ENERGY FOCUS

GLOBAL

NAMIBIA’S OIL MOMENT

GLOBAL

NAMIBIA’S OIL MOMENT

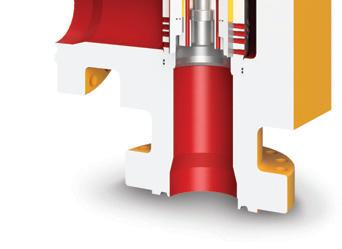

As a UK based manufacturer with over 50 years of experience in supplying Control and Choke valve products to the world’s energy markets, KOSO Kent Introl is ideally positioned to support the energy sectors on their journey into cleaner energy be it land, sea or below.

We engineer and supply high-quality valves to perform in some of the most severe service conditions throughout the world.

Supporting your investment over its life cycle with OEM spares, ensuring your valves continue to perform to their optimum.

With our comprehensive records of every valve and component we have ever supplied, we can help you devise and implement a strategic plan for the asset management of your valves.

We have the facilities, expertise and flexibility to ensure that your valves are maintained safely, effectively and promptly.

As the assets life progresses, we can review and engineer a suitable upgrade or replacement internals to ensure your process is running at its optimal level.

With our in-house Laser Powder Bed fusion technology and a team of expert additive engineers, we can specify, design and produce components quickly in-house.

/

5 Foreword From the Chief Executive

6 View from the top Mike Pettigrew, CEO, ASCO

10 News and events Energy Exports Conference 2025

13 One supply chain. Many technologies. One reality! Rebecca Groundwater, Head of External Affairs, EIC

16 The big question Which new regions are members targeting?

18 Special feature: Time to look closer The untapped potential of frontier energy markets, Jonathan Dyble, Partner, WD Editorial

22 Power plays Three strategic alliances shaping global energy trade, Tom Wadlow, Partner, WD Editorial

38 My business Dean Rossiter, Managing Director, Transcar

The Energy Industries Council

89 Albert Embankment, London SE1 7TP

Tel +44 (0)20 7091 8600

Email info@the-eic.com

Chief executive: Stuart Broadley

Should you wish to send your views, please email: info@redactive.co.uk

Editors Sairah Fawcitt +44(0)20 7880 6200 sairah.fawcitt@redactive.co.uk Lucas Machado +55 21 3265 7402 lucas.machado@the-eic.com

Account director Deniz Arslan

Production director Jane Easterman

Lead designer Craig Bowyer

Senior designer Gene Cornelius Picture editor Akin Falope Content sub-editor Kate Bennett

Sales and advertising

Michael Raymond +44(0)20 7324 2763 michael.raymond@redactive.co.uk

Energy Focus is online at energyfocus.the-eic.com

ISSN 0957 4883

© 2025 The Energy Industries Council

26 Chile’s green hydrogen boom Marco Maedo, Energy Analyst, EIC Rio de Janeiro

28 Winds of change blow through Philippines Hazwani Izzati, Energy Analyst, EIC Kuala Lumpur

30 Crude awakening: Namibia’s energy rise Guilherme Martins, Energy Analyst, Rio de Janeiro

32 Japan’s power transformation: Opportunities ahead Aisyah Sarjuni, Research Analyst, EIC Kuala Lumpur

35 The Nordic nuclear shift Firdaus Azman, Energy Consultant, EIC Kuala Lumpur

Energy Focus is the official magazine of the Energy Industries Council (EIC). Views expressed by contributors or advertisers are not necessarily those of the EIC or the editorial team. The EIC will accept no responsibility for any loss occasioned to any person acting or refraining from action as a result of the material included in this publication.

Publisher Redactive Media Group, 9 Dallington Street, London EC1V 0LN www.redactive.co.uk

Recycle your magazine’s plastic wrap – check your local LDPE facilities to find out how.

STUART BROADLEY

The Energy Exports Conference (EEC), EIC’s annual flagship event, is back on 3-4 June, once again at P&J Live in Aberdeen.

The UK accounts for just 2% of the world’s energy market and 1% of global emissions. With this in mind, EEC represents EIC’s belief that growth and decarbonisation are enabled by looking outwards to export and international trade strategies, rather than inwards.

The imperative must be international growth, responding to new challenges such as tariffs and long-term issues such as net-zero implementation. It’s time to get moving and make connections.

Your growth strategy must be clear and sober in these challenging times, removed from inarticulate and inauthentic energy policies. It should be rooted in the basics, but with differentiation, adaptability and agility, as well as being highly people and client-centric. Without embracing global opportunities and all energy technologies, you may lose your key skilled staff and profitable contracts. The winners will be businesses that have the entrepreneurial spirit to take opportunities from crises. Depending on where you are in the world, you’ll have a different perspective on the best way to grow your business. For this reason, it’s a pleasure to feature ASCO CEO Mike Pettigrew in this issue’s View from the

Top interview, where he shares his unique insights and vision for business growth.

There are exciting projects around the world, and EEC gives companies access to hundreds of contacts and enables businesses to learn about new export opportunities as they listen, engage and connect with the international energy community.

Global policies are being exercised on an epic scale. Be it energy security, net zero, international trade, technology and artificial intelligence, intergovernmental relationships or even entire world orders, all are up for grabs. How to invest in a world of unpredictability? And, more importantly, how to stay calm in the middle of the storm?

Global policies are being exercised on an epic scale

The usual challenges remain: the need to be profitable and to thrive; the thrill of unlocking opportunities and finding uniqueness and strength against competitors; the need to work together to win, knowing that 2+2 should always equal more than 4. Supply chain businesses will find a way to prosper. They have the ability, creativity, expertise and friendship focus needed to find a way.

But bigger investors care little about these business niceties. They are focused

on their return on investment and longterm stable markets. Investors in multibillion-dollar infrastructure and energy projects want consistency and certainty. The race is now on to attract trillions of unspent, unallocated dollars – and it’s no longer about government subsidies or the planet. Heads and hearts have turned to deal-making with confidence – and the companies, technologies and countries that can provide this will win. This moment will drive the movement of money, people, facilities and mission-critical capabilities. Business will follow the money.

The challenges are big, but getting together as an industry, thinking together and looking at global opportunities together will give us a better feeling of direction.

In your country, are you winning the race to attract investors? If you are in the supply chain, have you found your new growth engine? Policymakers, have you adapted to the new normal? We hope this issue will help you answer some of these questions. But there is nothing better than being out and about, listening and talking to the experts directly, and, of course, learning about projects around the world. For that, you need to be in Aberdeen at EEC.

STUART BROADLEY Chief Executive Officer, Energy Industries Council stuart.broadley@the-eic.com

Mike Pettigrew explains how ASCO is navigating global uncertainty by investing in new markets, forming strategic partnerships, and backing its people with both vision from the top and boots on the ground

Mike Pettigrew became CEO of ASCO in October 2023, following rapid progression through senior roles since joining in January 2022. Initially General Manager for its shipping agency and freight management services, he moved into the role of UK Managing Director later that year. With more than 20 years’ experience across defence, oil and gas, marine, power, nuclear and engineering, Mr Pettigrew previously spent 13 years at Babcock and served for three years as a non-executive board member at Decom North Sea.

You’ve been ASCO CEO for nearly two years – what has this role, in this sector, at this time, taught you about leadership?

I’ve spent my entire career in critical engineering environments – from power and aerospace to ship design and build – so I was already convinced of the importance of ‘on-time’ materials management and logistics as an enabler of success. What I learned at ASCO, however, was that both our clients and even our own people didn’t always fully appreciate the value they delivered.

My role in ASCO has been less about process assurance and governance, and more about vision and inspiration. By painting a clear picture of what the future could look like, I’ve seen our incredibly talented team create their own roadmap to get us there.

What growth strategies are working best for ASCO in today’s challenging market?

is on enabling critical, always-on industries to operate more effectively, efficiently and safely – the industry they are in is almost immaterial.

How has ASCO’s international investment strategy evolved in response to changing energy demands?

We’ve been steadily increasing our investment in global expansion – and this isn’t a recent pivot, it’s been central to our strategy for years. Over the past three to four years, we have entered new markets such as Senegal and Suriname, while strengthening our presence in the UK, Australia, Norway and Canada. Looking ahead, Africa, the Middle East, the US and the Caribbean are firmly on our radar as major growth regions.

How is ASCO different from other freight and logistics companies?

9 COUNTRIES OPERATED

5 EXPORT DESTINATIONS

26% SHARE OF EXPORTS OF REVENUE

First and foremost, ASCO is not just a freight and logistics company. We’re a diversified services business; freight and logistics is just one part of our integrated offering.

It’s not just one thing but a blend of deep experience, strong customer relationships and, most importantly, highly skilled people. Oil and gas remains at the core of our heritage and will be a critical part of our future, but we recognise the need to adapt and apply our proven capability in new sectors and geographies.

c.1,500

We’ve recently had success in Norway (metals) and Canada (pulp and paper), and we’re continuing to make inroads into other diverse markets. Our focus

What sets us apart is our ability to balance the pragmatic and practical skills of a traditional logistics operator with the thought leadership and innovation of a specialist consultancy. We don’t just identify opportunities –we have the capability to execute them, too. We’re the brains and the boots, if you like.

We don’t just identify opportunities –we have the capability to execute them. We’re the brains and the boots

Ultimately, it all comes down to our people. Their capability is what truly differentiates us and is what I’m most proud of.

ASCO is winning awards for sustainability – why is this important to you?

At ASCO, sustainability is not just about environmental credentials or our commitment to net zero by 2040. Sustainability is about ensuring that we are responsible custodians of the business, building a business with a long-term and prosperous future for our people, their families and the communities in which we operate.

Our annual Sustainability Report is not simply a reflection of our netzero-focused activities; it is, in essence, a complete picture of our business. It’s become an industry-leading publication, recognised by clients and industry bodies.

You should never pass up the opportunity presented by a good crisis

Net zero seems to be in jeopardy, at least in some parts of the world. How is ASCO approaching this?

I don’t believe net zero is in jeopardy in the long-term. Geopolitical shifts are inevitable, and it is important that the long-term move towards a carbon-free future is not lost in the current noise and polarised debate.

While new energy is an important area of diversification for us, it’s not the only one. It would be myopic to assume that a business rooted in oil and gas can only segue into new energy. The skills, capability and mindset developed in the most challenging environments in the world, offshore oil and gas, are second to none. Companies that cut their teeth in this industry have a huge amount to offer across a range of critical industries.

Global freight has been at the forefront of global geopolitics and the pandemic for the past five years or more – either able to take advantage, or being battered by market headwinds. Does 2025 look any more stable and investable?

This year doesn’t feel any more stable than recent years – even with the pandemic now in the rearview mirror. That said,

most of ASCO’s operations are intramarket, and therefore not overly affected by global freight dynamics. However, the knock-on effect is real: market volatility increases project costs for our clients, which in turn delays final investment decisions and subsequent work for ASCO.

Is world trade and trust between countries and companies now harder to broker than in recent times? How do you navigate these times?

At a government level, yes. However, we are not seeing evidence of this at company level. All businesses are just trying to navigate global challenges. Where there’s opportunity for collaboration and mutual benefit, politics tends to take a back seat.

Freight companies are barometers of trade health and prosperity in some ways. Which sectors and regions are doing best right now, from what you see, and which are struggling?

ASCO isn’t a freight company in the traditional sense – we are not a massmarket shipper of goods. That said, in the UK, oil and gas has taken a significant hit from successive governments. The same is not true in other geographies. New

energy, in particular offshore wind, has also been dealt a blow, with a number of major operators adjusting their strategic focus. While this has perhaps delayed progress, we still believe there is a significant market to target in the long-term.

With new energy markets opening, how do you assess market readiness? What major factors determine whether ASCO enters a new market?

When identifying new markets, our initial approach is to identify major industry trends and broad market intelligence. We then look at the latent capability in those markets to identify if we have a strategic or competitive advantage. Establishing a presence early pays dividends. This can be a tough decision because you have to start spending money and committing prized resources – people –long before any expectation of revenue. This was certainly the case for us in Senegal in 2018–19, and is now the case in Namibia.

The makeup of potential customers is also very important. Ideally, we’re invited in by an existing client that is expanding into a new market – for

ASCO Tananger Base, Norway

Peterhead, Scotland

Aberdeen, Scotland

example, bp in Trinidad 25 years ago, and TotalEnergies in Suriname in 2023. Ideally, we look for markets where our presence is not entirely linked to one customer or one project.

Breaking into new markets is never easy – what’s the biggest risk ASCO is taking right now, and why is it worth it?

Namibia is our biggest calculated risk right now. In 2024, we decided to relocate our Africa MD, Alisdair Duncan, from Dakar to Windhoek. This comes with significant cost and no cast-iron guarantee of business. However, we believe that Namibia will finally fulfil its potential as a major offshore and onshore energy hub. ASCO has a unique capability to help the operators, Tier One contractors and the Namibian government in maximising the opportunity.

What global partnerships or collaborations are helping ASCO to stay ahead in the competitive freight and logistics sector?

It stands to reason we would say that EIC is an important partner in providing opportunities for ASCO globally. On a broader scale, we are very open to forming strategic partnerships and relationships with companies that bring complementary skills, and even, in some instances, partnering with companies that would traditionally have been seen as our competitors.

Looking ahead, what are the biggest challenges and opportunities for ASCO in 2025 and beyond? And how is ASCO positioning itself to stay ahead of the curve?

This year looks set to be an interesting one. Geopolitical issues are creating a great deal of turmoil in many markets, but you should never pass up the opportunity presented by a good crisis. Our ability to adapt and thrive has been proven time and again.

The ASCO team has already shown that it can break into new markets and expand into new sectors. That ambition and adaptability will serve us well in the years to come.

Breaking into global markets has never been easy, but the EIC’s Energy Exports Conference is helping to change that. Now a must-attend event for the energy supply chain, EEC is where international opportunities meet real business growth

BY SARAH MCKENZIE, INTERIM HEAD OF GLOBAL EVENTS & CAMPAIGNS, EIC

The Energy Exports Conference (EEC) is the EIC’s flagship event –and one of the few times in the year we welcome all of our regional directors together to showcase the diverse projects and developments taking place in their region. We also welcome our Advisory Committee partners: Aberdeen City Council, Decom Mission, the Department for Business & Trade (DBT), Energy Transition Zone, Global Underwater Hub, Offshore Energies UK, the North Sea Transition Authority, Scottish Development International (SDI) and UK Export Finance. Together, we shape the conference programme and welcome speakers and delegations from around the world to Aberdeen.

A platform born from need

The UK supply chain sector plays a crucial role in the country’s economy, but

breaking into the export market has long been a challenge. For years, businesses have struggled to find viable routes to access foreign markets and grow their presence globally. Enter EEC – an event designed to open doors and connect companies with export-focused insight and support. Launched in 2019, EEC was created in response to a significant need in the UK energy supply chain: a platform sharing how they could access overseas potential

and explore their exporting strategy – one of the most difficult growth strategies in which to succeed.

Evolving to serve the supply chain

From inception, EEC has focused on highlighting export opportunities directly to the supply chain. But as it evolved, so did the needs of its audience. In 2023, the Advisory Committee made a landmark decision: the event would be free to attend. This ensures that all businesses, particularly small-to-medium enterprises, cam access the information that could help them to navigate and thrive in their exporting strategies.

in opportunities and allow a years’ networking in a week

This was not just about making the event accessible, but also about reinforcing its core mission: to be the go-to space for anyone in the supply chain who wants to break into markets beyond the UK. As a result, EEC has

2000+

REGISTERED ATTENDEES

become the main event for identifying worldwide energy opportunities and meeting decision makers.

Powering global connections

1200+

REGISTERED COMPANIES 420+

work with a major player from outside the domestic market.

While networking and meetings are at EEC’s heart, it also provides a truly immersive experience for delegations. One of the highlights each year includes the site visits to local offshore wind farms, including Aberdeen and Kincardine Offshore Wind Farms. This allows delegations to witness firsthand the scale and innovation of the UK’s renewable energy sector, which is becoming an increasingly important part of the global energy supply chain.

As EEC grows, its focus is on ensuring that UK supply chain is well-represented and competitive. The Advisory Committee is adamant about keeping the experience in-person, ensuring that businesses show their true commitment to the sector. This face-to-face approach fosters genuine relationships and creates meaningful opportunities for collaboration and trade.

3–4 June 2025 Aberdeen, UK Pop in and see the team on the

One of the cornerstones of EEC’s success has been its close partnership with the DBT and SDI. These collaborations have ensured that the event attracts delegations from across the world, broadening its reach and impact. During the last six years, we have welcomed large delegations from Japan, Greece, Africa, Turkey, Spain, Brazil, Peru, Chile and Ukraine.

In 2023 and 2024, EEC had the privilege of welcoming delegations from Aramco Overseas from the Hague, where the procurement team connected with more than 450 companies – a significant achievement for both the visiting delegates and the UK businesses that were eager to

As the world economy evolves and international markets shift, EEC’s role in facilitating global trade for UK businesses has never been more crucial. For those attending or reading about the event – whether during or after – this is just the beginning. EEC 2025 will showcase more than US$100bn in opportunities and allow delegates to do a years’ networking in one week while bringing global delegation to Aberdeen, Scotland.

Meet the Energy Players in Sabah (SOGCE 2025)

3 July 2025 Sabah, Malaysia

For more information: kualalumpur@the-eic.com

EIC Connect Energy Brazil 7 August 2025 Rio de Janeiro, Brazil

For more information: rio@the-eic.com

EIC Pavilion at Offshore Europe 2025

2-5 September 2025 Aberdeen, UK

For more information: internationaltrade@the-eic.com

Check out our full calendar with in-person events, webinars, trade delegations, pavilions and training sessions on the-eic. com/Events/Calendar

EIC Insight Report: Africa OPEX

EIC Insight Report: Wave & Tidal

EIC Insight Report: North America OPEX

Access to these reports is free to EIC members on EICDataStream. If you’re not a member and want to know more, please visit the-eic.com/ Membership

Are you up to date on the latest project developments in the energy market? The EIC’s leading market intelligence database – EICDataStream – contains

WITH EICDATASTREAM YOU CAN:

• Access details on over 16,000 CAPEX projects across all energy sectors

• your business development strategies

• Explore a truly global database, updated

•

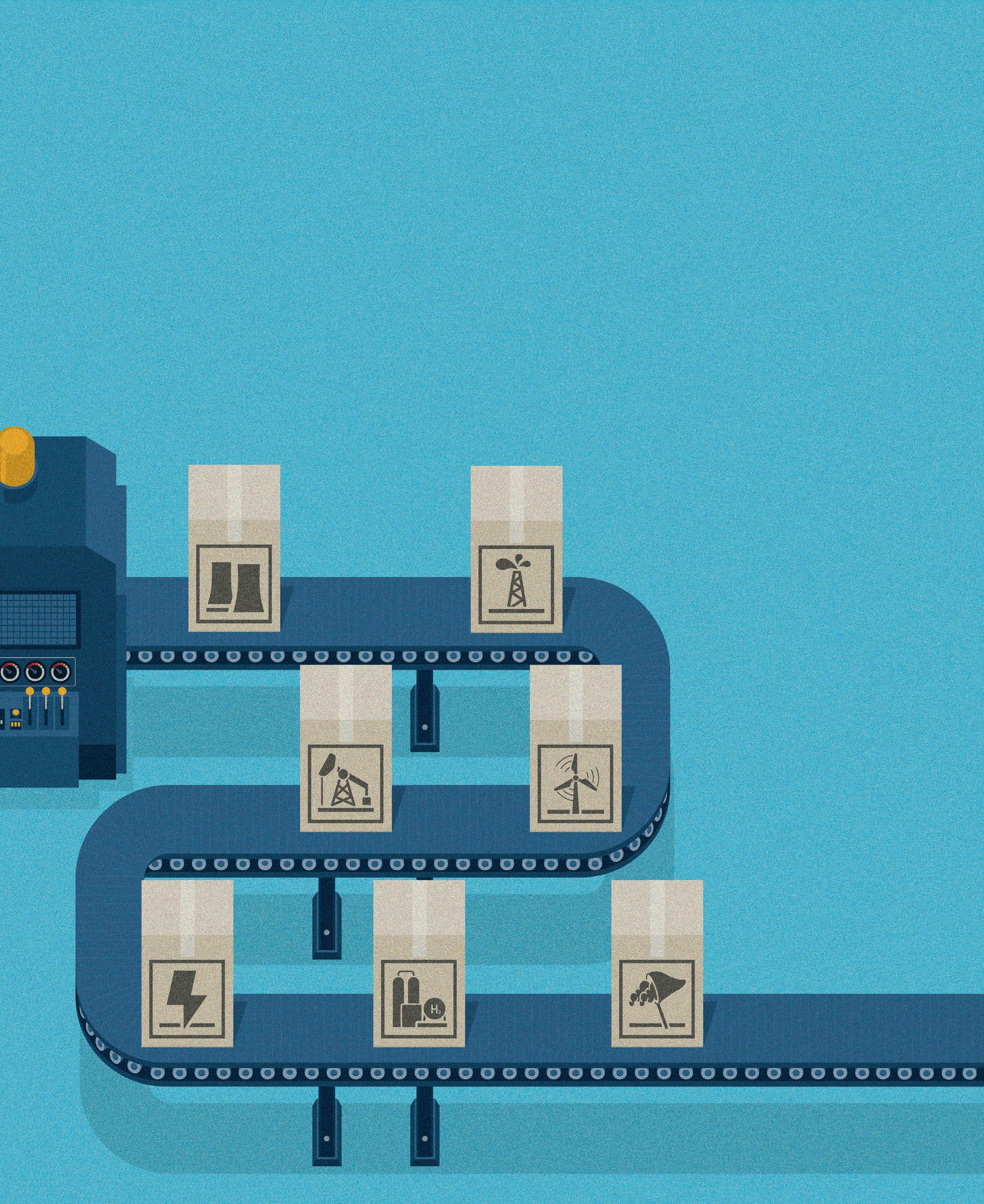

The UK energy sector must recognise the integration of its supply chain across technologies and borders — or risk losing it entirely

BY REBECCA GROUNDWATER, HEAD OF EXTERNAL AFFAIRS, EIC, WITH EICSUPPLYMAP DATA FROM CHRIS SHIRLEY, MARKET INTELLIGENCE MANAGER, SUPPLY CHAIN, EIC

’m beginning to sound like a broken record, but it is worth repeating: there is one single supply chain –and it spans many technologies.

Our members operate in nuclear, gas, wind, solar and, more recently, hydrogen and carbon capture. They are active across the whole value chain, from top to bottom, and we also represent companies working in legacy sectors such as oil and gas, petrochemical, transmission and distribution, marine and more.

The numbers behind the narrative

Because our members are active in more than one technology – and usually more than one country – EIC is uniquely positioned to highlight global trends while also focusing on the often-overlooked micro-level of the supply chain.

There is not a ‘good’ renewables supply chain and a ‘bad’ oil and gas supply chain, despite what some energy policies imply. There is only one, increasingly integrated, energy supply chain. And the data tells a compelling story. According to EICSupplyMap – our energy supply chain database, mapping the capabilities of all the sectors, regions and industries that make up the UK supply chain –82.9% of the UK’s energy supply chain is reliant on oil and gas. Critically, 72.3% of that oil and gas supply chain has diversified into renewable and net-zero technologies. Only 2% of the UK renewables and net-zero supply chain grew from non-oil and gas capabilities1

Leadership without delivery?

The UK has long prided itself on being a global leader in energy innovation. But today we lack

We led the way, but we are now the guinea pig nation for a ‘just transition’

the pace needed to deliver the ambitions of our policies — and the projects on which our supply chain needs to work.

Instead, having led the way, we are the guinea pig nation for a ‘just transition’. We are seeing our supply chain companies explore global opportunities where the divide between oil and gas and renewables is less pronounced – and where projects do get off the ground, reach a financial investment decision and start work.

We see our members increasing their capability in new technologies – but not here in the UK. They are growing elsewhere, and that means making hard decisions about where to invest for the future: the UK or the Middle East, for example.

Long-term implications

And how does this play out? If the current trend continues and our members keep seeing greater opportunities abroad, as they already are, we face a long-term loss of capacity here at home.

We currently have an integrated supply chain with a great capacity to deliver work ( Table 1 and Table 2 ). But we are at risk of diminishing our ability to entice investment and deliver projects in the UK. Take Scottish companies, for example. This does them a huge disservice – framing this as oil and gas versus new technologies misses the point entirely. Our supply chain companies are already engaged in net-zero technologies, and are ready to get to work. But the projects they need to move forward in the UK are still not coming online, and time is running out.

As with everything, time matters. Supply chain companies typically need three to five years to move into a new sector, and five to 10 years to become profitable. That’s assuming the work is there to sustain a steady flow of development. Without new licences and clear pipelines, there will soon be no projects — and, at a much faster rate, no jobs. And without projects, there is nothing to transition into.

For many companies, leaving the UK will be the only viable option. And when that happens, we’ll be left hoping they return when the work does finally materialise, rather than ensuring they never had to leave in the first place.

EICSupplyMap, defi ned as companies with revenues of more than £1m. Correct as of March 2025

Capabilities as percentage of

Tables 1 and 2 show the depth and diversity of energy supply chain capabilities across Scotland and the rest of the UK. With strong crossover between legacy and low-carbon sectors, the capability to deliver net zero is here, but without clear policy and project pipelines, that capability risks going elsewhere

82.9% of the UK’s energy supply chain is rooted in oil and gas… 72.3% …of which 72.3% has diversified into renewables and net-zero tech

No certainty, no moving forward = no definitive projects

No projects = certainty elsewhere

Project action globally = more work abroad

Global energy leaders reveal their strategic focus on new regions – from Speedcast’s connectivity push in Brazil, Saudi Arabia, and West Africa, to Workforce Solutions’ renewable workforce expansion in Asia and Australasia, and Unger Steel Fabrication’s global diversification beyond LNG into mining and manufacturing

Richard Elson

Paul Mudd

Executive Vice President – Energy at Speedcast

Speedcast is expanding our presence and infrastructure in locations where our customers need critical connectivity and support, including Brazil, Guyana, Saudi Arabia (KSA), offshore West Africa and other regions of growth. In Brazil, we recently scaled up our Macaé facility – the primary hub for our South American energy operations – upgrading our teleport infrastructure and extending office space to support our local footprint.

We will continue to invest in mature and emerging regions and markets of significant growth potential

In KSA, we’re nearing completion of our Newtec Hub build-out, following the successful launch of a new data room and office to serve regional customers. With both a general class Internet Service Provider licence and a non-terrestrial network licence, our Saudi company can provide very small aperture terminal services inside KSA. Leveraging our SIGMA™ network management platform, along with the integration of Starlink into our connectivity toolkit, we will continue to invest in mature and emerging regions and markets of significant growth potential. Whether it’s an energy rig in the Persian Gulf or a floating production storage and offloading unit in the North Sea, we ensure a seamless, fully managed service that customers can rely upon.

About Speedcast

Speedcast delivers communications and IT services across sectors including maritime, energy and mining. It leverages its global network platform to provide fully connected systems that harness technologies and applications to transform what remote operations can achieve.

Business Development Director at TRS Workforce Solutions

TRS Workforce Solutions is targeting Asia and Australasia with its ONEMSP model to build on its success in the UK, Europe, the US and Canada. In preparation for this move, we conducted extensive market research to shape a tailored entry strategy – one that understands the regions’ unique demands and recognises renewable energy projects in the area.

Asia is seeing a renewable energy boom, expecting to account for 50% of global renewable capacity by 2030, with more than 10m sector-specific jobs in the same period. Australasia will see its workforce double to achieve 82% renewable generation by 2029; New Zealand, 100% generation by 2035.

Government support for the Australia Renewable Energy Target is backing local talent acquisition initiatives and providing specialised training to ensure a skilled workforce is ready to meet complex project requirements. These large-scale projects require a diverse range of skills, from engineering to project management, necessitating a robust recruitment strategy that integrates with our capabilities, leveraging TRS Staffing Solutions’ local expertise in Asia and Australia.

The expansion of the ONEMSP Model is set to drive the region’s renewable energy ambitions by providing access to a skilled workforce, ensuring successful project delivery with enhanced visibility and control over workforce resource planning.

About TRS Workforce Solutions

TRS Workforce Solutions, a division of TRS Staffing Solutions, provides cost-efficient, compliant workforce solutions. Launched in January 2022, it developed and delivered the ONEMSP project model, expanding capability to optimise broader skills engagement.

Tom Pashley

Chief Commercial Offi cer at Unger Steel Fabrication

We are visiting Australia to gain exposure to the metals, mining and infrastructure markets

Unger Steel Fabrication serves the Gulf Coast liquefied natural gas (LNG) market through our partner Bechtel. This will continue with the LNG export terminal boom driven by US government support and approvals for its Department of Energy to issue LNG export licences. As a result, many projects have reached a final investment decision and Federal Energy Regulatory Commission approval. We are pushing to expand our offering across our global business units. For example, we are visiting Australia to gain exposure to the metals, mining and infrastructure markets.

Our low-cost UAE centre helps us to seek out opportunities, with Dubai’s Jebel Ali port being a logistics hub. We are also leveraging Unger’s European business, with European projects including data centre and semiconductor plants. Using Austrian and German fabrication facilities, we can offer domestic production supplemented by competitive rates from our UAE business. This approach makes us attractive to projects where quick lead-in items and changes can be accommodated, at competitive prices. The UAE business is accredited by the Canadian Welding Bureau; on the back of this, we will review mining and manufacturing opportunities. We see this diversification as key to our long-term success and expansion plans.

As global demand for clean, affordable energy accelerates, frontier markets present a vast yet underinvested opportunity. Unlocking their potential is crucial to achieving net-zero goals –requiring bold collaboration, strategic investment and a renewed focus on export market development

BY JONATHAN DYBLE, PARTNER, WD EDITORIAL

Frontier and emerging energy markets are critical to the global energy transition.

As the world races to meet net-zero targets, developing nations hold the keys to both decarbonisation and the expansion of global energy access.

From south-east Asia to sub-Saharan Africa, the demand for affordable lowcarbon energy is surging, driven by rapid population growth, urbanisation and rising energy requirements. This combination makes these markets ripe for investment – which is greatly needed.

Trump and growing geopolitical tensions are unlikely to help the situation, driving increased protectionism.

Indeed, Graham Burns, Engineering, Procurement and Construction Development Manager for Europe, the Middle East and Africa at Dräger, argues that the resulting market volatility is a major risk to progress. He highlights that uncertainty could stifle investment or divert it back towards traditional energies.

without strong financial support or de-risking mechanisms.

Critically, most EMDEs still lack the investment-grade credit ratings that major institutional investors demand. Indeed, a recent World Economic Forum (WEF) study highlights that almost three quarters of EMDEs have a sovereign risk rating of B+ or lower from major credit rating agencies such as Standard & Poor, with this being outside the parameters accepted by most private investors.

“The biggest risk is energy investment policy,” he says. “Just a year ago, we were all working towards net zero, yet recent major political shifts have led to some companies putting the brakes on.”

Policy inconsistencies do not help. While governments around the world have made bold net-zero pledges, a lack of coherent and consistent policy frameworks makes long-term planning difficult. Shifting regulations raise the risk of stranded assets, for example.

these economi two-thirds of t

However, with account for 74 2050, the In Agency p in these econo must increase support the tra p

Currently, just one-fifth of global energy investment has gone to emerging market and developing economies (EMDEs) excluding China, despite these economies being home to around two-thirds of the world’s population. However, with EMDEs projected to account for 74% of energy consumption by 2050, the International Energy Agency (IEA) projects that investment in these economies (excluding China) must increase five-to-seven-fold to support the transition to low-carbon development pathways, rising from US$270bn annually to at least US$1.7tn by the early 2030s.

Graham Burns, EPC Development Manager for EMEA, Dräger

Despite these risks and headwinds, the WEF has shown that investing in clean energy in EMDEs can still be a viable and attractive opportunity. The Network to Mobilize Clean Energy Investment in EMDEs, for example, showcases 100 case studies across 47 EMDEs that have proven to be successful.

For this to happen, new export market development must take centre stage. However, the EIC’s Survive and rive 2024 report highlights that it remains the least-used growth strategy for an eighth consecutive year. COP29 pledges to triple the annual nance flows to developing countries to US$300bn by 2035 will help. However, meeting and exceeding the necessary investment targets to open up new energy markets will only be possible if governments, financial institutions and the private sector work together.

Lucia Torres, Director for Solution Management for Energy at Hempel, agrees that this could create complications in relation to cross-border cooperation at a time when international collaboration is crucial. “Regulatory barriers are already fragmented, complex and costly to comply with, from volatile organic compound limits and performance certifications to red raw materials,” she says. “However, geopolitical instability and market volatility may now also disrupt policy support for renewable energy and the adoption of new technology.”

US$270bn ann the 2030 For this to h market develo stage. Howeve Thrive 2024 rep remains the lea c pledg climate finance countries to U However, mee necessary inve new energy m if governments the private sec

In turn, there are several rewards available for early movers in EDME energy markets: Torres highlights that it can help to “secure long-term contracts and brand recognition, so long as companies are able to establish strategic alliances to help reduce entry costs and speed up deployment”.

She adds: “Entering new geographies can also improve the ability to serve global customers more effectively. Given the high level of interconnectedness in the value chain, particularly in globally oriented markets such as the energy market, being present in more markets can strengthen a company’s competitiveness.”

The risks and rewards of new market entry

Unfortunately, recent energy policy changes under US President Donald

The an market entr Unfortunately under

For businesses seeking to establish themselves in new energy markets, there are several other risks to consider. High upfront costs remain a significant barrier, particularly for capital-intensive clean energy projects, which often struggle to attract private investment

Collaboration is essential to breaking barriers

The opportunities are clearly there. So, how can businesses proceed with confidence, navigating

Why frontier & emerging energy markets matter

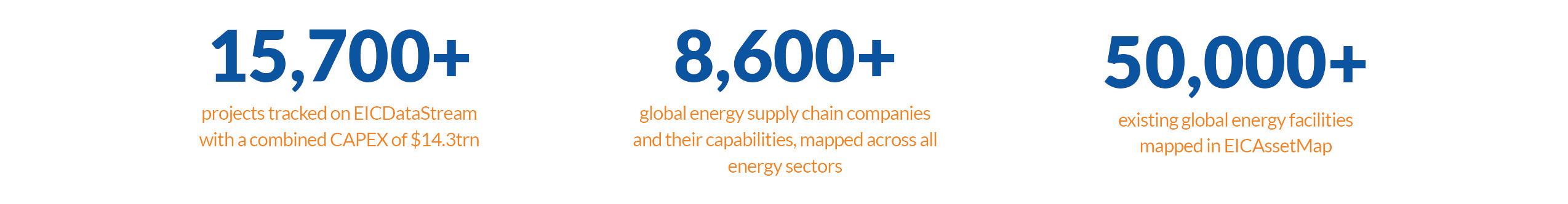

66% OF THE GLOBAL POPULATION LIVES IN EMERGING MARKET AND DEVELOPING ECONOMIES (EMDES)

protectionism and regulatory hurdles to successfully establish themselves in new energy markets?

74% OF PROJECTED GLOBAL ENERGY CONSUMPTION BY 2050 WILL COME FROM EMDES

Rapid growth driven by: Population boom Urbanisation

Rising energy demand

The investment gap

Only 1/5th of global energy investment goes to EMDEs (excluding China)

US$1.7tn annual investment by early 2030s (IEA)

5% of EMDEs rated B+ or lower, limiting access to private capital

“Partnering with players in the value chain, whether these are direct customers, industry bodies or suppliers, should be a priority,” says Torres. “These partnerships improve credibility and offer shared risk

To succeed… companies and their approaches need to be seen as safe, proven and trustworthy. That’s what builds longterm confidence – in any energy source, and in any market

Graham Burns, EPC Development Manager for EMEA, Dräger

management opportunities. At Hempel, our global presence is incredibly useful, enabling us to navigate challenges through local insight.”

She also highlights how partnerships can help in accessing local talent and expertise, with this being crucial to build sustainable geographical expansions.

“Having employees who understand the local dynamics and who are able to develop and deploy products and services add significant competitive advantage,” she adds.

For Burns, collaboration is also crucial to success; he points to the success of the HyNet North West industrial decarbonisation cluster in north-west England and north Wales as a blueprint for cooperative success.

“It’s a model that drives down average costs by involving multiple market players and securing guaranteed energy off-takers,” he explains.

“It essentially reduces risk. In EMDEs, the same applies. Progress depends on collaboration – whether in technology, safety, financing or other areas. No single party can bear the risks alone. It must be a collective effort.”

Entering new geographies can also improve the ability to serve global customers more effectively

Lucia Torres, Director for Solution Management for Energy, Hempel

The WEF has already shown that collaboration breeds success. Its Network to Mobilize Clean Energy Investment in EMDEs allows emerging economies to quantify clean energy finance needs and share best practices. Since its launch in 2024, the Network has already surfaced more than 100 policy measures, de-risking tools and finance mechanisms.

Strategic partnerships and joint ventures such as this are crucial, providing important market insights to help navigate increasingly complex regulatory standards and potential cultural barriers. Government engagement is also crucial, with transparent national energy plans helping to reduce uncertainty, signal priorities to investors and coordinate stakeholders, thereby strengthening project bankability.

In addition, collaboration is essential to the development of major instruments such as blended finance, green bonds and carbon credit mechanisms, which can further build investor confidence in EMDEs.

Positioning for success in an evolving global energy landscape

EMDEs are undoubtedly at a critical point in unlocking their own economic development. However, it is imperative that governments, financial institutions and the private sector work together to progress both net-zero and development goals in the face of increasing protectionism and evolving geopolitical uncertainty.

The development and deployment of de-risking tools and innovative financing mechanisms will go a long way towards making EMDEs more attractive and viable as investment opportunities. However, businesses must also consider how to position themselves for success in the evolving global energy landscape as they explore new export market development.

“Businesses must stay connected to their customers to truly understand what their pain points are,” Torres says. “In this way, products and services won’t become obsolete in this fast-changing landscape.”

Burns adds a crucial reminder: “You also need to do your due diligence regarding safety.”

“If you build an asset and there are high-profile safety incidents early on, it can create a world of challenges. Just look at hydrogen – the reason that we’re more likely to see it in freight and larger cargos than fueling our everyday cars is down to public perceptions about safety.

“To succeed across renewables, energy efficiency, electrification, bioenergy, CCUS, hydrogen and more, companies and their approaches need to be seen as safe, proven and trustworthy. That’s what builds long-term confidence – in any energy source, and in any market.”

POLICY SHIFTS MARKET VOLATILITY GEOPOLITICAL INSTABILITY

SECURING LONG-TERM CONTRACTS BOOSTING COMPETITIVENESS EXPANDING GLOBALLY

COLLABORATION IS ESSENTIAL TO BREAKING BARRIERS

Partner within the value chain

Access local talent and expertise

Improve market credibility

POSITIONING FOR SUCCESS

Develop export opportunities

Ensure safety and trustworthiness to build long-term confidence

Adapt strategies, products and services

GLOBAL TRADE

Collaboration between countries is what will lead to a cleaner, more efficient and more secure global energy supply system

BY TOM WADLOW, PARTNER, WD EDITORIAL

As the world recalibrates its energy systems in response to climate imperatives and geopolitical events, strategic energy partnerships have emerged as crucial conduits for ensuring security, driving economic growth and accelerating the transition to a cleaner world.

From Asia Pacific to the Atlantic, bilateral and regional energy trade relationships are reshaping the global energy landscape. Here, we take a look at three such alliances.

Australia and Japan: From coal to hydrogen

Australia and Japan represent one of Asia Pacific’s most enduring energy partnerships. Australia provides more than a third of Japan’s energy imports, including most of its coal and liquefied natural gas (LNG).

“This longstanding trade has fuelled Japan’s economy and strengthened Australia’s prosperity through decades of investment,” explains Azman Nasir, Regional Director (Asia Pacific) at EIC.

With both nations committed to net zero by 2050, the relationship is evolving. Historically dominant coal is giving way to cleaner alternatives.

“While coal remains dominant, the focus is shifting toward hydrogen to balance economic stability with sustainability goals,” says Nasir. Japan’s coal imports reached A$57.1bn in 2022, but its high emissions profile is pushing both nations toward a 2030 phase-out. Japanese expertise is proving instrumental in Australia’s hydrogen development, with around A$2.1bn

This trade has fuelled Japan’s economy and strengthened Australia’s prosperity economy and Australia’s

invested in projects such as the Hydrogen Energy Supply Chain. Companies such as Mitsubishi Heavy Industries are working with Australian firms to develop green hydrogen facilities, while the JapanAustralia Partnership on Decarbonisation supports joint research and development in clean energy solutions.

“Moving forward, their energy trade could evolve from raw materials to processed clean energy, setting a precedent for sustainable energy supply chains in the Asia Pacific region,” Nasir says.

UK and Europe: Shared resources, shared future

In April, the energy relationship between Australia and Japan was bolstered by the opening of Mitsubishi Heavy Industries’ new branch office in Perth, Western Australia.

Despite Brexit, the energy trading relationship between the UK and Europe remains robust, built on geographical proximity and mutual interest in energy security.

“There is one thing that’s really very clear – there is continual trade, and one of the aspects that hasn’t really been impacted by any of the issues of Brexit has been trade in electricity and other commodities,” explains Neil Golding, EIC’s Director of Market Intelligence.

Perth is a hub for economic development in Western Australia, with robust mining and natural resources industries and a state government that is supportive of decarbonisation infrastructure and projects such as hydrogen, ammonia, and carbon capture, utilisation and storage. In opening the new office, Mitsubishi Heavy Industries aims to deepen cooperation with local companies, tap into the region’s decarbonisation-related business opportunities, and enhance its responsiveness to the Australian market.

The Nemo Link interconnector between the UK and Belgium exemplifies the benefits of cross-border energy infrastructure. This 1GW capacity undersea cable has become crucial to the energy systems of both countries since its 2019 launch.

Bart Goethals, Chief Commercial Officer of Nemo Link, part of Elia, comments: “Nemo Link plays an important role in enhancing economic welfare, increasing energy security, and enabling renewable energy integration for both the UK and Belgium.”

Its value was proven during the recent energy crisis, he adds: “GB was relatively better supplied with gas and could generate electricity at a lower price to export via interconnectors like Nemo Link to continental Europe.”

Nemo Link has transported 36TWh of electricity between the countries, with 30.7TWh imported to the UK. Its reliability stands at 99.5% availability outside planned maintenance.

“Thanks to its outstanding commercial performances, Nemo Link returned over €200m to British and Belgian consumers,” says Goethals. It has also delivered environmental benefits, with around 1.4m tonnes of CO2 emissions avoided in its first five years.

With the EU-UK Trade and Cooperation Agreement up for revision in 2026, energy cooperation is likely to feature prominently, with assets such as Nemo Link highlighting Europe’s shared energy future.

Central to this relationship is the network of interconnectors – bidirectional electricity and gas transmission cables that enable flexible cross-border energy flows. These have become increasingly important as both regions incorporate more renewable generation.

“They are bidirectional and grid sharing,” says Golding. “Ultimately, using renewable resource that’s in the North Sea and then dependent upon where the draws are, the electricity can be moved in either direction. The North Sea is our shared resource and that’s the way we should look at it – as a shared resource.”

Major projects in development include Nautilus, connecting the UK and Belgium, and LionLink, joining the UK and Netherlands. These involve

The China-Brazil trade relationship is expected to expand, driven by economic complementarities

several major players, including the UK’s National Grid, TenneT and Elia.

The UK’s role in supporting European energy security became evident during the energy crisis that followed Russia’s invasion of Ukraine. More than a quarter of Europe’s lost Russian energy was replaced by UK exports, with the country’s LNG terminals serving as crucial entry points for global supplies.

Analysis from Energy UK shows that greater UK-EU cooperation could reduce the cost of meeting the 300GW offshore wind target in the Ostend Declaration by €13bn, highlighting the economic case for cross-border collaboration.

Looking ahead, the UK Government aims to achieve 18GW of interconnection capacity by 2030, which will almost entirely be to countries in the EU Internal Energy Market. According to the National Energy System Operator, GB interconnector capacity is set to almost double by 2050, even in the most conservative scenarios.

To aid this and other objectives, some industry experts have called for the UK to return as a full member to the North Seas Energy Cooperation, where it currently holds observer status.

China and Brazil: Complementary economies, strategic partnership

The energy trading relationship between China and Brazil shows how complementary economies can create mutually beneficial partnerships. China, with its massive manufacturing capacity and growing energy demands, has found in Brazil a reliable partner for both traditional and renewable energy.

“It is highly significant, as China is Brazil’s largest trading partner and a key investor in its energy infrastructure,” explains Clarisse Rocha, Director –Americas at the EIC. “China and Brazil have complementary economies.”

Brazil has become a crucial oil supplier to China. “In 2024, Brazil’s oil exports increased by 5.2%, with China being the main destination,” says Rocha. “The Chinese market absorbed 45% of Brazil’s total oil exports.”

This relationship extends to infrastructure: 20 of the 39 floating production storage and offloading units contracted by Petrobras abroad are being built in Chinese shipyards.

Meanwhile, China has become dominant in Brazil’s renewable sector. In 2024, nearly all imported solar panels in Brazil came from China, with purchases increasing by 25%. Chinese wind turbine exports to Brazil have also surged, with their volume increasing sixfold in 2024 and their value rising by 256% to US$346m.

Chinese companies are establishing a significant presence in Brazil’s renewable infrastructure. State-owned SPIC has inaugurated major solar projects in Ceará and Piauí, while State Grid is developing Brazil’s largest power transmission project, valued at US$3.6bn.

This partnership is strengthening further with a focus on green hydrogen. In August 2024, State Grid subsidiary CPFL Energia announced a partnership with Mizu Cimentos for a green hydrogen production pilot plant.

“The China-Brazil trade relationship is expected to continue expanding, driven by economic complementarities, deepening renewable cooperation and growing Chinese investments in Brazilian infrastructure,” Rocha says.

These three strategic partnerships reflect the broader trends that are reshaping global energy trade.

First, traditional fossil fuel relationships are evolving to incorporate cleaner alternatives, as shown by Australia and Japan’s pivot toward hydrogen. Second, crossborder infrastructure and market integration are driving energy security and economic efficiency, demonstrated by the UK-Europe interconnector network. And third, complementary economic strengths can create powerful synergies in both traditional and renewable energy sectors, as seen in the China-Brazil relationship.

As the global energy transition accelerates, these strategic partnerships will likely deepen and evolve further, balancing immediate energy security concerns with longterm sustainability goals. The nations that successfully navigate these relationships will be well-positioned to thrive in the emerging clean energy economy.

Key highlights

US$1.3bn

JAPANESE INVESTMENT IN AUSTRALIA’S HYDROGEN (A$2.1BN)

256%

SURGE OF CHINESE WIND TURBINE EXPORTS TO BRAZIL

US$224m

RETURNED BY NEMO TO BRITISH AND BELGIAN CONSUMERS (€200M)

hile has emerged as one of Latin America’s most advanced green hydrogen markets, driven by bold government targets and a wealth of renewable resources. The country’s National Hydrogen Strategy, launched in 2020, has the ambitious goal of producing 1m tonnes of green hydrogen per year by 2030, with a total of 25GW of electrolysis capacity.

Chile’s green promise

Abundant solar radiation in the Atacama Desert and powerful Patagonian winds in the Magallanes region make Chile a prime location for green hydrogen production. With more than 1,800GW of renewable energy potential – 70 times its current energy demand – the country is positioned to produce highly cost-competitive green hydrogen. By 2030, it aims to offer the world’s cheapest green hydrogen at less than US$1.5 per kg. While commercialscale production is still in its early stages, pilot projects such as Haru Oni, a 3.4MW wind-powered demonstration plant operated by HIF, have already proved their early feasibility by successfully exporting synthetic fuels to Europe.

The Chilean government has developed a robust policy framework to bolster its green hydrogen sector. Launched in 2024, the Green Hydrogen Action Plan 2023–2030 builds on targets set in the 2020 strategy with 81 priority measures. Major initiatives to encourage private investment include a streamlined permitting process, enhanced access to green hydrogen project financing, the development of standards, and the introduction of subsidies, tax incentives and investment support.

A forthcoming regulatory roadmap is planned to close legal gaps and create or update 20 hydrogen-related regulations. Fiscal incentives are comprehensive, with the US$1bn H2V Chile financing facility

Chile’s booming green hydrogen market offers vast investment opportunities, strong government support and competitive export potential

BY MARCO MAEDO, ENERGY ANALYST, EIC RIO DE JANEIRO

leading the way to help de-risk projects and trim capital costs. It is funded by the Chilean Economic Development Agency (CORFO) with support from the InterAmerican Development Bank, World Bank, EU and other partners. Additional measures include VAT exemptions, R&D tax credits, and up to 60% co-financing for electrolyser manufacturing facilities.

Despite the strong momentum, Chile faces structural challenges. Infrastructure gaps persist, especially as electrolysis capacity may be situated in remote regions that are rich in renewable energy but lack transmission grids and port infrastructure. Water scarcity is another constraint; electrolysis requires substantial amounts of water, and many regions are already under high stress. Lengthy permitting processes further hinder progress; HNH Energy, for instance, spent four years preparing its

environmental application. Additionally, local opposition in Magallanes, where projects threaten ecotourism and ranching, underscores the importance of sensitive development.

These challenges, however, do not undermine Chile’s potential to become a global leader in the hydrogen market. Multiple geopolitical agreements reinforce its ambitions. The government has signed memorandums of understanding with more than 12 nations, including Germany, the Netherlands, Japan and Belgium, aiming to create green hydrogen corridors and funding mechanisms. The Team Europe Initiative and Global Gateway Fund exemplify strategic partnerships that are driving infrastructure and certification standards for the country’s hydrogen sector.

Chile’s political stability, transparent governance and extensive trade agreements make it a reliable export partner. Ports and shipping infrastructure are evolving to support ammonia and methanol exports, while domestically, industrial sectors, including mining, logistics and gas processing facilities, are potential offtakers.

Five projects have already secured offtake agreements, with deals split between national and international buyers. Notable projects include HNH Energy’s US$6bn green ammonia project, which has signed a 10-year contract to supply approximately 350,000 tonnes of ammonia annually to global agribusiness company Ameropa. Similarly, the Cabo Negro green hydrogen project, developed by HIF and Enel, has signed a supply agreement with Faro del Sur for the export of clean fuels and methanol.

Domestically, the MowiUACh green hydrogen pilot project will use its hydrogen output to decarbonise Norwegian seafood company Mowi’s

aquaculture operations in the Aysén region. Similarly, the Port of San Antonio green hydrogen project has entered an agreement to support the decarbonisation of port operations. In contrast, the HyEx green ammonia project, a collaboration between Engie and Enaex, will produce green ammonia for use in the mining industry.

Exciting future ahead

Chile currently has less than 900MW of green hydrogen capacity due online by 2026. Although this falls short of 2030 targets, projections indicate a sharp ramp-up between 2030 and 2032, driven by mega-projects such as TotalEnergies’ US$16.3bn H2 Magallanes and the HNH Energy project. There are opportunities across the entire supply chain, spanning electrolysis production, water management solutions, transport logistics, and engineering, procurement and construction services.

In March 2025, CORFO awarded grants totalling US$25.6m to Chinese electrolyser manufacturers Hygreen Energy and Guofu and Spanish firm Joltech Solutions to establish local production facilities. This initiative seeks to develop a domestic electrolyser supply chain for industrialscale green hydrogen production and its derivatives, creating a major opportunity for Chile’s supply chain. While foreign companies currently dominate the market, CORFO’s incentives are expected to accelerate the emergence of local players in the near future.

Chile’s hydrogen market is open to innovation, collaboration, and growth. There has never been a better time for forward-looking businesses to invest, build partnerships and help shape a clean energy future in South America.

projects proposed for developme nt US$104bn CAPEX est.

59GW/2.4mtpa capacity additions est.

Electrolysis capacity targets 5GW by 2025 25GW by 2030

Green finance US$1bn

H2V Chile Financing Facility, funded by CORFO and international development banks

US$25.6m to Chinese and Spanish electrolyser manufacturers in March 2025

Global momentum MoUs: Germany, Japan, Belgium, Netherlands

With vast potential and surging global interest, the Philippines is poised to become Asia’s offshore wind powerhouse

BY HAZWANI IZZATI, ENERGY ANALYST, EIC KUALA LUMPUR

The Philippines is positioning itself as a major player in the renewable energy landscape, leveraging its extensive coastline and abundant wind resources. Its archipelagic geography offers strong and steady trade winds, creating ideal conditions for offshore wind development. Estimates suggest offshore wind potential of 178GW, with 18GW from fixed-bottom turbines and 160GW from floating turbines. This untapped resource has the capacity to play a crucial role in accelerating the Philippines’ transition to a green energy future.

The country’s ambitious offshore wind targets are gaining global attention. Building on the foundation set by the Renewable Energy Act of 2008, the Philippines Offshore Wind Roadmap (2022) and the Philippines Energy Plan (2023–2050) aim to develop up to 50GW of offshore wind capacity by 2050. PHILIPPINES

Recent policy reforms and the launch of dedicated offshore wind auctions underscore the country’s strong commitment to the sector. The Renewable Portfolio Standard mandates contributions from all power industry stakeholders towards renewable energy expansion, while the Feed-in Tariff system guarantees fixed renewable electricity rates for 12 years, reducing investment risk. The Offshore Wind Roadmap identifies six major development zones and outlines growth scenarios ranging from 3GW to 20GW by 2040. Additionally, measures such as allowing 100% foreign ownership of renewable projects, and introducing tax incentives, subsidies and streamlined permitting processes for faster project implementation, have significantly boosted international interest.

rough waters

Despite the Philippines’ potential, the offshore wind market faces several challenges. Grid infrastructure

constraints hinder renewable energy integration, which is compounded by capacity constraints and the intermittent nature of wind sources. While upgrades to the transmission network are essential, persistent delays pose risks to project timelines. The local supply chain also lacks comprehensive capabilities, forcing developers to rely on imported components.

Port infrastructure remains underdeveloped, although upgrades are ongoing at important locations such as the Port of Batangas and the Port of Currimao. However, limited vessel availability continues to thwart project progress.

Financing is another critical challenge, as international lenders remain cautious about entering the market due to limited familiarity with local regulations. The government is working to address these gaps through streamlined permitting processes and collaborations with multilateral lenders.

The Philippines aims to develop up to 50GW of offshore wind capacity by 2050

The Philippines’ offshore wind pipeline is set to expand significantly, with most projects expected to come online from 2030 onwards. Currently, 40 projects are in the feasibility stages, with the largest anticipated surge of new projects in 2034 –13 developments are expected.

From 2030 to 2032, most projects will deploy fixed-bottom turbines, with a projected capacity of 4.8GW by 2034. The country’s largest fixed project, developed by Aboitiz Power Corporation, will be a 3GW facility that is slated for completion by 2037.

The floating wind sector is also gaining traction; BlueFloat Energy is leading the charge with 7.5GW of planned capacity across four projects. Vind Energy Corporation follows, with 6.2 GW across five projects featuring both fixed and floating turbines. Additionally, Corio Generation has announced 3GW in planned capacity targeting operations by 2033.

The Philippines’ strong government support, regulatory stability and ambitious clean energy targets make it a promising export market. Its strategic location also supports regional energy exports. Furthermore, trade agreements and infrastructure improvements are making the market increasingly accessible to foreign investors and developers. The rising demand for energy innovation and expertise presents lucrative opportunities for the supply chain. With local manufacturing capabilities still developing, there is significant potential for international collaboration and partnerships to supply essential components and services.

The Philippines is creating a great opportunity for businesses to form partnerships and invest in the supply chain, especially given the government’s strong support and attractive incentives for renewable projects. The country’s strategic location and increasing demand make it an ideal place for investment. Taking advantage of these opportunities will not only drive a sustainable future but also secure an important role in Asia’s growing renewable energy market.

178GW

potential capacity

18GW

fixed-bottom turbines

160GW

floating turbines

41 projects proposed for development

US$68.3bn

CAPEX est.

39GW

(21.8GW could be floating offshore wind) capacity additions est.

2031

first power expected in 2031

Capacity targets

5GW by 2030

21GW by 2040

Up to 50GW by 2050

Global momentum

Collaborations:

Denmark

Norway

UAE

Spain

UK

Namibia’s offshore oil and gas industry is set for significant growth in 2025

Strategic reforms, giant discoveries and global interest are transforming Namibia into Africa’s hottest frontier for oil and gas exploration

BY GUILHERME MARTINS, ENERGY ANALYST, EIC RIO DE JANEIRO

In recent years, Namibia has become one of Africa’s most sought-after destinations for oil and gas exploration. Favourable geology, supportive government policies and an investor-friendly environment have attracted a growing number of heavyweight international oil companies (IOCs) eager to tap into the country’s rich offshore reserves.

Nambia’s energy boom is primarily centred around the Orange Basin –a prolific geological formation that has been the site of several major hydrocarbon discoveries, including the highly publicised Venus and Mopane wells. These successes have bolstered the country’s reputation as an emerging oil and gas hub, significantly boosting its global credibility among investors and industry stakeholders.

Policies driving investment

A major driver of this favourable investment climate has been the adoption of progressive policies such as the Investment Promotion Act. This legislation has played an essential role in attracting capital to the Namibia’s priority sectors, particularly the oil and gas industry. By lowering regulatory and operational hurdles for IOCs, Namibia has established a more enabling environment for large-scale energy projects, accelerating both exploration and development activities.

Venus: Game-changing giant

TotalEnergies’ Venus discovery, first drilled in 2022, has been hailed as one of Sub-Saharan Africa’s largest-ever oil fields. The Venus-1X well confirmed a substantial light oil reservoir, with further appraisal wells reinforcing the basin’s high potential. Given its scale, the Venus discovery is expected to attract significant development investments and could lead to Namibia’s emergence as a major oil-producing nation. The US$5bn project has already drawn considerable industry attention, with TotalEnergies and its partners, including QatarEnergy, Impact Oil & Gas and NAMCOR (National Petroleum Corporation of Namibia), having selected a floating production, storage and offloading (FPSO) vessel to handle 150,000bbl/d and 500MMcf/d. The outcome of the Venus field’s appraisal and commercial viability will play a pivotal role in shaping Namibia’s future as an oil-producing nation.

Mopane driving momentum

Meanwhile, Galp Energia’s Mopane discovery has garnered significant attention due to its rapid pace of development. Following a series of successful exploration and appraisal operations, the final investment decision for full-field development may

be imminent. Recent discoveries at Mopane-2A, including gas-condensate in AVO-3 and light oil in AVO-4, have prompted the company to proceed with Mopane-3X, which targets two additional prospects. The results of this drilling campaign are eagerly awaited as they could have significant implications for the basin’s overall hydrocarbon potential.

The much-anticipated farm-out agreement, slated for Q4 2025/Q1 2026, is being closely monitored by the international oil community. Among the companies expressing interest, Brazil’s national oil company Petrobras has publicly declared interest in operating in Namibia, signalling strong global confidence in Namibia’s energy potential.

Namibia’s offshore oil and gas industry will grow significantly in 2025. The country is entering a pivotal phase, with seven wells planned for drilling this year and upcoming licensing opportunities. New blocks across deepwater, ultra-deepwater and shallow-water zones will open the door to new collaborations and exploration campaigns – further cementing Namibia’s status as an emerging hydrocarbon hotspot.

For EIC members looking to expand into Namibia’s oil and gas sector, this translates into opportunities across the value chain – from drilling services and subsea systems to FPSO technologies, logistics and local content initiatives. As the country’s energy landscape evolves, proactive engagement and strategic partnerships will be key to unlocking long-term value in this dynamic market.

To be one of the largest oil producers in Africa by 2035, producing 0.5MMboe/d

3 projects proposed for development

US$7.8bn

CAPEX est.

2 FIDs expected by the end of 2026

2028

first oil production expected 20bn

barrels offshore reserves est.

220,000 km2 of offshore licence acreage

7 new wells planned for 2025

US$5bn

investment by 2027 to expand critical infrastructure to support oil production

International players

Active in Namibia

BW Energy, Bermuda

Chevron, US

Eco Atlantic, Canada

Galp Energia, Portugal

Impact Oil & Gas, GB

QatarEnergy, Qatar

Shell, GB

TotalEnergies, France

Petrobras (incoming), Brazil

Japan’s energy transition accelerates as LNG, hydrogen and ammonia co-firing reshape its power sector, offering strategic opportunities for global partnerships

BY AISYAH SARJUNI, RESEARCH ANALYST, EIC KUALA LUMPUR

Japan’s energy landscape is undergoing a profound transformation as the nation navigates towards its target of zero-emissions by 2050. Under its recently approved Seventh Strategic Energy Plan, Japan reaffirmed its commitment to energy security, anticipating surging demand from digital and green initiatives.

The country’s Cross-regional Coordination of Transmission Operators (OCCTO) projects an additional 5.37GW in peak power demand by 2033, fuelled by the expansion of data centres and semiconductor chip plants. To ensure a stable, long-term energy supply, Japan’s energy plan highlights the pivotal role of upcoming gas and nuclear power plants.

Gas power dominates

As of Q1 2025, gas-fired power projects account for 10.5GW of the total 12.8GW of power capacity to be added to the Japanese grid by 2035. Nuclear comes second, with 2.1GW capacity. Despite the nuclear power sector’s resurgence, especially since 2024, gas-fired power plants will continue to play a major role in the country’s future energy landscape.

Between April 2023 and March 2024, Japan launched its long-term zeroemissions power auction, which aims to accelerate progress towards decarbonisation goals by 2050. Though the auction targets clean energy options, power plants fired by liquefied natural gas (LNG) were included to facilitate the gradual transition away from coal; 5.76GW out of 9.77GW was awarded to 10 LNG power projects, focusing on the expansion of existing coal and LNG power plants by 2030.

Co-firing push

Notable projects include Kansai Electric Power’s 1.8GW Nanko LNG Power Plant and JERA’s 1.18GW Chita LNG Power Plant. As Japan progresses through its decarbonisation efforts, ammonia and hydrogen co-firing will be progressively integrated into its LNG power plants. The auction also included project awards for 770MW of ammonia co-firing and 55.3MW hydrogen co-firing, however, further details regarding the projects remain undisclosed. The auctioned projects will receive an annual funding of US$1.12bn over a 20-year period. With that target in mind, Japan’s LNG terminals require significant infrastructure upgrades to accommodate additional storage and blending technologies for ammonia and hydrogen. Japan’s Mitsubishi

7

for

10.5GW by 2035

Funding US$1.12bn

auctioned projects receive per year for 20 years

Global momentum Collaborations: Vietnam Thailand

Singapore Taiwan

Power spearheads the development of co-firing turbines, which have been largely contracted in upcoming gas power projects across Japan and the Asia Pacific region.

However, current hydrogen-capable turbines are limited to 30% hydrogen by volume, while ammonia-capable turbines are still undergoing an active development phase. The Ministry of Economy, Trade and Industry (METI) has acknowledged that high hydrogen and ammonia costs pose a substantial challenge for co-firing initiatives. To address this, METI has allocated up to US$20bn to bridge the gap between lowcarbon and fossil-based hydrogen, which can improve the profitability of future co-firing projects.

While Japan has a stable LNG supply from long-term supply agreements, the rapid rollout of renewable energy and nuclear restart projects has contributed to a recent LNG surplus. This surplus offers higher project profitability with lower fuel prices, but risks market volatility for long-term agreements.

Japan’s energy transition opens critical opportunities in grid upgrades, terminals and advanced gas technologies

Grid limitations may also hinder the deployment of upcoming gas power plants, potentially driving up electricity prices as demand outpaces supply.

Despite these challenges, Japan remains steadfast in providing strong regulatory and financial support to its gas power sector. To foster its supply chain development, tax credits will be approved for companies that are investing in advanced gas turbine technologies. Government-backed financial institutions such as Japan Bank for International

Cooperation offer loan guarantees to mitigate large-scale LNG infrastructure development and upgrades. Japan’s open-door policy also targets a balance of US$666.4bn in foreign direct investment by 2030, including strategic partnerships within the energy sector.

The government strategically plans to stabilise its LNG market by reselling surplus LNG through gas power plant developments across the APAC region. For instance, JERA has shown strong interest in supporting upcoming LNG power plants in Vietnam, including Ca Na, Hai Phong and Nghi Son LNG-fired power plants.

To support grid infrastructure development, METI has drafted the WideArea Grid Long-Term Policy to outline domestic grid expansion within the next decade. OCCTO forecasts investments of up to US$52.9bn for transmission and distribution by 2050.

Japan’s realistic transition strategy provides a clear outlook for a reliable shift towards its targeted energy mix. As the government curates its energy framework around LNG as a transition fuel, its path forward is not without its own set of challenges. The government’s significant support for the gas power sector through technology upgrades, incentives and LNG market stabilisation strategies creates a fertile foundation for industry partnerships.

Significant supply chain gaps, such as the modernisation of terminal and grid infrastructures and the advance of gas turbine technologies and components present opportunities for domestic and foreign collaborations to drive Japan’s power sector towards its long-term objectives.

ARE YOU READY TO EXPORT?

Email: aisyah.sarjuni@the-eic.com

Norsk Kjernekraft AS 4

Norway Compact Molten

Norsk Kjernekraft AS Norway Mongstad

Reactor Power Barge US$3BN

Norsk Kjernekraft AS

Norway and Sweden are turning to small modular reactors to secure low-carbon power for industry, with opportunities opening fast for suppliers, investors and innovators

BY FIRDAUS AZMAN, ENERGY CONSULTANT, EIC KUALA LUMPUR

Norway Lund SMR Project (Dalane Kjernekraft) US$1BN

PUS$7.5BN

Norsk Kjernekraft AS

4 Øygarden SMR Project

er-capital energy consumption in the Scandinavian region is among the world’s highest, driven by cold climates and electrification trends. Despite renewables dominating electricity generation – hydropower in Norway, a mix of nuclear and hydropower in Sweden – both countries face escalating energy security challenges as demand surges from rising industrial electrification and emerging sectors such as artificial intelligence.

To future-proof their energy systems, both Norway and Sweden are exploring small modular reactors (SMRs) to provide baseload power for their energy-intensive industries. Although nuclear is well-established in Sweden, SMRs are a novel frontier technology in both countries.

SMRs: The new nuclear frontier The rise of SMRs features prominently in both nations’ recent power development plans. In Sweden, this shift aligns with the country’s updated “100% fossil-free” goal – an ambitious target that replaced its earlier renewable-only commitment in 2023. Norway, meanwhile, is turning to SMRs to diversify beyond its traditional reliance on hydropower. With electricity demand expected to soar by 65% by 2050, Norway faces a hard truth: its hydropower capacity is nearing its limit.

Sweden, too, is feeling the pressure. Despite its robust mix of large-scale nuclear and hydropower, the country is grappling with surging energy needs from heavy industries including metallurgy, and pulp and paper.

In both countries, SMRs are emerging as a timely solution –

particularly as investor enthusiasm for large conventional nuclear projects wanes. The costly delays seen at the UK’s Hinkley Point C and Finland’s Olkiluoto plant have left many wary.

Compact power, big potential