Anotefromtheeditors

EconomicPersepectivesisthePerseEconomics Magazinededicatedtostudentsrunbystudents. Publishedtermly,EconomicPersepectivesseeksto explorethecomplexworldofEconomicsonatheme-by -themebasis.

ForourSummeredition,wehavechosenthetheme Crisis.Theworldtodayfeelsincreasinglyunstable.From geopoliticalissuessuchastheUkrainewar,Israel-Hamas andincreasingtensionsinAsia,todomesticissuessuch assluggishgrowth,in��ationandwideninginequality.Eveninternationaltradeseemstobeunder threat,withtariffsandprotectionismmakingacomeback.Crisis,itseems,isthede��ningbackdrop intoday’seconomy.

Thiseditionincludesfourteenuniquearticlesdivingintomanyaspectsofcrisissuchaseconomic, politicalandsocialissues.Thiseditionalsoincludes��vetimelypiecesoncurrentaffairsandtwo insightsintofamouseconomistswhoseideashaveshapedhowweunderstandandrespondto crises.Wealsohave4bookreviewsfromtheChristmasBookReviewCompetition.

Thecollectionofdiversearticlesaimstoshowcasethediversityanddepthofthoughtwithinour writers.Fromre��ectiveessaysonhistoricalturningpointstosharpanalysisoncurrentglobal tensions,wehopethateverysinglearticleofferssomethingthatinformsandinspiresyou.

We’reveryexcitedtosharethiseditionwithyou!Astheworldnavigatesthecurrentuncertainty, webelievedrawingattentiontothesetopicsmattermorethanever.Weinviteyoutodiveinand enjoytheSummereditionofEconomicPersepectives!

RichardZ,AshvikG,SamR

WhatDidtheDotComBubble

TeachUsAbout TechHypeand MarketMania?

Thedotcombubbleoccurredduringthelateyears ofthe1990'sandwasacrashthatwascausedby overoptimismsurroundingthedevelopmentofthe internet.Inasmallperiod,hugeamountsof internet-basedcompaniesstarted,andprofessional investorsandthepublichadthebeliefthatthe internetwouldtransformtheeconomy.Thisledto largescaleinvestmentinthesecompanies.

Thisoccurredprimarilyduetothewidespread beliefthatanyinvolvementwithintheinternet wouldleadtohugepro��ts,despitethecompany’s realstability.Thisoptimismandthesubsequent expectationsweremassivelymisplacedconsidering thesecompanieshadlittletonovalueandnoreal pro��t-makingplan.Manyofthemhadnomore thana‘.com’label.Despitethis,therevaluestill rocketedundertheassumptionthat��rstentryinto theinternetworldwouldguaranteefutures success.Eventuallythebubbleburstintheearly 2000's,andtrillionsofdollarsofvaluewerelost. Thistaughtvaluablelessonstosocietyaroundthe issuesofmisplacedexpectationsandtherisks aroundhypedrivenvaluations.

Therapidin��ationoftechstockpricesduringthe dot-combubblewasanexampleofspeculative mania.Thisiswhenpeopleinvestbasedonpublic excitementratherthan��nancialindicatorsshowing itstruevalue.Herdingbehaviourwasalso displayed,aspeopleirrationallyinvestedinto

internetcompaniespurelyintheaimto‘followthe crowd’. Psychologicaleffectssuchas overcon��denceandcon��rmationbiasfurther helpeddrivethesevaluationsup.Peoplewerenot onlyexcitedaboutthefutureoftheinternet,but theywerealsoafraidnottoinvestinit,believing thatinnotdoingso,theywouldmissoutonlarge pro��ts.

Oneofthebiggestlessonsthatinvestorshave learntfromthebubbleisthatvaluedoesnot alwaysliveuptohypeandoptimisticexpectations setuponthesecompanies.Evenwhennew technologysuchastheinternetistransformative, manyoftheoriginalcompaniesfailandonlya smallproportiongoontoachievesuccessinthe market.Manyofthecompaniesthatcollapsed duringthecrashwerenotwrongaboutthefuture ofinternettechnologyortheirsubsequentideas, buttheyweretooearlyintothemarketwhichled tothembeingpoorlymanagedandbuilton unstablebusinessmodels.(Thisdidhoweverlead tosecondentrantshavinghugesuccessasa result.)AnexampleisWebvan,acompanywhich expectedtheriseofonlinegroceryshopping,butit expandeditsoperationsatanunsustainablerate, astheyhadnotbuilttheef��cientlogisticsbehind it��rst.Thisfailureshowsthatbeingaheadof othersinthemarketmeanslittlewithout��nancial discipline.

However,somecompaniessuchasAmazonand eBaysurvivedthecrashandhavegoneonto becomedominantretailersinthemarket,somuch thatitisnearlyimpossibleforothermarket entrantstoendure.Thiswasbecausetheycreated stablebusinessplans,growingtheircompany sustainablybeforetheirdramaticincreasein valuation.Eventually,allowingthemtomakelarge pro��tsthatwerestableandjusti��ed.Amazon focusedoncustomersatisfactionandlong-term planningwhilstothersimilarcompaniesattempted tothriveofftheshort-termhype.Thiscontrast showsthatevenduringperiodsofspeculation, lastingtechnologiescanstillbedeveloped,evenif manyoftheearlyentrantstothemarketfail.The dot-combubblespedupthedevelopmentofkey infrastructure,suchasdatacentresand broadband,whichhavenowbecomethe foundationsoftoday’sdigitaleconomy.

Anotherkeylessonfromthecollapseisthatall valuationsmustbebackedbysigni��cantdata ratherthanpureoptimism.Duringthebubble, investorsneglectedtraditional��nancialanalysis andwerevaluingcompaniesbasedoffpredicted webtraf��candpossiblefuturemarketshare,even thoughthesethingsmayneveroccur.Theeventual burstandcollapseremindedinvestorsthat businessesmustsustainablygeneraterealrevenue beforegoingontoeventuallyturnapro��tto increasetheirvaluation.

Theselessonsremainimportanttoinvestorsin today'seconomy.Overthepastdecade,areassuch ascryptocurrenciesandAI,haveallseensimilar signsofhypeandoverspeculation,re��ecting previouspatternsseeninthedotcomera.Likethe internetinthelate90’s,thetechnologybeing developedtodaywillbesigni��cantinshapingthe future,andthismaycausehypetoonceagain alterinvestmentsmadebythepublic. Furthermore,thespeedofcommunication nowadays,withplatformssuchasX,meansthat thesespikesdrivenbyhype,occurmuchmore rapidlythantheypreviouslydid,thusreducingthe timeforrational��nancialanalysis,pavingtheway formoreimpulsivebehaviour

Inconclusion,thedot-combubbleprovidesa lastinglessontoinvestorsthatwhileinnovation candriveprogressandfuturedevelopments, uncheckedhypeandoverspeculationoftenleadsto economicdamageandcollapse.Thecrashrevealed thedangersofignoringfundamentalanalysisin favourofoptimism,andhowirrational,herd-driven investingcandistortmarkets.However,thebubble alsohighlightedthatperiodsofextreme speculationcanprovideabasisforfuture breakthroughs,asevidencedwithcompanieslike Amazon.Asthemoderneconomymovesintonew technologicalinnovation,basinginvestmentson solid��nancialprinciplesandindications,will remaincrucialinavoidinganothercollapse.

GeorgeS,Y12

HowCrisesShapeEconomic Policy

AlmostacenturyhaspassedsincetheGreat Depression,themostsevereeconomicdownturnin modernhistory.WithGDPfallingby30%, unemploymentrisingtohistoriclevelsof25%and industrialproductionhalving,ittookoveradecade toreturntopre-depressionoutputlevels.

Economistsaccreditthiscrisistofourmainfactors: thestockmarketcrashof1929;thecollapseof worldtradeduetoincreasedimportduties;bank failuresandpanics;andthecollapseofthemoney supply.

wartimeeconomy.AsKeynesianismwasadopted, ��scalpolicysustaineddemandandprioritisedfull employment.Theresultwasstronggrowth,low unemploymentandrisinglivingstandardsacross theindustrialisedworld.Thisbecameknownasthe ‘GoldenAgeofCapitalism’. ThatwasuntiltheGreatIn��ationofthe1970s.

However,muchofthiswasmadeworsebythe starkfailuresofclassicaleconomics.

Theoilcrisesof1973and1979–causingoilprices toskyrocket–-triggeredsharprisesinin��ation andstagnantgrowth.Keynesianismcrumbled underthisweightinfearthattighteningpolicy wouldincreaseunemployment,allowingin��ation tospiral.

Asmarketsandunemploymentspiralled,the commitmenttoalimitedgovernmentrevealedits ��aws.Fallingincomesandincreasedsavingfurther depressedconsumptionandworsenedthe downturn.However,JohnMaynardKeynesargued thecaseforactivegovernmentinterventionto stimulatedemandandsupportemployment.

ItwasonlytillthepostwarerawhenKeynesian economicsbecamewidespread.Beforethis, governmentswereforcedtotakeunprecedented controloverproductionandlabourtomanagethe

Monetarismgainedtractionbyemphasisingthe controlofin��ationthroughmanagingthemoney supply,ratherthanrelyingongovernment spendingtostimulatedemand.Monetaristsargued thatmonetarypolicywastooloose–withthe moneysupplyalmostdoublinginthe1970s–contributingtosigni��cantin��ation.Thistheory wasmostnotablyadoptedbytheUSFederal ReserveunderPaulVolcker,wheninterestrate hikesandtightermonetarypolicybroughtin��ation downfromdoubledigits.

ItwasthreedecadeslaterwhentheGlobal FinancialCrisismarkedanotherpivotalmomentfor economicpolicy.Triggeredpartlybyacollapsein thehousingmarketandexcessiverisk-takingby ��nancialinstitutions,thecrisisledtoameltdown oftheglobal��nancialsystem.Inresponse, governmentsandcentralbankswereforcedto abandonstrictmonetaristorthodoxy.Instead, therewasanintroductionoflargestimulus packages,interestrateswereslashedtonearzero andcentralbanksbegantousequantitative easing.

ThismarkedareturntoKeynesianism,combined withtheimportanceofthemoneysupplyin monetarism,knownaspost-Keynesianeconomics. Currenteconomiccrisispolicyremainslargelythe same.ThiswasseenintheCOVID-19pandemic, whengovernmentsunleashedvast��scalstimulus andcentralbankseasedmonetarypolicy.

MaxPlanck,theNobelPrizewinningphysicist, famouslyremarkedthat“scienceadvancesone

funeralatatime”.Bythathemeantthatrather thananyonechangingtheirmind—inresponseto reasonableargumentorthepresentationofnovel data—newideasgraduallyreplaceolderones. Muchofthesamecanbeappliedtoeconomic theory:itadvancesonecrisisatatime.Thefailure ofpolicymakersintheGreatDepressionspurred theadoptionofKeynesianism,theGreatIn��ation ledtotheadoptionofmonetarismandthe2008 crisisrenewedfocusonbanking.

Despitethis,therehasalsobeenarevivalof discreditedideas.TherecentattemptsbyPresident Trumptoturntoprotectionism–placingsteep tariffsonanumberofmajortradingpartners–mirrorstheeconomicnationalismofthe1920s. Then,thehightariffscontributedtoacollapsein internationaltrade,whichdeepenedthedownturn. Historywouldsuggestthatsuchpoliciesrarely deliverlastingprosperity

WillG,Y12

TheAsianFinancialCrisis (1997)VsTheEuropeanDebt Problem(2010)

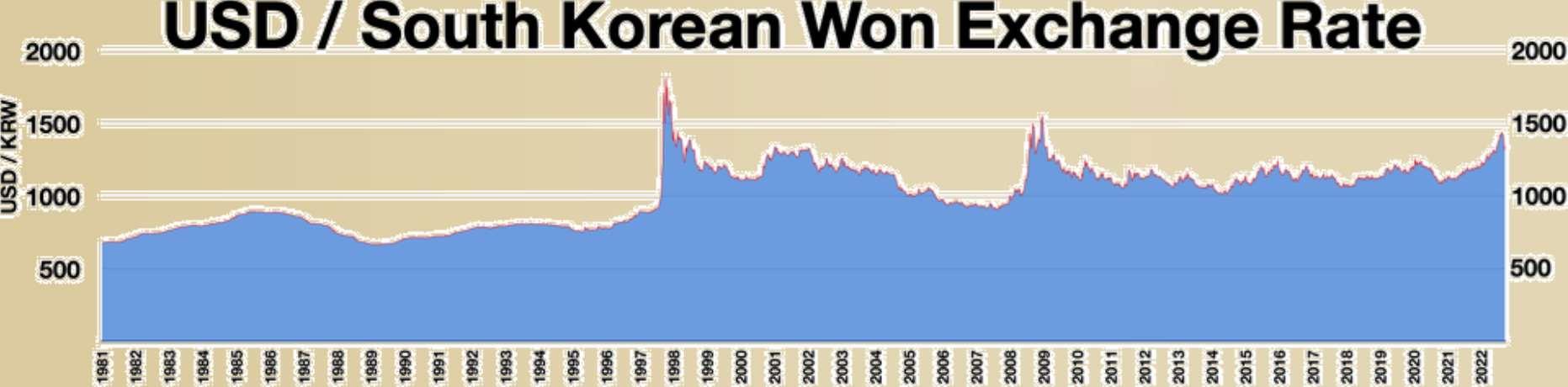

TheAsianFinancialCrisis(AFC)of1997startedin Thailand,onthe2ndofJuly,followingthe devaluingoftheThaiBhat,aftertheThai Governmentarti��ciallystrengthenedtheBhat.This wasduetothelackofforeigncurrencysupport,in a��xedexchangerateagainsttheUSDollar.A��xed exchangerateiswhereacountry’scurrencyis “pegged”toanothercurrency,wheretheCentral Bankmaintainsthe��xedvalueviaapredetermined rate.ThecrisislaterspreadtoJapanandSouth Korea,whichbothsawthedevaluationoftheYen andWon,respectively.Thiswasfollowedbya devaluationoftheJapaneseStockMarkets,anda decreaseinthevalueofassetpricesinJapanand SouthKorea,withanincreaseinconsumerdebts.

corporationssawstockpricesfallonWallStreet, partlyduetothedevaluationoftheRussianRuble andseveralLatinAmericancurrencies.For example,CitigroupandJ.P.Morgantookhitsfrom RussianbonddefaultsandlargeLatinAmerican

debtrisks,andthe 1998WallStreet Crisis,wheretheDow Joneslost~20% fromJuly-Sept.of 1998.

Inthe4largestAssociationofSoutheastAsian Nations(ASEAN)economiesofSingapore, Indonesia,MalaysiaandThailand,theforeigndebt toGDPratiorosefrom100%to167%,inthe periodfrom1993-96,withapeakat180%during theworstofthecrisis.Thenewlyindustrialised northerncountries,suchasChinaorJapanfared muchbetter,onlysufferingagenerallossof consumerdemand,andcon��dencethroughoutthe region.TheInternationalMonetaryFund(IMF) launcheda$40billionrescuepackagetostabilise thecurrenciesofSouthKorea,Thailand,and Indonesia.However,itdidlittletoaddressthe worseningdomesticcrisisinIndonesia.Thisis illustratedbySuharto,theIndonesianpresident anddictator,beingforcedtostepdownafter30 yearsinpowerin1998,inthewakeoftheriots thatwerecausedbyadrasticdevaluationofthe IndonesianRupiah.TheeffectsoftheAFCpersisted into1998.Duringthistime,manymultinational

TheECBsetlow interestratesthat encouragedNorthern EuropeaninvestorstolendheavilytoSouthern countries.Atthesametime,Southerneconomies wereincentivisedtoborrowduetothecheap credit.Thisledtotheaccumulationofthede��cit intheSouth,incountrieslikeGreece,Spainand Italy.TheGreekrevelationinlate2009,wherethe budgetde��citwas15.4%ofitsGDP,anditsdebt toGDPratiowas126.8%,triggeredafurtherwave ofalossofinvestorcon��dence.Thisledtoa soaringofbondyields,inthefearsofadefault, whichcanbeseenwherebyMar.2013,the10yearBondYieldofGreecepeakedataround

42%.The2008–2009GlobalFinancialCrisis worsenedtheEuropeanDebtCrisisbyexposing vulnerabilitiesintheECB’sbankingsystem.Rising governmentdebtfrom��scalstimulus,combined withlowgrowthandmarketinstability,made recoverymoredif��cult.TheresponsebytheECB, underthePresident,Trichet,initiallyfocusedona stimulustocatalysetherecoveryoftheEurozone members,butwhentheEurozonein��ationrate roseto2.8%by2011,duetotherisingoilprices causedbytheArabSpring,theECBraisedinterest ratestwicein2011,from1.0%to1.5%fromAprJul2011.ThisworsenedtheEurozonedebtcrisis, asbyincreasingtheinterestrate,ata“one-size-

��ts-all”mindset,wouldexacerbatetheSouthern economies,reliantonforeignlending,whilstfailing toaddressthecauseofthein��ation,whichwas supplyside,ratherthandemandside.Many EuropeanbanksofwealthierEurozonecountries, suchasGermanyorFranceheldlargeamountsof SouthernEuropeandebt.Duetotheincreasein bondyields,themarketvalueofthesedebtassets plummeted,threateningtheir��nancialstability. ThisisillustratedthroughthecollapseofDexiain late2011,aFranco-Belgianbankwithheavy exposuretotheGreekandItaliandebtcrisis.

Incomparison,thecollapseofthe��xedexchange ratesoftheSoutheastAsianCountries,suchasthe BhatorRupiahwasthecauseofexcessiveshorttermborrowing,whichcumulatedtoalarge foreigndebt,combinedwiththeirweakbanking sectors,ledtothesocialunrestseeninIndonesia. Regionally,thecrisisdevastatesASEANeconomies throughmassivecurrencydevaluationsandledto thecollapseoftheRublein1998,andtheIMF responsepushedmillionsintopovertyinthe region.Internationally,theAFCledtothesmaller WallStreetcollapse,whichforcedaFED-bailout, andthe1999currencycrisisinBrazil.Incontrast, theEuropeanDebtCrisisworsenedtheregional inequalities,splittingthericherNorthernmembers fromtheSouth,highlightedbyGreecesufferinga youthunemploymentrateofaround33%. Internationally,itthreatenedthevalueoftheEuro, whichrequiredECBintervention,suchasthe “whateverittakes”intervention.Bothcrises highlightedthesocialcostsof��nancialinstability. InAsia,theeconomiccollapsesparkedviolentriots inIndonesia,thatendedSuharto’sdictatorship, whilstinEurope,theDebtcrisisfuelledtheriseof Syriza,Greece’santi-austerityparty,which opposedgovernmentspendingduringarecession. IntheJanuary2015elections,Syrizawon149 Parliamentaryseats;2shyfromanoutright majority,whichre��ectedwidespreadangerover theECB’simplementationsofausteritymeasures. However,theirrecoveriesalsocontrasted,with SoutheastAsiaabletoincreasetheirexport-led growth,toboosttheiraggregatedemandandit sawmostASEANeconomiesrecoveringtoprecrisislevelsbytheturnofthecentury.However, SouthernEuropesufferedfromadecadelong periodofstagnation,withtheGreekRealGDP growthsince2009,being16%lowerin comparisontothelevelssince2008.Therefore, theAsianFinancialCrisissuggeststhatcrisis responsesmusttaketheshort-termstabilityand long-termcompetitivenessintoaccount,whilstthe EuropeanDebtCrisisdemonstratesthedangersof anoncoherentmonetarypolicy,and��scalpolicy, wheretherecannotbea“onesize��tsall”solution, andthateachEurozonemember’seconomyneeds differentreforms

HarryL,Y12

BlackWednesday,the1992 SterlingCrisis

OnSeptember16,1992,theUnitedKingdomfaced aseismic��nancialcrisisthatwouldbe rememberedasBlackWednesday.Thisdaysaw theBritishpound'sabruptexitfromtheEuropean ExchangeRateMechanism(ERM),asystemaimed atstabilisingexchangeratesamongEuropean currencies.TheeventreshapedUKeconomic policy,tarnishedthegovernment'sreputation,and elevatedthein��uenceofcurrencyspeculators, mostnotablyGeorgeSoros.Thisarticledelvesinto thecauses,events,andlastingimpactsofBlack Wednesday,offeringaclearperspectiveona de��ningmomentineconomichistory.

TheERM,establishedin1979,wasacornerstone ofEuropeaneconomicintegration,designedto minimizeexchangeratevolatilitybypegging membercurrencieswithinanarrow��uctuation band.TheUKjoinedinOctober1990underPrime MinisterJohnMajor,��xingthepoundat2.95

DeutscheMarks(DM)witha±6%��uctuation range.ThemovewasintendedtocurbtheUK’s persistentin��ationandalignwithEurope’spush formonetaryunity.

However,thetimingwasunfavourable.TheUKwas grapplingwitharecessionandhighin��ation,while Germany,adominantERMmember,facedthe costsofreuni��cation.TheBundesbank’shigh interestrates,meanttocontrolGermanin��ation, strainedweakereconomiesliketheUK,which neededlowerratestospurgrowth.Thiseconomic mismatchsetthestageforthepound’sprecarious positionwithintheERM.

Bymid-1992,theERMshowedsignsofstrain.The poundtradedneartheloweredgeofitspermitted band,andspeculativepressureintensi��ed. Currencytraders,includinghedgefundmanager GeorgeSoros,betheavilythatthepoundwas overvaluedandunsustainableatitspeggedrate.

Severalfactorsfuelledthisscepticism.TheUK’s recessionwarrantedlowerinterestrates,butERM membershiprequiredhighratestodefendthe pound,sti��ingrecovery.Germany’shighrates strengthenedtheDeutscheMark,makingitharder forweakercurrencieslikethepoundtomaintain theirpegs.DisagreementsamongEuropeanleaders overmonetarypolicyweakenedtheUK government’scommitmenttotheERM,aspublic andpoliticalsupportwaned.Hedgefunds,ledby Soros’sQuantumFund,amassedmassiveshort positionsagainstthepound—reportedly$10 billion—anticipatingitsdevaluation.

ChancellorNormanLamontvowedtodefendthe pound’sERMpeg,signallingreadinesstoraise interestratesanddeployforeignreservesto counterspeculators.

BlackWednesdayunfoldedwithrelentlesspressure onthepound.Asmarketsopened,thepoundfaced intenseselling.TheBankofEnglandintervened, spendingbillionsinforeignreservestobuypounds andbolsteritsvalue.Todeterspeculators,the governmentraisedinterestratesfrom10%to12% earlyintheday.Whenthisfailed,asecondhiketo 15%wasannounced—anunprecedentedmove. Despitetheseefforts,thepoundcontinueditsslide towardtheERM’slowerlimit.Speculators,sensing weakness,intensi��edtheirselling.Byevening,with reservesnearlydepletedandthepoundstill falling,ChancellorLamontannouncedtheUK’s withdrawalfromtheERM.Thepoundwasallowed to��oat,resultinginanimmediatedevaluation.

TheBankofEnglandreportedlyspent£3.3billion inreservestonoavail.GeorgeSoros,dubbed“the manwhobroketheBankofEngland,”earnedan estimated$1billioninpro��ts.Theaftermathof BlackWednesdaywassigni��cant:Thepound’s devaluationbyroughly15%madeUKexports morecompetitivebutraisedin��ationandimport costs,affectingconsumers.JohnMajor’s Conservativegovernmentsufferedasevereblow toitsreputation,contributingtoitslandslide defeatinthe1997election.FreedfromtheERM, theUKadopteda��exiblemonetarypolicy, graduallyloweringinterestratestoaidrecovery. ThecrisisalsowasafactorintheBankof England’sindependencein1997.

BlackWednesdayleftalastingmarkontheUKand global��nance.Thecrisisfuelleddoubtsabout Europeanmonetaryintegration,in��uencingthe UK’sdecisiontooptoutoftheEuroandservingas atouchstoneforEurosceptics.Theevent highlightedthepowerofhedgefundsand speculators,exposingthefragilityof��xed exchangeratesystems.Thecrisisrevealedthe ERM’sinabilitytoaccommodatedivergent economies.TheItalianlira’sexitin1992further weakenedthesystem,pavingthewayforreforms leadingtotheEuroin1999.

BlackWednesdayhighlightedthechallengesof maintaining��xedexchangeratesinaglobalized economy.Itshowedthatmarketforcescan overpowerevenwell-resourcedgovernmentswhen economicfundamentalsaremisaligned.FortheUK, thecrisiswasapainfulbutcruciallessonin prioritizingdomesticeconomicneedsoverrigid internationalcommitments.

BlackWednesdayremainsalandmarkineconomic history,illustratingtheperilsofmisaligned monetarypoliciesandthepowerof��nancial markets.Whileitbroughtimmediatehardship,it alsosetthestageforamoreresilientUK economy.ThelegacyofSeptember16,1992, continuestoinformdebatesonmonetarypolicy, Europeanintegration,andthedynamicsofglobal ��nance. CameronR,Y12

TheCrisisof Overconsumption:How BusinessesAreFuelling

Buyer’sRemorse

Youjustboughtanewphone.Minuteslater,a noti��cationpopsup“Customerswhoboughtthis alsopurchasedtheseaccessories.”Youclick,you spend,andbytheendoftheday,yourbudgetis blownandyourbankaccount’scrying.Thisfamiliar scenarioisahallmarkofmodernecommerce.We liveinanerawhereconsumerspendingis frictionless,impulsive,andoftenaddictive.Butthis isn’taccidental-it’sbydesign.

Asbusinessesperfecttheartofupsellingand personalization,consumersareleftgrowthbuyer’s remorseanddebt.Isthisclevermarketingan emergingcrisis?Thisreportdelvesintohow strategicbusinessdesignsactivelyfuel overconsumptionanditssigni��cantpersonaland economicconsequences.

-the-wheeldiscounts,countdowntimers,and exclusive��ashsales-thatmimicaddictivereward cycles.Theseplatformsutilisethesameconceptas betting/gambling,promotingimpulsivebuying behaviourevenforitemsconsumerdoesn'ttruly needinreality.

Modernbusinessesleveragedeeppsychological insightstostimulatepurchasing,transformingthe actofbuyingintoanunconsciousdrive.Ecommerce hasbecomeatestinggroundforperfectingthese techniques,makinginnovationfasterandfaster.

Purchasingisdeeplyconnectedwithdopamine,a neurotransmitterassociatedwithmomentswhen rewardandpleasureishigh.Critically,dopamineis releasednotjustuponreceivingareward,butin theanticipationofit-adynamicheavilyexploited inonlineshopping.Thedelaybetweenorderand deliverymaximizesdopaminespikes,keeping consumersengagedandcravingtheeventual oftheiritem.

Theuseofscarcityandurgencytechniquestrigger lossaversion,wherethefearofmissingout overtakesrationaldecision-making.Examples include,“Only2left!”and“Buyinthenext15 minutes.”Thesetacticsincreasesalesbyleadingto emotionalandimpulsivepurchasesthatmany consumerslaterregret.

Moreover,businessescapitaliseonthecriticalpostpurchasewindowwhentrustanddopaminelevels

Thisisnoaccident.PlatformslikeTemuandTikTok Shopintegrategami��edshoppingexperiences

peak.Atthismoment,consumersarehighly receptivetoadditionaloffers,especiallywhen presentedas"logicaladd-ons."Withone-click upsellsandinstant-paymentoptions,companies ensurethispsychologicalmomentumcontinues uninterrupted,keepingconsumersinacontinuous loop.

Businesseshaveremovedfrictionfromthebuying processitselfthroughinnovationslikeone-click purchasesandbiometricauthentication,making transactionprocesseasierthanever,boosting websiteconversionratesandreinforcingthehabit ofspontaneousbuyingforconsumers.

BuyNow,PayLater(BNPL)serviceslikeKlarnaand Afterpayfurtherhighlightthisissue,byreducing theinitialupfrontcost,theycreatetheillusionof affordability,leadingconsumerstospendmorethan theyotherwisewouldhavewhenvisitingthe website.TheaverageBNPLorderis18%largerthan traditionalpurchases.Thisdeferred-paymentmodel isparticularlyappealingtoyoungerconsumers,who maynotfullygraspthelong-termconsequencesof stackingmultiplerepayments.

Theresultiswhatsomecall“phantomdebt”,which are��nancialobligationsthataren'timmediatelyfelt orre��ectedintraditionalcreditscoresbutinstead accumulateinthebackgroundwithoutreal attention.Thedangerofthisisconsumers eventuallyrunningoutofmoney,increasingdebt andthepopulationbecoming��nanciallyfragile.

theitems.Around45%keeptheunwanted products,eitheroutofguilt,convenience,or perceivedobligation.

IntheUK,BNPLusagehassurged,withover42% ofadultsusingitasof2025.Alarmingly,more than10millionpeoplepaidalatefeein2023,and oneinfouryoungadultsarenowin��nancial dif��culty.Thelackofregulationaroundthese services,untilrecently,allowedprovidersto sidesteprigorousaffordabilitychecks,worsening thedebtcrisis.

Despitethiscrisis,somecompaniesareprovingthat ethicalbusinesscanbegoodbusinessand pro��table.Patagoniafamouslylauncheda“Don’t BuyThisJacket”tohighlighttheenvironmental costofconsumerismontheplanetandclimate change.Themoveaccidentlyboostedtheirsalesby justover30%,provingthatauthenticityand emotionalmarketingcanbuildloyaltyfarmore powerfullythanpricedropscould.

tmorefromreplacementthan fromdurability.Fastfashionandconsumertech exemplifythisstrategy.Someproductsareoften manufacturedintentionallywithlimitedlifespans, replaceablebatteriespushing consumersintobuyingnewermodelsfasterdueto theproductqualitydecreasingovertime.

Brandscerti��edasBCorporations-whichbalance pro��twithpurpose-aregainingpopularity.Young consumersandstudentsareshowingawillingness topaymoreforproductsthatre��ecttheirvalues. A2024Nielsensurveyfoundthat73%ofglobal consumerspreferbrandsthatareenvironmentally responsibleandsociallyconscious,thenonesthat aren’t.

Toconclude,overconsumptionisnotjusta symptomofpersonalirresponsibilitytherefore,it’s abusinessstrategywhichhasbeencarefully designed.Fromalgorithmicupsellstofrictionless BNPLservices,companieshavebuiltecosystems thatencourageimpulsive,continuousspending. Whilethesetacticsdriverevenue,theyoften undermineconsumerwell-being,��nancialstability, andmentalhealth,leadingtoadangerouscrisis

A2023SimplicityDXsurveyfoundthatnearlyhalf ofonlineshoppersmadeimpulsepurchases,and 56%regrettedthem.Manycitedreasonssuchas buyingitemstheydidn’tneedoractingon emotionalimpulsestriggeredbydigitalnudges. Despitetheseregrets,manyconsumersdon’treturn

EvanJ,Y12

EconomicWarfareThrough Terrorism:Analysingthe EconomicImpactofthe2025 KashmirCrisis

TheterroristattackinPahalgamonApril22, 2025,servesasaquintessentialexampleof economicwarfaremaskedasreligiousextremism. Inadditiontothetragiclossof26lives,this operation,supportedbyPakistan,wasintentionally plannedtocausesigni��cantharmtoIndia's economicframework,primarilyfocusingonthe tourismindustry,whichaddsroughly₹2.4trillion eachyeartoIndia'sGDP.

• Currencydepreciation:2.1%againstUSD (withinRBIcomfortzone)

• Bondyieldspread:Increasedby15basis pointsbeforenormalising

India'sdefencebudgetallocationof₹6.81trillion forFY2025-26representsastrategicinvestment withsigni��cantpositiveexternalities.Thedefence expendituremultiplierinIndia'seconomyis estimatedtobeat1.4x.

TheattackinPahalgam,whichspeci��callytargeted Hindutourists,wasastrategicmovedesignedto disruptKashmir'stourismsector.Inthefollowing month,theregionfacedimmediatecancellationsof bookingsamountingtoaround₹8,500crores, withhoteloccupancyplungingfrom85%to23% injusttwoweeks.Thisnegativemultipliereffect alsoimpactslocalhandicrafts,transportation,and hospitalityservices,resultinginapproximately 180,000joblossesintheKashmirValley.

India's��nancialmarketsshowcasedimpressive systemicstrengthamidstthecrisis.Theinitial declineinmarketcapitalisationof₹4.2trillionon April30bouncedbackwithineighttrading sessions,re��ectingcon��denceamongstinvestors.

• Employmentgeneration:2.8milliondirect andindirectjobs

• Exportpotential:₹21,000croresindefence exportsby2026

• Industrialcapacity:40%increasein domesticdefencemanufacturing

Despitethecrisis,India'scurrentaccountde��cit remainedstableat1.3%ofGDP,wellwithin sustainablelimits.Theservicestradesurplusof $156billionprovidedcrucialbalanceofpayments support.TheReserveBankofIndia'sin��ation targetingframeworkprovedeffective,withcore in��ationremaininganchoredat3.8%.

• Creditgrowth:11.2%year-on-year

• Sensexvolatility:2.3%(comparedto4.7% duringthe2019Balakotcrisis)

• Governmentbondyields:10-yearyield stabilisedat7.1%

• ComparativeEconomicVulnerability:India vs.Pakistan

Pakistan'sdebt-to-GDPratioof89.2%compared toIndia's57.1%highlightsthestarkdifference in ��scalsustainability.Pakistan'sforeignexchange reservesof$9.1billion(enoughtocover1.5 monthsofimports)versusIndia's$650billion (enoughtocover11months)demonstratesthe asymmetriceconomiccapacityforsustained con��ict.

• GDPpercapita:India($2,612)vsPakistan ($1,596)

• Forexreserves/GDP:India(18.2%)vs Pakistan(2.4%)

• Currentaccountde��cit:India(-1.3%)vs Pakistan(-4.1%)

Pakistan'seconomicterrorismstrategyre��ectsits inabilitytocompetethroughlegitimateeconomic means,butthereputationalcostsandinternational sanctionscreatenegativenetpresentvaluefor Pakistan'seconomy.

India'slong-termprospectsdespitetemporary securityshocks.

Thegovernment'scounter-cyclical��scalpolicy duringthecrisisincluded:

• Emergencytourismsupportpackage: ₹15,000crores

• Defenceinfrastructureacceleration: ₹25,000croresadditionalallocation

• Borderareadevelopment:₹8,500crores foreconomicintegration

Thepolicymixofaccommodativemonetarypolicy andtargeted��scalsupportcreatedoptimal macroeconomicstabilisationwitha��scalmultiplier of1.6timesfordefenceandinfrastructure spending.

India'spotentialGDPgrowthof6.8%remains intactdespitesecuritychallenges,supportedby:

• DemographicDividend:Working-age populationgrowthproviding0.8percentage pointsofGDPgrowth

• DigitalInfrastructure:Digitaleconomy contributionexpectedtoreach20%ofGDP by2026

• ManufacturingRenaissance:Production LinkedIncentiveschemestargeting$520 billioninmanufacturingoutputby2027

ForeignDirectInvestment��owsof$83.5billionin FY2024-25demonstrate investorcon��dencein

The2025KashmircrisisdemonstratedthatIndia's economicfundamentalshaveevolvedintoa strategicasset.Theeconomy'sabilitytoabsorb externalshockswhilemaintainingitsgrowth momentumre��ectsthesuccessofitsstructural reforms.Pakistan'sresorttoasymmetriceconomic warfarethroughterrorismrevealsitsrecognition ofIndia'sconventionaleconomicsuperiority.Still, thediminishingreturnstoterroristtactics, combinedwithIndia'sgrowingeconomicresilience, suggestPakistan'sstrategyisbecoming counterproductive.India'strajectorytowarda$7 trillioneconomyby2030remainsintact, positioningitasthedominantregionaleconomic power.

AskvikG,Y12

Caneconomicsbe usedinwarfare? Aninsightinto OperationBernhard

OperationBernhardwasaformofeconomic warfareusedbytheNazi’sinWorldWarTwoto destabilisetheBritisheconomy.Originally,itwas namedoperationAndreasandoccurredin 1940.Theinitialplanwastodropforgedbank notesoverBritain,causinghyperin��ation, destroyingthesterlingasaworldcurrency, makingithardertotradesuppliesand��ghtawar. However,itendedin1942whenitsheadAlfred Naujocksfelloutoffavourwithhissuperiorof��cer Heydrichwithnonotesbeendistributed.The operationwashoweverrevivedlaterbutthe intentionhadchanged,SSMajorBernhardKruger wastaskedwithforgingbanknoteswhichcouldbe usedto��nancetheGermanwareffort,notably £100,000fromthisoperationwasusedtoobtain informationthatsetItalianleaderBenitoMussolini free,andtheypurchasedgoldto��nancethewar. TheintentionchangedastheLuftwaffehadtaken ahugelossinnumbersandthuswantedtofocus thelimitedresourcestheyhadonbombingBritain andnotbombingtheeconomy.

TheBritishBanknotesweremadefromwhiterag paperandblackprinting.TheBankofEnglandhad apparentlybeentippedoffaboutthescheme howeverwerecon��dent(probablyovercon��dent whenconsideredthebanknoteshadhardly changedsince1855)thatthenotescouldnotbe forgedduetosecuritymeasures.Theseincluded 150minormarks,thevignetteofBritanniaaswell asthesignatureofthechiefcashieroftheBankof England,analphanumericserialdesignation,and paperwhichhadthenocellulose.Tobreakthe

serialdesignationtheNazi’semployedbanking expertstoexaminerecordsofcurrencyandtryto replicatetheorder.Likelythehardestpartwas reproducingtheVignetteofBritannia,whichisin theboxbelow,theynicknameditthe‘’bloody Britannia’’asitwassodif��cultandsourcesstill criticisetheeyesweren’tright.Theforgerywasso precisethattheGermanscreatedwaterofthe samechemicalbalanceasBritishwater,aswhen doneinGermanwaterthepaperlookedidenticalin normallightbuttoodullinUV.Thenoteswere createdbyconcentrationcampprisoners,some Jewish,whowereskilledincraftsmanship, engraving,printingandbanking.Theprisonersnow hadelevatedlivingconditions,withaccessto cigarettes,radios,newspapers,apingpongtable andextrarations.Theunitcreatedanestimateof around£132millioninbanknotes(around5bn today)with140prisonersworkingtwotwelvehournonstopshifts.Thishighlightsthespeed,skill andexpertisethatwentintomakingsomeofthe bestforgedmoneyevermadetothisday.Some saythattheyeventriedworkingslowlysothey weren’tkilledafteritwasmade,andtheleader didn’twanttoreturntothefrontline.Atthepeak ofproductioninmid1943-44approximately 65,000noteswereproducedamonth.Inorderto furtherensurethereliabilityofthenotes,40to 50prisonersstoodintwocolumnspassingthe

notesbetweeneachother,folding,pinningcorners, writingBritishnamesandaddressesonthe reverse,addingdirt,sweat,andgeneralwearand teartopassthemoffasreplicas.Thebestreplicas, grade1,wereusedinneutralcountriesbyNazi spies,Grade2wereusedtopaycollaborators, grade3weresavedtopossiblydropoverBritain andGrade4weren’tgoodenoughtobeused.The Naziauthoritiesweresopleasedwiththese replicastheyawarded12prisoners-3Jewish,war meritmedals.SomesuspecttheuseofJewish prisonerswastohelpdisguisethemasrealnotes asJewishpeoplewouldn’tbeworkingwiththe German’sthusshouldn’thavethefakemoney improvingitsreliability.

Theeconomyisacrucialpartof��ghtingawar,if thegovernmentcan’t��nanceit,thecountrycan’t ��ghtit.InthecaseofoperationBernhard,itis confusedwhetherthismethodcanbeusedto��ght awar.Apparently,ChurchillandRoosevelthad alsoconsidereddoingsomethingliketheGerman’s butthoughtagainstitasitseemedlikeawaste. ThissentimentwasevensharedwithintheNazi’s whentheplanwasproposedReinhardHeydricha superiorof��cerheadofthepolicelikeditbutwas worriedaboutusingcriminalstodoit.Joseph GoebbelstheReichMinisterofPropagandacalledit

‘’agrotesqueplan’’andWaltherFunk,theReich MinisterofEconomicaffairs,wasworrieditwould breachinternationallaw.ItwasAdolfHitlerwho gavethe��nalapprovalforittoproceed.The operationwaslikelyquite��awedwhenconsidered theamountoftimeandresourcesthatwere distractedfromthewarefforttomakethese notes,butitislikelyconsideredasuccessasthe noteswereused.Perhapsthetoday’sequivalent wouldbecybersecurityandhackingbank accounts,��llingthemwithmoneycreating hyperin��ation.Thehopewouldbepeoplewouldn’t spendthemoneysothegovernmentcantakeit outofcirculationbutinreality,whoknowswhat wouldhappen.Otherexamplesofeconomicsused inwarfare,couldbeablockadecausingcountries tonotbeabletotradeorgetsuppliessothey cannot��ghtawar,theGermanstriedthisbyU boatingshipstoEngland.Otherexamplescould bedestroyingsupplyoffoods,orsupplylinesso resourcescan’tbereceived,expropriation(seizing privatepropertyforpublicinteresthappenedwith ChelseaFCinRusso-Ukrainewar).

Theprisonerswereveryluckynottobekilledas thecampwasliberatedbyUSforces,theleaders werenotchargedforawarcrimeforforging enemycurrencyandinsteadwereaskedbythe

Frenchtohelpthemforgepassports(they refused).ManyofthenoteswerethrownintoLake Toplitzandsincetherehavebeenmanysearches forthem.Sincebankexpertshavenamedthe

forgeries‘’themostdangerouseverseen’.Itis estimatedaround£15-20millionwereingeneral circulationbytheendofthewar.Asaresultof thisfromApril1943theBoEstoppedreleasingall notesabove£10andinFebruary1957anew£5 notewasreleased,February1964£10,July1970 £20,March1981£50.Hadthesecurrenciesbeen releasedtheBritisheconomywouldhaveswirled intoturmoil.Theamountproducedwasaround 15%ofallnotesincirculation,morethantheBoE hadinreserve.Anincreaseinthemoneysupply allowsformoremoneytochasethesamenumber ofgoods.Thismeansthatpeoplewillpayhigher pricesforthesamegoodasdemandhasincreased.

Thislargeincreaseinmoneysupplywouldhave causedhyperin��ation.Thiswoulderodethe purchasingpowerofthesterlingmakingtrade dif��cult,awarharderto��ghtandcouldhavewon Germanythewar.Thiscanbeshownthroughthe FisherEquationofExchangewhereMV=PQwhere m=moneysupply,v=velocityofmoney,p= Generalpricelevel,Q=RealGDP.Thisexplainsthat in��ationisdrivenbymoneysupplyincreases assumingVandQareconstant,andthus OperationBernhardincreasingthemoneysupply shouldresultinin��ation.

The1973OPECOilEmbargo: Causes,Crisis,and

Consequences

The1973energycrisis,alsoknownastheOilShock of1973-74,wasasigni��canteconomiccrisis,with seriousinternationalconsequences.Itwasaperiod whereoilpricesskyrocketedduetoanembargo placedontheUnitedStatesanditsWesternallies byOPECcountries.Theembargowasliftedthe followingyear;however,itsconsequenceswerefelt severelyacrosstheglobaleconomy,intheformof adecadeofhighunemploymentandstag��ation duringthe1970s

Theprimarytriggerofthe1973Oilembargowas theYomKippurWar.Thiswasasurpriseattackby Egypt,JordanandSyriaagainstIsrael,inan attempttoregainlostterritoriesfromthe1967Six DayWar.Inresponse,thenPresidentRichardNixon decidedtoprovideIsraelwith$2.2billionin emergencyaid,whileotherWesternalliesalso providedmilitaryandlogisticalsupporttoIsrael. ThisdeeplyangeredtheoilproducingArabnations intheMiddleEast,whosawIsraelastheir ideologicalenemy.DuetotheirhelpofIsrael,the ArabmembersoftheOPEC(Organisationof PetroleumExportingCountries),ledbyKingFaisal ofSaudiArabia,implementedatotaloilembargo ontheUnitedStatesonOctober17th,whichwas laterextendedtootherWesternallies.Atthesame time,byDecember1973OPECmembershad dramaticallycutproductionlevelsto25%ofwhat theywereinSeptember,aswellasraisingtheprice ofoil.Thiswasthe��rsttimethatoilhadbeen properlyusedbyArabOPECcountriesasapolitical

LukeF,Y12

weapon,highlightingthegrowingpowerthatOPEC countrieshadoverforeigneconomies.Oilproducing countriesalsosawtheembargoasadisplayof economicnationalism.Thesecountrieshadlongfelt thattheywerebeingexploitedbyWesternoil companies,knownasthe‘SevenSisters,’andsaw theembargoasawayinwhichtotakebackcontrol oftheirownresourcesandobtainmorein��uence concerningoilprices.

Inthefollowingmonthsaftertheembargo,there waschaosacrossWesterncountrieswhoimported signi��cantquantitiesofoil.Beforetheembargo,a barrelofoilwassellingforabout$2.90.By January1974,priceshadquadrupledto$11.65per barrel.Westerneconomiesthatwereheavilyreliant oncheapimportedoilfromtheMiddleEastwere hitthehardest.IntheUnitedStates,thepriceof regulargasolinerosebyaround36%inlessthana year,coupledwithgasshortagesandrationing whichledtolongqueuesatgasstations.Japan,in particularwashardhit,havingimportedsome90% oftheiroilfromtheMiddleEast,andevenhadto cutbackonnonessentialautomobileusageto preserveitsstockpile.

Theeconomicimpactswerejustassevere.Across thedevelopedworld,in��ationsurgedduetothe higheroilprices.Anewconceptof‘stag��ation’ occurred,asrisingpricescorrespondedwith stagnatinggrowth.Industrialproductionslowed, unemploymentrose,andbusinesscon��dence plummetedduringtherecessionthatfollowed. By 1980,Japan’sunemploymentrate,whichhad averaged1.0percentfrom1960to1978,was13.5 percent;forFranceandtheUnitedStates,the1980 ��gurewas15percent;fortheUnitedKingdom,23 percentasdisruptionsfromtheshockwerefelt acrosstheglobe.

Thecrisisrevealedtotheworldthevulnerabilityof manyoftheworldsmostdevelopedeconomiesto importedoil.However,forOPECcountries,the crisisthatfollowedtheembargoshowcasedthe powerheldbyMiddleEasternoilproducing countriestosubstantiallyimpacttheglobal economy,somethingpreviouslythoughtofas inconceivablefordevelopingcountries.Thiscreated

ashiftinglobalpowerdynamicswithOPEC emergingasapowerfuleconomicblockthat demandedrespectandrevampedforeignpolicy.

Inaddition,thecrisissparkedchangesfrom Westerngovernmentsregardingenergypolicy.It wasclearthatitwasnolongersafetorelypurely onMiddleEasternoil,andgovernmentsinvestedin alternativeenergysources,moreenergyef��cient manufacturingandproductsandstrategicenergy reserves.In1977,theUScreatedtheDepartment ofEnergytooverseethesechanges,whilesimilar changeswereenactedinEuropeandJapanas energybecameamuchmoreimportantfocusfor countries.

Economically,theoilcrisiscontributedtoa prolongedperiodofinstabilitythathadnotbeen seensinceWW2.CentralBanksstruggledto respondeffectivelytoacombinationofbothhigh in��ationandlowgrowth,asalteringtheBankrate wouldbene��tonesideandhindertheother.This startedthebeginningsofre-evaluationofeconomic policyframeworks,asKeynesianeconomicsfellout offashionandMonetarismbrie��yroseto prominence.Theperiodofstag��ationalso challengedthelong-heldbeliefthathigher unemploymentandeconomicrecessionswouldbe metwithlowerin��ation,asthe1970speriod provedthatthisconcept,andthePhillipscurve, wasnotguaranteed.

The1973OPECOilEmbargowasn’tjusta temporarydisruptioninsupply.Itwasaseismic event,onethatredeterminedtheglobalorder, contributedtoadecadeofeconomichardshipthat interruptedaperiodofunprecedentedprosperityin theWest,andexposedthevulnerabilityand dependenceofsomewesterncountriestoMiddle Easternoil.Duetothecrisis,governmentswere forcedtorethinkglobalrelations,diversifytheir energysourcesandaltereconomicpolicy.Moreso, itservesasareminderofthepowerthatcountries whohaveresourceshold,inaworldmore interconnectedthanever.

DylanS,Y12

Lostimagination: Thebackpedallingof innovationandthenewfound over-relianceonwhathas worked

Acrosstheextensivelifespanofeconomics, innovationhasmostfrequentlythrivedatthe crossroadsofbothnecessityandimagination.This behaviourcanbetracedasfarbackastoperiods suchastheRenaissance,whereinventorswere constantlysearchingfornewanswerstopreviously solvedquestions.Ground-breakingdiscoveriesand inventionshaveremouldedtheinterworkingof entireindustries,creatednewmarkets,andpushed societyforward,yet,inmorerecentdecades,a worrisometrendhasemerged.Atrendthat,atits core,prioritisesre��nementoverreinvention.

aversiontofacingriskshownbymodernday businesses,thepopularityofnewAItechnologyand itsinnovativenaturefordecisionmakinghascaused avastshiftinbusinesses,previouslyboundbythe pressuresofshort-termpro��tability.Companies wouldnowprefertoreapthesaferbene��tsof adoptingAIintoexistingframeworkratherthanthe riskierbreak-and-reworkstrategiesofgrowth.

Theleaderofthislatesttrendisfoundinthe increaseinthedependencyonarti��cialintelligence anditsdata-drivendecisionmaking.Whilstparading ef��ciency,itinadvertentlysuffocatescreativityby beingdesignedtoextrapolateinformationfrom provenmodels,asopposedtoexploringnewer, potentiallyriskieralternatives.Withtheincreasing

AI,however,mayinfactbedetrimentaltolongterminnovation.Thoughseeminglymoreoptimalin termsofguaranteedgrowth,bycreatinganoverrelianceonpastwinsweclosethedoorsto discoverparadigm-shiftingadvancements.

Theeconomicconceptofcreativedestructionisthe historicaldriverofinnovation.Thecycle,ofwhich outdatedindustriesarebrokendowntomakeway formorecutting-edgeones,hasinfamouslypaved technologicalprogressforcenturies.Mechanical carstakingoverthehorse-drawncarriages,digital

streamingofmusicand��lmhaserasedphysical media,andpersonalcomputingrevolutionised paper-basedworkplaces.

Today’seconomiclandscape,however,isfarmore cautious.

recommendsthatthelikelihoodofchoosing unconventionalapproacheswhichcouldspur otherwisesurprisingeconomicgrowthwouldbe reduced.

Largely,ourcurrentstartupeconomycentralises ensuringpredictablereturns.Establishedcompanies haveshiftedprioritiestopro��tabilityoverresearch anddevelopment,whichisslowlyerasinghigh-risk, high-rewarddevelopment.

Oneoftheclearexamplesofthistrendof behaviourliesinstockbuybacks.Insteadof investingrevenuesintoresearchwiththepotential ofyieldingpioneeringpotential,leading corporationsandmonopolieshaveinstead designatedincrediblesumsoftheirowncapitalinto repurchasingtheirownshares,astrategythatholds sound��nancialstability,butperhaps,creatively unambitious.Google,notably,leadstock-buybacks in2024byrepurchasing$46.7bnoftheirown shares.Trendssuchasthisincreasedincentiveto playitsafeintheeconomyre��ectsthebroader shiftintheprioritiesofcorporations:minimisingrisk andmaximisingpro��tability.Firmswillrather reinforcetheiralreadyexistingmarketdominance insteadofventuringtheunchartedterritoryofrisky decisionmaking.

Anotherfactorthatisin��uencingtherisk-averse innovationisthebehaviourofconsumers themselves.Togaugethepreferencesof consumers,companiesnowheavilyrelyonthe analysisofcurrentmarketdemand,creatinga positivefeedbackloopwhereoffersarecateredto familiardemand,andtomimicpopularproductsor servicesthatconsumersareproventoengagewith insteadofseekingnewpossibilities.Thisis especiallynoticeableofathemeinthe entertainmentindustry.Hollywood,renownedonce asapoolofnew,excitingideas,nowmajorly favourssequels,rebootsandfranchisesovermore originalstorytelling,thusensuringastableamount ofrevenuefromprojects.Similarly,companiessuch asApplehaveplannedcyclesofincremental softwareimprovementratherthanreleasing entirelynewparadigms.Furtherstill,algorithms basedonrecommendationonplatformssuchas Amazon,SpotifyandNet��ixfunnelusers'content thatreinforcestheirexistingtastestobettertempt engagement.Asaresult,marketdynamicsshift towardtheoptimisationofpro��tablemodels.

Theintegrationofarti��cialintelligenceintoour everyday,regardedasthelatestinnovationasa tooldesignedforourprogress,paradoxically contributestothesteadydeteriorationofour originality.Deeplearningalgorithmsaredesignedto dissectpatternsfromexistingsources,meaningthe outputswillbeintrinsicallyconstrainedbywhathas alreadybeendone.Generatedliterature,musicand evenartworkshadowpastpreferencesandstyles, repeatingfamiliaraestheticsinsteadofpioneering newones.Inasimilarsense,in��nancialmarkets, investmentstrategiesdrivenbyAIfavourstable assetssuchasinfrastructureorcommodities.

Whilsttheef��ciencyofarti��cialre��nementgrants ustheopportunityofguaranteedeconomic stability,itpromptsanimportantquestion:canwe trulycallprogressmeaningfulifitcallson repeatingpastsuccesses?Theveryfutureof innovationinnotonlyoureconomy,butourworld, isnotmerelydependantonoursocietalsystems;it alsoasksforacollectivepushtoembrace originalityinourideas.Ifwecontinuetosolely re��newhathasworkedbefore,weultimately jeopardisethehonestyandintegrityofprogress. Equally,weriskstagnatinginacycleofimitation ratherthansparkinginspirationforfuture advancements.

WillJ,Y12

Worryingly,governmentsandcentralbanksare showcasinganincreasingrelianceonalgorithmic modelstoguidepolicy-making,whichcouldbea gravepathwayfordecisionmakinginwhich��scal decisionsaresoheavilyimpairedbywhatthepast

TheEconomicsof Division:HowInequality FuelsCon��ict

Ineconomics,inequalityreferstotheuneven distributionofincome,wealth,oropportunities amongindividualsorgroupswithinasociety.In recentyearstheconversationaroundinequality hasshiftedfromthemarginstomainstream.As theglobalwealthgapwidens,thefalloutisno longerthatoftheory;itseconomiccon��ict, politicalinstabilityandapotentialthreattothe longtermfunctionalityofcapitalism.

Sincethe1980s,economicinequalityhasgrownin nearlyeveryregionoftheworld.Accordingtothe WorldInequalityDatabase,thetop1%ofearners captured38%ofglobalwealthgrowthbetween 1995and2021,whilethebottom50%sawjust 2%.These��guresaren’tjustabstract–they representastructuralshiftinhoweconomies allocateresources.Thischangewasinnosmall partduetoapoliticalshifthighlightedduringthe Reagan-Thatchertohaveamarketfocused economy.The1980’ssawanemphasisonfree markets,deregulationandtaxcutsforthewealthy –thedecreasingprogressivetaxsystemcaused thegapbetweentherichandthepoorto increase.

economicinequalitytosocialandpolitical instability.A2019InternationalMonetaryFund (IMF)reportfoundthatinequalitysigni��cantly correlateswithhigherlevelsofunrest,particularly wheninequalityisbothvisibleandpersistent.In countrieswhereupwardmobilityislimited, disparitiesinwealthandincomeareoften interpretednotasnaturalmarketoutcomes,butas symptomsofariggedsystem.Thisunrestcanbe seenhistoricallywiththe“giletsjaunes”(yellow vests)proteststhateruptedin2018weresparked byafueltaxwhichwasreceivedasataxaimedat marginalisingworkingclasscitizens.Similarlythe ArabSpringuprisingswerestarteddueto economicdesperationandjoblessnessamong youth.

Thereisgrowingempiricalevidenceconnecting

Inequalitydoesn’tjustfuelstreetprotests;it corrodesinstitutions.Aswealthbecomes concentratedinfewerhands,sotoodoespolitical in��uence.Policiesincreasinglyre��ecttheinterests oftheelite.Thisdestroyedthelegitimacyof democraticinstitutionsandmakesworsethe dividesthattheseinstitutionsweremadetobridge. Moreover,highinequalitytendstoreducethe effectivenessof��scalpolicy.Researchbythe OECDshowsthatinunequalsocieties,public supportfortaxationandredistributiondecreases,

evenforthosethatwouldbene��tfromit.This resultsinafeedbackloop:inequalityleadsto politicalcapture,whichleadstofurtherinequality. Beyondthesocialimplications,inequalityisalso badfortheeconomy.AstudybytheIMFfoundthat countrieswithlowerincomeinequalityexperienced longerperiodsofsustainedgrowth.Thisisbecause whenwealthisconcentrated,consumption stagnates–sincethewealthytendtosavemoreof theirincomethanthepoor.Thisleadstoan underutilisationoftheeconomiccapacityanda negativeoutputgap.Additionally,inequality distortslabourmarketsandresultsinareductionof productivity.Talentissquanderedwhenaccessto goodeducationisamatteroftheschoolingyoucan afford–highlightedbythe2019collegeadmissions scandalwhereWilliamSingerpaidforhighschool studentstotakethe‘sidedoor’intoIvyLeague schools.

wealthtaxorincreaseinheritancetax,whichcan rebalancepublicrevenueswithoutstopping innovation.

:Directingfundstoward education,healthcare,andinfrastructurenotonly improvessocialoutcomesbutalsoenhances productivityandlaborforceparticipation.

:Raisingminimumwages, promotingunionisationcanhelprestorebargaining powertoworkers.

Tacklingmonopolisticpractices andrent-seekingbehaviourcanreduceexcess pro��tsthatfuelinequalityandslowinnovation.

Thereisnosimplesolutiontoinequality,butthere areseveralwaystoreduceit.

:Byclosingtaxloopholes anddevelopingaprogressivetaxsystemwecan

ThomasPikettyoncewrote,“Wheninequalityistoo great,theideaofmeritocracybecomesamyth.”In today’sworldwherebillionairescanaccumulate morewealthinaweekthanmanydoinalifetime, thismythisbecominghardertosustain.The inequalityweexperiencetodayisrepresentedasa politicalandeconomicdivideinsocieties.Thisdivide mustbeaddressedinthefuturetosustain capitalismandthelifewecanenjoytoday.

MikaM,Y12

DoesChina’sBeltandRoad Initiativespelltroublefor associatedcountries?

Sinceitslaunchin2013,China’sBeltandRoad Initiative(BRI)hasbecomeacentralforceinglobal infrastructuredevelopment.Focusingonsixmain economiccorridorsofwhichtheChina-Pakistan EconomicCorridorandNewEurasianLandBridge arethemostdeveloped,itspansover150 countries,encompassinginvestmentsintransport, energy,telecommunications,anddigitalsystems. Formanydevelopingnations,theBRIhashelped

��llachronicinfrastructure��nancinggapespecially inAsiawhereithasbeenestimatedthat$900bn ofinfrastructureinvestmentisrequiredannually forthenextdecade,notjusttraditionalareassuch astransportationandsanitationbutalsorenewable energyandmakingstridesdigitallyaswell.But alongsideitsreachandambition,theinitiativehas provokedgrowingscrutinyoverdebtrisks, geopoliticalin��uence,andgovernancestandards.

Atitsheart,theBRIisaboutconnectivity.Railways inEastAfrica,portsinSouthAsia,highwaysacross CentralAsia,and��bre-opticnetworksstretching throughtheMiddleEastallre��ecttheimprintof Chinesecapitalandengineering.TheChina–Laos railway,forinstance,hasdramaticallyreduced traveltimesandopenedtraderoutesinSoutheast Asia.Similarly,Pakistan’sChina–PakistanEconomic Corridor(CPEC)hastransformedkeylogistical corridors,includingthestrategicallyimportant GwadarPortwhichisseenaslinkingthelandand navalcomponentsoftheBRI.Howevertherehave securitychallengesthankstoincreasingtensions withIndiaandeconomicheadwinds

energysectors.ThroughtheDigitalSilkRoad,China hashelpedbuild5Ginfrastructure,datacentres, enablingthedevelopmentofe-commerceplatforms acrosstheGlobalSouth.TheBRIhasbackedamix offossilfuelandrenewableprojects,thoughcoal��redplantsstillaccountforasigni��cantshareof Chineseoverseasenergyinvestment.

However,theBRIhasnotbeenwithoutcontroversy. Severalparticipatingcountrieshavefallenintodebt distress.SriLanka’shandoverofHambantotaPort toaChinese��rmundera99-yearlease,after failingtoserviceloans,isoftencitedbycriticsas anexampleof“debt-trapdiplomacy”.Concerns havealsobeenraisedoveropaqueloanterms, environmentaldegradation,andthelimiteduseof locallabourand��rmsinconstructioncontracts.

TheBRIhasacceleratedthephysicaltransformation oflargepartsofthedevelopingworld.Ithas improvedlogisticsandexpandedaccessto electricity,reducingtradebarriersandaccordingto theWorldBankreducingthecostoftradefrom2.2 to1.2%.Bycreatingnetworksofrail,road,port andpowerinfrastructure,theBRIhashelped integratepreviouslymarginalregionsintothe globaleconomy.

Theinitiativehasalsoexpandedintodigitaland

Yetthelong-termeffectivenessofthis infrastructuredependsonmorethanconcreteand steel.Someprojectshavebeenpoorlyconstructed withnegativeconsequencessuchastheNoviSad Stationcollapsekilling15lastJuly,astationthat recentlybeenrenovatedbytheBRI.Othershave

seenproblemswithdebtsuchasKenya'sStandard Gaugerailwaywhichhadtobestoppedbeforeit reachedtheUgandanborderduetoKenya's increaseddebtandthereisalackoftransparency aroundtheinterestratesinthedealasChinese banksarenotintheParisClub. Asglobaldemandforinfrastructurecontinuesto rise,theBRIstandsasbothamodelanda cautionarytale.Ithasshownwhatispossiblewhen ��nanceallowsbutalsowhatcangowrongwhen long-termviabilityissidelinedandoversight reduced.WithChinanowenteringamorecautious phaseofoverseaslendingandtheG7proposing alternativesliketoBuildBackBetterWorldInitiative andtheBlueDotNetwork,theBRImayevolvefrom asingularundertakingintooneofseveral competingmodelsfordevelopment. Nonetheless,itsimpactisalreadyseenpositivelyby manywith130endorsements.TheBeltandRoad

Initiativehasnotjustaddedtothestockofglobal infrastructure,ithasfundamentallyalteredwho buildsit,howitisbuilt,andwhosevisionitserves. Ultimatelyforrecipientsofinvestment,abene��t wouldbehowitallowsformoneythatwouldhave earmarkedinthenationalbudgetforinfrastructure tobespentelsewhereonareassuchashealthcare andeducationforthosethatstrugglewitha skilledppworkforceorunhealthypopulationor evendefenceforcountriesingeopoliticalhotspots suchastheSouthChinaSea.However,in surrenderingcontrolofsaidinfrastructurewiththe introductionofthatexternalinvestmentthereisa concernthatChinamayusethistobeabletobring countriesintoitssphereofin��uenceandevenexert in��uenceondomesticpolicies.

JoshH,Y12

WhenMoneyDies: TheCorruptionandEconomic

Mismanagementbehind Zimbabwe’sHyperin��ation

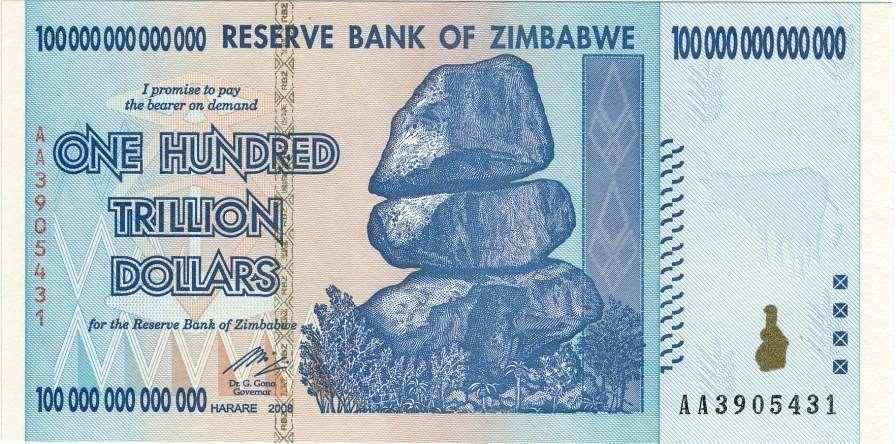

Hyper-in��ationisarapidanduncontrollable increaseinthegeneralpricelevelofgoodsand servicesinaneconomy.Itisusuallycharacterised byamonthlyin��ationratewhichexceeds50 percent,rapidlyerodingthevalueofacurrency. From2001to2009,Zimbabweexperiencedrates ofin��ationabove100percentannually,butthis escalateddramaticallybetween2007and2008. ByNovember2008,therateofin��ationhad peakedat79.6billionpercentpermonth,meaning

pricesnearlydoubledevery24hours.Inresponse, Z$100,000,000,000,000(OneHundredTrillion dollar)noteswereinjectedintocirculationin January2009,worthabout£20atthetime.Most Zimbabweanshaveenduredsevereeconomic hardshipandcollapseasaresult,andtheeffectsof thecrisiscontinuetolingertoday.Therewere variouscausesforthiscrisis,butthisarticle identi��estheeconomicmismanagementand corruptionunderRobertMugabe’sgovernmentto

bethemostsigni��cant.

Duringthehyper-in��ationaryperiod,Mugabewas thepresidentofZimbabwe.Mugabewasa Zimbabweanrevolutionaryandpolitician,who playedacrucialroleinthecountry’sstrugglefor independencefromBritishcolonialrule.Zimbabwe gainedindependencein1980,andMugabebecame thecountry’s��rstPrimeMinister.Intheyears following1980,ZimbabwehadanaverageGDP growthrateof4.3percentayear,showingsignsof economicprosperity.Thiswasdrivenbystrong agriculturalproduction,andthemineralreserves havinghugedepositsofdiamonds,gold,iron,and othernaturalgoods.However,bytheendofthe 1990s,Zimbabwe’seconomicprogresscametoa haltandthecountry’seconomyentereda depression.Thiswaslargelybecauseofdeclining productivityandrisingpublicdebt.Theeconomic downturnmadeZimbabwe’seconomyvulnerable, andthegovernmentsresponsesdrivenbygreed, politicalopportunism,andracism,playeda signi��cantroleinintensifyingthecountry’shyperin��ationarycrisis.

TherecklesspoliciesintroducedinZimbabweby Mugabe’sgovernmentwereaverysigni��cantcause ofthehyperin��ationcrisisanddemonstratesevere economicmismanagement.Oneofmostdevastating examplesofthiswasthepoorlystructuredland

reformsintheearly2000s,whichaimedto redistributewhite-ownedcommercialfarmstoblack Zimbabweans.Inthemid-1990s,about4,500white familiesownedthemajorityofcommercialfarms, employing350,000blackworkers,andsigni��cantly supportingthecountry’seconomy.Thiswasseenas aheritageofcolonialismandsparkedopposition fromMugabeandotherstoreturnthe‘stolenlands’ toblackZimbabweans.Consequently,controversial policieswereimplementedwhichendorsedand legalisedviolenttakeoversofwhite-owned commercialfarms,withoutcompensation.These wereissuedhastily,withoutsuf��cientplanningand infrastructure.Thisledtoamarkeddeclinein agriculturalproductivityasinexperiencedfarmers struggledtomaintainproductionlevels,which reducedagriculturaloutput.Furthermore,anarchy madethecountryuninvestabletoforeigninvestors andby2001,foreigndirectinvestmentinZimbabwe felltozero.Withbanklendingtofarmershaving driedup,themajorityoffarmssufferedfroma severelossofincomeandthoseevictedwereunable topaybacktheirloans.Thesefactors,combined withthemassdefaultoffarmloansmeantthat dozensofbankscollapsed,whichhadhugenegative consequencesfortherestoftheZimbabwean economy.Withtheeconomycollapsing,government revenuedecreased,creatingalarge��scalde��cit.To

addressthis,aswellas��nanceanincreasing relianceonfoodimportstoreplacethecontracting agriculturaloutput,thegovernmentexcessively printedmoney,rapidlyincreasingthemoneysupply. Asthegovernmentprintedmoremoney,thesupply ofmoneyincirculationexceededthedemandfor goodsandservicesintheeconomy.Theimbalance decreasedthecurrency’svalue,leadingto skyrocketingpricesforeverydaygoodsand services.

Furthermore,corruptioninZimbabwesigni��cantly impactedthecountry’seconomy,andcontributedto theperiodofhyperin��ation.Thoseinpower frequentlytookadvantageoftheirpositionand exploitedthenaturalresourcesinZimbabweto augmenttheirpersonalwealth,forexamplethrough theMarangediamond��elds.Wealthwasrecycled withinatinyeliteandkeptoutofrangeofthe commonman.Thoseinpowercouldgetawaywith thisduetotheweakinstitutionalframework,which providedfewopportunitiesforscrutinyandrarely heldthegovernmenttoaccount.Consequently, publicspendingwasdistortedasgovernment resourcesweremisusedforpersonalenrichment. WidespreadcorruptionmadeZimbabweunattractive toinvestors,whowerecautiousof��nancial mismanagement.Asaresult,thegovernmentwas unabletoaccesscapitalorcreditandhadtoresort toprintingmoneytofundde��cits,hence signi��cantlydevaluingtheZ$untilitbecame verticallyworthless,andtheeconomyspiralledinto chaos.Moreover,theZimbabwegovernment underreporteditsmoneyprintingactivitiesbyover 20milliondollarsamonth.Thedishonestyeroded publictrustinthegovernmentanditsabilityto addresstheeconomiccrisis,whichaddedtothe overallinstabilityanduncertaintyinthecountry, makingitevenmorechallengingtoovercomethe hyperin��ationcrisis.

contributedtoin��ation.Forexample,Mugabe’s governmentsetmaximumpricesforessentialgoods totrykeeppricesaffordableduringthehigh in��ation.Thismeantthatmanyproducerscouldnot maintainpro��tabilitysoreducedproductionor stoppedsellingcertaingoods.Thegovernment of��cialsresponsibleforenforcingthepricecontrols thenabusedtheirpowerbyallowingorparticipating intheillegalresaleofthesegoodsontheblack marketatmuchhigherprices.Asaresult,scarce goodswereonlyavailableontheblackmarkets, wherepricesweremuchhigherthangovernment limits,whichoftenmadein��ationworseaspeople hadtopayextremelyhighpricesforthesegoods. Consumersbecamemorerushedtospendtheir moneyastheyexpectedpricestocontinuetorisein thefuture,henceincreasingthevelocityofmoney. UndertheQuantityTheoryofMoney(MV=PQ), whereV(velocityofmoney)isincreasingandQ (realoutput)isdecreasing,P(pricelevel)mustbe increasingfortheequationtoremaininbalance, hencetheextremelyhighin��ationrate.

Finally,anotherexampleofhowcorruptionand economicmismanagementcontributedto hyperin��ationinZimbabwewasthroughthepoor economicpoliciesthatwereimplementedwiththe motivationtobene��ttheelite.Corruptof��cials manipulatedpricecontrolstobene��tthemselvesor theirassociates,whichexasperatedshortagesand

Onbalance,whilstrecentadvancesineconomic policyandinstitutionalframeworkshaveresultedin relativeglobalpricestability,Zimbabwehasclearly sufferedfromtheconsequencesofeconomic mismanagementandcorruption.Theperiodof hyperin��ationwastheresultofalackof accountableandtransparentleadership,leadingto corruptionandcatastrophiceconomicmanagement. Thecombinationoftherecklesslandreforms, exploitationofnaturalresourcesandthe manipulationofpricecontrolswereultimatelykey driversofthecollapseoftheZ$,whichresultedin seriousconsequencesforZimbabwe.

VerityV,Y12

TooBigtoBail:Thecollapseof LehmanBrothers

Everyonehasheardtheage-oldmantraof��nancial institutionsthatare‘toobigtofail’,meaningthat theyaresocrucialtotheeconomythattheir collapsewouldbedevastating,andtheyare thereforesupportedbythegovernmentwhen facingpotentialfailure.Thetermwasbrought moreintothepubliceyeinthewakeofthe2008 ��nancialcrisiswherehundredsofUS��nancial institutionsreceivedsomesortofaid,whetherthat wasintheformofthegovernmentsTroubled AssetReliefProgram(TARP)ordirectindividual bailouts,inanattempttokeepthese��rmsfrom goingbankruptandforthemostparttheiractions weresuccessful.However,foroneinstitutionthe bailoutdidnotgoaccordingtoplanandonthe 15thofSeptember2008thefourthlargestUS investmentbank,LehmanBrothers,��ledforthe largestbankruptcyinUShistory.Buthowdiditall gosowrong,andwhyweretheytheonlybankof thiscalibreallowedtofail?Themainculpritlies intertwinedwitharootcauseoftheentireGlobal FinancialCrisis:Subprimemortgages. Lehmanwasoneofthe��rstofWallStreet’s

investmentbankstoenterthemortgagebusiness withtheir1997acquisitionofAuroraloanservices, andthenin2000thepurchaseofBNCMortgage LLCquicklymadethemaforcetobereckoned with,asfouryearslatertheyhadmade$40bn fromloansandby2006AuroraandBNCwere lendingalmost$50bnpermonth.These2 companieshoweverwerenotwithoutrisk,with thembeingAlt-Aandsubprimelenders respectivelywhichmeansthattheylenttopeople whomayhavehadmoredif��cultyinrepaying.This meansthattheseloanswereriskierandusually hadlower-qualitycollateralandhigherinterest rates,sotheywere‘subprime’(Alt-Abeinga middlegroundbetweenprimeandsubprime).

OvertimeLehmancontinuedtogrowandsodid thelevelofriskwithinthebank’slendinghabits. Theybegantoleveragetheircapitalathugerates andaccordingtotheirownbalancesheeton November30th,2007,theyhad$691bnworthof assetsbackedupbyonly$22.5bnofequity-this meanstheywereleveragingtheirassetsatalmost 31x.Whileyes,thisisanoutrageousrateforan

investmentbanktoday(asitisusuallyhedgefunds whousethisamountofleverage)itisimportantto notethatLehmanweren’ttheonlyonesdoingthis atthetime.Leveragingthesesubprimemortgages wasgolddustandthebiginvestmentbankswere ridingthehighuntilLehmanhappenedtobethe ��rsttocomecrashingdown.GoldmanSachsand MorganStanleywerealsoleveragingathugerates (26.2xand28.9xrespectively)howeverthe differencewasthesizeofboththeirassetsand equitywasmuchlarger,withGShaving$1120bn backedby43,andMShaving$1045bnbackedby 36).Thiscombinationofthembeingsmaller,more leveragedandmoreinonsubprimemortgagesthan theotherbanksledtoLehmanbeingthe��rsttofail whenthecrisisstruck.

Thecauseofthesubprimemortgagecrisiswasthe burstingoftheUShousingbubblewhichpeakedin 2006whererisinghousepricesoveralongperiod oftimeledtoborrowerstakingonmorerisky (subprime)mortgagesassumingthattheywould quicklybeabletopayitback,howeveroncethe bubblepoppedandhousepricesstartedtofall, interestratesbeguntoriseandmanyborrowers couldnotaffordtorepaytheirmortgagesleading toadramaticincreaseindefaultsandforeclosure. Thisledtothedemandformortgage-related securitiesevaporating.

ThebeginningoftheendforLehmancamein August2007wheretheyclosedtheirsubprime lenderBNCMortgageonaccountthatthepoor marketconditions“necessitatedasubstantial reductioninresourcesandcapacityinthesubprime space”.Butasthecrisiscontinued,theholeLehman haddugbytryingtoholdontotheirmortgage securities(whetherthiswasaconsciousdecisionor justinabilitytosell)justgotdeeper:inthe��rsthalf of2008Lehmanstocklost73%ofitsvalue,and astheyearwentonthestockcontinuedto plummetuntilitwasclearthatLehmanwerein desperateneedofhelp.

AsImentionedbefore,thereasonthishappenedto Lehmanbeforetheothermajorbanksisbecause theywereslightlysmallerandslightlymoreinon subprimemortgagesanditwasthecombinationof theselittlethingsthatledtothembeingoneofthe ��rsttoneedabailout,butthereasontheynever

receiveditisslightlydifferent.Afewmonthsbefore thisasmallerinvestmentbanknamedBearStearns wasinasimilarsituationtoLehmanandtheFed orchestratedtheirsaletoJPMorganChaseaswell as$30bnofbacking.Thisbailoutsparkedpublic andpoliticalbacklashaspeoplerealisedthatif banksknewtheycouldtakewhateverrisksthey wantedandalwayshavethegovernmentasa safetynet(moralhazard),theywouldstarttotake advantageofit.So,whenLehmanbegantocollapse afewmonthslatertheFedwasunderpressureto notappearasiftheywerebailingoutWallStreet again,sosomepeoplebelievethebankwasallowed tofailasawarningtoothersandtoshowthat thesebailoutswerenotguaranteed.Therewere alsootherreasonsthebailoutdidn’thappeninthe endsuchasaseeminglyassuredpurchaseby Barclayssuddenlyfallingthroughasithadbeen vetoedbytheBankofEngland.

ButintheendafterLehmanhadgoneunder,partly duetotheirownrisktakingandpartlybecauseof unfortunatetiming,theUSgovernmentandFederal reservecontinuedtofund$700bninbailoutsfor otherbanksasLehman’scollapsewascatastrophic forthemarketsandmanypolicymakershavesince admittedthatitwasthewrongdecision.So ultimately,LehmanBrotherswasjustslightlymore atriskthantheotherbanksandtheywereallowed togounderasawarningtoother��rms–butthe aftermathrevealedthatfortheU.S.Government, nobankisTooBigtoBail.

LachlanM,Y12

CrisisCapitalism:Pro��ting fromTragedy

Intimesofcrisisduetoeitherpandemics,warsor naturaldisastersthereisoftenwidespreadchaos anddesperationforpeoplebattlinglossofjobs andstrivingforeconomicsurvival,yetthereare alsoafewwhoareabletoutilisethesetragedies inordertopro��t.Thisisoftenknownascrisis capitalismwhichhighlightstheethicaldilemmas thatariseaspro��tmotivesfor��rmsclashwiththe wellbeingofsociety.Examplesofthiswouldbe pricegougingandstockpilingoftenatthehandsof insuf��cientgovernmentregulationsduringcrises whichinternincreasestensionsbetweeneconomics andthecollectivegoodofsociety. Thisarticle explorestheethicalandpracticalcon��icts surroundingpro��teeringandraisescritical questionsbetweenthebalanceofthe��rm's responsibilityand��nancialgains.

Firstly,crisesoftencausedisruptionsofsupplyand demandinmarketswhichcreatesimbalances betweencorporatepro��tmotivesandsocietal needsleadingtowidespreadcon��ictofobjectives. ThisisshownduringtheCOVID-19pandemic wherethereweresigni��cantshortagesofessential goodssuchaspersonalprotectiveequipment (PPE),handsanitizersandventilatorswhichcaused pricestorapidlyincrease.Duringthis��rmssuchas

3M,anAmericanmultinationalconglomerate operatinginthe��eldsofindustry,workersafety, andconsumergoodsfacedaccusationsofprice gouging.Pricegougingisreferredtoasthe unethicalpracticeofraisingpricesonessential goodsandservicesduringemergencies.For instance,sharpincreasesinthecostofmedical supplies,food,orfuelduringpandemicsornatural disasters.Inthiscase3Mwereaccusedofprice gougingmaskssellingthemat7xmorethan marketpricewhichwasaround$1.Althoughnot directlythecompanies'fault,third-partysellers wereplacingPricesfor3Mmasksatupto$198.99 forapacketof10onamazon.Inaddition, pharmaceuticalcompaniessuchasModernaand P��zerreportedrecord-breakingrevenuesfrom vaccineswhichinitiatedcontroversyaboutwhether theywerepro��tingexcessivelyfromtheglobal suffering.

Alongsidepandemicsafternaturalcrisessuchas hurricaneKatrinatherewherehousingcrisesin placessuchasNewOrleanswheredemandfor housescompletelyoutstrippedsupplywhich renderedfamiliesunabletoaffordthemostbasic accommodation.AccordingtotheOCALAPriorto thehurricane,themedianhomepriceinthe secondquarterof2005was$152,600,re��ecting an11%increaseoverthepreviousyear.Inwarsit isoftenthearmsmanufacturerssuchasLockheed MartinandRaytheonthatoftenseethemost signi��cantincreaseinstockpricesoftenderived fromgovernmentspendingofmilitaryequipment whilecivilianssuffer.FromtheRussiainvasionof UkraineLockheedMartinstockpricehasincreased from360.14USDonJan7th2022,to611.81USD onthe18thofOct2024.Thisstaggeringgrowth ofnearly70%re��ectsthedirect��nancialbene��ts thatdefencecompaniesgainduringprolonged militarycon��ictsandthereforewithoutadoubt

thisshowstheextentinwhich��rmsare pro��teeringfromthesufferingofsociety.

societaldivides.

Theseexamplesshowtheextentinwhich corporationscancapitaliseonthedisruptions causedbycrisesandtheincreaseinsocial inequalitiesbecauseofit.Forvulnerablesocieties, theimpactofthispro��teeringismuchmore extensivewithlow-incomehouseholdsstrugglingto affordbasicnecessitygoodssuchasmedical suppliesneededtopreventthetransmissionof diseasesorshelterafternaturaldisasters.Many businessesdefendsuchactionsbyblamingsupply chaindisruptionsforexample,JonTaffer,a prominentbusinessconsultantwhostated"There's ahugesupplychainissuehappeningrightnowthat isoutoftheircontrol." howevercriticsarguethat pro��teeringduringcrisesdeepenssocietaldivisions andruinstherelationshipoftrustbetween��rms andhouseholds.Anotherexampleofthisishow pharmaceuticalcompaniesclaimthathighpro��ts fundresearchanddevelopmentwhichinturn enablesrapidvaccineproduction.However,the monopolizationofmedicalresourcesandhighcosts forlow-incomedevelopingcountrieshastherefore createdtheviewthat��rmsareseentobe prioritizingrevenueoverglobalequity. Duetothis theroleof��rmsincrisesremainsethicallyand practicallydivided.Ontheonehand��rmsdoneed toprioritisepro��tsandthereforeincentivise innovationandincreasetheef��ciencyofgoodsthe productionoftheirgoodsasshownwiththerapid developmentofcovidvaccineswhichcouldbe arguedasapositiveduetoitsabilitytoenablea quickresponsetocombatthevirus.Althoughon theotherhandtheuncheckedpro��teeringoften leavesthemostvulnerableareasofsocietybehind inordertoturncrisesintoopportunitiesandareas toexploitratherthanequitablerecovery. Abalancemustbestruckinwhichgovernments, regulatorybodiesorotheralternativesmust intervenetopreventunethicalpractices suchas pricegougingandmonopolisticbehaviours. However,thismustalsoallowcompaniesto maintain��nancialresponsibilityandstillkeep ethicalframeworkswhichcanhelpbusinesses navigatethesetensionswhichensuresthey contributetocrisisrecoverywithoutdeepening

IftherewasGovernmentinterventionsuchasprice capsoranti-gouginglawswhichaimtoprotect consumers,thiscouldcreatedebateontheroleof thestateineconomicaffairs.Ithasbeenargued thatsuchinterventionsarenecessarytoprevent exploitationduringtimesofcrisisandtoensure accesstoessentialgoods.Critics,however,claim thattoomuchregulationunderminesmarket ef��ciencyandcouldresultinshortagesif businessesarediscouragedfromsupplyingessential goodsatcompetitiveprices.Ethicalargumentsfor governmentinterventionemphasizetheneedto protectvulnerableconsumersandensurefairness duringcrises.Whenleftunchecked,marketforces canleadtoexploitation.However,fromafreemarketstandpoint,excessiveinterventionmay interferewithsupplychaindynamicsand innovation.Balancingregulationandmarket freedomisadif��cultethicalchallenge,particularly intimesofwidespreadscarcity.

Whileitsimportanttoconsiderthatpro��teering duringcrisesraisesalotethicalconcerns,it’salso importanttoacknowledgethatthefreemarket playsanessentialroleindrivinginnovationand ef��ciencyparticularlyinemergencies.Forexample, thedevelopmentofCOVID-19vaccinesbyP��zer andModerna,thoughhighlypro��table,played leadingroleinmitigatingthepandemic.Becauseof thispro��tmotivescanincentivizemorerisktaking andinvestmentinsolutionsthatmightnotemerge underheavyregulation.However,thisdoesn’tmean companiesshouldoperatewithoutoversight.A balancedwayforwardcouldincludetargeted governmentintervention,suchastemporaryprice capsonessentialgoods,subsidiesforcritical services,andstrongeranti-gouginglawsduring statesofemergency.Additionally,implementing crisisspeci��cwindfalltaxesormandating reinvestmentaportionofpro��tstowardspublic healthorinfrastructure.Thiscouldthereforehelp ensurethat��rmscontributetorecoverywhilestill bene��tingfrommarketmechanisms.Thisapproach maintainsthedynamismofthefreemarketwhile promotingethicalresponsibilityandequitable outcomesduringtimesofcrisis.

LukeH,Y12

FragileCon��dence: UKConsumersina Post-

Tari��World

YouwanttobuyaPlayStation5toplaygames withyourmatesafterschoolandsaveenoughto beabletobuyboththe£340consoleitselfanda brand-newdigitalgamethateveryoneelsewants, savingformonthstogetbothatthesametime. Althoughwhenyou��nallyreachyourplanned savingsof£400,suddenly,thePS5youyearned forisnowtooexpensive–heartbreaking!

SonyhasincreasedthepriceofitsPS5by25%, withtheJapanesegamedevelopersayingithadto makethe“toughdecision”asthevideogame industryreelsfromDonaldTrump’stariffs. Claiming“achallengingeconomicenvironment, includinghighin��ationand��uctuationexchange rates”isbehindtheirrationale.Whileitmightbe frustratingnotbeingabletoplaygameswithyour friends,there’samuchbiggerissuegoingon globally.Industriesaroundtheworldarestruggling withtheeffectsofnewtariffsintroducedbythe U.S.President.OnMay23rd,heproposeda50% tariffonallgoodsimportedfromtheEuropean Union.TheUKisnotdirectlytargetedbythis policy(sinceit’snolongerintheEU),butit’sstill beingaffected.That’sbecauseglobalsupplychains areinterconnected—andwhentheU.S.putsup tradebarriers,theshockwavesarefelteverywhere. WhatcouldthesemeanfortheUKconsumer?

Perhapsthemostobviouseffectisthatonin��ation andthecostofliving.Trump’s60%tariffon ChinesegoodsandtargetedEUexportsadds in��ationarypressureworldwideasimportedgoods becomemoreexpensive,notjustfromtheU.S.but alsothroughlengthier,moreredirectedsupply chainsasimportersareforcedtoredirectthrough Europe.UKin��ationhasbeencitedtorisebyupto 4percentagepointsaccordingtotheNational

InstituteforEconomicandSocialResearch (NIESR),astheBankofEnglandmaintainhigher interestratesandpermittingtariffenforcement. Naturally,risingcostsoflivingcouldapplyaheavy squeezeonhouseholdbudgets–lowerincome householdsexperiencerisingfood,clothing,and electronicspricesgreater,whichservestoincrease themarginalpropensitytoconsume.Hence,a largerproportionofanyadditionalincomeistaken uponnecessitiesandthecostofliving intrinsicallyishiked.Within��ation alreadystrainingUK households,the BoE

areleftwithadif��cultbalancingact:shouldthey keepinterestrateshighandcontrolprices,butat theriskofstagnatinggrowth?

Ontheotherhand,thesetariffsmeanalotforjobs andproductsintheUK–particularlyautomotive, steelandretailindustry.TheUKautoindustryis greatlyreliantonexportstotheU.S,particularly modelsofRangeRoversandMiniCoopers–Trump’s25%tariffoncarimportsfromEurope mayextendtotheUK,despiteBrexitindependence. Thisleavescar��rmssuchasBMW(Mini)facing multi-million-poundlossesthatwouldforcethem toscalebackUKproduction,reduceinvestmentand possiblymovingproductiontotariff-exemptzones; itisapproximated25,000jobsinthissectorareat risk,mostlyinregionsalreadyvulnerableto economicdownturni.e.industrialestates.Thesteel industrywillbearthebruntofTrump’sreturning longstandingtariffsonmetals,asUKproducers facedecreasedordersfromU.S.partners–adding toanalreadydecliningsectorintheUnited Kingdom.Thismeansjobsin traditionalmanufacturing epicentres,

suchastheMidlandsandNorth,areparticularly exposed.Finally,theimpactoftariffsonretailand smallbusinessesispossiblythemostdirectwith 62%ofUKbusinessestradingwiththeU.S. reportingnegativeimpactsaccordingtotheBritish ChambersofCommerce(BCC).Retailersreliant uponAmericanbrandsand/orcomponentslike electronicsandartisangoodsarethemost vulnerable–manyareforcedtoraisepriceor, worryingly,cutentireproductlinestostaya��oat thusstarvingtheBritishpeopleofthepotential bene��ts.

Alternatively,theUKretailsectorcouldexperience importsurgesinresponsetothetariffs.AsTrump’s renewedimpendingtradewarwithChinacontinues, Chinese-madedisposablegoodssuchase-cigarettes areredirectedintoalternativemarkets.TheUK, beingoneofEurope’smostderegulatedconsumer markets,isbecomingtheidealdestination.Inthe ��rstquarterof2025alone,UKimportsofvaperelatedgoodssurgedby40%year-on-year.ForUK retailers,thisofferschancestoundercutdomestic priceswithanexcessinsupply–somethingheavily undesirablefordemeritgoodslikethis.However, thisimpendingimportsurgecoincideswiththe scheduledbanonsingle-usevapeslaterin2025, veryworryinglythreateningto��oodthemarket justbeforethebancomesintoforceandheavily encouragingblack-markettrading.

Towrap-up,theUKisonceagaincaughtinthe unintendedcross��reofatradewar–despitepostBrexitseparationthatpromisedtodistinguishus fromEuropeanUnionregulatoryandtradepolicy. Forconsumers,theissuesaretangible–higher prices,fewerchoicesandultimatelymore uncertainty.Signsofresilienceareemerging, boostedbydomesticpolicyandstrongerlabour markets,althoughUKhouseholdsandpolicymakers willneedtostayalertasglobaltradeshocksare likelytopersist.

TeddieC,Y12

Trump’stari��s:Opportunities fortherich, demiseforthepoor.

Atariffisataxplacedbyagovernmenton importedgoods.Itraisesthecostofforeign productstomakedomesticalternativesmore appealing.Tariffsservemultiplepurposed: protectingdomesticindustriesbygivinglocal productsapriceadvantage,increasinggovernment revenuethroughthetaxescollectedonimports, andactingaspoliticalleverage,especiallyduring internationaldisputesortopressuretrade partners.

However,whiletariffscanbene��tlocal manufacturersandgenerateincomeforthe government,theycanoftenhurtconsumersby raisingpricesacrosstheboard,whenbusinesses areforcedtopaymoreforimportedrawmaterials ofproducts,theypasthatcostontoconsumers.As aresult,thecostoflivingincreases,andproduct varietycanshrinkbecausesomegoodsbecome tooexpensivetoimportorsellpro��tably.

Duringhissecondpresidencyin2025,President Trumpannouncedanoverall10%tariffonall

importedgoodsenteringtheUnitedStatesonApril 25th.Thisbreadmovewasfollowedbyahigher, targetedtariffaimedatspeci��ccountries.Notably, chinafaceda145%tariffonallgoodsenteringthe UnitesStates.Inresponsetothis,Chinaimposed retaliatorytariffsofupto125%onAmerican exportscreatingtensionbetweenthetwocountries. Thesetariffswerejusti��edbyTrumpasnecessary fornationalsecurityandtoprotectAmerican manufacturing.However,thepolicieshadserious consequences,bothdomesticallyandglobally.

effects.

Additionally,largercorporationswithamore diversesupplychainweremoreabletoabsorbor workaroundtariffsastheyhadalargersupply base.Smallerbusinesses,particularlythoserelying onimportsfromChina,facedcoststheycouldn’t offset.Thiswidenedtheeconomicgapbetween largeandsmallbusinesses.

Thesuddenannouncementofthesetariffsledto signi��cantmarketinstability,similarinscaletothe 2008��nancialcrash,theDowone’sIndustrial Averagesdroppeddramatically,andinvestors wavered.Thepanicnegativelyimpactedmiddleand working-classAmericanconsumers.Particularly thoseinmanufacturing,retail,andagriculturaljobs. Securitywithinthesejobsweakenedandpricesrose oneverydayitems.

Atthesametime,wealthyinvestorswereaboveto capitaliseonthesituation.Withaccessto��nancial advisorsandavailablecapital,theywerewell positionedtobuystocksatlowpricesduringthe marketdip.Astheeconomybegantoriseagainand stabilise,theseearlyinvestmentsproduced signi��cantpro��ts.Thiscausedtherichtogetricher, apatternseencommonlythroughouthistory.Those whoalreadyhavewealthtendtobene��tfrom volatility,hikelower-incomegroupssufferfromits