Dawa Sherpa Publisher

As school will be starting up soon, I’m recalling my back-toschool days. Gathering and sharpening my No. 2 pencils, getting the proper lined notebook paper, and most importantly having the coolest backpack. But learning in today’s fast-paced, tech-driven world, digital tools, tablets and personal computers have become the staple.

The shift to digital learning has opened up many possibilities and has reshaped how we learn. Students can learn at their own pace, revisit challenging concepts, and explore new topics outside traditional curriculums as well as gain access to a global library of resources. And, digital platforms provide powerful ways for teachers to track progress, tailor instruction, and collaborate with students.

However, it’s important that students develop digital literacy and maintain focus amid online distractions. Digital tools don’t replace traditional learning—they enhance it. More importantly, let’s not forget the importance of personal discussion and sharing of experiences that can’t be replicated on a digital screen.

O ered by: Dolan & Associates, P.C.

Here is the final segment of the top 10 common mistakes people make when they die.

Misunderstand Beneficiary Designations. Beneficiary designations are often used in planning but can have unintended consequences if misunderstood. Beneficiary designations override the instructions left in your will or trust. ey also do not allow flexibility for unforeseen changes like a child who predeceases you, which can unintentionally disinherit grandchildren.

Failure to Plan for Disability. Another common mistake is failing to plan adequately for a mental disability. Not planning for a possible mental disability can create significant problems for those who will be responsible for taking care of you. Caring for a person with a disability is hard enough. Having to overcome the legal challenges caused by a lack of planning can be overwhelming and also increase the complexity of things following your death.

Fail to Discuss Matters with eir Family. Communication is critical to a successful transition upon your disability or death. Failing to openly share information and discuss your plans with your family puts everyone at a disadvantage. Studies have shown there is a 50% chance that you will need care before you die, so have the conversation with your family before it is too late. Sharing openly with your family may be the single largest component in producing a smooth transition upon your disability or death.

Don’t let your failed estate planning be the horror story everyone talks about when they get together for coffee. Take the steps necessary to avoid these common mistakes so that things will go smoothly when you die.

If you have questions about these issues, you are encouraged to gain more knowledge about available estate planning options, by visiting www. EstatePlans atWork.com to sign up for a complimentary educational workshop.

•

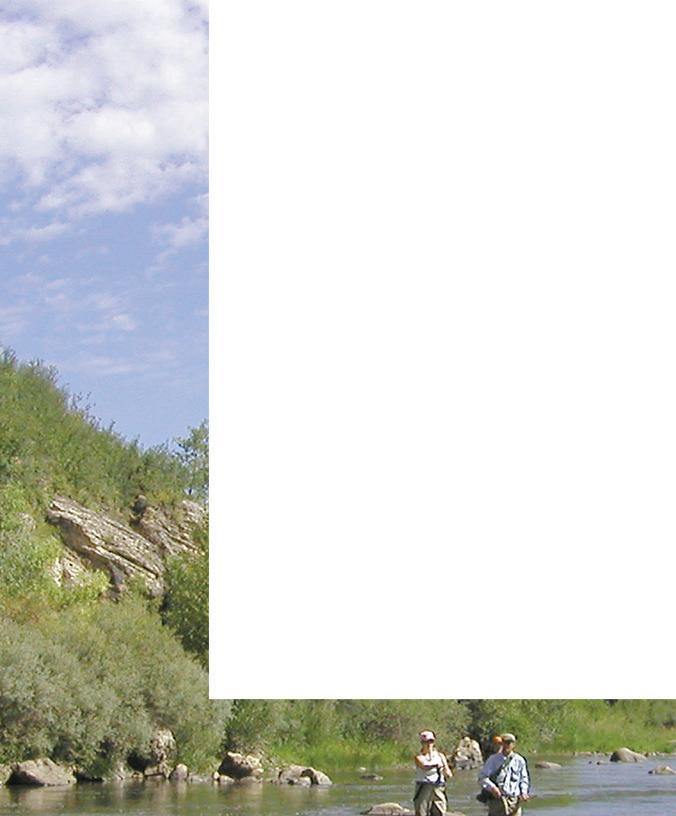

Located in the heart of Brighton, Colorado, we grow and sell tasty garden veggies (all picked by hand), gorgeous flower baskets and pots, high quality bedding plants, and healthy starter plants for your home vegetable garden. Palizzi Farm offers a wide variety of fresh and healthy veggies, and plants

Asparagus

Basil

Black eye peas

Broccoli

Calavacita

Celery

Cilantro

Dill

Italian green beans

Kale

Kohlrabi

Okra

Rhubarb

Squash blossoms - call in advance

Sweet Corn - Peaches 'n' Cream

Sweet English peas

Swiss chard

Wax Beans

Green Beans

*Call for seasonal availability

for all of your gardening and culinary dreams! If you would rather enjoy the fruits of our labor, pick up one or several of the gorgeous blooming flower baskets we have prepared for your yard and patio enjoyment, or some of our home grown produce.

Don’t

Yellow squash

Zucchini

Cantaloupe (Rocky Ford)

Watermelon

Beets - red, golden, & candy stripe

Bell peppers

Brussels Sprouts

Cabbage

Carrots

Cauliflower - white, purple, orange

Chiles - MANY varieties

Cucumbers

Eggplant

"Hot House" Tomatoes

Green Tomatoes

Field Tomatoes

Tomatillos

Green onions

Leeks

Lettuce - green leaf, red leaf, romaine

Onions - red, white, yellow

Pickling cucumbers

Radishes

Spinach

Colorado Cherries (Pie Cherries)

Sugar snap peas

Bedding Plants

Hanging Baskets

A non-invasive treatment using a targeted beam of light to stimulate cellular activity and speed up the body’s natural healing process. The M7 MLS laser’s robotic head scans the treatment area and delivers a beam of light that penetrates deep into the tissues stimulating mitochondria in cells, which increases ATP production, cell growth, and blood flow to the area. MLS laser therapy can help with pain reduction, decrease swelling, increase circulation, and improve healing time.

Thirteen years ago, two little boys stepped timidly into our dojo — Logan, 5, and Trevor, just 4. eir first class? Lots of tears, because they were nervous and scared of this new place and the strangers around. But that day marked the start of a journey that would shape their character, challenge their limits, and eventually turn them into the kind of young men every parent hopes to raise.

Karate became more than a hobby for the brothers—it became their proving ground. While other kids came and went, Logan and Trevor showed up. Week after week. Year after year. ey trained with focus, pushed through frustration, and even when they failed rank tests— sometimes more than once—they kept coming back. Not because it was easy, but because quitting would mean giving up on the bigger goal: earning their black belts.

eir parents were their quiet champions. Never making excuses, always encouraging effort over outcome. Whether it was driving to class, sitting through innumerable hours of training, or setting an example of perseverance in their own lives, they created a foundation the boys could stand on—even when self-doubt crept in.

When COVID hit and the dojo doors closed, Logan and Trevor didn’t take a break. ey cleared space at home, logged into Zoom, and trained through screens and living room obstacles. at discipline paid off. After eight years of consistent effort, they both earned their black belts—marking not just a milestone, but a moment of transformation.

e story doesn’t end there

Today, Logan and Trevor are instructors at the same school where they once struggled as white belts. ey’ve discovered a new joy in teaching and mentoring the next generation of martial artists. ey are, in every sense, the kind of black belts who lead by example—not just in technique, but in character.

Outside the dojo, the brothers are just as driven. Both are passionate about cars and spend their free time turning wrenches with their dad. Trevor, a Brighton High School student, plans to become a technician or open his own business. Logan, will soon be attending the School of Mines, and manages to balance academics with his automotive passion and a Lego collection that rivals most hobby stores.

eir lives are full of horsepower, homework, and hard-earned wisdom. But at the center of it all is a deep love for their family, their roots, and the journey that started with two scared little boys walking into a karate class.

Logan and Trevor are more than black belts. ey’re reminders that real growth takes time, that failure is part of the path, and that when young people are supported—and refuse to give up—they become exactly the kind of leaders our community needs.

ered by: Tim Roberts - Edward Jones

Whenit comes to managing your money, there’s more to consider than just the bottom line. For many people, investing isn’t only about building wealth or reaching goals — it’s about making sure their dollars support charitable causes and principles that are in line with their closely held values.Whether your focus is on protecting the planet, aligning with your faith or giving back to your community, a financial advisor who understands your values can help you build a portfolio that reflects what matters to you. Here’s how to help find a good fit.

Before you start searching for a financial advisor, take a moment to reflect on your own values. Are you passionate about sustainability? Do you want your investments to avoid companies that conflict with your faith? Is charitable giving a big part of your life and something you want to incorporate into your financial strategy?Make a list of your top priorities. Understanding what drives you can help make it easier to find a financial advisor who shares and respects your vision.

Do Your Homework

Once you’ve clarified your goals, start looking for financial advisors who focus on values-based investing. Terms like “socially responsible investing” (SRI), “faith-based investing,” “impact investing” or “ESG” (which stands for environmental, social, and governance) are good keywords to use during your search.Browse financial advisor websites and check their credentials. Some may highlight their experience with sustainable funds or philanthropic planning. Look for signs that they’re comfortable helping clients invest with a conscience.

After narrowing your list, schedule a few introductory discussions, which can be done in person or remotely, depending on your preference. ese chats are your chance to learn more about how the financial advisor works and whether they’ll be a good fit.Ask about their investment approach:

• Do they offer portfolios with a focus on ESG or faith-based fi lters?

• Have they worked with clients who have similar values to yours?

• How do they assess charitable giving strategies or donor-advised funds?

• Do they know the complex tax rules associated with charitable giving? Listen closely to the questions they ask of you. Are they truly interested in what matters to you? Do they understand your values and priorities? Also, consider their communication style. Will they keep you updated regularly? Are they open to collaboration when you want to adjust your plan?

Choosing a financial advisor is a personal decision. Beyond their professional qualifications, you want someone who listens well and respects your goals. Don’t hesitate to meet with several financial advisors before making your choice. e right person will make you feel understood and supported, both financially and personally.Ideally, you and your financial advisor will forge a long-term relationship that spans the changes and milestones in your life. As the details of your financial strategy may change, you’ll still want to hold onto your values in your investments.

Whether you’re hoping to reduce your carbon footprint, stay true to your faith or make the world a better place through giving, you don’t have to choose between your values and your financial future. Many good financial advisors can help you do both.Taking the time to find someone who shares your vision can help you feel confident that your investment strategy can align with your personal beliefs.

What matters most to you matters to us

We help you prioritize what matters most to you

My team and I will work with you to develop a personalized financial strategy that includes advice, tools and resources to help you achieve your financial goals. We’ll do this by:

We’ll help you identify and define your unique financial goals. And then we’ll tailor-build investment strategies that help you work toward those goals. Our single focus is helping you achieve what’s most important. And you’ll backed by our entire team each step of

• Getting to know what’s important to you.

• Using our established 5-step Process to create your personalized financial strategies

• Partner with you over the years to help you stay on track

What matters most to you matters to us

Give us a call.

We’ll help you identify and define your unique financial goals. And then we’ll tailor-build investment strategies that help you work toward those goals.

We’ll help you identify and define your unique financial goals. And then we’ll tailor-build investment strategies that help you work toward those goals. Our single focus is helping you

Our single focus is helping you achieve what’s most important. And you’ll be backed by our entire team each step of the way.

Achievingand maintaining better hearing is a process that requires work on the part of the hearing aid wearer and the hearing professional. Since every individual is unique both in their hearing loss and their brain processing capacity, communication and teamwork with the hearing professional is critical to ensure the best hearing outcomes. We strive to give patients plenty of time to ensure issues are addressed. Adjusting to hearing aids takes time. e adjustment period varies by person. e longer an individual with hearing loss waits to get hearing aids, the more time and effort it takes to get used to them. Modifications to both the physical fit and the sound quality are typically necessary. First time wearers almost always find hearing aids to be too loud initially as their auditory system, including the inner ear, nerves and brain, all work more when receiving proper amplification. Initially, the auditory system resists change. In order to improve adaptation, we program new hearing aids with less amplification initially, then increase it over time (weeks or even months), allowing the brain to adapt.

clearly, they actually started to understand and had use more mental energy to process what was being said. Hearing aids require maintenance on the part of the wearer as well as the professional. e human body is very harsh on hearing aids. Devices can malfunction due to wax, oil, sweat and other factors. e chemical composition of excretions from the skin along with environmental factors will cause devices to deteriorate and malfunction over time. Individuals need to clean and perform simple regular maintenance to ensure the devices continue to work properly. Regular professional cleanings help ensure peak performance and the longevity of the devices. Hearing aids that are cleaned regularly last longer and perform better over time.

In a recent continuing education course I completed, the results of a study on the impact that wearing specific hearing aids had on the wearers was presented. Researchers collected data on numerous effects of hearing aids on wearers. For most, wearing hearing aids helped them more easily understand and cause them to be less tired. For some, however, it made them more tired. Why would this occur? Most likely because when individuals who are isolated due to lack of hearing could finally hear

e majority of the time, performance issues can be resolved in the office. At other times the devices must be sent in to the manufacturer for repair. e manufacturer warranty covers not only parts that malfunction prematurely, it also covers when the microphones or receiver stop working due to improper cleaning and maintenance. And while some hearing devices are water proof or extremely water resistant, others may not be. In the event that water causes the microphones to fail, the warranty will cover that as well.

Blue Ribbon Hearing & Tinnitus Center was established in Brighton in 2017 by owner and operator John Wilson, a graduate of Fort Lupton High School and Brigham Young University.

O ered by:

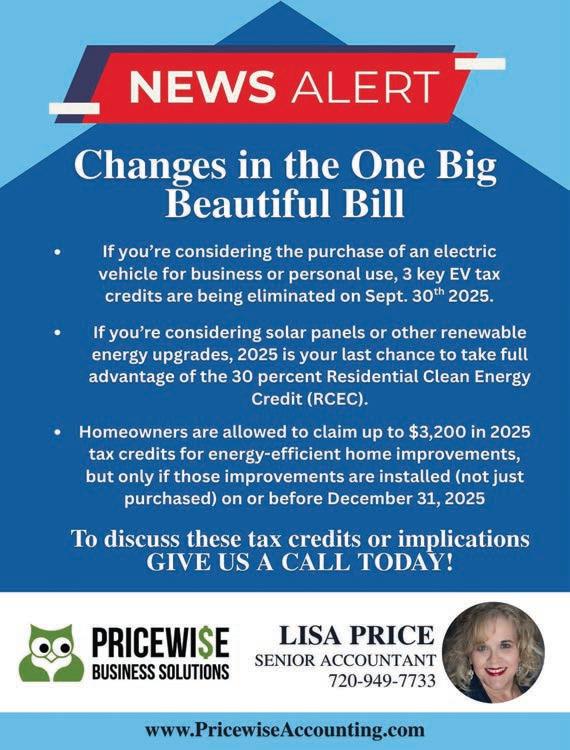

If your business finances are a mess, you’re not alone—and it’s not too late to get back on track. Mid-year is the perfect time to pause, regroup, and take control of your books before the end-of-year rush. Whether you’re behind on reconciling accounts, tracking expenses, or categorizing income, a few small steps now can save you time, stress, and money down the road.

Here are some easy steps to get started:

1. Set aside dedicated time – Block off an hour or two each week just for financial tasks. Treat it like a meeting you can’t miss.

2. Start where you are – Don’t worry about perfection. Begin with your most recent bank statement or transaction log and work backward.

3. Organize your receipts and records – Use folders (digital or physical) to sort documents by month or vendor. Apps like QuickBooks or Wave can help simplify this.

4. Reconcile your accounts – Match your bank and credit card statements to your bookkeeping records. is helps catch errors and ensures accuracy.

5. Ask for help if needed – A professional bookkeeper or accountant can quickly bring order to the chaos and offer tools to keep you on track going forward.

Remember, progress is more important than perfection. Each small action brings clarity and confidence. Your finances don’t have to be flawless—they just need to be functional.

Take the first step today. Schedule a power hour with yourself or reach out to a professional who can lighten the load. You’ve worked hard to grow your business—now, give it the financial clarity it deserves. Getting caught up now means fewer headaches later and more time to focus on what you do best: running your business.

65 often brings a major

insurance decision: Should you stick with your employer-sponsored coverage or enroll in Medicare? e answer depends on the size of your employer and how your current plan stacks up against Medicare.

If you work for a company with fewer than 20 employees, Medicare generally becomes your primary coverage, and it’s important to sign up for Part A and Part B on time to avoid late penalties. However, if your insurance is a group plan with an employer has 20 or more employees and offers a creditable group health plan, you may be able to delay Medicare Part B without penalty — allowing you to maintain your current insurance until retirement.

We have years of experience and can help you compare premiums, deductibles, provider networks, and drug formularies between your workplace plan and what Medicare offers. We can help you understand which option gives you the best value and coverage. Remember: this isn’t a one-size-fits-all decision — the right choice hinges on your personal health needs, work plans, and finances.

Our services are never a cost to you, so please don’t hesitate to call our office and schedule an appointment (303) 887-8584. You can also scan the QR code and attend one of our in-person or virtual seminars to learn more.

O ered by:

If you are currently on a Medicare Advantage Plan, you have some benefits that you may not be using or may still have a balance available. One of the benefits is a Dental benefit. Your plan might include Preventive Dental only. In that case, you can get two cleanings and exams and one bitewing x-ray in the calendar year. If your plan includes comprehensive dental coverage, then you could have coverage for a service you have put off but no longer need to.

You might also have a Vision benefit. is benefit will generally cover one routine eye exam per year. is exam might even include refraction. e plan also usually gives an allowance to put toward frames or contacts.

e Hearing benefits vary from plan to plan. All will include an annual routine hearing exam. Some will give you an allowance toward hearing aids and others will give lower copay amounts for hearing aids. Some give an annual allowance, and others restrict the allowance to something like “every 2 years” or “every 3 years”.

You also likely have a quarterly, or monthly, benefit for Over-the-Counter (OTC) items. is is a benefit that allows you to get things like toothpaste, toothbrushes, bandaids, vitamins, supplements, shower stools, adult diapers, and more with your allowance. Unless your plan specifies otherwise, you usually need to use the OTC amount in the period, or it will be gone. If it is a quarterly benefit, it will only be available for the quarter.

Remember all benefits end at the end of the calendar year and reset January 1 to the new plan offerings. If you have questions about how your plan works, you can call the Member Support/Customer Service number on the back of your plan’s card or call me and I can help you.

If you have Medicare plus a Medicare Supplement, your plan might have some added benefits but few plans do. You might have a Vision Discount, Hearing Discount, or a gym membership built into your plan. Be sure to ask your plan, agent, or feel free to call me to find out if you have anything available to you.

The “fourth trimester” appointment is for staying connected and addressing concerns

Offered by: Intermountain Health

The journey of new motherhood extends far beyond the delivery room. As you cradle your newborn in your arms, you enter what is often called the fourth trimester—an essential period of postpartum recovery and adjustment.

“We know that the fourth trimester is a sacred and transformative time, where the delicate dance of mother and baby truly begins,” shared Megan Bristol a certified nurse midwife with Intermountain Health St. James Hospital in Butte, MT. “Many women experience a range of emotions, including happiness, anxiety, sadness, and fatigue, commonly known as the ‘baby blues.’ Addressing maternal mental health needs during the fourth trimester is essential to prevent and manage postpartum depression and support maternal well-being.”

In a recent KUTV appearance, Hollie Wharton, a certified nurse midwife and nurse practitioner at Intermountain Health Alta View Hospital in Sandy, UT, dove into the significance of postpartum check-ups.

What does the fourth trimester entail?

The fourth trimester, often overlooked, extends beyond childbirth and delves into the critical postpartum period. This phase, marked by hormonal fluctuations and adjustments to new family dynamics, requires special attention to both physical and mental well-being.

“Coming in for your postpartum checkup is very important to make sure your body is healing, physically and also mentally,” said Hollie. How do I approach the fourth trimester?

Navigating the challenges of the fourth trimester involves self-care and understanding the importance of mental health. This period is a delicate phase for mental health, with risks of postpartum depression and anxiety. Even moms with no history of mental health problems can be affected.

“Postpartum depression and anxiety can be very scary, and patients may not know it’s happening,” said Hollie.

Recognizing the signs and seeking support from healthcare providers can make a significant difference in a mother’s well-being. Hollie also emphasized building your support community.

“It takes a village to take care of a child and newly delivered mother,” said Hollie. “Set up a break for a couple of hours at least every two weeks for selfcare, or to do whatever heals you.”

This support system can also help with a postpartum essential: getting enough sleep.

“I tell moms they will be more resilient if they are getting enough sleep,” said Hollie. “It’s important to sneak some naps in during the day while the baby is sleeping.”

Why are postpartum check-ups important?

Postpartum check-ups serve as a crucial bridge between new mothers and healthcare providers. One to two postpartum visits are recommended and are often covered by insurance as maternity care.

These check-ups offer a platform to discuss physical healing, mental health, and any challenges faced during the fourth trimester. It’s the first step in uncovering potential issues and ensuring a healthy recovery.

“We are often a woman’s primary care provider, so women feel comfortable talking with us about their concerns,” said Hollie. “But if you don’t come in, we don’t know what’s going on.”

Leverage the strong relationship forged with your healthcare provider during pregnancy. Postpartum check-ups become a cornerstone for staying connected and addressing concerns.

And remember – the fourth trimester is not just an extension of pregnancy. It’s a phase of transformation, resilience, and the beginning of a beautiful new chapter.

Intermountain Health Platte Valley Hospital’s Women’s and Newborn Center is here to support you through every stage of your journey—including the fourth trimester. To learn more, call us at 303-498-3400.

have police cars, fire trucks, tractors, snow plows, buses and much, much more.

Presented by: Scott and Lora Nordby, Berkshire Hathaway HomeServices Colorado Real Estate

Ifyou’re wondering why mortgage interest rates for consumers don’t follow the Federal Reserve’s fund rates to banks, there’s a good reason. Interest rates are tied to benchmarks based on how long the debt lasts. e federal funds rate applies to overnight lending between banks, while consumer mortgages are typically long-term, as much as 30 years.

at’s why mortgage rates are more closely aligned with the 10-year Treasury note yield. According to Investopedia, the yield reflects the interest the government pays to investors over 10 years, making it a more relevant benchmark for long-term loans like mortgages. Most homeowners don’t stay in their homes for 30 years anyway—the average is eight years, while the median is 13.2 years.

Lenders set mortgage rates by adding a “spread” on top of the 10-year Treasury yield. is spread accounts for the difference between mortgagebacked securities (MBS) and Treasury yields, as well as risk, inflation expectations, and market demand.

Curious how today’s rates affect your buying power? A Forever Agent SM can help you understand your options and plan your next move with confidence. Connect today at 303-905-8850 or visit BHHScoloradorealestate.com to find a trusted Forever Agent SM at Berkshire Hathaway HomeServices Colorado Real Estate.

THORNTON $1,550,000

6 Beds | 4 Full Bath + 2 Half Bath | 5,132 Sq Ft 8655 E. 130th Ave., Thornton, CO

Toni Klein 303-345-8034

COMMERCE CITY $575,000

4 Bed | 3 Bath | 2,838 Sq Ft 10680 Norfolk St, Commerce City, CO

Deb Stephenson 303-501-7377

WIGGINS $500,000

5 Bed | 2.5 Bath | 2,956 Sq Ft 107 Larkspur Cout, Wiggins, CO Gina Bradshaw 720-732-2360

COMMERCE CITY $685,000

5 Bed | 3 Bath | 4,594 Sq Ft 9716 Uravan Street, Commerce City, CO

Cinthia Martinez 720-255-6201

Thornton, CO Beth Ann Mott 303-919-6864

THORNTON $460,000

2 Bed | 1 Bath | 1,236 Sq Ft 13322 Ash Circle, Thornton, CO

Gina Bradshaw 720-732-2360

10K CONCESSIONS

MUST SEE INSIDE

AURORA $525,000

3 Beds | 2 Bath | 1,842 Fin Sq Ft 3955 S Nucla Street, Aurora, CO

Stan & Shannon Wester 720-254-0215

You can’t choose who they’ll be in the world.

But you can choose how to bring them into it.

Our highly trained experts put you and family first and your comfort and care are our top priority throughout your pregnancy. Experience the best in personalized care with Intermountain Health.

The best choice for maternity care.