MATTERS MANUFACTURING

We don’t have a hotline to the Chancellor, but if we did, this is our ask for business

We’re in a bit of an awkward position for this issue.

We go to print the week before the muchanticipated Autumn budget, and I don’t have a hot-line to the Chancellor’s o ce – or a crystal ball to predict what she’s going to announce, more’s the pity.

There has been considerable speculation in the national and financial press about what the government plans to do, and it’s not looking good for businesses.

But companies across the region have been clear for months about what they need: continuity, clarity of mission and a strategy to get there.

The CBI sent its budget recommendations to the Treasury in September. Its members want to see a positive vision and framework for longterm growth.

Reform of business rates, the planning system and increasing access to capital through pensions reform should be at the top of the Chancellor’s priority list, say CBI members.

Reforming the apprenticeship levy, accelerating the adoption of new technologies, helping companies transition to net zero and supporting that transition more widely are also key priorities.

Members of the CBI tend to be the country’s biggest businesses. Do smaller companies want the same thing?

Nicky Godding Editor

By and large yes, but most SMEs are also calling for better tax incentives to help them invest in their businesses. Until they have clarity (that word again), few will commit to investment – and who could blame them?

The government has already acknowledged that the apprenticeship levy needs to change, announcing a new growth and skills levy to replace the current version.

This will allow funding for shorter apprenticeships, giving learners and employers greater flexibility over their training than the existing system – where apprenticeships run for at least 12 months.

And with regard to investment in small businesses, it has also extended the Enterprise Investment Scheme and the Venture Capital Trust by 10 years to April 2035. It was due to run out next year.

In this issue we shine a light on manufacturing. Despite dropping down the list of global manufacturing countries, the sector remains fundamental to our economy. Our second feature is private wealth where we look at market trends and investor strategies.

Our big interviews are with Simone Hindmarch of Commercial, for whom building a £100 million business is just the start, and George Herbert of family business Hobbs House Bakery which, despite being a £7 million turnover business, rightly considers itself still an artisan bakery. We find out why.

UK manufacturing accounts for more than a third of all the country’s goods and services exports. We examine the

Commercial

just taken over the top job at Commercial, and the pandemic hit, but Simone came out

for the business

A specialist shoemaker in Herefordshire has secured a grant of more than £5,000 to boost production and sta .

This figure may not be in the same league as the millions of pounds in investments regularly reported in this magazine, but goods made by British artisans have seen a surge in popularity in recent years.

One estimate says that the craft industry contribues £3.4 billion to the UK economy, and more people are trying to build businesses in the sector after reevaulating their lives after Covid.

The most profitable craft business is handmade jewellery, but that’s not stopped Gaucho Ninja Leather building a business near Hereford which makes specialist barefoot shoes, using traditional techniques.

It says its footwear can improve posture and alleviate foot and lower limb problems.

Spanish exile Lisandro Serra Delmar has used his family tradition in leatherwork and a knowledge of martial arts to launch the business making traditional Japanese tabi boots for friends.

A Rural Enterprise Grant of £5,087 secured through Herefordshire Growth

Hub allowed Lisandro and his fellow director, wife Harriet Duke, to expand their their factory near Hereford.

There are also plans to recruit parttime sales and marketing support. The company already employs a commercial director and craft shoemaker.

Lisandro said: “We were at a stage where we needed to make the business more sustainable, and to make things more a ordable for customers.

“We opened the business to an investor, which allowed us to source some artisan factories in Spain. But to do this we needed to build a mezzanine to store extra stock and process sales more e ciently.

“The wood burner now keeps us warm and keeps the products dry. We couldn’t have done this without the help from the Growth Hub.”

The company launched in Spain and moved with Lisandro to Herefordshire when he relocated to join Harriet in 2019.

“The shoes last a long time and I like the idea that you buy a pair of shoes once and if you look after them, you can repair them...”

Lisandro said: “Ten years ago I opened an online shop on Etsy, selling these leather tabi, then people started asking “can you make a tall boot, can you make a rubber sole?” and so on. I discovered that these shoes already had a name, barefoot shoes. They are not only healthy in terms of posture and in the treatment and prevention of many issues with feet like plantar fasciitis, but they also help connecting with the ground and having an awareness of your senses.

“I am passionate about tradition. The shoes last a long time and I like the idea that you buy a pair of shoes once and if you look after them, you can repair them, resole them and start to create a story that grows with your footwear.”

The company is now working with the Herefordshire Growth Hub to apply for further funding, which would go towards specialist equipment to expand the customisation side of the business.

Oh we do like to work along the prom, prom, prom …

Cheltenham Borough Council has put its municipal o ces on the town’s iconic Promenade up for sale.

The 68,290 sq ft, Grade II* listed building is a town centre landmark. The council has occupied the building for 100 years.

Cheltenham’s famous Promenade is going through some seismic changes. Earlier this year its famous Cavendish House department store closed for good. The building is currently home to a number of pop-up stores while plans for its future are being discussed.

The historic municipal o ces, on the opposite site of the street, could be

converted into valuable commercial, o ce or residential space.

Daniel Rich, Director at Avison Young which is marketing the property, said:

“This historic building represents an unrivalled opportunity in the heart of Cheltenham.”

Cllr Rowena Hay, leader at Cheltenham Borough Council, described the sale as a magical opportunity to put the historic building back on the map.

She said: ‘’The benefits that will come with appropriate redevelopment of this much-loved, iconic building will allow our town to evolve and prosper.”

M&G Real Estate has completed its acquisition of a joint venture partner’s interest in Cribbs Mall in Bristol – one of the most successful shopping hubs in the UK.

It means the mall, now home to more than 150 shops and restaurants and employing more than 6,000 people from within a 20mile radius, is back under the ownership of its original cornerstone investors M&G Real Estate and Baylis Estates Ltd who funded its construction in 1998.

Scott Linard, portfolio director at M&G Real Estate, said: "As long-term investors in Cribbs Mall we are delighted to increase our stake in the shopping centre.

"With the increased investment taking

place across this area of Bristol, including the opening of the new Wild Place Bristol Zoo nearby and the redevelopment of Filton Airport, it is an exciting time for Cribbs Causeway, and we are looking forward to working with other key stakeholders to ensure we continue to attract visitors from across Bristol, the South West, Wales and West Midlands.

In September the mall secured lettings with three growing retailers for a combined 340 sq ft of space at the shopping centre.

Sportswear manufacturer Castore, jewellers Austen & Blake and makeup specialists KIKO Milano will occupy 573 sq ft, 967 sq ft, and 800 sq ft units respectively.

More than 11 million people chose to visit Coventry last year, marking a new record.

Coventry's visitor economy grew by more than £100 million on the previous year and increased by £261 million on prepandemic figures.

The new statistics were revealed in an economic impact report on tourism in the city, commissioned by destination management organisation, Destination Coventry, in partnership with West Midlands Growth Company.

Visitor direct expenditure with the city’s hospitality, leisure, retail and tourism businesses was up almost 14 per cent.

A total of 7,911 jobs are now supported by the expanding visitor economy in the city.

Tourism is an important part of the UK economy, contributing more than £250 billion a year.

Coventry continues to grow at a faster rate than the West Midlands Combined Authority area in the percentage of growth for visitor numbers, economic impact and total employment – with visitor numbers growing five per cent faster than the rest of the area.

Paul McMahon, Managing Director of Destination Coventry, said: “These latest figures reflect the second full year of Destination Coventry’s operations and highlight what can be achieved when businesses across the tourism sector work together to achieve positive outcomes.

Destination Coventry is a collaboration between Coventry City Council and Coventry & Warwickshire Chamber of Commerce.

Cllr Jim O’Boyle, Cabinet Member for Jobs, Regeneration and Climate Change at the city council, added: “We have seen a massive amount of change in

the city in the past few years in the city centre, refurbished heritage venues and a redeveloped railway station.”

Corin Crane, Chief Executive of Coventry & Warwickshire Chamber of Commerce, said: “Coventry is outperforming the rest of the West Midlands.”

Why is Coventry so popular? Legend has it that the city was the birthplace of St George, the dragon-slayer and patron saint of England.

The British car industry is said to have been founded in a disused Coventry cotton mill in 1896 and of course there is the incomparable, historic Coventry Cathedral. First founded as a convent in the year 700, the site has withstood King Canute, a couple of King Henrys, the English Civil War and most recently the German Luftwa e which destroyed the first cathedral in 1940. The new one was built adjacent and consecrated in 1962.

Do you feel stressed, burned out, frazzled? Is your work environment (or home o ce) uninspiring?

Fear not, Wiltshire Wildlife Trust wants to help your workplace become a haven for wildlife and a source of sta wellbeing.

Thanks to government funding until March next year, Wiltshire Wildlife has launched a project to help companies transform workplaces across the county into thriving spaces

for nature, boosting employee wellbeing and encouraging a deeper connection with the natural world.

Its Wild Workplaces project o ers practical ideas to bring nature into your work life.

They include workshops and activities, exploring the benefits of nature for mental and physical health and tips for creating wildlife-friendly gardens to implementing nature-inspired wellbeing programmes. Sign us up.

The UK manufacturing sector has been a major contributor to the success and wealth generation of the UK economy, global development and influence, for centuries, writes Richard Baker, Partner at national audit, tax, advisory and consulting firm Crowe.

As an island nation, the country’s forefathers, realised that with limited natural resources, to be a successful trading nation, and to provide sustainable income for the exchequer, the UK needed to add value by virtue of innovation, creativity, entrepreneurship and skilful hard work.

The vision and inspiration of the preVictorian enlightenment, driven by the likes of the Lunar Society, provided the building blocks for what became the ‘Industrial Revolution’ and created a string of manufacturing, agricultural and engineering successes of which examples continue and remain, throughout the globe.

British engineering and ingenuity and innovation has also played a key role in keeping the UK and the people of the world, safe, free, fed and watered and it continues to do so. In their 2024 report ‘The True Impact of UK Manufacturing’, Lloyds Bank, (working with Oxford Economics and the Manufacturing Technologies Association), identify that the sector is worth £518 billion to the UK economy (23.1% of GDP).

Despite its significance to the economy, 87% of the respondents to Crowe’s last manufacturing survey said the government support for the sector is inadequate.

Crowe teamed up with various industry figures earlier this year to answer this question and published a “Manifesto for Manufacturing” (www.crowe. com/uk/industries/manufacturing).

The manifesto is based on five pillars:

Skills and education

• Strategic review, refocus of education engagement and provision with manufacturing.

• Overhaul the apprenticeship system and its funding processes, including introduction of a tax credit-based system and introduce training incentives for UK graduates.

• Supported graduate level study fees for (STEM) subjects.

• Reintroduction of enhanced Research and Development relief at 130% uplift for SMEs.

• Training and education measures to build UK cyber resilience and secure technology supply chains.

• Better communication of support and funding streams.

The route to net-zero

• Strategic financial support for manufacturing businesses to decarbonise as part of a single national strategy and assistance scheme.

• A reshoring initiative to provide funding and support for reshoring to the UK of products and components currently produced abroad.

• Carbon Border Adjustment Mechanism (CBAM) to protect ‘homegrown’ production.

• National standardisation of net zero and carbon neutral expectations and requirements.

• Root and branch risk assessment covering supply chains and national infrastructure plans of UK steel production and technology dependent production processes.

• Public industry procurement process that favours UK suppliers as a point of preference.

• Utilisation and support of the SME supply chain.

Finance and investment

• Capital grants scheme to digitise manufacturing processes and support decarbonisation.

The Government has recently published its Industrial Strategy, “Invest 2035” which references advanced manufacturing as a key area of future growth. Fostering a pro-business environment and working in partnership are key principles. Whilst the messages are positive, time will tell what practical, real-life actions will arise from Invest 2035.

More discussion and commentary can be found in Crowe’s manifesto document which can be viewed here: www.crowe.com/uk/ industries/manufacturing.

If you would like to know more, please do get in touch with Richard Baker: richard.baker@crowe.co.uk www.crowe.co.uk

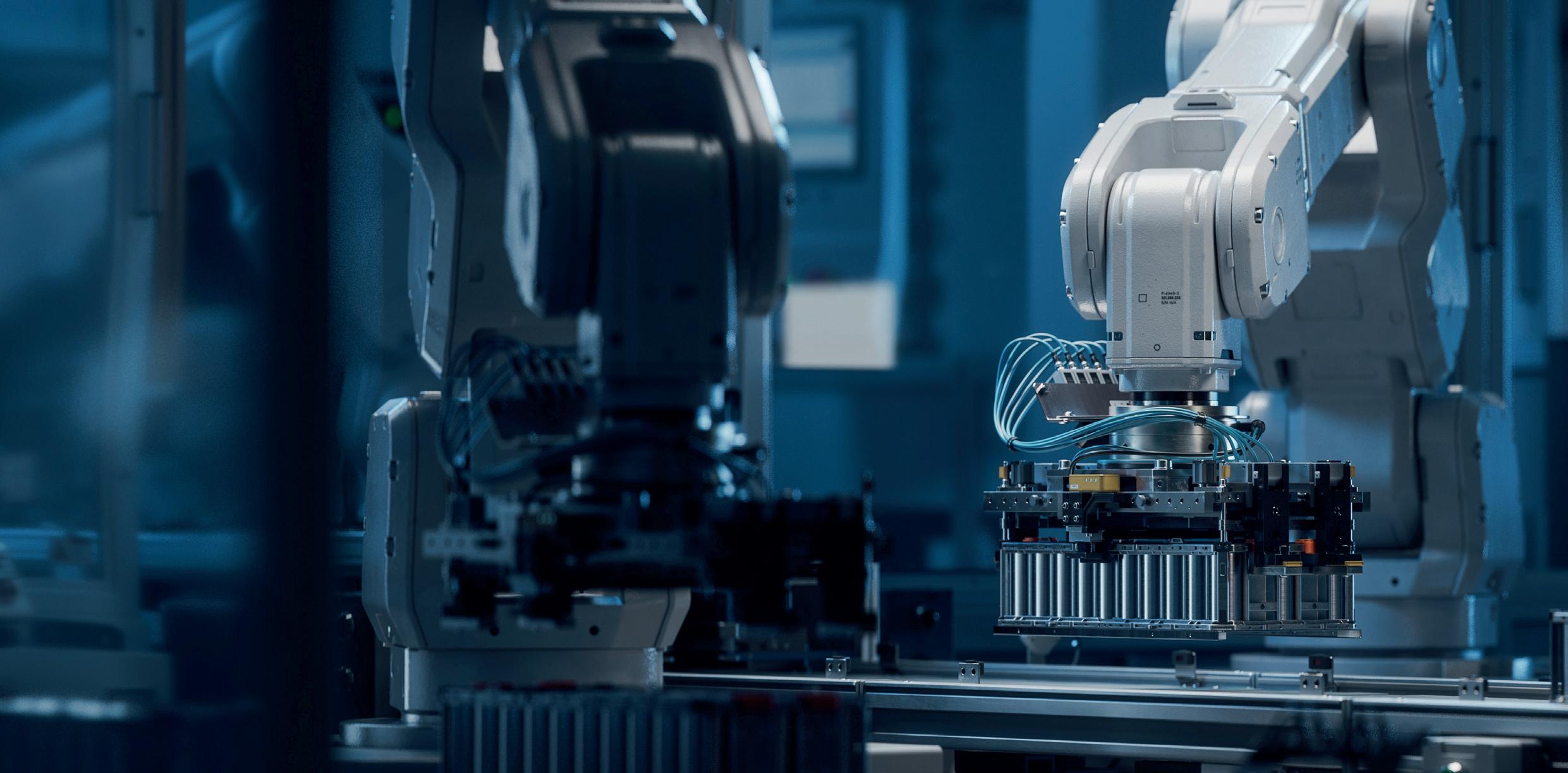

The UK could be losing its standing among the world’s top manufacturing nations. How can we get back on track?

By Daniel Face, senior reporter

UK manufacturing has been hit with a wake-up call.

The latest analysis from Make UK, the membership organisation which represents manufacturers across the UK, shows the country has fallen from eighth to 12th place among the world’s leading manufacturers, with an industry output of £217 billion.

Now ahead of the UK are Taiwan, which continues to enjoy high demand for its top-of-the-range semiconductors; Russia, with an ever-growing defence sector to maintain its war in Ukraine, and Mexico, a big climber this year thanks to a thriving automotive, aviation and aerospace ecosystem.

Could it be that manufacturing simply isn’t as crucial to the national economy as it always has been? Not according to the data.

This April, big industry names from across the country gathered in Birmingham for MACH 2024, the UK’s national exhibition

for engineering and manufacturing.

It was there that event host MTA – the Manufacturing Technologies Association – unveiled its new report, The True Impact of UK Manufacturing, in collaboration with analysts at Oxford Economics.

The paper broadens the scope o ered by Make UK, placing the real value of manufacturing to the UK economy closer to £518 billion. That works out to be around 23 per cent of GDP.

It goes on to identify that “making things” accounts for more than a third of all UK goods and services exports, directly supporting 7.3 million domestic jobs.

If manufacturing does in fact prop up almost a quarter of the national economy, this latest stumble in the world rankings should be all the more alarming.

What’s to blame? We can roll out the usual suspects of the past few years

– inflationary headwinds, supply chain issues stemming from global conflicts, the lingering impact of the pandemic on any manufacturer that wasn’t churning out vaccines.

And even many of those are now having to make a stark pivot. Just look at AstraZeneca collaborator OXB – formerly Oxford Biomedica – which, having been one of the UK’s biggest manufacturers of the Covid-19 vaccine, is settling into a new identity as a cell and gene therapy contractor.

Evidently, though, other nations have weathered those storms better than our own. It might help that the government has just launched a green paper on its proposed Industrial Strategy, which puts advanced manufacturing at the top of its eight focus areas.

The other focus areas include clean energy, the creative industries, defence, digital technologies, financial services, life sciences, and professional and business services.

“... industry is a far greater contributor to GDP and jobs than listed in national accounts”

What unique challenges has the UK faced? The big one is of course Brexit, which has burdened businesses with higher import and export tari s, delayed key investment decisions and squeezed the skilled labour market.

But most in the industry would agree that all these issues combined could have been better navigated given a confident, consistent plan from Westminster.

“Every other major economy, from Germany to China to the US, has a long-term national industrial plan,” says Stephen Phipson, head of Make UK.

“Even Barbados has one. As such, the UK is an outlier.”

Johnathan Dudley, head of manufacturing at national accountants Crowe, says: “In our latest annual manufacturing survey, which we use to gauge the temperature of the sector, our key findings reveal that 68 per cent of businesses in the sector are expecting a growth in sales this year despite global turbulence and di cult economic conditions, but 87 per cent of manufacturers are unhappy with the government support.

Much has been made of Labour’s “first mission in government” to achieve the highest sustained economic growth of all the G7 nations. And while the O ce for National Statistics suggests this has

been the case at least for the first half of 2024, it remains doubtful whether that momentum can be maintained over the coming years.

Meanwhile, here is a key industry crying out for support and investment. If that’s what the new government is able to provide, it could help turn a wishful manifesto pledge into a realistic vision.

Johnathan adds: “Manufacturing in the UK still contributes one fifth of the country’s GDP and continues to grow.

“At Crowe we recognise the importance of manufacturing to the UK in keeping our country competitive. Our manifesto, published ahead of the Summer election, provides a blueprint for the government which drives innovation, job creation and decarbonisation of the economy, securing the industry and the country’s long-term prosperity.

“UK manufacturing has a global reputation for innovation, creativity and excellence,” he continued. “We invest in supporting this and urge the new government to work with us, and the manufacturing sector as a whole, to produce their promised strategy.”

Heading into the July election, Labour put forward a four-pronged industrial strategy.

They committed to deliver clean power by 2030, ‘care for the future’ (opportunities here for health and care manufacturers), harness data for public good (think artificial

intelligence and data-driven supply chain management) and build a resilient economy.

Four months on, while it has introduced its industrial strategy green paper, there have been no big spending promises directed squarely at manufacturing (unless the chancellor pulls something out of the bag in the budget, which happens after this magazine goes to print).

We’ve seen nothing so far to match, for example, the scale of the Inflation Reduction Act in the US – a move which has seen billions of dollars invested in clean energy manufacturers.

Across the manufacturing industry, from large companies to small and mediumsized enterprises, there are calls for the government to make its vision clear.

Only then will they begin to commit to making the investments they need to grow.

Now comes a make-or-break moment. The worst the new government can do at this moment is nothing, leaving the industry underfunded, under-skilled and without direction.

A government with a potential new strategy – whose is it to execute?

As things stand, the job falls to the minister for industry, a role encompassing the departments for both business and trade and for energy security and net zero.

Manufacturing is therefore just one of many concerns for the new incumbent Sarah Jones, whose responsibilities also span retail, hospitality and professional services, to name a few.

The industry has already made clear it feels neglected under the current arrangement. The latest Manufacturing Outlook Report from Crowe found that nine in 10 manufacturers were unhappy with the current level of government support.

For them, a strategy alone won’t su ce. They need someone fighting their corner to see it through to fruition.

Johnathan Dudley says: “It’s high time that a dedicated minister for manufacturing was established to unlock the sector’s potential.

“We want them to understand what we are hearing from our regular engagement with the manufacturing sector through our surveys and roundtable events which give us the insight to lobby government on the sector’s behalf. They can light the fuse of a new industrial revolution in

the UK by aligning innovation, economic development and education, and support nearly a million green jobs to help get this country making, building and adding value again.”

Growth ambitions will be driven over the coming years by major carbon capture projects and new battery gigafactories, spearheaded no doubt by some of the biggest global players in the industry –think Tata and Japan’s AESC Group.

But a dedicated minister wouldn’t just push flashy initiatives. They’d also be a key voice for the UK’s 260,000-plus small and medium-sized domestic manufacturers.

“We need a hero within the corridors of power,” adds Andrea Wilson, an SME director and longtime advocate for a ‘manufacturing champion’.

“Government policy is most often informed by original equipment manufacturers (OEMs), large businesses or career civil servants.

“As a result, we see decisions made, policies implemented, and support o ered – the majority of which are not fit for purpose for the SME community.

“Listening to SME business prior to deciding what will help them will save this and future governments billions in wasted, over-administered and underutilised support.”

After a disappointing performance last year, the latest data suggests the industry could finally be turning a corner.

The S&P Global UK Manufacturing PMI (purchasing managers’ index) hit a 26-month high this August at 52.5.

This comes even as export orders fall for the 31st consecutive month, which has been put down to weaker demand from Europe and a slowdown in mainland China.

Rather, the domestic market has been leading the charge, as output, new orders and employment all picked up.

Large-scale producers have been particularly busy hiring, while small firms saw a mild increase in jobs and medium-sized companies made cuts.

“The upturn is broad-based across manufacturing,” said Rob Dobson of S&P Global Market Intelligence, “with the investment goods sector the standout performer.”

More than £2.2 million in grants has been awarded by Made Smarter West Midlands over the past three years to help the region’s manufacturing and engineering businesses adopt digital technologies.

Born out of an industry-led review in 2017, Made Smarter has grown into a national programme aiming to ensure that domestic manufacturers keep up with the latest innovations in the industry and build a workforce fit for the future.

It champions decentralisation, real-time analytics and virtualisation, whereby businesses produce virtual replicas of physical processes and models to better understand potential production blockages and reduce machine downtime.

The Conservatives had committed to expanding the Made Smarter adoption programme to all nine regions of England in 2025-26, before expanding to the other home nations the following year.

firms

Now the new government is being urged to carry forward that pledge – and what better template to replicate across the country than that of the West Midlands, led by local growth hubs in Coventry and Warwickshire, Birmingham and Worcestershire.

From its inception in June 2021 up to April 2024, a total of 635 businesses in the region had registered with the programme, generating an estimated £158 million gross value added (GVA).

Participants are given access to advice, leadership and skills training, as well as grant funding for digital internships and technology projects.

Craig Humphrey of Coventry and Warwickshire Growth Hub has hailed the programme a “runaway success”, while Onur Eren at WMG (the University of Warwick’s manufacturing group) says it sets “a new benchmark for digital excellence to continue in our region”.

Small and medium-sized manufacturers are being called upon to deliver support and spares for non-combat equipment aboard UK warships and submarines.

Coming as part of the Ministry of Defence’s Marine Systems Transformation (MAST) programme, the new seven-year framework will be worth up to £850 million.

It was announced by the minister for defence procurement, Maria Eagle, on a recent visit to Somers Forge – a West Midlands manufacturer of bespoke naval parts and one of several in the region able to bid for work under the framework.

“We’ve been a defence supplier since 1912 and are incredibly proud of our heritage supporting the Royal Navy,” said Samson Folkes, managing director.

“For Somers Forge, winning contracts through MAST can help us sustain vital jobs and apprenticeships in the Midlands, as well as underpin our growth ambitions.”

Warwickshire firms have been invited to share in a £500,000 business support initiative to help them boost sales, create jobs and improve productivity.

The Warwickshire Manufacturing Growth Programme, delivered by Oxford Innovation Advice, has already helped more than 80 local companies with coaching, consultancy, free workshops and signposting to other schemes.

Those on the programme start out by discussing their growth ambitions and challenges before gaining access to GROWTHmapper, a suite of diagnostic tools to identify opportunities for expansion.

It’s available until March 2025 for manufacturers across North Warwickshire, Nuneaton, Bedworth, Rugby, Stratford-upon-Avon and Warwick.

A major source of support for manufacturing over the years has been the Catapult Network, comprising nine centres across the UK – including three in the South West and West Midlands.

The Catapult Network was set up by Innovate UK in 2011, to provide a unique combination of cutting-edge research and development facilities and world-class

Founded in 2010 by the universities of Birmingham, Nottingham and Loughborough, The Manufacturing Technology Centre (MTC) operates three sites around the UK, with a base in Coventry. It employs almost 1,000 sta –mainly engineers and scientists – helping manufacturers develop new products and implement novel tools and technologies into existing processes.

This summer, MTC launched its new sustainable materials hub, complete with polymer and ceramic additive manufacturing (AM) machines to manufacture net zero products.

The hub also has material reprocessing equipment to recycle waste materials and parts into feedstock.

Older than the South West’s other centres, WMG (Warwick Manufacturing Group) was founded in 1980 as an academic department of the University of Warwick, o ering a part-time master’s degree for industry sta .

It now supports undergraduate engineers, teaching automotive, manufacturing and mechanical engineering.

technical expertise to support UK business innovation.

The Manufacturing Technology Centre in Coventry, National Composites Centre in Bristol and WMG (Warwick Manufacturing Group, part of the University of Warwick) are all part of the network.

Established by the government-funded agency Innovate UK, each operates as

More recently, the centre was granted £1.85 million by the Department for Science, Innovation and Technology to build a hazardous operations cell with capability to build and dismantle prototype battery modules and packs.

As part of the Catapult Network, WMG also lends its expertise in battery development, electrification, material sustainability and digital twinning to the region’s manufacturers.

In the past, the centre has helped Coventry’s Expert Technologies Group automate development of mechanical fixture plans and worked with Alpha Anodising to cut energy costs and implement sustainable solutions into its processes.

a private, not-for-profit business aiming to bridge the gap between research and commercialisation.

Catapult centres work with manufacturers of all sizes – from start-ups and entrepreneurs to multinational corporations – providing business growth, technology and supply chain development services.

They also o er apprenticeships and continuous professional development courses to help keep the local workforce up to date with the industry’s latest innovations.

The National Composites Centre (NCC) opened in 2011, backed by the research excellence of the University of Bristol and close to many of its five founding members – Airbus, AgustaWestland, GKN Aerospace, Rolls-Royce and Vestas.

It sprung up o the back of a government strategy to grow the nation’s share of the growing global market for composites – materials like reinforced concrete and plywood which comprise two or more constituent materials.

Nowadays, the centre works closely with the South West’s aerospace, defence, space, energy, transport and construction sectors, helping industry partners develop higher performing, longer lasting products with less waste.

It has recently picked up funding from the Department for Science, Innovation and Technology to set up the UK’s first research lines for carbon fibre production.

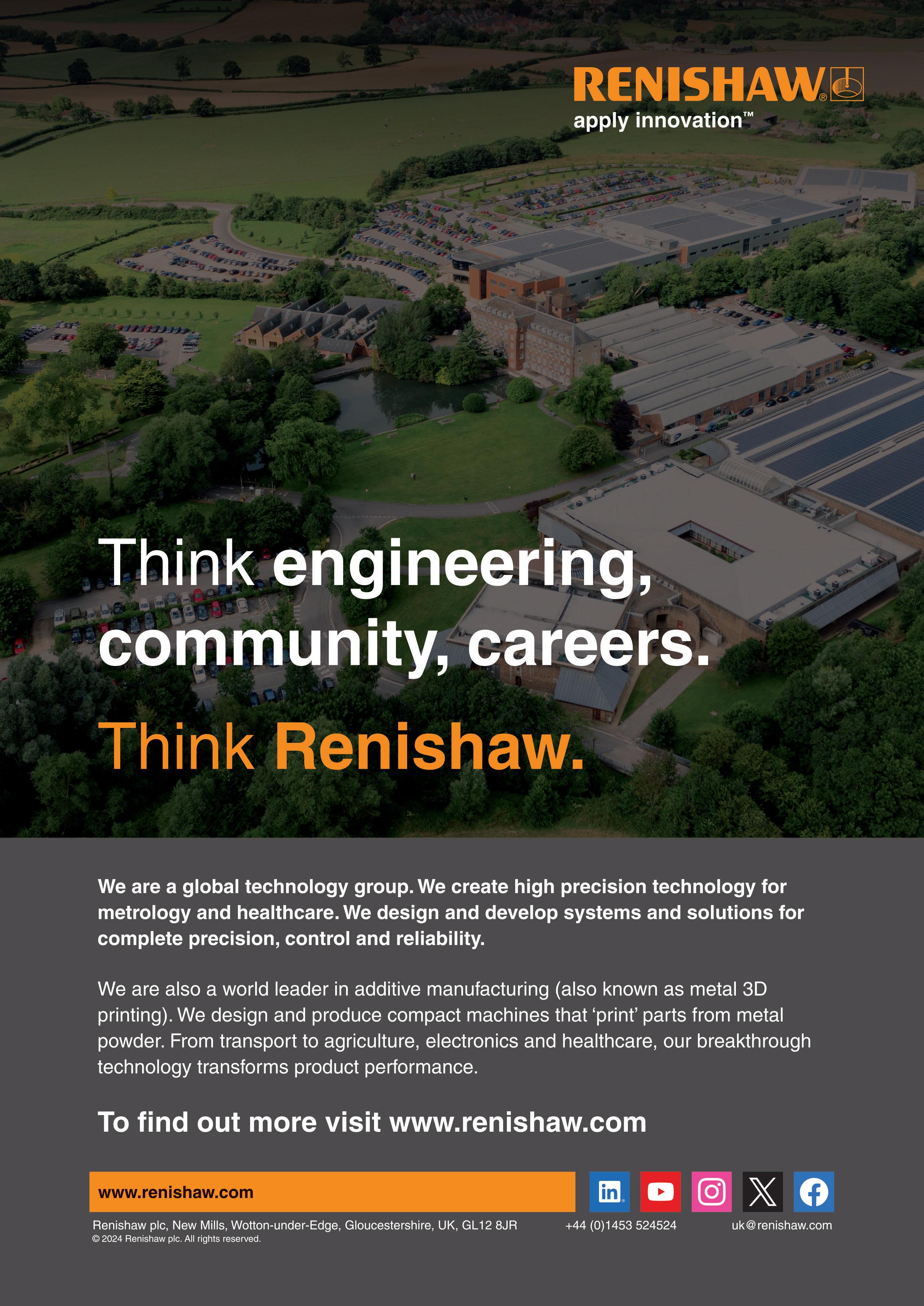

One firm helping to forge the next generation of manufacturing talent is Renishaw, the Gloucestershire-based global manufacturer and supplier to the aerospace, automotive, energy and healthcare sectors.

Among the courses o ered by Renishaw is the Level 3 Engineering Technician Apprenticeship, on which learners take part in a series of six-month placements –rotating between production, maintenance and the machine shop.

Ruqayyah Girach and Ed Baker are both currently in their third year on the course, having hopped between the firm’s various departments.

“Because Renishaw is so big, we’ve had a taste of a small part of it,” said Ruqayyah. “We get the opportunity to see what we like and enjoy.

“One of the first things my manager said is that he doesn’t micromanage, and I like having that independence to be able to go o and do jobs in my own time.”

Ed agreed: “We’re treated as proper fulltime employees.

“We’ve been able to learn from one placement and carry it forward to the next, which has been really valuable.”

Ed isn’t the first in his family to have trained under Renishaw. His older brother also apprenticed with the firm, and both of his brothers now hold engineering degrees –an option he’s weighing up in the long term.

“I took engineering at secondary school. Then I went to Hartpury College and did sport and exercise science.

“I got into multiple universities to do physio, and I was umming and ahing about it.”

On the other hand, an apprenticeship would help fund his other passion, sailing. This past year has taken Ed to Mallorca for the Under 21 European Championships –something he’s been able to successfully juggle with his course.

For Ruqayyah, apprenticing was always the way forward.

“After my A levels, I didn’t really want to sit in a classroom for hours on end. I like it here because you’re always on your feet.

“I hobby hop a lot, so I can go from embroidering to painting to all sorts of things. I like to always be learning about di erent things.”

That’s what she enjoys about Renishaw – the diversity o ered by its various placements. “I knew I’d have the opportunity to change if I wanted to.”

For everything they’ve both got out of the course, they’ve also given a lot back, and their lecturers have taken note.

The duo swept last year’s Gloucestershire Engineering Training Awards, between them picking up seven of the eight available accolades in a cohort of around 120.

Ruqayyah was named apprentices’ apprentice of the year, best dual skilled apprentice and best overall fitter, and was commended for her overall contribution to the centre.

“I put in a lot of e ort in the first year,” she said, “to prove not just to my college but to the company as well that I’m a hard worker.

“It was nice to be recognised because I wasn’t that great in school. My parents were really happy, I was really happy and Renishaw was really happy.”

Ed took home awards for best electrical apprentice and best overall turner.

“I didn’t notice how much e ort I was putting in. It just felt natural.

“After eight rotations of apprentices, I thought the lecturers would have forgotten about me. But I think out of enjoyment, I actually produced some pretty good work.”

Looking ahead to the future, Ed’s keen at some point to follow in his brothers’ footsteps and pick up a degree.

Ruqayyah knows she wants to further her education, but she’s taking the time to enjoy her current placement – which she’s looking to extend for another six months.

Expert Technologies Group in Coventry has won a multi-million-pound contract in Europe following a €1.4 million financing deal.

A supplier to major UK-based original equpment manufacturers, the group designs and delivers robotic assembly systems, tools and special machinery which support automation in industry.

It’s now begun a new project with the Spanish arm of Sumitomo Electric Bordnetze (SEBN), a global parts supplier for the automotive industry.

This latest deal will see Expert Technologies deliver two new automated auxiliary harness assembly lines for electric vehicles.

The business has also secured €1.4 million in working capital from NatWest thanks to help from the government’s UK Export Finance, which it will use to create up to 10 new jobs.

Angelo Luciano, CEO of Expert Technologies, said: “The support we received from UK Export Finance has allowed us to successfully be awarded the project with SEBN, who are a new customer to us.

“We look forward to developing the relationship further.

“This is the first project we’ve been awarded in Spain since both Brexit and Covid, and we hope that it’s a catalyst for further projects in mainland Europe.”

Warwick’s Astheimer Design showcased its latest innovation – an electric quadricycle for last-mile urban deliveries, at Cenex Expo this September.

Built as part of a joint venture with Prodrive in Oxfordshire, EVOLV is just 3.2 metres long and 1.4 metres wide,

but o ers a load capacity of 4m3 to rival mid-size vans.

“Everything about the design is fit for purpose,” said Carsten Astheimer, founder and creative director of Astheimer Design.

“It’s lightweight, robust and simple, which fits harmoniously with our philosophy of removing everything superfluous.

“The result is iconic in its simplicity, with the platform adaptable to the individual needs of each customer.”

For more about these so-called ‘tuktuks of the Western world’, see our front-cover feature on The Future of Automotive in the September issue of The Business Magazine.

Growth has remained anaemic for manufacturers in the South West so far this year – but business leaders are generally optimistic for the future.

These are the findings of the latest Manufacturing Outlook from Make UK and BDO.

Almost six in 10 companies surveyed believe the recent change in government will produce better economic growth overall for the coming year. In contrast, just six per cent expect GDP to decline.

The good news is that balance on output in the South West is forecast to jump from +7 to +14 per cent in the next quarter, which compares favourably to the more muted national picture.

Total orders are also expected to rise from +0 per cent to +29 per cent. The overall story, though, is a mixed bag.

“This quarter presents a tale of two halves for the South West,” said Keri Anne Mruk, region director at Make UK, “with recruitment intentions and investment taking a dip.

“Business confidence continues to climb, however.

“Now is the time for government to pick up the pace and deliver on pre-election promises, most notably the publication of a long-term robust industrial strategy.”

Matthew Sewell, BDO’s head of manufacturing for the South West, echoed this sentiment.

“Manufacturers are hopeful that a period of greater political stability will provide a better economic outlook ahead,” he added, “and that in turn is boosting business confidence.

“Time will tell if that confidence can translate to output and orders, or indeed recruitment intentions, where the South West relies heavily on skilled workers taking up manufacturing positions.”

Plant-Ex Ingredients, a family-owned manufacturer of natural food colours, flavours and extracts, has secured a £9 million minority investment from BGF.

Founded in 2010 by Giles Drewett, the Bristol business supplies food manufacturers around the world via a network of distribution partners.

It recently moved to a new factory in Bristol, doubling its footprint, and now

hopes to make further inroads in the US market after launching an LLC in Chicago earlier this year.

BGF investor James Skade said: “The rate at which Giles and the team have been able to grow Plant-Ex in a relatively short space of time is testament to their passion and hard work.

“We look forward helping them fulfil their objectives.”

Plant-Ex has also brought aboard non-executive chair Susan Barratt, whose career has included roles at the Institute of Grocery Distribution and Department of Health and Social Care.

As work continues on two nuclear reactors at Hinkley Point C power station in Somerset, one local firm has been busy building stainless steel components for the facility.

Established in May 2021, Framatome’s centre of excellence in Avonmouth near Bristol produces parts for nuclear steam supply systems, which use the heat released by nuclear fission to generate steam and ultimately drive the turbine generators.

It’s home to a four-metre, 400-ton

hydraulic synchronised press brake – one of the largest in the UK – which is used to fold critical components.

The centre also has the capability to implement multiple methods of manufacturing and assembly, including full modular solutions and pipe manufacture.

With specialised equipment comes a skilled workforce competent in tungsten inert gas), metal active gas and stud welding.

The highly specialised components built by the team include pools, tanks and liners for use in evolutionary power reactors, a relatively newer model first deployed in China in 2018.

The latest set has now been delivered on site at Hinkley Point.

Framatome also signed a series of multibillion-pound contracts earlier this year to deliver a replica of the Hinkley Point C reactors at Sizewell C in Su olk.

Sustainability is front and centre for most manufacturing businesses today – and none more so than one of Gloucestershire’s largest exporters.

Prima Dental Group, designer and engineer of precision dental instruments and products for the growing healthcare and cosmetic markets around the world, is committed to securing a brighter future for people and the planet.

And it’s this forward-looking focus that is supporting the company’s success. Not only has it grown to become the world’s largest dental bur (drill) manufacturer, this year also saw the business crowned with an esteemed King’s Award for Enterprise for International Trade.

Sustainability isn’t new to Prima, with significant impacts on improving its performance already under its belt.

By adopting a circular economy principle the business has reduced its landfill disposal from 70% to zero. This, along with other measures to reduce waste and improve resource e ciency, has been evidenced through the company’s ISO 14001 accreditation – the global standard for environmental management.

This sits in tandem with the company’s energy e ciency policy, which focusses on optimising production processes and using renewable energy resources where possible. This work has been certified with the organisation’s ISO 50001, with a robust framework in place to ensure continual improvement in this area.

The pursuit of better – Prima’s mission –drives all that it does and encapsulates how innovation drives its progress and that covers sustainability too.

The company integrates sustainability into every aspect of its operations, from energy-e cient production facilities to meticulous recycling initiatives. A team of dedicated Energy Champions continuously monitor and evaluate the organisation’s performance, driving ongoing improvements and setting new benchmarks for sustainable excellence.

The business only uses green energy, causing no harm to the natural environment. At the company’s main production facilities and head o ces

on the Waterwells Business Park in Quedgeley solar panels have been installed. Just one example of the company’s dedication to renewable energy solutions, this saves 90 tonnes of carbon dioxide emissions (CO2e) per year, while some 2,270 tonnes of emissions will be saved over the lifespan of the panels. That’s the equivalent to 5.7 million miles in an average petrol car.

Intelligent lighting, along with maximum insulation, air source heat pumps and e ciency improvements in the compressed air system o er sustainable energy solutions for the three sites. These initiatives have resulted in substantial annual carbon dioxide savings in excess of 100 tonnes, which equates to 4,760 trees planted per year.

The company’s environmental policy sets out a series of practices which include detailed recycling and waste management initiatives. These cover the recycling of byproducts from its manufacturing process, the exclusive use of recycled paper for packaging and marketing collateral, and, where possible, using recyclable end-user packaging.

In terms of supply chain emissions, a continual review of waste management services and suppliers is in place – and it’s this assessment that has helped ensure Prima’s landfill disposal is zero.

When it comes to its consumption of natural resources, the business is championing its employees to be more responsible in this area, evidenced through its employeedriven programme ‘Health, Safety, Environment and Sustainability Champions’ across all departments.

As a firm, the elimination of disposable plastics cups (330,000 cups per year) and addition of waterless urinals (saving 1.5 million litres of water) have contributed to a total saving of 11.5 tonnes of CO2e each year.

Prima exports to more than 90 countries, with two joint ventures (in Brazil and Hong Kong) and two subsidiaries (in China and India). By prioritising local suppliers and reducing global travel, the company further mitigates its environmental impact while fostering strong community relationships. And, when it comes to sourcing suppliers, the business retains local services, where possible.

Meanwhile, the introduction of localised sales teams, adjusting UK working hours to accommodate di erent time-zones, alongside an increased use of technology for virtual meetings, has significantly reduced global travel.

With new initiatives and increased productivity through its innovative strategies comes increase in demand. Over the past ten years Prima has grown by 236%, enabling the company to further invest in its people, increasing headcount by 62 in 2023.

As one of the largest private-sector employers in Gloucester, supporting and nurturing talent is key. Strong links with

THESE INITIATIVES HAVE RESULTED IN SUBSTANTIAL ANNUAL CARBON DIOXIDE SAVINGS IN EXCESS OF 100 TONNES, WHICH EQUATES TO 4,760 TREES PLANTED PER YEAR.

universities sees the business o ering sponsorship for PhD students, summer internships, work experience, shadowing and research project opportunities.

The company’s charity committee oversees a programme of fundraising –which the company matches - for local causes. Volunteering forms part of this, with colleagues given time o from work to support local initiatives, such as litter picking. Local sponsorships also o er a way for the business to give back, including working with primary schools.

In terms of Prima’s impact on wider global society, its work supports accessibility and a ordability in developing markets –ultimately ensuring better dental care for patients.

As the company looks ahead, it remains committed to environmental responsibility and industry leadership, aligning with its vision to become the most admired and respected dental and medical rotary business in the world.

Plans include continued strategic business expansion, following £7m investment in new equipment in 2023 which delivered increased e ciency and supported growth.

The focus for export is to drive local manufacturing. Tailored for their respective markets, Prima is set to deliver 75% local production in India and 93% local production in Brazil. These significant changes will minimise its carbon footprint by reducing shipping and travel – an initiative which not only underscores the company’s dedication to the planet, but also sets a precedent for responsible manufacturing practices.

The company’s ESG (Environmental, Social and Governance) initiatives will remain central, with investments in environmental awareness, training and measures to decrease waste. The company estimates significant savings, projecting a reduction in excess of 100 tonnes of CO2 emissions per year, showcasing its contributions to the environment as it strives towards becoming an industry leader in sustainability.

Can selling office supplies and services change the world? Simone Hindmarsh says so, and her actions prove her point

By Nicky Godding, Editor

The year 2020 wasn’t exactly the one Simone Hindmarch was expecting. She’d not long taken over as Managing Director at Commercial in Cheltenham and was planning to take the business to a £100 million turnover.

Then the Covid pandemic closed o ces across the UK. The result? The £60 million turnover company saw its annual income drop to a fraction of that overnight.

Because although it does a lot else, a large proportion of Commercial’s income since it was set up in 1991 has been from selling o ce goods and services, from IT systems to o ce and print supplies, and when everyone is ordered to work from home –well, you can see the problem.

She and her brother Arthur Hindmarch, Commercial’s Chairman, could easily have thrown in the towel. Many others did, and few blamed such a response to a once-in-ageneration crisis.

While Simone might look tall and willowy on the outside, inside there’s a fierce moral compass and steel backbone, buoyed by a personal angle to the story too, as she explains.

“When Covid hit, I was 52 and Arthur was 54. I’d just got divorced and sold my house.”

She also didn’t want a repeat of what had happened to her father. “Our dad had lost everything when he was 53 and I didn’t want that to happen in our generation. We’d poured everything into building the company over the last 30 years and before the pandemic we were hitting all our targets.”

Fast forward almost five years, and Commercial is on track to turn over more than £100 million this year.

How has the company done it?

“To me, Commercial has always been a living, breathing entity. It sustains a lot of people and their families, and we were all in it together,” says Simone.

But back when Covid closed Britain’s o ces, the company’s income wasn’t going to bounce back quickly. The furlough scheme hadn’t yet been announced and the company’s salary bill was more than a million a month, so the first call was to the bank.

Simone’s next priority was a plan. “O ces might have been closed, but we’d just won the Iceland supermarket account, so we began to get a feel for what was needed, and that was PPE and sanitisers – all those sorts of things. I shu ed sta around and put people in the roles where they would be most e ective.”

Simone moved senior sales executives into buying roles because at that time the hardest job was finding the products, not selling them. Then Commercial began helping its customers set employees up at home.

“We’d been a technology-led business for years, but before Covid we didn’t prioritise supporting hybrid working. Now we do, and that’s not likely to change.”

“Then our customers asked us to help them encourage people back into the o ce and make them feel safe there.”

While Commercial was pivoting to meet a whole new raft of customer requirements, we all saw something else happening: the planet was enjoying a respite.

For months the number of international flights were down to single figures, and for many of us nature became a priority, as pretty much every other social and leisure activity was closed.

And that went to the core of Simone’s ethos. Since 2006, Commercial Group has been loudly advocating a reduction in greenhouse gases and promoting sustainability.

Simone’s epiphany came after Sky invited her to an event at the Tate London where the global media company was launching its sustainability strategy. Al Gore, the man behind the now famous documentary An Inconvenient Truth was speaking in person.

After listening to him talk with such passion, she wanted to act.

“It changed my thinking, and as a result, has completely changed the way our has company operated over the last 18 or so years.”

While it was survival more than sustainability which drove Commercial and its customers between 2020–2022, Simone knew that combatting climate change would soon be high up on the global agenda again

I am driven by being successful, but I’ve never made decisions based on the money I might earn. It’s just not in my nature

Simone Hindmarch, Managing Director

and the company continued to operate as sustainably as possible.

Commercial began o ering a raft of new products. These include installing solar panels and voltage optimisation to reduce energy usage. Commercial also installs digital screens into retail outlets. These are more e cient than traditional posters and signage, and increase turnover too says Simone – a double benefit.

“Bringing an online experience into the store can achieve a much smaller energy footprint, but a better experience for customers,” Simone explains.

“We're also supporting organisations through our ESG (environmental, social and governance) consulting, helping them do anything from setting their plan and measuring their footprint to achieving a route to carbon net zero.”

Commercial now operates hybrid working but Simone makes sure that all sta come together every week, whether they’re in the o ce or working from home.

“Life for me is about growth and knowledge.,” she says. “During Covid we launched a learning day where everyone comes on a call to discuss new products and services, and we’ve kept that going. We can talk about anything – what one small team is doing, or Commercial’s work around Scope 3 on climate change.”

The classifications known as Scope 1, 2 and 3 were developed in 2011 by the World Resources Institute and the World Business Council for Sustainable Development. Scope 3 involves managing indirect emissions by a company’s supply chain.

When did Simone realise that Commercial would probably survive Covid? “I knew in a year. By that time, we had enough in the bank and while it was mentally and physically tough on us all, we had learned enough to keep going.

“Our culture is our superpower. I feel hugely privileged and honoured to lead such an amazing organisation. I don’t feel like it’s mine, rather that it’s run by all of us.”

Commercial has a sta of around 320 people, including a 60-strong sales force.

Now the business has smashed its £100 million annual turnover target, what’s next? “£200 million”, she says promptly. “My job is to build a springboard for that to happen.”

“We want to help businesses operate more e ciently and we have the knowledge and capabilities to do that,” she adds.

“I am driven by being successful, but I’ve never made decisions based on the money I might earn. It’s just not in my nature. I could probably have made a lot more years ago by following the profit route, but I haven’t.

“I was challenged by our client Sky at the right time to do what many corporates were starting to do. I felt we had an obligation because we are a good company with a strong moral compass.

“One of our big clients is Tesco and like all big clients they want to know what their suppliers are doing in terms of carbon reduction. And meeting that challenge keeps us motivated and innovating.

“Because we adopted the carbon reduction challenge early, we got a seat at the table alongside other forward-thinking companies, although we were far smaller at the time than anyone else.

“And we didn’t give the job of sustainability to just anyone in the company, we put it front and centre of everything we did – and still do.

“The bit that I didn't anticipate was how much it would enrich the culture of the company.”

Simone’s commitment to social improvement in the local community is also seeing success, though it’s taken around 10 years.

In 2015 she set up the Commercial Foundation, an independent social enterprise to support young adults who have previously experienced barriers to work. It helps them get their lives back on track.

Its digital studio, We. Do. Print, provides printing services and is now operating at a profit.

Simone is hugely proud of its success.

“Over the last 10 years we have changed the lives of close to 200 people who were experiencing big life challenges. For years it cost us a lot to run, but now it’s making money.”

And it’s helped the business too, although that wasn’t why she set it up in the first place.

“The foundation can be the di erence between a major corporate becoming a customer or not,” she explains.

“When they visit, they see something di erent. When they ask us what we’re doing around social mobility, we introduce them to some of our young people working at the foundation.”

She’s now getting excited about a new project – buying a farm for the company.

“With more people working fewer hours as technology takes over in some areas, what are they going to do with their free time? I watched a series called The Biggest Little Farm where a young couple develop 200 acres outside Los Angeles and I thought – we could do that.

“We could o er everyone at Commercial short working stays on the farm with their families. I’m already looking for land.”

For Simone the ideas just keep coming, but it’s also about making the right decisions.

“Some will be longer term, but ultimately, they need to benefit society and the business. We want to be purposeful, and everything we do is with that objective.”

A Cirencester artisan Italian gelato ice cream company has branched out into dog-friendly ice cream.

The lactose free, low fat, low sugar ice cream, Gru es, has been developed over four years by Dolcetti founder, Rob Gibson.

Rob said: “The market for dog ice cream has soared in the last few years, and while such ice cream should only be an occasional treat as part of a balanced diet, I wanted to see if I could apply my expertise in ice-cream making to the canine world.”

The new product, currently available in three flavours: beef, vanilla and chicken, is just part of the evolution of Dolcetti since the business launched in Cirencester around 12 years ago.

Rob first learned to make (human) Italian gelato ice cream in his native South Africa and helped establish the largest chain of ice cream parlours in the country.

When he moved to the UK, he set up Dolcetti and now supplies local hospitality venues alongside running an ice cream parlour at his factory on Wilkinson Road, Love Lane, Cirencester.

The Gelato for Rob’s ice-cream for humans is made from milk, cream, sugar, natural

stabilisers and contains little or no air and has no artificial flavourings, palm oil or whey powder. Most ingredients, including the milk and fruit, are sourced locally.

As the business has grown, it expanded out of its original site and over the last few years Rob has not only been developing his unique Gru es dog ice cream, but also moving into and fitting out a larger facility on the same Love Lane trading estate.

Rob said: “All our investments are aimed at growth, and I’m really excited about 2025. We have new equipment going into our Cirencester site and have appointed a wholesale distributor in Bromsgrove which has extended our market reach.

“For our Gru es dog ice cream we have distributors in Bristol and South Wales. It can also be bought through our website using a frozen next day mail order service.”

One of Cheltenham’s most well-known businesses has been sold to a Tyne & Wear wholesale business for £70 million.

Creed Catering Supplies, which reported revenues of more than £130 million over the last 12 months, has been bought by Kitwave Group plc.

The companies say there will be no changes to the Creed depot, operational, sales, head o ce teams, management team and Board.

Chris Creed remains CEO of Creed Foodservice, with Philip de Ternant continuing as Chairman.

Miles Roberts will continue to be Managing Director, running the dayto-day with his current Directors. Philip Creed, the other family member involved in the business, will continue to support the company’s sustainability initiatives.

Chris said: “We have been evaluating our plans to take our business to the next stage for some time now and are delighted to be able to share our growth plans.

“Our objectives have always been to keep the Creed name, remain a member of the Country Range Group, secure the right investment and strengthen our infrastructure and capacity to secure our long-term growth; and I’m pleased to say that all these goals have been achieved.

“Creed has thrived on family values for more than 50 years and our people, culture and values remain woven into the fabric of our extended business.”

Ben Maxted, Chief Executive O cer of Kitwave, said: “Creed has an exceptional heritage and is one of the UK’s leading foodservice wholesalers.

“In line with our buy and build strategy, Creed is also expected to significantly enhance the Group’s earnings along with providing material buying, operational and financial synergies.”

In March, the government unexpectedly announced its purchase of land at Oldbury (the site of a former nuclear power station). Now a private company has acquired nearby Berkeley. Everything is in place for a major investment in nuclear, but the government needs to get a move-on

By Nicky Godding, Editor and Ian Mean, Business West Gloucestershire director and member of Gloucestershire’s

Before it got booted out of o ce this summer, the previous government made a surprise announcement.

Great British Nuclear, the arms-length body responsible for driving delivery of new nuclear projects, would buy land at Oldbury, home to a nuclear power station from 1967 to 2011.

It paid £160 million for Oldbury and Wylfa, another former nuclear power station site in North Wales.

The site at Oldbury (and its close neighbour at Berkeley) has been long championed by the region’s pan-regional partnership, the Western Gateway, for the development of net zero technology, green skills and jobs.

Berkeley and Oldbury are among several nationally prioritised sites which have the potential to host multiple small modular reactors (SMRs) and are part of the

government’s SMR siting process led by Great British Nuclear.

The reactors themselves are being pioneered by Rolls-Royce SMR which says a single such reactor could power one million homes for 60 years.

The news of the acquisition was followed by South Gloucestershire and Stroud (SGS) College’s announcement that it had successfully sold its 40-acre Gloucestershire Science and Technology Park at Berkeley to Chiltern Vital Berkeley for £6.5 million.

The new owner intends to create a lowcarbon technology super-cluster at the site and develop it into a centre of excellence for nuclear power research and development.

Chiltern Vital Group (chaired by Lord Grade, former chairman of the BBC) which owns Chiltern Vital Berkeley, is also supporting Rolls-Royce in the selection of UK sites for the roll out of its SMRs.

The Berkeley and Oldbury sites were home to the world’s first civil nuclear power stations, opened in the 1960s.

But the government needs to get a moveon over the establishment of a cluster of new small modular reactors.

The sale by South Gloucestershire and Stroud College of its Gloucestershire Science and Technology Park to the Chiltern Group is the start of a potential economic game changer for our region.

However, the new government has been talking consistently about weather reliant solar and wind power. But the weakness of these sources long term seems obvious.

“The new owner intends to create a low-carbon technology supercluster at the site and develop it into a centre of excellence for nuclear power research and development”

a leading player in this new, multi-billionpound global market.

Reaching a successful outcome in the GBN selection process, at pace, will enable immediate investment in the UK supply chain, create jobs and deliver the longterm energy security and low-carbon future that the country needs.

What we need is an urgent government decision on the company being awarded permission to develop and build these SMRs – each the size of a few football pitches.

In late September Rolls-Royce revealed that it will be invited by Great British Nuclear to negotiate on the deployment of UK units, alongside three international SMR developers.

The case for Rolls-Royce’s nuclear power ambitions got a further boost when the Czech government selected Rolls-Royce SMR to build mini nuclear power plants in the country. It is also in the final two in Sweden’s SMR selection process.

It is a big vote of confidence for the company, and it is highly likely it will be

The mini nuclear reactors will bring benefits to the whole country in reducing reliance on gas and oil as well as the benefits of local jobs and in international trade.

Gloucestershire – as in the 1960s – will be the “ground zero” for this innovation with the guarantee of SMRs being built at Oldbury and Berkeley playing a vital supportive role.

A bright future for young people to work in this sector is tangible.

Those entering secondary education today will be in high demand for the SMR operators as well as the blue-chip AI data centres, hydrogen production plants, agritech companies, research institutions and business start-ups attracted to an SMR site.

The government needs to make some firm decisions on these new mini nuclear reactors. The benefits to Gloucestershire, which already has nuclear in its DNA, will be major.

The Rolls-Royce SMR is the UK’s first domestic nuclear technology in more than 20 years – providing a British solution to a global energy dilemma.

Each small modular reactor will produce enough stable, a ordable, emission-free energy to power a million homes for at least 60 years.

Rolls-Royce SMR has received government funding of £210 million as part of Phase 2 of the Low-Cost Nuclear Challenge Project, administered by UKRI, which has been supplemented by £280 million of private capital.

A new study commissioned by Hydrogen South West, which is driving the development of hydrogen infrastructure in the region, has revealed that up to 10 per cent of South West vehicle fleets could be running on hydrogen by 2030.

This may not come as news to more than 100 people at a business breakfast meeting organised by SevernNet and hosted by Avonmouth-based Molson Group. The company sits at No 9 in our South West 250 ranking celebrating the region’s top privately-owned businesses by annual sales turnover.

SevernNet, which supports businesses, the local community and other stakeholders across Royal Portbury Dock, Avonmouth, Severnside and Western Approach, invited guests to learn what the industry is doing to decarbonise mobile heavy equipment.

They heard from Henry Moore, Commercial Director at Molson Group and Sam Mercer, CEO at Plantforce. A question and answer panel included Chris Matthew,

Commercial Director of Plantforce, Paul Lownes, Programme Director at Gravity, a major new business campus being developed near Bridgwater, Derek Healey, Technical Manager at waste management company Suez, Rhianydd Gri th of the West of England Industrial Cluster and Chris Adam, Engineering Director at The Bristol Port Company.

Guests were welcomed by Molson Group CEO, Robin Powell. He said: “Part of our role here at Molson Group is understanding the requirement of the

users, our customers, and working with manufacturers to ensure that they’re building the products the industry is looking for, which is increasingly the decarbonisation of equipment.”

Emissions from non-road-based equipment contributes 2.7 per cent of the UK’s emissions.

The industry has been investing significantly in reducing this through improving e ciency, changing the way existing machines are driven and operated,

buying more fuel-e cient machines and using new technologies which can operate using alternative fuels.

In the UK as a whole the transport sector made up 34 per cent of the country’s CO2 emissions in 2022. Hydrogen is expected to be the dominant choice for heavy vehicles that have high utilisation, heavy loads and require long ranges, but the development of hydrogen-powered equipment is not as advanced as that of battery-powered equipment which is already in use in less heavy-duty areas of the industry.

Molson Group is working with equipment manufacturers and customers to drive innovation of hydrogen-powered equipment. Henry Moore at Molson Group, said: “We want progress on the development of both hydrogen-power vehicles and electric battery-powered equipment for the lighter-use vehicles and equipment as fast as possible because our customers are crying out for it.”

Molson Group already has a range of low emission technology vehicles and equipment at its Avonmouth site and is partnering with other manufacturers on identifying more ways of replacing diesel engines with lower emission equipment.

But the panel admitted that all new equipment and alternative fuels come with their own challenges, from run time and rechange to the cost of purchase and support, and the adoption and training of drivers and operators.

One of the biggest issues the industry is facing is around infrastructure challenges, including grid connections and enough power supply to be able to recharge battery-powered equipment in the right area at the right time.

Ultimately, it is the industry which is currently driving a lot of the innovation around hydrogen and battery-powered plant and equipment, and industry leaders are calling for the government to give clarity on what the future regulations will be so that investment can be made in areas it is needed.

Gloucestershire-headquartered IT group Kubus has received a £9 million investment from BGF to accelerate its global growth plans.

Founded 21 years ago, Kubus, based in Cirencester and a value-added reseller, o ers IT infrastructure solutions, including in networking, storage and cyber security to blue chip firms and public sector organisations.

As well as the £9 million injection, the Kubus leadership will be bolstered with the appointment of non-executive chair Paul Brennan who comes aboard via equity investor BGF's talent network.

"We are thrilled to partner with BGF and leverage their expertise and resources to take Kubus to the next level," said Andrew Humphrey, CEO of Kubus, which sits at No 125 our our South West 250 ranking.

"As a business based in the heart of the Cotswolds, we’re proud to be working

with businesses and organisations across the world.”

Kubus already works with several IT vendors in the sector, including Juniper Networks, Cisco, Dell, Fortinet and Pentera.

In the year to the end of March 2024, the firm reported £35 million turnover and £2.6 million in earnings before interest, tax, depreciation and amortisation.

The BGF investment will help it make targeted acquisitions, enhance its marketing and sales capabilities, strengthen its operational infrastructure and explore new market opportunities.

The Kubus investment continues a strong year for BGF’s South West team following a £9 million investment in natural food ingredient manufacturer Plant-Ex and the successful exit from construction engineering company Hydrock. Both companies are based in Bristol.

Swindon Motor Group

Dick Lovett is expanding its successful bodyshop function into Melksham to support its dealerships. It bodyshops specialise in automotive accident repair, wheel refurbishments and SMART repairs.

The company’s established Bodyshops in Bristol and Swindon specialise in automotive accident repair. It also has a dedicated wheel

centre facility in Swindon which sits next to its Ferrari dealership.

The new facility will mean customers benefit from additional services when visiting its BMW, MINI and Jaguar Land Rover Melksham dealerships.

Dick Lovett, a family business since 1966, sits at No 2 of our South West 250 ranking.

A funding award of £127,000 from Arts Council England will help Bristol-based Spectroscope expand its collective of artists and producers and take a programme of immersive artworks around the world.

The South West’s creative industries are significant drivers of the region’s economy. In fact Bristol and Bath collectively is the UK’s third largest media hub, with a reported £650 million gross added value from more than 6,000 businesses.

Nationally, the economic contribution of the UK creative industries grew by 6.8 per cent in 2022 to reach £124.6 billion, according to government estimates.

Spectroscope, founded by acclaimed deaf curator Cathy Mager in 2022, has now appointed Cat Roberts as head of programme and production.

Cat has previously managed Bristol’s largest event spaces and venues, and has taken on management and production roles for Glastonbury Festival, Boomtoom

Fair, Forwards Festival and Love Saves the Day.

The investment from Arts Council England, and further awards from other organisations, will enable Spectroscope to deliver a programme of new artworks between now and 2026 across the UK, Australia, US and China. It will also support Spectroscope’s longer-term ambition to better support creative development and artworks by disabled artists.

Cathy said: “This major funding award is a pivotal moment for Spectroscope and real recognition of our organisation’s mission and contribution to the sector.”

Phil Gibby, South West Area Director for Arts Council England, said: “We are incredibly proud to award a National Lottery Project Grant to Spectroscope.

“Cathy’s national and international ambitions for a foundry of talent led by disabled artists will prove to be one of the most significant cultural developments to emerge from the South West in recent times.”

£300m investment for region’s SETsquared partnership

The SETsquared Partnership universities – Bristol, Bath, Cardi , Exeter, Southampton and Surrey, has revealed a new £300 million spin-out focused investment vehicle with regional investment firm QantX.

The aim is to support the growth of science and technology companies addressing global challenges.

The initiative was announced by Sir Richard Olver, Chair of QantX, at the Regional Investment and Health and Life Sciences Summit held in Bristol, which Science Minister Lord Patrick Vallance also attended.

The SETsquared Partnership has a research portfolio of more than £600 million and has produced more than 230 spin-out companies.

Despite this success, the potential impact of R&D to power regional growth and productivity is being held back due to significant imbalances in equity funding across the UK.

A consultation on how Bristol Harbour could be transformed over the next 20 years has been launched.

The Harbour Place Shaping Strategy (HPSS) sets out a long-term vision for the future of Bristol’s floating harbour to make it more accessible and welcoming, better able to adapt to climate change, thrive economically and improve as a leisure and heritage destination.

As well as seeking views on the HPSS’s draft vision, the consultation aims to gather feedback on how improvements to the harbour's waterspace and the six distinct areas that surround it could help achieve the vision.

Cllr Andrew Brown, Chair of the Economy and Skills Committee, as well as the Harbour Committee said: “We want to create a strategy that will encourage residents, businesses and our communities to work together to rejuvenate our historic harbourside.

“We want to make sure Bristol can be enjoyed by our city’s growing population

We want to create a strategy that will encourage residents, businesses and our communities to work together to rejuvenate our historic harbourside

Bristol-headquartered aerospace and technology company Vertical Aerospace which is pioneering zero-emissions aviation, achieved a significant milestone in September.

Its latest prototype completed the first phase of a piloted flight test programme at the Vertical Flight Test Centre.

The VX4 prototype conducted multiple piloted tethered flights and ground runs, across 20 piloted test sorties, completing a total of 70 individual test points.

Vertical will now progress to piloted untethered thrustborne testing, as soon as it receives permission from the Civil Aviation Authority.

The company said its flight tests have already shown the aircraft’s incredible stability – particularly in ground e ect, typically one of the most challenging flight conditions.

Stuart Simpson, CEO at Vertical, said:

and an increasing number of visitors.”

The area includes the harbour’s water space, and the land immediately surrounding it from Junction Lock Bridge near Underfall Yard to Totterdown Basin behind Temple Meads Station.

It connects the city’s three major regeneration projects being progressed by the council in partnership with stakeholders across the city, Western Harbour, City Centre and Temple Quarter.

“During the past few months we have delivered our most advanced full-scale VX4 prototype, have gone from first powered ground test to ‘wheels up’ in just one week and completed the first phase of our piloted test flight programme.

“Every day I continue to be deeply impressed by the phenomenal engineers we have and the progress we are making here in Bristol as we build a new generation of aviation.”

The Leader of Swindon Borough Council, Cllr Jim Robbins, has issued a rallying cry to landowners, developers, educational institutions and other organisations with a stake in the future of Swindon town centre to help drive its regeneration over the next decade.

Addressing a meeting of representatives from more than 30 organisations, Cllr Robbins said that “moving the dial” on progressing work to rejuvenate the town centre will depend on the private sector bringing forward innovative proposals and investment to unlock its future.

The partners were convened by the council to help develop its ambitions for the town centre that will be set out in a document called the ‘Vision for the Heart of Swindon’, to be tabled at a council Cabinet meeting.

Representations from organisations including FI Real Estate Management (owners of the town’s Brunel shopping centre), GCL (representing The Parade), William Arthur Property (owner of commercial property in the town centre), Network Rail and the University of Bath will

review the latest draft of the document.

Cllr Robbins urged partners to be bold and help lead the reinvention of the town centre. He highlighted the snowball e ect of how investment in new housing, employment and educational space can act as a catalyst to help generate a vibrant future.