FAITH MOVES US FORWARD

Mission

To help our members and our community achieve financial success by providing them with the highest level of personalized service.

Vision

Ukrainian Federal Credit Union will be the financial provider of choice for our members and will be one of the leading Credit Unions in the USA.

Our brand will be recognized for:

• Exceptional service;

• The newest digital features for an outstanding member experience;

• Being a great workplace for employees;

• A resource for our members to learn and share;

• A community outreach process that supports our common bond membership.

Our Values

• Caring Culture

• Open Communication

• Superior Service

• Personalized Solutions

має за мету стати головною фінансовою установою для наших членів і бути одним з лідерів серед кредитних спілок США.

Наша відмінність

полягатиме в:

• Найкращій якості обслуговування, знаннях та досвіді;

• Найновіших цифрових

можливостях;

• Найкращому робочому місці

для співробітників;

• Ресурсі для наших членів, щоб вчитися і ділитися досвідом;

• Процесі співпраці та

підтримки громади.

Наші Цінності

• Дбайливе ставлення

• Відкрите

2025 ANNUAL MEMBER MEETING

Board of Directors

President & Board Chairman / Wasyl Kornylo

Treasurer / Barbara Tymoc-Gutierrez

Secretary / Dr. Evhen Lylak

1st Vice President / Yaroslav Fatyak

2nd Vice President / Bohdan Zakharchyshyn

Board Member / Tamara Denysenko

Board Member / Olga Kovaliov, CPA

Associate Board Member / Rostislav Melnik

Board Member Emeritus / Myron Babiuk

Honorary Board Members / Yaroslav Kirik, Jurij Kushner, Myron Babiuk

Supervisory Committee

PO Box 17022, Rochester, NY 14617

Chair / Dr. George Hajduczok

Members / Vasiliy W. Gritsyuta, Ihor Levkiv, Nicolas Boberskyj, CPA, Tania Laba

Community Relations Committee

Chair / Tamara Denysenko

Members / Yaroslav Fatyak, Alexander Oryshkevych, Bohdan Zakharchyshyn

Executive Staff

Chief Executive Officer / Oleg Lebedko

Chief Operating Officer / Tanya Dashkevich

Chief Financial Officer / Oleksa Nowosiadlo, CPA

Chief Lending Officer / Maria Milazzo

Chief Information Officer / James Frey, CISM, CRISC, CISO

Chief Human Resources Officer / Kelly Nield, CUHRCP

Management Team

eServices Manager / Mariya Nolan, CEBO

Compliance Officer / Kaitlin Crilow

Marketing Manager / Alexander Oryshkevych, CUCME

Regional Branch Manager for Rochester & Webster / Galina Dyakiv

Syracuse Branch Manager / Irina Dobyuk

Regional Branch Manager for Citrus Heights & Rancho Cordova / Mikhail Tkach

Boston Branch Coordinator / Liubov Zelenkova

Regional Operations Manager / Sophia Kenn

Federal Way Branch Manager / Oksana Pierce

Parma Osnova Branch Manager / Maryana Rybay

Regional Branch Manager for Portland & Vancouver / Volodymyr Kovalyshyn

Regional Branch Manager for Spartanburg & Charlotte / Nataliya Chey

Editorial Staff

Editor-in-chief / Alexander Oryshkevych

Editors / Tetiana Zborovsky, Oleg Lebedko, Tetiana Kozak

Photo Credit / Olesia Golub, Sean Sweeney

Layout & Graphic Design / Sukhenko Design

Ukrainian-American Community Foundation, Inc.

Chair / Dr. Evhen Lylak

Treasurer / Tamara Denysenko

Secretary / Alexander Oryshkevych

1st Vice President / Barbara Tymoc-Gutierrez

2nd Vice President / Wasyl Kornylo

Members / Galina Dyakiv, Yaroslav Fatyak, Volodymyr Otvarukhin, Bohdan Zakharchyshyn

2024 ANNUAL REPORT / 2024

President's Report

WASYL KORNYLO | PRESIDENT & BOARD CHAIRMAN

Dear Members, Employees, and Partners,

As we close the chapter on 2024, I am honored to share this annual report celebrating our achievements, resilience, and unwavering commitment to our mission.

Despite uncertain economic times, Ukrainian Federal Credit Union has navigated challenges with strength, innovation, and a steadfast focus on our community. Our culture supported by our mission and values remain unchanged: We care about our members and employees and strive to continuously improve our daily financial banking relationships.

STRONG PERFORMANCE IN AN UNCERTAIN ECONOMY

The financial landscape in 2024 presented hurdles for many, yet Ukrainian Federal Credit Union has continued to grow and serve our members effectively. Thanks to prudent fiscal management, strategic investments, and our dedicated team, we have achieved positive financial results while maintaining stability for our members. From deposit growth to strong lending practices, we have ensured that our credit union remains a pillar of trust and support.

завдяки силі, інноваціям і незмінному фокусу на нашій спільноті. Наша діяльність спирається

A CULTURE OF CARE AND COMMITMENT

At the heart of our success lies our caring culture— one built on a deep commitment to our members and employees. Every decision we make, every service we offer, is rooted in our mission to empower and uplift our community. Whether providing personalized financial guidance or fostering a workplace that values and supports our employees, Ukrainian Federal Credit Union continues to strengthen its foundation with compassion and integrity.

INNOVATION & EXCELLENCE IN MEMBER EXPERIENCE

Our pursuit of continuous financial innovation has never wavered. This year, we introduced new digital banking features, enhanced security measures, and streamlined customer interactions—all designed to improve convenience and accessibility for our members. Our commitment to service excellence ensures that every member receives the best financial tools and resources to build a prosperous future.

STRENGTHENING COMMON BONDS ACROSS OUR 14 BRANCHES

The unity of our branches and the communities we serve remain central to our mission. Through outreach programs, member events, and initiatives that reinforce our common bonds, we have strengthened connections across all locations. We are more than a financial institution: we are a family, dedicated to supporting each other and fostering growth for all who rely on us.

LOOKING AHEAD

As we step into 2025, our promise remains unchanged: to uphold the values of trust, care, and innovation that define Ukrainian Federal Credit Union. We will continue to adapt, grow, and strengthen our financial and social impact—ensuring that every member benefits from our commitment to excellence.

On behalf of our board, leadership team, and employees, thank you for your continued trust and support. Together, we move forward with confidence, ready to embrace the opportunities that lie ahead.

Sincerely,

Wasyl Kornylo President & Board Chairman

CEO Report

It is my privilege to present the 2024 CEO Report for Ukrainian Federal Credit Union, reflecting both the challenges we faced and the progress we achieved. This year tested the financial services sector in unprecedented ways, yet our credit union demonstrated strength, adaptability, and unwavering commitment to our members and mission.

The rapid and sustained increase in interest rates compressed our net interest margins, while higher funding costs placed additional pressure on earnings. Simultaneously, 2024 continued a prolonged recession in the trucking industry, leading to a spike in loan delinquencies. This required increased loan loss provisions and a more determined approach to loan servicing and workout strategies.

Despite these headwinds, UFCU remained focused on prudent financial management, member support, and digital innovation.

членам і нашій місії.

Швидке та тривале зростання відсоткових ставок

FINANCIAL HIGHLIGHTS

n Total Assets: $395,964,860

We approached the $400 million milestone as member loans and deposits continued their steady growth.

n Loan Portfolio: $346,953,065

Our loan department and branch employees processed 1,767 new loans in 2024, totaling nearly $66 million.

n Delinquency Ratio: 1.10%

Delinquencies and loan losses increased slightly during 2024, but we continually monitored and mitigated the situation while increasing the allowance for loan losses.

n Deposit Growth: 3.52%

Despite stiff competition for deposits among financial institutions, we were able to grow our portfolio.

n Net Income: $8,928

This figure decreased from previous years as we allocated more funds to provision for loan losses.

n Membership Growth: 5.28%

Significantly above the average for credit unions nationwide.

MEMBERSHIP AND COMMUNITY COMMITMENT

Our membership continued to grow, fueled in large part by the ongoing arrival of humanitarian parolees from Ukraine. In 2024, 3,256 new members joined UFCU, bringing our total membership to 28,708 across 14 branches in eight states. We remain dedicated to supporting newcomers in building a secure financial future, offering tailored products such as starter credit cards, secured loans, and Ukrainian-language support services.

Community partnerships continued to be a cornerstone of our mission. Eight new organizations and churches joined our field of membership as common bond entities. UFCU maintained its support for member churches and charitable organizations, including those providing humanitarian aid to Ukraine.

портфель: $346,953,065

n Рівень прострочення: 1.10%

Прострочення

ЧЛЕНСТВО

STRATEGIC INNOVATION AND MEMBER SERVICES

Recognizing the need to modernize and remain competitive, 2024 was a year of strong investment in digital transformation and information security. UFCU accelerated the development of digital services to expand access, enhance security and efficiency, and meet the evolving expectations of our growing and geographically dispersed membership.

Key achievements included:

n Developing a digital-first microbranch model, combining reduced physical presence with enhanced online capabilities.

n Enhancing mobile and online banking and application tools for improved user experience.

n Strengthening fraud detection and response protocols amid rising industry-wide cyber threats.

n Expanding the use of digital communication and marketing channels to improve member engagement and service delivery.

LOOKING AHEAD

As we look toward 2025, our focus will remain on managing risk proactively while enhancing operational efficiency, digital accessibility and member experience. We will continue refining our loan portfolio strategy, expanding our digital ecosystem, and investing in staff development to meet the demands of our growing footprint.

We understand that in today’s complex environment, resilience and innovation must go hand-in-hand. Our leadership team is committed to adapting swiftly and strategically to ensure UFCU’s long-term strength.

GRATITUDE AND COMMITMENT

To our members, volunteers, staff, and board: thank you for your unwavering trust, hard work, and dedication. Your support is the foundation of our success. Together, we will continue to grow stronger and serve with purpose — rooted in our values and united by our vision of financial empowerment and community support.

Основні досягнення: n Розробка концепції цифрового мікровідділення, що

поєднує зменшену фізичну присутність із розширеними онлайн-послугами.

n Покращення мобільного та онлайн-банкінгу та інструментів подачі заявок.

n Посилення виявлення шахрайства та реагування на кіберзагрози

Mamakaziyeva

Mariia Topinko

Victoria Kolos

Karina Dzhaman

Phillip Onufriychuk

Sofiia Topinko

Jennifer Drozdovska

Emilla Drozdovska

David Skoroplyas

Svytoslav Drozdovska

Artys Pechenyy

Ibrahim Mamakaziyev

Larisa Zhushma Maksim Zholobov

Adam Zholobov

Gideon Dobyuk

Vadim Skoroplyas

Evangelina Zhushma

Ana Pototsky >

Statement of Financial Condition

For the Years Ended December 31, 2024 and 2023

Loans receivable, net of allowance for credit losses of $1,777,293 and $1,528,801 at December 31, 2024 and 2023, respectively

Statement of Income

For the Years Ended December 31, 2024 and 2023

Treasurer's Report

BARBARA TYMOC-GUTIERREZ | TREASURER

It is my honor to present the Treasurer’s Report for the Ukrainian Federal Credit Union (UFCU) for the fiscal year ending December 31, 2024.

Despite a year marked by persistent economic headwinds and global uncertainty, UFCU continued to uphold its strong financial foundation. Our focus remained steadfast on preserving the safety of our members’ assets, maintaining overall financial stability, and enhancing the services we offer. I am pleased to report that 2024 was another year of steady growth, prudent management, and impactful community engagement.

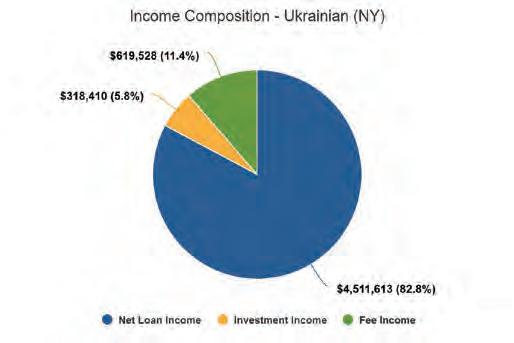

As of December 31, 2024, UFCU's total assets reached $396 million, reflecting a 1.5% increase from the previous year. This moderate but consistent growth underscores the trust and continued commitment of our members. On the lending front, UFCU had $347 million in total loans outstanding, representing a 2.9% increase over the prior year. These loans were diversified across several categories: 62% were residential loans, 12% were truck loans, 10% were consumer loans, 8% were church loans, and 7% were commercial loans. Our loan delinquency rate remained low at 1.1%, illustrating the effectiveness of our responsible lending practices and sound risk management strategies.

Member deposits grew by 3.5% to a total of $351 million, signaling both stability and increasing confidence in UFCU’s ability to safeguard and grow member assets. Our membership also grew to 28,708 individuals, a 5.3% increase that highlights our ongoing relevance and outreach within the Ukrainian-American community and beyond.

From a financial performance standpoint, UFCU concluded the year with a net income of $8,928. This positive result allowed us to reinvest in critical areas such as service enhancements, technology upgrades, and our ongoing community initiatives. Our capital position remains strong, with total net worth reaching $31.7 million. With a net worth ratio of 8.02%, UFCU continues to exceed the National Credit Union Administration’s benchmark of 7% for “wellcapitalized” institutions, affirming our enduring financial strength and resilience.

In 2024, UFCU achieved several important strategic milestones. We successfully launched a new mobile banking application featuring improved security, Zelle integration, and multilingual accessibility, enhancing the digital banking experience for our diverse membership. Our commitment to community support remained a priority as we expanded humanitarian aid initiatives for Ukraine and increased our involvement in local Ukrainian-American programs.

We also reinforced through our UACF Foundation our dedication to youth and education by awarding 20 college scholarships and introducing new programs focused on youth savings and financial literacy, preparing the next generation for financial success.

On behalf of the Board of Directors and our dedicated staff, I thank you—our valued members—for your continued trust and loyalty. As we move forward, UFCU remains deeply committed to our mission of financial empowerment and cultural unity, serving the needs of the Ukrainian-American community with integrity and care.

UFCU ASSETS

$313,415,983

$196,755,365

адміністрації кредитних спілок США (NCUA) у 7%, визначений для «висококапіталізованих» установ.

раз підтверджує нашу фінансову стійкість.

У 2024 році ми досягли

із підвищеним

n

Рівень простроченої

Report from the Community Relations Committee

TAMARA DENYSENKO | COMMITTEE CHAIR

Since 1953, Ukrainian FCU has been dedicated to supporting its membership-based common bond organizations. The first UFCU common bond s were the Ukrainian National Association (UNA) and Ukrainian Fraternal As sociation (UFA).

In the early 1980’s, UFCU leadership began expanding and growing UFCU common bonds to include churches and community organizations, first in Rochester, NY and since 2000 in multiple states across the USA coast-to-coast. Firmly believing in building and sustaining strong community ties, UFCU actively sustained the cooperative mission of “People Helping People” through volunteerism, financial education, community outreach programs, and donations to UFCU common bond churches, charitable, educational, civic, and cultural organizations. In 2010, UFCU established the Ukrainian American Community (UAC) Foundation in support of its charitable outreach.

In 2024, UFCU continued to grow its common bond membership base and now includes over 100 churches and organizations across the USA. In coordination with its UAC Foundation, UFCU provided over $140,000 in community support, scholarships, humanitarian

COMMITTEE MEMBERS

and cultural initiatives in 2024. UFCU also assisted Ukrainian Consuls with onsite services at various branch locations.

In 2028, UFCU will reach a special milestone - its 75th Anniversary with its mission - “to help our members and our community achieve financial success by providing them with the highest level of personalized service” and vision “to be the financial provider of choice for our members and one of the leading Credit Unions in the USA”.

For more information visit: ukrainianfcu.org/community

YAROSLAV FATYAK

ALEX ORYSHKEVYCH

BOHDAN ZAKHARCHYSHYN

ініціативи

культурних

своєї членської бази, яка сьогодні включає понад 100 церков і організацій у США. У тісній співпраці

активно сприяла роботі українських консульських представництв,

Consulate Services

Spartanburg, SC

Parma, OH

Rochester, NY

Report from the Supervisory Committee

DR. GEORGE HAJDUCZOK | CHAIR SUPERVISORY COMMITTEE

This past September 2024, the Ukrainian Federal Credit Union (UFCU) Board appointed its Supervisory Committee for the coming year. The board reappointed three regular past- committee members and the committee chair for another term.

George Hajduczok was reappointed as chair, while Vasiliy Gritsyuta, Nicolas G. Boberskyj and Ihor Levkiv continue their service to the committee. The Supervisory Committee also welcomes our newest member, Tania Laba. Originally from Rochester, Tania has been with the Selfreliance Federal Credit Union in Chicago for thirtysix years where she ascended to Vice President of the Lending Department. She recently moved back to Rochester and graciously volunteered to serve on our committee. We welcome Tania and look forward to her participation. We always welcome volunteers to serve on our committee from any of our branches, so if interested, please do not hesitate to contact me or a Board member.

The committee held its own separate meetings as noted in the committee minutes and met with the board during the year virtually or in person. The plan of work was completed and all communications and prescribed written reports were posted to the secure UFCU Basecamp page to ensure that UFCU is compliant with the Federal Credit Union Act, the rules and regulations of the NCUA, and UFCU’s own by-laws.

The Supervisory Committee conducted a thorough and recurring set of audits throughout the past year that show the Credit Union currently is financially strong and well managed. The committee audit responsibilities included contracting with an Internal Auditor to establish an audit rotation of key areas and submitted reports on compliance requirements for the Credit Union. The results of the Bank Secrecy Act audit and several other audits were reviewed as positive for both our internal and external network controls and information security. The internal audit review process continued on schedule and has provided management and the board with significant feedback about the policies and procedures in place to maintain our member security.

For the year ending 2024, the auditing firm of Bonadio & Co. LLP, served as an external auditor to review UFCU’s financial statements. The Credit Union received an unqualified opinion statement from the external auditors during the year, and the committee was provided a statement that the yearly verification of member accounts had been

performed. The recommendations of the yearly audit were formally submitted to UFCU management, and the committee followed up with management for responses to the recommendations stated in the audit. The results of that audit stated that the overall quality of the Credit Union’s financial reporting was presented fairly in all material respects and conformed to the accounting principles generally accepted (GAAP) in the United States of America.

In addition to reviewing all the professional audits, the Supervisory Committee also conducted quarterly closed accounts reviews in conjunction with COO Tanya Dashkevich. The committee has maintained open lines of communication to resolve member concerns and correspondences through a separate mailing address and a published member-contact, online address. The committee again was able to fulfill the assigned fiduciary responsibilities in a timely fashion and is giving its full support to the current board and management. The Supervisory Committee stands ready to aid in the resolution of any member inquiries that may arise during the 2025 calendar year.

повному обсязі. Всі комунікації та обов’язкові

нормативам NCUA та Статуту

в

Report from the Ukrainian-American Community Foundation

DR. EVHEN LYLAK | PRESIDENT

The Ukrainian American Community Foundation, Inc. established by the Ukrainian FCU in 2010 has donated more than $505,687 to a variety of community, cultural, humanitarian, and educational initiatives.

Additionally, the UAC Foundation continues to be an approved host organization, in coordination with US-Ukraine Foundation as the national grantee, for the COIL (Congressional Office for International Leadership) Open World Ukraine program.

In 2024, Ukrainian Federal Credit Union donated $20,000 to the UAC Foundation, and other donations of $3,650 were generously provided for humanitarian aid and scholarships by various individuals and community groups. The UAC Foundation sponsored a wide range of projects throughout the year for the benefit of the greater UFCU Community including: the Rare Books, Special Collections, and Preservation (RBSCP) project at the University of Rochester Libraries for completion of the digitization of all early ledgers and manuscripts and all the audiovisual materials from the Ukrainian Rochester Collection; public community lectures in concert with the Skalny Center at the University of Rochester on topics such as the ongoing war in Ukraine; the “Red Harvest” (Graphic novel presentation program) in tandem with the Rochester Holodomor Commemoration; the Mykola Dupliak lecture and book presentation at the Pylyshenko Community Library at UFCU; the ongoing Ukrainian artifacts exhibit at the Irondequoit Public Library; the Dnipro, UACF and East Irondequoit Middle School & Library On-line project; COIL/Open World Program on Serving Children in Time of War; the collaborative project with the Strong Museum of Play entitled “War Toys: Ukraine” - an exhibit exploring the impact of armed conflict on children; and the establishment of Ukrainian of the Year award recognizing ROC Maidan for the work of collecting and shipping humanitarian aid containers and medical supplies to Ukraine.

The following UFCU community organizations and other community non-profit organizations received support from the UAC Foundation in 2024: Ukrainian Museum-Archives • Cultural Forces Concert • Irondequoit Public Library • Nazareth University Centennial Ukr. Partnership • ROC Maidan • University of Rochester – Ukrainian Rochester Collection •

UNWLA Br. 120 - Holodomor Lecture • Revived Soldiers

Ukraine • The Child Advocacy Center of Greater Rochester • The Ukrainian Museum in NYC • UCCA/UNIS • U.S. Ukraine Foundation • Ukrainian Catholic University Foundation • Ukrainian World Foundation USA • United Help Ukraine • Ukrainian History and Education Center • Ukrainian Free University Foundation (NYC) • Ukrainian Studies Fund (Harvard Ukrainian Research Institute) • Yara Arts Group.

Since 2010, the UAC Foundation awarded over $207,500 in undergraduate and graduate scholarships. In 2024, nine UFCU, one EZ Income Tax and two Pylyshenko Family named scholarships, for a total of$12,000, were awarded to the following student UFCU members: Polina Asanova, Diana Babinchuk, Julia Biggs, Maksym Cherevatyi, Dominic Cimino, Natalia Croop, Markian Dwulit, David Dyakiv, Vladimir Maystrenko, Andrew Pitolaj, Andrian Rachynskyy, Anna Yevdokymova,

The UAC Foundation, Inc. looks forward to continuing its mission of serving as a non-profit, 501(c)(3) charitable institution for the Ukrainian Federal Credit Union for many years to come. The UAC Foundation accepts donations from our supporters in several different ways. Please contact us through the UFCU website with any questions about our mission and future goals.

THE UACF BOARD OF DIRECTORS FOR 2024

Evhen Lylak | President

Barbara Gutierrez | 1st Vice-President

Wasyl Kornylo | 2nd Vice-President

Tamara Denysenko | Treasurer

Alexander Oryshkevych | Secretary

Directors | Galina Dyakiv, Yaroslav Fatyak, Bohdan Zakharchyshyn, and Volodymyr Otvarukhin

Українська Американська Громадська Фундація, Inc. (УАГФ), заснована Українською Федеральною Кредитною Спілкою (УФКС) у 2010 році,

COIL (Congressional Office for International Leadership) Open World Ukraine.

жертв Голодомору;

n лекцію та презентацію книги Миколи Дупляка в бібліотеці ім.

Пилишенка при УФКС;

n постійну виставку українських артефактів у громадській

бібліотеці Айрондеквойта;

n спільний онлайн-проєкт «Дніпро, УАГФ

n

Східного Айрондеквойта»;

COIL/Open World,

2024 UKRAINIAN AMERICAN ORGANIZATIONS OF THE YEAR

In 2023 the UAC Foundation reintroduced the Ukrainian American Organization of the Year award by selecting Roc Maidan for its continued outstanding humanitarian aid efforts to support Ukraine. In 2024 UACF expanded the award to two categories: domestic & international. We’re proud and excited to announce that the following two organizations were nominated and selected to receive the award:

DOMESTIC CATEGORY

UNWLA, Branch 120 unwla.org

INTERNATIONAL CATEGORY Ukrainian Bandurist Chorus of North America bandura.org

Congratulations to each organization on this historic achievement! We invite all readers to learn more about each organization by visiting their website. Nominations for the 2025 award will open on November 1, 2025.

року», відзначивши RocMaidan за послідовну та значущу

Pictured above: Ukrainian Bandurist Chorus of North America

Pictured Right: UNWLA, Branch 120 with Serhiy "Foma" Fomenko

Two

branches find new homes to better serve our members

In 2024 we relocated our Portland, OR branch to Clackamas, OR. In June 2025, after over 30 years in Tipperary Hill – an Irish neighborhood mixed with Ukrainian roots – we moved our branch to the village of Camillus, NY and just 4 miles west of our previous location (pictured below). Both relocations were completed out of the desire to both optimize our retail space and elevate our level of service to our members. Both branches were fully renovated to meet the standards of modern day banking, and to support our growth as we look to the future. While the locations may have changed, our commitment to service and to our members in each respective area remains constant. Please visit us! Find all branch locations on the back cover of this Annual Report. Два відділення знаходять

в місті Клакамас, штат Орегон.

У червні 2025 року, після понад 30 років діяльності в районі Тіпперері-Гілл

Staff at our newly relocated Syracuse branch

Did

you know UFCU offers Medicare Assistance?

As of April 1, 2025 Ukrainian Federal Credit Union (UFCU) has a dedicated health insurance team available to assist adults 65 years of age or older in maximizing their Medicare benefits. Medicare options can change annually, so there is no better time to have our internal expert review your Medicare benefits. This is a free service to UFCU members who are residents of New York, California, Oregon, or Washington, and there is no further obligation. To schedule an appointment you may reach Volodymyr Kovalyshyn directly by calling (360) 597-2096 or send him an email at vkovalyshyn@ukrainianfcu.org. We are able to provide service in English or Ukrainian, and look forward to speaking with you about your Medicare Benefits!

To learn more visit ukrainianfcu.org/medicare/

The primary objective of a CUSO is to provide specialized services that benefit credit unions and their members. In this case EZ Income Tax provides the following to its clients and UFCU members:

n Tax preparation & planning

n Single Owner Payroll Services

n Sales Tax

n LLC Registration

n Bookkeeping & Compilation Services

UFCU welcomes EZ Income Tax as a Credit Union Service Organization (CUSO) УФКС

про

з EZ Income Tax —

CUSO, яка пропонує

послуг. CUSO (Credit Union Service Organization)

юридично відокремлена

створена

What are the benefits of partnering with EZ Income Tax?

n Expands our overall personal & business offerings all under one roof

n Cost efficiency through the sharing of resources, which ultimately leads to savings for the UFCU member

n Access to experts who can guide UFCU members through challenging financial decisions

The EZ Income Tax office is open year round! Call or email to make an appointment. Services are provided in English and Ukrainian. Now serving clients across the U.S.

EZ Income Tax

824 East Ridge Rd. (lower level) Rochester, NY 1462 (585) 266-8620 admin@ezincometax.org

Hours During Tax Season

n Monday - Friday, 10am – 6pm n Saturday, 9am – 1pm

Hours After Tax Season

n Monday - Thursday, 9am – 5pm

According to the National Credit Union Administration (NCUA), a CUSO is not a credit union and is a separately formed, legal entity created under applicable state or federal law. Read more in the Examiner’s Guide on the NCUA website.

EZ Income Tax

824 East Ridge Rd. (нижній

Rochester, NY 14621 (585) 266-8620 admin@ezincometax.org

Meet RADA

We’re excited to introduce a new face to the UFCU family –meet RADA, our new bilingual virtual assistant!

RADA is a chatbot that speaks both Ukrainian and English, ready to help you find quick answers and guide you through UFCU services online. She’s still learning the ins and outs of everything we offer, so please be patient as she gets smarter every day.

RADA also gives you direct access to chat with real UFCU team members during business hours – so you can get the help you need in real time, from wherever you are.

This is just one of the ways UFCU is working to create a better, more connected experience for our members — offering new ways to stay in touch, ask questions, and get support online.

Stop by our website, say hi to RADA, and experience this new way of connecting with us!

Знайомтесь – РАДА

Ми

IN THE COMMUNITY

In addition to offering our members low loan rates and high deposit rates, UFCU reinvests in its branch communities and common bond organizations via sponsorships and/or volunteering at events throughout the year. We also highlight some of the work our community members are doing to support Ukraine.

A. Portland, OR & Vancouver, WA branch teams at the Ukrainian Day Festival in Fairview, OR

B. Boston Branch Coordinator, Liubov Zelenkova, presents during a mortgage seminar

C. Members & friends of our Ukrainian American community in Western NY gather at Niagara Falls, NY for Ukrainian Independence Day

D. Staff take part in a health & wellness activity on the water

E. Bring Your Child to Work Day at our Charlotte, NC branch

F. Youth ride the wagon during the annual Ukrainian Village Parade in Parma, OH

G. Small business networking breakfast at our Citrus Heights, CA branch

H. Stand with Ukraine rally in Boston, MA

I. Charlotte, NC branch celebrates its 5th anniversary

J. Barvinok Dance Ensemble celebrates its 20th anniversary

K. Ukrainian flag raising at Syracuse, NY City Hall

L. "Українське

(Ukrainian group of individuals & resources) meets at Resurrection Church in Rocklin, CA

AROUND UFCU

June 14

Ukrainian Soul Festival Slavic Assistance Center Carmichael, CA

June 28 & 29

Pierogi Fest

Holy Trinity UOC North Royalton, OH

July 11 – 13

Ukraine Fest Soyuzivka Kerhonkson, NY

July 12

Ukrainian Day Festival

St. John the Baptist UOC Johnson City, NY

July 12

St. Vladimir Ukrainian Festival Parma, OH

July 13

Ukrainian Heritage Festival

St. Peter & Paul UCC Auburn, NY

July 25 & 26

Ukrainian Festival

St. John the Baptist UCC Syracuse, NY

August 9

Seabreeze Family Picnic Rochester, NY

August 14 – 17

St. Josaphat’s Ukrainian Festival Rochester, NY

August 23

Ukrainian Village Parade Parma, OH

August 23

Ukrainian Day Westmoreland Park Portland, OR

August 23 & 24

Ukrainian Festival

St. Josaphat’s UCC Parma, OH

August 23 & 24

Ukrainian Independence Day Boston City Hall & Christ the King UCC Boston, MA

August 24

Ukrainian American Day Dnipro Ukrainian Cultural Center Buffalo, NY

August 24

Ukrainian Independence Day Cabarrus Brewery Concord, NC

August 24

Ukrainian Independence Day California State Capitol Sacramento, CA

August 30 & 31

Ukrainian Festival

St. Andrew UCC Parma, OH

Branch Locations

TOLL-FREE: 877-968-7828

Rochester, NY

Main Office & Branch 824 East Ridge Rd. Rochester, NY 14621

585-544-9518

Amherst, NY 2882 Niagara Falls Blvd. Amherst, NY 14228

716-799-8385

Buffalo, NY

562 Genesee St. Buffalo, NY 14204

716-847-6655

Citrus Heights, CA

7084 Auburn Blvd. Citrus Heights, CA 95621

916-721-1188

Federal Way, WA 716 S 348th St. Federal Way, WA 98003 253-237-5293

Matthews, NC 1730 Matthews Township Pkwy. Matthews, NC 28105 704-246-3040

Parma, OH Osnova Branch 5602 State Rd. Parma, OH 44134 440-842-5888

Portland, OR 12893 SE 97th Ave. Clackamas, OR 97015 503-774-1444

Rancho Cordova, CA 11088 Olson Dr. Rancho Cordova, CA 95670 916-894-0822

Spartanburg, SC 225 W Blackstock Rd. Spartanburg, SC 29301 864-754-3770

Syracuse, NY 4801 West Genesee St. Syracuse, NY 13219 315-471-4074

Vancouver, WA 6115 NE 114th Ave. Vancouver, WA 98662 360-597-2096

Webster, NY 900 Holt Rd. Webster, NY 14580 585-545-6276

Westwood, MA 282 Providence Hwy. Westwood, MA 02090 781-493-6733