It might look rather like Business & Innovation Magazine, and that’s because it is – in all but name.

Our last issue in March was the final one to carry the title Business & Innovation Magazine, which we first launched in May 2017. After being acquired by Black Ox Ltd last year, we are now proud to adopt their magazine title as a regional publishing company which supports and reports on regional business.

Black Ox’s flagship title, The Business Magazine South East, covers business news from the Thames Valley, Surrey, Kent, Sussex, the Solent and the South Coast and has been published for more than 20 years. This issue covers the South West, West Midlands and Oxfordshire.

And the magazine is, as usual, packed with news, interviews and features.

In this issue, we pay tribute to King Charles III on his coronation. Our new king was, as Prince Charles, forthright in his views on many topics, not least of which was giving disadvantaged young people a helping hand. In 1976, after leaving the Royal Navy, he launched The Princes Trust. In 1983, the Trust set up its enterprise programme which has since helped more than 90,000 young people between 18-30 to start their own business.

In total, The Trust has helped more than a million young people to date and helps tens of thousands more across the UK each year. This is an amazing and ongoing initiative and you can read more about it in our Skills pages.

Our headline feature is Keep the Money Flowing. Where do start-ups, scale-ups and SMEs go to find growth funding?

We’ve interviewed some of the region’s most knowledgeable investors and explain

the range of funding options available to ambitious companies.

Our ambitious leaders in this issue are truly inspiring. We meet Fiona Shiner who, in just a few years, has established a hugely successful vineyard which is already winning international acclaim for its wines, and talk to Ross Morgan at Tokamak Energy, the company grappling with one of the world’s toughest physical challenges – achieving nuclear fusion which could provide the world with limitless energy.

Elsewhere in the magazine we put research and development under the microscope, attempt to explain quantum computing and reveal 10 of the region’s coolest technology innovations, from sustainable jet engines to a new electric car engine capable of going from 0-60mph in less than 1.5 seconds.

What all the innovators behind these new technologies did was never give up. We didn’t know until we started researching the topic that Sir James Dyson created

more than 5,000 prototypes before he succeeded in building his DC01 bagless vacuum cleaner.

As Thomas Edison, the 19th century inventor of the light bulb, was reputed to have said: “I have not failed, I’ve just found 10,000 ways that won’t work.”

Mr Edison also contributed to the invention of the phonograph and the motion picture camera. It’s not too grandiose a statement to say that this man changed the world. But little could he have known the global impact his innovations would go on to have.

This magazine is packed full of innovation, including a company making fuel out of chip fat to another developing sustainable construction materials and many more.

Their names may not be Dyson or Edison, but it’s likely some of their ideas and innovations will go on to have just as much an impact on society.

We hope you enjoy the read.

Kirsty Muir Head of Print and Advertising

Transport company William Gilder has revealed the future of UK truckstops.

The new truckstop at Teddington near Ashchurch, Tewkesbury opened in February, o ering a secure facility for the tens of thousands of lorry drivers who drive our highways day and night.

It’s a far cry from the truck stops of old – greasy spoon cafes o ering plates of cholesterol-busting fried foods with pints of tea on formica tables – and where domestic car drivers feared to enter.

According to the Road Haulage Association: “The state of lorry parking facilities is a national disgrace.

“Nowhere else in western Europe is there such ramshackle, unsafe and unhygienic provision for the basic human needs of lorry drivers.”

That’s no longer true in Gloucestershire. The Teddington truckstop, just o the M5’s Junction 9 and next to William Gilder’s head o ce, o ers drivers showers, laundry facilities, a bunkered fuel service – even a licensed restaurant which looks more like the fabulous Gloucester Services.

The development, which includes the company’s new head o ce, is estimated to have cost around £2 million.

Last year the government promised up to £100 million to help the HGV industry improve the UK’s roadside facilities, and this is the first of four truckstops that William Gilder hopes to build – others are planned for Evesham, Cirencester and Avonmouth near Bristol.

At last year’s announcement of the £100 million funding, roads minister

Richard Holden said: “Hauliers and drivers are critical to our economy. But for decades, our truckers have had a raw deal. I’m proud our government is providing match funding support to the industry to boost drivers’ welfare, safeguard road safety and make sure driving an HGV is an attractive career by providing the facilities and respect lorry drivers deserve.”

William Gilder Group Director, Mark Fowles, said: “Everyone relies on lorry drivers, but few appreciate how the goods get to where they’re needed, or the infrastructure required to support that. Other than truckstops, the alternative is often an open layby.

“We o er all the provisions and security; those services people don’t appreciate that lorry drivers need – but do.”

The new restaurant also has a large mezzanine floor which Mark hopes the local community will use.

“We are a family business and William Gilder, the founder, farms nearby,” added Mark. “We also plan to put our locallyreared beef on the restaurant menu.”

William Gilder started the business in 1985 as an agricultural contractor. Since then the company has grown to include road haulage, waste management and – more recently – development.

Oxford-based autonomous vehicle software developer Oxbotica is to collaborate with Google Cloud.

Combining Google Cloud’s cloud infrastructure with Oxbotica’s autonomous vehicle software, the partnership will help last mile-logistics, light industry and public transport, to adopt autonomous driving.

Oxbotica intends to develop, test and validate its technology using Google Cloud’s computing and data analytics products, along with improving its security using Google Cloud’s cyber-security technologies.

Gavin Jackson, CEO of Oxbotica, said: “Google Cloud is a global leader in cloud infrastructure, and using its technology and AI powered tools will strengthen our customer proposition.”

Thomas Kurian, CEO of Google Cloud, added: “The combination of Oxbotica’s leading technology and our reliable infrastructure, AI and data-enabled cloud platform has the potential to accelerate autonomous mobility in a variety of industrial use cases.”

In January Oxbotica, which was established in 2014, announced that it had raised $140 million to deploy its operating system for Universal Autonomy in multiple commercial and industrial domains around the world, bringing the total raised by the company to $225 million since it was established.

Oxbotica has a number of firsts to its name, including running the first UK autonomous trial airside at Heathrow Airport in 2018, the first autonomous passenger rides as part of the UK’s DRIVEN project in 2019 and leading Britain’s first multi-city autonomous vehicle demo, Project Endeavour, in 2020.

It has also seen investment from food retailer Ocado and German tech company Zahnradfabrik Friedrichshafen (ZF), among many other investors.

The Cotswolds is about to get a new events and wedding venue.

Warwickshire property development and investment company the Wigley Group will build and operate the new £2 million venue near Cheltenham at Naunton Downs Estate.

Planning consent has been granted on a 5,000 sq ft barn, and construction is set to start this year.

It follows National Hunt racehorse trainer Ben Pauling’s purchase of the 200-acre site last April, which includes a golf course and dining, entertainment and retail venue. The joint venture will also invest £300,000 to upgrade the existing venue and golfing facilities.

Ben said: “The existing dining and entertainment venue and Fitzdares Club are well-established and we believe there is significant potential for a luxury venue in this location that can cater for a wide range of events – personal, business and racingrelated.”

Chief Executive O cer, James Davies, said: “We have got to know Ben and his wife Sophie really well over the last few years and can see the potential that Naunton Downs presents.”

“Hauliers and drivers are critical to keep our economy motoring. But for decades, our truckers have had a raw deal when it comes to decent roadside facilities”

The BBC’s Repair Shop is inspiring similar projects all over the UK.

Worcestershire business

Morris Commercial has joined the race started by Volkswagen’s ID Buzz to bring retro cargo vans to market.

The start-up, based at Hinton-On-TheGreen, is reviving the iconic 1950s Morris J-Type van. With a multi-millionpound funding round completed, Morris Commercial says it should have cargo vans on the road by next year.

The Morris JE electric van draws inspiration from the iconic Morris J-Type, arguably one of the most recognisable vans of the 1950s and combines modern battery technology and lightweight carbon-fibre construction with classically inspired British design. Most components of the Morris JE are recycled and recyclable.

Substantial funding and resources have already been invested to bring the Morris JE from concept to a production prototype.

The funding will enable Morris Commercial to recruit further expertise, and strengthen its partnerships with core suppliers. Morris Commercial expects that deliveries of the Morris JE will begin in early 2024.

Dr Qu Li, Chief Executive O cer of Morris Commercial, said: “With this new investment, we will be able to accelerate product development and take the Morris JE to market. I am very excited about the future for Morris Commercial and look forward to delivering our iconic van to our many thousands of pre-registered customers around the globe.”

Bristol and Wiltshire firms are celebrating after claiming titles at the FSB South West Small Business Awards.

The UK’s first women’s urinal business snagged two titles. Peequal, set up by Bristol University graduates Hazel McShane and Amber Probyn, won both the best Business and Product Innovation prize and the best Start-Up award.

Devizes-based chartered accountants Charlton Baker scooped the FSB Larger Small Business title, Swindon’s Top Professionals Access Limited won the new Diversity and Inclusion award, and Dan Yates from Warminster-based

Greener won the Young Entrepreneur title.

It was the second consecutive year that the FSB Young Entrepreneur accolade had come to Wiltshire following the success of gardener Alfie Jones, of Royal Wootton Bassett in 2022.

For Peequal, the awards are the latest boost to their growing business which has captured widespread national media interest and already seen the company’s unique women’s urinal in operation at a number of key festivals including Glastonbury, Wilderness, Green Man and Shambala.

The latest is a repair café which is opening at the University of West England’s Frenchay Campus this year, following nearly £90,000 funding from the Royal Academy of Engineering.

Engineering students are setting up the MAKERS project (Making and Knowledge Exchange for Repair and Sustainability) to improve representation from women and people from Black, Asian or Minority Ethnic groups, alongside those from under-represented backgrounds.

Working alongside community groups from Easton, Eastville and St Paul’s, which have established similar schemes in their areas, the café is hoping to open in the university’s School of Engineering in October.

Using UWE Bristol’s engineering equipment, the project will help solve problems and fix broken goods, upskilling those involved in the scheme and supporting the circular economy. The repair café will run until May next year and will build on UWE Bristol STEM partnership projects in the city.

Dr Laura Fogg-Rogers, UWE Bristol Associate Professor for Engineering in Society, said: “At a time when so many are struggling to make ends meet, MAKERS will help by giving new life to valued things; make new friendships between the University and Easton; and remove things from landfill. A real, living, example of the circular economy where it’s needed most.”

UK start-ups raised $30 billion last year. While that’s a drop from the peaks of 2021, it was still 72 per cent higher than the 2020 total, according to Tech Nation in its last report. But with the landscape for investment funding tightening, can businesses still attract investment?

By Nicky Godding, EditorWith the very public demise of the USA’s Silicon Valley Bank in March, and many global technology firms resizing downwards after their pandemic boom, does this mean it’s more di cult for startups and scale-ups to raise the funds they need to grow?

Almost certainly. But for entrepreneurs completely invested in their technology innovations, while it may take a bit longer to raise the funding – seasoned and patient investors haven’t lost their appetite for a well-researched and developed idea which has real world benefits – look at the growing appetite for investment in fusion (see our interview with Tokamak Energy elsewhere in this issue).

According to the British Business Bank’s Finance Markets Report 2023, lending volumes grew in 2022 with challenger and specialist banks accounting for a record share of gross lending. But there are increasing signs of di culties in accessing finance, the report’s authors admitted.

And finance to support innovations are essential to deliver the long-term economic growth the country needs, it added.

The bank’s March SME Finance Survey revealed that gross bank lending increased by almost 13 per cent in 2022, but net lending fell by £8.5 billion in large part reflecting the repayment of Covid loans.

For the smaller business equity finance market specifically, investment activity has slowed considerably since Q3 2022.

Recent years have seen larger equity deal sizes and increased company valuations but in recent months investors have re-evaluated their positions leading to smaller deals and lower valuations.

So what are investors buying into?

Green innovation, according to the report, with net zero deals outperforming the wider equity market. These deals currently make up 12 per cent of all smaller business equity deals compared to only five per cent in 2018, and deal values are rising even faster. The investment value of net zero-related deals rose by a hefty 184 per cent over the past year, soaring to a new record level of £1.7 billion.

Innovative businesses are more likely to use some form of external finance (65 per cent versus 58 per cent of non-innovators, according to the British Business Bank’s report). Smaller businesses seeking finance to innovate are also reported to be using a wide range of finance products, with many smaller businesses opting for grant finance, asset finance or bank overdrafts to help them develop and adopt innovative products and processes.

However, the availability and cost of finance remain significant barriers to innovation.

Science Creates is a Bristol-based deep tech ecosystem including two incubators and a venture capital investor which helps scientists and engineers commercialise their scientific discoveries. It was launched around seven years ago by Dr Harry Destecroix, who sold his biotech start-up, Ziylo, to Novo Nordisk for up to $800 million in 2018 (he was just 31 one at the time).

In partnership with the University of Bristol, Science Creates now combines specialist incubator facilities (which include laboratories, o ces, event space, deep tech and finance mentors) across two sites in the city with a dedicated venture capital fund.

Despite his eventual success in selling his business, Harry originally struggled to raise money and had been turned down by venture capital investors. He didn’t want that to be a barrier for other promising businesses in Bristol which at that time had almost no venture capital sector, and few spin-outs from its universities.

So he founded Science Creates. Just a few years later, the university is sitting comfortably in the UK university top 10 for spin-out companies.

Dr Catherine Fletcher, who did her PhD in Synthetic Organic Chemistry at Bristol, is principal at Science Creates Ventures.

“We invest in deep tech and encourage and enable scientific founders to become entrepreneurs. We are founder-friendly, but we also want them to understand where their skillsets lie. If they want to become their new company’s chief executive, then we will support them. Equally, some prefer to take a chief technology o cer or chief scientific o cer role, remaining close to their technology where most of the focus needs to be at the early stage.”

For Catherine, there are three main elements to commercialising innovation and making it attractive to potential investors: the technology, the team behind it and the potential product.

“What you will often hear is, if the right team has an idea and it doesn’t work, a great team will make it work. And if you are in a sector such as software as a service, that may well be true. But at Science Creates we are talking about deep tech, about layers and layers of research and development in wide-ranging areas from bio or agri-tech to engineering, and where perhaps years of research has finally resulted in the securing of intellectual property on the idea.

“If you have proved your technology works, and there is a need or appetite for it, then you want the right person driving the business’s development, and that might mean bringing expertise in from outside.”

She also warns about taking a product to market too early.

“In deep tech things need to be done di erently,” says Catherine.

Start-ups in the deep tech sector risk being shoehorned into a route to market when they haven’t fully explored the full scope of their technology. Investors, who perfectly understand market risk, can encourage start-ups down the market route too early.”

“We say: if a founder spends longer de-risking the technical part, they will have a better understanding of the limitations of the technology and what the first product should be, then the market risk is reduced because they will be more likely to deliver. This results in a product with a much better market fit.

If you lock in your product too early and take it to market, it’s more di cult to adapt and more likely to fail.”

This is a tough strategy to follow with few enough early-stage investors, but most deep-tech investors understand the long time horizons to market, although there are always opportunities for early exits for the best companies.

Science Creates Ventures invested in five companies last year. Nebu-flow is developing the next generation of nebulisers; Open Bionics continues to successfully develop its prosthetic Hero Arm; Scarlet Therapeutics is applying advanced genetic engineering to red blood cells aiming to transform them into new treatments; IsomAb is taking a di erent approach to developing isoform specific antibodies to treat diseases with limited treatment options and Kelpi is harnessing the novel properties and environmental benefits of seaweed to replace single-use plastics with bioplastics.

In the last year alone, these companies collectively raised more than £25 million.

“We don’t invest in unproven ideas, we invest in IP,” added Catherine, “most of which have been developed by university spin-outs.”

Entrepreneurs and founders of start-ups who network and take advice both o ered and asked for are more likely to secure investment and become successful than those who don’t.

You can’t be an expert in everything.

So says Richard Cooper, managing director of Oxford Innovation Finance, the home of OION (Oxford Investment Opportunity Network), one of the oldest and largest angel investment networks in the UK, and the Oxford Innovation EIS Growth Fund.

One of the biggest problems, he says, is when entrepreneurs or founders of startups are looking for funding, they don’t always think like an investor.

“There is a definite weakness in fundingraising for the pre-seed phase of a business,” he says.

Pre-seed funding is the investment round which comes when a start-up needs funding to develop their idea into revenuegenerating businesses.

In the past, this round of funding was often achieved through angel investors, family and friends, but in recent years early-stage investors have seized the opportunity to invest. Now, however, such investors are fewer and further between.

“A lot of founders think their technology or science is absolutely brilliant – and so they should. But angel investors in particular are usually generalists and won’t always understand the detail,” said Richard.

Spending a five-minute pitch introducing their technology might seem like time well spent to a founder, but an investor wants to know how the company is going to grow, the capabilities of its management team and the business model.

“While I can totally understand why founders do this – I used to run a software company myself and was so excited about the tech I was developing that I wanted to tell everyone. But a potential investor needs to understand the bigger picture, and that can be quite hard to do. A founder needs to describe how they are going to grow the business and how an investor can exit.”

Oxford Innovation Finance has a large angel investment group of around 670 members. And while Richard admits that investment rounds are taking longer for everyone, thanks to the current di cult economic climate, his organisation hasn’t seen a big downturn in investments because not all angel investors have been a ected.

What can a start-up do to secure the funding they need to get their ideas o the blocks?

Contacting Innovate UK to apply for a grant is a good first step. And while such grants are not handed out like sweets (this is government funding after all), if a start-up business has a good idea and is willing to put in the time to explain and justify it, they are more likely to be successful.

And if it’s good enough for Innovate UK backing, this will help fuel investor confidence.

Potential investors will need to understand the traction of a business. For instance for a software company, it’s all about revenue. For a bio-tech or health-tech it’s about early trials.

Richard also advises founders to try and raise more than they need, because it’s incredibly time-consuming to have to start fundraising again within six months when they should be focusing on product or technology development.

“You need to raise enough for 18 months

Founders and entrepreneurs should take advice if they want success, because you can’t be an expert in everythingRichard Cooper, managing director of Oxford Innovation Finance. Photograph by Tricia de Courcy Ling

so that you have a runway on which to build the business.

“I understand that some founders don’t want to give away equity early on – that approach works in boom times, but not so well in our current economic situation. In the long-term, raising more earlier will work better for the business.”

The strategically-thinking founder will be planning all equity funding raising rounds from the beginning. “This approach gives an investor confidence,” says Richard. “While an investor understands that a start-up is likely to have to adapt to circumstances and there will be hurdles along the way, at least they will understand about dilution levels – and it’s better to show you have a plan than no plan.”

Richard adds that investors will also look at how a management team copes with inevitable challenges. “New tech can be brilliant, but if it’s really innovative, there are likely to be issues to overcome. How a management team reacts to those is the di erence between a good technology company and a mediocre one.”

When working with a start-up seeking investment, Oxford Innovation Finance will

advise them on building the right team, including finding a leader with the right experience to help build the business.

“We usually have a board observer on a company in which we have invested. They will share their industry knowledge and advise on what’s worked before and what hasn’t.”

Oxford Innovation Finance invests in technology and business-to-business and its sweet spot currently is the second and third round of funding, pre-series A. While the business is based in Oxford it does invest nationally.

“We will often get a batch of certain companies in one sector, and it can be very hard to pick and choose, which is why we advise founders to network and find mentors and advisers.

“Start-ups don’t start their business because they love finance and raising money,” said Richard.

“They start their businesses because they are passionate about building a company to meet a real need in the market.

“If they are not educated in how to raise funding, that’s di cult. There is some education going on, and over the last five or six years the quality of companies coming through has improved, but we need to cement that.”

Last year Richard and his team saw a lot of founders presenting technology in the mental health space. This year there is a lot of green-tech.

Innovate UK’s Edge programme is particularly good, he says. “Founders can pitch, and we can give high-level feedback. It’s a really good initial education.”

“Start-ups don’t start their business because they love finance”

“I understand that some founders don’t want to give away equity early on – that approach works in boom times, but not so well in our current economic situation”Oxford Innovation Finance participated in a £4.1 million funding round in Anaphite last year, which is enhancing Li-ion batteries with graphene, to help power the sustainable energy revolution

According to data company Experian, in spite of high inflation, rising energy costs and other economic challenges, around a quarter of UK small and medium-sized enterprises remain resilient – making them “good risk” prospects for lenders. The challenge for would-be lenders will always be how to di erentiate between those which are a good credit risk and others which may be less able to meet their financial commitments over time.

From bank loans to private equity, angel investment or crowd-funding, there are many di erent types of borrowing, or ways a business can raise investment to drive a long-term strategy or to manage shorterterm cash flow challenges. But start-ups or scale-ups seeking to raise money should proceed with caution and always take expert advice.

The most widely used form of finance used by UK businesses.

A business borrows a sum of money, either as a loan, or (generally more expensive) an overdraft and pays it back over an agreed period of time.

There are additional forms of debt finance. Two of the most widely-adopted are finance secured on assets and factoring.

Asset finance (leasing or hire purchase) can be ideal for businesses seeking help to buy expensive assets, without using funds earmarked for cash flow.

Factoring turns invoices into working capital. A business sells its invoices to a third party (a factoring company) at a discount. Invoice factoring can be provided

by independent finance providers, or by banks.

Capital is invested into promising startups or small businesses in exchange for equity. Funding such as this usually comes from wealthy investors, investment banks or other financial institutions looking for opportunities to support young companies in the hope that early investment will help them grow faster, making money for the investor and the founders. The financial investment may come with managerial or technical support.

Venture capitalists will often invest in a number of small companies, taking around 50 per cent equity in the business. This helps them spread their risk, and often allows the business founders to retain equity in the business so that its success will also deliver for them as well as their investors.

This is a way for young companies to secure financing without giving up equity or having the burden of inflexible debt repayment conditions.

Investors agree to invest capital in a company in exchange for a percentage of the company’s ongoing total gross revenues. It is an alternative investment model to more conventional equity-based investments, such as venture capital and angel investing, as well as debt financing.

It means a young company can raise capital without sacrificing part of its equity or pledging a part of its assets as collateral.

Private equity investors take shares in a business. Like venture capital, the investors are generally high net worth individuals, or large institutional investors, such as pension funds or companies acting on their behalf. The goal of private equity investors is generally to take control of the whole business and so they usually invest in mature or proven businesses which the investors feel have fundamentally good products or services but have unrealised potential because of poor management or other ine ciencies.

High net worth individuals (“angels”) who are willing to invest their own funds.

Angel investors seek to share in the successful growth and have a return on their investment. However, angel investing is generally regarded as “patient capital” (an investment made for the longer term), and they may not see an exit or a return on their investment for up to eight to 10 years.

While business angels can invest on their own, more frequently investment is made alongside other angel investors through syndication. This enables them to pool funds and share the risks.

There is a regulatory framework for angel investing that protects angels and the entrepreneurs.

Before receiving business plans or beginning to make angel investments, an angel investor must self-certify as either a High Net Worth or Sophisticated Investor.

A certified high net worth individual must have a net income in excess of £100,000 or net assets in excess of £250,000 over and above their pension fund assets and private residence.

A sophisticated investor must have either been a director of a company turning over at least £1 million within the last two years, have made more than one investment in an unlisted company in the last two years, be a member of a network or syndicate of business angels for at least six months or have worked in the past two years professionally in the private equity sector or in the provision of finance for small and medium enterprises.

The government’s Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) give angels generous tax breaks. By making investing less risky for investors, the schemes help businesses grow.

Under EIS, angels cannot take more than a 30 per cent share of a business, which makes sure that entrepreneurs stay incentivised.

Not strictly borrowing, because they don’t have to be paid back, grants from government are often di cult to find and sector specific. Application forms are also often time-consuming to complete. Contact the government’s innovation agency, Innovate UK, which operates many funding schemes.

The value of grants varies greatly but can be between £1,000 to £100,000 for small or medium-sized businesses, or much larger for the high growth businesses that the government wants to encourage.

Raising capital through collective funding of individual investors. These can be friends and family or, increasingly, amateur investors or individuals seeking opportunities to invest their money via online or social media platforms.

Crowdfunding platforms, such as Crowdcube or Seedrs, o er a public arena to showcase a business’s products or services. There are di erent sorts of crowdfunding websites, including rewards-based where the investee o ers their product or service as a reward, equity-based where the investee gives up a portion of the business to the investor, or donation-based – often used for social enterprises or community interest companies.

Peer-to-peer lending matches up potential investors with borrowers, who could be individuals or businesses.

They appeal to investors willing to take on more risk with their cash for higher interest rates o ered than typical savings accounts.

Retail investors access an online platform to provide loans to consumers or small business borrowers. These platforms facilitate the lending, undertake credit assessments and other risk management, but do not act as a counter-party to the loan, and contracts are direct between the investor and the borrower.

In 2019, the Financial Conduct Authority imposed stricter rules for peer-to-peer platforms to protect less experienced investors. One of these rules was the introduction of a requirement that platforms assess investors’ knowledge and experience of peer-to-peer investments where no advice has been given to them.

“Crowdfunding platforms, such as Crowdcube or Seedrs, offer a public arena to showcase a business’s products or services”Abingdon-based EcoSync raised more than double its £400,000 Crowdcube target to further develop its smart tech to enable those managing commercial buildings to stop heating empty rooms Carbon Gold, the Bristol-based organic, peat free planting aid business founded by Craig Sams, (who also founded Green & Blacks Chocolate], smashed its £200,000 Crowdcube funding target earlier this year

Although concerned that the UK is becoming a harder environment to scale in, nine in ten of the UK’s scaling companies expect to continue growing in the coming 12 months.

One in five expect to scale at 50 per cent or more. These insights were revealed in the ScaleUp Institute’s 2022 Annual Review, which also recorded

a strong scaling pipeline and a 13 per cent increase in the number of ‘visible’ scale-ups to 8,457 – which it defines as those breaking through the £10.2 million turnover barrier or £5.1 million in assets. That is a 119 per cent increase since these were first tracked in 2017.

The report included a survey of more than 300 chief executives of

high-growth scaling companies across the UK with a combined turnover of £2.5 billion.

Almost 40 per cent of the scale-ups surveyed have a female or ethnic minority founder or chief executive. More than 60 per cent want to export more this year and more than half expect to raise further funds to fuel growth.

Fifty of the UK’s leading women entrepreneurs – including a number from across our region – have been backed by Innovate UK for game-changing ideas.

From a pedal-powered games controller to an AI digital prehabilitation programme for cancer patients before receiving treatment, Innovate UK’s Women in Innovation Awards will empower the women to scale their innovative businesses.

Each winner will benefit from a £50,000 grant, one-to-one business coaching, networking opportunities, role modelling and training.

The Awards reflect the government’s ambition to give more support to women innovators and business leaders.

The entrepreneurs include Sarah Nicolls, from Stroud, founder of Future Piano and concert pianist, who is revolutionising the design of grand pianos with her lightweight, portable yet totally acoustic “Standing Grand”. This innovative product fits in modern homes without compromising on sound while reducing the weight and carbon footprint of a normal grand piano by 60 per cent.

Another entrepreneur is Samantha Payne, from Bristol, who co-founded Open Bionics, a robotics company building multi-grip bionic arms for amputees, which are 3D printed to make them more a ordable. Disney granted the company royalty-free licence agreements, enabling them to produce prosthetics based on fan-favourite characters like Black Panther, R2-D2 and Iron Man. A “Sidekick” app syncs the arm to the phone for personalisation, training and tracking performance.

Dr Rebecca Allam, also from Bristol, is a haematologist who has founded PreActiv, a ‘prehabilitation’ programme using the time people have before a cancer treatment to better prepare them for it. Her innovative

AI-led digital platform creates personalised programmes from the time of diagnosis potentially reducing the risk of complications by 51 per cent, cutting down hospital stays by a third and allowing quicker recovery.

Laura Scanlon, again from Bristol, cofounded Fatima, a research platform that ensures data is ethically collected, securely stored and rapidly analysed. This helps organisations looking to have a greater social impact to better understand the challenges of and to reach vulnerable people who are often overlooked and mistreated, and their data used without their consent or knowledge.

Emma Heathcote-James from Worcestershire founded Little Soap Company in 2008. Since then the business has expanded to four full ranges, with 30 key lines in all the main chemists, supermarkets and online giants. As well as selling kind, quality products, each bar replaces an unnecessary plastic bottle, tub, pot or tube. The company obtained BCorp status in 2020 and all its products are vegan, cruelty free, RSPO Palm, and made in the UK.

“There is currently no option of truly sustainable, plastic-free products in this category in UK supermarkets or chemists,” she said “Seventy five per cent of market share is from just three major players – all using plastic packaging. Quite simply we will shake up what is currently a very unsustainable and un-eco category.”

Innovate UK, the country’s innovation agency, provides funding to help stimulate innovation in the UK economy. It encourages businesses to work with other commercial and research organisations.

Innovation is never easy, especially in the early stages of developing an idea before taking it to market. Sometimes businesses might need to work together, supported by a research and technology organisation which can lead the project.

The level of funding available from Innovate UK to develop innovation will depend on the size and type of the organisations applying (either businesses, research organisations, public sector organisations or charities undertaking research) and their role in a project. Organisations fall into three categories: businesses, research organisations and public sector organisations or charities undertaking research. Businesses applying must be registered in the UK.

There are dozens of open competitions on its website, which are being added to regularly. Here are some of its latest. More details on all of them, along with all other criteria around funding applications (and there are many) can be found on www.ukri.org. A word of warning – beware of the tight opening and closing dates.

The University of Warwick has joined forces with seven other research-intensive Midlands universities to form an investment company for early-stage technology businesses.

Midlands Mindforge plans to raise up to £250 million from institutional investors, strategic corporate partners and other qualifying individuals.

The Midlands Innovation partnership also involves the Universities of Birmingham, Cranfield, Keele Leicester, Loughborough, Nottingham and Aston.

Together, they will aim to support fledgling businesses in sectors such as clean technology, AI and computational science, life sciences and health tech.

Professor Trevor McMillan OBE, Chair of the Midlands Innovation Board and Vice-Chancellor of Keele University, said:

“We have one of the largest research communities in the UK, with more than 14,500 academics who have a strong track record collaborating on innovative research

ideas that turn spin-outs into successful businesses.

“This new company creates an ecosystem to better support our research entrepreneurs and encourage innovation. By cultivating an environment where post-graduate students and researchers with commercial ideas can benefit from early access to investment, we can create opportunities for our people, place, and partnership to flourish.

“Midlands Mindforge will allow our universities to scale up their research and enterprise activity. It is a catalyst for building ground-breaking businesses that help to boost economic growth, create highly skilled jobs, and support the UK’s bid to be a global science and technology superpower.”

Compared with other UK university groupings, Midlands Innovation shares the most post-graduate students, the highest levels of annual income, and the most research disclosures and patents generated per unit of research spend in the last three years.

Toddle Born Wild, a baby skincare brand which last year secured £60,000 from two of the BBC’s Dragons, Deborah Meaden and Steven Bartlett on Dragon’s Den, has landed a finance package of £26,000 from HSBC.

The funding from HSBC UK’s Green SME fund has been used to develop more sustainable packaging with assistance from sustainable plastic research from the University of Wrexham.

Toddle Born Wild was founded by former

Ecoversity UK, a Community Interest Company developing the industrial hemp sector, has joined the Hartpury Tech Box Park to support local farmers in exploring the many uses of hemp.

Lydney-based Ecoversity UK Chairman Marcus Morley-Jones, said: “Hemp is a multifunctional premium cash crop, so versatility is a word you’ll hear a lot about growing this plant. What this means for the farmer is that ample amounts of food, fuel and fibre can be harvested in a single rotation – which also functions as a powerful carbon sink and natural soil conditioner.

“We’re seeing the plant reappear increasingly more in our diets, clothing and even in our construction materials. However, most businesses have no option but to import such products as UK farmers struggle to source a viable and scalable processing solution to meet demand. Here is where putting resources into education can help de-risk the supply and value chain, to enable local farmers and businesses to successfully test the crop as part of a local circular economic system.”

RAF o cer Hannah Saunders after she struggled to find suitable products to protect her child's skin from outdoor weather.

Thanks to the expertise of Deborah and Steven, the business expanded into the USA, where it sold out in six weeks. The HSBC funding will also help the business expand through new job creation, sourcing materials from UK suppliers and moving into new headquarters in Staunton, Gloucestershire.

Gloucester City Council has signed a deal with IHG Hotels & Resorts for a 131-bedroom Hotel Indigo at The Forum development in the city centre.

The deal sees the city welcome its first international upscale hotel brand as an anchor occupier in the £107 million project, which is being developed by the council in partnership with Reef Group.

The Forum is part of an ambitious programme of regeneration under way in the city centre and a central part of the council’s King’s Quarter regeneration, which will deliver two acres of pedestrianised public space.

This includes the £5 million transformation of King’s Square, which was o cially launched in April 2022.

The Hotel Indigo brand, part of IHG Hotels & Resorts, has hotels in cities all over the world including London, Berlin, New York, Hong Kong and now Gloucester.

Gloucester-based AIS (formerly Advanced Insulation Systems), a global leader in the design and manufacture of insulation and passive fire protection systems, has been awarded a substantial contract to provide its ContraFlex advanced insulation jackets for a FPSO – floating production storage and o oading –vessel in Brazil.

The contract was awarded by a Japanese company operating in Brazil.

The contract includes 400 sq m of thermal insulation for valves, flanges

and pipes. It also includes the installation of all jackets after delivery.

This is AIS in Brazil’s first substantial order for thermal insulation for o shore applications.

The jackets will be installed in the Brazilian pre-salt area, in the Santos Basin. The FPSO – which produces crude oil and gas at sea – is capable of processing 150,000 barrels of oil per day, 280 million standard cubic feet of gas per day, and has a storage capacity of 1,600,000 barrels of total fluids.

Hartpury University and Hartpury College is a specialist education provider in the heart of Gloucestershire, home to over 4,500 students studying PhDs, postgraduate and undergraduate degrees, and diplomas in sport, equine, animal, agriculture, veterinary nursing and A-levels. In addition to education and training, Hartpury has built a strong reputation for its close ties with business and the community.

Transform your business with a Knowledge Transfer Partnership (KTP) Hartpury University has recently been successful in its application to join Innovate UK’s Knowledge Transfer Partnership (KTP) programme.

KTPs connect forward-thinking businesses with the UK’s world-class knowledge bases to deliver business-led innovation projects. Taking part in a KTP with Hartpury University can benefit your business by helping to solve a specific challenge that you may be facing. You can access academic expertise and resources that you don’t have in-house, and the projects are part-funded by an Innovate UK grant.

Working with Hartpury University, you’ll potentially improve your business processes and performance, while also becoming more competitive and productive. Hartpury’s population of postgraduate students is brimming with talent, ready to help.

In addition, a Knowledge Transfer Partnership with Hartpury could help your business to:

• Embed expertise and generate new knowledge including through upskilling and training your own workforce, expanding capabilities, and fostering a culture of innovation.

• Access the latest technologies led by university academics and students in Hartpury’s state-of-the-art facilities, applying them to your daily business practices.

• Gain privileged access to a world-class knowledge base and resources including academics actively engaging in global research projects.

• Increase revenue through access to new markets, comprehensive networking opportunities and new product development.

• Improve profits through e ciency gains, increase productivity and improve processes.

• Test new products and ideas before taking them to market, making investment or securing additional funding.

• Gain a competitive advantage by using enhanced intelligence to truly meet the needs of your customer base.

For more information, contact Jane Williams, Head of Research at Hartpury via jane.williams@hartpury.ac.uk.

Stuart Emmerson has been Director of Business Development at Hartpury since 2019 and has led the growth of a team that has been instrumental in securing innovative, positive partnerships and an outward-looking approach. An instinctive collaborator, Stuart’s belief that success is more impactful when it’s shared, has been carried through to a range of partnership and funding successes.

“Hartpury has so much to o er the business community, local government and the third sector. It’s been truly rewarding to see our impact and partnerships evolve and grow in recent years,” says Stuart.

“We have so many fantastic success stories of collaborative e orts and I’m committed to building on this in the years to come. Working with our outstanding local, regional and national partners we’re set on futureproofing and positively impacting the industries we’re passionate about.

“It’s great to see the success and benefits that can be enjoyed through joinedup thinking between business, local government, our leading academics and our talented student population.”

Businesses can get involved with Hartpury in a number of ways. These include:

Live student projects and consultancy

Hartpury’s Sports Business Hub is a strong example of an initiative designed to link business with a postgraduate student to carry out a live consultancy project.

Placements

Providing a placement opportunity for a Hartpury student comes with a variety of benefits. Not only will your business have additional resources and fresh thinking, but you’ll also tap into the specialist skills and knowledge they’re gaining as they progress with their studies. Who knows, your placement student could even become a future employee.

Graduates

Hartpury graduates enjoy high levels of employability so why not access an unrivalled pool of graduate talent to fill your next vacancy, also developing their knowledge and skills to make a di erence in your industry.

Collaborative Research and Development

Hartpury academics frequently engage in global research projects with industry partners.

Mix business with pleasure

Hartpury enjoys an enviable reputation for having produced more than 250 elite athletes and has invested heavily to develop its sport facilities over the years. The institution is home to ten elite sports academies that support students to compete regionally and nationally.

Hartpury’s commercial equestrian centre is also well regarded, hosting a busy calendar of competitions each year. The events are a great day out for all the family as well as a refreshing outdoor escape for businesses seeking a unique company away day.

GET INVOLVED: SPONSOR

Why not place your brand front and centre, by sponsoring one of Hartpury’s elite

The Tech Box Park currently o ers FREE dedicated, practical working space and support packages for selected start-ups and businesses looking to accelerate routes to market through testing, researching and developing new products more successfully.

The Agri-Tech Centre is at the forefront of the agri-tech revolution. Working with industry partners, Hartpury is helping to develop new solutions to some of the biggest challenges facing the sector including climate change, food security, animal welfare and productivity.

The centre is an ideal base for research projects exploring the potential of new innovations in agriculture including the use of drones for crop monitoring and management, exploring the potential of robotics for livestock farming, and developing new techniques for sustainable food production.

A word from Prof Andy Collop Vice-Chancellor, Principal and CEO of Hartpury University and Hartpury College

“At Hartpury, we’re passionate about fostering a culture of problem-solving, learning and innovation. The synergy

The Hartpury business development team has enjoyed great success in securing funding to help with research projects. Teaming up with Hartpury could help your business more successfully secure joint funding opportunities.

sports academies, teams or equine events?

GET INVOLVED: SPECTATE

If you’re still unsure whether to sponsor a sports team or an equestrian event, why not attend as a spectator instead? Matchdays are a good choice of familyfriendly entertainment or a corporate evening out.

To learn more about corporate tickets and hospitality as well as partnership packages, contact James Forrester, Hartpury’s Head of Sponsorship and Business Engagement via james.forrester3@hartpury.ac.uk.

Watching sport at Hartpury isn’t just fun and a ordable, it also provides an opportunity to catch up with your peers, unwind in the fresh air or network for new business.

T: 01452 702796

E: stuart.emmerson@hartpury.ac.uk

W: www.hartpury.ac.uk

between Hartpury and business creates an ongoing cycle of progress and growth for all involved, helping business to access the latest research and talent but also ensuring our degrees, diplomas and other academic programmes are aligned with the needs of industry.”

The week after the 2023 Cheltenham Festival and tailor Tom Wharton looks surprisingly relaxed considering he dressed more than his fair share of wellheeled racegoers.

“It was manic in the weeks before,” he says. “We were getting calls from those who wanted something almost at the last minute. But it doesn’t matter how much money they were prepared to pay – you just can’t rush good tailoring.”

Having worked around the clock for the month leading up to Cheltenham, what did Tom do during race week? “I went to play golf in Spain. It’s a great way to relax.”

Tom’s reputation for quality tailoring using the best British tweed has grown, helped by the endorsement of clients such as the cricketer Michael Vaughan, TV presenter Dan Walker (and his Strictly partner Nadiya Bychkova), The Feeling’s Richard Jones (husband of Sophie EllisBextor) and Gloucestershire celebrity, Laurence Llewelyn-Bowen.

Barrington Ayre’s turnover grew around 40 per cent last year, but Tom emphasises this is a lifestyle business. “We want to spend time with our children and that means

By Nicky Godding, Editorspending Thursday afternoons watching them play sport if we want to.”

Since the pandemic, Tom’s wife Kate has taken on the operational side of the business so he can dedicate more time to clients.

“If people book an appointment at Barrington Ayre, they want to see me, not an assistant.”

He is also commuting regularly again to see clients, in London, Alderley Edge in Cheshire and across the South West.

While work is flowing, the pandemic was, initially, a massive challenge.

“Before Covid the business was building well. I have a great clientele in Gloucestershire as well as nationally.

“There aren’t many bespoke tailors here so local gentlemen’s outfitters such as Scott’s in Cirencester passed their bespoke work to me, and I would pass othe-peg enquiries back to them.

“And as we are a bit younger, and less intimidating than a Saville Row tailor, we were welcoming people who haven’t previously ventured into bespoke clothing.”

The pandemic not only a ected Tom’s business, but also his wife Kate who was working in luxury travel. Everything ground to a halt.

But not for long. “The tailoring world isn’t massive and we all kept talking. I suggested to a fabric supplier that we make face masks – so we ordered 2,500 smart ones just before it became mandatory. It got us through a month and kept some money coming in.

Tom then had an idea. “I love submariner jumpers and was introduced to a chap from Macclesfield who made them. We redesigned one to a style I’d always loved and hoped other people would like them too.”

The jumpers sold like wildfire. Then he came up with a range of knitted jackets which the business could sell without having to meet people.

“It gave us a few more income streams,” he said.

15 years ago. Now he is producing beautiful bespoke tailoring for a classy client list including sports stars and

When it seemed like half of London moved to the Cotswolds, Tom welcomed new clients who had previously used London tailors. “A few have returned to their old tailors, but many are still with us,” he said.

Another, perhaps surprising, thing that happened during lockdown was that a lot of Tom’s clients changed shape.

“Many larger customers dropped a considerable amount of weight. Perhaps the more mature gentlemen who had previously enjoyed life and long lunches began to realise that Covid was harsher on the larger frame. Many have stayed at their new lower weight, so we have not only remade their wardrobes, but as they take more pride in themselves, they’ve loved expanding their wardrobe.”

When the world opened again, the phone started ringing o the hook. “There were weddings everywhere as people were making up for lost time, but we were still running on 50 per cent manufacturing capacity because rows of machinists had been taken out thanks to social distancing.”

With Covid, hopefully behind them, Tom is once again looking to the future, but he reflects on the previous two years.

Barrington Ayre’s main workshops are based in Leeds, but it does have a small workroom on site which produces Tom’s “Made in Cirencester” range.

“We stuck with the people who make for us through Covid, because we’ve worked together for 10 years or more. There is trust, honour and loyalty there – on both sides. For instance, they asked us to put orders in during Covid when we really didn’t have the clients, so I asked them to make us jackets and a few other things to keep us going. The mills were the same. I bought some rolls of fabric, so they had some money coming in.”

British tailoring is back in fashion for another reason – Tom’s fabrics are completely sustainable. “Tweed is waterproof, which is why our tweed ski suits are becoming more popular. Customers love the fact that they are not heavy and help regulate body

temperature on the ski slope and the après ski bar afterwards.”

Tom’s customers increasingly want to know where the fabric comes from. “Lovat Mill in Hawick makes our cloths and it welcomes visitors. I’ll give our customers the fabric code and if they’re visiting, they get a kick seeing it on a big roll.

The best tweed is made in Scotland and the North of England, says Tom, thanks in large part to the soft water, which gives it a unique finish and softness.

“The Italians do a soft version but real tweed comes from Britain. That’s where it’s made, the material is dyed, and where the colours are from. No one does it like us.”

Tom is the perfect model for his clothing. Dapper and perfectly presented. Does he own a pair of tracksuit bottoms? His face says it all, but he concedes “I do own a pair of jeans.”

“The Italians do a soft version but real tweed comes from Britain. That’s where it’s made, the material is dyed, and where the colours are from. No one does it like us”

Cheltenham content agency Squashed Robot has directed the music video for Lewis Capaldi’s new song Wish You The Best.

Gloucestershire has a new awards programme for its thriving food and drink industry and the first Gloucestershire Foodie Awards were revealed at Gloucester’s stunning Blackfriars Priory.

Guests enjoyed food made by country food businesses The Dirty Boys Kitchen, Salt Bakehouse, The Ground and Round Burger, and Non-Solo.

Seventeen winners were announced on the night including Yves Ogrodzki of the Cheltenham restaurant L'Artisan who was named Casual Chef of the Year, and Brett Russell of Cirencester’s Tierra & Mar, who won the award for Fine Dining Chef. The Natural Cookery School in Nailsworth also won the cookery school award and the award for Food and Drink retailer went to The Cotswold Vegbox, based near Chipping Campden.

Made in Gloucestershire, an organisation flying the flag for local food and drink

producers, announced Kitchen Garden Foods, Woodchester Vineyard and Eastington Farm Shop as winners.

Young Chef of the Year went to Liam Robbins, of the Speech House Hotel in the Forest of Dean.

Liam said: “I am well chu ed. Thank you for giving me this opportunity. I’ve just turned 18 and it is a great birthday present.”

Jonathan Smith, Founder of the Gloucestershire Foodie Awards, said: “The awards demonstrate the quality and dedication of what Gloucestershire produces – incredible food, drinks, and innovation all on show.”

The company teamed up with actors David Bradley and Tom Lewis to create the video for the song from Capaldi’s next album Broken By Desire To Be Heavenly Sent.

The video, filmed in Great Missenden and Little Missenden, was written and directed by Squashed Robot Creative Director Phil Beastall, who previously wrote and directed the 2019 video for Someone You Loved, which has more than 180 million views on YouTube.

The video plays homage to the story of Scotland’s legendary dog Greyfriars Bobby, who is believed to have spent 14 years guarding the grave of his owner until his own death in 1872. Harry Potter and Game of Thrones star David plays John, a local postman in a small village.

Phil said: “This is a story that Lewis wanted to tell as a proud Scotsman, so we knew the video needed to be as powerful as the song that it accompanied.”

A PhD student from the Royal Agricultural University in Cirencester who has made sustainable rope from British wool has won a coveted Women in Innovation award.

Kate Drury is one of just 50 winners, selected from more than 900 applications, in the annual Women in Innovation Awards,

run by Innovate UK and UK Research and Innovation.

Kate, who is studying for a PhD in Wool at the RAU, will now receive a £50,000 grant, business coaching, and training opportunities to help grow her business.

Kate’s company, Sustainable Rope Ltd,

was set up 18 months ago and uses traceable wool from British farms, through the British Wool Auction, to make rope from 100 per cent wool which is biodegradable and renewable, meaning it o ers a sustainable and environmentally sensitive alternative to traditional plastic rope, reducing micro plastic pollution.

Restructuring advisers FRP has secured the sale of Bristol-based British Corner Shop to private equity company Rcapital.

British Corner Shop was established in 2004 and sells more than 6,000 British food products to expats worldwide using its own direct to consumer operations and through online marketplaces. The company operates from a head o ce and warehouse facility in Yate, Bristol and a distribution hub in the Netherlands.

British Corner Shop faced operational challenges following Brexit and through the pandemic, which led to the need for an accelerated mergers and acquisitions process. Jonathan Dunn and Andrew Sheridan were appointed Joint Administrators in March and immediately completed the sale of the business and assets to Rcapital.

The transaction with Rcapital, which includes the UK operations and the share acquisition of British Corner Shop’s Dutch subsidiary, ensures the transfer of all 28 jobs in the UK and 23 jobs in The Netherlands. Rcapital will continue to trade British Corner Shop as it supports the long-term recovery of the business.

Joint Administrator of British Corner Shop Limited, Director Jonathan Dunn, said: “British Corner Shop has been a well-known growth story in Bristol and is relied upon by more than 600,000 expats around the world for a taste of home. While Brexit and COVID had considerable impact on the business and its ability to keep trading, the proposition has strong fundamentals.

Chris Campbell, Partner at Rcapital, said: “Rcapital’s investment o ers British Corner Shop an exciting opportunity to build its global expat market share by capitalising on its strong brand, worldclass technology platform and distribution network. Our financial expertise will support the management team as they take the business into a new phase of growth and development.”

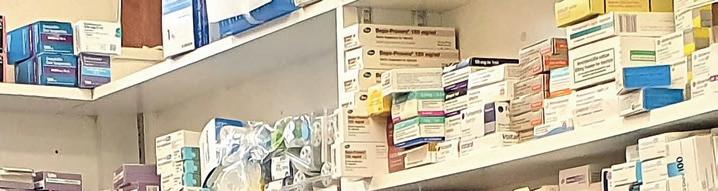

Electronic prescription dispensing is set to reach England’s most remote corners after a new piece of software, designed in Bristol, was accredited by the NHS.

Titan PMR has become the first viable software to be given full release authority by the NHS to provide electronic prescription services (EPS) to dispensing doctors – surgeries with an additional licence to dispense medicine on site.

More than 1,000 of these doctors, who provide a vital service to almost 10 million people in rural communities, can now o er patients the same level of benefits and e ciencies that electronic prescriptions have brought to pharmacies around the UK.

Currently written paper prescriptions from dispensing doctors account for around seven per cent of the total prescriptions in England – around 6.5 million each month.

“Until now dispensing doctor surgeries have basically been in the digital dark ages when it comes to dispensing medicines,” said Tariq Muhammad, a tech entrepreneur and CEO of Bristolbased Invatech Health, which developed Titan PMR.

“This accreditation means that doctors

can spend less time pushing paper and more time speaking to people and helping with their problems.

“For the NHS, digital dispensing of medicines is like taking away the final blockage from a dam that’s ready to burst. We are already administering one in 20 prescriptions in the country and that figure’s growing every day.

“We just want to help bring the benefits of technology to every sector where medicines are dispensed. Everybody wins – patients, our communities, the NHS, pharmacists and now dispensing doctors too.”

Laura Wright is the manager of Stoneleigh Surgery in Milnthorpe, Cumbria, where Titan was tested in a dispensing doctor surgery.

“With multiple surgery locations, each of which are able to generate prescriptions, we were keen to start working with EPS,” she said. “Paper prescriptions would often not be available when patients came into the dispensary but now they are immediately available at the surgery.

“There’s an increased level of safety, and it’s much easier to find what stage the patient’s medication is at.”

Neighbourly, the Bristol-based giving platform that matches businesses with local good causes, is doing more to help medium-sized enterprises increase their local social and environmental impact.

New features have been built into the platform specifically to help mid-tier organisations find and support local charities and causes their sta and customers care about, across Bristol and beyond through employee volunteering, surplus product redistribution and financial donations.

The features not only create transparency around what’s needed locally but also enable companies to measure the positive e ect of their giving programmes through real-time impact dashboards which provide social and environmental metrics for ESG and sustainability reporting.

To date, the Neighbourly platform has worked exclusively with enterprise-sized businesses and facilitated the donation of more than 120,000 volunteer hours, £23 million in funding, and more than 125 million meals worth of surplus food. This equates to a total financial impact of more than £255 million and a C02 saving of 198k tonnes, the organisations says.

Neighbourly has supported numerous international businesses global brands including M&S, WSP, Aldi, Gallagher, Lidl, Samsung, B&Q and Virgin Media O2 to deliver UK-wide but locally driven giving programmes.

Now the focus is on engaging the midmarket business community through a city-led activation strategy – starting with Bristol – with a call for leading businesses from across the area to sign up and be part of the movement to create £1bn in impact by 2025.

Neighbourly’s network includes more than 25,000 vetted charities and local community groups – in the Bristol region alone there are more than 800 good causes on the platform, including

schools, community centres, parks and homelessness charities seeking help.

Neighbourly CEO Steve Butterworth said, “Our home city was an obvious choice to kick o our mid-tier launch plan. Bristol has an abundance of successful businesses that operate in the heart of their local communities. Using the Neighbourly platform will enable businesses to help build happy, healthy, and more resilient neighbourhoods and to measure their positive impact, which is truly unique to Neighbourly.”

Neighbourly says it is currently the only platform which enables businesses to manage all their local giving in one place, helping companies to put their communities at the heart of responsible business.

“Our home city was an obvious choice to kick off our mid-tier launch plan. Bristol has an abundance of successful businesses that operate in the heart of their local communities”Neighbourly CEO - Steve Butterworth with Chief Operating O cer Zoe Colosimo

Bristol-based packaging specialist SH Fiske Ltd has been acquired by RH Fibreboard in a deal brokered by Harbourside Corporate Finance.

YTL Developments has received approval from South Gloucestershire Council to revitalise a Grade II listed aircraft hangar into a new lifestyle hub at Brabazon.

Originally built in 1917, Hangar 16U housed Battle of Britain fighter planes, including Hawker Hurricanes. The restoration work will see this historic structure return to support community life as it is transformed into a new public library, café, gym, social and wellness hub.

Bristol-based architects Ferguson Mann have designed Hangar 16U to live up to the legacy of its past, ensuring that distinctive features such as the original hangar doors are restored and rehung. The iconic Belfast trusses and intricate red brickwork will also be fully preserved, they promise.

Hangar 16U is located between The Hangar District – the first phase of 302 homes at Brabazon, almost half of which

are now completed and occupied – and the 15-acre Brabazon Park, which will be a modern re-imagining of Britain’s historic tradition of public parks. Work to restore the building is due to start soon and open next year.

YTL Developments is wholly owned by international group YTL Group. In the UK, YTL owns Wessex Water, GENeco waste to energy and the Gainsborough Bath Spa Hotel.

Sebastian Loyn, Planning and Development Director at YTL Developments said: “Hangar 16U has an incredible history and we can’t wait to bring this building into public use.

“As an early aircraft hangar in a pioneering era of aviation, it was at the centre of community life in North Bristol. The work will transform it into a new local hub at the heart of the community once again.”

Based out of Longwell Green, Fiske specialises in designing, developing and producing packaging for a variety of market sectors.

Its range includes conventional transit packaging to decorative cardboard boxes. Fiske has 25 employees, operating out of specialised facilities.

RH Fibreboard, part of the investment group Goonvean, views the move as a good way to bolster manufacturing capabilities in the South West, diversify its customer base and boost existing distribution channels.

Richard Jarratt, the previous major shareholder of SH Fiske, said: “After over 30 years heading the business, we are extremely pleased to be passing over the custody of the company to a familyrun investment group who we are sure will facilitate the exciting next stage of the company’s history.”

Inductosense, the University of Bristol spin-out company which has developed an ultrasonic sensor for monitoring corrosion, cracks and defects in industrial structures, has secured new investment.

This latest round brings the total amount raised by Inductosense to more than $10 million.

Inductosense has developed a WAND (Wireless and Non-Destructive) system based around wireless, batteryfree ultrasonic sensors.

These are permanently attached to metal structures to provide simple and accurate wall thickness monitoring.

Its clients benefit from a reduction

in cost and time associated with conventional monitoring.

The WAND technology has already been deployed internationally in a range of industries including oil and gas, chemical, nuclear and mining.

The latest round of investment comes from Aramco Ventures.

There are more than 700 vineyards in the British Isles. That sounds a lot, but Italy has more than 45,000 and France 27,000 (the European Union has around 45 per cent of the world’s wine-growing areas).

So it is even more impressive that a UK vineyard established in just 2007, which only bottled its first wine 13 years ago, produced a Sauvignon Blanc in 2021 judged one of the best in the world by some of the globe’s most experienced wine connoisseurs.

Earlier this year the Global Sauvignon Blanc Masters awarded Woodchester Vineyard’s Sauvignon Blanc a Master medal. It is the first English still wine ever to have won the prestigious award. The woman behind the success of the Gloucestershire vineyard is Fiona

Shiner, a qualified lawyer who only took up viticulture when she returned from Hong Kong in 2002 with her accountant husband, Niall and their three children.

“We went to Hong Kong in 1985 for three years and stayed for 17. We had an amazing time but came home because Niall’s job brought us back to the UK and we wanted our children to experience life in England.”

On their return, Fiona and Niall bought his parents’ Cotswold stone house which sits deep in a valley near Stroud. It had some land given over to a few rare breed sheep.

It took time to settle back in. “I was looking to go back to work and the obvious choice was the law, but I was keen to explore a non-o ce-based role, so I looked for an

alternative. We had a few acres around the house, and I thought that perhaps I could make them work for us.”

She began wondering about planting vines after her mother-in-law mentioned that its south-west-facing slopes could be perfect for grape growing, and the Romans may have planted vines there.

Inspiration came after a visit to several English vineyards, including Camel Valley. The rare breed sheep departed and Fiona planted just one acre with Bacchus, Pinot Noir and Seyval Blanc vines.

“That was our trial area. There was no reference point for us and no recent history of viticulture in the area. While Three Choirs in north Gloucestershire has been established since 1984, they are on

red sand and we are on steep limestone brashy soil.”

Mothers-in-law are often right and four summers later, with advice and bottling help from Three Choirs, Fiona and Niall celebrated their first harvest.

“It was a tense, nervous moment when we tried our first wine. While we had done our research, you can never be sure. It was a huge relief that not only did we like it, but so did William’s Kitchen restaurant and delicatessen in Nailsworth which bought the majority of the 700 bottles from our first small harvest.

Vines take around seven to eight years to

mature and start producing decent crops, so buoyed by her early success, Fiona enrolled on viticulture and winery workshops at Plumpton College near Brighton, the centre of excellence for wine making in the UK and where a lot of English winemakers go. “Our winemaker, Jeremy Mount trained there.”

More land was planted to vines and Fiona began to seriously consider establishing a winery. “Our first crop in 2010 was quite good, but 2011 brought a three-month drought at the beginning of the year. We watered by hand. The yield was tiny, and we realised what a roller coaster the whole winemaking business was. For example, the year 2018 was amazing. We picked 180 tonnes – we’ve never picked that much since. In 2020 our yield was 59 tonnes.

Woodchester now produces on average around 85-90,000 bottles a year. “This will increase when our additional acreage comes online.”

England is a cool climate for viticulture and our humid and damp conditions can make it challenging to grow vines. It rains a lot.

But vines do need water, particularly at the beginning of the year when the vines are getting going. “A bit of rain during the summer helps too. In England we usually get more rain than we want but in 2022 the summer was almost too dry.

“A cold winter is good news though, as it kills o diseases from the previous season and gives a fresh start. It also holds backbud burst, because early buds are more vulnerable to spring frosts.”

Like most vineyards, Woodchester has some frost pockets and uses bougies (antifront candles) to protect the young buds. These look like paint pots full of wax and are dotted around the vineyard.

“We have temperature monitors in the vineyard connected to my phone. If the temperature drops below a certain level, usually at unsociable hours such as 3am, I get a call and we mobilise a few people.

“We have more than 100 bougies to light which takes around half an hour. The bougies can lift the temperature by one to two degrees and make all the di erence to the survival chances of the young buds.”

Europe su ers similar weather events, says Fiona. “Burgundy for example, can get hit by frosts much worse than ours.

“The weather is one major factor that we can’t control and this dictates the vine varieties we plant and the styles of wines we make,” she continued. “With our Bacchus variety, for example, we can make a good quality still wine every year whatever the English weather. We have other still wine varieties, such as Ortega which ripens well in an average English summer. A lot of them are not familiar names, but we also have Chardonnay, Pinot Noir, Pinot Meunier and, of course, Sauvignon Blanc – the more classic varieties for still and sparkling wine and some newer varieties such as Regent, created in the 20th century with disease resistance in mind – so there is less input into the vineyard, as well as quality.

“We look at what will grow in our cooler climate to ensure quality wine whatever the season. Our plantings allow for a degree of flexibility in the wines we produce each year depending on the harvest. Our red wine clones can go into our sparkling rosé, to give lots of character. But in a really hot summer we will pick what is suitable to make a good red wine. Pinot Noir in England is getting a nice reputation. 2022 will be a good year for English red I think.”

In viticulture, the term “clone” refers to a vine of a particular variety selected and propagated for specific qualities. Pinot Noir has more than 100 di erent clones. A sparkling wine clone tends to be higher producing, maintaining acidity for longerlasting sparkling wines. Dijon clones, for example, are suitable for still Pinot Noirs. They are slightly lower yielding and more focused on wine flavours and aromas.

“In cooler years we will use our Pinot Noir in sparkling wine but in a really good summer we can also make a still Pinot Noir from suitable clones.

Fiona has planted around 10 di erent Pinot Noir clones and while still wines are a particular interest of hers, Woodchester Valley now also produces white, rosé, red and sparkling wines from 58 acres.

It is single estate, unusual in the UK, only making wine from the grapes it grows.

“We look at what will grow in our cooler climate to ensure quality wine whatever the season”