Publisher

The Brighton Buzz

During May I mentioned that I would take on the job of sprucing up my yard. And, now that it has been somewhat accomplished, what’s next? Barbecue!

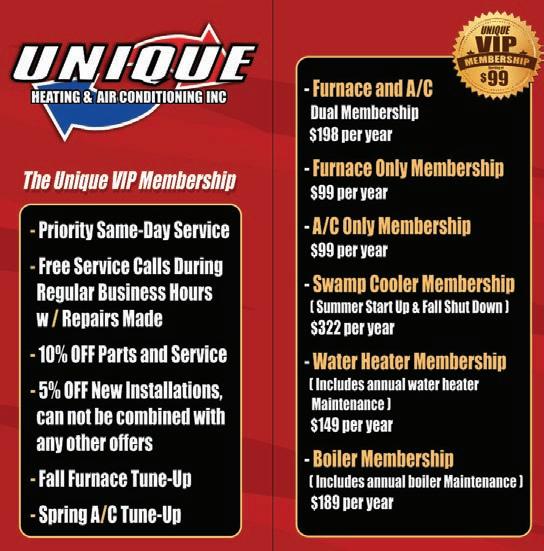

Barbecue is more than just a method of cooking — it’s a tradition that brings people together through food, fire, and friendship. Whether it’s a family cookout in the backyard, a neighborhood block party, or a community barbecue in the park, it’s a timeless opportunity to gather and is a highlight of July. The smell of grilled meat and vegetables often draws a crowd, turning even a simple meal into a memorable occasion. Whether you cook over charcoal, wood, or gas – according to many of my barbecue connoisseur friends –today there are a plethora of grill options that can perfect the final outcome. Luckily for you, there are several in our community, including Agfinity Ace Hardware (page 10) who can aid in choosing the right one.

As for the grilling itself – if you’re looking for a cut above – Legacy Beef (page 28) offers a premium selection. And of course, for those who have perfected grilled vegetables, the quality and selection among the farms in and around Brighton such as Lulu’s Farm (page 29) are unmatched.

So, scrape off that rack, pick your favorite wood, and be the envy of your neighbors as that beckoning aroma wafts through the air.

O ered by: Dolan & Associates, P.C.

(Part 2 of 3)

In this three-part series, the following are 3 of the top common mistakes people make when they die.

Focus on Taxes. Spending too much time and energy focusing on tax implications and overlooking critical family issues that arise upon and after death can cost you and your family much more than what you would have paid in tax. Saving taxes is important, but it shouldn’t be put ahead of family consideration and future harmony.

Confusion about Documents. Another common mistake is the belief that the estate planning documentation you have put in place will accomplish specific goals when it does not. You should know what documentation you have, why you have it, and what it accomplishes. Also, you should know how it works in relation to the other steps you take in an effort to have an effective estate plan.

Don’t Know What Options Are Available. Putting a plan in place without knowing what all of the options are to produce an effective plan is a common reason why estate plans fail to meet their objectives. ere is no such thing as a one-size-fits-all estate plan. You should understand what options are available to you so you can maximize the benefit to your family upon and after your death.

Don’t let your failed estate planning be the horror story people talk about when they get together for coffee. Take the steps necessary to avoid these common mistakes so that things go smoothly after you die.

Tune in to next month’s Brighton Buzz for final installment of the Top 10 Mistakes People Make When Dying, and if you have questions about these issues, you are encouraged to gain more knowledge about available estate planning options, by visiting www.EstatePlans atWork.com to sign up for a complimentary educational workshop.

O ered by: Tolison & Williams Attorneys at Law

We are always surprised by how fast a year passes and cannot believe it is already time again for our annual Brighton Buzz cover and this message to our community! e expressions “time flies when you are having fun” and “time flies as you get older” have proven to be true once again.

Our team has accomplished a lot over the last year and Katie and Casey are proud of their team in their professional and personal lives. We think we have helped a lot of people and families navigate usually negative and difficult situations and will continue to work hard to do so.

e elder law team welcomed a new team member as Casey’s legal assistant, Crystal Rippin, and she has already proven to be a vital and valued part of our work family. Crystal grew up in Brighton and is dedicated to the community and its promising future, and we are grateful to have her on the team. Casey and her team spearheaded last year’s “Senior Law Day” event for Adams and Broomfield Counties, and it was a great success. e day long event included free workshops on elder law topics, a variety of resources for senior citizens, and some great people, food, and fun. Casey and her team extend a heartfelt “thank you” to the volunteers and sponsors that contributed their valuable time and resources to help us support our community. Unfortunately, due to a lack of sponsorships and other funding, the event is not happening

this year, but the planning committee hopes to bring it back, and stronger than ever, in 2026. Katie, Zack, Carla, Cindy, and Dana had a very successful year, assisting nearly 400 folks navigate life altering situations-something we do not take lightly! We still maintain a superior rating on AVVO.com and have been honored to receive our 13th annual peer-nominated award from ompson Reuters Super Lawyers. Our team is just kicking butt and changing names!! Just a friendly reminder-if you have a family member or friend in need of some advice regarding a family law matter, we still offer a free 30-minute consultation and would be honored to assist!

Our office also welcomed a new mascot this year-a sweet little rescue pup named “Hoss.” Hoss is spending a lot of time in our office, so be sure to give him a cuddle if you come in.

While the construction and traffic may be frustrating, Brighton is continuing to grow and flourish, and we are happy to be here and grow and flourish with it. Even though Brighton is growing so much, we appreciate and respect the “small town” past and hope that we can carry on some of the core “small town values” that we value. We thank Brighton and the surrounding communities for your business, relationships, and support. We wish everyone a safe and festive summer and look forward to continuing to serve our community.

I spent over three months with another real estate agent before I was introduced to Mike. After I made the switch to Mike, I was able to go under contract in one week! He and his wife have extensive knowledge of the market and made great suggestions at every turn. Mike is a fantastic agent, very responsive, and gets aggressive when you need to in order to get the deal you want done. If I could give him more than five stars, I would. Fantastic experience all the way around and couldn’t have asked for anything more. Whether your looking to buy or sell, Mike and his team will get the job done without question. Super big thanks to Mike and Lindsy for making my first Colorado home purchase amazing!

– Matt Pruitt

•

•

•

Itwas almost time for our Pre-Karate class. From my desk I could see Justin outside, running full speed towards the front door. He pulled the door in a single yank and dashed into the waiting area. Shoes and socks flew out because Justin didn’t much care where they landed. Walking slowly behind on the sidewalk was his grandfather Mr. Simmons, who most of the time looked like he was carrying the weight of the world on his shoulders. He came in, and momentarily looked up at me, gave me a half smile then followed in toward Justin who was by then standing on a chair in the lounge. I often thought about how hard it must be for Mr. Simmons to raise Justin on his own. Because of some family circumstances he had full custody of this vivacious four year old with sparkling eyes, the energy of an atomic reactor, and the attention span of a flea. He enrolled Justin in our Karate school as a last ditch effort to help him manage this ball of energy who would hit older neighbor kids, bite others at daycare, and even kick his teacher.

One afternoon Mr. Simmons came to tell me that Justin had just pushed a kid at daycare. I shook my head in disbelief while Justin was just standing there as if nothing had happened. I asked him: “Justin why would you do that?”, he shrugged and replied in his high pitched voice: “He called me a *****.” Everyone in the room gasped as the word casually left Justin’s mouth. Mr. Simmons just hung his head in defeat.

Of course I had the mandatory conversation with Justin about self control and the appropriate use of language, then got back to work. e months passed and Justin remained a very challenging student at Karate and elsewhere. But I knew he had great potential so I refused to give up on him. Little by little after more than a year of work, there was light at the end of the tunnel. Justin began to control his emotions more often and began to focus better. Not perfectly but better.

One day Mr. Simmons came to me and told me in amazement that Justin had an altercation at school, a student had pushed him against the wall, and lo and behold, Justin didn’t hit back. By this time Justin had become well skilled in Karate, he was strong and fast for a six year old, and had just won gold at our last tournament. e fact that Justin held himself back was something completely new for his quick-tempered self.

And there it was. Justin had always reacted out of anger, fear, and frustration. Now, he had found true confidence and self-control. He believed in himself and his ability to defend himself, to the point that he didn’t need to prove it. Justin had turned the proverbial corner. Some students take longer than others to get on the right path, but consistency, his grandpa’s dedication, and our willingness to never give up on him, really paid off.

Mr. Simmons and Justin moved to another state a year later and I haven’t heard from them since. But my hope is that Justin has continued to grow and improve, and maybe found another Dojo where he will continue to thrive. If you’re working with a child who struggles with anger or self-control, remember that inside every storm of energy there is potential for something amazing— if only we believe in them and provide the support they sorely need.

We’re getting close to the Fourth of July, our national Independence Day. is celebration may get you thinking of the many freedoms you enjoy. But have you thought of what you might need to do to attain financial freedom? Your first step is to define what financial independence signifies to you. For many people, it means being able to retire when they want to, and to enjoy a comfortable retirement lifestyle. So, if this is your vision as well, consider taking these steps:

• Pay yourself fi rst. If you wait until you have some extra money “lying around” before you invest for retirement, you may never get around to doing it. Instead, pay yourself first. is actually is not that hard to do, especially if you have a 401(k) or other employer-sponsored retirement plan, because your contributions are taken directly from your paycheck, before you even have the chance to spend the money. You can set up a similar arrangement with an IRA by having automatic contributions taken directly from your checking or savings account.

• Invest appropriately. Your investment decisions should be guided by your retirement goals, along with how long you have before you need the money and how comfortable you are with different levels of investment risk. If you deviate from these guideposts — for instance, by taking on either too much or too little risk — you may end up making decisions that aren’t right for you and that may set you back as you pursue your financial independence.

• Avoid fi nancial “potholes.” e road to financial liberty will always be marked with potholes you should avoid. One such pothole is debt — the higher your debt burden, the less you can invest for your retirement. It’s not always easy to lower your debt load, but do the best you can to live within your means. A second pothole comes in the form of large, unexpected short-term costs, such as a major home or auto repair or a medical bill not fully covered by insurance. To avoid dipping into your long-term investments to pay for these short-term costs, try to build an emergency fund containing three to six months’ worth of living expenses, with the money kept in a liquid, low-risk account.

• Give yourself some wiggle room. If you decide that to achieve financial independence, you must retire at 62 or you must buy a vacation home by the beach, you may feel disappointed if you fall short of these goals. But if you’re prepared to accept some flexibility in your plans — perhaps you can work until 65 or just rent a vacation home for the summer — you may be able to earn a different, but still acceptable, financial freedom. And by working a couple of extra years or paying less for your vacation home expenses, you may also improve your overall financial picture.

Putting these and other moves to work can help you keep moving toward your important goals. When you eventually reach your own “Financial Independence Day,” it may not warrant a fireworks display — but it should certainly add some sparkle to your life.

We help you prioritize what matters most to you

My team and I will work with you to develop a personalized financial strategy that includes advice, tools and resources to help you achieve your financial goals. We’ll do this by:

• Getting to know what’s important to you.

• Using our established 5-step Process to create your personalized financial strategies

• Partner with you over the years to help you stay on track

We’ll help you identify and define your unique financial goals. And then we’ll tailor-build investment strategies that help you work toward those goals. Our single focus is helping you achieve what’s most important. And you’ll be backed by our entire team each

It’s

Let

A non-invasive treatment using a targeted beam of light to stimulate cellular activity and speed up the body’s natural healing process. The M7 MLS laser’s robotic head scans the treatment area and delivers a beam of light that penetrates deep into the tissues stimulating mitochondria in cells, which increases ATP production, cell growth, and blood flow to the area. MLS laser therapy can help with pain reduction, decrease swelling, increase circulation, and improve healing time.

are announcing our CALL

for our Excellence in Arts Awards

Brighton has a vibrant and growing cultural arts community, and BCAC would like to celebrate individuals, groups, and businesses within Brighton who are cultural arts champions.

The excellence in ArTs AwArds October 2nd, 2025 at 6:30pm Armory Performing Arts Center 300 Strong St., Brighton CO

For nomination form go to: https://brightonculturalarts.org/excellence-in-arts/excellence-in-arts-nomination-form/

OnJuly 4th, we will celebrate the signing of the Declaration of Independence and what many consider the birthday of the United States of America. For most, it will be a day of family, fireworks (make sure to protect your hearing!), food and fun. Hopefully, most people will remember with gratitude what it means, and what it took, to create and maintain a free and independent nation.

In preparing for this article, I considered what independence looks like for a child, a teenager, and adults at different life stages, as well as what it means to be an independently owned and operated business. So much of being able to be independent is making and executing decisions without the control of outside entities. For nearly everyone, we go from complete dependence in infancy to independence in adulthood, and eventually back to dependency toward the end of life. One small thing that makes a big difference for maintaining independence later in life is being able to hear and communicate effectively. e acts related to addressing and treating hearing loss can prevent many of the ailments, such as dementia and falling, that rob adults of their independence.

What makes Blue Ribbon Hearing & Tinnitus Center independent?

One of the biggest concerns I had when deciding to establish Blue Ribbon Hearing & Tinnitus Center was how to finance the creation of the business. After working for a decade in the industry, I could see many of the benefits and the pitfalls that came with outside entities influencing the operations of a business. is included lenders, insurance companies, advertising agencies and product suppliers, specifically hearing aid manufacturers.

Financing a business typically requires borrowing money. In the case of the hearing aid industry, this means getting loans from a bank, credit union, through the Small Business Administration (SBA), using credit cards, or quite commonly, taking a loan from a hearing aid manufacturer. All of these financing sources come with a variety of positive and negative implications.

As I researched each of the options, the positives of borrowing money from a hearing aid manufacturer were very intriguing. No-interest loans and other offers were tempting. However, the obligation of being required to exclusively or primarily sell one manufacturer’s product, was more than enough reason to avoid borrowing and entering into any sort of exclusive contract.

Owing money to a lender of any type decreases freedom as “the borrower is slave to the lender.” With that in mind, instead of borrowing to start the business, we figured out a way to “boot strap” and self fund. While this meant we started out small, with minimal advertising and little to no fanfare, it also meant we could be more maneuverable in dealing with obstacles. is proved to be especially true during with Covid-19 pandemic where were able to endure without receiving any sort of bailout . Running the business debt free allowed us to weather the storm.

Next month will mark eight years since Blue Ribbon Hearing and Tinnitus Center went from being an idea, to becoming an actual business. When it comes to your hearing needs, please consider supporting a locallyowned, independent business as your support has a major impact on us and your money stays within the local community. ank you for ensuring our continued independence and success.

O ered by T. Lloyd Worth, Worth Wealth Management

According to the FBI, cybercriminals are becoming more sophisticated in their attacks by leveraging artificial intelligence (AI) to conduct social engineering attacks. Cybercriminals can now use these tools to create scams uniquely tailored to specific victims and use them to remove common phishing tell-tale flags – whilst faking familiar voices, faces, and mannerisms. Overall, this increases the chances for successful attacks that lead to financial fraud and data theft.

Artificial

Cybercriminals use AI to analyze vast amounts of public data, to craft emails that include specific details about the victim such as but is not limited to name, job title, recent activities, and email address – making the phishing attempt seem much more relevant and legitimate.

• Increased Success Rate: Highly personalized phishing attempts are more likely to trick users into clicking malicious links or providing sensitive information.

• Difficult to Detect: AI-generated phishing emails can appear very similar to legitimate communications, making them harder to identify as fraudulent.

• Wider Reach: AI allows cybercriminals to automate phishing attacks, which helps them target a larger pool of potential victims.

Artificial

AI is increasingly being used in voice and video scams as well, leveraging these advanced tools to deceive victims to commit financial fraud and steal sensitive information. AI tools are used to create realistic fake videos (deepfakes) or audio by mimicking a person’s voice, facial expressions, and mannerisms. Cybercriminals use these to impersonate trusted individuals such as family members, celebrities, or executives and entice their victims into divulging sensitive information or providing financial compensation. For example, be on the lookout for deepfakes impersonating your trusted contacts using deepfakes to try to get financial information. Anything involving PII should be done in person or using known/verified callback options.

• Increased Realism: AI-generated content is often indistinguishable from real audio or video, making it harder for victims to detect scams.

• Erosion of Trust: e ability to replicate voices and videos undermines trust in digital communication, as people can no longer rely on what they see or hear.

• Targeted Exploitation: Scammers can use AI to target vulnerable individuals, such as the elderly or those unfamiliar with technology, increasing the likelihood of success.

• Financial and Emotional Harm: Victims may lose money, sensitive information, or suffer emotional distress from being deceived by someone they “trust”.

• Stay Informed: Keep up with the latest scam trends and tactics used by cybercriminals.

• Use Strong Passwords and MFA: Create complex passwords for each account and enable multi-factor authentication to add an additional layer of security and verification.

• Be Skeptical: Avoid clicking on links or downloading attachments from unknown sources. Verify the contact information of anyone who is attempting to reach out to you.

• Use a Safe Word: Establish a family or team “safe word” to confirm identities during sensitive communications.

• Be Cautious of Urgent Requests: Scammers often create a sense of urgency, so take a moment to assess the situation before acting.

With the emergence of AI, cybercriminals have made it a point to take full advantage of these tools to create malicious, sophisticated cyberattacks that are increasingly difficult to detect. Cybercriminals will use any tools at their disposal to commit heinous cybercrimes for financial gain. While AI-based cyberattacks are a growing concern, they are not insurmountable. By combining technology, education, and vigilance, you can protect yourself and your families from falling victim to these sophisticated attacks. e key is to remain proactive, skeptical, and informed in this evolving digital landscape.

Turning 65 is a big milestone — and for many, it also means becoming eligible for Medicare. But here’s a little-known fact: if you’re already receiving Social Security benefits when you hit 65, you’ll be automatically enrolled in Medicare Parts A and B. So, if you have work insurance, that is as good as Medicare you can return the card and delay if that makes the most sense. (not sure how to evaluate, give us a call) However, if you’ve chosen to delay claiming Social Security (often to maximize future benefits), you must actively sign up for Medicare during your Initial Enrollment Period (a seven-month window that starts three months before your 65th birthday) if you do not have coverage with your work or your spouse’s work, that is as good as Medicare.

Most have friends and relatives trying to be helpful but often they have differences in their situation. e best part is you have access to a nocost resource that will provide reliable information about your situation, steering you clear of any enrollment mistakes. Don’t assume everything is automatic — missing an enrollment window or enrolling prematurely can lead to some expensive surprises.

We have years of experience and can help empower you with the information you need to make the best healthcare selection for your needs and budget. Our services are never a cost to you, so please don’t hesitate to call our office and schedule an appointment (303) 887-8584. You can also scan the QR code and attend one of our in-person or virtual seminars to learn more.

O ered by:

Summer is often thought of as a season for vacations, weddings, and relaxation—but it’s also a good time to consider how your summer activities may affect your taxes. A little awareness now could lead to savings (or fewer surprises) next tax season.

1. Marriage: Tying the knot? Don’t forget the paperwork. Newlyweds should notify the Social Security Administration of any name change and submit IRS Form 8822 to update their address. Keeping records current helps avoid delays in processing your tax return.

2. Summer Day Camp: Sending your child to a summer day camp may qualify you for the Child and Dependent Care Credit. Just remember: overnight camps don’t count, and you’ll need proper documentation.

3. Business Travel: Traveling for work over the summer? Keep receipts and track your expenses. You may be eligible for deductions if the travel is away from your main place of business.

4. Part-Time or Gig Work: Seasonal jobs and side gigs may not generate enough income to owe federal tax, but fi ling a return could lead to a refund. Also, earnings via apps may trigger a 1099-K form—be prepared.

5. Home Improvements: Planning energy-efficient home upgrades? e IRS offers up to $3,200 in tax credits for qualified improvements like solar panels, new windows, or energy-efficient HVAC systems.

Summer may be short, but the financial impact can last all year. Stay taxready by tracking activities and keeping documentation organized.

Need help navigating how summer activities may impact your taxes? Contact Pricewise Business Solutions today at (720) 949-7733 for a personalized tax consultation. Let’s turn your summer fun into smart financial planning!

O ered by:

my

that this article will help you avoid any nasty surprises in the future.

ere might come a time when you need to have a medical procedure or treatment. You could be told you require medical equipment that may or may not have been discussed ahead of time. I want to be a voice of warning for some things that could happen when you get the equipment without discussing it with your insurance plan first.

I had a client call me recently. He had a procedure done and was told he would need a certain piece of medical equipment. e Medical Equipment Supplier didn’t bill insurance but told him he could submit the receipt for reimbursement.

If you have an HMO Medicare Advantage Plan, this will not work. In an HMO situation, you must use in network providers only. e only way another provider might be accepted is through prior authorization.

In the case of my client, this particular medical supplier was one of the only ones in the area who supplied the specific equipment that he needed. If there were no other suppliers available and his doctor would have requested prior authorization, that could have justified the Medicare Advantage HMO plan approving the equipment. But there is no guarantee, especially with a provider who will not bill insurance.

When it comes to insurance, it is always best to get prior authorization (ask for permission) rather than assume things will be covered after the fact (begging for forgiveness).

As always, I am happy to help answer your questions at anytime. Just give us a call or text.

Offered by: Intermountain Health

Nothing feels better than a good night’s sleep, especially if you’ve had quality sleep. Considering that we spend a third of our lives asleep (or at least trying), it makes sense that improving your sleep is important: It will make your waking hours more productive, focused, and happy.

You can think of the actions you take for a good night’s sleep as your “sleep hygiene,” which just like brushing your teeth must be done consistently. Where and how you sleep, your sleep habits, and even the type of mattress and pillow really do matter.

If you struggle with sleep, know that it takes trial and error to find solutions. Here’s a few things that will make a difference:

1. Create a Relaxing Sleep Environment

Your bedroom should be a sanctuary for sleep. Avoid using it for activities like studying, watching TV, or going online. “Changing your environment can make your nights more conducive to sleep,” says LoAndra Berg, nurse practitioner at Intermountain Health’s Utah Valley Pulmonary Clinic. Ensure your room is dark, quiet, and cool. Consider redecorating to emphasize relaxation.

2. Choose the Right Mattress and Pillow

Comfort is key to a good night’s sleep. When buying a new mattress, find one you can try out at home. Many online retailers offer in-home trials. Your pillow should also be comfortable and not contribute to allergies. If you have allergies, you won’t breathe as efficiently, which can disrupt your sleep.

3. Establish a Bedtime Routine

One hour before bed, start preparing yourself for sleep. Engage in calming activities that signal to your brain it’s time to wind down. Avoid electronic gadgets and turn down the lights. “Everyone develops coping strategies in times of stress, but once the stress is gone, those coping strategies may become habits that interfere with restful sleep,” Berg notes.

4. Exercise Regularly, But Not Too Late

Exercise can significantly improve your sleep quality. “One of the many benefits of exercise is serotonin, a chemical released in the brain that helps our bodies adjust and boosts our energy,” explains Dr. Tom Cloward, medical director of the Intermountain Sleep Disorders Center. However, avoid working out too close to bedtime, as it can leave you restless. If you find it necessary to work out in the evening, consider incorporating bedtime yoga into your routine to help settle down. Bedtime yoga can calm the body, slow the breath, and focus the mind, preparing you for a restful night.

Eating heavy or spicy meals late at night can impact your sleep. Avoid alcohol, caffeine, and tobacco in the evening. “The last few hours of the day should be when your body is winding down,” says Dr. Cloward. These substances can interrupt your sleep cycle, making it harder to fall and stay asleep.

If you’ve tried these tips and still

visit a doctor. You could have

Ashomeowners evaluate remodeling projects, understanding which updates offer the strongest return on investment is essential— especially in today’s market. Each year, Remodeling Magazine releases cost vs. value data that highlights which projects offer the best financial return when a home sells. For Denver homeowners, the current numbers reveal a clear trend: simple, exterior updates continue to deliver the highest payback.

At the top of this year’s list is a garage door replacement, averaging $4,420 to complete, with a resale value of $9,539—an impressive 215.8% return. Closely following is a steel entry door replacement, with a cost of $2,241 and a resale value of $3,864, recouping 172.4% of the investment. ese projects prove that first impressions truly count.

Additional standout projects include:

• Manufactured stone veneer: $11,218 job cost, $12,543 resale (111.8% recouped)

• Minor kitchen remodel (midrange): $25,898 job cost, $21,337 resale (82.4% recouped)

• Fiber-cement siding replacement: $22,030 job cost, $18,069 resale (82.0% recouped)

Interior updates still hold value but tend to offer lower returns compared to exterior improvements. A midrange bath remodel recoups 74.4%, while wood window replacements return 71.3%. Even energyefficient upgrades often recoup between 70-100%, according to national sources like Realtor.com.

On the other end of the spectrum, larger upscale remodels offer lower returns. A major upscale kitchen remodel recoups just 29.9%, and a primary suite addition (upscale) returns only 16.8% of its cost.

Whether preparing to sell or planning for the future, knowing which updates deliver true value is key.

Wondering how your remodeling plans could impact your home’s value? Your Forever Agent® at Berkshire Hathaway HomeServices Colorado Real Estate can help you make smart updates and plan your next move with confidence. Call 303-905-8850 or visit BHHScoloradorealestate.com to connect with expert guidance.

BRIGHTON $980,000

5 Beds | 4 Bath | 3,500 Fin Sq Ft 10080 E 160th Place, Brighton, CO

Deanna Gamboa 720-422-9320

THORNTON $725,000

3 Beds | 2 Bath | 3,570 Sq Ft 1936 E 144th Drive, Thornton, CO

John Mosher 720-849-2023

BRIGHTON $450,000

3 Bed | 2 Bath | 2,186 Sq Ft 169 Westin Avenue, Brighton, CO

Gina Bradshaw 720-732-2360

BRIGHTON $550,000

2 Bed + Den | 2 Bath | 3,483 Sq Ft 3936 Costillo Court, Brighton, CO

Josh Rogne 720-261-1792

COMMERCE CITY $365,000

3 Beds | 3 Bath | 1,488 Fin Sq Ft 14700 E 104th Ave. #1404, Commerce City, CO

Stan & Shannon Wester 720-254-0215

$10K SELLER CONCESSION FOR RATE BUY DOWN

Deanna

MAIN FLOOR PRIMARY SUITE

THORNTON $540,000

3 Beds | 2 Bath | 2,660 Sq Ft 10532 Madison Street, Thornton, CO

Beth Ann Mott 303-919-6864

BUILD YOUR NEW CUSTOM HOME

BRIGHTON $300,000

Land | 1.6 Acr. | No HOA | Boats & RVs allowed 30350 E 161st Avenue, Brighton, CO

Deanna Gamboa 720-422-9320

At Platte Valley Hospital – Sleep Medicine, we offer in-lab and in-home sleep studies.

Sleep disorders can impact your life in many ways. Are you experiencing any of these symptoms?

• Excessive sleepiness or daytime sleepiness

• Finding it difficult to stay awake during the day

• Insomnia, trouble falling asleep or remaining asleep

• Fluctuations in your schedule that interfere with a healthy sleep schedule

• Fatigue

• Memory loss, attention deficit, brain fog or difficulty concentrating

• Hypertension

• Moodiness, depression, anxiety, mood disorders, ADHD/ADD

• Cardiac symptoms