Sudan Case Study | 73

FIGURE 4.18

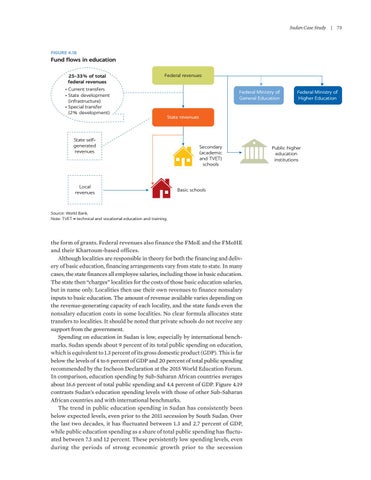

Fund flows in education 25–33% of total federal revenues • Current transfers • State development (infrastructure) • Special transfer (2% development)

Federal revenues Federal Ministry of General Education

Federal Ministry of Higher Education

State revenues

State selfgenerated revenues

Local revenues

Secondary (academic and TVET) schools

Basic schools

Source: World Bank. Note: TVET = technical and vocational education and training.

the form of grants. Federal revenues also finance the FMoE and the FMoHE and their Khartoum-based offices. Although localities are responsible in theory for both the financing and delivery of basic education, financing arrangements vary from state to state. In many cases, the state finances all employee salaries, including those in basic education. The state then “charges” localities for the costs of those basic education salaries, but in name only. Localities then use their own revenues to finance nonsalary inputs to basic education. The amount of revenue available varies depending on the revenue-generating capacity of each locality, and the state funds even the nonsalary education costs in some localities. No clear formula allocates state transfers to localities. It should be noted that private schools do not receive any support from the government. Spending on education in Sudan is low, especially by international benchmarks. Sudan spends about 9 percent of its total public spending on education, which is equivalent to 1.3 percent of its gross domestic product (GDP). This is far below the levels of 4 to 6 percent of GDP and 20 percent of total public spending recommended by the Incheon Declaration at the 2015 World Education Forum. In comparison, education spending by Sub-Saharan African countries averages about 16.6 percent of total public spending and 4.4 percent of GDP. Figure 4.19 contrasts Sudan’s education spending levels with those of other Sub-Saharan African countries and with international benchmarks. The trend in public education spending in Sudan has consistently been below expected levels, even prior to the 2011 secession by South Sudan. Over the last two decades, it has fluctuated between 1.3 and 2.7 percent of GDP, while public education spending as a share of total public spending has fluctuated between 7.3 and 12 percent. These persistently low spending levels, even during the periods of strong economic growth prior to the secession

Public higher education institutions