MATTERS MANUFACTURING

By the time you read this, the budget will have been and gone, and businesses will have a clear view of what they face in the years ahead.

Due to our print deadlines, we have just missed the budget announcement, however, thanks to continual leaks over the past few months, we have a pretty clear picture of the direction of travel.

Capital Gains and Inheritance taxes are likely to increase, and carried interest in the private equity space is set to be abolished.

When Labour came to power early this year, they did so largely on their promise of competence and a vow to grow the economy.

This promise created optimism in the business community and was reflected in conversations I had with contacts.

The mood more recently has been more downbeat, with a growing fear that the incentive to take risks in the UK is being diminished by higher taxes and that this will have a stifling effect on innovation and encourage more entrepreneurs to off-shore.

On a more positive note, there are still a lot of exciting things happening in the South East’s economy, particularly in the tech, property, and corporate finance space.

It was refreshing to interview three up-andcoming property stars for The Business

Magazine Property Podcast, where topics ranged from imposter syndrome to mentorship and networking.

If you want some inspiration as we come into the darker time of the year, then do give it a listen. It’s available on all major podcast channels, with a recorded version also available on YouTube.

We always strive not just to be on the sidelines of the region’s economy but to be involved and encourage growth, and we have been actively contributing to the Reading Tech Cluster as media partner.

The Cluster has had a promising start and will, in time, show what can be achieved when the region collaborates and comes together for the greater good.

This collaborative working is also shown through our close relationships with the Thames Valley Chamber of Commerce, Hampshire Chamber of Commerce, and the Dorset Chamber.

The flow of deals on our Deal Ticket platform has accelerated in recent months due to the likely rise in Capital Gains Tax.

October saw Glasgow’s iomart acquire Marlow-based IT managed services outfit Atech Cloud for £57m, while Chippenhambased inhaler manufacturer Vectura Group, owned by tobacco firm Philip Morris International, was acquired by Molex Asia Holdings for £150 million.

Our main interviews are with Hampshire County Council Leader

Stephen Emerson Managing Editor stephen.emerson@thebusinessmagazine.co.uk

Cllr Nick Adams-King, who talks on how devolution can benefit the region’s businesses, and we also catch up with Kier Kemp of rising Kent firm Condimaniac on what it takes to build a cult brand.

For the third year, we are delighted to collaborate with leading national law firm Freeths and Milton Park, the 250-acre business and technology park on a special 22-page Life Sciences Supplement.

Our roundtables, on the South East’s tech sector and our first Women in Property event, allows us to hear and report directly from those at the coalface of their sectors.

Whatever the budget holds, businesses in the South East will do what they have always done in times of uncertainty which is focus, innovate and strive to succeed.

We look forward to continuing to tell your stories in 2025.

Ethical business needs to become “desirable and sexy as well as deeply trusted”, retail guru Mary Portas told the world’s largest ever gathering of 1,200 B Corps.

“That’s what makes beautiful business.”

The B Corp movement began in the USA in 2006, when friends Jay Coen Gilbert, Bart Houlahan and Andrew Cassoy shared a vision to make business a force for good. They founded B Lab, a nonprofit organisation that certifies businesses for their social and environmental impact.

Speaking on the first day of the inaugural Louder Than Words festival for UK BCorps held in Oxford, Mary said pre-owned items had grown desirable in part because charity shops were stealing the ideas of luxury brands.

She pointed out that while filming Queen of Shops for the BBC back in 2007,

the team were able to boost footfall by doing away with the word charity and making shops cool.

“We’re now seeing charity shop revenue surge 300 per cent faster than fast fashion,” she said.

“Owning pre-owned is becoming a badge of honour.”

She also warned business leaders against ethical grandstanding.

“Around the world, we’re concentrating much more on what divides us than what brings us together. But in business, taking the moral high ground doesn’t work.”

Other speakers for the event included Chris Turner, executive director of B Lab UK, and Anuradha Chugh, former managing director of ice cream giant Ben & Jerry’s, which tracks the carbon footprint of its ice cream (apparently a

single pint of Ben & Jerry’s produces about 3.4 lbs of carbon dioxide equivalent).

The company sets out how it plans to reduce its climate impact on its website.

Layla Moran, MP for Oxford West and Abingdon, said: “I’m delighted that B Lab chose Oxford as the location for its very first Louder Than Words festival.

“Oxford is known internationally for its contribution to academia, but it’s also a city focused on changing business for the better.

“A number of certified B Corps have their home here and are showing what’s possible when businesses are empowered to put people, the planet and profit on a more equal footing.”

There are a total of 256 B Corp registered companies based in the South East of England.

ss

Reading’s Altitude Angel has teamed up with Hampshire-based air traffic control services company NATS to launch a new initiative at Aberdeen International Airport.

The two firms have established a drone flight approval service to help operators more easily access airspace around the site.

Drone pilots wanting to fly in or through the flight restriction zone around the airport can now request access at the touch of a button.

Operators can submit flight plans online or via the Altitude Angel Drone Assist app, which are then reviewed, approved or amended by the air traffic control team in as little as a few minutes.

The service replaces a manual process that could sometimes take 14 days or more.

In September the Civil Aviation Authority published a plan that will see drones fly regularly and routinely beyond line of sight unlocking benefits across society.

This work builds on the regulator’s ambition for full integration of all airspace users in the skies above the UK.

The plan focuses on demonstrating beyond visual line of sight (BVLOS) activities by the end of this year and establishing routine BVLOS operations by 2027.

The Civil Aviation Authority’s delivery model is a key part to guarantee that BVLOS operations in the UK are run safely. This includes checking safety features in drone technology, comprehensive pilot training and enabling the sharing of the UK’s airspace safely.

The only way is up – Surrey researchers lead

Could vertical farming be the key to improving the UK’s food system?

This is the question behind a new research project led by the University of Surrey and backed by a £1.4 million grant from UK Research and Innovation.

Vertical farming is a method of growing crops in stacked layers, often indoors, using controlled environments.

Unlike traditional farming, it doesn’t rely on soil or natural sunlight, but instead uses soilless techniques and artificial lighting to create the best conditions for plant growth.

This allows crops to be grown yearround, regardless of weather conditions, and makes more efficient use of space and resources.

On the flip side, it also uses a lot of energy.

The Vertical Farming to Improve UK Food System Resilience project investigates how to improve the country’s supply of

nutritious leafy greens, essential for a healthy diet.

Dr Zoe Harris at the university’s Centre for Environment and Sustainability, said: “There’s been little in-depth analysis of the risks to our country’s leafy greens supply, nor a thorough examination of the benefits and trade-offs vertical farming could bring to the UK food system.”

The research team will work with farmers, industry, government and the local community to ensure the project focusses on real-life, immediate benefits.

Involved in the project are environmental and social scientists, as well as UK Urban AgriTech and five farm partners – Flex Farming, Innovation Agritech Group, Farm Urban, GrowPura, and LettUs Grow.

Dr Lada Timotijevic from the University of Surrey added: “We want to create tools that make it easy to see the impact of expanding vertical farming on considerations including food supply, land use and the environment, so we can make smart decisions for the future.”

An Indian multinational conglomerate, and co-owner of the Indian Premier League cricket team Delhi Capitals, has bought a majority stake in Hampshire Sport & Leisure Group, the company which owns Utilita Bowl, the home of Hampshire Cricket.

GMR Group (GGPL) plans to acquire all the company within the next two years and set up the venue for longterm growth and financial sustainability. Hampshire Cricket will become the first English club to join an international cricket group.

Rod Bransgrove, chair of Hampshire Sport & Leisure Holdings Group, said: “This is the fulfilment of a dream for me and, I hope, for all Hampshire Cricket supporters.

“Beyond our team’s accomplishments on the field over the past 24 years, we’ve transformed our stadium into a premier test match and events venue and one of the most exceptional cricket and leisure facilities in the country.

“We’ve also been pioneers in the development of women’s cricket and have consistently innovated throughout this relatively short history.

“After a thorough selection process, we believe GGPL is the perfect organisation with the right people to build on our proud legacy.”

The new owners hope to enhance the multi-sports and leisure facilities at Utilita Bowl, including the stadium, hotel and

golf course. They’ve also pledged to further cricket development of the teams.

Grandhi Kiran Kumar, corporate chair of GMR Group, said: “What initially attracted me to Hampshire was the way it was run by Rod, whose leadership ethos closely mirrors that of the GMR Group.

“I believe GGPL is in the best position to carry Rod’s legacy forward and continue building on the strong foundation he has established.

“With this acquisition, along with our investments in the US, Dubai and India, GMR is focused on engaging and connecting with the global youth.

“Our vision is to transform sports into a platform that unites people and cultures, drives global excellence and nurtures the creation of future world champions.”

Rod will continue as group chairman until at least September 2026, while David Mann will retain his role as CEO.

GMR Group operates across various sectors, including infrastructure, airports, power and sports, and supports initiatives in rural development, education, health and skills development.

The news has also been welcomed by the England and Wales Cricket Board. Richard Gould, Chief Executive Officer said: “This is an exciting time for Hampshire Cricket, and I’d like to welcome GGPL to cricket in England and Wales.”

Major players from the Buckinghamshire’s thriving space ecosystem gathered at Westcott Venture Park to celebrate successes and discuss the future of the industry.

The Westcott Showcase attracted more than 200 delegates.

Developments in rocket propulsion, sustainability in space and the fast-growing drone sector were showcased.

This year’s event was organised by Buckinghamshire Enterprise Zone, the county council and partners of the Westcott Space Cluster.

Visitors also witnessed the launch of Westcott Space Hub – funded by the UK Space Agency, Westcott Venture Park and Buckinghamshire Enterprise Zone – which will advance space research, manufacturing and testing.

The government considers the space sector as critical in meeting its wider goals, including becoming a science and technology superpower.

A UK Space Agency report estimates that the country’s space industry income was £17.5 billion in 2020-21. The space sector also provided an estimated 48,800 jobs while supporting an additional 78,000 jobs across the supply chain that year.

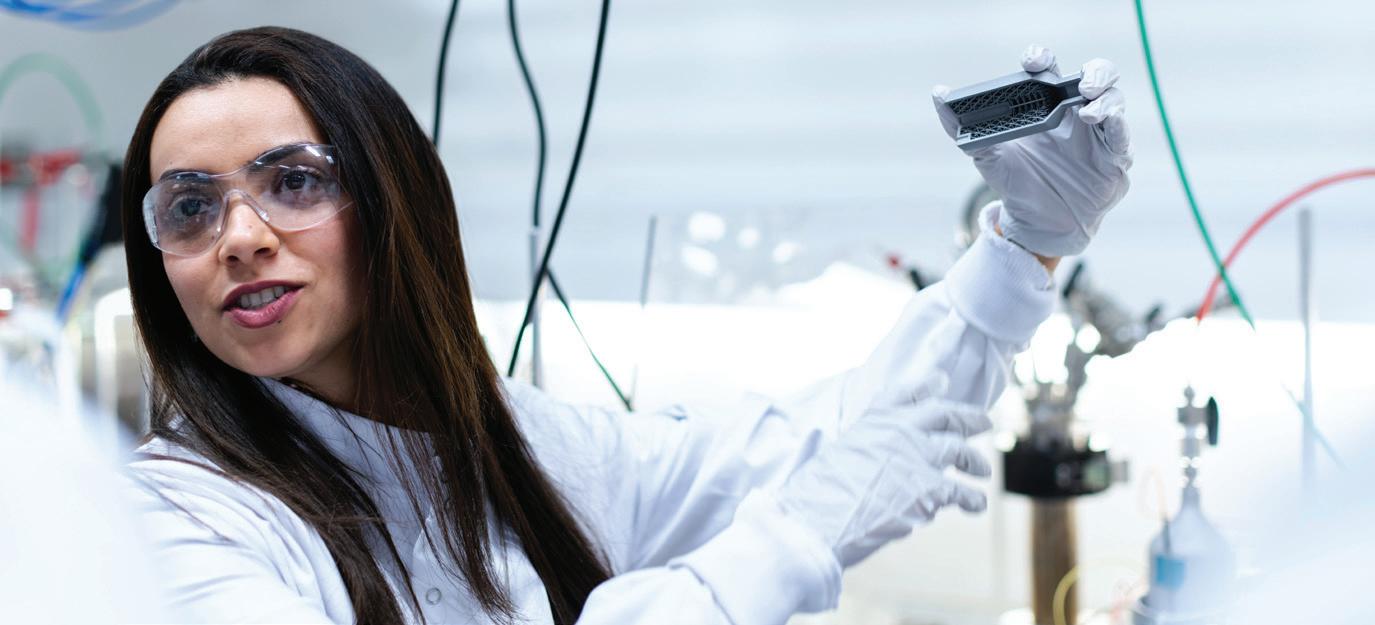

The UK manufacturing sector has been a major contributor to the success and wealth generation of the UK economy, global development and influence, for centuries, writes Richard Baker, Partner at national audit, tax, advisory and consulting firm Crowe.

As an island nation, the country’s forefathers, realised that with limited natural resources, to be a successful trading nation, and to provide sustainable income for the exchequer, the UK needed to add value by virtue of innovation, creativity, entrepreneurship and skilful hard work.

The vision and inspiration of the preVictorian enlightenment, driven by the likes of the Lunar Society, provided the building blocks for what became the ‘Industrial Revolution’ and created a string of manufacturing, agricultural and engineering successes of which examples continue and remain, throughout the globe.

British engineering and ingenuity and innovation has also played a key role in keeping the UK and the people of the world, safe, free, fed and watered and it continues to do so. In their 2024 report ‘The True Impact of UK Manufacturing’, Lloyds Bank, (working with Oxford Economics and the Manufacturing Technologies Association), identify that the sector is worth £518 billion to the UK economy (23.1% of GDP).

Despite its significance to the economy, 87% of the respondents to Crowe’s last manufacturing survey said the government support for the sector is inadequate.

Crowe teamed up with various industry figures earlier this year to answer this question and published a “Manifesto for Manufacturing” (www.crowe. com/uk/industries/manufacturing).

The manifesto is based on five pillars:

Skills and

• Strategic review, refocus of education engagement and provision with manufacturing.

• Overhaul the apprenticeship system and its funding processes, including introduction of a tax credit-based system and introduce training incentives for UK graduates.

• Supported graduate level study fees for (STEM) subjects.

• Reintroduction of enhanced Research and Development relief at 130% uplift for SMEs.

• Training and education measures to build UK cyber resilience and secure technology supply chains.

• Better communication of support and funding streams.

• Strategic financial support for manufacturing businesses to decarbonise as part of a single national strategy and assistance scheme.

• A reshoring initiative to provide funding and support for reshoring to the UK of products and components currently produced abroad.

• Carbon Border Adjustment Mechanism (CBAM) to protect ‘homegrown’ production.

• National standardisation of net zero and carbon neutral expectations and requirements.

Secure the UK’s supply chains

• Root and branch risk assessment covering supply chains and national infrastructure plans of UK steel production and technology dependent production processes.

• Public industry procurement process that favours UK suppliers as a point of preference.

• Utilisation and support of the SME supply chain.

Finance and investment

• Capital grants scheme to digitise manufacturing processes and support decarbonisation.

The Government has recently published its Industrial Strategy, “Invest 2035” which references advanced manufacturing as a key area of future growth. Fostering a pro-business environment and working in partnership are key principles. Whilst the messages are positive, time will tell what practical, real-life actions will arise from Invest 2035.

More discussion and commentary can be found in Crowe’s manifesto document which can be viewed here: www.crowe.com/uk/ industries/manufacturing.

If you would like to know more, please do get in touch with Richard Baker: richard.baker@crowe.co.uk www.crowe.co.uk

The UK could be losing its standing among the world’s top manufacturing nations. How can we get back on track?

By Daniel Face, senior reporter

UK manufacturing has been hit with a wakeup call.

The latest analysis from Make UK, the membership organisation which represents manufacturers across the UK, shows the country has fallen from eighth to 12th place among the world’s leading manufacturers, with an industry output of £217 billion.

Now ahead of the UK are Taiwan, which continues to enjoy high demand for its topof-the-range semiconductors; Russia, with an ever-growing defence sector to maintain its war in Ukraine, and Mexico, a big climber this year thanks to a thriving automotive, aviation and aerospace ecosystem.

Could it be that manufacturing simply isn’t as crucial to the national economy as it always has been? Not according to the data.

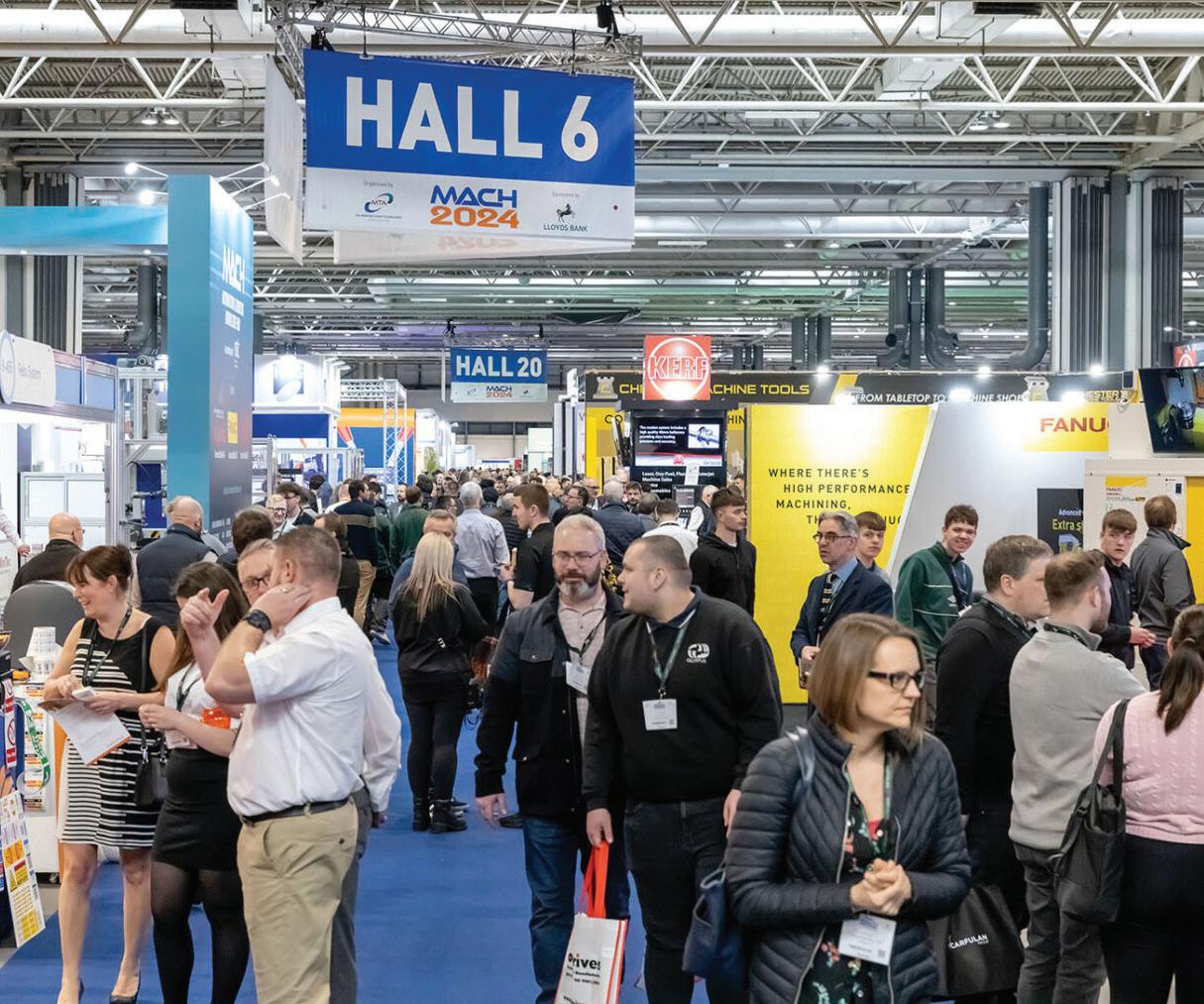

This April, big industry names from across the country gathered in Birmingham for MACH 2024, the UK’s national exhibition for engineering and manufacturing.

It was there that event host MTA – the Manufacturing Technologies Association – unveiled its new report, The True Impact of UK Manufacturing, in collaboration with analysts at Oxford Economics.

The paper broadens the scope offered by Make UK, placing the real value of manufacturing to the UK economy closer to £518 billion. That works out to be around 23 per cent of GDP.

It goes on to identify that “making things” accounts for more than a third of all UK goods and services exports, directly supporting 7.3 million domestic jobs.

If manufacturing does in fact prop up almost a quarter of the national economy, this latest stumble in the world rankings should be all the more alarming.

What’s to blame? We can roll out the usual suspects of the past few years – inflationary headwinds, supply chain

issues stemming from global conflicts, the lingering impact of the pandemic on any manufacturer that wasn’t churning out vaccines.

And even many of those are now having to make a stark pivot. Just look at AstraZeneca collaborator OXB – formerly Oxford Biomedica – which, having been one of the UK’s biggest manufacturers of the Covid-19 vaccine, is settling into a new identity as a cell and gene therapy contractor.

Evidently, though, other nations have weathered those storms better than our own. It might help that the government has just launched a green paper on its proposed Industrial Strategy, which puts advanced manufacturing at the top of its eight focus areas.

The other focus areas include clean energy, the creative industries, defence, digital technologies, financial services, life sciences, and professional and business services.

“... industry is a far greater contributor to GDP and jobs than listed in national accounts”

What unique challenges has the UK faced? The big one is of course Brexit, which has burdened businesses with higher import and export tariffs, delayed key investment decisions and squeezed the skilled labour market.

But most in the industry would agree that all these issues combined could have been better navigated given a confident, consistent plan from Westminster.

“Every other major economy, from Germany to China to the US, has a long-term national industrial plan,” says Stephen Phipson, head of Make UK.

“Even Barbados has one. As such, the UK is an outlier.”

Johnathan Dudley, head of manufacturing at national accountants Crowe, says: “In our latest annual manufacturing survey, which we use to gauge the temperature of the sector, our key findings reveal that 68 per cent of businesses in the sector are expecting a growth in sales this year despite global turbulence and difficult economic conditions, but 87 per cent of manufacturers are unhappy with the government support.

Much has been made of Labour’s “first mission in government” to achieve the highest sustained economic growth of all the G7 nations. And while the Office for National Statistics suggests this has been

the case at least for the first half of 2024, it remains doubtful whether that momentum can be maintained over the coming years.

Meanwhile, here is a key industry crying out for support and investment. If that’s what the new government is able to provide, it could help turn a wishful manifesto pledge into a realistic vision.

Johnathan adds: “Manufacturing in the UK still contributes one fifth of the country’s GDP and continues to grow.

“At Crowe we recognise the importance of manufacturing to the UK in keeping our country competitive. Our manifesto, published ahead of the Summer election, provides a blueprint for the government which drives innovation, job creation and decarbonisation of the economy, securing the industry and the country’s long-term prosperity.

“UK manufacturing has a global reputation for innovation, creativity and excellence,” he continued. “We invest in supporting this and urge the new government to work with us, and the manufacturing sector as a whole, to produce their promised strategy.”

Before the election, Labour put forward a four-pronged industrial strategy: to deliver clean power by 2030, ‘care for the future’ (opportunities here for health and care manufacturers), harness data for public good (think artificial intelligence and datadriven supply chain management) and build a resilient economy.

Four months on, while it has introduced its industrial strategy green paper, there have been no big spending promises directed squarely at manufacturing (unless the chancellor pulls something out of the bag in the budget, which happens after this magazine goes to print).

We’ve seen nothing so far to match, for example, the scale of the Inflation Reduction Act in the US – a move which has seen billions of dollars invested in clean energy manufacturers.

Across the manufacturing industry, from large companies to small and mediumsized enterprises, there are calls for the government to make its vision clear. Only then will they begin to commit to making the investments they need to grow.

Now comes a make-or-break moment. The worst the new government can do is nothing, leaving the industry underfunded, under-skilled and without direction.

But listen to the needs of manufacturers, act accordingly, and there’s no reason why the UK can’t regain its standing among the world’s best.

A government with a potential new strategy – whose is it to execute?

As things stand, the job falls to the minister for industry, a role encompassing the departments for both business and trade and for energy security and net zero.

Manufacturing is therefore just one of many concerns for the new incumbent Sarah Jones, whose responsibilities also span retail, hospitality and professional services, to name a few.

The industry has already made clear it feels neglected under the current arrangement. The latest Manufacturing Outlook Report from Crowe found that nine in 10 manufacturers were unhappy with the current level of government support.

For them, a strategy alone won’t suffice. They need someone fighting their corner to see it through to fruition.

Johnathan Dudley says: “It’s high time that a dedicated minister for manufacturing was established to unlock the sector’s potential.

“We want them to understand what we are hearing from our regular engagement with the manufacturing sector through our surveys and roundtable events which give us the insight to lobby government on the sector’s behalf. They can light the fuse of a new industrial revolution in

the UK by aligning innovation, economic development and education, and support nearly a million green jobs to help get this country making, building and adding value again.”

Growth ambitions will be driven over the coming years by major carbon capture projects and new battery gigafactories, spearheaded no doubt by some of the biggest global players in the industry –think Tata and Japan’s AESC Group.

But a dedicated minister wouldn’t just push flashy initiatives. They’d also be a key voice for the UK’s 260,000-plus small and medium-sized domestic manufacturers.

“We need a hero within the corridors of power,” adds Andrea Wilson, an SME director and longtime advocate for a ‘manufacturing champion’.

“Government policy is most often informed by original equipment manufacturers (OEMs), large businesses or career civil servants.

“As a result, we see decisions made, policies implemented, and support offered – the majority of which are not fit for purpose for the SME community.

“Listening to SME business prior to deciding what will help them will save this and future governments billions in wasted, over-administered and underutilised support.”

After a disappointing performance last year, the latest data suggests the industry could finally be turning a corner.

The S&P Global UK Manufacturing PMI (purchasing managers’ index) hit a 26-month high in August at 52.5.

This comes even as export orders fall for the 31st consecutive month, which has been put down to weaker demand from Europe and a slowdown in mainland China.

Rather, the domestic market has been leading the charge, as output, new orders and employment all picked up.

Large-scale producers have been particularly busy hiring, while small firms saw a mild increase in jobs and medium-sized companies made cuts.

“The upturn is broad-based across manufacturing,” said Rob Dobson of S&P Global Market Intelligence, “with the investment goods sector the standout performer.”

While it battles mounting losses and slow revenue growth, Reaction Engines hopes that its financial woes won’t stop the trialling of its heat exchanger technology on British naval vessels and in American industry.

In partnership with BAE Systems, the Oxfordshire firm will investigate how these systems could help achieve environmental improvements and operational benefits for the Royal Navy through waste heat recovery and exhaust cooling.

Its lightweight heat exchangers can be integrated alongside a ship’s existing diesel engines and gas turbine propulsion systems, as well as next-generation hydrogen and hybrid electric alternatives.

They’re also suitable for other defence applications in the air and on the ground.

Reaction Engines recently attracted the attention of the US Department of Energy, which has appointed the company alongside Ohio’s Echogen Power Systems on a $3 million three-year project to help decarbonise industrial processes across the US.

Together, they’ll develop a pilot-scale heat pump capable of heating air to more than 300C from ambient temperatures using supercritical (highly compressed) CO2.

This technology has the potential to reduce lifecycle carbon emissions by more than 90 per cent and energy intensity by more than 50 per cent relative to natural gas-fired heaters.

According to media reports, as we go to print Reaction Engines is in talks to secure a cash injection from overseas investors.

Banbury-based motorsport manufacturer Prodrive showcased its latest innovation, an electric quadricycle for last-mile urban deliveries, at Cenex Expo this September.

Built as part of a joint venture with Astheimer Design in Warwick, EVOLV is just 3.2 metres long and 1.4 metres wide, but offers a load capacity of four square metres to rival mid-size vans.

“EVOLV demonstrates how our collective innovative design and engineering can push the boundaries of what a last-mile EV can achieve,” said Dr Iain Roche, CEO of Prodrive.

“A compact footprint can go hand in hand with serious capability and efficiency.

G3 Systems in Portland, Dorset has been appointed to deliver a further six mobile roller brake testing (MRBT) systems for the Ministry of Defence (MOD).

The contract comes as part of the MOD’s Project Amphora, an initiative aiming to provide support for multiple containerised deployable systems that are critical to military operations.

G3 Systems was first contracted to deliver 12 MRBTs in 2018. This latest batch is due for delivery by next March.

The company will ensure that the systems can be made fully operational by two trained operators in under two hours from deployment, and ready to move in less than an hour.

Nick Rose, managing director at G3 Systems, said: “We’re delighted to be supporting the MOD again under Project Amphora.

“This is an excellent way to leverage our expertise in providing agile and effective solutions, ensuring that the military can rely on robust infrastructure even in the most demanding environments.”

“EVOLV offers the best of both worlds, injecting versatility without compromise into a logistics fleet.

“Together with Astheimer, we’ve assembled a talented team comprising logistics specialists, designers and engineers to identify, solve and deliver solutions that will make a difference to this segment.”

For more about these so-called ‘tuk-tuks of the Western world’, see our front-cover feature on The Future of Automotive in the September 2004 issue of The Business Magazine.

After quickly selling out the first editions of its Bentley Blower Jnr –an 85 per cent scale recreation of the iconic British racer – Hedley Studios has now launched a configurator to help customers personalise their own designs for the car.

Hedley Studios designs and builds what it describes as “automotive art pieces”.

Almost everything is customisable, says the Bicester business, from colourways and interior trims to tonneau covers and specific race numbers.

There are also six curated packs available, including “The Black Pack” – harking back to Woolf Barnato’s famous race against the Blue Train – and “The Grey Pack”, which pays tribute to the Speed Six that took victory at Le Mans in 1929 and 1930.

A total of 250 configurable models are available, taking the production run of the Bentley Blower Jnr to 349 worldwide.

“Since we launched the Bentley Blower Jnr last year, its reception has blown us away,” said copany founder and Ben Hedley.

“With all first editions sold out, we’re excited to launch the configurable options for the Blower Jnr.

“Craftsmanship lies at the heart of what we do, and giving clients the opportunity to curate their very own Bentley Blower Jnr through our online configurator provides a wonderful route into owning a slice of history, but with a very personal touch.

“Each configured pack we have on offer bears its own unique story and provenance, celebrating the great seminal moments and creations of the legendary Bentley brand.”

Manufacturers in the South East have enjoyed slow and steady growth in recent months – but business leaders are hoping for a major boost.

These are the findings of the latest Manufacturing Outlook from Make UK and BDO.

Almost six in 10 companies surveyed believe the recent change in government will produce better economic growth overall for the coming year. In contrast, just six per cent expect GDP to decline.

Balance on output in the South East is forecast to jump from +8 to +59 per cent in the next quarter, which compares

favourably to the more muted national picture.

Total orders are also expected to rise from +33 per cent to +60 per cent, backed by strong recruitment intentions from companies over the coming months.

“This is a very positive set of results which reflects the boost to stability provided by the new government,” said Keri-Anne Mruk, region director for the South East at Make UK.

“We now need to see this momentum maintained with investment in major infrastructure projects which will provide a long-term return for the economy overall.”

Matthew Sewell, head of manufacturing for BDO in Southampton, echoed this sentiment.

“Manufacturers across Southampton and the wider South East region are hopeful that a period of greater political stability will provide a better economic outlook ahead, and that in turn is boosting business confidence.

“All eyes are on the government’s next steps.

“We need an industrial strategy that is fit for purpose to ensure that the confidence firms currently have in future economic prospects is not misplaced.”

The company unveiled its new Oxford headquarters this September – “a symbol of our long-term vision”, says CEO Bruno Even

At the very far end of Oxford Airport, down a long road, Airbus Helicopters has been quietly working away on its new UK home.

The facility was originally confirmed in May 2022 while the pandemic stalled construction.

But now it’s here, and it’s big – 125,000 sq ft with eight landing pads and capacity for 32 helicopters at a time.

If there’s a silver lining to the delay, it’s that 2024 marks half a century since the company’s inception.

“Fifty years ago, a new business was created in the UK, not far from Heathrow,” CEO Bruno Even told visitors.

“It was called McAlpine Helicopters, founded by Kenneth McAlpine – grandson of the famous British industrialist Sir Robert McAlpine.

“What was then Aerospatiale noticed McAlpine’s high performance, and in 1993 took a 10 per cent stake before fully acquiring it in 2007.

“By then it was Eurocopter, and today of course we are Airbus Helicopters.”

The company has since swapped Heathrow Airport for Oxford, where it had grown to occupy a mishmash of 1940s hangars and offices.

One of the core aims of the move was to consolidate its various operations under one roof.

Although the helicopters are built at Airbus plants in Germany and France, Bruno was keen to stress that the UK is very much a “home country” for the global business.

Its 250 staff in Oxford are responsible for retrofits and completions on models arriving from the continent, as well as maintenance, repair and overhaul for civil and military clients alike. The new HQ even has its own design office.

Another key focus is on training. Almost 200 technical apprentices have learned the ropes at Airbus Helicopters’ Oxford base over the years – but with more classrooms and simulators, it should now be able to cater to larger cohorts.

The facility also houses a dedicated training workshop for engineers, complete with stripped-down parts from scrapped Airbus craft.

Nor does the training stop at their own employees.

“Today, all UK military pilots and rear crews learn their military flying on Airbus helicopters,” said Bruno.

“That’s because we provide and support the fleet of 36 Junos and Jupiters in the Military Flight Training System.

“It’s a great responsibility to support the next generation of military aviators.

“And in the air ambulance sector, we provide two-thirds of the UK’s fleet. Putting all this together with our private, business and utility customers, we’re supplying about half of all the turbine helicopters in the UK.”

Among the many models showcased was a new H135, due for delivery to London Air Ambulance later that day.

A lightweight twin-engine rotorcraft, the H135 has been deployed in more than 60 countries, having flown a combined seven million hours.

It was this that caught the eye of the Prince of Wales – a patron of the lifesaving charity and himself a former RAF helicopter pilot – as he paid a surprise visit to Airbus just days after telling Welsh Air Ambulance crews he’d love to get back in the skies.

Also on display was a decidedly unhelicopter-like innovation, the Flexrotor – a tactical unmanned aircraft system with vertical take-off and landing capabilities.

Bearing a maximum take-off weight of 25kg, the craft is designed for land and sea-based military operations and can

withstand extreme conditions from desert heat to Arctic cold.

With a new facility also comes modern sustainability standards.

The building is kitted out with energyefficient lighting and heating, and as such generates 50 per cent lower carbon emissions than the company’s previous base.

Airbus Helicopters has also committed to make full use of the sustainable aviation fuel available at the airport.

This is now produced on site by fellow occupier OXCCU at its OX1 demonstration plant.

“This £55 million investment underlines our commitment to growing our presence in the UK,” Bruno concluded, “where we will continue to serve both civil and governmental customers.

“The new building is a vastly improved working environment, both inside for our technical workforce and outside for flight operations.

“We have more space with better equipment, and we look forward to higher productivity as a result.”

Polystyrene foam (you may know it as Styrofoam) has long been the go-to option for manufacturers looking to package delicate electronics, glass, luxury products – anything they’d prefer not to shatter in transit.

But the tide is turning. In April 2022, the UK government imposed a tax of more than £200 per tonne on plastic packaging that doesn’t contain at least 30 per cent recycled plastic.

That’s not to mention growing consumer consciousness not just about the products we buy, but how they’re shipped to us, and where those endless mountains of foam wotsits end up.

As such, more and more businesses have sprung up in recent years offering eco-friendly alternatives like corrugated cardboard and finely shredded ‘wood wool’.

Among them was a once small Surrey start-up with a rather different approach.

Founded in 2019, the Magical Mushroom Company has built a thriving international operation out of the very soil itself.

The company works with mycelium – a sprawling underground network of thin fungal strands which can bear fruit on the surface in the form of mushrooms.

Mycelium contains a natural substance, chitin, which is perfect for packaging. Not only does it serve as a natural binding glue, but it’s also water-resistant and flame retardant.

To this, its technicians add an agricultural byproduct – usually hemp, which locks in carbon dioxide, but often wheat or sawdust – before leaving the mixture in a shaped mould to grow.

The process is surprisingly quick. Within just a week’s time, the packaging is kiln dried and ready to go.

Once the customer has received the product, they have plenty of options to dispose of the fungal casing, which is 100 per cent biodigestible.

That means it can be crumbled down into small pieces and left to decompose in the garden or compost heap over the course of around a month and a half.

The Magical Mushroom Company has worked with a radiator manufacturer, luxury ice cream brand, candle-makers, and – fittingly – a couple of mushroom supplements businesses.

That’s not to mention Dorset’s own cosmetics giant, LUSH.

It begins by establishing a client’s design requirements, before the in-house prototyping and product testing teams take over.

Testing can be as rigorous as the client requires. Many are shipping premium, expensive goods – others, like Hampshire’s Raymarine, fragile electronic equipment.

After use, mushroom packaging can be crumbled up and added to compost

Once moulded and dried, prototypes are dropped, crushed and shaken about to ensure they’ll hold up during transit. Temperature and humidity tests are also particularly important for perishables.

The company still retains its headquarters in Esher, Surrey, but has also opened two facilities in Nottingham and another in Bulgaria – ramping up production to 200,000 units a week.

In 2022, it closed a £3 million seed funding round led by fellow mycelial materials firm Ecovative Design and with participation from Dale Vince, founder of Ecotricity.

The team are now looking to break into the American market, having secured their first US client in online superstore WineDirect and drawn up plans for the Magical Mushroom Company’s first stateside factory.

Instead of wasting hundreds of thousands of pounds and several years on implementing a traditional ERP, manufacturing SMEs from the UK have found a solution that costs a tiny fraction of that and takes just weeks to set up.

MRPeasy is a manufacturing resource planning system designed specifically for small and medium-sized companies. This focus on SME manufacturing already sets it apart from others on the market that started as accounting or inventory tools or as offshoots of huge ERPs like SAP. But the real difference lies in its cost and user-friendliness.

Andy Nancollis, CTO of Motion Impossible, a camera dolly systems manufacturer from Bristol, highlights the price of the software: “The cost was a big factor—most ERP systems are big and quite expensive, so MRPeasy stood out from the start. While very affordable, it still manages to offer everything we need, with plenty of room for us to grow into the software. This seems to be unique to MRPeasy.”

For some, the transition to MRPeasy was a refreshing change from more complex systems. Suzanne Boak, Production Manager at Splosh, a cleaning product manufacturer in Wales, compares it to Netsuite: “Netsuite was a behemoth and quite difficult to work with. MRPeasy feels like a breeze. It’s intuitive and simple. There’s no fear that you’re going to press something and the whole thing’s going to explode.”

People also appreciate the ease of setup and practical support. “I set MRPeasy up myself, and it was that easy,” says Ralph Jones, Director at Britannia 2000 Holdings, a surveillance technology manufacturer from Windsor. “The online help has been really quick to respond to any issues.”

The right functionality for every industry

MRPeasy offers the necessary functionality for a diverse range of industries. This includes everything from food and chemicals to electronics and precision engineering.

For A Wrate Engineering, a precision engineering company in London, MRPeasy has been transformative. “It is 1,000 percent better than what we were previously using. I love it. We now have all the information in one place,” says Lee Brien, Director of Operations. “All you need to find is just one click away, which saves a huge amount of time.”

Cantium Scientific, an air quality test systems manufacturer from Norfolk, considers MRPeasy an essential part of their business. “It helps us stay on track with customers in 50 countries. It’s the framework for how we manage things,” says Managing Director Stephen Plumridge.

Alistair Watson, Managing Director of Stakam, a chemical manufacturing company from Arbroath, Scotland, says: “I feel like we struck gold with MRPeasy. It’s become such an asset that I often grapple between wanting to keep it as our secret weapon and the desire to showcase our robust systems.”

The praises across sectors echo a common theme: MRPeasy delivers a high level of functionality at a fraction of the cost of traditional ERP systems, making it the ideal choice for SME manufacturers.

A celebration of the best of the Thames Valley 250’s businesses has highlighted the strength and depth of talent across the region.

The Thames Valley 250 comprises the top privately-owned businesses (by turnover) headquartered in the region, defined as Oxfordshire, Berkshire, West Surrey, North Hampshire and parts of Buckinghamshire.

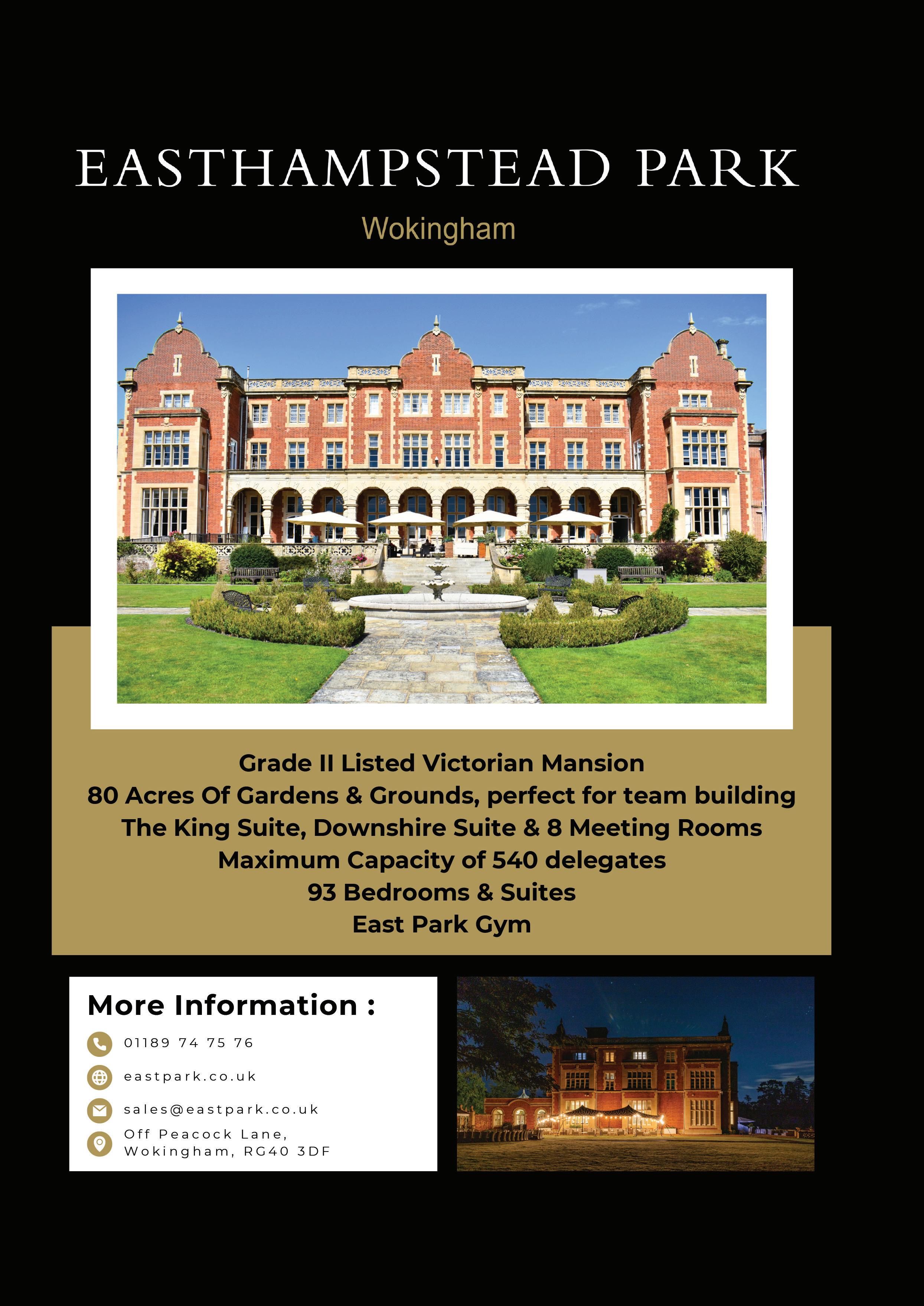

Gateley Legal, Morgan Lovell, Verlingue and Blue Peak Consulting sponsored the TV250 this year. The 14th annual awards event was held at Easthampstead Park, Wokingham.

Richard Thompson, Chief Executive of The Business Magazine, which compiles the ranking, noted that this year’s TV250 employs more than 144,000 people and generates a turnover of almost £35 billion.

“The companies making up the TV250 have achieved 18% year-on-year growth in turnover,” he said.

Guest speaker Jacob Leone, Investment Director at private equity firm LDC, provided insights into private equity funding. LDC typically invests £10-£50 million in mid-sized businesses. The firm has been operating in the Thames Valley for 20 years and has provided £600m of funding in the region over the past 12 months.

Jacob highlighted some key reasons for accessing private equity, including business owners looking to exit and management teams seeking to buy into their business. He also covered the pros and cons of this type of funding.

“On the positive side, private equity firms offer strategic support and advice as well as providing capital. We can help professionalise businesses to continue their growth journeys. On the negative side, it’s a more expensive form of capital than taking on debt,” he said.

CEO OF THE YEAR (UNDER £50M)

WINNER: Paul Hargreaves – Cotswold Fayre

FINALISTS: Will Barrett – Francis Construction • Justin Brinklow – Ontime Automotive • Neil Pizzey – Amazon Filters • Anthony Young – Bridewell

CLIMATE & SUSTAINABILITY AWARD

WINNER: Exclusive Collection

FINALISTS: Cotswold Fayre • Roc Technologies • Westcoast • Whistl

CEO OF THE YEAR (OVER £50M)

WINNER: Richard Dick – Lucy Group

FINALISTS: Rob Collard – Collard Group • Martin Dodd – Huntswood CTC • John O’Hanlon –Waylands • Bashir Parkar – BAP Pharma

ENTREPRENEURIAL BUSINESS OF THE YEAR

WINNER: Collard Group

FINALISTS: BAP Pharma • Cotswold Fayre • Lucy Group • Roc Technologies

FAST RISER OF THE YEAR

WINNER: RH Amar

FINALISTS: Amazon Filters • Bridewell • Francis Construction • Waylands

LEADERSHIP TEAM OF THE YEAR

WINNER: CleanEvent Services

FINALISTS: BAP Pharma • CV-Library • Roc Technologies • Waylands

ONE TO WATCH

WINNER: Francis Construction

FINALISTS: Bridewell • Cotswold Fayre • RH Amar • Waylands

EMPLOYER OF THE YEAR

WINNER: Xtrac

FINALISTS: AND Digital • CleanEvent Services • Collard Group • RH Amar • Roc Technologies • Whistl

TO READ MORE ABOUT THE WINNERS SCAN THE QR CODE

632,756 UK businesses are in ‘significant’ financial distress, up 5.1 per cent on the prior quarter (Q2 2024: 601,950) and 32.3 per cent higher than Q3 2023 (478,176)

Significant’ financial distress increased in 21 of the 22 sectors covered by Red Flag Alert in Q3 2024 versus Q2 2024

In Q3 2024 ‘significant’ financial distress rose particularly rapidly in Utilities (+19.3 per cent), Food & Drug Retailers (+10.4 per cent), Financial Services (+9.94 per cent) and Bars & Restaurants (+8.7 per cent)

The number of businesses in ‘critical’ financial distress fell quarter on quarter by 23.2 per cent to 31,201 in Q3 2024 (Q2 2024: 40,613), 17.3 per cent lower than Q3 2023 (37,772)

This trend was seen in the Hotels & Accommodation (-33.5 per cent), Construction (-28.5 per cent) and Real Estate & Property Services sectors (-26.5 per cent), in particular, with all experiencing a reduction in ‘critical’ financial distress versus Q2 2024.

The sectors experiencing the highest numbers of companies in ‘critical’ financial distress were Support Services (4,860), Construction (4,324) and Real Estate & Property Services (4,099).

The latest “Red Flag Alert” research from leading UK advisory firm Begbies Traynor, which has provided a snapshot of British corporate health for almost two decades, highlights the challenging conditions UK businesses continue to face, with the number of companies facing ‘significant’ financial distress up around five per cent in Q3 2024 to 632,756 businesses (Q2 2024: 601,950).

The steady increase in companies experiencing ‘significant’ financial distress was driven by noticeable increases in distress in the Utilities (+19.3 per cent), Food & Drug Retailers (+10.4 per cent), Financial Services (+9.94 per cent) and Bars & Restaurants (+8.7 per cent) sectors.

With 21 of the 22 sectors monitored by Red Flag Alert reporting the level of ‘significant’ financial distress increasing in Q3 2024 versus the prior quarter, the latest data highlights how the heightened level of economic uncertainty is impacting businesses in almost every corner of the economy across the UK and pushing another 30,000 companies into financial distress.

Julie Palmer, Partner at Begbies Traynor, said: “With the end of the year now in sight, many British companies must be looking ahead to the finish line with a cautious degree of optimism for what 2025 has to offer after a difficult year. So far 2024 has

been hard to navigate for companies and the final quarter looks no different as a high degree of uncertainty weighs on the UK economy.

“With over 630,000 firms now in significant financial distress, more than thirty per cent higher than this time last year, no section of the country’s economy is immune from the legacy debt built up by many businesses during the pandemic.

“It is also apparent that the toxic effect of high inflation is still filtering down to businesses. The construction sector in particular continues to struggle with the legacy of high materials and labour inflation which have led to some highprofile insolvencies recently. This is a trend that I expect to continue, and I do not believe ISG will be the only major casualty in this sector with the domino effect likely to hit the sub-contractor community in due course.

“For some, the prospect of a change of government was viewed as a potential catalyst for a much-needed economic boost, but there are significant concerns surrounding what the next Budget might hold for the economy and the knockon effect could be damaging for many businesses teetering on the edge of collapse, as it seems certain many will have to deal with higher employee-related taxes.

Ric Traynor, Executive Chairman of Begbies Traynor, added: “As we move into the final quarter of 2024, the decline we have seen in ‘critical’ financial distress is a welcome surprise after a challenging year. That said, it is too early to say if this is a trend that will continue into the autumn – traditionally a busy period for corporate insolvencies.

“The government’s Employment Rights Bill could make it more difficult and more expensive to employ staff.

“Companies must also contend with geopolitical risks that could derail any domestic policy, including conflict in the Middle East, which could at the very least result in a spike in energy prices and bring back the spectre of high inflation. Added to this is the upcoming election in the US, which has the potential to impact both foreign and economic policy.

“Against this backdrop, the only certainty is uncertainty, and we know this is bad for both business and investment alike. It is clear that the UK economy is far from being out of the woods.”

Begbies Traynor’s Red Flag Alert has been measuring and reporting corporate financial distress since 2004. It has become a benchmark on the underlying health of companies across every sector and region of the UK.

Red Flag Alert’s algorithm measures corporate distress signals, drawing on company accounts and factual, legal and financial data from a wide range of relevant sources, including intelligence from the UK’s leading insolvency business, Begbies Traynor.

Companies are measured against a new scorecard of indicators to give greater insight and accuracy into the health of businesses. Two years of work by data scientists analysing eight years of data, taking into consideration pre, during and post-pandemic insights to find signals and patterns indicating businesses in distress, combined with AI tools, means that Red Flag Alert aims soon to be able to predict how many companies in trouble will go on to fail.

Beans Coffee Club distributes 130 different roasts from more than 20 suppliers

Beans Coffee Club has secured a £100,000 loan via the Thames Valley Berkshire funding escalator to scale up its business.

Based in Bracknell, Beans runs an online platform connecting coffee enthusiasts with more than 20 independent UK roasters.

It runs a subscription service personalising selections based on individual preferences. Unlike typical single-roaster subscriptions, Beans provides customers with access to 130 different coffees.

This latest loan, provided by equity investor The FSE Group, will enable the business to hire a new marketing expert and begin approaching agencies as it looks to build brand visibility and cash in on the growing popularity of homebrewed, cafe-quality coffee.

Fiona Jones launched Beans Coffee Club alongside husband Richard in 2019. They successfully pitched to the Dragons on BBC’S Dragon’s Den last year, bagging a £50,000 investment.

“As a relatively early-stage business, there are limited options to raise funding from mainstream finance providers,” she said.

“We’re delighted to be working with The FSE Group. Their support will help us reach new customers and continue to promote the incredible work of independent UK roasters.”

Beans Coffee Club has shown strong growth since its inception.

Annual sales have almost tripled since 2022, and the company is looking to

achieve five times this over the next three years.

The team believe their focus on sustainability and fair pricing for roasters and farmers will resonate with a growing number of coffee lovers looking for ethical, high-quality products.

Paul Smith, investment manager at The FSE Group, added: “Beans Coffee Club has demonstrated a proven and scalable business model with impressive year-onyear growth.

The new hires and marketing partnerships funded by this loan will be critical to delivering their ambitious growth plans.

“We’re excited to support such a driven and innovative team.”

Mechanical and electrical engineering firm Campbell West is celebrating significant growth over the past 12 months.

The Bracknell business posted revenues of £10 million – up 54 per cent on the previous year – and is aiming for £13 million next year.

A highlight was securing a £6 million project to deliver building services infrastructure for the new ophthalmology department alongside refurbishments at Ashford and St Peter’s Hospitals NHS Foundation Trust in Surrey.

The company has also welcomed seven new team members, including estimators, a quantity surveyor, financial assistants and project managers.

“While market conditions have improved, much of our success is due to our motivated, self-driven team working to deliver high-quality service to our clients,” said co-owner Steven Campbell.

“The fact that we’re able to offer a single point of contact to clients for mechanical and electrical services has also set us apart from others.

“We’ve restructured the business and enhanced expertise by investing in training and development. This has enabled us to take on larger projects, which has bolstered our revenue.”

Steven founded the company in 2017 with Daniel West, whom he met while working as an apprentice.

With an initial focus on the healthcare sector, Campbell West has expanded into local government, education, data centres, workspaces, industrial buildings and large residential projects.

A Reading-based med-tech Occuity has achieved CE marking for its PM1 pachymeter device, paving the way for sales in Europe and beyond.

The PM1 can measure an eye’s corneal thickness in just a few seconds, allowing for fast and safe diagnosis of glaucoma.

It’s the world’s first handheld, non-contact optical pachymeter.

CE marking is a European safety standard which validates the safety, efficacy and environmental standards of the PM1.

Having built a strong global distribution network, the company now plans to transition from product development to

revenue generation and says it is primed to ship the PM1 to key markets.

“CE marking opens the door to new commercial opportunities and validates the hard work our team has put in,” said CEO Dr Dan Daly.

“With the PM1 ready for market and a strong pipeline of products following closely behind, all built on an innovative platform that leverages Occuity’s groundbreaking optical technology, we’re poised for substantial future growth.”

The company also closed a convertible loan note round in October, offering a final window for investors before the business enters full commercialisation.

Windsor & Eton Brewery has closed a successful second equity raise on crowdfunding platform Republic Europe (formerly known as Seedrs) after surging past its £200,000 goal within the first 24 hours.

The business secured the backing of 427 investors for a total of £384,500, with individual shares sold at £3.42.

This latest raise follows a record sales year for the brewery’s four bars in Windsor in owns, and the 350-plus venues it supplies around the country.

The team is planning to put the money towards opening a new pub, as well as running their first sustained marketing campaign and boosting capacity at the brewery.

“We’re delighted with the response from both existing and new investors,” said co-founder and chair Will Calvert.

“Fourteen years after we brought craft brewing back to the heart of this historic brewing town, we’re so pleased that our supporters remain as excited about our plans as we are.”

ByBox, a software and supply chain management provider based in Slough, has unveiled its new name – Thinventory.

Thinventory oversees a network of ‘smart lockers’, enabling clients with large numbers of field engineers to securely collect and return equipment and parts at convenient locations.

The business operates in 31 countries and delivers 30 million items a year.

Executive chair Stuart Miller said: “We started out to simplify distribution and secure inventory closer to the point of use, helping customers meet tight service level agreements at lower costs.

“Our network of 45,000 lockers worldwide has been pivotal in achieving this.

“As we’ve grown, so has our ambition, with technology and innovation now key in providing the best solutions for customers as we invest more in research and development than ever before.

“Rebranding as Thinventory represents our dedication to reducing waste, optimising processes and delivering value.

“We’re proud of what we’ve achieved to date and are excited for the future.”

The new name will feature on the company’s head office in Slough, as well as its distribution centres in Bristol, Coventry, Doncaster, Glasgow, Huntingdon, London, Milton Keynes, Solihull and Warrington.

Revolution-ZERO aims to do away with single use medical supplies

A Hampshire medical textiles business has secured £1 million investment to accelerate growth from the South West Investment Fund via fund manager The FSE Group.

Revolution-ZERO was founded in 2020 to replace single-use medical textiles with more effective, economic and sustainable alternatives.

It aims to have six operational medical textile processing units by 2026, rising to 24 by 2028, and wants to become a £25 million turnover business within the next three years.

Founder and CEO, Tom Dawson, said: “Our model has already shown significant potential in reducing single-use item

dependency in healthcare settings and this funding will help us scale these solutions more rapidly.”

In the UK alone, around 53,000 tonnes of single-use regulated medical textiles are consumed annually, costing the NHS more than £400 million.

Revolution-ZERO aims to disrupt this market, which is valued at £405 million annually in the UK and £4 billion across Europe.

Anna Staevska, FSE investment manager, added: “We see Revolution-ZERO’s innovative approach to medical textiles as a game-changer for the healthcare industry.”

Precision Fuel & Hydration is to remain official hydration partner for IRONMAN triathlon events in Europe, South Africa and Oceania through 2025 after a successful fivemonth collaboration.

The Dorset business will also supply the upcoming IRONMAN 70.3 World Championships in Taupo, New Zealand this December.

Since May, Precision Fuel & Hydration has provided its PH 1000 electrolyte drink to athletes at more than 40 IRONMAN events.

PH 1000 is designed to enable athletes to pull on two of the ‘three levers’ of endurance sports nutrition – fluid and sodium – with the third lever, carbohydrate, being delivered through a selection of energy products and snacks from other brands.

CEO Andy Blow, said: “Having raced IRONMAN triathlons as a pro back in the early 2000s, I’m delighted that we are continuing as an official partner and that we were able to expand our support to more triathletes around the world.

“It was my own experiences with hydration and cramping issues in races such as Kona and Nice that led to the founding of our business back in 2011.”

The UK’s National Oceanography Centre (NOC) in Southampton is trialling a fossil-free marine diesel to fuel the Royal Research Ships James Cook and Discovery.

Hydrotreated vegetable oil (HVO), made from used vegetable oils, fats and non-food crops, significantly reduces net CO2 vessel emissions compared to conventional diesel fuel.

The trial is funded by the UK’s Natural Environment Research Council which owns the two vessels.

HVO can be used as a “drop-in” replacement in marine engines and because it’s made from already used products and non-food crops, its life-cycle CO2 emissions are much lower than fossil fuel.

Kevin Williams, Head of Research Ships Engineering, said: “NOC is focused on understanding and protecting our ocean. Reducing our own environmental footprint is a key part of that.”

HVO is one of the more stable biofuels, which means it’s suitable for the different conditions NOC vessels operate in, from high temperature regions to the Arctic. However, there are some challenges around its use, such as cost and availability, especially in remote places.

Merlin Entertainments, has launched its 2024 Engineering Academy.

Merlin Entertainments, which sits at No 1 in our Solent 250 list of private companies, has announced the second year of its innovative UK-based Engineering Academy, alongside the launch of its 2024 engineering apprenticeship cohort.

This pioneering academy programme run by the global leader in branded entertainment destinations, aims to equip both Merlin’s technical employees and new

apprentices with the skills and knowledge needed to thrive in a rapidly evolving technological landscape.

The 2024 cohort will consist of 27 individuals, reflecting a 63 per cent growth from the previous year. This expansion underscores Merlin’s commitment to developing an engineering workforce that is technologically adept and industry ready.

Meachers Global Logistics has invested more than £1 million in its fleet and new faces in key areas of the business.

The recent purchase of 10 trailers and six tractors is part of an ongoing investment into the Meachers fleet. Six of the trailers will be dual branded with Meachers’ customer Prysmian Cables and Systems, formerly Pirelli Cables, based at Eastleigh.

Meachers’ former Commercial Director Gary Whittle has also taken over the role of Operations Director, following the retirement of Rob Lewis in March.

He explained: “Prysmian is a long-standing trading client and so we are pleased to foster our relationship by increasing the fleet size and including them on the branding. We’re investing in our assets and building for the future to make us bigger and more resilient.

“We’re supporting the infrastructure of the organisation, with training, promotions, and new faces joining us in key midmanagement roles. We’re aiming for a broad resilient team in anticipation of future customer demands,” said Gary.

Meachers sits at No 110 in our Solent 250 list.

Primarily targeting current UK employees and new apprentices, the academy provides hands-on training tailored to the future of engineering and facilities maintenance roles.

The academy ensures that participants are not only equipped to navigate the evolving tech landscape but are also primed to drive innovation across the industry.

Hall & Woodhouse invests in Holidaymaker

Dorset brewery Hall & Woodhouse, which sits at No 40 in our Solent 250, has invested in Dorset-based small business, Holidaymaker, to support its mission to bolster the holiday park and hospitality industry with increased guest engagement technology.

The Holidaymaker guest experience app was created in 2020 to drive revenue, boost brand loyalty, and increase repeat business for hospitality brands. The founding aim of Holidaymaker was to develop a technology that revolutionises the way businesses in the sector connect with guests.

Anthony Woodhouse, Chairman of Hall & Woodhouse, said: “We feel strongly about backing Dorset-based winners and enabling entrepreneurs to unlock their full potential. Holidaymaker was an obvious investment for us as a business due to its work in the hospitality sector.”

“It is an exciting time to be working closely with Holidaymaker, as it looks to grow and push the boundaries of what can be achieved in the sector. We are eager to see what learnings we can apply to our own business through this partnership.”

Hampshire’s leading IT managed service provider, Aura Technology, has taken a bold step forward by merging with Oxfordshire-based claireLOGIC. This strategic partnership is set to revolutionise the IT landscape, bringing together two powerhouses to deliver unparalleled service and expertise.

With its strong presence in Southampton and London, Aura Technology has been a trusted partner for many businesses in the region. With a team of over 100 dedicated professionals, Aura has built a reputation for delivering proactive IT solutions that prevent issues before they arise. Their client-centric approach ensures businesses can focus on what they do best, leaving their IT needs in capable hands.

claireLOGIC, headquartered in Oxford, has been a beacon of excellence in IT support since its inception in 2011. Serving a diverse range of sectors across Oxfordshire and London, claireLOGIC offers a comprehensive suite of services, including IT support, cloud services, managed services, and consulting. Their team of highly-skilled engineers is passionate about providing the best possible service to clients, ensuring their IT infrastructure is robust and reliable.

The merger of these two industry leaders is a natural progression driven by a shared vision and complementary strengths. Tim Walker, founder and Managing Director of Aura Technology, has been the Chairman of claireLOGIC for the past seven years. Tim reflected on this exciting development: “We’ve realised many similarities between the two businesses. More recently, we’ve been exploring if there are more ways in which we could collaborate and work together more.”

This merger is not just about combining resources; it’s about creating synergy to drive innovation and growth. Andre Vaux, co-founder and Managing Director of claireLOGIC emphasised the potential of this partnership. “We’ve had a longstanding relationship with Tim and developed a great synergy. We agree that both businesses have brighter futures together, and we can grow into new areas and work together as the market changes. We’re all looking forward to this next chapter,” Andre stated.

This merger promises enhanced service offerings and more excellent resources for both companies’ clients. The newly enlarged Aura Group will continue to deliver the high-quality support that clients have come to expect, with the added benefit of expanded expertise and capabilities. “For all of our customers, nothing will change in how we serve them. Our services and commitment to delivering high-quality support is unwavering. It’s an exciting time for Aura Technology and claireLOGIC,” Tim summarised.

In conclusion, the merger of Aura Technology and claireLOGIC is a testament to the power of strategic partnerships. By combining their strengths, these two companies are poised to lead the way in IT-managed services, delivering unmatched value to their clients. As the IT landscape continues to evolve, Aura Technology and claireLOGIC are ready to navigate the future together, unlocking new horizons and setting new standards of excellence.

Banking partner at Shakespeare Martineau Jake Holmes shares the latest trends for SME and mid-market lending across the South, including insights from his banking and advisor contacts.

With the UK general election behind us and interest rates falling, the appetite for lending to the region’s businesses remains strong across most sectors, despite lower transaction volume.

This is, in no small part, down to the quality of the businesses. As John Turner, area director at Lloyds Banking Group explained: “We’ve seen over recent years that SMEs on the South Coast are very resilient –they’ve experienced Brexit, Covid, supply chain issues, the cost-of-living crisis, inflationary pressures and rising interest rates. They’ve managed to survive and thrive, despite these headwinds.”

Tech remains a hot sector, as Carey Moore, regional director at NatWest, highlighted: “Technology businesses are particularly desirable to lenders given their growth prospects, and there is no sign of this abating.”

Anthony Donohue, head of corporate, added: “This is a focus sector and we’ve been really effective in supporting such businesses through NatWest’s new product, which allows intellectual property to be leveraged as collateral for borrowings”.

Illustrating the improved market sentiment, Santander UK reported a record year of new client wins, particularly SMEs. Matt Shaw, regional director, noted: “Manufacturing and wholesale businesses continue to thrive, particularly those trading internationally. Debt processes have ramped up and our Growth Capital team are looking at some notable transactions completing Q4/Q1.”

There are inevitably pockets facing challenges; such as the construction industry where developers are struggling to achieve gross development value sales. The commercial property market also remains somewhat subdued. Dan Curtis, in-house counsel at MSP Capital, commented: “At the start of 2024 we saw

Developers have faced tighter margins, leading them to approach opportunities with greater caution

signs of the market picking up. The interest rate cut stimulated activity from first-time buyers and the election brought renewed optimism, however warnings of a ‘painful’ budget led to a return of uncertainty in the market, with clients delaying or even halting transactions.”

The resulting downturn in real estate activity has created some interesting shifts in the property financing market. As Ben Myers, commercial finance manager at Onyx Money flagged: “Developers have faced tighter margins, leading them to approach opportunities with greater caution. However, whilst we’ve seen a decrease in the volume of funding requests, the quality has notably improved.”

At the same time, it can’t be overlooked that uncertainty brings opportunity and, as Dan Curtis points out, “Opportunistic clients wasted no time seeking out lenders capable of making swift decisions to strike deals where vendors needed to complete before the budget was released.”

Capital remains readily available for businesses across the South, but it is fair to say that it is being provided by, and sourced from, a broader range of suppliers than before.

We’ve seen an increase in wholesale financing as a workaround to direct lending to businesses with higher risk profiles. Moreover, where some banks have indicated a diminished appetite for smaller deals, this has created opportunities for other lenders to pitch for transactions where they would previously have been outpriced.

Similarly, borrowers are now looking at the whole market when evaluating how they meet their capital requirements, and increasingly this includes debt funds. Funds are issuing credit-backed terms much quicker than major banks and this ability to mobilise makes them attractive to businesses.

We’ve also seen an uptick in equity being used to fund investment. Cat Dilloway, investor at Business Growth Fund, reported: “We’ve had a really busy year so far, and have deployed £18m into businesses on the South Coast. It’s a vibrant region for SMEs, and we can see a lot of opportunities to deploy more growth capital, partnering with ambitious businesses in the area.”

With increased competition among major banks, bolstered by the availability of private equity capital, there has been a marked softening of lending criteria. A prime example is the treatment of vendor debt on transactions, with senior

lenders no longer insisting this be fully subordinated (albeit this has meant intercreditor negotiations are more protracted).

We’ve witnessed banks taking higher ‘singleholds’ on transactions, when previously they’d share their commitment with other lenders through ‘club’ deals; possibly as a means of achieving growth in a somewhat volume restricted market. It’s now common to see single lender deals of £50m.

Perhaps it should come as no surprise given the turmoil of recent years, but there is a definite shift to borrowers seeking greater flexibility when it comes to debt terms.

Jeremy Richards, director at PKF Francis Clark notes: “Customers appear willing to pay higher margins/fees to achieve flexible terms including bullet (vs amortising) repayment profiles and additional headroom in financial covenants.”

There’s also been a resurgence in accordions (where possible upsizes in loans are baked into facility agreements) and businesses are either seeking ‘five-year money’, or extension options are being incorporated to allow them to extend facilities by one or more years.

With more funders than ever to approach, there is plenty of scope to explore such options.

Despite sustainable finance remaining a priority for banks, there’s been modest

uptake in the SME and mid-markets. Recognising that this may be attributable to the perception that external monitoring costs (to demonstrate compliance) might outstrip the benefits to be gained through such facilities, certain banks are introducing streamlined products and tools (particularly for SMEs), such as Lloyds’s clean growth finance incentive scheme and green buildings tool.

It’s worth noting that most banks now have a mandatory section in their credit paper dealing with sustainability, so businesses need to address this when borrowing, even where they’re not looking to utilise a sustainability product.

Lenders unanimously report that transactions are taking longer; the average duration stretching to several months in some cases. The reasons aren’t entirely clear, although when it comes to acquisition financing, this may be because the underlying acquisition process has slowed. It’s quite common to see latestage price chips which can reopen negotiations and stall completion.

Despite businesses breaching financial covenants (largely those exposed to discretionary consumer spending, like hospitality), we’ve seen little evidence of bullish enforcement behaviour from lenders, save for when businesses fail to engage after experiencing financial difficulties.

As Graeme Lipman, director at Begbies Traynor says: “Proactive communication with lenders remains key. Lenders are most amenable to supporting businesses that demonstrate transparency.”

As it stands, there is a sense of renewed optimism for the SME and mid-markets across the South Coast, and we expect lending activity to remain strong throughout Q4 2024 and Q1 2025. For help and support financing your business contact Jake.Holmes@shma.co.uk

County council leader Nick Adams-King is determined to get the voice of business heard by government

by Stephen Emerson, Managing Editor

Tenacity is a quality vital to success in both politics and business says Hampshire County Council Leader Cllr Nick AdamsKing, and there are early signs that his dogged determination is paying off.

In September, an expression of interest in a devolution deal was submitted by Hampshire, together with Isle of Wight, Portsmouth and Southampton City Councils in an act of unity that had failed to materialise on three previous attempts.

The devolution deal would equip Hampshire with a mayoral devolution set up like that seen in Greater Manchester, with the county able to negotiate with central government as a unit on key areas including economic development, planning and transport.

Nick said: “You need patience and tenacity to succeed in politics. If you give me a challenge, I will stick at it and not run away.

“If you can fix the macro then it enables you to deliver on the micro and those little wins are the most important.”

Born in Cambridge, brought up in North Devon and now living in Romsey, Nick’s early career and years in business have left an imprint on him.

The son of North Devon sweet shop owners, he first studied as a chartered

You need patience and tenacity to succeed in politics. If you give me a challenge, I will stick at it and not run away from it

surveyor, before running a post office and working in the relocation department of The Nationwide Building Society.

He then set up his own corporate relocation company focused on moving businesses around the country, with a particular focus on the blue-chip sector.

The firm, which counted Marks & Spencer, Pfizer and GlaxoSmithKline, among its client base, grew from a team of four people to 100 and a turnover of £65 million.

Nick sold the relocation business in 2001 and invested in a restaurant in Bournemouth which developed a reputation for drag cabaret.

He opened several similar restaurants in the seaside town, even expanding overseas into Prague in 2003.

His early involvement in politics stemmed from a frustration at Bournemouth Council’s attitude towards business, and he won a seat on the authority in 2005 for the Conservatives.

He stood for parliament in 2010 for the Mid Dorset and North Poole constituency but lost by a slender margin of 269 votes.

He said: “I’m glad I didn’t win as I think that through my career in local government, I have had a much greater impact than I would have done had I become an MP.”

Life shifted to a different gear when he entered into a civil partnership with his partner and now husband James, a doctor at Southampton General Hospital, with whom he has adopted first a son and then a daughter.