included Andrews International, an international subsidiary of USSA which operates offices in Ontario, Quebec, Manitoba, Saskatchewan, Alberta and B.C. The acquisition expanded Allied Universal’s existing Canadian presence, which includes locations in Calgary, Halifax, Montreal, Vancouver, Toronto and Waterloo, Ont.

“We’ve been growing organically [in Canada],” said Jones. “We continue to look for strategic acquisitions and continue to have discussions. Canada is big on our list and I think you’ll be seeing some announcements, hopefully in the

near future.”

Jones added that the company continues to grow in new directions, augmenting its guarding platform. Systems integration, monitoring and technology investments are all high on the list, he said (the company operates a monitoring facility in Dallas).

“We’re currently in that space and provide those services. We want to build that significantly larger — designing and installing and managing security camera systems, access control systems, alarm systems and monitoring those,” explained Jones.

“These are the types of investments that we’re making in the company. This is how we think we’re going to change the traditional security guarding industry. This is what CDPQ really bought into.”

— Neil Sutton

SP&T News hosted the 4th annual Mission 500 Security Industry Hockey Classic on Feb. 21 in Toronto, raising more than $16,000 to support Toronto Crime Stopper’s youth initiatives.

Ten teams participated in tournament play. In a final bout between teams Graybar and Mircom, Graybar emerged victorious with a 4-0 win. The event was support by generous sponsors: Hikvision Canada (Hall of Fame sponsor); Axis Communications, Mircom Group, Anixter (MVP sponsors); Tyco, G4S, Automatic Systems Group, Circle K, 3SI Security Systems, Aiphone, Graybar Canada, TSOC, ADT Canada, CDVI, CANASA and Titan Products Group (All Star sponsors). Many thanks to players and supporters for another great year.

EBy Victor Harding

Annual security conference is a wealth of information for security dealers and professionals

very two or three years, I make a point to go to the annual Barnes Buchanan (BB) security conference in Florida.

It is focused on the security alarm industry and attracts industry players, bankers and M&A advisors. I recommend that any mid to large sized player in the Canadian electronic security industry attend every so often as well. Not only are the educational sessions good, but the opportunities to network and learn are significant.

With the qualifications that BB reports strictly on American activity, and by their own admission tells us their data is not foolproof, this is what I picked up from this year’s conference, held in February.

“New technology is attracting customers who now realize that their alarm systems can do way more.”

Overall, revenues in the electronic security industry through 2018 continued to grow both on the installation and monitoring/ service sides. This is probably true in Canada well.

BB gave its reasons why the electronic security industry continues to grow but this is what I think: Even with all the talk of DIY and new players like the cable companies in the industry, the market penetration of alarm systems is still below 30 per cent. New technology is attracting customers who now realize that their alarm system can do way more than simply monitor for burglary and fire. You can see security images on your smartphone

and use it to open your doors, turn on the lights and control the heat. Also, DIY and MIY (monitor it yourself) companies are proliferating like crazy.

If you are running a security company, this is what happened to the three key metrics in the industry in 2018:

a) The net margin on monitoring and service revenue, with more and more added services like alarm.com and cell, continues to drop. It is now at about 54 per cent. When I first got into the industry, and systems mainly just had digital monitoring, it was closer to 65-70 per cent.

b) The overall gross attrition rate, now at 11.6 per cent, continues to drop partly because of the extra services mentioned above.

c) The overall cost to create new RMR increased a little to 29X.

Know that the cost to create residential accounts, where the system is installed for very little, is almost always much higher than for commercial accounts. Handling house moves well is still the best way to reduce attrition as moves still account for 41 per cent of all cancellations of alarm accounts. A good alarm operator manages to capture one or both of the two opportunities generated from a move — either the existing customer moving to a new premise

or the new customer moving into the old premise.

While EBITDA is still the standard variable you use to value fire and integration businesses, Steady State Net Operating Cash Flow (SSNOCF) is fast becoming the key measure for companies with significant monitoring RMR. SSNOCF gets at the cash flow an alarm company generates after accounting for the cash cost of replacing its annual attrition.

There are lots of threats to small and medium sized alarm dealers in both Canada and the U.S. — DIY, the large nationals, the telcos, etc. However, the smaller players can still beat the bigger players on key items like creating new RMR at a much lower cost, running with significantly less attrition and generally providing better service. When all is said and done, the cable /telcos in the U.S. have only managed to secure two per cent of the American RMR market. In fact, two of the telcos have left the U.S. security market in the last year.

The best session put on at BB this year, in my mind, was that by Comcast — the success story of the cable companies in the U.S. with more than one million subscribers. Their brand, called Xfinity Home, offers the most advanced technology in the industry and through a partnership with Comcast, Rogers

Smart Home Monitoring will be leveraging this technology in Canada starting almost immediately.

Two other subjects were spotlighted at this year’s BB conference, illustrating their growing importance to the industry:

PERS has grown its target market well beyond placing pendants around people’s necks in case they fall. The technology has taken off with mobile PERS units being worn on wrists. Every alarm dealer should be able to provide some kind of up-to-date PERS unit.

Video monitoring of all kinds is exploding. This is being driven partly by the concepts of “verified response” where the responding authorities are demanding pictures of what is happening before rolling a unit and video analytics, which are doing a better job every day of isolating real from false security threats. You can’t pretend to be a successful wholesale monitoring station today without providing video monitoring.

These comments reflect just some of what I gleaned from the education sessions. If you work the conference properly, you can pick an equal amount of information by networking with people.

Victor Harding is the principal of Harding Security Services (victor@ hardingsecurity.ca).

By Patrick Straw

From April through October, the Canadian Security Association will host trade show

Trade shows have proven to be an important opportunity to explore what’s new in product and service offerings, enable visitors to meet industry experts and forge important alliances.

The Security Canada shows are just the place to explore and learn all the latest developments in security.

Security Canada trade shows, presented by the Canadian Security Association (CANASA), begin the 2019 season in Laval, Que. on April 24.

professionals from across the industry as well as government and military will all be in attendance at this important event in the nation’s capital. For information, visit www.securitycanada.com/sco

Security Canada East offers security professionals access to cutting-edge security technologies brought to the industry by the leading companies in their respective fields. For information on Security Canada East, please visit www. securitycanada.com/sce

The upcoming Security Canada events across the country are shaping up as the largest ever held.

Security Canada Ottawa: Held May 8 at the Ottawa Conference and Event Centre. Security

Security Canada Alberta: Held in Edmonton on May 29 at the River Cree Resort and Casino. On offer at this event are exhibitor education sessions where experts in their fields discuss their products and services. For information, visit www.securitycanada.com/scalb

Security Canada West: Coming to Richmond, B.C. on June 19 at the River Rock Casino Resort. The largest security show in the region also includes exhibitor education sessions as well as a free cocktail reception on the show floor. For information, visit www. securitycanada.com/scw

Security Canada Atlantic: Held in Moncton, N.B. on Sept. 11 at Casino New Brunswick. This event is the premier security show in one of the fastest-growing regions in Canada and

will offer exhibitor education sessions and a free cocktail reception. For information, visit www. securitycanada.com/sca

Security Canada Central: Finally, the largest security trade show in the country, Security Canada Central will come to Toronto on Oct. 23 and 24 at the Toronto Congress Centre. The people who define the security industry will all be there as thousands of security professionals come to network and learn about all the latest security products and technologies. For information, visit www.securitycanada.com/scc

For all the information on these vital trade shows, please visit www.securitycanada.com or call Steve Basnett directly at 1-800-538-9919 ext. 224. For information on membership in Canada’s largest security association, please contact Erich Repper at erepper@canasa.org or call 1-800-538-9919 ext. 223.

Patrick Straw is the executive director of CANASA (www.canasa.org).

TBy Colin Bodbyl

With prices coming down, thermal imaging cameras have grown in popularity

hermal imaging has been around a long time. Historically dominated by one manufacturer, thermal cameras have proliferated over the last decade and are now available from several popular manufacturers.

“When used in the right applications, they are capable of doing things no other camera ever could.”

While the costs of these cameras are still high, they have come down substantially and today you can even find thermal cameras for only a few hundred dollars. Popular in military applications, thermal cameras also have many practical applications for your standard integrator.

In order to find the right applications for thermal cameras, it is important to first understand how they work. Thermal cameras capture infrared radiation given off by all objects. We perceive infrared radiation as heat, but heat is also a high frequency infrared that the human eye cannot see.

Thermal cameras use special sensors to capture the infrared radiation which is then processed and converted into an image. These images are typically at much lower resolution than high definition visual cameras. In fact, a high-resolution thermal camera is considered a camera with a resolution of 640x480, or only a third the resolution of a 1080p camera.

There are limitations with thermal cameras due to the fact they can only see infrared radiation. Thermal cameras cannot produce colour images. While they can present the data in different

formats, including a coloured image where red represents hot areas and blue cold, thermal cameras cannot capture the actual colour of an object. As a result of their lower resolution, they also struggle to capture fine details like the human face and in turn are not ideal when used to produce evidence in court.

Despite these limitations, thermal cameras have two major strengths that drive their value. First, they are immune to darkness and can operate without any visual light. Due to their ability to operate without light, they are capable of seeing extreme distances. This combination makes them perfect for large properties or rural areas where lighting is scarce. Their second strength is the ability to measure temperatures in specific areas of the scene, something no other camera can do.

Video analytics and other AI technology is also extremely effective when used on thermal images. Two of the biggest challenges for video analytics to work well is poor contrast and changing lighting conditions, both of which thermal cameras excel in overcoming. Due to the high contrast of warm objects like people and vehicles against cooler backgrounds like plants and buildings, video analytics on thermal cameras can easily distinguish between these objects. Furthermore, thermal images look the same any time of day, so the analytics can easily train on a consistent image that never changes.

Another lesser known use for thermal cameras is real-time temperature monitoring. Certain thermal camera models have the ability to measure the temperature of objects in a scene. If the tem-

perature rises too high, an alarm is triggered. This technology is commonly used to monitor machines and substation transformers that can cause significant damage if allowed to overheat.

Thermal cameras may be a niche product and due to their inherent limitations will never entirely replace traditional surveillance cameras. However, as costs continue to come down and availability improves, expect to see thermal cameras becoming a lot more common. Their unique ability to see in the dark and measure temperatures means that when used in the right applications, they are capable of doing things no other camera ever could.

Colin Bodbyl is the chief technology officer of Stealth Monitoring (www.stealthmonitoring.com).

Security Canada East Sheraton Laval

Apr 24, 2019

Security Canada Ottawa

Ottawa Conference & Event Centre May 8, 2019

Security Canada Alberta

River Cree Resort & Casino

May 29, 2019

Security Canada West River Rock Casino Resort June 19, 2019 Serving

Halifax | Moncton | Edmonton

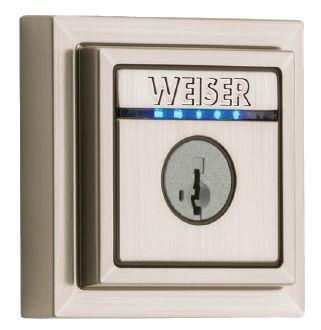

Using a phone to open doors, instead of a key card that can be easily lost, can make life easier for both end users and security teams, but there are barriers to adoption.

By Will Mazgay

For decades, key cards have been a pivotal piece of access control in public spheres, but increasingly, more offices, educational institutions, condominiums, hotels and other organizations are making this part of their security system digital, with access control through mobile phones.

“Some of the benefits are clear … you don’t have to worry about a lost or forgotten card.”

— Brandon Arcement, HID Global

Research firm IHS Markit found nearly 20 per cent of sales of access control readers sold in North America in 2018 were designed to be able to accept mobile credentials, and the global market size for mobile-capable access control readers is expected grow from approximately 700,000 annual unit shipments in 2018 to nearly 2.5 million shipments by 2023. Also, by 2023, more than 10% of new security credentials issued worldwide will be mobile credentials.

Bryan Montany, analyst with IHS Markit, says industries with a high proportion of Millen-

nials and Generation Z workers, such as IT, web services and marketing, represent strong markets for mobile credentials, as do other types of corporate offices, higher education and hospitality.

Montany continues, “Another strong market for mobile credentials are commercial buildings that employ a significant percentage of tempo-

rary workers, such as contractors.” He says managing credentials for temporary workers is much easier through mobile than with cards or badges.

The security technology industry’s heavy hitters are investing in this technology in a big way.

HID Global, for example, has 2,500 organizations using its Mobile Access solution, first

launched in 2014. This is according to Brandon Arcement, senior director, Strategic Partnerships at HID Global.

So why is using a phone as a key becoming so popular, and why is this technology more appealing than a plastic card?

Arcement lays out three value propositions:

1. Greater user convenience

“For users, some of the benefits are clear: you have fewer items to carry, you don’t have to worry about a lost or forgotten card,” Arcement says. Also, “you don’t have to go to a specific location or wait for a shipment in the mail to get a credential — it’s delivered in milliseconds over the air.”

2. Greater operational efficiency for the security department itself

“Think about a large global organization operating in several countries. Today they are managing pieces of plastic with RFID chips in them that they are shipping and printing and distributing and managing around the world,” he says.

“With mobile access, they can convert that process of managing those physical pieces of plastic into digital, online and automated processes.” Acrement also notes that overnight shipping an access card to a new employee can cost $40-$50 a piece.

3. Higher security

“The vast majority of cards that are used today have significant security vulnerabilities,” Arcement says. “HID Mobile Access uses very secure technology to encrypt the data being exchanged between the reader and the phone. It cannot be forged or cloned or spoofed the way many prox cards, magnetic stripe and legacy smart cards can be.”

Arcement says managing lost credentials is also easier with mobile.

“We did a study some years ago that showed the average lost card took three days to be reported lost or stolen,” Arcement says. “If you compare that against the fact that the average person checks his or her phone 70 times a day, it’s far less likely that a mobile device is lost, forgotten or stolen, and if it is, you can revoke the credential over the air — it’s noticed immediately and wiped within the hour.”

According to Arcement, another element boosting security for mobile credentials is the presence of phone authentication via biometrics, such as facial recognition or touch ID. Whereas, if someone get a hold of a card, they immediately have access to whatever it opens.

Montany agrees that phone-based biometrics are a major selling feature of mobile credentials, as they “offer increased security to end users at a much cheaper price than the average cost of installing biometric readers on-site.”

Lastly, mobile credentials provide flexibility. “With cards, any time there’s a vulnerability it’s required to replace all cards. With mobile applications, security updates are addressed in the

middle of the night in a few seconds while everyone sleeps,” Arcement says.

How does it work?

Providing mobile credentials is done through two different types of communication technology, Bluetooth and near field communication (NFC), and debate swirls over which is superior.

NFC only works at close range and mimics contact with an access card.

“In terms of emulating the traditional card experience, NFC does that best,” says Arcement. “Whenever you’re trying to disrupt an industry or change an industry, a lot of times the best thing to do is just emulate what the user had before. So NFC is more consistent, more reliable and more familiar to someone who’s conditioned to using a smart card.”

The downside is that the read range is limited to 10 cm, and it’s also open on Android, but closed by Apple, which is prohibitive for many smart phone users.

On the other hand, Bluetooth is available cross-platform with no conditions. The other value is its long range.

“What it (Bluetooth) lacks in speed and throughput and familiarity in a conditioned user, it makes up for by innovative ways to open up a door. For instance, triggering a door as you walk up to it by tapping something on your device, so

by the time you get there it’s already opened,” says Arcement.

Bluetooth is also ideal for parking garages, because users don’t have to roll down their car window to access the premises. It can also be programmed to work within close proximity to door readers, like cards, in addition to being used from a distance.

He argues that HID’s solution provides the best of both worlds by supporting both NFC and Bluetooth.

“That combination of both makes it a more seamless access experience, because there are some circumstances where NFC is preferred and there are some very good cases for the use of Bluetooth,” Arcement says.

For HID’s mobile credential solution, an organization’s physical access control system is largely preserved: wiring, cabling, panels, power supplies, software. The only hardware upgrade that is potentially necessary is HID readers compatible with the firm’s solution. “Those will support your existing card population alongside mobile credentials that can reside on either Android or iOS operating systems,” says Arcement. “If you’ve purchased something in the last few years, chances are very good that it will work with the solution,” he continues. “But obviously there is a lot of legacy infrastructure out there from HID, sister organizations, as well as the competition that would not be compatible and would need to be upgraded.”

The cost of upgrading readers, despite the fact that they accommodate card credentials as well, can be a barrier for some firms.

One method to bring down the cost of implementation, which isn’t always possible depending on the technology, is by retrofitting existing readers or locks, a solution that is appealing in the hotel industry, where the prospect of replacing every lock on a property is very expensive.

Fuel Travel Marketing, a software support and marketing firm that operates a white label app for boutique hotels, is partnering with ASSA ABLOY Hospitality to add mobile phone access control to its app’s functionality.

For hotels to integrate mobile credentials throughout their properties, they have two options, according to Stuart Butler, chief operating officer at Fuel Travel. “Either you can buy the lock with the wireless communication functionality built in or you can actually retrofit existing locks to work with this technology,” he says. “They essentially add a chip into the existing lock so you’re not having to replace the physical hardware.” Butler asserts that this can be a huge cost saver.

This system employs short range Bluetooth — users have to hold the phone right up to the lock. Butler says the close proximity reduces the risk of the data exchange between the lock and the phone being intercepted, and encryption provides an additional layer of security.

The firm’s app provides independent ho-

tels with the ability to offer the same high-tech features available on the big chain’s apps, such as booking capabilities, tourist information, value-added promotions, and digital check-in and check-out. Mobile access control is just the latest piece of that puzzle. Butler says it helps to streamline the check-in process, allowing guests who have checked in digitally ahead of time to simply show up at the front desk at an express line with a piece of identification, and then authenticate into the mobile app — using either biometrics or a password. After this, they are given access to their mobile key.

Butler says user conveniences like mobile access control are essential to help independent hotels compete with chains, which have traditionally been early adopters of technology. “They were early upgrading their websites to be mobile friendly, they were early releasing mobile apps, so they have a tool kit and infrastructure at scale that makes it hard for independent hotels to compete… especially Marriott and Hilton primarily,” he says. Both Marriott and Hilton offer digital keys on their hotel apps.

Despite the convenience provided to users by mobile credentials, there is still hesitation to adopt the technology.

Arcement says he sees hesitation from organizations and security professionals because

“Cards and badges won’t be disappearing any time soon.”

— Bryan Montany, IHS Markit

of unfamiliarity. “This is new technology, where there is still some reluctance by some in order to adopt it until it’s more proven…there are still many in the security industry who wait until there are more definitive use cases and studies and follow the market.”

IHS’s Montany concurs: “Access control is a very slow market to evolve and embrace new technologies, and mobile credentials are no exception.”

He reiterates that the cost of mobile capable readers and installation is a stumbling block for some companies, “Mobile-capable readers tend to cost at least $50 more than non-capable variants.”

Montany also says fear of cybersecurity vulnerabilities is causing hesitation. Any time an organization is hosting data remotely beyond their central control, as is the case with smart phones, regardless of the encryption, there are risks, he says.

There are also some markets where adoption generally isn’t gaining much traction, he explains, such as transportation, industrial facilities, gov-

ernment buildings and health care, “where buildings tend to employ much more sophisticated access control systems that still require physical credentials,” says Montany.

Arcement is optimistic about the future of the technology, “It’s a once in a generation change for our industry. I think we’ll see significant growth, modest growth likely over the next few years and then a significant pivot or inflection,” he says. “Of the 2,500 customers that we have, you can probably count on one hand the number that have replaced cards.”

Montany says we are a long way off from mobile credentials replacing physical credentials completely, and instead we will see a hybrid approach, where access control readers are designed to accept either mobile or physical credentials. He explains that more mobile-capable readers are being adopted in anticipation of later implementation of mobile credentials.

Montany says, “There are a few specific markets where outright replacement of physical credentials with mobile credentials is slightly more likely — hotels, university campuses, businesses that hire younger employees — but, most access control vendors view mobile credentials as an additional feature to offer along with physical credentials, so cards and badges won’t be disappearing any time soon.”

By Paul Laughton

From planes to trains, automobiles to buses, and from streetcars to ferries, today’s multi-modal transportation hubs are linking each more closely together to increase efficiencies for both travellers and cargo.

The challenge for security professionals is transforming existing surveillance systems into more intelligent, interconnected and user-friendly ones.

For passenger and cargo terminals, a robust network of cameras and sensors must be designed and installed indoors and outdoors to monitor checking zones, registration zones, passport and custom check zones, halls, entrances and exits, elevators, stairways and parking.

Significant advances in smart camera technology can greatly improve surveillance in these vast facilities. These advancements allow security events to be better understood and interpreted

at the origin, enabling a security protocol to be acted upon immediately, saving time and manpower costs.

Today’s IP-based systems use cameras equipped with their own computers, operating systems, CPUs and memory, with software and analytics that enable much of the processing work to be done “on the edge” of the network as opposed to a server. For example, if a camera detects someone trying to scale a wall to enter a restricted area, it can trigger an audio warning through a speaker while simultaneously interpreting the event, sending relevant data and an alert to the central surveillance location where further action can be taken.

Intelligent technologies that go beyond

Along with facial recognition, today’s advanced security cameras offer an array of features. These solutions allow for people counting and typing, identification within checking zones, unattended

cargo detection, intrusion protection and sound detection as well as integration with other security systems such as fire-fighting equipment. Powerful new compression technologies, like Zipstream, reduce storage and bandwidth requirements as much as 50 per cent, while not compromising forensic information such as faces, tattoos or licence plates.

Major considerations with transportation hubs such as aerodromes include but are not limited to:

• Perimeter protection to detect a potential threat at the earliest possible stage;

• Verifying the extent and severity of the breach, and;

• Providing visual information to adopt an appropriate response

The sheer size of aerodromes can be overwhelming, particularly with the variable light conditions that are generally present. Thermal (infrared) cameras coupled with video analysis software can protect an area at any given time of the day, irrespective of the light conditions. Even in difficult weather conditions such as rain, fog, snow,

smoke, or glare, thermal cameras provide reliable alerts while greatly reducing false alarms thanks to powerful filtering algorithms. This is ideal for aerodromes as they do not interfere with air traffic control equipment and can be installed on existing fences, on buildings or even within the airside zone. The range of these cameras is impressive too, with real-time image analysis available 24 hours a day at distances ranging from 100 to 400 metres. Thus, a few cameras equipped with analytical solutions are enough to monitor the perimeter of a transportation hub, up to several kilometres.

Surveillance cameras can be installed to monitor wide overviews of expansive areas, to day and night functionality with features such as PTZ (pan, tilt, zoom), 360° pan, and lowlight capabilities. The system is also easily scalable — ground staff can identify areas that need extra monitoring, which the security team can then implement. When brought together onto a secure platform, this robust surveillance system not only provides counter-terrorism protection, theft prevention, and the monitoring of passenger and cargo processes, but the intelligence it gathers can also help optimize their movement and increase productivity.

Not only does “edge computing” allow for better surveillance, it can also record and interpret data to help with transportation logistics. This integration can help in a multitude of ways including minimize waiting times, improve passenger flow and ensure the right service is delivered to the right aircraft at the right time. A good example of this is Munich Airport where a monitoring system was installed that greatly assists ground crew who service more than 400,000 takeoffs and landings each year. Some of the 1,800 cameras in use at the airport are positioned at each gate to allow ground crew to see exactly when an airplane lands so servicing can begin as soon as possible to avoid costly delays.

From disembarking passengers and their luggage to reloading food and beverage, there are many tasks required to service an aircraft occur prior to rolling back for the next takeoff. The system is controlled by centralized monitoring software that alerts ground crew to arriving aircraft, allowing for the chain of events to begin as soon as possible.

Today’s global marketplace requires airtight security wherever valuable cargo may be stored while awaiting transport, adjacent to or near ports and airports. Major shipping company, Purolator sought to upgrade their outdated analogue video surveillance systems to sophisticated IP solutions in all their service locations. The goal was to support and monitor quality control, validate retail transactions and aid investigations of customer inquiries and criminal activities. Some of their locations have limited resources and are in remote areas. The company’s team was concerned

about rolling out network technology that would not only challenge bandwidth constraints but would require significant funds for software licences. Their new system combines IP cameras with Companion video management software and 2TB or 4TB Companion Recorders for easy retrieval, local storage and remote monitoring of the superior-quality video footage. Now they can accurately record transactions and the new system makes it far easier to manage customer inquiries and illegal activities.

“Smart camera technology can greatly improve surveillance in these vast facilities.”

With an intuitive interface, security personnel can use the system with minimal training and remotely monitor activity, reducing the number of onsite guards it employs. The management software automatically sends alerts when someone enters a restricted area, creates a protected video record of events allowing for quick search and retrieval of video footage and detailed analysis of the high-resolution images captured by the cameras.

Similarly, in ports and marine terminals, operators need a cost-efficient system to streamline the movement and inspection of containers as they move to and from the rail yard. The Virginia Port Authority’s Norfolk Terminal sees about 700 containers pass through daily, but this can triple during the busy pre-holiday period. To handle the increased volume, the Virginia Port Authority has deployed an array of network cameras mounted on light poles and container handling equipment to transmit container identification numbers, slot locations, rail car numbers and other data to inspectors monitoring a video wall in the administrative control centre. High resolution cameras take snapshots of each container from multiple sides as they travel through the rail yard, allowing inspectors to remotely track shipments and examine every cargo box for damage without leaving the safety and comfort of their office. The process is much faster than having inspectors walk up and down the container tracks, saving time and money.

Operators of large urban transportation systems also require security on public buses and trains, but with hundreds if not thousands of vehicles operating day and night, city budgets make it impossible to have security guards on board. Today’s specialized high-performance cameras designed specifically for mobile surveillance are adapted to the requirements and challenges of rolling stock: limited physical space, extreme shock and vibration, rapidly shifting light conditions, minimal storage space, and more.

Mobile surveillance solutions can withstand vibrations, and with HDTV image quality and

Wide Dynamic Range, fluctuations in light during driving is not a problem. Network video is ideal for wireless transmission over 3G/4G/ LTE, mesh net and WiFi, so an onboard system can benefit from easy remote assistance. Other capacities such as GPS, accelerometer, and a driver alarm button for instant security alerts can be integrated. In addition, smart cameras can adapt the video quality to the bandwidth connection available, while simultaneously recording an additional onboard video stream at full frame rate and full video quality. Image compressing technology reduces the size of files while preserving important details, so data can flow more quickly with lower storage and bandwidth requirements. Recording and archiving is possible inside with the camera or within onboard vehicle computers allowing high-quality recordings of incidents to be extracted wirelessly from vehicles to minimize costs and shorten investigation times.

A 2015 survey conducted by the UITP (International Association of Public Transport) found that 25.7 per cent of public transit systems still operate solely analogue cameras, and 2.9 per cent operate hybrid systems. It also found that 85.3 per cent of respondents actively considering upgrading their surveillance systems will look at IP/network cameras, suggesting a clear preference for digital technology. As this transition from analogue to digital occurs, an interim solution is provided by video encoders.

Munich Airport is the second largest airport in Germany with about 33 million passengers annually. To update the existing security system and enable it to be controlled via centralized management software, all the cameras had to transmit digital images. About a third of the airport’s analogue cameras were equipped with video encoders, which converts analogue signals into digital streams that can be sent over an IP-based network, such as a LAN, Intranet or Internet. Users can then view live images using a password-protected user account on the web or with video management software on a local or remote computer via a secure account. This can be a major cost saver as it allows functioning analogue cameras to be integrated instead of replaced, protecting existing investments while allowing a gradual change over to an IP-based system.

With the advances in surveillance technology now available, along with flexible, scalable solutions, transportation and cargo hubs can get perfectly clear images, both in real-time and recordings. These advances in surveillance technology make it possible for any transportation and cargo authorized personnel to access relevant information from anywhere, at any time. It also allows for automatic incident alerts and alarms, and it creates a cost-efficient, flexible and future proof video surveillance platform.

Paul Laughton is the architect and engineering manager at Axis Communications (www.axis.com).

The Securitron M680E Series

Magnalock with EcoMag technology has an increased holding strength of 1,200 lbs and is eco-friendly, with an average power draw as low as 60mA at 24V, allowing for use of smaller backup batteries and longer wire runs of thinner wire. This change in power represents a total reduced energy consumption of up to 80 percent over the previous Securitron M680 series. A new strike plate mounting template ensures strike alignment upon installation. This series has optional, integrated features such as passive infrared motion detector, Securitron BondSTAT bond sensor, Door Position Switch and door prop sensing. www.assaabloyesh.com/eco

The CM-CPC1 Clear Protective Cover is designed to protect any Camden flush mount, single gang, door activation device, including push/ exit switches, keypads and key switches – without limiting the operation of the device. The CM-CPC1 is supplied with a gasket and is suited for both indoor and outdoor use. CM-CPC1 heavy-duty polycarbonate covers protect single gang door activation devices from rain and snow outdoors and, in harsh indoor environments, protect devices from water, dust and chemicals. www.camdencontrols.com

As part of S&G’s Digital Platform, NexusIP is a fully scalable solution that allows for real-time, remote monitoring and control of one lock or multilock location network for a more reliable IP safe lock. Utilizing Wi-Fi networks that are already in place, NexusIP requires no additional components or drilling. The lock uses existing safe power connections, or its own external power source, to deliver consistent extended power. With the ability to assign up to four opening windows – per day, per schedule for up to 100 users through remote access control – NexusIP can be customized to fit a specific application. www.sargentandgreenleaf.com/nexusip

Morse Watchmans

KeyWatcher Fleet offers fleet managers a wide array of tools to maintain and optimize vehicle usage while reducing many operational costs. Managers can create user role-based “Pools”, or groups of vehicles, to automatically assign each vehicle accordingly. Flexible booking workflows enable customization to balance usage, ensure vehicle availability and more. A range of service features makes it possible to report problems and automatically initiate new or scheduled work on each vehicle. www.morsewatchman.com

The new 1551V miniature ventilated sensor enclosures are designed to house sensors and small sub-systems installed in the manufacturing environment as part of IoT systems. The 1551V enclosures are designed around the PCB sizes selected by leading sensor manufacturers for their latest generations of products. The ABS UL94-HB 1551V is available in black, grey and white as standard; four plan sizes, 80 x 80, 80 x 40, 60 x 60 and 40 x 40mm are all 20mm high, maximum PCB sizes are 74 x 74, 74 x 34, 54 x 54 and 34 x 34mm respectively.

www.hammfg.com

Key featured enhancements of Ocularis 5.7 Video Management System include a new Recorded Video Backup function that allows recorded video to be saved to a secondary location on the system at no extra cost. Additionally, the new Mirrored Recordings feature, available in Ocularis 5.7 Ultimate, allows the simultaneous recording of all cameras on two recording servers, ensuring that recorded video is never lost from failure of the primary recording server. Ocularis 5.7 employs enhanced TLS 1.2 encryption for stronger security against cyber-attacks. www.onssi.com

The AMS-2111 Series is designed for industrial and enterprise wireless access applications. Embedded with the Qualcomm/Atheros AR9331 chipset, it features network ro bustness, stability and a wide network coverage with a very low voltage input. Based on IEEE 802.11 b/g/n, the access point supports high-speed data transmission of up to 150MBps. The AMS-2111 Series is capable of operating in different modes. The unit also allows the user to position the wireless antenna in a better signal-broadcasting location for improved wireless coverage and signal strength. www.antaira.com

Speco’s 4K Flexible Intensifier Technology Cameras, the O8FB7M and O8FD4M, offer colour in low light, and they are equipped with 4K resolution. The O8FB7M and O8FD4M are designed to fit any lighting application. These cameras have three settings: Colour in low light, monochrome without IR in low light, and monochrome with IR in almost complete darkness. They also come with an included junction box, and feature a five year warranty. www.specotech.com

The FP-XMLPAB “extra medium” is a low profile articulating wall mount with tilt and list adjustment capabilities. The FP-XMLPAB is a low profile alternative for mounting larger flat panel displays. With a closed depth of 1.5 inches and a fully opened extension of 16.2 inches along with a fully adjustable 15 degree tilt, 3 degrees list adjustment and ± 45 degrees of rotation, customers can get a flat panel to the optimal viewing angle needed for any room or office. For added safety and security, the mounting rails accept padlocks for peace-ofmind.

www.videomount.com

The new ExD Explosive Environment camera range is a 360-degree single-sensor camera with an explosion protected housing. The range is designed to safeguard environments in markets such as oil and gas production and refineries, power and utilities, wastewater treatment, grain handling and storage, and other hazardous materials facilities. The Oncam ExD camera range helps ensure the safety of the surrounding atmosphere by containing electrical sparks that can ignite and potentially cause significant harm to both people and assets. www.oncamgrandeye.com

Security Center is an open-architecture platform that unifies video surveillance, access control, automatic licence plate recognition (ALPR), communications and analytics. Version 5.8 features customizable live dashboards, enhanced privacy protection, a map-driven mobile app, and new functionalities that help users actively monitor the health of their system and ensure compliance with cybersecurity best practices. Security Center 5.8 will enable users to create custom dashboards that will display real-time data, such as video feeds, alarms, reports and charts.

www.genetec.com

The DSC1500 portable beam barricade sets up quickly and temporarily to block vehicles. The barricade secures locations during short-term events and anywhere a beam barricade is needed for interim security. With a clear opening of 16 feet (4.8 m), the DSC1500 is M30 certified, able to stop a 15,000 pound (66.7 kN) vehicle going 30 mph (48 kph). The DSC1500 tows into position to control vehicle access within 10 minutes. No excavation or sub-surface preparation is required. Once positioned, the mobile barricades unpack themselves using manual hydraulics. www.deltascientific.com

Symphony 7.2 is the latest version of Senstar’s intelligent video management software (VMS). Symphony delivers an all-in-one solution for video management, video analytics, PIDS integration, and alarm management for deployments of all sizes. The VMS securely shares video clips with third parties with an integrated cloud video upload feature. It features a revamped Alarm Console which allows for better event management with simplified workflow. It also allows the user to navigate from camera to camera with Visual Tracking Links and features PostgreSQL database support. www.senstar.com

Wavestore’s high-density massive storage solution PetaBlok is available in various sizes from 48 HDD bays (480TB) taking up 8U of space, to 204 HDD bays (2.04PB) accommodated within 16U. This enables each PetaBlok to store images captured by over 235 4K resolution cameras in real time, for 120 days. The ability to offer flexible storage options, which can be expanded as the overall system grows, is enhanced by the option to add failover in order to provide system robustness and reliability, whilst negating any single point of failure. The solution is pre-installed with Wavestore’s Video Management Software (VMS). www.wavestore.com

The D1xB2 Xenon and LED explosion proof beacons are the latest addition to the comprehensive range of visual warning devices that use the same light engines and control circuitry with a choice of housing materials. The marine grade LM6 aluminum enclosures D1x, BEx and D2x,the 316L stainless steel STEx family and the GRP GNEx provide a variety of mechanical protection, corrosion resistance, weight and prices to suit different requirements.The Polycarbonate, UV stable lenses are available in amber, blue, clear, green, magenta, red and yellow. www.es2.com

STI’s lockable EnviroArmour Enclosures are available in fibreglass or polycarbonate with several ventilation options. The wireless friendly, non-metallic lockable enclosures are durable and reliable, helping to guard sensitive devices against weather, vandalism, tampering and theft. They are suited for devices requiring protection against rain, sleet, snow, splashing water, hose directed water and impact. They are for use with control panels, medical equipment, alarm panels, wireless equipment, DVRs and more. A variety of sizes and options are available in both models. www.sti-usa.com

The new 2U Blackjack X-Rack server, the DW-BJX2U is the latest addition to the company’s Blackjack family. The Blackjack X-Rack comes with DW Spectrum IPVMS server installed for setup and configuration, and is recommended as a complete solution with one or more Blackjack NAS devices for recording and Blackjack Client for monitoring. Blackjack X-Rack servers can manage single- and multi- sensor IP cameras of any resolution, with an equivalent capacity of up to 200 2.1MP cameras at 30fps and a maximum of 1200Mbps throughput.

www.digital-watchdog.com

Platinum Tools

The shielded Cat6A/7 RJ45 (8P8C) modular connector (p/n 106240) is designed to terminate round solid or stranded, 28 – 26 AWG, Cat6A/7 network cable. The connector contains 3-Prong contacts that hold the wire in place giving a reliable connection, and meets and exceeds 10Gig performance standards. The cable jacket outer diameter size range is 0.224in. – 0.335in. (5.7mm – 8.5mm). The Insulation diameter (conductor) size range is 0.037in. – 0.041in. (0.94mm – 1.05mm). The connector is designed for both shielded and unshielded cabling, and is compatible with CAT7, CAT6A, CAT6E and CAT6. www.platinumtools.com

The WeSuite Site Survey is a project documentation tool that ties in automatically with WeEstimate. The Site Survey Module allows users to create simple to highly detailed site surveys on their iPads, tablets or laptops. Users represent a job site on the Site Survey canvas by uploading images of floorplans, maps, photos, or by sketching layouts and then drag-and-drop real parts and part packages into place. The software adds all specified parts to the corresponding project folder along with pricing. When the user is ready to generate a proposal, a bill of materials is automatically created. www.wesuite.com

Available in either 2 or 5MP indoor or outdoor configurations, the Wisenet X series Plus line of cameras utilize magnets to lock sensor modules into the housing for instant snap-in installation. Electricians can run conduit with a single PoE connection to the mounting plate without the camera base, module, and top cover. This allows security professionals to snap the camera and covers into place in minutes. Camera modules are available with options such as PTRZ, IR and a heater. Housing choices include indoor, outdoor and a new compact plenum-rated flush mount. Removable skin covers are available in white, black and ivory. www.hanwhasecurity.com

By Neil Sutton

Smart network organization the Zigbee Alliance has already achieved a lot this year. In January, the alliance and fellow IoT standards body The Thread Group jointly announced the completion of the Dotdot 1.0 specification to improve IoT interoperability. According to a statement from the organizations, the specification will “enable new IoT applications, and improve the consumer experience by reducing IoT fragmentation.”

“The DIY is useful but we’re not there yet.”

In the same month, the Zigbee Alliance also announced that Amazon will join its board of directors. SP&T News spoke to Tobin Richardson, president and CEO of the alliance, recently about the drive towards interoperability, the role of major players like Amazon in the smart home, and how professionally-installed and DIY home automation systems can continue to co-exist.

SP&T News: What’s new with the Zigbee Alliance?

Tobin Richardson: More recently, we’ve had ecosystems joining. We’ve had Comcast join the board of directors, Amazon joining the board of directors. These have been the ecosystem plays that have said, we need all these devices to talk to each other, so they’re not having to manage different walled gardens.

Today we’re focused on Internet of Things and we’re seeing a lot of traction in smart homes, but we’re also focused on smart buildings and smart city. If you look at the volume of sales — I don’t want to say it’s evenly split — but the workgroups that are active in the alliance and certification that we’ve got going fit

into those categories pretty well.

SP&T: Is Amazon’s increasing participation in this market raising the level of awareness for smart home?

TR: They’re really bringing a coherence to the smart home. What we saw, a few years ago, was even though organizations and companies would use standards, whether it was WiFi or even Zigbee, they would do things to really still keep those ecosystems closed. If you’re only looking at six months or a year, then maybe that’s an OK business model. I think Amazon has shown, through the introduction of voice, a different experience. But also their alignment to as many products as possible from as many vendors as possible. That’s a really good alignment with open standards that are then truly, really open in multi-vendor environments. That’s a great alignment with an organization like ours or even with any standards organization. We’re really happy to see them do that in a way that brings that energy and that focus on delivering great consumer experiences into the standard.

We have great engineers, computer scientists and PhD’s and companies that are building the products — what really drives useful standards, though, are companies that are actually using them and stand to benefit by products interoperating at a really easy level and simple way for consumers. For the smart home market, that’s really important. It’s a good alignment with their business model and also the continued evolution of Zigbee, as we look at more and more devices talking to a smart home hub.

Also what Amazon is doing to reduce the number of hubs in the home is really important. The more hubs you have, the more areas for complexity and confusion on the consumer side. If you have a smart home hub you can get to with a voice, and from there access all the

different devices, it makes for a better consumer experience. Amazon has been really great within the Zigbee Alliance at driving this notion of: even the hubs have to act the same. That’s not something we really saw before.

SP&T: What is the role of the professional installer in the home market?

TR: As an organization, we’re just starting to touch that community through member companies such as Legrand… We’re excited to start working with them. We are stepping up our outreach to the developer community as well as installer networks in 2019 through our relationships with some international organizations that touch those communities. There will be an ability to get up to speed on some of the nuances of open standards versus what they may have always known and always been used to. As consumers demand more from that, I think there’s still a strong role for installers. The DIY is useful but we’re not there yet, and Amazon even recognizes that.

SP&T: Is there an opportunity for DIY and professionally installed systems to co-exist or even collaborate to some degree?

TR: Yes, I think there is in the nearterm. New technology takes a while to build up. Amazon or Google or others may want to have 200 devices in the home and capture that data and develop some interesting learning that helps the consumer and also maybe helps people sell to you. But it’s a very small percentage of the population that knows how to install 200 devices in their home in an intelligent way today. That doesn’t change overnight. For the installer community, there is a huge role here in the near-term. I think there’s an opportunity to learn about some of the newer technologies, especially the ones that have the largest reach. Five years ago, when I was being

asked this question: which product is going to take off in the smart home first? Which model is going to win out? Is it going to be DIY? It’s all of the above and none of the above. One’s not going to dominate in the near-term because the technology is complex and can break. There’s still a need for a curated process and a curated experience. But there are also the folks who want to do it themselves.

SP&T: How do you address the ongoing cybersecurity concerns with networked devices?