1 2023 1 01 Volume for Guide No. a new outlook on minnesota real estate

ABOUT

From the lakes to Minneapolis + St. Paul, and everywhere in between, our philosophy is simple: clients come first. We believe that if you’re not left with an amazing experience, we haven’t done our job.

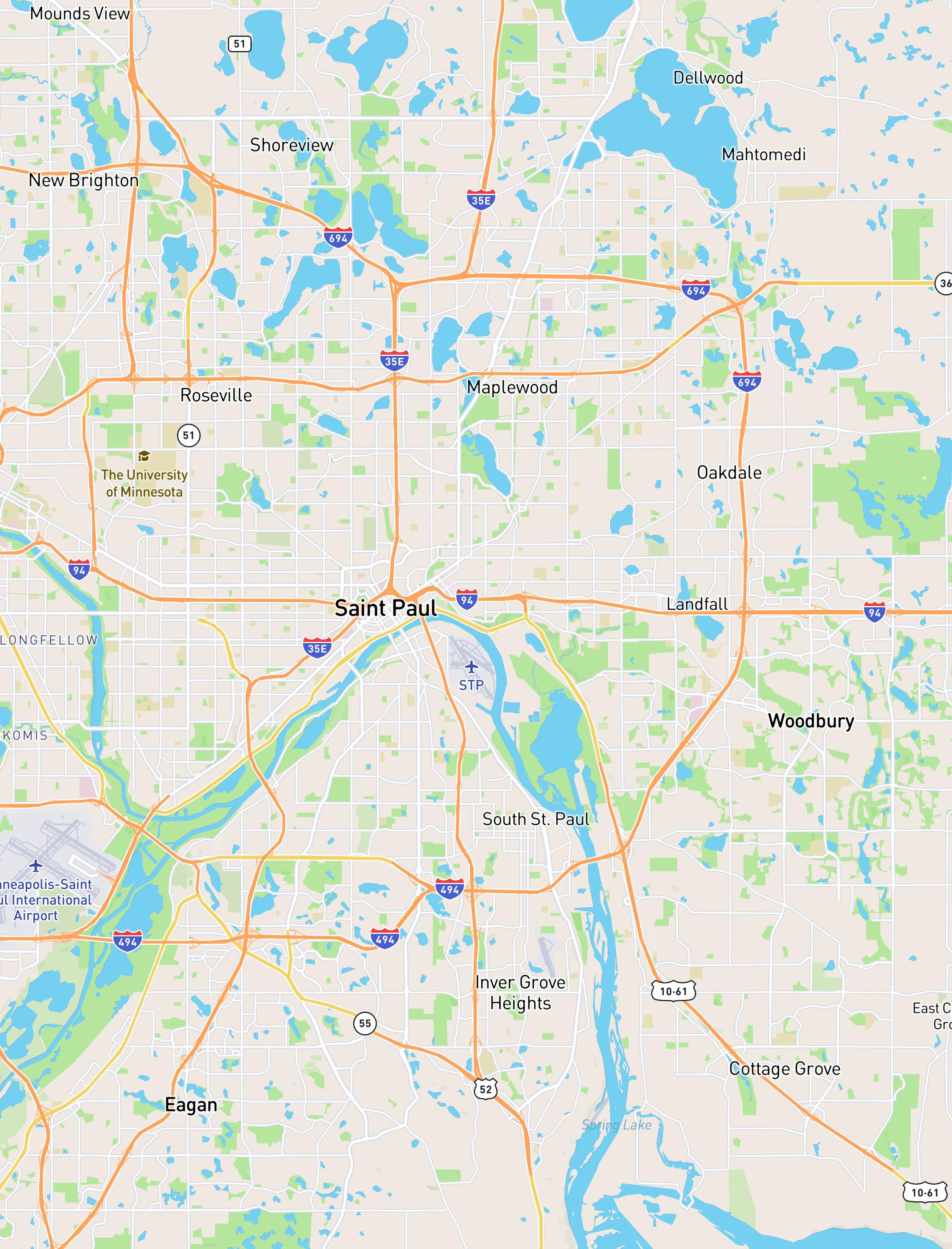

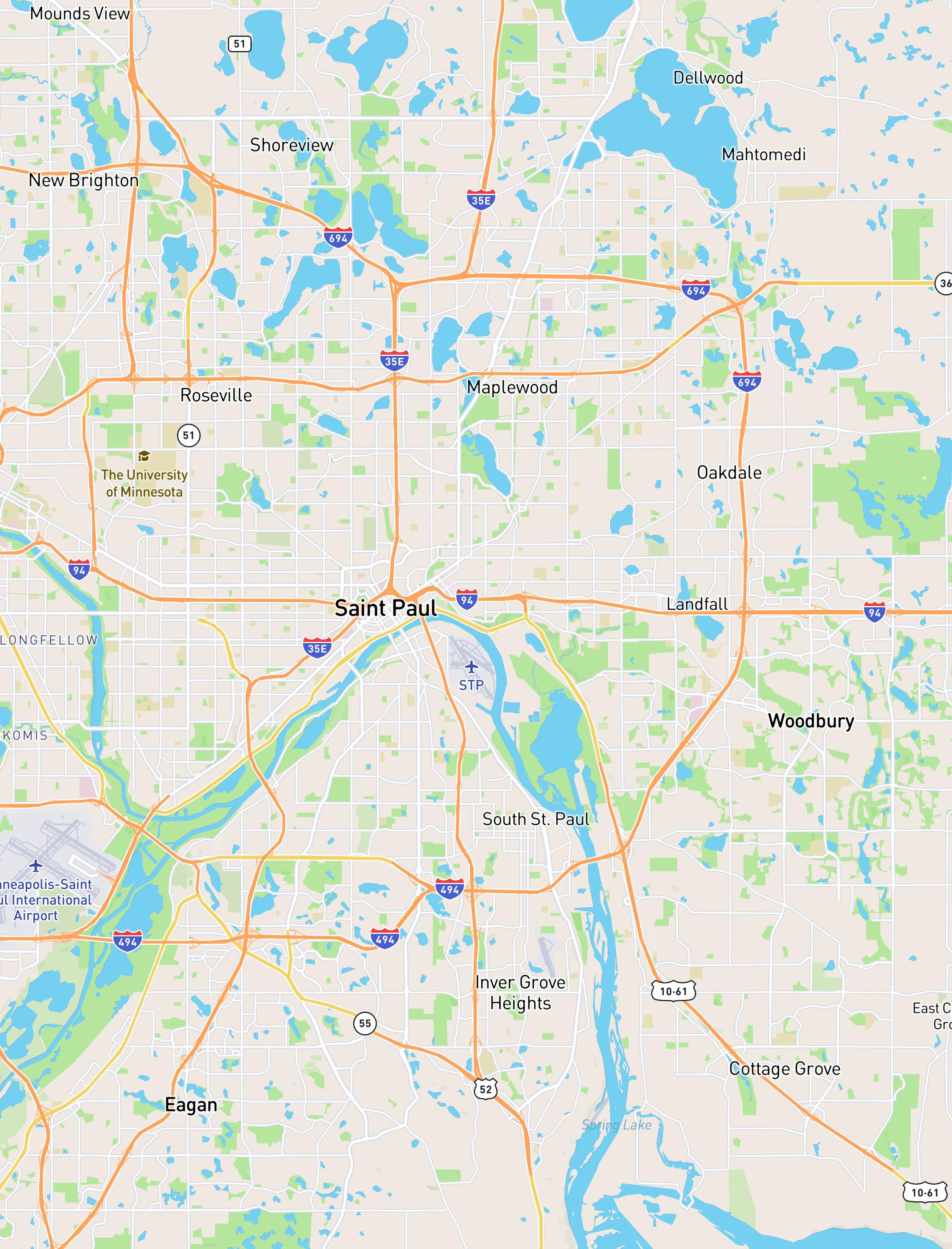

With our extensive knowledge of Twin Cities real estate, you can rest assured that you are working with some of the most knowledgeable and experienced agents in the business. West + Main’s commitment is to provide only the best and most timely information to our clients. We are your go-to source for Twin Cities area insight and advice.

THANK YOU

Thank you for the opportunity to equip you with helpful information regarding purchasing and selling Minneapolis + St. Paul Real Estate. We not only specialize in the Metro Area’s awesome + diverse communities...we live + play here, too! So, we’ve also included several guides to help you make the most of living in the Twin Cities and surrounding areas... whether you’re a born-and-bred local or are just getting to know our beautiful state, we hope that you will find it useful. Want a recommendation or need a resource? Contact us, we’re here to help with whatever you might need.

Volume 01 No. 01 West + Main Homes

WEST + MAIN | 01 CONTENTS BUYERS 03 THE HOME BUYING PROCESS 11 Steps to a New Home 08 BUYER INSPECTIONS What You Need to Know 09 CLOSING TIMELINE Plus Common Buyer’s Costs SELLERS 14 OUR PROMISE We Work for You 16 SELLING YOUR PROPERTY Trust Us to Tell the Story of Your Home 19 OUR SERVICES What We Provide RESOURCES 22 TWIN CITIES MAP Your guide to Minneapolis + St. Paul 24 MINNEAPOLIS MAP 25 ST. PAUL MAP 26 LOW MAINTENANCE PLANTS Learn, Plant and Enjoy

THE HOME BUYING PROCESS

Everything You Need to Know

WEST + MAIN | 03 BUYING PROCESS

1. 2.

FIND A REALTOR ® WHO IS RIGHT FOR YOU AND AGREE TO WORK TOGETHER

Selecting a great team to represent you in the purchase of your new home is critical. There are many great realtors out there, but choosing the one to work with is the most underestimated step in the process. Buying a home is often the largest, most important purchase a family makes. You deserve to be represented by a team who is adept at navigating all the intricacies of the identification of the right property, the negotiation, the transaction, and as well as the closing. Our team is made up of exceptionally well trained, full-time, local experts who will walk you through the process. Our fiduciary duty is to put your interests - financial and otherwise above everyone else’s, including our own. When we agree to work together, it requires clear lines of communication both way. Our clients love us because we will talk them out of purchasing a property that is not right for them just as fast as we will encourage them to buy one that is right for them. Customizing your unique property search provides you with information on homes that are most relevant to your buying experience, without inundating you with information that is not pertinent to your specific situation.

THE HOME INTERVIEW

Listening is one of our superpowers. This isn’t just going to the car lot and picking either a red one or a blue one. We consider ourselves “professional real estate matchmakers” when it comes to fulfilling our clients wants and needs. It’s not just about how many beds and baths you want. We want to find out what’s important to you about having a larger backyard or a mountain view. It’s about sitting down together and taking the time to discover what “the perfect home” looks like for you.

3.

FINANCING & PRE-APPROVAL

Whether you’re paying cash or seeking financing, the conversation about how we’re going to get from point A to point B is an important one. If getting a loan, sellers want to see that you are pre-approved with a reputable lender. They also want to see proof of funds for the stated down payment and closing costs. If paying cash, sellers want to see proof of funds sufficient to complete the transaction.

Volume 01 No. 01 West + Main Homes BUYING PROCESS

Buying a home can be a fun and exciting process, but it can also be very stressful. Understanding the process can really help to make it a smooth and successful transition.

COMMON PRE-APPROVAL NEEDS LIST:

Most lenders will need these items to get you preapproved for your home loan.

• the last 2 years tax returns

• copies of your most recent paystubs

• permission to run your credit

• proof of funds (showing down payment, closing costs and possibly reserves)

MONTHLY COSTS OF OWNING A HOME:

• mortgage (principal and interest)

• property taxes

• insurance

• utilities

• maintenance

• homeowners association fees (if any)

HOW MUCH CAN YOU AFFORD?

Knowing your true budget is very important when buying a home. To determine how much house you can afford, it’s best to start by asking yourself what total monthly payment you are comfortable with. That number, combined with the interest rate and down payment will determine your baseline. We will consult with you and walk you through the process of deciding which financing options are best for your particular situation. Don’t leave yourself short; set aside some money for moving expenses, repairs, renovations,

and perhaps some new furniture. We can recommend excellent Mortgage Brokers to help you with this very important step in the home buying process.

4.

LET’S GO SHOPPING (THE FUN PART)

Now the fun part begins. We get to go shopping. Based on your criteria, we’ll be on the hunt for homes which we think might be a good match. We’ll send you properties to consider and you can send us properties which catch your eye as well. If you have any questions or would like us to adjust the parameters of your search, just let us know. We are constantly networking with other top agents in the area to find coming soon and pocket listings (listings not yet available to the public). If your ideal home isn’t on the market, we’ll go find it.

5.

SUBMIT THE OFFER

Depending on the market, there are many different strategies on how to approach writing the offer. We are experts in helping you craft the best offer to have the greatest chance of getting it accepted. In a multipleoffer situation, there are many things we can do to structure a more attractive offer for the seller. These races are often won by inches, not by miles. In a slower market, we can be more aggressive with our approach. Typically, most offers are written so the buyer has to put an initial deposit (sometimes called “earnest money deposit” or EMD) a small percentage of the purchase price into escrow. This shows the seller that you have skin in the game.

We will give you a sample purchase agreement to read ahead of time so you can ask us any questions you might have. This saves time when it’s go time.

WEST + MAIN | 05 BUYING PROCESS

6.

NEGOTIATE THE OFFER

Whenever possible, we will present your offer in-person to the seller or the listing agent. Unless we’re told otherwise, our goal is always to get your offer accepted at the lowest possible price and the most favorable terms. The seller can accept, reject, counter, or ignore your offer. Usually, we can expect a counter.

7.

DUE DILIGENCE

Most offers will be written with an investigation contingency. This due diligence period is the time when you can perform inspections on the property and get comfortable with exactly what it is you are buying. We strongly recommend you attend the inspections. The average inspection takes about 3 hours. This is your opportunity to put the property under a microscope and discover if anything is wrong with it. You will receive disclosures from the seller to learn about the history of the property. With a condo or townhouse, there will also likely be homeowners association documents and CC&R’s (covenants, conditions & restrictions) to read through and approve.

If there are any unforeseen health and safety issues with the property that were not apparent when we submitted the offer, we can prepare aDue Diligence Request. The seller is under no obligation to address these concerns. We will walk you through the process, have detailed conversations and provide advice about how we think you should proceed.

8. REMOVE CONTINGENCIES

Contingencies are essentially conditions or the purchaser’s ways of terminating the contract without losing any of the earnest money deposit. If you are comfortable with the condition of the property and the appraisal and loan are approved, then it’s time to remove all contingencies. Contingencies can be removed one at a time or all at once. This is VERY IMPORTANT! If you remove all of your remaining contingencies and, for whatever reason, don’t proceed with the transaction, you are putting your earnest money deposit (usually 3% of the purchase price) at risk. Most buyers elect to do a final walk through before loan docs go to the title company and for you to come in for signing. This is done to verify the condition of the property and to make sure that any repair items agreed to were performed to your satisfaction.

9.

LOAN DOCUMENTS

You’re almost home. Now that you know you’re moving forward with the transaction, the remaining steps are for your lender to prepare the loan docs for your review. You will be expected to deliver your down payment when you come to the closing.

Volume 01 No. 01 West + Main Homes BUYING PROCESS

®

FIND

10.

A

REALTOR

WHO IS RIGHT FOR YOU AND AGREE TO WORK TOGETHER.

BEFORE YOU MOVE IN: UTILITIES

THE HOME INTERVIEW.

Don’t forget to change the utilities to your name starting the day of possession. This includes your phone, cable, internet, power, and gas services. Also, remember to cancel the utilities at your previous residence. Water is the only utility transferred at closing by the title company.

MOVERS

If you are using professional movers, book early. They are often booked several weeks out.

MAIL FORWARDING

Selecting a great team to represent you in the purchase of your new home is critical. There are many great realtors out there, but choosing who to work with is the most underestimated step in the process. Buying a home is often the largest, most important purchase a family can make. You deserve to be represented by a team who is adept at navigating all the intricacies of the identification of the right property, the negotiation, the transaction as well as the closing. Our team is made up of exceptionally welltrained, full-time local experts who will walk you through the process. Our fiduciary duty is to put your interests (financial and otherwise) above everyone else’s (including our own). When we agree to work together, it requires clear lines of communication both way. Our clients love us because we will talk them out of purchasing a property that is not right for them just as fast as we will talk them into one that is right for them. Customizing your unique property search provides you with information on homes that are most relevant to your buying experience, without inundating you with information that is not pertinent to your specific situation.

Gather all your bills, statements, tax information, healthcare information, and anything you make automatic payments on. Sit down and make a list of these things early, because you don’t want to forget any. It’s time to start giving out your new mailing address. You might also want to have your mail forwarded through the post office.

CLEANING

Most people want to move into a freshly clean home. Now is the time to schedule a cleaning crew to give the property a good, deep cleaning before moving in.

Listening is one of our super-powers. This isn’t just going to the car lot and picking either a red one or a blue one. We consider ourselves “professional real estate matchmakers” when it comes to discussing our clients wants and needs. It’s not just about how many beds and baths you want. We want to find out what’s important to you about having a larger backyard or an ocean view. It’s about sitting down and really taking the time to discover what “the perfect home” looks like for you.

11.

3.

MOVING DAY!

FINANCING & PRE-APPROVAL.

Finally, the day we have all been waiting for! Once you have received the keys and possession is officially transferred, you are free to move in and enjoy your new home.

Whether you’re paying cash or seeking financing, the conversation about how we’re going to get from point A to point B is an important one. If getting a loan, sellers want to see that you are pre-approved with a reputable lender. They also want to see proof of funds for the stated downpayment and closing costs. If paying cash, sellers want to see proof of funds sufficient to complete the transaction.

WEST + MAIN | 07 BUYING PROCESS

BUYER INSPECTIONS

It’s critical to take advantage of the opportunity to perform routine inspections on a property you are considering purchasing. Inspectors are experienced, trained professionals hired to put the house under a microscope and find common problems, malfunctions and/or defects in the property. Below is a list of some of the inspections buyers may choose to do:

• PHYSICAL INSPECTION

• SEWER LINE SCOPING

• SEPTIC INSPECTION

• ROOF INSPECTION

• STRUCTURAL OR GEOLOGICAL INSPECTION

• HVAC INSPECTION

• RADON TESTING

REQUEST FOR REPAIRS

The next step is to review the reports and decide whether or not there are any unforeseen health and safety items we’d like to ask the seller to correct. Although this is often the 2nd round of negotiations between buyers and sellers, it’s also a time when deals come to a stalemate. Here we recommend keeping the big picture in mind.

Volume 01 No. 01 West + Main Homes BUYING PROCESS

TYPICAL CLOSING TIMELINE

A title company is a neutral third party whose primary job is to prepare and execute the mutual instructions of the parties involved for closing. They ensure free and clear title and prepare all docs for closing. Here is a typical timeline for an escrow:

TYPICAL BUYER CLOSING COSTS

Although everything is negotiable in real estate, a buyer can generally expect to pay for many of these common buyer’s closing costs:

• “lender’s” title insurance policy premium

• buyer’s title policy

• title closing fee

• document preparation (if applicable)

• recording charges for all documents in buyer’s name

• all new loan charges (except those required by lender for seller to pay)

• interest on new loan from date of funding to 30 days prior to first payment date

• assumption or change of records fee for takeover of existing loan

• beneficiary statement fee for assumption of existing loan

• inspection fees

• home warranty (defined by contract)

• city transfer or conveyance tax (defined by contract)

ACCEPTANCE DATE - All milestones in the timeline start from the Date Of Acceptance which occurs when the executed purchase agreement is delivered to the other party.

EARNEST MONEY DEPOSIT - Also called the “Initial Deposit” is usually due 24 hrs after acceptance.

SELLERS DISCLOSURES - Usually due 7 days after acceptance.

BUYER’S INVESTIGATION - Buyer completes all due diligence, inspections and approves of reports such as disclosures and homeowner’s association rules.

CONTINGENCY REMOVAL - When satisfied, buyer removes inspection contingency, appraisal contingency, loan contingency and any others. It is very important to discuss the removal of contingencies with your agent because at some point, the earnest money deposit could be at risk, if the buyer doesn’t proceed with the transaction and no longer has any contingencies in place.

FINAL WALKTHROUGH - This is the buyer’s opportunity to verify that the property is in substantially the same condition as when they first wrote the offer. This usually occurs within 5 days of the expected closing date.

LOAN DOCS - Buyer signs loan docs at the closing table, having had the chance to review them in advance.

LOAN FUNDS - The lender receives the loan docs and funds the loan.

POSSESSION - Keys are typically transferred to the buyer at the closing table, unless there is delayed possession or a rent-back that has been agreed upon.

Buyer’s Responsibility Other’s Responsibility Buyer + Other’s Responsibility

WEST + MAIN | 09 BUYING PROCESS

THE HOME SELLING PROCESS

Get Top Dollar with Top-Notch Marketing

WEST + MAIN | 13 SELLING PROCESS

OUR PROMISE

We promise to provide our clients a world-class experience from start to finish and continuously over deliver. We promise to provide an exceptional customer experience that will have every client we work with singing our praises. We want to make sure that the next time our clients hear of someone looking for an incredible REALTOR ® , that our name is sure to come up. If you’re waving your arms and shouting our name, then we know we’ve lived up to our promise. Client referrals mean the world to us, because they mean that we made an impact on our clients’ lives.

Volume 01 No. 01 West + Main Homes

SELLING YOUR MINNESOTA PROPERTY

You made a great investment in your Minnesota property, and whether you have owned it for just a few months, or for years or even decades, we consider it our goal to make sure that you sell it quickly, and for the highest profit possible. We don’t stop there, though…we also strive to provide West + Main clients with a smooth transaction, as little hassle as possible, and a seamless process with transparent and constant communication.

Volume 01 No. 01 West + Main Homes SELLING PROCESS

WHAT YOU CAN EXPECT

Honest advice. From preparing your home for sale to handing over the keys to the property’s new owners, we are here at every step, bump, and curve in the journey.

The West + Main Selling Strategy:

PREPARE YOUR PROPERTY FOR SALE

You might keep your home looking like a designer showroom every day…if that’s the case, great! Let’s put a sign in the yard and let the showings begin! But, if you’re like most of the people that we work with, you have a little work to do first. This might involve: • decluttering + depersonalizing • minor touchups • small repairs • staging • deep cleaning and, in some cases, it might even mean some cosmetic upgrades or even remodeling.

Every situation is different, and depending on your Real Estate goals, it might take a few days or even weeks to get your house ready, and that’s totally ok with us. We have a large network of contractors and professionals who have done a great job for our clients and our agents. If you need a recommendation or referral for a plumber, electrician, painter, handyman, etc, just let us know, we will be happy to make an introduction or pass along their information.

PRICING + POSITIONING YOUR PROPERTY

One thing we say over and over again is “Don’t trust the estimate.” Even though Zillow, Trulia and other Real Estate marketing platforms might pop out a number for your property, it’s always better to have a local professional tour your home, consider all of the factors involved, and run a detailed analysis in order to make sure your home is perfectly positioned for the market. Speaking of positioning…did you know that there are very drastic differences in numbers of showings, multiple offer potential, and even escrow timelines depending on which day and week you choose to list your Minnesota property? We keep a close eye on the statistics, annual histories, and many other factors in order to make sure that your house hits the market at exactly the right time - and it’s not the same for every type of home, neighborhood, or city! Listing at the non-optimal time can cost you thousands or even tens of thousands of dollars in potential profit.

NEED TO SELL AS-IS, QUICKLY, OR EVEN OFF-MARKET? WE CAN HELP WITH THAT AS WELL.

We are always happy to create a Comparative Market Analysis for your property so that you will have an idea of where you stand financially. We will also generate an Estimated Net Sheet so that you can see every line item and cost involved, as well as your potential bottom line profit. Pricing is another important factor.

MARKETING MATTERS

Our in-house marketing department is a team of seasoned professionals who are passionate about making sure your home’s story is seen + heard by potential homebuyers. From beautiful flyers to expertly crafted property descriptions and photos, our goal is to target your property’s audience with attention-catching materials that get doors unlocked. This might include targeted online advertising, print materials, highlighted exposure in our widely distributed newsletters, feature placement on our blog + website, and more. Every home’s story is special + unique…we can’t wait to tell yours.

WEST + MAIN | 17 SELLING PROCESS

EXPERT NEGOTIATION

The best contract for your situation might not always be the highest price…we will help you consider all of the factors involved so that you not only go under contract but also make it to the closing table. This might include considering the best dates + deadlines for your timeline, as well as provisions like waived inspections or offers that include appraisal gap coverage. If you need to find a replacement property or would like to have the option to rent your home back for a few days or even weeks after closing, that is also something that we consider when reviewing and negotiating offers to purchase your home.

TRANSACTION MANAGEMENT

Once you’re Under Contract, we work to keep everything on track + moving forward as smoothly as possible. From important Dates + Deadlines to coordinating with your Buyer’s Agent, Lender, and the Title Company...there are a lot of moving pieces + parts involved.

1.

ACCEPTANCE DATE

All milestones in the contract start from the Date Of Acceptance which occurs when the executed purchase agreement is signed by all involved parties.

2.

EARNEST MONEY DEPOSIT

Also called the “Initial Deposit” is usually due 24 hrs after acceptance and will be deposited in an escrow account and applied to the Down Payment at time of purchase.

3. SELLERS DISCLOSURES

Usually due 7 days after acceptance, but it’s a good idea for Sellers to get these completed to the best of their knowledge ASAP.

4. BUYER’S INVESTIGATION

Seller allows Buyer to complete all due diligence, property inspections and reports such as disclosures and homeowner’s association rules. Often, these investigations lead to another round of negotiations.

5.

CONTINGENCY REMOVAL

When satisfied, Buyer removes inspection contingency, appraisal contingency, loan contingency and any other deadlines. Once all deadlines have passed, Buyer’s earnest money becomes non-refundable.

6.

FINAL WALKTHROUGH

Seller allows Buyer to verify that the property is in substantially the same condition as when they first wrote the offer by walking the property. This usually occurs within 5 days of the expected closing date.

7. CLOSING + POSSESION

Seller and Buyer typically meet at the closing table to sign all property transfer documentation. Keys are typically transferred to the Buyer at the closing table, unless there is delayed possession or a rent-back that has been agreed upon.

SELLING PROCESS

Volume 01 No. 01 West + Main Homes

Trust us to tell the story of your home.

We think Minnesota sellers should expect more from their real estate selling experience and we strive to make the process as easy + smooth as possible.

More Experience and Expertise

The combined experience of a team of top-notch agents and expertise in staging, marketing and negotiation.

More Services

Assisted home preparation, professional cleaning and staging, and more.

More Marketing

HDR photography, floor plans and even drone tours if appropriate, with unparalleled reach and exposure, including targeted advertising and a strategic marketing strategy for each property we sell. Custom collateral designed for every listing by our in-house design team.

More Negotiating Skills

Top-notch pricing and negotiation skills from a team of experienced agents with extensive knowledge of the Minnesota market.

A Better Experience

Formal seller onboarding process so our sellers always know what to expect, and assistance at every step in the process.

We Help Buyers Fall In Love

We connect emotionally with your target Buyer through outstanding photography, floor plans/video/ interactive tours and targeted copywriting. Our goal is to make Buyers fall in love with your home before they ever walk in the door.

WEST + MAIN | 19 SELLING PROCESS

THE WEST + MAIN HOMES TEAM PROVIDES:

RESOURCE GUIDE

Living in Minnesota

WEST + MAIN | 21 RESOURCES

TWIN CITIES

LOW MAINTENANCE HOUSE PLANTS

Succulents

Succulents love light and need about six hours of sun per day, depending on the type of succulent. Don’t forget to rotate your succulents to make sure they grow evenly.

Chinese Money Plant – Pilea peperomioides

Grows best in a shady spot with weekly watering, according to The Little Book of House Plants and Other Greenery. Bonus: You can replant the offshoots that sprout from the base of the stem and give them as gifts.

Spider Plant

The spider plant is so named because of its spider-like plants, or spiderettes, which dangle down from the

mother plant like spiders on a web. Likes bright light and weekly watering.

Prayer Plants - Calathea “Prayer plants” will fold up at night and open wide during the day. Place in a semi-sunny spot and keep the soil moist to keep it happy.

Aloe

With its prefere nce for indirect light, aloe would love a spot on your desk or bedside table. Give it a good soak every week or two for optimal growth. Bonus - the gel from aloe vera leaves can be used topically, but keep away from pets and don’t eat.

Volume 01 No. 01 West + Main Homes

“The best things in life are simple, abundant, and free.”

- Debasish Mridha

MINNEAPOLIS + ST. PAUL 612-502-5202 | hello@westandmainmn.com WEST and MAINMN.COM