As the New Year rolls in, we all look forward to the opportunity to reflect on the past year and make plans for a healthy, Happy New Year! Hitting that Refresh button is relieving and an impetus for personal growth with twelve new months to create our best year yet.

The Brighton Buzz is entering 2023 in a period of transition. Susan Kline, long-time Publisher/Editor, is looking forward to her transition into retirement. Her love of the magazine, commitment to its growth, and her contribution to the community has been her driving desire throughout her many years with the magazine. Susan’s 17 years of knowledge and connection she has built in the community will surely be missed. We thank Susan for her devotion to The Brighton Buzz and wish her a Happy Retirement!

I will be taking over the Publisher/Editor responsibilities and am looking forward with enthusiasm to bringing the magazine into the next chapter of its life. Mario Waller, Art Director for The Brighton Buzz, has handled the graphics and production for the past two-and-a-half years and will continue in those duties as well as assist me in this transition. We are committed to providing our readers with the valuable resources and information they’ve become accustomed to with each new issue.

We’re wishing you and your family all the joy and prosperity you envision for 2023. Dare to Dream!

From All Of Us,

sport of rugby is rapidly growing in popularity and recognition, especially with football families and coaches that embrace the safe tackling methods taught in rugby. With over 50 years of combined playing and coaching experience between all of our coaches we are continuing our mission to grow the sport of Rugby in Brighton, build strong character in our players, and develop competitive teams. Our high school practices start promptly in January with games beginning in March.

No prior Rugby experience is required, we invite every 8th through 12th grade boy AND girl to come out and embrace this incredible sport. Check for updates at: www.brightonyouthra.com, www.facebook.com/ BrightonyouthRA/, or emailus at: brightonyouthra@gmail.com.

O

ered by: Dr. Eric Anderson DC and Heidi Anderson Brighton Clinic of Chiropractic

ered by: Dr. Eric Anderson DC and Heidi Anderson Brighton Clinic of Chiropractic

getting older!” How many times do you go to your doctor and you are told that your aches and pains are because you are getting older or it’s arthritis? What is arthritis? It means you have inflammation in a joint typically resulting in pain and/or stiffness of that joint.

e most common type of arthritis is called osteoarthritis. If you’ve had it for a long time, you can see those changes on an x-ray like bone spurs/calcium deposits on the bones and joints called DEGENERATION. I see a lot of degeneration of the discs and joints of the spine on x-rays. You cannot see pain on x-rays. So, what could be causing the pain and symptoms?

Often it is misalignments of the joints that cause inflammation or swelling around that area which affects the nerves which can lead to pain or various symptoms depending on which nerves are involved. ese misalignments are called SUBLUXATIONS. is is what chiropractors specialize in finding and correcting. ose subluxations also cause tight muscles and thus decreased range of motion. is all affects your function. If a joint has limited movement over time it degenerates. is is why I don’t like it when doctors say, “you are just getting older”. Technically both your knees are the same age, right? So why aren’t both wearing out? is is why somebody will have one knee (for example) that has bone on bone and the other doesn’t. Your body has compensated due to lack of motion in one, but either knee can wear out.

We love educating people about their bodies and how they function. Our office specializes in a consultation that includes taking a detailed history followed by a comprehensive evaluation testing for subluxation degeneration. Call now 303-993-6092. Happy New Year!

•

•

•

•

“You’re

followed

assisted us throughout

boxes for us. They made the process easy and enjoyable. They explained our options throughout the process and advised us as to the pros and cons of each option. I can’t thank them enough for what they did for us. They also were very friendly and amicable. If we ever move again, we will gladly sign up with Lindsy and Mike again.!!!’’

and

Jan. 1, 2023, the state will require businesses and retail food establishments with more than three locations in Colorado to charge customers a $0.10 fee for each single-use plastic and paper bag used at the point of sale. e State of Colorado passed House Bill 21-1162 in 2021, also known as the Plastic Pollution Reduction Act, which institutes a bag fee on carryout bags in Colorado.

Between January 1, 2023 and January 1, 2024, a store may furnish a recycled paper carryout bag or a single-use plastic carryout bag to a customer at the point of sale if the customer pays a fee of 10 cents per bag. Beginning January 1, 2024, a store may furnish only a recycled paper carryout bag to a customer at the point of sale at a fee of 10 cents per bag and prohibits businesses and retail food establishments from providing single-use plastic carryout bags to customers.

Certain retail food establishments, and small businesses that operate solely in Colorado and have three or fewer locations, may provide single-use plastic carryout bags. Additionally, the carryout bag fee does not apply to a customer that provides evidence to the store that the customer is a participant in a federal or state food assistance program. For additional exemptions, visit www.brightonco.gov/bagfee

Beginning Jan. 1, 2024, the act prohibits a retail food establishment from distributing an expanded polystyrene product (more commonly known as Styrofoam™) for use as a container for ready-to-eat food in this state.

e State of Colorado requires any store located in the City of Brighton begin charging the 10 cent bag fee on every bag starting January 1, 2023. e store is entitled to retain 4 cents of the bag fee revenue, and must remit the remaining 6 cents to the City of Brighton on a quarterly basis. Businesses also have the option of not providing any single-use bags.

For more information about the carryout bag fee visit www.brightonco.gov/bagfee.

It’s another ursday afternoon at the Dojo. I’m sitting in my office waiting for our Pre-Karate students to fi le in for the fi rst class of the day. Little Vicky is one of the fi rst ones to burst in through the front door, skipping as she makes her way in. She makes an abrupt stop in front of my office door and shouts: “Hi Sensei!” She then proceeds to tell me all about what she did at school today, what is going to happen tomorrow, and fi nally asks me if she will be getting a stripe on her belt today. I reply that if she practiced and has good discipline in class, she could earn a new stripe.

ese types of interaction may seem innocent enough, but over the years I have learned some amazing lessons by paying attention to the kids at our Dojo. One thing I’ve learned is that children are full of joy and expectation of what today and tomorrow will bring. Life is an adventure with many wonderful surprises to be lived and discovered every day. It is so refreshing to be around them.

As adults though, many of us have become critical and cynical

about the time in front of us. We dread Monday and look forward to Friday, as if the days in between were just a drag on life. But what if we approached the week and every day like those little kids, with a happy expectation of wonderful things to happen to us and around us?

Looking at our youngest students’ outlook I realize that their positive attitude is halfway in the road to happiness. Making things happen is the other half. What is it that you want from the day, the week, the month, or the year? Go make it happen, expect it to happen, and be happy and cheerful in the process. Life may not always be perfect, but having a purpose and a positive attitude makes life worth living, yes, even on a Monday.

Frank Sinatra sang “ e best is yet to come, and won’t that be fi ne? You’ve seen the sun, but you ain’t seen it shine”. It is defi nitely possible that your best years are just ahead of you. You may have had a good life so far, but I truly believe that God has wonderful things in store for us, better than anything in our past. if we trust and have the will and the attitude to make it happen. I sure hope we do. at’s what I wish for you and for me this new Year.

Hi, my name is Hannah Duensing. I am the owner of Peaks and Paint LLC. A little story about how this business got off the ground: After my Grandma passed away, I made a painting in remembrance of her and gifted it to my Grandpa; this painting sparked his healing/grieving process. e effect that had on me, to know that painting could be so inspiring, healing, and life changing; I knew I wanted to do it for a living. I wanted to make painting a full-time business, so I started Peaks and Paint LLC. I host traveling paint and canvas workshops. Birthday parties, work events, family get togethers, etc. I would be honored to paint with you and host an experience that can provide synergy among co-workers, family members, and friends. Providing people with a fun creative outlet is my main goal. I have met so many people during my paint workshops; and to think that I can bring them healing and joy with art makes my heart so full. e amount of support I feel from my community, friends, and family is overwhelming and I am so grateful for each and every person who has helped me along this journey. ey believed in me from the start. I would like to give an extra thank you to Copper Rail, Mountain Cowboy, Something Brewery, and Bee & istle for believing in me and supporting my small business! Contact Peaks and Paint for your next paint workshop!

Each month when I sit down to write these articles, I often look back to see what I’ve written for that month the previous year. It’s always interesting to see what’s changed or deviated from projections, and this month is no exception! Who knew that my statement about “life as roller coaster ride being the new norm” would prove so true, because, like it or not, 2022 was a roller coaster of its own.

Even though financial experts initially projected very little difference between 2021 and 2022 for the housing market, there actually was quite a difference. e mortgage rate increases, much higher than the original modest predictions, and inflation were the primary factors in a slow-down of home sales by pricing some buyers out of the market, while forcing others to narrow their list of options.

With the projected continuing rise of mortgage rates, it remains to be seen what 2023 will look like for the real estate market. We are though, already seeing some creative work-around strategies, though most are short-term/temporary fi xes intended to bridge the gap between the current landscape and financial markets and inflation slowing down, to make it possible for buyers to move forward with their home purchase now rather than waiting.

is just goes to show that working with an experienced REALTOR® and their network of complementary professionals is more important than ever. As always, Joni and I are here to help you with your buying and selling needs, and we look forward to working with you to forward your real estate dreams in the coming months!

For proven expertise in establishing your home value and/or searching for a new or existing home, please call Jan at (303) 520-4340.

This holiday season is particularly exciting, because we are expanding our Brighton clinic and moving to a new location. Beginning in January 2023, you can come see us at 606 S. 4th Ave in the Balanced Life Chiropractic building. We will be practicing in the space previously occupied by Brighton Acupuncture, so patients that are already getting treatment here can seamlessly continue coming to the same location for help.

We are also excited to be bringing Neurofeedback Training (NFT) to the Brighton area, starting in early 2023. Symptoms of common conditions including ADHD, anxiety, depression, PTSD and others are often the result of certain brainwaves that are not operating at the right frequencies, speed or intensity. NFT teaches your brain (without medications) a new way to function through a relaxing, nearly effortless experience that can provide much-needed relief. Keep an eye out for more information on when NFT will be available at our new location.

IAA is in network with most major insurance companies, so give us a call at 720-317-3022 and we can check your plan for the specifics on coverage. U.S. Military Veterans receive no-cost treatment with a referral from the Veterans Administration. In celebration of our expansion, we will be offering $25 off the first visit for those without insurance coverage. Visit our website at www.integratedacupunctureassoc.com for more information.

Come check out the new digs!

It’s that time of year when many of us promise ourselves we’ll go to the gym more, or learn a new language, or take up a musical instrument, or any number of other worthy goals. But this year, when making New Year’s resolutions, why not also consider some financial ones?

Here are a few to consider:

• Don’t let inflation derail your investment strategy. As you know, inflation was the big financial story of 2022, hitting a 40-year high. And while it may moderate somewhat this year, it will likely still be higher than what we experienced the past decade or so. Even so, it’s a good idea to try not to let today’s inflation harm your investment strategy for the future. That happened last year: More than half of American workers either reduced their contributions to their 401(k)s and other retirement plans or stopped contributing completely during the third quarter of 2022, according to a survey by Allianz Life Insurance of North America. Of course, focusing on your cash flow needs today is certainly understandable, but are there other ways you can free up some money, such as possibly lowering your spending, so you can continue contributing to your retirement accounts? It’s worth the effort because you could spend two or three decades as a retiree.

• Control your debts. Inflation can also be a factor in debt management. For example, your credit card debt could rise due to rising prices and variable credit card interest rate increases. By paying your bill each month, you can avoid the effects of rising interest rates. If you do carry a balance, you might be able to transfer it to a lower-rate card, depending on your credit score. And if you’re carrying multiple credit cards, you might benefit by getting a fixed-rate debt consolidation loan. In any case, the lower your debt payments, the more you can invest for your long-term goals.

• Review your investment portfolio. At least once a year, you should review your investment portfolio to determine if it’s still appropriate for your goals, risk tolerance and time horizon. But be careful not to make changes just because you feel your recent performance is not what it should have been. When the financial markets are down, as was the case for most of 2022, even quality investments, such as stocks of companies with solid business fundamentals and strong prospects, can see declines in value. But if these investments are still suitable for your portfolio, you may want to keep them.

• Prepare for the unexpected. If you encountered a large unexpected expense, such as the need for a major home repair, how would you pay for it? If you didn’t have the money readily available, you might be forced to dip into your long-term investments or retirement accounts. To prevent this, you should build an emergency fund containing three to six months’ worth of living expenses — or a year’s worth, if you’re retired — with the money kept in a low-risk, liquid account. These resolutions can be useful — so try to put them to work in 2023.

If you have a Medicare Advantage Plan you will typically, but not always, get a new card for use in the new year. With a Medicare Advantage Plan, you will use that same card at your doctor, and your pharmacy if your plan includes drug coverage. Most plans of this type also allow you to pursue your New Year Resolutions by using the same card to access fitness benefits at a local fitness facility. Most carriers are continuing or expanding Over the Counter benefits.

For those people that opted for a Medicare Supplement (Medi-gap) insurance, a type of coverage that requires a separate premium for insurance that pays the ‘Gaps’ between original Medicare and the total owed, typically you will not receive a new card. Hopefully, you reviewed and updated your Part D coverage and have a new card if you changed plans. Provide your new information to your pharmacy at your first visit in 2023.

With Part D coverage offered by private insurers, you will be able to get 1 refill of your prescriptions the first time using your prior year coverage if your new card hasn’t arrived, or the medication is awaiting a preauthorization on your new plan.

If you are unsure of what your plan covers and what rights you have allowing changes, please contact my office, as a local broker I’m glad to answer questions.

Lisa Asmussen is a licensed certified Medicare Insurance Broker, local in Brighton. We

Lisa

Happy New Year! The new year comes with all sorts of NEW plans. How you’re going to eat, exercise, save money, spend your time, and so much more.

If you recently changed your Medicare insurance coverage, you might be wondering what kinds of extra benefits you have. For example, if you have a Medicare Advantage plan, you probably have a fitness program built in. Programs like Silver Sneakers, Renew Active or Silver & Fit are available. This helps you check the Exercise box on the goal setting sheet.

In the money saving category, don’t forget that your Medicare Advantage plan most likely comes with a benefit that gives you money toward Over-the-Counter (OTC) items. This OTC benefit is a quarterly benefit. Generally the dollars don’t roll from one quarter to the next so plan wisely. You can use these credits for personal care items like supplements, pain reliever, toothbrushes and toothpaste, bandaids, adult diapers, shower stools and more!!

And don’t forget the added Dental, Vision and Hearing Insurance built into most of your plans. Just remember to look at the network of providers to make sure your provider is in the plan.

Now, if you have Medicare + Medicaid, then you have some great additional perks in your Medicare Advantage plan. One great thing is money to spend each month on groceries or utilities. Money savings –check! Generally, you also have a larger dental and vision benefit. Money savings – check again!

Each plan is built very similarly but also different so be sure to check the details, and if you need help understanding, please let me know. I’d love to help.

Unless you live on another planet, you are fully aware of this thing called inflation — whether you’re at the grocery store, a gas station, buying clothes online, hiring a contractor or doing almost any other thing that requires spending money for something. Earlier this year, the Federal Reserve started raising interest rates to rein in inflation, which reached another 40-year high in June. By raising rates, the Fed hopes to slow the economy and inflation. at’s because as borrowing becomes more expensive, consumers tend to reduce spending. e drop in demand for goods eventually leads to lower prices.

e Fed doesn’t set interest rates on credit cards, mortgages, auto loans, and savings accounts, but its actions influence those rates. Here are four ways interest-rate hikes can affect your finances and how to deal with the impact:

Most cards charge a variable rate that’s tied to the bank’s prime rate — the rate banks charge their best customers (many consumers pay an additional rate on top of prime, based on their credit profile.) Banks typically raise their prime rate quickly after the Fed boosts its key rate. HIKING TIP: It may take a couple of statements before you notice the impact of a rate increase. Start paying down any balance before rates get much higher, focusing on the card with the highest rate first.

If you have a fixed-rate mortgage, your monthly payments will stay the same. If you refinanced over the last few years and locked in a rate in the 2% to 3% range, that was really good timing. However, if you have an adjustable-rate mortgage (ARM), you may be faced with having to make larger payments, depending on the terms of your loan. HIKING TIP: If you have an ARM, budget for higher payments. Or, if you anticipate buying a home within the next year or two, take steps to improve your credit score so you can secure a lower interest rate.

is allows you to borrow against the equity in your home as needed, usually at a variable interest rate. Borrowers typically pay only interest on the amount borrowed for the first 10 years, and thereafter must repay interest and the principal over the next, say, 15 or 20 years. Your Home Equity Line of Credit (HELOC) rate can adjust monthly or quarterly. So, if you have an outstanding balance, your payments will likely go up when the Fed implements a rate hike. HIKING TIP: If you have a HELOC, budget for higher payments. You can also pay down your HELOC balance to reduce the interest you pay, or talk to your lender about options, such as refinancing.

It’s already more expensive to buy a new or used car, as their prices have increased dramatically over the last two years. is is due to a number of reasons that have resulted in supply not keeping up with demand. Unfortunately, if you’re planning on financing the purchase of a vehicle in the near future, you’ll need to add in the higher cost of borrowing.

HIKING TIP: Make a down payment of at least 20% of the purchase of a new car, and no less than 10% for a used car. A sizable down payment will lower your monthly payments and could help secure a lower interest rate. Feel free to reach out to Lloyd Worth at Worth Wealth Management for help on this or other financial questions you may have. He can be reached at (303) 558-0214 or Lloyd.Worth@LPL.com.

• Financial Planning

• Investment Advice

• Life Insurance

• Disability Insurance

• Long Term Care Insurance

• College/529 Plans

• Annuities

(303) 558-0214 www.WorthWealthManagement.com

• Social Security Strategies

• IRAs & Roth IRAs

• Investment Accounts

• REITs

• Business Succession Planning

• Company Retirement Plans

203 Telluride Street, Suite 200, Brighton, CO 80601

Securities and Advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

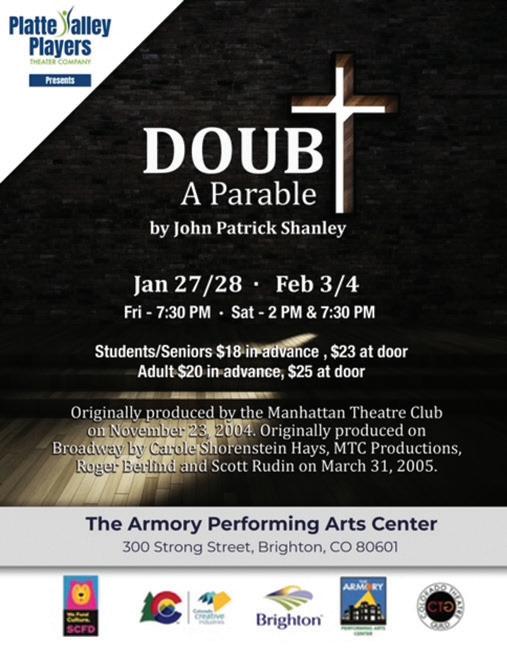

The Platte Valley Players, Brighton’s nationally award-winning community theater, presents “Doubt - A Parable” for two consecutive weekends, Friday and Saturday January 27-28 and February 3-4 at the Armory for the Performing Arts in Brighton, Colorado. Show times are 7:30 pm each night with a matinee at 2:00 pm each Saturday.

This Tony Award Winning and Pulitzer Prize Winning play by John Patrick Shanley is set in a Bronx Catholic school in 1964, where conservative, imposing school principal Sister Aloysius accuses progressive, charismatic Father Flynn of becoming too close to a boy in his class. She initiates a campaign to have him relieved of his duties, armed only with her own suspicion and few circumstantial specifics, while enlisting the help of a young, subordinate nun and the boy’s mother. This taut, engaging play balances humor with complicated human issues, leaving the audience to wonder, “What do you do when you’re not sure?”

“Anyone who is a fan of theatrical drama should see this play. With only four characters, the writing really shines as the story unfolds from suspicion to accusation to confrontation”, said Kelly Van Osbree, Artistic Director of the Platte Valley Players and Director of Doubt - A Parable. “We have four wonderful actors who love these characters and will give the audience plenty to think about by the end of the performance. It’s going to be terrific!”

Tickets for “Doubt - A Parable” are available through the Platte Valley Players website at www.plattevalleyplayers.org. Tickets are $20 for Adults in advance and $25 at the door. Seniors and Students are $18 in advance and $23 at the door.

The non-profit Platte Valley Players are thankful for funding partnerships of the Colorado Creative Industries, The SCFD Fund, the City of Brighton’s Lodging Tax Grant and the Brighton Arts Commission along with the support of many local businesses who are dedicated to sustaining live performing arts.

According to a Policygenius analysis of 2022 premiums, Colorado homeowners pay an average of $208 per month or $2,496 per year for home insurance for a policy with $300,000 in dwelling coverage. This means that home insurance premiums in Colorado increased at almost double the rate of inflation (8.6%) from May of 2021 to May of 2022. There was an increase of nearly 18% in premiums due to a mix of rising inflation, labor shortages and higher rebuild costs. This is compounded by the wake of recent natural disasters like wildfires and hailstorms. The Marshall Fire from December of 2021 was the most destructive in state history, and that combined with record-high inflation is forcing replacement costs and insurance premiums to increase.

Insurance premiums are based upon the cost to rebuild a home, not the market value. Allstate will annually adjust the replacement cost for our policyholders to keep up with the inflation and market. As a result of the hot real estate market and rising material costs, most Coloradans have seen their homeowners insurance increase from the prior year.

When you’re looking at your policy in the new year, make sure to review your dwelling replacement amount, which is what you would receive if your house was completely destroyed. There is additional coverage offered through Allstate called Building Structure Reimbursement Extended Limits that can increase the cost to rebuild above the dwelling amount.

We will be fast approaching hail season, so make sure to review your deductible for a wind and hail loss. We are seeing some insurance carriers mandate a percentage deductible for these type of losses, which is a terrible thing to experience. That means you’d have to come up with that percentage of your dwelling coverage before the loss would be paid by the insurance company. For example, if you have a 1% deductible and the dwelling is insured for $500,000, that’s a $5,000 deductible coming out of your pocket.

Although American Family was found to offer the “cheapest” homeowner insurance, Allstate was named the best company for most Colorado homeowners. We are here to help! Call or text 303.219.1470 for a review of your current policy. Hindsight is 20/20 but not when it comes to insurance. Make sure you’re covered before it’s too late.

Offered by: Michael A. Dolan

Offered by: Michael A. Dolan

the end of each year, we reaffirm what we know we need accomplish, by making a resolution for the new year. Unfortunately, we then get busy doing other things. But don’t worry, there are some things, like estate planning, that we can put off forever and not have to suffer the consequences!

Procrastinating on your estate plan will result in your family spending large amounts of your hard-earned money and a good bit of their mental sanity, to take care of you if you become disabled. However, it won’t bother you; you’re incapacitated! If your affairs are complete chaos after your death, and as a result your children fight over how to handle them and never speak to each other again, it won’t bother you; you’re dead! If large amounts of your estate are spent on unnecessary fees and costs after your death, it won’t bother you; you’re dead! If you wanted your children to share equally in your estate, but instead a large portion went to only one child, it won’t bother you; you’re dead!

But…if these things concern you now, why are you resolving to worry about them for another 365 days? Do something about it!

We are confident that taking the time to do your estate planning won’t make you die any sooner, and we are confident it won’t make you live any longer. But we do know for certain that a professionally designed, implemented, and maintained estate plan will make life a lot easier on your family, both emotionally and financially. Instead of making an empty resolution, take the action necessary to get your estate plan in order.

If you would like to learn more about an estate planning process that is producing great results for families, visit www.EstatePlans atWork.com to sign up for a complimentary educational workshop.

January is the time for New Year’s resolutions when people often begin the process of ending old habits and beginning new ones as a way to better themselves and their lives. ese changes generally involve modifying diet, increasing physical activity, or altering monetary habits. Sometimes these resolutions are effective and lead to permanent change. Often, they are short lived and quickly forgotten. Typically, change is hard and doing new things is difficult. However, in the long run, positive healthy change is worth it.

One change that many people struggle with is treating hearing loss. Hearing loss is relatively invisible and in the short term usually only causes emotional and psychological pain, as opposed to physical pain, so it is often overlooked and treatment is pushed off. Because there is a cost to change, many find it difficult. Regardless of the cause of hearing loss, and why it has not been treated in the past, knowing that it can bring significant improvements in life makes it easier to begin the process.

Research has shown wearing hearing aids decreases listening effort. Reduced listening effort decreases cognitive loading or “strain on the brain” and decreases stress. is was demonstrated beautifully when a new patient came in who had not used hearing aids before. After a consultation where we discussed the patient’s hearing loss and options, we programmed some hearing aids and put them on the patient. We continued our conversation and after a while a family member asked what the patient thought. e response was, “I don’t have to put any effort into hearing you now. It so much easier now that I don’t have to work so hard to figure out what you are saying.” Reduced listening effort leads to improved physical and mental health. In addition, studies have shown a reduction of blood pressure in family member’s and loved ones who no longer have to yell to be heard.

While some benefits are immediate, others are realized after an extended period of time. Untreated hearing loss is the leading treatable factor contributing to dementia. Treating hearing loss has the immediate effect of decreasing the rate of cognitive decline (brain shrinkage) and improves mental health. During a routine appointment for ear wax removal and hearing aid cleaning a patient told me, “Now I know I should have done something a long time ago. I wish I would have done something sooner.”

Hearing aids improve communication and can improve personal relationships and help maintain a healthy social life. Another patient expressed appreciation for the help I had given. He said, “You will never know how much of a difference you made in my life. It has changed significantly. My quality of life is so much better. My relationship with my wife and daughter is so much better. I am not missing out like I was.” He went on to say, “During anksgiving I watched my mom and brother who both have hearing loss as they missed out on conversations and stories. ey were left out of almost everything even though they were in the same room. I wish they realized how much better life would be if they wore good hearing aids.”

If you or a loved one has untreated hearing loss, or the hearing devices you are wearing are not helping as much as you think they should, give us a call.

Offered by: Dawn M. Dycus, M.D. - Brighton Pediatrics, P.C.

and flu season also marks a rise in kids with ear infections. Ear infections are the result of unhealthy bacterial growth behind the ear drum. When this occurs, the area behind the ear drum becomes inflamed and filled with pus, causing the ear drum to turn red and bulge outward.

Bacteria can infect the area behind the ear drum whenever there is fluid buildup. This fluid usually builds up behind the ear drum over the course of several days whenever a child has a viral illness, such as RSV, flu, or a cold. Instead of an illness, sometimes the eustachian tube connecting the ears and nose doesn’t function well, gets plugged, and then becomes the source of the fluid buildup.

Symptoms of an ear infection include increased crying (especially while laying down), trouble sleeping or frequent wakings at night, fevers, and fluid/discharge coming out of the ears. Many parents also notice when their child starts tugging, poking, or grabbing at the ears. Sometimes messing with the ears is truly an ear infection, and other times might be related to teething, exploration, or a self-soothing behavior. This can make it hard to detect an ear infection and is an important reason why your child’s doctor needs to look at the ear drum before prescribing antibiotics.

Recent studies show that many ear infections can resolve on their own without needing antibiotics. Your child’s doctor might discuss with you a “watch and wait” approach instead of jumping straight to starting an antibiotic. In cases of more severe infections, an antibiotic may be necessary and will be prescribed by your child’s doctor. In either case, your child’s symptoms should improve within 36-48 hours. If your child is not improving in this timeframe, it is recommended to follow up for further evaluation.

Additional advice regarding ear infections and other illnesses can be found on our website at www.brightonpeds.com

Offered

The new year has arrived and I hope you all had an awesome Christmas! Now it’s time to take a deep breath and relax now that the hustle and bustle of Christmas is over. Oh wait!….We still have the hustle and bustle of this thing called LIFE! ankfully there’s a place you can go to for some nice pampering goat milk bath and body care products.

Soak your problems away with a goat milk bath bomb with nourishing oils, get some aromatherapy with an energizing or calming shower steamer, while you cleanse yourself with a wonderful hand crafted goat milk soap that’s safe for all skin types.

I get my farm fresh goats milk from Strasburg CO and have been making my products since 2019. I started out with my website: goatbubbles.com, then decided in May of 2022 to open a storefront. Please come on in and check it out! ank you so much for all your support!

5:00 PM - 7:00 PM

Tuesday, January 17, 2023 Lizzie’s Axe Throwing Board of Directors Meeting 8:30 AM - 10:00 AM Tuesday, January 17, 2023

Chamber Alliance Meeting 7:45 AM - 9:00 AM Wednesday, January 18, 2023 Quarterly

NonProfit Council 11:30 AM - 12:30 PM Tuesday, January 24, 2023

Offered by: Wellyssa’s Well

Offered by: Wellyssa’s Well

Divination is a universal practice found in virtually every culture across the globe. Written evidence for divination goes back to the early 2nd millennium in Mesopotamia; but more ancient practices have been verified throughout the ancient world, in the Near East, Egypt, the Levant, Greece, Italy, China, Japan, South America, Denmark-Sweeden-Norway and Africa. e biblical prophets used various forms of divination in reading the future, such as reading the omens of birds and clouds, the drawing of lots and the tossing of sticks and seed upon the ground. In the New Testament, the magi read the signs in the heavens (astrology) to find the Christ child. Medieval kings and modern presidents have consulted astrologers and tarot readers to determine the most propitious time for various events. And shamans, priests and holy persons have used divination to aid their community for centuries.

During the rise of Christianity divination was forbidden for a time, and outside of religious concerns, some leaders in the Arab nations and in Europe forbid it’s use for political reasons, especially astrology because of its accuracy. Despite various attempts to outlaw divination, and to color it as evil or the work of unnatural malevolent forces, divination remains relevant and sought after. e 19th century brought a grater interest and curiosity into all things occult, including divination methods with the rise of the “spiritualist” movement. Many resource manuals, tarot and oracle decks, as well as classes in how to perform divination or talk with ones ancestors became available during this time. Another surge in interest took place in the 1980’s and continues through current times.

Interdisciplinary studies between science and metaphysics have deepened our understanding both of histories, purposes, and roles of divination practices. Divination is a means of gaining knowledge that is not obtainable by normal modes of scientific or worldly investigation. e greater majority of diviners use their ability to connect with their spirit guides and ancestors, in some cases Deity or angelic energies, as well as those of the client they are working with to obtain answers and insight in future or past events. It is a primary practice used by shamans, seers, priests, witches and healers. ere are numerous methods of divination, some very ancient like peering into water (scrying), reading the patterns in sand and stone, or the patterns made by throwing bones or a handful of seeds on the ground. e Chinese “I Ching” was developed 3000 years ago, e Hindu Jyotish Astrology is at least 4000 years old, possibly older, the Mayan divination calendar, or Tzolk’in, where in they used the stars to calculate the day and then divined the meaning and attributes of that day with various seed weavings upon the calendar has been used for 3000 years, and the Greeks had literally 1000’s of types of divination and omen interpretations for every natural event one could imagine such as the swirling of leaves in the air, the reading of a lamb’s entrails before battle and patterns viewed in the waves of the sea. e first tarot decks were created in the early 1400’s in Italy and today there are many different types of tarot and oracle decks, both serious and fanciful. It has become an actual art form.

People have always wanted and needed to know what the future holds. May the birds fly well, may the tea leaves bring clarity, may the Runes show me the truth and may the cards assure a bright future.

The purpose of the Advisory Board is to advise and assist in the needs and operations of Eagle View. The Board meets Tues. Jan 17 and Feb 21 at 1:00 p.m. Members are: Dave Thomas, Peggy Jarrett, Dan Buckner, Olly Ramirez, Steve Yarish, Bill Alsdorf, Heidi Storz, Judy Schissler, George Phillips, Gayle Shibao, and Barbara Spakoski. Visitors are welcome.

Together we can continue to enhance the great programs and services offered for seniors and active adults in the Brighton area. Your financial support will be recognized on the donor wall at Eagle View. All donations are tax deductible. Make donations payable to: Brighton United Senior Citizens, 1150 Prairie Center Parkway, Brighton, CO 80601.

Donor Opportunities for Wall Recognition:

Friend: $100 - $499 Memorial: $100+ Sponsor: $500 - $999 Benefactor: $1000+

A hot, nutritious lunch is provided by Volunteers of America, Mondays and Thursdays at 11:30 a.m. Please reserve your meal in advance. For Mondays, reserve the Thursday before; for Thursdays, reserve the Monday before. Call Eleanor at 303-655-2271 between 10:00

Feel great with a massage by our certified therapist, Laurie Lozano Maier. She has over 12 years of massage therapy experience. Call 303-655-2075 to make a one-hour appointment. Pay Laurie at the time of service - check or cash.

$60

Deadline: Two days ahead

Are you living in the Brighton area and don’t have any family in the area? You are not alone. This is your chance to meet others that are in the same situation. Perhaps you can find a new friend!

Fri. Jan 6 - 1:00 p.m.

Deadline: Thurs. Jan 5

The firefighters from the Brighton Fire Department will perform FREE blood pressure checks for one hour.

Stop by!

Mon. Jan 9 @ 10:30 a.m.

Thurs. Jan 26 @ 10:30 a.m.

1150 Prairie Center Parkway, Brighton, CO 80601

303-655-2075 I evacinfo@brightonco.gov www.brightonco.gov

Hours: Monday - Friday 8:00 a.m. - 2:00 p.m.

a.m. - 2:00 p.m. Mon. & Thurs. to make a reservation. Daily meal donations are appreciated. $2.50 Donation per meal if age 60+ $8.50 Mandatory charge if under 60

Do you need help and are unsure where to turn? Evon Benitez will assist you with completing forms and finding needed services. You’ll need to make an appointment to see Evon as she’s often meeting with others. To make an appointment, call Evon at 303-6552079. Please leave a message.

Basic medical equipment is available to loan out. Items may include wheelchairs, front wheel and seated walkers, canes, crutches, toilet seat risers, commodes, and bath benches. There is no guarantee what will be available at any time. Call 303-655-2075 for information.

The Senior Wellness Clinic focuses on health promotion and disease prevention for seniors 55+. Operated by Visiting Nurses Association (VNA), services include foot care, health checks, and blood pressure checks. The fee for foot care is $35 payable at the time of your appointment. Foot care may be Kaiser covered with pre-approval. Reduced fee available upon approval. Masks required for everyone. Call 303-655-2075 for appointment.

Clinic hours: 9:00 a.m. - 2:30 p.m.

Ever wish you could make a difference in Brighton? You can! This group is about fun, easy ideas for spreading a little kindness throughout the community. Each month we pick a project. Call Sue at 303-655-2076 for information. No meeting in February. Wed. Jan 11 - 11:00 a.m.

You and your partner are competing against all other partners to bid and win the best hand on each board. Instruction on playing duplicate and scoring will be reviewed and discussed each session. You MUST have a partner to play Duplicate Bridge and should use the same partner for this two-day challenge. Tell us your partner at registration. Facilitator: Bobbi Jo Unruh. Wed. Jan 11 & 25 - 11:30 a.m. - 3:30 p.m. $10 (2 wks)

Deadline: Mon. Jan 9

Through our STOP THE BLEED® class you’ll gain the ability to recognize life-threatening bleeding and intervene effectively. The person next to a bleeding victim may be the one who’s most likely to save him or her. With knowledge and training, YOU could help save a life in those critical moments. This hands-on class teaches you how to control bleeding using packing, pressure, and tourniquets before medical personnel arrives.

Bee a part of The Buzz next month! To advertise, call: 303.404.2000

Need help with your laptop, tablet, or smartphone? We will do our best to help you become more comfortable using your device. Schedule an appointment with Calvin at 303-655-2187.

You will need to purchase a Zoom membership for each newsletter in order to participate online. Purchasing a membership will give you access to all EVAC’s programs that are being offered on Zoom for two months. Only Zoom members will receive the E-Blast with Zoom links. To register, see page 1 on the registration sheet. Cost: $20 for two months.

Jan & Feb Membership $20

Via Mobility - provides specialized transportation within the City of Brighton. Via can take you to medical appointments, grocery shopping, and Eagle View, to name just a few of the places you can go in Brighton. New Via users - call 303-447-2848 ext. 1014 to get started. To schedule rides, call 303-447-9636. Free rides to and from Eagle View to seniors living in the Brighton Via service area are provided by funding from the Senior Advisory Board.

FlexRide - This is an RTD service. Call 303-994-3549 for reservations. The driver will pick up and deliver you anywhere within Brighton, Mon - Fri. 6:00 a.m. - 7:00 p.m. Cost is the local RTD bus fare.

Wed. Jan 11 - 12:00 noon

Free Deadline: Mon. Jan 9

Dr. Ellen Stothard, Research and Development Director for the Colorado Sleep Institute will discuss ways to get more consistent sleep, why sleep is important to us, and the process of sleep and the circadian system. Her research focuses on understanding how daily activities, especially sleep/wakefulness behaviors and light exposure, can lead to altered behavioral decisionmaking and adverse metabolic health outcomes. This will be a live, virtual presentation with Dr. Stothard on the screen.

Wed. Jan 11 - 1:30 p.m. Free Deadline: Tues. Jan 10

Bunco is an easy and fun game of dice. Enjoy an afternoon of fun, laughter, and prizes. Thursdays - 1:15 p.m.

Jan 12 & 26 $4.00 (each day)

Deadline: Wed. before

EVAC & Zoom

Explore how we hear classical music outside the concert hall through advertisements, cartoons, and animation. Enjoy this fun hour of the most ubiquitous music even the most unassuming of us have come to love.

Presented by Gary Crow-Willard.

Thurs. Jan 12 - 1:30 p.m. $5.00 Deadline: Tues. Jan 10

January is Elvis’ birthday month. We’ve invited Nevan Castenada to come and perform everything Elvis! He looks like Elvis, sounds like Elvis, and you’ll be transported back in time. We’re serving chili dogs and all the fixings.

Fri. Jan 13 - 12:00 noon

$6.00 Deadline: Wed. Jan 11

Receive one-on-one assistance on Medicare issues from Ann Brothers. She is specially trained on Medicare insurance programs, including Medicare Part D. Call Evon at 303-655-2079 to make an appointment. For general Medicare questions you can also call Benefits in Action at 720-221-8354.

Tues. Jan 17 - 10:00 a.m. - 1:00 p.m. Deadline: Thurs. Jan 12

EVAC &

The world’s first national park, Yellowstone, was created by an act of Congress in 1872. Today, the national park system includes over 400 units (63 national parks), over 84 million acres of land, and hosts over 300 million visitors per year. Join Active Minds as we tell the story of the development of our national parks system and highlight some of the more notable parks and their

Take AARP’s driving refresher course of safe driving practices and rules of the road. Most companies offer a discount off auto insurance for course completion.

Wed. Feb 1 - 12:00 noon - 4:30 p.m.

$20 - AARP member

$25 - Non-member

Deadline: Mon. Jan 30

Professional illustrator, Frank Pryor, will teach you with his unique “A, B, Cs of Drawing.” Using a pencil, eraser, and blending stumps, he will share techniques he has used for more than 40 years to capture the world around you. This class is for all ability levels. Supply list at registration. No class Jan 16 or Feb 20.

Mondays - 9:00 - 11:30 a.m.

$80 (3 wks)

Session 2: Feb 6, 13, 27

Deadline: Thurs. Feb 2

stories.

Wed. Jan 18 - 1:30 p.m. $5.00

Deadline: Tues. Jan 17

Moving through the grieving process is a challenge for all of us. Having information about what we may expect and how to handle the many feelings and adjustments that come with loss can be comforting. Come hear what the experts in the field of grief and loss have learned about our common human experience of loss. Facilitated by Pennock Center for Counseling.

Wed. Jan 18 - 2:00 p.m. $2.00

Deadline: Tues. Jan 17

EVAC & Zoom

In 1921 she founded the American Birth Control League, the precursor to the Planned Parenthood Federation, and spent her next three decades campaigning to bring safe and effective birth control into the American mainstream. Presenter Paul Flanders is a former high school history teacher and monthly presenter at EVAC. Thurs. Jan 19 - 1:30 p.m. $4.00

Deadline: Wed. Jan 18

Who doesn’t love music from the 50s and 60s? We are going to have some fun with Studio 8 playing great music. We hope you will wear your favorite 50’s attire - poodle skirts, jeans, letter jackets…why not?!? Root beer floats, music, singing and dancing; it’s a great way to spend a wintery afternoon.

Fri. Jan 20 - 1:00 p.m. $5.00

Deadline: Wed. Jan 18

Some painting skills are helpful for this class. All supplies and instruction provided for you to have fun painting and finishing a beautiful canvas picture. Please see the display case for the example. Instructor: Judy Schissler.

Thursdays - 8:30 - 11:00 a.m. Feb. 9 & 16

$30 (2 wks)

Deadline: Tues. Feb 7

Aging to Sage-ing introduces you to a new way of living the second half of your life, sometimes called “sage-ing” or “conscious aging.” Explore how to make the years ahead satisfying and productive. The program draws from a model of aging developed by Rabbi Zalman Schachter-Shalomi. Engage in topics like life wisdom, forgiveness, service, and legacy through lively discussion and learning activities. Facilitator: Kathy Jensen. No class Jan 16 or Feb 20.

Mondays - 1:00 - 3:00 p.m.

Jan 9 - Feb 27

$20 (6 wks)

Deadline: Fri. Jan 6

Feathered Friends: Red-Tailed Hawk

Join us for Feathered Friends where our guest will be the red-tailed hawk. This most “common” of North American hawks is anything but ordinary, with a dazzling array of plumage types and a range that extends to every US state except Hawaii.

Tues. Jan 24 - 1:00 p.m. $5.00

Deadline: Mon. Jan 23

Beyond Vision will be offering a peer support group for older adults. At this kickoff program, get to know your peers, share tips for living with low vision in your community, and learn about the resources available.

Wed. Jan 25 - 1:00 p.m. Free

Deadline: Mon. Jan 23

Our monthly cribbage tournament is lots of fun and includes prize winnings. Just drop in and pay fee to the tournament volunteer.

Wed. Jan 25 - 12:30 p.m. $4.00

Their performances are always a lot of fun and only last about 20 minutes. Drop in for the free show and support our hard-working acting troupe! Play is done in time to enjoy the VOA lunch afterwards. RSVP necessary for lunch two days in advance to 303-655-2271.

Thurs. Jan 26 - 11:00 a.m. Free

Be sure to check out our Trips!

Note: Not all offerings are listed here. Please visit www.brightonco.gov for a complete listing.

Interested in learning how to draw caricatures? Whether you are a beginner, intermediate, or experienced artist, this class is for you! You will learn to see the way a caricature artist sees and captures the likeness and ‘personality’ of a person of any age, or a pet of any kind, in a unique way! Materials needed: 9” X 12” drawing pad, pencils, erasers, and small markers (Other materials will be recommended during the class.)

Instructor: Frank Pryor.

Tuesdays - 1:00 - 3:00 p.m.

$80 (4 wks)

Session 1: Jan 10 - 31

Deadline: Fri. Jan 6

Session 2: Feb 7 - 28

Deadline: Fri. Feb 3

Join instructor Linda Addison in transforming painted pinecones into a lovely winter flower arrangement. No green thumb required; this cute craft will give you joy year after year. All supplies included. Please see display case for example.

Fri. Feb 24 - 10:00 a.m. - 12:00 noon

$15

Deadline: Wed. Feb 22

Find your ancestors and record the information using the computer and other resources. Facilitators Sheryl Johnson and Fred Trail will work 1-on-1 with students to show you how. Class limited to 3 people on the EVAC computers - tell us at registration if you need one. Five more students can bring a laptop or I-device with wireless capabilities. Some computer ability necessary. Bring a flash drive and pencil with eraser.

Fridays - 9:00 - 10:30 a.m. Jan 6 - 27 $10 (4 wks)

Deadline: Wed. Jan 4

You’ll be making 4 cards for any occasion. Learn techniques to complete the cards such as stamping and die cutting. All supplies included in fee. Linda Addison is a certified “Stampin’ Up” card instructor. See display case for card samples.

Fridays - 10:00 a.m. - 12:00 noon $15

Session 1: Jan 13 Deadline: Wed. Jan 11

Session 2: Feb 10 Deadline: Wed. Feb 8

This class is for those new to the Instant Pot who want hands-on experience and help. You’ll cook beef stew and leave with a meal. Bring your Instant Pot and a wooden or silicone spoon. All other ingredients will be provided. Get tips and tricks for cooking success, caring instructions, and discuss other recipes. Instructor: Amy Wilson. Tues. Jan 17 - 10:00 a.m. - 12:00 noon $25 Deadline: Thurs. Jan 12

This class is for those more experienced Instant Pot users. You’ll cook a combination of chicken, sausage, and rice dish and leave with leftovers. Bring your Instant Pot and a wooden or silicone spoon. All other ingredients will be provided. You’ll get tips and tricks for cooking success, caring instructions, and discuss other

We have two tables that are first-come, first-serve during business hours. 25¢ per day

Join us in the dining room every Thursday with Barbara as our caller. One card per player. Win gift cards!

Thursdays - 12:15 p.m.

This is “women only” time to enjoy the pool tables.

Mondays - 1:00 - 4:00 p.m. 25¢ per day Closed on Jan 16, Feb 20

recipes. Instructor: Amy Wilson.

Tues. Feb 7 - 10:00 a.m. - 12:00 noon $25

Deadline: Thurs. Feb 2

Learn what an Instant Pot is and how to use it. No Instant Pot required! Instructor Amy Wilson will prepare two dishes for the class to sample while providing tips and tricks, a review of features and functions, and basic pressure cooking terminology. Tues. Jan 31 - 10:00 - 11:30 a.m.

$10 Deadline: Thurs. Jan 26

Would you like to learn to paint? Instructor Judy Schissler is here to teach the basics. Session 1 will focus on preparing a canvas and how to use different brushes. Session 2 will focus on using a color wheel to create art with complementary colors. Supplies are included but please bring your own color wheel (found at craft stores).

Thursdays - 10:00 - 11:00 a.m.

$7 (each 1-day class) Session 1: Thurs. Jan 19 Deadline: Tues. Jan 17 Session 2: Thurs. Jan 26 Deadline: Tues. Jan 24

Combine pen and ink designs with watercolor washes to create beautiful art. Start with a base design and then make the drawing uniquely yours. Drawing patterns will be provided. Washes are done with watercolor paints and/or watercolor pencils. Supplies list available at registration. Instructor: Sharon Krohn. 9:30 a.m. - 12:00 noon

Wednesdays Deadline: Monday before Session 1: Poppies in a Vase Jan 11 - 25

$45 (3 wks)

Session 2: Beach Treasures Feb 1 - 22 $60 (4 wks)

Knit & Crochet Drop-in

Drop in to knit or crochet with others. No instructor.

Wednesdays - 10:00 - 11:30 a.m. Conference Room 25¢ per day

This is an easy game to learn - it’s regular dominos with a fun twist.

Wednesdays - 12:30 - 3:30 p.m.

Need help with your laptop, tablet, or smart phone? Whether it is setting up a Gmail account or getting to know Zoom, we will do our best to help you become more comfortable using your device. Schedule an appointment with Calvin at 303-655-2187.

EVAC & Zoom

Improve your fitness level through movement and exercises. Exercises can be done seated or standing. Improve your leg and upper body strength, balance, and posture. Be ready with a good sturdy chair, two hand weights, and a fitness band or dishtowel. Instructor: Rosalie Farrer.

Tuesdays - 9:00 - 10:00 a.m. $20 (4 wks)

Session 1: Jan 10 - 31 Deadline: Fri. Jan 6 Session 2: Feb 7 - 28 Deadline: Fri. Feb 3

Enjoy the benefits of yoga without getting on the floor! Stretching releases tension in the body returning it to proper alignment, as well as increasing range of motion and building strength. Yoga exercises are done with the support of a chair to improve posture, flexibility, and strength. Instructor: Dottie LaFleur.

Tuesdays - 10:30 - 11:30 a.m. $20 (4 wks)

Session 1: Jan 10 - 31 Deadline: Fri. Jan 6 Session 2: Feb 7 - 28 Deadline: Fri. Feb 3

Computers with free internet are available when Falcon Room is unoccupied. Ask the front desk for assistance. A cleaned and sanitized keyboard will be checked out for you to use.

Free Wi-Fi

Free Wi-Fi is available throughout EVAC. Inquire at front desk.

Wood Carving Drop-in

Learn to carve wood or work on an existing project. Call Norm at 978-568-1191 to arrange free instruction.

Tuesdays - 8:15 - 10:15 a.m. 25¢ per day

Play Scrabble with others who enjoy the game. Wednesdays - 12:30 - 3:30 p.m.

Pinochle Pals

Tuesdays - 12:30 - 3:30 p.m. Room: Falcon Bridge

Fridays 12:30 - 3:30 p.m.

Room: Talbot Judy: 303-378-5226 Please call if new.

Follow and like us to stay up-to-date

Bee a part of The Buzz next month! To advertise, call: 303.404.2000

What will the new year bring for homebuyers, homeowners, and home sellers? Lower or higher home prices? Higher or lower mortgage interest rates? Or a continuation of the overheated pandemic-inspired housing market?

ere’s no question that the blistering housing market of the past three years was hard on homebuyers. By October 2022, the average mortgage interest rate for a 30-year fi xed is 7.24%, more than double the 3.22% level in January 2022.

According to Fannie Mae, the combination of high inflation, monetary policy tightening, and a slowing housing market is “likely to tip the economy into a modest recession in the first quarter of 2023.”

Many economic forecasters believe housing prices will decline, but that homebuyers shouldn’t fear buying during a declining market. Morgan Stanley predicts a 7% dip in home prices for 2023 that would return housing prices to where they were in January 2022 – 32% higher than prices were in March 2020 when the pandemic began. Economists with Goldman Sachs and Moody Analytics are predicting 5% to 10% declines in home prices, based on lack of homebuyer affordability, slowing housing sales, fewer mortgage applications, and a looming recession, however mild.

BusinessInsider.com reports that the Federal Reserve’s overnight rate hikes have raised mortgage interest rates, pushing affordability to new lows, but that a recession could bring interest rates down again. at combined with softer home buying demand due to inflation and sellers lowering their prices would make spring and summer 2023 great times to buy a home.

Your Berkshire Hathaway HomeServices Colorado Real Estate Forever Agent is always here to help with your real estate needs and questions. Visit BHHScore. com or call us at 303-905-8850 to talk with someone who is knowledgeable about real estate in your neighborhood. We look forward to serving you in the new year.

Shannon Wester

Jacob Wurtsbaugh Tracy Younger

Michelle Pierce Tabatha Ratliff

Josh Rogne

Deb Stephenson Donelle Thompson

Stan Wester

Kathy Kallner

George Martinez

Emily Miller Krissy Neuenberger

Scott & Lora Nordby

Jill Nunez

Therese Devendorf

Rhonda Engle

Amy Figliola

Deanna Gamboa

Linda Hepperle Mandy Jury

Anisa Archuleta

Alex Avalos

Tara Basagoitia

Linda Benker

Angie Carns

Shannon Wester

Jacob Wurtsbaugh Tracy Younger

Michelle Pierce Tabatha Ratliff

Josh Rogne

Deb Stephenson Donelle Thompson

Stan Wester

Kathy Kallner

George Martinez

Emily Miller Krissy Neuenberger

Scott & Lora Nordby

Jill Nunez

Therese Devendorf

Rhonda Engle

Amy Figliola

Deanna Gamboa

Linda Hepperle Mandy Jury

Anisa Archuleta

Alex Avalos

Tara Basagoitia

Linda Benker

Angie Carns

Awarded by the Emergency Medical Services Association of Colorado (EMSAC), Platte Valley Ambulance Service (PVAS) aims to provide the highest quality emergency medical care when you need it most. Our team has the expertise and technology to ensure you and your loved ones are safe and comfortable.

Thank you to EMSAC for this prestigious award!