Dawa Sherpa Publisher The Brighton Buzz

I’vementioned the efforts I took to make my yard something to be proud of this year. Utilizing the many quality lawn and landscape services that we feature within the Brighton Buzz, I can say it was a success. With colder temperatures fast approaching, it’s now time to turn my attention to winterizing to ensure that next year’s landscaping will rival this year’s results. Fortunately, I will be able to rely on those same quality services to accomplish this and the knowledge and expertise they have shown me this summer. If you’re looking for help getting your trees and landscaping ready for the changing season, you can find it here!

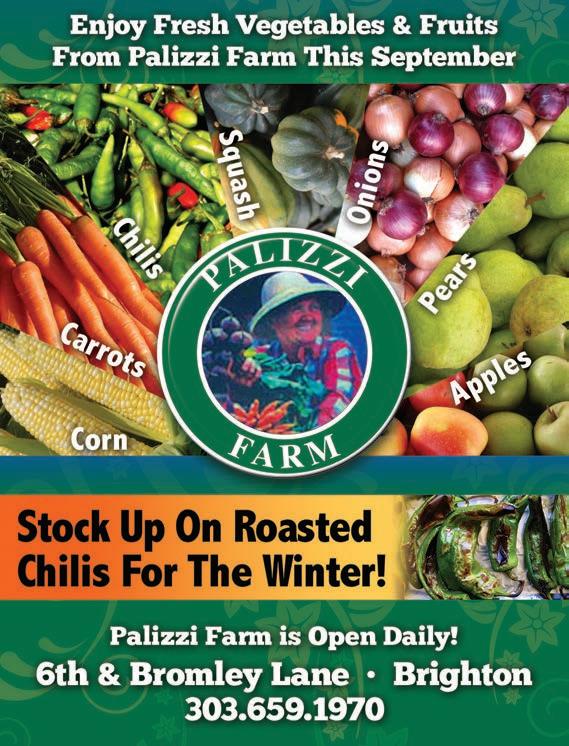

Speaking of seasons, don’t forget to check out the many end-of-season harvests offering a wide variety of fresh and healthy veggies that are featured at the local farms in our area.

And last but certainly not least, make sure your home is prepared for the winter. Several of our advertisers are offering great offers and low-cost checkups to ensure that no matter what the temperature is, you’ll remain comfortable through the changing seasons. The season of change is upon us!

Enjoy your Autumn!

Offered by: Dolan & Associates, P.C.

The traditional approach to estate planning in America is a challenging system, at best. The chance of a successful planning experience is remote if you define “success” as “meeting people’s expectations”.

Most people consider the subject of death and dying taboo, and as a result, professionals have created a reactive system that has the capability of producing as many problems as it solves. The process usually starts with professional advisors accommodating the individual’s desire to make the process as short as possible (think: trip to the dentist!). Sadly, as long as the experience is short and relatively painless, most “planning” experiences are treated as “successful”. However, this is an extreme disservice to you and your loved ones because those you love are often left to suffer the consequences of this type of planning.

Professionals rely on sterile form documents, with little effort to educate individuals about their options, and the additional steps necessary to actually produce results. This includes financial advisors who recommend simple document acquisition, and attorneys who perpetuate the myth that the documents accomplish everything. In reality, people accomplish the tasks associated with estate planning, and people receive the benefit, or bear the brunt of, the results produced through the planning process.

Understanding the steps needed for success, customizing the plan to fit your family, and preparing your family to effectively implement the plan are critical steps to producing a smooth transition upon disability and death. These steps are regularly disregarded in most estate plans because they take more time and effort.

There is a better process available for those who take the time to seek it out. If you have questions, I encourage you to gain more knowledge about the available estate planning options, by visiting www.EstatePlansThatWork.com to sign up for a complimentary educational workshop.

•

•

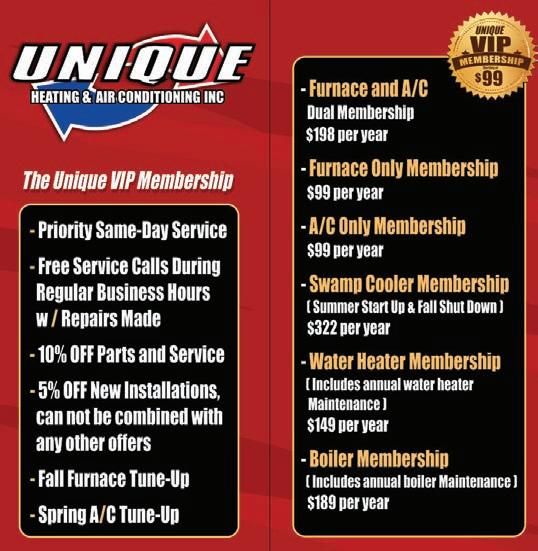

$39 Fall Deep Clean and Tune-Up Special

For new customers (normally valued at $199)

• Dirt, dust, and debris are the #1 cause of HVAC breakdowns.

• Deep clean + maintenance is the best protection for your furnace and investment.

• Our techs spend up to 2 hours cleaning every part, piece by piece.

• A clean system means up to 30% energy savings

• No Breakdown Guarantee through the entire winter

• Elongates lifespan of system

• Peace of Mind

Whenmost people think of karate, they picture lightning-fast kicks, powerful punches, and students breaking boards. But step into a dojo, and you’ll quickly realize it’s more than a place to practice selfdefense—it’s a classroom where life lessons are taught every day.

From the first bow, students learn that respect comes before action. Just like raising your hand in school before speaking, bowing in karate is a reminder that discipline and courtesy set the tone for learning and engagement. It’s a habit that extends beyond the mat, teaching children to greet teachers, coaches, and parents with the same level of respect.

Karate also mirrors the school experience in structure. Students are given lessons, practice drills, and then tested to measure their progress. Earning a new belt is like moving to a higher grade—it’s a sign of growth, responsibility, and hard work paying off. Kids learn that advancement doesn’t come overnight and that it’s earned, not given. It’s the result of consistent effort, patience, and disciplined practice—the same qualities that help them succeed in academics and other areas of life.

e dojo is also a unique place where failure is not the end but part of the process. Failing a test, forgetting a form, or losing at a tournament are all opportunities to practice resilience. Children discover that it’s okay to fall short, as long as they stand back up and try again. at mindset gives them the confidence to handle setbacks in school, sports, and friendships with maturity.

Perhaps the most valuable lesson is teamwork. While karate is often seen as an individual sport, students train with partners, help younger classmates, and encourage each other during challenges. is spirit of cooperation teaches empathy and leadership—two qualities every parent hopes to see in their child.

e dojo, like the classroom, is about preparing students for the real world. At our dojo, our mission is not just to develop skilled martial artists, but strong, respectful, and confident individuals who succeed in life—on and off the mat. And that’s what makes our work so rewarding.

If you feel your child could benefit from karate training, I invite you to come check us out. We stand proudly by our results.

— Sensei Willy Strohmeier

ered by: Forrest Hough - Edward Jones

Now that the “One Big Beautiful Bill Act” has become federal law, there is a lot to unpack for American taxpayers and investors. Here, we’ll focus on the tax impacts.

For starters, the law permanently extends certain major tax provisions from the 2017 Tax Cuts and Jobs Act (TCJA) that were set to expire at the end of this year, such as permanently extending lower income tax rates for individuals, the higher standard deduction, the expanded child tax credit, the higher alternative minimum tax (AMT) exemption and phase-in thresholds, and the higher federal estate, gift and generation-skipping transfer tax exemption ($15 million per individual and $30 million for married couples in 2026).

But as the name of the law says, the act is “big,” and there are a number of other changes that could impact American taxpayers. Here’s a closer look:

Individuals: e new law delivers several changes that can help individuals further reduce their taxes, including the temporary ability for taxpayers below certain income thresholds to deduct portions of income for individuals age 65 or older, overtime pay, qualified tips and interest on qualified passenger-vehicle loans; a slightly higher charitable contribution deduction for non-itemizers beginning in 2026 ($1,000 for single fi lers and $2,000 for joint returns); and greater flexibility to use 529 accounts for K-12 and homeschooling expenses.

e act also extends certain TCJA provisions that limit or eliminate some tax benefits, like the elimination of personal exemptions, limits on the state and local tax deduction (albeit with a higher cap, which is subject to phaseout, through 2029), limits on the amount and type of loans eligible for the mortgage interest deduction and the termination of miscellaneous itemized deductions. Additionally, there are new changes that could increase taxes for some individuals, such as a new 35% rate cap on itemized deductions and a new floor for itemized deductions of charitable contributions, both beginning in 2026, as well as the elimination of several clean-energy credits.

Businesses: e new law extends or enhances several tax benefits that could help firms up and down Main Street, as well as America’s farmers. For example, it permanently extends TCJA’s “qualified business income” deduction (often referred to as the “199A deduction”) for individuals who own “pass-through” businesses (businesses other than sole proprietorships for which owners report business income on their individual tax returns) and increases phase-in thresholds for the deduction, which may allow more individuals to qualify.

It also permanently reinstates the 100% bonus depreciation deduction for qualifying assets placed into service after Jan. 19, 2025; permanently reinstates the ability for small businesses to immediately deduct the full amount of qualified domestic research and development (R&D) expenses in the year they’re incurred (which may be retroactively applied for qualifying small businesses); and for purposes of calculating business interest limitations, permanently reinstates the exclusion of depreciation and amortization expenses in the limitation base.

Additionally, small business owners and farmers may benefit from an increase to the allowable expense for qualifying property from $1 million to $2.5 million, potentially enabling them to expense more business equipment purchases. And, finally, the act extends or enhances tax credits for employer-provided childcare and paid family and medical leave benefits.

Individuals and businesses can use additional tax savings to meet current expenses or toward a financial goal, like saving for retirement or moving forward with a business expansion. Consider consulting financial, tax, and legal professionals to help assess specific situations.

AsI considered what to write during this month of Blue Ribbon Hearing & Tinnitus Center’s 8th anniversary, I recalled having written in the past about the law of the harvest and reaping what we sow. Now as the summer is coming to an end and we are entering the fall or autumn season, we will be harvesting what we planted earlier in the year. Back in the spring, a patient gave me some heirloom tomato plants for my garden. I had dutifully planned and prepared to plant the tomatoes along with other plants during the recommended time for our area, which is some time between Mother’s Day and Memorial Day. However, for a number of reasons, including cooler wet weather and hail storms that hit our neighborhood, I was unable to complete planting my garden until the beginning of July.

en last week, the same patient who gave me the plants called and asked if I had any tomatoes ready. I had to tell her that, though I had some on the plants, it would be some time yet before I would have any to pick. She then offered to bring me some, which she did. At that time I sheepishly explained the reason I did not have any ready as I planted late. She said she had actually planted in early May and already had a bumper crop. If things continue as they are, by the time the season has ended, she will have had a much more successful harvest than I will because she started sooner. After our discussion on gardening, I reflected on how much of a difference her planting earlier in the year impacted the success of her garden.

During that same week I had also had several different patients get new hearing aids, and I was able to compare the successes and struggles

they were having based on how long they waited to first start wearing hearing aids. Universally, those who first start wearing hearing aids sooner after they start having hearing problems end up with a much better long term experience. ose who wait longer allow their brain and auditory system to degrade more and at a faster pace. at degradation slows the moment a person begins wearing hearing aids. Wearing hearing aids can decrease the rate of cognitive decline and brain shrinkage. In a recent study published by the Journal of the American Medical Association (JAMA), a study of nearly 3000 people showed 32% of the individuals with dementia could have their cause of dementia attributed to hearing loss.

One of the patients who got the new aids is 82 years old. I have been helping him with his hearing aids since he was 66 years old. He started wearing hearing aids in his mid 50’s after losing his hearing from loud noises associated with his work as well shooting firearms. Most people I test with a hearing loss as severe as his have a significantly diminished ability to understand speech. However, when I tested his hearing I found that he had perfect word recognition because he had worn his hearing aids constantly since he first found out he needed them nearly 30 years ago. Having treated his hearing loss from the beginning, he prevented additional damage and shows no signs of dementia.

Here at Blue Ribbon Hearing & Tinnitus Center, we are committed to educating the community on the need to prevent and treat hearing loss. We provide everything from custom hearing protection to the latest state-of-the art premium hearing aids. ank you for you continued support over the past 8 years.

Offered by:

Running a small business comes with many expenses, but tax credits can provide meaningful savings by directly reducing the amount of tax you owe. Unlike deductions, which lower taxable income, credits lower your tax bill dollar for dollar. Here are five valuable tax credits that small business owners should consider:

1. Work Opportunity Tax Credit (WOTC) - is credit encourages businesses to hire individuals from targeted groups facing employment barriers, such as veterans, ex-felons, or long-term unemployed individuals. Depending on the employee hired, credits can be worth up to $9,600 per worker.

2. Research and Development (R&D) Tax Credit - Even small businesses may qualify for this credit if they invest in developing new products, improving processes, or enhancing software. e credit can offset income taxes or, for qualified small businesses, payroll taxes—making it especially valuable for startups.

3. Employer-Provided Childcare Credit - If your business provides childcare facilities or contracts with third-party childcare providers, you may be eligible for a credit of up to 25% of childcare expenses and 10% of childcare resource and referral services. is not only supports employees but also reduces your tax burden.

4. Disabled Access Credit - Small businesses that make their facilities more accessible to individuals with disabilities—such as installing ramps, widening doorways, or offering adaptive equipment—can receive a credit of up to 50% of eligible expenses.

5. Small Employer Health Insurance Credit - If you provide health insurance through the Small Business Health Options Program (SHOP) Marketplace, you may qualify for a credit worth up to 50% of premiums paid. is incentive helps businesses offer benefits while lowering costs. Final oughts

Don’t leave money on the table—make sure your business is getting every tax credit it deserves. Contact Pricewise Business Solutions today to review your eligibility and start saving on your next tax bill.

Medicare’s Annual Enrollment period is right around the corner, running from October 15 through December 7. During this time, beneficiaries can review and make changes to their Medicare Advantage (Part C) or Prescription Drug (Part D) plans. September is the ideal time to get ready. (Steer clear of the misleading TV ads, we can offer reliable information about programs you may qualify for – there is nothing offered on a TV ad that a local professional agent cannot offer, explain and service.)

Start by reviewing your current Medicare plan—whether it’s Original Medicare, a Medicare Advantage plan, or a Part D Prescription Drug plan. Make note of your current coverage and out-of-pocket costs. It’s also key to make a list of your current medications, preferred doctors and hospitals. If you’d like to get a review you can click our link to provide your information through our HIPPA compliant link.

Then watch your mailbox for the Annual Notice of Change (ANOC) from your current plan. These typically arrive mid to late September. This important document outlines any changes in your Medicare Advantage or Prescription(Part D) Plan. You’ll want to check whether your preferred doctors, hospitals, and prescriptions are still included. Also costs of services will likely change for different aspects of care. Changes to coverage accepted at some facilities is likely this coming year.

If you’re happy with your current plan and the 2026 changes, no action is needed.

If you’re unsure about your options or want to verify current coverage or change coverage, free help is available. Our services are never a cost to you, so please don’t hesitate to call (303) 887-8584. You can also either scan the QR code and attend one of our in-person or virtual seminars. Or use the Review QR code to schedule with our licensed agents, submitting the information will trigger a call from us to set up your individual consultation.

Taking time now to prepare can save you money and ensure you get the best care in the year ahead with the least amount of stress as we navigate this year’s Medicare choices.

O ered by T. Lloyd Worth, Worth Wealth Management

Inthe FBI’s 2023 Internet Crime Report, email spoofing has cost the world over $18 million and leads all other categories with the most complaints filed. An average of 3 billion spoofing emails are sent per day. Understanding how to identify and avoid them can prevent you from becoming a victim and keep your accounts secure. Cybercriminals are using the email spoofing tactic to trick users into divulging sensitive information that may lead to financial fraud and potentially identity theft.

What is Spoofing?

Spoofing occurs when bad actors send emails or other correspondence purportedly from legitimate businesses. Spoofing can also refer to hosted websites that mimic official ones but with the malicious intent of collecting your sensitive information. Different types of spoofing may occur separately but often are used together to further deceive or disguise their intent to unsuspecting victims. Spoofing is often the first step in escalating into larger cyber threats, such as malicious phishing campaigns and ransomware attacks.

Types of Spoofing

Some of the most common types of spoofing are listed below:

• Email Spoofing: Spoofers will send emails that appear to be from legitimate sources, such as large reputable companies, friends or family. In reality, the emails contain malicious links or files. Due to the false sense of security created by the appearance of legitimacy, individuals may be more susceptible to clicking on these links than those in “normal” spam emails.

• Website Spoofing: Website spoofing also aims to convince users that the website they are interacting with is legitimate. Since these fake websites are created to perfectly replicate the authentic versions, it is easy for users to miss key signs that could tip them off and protect them from interacting with malicious links. Examples include typo-squatting, domain impersonation or website redirection.

• SMS/Caller ID Spoofing: is type of spoofing involves threat actors changing the appearance of their phone number to a legitimate contact on your device to disguise their malicious intent. SMS text messages can be used by legitimate companies for marketing purposes, but bad actors can also use this tactic (SMS spoofing) to imitate communications from the same businesses, friends and family. Similarly, Caller ID spoofing happens when bad actors appear to be calling from a reputable company or acquaintance. Bad actors will use these methods to collect personal information or to commit financial and identity crimes.

Understanding a spoofer’s tactics can help you avoid falling victim to one. Please see the following signs below to help you identify a potential spoofing attack:

• A spoofer’s messages or emails may reflect urgency that a legitimate sender’s emails would not.

• Spoofers may ask for personal information through emails or other channels.

• Spoofers may have poor spelling or grammar.

• Spoofers sometimes make suspicious requests, such as asking you to reset your password through a text.

Avoiding spoofing requires attention to detail and skepticism. Below are some quick tips to protect you and your accounts:

• Verify communications are legitimate: Directly contact individuals you have a personal relationship or interaction with and verify communications were legitimate. Use the LPL Report Phishing button or contact us if you receive a suspicious email, text or other communications.

• Block unknown numbers: If you receive calls or texts from unknown numbers, you can block them to avoid further contact.

• Don’t respond instantly: If you get a text requesting urgent action, take a minute to confirm that the sender is legitimate before replying.

• Do not respond to questions from unknown calls: When receiving unknown calls, do not respond to questions, especially if they are yes or no questions.

• Never reset your password if you did not initiate it: Do not respond to random SMS requests to reset your password, even if says it is from a trusted source. Spoofing has been happening since the 1970’s and will continue to be a threat. ere is a good chance that you have already experienced spoofing. erefore, it is in your best interest to not only understand the dangers associated with falling victim to spoofing, but also red flags and tactics spoofers use to bait their victims.

If you wish to discuss the material in this article, or other financial matters, please reach out to Lloyd Worth of Worth Wealth Management at (303) 338-0214 or Lloyd.Worth@LPL.com. We take your financial security seriously.

• ISA Certified arborists and climbers on each crew.

• Full workers comp and general liability insurances.

• New equipment specific for tree work.

• Friendly, knowledgeable crews.

• Superb cleanup, low impact on your property.

• Always safe and efficient. Safety is our top priority!

• Tree Pruning & Removal

• Tree Planting

• Winter Deep Root Watering

• Tree & Shrub Pest Control

• Stump Grinding

• Deep Root Fertilization

• Commercial Tree Services

Offered by:

is in the near future and with that is the Medicare Annual Enrollment Period (AEP). Get ready for the uptick in Medicare Commercials! (Hard to believe there could be more, right?)

With AEP, there are a few things you can do. During this time, October 15 – December 7, you are allowed to leave a Medicare Advantage Plan, switch to a different Medicare Advantage Plan, or change/add a Medicare Prescription Drug Plan. If you decide to make a plan change, the new plan would be in effect January 1.

Many people think they can just keep rolling with the same plan from year to year and never see a major change in coverage. Honestly, you can a lot of the time. Unfortunately, that is not always the case.

Medicare Prescription Drug Coverage changes every year. Some insurance companies will change the monthly premium, others will change the list of medications they cover, and others will cancel one plan and move everyone to another, more expensive plan within the company.

Because of these changes, I always recommend checking your plan coverage to be sure it will still be beneficial for you the following year. It can be as simple as a quick phone call or email to your Medicare Insurance agent. If you have any questions or need assistance, please contact us and schedule a time to chat.

Offered by: Intermountain Health

Sniff sniff! Achoo! Burrr! The familiar sounds of the flu are ringing in the season, and it’s time for health precautions. Sonya Norman, MD, at Intermountain Health Brighton Clinic knows these sounds well and answered some questions.

When is the flu season?

Flu season is between October to March, but it does fluctuate. Most people associate influenza with the colder fall and winter weather. Influenza is present year-round but peaks in this period. Who is at risk for getting the flu?

This answer is simple: everybody.

“Anybody can get the flu, but there are people who are more at risk,” said Dr. Norman. “This includes people with compromised immune systems and groups like babies, kids, and the elderly.”

Regardless of your immune system status, Dr. Norman stressed that you can’t assume you won’t get the flu. Getting the flu shot and mastering health precautions is your best line of defense.

What can I do to prevent the flu?

Wash your hands. Stay home if you’re sick. Wear a mask if you’re at high risk. And, most importantly, get the flu shot!

Even if you do all these things, there is a chance you will get the flu. The flu shot either prevents influenza or makes your symptoms less severe if you do get it. “The flu shot is always worth getting because influenza is miserable,” Dr. Norman explained. “Even if you’re not somebody at risk for getting severely sick, having the flu generally is miserable.”

When should I get the flu shot?

Dr. Norman suggested getting the flu shot in October at the earliest. “The effectiveness of the flu shot wanes over time,” she said. “If you got your flu shot in August, it might not be as effective by the end of flu season.”

It’s important to emphasize that the flu shot will not make you sick, but you may have side effects. These include fatigue, arm pain, or even a low-grade fever after the vaccine. This means your immune system is responding to the shot, and everything is working!

Where can I get my flu shot?

The flu shot is accessible and can be found in doctor’s offices, pharmacies, and more. Need a flu shot? Schedule an appointment with your primary care provider or visit one of Intermountain Health Platte Valley Hospital’s community flu clinics. A list of dates and locations are on the back cover of this month’s Brighton Buzz.

1150 Prairie Center Parkway, Brighton, CO 80601

303-655-2075 I evacinfo@brightonco.gov www.brightonco.gov

Hours: Monday - Friday 8:00 a.m. - 4:00 p.m.

The purpose of the Advisory Board is to advise and assist in the needs and operations of SCAAC. The Board meets Tues. Sept 16 and Oct 21 at 1:00 p.m. Members are: Dave Thomas, Peggy Jarrett, Lou Ellen Bromley, Dan Buckner, Karen Swaithes, Steve Yarish, Bill Alsdorf, Heidi Storz, Gayle Shibao, Barbara Spakoski, Janet Olivieri, and Randy Thornton. Visitors are welcome.

Charitable Contributions

Together we can continue to enhance the great programs and services offered for seniors and active adults in the Brighton area. Your financial support will be recognized on the donor wall at Eagle View. All donations are tax deductible. Make donations payable to: Brighton United Senior Citizens, 1150 Prairie Center Parkway, Brighton, CO 80601. Donor Opportunities for Wall Recognition: Friend: $100 - $49 | Memorial: $100+ | Sponsor: $500 - $999 | Benefactor: $1000+

Outreach & Referral

Do you need help and are unsure where to turn? Evon Benitez will assist you with completing forms and finding needed services. You’ll need to make an appointment to see Evon as she’s often meeting with others. To make an appointment, call Evon at 303655-2079. Leave a message.

VOA Lunch

A hot, nutritious lunch is provided by Volunteers of America, Mondays and Thursdays at 11:30 a.m. Please reserve your meal in advance. For Mondays, reserve the Thursday before; for Thursdays, reserve the Monday before. Call Eleanor at 303-655-2271 between 10:00 a.m. - 2:00 p.m. Mon. & Thurs. to make a reservation. Daily meal donations are appreciated.

$2.50 Donation per meal if age 60+

$8.50 Mandatory charge if under 60

Senior Wellness Clinic

Preparing to sell your home? You don’t need a full-scale renovation to impress potential buyers. In fact, a few smart, small updates can significantly elevate your home’s appeal—both inside and out. ese cost-effective improvements are not only doable over a weekend, but they also pack a serious punch when it comes to first impressions and perceived value.

Here are four easy projects that can give your home a polished, readyto-sell look:

1. Swap Out Tired Hardware

Details matter. Replacing outdated doorknobs, cabinet pulls, faucets, and even closet hooks with clean, modern options can quietly elevate your space. ese changes are quick to tackle but can help your home feel more current and well-cared-for.

The Clinic focuses on health promotion and disease prevention for seniors 55+. Operated by Visiting Nurses Association (VNA), services include foot care, health checks, and blood pressure checks. The fee for foot care is $40 payable at the time of your appointment. Foot care may be Kaiser covered with pre-approval. Reduced fee available upon approval. Masks required for everyone. Call 303-655-2075 for appointment. Clinic hours: 9:00 a.m. - 2:30 p.m. Fridays: Sept 5, 12, 19, Oct 3, 10, 17 - Mondays: Sept 8, 22, Oct 13, 27

Tech Tuesdays

Need help with your laptop, tablet, or smartphone? We will do our best to help you become more comfortable using your device. Schedule an appointment with Calvin at 303-655-2187.

Transportation

Via Mobility - provides specialized transportation within the City of Brighton. Via can take you to medical appointments, grocery shopping, and Eagle View, to name just a few of the places you can go in Brighton. New Via users - call 303-447-2848 ext. 1014 to get started. To schedule rides, call 303-447-9636. Free rides to and from Eagle View to seniors living in the Brighton Via service area are provided by funding from the Senior Advisory Board.

FlexRide

This is an RTD service. Call 303-299-6000 for reservations. The driver will pick up and deliver you anywhere within Brighton, Mon - Fri. 6:00 a.m. - 7:00 p.m. Cost is the local RTD bus fare.

Please visit www.brightonco.gov for a complete listing of all offerings.

2. Refresh Your Landscaping

First impressions start before anyone walks through the door. A tidy, welcoming yard can set the tone for the entire showing. You don’t need to reimagine your whole landscape—try painting the fence, adding mulch, trimming hedges, and introducing a few native plants or potted flowers. Even small touches can make your exterior feel more inviting.

3. Paint With Intention

Fresh paint is one of the simplest ways to make your home feel brighter and more open. Neutral shades—like soft white, cream, or beige—help buyers picture themselves in the space, and they tend to photograph well, too. A new coat inside or out can make a space feel well-maintained and move-in ready.

4. Update the Lighting

Lighting can completely change the feel of a room. Swap in a modern fi xture, add a statement piece, or simply use brighter bulbs to help create a warm, welcoming atmosphere. It’s a subtle update that doesn’t go unnoticed.

ese kinds of small updates aren’t about overhauling your home, they’re about showing it in its best light. If you’re curious which changes will make the biggest impact in your market, talk to Your Forever Agent® at Berkshire Hathaway HomeServices Colorado Real Estate. ey’ll help you focus your time (and budget) where it counts. Connect today at 303905-8850 or visit BHHScoloradorealestate.com.

BRIGHTON $800,000

3 Beds | 2 Bath | 1,714 Sq Ft 30344 E 165th Avenue, Brighton, CO

Tabatha Ratliff 303-908-6518

$1,100,000

Bed | 3 Bath | 3 Car Garage | 4,335 Sq Ft | 1.34 Acr. 5015 Prairie Lark Lane, Severance, CO Mandy Jury 720-371-6733

10K CONCESSIONS

KEENESBURG $430,000

3 Beds | 3 Bath | 1,819 Sq Ft 325 Thomas Avenue, Keenesburg, CO

Tabatha Ratliff 303-908-6518

BRIGHTON $535,000

3 Bed | 2 Bath | 3,483 Sq Ft 3936 Costillo Court, Brighton, CO

Josh & Kristen Rogne 720-261-1792

BRIGHTON $365,000

3 Beds | 2 Bath | 1,440 Sq Ft 857 Mockingbird Ln, Brighton, CO

Deanna Gamboa 720-422-9320

CITY $685,000 2 Beds | 2 Bath | 1,448 Sq Ft 12625 Madison Way, Thornton, CO Amy Figliola 303-514-2633 THORNTON $485,000