Dawa Sherpa Publisher

Now that the holiday rush is upon us, it’s easy to default to big-box stores and online giants. But choosing to shop local will help strengthen our communities in lasting ways.

Whether it’s a unique, handcrafted item from a neighborhood artisan, a batch of cookies from the bakery down the street, or a carefully curated gift from one of the many downtown Brighton boutiques, locally sourced presents carry a personal touch that mass-produced items can’t match. Spread the holiday cheer to our local community by supporting our small businesses. Not only will you find unique treasures, but you’ll also contribute to the livelihood of our local communities.

And there’s the convenience factor. Local stores can offer personal and more knowledgeable service, shorter lines, and unique items you won’t find elsewhere. Many also offer gift-wrapping, special events, and holiday promotions that make the experience festive and stress-free.

This season, consider shifting even a portion of your gift budget to our hometown businesses. Don’t forget to check out the Downtown Business Directory on pages 20-22!

A few small choices can add up to a big difference— supporting the people who make our community feel like home. Who knows, you may find the perfect present as well as make a new friend along the way.

Clothes, jewelry, toys, gift cards and candy are staples when it comes to arranging for a holiday gift for your spouse or family members. What about considering alleviating something that you or your family may have been possibly worrying about for years? Gifts are gone and forgotten very quickly (especially chocolates!). How about doing something that can end worry, and provide wonderful loving protections for your family into the future?

Putting an effective estate plan in place can be just such a loving gift. It’s something people tend to procrastinate around and worry about in the back of their minds. You’re not going to die or become disabled today…Right?

It would be a wonderful gesture to begin the process of putting an estate plan in place as a gift for the holidays. ink about the problems and issues it can alleviate at the time of your death, and more importantly if you become disabled before you die. Surprise them with a gift they will be deeply grateful for. An unselfish act of love that will be much more beneficial to your loved ones than clothes, gift cards, or chocolates; allowing them to be confident that things are in order in the future, and that they will not face a huge mess upon your disability or death. is is a great way to show your love and care for them.

If you are not sure how to get started with the process, we encourage you to get some education around the subject. If you would like to learn more about available estate planning options, visit: www.EstatePlans atWork. com to sign up for a complimentary small group educational workshop. We at Dolan & Associates, P.C. wish everyone a Merry Christmas, a

For new customers (normally valued at $199)

• Dirt, dust, and debris are the #1 cause of HVAC breakdowns.

• Deep clean + maintenance is the best protection for your furnace and investment.

• Our techs spend up to 2 hours cleaning every part, piece by piece.

Benefits of Annual Fall Maintenace

• A clean system means up to 30% energy savings

• No Breakdown Guarantee through the entire winter

• Elongates lifespan of system

• Peace of Mind

O ered by: Colorado Karate Club

It is one of my favorite times of the day, my first Karate class is starting to walk into the school, the Pre-Karate Class, our three, four, and five year olds are taking their places on the mat. Before class starts, I come in a few minutes early to talk to the students and learn about their day. ey are always very excited to tell me all about it.

Today, the first one to raise his hand was Mark, a lively five year old with sparkling eyes. He excitedly calls out to me: “Sensei, Sensei…”, I turn my attention to him and say, “yes Mark?” He goes on and relates to me the latest game he has been playing on his grandma’s phone, some alien shooting game. He is talking so fast that I have trouble keeping up. Mark’s eyes shine with excitement as he relates how he shot the aliens and how he maneuvered around them.

As I listened to him, I found myself sharing his joy just from his sheer enthusiasm. For some reason that stuck with me, and that evening, after classes, I thought about how happy he was to be heard, and how happy I was to listen. I also thought about all my daily interactions, and how I feel when someone listens to me intently… or conversely, how I feel when someone doesn’t.

For a child, and actually for adults as well, being listened to builds up their confidence and self esteem, it tells them that what they have to say matters to us, that we value them, and that they are important to us. However, contrary to what most of us believe, listening is not quite that easy, it takes work and practice. So I wanted to share with you a few tips to help us all listen better. I hope you will give them a try.

1. Refrain from giving advice - most people are not asking for advice, they just want to be heard. Giving advice implies judgment, and we all hate to be judged.

2. Stop thinking about what you are going to say next - We all have done that, the person is still talking and we are already thinking about our reply. Stop yourself right there, and simply immerse yourself into what the other person is trying to tell you.

3. Avoid the “Me too” response - Keep the focus on the other person. We always want the world and the conversations to revolve around “me”, but stop yourself from inserting “me” into the conversation. It is about them, so keep it that way.

4. Be sincerely interested in the other person - try to truly understand what they are thinking and feeling as they speak. Dare to care.

Making the effort and taking the time to listen is one of the best gifts we can share with those around us. When someone talks to you, they are telling you that you are important enough to them to share their experiences with you. So take the time today and give someone the gift of your undivided attention. You will both benefit from it.

Willy Strohmeier

Roberts - Edward Jones

Giving to charity feels good, but understanding the tax benefits can benefit both the charity and you. Whether you donate regularly or are planning your first gift, knowing how charitable tax deductions work can help you make informed deci- sions while supporting causes you care about. Here are things to consider:

e basics: Itemizing vs. standard deduction. To benefit from charitable tax deductions, you need to itemize your de- ductions on your tax return. Everyone automatically receives a standard deduc- tion, which in 2025 is $31,500 for married couples fi ling jointly or $15,750 for single fi lers. You’ll only benefit from itemizing if your total deductions, including charitable gifts, exceed these amounts.

For many people, charitable donations alone won’t push them over the standard deduction threshold. However, when com- bined with other deductible expenses like mortgage interest or state and local taxes, itemizing can make financial sense.

If you give regularly but don’t usually exceed the standard deduction, consider “stacking” your donations. Instead of do- nating $5,000 annually, you might donate $15,750 in one year to exceed the itemization threshold, then take the standard deduction in subsequent years.

Ensure your donation qualifies. To claim a deduction, you must give to a qualified charitable organization recog- nized by the IRS. You can verify an organ- ization’s status on the IRS website or ask the charity for their determination letter. Donations to individuals, even those in need, don’t qualify for tax deductions.

Additionally, you can’t receive per- sonal benefits in exchange for your dona- tion. If you give $500 to a charity but receive concert tickets worth $200, your deductible amount is only $300.

How much can you deduct? e IRS limits charitable deductions based on your adjusted gross income (AGI). For cash donations to public charities, you can typically deduct up to 60% of your AGI. If you donate stocks or other appreciated assets you’ve held for more than a year, the limit is generally 30% of your AGI.

If your donation exceeds these limits in a single year, you can carry forward the unused portion for up to five years.

What to donate. ink strategically about what you donate. While cash is easiest, donating appreciated stocks can provide additional tax benefits since you avoid paying capital gains taxes on the investment’s growth.

Keep good records. Documentation matters. For donations under $250, a can- celed check or receipt works fine. Cash donations of $250 or more need written acknowledgment from the charity. For larger non-cash donations of property ex- ceeding $5,000 in value, the IRS requires a qualified written appraisal. Keep these records with your tax documents in case the IRS requests proof. See IRS Publication No. 526 and No. 561 for information on charitable contributions and valuing do- nated property.

e bottom line: Charitable giving may start with your heart, but understand- ing the tax implications helps you give more effectively. Work with a tax profes- sional and a financial advisor to develop a giving strategy that aligns with both your charitable goals and financial situation. With thoughtful planning, you can maximize both your impact on causes you care about and the tax benefits you receive.

your

7 AM Somewhere

119 N. Main St.

720-967-87044

Anthony’s Pizza

119 W. Bridge St.

303-659-0804

Bubba Chinos

201 S. Main St.

303-654-0360

Berry Blendz

275D Pavilions Way

303-862-7554

Carniceria Premium

227 N. Main St. 303-246-0660

Chile con Quesadilla

227 N. Main

303-995-3757

Coldstone Creamery

245 Pavilions Place

720-685-0364

Dutch Bros. Coffee

120 W. Bridge St. 877-899-2767

El Camaron Loco

218 N. Main St.

303-659-1239

Fish Tail Cuisine of India & Nepal

305 Pavilions Place 720-458-6644

Kikos Authentic

Mexican Food

290 N. Main St. 303-659-0262

La Estrellita 45 N. Main St. 303-654-9900

La Sierra

361 N. Main 303-659-4359

Lupita’s Mexican Restaurant

75 West Bridge 720-639-9651

Main St. Cafe

161 N. Main St. 303-558-0874

Main St. Grill 165 N. Main St. 303-835-2604

Papa John’s Pizza

126B W. Bridge St. 303-659-9000

Pho 81

275F Pavilions Way

303-835-2479

Qdoba

Mexican Eats

275 A Pavilions Way 303-637-0028

Santiago’s

128 W. Bridge St. 303-654-1447

South Philly Cheese Steaks

220 Pavilions Place 303-558-0905

Starbucks 59 Bush St. 303-659-1167

Sunrise Sushi

245 Pavilions Place 303-498-0934

Tacos Chihuas 248 N. Main St. 303-637-0933

Tacos Orientales Chihuahua 105 E. Bridge St. 720-512-5307

Willow and Fern

315 S. 4 th Ave. 303-386-3377

Wolf and Honey Coffee + Cocktails

43 N. Main St. 720-869-8240

GREAT LIBATIONS:

Big Choice Brewing 21 S. 1st Ave. 303-498-0150

Copper Rail Bar & Grill

174 S. Main St. 303-655-9933

Flood Stage Ale Works 170 S, Main St. 303-654-7972

Jerry’s Bar & Grill 130 N. Main St. 303-659-3788

Jordinelli’s Sports Bar & Grill

25 N. Main St. 303-659-1055

Something Brewery 117 N. Main St. 720-939-3883

RETAIL THERAPY:

Blown Glass Gifts 16 N. Main St. 303-262-1352

Brighton Bulldog Tires 125 W. Bridge St. Unit A 303-659-0868

Doobie’s Smoke Shop 8 Great Western Rd. 303-654-0627

Floreria Fantasia 2 236 E. Bridge St. 720-322-3968

Game Trader 2 S. Main St. 303-637-7503

Kismet Starrz 29 N. Main St. Suite 101 303-659-4428

La Bodeguita 60 Bush St. 720-634-4181

Main St. Creatives Gallery 36 S. Main St. 303-655-2176

Mile High Hydroponics 37 Strong St. 303-637-0069

My Local Boutique 5 N. Main 303-916-1247

(continued)

Odd Alley-Kat Emporium & Frame Shop

240 S. Main St.

720-967-8144

On Pins & Needles

39 N. Main St.

720-667-4086

Pine Grove Mecantile and Coffee Bar 17 N. Main 720-5972196

Paisano Liquors

126A W. Bridge St. 720-685-0306

Prestige Design

117 N. Main St.

720-933-2590

Shades of Divine

155 E. Bridge St. 303-952-9138

Tortilleria Chihuahua 118 Strong St.

303-655-0573

Truckwerks

300 Bridge St. 303-955-6443

Wireless Solution

290 N. Main St. 720-372-8540

Wolf and Honey

Coffee Bar and Boutique 43 N. Main St 720-869-8240

Yami’s Boutique 116 Strong St.

Whispering Willow 29 N. Main St.

ENTERTAINMENT:

AMC Brighton 12

250 Pavilions Place

303-655-1591

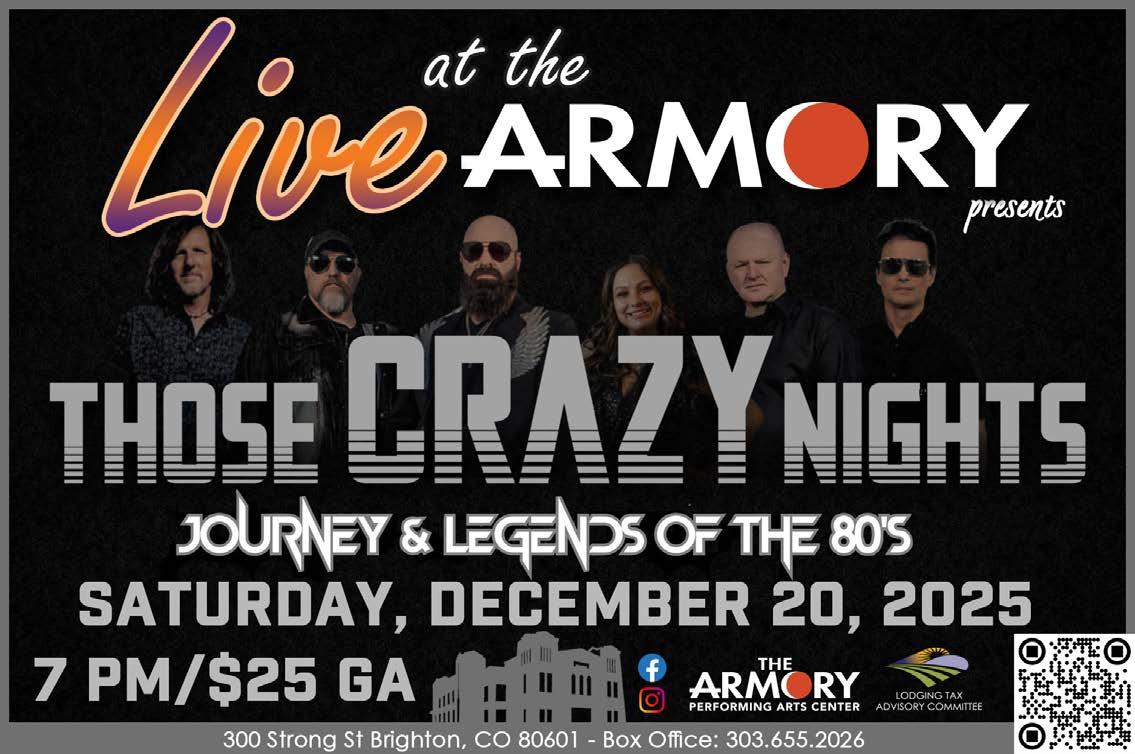

Armory Performing Arts Center

300 Strong St. 303-655-2026

Fiesta Time Rentals

234 N. 4 th Ave. 303-659-0419

Lizzie’s Axe Throwing

343 S. Main St. 303-954-9838

PERSONAL SERVICES:

A Nu Do Salon

119 W. Bridge St. 303-835-2375

Alchemy Art Collective

35 Strong St. 720-485-3435

Art of Hair Salon

10 N. Main St. 303-655-7385

Autowash @ Platteview

124 W. Bridge St. 303-927-9061

Beauty Zone

148 N. Main St. 303-654-2600

Bellisima Beauty Spa

238 E. Bridge St.

Bob’s Barber Shop

169 E. Bridge St. 303-659-3389

Branch Out Studios 21 S. 3 rd Ave. 720-634-6793

Fina’s Salon

124 N. Main St. 303-659-1617

Flower of Life Photography

119 E. Bridge St. 720-883-5691

Home of the Fade

204 S. Main St. 562-417-2776

Imagen Salon

301 N. Main St. 303-637-7108

Jay Jay Barber Shop

274 E. Bridge St. 303-862-6081

Lashit Loft

12.5 N. Main St. 720-280-9084

Legendary Barber

Studio

49 S. 3rd Ave. 720-408-8172

New You Brighton 3 N. Main 720-388-0019

Nomad Tattoo

238 E. Bridge St. 720-295-9563

Pretty Nail Spa

245B Pavilions Way 303-659-0863

Prophecy Barbershop

113 E. Bridge St. 720-926-3259

Saba Beauty

29 N. Main St. Ste. 106 720-421-1335

Salon de Belleza Perla

290 N. Main St. 720-685-7888

Salon Rene De Belleza 176 E. Bridge St. 303-654-0430

Silk Medical Aesthetics and Spa 117B N. Main St. 720-287-2067

Style Zone

18 N. Main St. C 303-659-3355

Stylish Nails 122 N. Main St. 303-637-0772

The Mane Image Salon & Spa 208 S. Main St. 303-659-9292

The Pink Door Boutiques & Nail Salon 25 S. Cabbage Ave. 303-498-0489

The Wax Shoppe 119 E. Bridge St Ste. 240 303-332-1508

Working Class Ink 27 S. 4 th Ave. 303-498-0066

PROFESSIONAL SERVICES:

1st Choice Driving Academy 220 Pavilions Pl. Unit E 303-654-8277

Aguirre’s Professional Services 29 N. Main St. #102 303-655-7635

Allstate Rippy Agency 220 Pavilions Place 303-219-1470

American Family Insurance - James Hood 70 N. 4th Ave. 303-659-0190

Army Career Center 220 Pavilions Pl. Unit B 303-637-0277

ATLAS CPAs & Advisors 21 North 1st Ave. Ste. 200 303-659-3951

Ayuda Financial Group 112 N. Main St.

Axiom Realty

321 Walnut St.

303-385-3550

Berkshire Hathaway Home Services

245D Pavilions Way

303-289-7009

Colorado Prestige Insurance

55 S. 4th Ave.

303-659-4744

H&R Block

66 S. Main St.

303-731-1021

Hope First Family Resource Center

390 Walnut St. Suite 130 720-654-6075

JnR Insurance Agency

21 N. 1st, Suite #140

720-773-5574

Key Team Real Estate

25 S. 3 rd Ave.

NY Life

123 S. Main St.

303-655-1234

Only Tax & Business

59 S. Cabbage Ave.

720-706-4343

Poodles and Doodles

Pet Grooming

210 S. Main St.

720-275-6867

Premier Group Insurance

124 N. Main St. B 720-685-8602

Primerica Financial Services

29 N. Main St. 720-841-4735

Provident Residential Mortgage, LLC

119 E. Bridge St. 303-654-7956

Strong’s Agency Inc.

51 S. 1st Ave. 303-659-3762

BUSINESS SERVICES:

Allo Fiber

139 N. Main St. 720-967-8050

Brice Steele Law Offices

25 S. 4th Ave. 303-659-3171

Brighton Chamber of Commerce

269 E. Bridge St. 303-659-0223

Cox Ranch Originals 117 E. Bridge St. 303-875-2881

Elwood Staffing 275C Pavilions Way 303-857-2358

Synergetic Staffing, LLC 109 E. Bridge St. 303-647-9496

Tiara PrintingMinuteman Press

260 N. Main St. 303-654-1700

U.S. Post Office 90 N. 4th Ave. 800-275-8777

Wilkinson Graphics Inc.

200 S. Main St. 303-659-1397

HEALTH & WELLNESS:

Anytime Fitness

225 Pavilions Way 720-609-9200

Lionheart Jiu Jitsu

284 N. Main St. 720-734-8900

Revive Beauty & Threading

119 E. Bridge St. #230 720-341-4226

Right Fit Nutrition 119 W. Bridge St. Unit W-A 720-275-9588

Surge Spin

300 E. Bridge St. 720-603-1047

Vibrant Jiu Jitsu

244 E. Bridge St. 720-561-0867

Unwind Massage Therapy & Spa 330 Walnut St. 303-835-8829

EVENT CENTERS:

Alli Event Center 100 S. 3rd Ave., 303-659-7775

Bella Sera Event Center 45 Strong St. 720-937-6337

Gather Brighton

301 S. Main St. 720-507-6881

HOME IMPROVEMENTS:

Dream Custom Carpentry

501 S. Main St. 303-993-2180

ERS Concrete

323 Walnut St. 303-659-4263

K&G Solutions

119 E. Bridge St. Ste 220 720-883-1267

Lobato Construction

123 N. Main St. 720-708-6534

Morris Flooring

250 N. Main St. 303-2557169

TRAVEL & LEISURE:

Around the Park RV Rentals

327 Walnut St. 720-432-9698

KIDS DANCE LESSONS:

Dancer’s Edge

24 N. Main St. 720-236-7644

As 2025 ends, small business owners and individuals alike should turn their attention to the upcoming tax year. Preparing early for 2026 means staying informed about new tax regulations, reviewing your financial position, and setting clear goals to strengthen your financial future.

Stay Ahead of Tax Changes

e IRS continues to refine tax brackets, standard deductions, and retirement contribution limits each year to reflect inflation and evolving legislation. For 2026, taxpayers may see adjustments related to the expiration of certain provisions from the Tax Cuts and Jobs Act (TCJA). Key areas to monitor include changes to individual income tax rates, the Qualified Business Income (QBI) deduction, and potential revisions to itemized deductions. Staying in touch with your tax professional ensures you take advantage of every credit and deduction available.

Review and Organize Financial Records

Now is the perfect time to review your bookkeeping, reconcile accounts, and ensure all documentation is accurate. A clean set of financial records not only simplifies tax fi ling but also provides a clear picture of cash flow and profitability— key indicators for making informed decisions in 2026.

Set Financial Resolutions

Use this opportunity to establish achievable financial goals. Whether it’s increasing savings, reducing debt, or investing in growth opportunities, aligning your personal and business finances with a well-structured budget is essential. Consider automating savings, reviewing insurance coverage, and planning for future tax liabilities to avoid surprises.

Partner with Professionals

Navigating tax updates and financial planning can be complex—but you don’t have to do it alone. e experts at Pricewise Business Solutions are here to help you stay compliant, optimize deductions, and develop strategies for growth. Call us today at 720.949.7733 to schedule a consultation and start preparing for a successful 2026 with confidence.

As the year winds down, the timing is perfect for two quick Medicare checkups—one to make sure you get everything you’ve earned in 2025, and one to help you step confidently into 2026.

First, don’t let valuable benefits slip away. Many Medicare Advantage plans include “use-it-or-lose-it” perks like over-the-counter allowances, dental or vision credits, or wellness rewards that disappear December 31. A few minutes now could save you real money.

For most Part D and Medicare Advantage changes the deadline is December 7!

If your Medicare Advantage plan is ending for 2025, be sure to choose a new plan by December 31 so you’re fully covered January 1. You may enroll up until December 31, if your plan is cancelled and you were sent a letter. Looking ahead to 2026, remember that certain costs reset annually. e Part B deductible will be $283. Knowing this ahead of time helps prevent those “Why am I getting a bill?” surprises in January. e standard monthly premium for Part B will be $202.90, deducted from social security monthly, if you are receiving payments.

Drug plans (Part D) may allow a one-time bridge fi ll if your new card or approvals aren’t active yet. Many plans also use the full $615 deductible at the start of the year, so if costs feel steep, you can use the Prescription Payment Plan to spread them out.

A little preparation today goes a long way. And if you’re on a Medicare Advantage plan and discover it’s not the right fit, remember—you can make a change between January and March if needed.

Our Headwaters team is right here in the community, ready to help you finish the year strong and step into 2026 with confidence and clarity.

• Insurance Accepted

• Self Pay Discounts Offered

• Financing Available

• Independent, Multi-line Dealer

• HSA and FSA Cards Accepted We

• Comprehensive Hearing Evaluations and Screenings

• Tinnitus Evaluations & FDA Approved Tinnitus Solutions

• Hearing Aid Cleaning/Maintenance, Modification, Repair, and Service

• Ear Wax Removal, Hearing Protection, and other Ear Health Products

TheHoliday season provides numerous opportunities for families, friends and loved ones to socialize. However, countless individuals with hearing loss needlessly miss out on the joy that should exist when socializing. Untreated hearing loss creates a very real, invisible barrier that often goes unnoticed. Individuals with hearing loss can be surrounded by family and friends, and at the same time feel completely alone as they are unable to follow or participate in discussions or conversations. Some symptoms of this include silence, incorrect answers, smiling and laughing but not talking, sadness, unexplained frustration, and isolation. Treating hearing loss with hearing aids can completely change the way that an individual with hearing loss interacts in social situations.

Untreated hearing loss can lead to changes in the brain that make it difficult to process and understand speech, especially in noise. Treating hearing loss sooner rather than later helps to preserve an individual’s ability to understand. Even with hearing aids, some individuals will struggle to understand due to changes to the brain and auditory system caused by delaying the treatment of hearing loss.

If you have a family member who has hearing loss, there are things you can do to help conversations be more productive and joyful. Some strategies that help are eliminating background noise, speaking more slowly and distinctly to give the individual time to process, and rephrasing instead of simply repeating when someone does not understand. Patience and kindness help.

If you suspect you or a loved one

a complete audiometric evaluation will help determine if the problem is just a hearing loss, or if it is a more complicated problem involving a decreased ability to discriminate speech sounds or inability to separate speech from noise. For those who wear hearing aids several things can be done to improve holiday hearing. Having hearing aids deep cleaned, removing earwax, or if the hearing aids are more than a year old, having hearing re-tested and reprogramming hearing aids may help hearing and understanding.

O ered by: Scott and Lora Nordby, Berkshire Hathaway HomeServices Colorado Real Estate

Fall 2025 may mark a turning point for homebuyers. After the slowest springsummer market in decades, conditions are shifting toward a more balanced market between buyers and sellers. Will buyers jump in, or will sellers resist? Here’s what it means for you.

• Inventory has risen for 22 consecutive months.

• Prices have plateaued—and cuts are accelerating.

• Mortgage interest rates are easing slightly.

Homes are spending longer on the market, giving buyers more leverage. In areas with six months of supply, sellers often lower prices and offer concessions. Previously “hot” markets are cooling quickly. Median prices in 19 of the 50 largest metros are below 2022 levels, including Miami (-5.7%), Austin (-5%), and Denver (-3.2%).

Still, many buyers hesitate, worried prices could fall further. But remember: the fundamentals that made these metros attractive—jobs, lifestyle, amenities— remain strong.

Nationally, inventory growth is slowing, and supplies remain 14% below prepandemic levels. Realtor.com shows only seven true buyer’s markets among the top 50 metros, so sellers still hold some power. e good news? Price cuts are widespread, pending sales are at multidecade lows, and homes are taking longer to sell for the 17th straight month—giving buyers more negotiating room.

Locally, Denver prices are down about 3% year-over-year, and homes are sitting longer compared to the pandemic boom. While other regions, like the Northeast and Midwest, are seeing price gains, Colorado’s market is stabilizing, offering buyers a chance to secure a home without the frenzy of recent years.

e housing market is—and will always be—a game of musical chairs. To build equity and long-term financial security, you need to be in the ownership seat. Consider these seven strategies:

1. Wait for home prices or mortgage rates to ease a bit.

2. Improve your credit by paying down debt.

3. Save for a larger down payment.

4. Buy now and refinance later if rates drop.

5. Consider an adjustable-rate mortgage.

6. Explore seller financing—often pricier overall, but with below-market rates.

7. Look for a smaller home or a more affordable neighborhood.

It may take years for the market to rebalance, but homes typically appreciate 2% to 4% annually. Prices are unlikely to fall meaningfully. e key is to think long-term—stay in your home as long as possible, and consider renting it out down the road. Whatever happens to the market, owning a paid-off home will always put you ahead.

Market conditions are shifting, and the right strategy can put you in a strong position. A Forever Agent SM at Berkshire Hathaway HomeServices Colorado Real Estate can help you evaluate the data, understand your opportunities, and plan your next move. Connect today at 303-905-8850 or visit BHHScoloradorealestate.com

3