Economic Catalyst oR catastrophe?

Economic Catalyst oR catastrophe?

EconomicPersepectives is the Perse Economics magazine dedicated to students, run by students. Published termly, EconomicPersepectivesseeks to explore the complex world of Economics on a theme-by-theme basis.

For the summer edition, we chose the theme of globalisation. Seemingly, every decision we make is influenced by global factors; from purchasing clothes manufactured in international supply chains to enjoying cuisines from diverse cultures, globalisation has created a complex network of connections shaping our societies and creating a unified world.

This edition includes thirteen articles on globalisation and two on the world of finance, each providing in-depth analysis to help us link together different phenomena that form the global economy of the 21st Century.

Thank you for joining us, and we hope you enjoy reading the summer edition of Economic Persepectives.

Ivan K, Varun V, Octavian M

How Have Japanese Management Techniques Contributed to the Country's Recent Rapid

Japanese history has been shaped by a 250-year period in which its economy became isolated to the extreme. Between 1639 and 1853, Japan's economy followed the policy of Sakoku, or 'a country in chains'. This characterised a period of near-complete isolation from the rest of the world, only maintaining distant trading relationships with China and Dutch traders living on an island in Nagasaki harbour. The Japan known today exhibits scores of evidence which suggest otherwise. It begs the question: how has the Japanese economy transformed from an introverted micro economy into a world-leading economy, overwhelmingly distinguished by its renowned trading attributes?

In 1970s, Japanese management practices became so popular that they posed serious competition to the longstanding European and American scientific management theories. These practices aimed to address one key issue which was emerging across American and European multinationals: worker commitment. Japanese employees exhibited very high levels of employee commitment; however this did not arise from inspirational or empowering leadership, but instead from a distinct organisational culture which gave established the foundation for Japanese globalisation which is seen today.

Japanese firms were strongly hierarchical, characterising traditional bureaucracy. When seen in western economies, this system individualises and segregates between different degrees of authority, typically causing unrest and disinterest. However, in Japanese companies, a socialising tendency arises. The most prominent feature of Japanese management techniques is the priority given to the values of the collective above that of the individual - every person involved or affected must commit to any decision being made. As such, a collective responsibility arose, reinforced further by the organisational strategy implemented: the presence of the seemingly bureaucratic structure was superficial, and its role was solely to align company values for all employees. Teams were put together based on skills and personalities instead

of job titles, meaning managers and employees worked side by side, across bureaucratic lines. Consequentially, the trust displayed throughout the firm was particularly unyielding, and everyone felt they had a place - no matter their job titlewithin the firm. Inevitably, this boosted employee satisfaction and involvement. As a result, employee commitment skyrocketed.

Japanese businesses exhibited intimate and tailored knowledge regarding their employees, which arose from a variety of practices. Firms offered lifetime employment, in turn binding them to their firms through strong corporate cultures and regular company-specific training programmes. The strong corporate culture became engrained through symbols, routines and investing in common values of the firm. This meant that work became leisure, and the firm became an extension of an employees' family - often to the deterioration of their real family, as you can imagine.

Whilst the individual businesses have techniques to enhance economic growth and productivity, the country itself seems to have a certain distinction which set it apart from other high-performing countries. Researchers, including Hampden-Turner and Trompenaars, created criteria in which countries - the UK, the US, Germany, Japan, Singapore and France - were tested on several dilemmas, and ranked accordingly with their performance. Interestingly, Japanese firms were ranked to have the most ascribed status - rather than achieved - and the most outwards-directed values when dealing with tasks. A status which is more ascribed breaks barriers between levels of bureaucracy, which inevitably creates a more committed team. The outwards-direction is symbolic of the corporate culture in which every employee's values are aligned to reach the collective's goal.

The method of coping with problems is equally as distinct. Japanese firms synthesised problems, rather than analysing each statistic and fact individually. Additionally, Geert Hofstede conducted research, in which Japan ranked as the least tolerant of uncertainty, significantly lower

than both the UK and the US. This idea can be seen most conspicuously in the 2007-09 Financial Crisis, in which risk-taking in the US soared. Americans analysed the threat of mortgages individually, but not the problem as a collectivethe collaterised debt obligations (CDOs), which were the financial products which proved corruptive to the US economy. The risk of CDOs were incredibly difficult to calculate, however they were perceived as catastrophic outcome but very low risk. Japanese management techniques, using a synthesised approach, would more successfully be able to determine risk, thus being able to realise the individual mortgages comprising the CDOs were largely high-risk securities.

Hampden-Turner and Trompenaars research into conceptions of time in relation to uncertainty is incredibly interesting. Japanese managers, as we have established, stick tightly to social norms, aiming to seek security and safety in their practices. However, they place importance on the long-term, similar to the US and the UK - although not quite as far into the future - but, more notably, think about time more synchronically - as opposed to sequentially - meaning they see each time period (past, present and future) as much closer together than the US or the UK. In reality, this is all that can be feasibly controlled by the

current firm managers, and so they place what they can do the most about in the highest regards, serving the long-term needs of society rather than the short-term needs of shareholders.

The outcome of this process is rapid expansion, especially to international economies. In the case of Japan, their manufacturing and technology sectors have seen a boom recently. Domestic Japanese companies, including Toyota, Sony and Nintendo, have globalised dramatically. The country itself ranks fourth among the world's leading importers and exporters. Economic growth has been seen to come hand in hand globalisation in Japan. This economic growth has arisen directly from outsourcing to international economies. Unique management techniques which have arisen in Japan, have enabled the country’s economy to execute these transactions on such a vast scale.

A lifeline, of sorts, has been extended to the Japanese economy: negative interest rates and volatile growth has encumbered Japan for decades. It is time for stability, and these management techniques are the key to securing growth, and in turn globalisation - the light at the end of the tunnel for Japan's economic uncertainty.

Jack S - Year 12

The division of labour is an economic concept first addressed by Adam Smith in the 1770s through his book, The Wealth of Nations. It refers to the separation of a work process into a number of tasks, with each task performed by a different

person. A simple way to conceptualise the concept is through a pizza restaurant; one person receives the order, whilst the other prepares the dough, another is in charge of toppings and someone else is in control of baking the pizza. Similarly, Adam Smith noticed the division of labour in a pin factory, where the production

process was split up between various workers, each in charge of their own task. The division of labour carries a variety of advantages, most notably increases in productivity. Going back to the pizza restaurant, it is far more efficient for the assembly process to be distributed between workers rather than leaving one worker to one pizza. Furthermore, the division of labour ensures consistency and quality in the final product. If each worker made one pizza, the quality would vary depending on how skilled each worker is. However, if someone is in charge of toppings, another of baking and a different worker of the dough, each pizza will remain consistent and of higher quality, assuming each worker does what they are best at. Adam Smith revolutionised economic activity with this concept, and it has since been adopted by economies worldwide.

On a business scale, the division of labour can be used to increase productivity, however the division of labour can also be seen on an international scale. Similar to the production process being divided within a company, the production process can also be separated amongst countries. Services make up 72% of the UK’s GDP, and 74% of the USA’s GDP whilst China makes up 28% of the global manufacturing industry. Similarly, Middle Eastern countries make up 26% of the world’s oil market whilst the USA, China, India and Russia

contribute the most to the worldwide agricultural industry. Evidently, some countries are more specialised in areas of the production process than others, and Adam Smith’s notion of the division of labour clearly explains these trends.

Take the example of Apple, one of the largest companies in the world with a market cap of $2.95 trillion. From product design in Silicon Valley, California to manufacturing lines in Vietnam, thousands of businesses and millions of people in more than 50 countries are part of Apple’s immense supply chain. However, it is not just Apple that has a massive supply chain, and when all businesses are aggregated, this leads to specialisation of different tasks around the world. Consequently, some countries perform more of one task than another due to their abundance of resources or skill. The UK is specialised in financial services, with London being a global financial hub, as well as biotechnology and pharmaceuticals, one example being AstraZeneca headquartered in Cambridge. In terms of manufacturing, most work is outsourced mainly to China, where specialisation and economies of scale make it far cheaper to mass produce.

The international division of labour continues to have numerous benefits, including the world’s economic growth and contribution to general increases in the standard of living, further creating competitiveness between countries and fuelling certain nations' rise to prominent global positions.

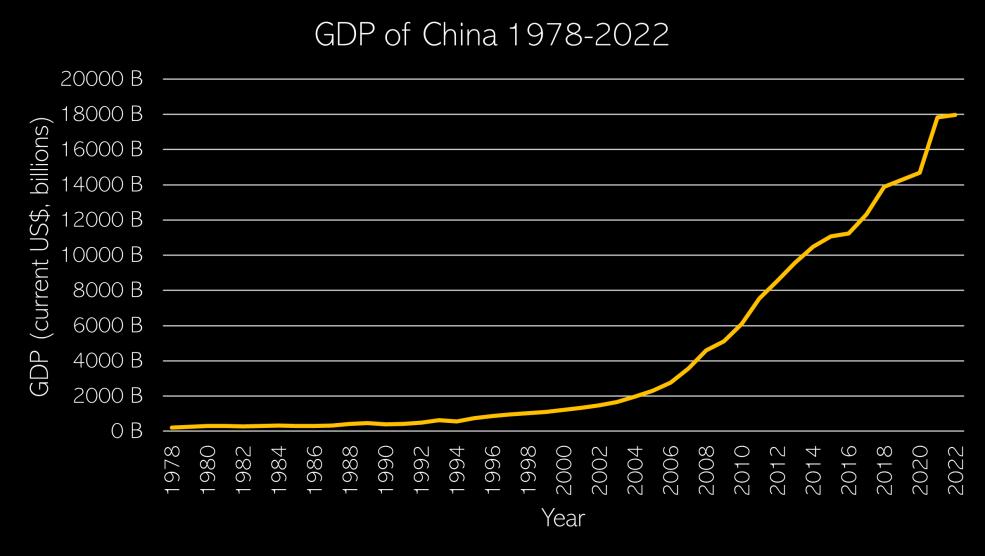

China is an evident example of the benefits of the international division of labour and miracle economic growth. Before the 1980s, China’s economy was 2% of global GDP, however now China contributes to 18% of global GDP. Economic reforms starting in the 1970s were key to China’s rapid growth. Initially, the Chinese Communist Party (CCP), after the Mao dynasty, liberalised trade and allowed foreign direct investment into the country. Although not having an immediate effect as too many businesses remained stateowned, the initial reforms allowed for more significant reforms to occur later. The second wave of major reforms occurred in the 1980s and 1990s, where China undertook a large privatisation of state-owned businesses. With the country

joining the World Trade Organisation in 2001, its private sector took off, causing an increase from $516 billion trade in goods to $4.1 trillion. At the same time, the Chinese economy moved from a planned, agricultural economy to a more liberal economy, solidifying itself as the manufacturing centre of the world. With trade liberalisation, China integrated itself into the global economy, specialised in manufacturing due to its vast labour force, leading to countries worldwide outsourcing production to China.

However, there are various drawbacks to the international division of labour, especially when supply chains become increasingly complex and large. Shipping accounts for roughly 3% of global emissions where, in a globalised world with manufacturing and distribution on different sides of the planet, emissions become increasingly high. Furthermore, this division of labour can lead to exploitation within certain industries and countries. Although regulations within the supply chain are tight in some countries, the same regulations cannot be enforced in other countries. This has led to numerous scandals regarding human rights violations, amongst them being the notorious Nike sweatshop scandal in 1991 where workers at the Indonesian Nike factory were forced to work long hours at very low wages in appalling working conditions.

Conclusion

In a functioning global economy, the international division of labour plays a crucial role. Through the specialisation of countries in certain tasks, the production process has split creating international supply chains. Not only has this permitted the economic incorporation of countries worldwide, yet it has also contributed to an overall increase in standards of living. Whilst the international division of labour is predominantly beneficial, its consequences should not be overlooked. Governments worldwide have a social responsibility to ensure safe corporate practices, in particular developing countries whose economies are reliant on primary sectors.

Octavian M - Year 12

China and India have, for a long time, been the world’s two most populous countries, with populations of 1.43 billion and 1.44 billion respectively. However, they have only been the economic superpowers that they are today for the past few decades. The growth in this time was largely thanks to globalisation. In this article, I will be discussing the impact of globalisation on developing economies by assessing how it has impacted these two countries.

After China’s economy was opened up by Deng Xiaoping’s liberalising reforms in 1978, it began to experience immense economic growth. These reforms allowed for FDI to flow in and for Chinese entrepreneurs to set up businesses, creating an environment of competition in the Chinese economy. This, combined with the incredibly low Chinese labour costs and rapid urbanisation, created an economy in which the manufacturing sector was able to thrive at very low costs, therefore able to charge very low prices. This manufacturing boom then led to economic growth, mainly driven by exports. This can be seen in data on export revenue – Chinese export

revenue has increased from $9.95 billion in 1978 to $3.71 trillion in 2022.

Globalisation has also stimulated economic growth in China through foreign direct investment (FDI). Due to the low cost of labour, many companies offshore - the practice of companies relocating production to another country - to China and therefore must invest in the economy in order to build the factories, offices, et cetera for the production of their goods and services to take place. Between 1990 and 2022, China received a total of $3.8 trillion in FDI – a figure only beaten by the USA.

However, social inequality in China has been strongly exacerbated by globalisation and the economic growth that it has created. Because of the strong focus in the Chinese economy on manufactured goods, the economic growth has been centred around urban areas. As the growth

was so strongly driven by exports, many of these industrial cities were built on the coast in the East of the country so that goods do not have to be transported across land before being shipped around the globe. This has caused a significant urban-rural / East-West divide, with the urban East experiencing from more and reaping more of the benefits of economic growth than the rural West.

Eastern China’s GDP was over 4x larger than that of Western China in 1994, with the two regions making up 58.5% and 14.1% of national GDP respectively.

It has also caused immense damage to the environment. China is currently the world leader in fossil CO2 emissions, producing 12.6 trillion tons annually. The strong manufacturing sector is largely to blame for this due to the manufacturing of goods being a very energy-intensive sector. Damage to the environment has also come in the form of

deforestation and soil degradation as a result of the rapid urbanisation that has occurred in order to keep up with China’s economic growth and the demand for jobs in urban areas.

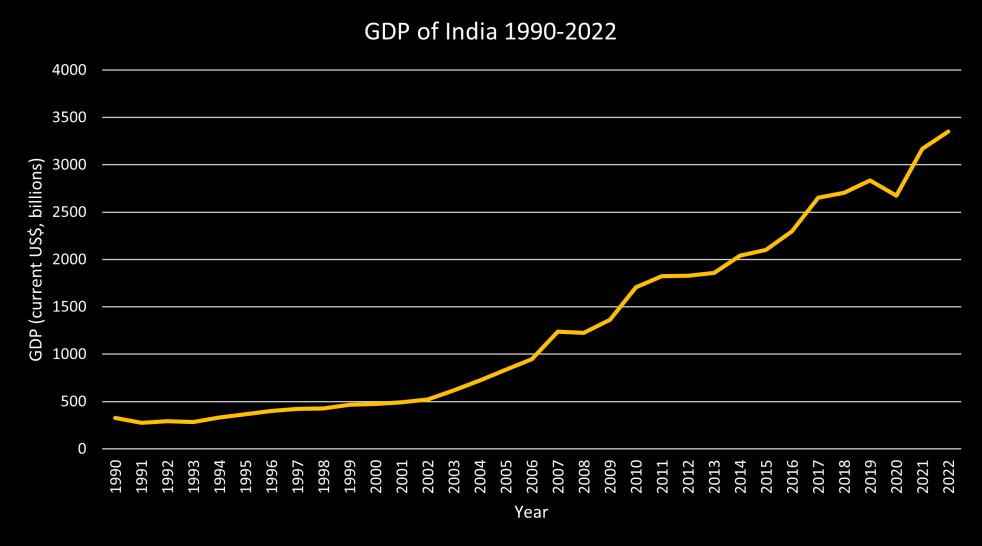

Similarly to China, India’s economic growth, while facilitated by globalisation, started with liberalisation of the economy. In 1991, the Indian government drew together a New Industrial Policy which deregulated industry and opened up the Indian economy to FDI. This improved the Indian economy as it allowed for a surge in services

exports through, for example, the importing of better technology due to the increased the FDI ceiling, pre-approving all FDI up to 51% foreign equity participation. This then allowed the Indian services sector to boost its international competitiveness.

However, unlike the growth of the Chinese economy, economic growth in India was based around the services sector rather than the manufacture of goods. Today, the services sector makes up 54.9% of the GDP of India. The IT sector is particularly important, contributing 7.4% to GDP. The importance of IT is even more apparent when looking at exports, with IT making up over a third of the £468 billion India earned through exports in 2022.

Another similarity to China is the impact of foreign direct investment. The growth of India’s services sector has been strongly driven by FDI, with the country receiving $972 billion since the turn of the century from many companies including Google and Microsoft. This FDI has led to the transfer of technology between India and the rest of the world, leading to an increase in the productivity and competitiveness of the Indian economy.

Due to the dominance of the services sector, relative to China, India’s growth has been centred around jobs which demand more highly-skilled workers and therefore jobs which pay more. This has led to a more significant demographic change in India in terms of classes, with the presence of a rising middle class in India being more present. This, alongside the cultural exchange that globalisation causes, has led to a shift in consumer spending and a demand for higher quality goods and services.

However, there is still awful inequality, as is present in China. Because of the focus around services, the economic growth was still largely in the city. This means that while the major cities, particularly the IT hubs such as Bangalore and Hyderabad, experienced rapid economic growth, the countryside was left behind.

Another inequality experienced in India is gender inequality. This can be seen in the gender pay gap, with the country having an economic parity of 39.8%, meaning the average salary for a woman are 39.8% of the average salary for a man. However, this is less significant than the inequalities seen in China as many companies actively sought to employ women and they provided flexible working hours to women in case they had to juggle the burden of professional work and domestic work.

Another negative impact is the impact on the environment. While 2.6 trillion tons of CO2 ever year may not sound like much when compared to China, it still makes India the third biggest producer of carbon in the world. Additionally, India too experienced rapid urbanisation so faced the problems of deforestation, water pollution and the like.

Overall, as seen in the cases of India and China, globalisation is able to stimulate rapid economic growth, especially when paired with liberalising government policy. However, due to the knock-on impacts of inequality and environmental degradation, it is important that government policy must also be put in place in order to redistribute income and improve sustainability.

Matt K - Year 12

Globalisation is used to define the process of integration between countries, businesses, and people, on a worldwide scale. The first signs of globalisation were observed only recently, in the early 20th century, when countries more fully embraced “outward-oriented” trade. The ability to access goods and services from other countries would result in greater strain being put on corporations, as suddenly their market became much more competitive, as companies scattered across the world can suddenly provide the same goods and services as domestic corporations. This effect of globalisation has resulted in the formation of massive multi-national corporations (MNCs), such as Microsoft, Google, and Amazon.

Before the process of globalisation began to kick off, countries would still engage in trade with one another, just on a much smaller scale. This was

partially due to the lack of easy cargo transportation, but also because of less world-wide integration. As technology progressed, it became much easier to engage with other countries and communities, hence trade became more prevalent. This increase in connectedness would result in countries importing goods from foreign businesses, which increased the supply of goods and services, but in turn made the market for certain items more competitive. For example, if a corporation in the UK had a monopoly on cars in the UK, and there was no foreign trade, the corporation would have no competition, as there would be no other way for residents of the UK to access cars. If the UK were then to openly trade with the rest of the world and were to import cars from a German corporation as well, the original UK corporation would have competition, as consumers in the UK could choose between the British and German cars

that they now have access to.

An increase in competition can have both negative and positive impacts on the economy. On the one hand, an increase in competition could result in companies developing better products in order to retain more consumers. which would have very positive effects, whereas on the other hand, the increase in competition could make it difficult for smaller start-up companies to gain traction after foundation, which could reduce options in the market. In some cases, corporations have found a way to distinguish themselves from their competition, which has led to them dominating not only their domestic market, but the global market as well. For example, Microsoft revolutionised computing technology, which led to them rising in popularity throughout the world, eventually turning them into a corporate superpower. If globalisation had not occurred, whilst they would have likely dominated the technology markets in the US, they would not have had access to other consumers across the world, and so would likely not have grown as big, as they would have much fewer customers

Whilst globalisation has proved very beneficial to large MNCs, such as Amazon and Microsoft, it can have negative effects on smaller start-up companies. Due to the integration of many countries, plenty of large markets have been fully saturated, as people from across the world can

share their companies. This makes it very hard for smaller businesses to grasp a foothold in the economy, as most ideas have already been had. The market is also dominated by corporative giants, meaning it is hard to draw attention and attract business when starting a small company. This unfortunately makes it very difficult to begin a company, which has negative effects on economic growth, as a lack of entrepreneurship impacts the productivity levels of an economy.

The ability for large corporations to expand their market internationally has resulted in the domination of many markets by large companies. For example, Amazon is currently the main figure in the retail market, reaching out to 58 different countries, and being used by 1.2 billion people. These types of numbers would simply not be achievable without increased globalisation. Large corporations have also been known to encourage globalisation, by pushing past borders to expand their businesses. For example, the West India Company extended its reach to the Caribbean and the Americas. Establishing new trade routes for the purpose of increasing customers would also serve to drive globalisation, which would lead to more companies expanding their markets to a global scale.

Thankfully, many countries, such as the UK, have set out policies to encourage the creation of new companies. For example, the UK employs tax breaks for start-up companies. This means that newer companies can earn profit without the effect of corporation tax, up to a certain point, meaning the risk of starting a new company is reduced slightly, as it becomes easier to earn back the money that was originally invested into the company. However, whilst this policy has some effect, it is unlikely that it would result in a drastic change – the fact is that, mainly due to globalisation, most markets are fully saturated, making it very difficult to find any sort of foothold as a newer corporation.

Another impact of globalisation on MNCs is resistance to demand-side shocks. Before the surge in globalisation seen in the 20th century, a demand side shock in an economy would affect companies greatly, as a decrease in demand for goods and services would drastically impact profits in corporations. This could have further negative effects for the economy as well. A lack of profit in companies could mean they would have to fire some workers, as they could not cover employment expenses, meaning a decrease in demand is likely to affect unemployment levels as well. However, nowadays, a decrease in demand for goods and services in a country has less of an impact on corporations, particularly dominant MNCs. This is because a shock in one country might affect profits somewhat, however these companies now have sources of income from across the globe, and hence are less likely to be drastically affected by negative changes in one economy.

Overall, globalisation can have great positive impacts on companies. It makes it easier for companies to grow, as countries are more integrated, and it becomes easier to import goods and services to other areas. It increases the number of potential consumers for corporations, and so companies have a greater potential to grow. It can also increase the security of companies, as the impact of a shock in one country has been greatly diminished, due to the widespread economic activity of many MNCs. However, this increased integration has led to an increase in the difficulty in creating start-ups, as many markets have become much more saturated than they would have otherwise been. In some cases, globalisation could serve to aid the growth of smaller companies, however. This is because it would allow smaller corporations to access consumers from across the world, giving them a market which is much bigger than it would have been otherwise. The trade-off for a larger market is the increased difficulty to establish oneself in these markets, and therefore the effects of globalisation can both hinder and aid smaller companies.

Rory W - Year 12

It is common to think of globalisation as an inexorable, self-driving process which is fueled by remarkable technological advancements. However, the reality is that interconnectedness from globalisation is very unpredictable and uneven. This article will explore the evolution of globalisation, shedding light on its driving force as well as its drawbacks.

To pinpoint the beginning of globalisation, we must journey back in time to ancient civilisations, in which trade routes such as the Silk Road were key in the exchange of goods, ideas and cultures between the East and the West. This occurred between 130 BCE and 1450s, which created the groundwork required for more extensive global networks. This period experienced the movement of numerous commodities. Examples include silk from China, spices from India, and gold and silver from the Roman Empire, which nurtured a preliminary form of global interconnectedness.

The Age of Exploration in the 15th and 16th centuries was another significant phase in early globalisation. Driven by an insatiable desire to seek out new trade routes and resources, European explorers discovered America and trade routes connecting to Asia. Columbus’s discovering of America ended pre-Columbian civilisation, while Magellan’s circumnavigation opened the door for the Spice Islands, which bypassed Arab and Italian middlemen. Although relative to total GDP trade was small, the impact on lives was extraordinary. As potatoes, tomatoes, coffee and chocolate were introduced to Europe, this triggered the price of spice to fall steeply. However, economists today wouldn’t regard this era as an era of true globalisation. Despite trade becoming more global, the resulting global economy was still siloed and uneven. The global supply chains, established by European empires, operated on a model of exploitation, including the slave trade. In turn, this created a mercantilist and colonial economy, far from a globalised one.

We refer to the initial major wave of modern globalisation as Globalisation 1.0, which occurred during the 19th century and continued until World War I. Impelled by technological advancements in the realms of transportation and communication, this era experienced developments of steamships and railways. This would significantly reduce travel costs and time.

During this period, European powers, notably Britain, dominated trade. Demand for raw materials and new markets was induced by the Industrial Revolution, driving imperial expansion and integrating Africa, Asia and the Americas into a Eurocentric global economy. Globalisation’s impact was evident: annually, trade grew by 3%, with exports skyrocketing from 6% of global GDP in the early 19th century to 14% by World War I. In the words of economist John Maynard Keynes, “The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole Earth.”

Investment was also more global due to investors in major cities funding international projects such as Suez Canal and railways in India. This led to an

increase in foreign direct investment (FDI) encouraging global connectivity. However, this period also gave substantial power to colonial powers resulting in large amounts of exploitation, often limiting how much benefit local populations really experienced. Since there was heavy reliance on a few dominant economies, this made the global system vulnerable to shocks. This led to widespread disruptions, and contributed to World War I.

The end of World War II led to Globalisation 2.0, in which there was the establishment of international institutions. At the Bretton Woods Conference in 1944, the International Monetary Fund (IMF) and the World Bank were founded. Their purpose was to ensure the global financial system was stable, while still aiding reconstruction. In 1947, The General Agreement of Tariffs and Trade (GATT) was established and had the purpose of reducing trade barriers so international trade could thrive even more.

The post-war period experienced high economic growth, with the United States at the summit as its

currency became the primary reserve currency. Technological advancements meant mass production was on a high which expanded international trade networks. Furthermore, mass media allowed ideas to spread swiftly across borders resulting in a more interconnected global culture.

Despite various conflicts and rising geopolitical tensions such as the Cold War in this period which hindered the effectiveness of economic exchanges between different blocs and gave way to a more divided world, Globalisation 2.0 was the perfect preparation for the next phase of globalisation.

We mark the late 20th century as the onset of Globalisation 3.0. This was propelled by the digital revolution and the internet. Information and communication technology (ICT) advancements meant the way firms operated changed. Exchanging information and transactions became seamless, strengthened by the introduction of personal computers, mobile phones and the World Wide Web. This completely revolutionized how people accessed information and communicated, accelerating globalisation’s progress.

The fall of the Berlin Wall in 1989, coupled with the collapse of the Soviet Union in 1991 concluded the Cold War era, started a new phase of improved interconnectedness. Eastern European nations made the transition towards market economies, while China’s economic reforms, initiated by Deng Xiaoping in the late 1970s, led to China’s entrance into the World Trade Organisation (WTO) in 2001 and proved to be a pivotal moment for global trade and investment.

The rise of global supply chains facilitated the optimisation of production efficiency as the various manufacturing processes became distributed across multiple countries. This concept draws from the theories of comparative advantage put forth by economists like David Ricardo. For example, countries with abundant natural resources, such as oil-rich nations in the Middle East or mineral-rich countries in Africa, specialised in the extract and export of these resources. Meanwhile, countries with highly skilled labour forces, like Germany or Japan, focused on manufacturing high-tech components and machinery. Other nations, particularly in Southeast Asis, became hubs for labour-intensive manufacturing, producing consumer electronics. This permitted the reduction of costs.

Regardless of its many benefits, Globalisation 3.0 still brought many challenges that the world had to face. Rapid technological advancements meant that various sectors lost the need for manual labour and replaced workers through automation, resulting in wage inequalities in many industries. The financialization of the global economy led to

increased volatility in financial markets, resulting in crises such as the Asian Financial Crisis in 1997 and the Global Financial Crisis in 2008. These crises highlighted the need for effective regulations.

Today, a new phase of globalisation unfolds, marked by the dominance of two global powers: the United States and China. The forefront of this phase lies in the cyber world. The digital economy, which was in its infancy during the third wave of globalisation, is prominent through e- commerce, digital services and 3D printing. It is bolstered by artificial intelligence advancements but faces significant threats from cross-border hacking and cyber-attacks.

Simultaneously, we are witnessing the expansion of negative globalisation, especially through the global impact of climate change. Pollution in one region can be the trigger for extreme weather events in another. Deforestation in critical areas such as the Amazon rainforest, the so- called “green lungs” has a devastating effect on not just the world’s biodiversity, but its capacity to cope with hazardous greenhouse gas emissions.

In conclusion globalisation has been a powerful driving force in improving economic connectivity and growth across the globe, creating a more efficient global economy. Through analysis of history, the evolution of globalisation can be seen, changing from basic trade between regions to the complex, integrated process which exists today. However, it is important to recognize the various challenges which globalisation gave rise to, most evident in the stark inequalities between different areas of the world. International Institutions should continue to carefully follow new advancements and update regulations regularly to effectively manage globalisation and limit the risks and negative impacts that globalisation can bring.

Ray L - Year 12

Labour mobility is the movement of people from one place to another. This often occurs when people seek improved pay in other countries, resulting in migration in today’s world.

In an interconnected economy, labour mobility plays a key role in ensuring gaps in employment are filled. Many migrant workers travel abroad seeking employment, where pay is far higher, whilst others leave their countries due to war and unstable political circumstances. With over 281 million international migrants, it is essential to assess the economic implications of global labour mobility.

For host countries, migrant workers play a crucial role in the economy, filling essential roles in healthcare, construction, agriculture, and technology. Consequently, sectors struggling with local labour shortages are greatly benefited by influxes of migrant workers. In the United States, for example, the tech industry heavily relies on skilled workers from India and China to maintain its innovative edge. These workers also contribute to their home countries through remittancespayments the workers send back home. According to the World Bank, remittances to low and middleincome countries reached $540 billion in 2020. This money is often spent on education, healthcare, and housing, fostering development, and reducing poverty. Furthermore, this influx of labour is crucial for host countries as migrant workers are one of the main ways in which developed countries deal with ageing populations.

However, a study by the National Bureau of Economic Research found that a 10% increase in the number of immigrants in the workforce could reduce wages for native low-skilled workers by about 1.7%, showing a negative consequence of migration on host countries.

The effects of labour mobility on source countries are very impactful. One of the most profound impacts is the fact that highly educated and skilled professionals, such as doctors, engineers, and scientists, leave their home countries for better opportunities abroad. While this migration can lead to better living standards for the individuals involved, it often leaves critical sectors in the source countries understaffed and underdeveloped. Whilst these individuals would be crucial for local development, they have left their original communities in search for opportunities abroad, leaving these regions with a less skilled labour force.

For instance, many countries in Sub-Saharan Africa and South Asia face severe shortages of healthcare professionals because many doctors and nurses have emigrated to more developed nations. Subsequently, this exacerbates public health challenges and limits the capacity of these countries to provide adequate medical care to their populations. Additionally, the emigration of skilled workers can hinder economic development in source countries. Industries that rely on technical expertise, such as information technology and engineering, may struggle to grow and innovate without sufficient human capital. Ultimately, this can create a vicious cycle where the lack of opportunities drives more people to leave the country, further depleting the talent pool.

On the other hand, remittances from migrant workers provide a lifeline for many families in source countries. These financial transfers help to alleviate poverty, improve living standards, and support local economies. For many developing nations, remittances constitute a significant portion of national GDP. For example, in countries like Nepal and the Philippines, remittances account for a substantial percentage of the economy, helping to fund infrastructure projects, education, and healthcare services. In 2022, Nepal’s remittance

payments accounted for 22.8% of GDP, a significant portion. However, reliance on remittances can also have drawbacks. Economies that depend heavily on remittances are vulnerable to economic downturns in host countries. If migrant workers lose their jobs or face wage cuts due to economic crises abroad, the flow of remittances can diminish, leading to economic instability in the source countries.

Policies to manage labour mobility effectively

Managing labour mobility effectively requires robust policy frameworks at both national and international levels. Countries need balanced immigration policies that protect local labour markets whilst meeting the demand for foreign workers. This includes fair recruitment practices, safeguarding migrant workers' rights, and providing pathways to citizenship or permanent residency. In Canada, for instance, nearly 20% of the population is foreign-born, and the country has developed comprehensive immigration policies that facilitate the integration of immigrants into the workforce.

International cooperation is also crucial. Multilateral agreements, like the Global Compact for Safe, Orderly, and Regular Migration adopted by the United Nations in 2018, aim to improve global migration governance and protect migrant rights. These agreements highlight the need for shared responsibility and collaboration among countries.

The Global Compact emphasises 23 objectives,

including minimising the adverse drivers that compel people to leave their home countries and enhancing availability and flexibility of pathways for regular migration.

Regional initiatives play a significant role as well. The European Union's free movement policy allows citizens of member states to work and live in any other member state, facilitating labour mobility within the EU and contributing to economic integration and growth. However, this requires strong coordination and harmonisation of labour standards to prevent exploitation and ensure fair competition. According to Eurostat, there were approximately 17 million EU citizens living in another EU country as of 2020, underscoring the significance of regional mobility.

Labour mobility is now a crucial part of the global economy. Without it, some of the richest countries would be crippled. Labour mobility seems like an ideal way of solving ageing populations and low birth rates in developed countries. Although remittance payments provide a solid short-term income for source countries, their ability to develop fully in the future may be limited. The effects on source countries should be closely watched and we should ensure that negative effects of immigration out of these countries are limited.

Globalisation and trade wars represent a doubleedged sword for growth in developing countries. Whilst globalisation can be essential for the expansion of a country’s economy, due to the influx of foreign enterprise and trade into the country, trade wars can disrupt these opportunities due to the imposition of tariffs that do not just impact the countries they are directly targeted at. The USChina trade war, a significant economic conflict between the two largest economies in the world, began to take shape in 2018 under the administration of President Trump. The origins of this trade dispute are over trade imbalances, intellectual property theft, and what the US perceived as unfair trade practices by China.

Trade wars disrupt established supply chains, diminishing trade volumes and amplifying costs for industries and consumers alike. Under the Trump administration, the United States adopted a more protectionist trade policy, with the imposition of tariffs, quotas and other trade barriers, which led to

mixed effects on both economies when the effects of the trade barriers set in. This trade war led to increased costs for American consumers and businesses, disrupted supply chains, and caused uncertainty in the global market. In particular, this trade war had great impacts on emerging markets and less developed economies. Emerging markets being heavily reliant on exports, are particularly vulnerable to global trade disruptions. The trade war between the US and China highlighted the fragility of these economies, which often depend on stable international trade to sustain growth. Less developed economies can often suffer from reduced export revenues and economic instability when their trade partners are involved in a trade war.

Despite this, trade wars can present advantages for third-party nations. These conflicts can create new trade pathways, enabling countries to diversify their exports and promote economic growth and prosperity.

Vietnam stands as a prime example of a country that has capitalised significantly on globalisation and strategic economic reforms. The Doi Moi reforms, (initiated in 1986), marked a pivotal shift towards liberalising trade policies, promoting economic growth, attracting foreign investment, privatising state-owned companies, and integrating into the global trading system. These reforms aimed to catalyse the Vietnamese economy and reduce the trade deficit. As a result, Vietnam has consistently recorded annual GDP growth rates of 6 -7%, positioning it among the fastest-growing economies globally. This remarkable growth has also precipitated a substantial decline in poverty, due to an increase in real wages, leading to better standard of living, and also more employment as the economy expands, illustrating the transformative power of globalisation and economic liberalisation.

The US-China Trade War: A Catalyst for Vietnam's Economic Gains

The trade conflict between the United States and China has further propelled Vietnam’s economic ascent. The imposition of tariffs on approximately $200 billion worth of Chinese goods by the Trump administration created a vacuum in the US market.

Given the similarities between Chinese and Vietnamese production capabilities, Vietnam emerged as a significant beneficiary, experiencing a 40% surge in exports of tariff-affected products to the United States. This shift underscores how developing countries can strategically position themselves as alternative suppliers during trade disputes, thereby enhancing their trade balance as their exports increase to eclipse the relative value of their imports. The resultant expansion of exportoriented industries has not only boosted productivity via capitalising on economies of scale but also increased employment opportunities, fostering broader economic development.

Adverse Impacts on Sub-Saharan Africa: A Comparative Analysis

Despite these potential benefits to some third-party countries, to others the trade war primarily between US and China represents a great problem. Sub Saharan African countries have experienced decreased commodity prices due to the trade wars. As the Chinese economy slows, their demand for raw materials like oil, similarly slows. Due to the reduced demand, global oil prices fall and countries like Nigeria, which are heavily reliant on oil exports, face reduced revenues. Due to this reduced global demand for a number of essential resources, Nigeria and other similar Sub – Saharan countries will suffer, due to their commodity-heavy export

numbers. In addition, as trade restrictions on China prompt African countries to seek alternative trade partners, they inadvertently expand American influence within their economies. This shift can lead to a dependency that undermines long-term economic stability and autonomy.

The socioeconomic repercussions of trade wars are profound, particularly for developing countries. A decline in export demand can precipitate business closures and downsizing, leading to increased unemployment. Workers in export-driven sectors, such as mining and raw materials in Sub-Saharan Africa, are especially susceptible to these economic demand side shocks.

Additionally, the reduction in Chinese exports results in a decline in aggregate demand (AD) in Sub-Saharan economies. These economies heavily depend on capital goods such as machinery, electronics, and vehicles. Without these vital imports from China, their productive capacity significantly suffers. Furthermore, trade wars indirectly increase inequality and poverty in developing economies as countries tend to be more reliant on export income and the revenue decline arising from fewer exports means that less money can be spent on healthcare, education and other social programs. This disproportionality impacts poorer sections of the population who benefit most from public healthcare and similar public goods, leading to the widening of income inequality, along with poverty increases.

To mitigate the adverse effects of trade wars, developing countries must pursue economic diversification. For instance, it would be advantageous for Nigeria to expand its economic base beyond raw materials to include sectors like services and technology. Diversification can enhance economic resilience, enabling countries to better withstand global economic fluctuations. However, this transition poses significant challenges, including the need for substantial investment in infrastructure, education, and technology.

In addition, it is important that Sub Saharan developing countries expand their existing trade

partnerships to spread their export revenue risk. For example, it would benefit Sub-Saharan African countries to seek to strengthen trade ties with emerging markets and regional trade blocs, thereby reducing their dependency on a single economic partner.

Trade wars pose significant challenges for developing countries, disrupting export markets and causing commodity price volatility. These economic problems translate to socio-economic adversity like job losses, increased poverty and inequality. By using strategies aimed at diversifying economic activity and enhancing diversity and efficiency of trade, developing countries can build more resilient economies and resist the problems associated with trade wars. The US-China trade war, initiated by the Trump administration’s tariffs on Chinese goods, aimed to address trade imbalances and intellectual property theft but resulted in increased costs and economic uncertainty for both countries. Winners and losers amongst other countries depend on a number of factors. In their research on how the USChina trade war affected the rest of the world, the National Bureau of Economic Research note that the heterogeneity in exporters’ responses to tradewar-induced price changes was more impactful than by specialisation patterns but conclude that the countries that benefited the most were those with a high degree of international integration, as proxied by their participation in trade agreements and foreign direct investment’.

Thus, trade wars highlight the need for effective global governance mechanisms and cooperation as countries have increased motivation to strengthen international institutions and agreements. Institutions like the World Trade Organisation are crucial in maintaining a fair and open global trading system, promoting trade liberalisation, and supporting economic stability, especially for vulnerable emerging and developing economies.

William C - Year 12

The Democratic Republic of Congo is known to be one of the most resource-rich countries in the world. Its untapped deposits are estimated to be valued at more than 24 trillion Dollars. 140 years after discovery, if a new nation was created using only the DRC's land, it would become the second biggest economy in the world. That is assuming no internal conflict, labour exploitation by multinational corporations (MNCs), and complete transparency of the transactions of the government and firms within its economy. These factors have all plagued nations with the potential to be a global economic power, all thanks to the resources within their borders. This article explores what those beyond the borders can do to mitigate these problems.

A way in which globalisation can prevent the resource curse is through increasing transactional transparency and accountability. A lack of transparency within low-income emerging countries prevents the public from holding government officials accountable for implementing policies to improve welfare nationally. This creates the opportunity for abundant natural resources to be used as a siphon for higher wages for governments and multinational corporations, due to the lack of disclosure of transactions.

To mitigate this, outside parties need to encourage governments and multinational companies to follow disclosure and anticorruption policy, and to administer domestic growth policies that would otherwise be overlooked by personal wants. Consequently, one policy that has been implemented is the Dodd-Frank Act, passed by the US Congress in 2011. The Act requires all extractive -industry companies that produce annual reports for the US Securities and Exchange Commission to disclose the description and sum of payments made to governments, eliminating the potential for

backroom deals. In this case, globalising this regulatory jurisdiction would increase worldwide transparency, whilst also removing problems of global competitiveness for US-based MNCs who would also put political pressure on removing the regulation.

Adding to this, numerous transparency initiatives such as the Extractive Industries Transparency Initiative (EITI) and Open Government Partnership (OGP) also support the disclosure of a wide range of government and business operations. However, with increased disclosure comes the need for understanding of the disclosed information. Currently, the global demand for this skill by far exceeds existing funding for programmes, giving light for donors to increase financing. This could be achieved through funding the World Bank's Global Partnership Facility for Social Accountability, for which a commitment of $15 million over 4 years would double available resources.

Consider MNCs as agents of globalisation. According to a recent study, MNCs often have excessive consideration for shareholder needs and the opposite for stakeholder needs in the extractive industry. Whilst MNCs appreciate the impact shareholders and debtors have on their success, it is their stakeholders and employees that ultimately have effects on the wealth of MNCs. As a result, MNCs must show more interest in the local government and employees' interests too, which is shown to benefit the socio-economic growth and development for resource-rich countries, in turn helping MNCs in their relationship with the local government. Even more rational global business leadership would include creating sustainable employment and continuous professional development for the local public.

But how can we do this? Currently, the desire for

profit maximisation that MNCs carry causes them to exhibit rent-seeking behaviour. They use their competitive advantage of more efficient technology and better information of extractive industries (mainly oil and gas) to create unnecessary barriers to entry. This helps them maintain market dominance. To capitalise on this, after obtaining profits from extracting resources, MNCs perform rigorous transfer pricing schemes to maximise tax avoidance. Transfer pricing is the practice of setting prices for goods and services that are transferred between different parts of a multinational company across borders. This is also carried out to satisfy shareholder desires. However, this aggressive profitseeking behaviour carried out by MNCs often leads to the neglection of corporate social responsibility (CSR) as the transfer pricing means that money is moved away from the resource-rich country. CSR includes responsibilities such as community engagement, fair labour practices and environmental protection, all improving local socioeconomic conditions. Therefore, to prevent transfer pricing, tax rates across borders should be set at similar levels (depending on other factors) to disincentivise transfer pricing. This is known as global tax harmonisation. Keeping money in the resource-rich country would incentivise MNCs to comply to CSR regulations which would improve local standards of living, preventing the resource curse. Currently, the G20 and OECD have agreed upon a proposal for a global minimum tax rate to combat this, and the EU is also involved in forming an international tax framework.

to ensure that revenue streams from the project are used to meet poverty reduction and sustainable development targets.

Through its low cost and lack of enforcement requirements, the policy seems ideal for providing support to economies that have discovered natural resources, mainly low-income ones. However, this indirect policy does not guarantee a fix to the problem. There is the obvious incentive for highincome countries to allow MNCs established in their nations to source resources from extractive resources elsewhere, usually at lower costs to bring higher profits. The fact that most representatives

Following the last two scenarios, regulation is clearly necessary in countries that suffer from the natural resource curse. This has especially come to light since the turn of the century. In 2004 the European Investment Bank, the lending arm of the European Union, published the extractive industries report. With the emphasis on low-income developing economies, the report mentioned that an international body should be responsible for assessing the viability of a natural resource extraction project in a country (following discovery) given its political and socioeconomic factors. Furthermore, the body (in collaboration with other financial institutions and international organisations) should continuously monitor the project if approved

that form the international regulatory bodies are of high-income countries means the chance of confirmation bias to approve resource extraction projects is high. It is the European Investment Bank, of course. However, if the international bodies in collaboration can consist of countries that have experienced a crisis because of abundant natural resources, and recovered from them, then this can help reduce the bias, and it may also improve the criteria for assessment and monitoring.

It is evident that this phenomenon has not gone unanswered. Numerous policies have been proposed in the hopes of putting natural resources to better use and achieve a greater standard of living. However, more needs to be done. Upon initial observation, this problem is larger than anticipated, and so while I feel that we are on the right track, future policies to be approved must compensate for the complexity of this issue.

Globalisation is the integration of markets, products, and information across the world. In recent times, it has largely boosted economies across the world, though its effects have been both positive and negative. This article will focus on how globalisation can influence income inequality globally, specifically the distribution of income amongst individuals and demographics within a society across the world.

Globalisation has allowed economic growth to bloom across the world by opening markets, facilitating trade, and enabling efficient supply chains. This has allowed certain countries to utilise their specialisation and take advantage of it, allowing them to have more efficient production and higher overall economic output. An example of this is China, where labour is relatively cheap when compared to other countries, resulting in other nations outsourcing their production to them. This means that costs of production are lowered, which can then be reflected in consumer-facing prices. Emerging markets have benefited from FDI (foreign direct investments) and access to international markets that arose because of increasing globalisation. Since China began to open up and reform its economy in 1978, GDP growth has averaged over 9 percent a year, and almost 800 million people have lifted themselves out of poverty, with countries such as India seeing similar benefits. The integration of these economies into the global market has created millions of jobs, raised incomes, and improved living standards for large segments of their populations. In these cases, globalisation has played an important role in reducing poverty and helping economic development. On the other hand, there are cases where globalisation has led to the uneven

distribution of economic growth and wealth, as the level of development a country has impacts its ability to take advantage of opportunities provided by globalisation. In the UK, the income of the richest 20% of people was over six times higher than that of the poorest 20%, while the richest 10% received 50% more income than the poorest 40%. This is a clear example of a developed country and its widening income inequality.

Globally, income inequality between countries has shown signs of decreasing. Developing countries have seen faster rates of growth compared to already developed countries, which has led to a convergence of incomes. This is evidenced by the rise in the middle class in countries such as China, India, and Brazil and is one of the positive aspects of globalisation. The closing gap between rich and poor countries just shows how globalisation is a

useful tool capable of balancing global economic disparities. However, the story is more complicated when we dive in and look at income inequality within countries, as for many countries, globalisation has been the cause of rising income inequality.

The labour market dynamics and their disruption are one such example. Many countries outsource their manufacturing and services at a fraction of the cost compared to domestic price levels. Many companies also relocate the processes (typically operational) of their businesses to other countries, which is known as offshoring, to avoid certain taxes and regulations. While these practices have benefited developing countries as more of their labour force is employed, this has also been detrimental to developed countries as it has resulted in job losses and a slowdown in wage growth for low-skilled workers.

Technology has a large role to play in globalisation, as both developed and developing countries now have more advanced technology to help with their production. Due to more automation and the use of digital platforms, those with skills focused on technology have an advantage, meaning that there is now a larger demand for skilled labour, which further widens the skill gap that is present in the labour market, contributing further to widening wage disparities. Globalisation has disproportionally benefited those in these technology sectors and has created a divide between those who can thrive in the new economy and those who cannot, further causing income inequality.

To conclude, the impact of globalisation on income inequality has been complicated, as although millions have been lifted out of poverty and economic growth has boomed, huge disparities and inequalities have occurred between different regions as a result of globalisation. In developed nations, globalisation has often led to a decline in manufacturing jobs, wage stagnation for low-skilled workers, and an increase in wages for high-skilled tech jobs, exacerbating income inequality. Conversely, in many developing countries, it has contributed to economic expansion and a flourishing middle class, though the benefits often remain concentrated among the elite. It is important for governments to recognise and act on this issue by revising current policies and creating new ones to focus on reducing and limiting the negative impacts of globalisation through schemes such as skills training, education programmes, fairer taxation, and more. By doing so, we can aim for a global economy where prosperity is more equally shared. Understanding and tackling the effects of globalisation on income inequality is essential for creating a fairer and more sustainable world for everyone.

Jonny P - Year 12

Advancements in science and technology have been the main driving force in globalising the world economically, culturally and socially. This article looks at the specific impacts of these developments and analyses them through various indicators. This theory that these advancements have been the main reason for globalisation was backed up by a study done by the World Economic Forum (WFO), where technological innovations such as the internet and advanced logistics systems have strengthened the myriads of links and connections that exist between companies, regions and countries in the present day.

The impact of scientific and technological development on the global economy.

The rapid development of science and technology has encouraged the process of global economic integration. Firstly, advances in science and technology have accelerated the speed and scale of information dissemination and facilitated the flow of all factors of the economy. Through new technological means such as e-mail, the Internet and mobile communications, companies can conduct business faster and reduce their reliance on geographical location, reducing transaction costs and improving efficiency. Secondly, advances in science and technology have created new industries and provided new contributors to economic growth. For instance, the advancement of Internet technology has facilitated the growth of ecommerce, enabling traditional enterprises to expand their global markets through online sales and cross-border e-commerce. Similarly, scientific and technological innovation has also led to the development of high-tech industries such as new energy, advanced manufacturing and biotechnology, providing new opportunities for upgrading the economic structure and sustainable development.

The development of science and technology has also had a profound impact on the labour market. The emergence of new industries and companies has pushed many opportunities into the job market, increasing the demand for high-tech talent, encouraging international talent mobility and improving the efficiency of the allocation of human resources to highly specified jobs. On the other hand, the application of automation and intelligent technology has made many jobs in certain sectors redundant or has at least started to, hinting at the possibility of mass layoffs and an uptick in unemployment rates which will eventually reduce once society has adapted.

The impact of scientific and technological development on global culture

The advancement of science and technology has significantly facilitated the integration of global cultures. Primarily, the prevalence and advancement of the Internet have made the transmission of information both efficient and accessible, enabling individuals to engage with and share the cultures of different countries and religions through online media such as music, films, photography and more. This has formed a basis for understanding and exchange between disparate cultures, reducing cultural barriers and promoting cultural diversity. The 20th century has seen a significant expansion in the use of social media platforms, which have enabled individuals to interact and communicate without the restriction of borders, sharing their life experiences and cultural perspectives. This kind of globalised cultural sharing helps to increase common knowledge and shared values among cultures and promotes the integration and development of global culture. The development of science and technology has also facilitated the emergence of new cultural industries

and art forms, sometimes digitising traditional cultural products such as music, film, and television, allowing for more widespread engagement. This has injected new vitality into the cultural and creative industries. At the same time, emerging technologies such as virtual reality technology and augmented reality technology have also brought new possibilities for artistic creation and cultural experience, enriching the connotation of global culture.

The impact of scientific and technological development on global society

Science and technology have had an influence on the way society runs today, changing the way of life and influencing the social relations of people. First, improvements in science and technology accelerated urbanisation processes. Development in high-speed transport, building designs, and cities increases the convenience and comfort of people's lives, hence attracting a large influx of people to urban centres. Paired with this rapid urbanisation, come traffic congestion and pollution which often present significant challenges for the population. Additionally, the introduction of all these new technologies has completely changed the way that society engages with one another, with a large part of daily interactions moving online, whether it be on social media, messaging services or games. New technology allows people to do things online that they never even thought were possible previously, altering the structure of society. This also brings many challenges in the form of cyber security and the potential risks that short-form content and prolonged time on screens can have, especially for younger generations.

Finally, the development of science and technology has changed the structure and order of global society. The widespread use of information technology has led to changes in the form and operation of social organisations, fostering the emergence of decentralised social networks. People can share information and organise actions through channels such as social media, increasing social participation and public discourse. This change in social structure provides new platforms and opportunities for building a democratic and just society.

In conclusion, the rapid development of science and technology has had a significant impact on globalisation. From an economic, cultural and social perspective, science and technology have promoted the process of global economic integration, facilitated the spread and integration of global culture, and changed people's lifestyles and social structures. However, it also faces challenges such as information security and resource imbalances, which require the global community to work together to achieve a more sustainable and inclusive globalisation process based on scientific and technological development.

Lok W - Year 12

The Russo-Ukrainian war has caused economic shockwaves all around the world. This has been most notably felt by us through changes in prices of oil and fuel as a result of disrupted supply chains. However, for millions of people the consequences of the war include losing their families and having their homes crumble because of a conflict raging ever since the disbandment of the USSR. This isolated incident is one of many in the world, with political tensions persisting between North and South Korea, and Palestine and Israel. This article will aim to understand how such political tensions influence the economy both globally and in the countries affected by war.

The war between the states of Russia and Ukraine has arguably had the biggest impact on the world economy, the greatest effect being on fuel. Russia is a big exporter of non-renewable resources such as oil and natural gas (this is obtained in the resource rich Volga-Ural oil and gas provinces located in the south of the country). Cutting the supply of fuel to western countries allowed Russia to retaliate against sanctions imposed by the United Nations which affected the UK significantly as prices of fuel rose dramatically, leaving many unable to use their cars due to insufficient fuel availability. Another considerable economic impact on the global economy due to this conflict has been the decrease of food exportation by Ukraine. Ukraine is known for having some of the most fertile land in the world, even being referred to as “the breadbasket of the Soviet Union” before its dissolvement, having been responsible for 30% of the USSR’s total food production. However, blockades made by Russia, for example in the Black Sea, have discouraged transportation companies

from delivering food out of Ukraine, meaning that global food markets – especially ones in Europehave suffered greatly. This has been reflected in price changes of certain food products as firms and governments rushed to find alternative supplies.

Another conflict which has had a particularly unique effect on the global economy is the war between Israel and Palestine. This conflict, similar to the Russo-Ukrainian war, has contributed to rising oil prices. Even though neither nation is a major producer of oil, their conflict has led to instability in the Middle East. The region includes some of the biggest exporters of non-renewable

energy such as Qatar and Saudi Arabia, which have access to the largest natural gas reserves in the world. Delays have also happened on shipping as Houthi rebels launched missiles towards ships passing through the Suez Canal, causing companies to reroute the freights away, an example of this being the Bab al-Mandab Strait. Subsequently, the rerouted journey makes shipping more expensive and time consuming. Moreover, the economies of Israel and Palestine themselves are affected significantly. Asides from the obvious considerations of substantial investment into defences and attack, investor confidence in the region has fallen dramatically. This has been reflected in a decrease of FDI (Foreign Direct Investment). However, a

influence of the Soviet Union, and the south being capitalist under the USA’s influence. The border between these two nations, known as the DMZ (demilitarised zone), is the most heavily guarded area on the planet. Tensions between these countries have also led to tensions rising between the United States and North Korea – most notably between ex-president Donald Trump and Kim Jong Un.

In conclusion, the rise of political tensions between countries has led to an increase in prices of necessities. This has been reflected in our economy today as we have been forced to find equivalents for Russia’s oil and Ukrainian produce. Consequently, the conflict resulted in reduced supply despite equal demand, leading to large amounts of excess demand. Furthermore, tensions in the Middle East led to higher prices due to lower investor confidence, having the potential to further destabilise the whole region. The historic conflict between North and South Korea ever since their division in 1945 has led to mass amounts of political instability, not solely between the two nations, but also between North Korea and allied nations of South Korea, such as the USA. Coupled with the strict rules of the North, the tension has further led to the border between the two countries being heavily guarded, rendering emigration out of North Korea impossible. Ultimately, political tensions affect the global economy in countless ways, and a solution needs to be found to ensure worldwide political stability and trust in global powers.

unique effect of this war is that its extensive coverage on social media has led people to undergo a mass boycott of big brands to put pressure on the countries for a ceasefire.

Having been unified since the Silla dynasty in the 7th century, Korea split in 1945. This split originally led to tensions over the two nations’ political control; the north being communist under the

S - Year 12

A $33,500 investment in the S&P 500 in 1973, would now be worth a staggering $5.1 million. The median home price in the US since 1973 has increased from $33,500 to $431,000 today. When it comes to investment, there have consistently been two contenders for the top spot: property and stocks. This debate over whether to invest in real estate or stocks is far from a new one; this has been discussion point among investors for decades with compelling arguments for each side. On the one hand, investment in property involves a tangible range of physical assets along with the potential for rental income and the prospect of capital appreciation over time. On the other hand, investment in stocks can provide investors with the opportunity to make significant returns as well as the advantages of diversification. The choice between these two investment routes is not simple; it depends on an array of factors such as financial goals, risk tolerance, market conditions and more. In this article the differences between these two methods of investing will be explained, exploring for whom these methods are best suited as there is no right answer for everyone.

Firstly, we must explore what property investing entails, and what benefits it could have. Property investing, also known as real estate investing, involves the purchase, ownership, management, rental, or sale of real estate for profit. There are various property investment strategies with the most popular being ‘buy to let’. At its core, property investing involves purchasing a property, securing a tenant, and collecting rent - this is the most traditional method of property investing. Investors can decide whether they would like to buy the property with a mortgage or with 100% cash. If one were to buy a property with a mortgage and rent it out, the aim would be for the rent to be higher than the mortgage repayments, therefore the tenant would be

essentially paying off the mortgage. Eventually, once the mortgage is fully paid off, the investor will own the property outright, effectively having the tenant cover the cost. Subsequently, if house prices are rising, an investor could benefit from an appreciation of the value of the house. This seems extremely straight forward however there are catches. Often it can be difficult to find a tenant, resulting in periods where no rent is being paid. Tenants can also cause difficulties, such as not paying rent or damaging the property, leading to additional costs for repairs. Consequently, it often isn’t the case that an investor can simply get a mortgage on a property, rent it out for more than the payments, and own the property out right in 20 years’ time. However, if you were to buy in cash, house prices do generally trend upwards over 10–20-year periods. Similarly with inflation, rents increase which provides a hedge against the potential rising costs of living. Another method of property investment is through adding value, where an investor buys a property, renovates it, and sells it for more. Portfolio diversification is another method of real estate investment involving investing in a variety of properties, including both houses and apartments, and both new and old properties. This diversification should also include both long term ‘buy and hold properties’, as well as fix and flip properties to create stability.