TARIFFS, an opportunity

AIN’T TOUGH TO REPLACE

Alternatives are there, but formulations need tweaking

Canada’s seafood sector is forced to seek new markets + CEREAL AISLE MAKEOVER WHOLE GRAINS, BFF PRODUCTS INJECT LIFE INTO A DECLINING CATEGORY

AIN’T TOUGH TO REPLACE

Alternatives are there, but formulations need tweaking

Canada’s seafood sector is forced to seek new markets + CEREAL AISLE MAKEOVER WHOLE GRAINS, BFF PRODUCTS INJECT LIFE INTO A DECLINING CATEGORY

Rely on the Comitrol® Processor Line by Urschel for free-flowing coarse to smooth particle solutions.

Labor saving: Continuous single pass operation without operator adjustments. Optional HMI.

Choose from interchangeable reduction heads, impellers, and set-ups, including feeding method and motor size, to fit your production needs.

The Urschel global network of sales and support has expanded. Urschel Canada is now open in Ontario with full coverage throughout Canada.

Contact Urschel Canada to learn more: 647-910-5017 | canada@urschel.com

NOVEMBER/DECEMBER 2025 • VOL. 85, ISSUE 6

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal, Customer Service

Tel: 416-510-5113 Fax: 416-510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

ED ITOR | Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

ASSOCIATE EDITOR | Steven McGoey smcgoey@annexbusinessmedia.com 416-510-5206

ASSOCIATE PUBLISHER | Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

MEDIA DESIGNER | Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR | Cheryl Fisher cfisher @annexbusinessmedia.com 416-510-5194

AUDIENCE DEVELOPMENT MANAGER | Anita Madden amadden @annexbusinessmedia.com 416-510-5183

GROUP PUBLISHER/DIRECTOR OF PRODUCTION | Paul Grossinger pgrossinger@annexbusinessmedia.com

CEO | Scott Jamieson sjamieson@annexbusinessmedia.com

Publication Mail Agreement No. 40065710

Subscription rates

Canada 1-year – $86.65 per year

Canada 2-year – $127.45

Single Issue – $15.00

United States/Foreign – $163.15 All prices in CAD funds

Food in Canada is published six times per year by Annex Business Media. Occasionally, Food in Canada will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Privacy Officer

Privacy@annexbusinessmedia.com 800-668-2384

No part of the editorial content of this publication can be reprinted without the publisher’s written permission ©2025 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

ISSN 1188-9187 (Print) ISSN 1929-6444 (Online)

As we close out one year and prepare for another, I thought of sharing some trends from a roundtable we hosted recently to give you a sense of the factors that’ll drive purchasing decisions in 2026.

Moderated by your’s truly, the roundtable featured industry experts Nick Gibson, Canada Lead, NielsenIQ (NIQ) Product Insights, Julie Istead, VP of R&D, Puratos, and Cassandra Rouleau, Senior Marketing Manager, Kerry.

The discussion began with potential avenues of growth for F&B manufacturers in these challenging times. While describing the overall environment as “tough,” Gibson said volume and tonnage growth has been “pretty flat,” in 2025 if inflation is not taken into account. He cautioned that finding genuine growth requires more precision from manufacturers. Istead added that economic factors make price extremely important. However, she countered the idea that price is the only driver, as consumers are ”willing to pay more for products that offer the value they’re looking for.”

Rouleau seconded Istead’s view on price being the main purchasing driver. She added consumers will adapt by trading down or trading away from foodservice, focusing on buying products with long shelf lives, and purchasing

when products are discounted. Gibson stressed that “not all consumers are the same.” According to recent NIQ surveys, 80 per cent of Canadians are either vulnerable or very careful with their spending. He pointed out that about one in five feel like they’re either thriving or unchanged despite market conditions. This segment is willing to buy BFY products even if they’re priced at a premium. He added that products made in Canada or have some sort of ‘Canadian-ness’ are performing well, while those made in the U.S. are disproportionately struggling. No surprises there!

Besides price, the most influential factor is health and wellness, and this trend is expected to continue in 2026. Healthconscious food trends include sugar/ salt reduction, gut health, clean labels, and improved energy claims. Gibson noted a majority of young brands have health and wellness front and centre. He reported that products containing whey protein are growing at “about three times the rate of the overall market”. Collagen-based products are also seeing substantial growth. Rouleau connected the health trend to a shift in consumer mentality, as they are constantly thinking about ‘what can I do today to improve my long-term health’. She emphasized consumers’ willingness to pay the extra price when

Nithya Caleb

the health claim is “science-backed.” For instance, probiotics are gaining traction as a functional, gut-friendly ingredient. Istead is seeing a similar trend in the baked goods sector, where consumers are fully aware of the gut-brain connection. Hence, they are looking for ingredients like sourdough, prebiotics, and probiotics. When asked for an ingredient to watch, Rouleau named fibre, calling it a “hero ingredient that we’re forgetting” because consumers know it improves gut health as well as overall mouthfeel.

All panelists agreed that consumers are unwilling to sacrifice moments of personal comfort despite the affordability crisis. Istead highlighted Puratos’s Taste Tomorrow survey, which found that seven out of 10 Canadian customers still want their sweet goods.

She also identified texture as a critical factor. Consumers want crunchy, crispy and flaky textures in a single bite. She noted the trend includes familiar combinations (e.g. crunchy and creamy) as well as textures that were previously unfamiliar to traditional North American consumers. What trends are you tracking? Let me know. Happy New Year!

Nithya Caleb ncaleb@annexbusinessmedia.com

Ferrero Canada has officially launched its new Ferrero Rocher chocolate squares production line at the Brantford, Ont., manufacturing facility, marking the firstever production of this product. This milestone is part of Ferrero’s landmark $445-million investment in Canadian operations. The ribbon-cutting event featured remarks from Ferrero leadership and government dignitaries including Michael Lindsey, president and chief business officer, Ferrero North America.

Lay’s gets major rebrand in 100 years

Lay’s revamps its look and its recipes for the first time in nearly a century.

Lay’s Baked and Lay’s Kettle Cooked chips are also getting an ingredient update. Lay’s Baked will be made with olive oil and have 50 per cent less fat than regular potato chips. A new version of Lay’s Kettle Cooked Reduced Fat Original Sea Salt will be made with avocado oil and offer 40 per cent less fat than regular potato chips.

Bolero Shellfish Processing fined $1M for non-compliance

Bolero Shellfish Processing, Saint-Simon, N.B., has been fined $1 million and barred from using the Temporary Foreign Worker Program for

Provisur Technologies introduces the new Hoegger X3 Pro form press with load sensing technology for forming of meat products like bacon, raw ham and pork loin. The new load sensing module consists of additional hydraulic control components that reduce the noise emission of the machine. Another feature of the X3 Pro is the toolless die set that reduces tool change time. www.provisur.com

10 years, until Sept. 17. 2035, for failing to provide proper wages and working conditions, complying with federal and provincial labour laws, and providing a workplace that is free of abuse. This is the biggest penalty ever issued by Employment and Social Development Canada.

Lassonde installs new production line Lassonde Industries inaugurates its first fruit concentrate ‘bag-in-a-box’ production line, installed in one of its Rougemont, Que., plants, at a cost of more than $10 million. The new line

Crawford Packaging introduces the CP-1000 high-performance tray overwrap machine. The CP-1000 is optimized for PVC & PE overwrap films, offers a throughput of up to 120 packs per minute, and has heated exit conveyor as well as automated feeding.

“We saw a gap in the market for a machine that could perform at high speeds while providing the versatility and value that today’s operations require,” said John Ashby, president of Crawford Packaging. www.crawfordpackaging.com

produces formats containing a flexible inner bag designed to hold fruit concentrates. These formats are ideal for a wide range of commercial and institutional clients, including quick-service restaurants, convenience stores, manufacturers such as microbreweries, distilleries and caterers, as well as other foodservice operators across North America.

Sour Puss moves production to Quebec Phillips Distilling Company, a Minnesota-based company and owner of the Sour Puss brand, is moving full production of the liqueur sold in Canada north of the border. Production will be carried out in partnership with Station 22 Distillery in Montreal. Launched in Canada in 1998, Sour Puss sold more than 1 million bottles for a total sales value exceeding $23 million across Canada in 2024.

Signode releases the Octopus Prestige stretch wrapper for high-speed beverage plants. The wrapper uses a top-down design, so all maintenance areas of the machine can be lowered to floor level. It has a Double-S film carriage system that allows for stable loads while reducing film consumption, a top sheet dispenser with floor level access for film roll change, as well as Signode’s RollCycler film roll changing system that can store up to eight film rolls. www.signode.com

Ready to navigate the ever-evolving landscape of the food and beverage industry? In a year marked by uncertainty and change, stay ahead with insights and analysis to help you strategize and thrive.

Dr.

Amy Proulx

ackaging foods and beverages into hermetically sealed cans or jars requires a high level of attention to preventive controls. Part 4, Division 3 of the Safe Food for Canadians Regulations (SFCR) outlines requirements for the processing of hermetically sealed low acid foods. In Canada and most of the world, the cutoff for low versus high acid foods is pH 4.6. As this value approaches neutral pH, food and beverage products can harbour highly toxic pathogenic bacteria known as Clostridium botulinum. Below pH 4.6, many yeasts, moulds, and bacteria can still thrive. This includes spore-forming bacteria that can be activated by heating processes. As pH drops into more acidic ranges, around pH 3.7 to 3.5, very few organisms thrive. Pasteurization can provide a risk mitigation strategy against spoilage.

Water activity is a significant variable in preventive controls. Small molecules, such as sugars or salts, can bind the water and prevent it from supporting microbial growth or chemical reactions. These molecules are present in jars of food including honey, jams, maple syrup, and many sauces. There is a Preservation Index formula where the combination of titratable acidity, pH, soluble solids, and water activity allow for the inherent stability of products. Think of ketchup that can be left out on a consumer’s counter, while spaghetti sauce would go mouldy in the same conditions. The relatively high levels of sugar, salt, and vinegar in ketchup create an inhospitable environment for spoilage organisms to thrive. While SFCR’s attention tends to focus on low acid products, the practices defined in the regulation are suitable for all hermetically sealed products. Unfortunately, SFCR does

Quality application of HACCP and preventive control systems has succeeded in reducing and eliminating risks of biological contamination in products. Exploding cans are mostly a thing of the past.

not give an in-depth description of what is required in a scheduled process other than including a description, the formulation, and the name of the person who prepared the documentation. The Canadian Food Inspection Agency’s (CFIA’s) Preventive Controls for Foods Guidance document contains a much more detailed write up, specifically for low acid food. It requires a product name and classification; container type, size, and closure; processing method and equipment (retort type, agitation, etc.); processing parameters (time, temperature, pressure) and critical intrinsic factors (pH, product formulation, viscosity, use of preservatives, fill, headspace, carbonation, etc.); and the name of the process authority or thermal processing specialist who prepared the documentation.

For each lot processed, can filling parameters, can seam integrity monitoring, thermal processing parameters, visual and destructive seal or closure inspection, deviation and defect records, and incubation testing

records must be maintained. Access and affordability of time-temperature dataloggers have been an important transformation, allowing operators to monitor the thermal process and apply sufficient time and temperature for safe production.

These records are very important because Clostridium botulinum is highly toxic. Some of us are old enough to remember exploding cans due to the slow outgrowth of non-pathogenic spore-forming bacteria. Quality application of HACCP and preventive control systems has succeeded in reducing and eliminating risks of biological contamination in products.

It’s highly recommended to hire a process authority or thermal processing specialist to evaluate documentation and operating procedures for production of hermetically sealed packages including cans, bottles, jars, aseptic tetrapak, and high barrier pouches. These specialists apply different techniques to identify processing parameters, including evaluation of the heating characteristics of any thermal processes and identification of cold spots within the process. Moreover, they evaluate the thermal properties and heating characteristics of the product. In most cases, they will apply mathematical models from engineering tables that have characterized the intrinsic properties of the product. Additional thermal testing at a laboratory may also be necessary.

When working with a consulting process authority it’s very important to ask about their experience. Ask for credentials and what authoritative references they use for their modelling.

Dr. Amy Proulx is professor and academic program co-ordinator for the Culinary Innovation and Food Technology programs at Niagara College, Ont.

Sunflower kernels are:

available raw or roasted

an excellent alternative to nuts

mild in flavour and add a pleasant crunch to food

a good source of fibre, Vitamin E, zinc and folate

ideal for a variety of foods including: bakery products, granola, snack bars, salad toppings and plant-based foods

Gary Gnirss

anada’s labelling approach often reflects a ‘my house is your house’ mindset. For example, a package of cookies imported from the U.S. may bear the name and address of a U.S. company, but there’s no need to declare the product’s country of origin. It is assumed a consumer would recognize the product originated in the U.S. This approach implies a sense of shared identity that may no longer meet consumer demands for transparency and clarity.

Canadian regulations also do not consistently require clear declarations of a food product’s origin. Consumers are often left without predictable or uniform information to make purchasing decisions. Even voluntary claims related to domestic production can be confusing. For instance, what is the difference between “Made in Canada” and “Prepared in Canada”? While a technical distinction exists, it is not always meaningful or intuitive for consumers. In the case of certain retail food commodities (e.g. a bag of cookies), it is sufficient when a Canadian domicile (name and principal place of business) is included on a label of an imported product along with the prefix “Imported by”. Consumers are then left to ponder, but from where?

To be fair, Canada does mandate clear country of origin declarations for certain food categories. For instance, meat and poultry products of foreign origin must display the country of origin on the main panel, next to the product name. Seafood labels must include a foreign state of origin, typically next to the company’s address. Processed fruits and vegetables only require country of origin labelling if a Canadian address is provided for a product of

foreign origin. In that case the declaration can be anywhere on the label, but must be 6.4 mm in height if the declaration of net quantity is more than 283.5 g and at least 3.2 mm in height if the declaration of net quantity is 283.5 g or less. If the food is of the same origin as that of the named domicile, no other origin markings are needed. Imagine how confusing this can be for consumers.

In the case of imported prepackaged dairy products, the foreign state of origin must be declared on the label. However, for a consumer prepackaged cheese packaged in Canada from imported bulk cheese that is subject to a standard, the declaration must be on the main panel. Can we make rules that are any more confusing!

Canadian rules are piecemeal and inconsistent, leaving many consumers frustrated and confused.

Much of this regulatory patchwork is the legacy of older labelling requirements that were effectively inherited under the Safe Food for Canadians Regulations (SFCR), which came into force in 2019. The Canadian Food Inspection Agency (CFIA) initiated efforts to modernize these rules, but the process was shelved due to COVID-19.

CFIA’s policies, adapted from Innovation, Science and Economic Development Canada, outline criteria for terms such as Product of Canada (all or virtually all major ingredients, processing, and labour must be Canadian, with no more than 2 per cent foreign content) and Made in Canada. The latter claim must be qualified, such as “Made in Canada with domestic and imported ingredients,” if foreign content is used.

Additional phrases like “Prepared in Canada” or “Baked in Canada” do not need to be qualified. Businesses may also identify themselves as Canadian, but this can be misleading if the actual food product is imported, unless the claim is properly qualified. Canadian guidelines may be a bit soft in this regard.

The maple leaf, a powerful national symbol, has also seen a resurgence in marketing. The iconic 11-point maple leaf is a registered trademark of the Government of Canada, and its use in commercial contexts requires authorization from Heritage Canada. This important fact may not be well-known in industry.

Even before recent trade challenges, the need to update Canada’s country of origin labelling rules was widely acknowledged. Today, consumers are increasingly frustrated with the lack of clarity and consistency in food labelling. Updating our origin labelling framework is not just a matter of regulatory housekeeping, but also an achievable and necessary step toward greater transparency and consumer confidence.

Gary Gnirss is president of Legal Suites, specializing in regulatory software and services. His email ID is president@ legalsuites.com.

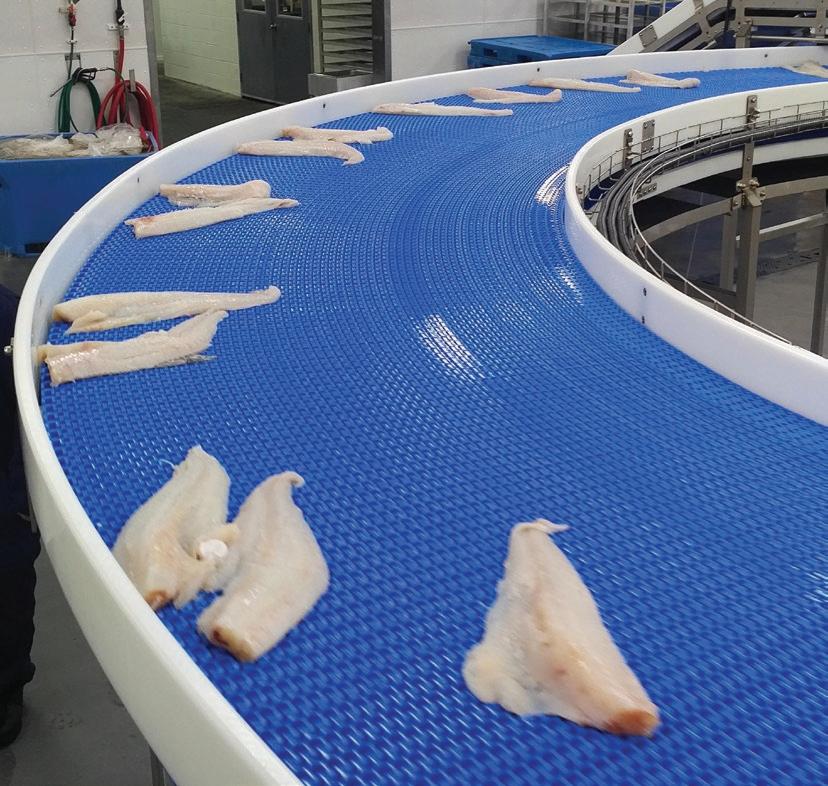

Tyson MacInnis

alk into most seafood plants in Atlantic Canada and the mix of old and new systems can be striking. Operators trim fillets by hand beside automated cutters. Paper yield sheets hang next to touchscreens. Sensors blink quietly on the wall while handwritten QC notes pile up on clipboards. Digitization is happening, but not fast enough to solve the productivity crunch facing Canada’s seafood processors.

The issue isn’t a shortage of technology, as Canadian innovators are building systems for automated cutting, defect detection, traceability, and cold-chain monitoring. The gap lies between what is possible and what is used on the floor. For small and mid-sized processors, new tech often feels risky and expensive. For tech solution innovators, getting commercial traction inside real plants can be painfully slow.

The opportunity is in closing that gap. When processors and innovators can meet halfway, the payoff for yield, labour productivity, and waste reduction can come fast.

According to a recent report from Future Skills Centre, meat and seafood are the least automated segments of Canadian food manufacturing.

For many operators, the obstacles to technology adoption are structural. With thin margins and short harvest seasons, it can only take a few bad days to wipe out a year’s profit, so gambling on an unproven system feels reckless. It’s easier to stick with less efficient, but proven, processing systems than to pour resources into expensive modernization projects. Even when the money is there,

With thin margins and short harvest seasons, it can only take a few bad days to wipe out a year’s profit, so gambling on an unproven system feels reckless.

integration is complex. Few facilities have the luxury of starting fresh; they run on decades-old equipment, handwritten QC logs, and a tangle of spreadsheets. Adding AI inspection or a cloud-based manufacturing execution system can feel like grafting new circuitry onto an old boat. It is technically possible, but takes patience and customized solutions.

Despite these challenges, operators of all sizes are finding ways to modernize, supported by a new wave of Canadian foodtech innovators. In Atlantic Canada, Moncton-based Area 52 has quietly become a global leader in automated lobster processing. Its modular systems have been installed in more than 60 plants, starting with stations that replace 10-person manual lines with one operator, thereby delivering immediate ROI and building confidence to automate further.

On the digital side, Nova Scotia’s Mabel Systems is helping seafood plants close the traceability gap between fishers, buyers, and the processing floor. That gap has become a growing pressure point as markets like the E.U. move toward mandatory digital traceability for seafood

imports. These examples show that the tools to transform Canada’s seafood sector already exist. What’s needed are the networks, capital and confidence to make them standard practice.

Collaborative funding models are showing how this approach can deliver results. Ocean Supercluster’s Generative AI for Seafood project—featuring ThisFish, Bitstrapped AI, and Orca Specialty Foods—is focused on testing AI-powered automation systems under production conditions to generate robust, affordable processing solutions for SMEs. CFIN’s Foodtech Next program takes a similar approach: one recently funded project featured a collaboration between Freshr Sustainable Technologies and Cooke Aquaculture focused on integrating Freshr’s antimicrobial-coated packaging film rolls into Cooke’s salmon packaging operations to demonstrate how sustainable, high-performance packaging can reduce waste and extend shelf life.

This is what a stronger national adoption model could look like: innovators and processors working side by side to test, refine, and scale technology that delivers real returns on the floor. It’s precisely how Canada can help its SMEs adopt new technologies, give innovators the feedback they need to refine their tools and unlock progress in one of our most important food sectors. The next edge for Canadian seafood won’t be what comes from the water; it will come from what we do after the catch.

Carol Zweep

ets are an integral part of the family with the most popular ones being cats and dogs. These pet owners expect the same level of quality for pet food as human food. Packaging is an integral part of the product as it contains, protects, communicates information and entices purchase. Currently, pet food packaging focuses on convenience and maintaining freshness while using sustainable materials that are presented in an appealing format.

Health and wellness are top of mind for pet owners. Food and treats are customized to meet the age and health concerns of pets. Packaging plays a vital role in maintaining quality including the food’s nutritional value. For shelf-stable products, adequate barrier properties are required to ensure protection against deteriorating factors such as moisture loss or gain and oxidation. Pet food and treats can be packaged in bags, pouches, tubs and cans. Fresh pet food requires refrigeration or freezing. Although oxygen barrier is not needed, the packaging needs to be adequately sealed and be able to withstand lower temperature storage.

Driven by environmentally conscious consumers and stricter regulations, the pet food industry is looking at sustainable options while maintaining the package’s function and appeal. Practices such as lightweighting reduce the amount of material and transportation cost, thereby lowering environmental impact. Compostable bio-based materials are made from renewable resources that have lower carbon footprints. Use of recyclable and PCR (post-consumer recycled)

materials promotes the circular economy by reusing existing resources. Packaging components, such as inks, adhesives, labels, closures and fitments, need to be appropriately selected to ensure the entire package is recyclable.

When switching to recycle-ready alternatives, one must also consider the impact of package change on the product’s shelf life.

Designing sustainable, convenient and attractive pet food packaging to meet industry demands should not compromise the package’s functionality.

Consumers prefer packaging that is easy to open, reseal and store. Singleserve, portioned meals provide the convenience and portability consumers are demanding. Tamper evident feature prevents product contamination and helps earn consumer trust.

The market for premium pet food is growing and packaging is crucial to convey this exclusivity. Design elements, such as graphics, finishes, coating, embossing and foil stamping, are needed to stand out on shelves. QR codes, NFC (near field communication) and AR (augmented reality) promote digital engagement with consumers. AR-enabled packaging allows consumers to experience immersive content such as virtual tours and product tutorials. Integration of QR codes and NFC tags allows information (e.g. ingredient sourcing, feeding guides, authenticity checks or brand story) to be shared with consumers.

Increased global pet population and humanization have changed consumer expectations for the pet food industry. Packaging provides competitive differentiation in a crowded market. Packaging can also build trust, entice the buyer, strengthen the brand and establish customer loyalty. Designing sustainable, convenient and attractive packaging to meet industry demands should not compromise the package’s functionality.

Carol Zweep is an associate with PAC Global. PAC Global is a not-for-profit, trusted advisor for its member-based global packaging network.

It’s not always a simple 1:1 swap when creating baked goods

— BY JACK KAZMIERSKI —

Eggs have been described as a “powerhouse ingredient” in baking, contributing to the structure, texture, flavour, colour and moisture of the end product. However, a number of factors are behind a shift from nature’s miracle food to egg alternatives, as food companies look for ways to cut costs and attract new customers.

“Eggs are multi-functional, acting as binders, emulsifiers, leavening agents and flavour enhancers, which makes them difficult to replace with a single ingredient,” says Kirk Borchardt, senior R&D chef with Ardent Mills. “While volatility in egg pricing has prompted many manufacturers to explore substitutes, other factors are also driving this shift, such as supply chain resilience, allergen and dietary considerations, and the growing demand for plant-based and vegan-friendly products.”

Kwee Choo Ng, product manager, rice ingredients and functional proteins, North America, at Beneo, says that eggs are one of the top eight major food allergens, and that removing them enables food producers to reach a broader consumer group.

Ng explains that egg alternatives have other benefits as well.

“From a nutritional perspective, these alternatives are cholesterol-free, lower in saturated fat, and support a ‘better-for-you’ positioning, making baked goods suitable for consumers seeking heart-healthy, plant-forward options.”

Moreover, companies with sustainability targets see egg alternatives to advance their green initiatives, Ng explains.

“Food producers are also looking for ways to reduce carbon footprints in line with their sustainability strategies,” she says. “Replacing animal-derived protein with plant-based protein is a feasible approach.”

While replacing eggs with alternatives may sound straightforward in theory, there are key differences that must be considered when rewriting recipes.

“Replacing eggs in baked goods creates a specific set of challenges for recipe formulation because eggs have a multi-functional impact on the final product in terms of taste, texture and appearance,” says Ng. “This is because they can be used for foaming and aeration, texturizing, emulsification, colour and flavour, as well as a glazing agent. This is why, depending on the type of application, an egg alternative also must deliver on this range of

Egg alternatives allow baked goods manufacturers to reach consumers who seek plant-forward food options.

technical properties.”

Ng says that the Beneo-Technology Center has been trying out ingredients for successful egg-free recipes, and they have found that faba bean protein concentrate can serve as a suitable solution for partial and total replacement of whole eggs, egg whites, and egg yolks.

“Depending on the ratio of eggs used, complete egg reduction can be achieved in baked goods such as muffins, shortbread, and meringue,” she says. “With some baked goods, such as pound cake, sponge cake and angel food cakes, complete egg replacements are a challenge, as eggs are primarily the leavening agent for their desired structure and moisture. It is also observed that the colour and flavour of the cake will be compromised. Therefore, in these products, we recommend partial replacement of eggs for cost reduction and carbon footprint reduction.”

Kirk Borchardt from Ardent Mills explains that it is essential to understand why eggs are part of a given recipe when making

plans to replace them with an alternative.

“Are they providing structure and leavening or are they simply binding ingredients together?” he says.

Borchardt explains that in products like cookies, muffins or pancakes, where eggs mainly add moisture and binding, substitutes can perform exceptionally well without compromising texture or taste. However, in more delicate applications like sponge cakes, meringues or custards, where eggs contribute to aeration or emulsification, replacement may require more fine-tuning. 25_010755_Food_In_Canada_NOV_DEC_CN Mod: October 21, 2025 2:32 PM Print: 10/22/25 page

Eggs are the jack-of-all-trades for the food industry, serving many purposes when incorporated into a recipe. When choosing an alternative, begin by answering the question, “What job do I want this egg substitute to do in this recipe?”

Kirk Borchardt, senior R&D chef with Ardent Mills, explains which egg alternatives serve each purpose the best.

Ingredients derived from chickpeas, soy or certain starch-protein blends can help stabilize emulsions.

For lift, combinations of starches and proteins, sometimes with leavening agents, can replicate the light texture eggs provide.

Natural flavour systems or plant-based proteins can help replace the mild richness eggs provide.

Turmeric, carotenoids or clean label colourants can replicate the golden hue of eggs.

Plant-based proteins can help retain water and improve mouthfeel.

Some plant proteins can partially replicate egg white foam, though achieving full volume often requires blending or process optimization.

Modified starches and proteins can form gels similar to egg coagulation, supporting structure in custards or fillings.

“The key is to balance functionality with sensory expectations and clean label goals,” says Borchardt.

Eggs are considered a cornerstone ingredient in baking due to their versatile functionality, adds Hadar Ekhoiz Razmovich, CEO and co-founder of Meala FoodTech. “Replacing egg with a single, high-performance ingredient that can deliver the desired rise and lightness prized in bakery products is highly challenging.”

When working with egg alternatives, food producers need to keep the pros and cons in mind, explains Borchardt.

“The main advantages of modern egg replacers are consistency, supply stability and allergen-friendly and plant-based formulations. They also offer cost management benefits by reducing exposure to egg market volatility,” he says.

The trade-offs, Borchardt adds, can include minor formulation adjustments to achieve the same aeration or structure as real eggs, depending on the application.

“However, advances in ingredient technology, particularly chickpea-based systems, have narrowed this gap considerably. Our R&D team has found that Ardent Mills Egg Replace, [which is primarily chickpea-based], performs comparably to eggs in many bakery applications, offering reliable texture, binding and moisture retention.”

Another key concern is taste. Ng notes that although a substitute like faba bean concentrate only has a mild/subtle “beany flavour,” it can be recognizable in the end product, depending on how much of it is used.

“Consumer awareness of faba bean pro-

According to Beneo, faba bean protein concentrate can partially and in some instances, totally replace whole eggs, egg whites, and egg yolks in baked goods.

tein is currently lower compared to more established plant-based proteins like pea, soy, and rice, but the bakery industry is increasingly incorporating it due to its functionalities against other alternatives,” she says.

Incorporating egg alternatives into existing recipes requires a bit of experimentation.

“Evaluate the substitute in finished products, as off-notes can be eliminated during baking and heat treatment,” says Ng. “Consider the use level and functionality – it will guide you to consider full replacement or partial replacement, and it is likely not going to be a one-to-one replacement.”

Borchardt recommends starting with a clear understanding of the role eggs play in each individual recipe, and then testing and adjusting gradually.

Since “plant-based replacers can interact differently with other ingredients, small tweaks to hydration, mixing time, or bake temperature can yield optimal results,” he says. “We also recommend working closely with your ingredient supplier. Ultimately, success comes down to thoughtful formulation and collaboration, leveraging ingredient expertise to create baked goods that deliver the same great eating experience consumers expect, with the added benefits of stability, sustainability and versatility.”

While eggs will continue to be a key ingredient in many foods, giving the end product the texture, structure, and volume that consumers expect, there’s definitely a place for egg alternatives, which can help food producers better manage costs, overcome supply chain issues, and expand their customer base.

How Canada’s seafood sector is navigating the market shortfall — BY TREENA HEIN —

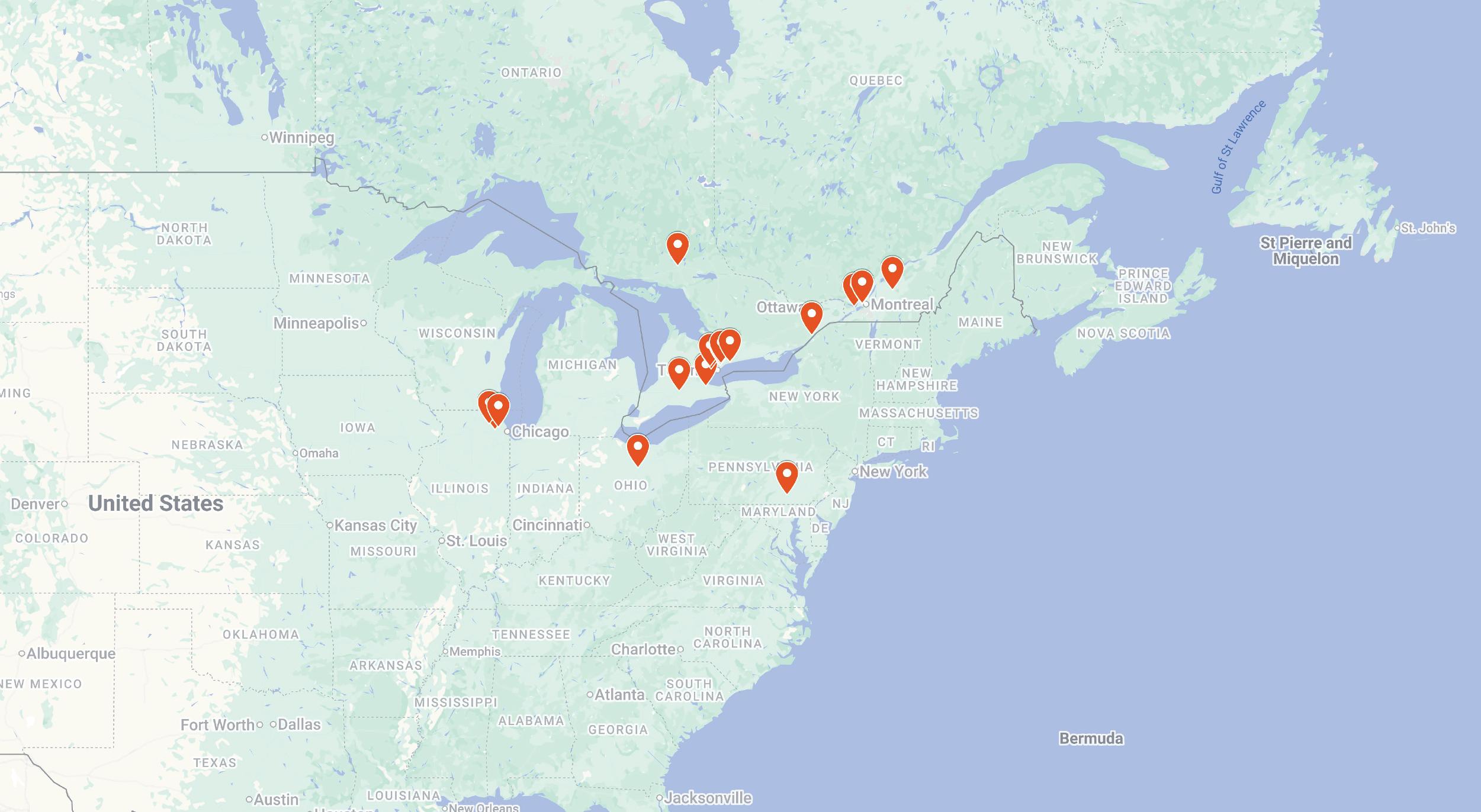

In March 2025, China placed tariffs on some Canadian seafood products in response to Canada’s tariffs on Chinese-made electric vehicles (EVs). This has had the expected – large and terrible – effect on fisheries on both coasts of Canada.

In addition to placing tariffs on Canadian fisheries products, canola, canola oil/meal, peas and certain pork products, China filed a complaint with the World Trade Organization against Canada’s EV tariffs. However, the Chinese have offered to lift their measures if Canada does the same. University of British Columbia political science lecturer Dr. Stewart Prest has been following the developments and says it’s hard to predict how these situations will play out.

“The Chinese government uses tariffs and the threat of tariffs against countries like Canada with products that are mainly dependent on sales to China,” he notes. “It’s a strategic move. There’s a possibility of a negotiated solution, and hopefully it will happen soon. We have seen China and Canada work through the really serious ‘Two Michaels’ situation in the recent past and we saw some steps towards more renewed trade connection after that, but now we’re in this trade war.”

According to Megan Eadie, executive director of the B.C. Crab

Fishermen’s Association, Canadian Dungeness crab is primarily sold as a live product and up to 90 per cent of the B.C. catch is normally exported to China. However, since March, Chinese orders sharply dropped off, crashing the price of crab.

“Over the summer, which is peak harvesting season, harvesters reported prices of roughly half what they were last year,” Eadie explains. “In some areas, vessels are choosing not to fish instead of operating at a loss. Many of our small commercial fishing businesses are facing immediate financial distress, without sufficient buffers or alternative markets.”

Overall, using monthly export data, Eadie reports that the value of Dungeness crab exports to China are down by nearly 60 per cent compared to the previous year. It was $11.89 million in June 2024 and $4.96 million in June 2025.

In addition to contacting the federal government to urge a deal that removes the tariffs, B.C.’s crab industry has also been working to pivot its markets. However, building up a new market for any product is, of course, a very slow process.

“We don’t know if there is a market that could absorb anywhere near the amount of product that China does,” adds Eadie.

As a nonprofit, her organization supports crab harvesters in fisheries management and keeping the fishery sustainable but has minimal resources for market development.

“We were previously doing some local marketing work, run-

ning the False Creek Crab Festival and collaborating on the B.C. Crab Festival, which we have continued. But we’ve also started on some international marketing,” Eadie shares. “We’ve attended some international seafood expos to meet with buyers from other markets, and to understand market demand and our competition. We need to continue learning about other markets, building relationships and advertising Dungeness crab, but this work is expensive, so we need government support.”

Like Dungeness crab from Canada’s West Coast, a large amount of the lobster harvested by Nova Scotia fishers is exported live to China.

“It’s about 40 per cent,” explains Kris Vascotto, executive director of the Nova Scotia Seafood Alliance. “Another 40 per cent goes to the U.S., and the rest to other Asian countries and Europe. Looking at live sales to China, during the months of April to August this year, we were down $100 million. We were hoping for sales to the U.S. to pick up some of the slack, but that hasn’t happened. There was a bit of demand recovery for China’s autumn festival that takes place in October, but it’s not much in the big picture at this point, and we are becoming concerned about replacement of lobster as a meal for special occasions in China, at home and at restaurants.”

Vascotto explains that his industry has already worked hard to diversify its markets. About 12 years ago, approx. 80 per cent of Canada’s lobster harvest was shipped live to the U.S. Prices at the wharf were low because American buyers knew they held the cards.

“So we started building the Chinese market for live lobster,” says Vascotto, “but it’s a broad impact across several other species. About 70 per cent of Nova Scotia’s total catch sent to China is lobster, and the other 30 per cent shipped to China is surf clam, cold water shrimp, whelk, sea cucumber and cod. Due to the tariffs, sales of all of it are down. Yearly lobster sales alone are about $500 million for Nova Scotia, so it’s been very impactful to our local communities.”

After the tariffs were announced, the lobster fishery sector looked immediately at other markets, but again, building up any market generally takes years. Vascotto notes that even if sales to the U.S., Europe and Asia-Pacific Rim countries increased by 10-20 per cent each, that makes little overall impact.

“We’ve tried to also build the processed lobster market here in Canada,” says Vascotto. “Our lobster fishery gets going in October, mainly November, and we’ll try to find markets interested in the product. We’re hopeful that relations with China can be worked out. But if you look at its history of tariffs, it took four years for the Australian rock lobster situation to be sorted out.”

Bob Creed, executive director of the P.E.I. Seafood Processors Association, notes that many regional exporters are still doing business in China, but “at the same time, our members are working hard to continue market development initiatives all around the world.”

Nearly 20 per cent of Canadian seafood exports go to China. Plus, some categories like prawns and geoduck are almost fully exported to China.

Canada is forced to find new markets for seafoods due to tariffs imposed by one of our largest trading partners, China.

The Canadian Centre for Fisheries Innovation (CCFI) in Newfoundland, owned by Memorial University, supports lab research and new product development for both farmed/aquaculture and wild-caught marine species.

Managing director Keith Hutchings explains CCFI initiates projects with industry players along the supply chain that can help meet consumer needs in new markets. This would include meeting food production and preparation standards for the seafood while aligning consumer cultural cooking norms as well as ensuring quality during transportation.

“As an example, we have had some preliminary discussions since the tariffs in March about product development project for lobster and have already worked with industry in exporting a high-end ready-to-cook cod, shrimp and scallop product,” he says. “Europeans consume a significant amount of seafood so that’s an important market to continue to examine and grow. Continued industry engagement and discussion on seafood product development will no doubt result in new company projects in current and new markets. CCFI will continue meeting industry requirements in processing, transportation, and packaging needs to grow export capacity.”

Whole foods and hi-protein options resurrect a declining category — BY

KAREN BARR —

Cereal has long been a pantry staple, but it has undergone significant evolution over the years. The oldest traces of cereal date back over 100,000 years. Later, cultivated grains such as wheat, barley, and rice were ground into porridge. The industrial age brought with it the production of ready-to-eat cereal in boxes. As the decades progressed, cereal became less prominent on the breakfast table as consumers questioned the health benefits of the products.

Today, modernized, better-for-you cereals are reinvigorating the cereal aisle.

“Over the past two years, we have seen an increase in new cereal launches by 12 per cent,” says Jo-Ann McArthur, founder of Nourish Food Marketing in Toronto. “People are eating breakfast at home not only because of the cost, but also due to hybrid work.”

McArthur highlights the top three cereal trends.

“Number one is healthy, but number two is that it also must be tasty. Number three is protein, as companies continue to add protein to everything. Consumers are also seeking whole grains and increased fibre for improved gut health.”

Cereal companies are adding protein in the form of protein powders made from beans, peas, legumes, nuts, and seeds. According to the Dietitians of Canada website, the average adult needs 0.8 g of protein per kilogram of body weight. Proteins are vital for muscle growth and repair,

maintaining cellular structure, and regulating the function of tissues and organs.

Findings from a report in the Journal of Nutrition, Health and Aging, conclude that 46 per cent of adults do not get enough protein in their diets. Muscle loss begins in middle age, and those who do not engage in regular exercise can expect to lose between 4 and 6 lb of muscle per decade.

Looking at grains, fibre is found in wheat, corn, oats, rice, quinoa and more, but it’s also found in fruit, nuts and seeds. According to Health Canada, women require 25 g of fibre per day, and slightly more if they are pregnant or breastfeeding, while men need 38 g. It’s important to note that almost half of Canadians are not reaching these goals. Fibre is vital for stimulating the digestive

system, lowering blood cholesterol, and helping to prevent illness.

When it comes to classic cereals, General Mills has launched Cheerios Protein, which contains 8 g of protein and is now available in chocolate and strawberry flavours. Emilie Knox, the vice president and business unit director of morning foods at General Mills, shared in a statement, “As protein continues to be an important priority for people of all ages, we specifically created Cheerios Protein with families in mind. We wanted it to taste great and to preserve the iconic Cheerios shape, but with a good source of protein, all in a convenient cereal we know everyone at the

breakfast table will love.”

Over at Post, Premiere Protein Mixed cereals are a powerhouse of protein, with 20 g per one cup of cereal. Kellogg’s Special K High Protein cereal contains 10 g of protein per 11/3 cup serving. Kashi Goactive Cereal Original includes 12 g of protein per 1¼ cup of serving, derived from plant sources, and features a blend of corn, wheat, triticale, brown rice, rye, and a hint of honey.

For protein on the run, think high-protein granola. Simply Protein bars pack a flavourful punch. The dark chocolate caramel variety includes soy protein isolate, sunflower seeds, pecans, and cashew butter. What’s more, each bar contains 12 g of protein and only 2 g of sugar. 88 Acres Cinnamon Maple Seed + Oat bars contain 7 g of protein per bar. Filled with organic seeds, this variety includes pumpkin seeds, sunflower seeds and ground flax seeds.

Stoked Oats was founded by Dr. Simon Donato, an ultra-endurance athlete and breakfast visionary. The idea started with nutrient-based, gluten-free, regenerative organic oats, sourced from Alberta and Saskatchewan.

The first product to market was Stone Age Oatmeal, a mix of oats, flax, chia, and pumpkin seeds, along with coconut flakes, almonds, and walnuts.

“It’s consistently one of our most popular products and can be used in multiple ways,” says Chanelle Mayer, CGO, at Stoked Oats.

Classically served as hot oats, it can be

prepared in the microwave or with boiling water, but it also makes for a delicious overnight oats option topped with berries. Stone Age Oatmeal contains 7 g of protein and 5 g of fibre per one-third cup of oatmeal.

Bucking Eh Granola, also containing 7 g of protein and 5 g of fibre per one-third cup, is the granola version of the Bucking Eh Oatmeal blend.

“Our community asked us to turn their favourite oatmeal into granola. It tastes like a healthy apple pie, made with oats, flax seeds, chia seeds, oat flour, dried apples, currants, mulberries, cinnamon, coconut oil and just a touch of real Canadian maple syrup.”

Another flavour to try is Mountain Maple, featuring a recipe with ingredients including oats, coconut oil, maple syrup, flax seeds, oat flour, chia seeds, and cinnamon.

One of the company’s newest innovations includes OatRice. Made with pure hulled oat groats, before they are rolled, steel-cut or quick-cut, this product is cooked like rice and can be eaten any time of day.

“It has double the protein and five times the fibre compared to white rice,” says Mayer.

Cereal brand Goldy’s is owned by two childhood friends, Daniel Carson and Daniel Schreiber, and features two product lines, Superseed Oatmeal and Superseed Cereal.

“Key ingredients for both products include chia seeds, hemp seeds, pumpkin

seeds, and buckwheat,” Carson explains.

The mission behind creating the brand was to offer a wholesome meal without compromising on taste.

“It’s a convenient, nutritious, and tasty breakfast option to meet the needs of busy individuals and families,” he adds.

The oatmeal line has a unique selling proposition.

“It’s naturally sweetened with organic date powder, making it a healthier alternative to traditional sugary breakfast options,” says Carson.

Goldy’s Superseed Oatmeal is available in a range of flavours, including Maple Harvest, Banana Sunrise, Strawberry Fields, and Cinnamon Valley. Each contains 5 g of protein and 5 g of fibre per 35-gram serving.

The superseed cereal was designed to be versatile.

“As an ingredient, it can easily be added to other foods, such as in baked goods, smoothies, or a topper for yogurt, all providing a healthier option for families,” explains Carson.

Varieties include Banana Cinnamon, Strawberry Lavender, Blueberry Ginger, Salted Cocoa, and Coconut Lime. This line contains even more fibre, with 7 g per quarter cup, and an additional 5 g of protein.

For a different grain, Go Go Quinoa offers gluten-free, organic puffed quinoa to eat on its own or add to other cereals. Organic Quinoa Flakes are marketed as a hot cereal alternative or as a baked ingredient in granola bars and desserts. These flakes contain 5 g of protein and 3 g of fibre per one-third cup.

As cereal companies continue to innovate, emphasizing the nutritional benefits of their products while introducing new flavours and incorporating healthier ingredients, the sector is on a positive trajectory.

Why waiting until May 2026 is too late — BY

DOUGLAS HART

—

With the high public awareness of free trade and tariff wars, there is an increased realization that Canada does not even have free trade within our own country. Interprovincial trade barriers have been in place for decades, including those inhibiting the movement of labour, trucking and the sale of wine. One wonders why the sale of Canadian wine is restricted by provincial borders when Canada is trying to expand free trade with other countries. It is time for Canada to walk the talk on free trade by removing provincial trade barriers for the sale of wines.

A snapshot of the Canadian wine industry

There are an estimated 615 wineries in Canada. B.C. has 245 and Ontario has 185 with the balance in Nova Scotia and other provinces. However, Ontario produces a high percentage of the wine in Canada (62 per cent) as they have considerably more acreage of grapes. Canadian wineries exported an estimated $99.8 million worth of wine in 2024. Eightyfive percent of this went to the U.S. This pales in comparison to the wine Canada imports. In 2024, Canada imported $2.67 billion of wine; 69 per cent of this came from France, Italy and U.S.

With U.S. wines taken off the shelves in many provinces in March, consumers are increasingly buying wines from their own province as well as those from Italy, France,

Spain, Chile and other countries. LCBO sales results show that since U.S. wines have been pulled from its shelves Ontario wines have enjoyed a big jump in market share followed by a less pronounced market share increase for other countries.

However, consumers are seeing few wines from other provinces at their liquor stores. Consumers in Ontario have a wide selection of Ontario wines but see very few B.C. wines. Similarly, B.C. consumers can buy B.C. wines but very few from Ontario. It is a common complaint from B.C. wineries that it is easier for them to sell their wine to Washington, Oregon, and other U.S. states than it is to sell to the Ontario market. To open up some of these provincial barriers, Canada is in the process of reforming its interprovincial trade laws for wine and alcohol to allow for direct-to-

consumer (DTC) sales of Canadian wine across provinces by May 2026.

Currently, wine and alcoholic regulations do not allow wineries to sell wine directly to consumers in other provinces. The federal government along with the provinces and territories signed a MoU on June 30, 2025, on an action plan for the DTC program.

The DTC plan would allow wineries, distilleries and craft brewers to directly sell wine and alcohol to customers in other provinces. Some in the wine industry are slightly ahead of this plan. Some wineries have been selling wine to customers in other provinces by way of their wine clubs, referred to by some as a ‘grey market’. Lightning Rock Winery, Summerland, B.C., recently announced plans to ship wine to customers in Ontario immediately even though regulations aren’t in place. The industry is clearly signalling to government that May 2026 is too late to launch this program.

B.C. and Manitoba already have a DTC wine agreement in place as does Nova Scotia. B.C. and Nova Scotia allow DTC wine sales if they consist of 100 per cent Canadian wine (VQA). Alberta was included in the B.C.-Manitoba agreement but then decided to include an ad valorem tax (a percentage-based liquor markup on ‘high value’ wine) along with its planned $3 per bottle admin fee. This move made B.C. wines too expensive and B.C. wineries have stopped selling to Alberta customers. This was seen as a tax grab particularly in

light of the fact that Alberta does not have a wine industry to protect. Therein lies the rub. The devil is in the details about how this system will work. Provinces will have to put aside their tendency to put additional taxes or mark-ups on wine coming in from other provinces to make this plan work.

The only way the industry sees this plan working is for wine to be sold to out-ofprovince customers on the same basis as selling to local consumers. For example, an Ontario customer would order wine from a B.C. winery and pay the usual B.C. sales tax but not any additional tax or LCBO mark-up when it arrives in Ontario (other than perhaps a small LCBO admin fee). The same arrangement would apply for a B.C. customer ordering Ontario wine. Wineries feel that this system will fail if provinces impose mark-ups or any fees beyond a nominal amount for out-ofprovince DTC sales.

The author’s interviews with wineries in Ontario, B.C. and wine grower associations show that there is keen interest in seeing a direct-to-customer program for wine. It is believed that wineries of all sizes would benefit. Small, medium- and large-sized wineries see opportunities to expand sales through their wine club program by presenting personalized offerings, special discounts and other promotions. Wineries make the highest profit by selling their wine at their tastings room and to wine club members as they do not pay liquor board mark-ups as they would at liquor stores.

The challenge for Canadian wineries, particularly for the small and medium-sized, is how to get their name in front of consumers in other provinces. Promoting their tasting rooms for visitors, expanding their wine club program to out-of-province consumers, offering spe-

cial wine selections, holding special events in target cities, creating a compelling website and effectively using social media are all options for wineries wishing to maximize their success for the DTC program.

Wine industry representatives believe the DTC wine program will allow greater choice for consumers, but caution that these sales may only eventually reach perhaps 2 per cent of all wine sales in Canada. So, for provinces that feel they will miss out on taxes, the vast majority of wine sales will continue to come from the provincial liquor stores.

If the provinces can come to an agreement to create a level playing field on how provincial admin fees, mark-ups, rebates will be handled, the DTC wine program would allow Canadian consumers to gain some degree of access to wines of their choice from other provinces.

However, this will not solve the problem of being unable to buy wine from other provinces at the liquor store. Even with the DTC program in place, the vast majority of Canadian wine sold at provincial liquor stores will continue to heavily favour their provincial wineries. So, to truly remove interprovincial trade barriers for wine the provincial liquor stores need to prominently display wine from other provinces.

Let’s give Canadian wines in liquor stores across Canada at least as much shelf space as afforded to wines from Italy, France, U.S., Chile and other countries. If we truly believe in free trade, then it’s time to remove provincial protectionism and open up the market for all Canadian wines.

Douglas Hart is president of Hart & Associates Management Consultants, a firm that has been providing business development services to the Canadian food and agriculture industry for over 30 years. He can be reached at douglashart@hartconsultants.com.

— BY FOOD IN CANADA STAFF —

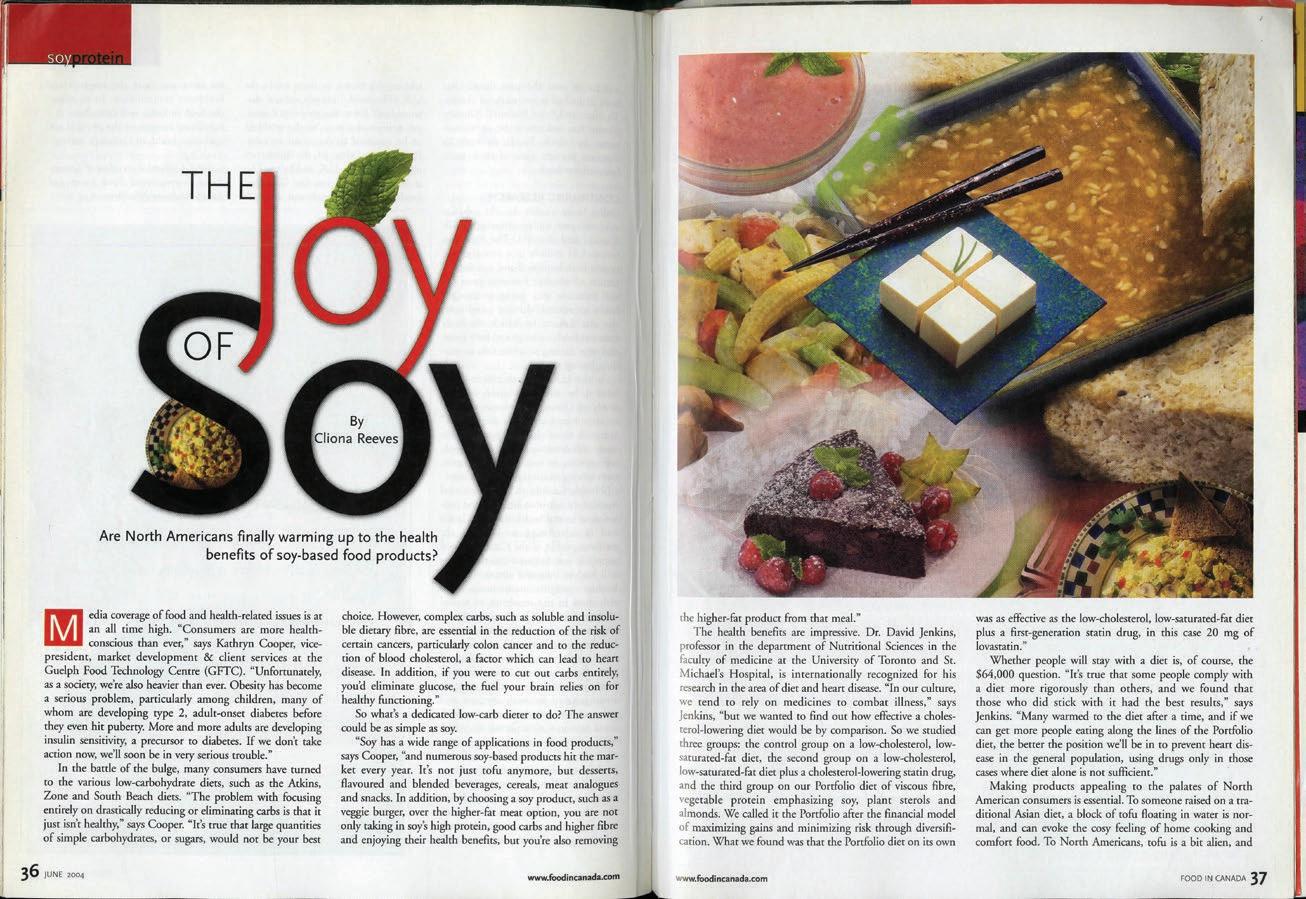

We continue our 85th anniversary coverage with a final stop in the early 2000s (the later years were covered in the Feb./March issue). The new millennium opened with the bursting of the dot-com bubble, an event that prompted a mild, but lengthy recession in the developed world. In the years that followed, several events took place that seemed to stop us in our tracks. SARS killed 800 people worldwide in 2003, including 44 in Canada. As food manufacturing increasingly consolidated, more producers began outsourcing labour to Asian and South American markets, while at the same time struggling to cope with cheaper imports from these same countries. Food safety became a critical issue following several high-profile cases of food-borne illness from produce.

The most defining moment of the 2000s will no doubt be the tragic events of Sept. 11, 2001. On that day Al-Qaeda members carried out a series of co-ordinated suicide attacks on the U.S., hijacking planes and crashing them into the World Trade Center towers and the Pentagon. Shortly after,

governments talked of increasing security at Canada-U.S. border crossings, conferences were cancelled or rescheduled and a gloomy economic forecast was predicted for the near future. Prompted by continued security concerns, in 2002, U.S. president George W. Bush signed the Public Health Security, and Bioterrorism Preparedness and Response Act, which addressed the possibility of deliberate contamination of the U.S. food supply, as well as reconnaissance related to foodborne illnesses. By December 2003, under Title III of the Act, called Protecting Safety and Security of Food and Drug Supply, Canadian food manufacturing facilities needed to be registered and every shipment of food to the U.S. required filing a prior notice of import.

In 2004, Voortman Cookies became Canada’s first food company to remove trans fats from its products.

The decade also opened with documented cases of bovine spongiform encephalopathy (BSE), first reported in France and then throughout Europe. Shortly after these cases were reported, the Canadian Cattlemen’s Association prepared a document entitled ‘Keeping Mad Cows out of Canada’. But in 2003, Canada confirmed its first case of BSE. Since then there were 11 cases.

The first fatal human cases of avian influenza were reported in 1997, when the virus killed six people in Hong Kong. In 2001, Hong Kong authorities ordered the slaughter of more than 1 mil-

lion chickens, quails, pigeons and ducks to try to stop the spread of the disease. But by 2004 the world was on high alert as avian flu was found in several countries, culls continued and more human deaths were reported. That year strains of the disease were also discovered in 22 farms in B.C.’s Fraser Valley, devastating its poultry industry. The feds ordered the slaughter of 19 million chickens, turkeys and ducks, training prisoners as backup for the bird cull in case of a worker shortage.

The obesity epidemic made headlines around the world in the early part of this millennium. The U.K.-based International Obesity Taskforce estimated that 35 per cent of Canada’s population is obese, and for the first time, it noted that incidents of childhood obesity are on the rise. These statistics brought increased scrutiny to the food industry in Canada in terms of both the quantity and type of food it produces.

In 2002 the Food and Drug Regulations were amended to make nutrition labelling mandatory on most food labels, to update requirements for nutrient content claims and to permit the use of five diet-related health claims on foods.

The harmful effects of trans fats were also making headlines. South of the border, the U.S. Food and Drug Administration proposed listing trans fats on Nutrition Facts labels. At the same time, a growing number of consumers and experts called for the complete removal of trans fats, prompting food manufacturers to re-evaluate their ingredient lists. In 2004, Voortman Cookies became Canada’s first food company to remove trans fats from its products.

North Americans’ desire to lose weight drives diets such as the low-carb, high-protein Atkins Diet. In 2003, at the height of its popularity, AC Nielsen reported that U.S. sales of meat snacks, nuts, cheese, diet carbonated beverages, sausages, frozen meat and seafood and whole-grain bread jumped significantly. On the other hand, sales of instant rice, cookies, orange

juice, cereal, regular carbonated beverages, dry pasta, potatoes and white bread saw a major decline. With Canada considered to be about six months behind the U.S. in the low-carb fad, many food manufacturers rushed to cash in on the trend. In total about 600 low-carb products were launched in 2003, only to find that consumers had lost interest just one year later.

Nutraceuticals was a hot topic then as it is now, as consumers search for better-for-you foods with a medicinal effect on human health. Ingredients having an impact on this market include Lyco-Red, which ensures a consistent level of lycopene in tomato products, omega-3 for eggs and dairy, antioxidants in superfruits and dark chocolate, and pro-, pre-, and post-biotics. Inulin, calcium and resistant starches were other new wonder ingredients. While the demand for “wellness foods” was high, consumers were also asking for more organics, whole grains and locally produced products. Specialty items, such as halal, kosher, gluten-free and authentic ethnic meals, were finding new markets with Canada’s diverse population, as well as among consumers increasingly concerned with food safety.

The early 2000s was also marked by food shortages and rising food prices due to demand from then-emerging Asian markets, adverse weather in some producer countries and increased use of biofuels. As more corn was diverted to ethanol production, less was available for food production and animal feed, boosting prices for producers.

In 2008, Patrick Boyle, then president and CEO of the American Meat Institute, said, “The mandate by Congress to utilize a key food ingredient as the dominant input for biofuels has inextricably coupled food to fuel prices, driving up costs for consumers and affecting the economy.” This concludes our 85th anniversary coverage. I hope you enjoyed the mini-trips down memory.

* This article was written using data sourced from previous issues of Food in Canada

PET PARENTS WANT MORE FROM EVERY BITE FOR THEIR FURRY CHILDREN

With rising expectations around healthy ingredients, today’s pet parents expect food to do more than satisfy hunger — BY REBECCA HARRIS —

Do you want a treat?” This favourite question is sure to set tails wagging. But these days, what pet parents are increasingly asking is, “What exactly is in this treat, anyway?”

As pets have become beloved members of the family, owners are paying closer attention to the quality of the treats they buy for their furry ‘children’.

“When purchasing pet treats, 36 per cent of pet owners prioritize natural or organic, 29 per cent look for products that promote gut health, 27 per cent want immune system care and 12 per cent choose treats with human-grade food,” says Candace Baldassarre, senior analyst at Mintel. “What we’re seeing is owners care about their pets as if they’re their own children. Our research shows that 84 per cent consider themselves a parent to their pet— whether they have their own children or not.”

Even in today’s tough economic climate, Canadians are still willing to indulge their pets.

“The pet industry has been as close to recession-proof as possible; consumers are spending and treating their pets and have continued to do so even during economic downtimes,” says Kenn Manzerolle, who is the pet vertical lead at Nielsen IQ Canada (NIQ). “Much like we need a break or reward, our furry companions who provide us love and support also deserve to be rewarded—and the easiest way to do

treat manufacturer.

that is through treating.”

It’s clear that today’s pet owners expect more from treats than just a tasty reward— they want products that deliver real benefits. Here’s a look at the key trends shaping what ends up in the treat jar.

What sounds like human wellness trends— immune support, gut health and calming effects—are now playing out in pet care.

“We are seeing pet supplements gaining traction across the globe, with functional benefits like immune support, mobility enhancement and calming aids with ingredients such as collagen, green-lipped mussel, CBD and mushrooms,” says Manzerolle. “What we are using for ourselves is

quickly becoming mainstream in the pet industry as we look to help our pets live longer, healthier lives.”

While supplements are growing as a category, some companies are incorporating these same functional benefits into pet treats—offering convenient and tasty ways for pet owners to support their pets’ wellness.

Gruffies is one such company focused on improving dogs’ health through treats. Founded in Whistler, B.C., by Jonathan Persofsky, the pet treat brand offers functional treats at an affordable price. Persofsky started out in the CBD pet treat space, but noticed that many pet owners, especially those with larger dogs, often skip preventative care because supplements can be expensive.

“I wanted to make a product line that was accessible and available,” he says. “There weren’t healthy dogs on the market that have functional benefits at a price point people could afford.”

Gruffies’ product lineup—which is certified USDA Organic—includes Original, Calming, Joint & Hip, Skin & Coat and Gut Health. Each product has a base of six superfoods—peanut butter, hemp seeds, barley, oats, molasses and flax seeds— delivering protein, fibre and omega 3s. On top of that, each variety is formulated to support a specific need. For example, Joint & Hip contains collagen-boosting organic greens, as well as turmeric and ginger to help reduce inflammation and alleviate joint pain and stiffness.

“They’re a combination of a healthy treat with functional benefits,” says Persofsky. “People can feel good about giving Gruffies to their dog in an easy way.”

Just as consumers scan food labels for real ingredients they can pronounce, the same thinking now applies to pet treats.

“In North America, people are well-ed ucated about their own food, and they want more real, nutritional foods for their pets,” says Lora Bai, director of Surrey, B.C.-based LoopyPaws, which makes a line of all-natural, treats for dogs and cats.

LoopyPaws specializes in freezedried goat milk treats, with prod ucts like Blueberry Goat Milk Frosted Crispies, Freeze Dried Egg Yolkgoat Milk Cubes, and Crispy Goat Yogurt in flavours such as pumpkin and strawberry, cran berry, veggie and apple, and blueberry. The colourful products are made with premium natural ingredients, are packed with protein and vitamins, and contain no artificial additives. The vibrant hues themselves come from fruits and vegetables.

aging issue, Tilted Barn stepped in. It developed a limited-time product, Beef & Saskatoon Berry Treats.

“We said, ‘we’ll take what you have and at least make some use of it’—we all hate throwing anything out,” Good says. The response was so positive, Tilted Barn now buys berries from Prairie Berries for seasonal product launches, including Saskatoon berry treats in the summer and cranberry treats through the winter.

NIQ’s Manzerolle notes that sustainability was a huge focus at this year’s SuperZoo—one of the largest trade shows in the pet industry.

“Sustainability is no longer a buzzword or trend, but now a critical element to a brand’s DNA, as consumers are shopping with their personal values in making many purchasing decisions,” he says.

“Goat dairy is easier for cats and dogs to digest and it’s a low-allergy protein,” Bai says. “And because our products are freeze-dried, they can be stored at room temperature and have a long shelf life.”

Alberta’s Tilted Barn Pet Co. is another company that prioritizes real ingredients. Its single-source protein treats for dogs— available in beef, Canadian bacon, lamb and bison—are made with all-natural, high-quality, whole ingredients from the human food market. The ingredients are sourced from across the Canadian Prairies, with the exception of lamb, which has to be sourced from New Zealand. The treats contain no additives or by-products.

“It was important to us that when peo ple looked at the ingredient panel, they recognized everything that was in it,” says co-owner Kim Good. “Our products are all single protein, which isn’t novel in the industry, but we’ve got high palatability. And we’ve been dedicated to keeping everything Canadian—even our bags and boxes are made in Canada.”

Tilted Barn’s commitment to Canadian ingredients goes beyond quality—it’s also about sustainability.

“Part of supporting Canadian agriculture was also having a reduced carbon footprint. So, we try to source everything as close as possible to us,” says Good.

That eco-conscious mindset has also inspired new products. When Prairie Berries, a Saskatoon berry farm, reached out about a batch of berries that couldn’t be used in the human market due to a pack-

Data from NIQ’s Product Insights solution in the U.S. shows products with sustainability claims on packaging growing much faster than those without, and the products with upcycled claims showing increases of over 30 per cent versus prior year.

Still, sustainability ranks lower on the list of purchase drivers for most pet owners. Mintel’s Baldassarre notes that just 12 per cent of pet owners prioritize sustainability, compared to 55 per cent who focus on price. Flavour and brand are also top considerations.

“Sustainable packaging is currently a nice-to-have, but it doesn’t resonate as strongly,” says Baldassarre. The exception is younger consumers: Among those 18 to 25, interest in sustainable packaging jumps to 24 per cent.

While price can impede purchases, Baldassarre says people still want to spoil their pets. “There’s no secret sauce to winning, but I think affordable prices alongside quality ingredients and made-in-Canada products are important to have.”

Raw opens new plant in Montreal

Pet food company Formula Raw opens a new 15,000-sf manufacturing facility in Montreal. The new plant boosts its monthly production of premium freeze-dried foods and treats for dogs and cats from 7,500 kg to over 30,000 kg. The facility is certified by CFIA and MAPAQ. The company has also secured USDA export approval. Already shipping to Asia and expanding into Europe and the U.A.E., the company is now actively seeking U.S. retail and distribution partners.

Healthybud successfully closes a $1.5 million strategic funding round. The round was led by Investissement Quebec with additional backing from entrepreneurs and experts in pet nutrition, marketing, logistics and consumer packaged goods. Notable investors include John Hart, founder and former CEO of Eagle Pack Pet Food. The founder of Zuke’s, a natural dog treat brand acquired by Nestle Purina PetCare in 2014, also joined the round. Healthybud will invest the new capital into expanding its presence in Canada and the United States by enhancing digital

marketing efforts, strengthening key partnerships, launching new product variations and scaling inventory.

Hagen Group mark its 70th anniversary. Founded in 1955 by Rolf C. Hagen, the company began in Montreal as a small import business. Today, Hagen Group is an international enterprise with six offices. It distributes its flagship brands in over 50 countries. Brands include Catit (cat nutrition and care), Nutrience (dog and cat nutrition and treats) Zeus (dog toys and accessories), Zoe (dog treats), Fluval (aquatics), Exo Terra (reptiles), Living World (small animals), and Hari (avian care).

PawCo launches salad for dogs

PawCo Kitchen introduces SuperSalad, a scoop of fresh, functional veggies for dogs. It’s made with real, whole ingredients like spinach, quinoa, carrots, and butternut squash, and is designed to support digestion. The SuperSalad can be added to the dog’s main food or served as a snack.

‘Feline favouritism’ drives growth: Euromonitor International

According to Euromonitor International’s World Market for Pet Care 2025 report, cat food was the fastest growing category with a CAGR of 6 per cent, while dog food only increased by CAGR of 3.8 per cent between 2020 and 2025. The shift demonstrates pet owners are increasingly choosing cats due to their lower maintenance and costs. By 2030, cat food is forecast to grow at a CAGR of 4 per cent in value. However, dogs remain dominant in pet food volume sales, expected to account for 66 per cent of global pet food sales by 2030.

Kevin Hart launches premium freeze-dried dog food brand

Kevin Hart officially enters the pet care industry with the launch of Hartfelt, a premium pet food brand. According to a company statement, “Hartfelt combines real ingredients and canine superfoods in expert-backed formulas to ensure adult dogs can enjoy strong muscles, healthy digestion, shiny coats, and a vibrant life.”

Puppy Love Pet Products recalls products

Puppy Love Pet Products voluntarily recalls certain Puppy Love and Puppy World brand pet treats that were between February 2025 to November 2025 due to salmonella contamination. At the time of writing 32 people were sickened with salmonella, mostly in Alberta and British Columbia. This includes 14 laboratory-confirmed cases of salmonella in Alberta, 15 in British Columbia, two in Ontario and one in the Northwest Territories. According to the Public Health Agency of Canada, there have been eight hospitalizations but no reported deaths.

(s + hrv + lte) (safety + high resale value + long-term efficiency)

What’s the smart fleet investment?

The equation is simple, offer your team the three essentials: safety, high resale value, and long-term efficiency. Subaru solves your fleet needs with precision. And it’s not just smart, it’s mathematically sound. Do the math, optimize your fleet costs.