Dawa Sherpa Publisher The Brighton Buzz

The Brighton Buzz recently entered our twentieth year of serving Brighton and northeast metro area! Many of our advertisers have been with us through the start. We are thankful for your partnership and support that has helped us fill every issue. Every ad you’ve placed, every renewal, every kind word — it’s all helped keep local businesses and voices alive in our pages.

You’re more than advertisers to us — you are the heart of our communities. Each ad you’ve placed has done more than promote a product or service — it’s helped us tell the larger story of who we are. Your support has turned every issue into a reflection of our communities — filled with familiar faces, local voices, and the vibrant energy that makes this place our home.

As we look back with gratitude and ahead with excitement, we are thankful for your continued partnership and your trust in our mission. And, for helping us keep local media thriving, one ad — and one article — at a time.

With genuine appreciation, we say — THANK YOU — for believing in our shared vision, for continuing to help us build a stronger business — and a stronger community.

Last month, we provided an overview of five typical estate planning tools. Now, let’s look at how you actually produce an estate plan that will allow things to go smoothly for your family after your disability or death. If your plan won’t work, why bother having one?

Effective estate planning is not an event. It is a process! If you would like your estate plan to produce results, you need to undertake a process through which you carefully gather and prepare the tools you and your family may need in the future, align your assets with those tools, and regularly adjust and maintain your set of tools and your plan. Simply buying a Will or Trust document is like going to your financial advisor, choosing specific investments, and then never looking at them again. at would not be wise.

Unfortunately you don’t know what your future holds. So if you are putting together a set of tools to be ready for whatever comes up in the future, you would prepare a variety of tools, particularly those that would provide the most benefit to you and your family even if you had a few extra along just in case.

You would also maintain those tools so they work when you need them. You should carefully look at your estate planning attorney’s process for maintaining your plan over time. Do they have a formal process for keeping the documentation up to date regarding legal changes and changes in your personal situation? Does your attorney have a process for notifying you when legal changes necessitate an adjustment in your plan? Does the attorney remind you periodically to review your plan to make sure it still meets your goals, and have a way for you to do so quickly and easily? Does the attorney work with you to ensure that your current and future assets stay properly aligned with your plan? Does your attorney have a process for helping prepare you and your family for the transitions that will come upon your disability and death?

If you can’t answer “Yes” to these questions, you may want to investigate a more thorough process of estate planning. Not having the right tools or having a bunch of rusty old tools (documents) is not the answer to eventual success. It is simply a false sense of security.

If you have questions about these issues, you are encouraged to gain more knowledge about

For new customers (normally valued at $199)

• Dirt, dust, and debris are the #1 cause of HVAC breakdowns.

• Deep clean + maintenance is the best protection for your furnace and investment.

• Our techs spend up to 2 hours cleaning every part, piece by piece.

Benefits of Annual Fall Maintenace

• A clean system means up to 30% energy savings

• No Breakdown Guarantee through the entire winter

• Elongates lifespan of system

• Peace of Mind

O ered by: Colorado Karate Club

Every so often, something happens in the dojo that reminds me exactly of why I chose this path. is week, I experienced one of those moments — a story nearly two decades in the making.

Back in October 2006, I awarded a young student his yellow belt. I still remember the look of pride on his face and the quiet confidence beginning to bloom in him. Like many kids who step through our doors, he was learning much more than punches and kicks — he was learning focus, discipline, and respect. He continued progressing in his training through the years and became not only a very skilled Karate-ka, but also a standup young man. en, life moved forward. Years passed, students grew up, and the dojo continued shaping new generations.

A week ago the phone rang, and a gentleman asked about having his four year old trying class. He continued and said: “Sensei I’m Abdiel”, I immediately recognized him, and asked him about his younger brother and sister who also trained with us back then. He was very surprised and said: “Yo DO remember me!” I said, “yes of course - It will be great to see you again”. A few days later, he walked back through our doors — now an adult, a foot taller than me, a father and a leader in his own family. His little one isn’t quite ready to start yet, but they’ll be back soon. What touched me deeply wasn’t just seeing a familiar face — it was seeing how the lessons from years ago had carried into his adult life. He remembered his time here with warmth and gratitude, speaking about how karate helped shape who he became. Hearing that, after 19 years, meant more to me than words can tell.

Moments like this remind me that what we teach on the mat extends far beyond the dojo walls. e techniques may fade, but the character endures. Confidence, humility, perseverance, and respect — these are the real black belts our students earn over time.

As instructors, we don’t always see the long-term results of what we pour into our students. But every now and then, life gives us a full-circle moment like this — proof that the seeds we plant truly take root.

I’m incredibly proud of the man he’s become and I am honored that he thought enough of his training here to return and share it with his child. It’s one of the greatest rewards of teaching — to see our students grow, succeed, and choose to pass on the same lessons that once shaped them.

Once a student, always family.

For many people, fall brings an impor- tant opportunity: open enrollment. While it may not sound as exciting as planning for the holidays, taking a careful look at your workplace benefits now could save you hundreds or even thousands of dollars next year.

Open enrollment is the period when you will choose your medical and other workplace benefits for the year ahead. Most employers hold it in the fall, with elections taking effect in January. Once the window closes, you usually can’t make changes unless you experience a major life event like marriage, divorce, the birth of a child or when a dependent has become an emancipated adult.

While it may be easy to simply renew last year’s choices, that could be a costly mistake. Your employer’s plans, providers or costs may have changed. It’s also possible your own circumstances are different than they were a year ago – for example, if you had a baby, got married or expect new medical needs. Taking a fresh look helps ensure your benefits match your life today.

Here are a few tips for navigating open enrollment:

Compare health plans carefully. Employers often offer more than one health, dental or vision option. Look at differences in provider networks, prescription coverage and premiums. If you and your spouse both have coverage options, compare plans across employers. Just be mindful that some companies charge a fee if you enroll a partner who has their own workplace coverage. Many plans offer wellness discounts on monthly premiums based on your personal health condition.

Check your life insurance. Many employers provide a base level of life insurance, with the option to buy more. If your family has grown or your financial responsibilities have increased, now is the time to make sure you have enough coverage to protect your loved ones.

Consider disability coverage. A short-term disability plan can help cover income gaps for up to 12 months during recovery from surgery, illness or childbirth. Long-term disability insurance offers protection if you’re unable to work again for an extended period up to age 65. Ideally, coverage should replace up to 60% of your pre-tax income.

Understand supplemental options. Some employers also offer accidental death and dismemberment (AD&D) insurance. While it can provide peace of mind, remember that it’s not a substitute for life or disability insurance, since it only covers specific accidents.

Take advantage of tax-friendly accounts. Flexible spending accounts (FSAs) and health savings accounts (HSAs) let you use pretax dollars for eligible medical expenses. If you have young children or other dependents, ask whether your employer offers a dependent care FSA to help off set care costs. Note that these are use-it-or-lose-it, so contribute only what you expect to spend every year. HSAs, available with high-deductible health plans, are more flexible, since unused funds roll over from year to year and can even serve as long-term savings.

Review your retirement savings. While your retirement plan usually isn’t part of open enrollment, this is a good time to revisit it. Make sure you’re contributing enough to earn your employer’s match. Small increases can make a big difference over time.

Open enrollment may not be the most thrilling item on your fall to-do list, but it could be one of the most important. Taking a little time now to review your employee group benefits could give you greater financial security and extra savings throughout the year.

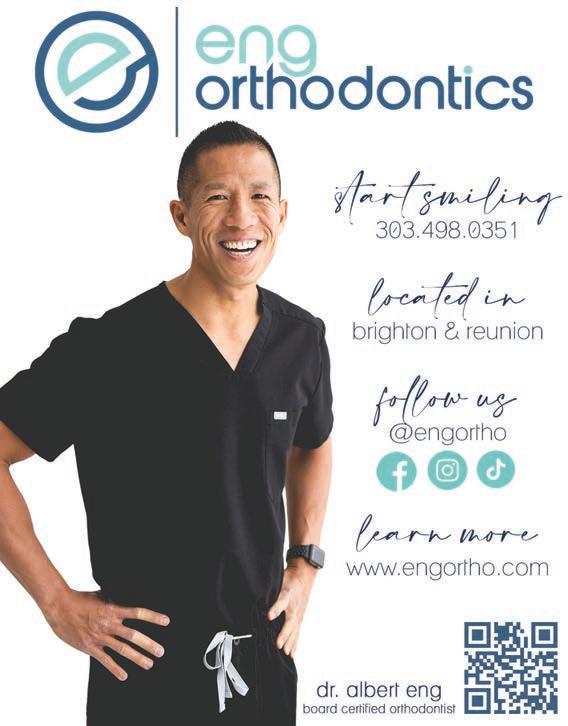

Saturday, Dec. 13th from 10am - 1pm at our office

with Santa!

We

be collecting Toys~For~Tots Donations from November 10th - December 12th

Feel free to bring a new unwrapped toy if you wish to contribute.

Many of our patients ask how they can enjoy the holidays without undoing their progress. e good news? With a few simple strategies and some modern tools, it’s entirely possible.

Here are my top tips for staying healthy this season:

1. Fill Your Plate Wisely

Start with lean proteins, vegetables, and whole grains. ese foods help you feel full and satisfied, making it easier to enjoy just a taste of those holiday favorites without going overboard.

2. Stick to Regular Meals

Skipping meals to “save up” for a big dinner often leads to overeating. Keep a consistent eating schedule with balanced meals and snacks throughout the day to maintain stable blood sugar and avoid cravings.

3. Practice Portion Awareness

Use a smaller plate and take your time eating. Savor the flavors with small bites. Pause before serving another portion and check in with your body – are you still hungry, or just eating out of habit?

4. Keep Moving

Whether it’s a short daily walk around the nei,ghborhood or joining a local fitness class, staying active supports digestion, energy levels, and overall wellbeing – even during the busiest time of year.

For some, healthy habits alone aren’t enough – and that’s okay. GLP-1 medications like Ozempic®, Wegovy®, Tirzepatide®, or Mounjaro® have been game-changers for many of our patients.

ese medications work by helping regulate appetite and improve, blood sugar control. People often find they feel full more quickly and have fewer cravings –both of which can make a big difference during holiday meals.

If you’re struggling with weight gain or managing conditions like type 2 diabetes, GLP-l therapy might be an option worth exploring. At Buffalini Primary Care, we’re here to help you decide what’s right for your individual health needs.

Offered by T. Lloyd Worth, Worth Wealth Management

Elder fraud, also known as elder financial exploitation, has been called the “crime of the 21st century” and deploying effective countermeasures have never been more important to protect our senior citizens.

The FBI’s Internet Complaint Center (IC3) creates an annual report outlining the internet threat landscape for US citizens and identifies common trends for the year. The 2023 IC3 report revealed that the losses by those over the age of 60 topped $3.4 billion, an almost 11% increase in reported losses from 2022. Last year, The FBI’s IC3 team received over 100,000 complaints from victims over 60, with victims losing an average of $34,000 because of scams. The FBI’s annual IC3 report highlights the increased risk that seniors face when managing their investments, as they are statistically the most targeted group for cybercriminals to exploit for financial gain.

Put simply, elder fraud is the illegal or improper use of an older person’s funds, property or assets. This most common form of elder abuse targets victims generally over the age of 60 and usually involves making false promises about financial benefits, commodities, or services that either do not exist, were never intended to be offered, or were misinterpreted. In 2023, the FBI’s IC3 recorded that investment scams against elders were responsible for over $1.2 billion in total financial losses. Seniors are typically targeted by cybercriminals for a multitude of reasons, some common reasons are listed below:

• Seniors have higher average net worth, usually have a regular source of income such as Social Security, and typically own assets such as properties, savings accounts, and retirement accounts

• Seniors are especially vulnerable due to isolation, declining mental and physical health, and may be more trusting than the average adult

• More susceptible to internet fraud due to technological barriers and literacy

• Seniors looking to retire may find themselves more open to alternative investments to safeguard their wealth

Elder Fraud Red Flags to Spot

Elder Fraud can take many forms, from scams targeting seniors directly to financial abuse by “trusted” individuals. Here are some key red flags to look out for to protect elders:

Unusual Financial Activity

• Look out for large, unexpected withdrawals or transfers from bank accounts

• Sudden changes in spending patterns, such as frequent purchases of gift cards or unusual online transactions

Isolation or Fear

• Increased isolation from family and friends

• Fear or anxiety when discussing financial matters

Unpaid Bills or Notices

• Unpaid bills or notices of overdue payments despite having sufficient funds

• Utilities or services being cut off unexpectedly

Strange Communication

• Frequent phone calls or emails from unknown individuals or organizations, especially those requesting personal information or money

• Pressure to make immediate decisions regarding finances, donations, or investments

Unfamiliar Businesses or Charities

• Donations to unfamiliar charities or causes that the elder has no history of supporting

• Payments to business or for services that the elder does not need or use How to avoid Elder Fraud?

Elder fraud can be perpetrated by a stranger and many times even someone close to the victim, such as a family member or caregiver. LPL Financial advisors frequently work with retirement age adults and/or may

be of retirement age themselves. To protect yourself against elder fraud, there are a few steps you can take to ensure that you are protected:

Simplify your finances

• Designate someone as power of attorney

• Limit access to financial accounts to only trusted individuals

Keep up to date on local scams and understand common scams

• Stay informed on the lates scams targeting seniors, such as lottery scams, investment scams, and phishing scams

• Educate seniors about the dangers of sharing personal information, especially over the phone, online, or with strangers Monitor and strengthen your financial and investment accounts

• Set up account alerts with banks and financial institutions to monitor suspicious activity

• Check credit reports annually to ensure no unauthorized accounts have been opened

Verify credentials before giving out confidential information

• Never wire money without verifying person or organization

• Do not provide any personal information unless the person is verified, and you were expecting the request

What to do if you are a victim of

If you or someone you know has fallen victim to elder fraud, immediately stop all communication with the scammer. If the scammer obtained any sensitive information such as your Social Security number, contact the credit bureaus as well as the Social Security Administration. If they have compromised any banking information, contact the financial institution as soon as possible so that they can assist with the situation.

If you would like to report a case of elder fraud to the FBI Internet Crime Complaint Center, please use this link: https://www.ic3.gov/Home/EF

More resources on common scams can be found on the FBI’s website linked here: https://www.fbi.gov/how-we-can-help-you/scams-and-safety/commonfrauds-and-scams

•

•

•

•

•

Last month I went into some details on what changes you can make during the Annual Election Period, October 15 - December 7. If you have any questions about what you can or cannot do, please give me a call.

As a reminder, having the assistance from an insurance agent is a complimentary service to you. I love this about my career! I get to help people and not present a bill after.

Why is using an agent so great? An agent who has been working with Medicare Insurance for a number of years has been through hours of ANNUAL Medicare Certification or Recertification training. As agents we learn about plan details from the area representatives and become familiar with the ins and outs of the plans and benefits.

When you have an agent who is a broker helping you (like me), you’re able to compare the different insurance companies and see what company might have a good fit for you. Brokers don’t have a specific interest in only one insurance carrier so we are unbiased.

If you happen to get a telesales call, you’ll end up speaking to a sales person, likely in another state, who will talk fast and only go over the perks of the plan. He/She may not cover your medication costs or whether or not your physicians are in the network. e person might also not realize you get a regular injection/infusion that is covered by your Medicare Supplement without a copay but if you switch to the Medicare Advantage Plan you’ll end up with a 20% coinsurance payment with each injection. ere are so many things to fully consider.

Please don’t hesitate to reach out to us or

whenever you have

We are always happy to help.

• Independent, Multi-line Dealer

• HSA and FSA Cards Accepted

• Comprehensive Hearing Evaluations and Screenings

• Tinnitus Evaluations & FDA Approved Tinnitus Solutions

• Hearing Aid Cleaning/Maintenance, Modification, Repair, and Service

• Ear Wax Removal, Hearing Protection, and other Ear Health Products • Insurance Accepted • Self Pay Discounts Offered • Financing Available

One of the most beautiful road trips in America is along the Pacific Coast Highway. A little over a hundred years ago the road was being developed and eventually interconnected a number of small existing roads stretching from the Pacific Northwest down to California. Some parts of the highway route began as simple game trails that became foot paths, and later dirt roads before being paved and incorporated into the highway system. Many roads around the world began the same way, starting out small as a single animal or person initially walked on them, followed by many people and animals marking a reliable path, and eventually becoming quite large roadways carrying thousands of cars a day.

Many different things follow a similar pattern. With hearing, the small neurological pathways in the brain that eventually allow a person to hear and understand speech begin developing before birth and are strengthened throughout life. e network is strengthened through repeated use. e more certain sounds are heard, the stronger the auditory pathways become. We can see this play out as musicians can have a significantly greater ability to identify specific sounds within a group of sounds compared to the average person. However, lack of use, as is the case with untreated hearing loss, leads to the decay of the pathway.

Learning and remembering also follow the pattern. Did you know if you hear something multiple times, it is easier to remember? Hearing things more than once, even if phrased differently, increases the likelihood of being able to recall what was said. Or as you may have read, or heard said before,

“Repetition is a law of learning.” is is one of the reasons the topics of these articles are presented multiple times in different ways. On the other hand, lack of use of skills or knowledge leads to forgetting part or all of what was once known.

Understanding this law has led scientists to develop numerous technologies to help improve the daily life of individuals. Artificial Intelligence, or AI, has opened opportunities for individuals who struggle to hear in noise to have a better chance of hearing and understanding. e hearing technology of today has been built on technology from the past, and now the technology of today is learning how to do an even better job now and in the future.

Last month the latest and most advanced technology for helping individuals hear was introduced to the public. is technology, known as Omega AI, is now available in multiple different styles, giving options to nearly everyone with hearing loss an opportunity for better hearing. According to a press release from the manufacturer “Omega AI introduces DNN 360, the world’s fi rst deep neural network–powered directionality and special awareness features. is advancement provides as much as 28% better speech intelligibility in challenging environments and up to an 8 dB signal-to-noise ratio improvement for better spatial awareness, all without sacrificing Starkey’s industryleading 51 hours of battery life or water resistance.”

As a hearing healthcare professional, I am grateful for the continued development, innovation and research manufacturers invest in to give me the best tools for helping individuals with hearing loss.

When it comes to lung cancer, any sign is worth checking out, no matter how small

Offered by: Intermountain Health

If you’ve got a cough, you might think it’s a common cold or COVID-19 infection. But if it lasts longer than eight weeks, it’s time to check your lungs.

In honor of Lung Cancer Awareness Month, let’s be aware. According to the American Lung Association, more than half of lung cancer patients die within a year of diagnosis. With such a deadly disease, early detection is key to survival.

“Many people mistakenly believe that lung cancer only affects smokers or that once diagnosed, there is little hope for survival,” said Dr. David Christianson, a medical oncologist with Intermountain Health Cancer Centers. “While smoking is a major risk factor, anyone can develop lung cancer. Treatments, including surgery, chemotherapy, radiation therapy, targeted therapy, and immunotherapy, are evolving, offering new hope even for advanced cases.”

It’s safe to assume no one is safe from lung cancer, but there are defined risk factors.

Cigarette smoking

Not surprisingly, smoking cigarettes is the number one risk factor. The CDC reports that 80-90 percent of lung cancer deaths are smokingrelated. Secondhand smoke inhalation also causes lung cancer.

Radon exposure

Radon is an odorless, clear gas that naturally occurs in some buildings. Long-term radon exposure is the second leading cause of lung cancer. Even people who have never used tobacco can die from radon exposure, which results in lung cancer.

Family history

Never underestimate the connection of family and personal history to your current health. If lung cancer has been in your past, it can be in your present. Especially with smoking or radon exposure, family history can put you at risk of lung cancer.

Environmental factors

You may have increased exposure to substances such as diesel exhaust, asbestos, and arsenal based on your daily environment. People living in areas with high air pollution are also at risk of lung cancer.

What are the warning signs of lung cancer?

When it comes to lung cancer, any sign is worth checking out, no matter how small.

Chronic cough

If you’ve got a chronic cough, don’t dismiss its significance. Many assume a recurring cough is a sign of getting older or COVID. But many lung cancer cases start with this symptom, which shouldn’t be ignored.

Long-term chest pain

Another symptom that can be mistaken for COVID is chest pain. If that COVID test is negative, and the chest pain lasts more than a month, it’s time to book an appointment.

Wheezing

You might brush off a noisy wheeze as age-related, but raspy breathing is serious. It means something is blocking your airway, which is worth looking at.

Shortness of breath

Many people experience shortness of breath after physical activity. But if this symptom extends past moments of exertion, it could be a bigger problem.

Coughing up blood

It should not take a health article to learn that coughing up blood is not good. If you see red droplets in your handkerchief, seek medical attention as soon as possible.

Chronic mucus production

Did you know that mucus is your body’s defense against irritants or infections? It could be lung cancer! If you are experiencing long-term phlegm production, determine what your body is defensive about.

Deciding to get checked out for lung cancer is a life-or-death decision. According to the American Lung Association, if you catch lung cancer while it’s still in the lungs, your five-year survival rate is 56 percent. But if cancer spreads, the five-year survival rate is only 5 percent.

“One of the greatest challenges with lung cancer is that it is often diagnosed at an advanced stage,” said Dr. Christianson. “Early-stage lung cancer is typically asymptomatic, meaning people may not experience noticeable symptoms or pain until the cancer has progressed. By then, treatment options may be more limited.”

Dr. Christianson encouraged patients to get regular lung cancer checkups, especially those with risk factors. “Lung cancer screening has been approved since 2015 for annual lung cancer surveillance in high-risk patients,” he said. “It is imperative that those at risk speak with their doctor about a low-dose CT screening.”

If you’re between the ages of 55 and 77 and currently smoke—or have quit within the past 15 years—you may benefit from a low-dose CT scan to screen for lung cancer. Early detection can make all the difference, and Platte Valley Hospital is here to support you every step of the way.

Our dedicated Lung Nurse Navigator is available to guide you through the screening process and help coordinate any necessary followup care.

To learn more or schedule a consultation, please call 303-498-2201.

Offered by:

Most people think of retirement plans as something you lock away until your 60s. But a Solo 401k isn’t just about the future—it’s a powerful tool for entrepreneurs, freelancers, and side hustlers to grow wealth and cut taxes today.

A Solo 401k allows business owners with no full-time employees to contribute as both “employee” and “employer.” For 2025, you can put in up to $23,000 as an employee contribution, plus up to 25% of business profits as the employer, with a combined cap of $69,000 (or $76,500 if you’re 50+). at’s far more than an IRA limit.

Here’s why it matters now:

1. Tax Savings Today. Contributions can be pre-tax, lowering your taxable income. at means more cash in your pocket every April. Or, if you choose the Roth Solo 401k option, your money grows tax-free.

2. Accelerated Wealth Building. With higher contribution limits, you’re sheltering and compounding more money each year. Even modest investments can snowball quickly when you’re putting away $30k, $40k, or more annually.

3. Flexibility for Business Owners. You can take a loan from your Solo 401k—up to $50,000 or 50% of your balance, whichever is less. at’s access to capital without a bank or credit card.

4. Planning Beyond Retirement. ese accounts also work as legacy tools. Solo 401ks can be passed on, creating generational wealth.

e bottom line: a Solo 401k isn’t just about distant retirement. It’s a versatile, tax-efficient vehicle for building net worth now. If you’re self-employed, ignoring this tool means leaving both money and opportunity on the table.

Every fall, it’s easy to focus on doctor visits and flu shots—but your Medicare plan deserves a checkup, too. Just like your annual physical helps you stay healthy, reviewing your coverage each year can protect your wallet and your peace of mind.

e Annual Enrollment Period (AEP) runs from October 15 through December 7, and it’s your once-a-year opportunity to make sure your plan still fits your life. Maybe your prescriptions changed, your doctor joined or left a network, or your plan’s costs or benefits have shifted. Even small updates can have a big impact in the year ahead.

At Headwaters Health & Wealth, our Medicare reviews are always free, with no obligation, just honest guidance from a local team that knows the plans, the carriers, and the changes coming for 2026. We’ll compare your current plan against other options to ensure you’re not missing out on benefits or paying more than necessary.

is is also the time of year when many drug plans adjust formularies or cost-sharing, so reviewing your prescriptions now can help prevent unpleasant surprises at the pharmacy come January.

ink of it as your coverage checkup – no co-pay, no waiting room, and no confusion. Just clear answers from people you can trust.

To schedule your free Medicare review, call Headwaters Health & Wealth or join one of our in-person or virtual Medicare education sessions. You’ll head into the new year confident your plan is working for you.

We do not offer every plan available in your area. Currently we represent 10 organizations which offer 106 products in your area.Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program(SHIP) to get information on all of your options.

DECEMBER 6, 1-5:30 PM

Founders Plaza

Downtown Brighton

Visit with Santa, face painting, Teddy Bear and Friends Tree.

Live music from...

4 - 5:30 p.m.

Tree lighting at

A Hometown Holiday Tradition

Sudoku is one of the most popular puzzle games of all time. As a logic puzzle, Sudoku is also an excellent brain game. If you play Sudoku daily, you will soon start to see improvements in your concentration and overall brain power. Start a game today and make it a part of your daily brain workout!

The goal of Sudoku is to fill in a 9×9 grid with digits so that each column, row, and 3×3 section contain the numbers between 1 to 9. At the beginning of the game, the 9×9 grid will have some of the squares filled in. Your job is to use logic to fill in the missing digits and complete the grid. Don’t forget, a move is incorrect if:

• Any row contains more than one of the same number from 1 to 9

• Any 3×3 grid contains more than one of the same number from 1 to 9

• Any column contains more than one of the same number from 1 to 9

The purpose of the Advisory Board is to advise and assist in the needs and operations of SCAAC. The Board meets Tues. Nov 18 and Dec 16 at 1:00 p.m. Members are: Dave Thomas, Peggy Jarrett, Lou Ellen Bromley, Dan Buckner, Karen Swaithes, Steve Yarish, Bill Alsdorf, Heidi Storz, Gayle Shibao, Barbara Spakoski, Janet Olivieri, and Randy Thornton. Visitors are welcome.

Together we can continue to enhance the great programs and services offered for seniors and active adults in the Brighton area. Your financial support will be recognized on the donor wall at Eagle View. All donations are tax deductible. Make donations payable to: Brighton United Senior Citizens, 1150 Prairie Center Parkway, Brighton, CO 80601.

Donor Opportunities for Wall Recognition: Friend: $100 - $499 Memorial: $100+

Sponsor: $500 - $999

Benefactor: $1000+

Do you need help and are unsure where to turn? Evon Benitez will assist you with completing forms and finding needed services. You’ll need to make an appointment to see Evon as she’s often meeting with others. To make an appointment, call Evon at 303-6552079. Leave a message.

The History Leading to the 14th Amendment

SCAAC & Zoom

The Fourteenth Amendment defines citizenship, prevents states from abridging the privileges or immunities of citizens, and ensures no state can deprive any person of life, liberty, or property without due process, or deny them equal protection of the laws.

Presenter: Paul Flanders.

Mon. Nov 10 -1:30 p.m.

$4.00

Deadline: Thurs. Nov 6

Kindness Counts

This group is about fun, easy ideas for spreading a little kindness throughout the community. Each month we pick a project. Call Ashleigh at 303-655-2076 for information.

Wed. Nov 12 - 11:00 a.m.

1150 Prairie Center Parkway, Brighton, CO 80601 303-655-2075 I evacinfo@brightonco.gov www.brightonco.gov

Hours: Monday - Friday 8:00 a.m. - 4:00 p.m.

A hot, nutritious lunch is provided by Volunteers of America, Mondays and Thursdays at 11:30 a.m. Please reserve your meal in advance. For Mondays, reserve the Thursday before; for Thursdays, reserve the Monday before. Call Eleanor at 303-655-2271 between 10:00 a.m. - 2:00 p.m. Mon. & Thurs. to make a reservation.

Daily meal donations are appreciated.

$2.50 Donation per meal if age 60+

$8.50 Mandatory charge if under 60

Basic medical equipment is available to loan out. Items may include wheelchairs, front wheel and seated walkers, canes, crutches, toilet seat risers, commodes, and bath benches. There is no guarantee what will be available at any time. Call 303-655-2075 for information.

The Clinic focuses on health promotion and disease prevention for seniors 55+. Operated by Visiting Nurses Association (VNA), services include foot care, health checks, and blood pressure checks. The fee for foot care is $40 payable at the time of your appointment. Foot care may be Kaiser covered with pre-approval. Reduced fee available upon approval. Masks required for everyone. Call 303-655-2075 for appointment. Clinic hours: 9:00 a.m. - 2:30 p.m.

Fridays: Nov 7, 14, 21, Dec 5, 12, 19 Monday: Nov 10, 24, Dec 8, 22

Duplicate Bridge

In Duplicate Bridge, teams of two compete using set hands to earn points by outplaying others. Play with the same partner for a two-month challenge - highest scores earn recognition! Facilitator: Bobbi Jo Unruh.

Wed. Nov 12 & 19 - 11:30 a.m. - 3:30 p.m.

$10 (2 wks)

Deadline: Mon. Nov 10

Book Club

Books are chosen at the previous meeting. Missed it? Call the front desk for the title. Please read the book before the meeting - available at libraries, bookstores, or online. Facilitated by Gayle Wudarczyk.

Wed. Nov 12 - 1:00 p.m.

Free

Deadline: Mon. Nov 10

Bunco

Bunco is an easy and fun game of dice. Enjoy an afternoon of fun, laughter, and prizes.

Thurs. Nov 13 - 1:15 p.m.

$4.00

Deadline: Wed. Nov 12

Need help with your laptop, tablet, or smartphone? We will do our best to help you become more comfortable using your device. Schedule an appointment with Calvin at 303-655-2187.

Feel great with a massage by our certified therapist, Laurie Lozano Maier. She has over 12 years of massage therapy experience. Call 303-655-2075 to make a onehour appointment. Pay Laurie at the time of service - check or cash.

Tuesdays and Wednesdays $60 for 1 hour

Deadline: Two days ahead

Via Mobility - provides specialized transportation within the City of Brighton. Via can take you to medical appointments, grocery shopping, and Eagle View, to name just a few of the places you can go in Brighton. New Via users - call 303-447-2848 ext. 1014 to get started. To schedule rides, call 303-447-9636. Free rides to and from Eagle View to seniors living in the Brighton Via service area are provided by funding from the Senior Advisory Board.

This is an RTD service. Call 303-299-6000 for reservations. The driver will pick up and deliver you anywhere within Brighton, Mon - Fri. 6:00 a.m.7:00 p.m. Cost is the local RTD bus fare.

Join Spencer Madsen from Gardens Care as he gives an overview on Medicaid. Learn how it works, how you can qualify, and how it may benefit you. He will also discuss financial qualifications, different programs available, and the difference between Medicaid and Medicare.

Thurs. Nov 13 - 1:30 p.m.

Free

Deadline: Mon. Nov 10

If you’re 62+ and own a home, you may qualify for a Reverse Mortgage to pay off your mortgage, gain extra retirement income, or buy your dream home. Learn about your options. Instructor: Jackie Hahn. Thurs. Nov 13 - 2:00 - 3:00 p.m.

Free

Deadline: Mon. Nov 10

The firefighters from the Brighton Fire Department will perform FREE blood pressure checks for one hour. S top by!

Fri. Nov 14 @ 10:30 a.m.

Wed. Nov 19 @ 10:30 a.m.

Please visit www.brightonco.gov for a complete listing of all offerings.

Friday Feast

Join the Micrograss Trio for some foot-stomping fun! They play a blend of Americana and bluegrass with a dash of Cajun flavor. We’re serving chili dogs, chips, salad, and cookies. Veterans will receive special recognition.

Fri. Nov 14 - 12:00 noon

$6.00

Deadline: Wed. Nov 12

Aging with Grace

“Welcome to society’s museum of senior citizens … or … take a tour of the newly-opened association of the elderly where wisdom, insight, and discernment can be found.”

Join presenter Daryl Meyers - international speaker, writer, musician, and retired chaplain - for this uplifting program that celebrates the wisdom, insight, and vitality of growing older.

Mon. Nov 17 - 1:30 p.m.

Free

Deadline: Thurs. Nov 13

Medicare Counseling

Receive one-on-one assistance on Medicare issues from Rosemary Evans. She is specially trained on Medicare insurance programs, including Medicare Part D. Call Nina at 303-655-2079 to make an appointment. For general Medicare questions you can also call Benefits in Action at 720-221-8354. Counseling by appointment only.

Tues. Nov 18 -10:00 a.m. - 12:15 p.m.

Deadline: Thurs. Nov 13

Billiards

We have two tables that are first-come, first-serve during business hours. 25¢ per day

Bingo In-Person

Join us in the dining room every Thursday with Barbara as our caller. One card per player. Win gift cards! Free to play.

Thursdays - 12:15 p.m.

Ladies Billiards

This is “women only” time to enjoy the pool tables. Mondays - 1:00 - 4:00 p.m. 25¢ per day

Knit & Crochet Drop-in

Drop in to knit or crochet with others. No instructor.

Wednesdays - 10:00 - 11:30 a.m.

Peer Room

25¢ per day

Mexican Train Dominos

This is an easy game to learn - it’s regular dominos with a fun twist.

Wednesdays - 12:30 - 3:30 p.m.

This month will focus on the ancient sport of falconry! UNESCO recognizes it as an Intangible Cultural Heritage, and Nov 16th is World Falconry Day. Join us to learn about its origins, meet our master falconer Anne Price, and see her newest surprise falcon up close.

Tues. Nov 18 - 1:00 p.m.

$5.00

Deadline: Fri. Nov 14

SCAAC & Zoom

Formed after World War II to unite Western Europe through trade, the European Union has since expanded and faced challenges such as the inclusion of Eastern Nations and Brexit. Join Active Minds to explore the EU’s origins and the issues shaping its future.

Wed. Nov 19 - 1:30 p.m.

$5.00

Deadline: Tues. Nov 18

Turkey Bingo

Play bingo to win a turkey, ham, or gift cards. Thanks to Mike D’Epagnier of Mutual Asset Corporation for his financial sponsorship of this event for the past 25 years! You do not need to be at the VOA meal to participate.

Thurs. Nov 20 - 12:15 - 1:00 p.m.

Free

Let Them Eat Cake

We’re opening up our retro recipe box and discovering uniquely American cakes with simple vintage charm, and the lovely flavors of yesteryear. Our taste buds will dance

Toys for God’s Kids

Make and/or assemble wooden cars to distribute to kids around the world through “Toys for God’s Kids.” Call Dave at 303-503-4926 for details.

Tuesdays - 8:15 - 10:15 a.m. 25¢ per day

Wood Carving Drop-in

Learn to carve wood or work on an existing project. Call Norm at 978-568-1191 to arrange free instruction.

Tuesdays - 8:15 - 10:15 a.m. 25¢ per day

Free Wi-Fi

Free Wi-Fi is available throughout EVAC. Inquire at front desk.

Cards, Cards, Cards!

New players welcome. Call the listed volunteer.

Hand and Foot

Mondays & Fridays - 12:30 - 3:30 p.m. Room: Falcon

Pinochle Pals

Tuesdays - 12:30 - 3:30 p.m.

Room: Falcon

nostalgically through time as we journey from forgotten recipes of Colonial America, all the way through the 20th Century (with a dash of modern-day methods thrown in for good measure). Grab a fork and let’s dig into both the cake - and the history behind it! Instructor: Toni Miller.

Fri. Nov 21 - 10:30 - 11:30 a.m.

$21

Deadline: Mon. Nov 17

A Salute to America’s Veterans

At the eleventh hour on the eleventh day of the eleventh month – we will remember them.” Today we’ll learn the story behind those words and honor America’s veterans from yesterday, today, and into our future. Presenter: Travels with Toni.

Fri. Nov 21 - 1:30 p.m.

$5.00

Deadline: Wed. Nov 19

Roosevelt in the Wild: Hunting, Politics, and the Making of a President SCAAC & Zoom

Discover how Theodore Roosevelt’s legendary hunts - his 1901 cougar hunt in Colorado and 1902 bear hunt in Mississippi - shaped his presidency, politics, and public image. This live virtual presentation features Dr. Charles Westmoreland, Professor of History at Delta State University.

Mon. Nov 24 -1:30 p.m.

$5.00

Deadline: Fri. Nov 21

Lending Library

Borrow books from the library for free and keep them as long as you need. Do NOT re-shelve books - our volunteer librarians do that for us. We accept donations of large print and paperback books only. We are especially needing more large print books.

Computers Available

Computers with free internet are available when Falcon Room is unoccupied. Ask the front desk for assistance. A cleaned and sanitized keyboard will be checked out for you to use.

Cribbage

Wednesdays - 12:30 - 3:30 p.m.

Room: Peer

Shirley: 720-685-3369

Tournament: $4.00

Wed. Oct 29

Bridge Fridays - 12:30 - 3:30 p.m.

Room: Talbot

Judy: 303-378-5226 - Please call if new

6

If you want to celebrate the holidays by pausing your home search until next year, you may be missing an excellent time to buy a home. Homes on the market during the holidays have typically been for sale for a while. ey could be overpriced or in less than move-in condition. e owners could be recent heirs, landlords, work transferees, divorcees, widowers, etc. What these homes have in common are highly motivated sellers.

As other homebuyers sideline themselves, you’ll also have an easier time shopping for homes and service providers like home inspectors, mortgage lenders, contractors, movers, and others. And you can save money – homes typically sell for more in the spring and summer than in the winter.

Lastly, closing your home purchase before January 1st gives you an extra year of tax deductions and benefits. If you close after that date, you must wait until the following year to claim benefits.

Different seasons offer different advantages, but the holidays can be uniquely beneficial.

Buying during the holidays could be the gift that keeps on giving. With fewer buyers in the market and motivated sellers eager to make a deal, you might find opportunities others overlook. A Forever Agent SM can help you navigate the season strategically and make your move with confidence. Call today at 303-905-8850 or visit BHHScoloradorealestate.com to find a trusted agent at Berkshire Hathaway HomeServices Colorado Real Estate.