FROM THE ENERGY INDUSTRIES COUNCIL

ENERGY FOCUS

VIEW FROM THE TOP Stéphane Aubarbier, Deputy CEO of Assystem

DRIVING GROWTH

Unlocking capital through investor confidence

RISE OF OIL AND GAS

North America drives energy growth

ASIA LEADS NUCLEAR

Expanding capacity, powering the future

From

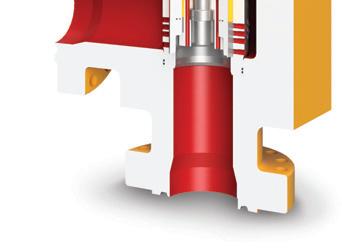

SPECIALIST CONTROL AND CHOKE VALVE SUPPORTING THE ENERGY SECTOR

MANUFACTURING SINCE 1967

As a UK based manufacturer with over 50 years of experience in supplying Control and Choke valve products to the world’s energy markets, KOSO Kent Introl is ideally positioned to support the energy sectors on their journey into cleaner energy be it land, sea or below.

CONTROL, CHOKE & SUBSEA SOLUTION

SPARES

We engineer and supply high-quality valves to perform in some of the most severe service conditions throughout the world.

ASSET MANAGEMENT

Supporting your investment over its life cycle with OEM spares, ensuring your valves continue to perform to their optimum.

With our comprehensive records of every valve and component we have ever supplied, we can help you devise and implement a strategic plan for the asset management of your valves.

SERVICE & MAINTENANCE

We have the facilities, expertise and flexibility to ensure that your valves are maintained safely, effectively and promptly.

OUR SOLUTIONS

UPGRADES

As the assets life progresses, we can review and engineer a suitable upgrade or replacement internals to ensure your process is running at its optimal level.

ADDITIVES

With our in-house Laser Powder Bed fusion technology and a team of expert additive engineers, we can specify, design and produce components quickly in-house.

FROM THE ENERGY INDUSTRIES COUNCIL

AUTUMN 2025 / ISSUE 60

From the EIC

5 Foreword

From the Chief Executive

6 View from the top Stéphane Aubarbier, Deputy CEO of Assystem

10 News and events Updates from the EIC

13 ADIPEC 2025 Event preview

16 The big question Which green tech provides the best opportunities?

18 Special feature: Five golden rules for a healthy supply chain Mahmoud Habboush, Communications Adviser, EIC London

20 No project pipeline, no progress

Jonathan Dyble, Partner, WD Editorial

38 My business

Richard Sargeant, Offshore Wind Strategic Development Lead, Intertek

Energy Transition

24 North America leads hydrogen and carbon capture

Jack Boggis, Energy Analyst, EIC London

The Energy Industries Council

89 Albert Embankment, London SE1 7TP

Tel +44 (0)20 7091 8600

Email info@the-eic.com

Chief executive: Stuart Broadley

Should you wish to send your views, please email: info@redactive.co.uk

Editors Sairah Fawcitt +44(0)20 7880 6200 sairah.fawcitt@redactive.co.uk Lucas Machado +55 21 3265 7402 lucas.machado@the-eic.com

Account director Deniz Arslan

Production director Jane Easterman

Lead designer Craig Bowyer

Senior designer Gene Cornelius

Picture editor Akin Falope Content sub-editor Kate Bennett

Renewables

26 Push for offshore wind gathers pace after setbacks

Hazwani Izzati, Energy Analyst, EIC Kuala Lumpur

28 Can Asia Pacific’s offshore wind supply chains keep up?

Rebecca Groundwater, Head of External Affairs, EIC London

Oil and Gas

30 Oil and gas projects surge globally

Mariana Messere, Energy Analyst, EIC Rio de Janeiro

Sales and advertising +44(0)20 7324 2763 energyfocus@redactive.co.uk

Energy Focus is online at energyfocus.the-eic.com

ISSN 0957 4883

© 2025 The Energy Industries Council

34 Power sector shifts for coal, gas and carbon capture

Aimi Termizi, Research Analyst, EIC Kuala Lumpur Nuclear

36 Powering up: Nuclear on the move

Jack Boggis, Energy Analyst, EIC London

Energy Focus is the official magazine of the Energy Industries Council (EIC). Views expressed by contributors or advertisers are not necessarily those of the EIC or the editorial team. The EIC will accept no responsibility for any loss occasioned to any person acting or refraining from action as a result of the material included in this publication.

Publisher Redactive Media Group, 9 Dallington Street, London EC1V 0LN www.redactive.co.uk

Recycle your magazine’s plastic wrap – check your local LDPE facilities to find out how.

17th March | London, UK

STUART BROADLEY

From the chief executive

The supply chain is united, across countries and companies, in its need for a consistent opportunity pipeline

At EIC, we are committed to being a leading voice for the energy supply chain. Working with our international partners, we advocate for impactful policy improvements, clear and well-funded industrial strategies and collaborative alignment, focusing on solutions that address today’s urgent energy challenges: energy security, meeting rapid demand growth and fair but urgent decarbonisation. Driving towards energy affordability (the lowest cost of energy) remains a consistent priority as well, but policies aiming to deliver cost savings are missing the mark.

The EIC Manifesto, published last year, represents the needs of the UK critical energy supply chain and includes five focus areas. This edition of Energy Focus will put under the spotlight one of those five: the need for a consistent and substantial pipeline of project opportunities to feed the hungry supply chain. Even though the manifesto is a snapshot of the UK state of play, we still think its insights merit discussion with an international audience.

This pipeline needs to cover all energy sectors and be active worldwide, not dominated by a specific market or a

single region. The behaviour necessary for this shift will be, as has been said before, collaborative – across countries and between companies, ensuring these business opportunities are maximised as quickly and cost-effectively as possible. However, the circumstances are making this harder, with energy security pressure, protectionist measures and populist policies posing significant obstacles. If every country and every company endeavours to plough its own energy field, we will have much more costly, much less

The stakes are high, the time and financial constraints are immense and uncertainty is everywhere

efficient, much less scalable crops to harvest. It will be the consumers and the energy-intensive industries who will have to pay for this stance, either now or at some point in the future. Competitiveness will be brought down and net zero will be further delayed, while larger nations, namely China and the US, push further ahead.

The stakes are high, the time and financial constraints are immense and uncertainty is everywhere. After all, investor confidence is impacted and the situation carries on.

Do not be downhearted, though –there are many bright lights of hope and success, whether it is the development of artificial intelligence and data centres, the record installation rates for mature renewable technology, the exponential growth in energy storage facilities or the nuclear revolution. On this last topic, I am delighted that our View from the Top interviewee in this edition is Stéphane Aubarbier, Deputy CEO at Assystem, who tells us how the company is placed amid the nuclear sector’s current momentum – and more.

The conversation does not stop here. There are four pillars left from the EIC Manifesto to explore, and we will be more than happy to share them in detail with you over the next issues. I hope you enjoy this first one and that it serves as a starting point for conversation, whenever and wherever you find us.

STUART BROADLEY Chief Executive Officer, Energy Industries Council stuart.broadley@the-eic.com

Stéphane Aubarbier

Stéphane Aubarbier, Deputy CEO of Assystem, talks to Energy Focus about the company’s role as a nuclear energy activist, innovation in SMRs and driving the global energy transition

At the Top: Stéphane Aubarbier

VIEW FROM THE TOP

Stéphane Aubarbier, an INSA Lyon and ESCP-EAP graduate, began his career at Assystem as a commissioning engineer, later leading its automotive sector. After five years at ABB managing maintenance and service activities across Southern Europe, he returned to Assystem in 2002 to create its engineering activities and redevelop its energy and nuclear sector. He became Executive Vice President in 2005, Chief Operating Officer in 2018 and Deputy CEO in 2023, overseeing all operations. He has presided over the French federation Syntec-Ingénierie and serves on the French Nuclear Industry Strategic Committee.

Assystem describes itself as an activist in nuclear energy development. What does it mean by this, and why is activism important to you?

We believe nuclear energy will be the cornerstone of the effort to decarbonise global electricity generation. It is the only energy solution that can replace fossil fuels with low-carbon energy production while satisfying base-load electrical demand.Assystem’s mission is to step up the energy transition throughout the world, and in this regard, we consider ourselves activists in the fight against climate change. We put all our energy into this, coupling our historical engineering expertise and project management with digital technologies to ensure a viable, efficient and reliable energy future for all.

With 59 years of experience, how has Assystem changed as a business, and what have been its key milestones or transformations along the way?

Assystem’s nearly 60-year journey reflects the shifting global energy landscape – from France’s 1960s nuclear boom to the global diversification that saw the group working in automotive and aerospace in the 2000s, refocusing on nuclear in 2017. Our milestone moments have

Assystem’s

been when we have correctly anticipated an emergent trend or shift; refocusing on nuclear was one such move. In addition, our ability to transform and strengthen our offer, focusing on digital at the right time and then project management, has allowed us to deliver more for customers – particularly relevant now, when resources in the nuclear marketplace are stretched.

What does being ranked among the nuclear energy sector’s top three companies mean for you and your stakeholders?

We have been able to secure our position because of our unrivalled expertise as an independent global nuclear engineering company. Among our competitors, we are the only company that is completely focused on the nuclear and energy transition sectors.

Assystem operates across a range of energy sectors. How do these sectors complement each other in your strategy for supporting the global energy transition?

Our experts work globally on the development of low-carbon electricity, in terms of both production and distribution, through the expansion of nuclear and renewable energies throughout the world. We also focus

13 COUNTRIES OPERATED

59 YEARS OF EXPERIENCE

1

NUMBER 1 INDEPENDENT NUCLEAR ENGINEERING COMPANY IN EUROPE

5,000

MORE THAN 5,000 NUCLEAR EXPERTS

£528m IN SALES

8,000 EMPLOYEES

on renovating power grids and developing new uses for electricity, such as decarbonising transport and industry through hydrogen.

Innovation is critical to meeting both performance and sustainability goals. How important are digital, data and AI to the future of the business?

As an industry leader in digital for complex projects, we consider digital technology key to accelerating nuclear power programme delivery. By bringing greater efficiency in delivering these infrastructure projects, digital technology will reduce nuclear power timescales –helping to attract new financing models and new customers to the market.

How important is collaboration to your success, and what have you learned about what makes a strong and effective partnership?

Given the scale and complexity of our projects, from nuclear power plants to energy transition infrastructure, no entity can succeed in isolation. In our experience, there are two key elements

Digital technology is key to accelerating nuclear power programme delivery

needed for a successful partnership, starting with mutual trust, transparency and cultural fit. We’ve learned that transparent communication – especially around risks and challenges – builds long-term trust, which allows for faster problem-solving and more resilient project teams. We always deliver the project awarded to us, but our approach is to see the big picture and be ready to step in and deliver in other areas to achieve a positive result for the customer. Our most effective partnerships are founded on a mutual commitment to securing success for the customer over individual company gain.

Second, it is about identifying the best capability in the right place at the right time. Part of our strategy is to work with local companies to deliver international projects. This transfers skills to local people, which improves long-term project sustainability and enables access to local supply chains, offerinf better value for materials and resources – and, in turn, improving long-term customer outcomes.

There has been a lot of talk about different solutions to power the data centre boom recently. What role do you see for nuclear in this space?

Nuclear power is attractive for energy intensive industries as it offers a stable

source of low-carbon electricity that, in the case of small modular reactors (SMRs), can be positioned next to industrial energy consumers and work off-grid.

Hyperscalers have already identified nuclear as a key power source in meeting their needs, as data centre demand becomes more urgent due to widespread AI adoption in our day-to-day systems. Nvidia is investing in SMR technology such as TerraPower to power data centres, and developers such as the UK’s Community Nuclear Power seek to place SMR technology at the centre of their industry-focused power projects.

Large-scale nuclear also has a role to play, and the Microsoft-financed planned restarts of nuclear plants such as Palisades in Michigan and Three Mile Island Unit 1 are examples of this in action. The challenge for the nuclear industry will be to deliver the power plants at the pace required to meet demand from this industry.

What is your view on the future of nuclear SMRs, and when do you expect this technology to move from pilot to scale?

Assystem explicitly identifies SMRs and advanced modular reactors (AMRs) as

essential technologies to accelerate the global energy transition, and we are currently supporting multiple developers on their projects, including Rolls-Royce SMR, Newcleo and Naarea.

There are two timescales for SMR development. The first relates to existing and/or proven technology for large-scale nuclear that has been made smaller. Technology such as the RollsRoyce SMR is of this type, deriving from the pressurised water reactor design used for decades in conventional reactors worldwide. We can expect to see these reactors available in the short term, in response to a clear demand on the market.

The second timescale concerns new technologies such as AMRs, which go beyond traditional water-cooled designs, incorporating innovative coolants like helium, molten salt and liquid metals,

which can improve efficiency and reduce waste. Some companies, such as Newcleo, have already submitted applications for Generic Design Assessment, a crucial step in the regulatory process for new reactor designs. However, as new technologies, AMRs are not expected to be widely available until the mid-2030s.

What are the main challenges to growing the nuclear industry right now?

Nuclear remains highly capitalintensive, and the cost of capital and perceived risks continue to deter privatesector investment. New finance models such as the Regulated Asset Base (RAB) will be essential to unlock institutional capital; the Sizewell C capital structure is backed by the RAB funding model. If standardised and made repeatable, SMRs could reduce scale risk and attract new funding sources. Publicprivate partnerships, tech-sector power purchase agreements and multilateral backing are emerging as critical enablers of nuclear scale-up.

Do you think critical nuclear capabilities need to be developed in the UK, or is it more pragmatic to build strong trading and technology relationships with other countries that already have that technology?

Our delivery model in every country in which we operate is to invest in developing local capabilities. This is core to our strategy and delivers multiple benefits for customers, decades after their projects have been completed. We have even taken this approach in the UK, which has a strong nuclear heritage and supply chain, because it has been three decades since nuclear power was constructed in the country and many skills are in short supply. In recent years we have taken

an active role in supporting knowledge transfer on the European Pressurised Reactor (EPR) programme at Hinkley Point C with commissioning experts from France who bring unrivalled knowledge from commissioning the Olkiluoto EPR in Finland. To support the successful delivery of Hinkley Point C and Sizewell C, we have also invested £45m since 2020 in acquiring specialist companies operating outside nuclear that add value to nuclear delivery, to secure the UK’s nuclear workforce in the long-term.

What strategic priorities or global markets are top of mind for Assystem as the energy transition accelerates?

Our international focus is on countries that are building nuclear power.

If you had one message for governments, industry partners and the next generation of talent about the future of nuclear, what would it be?

When a government commits to nuclear power, it is not just investing in decarbonised electricity – it is investing in its country’s long-term scientific capability, the high-value skills of its people and their energy sovereignty for an entire century. Nuclear is the only energy solution that can replace fossil fuels and provide a stable, low-carbon and abundant supply of electricity to meet energy demand today and in the future. The technology is constantly evolving, and in the 21st century, nuclear fusion will also play a key role is delivering decarbonised electricity.

NEWS & EVENTS

EIC: giving the supply chain a seat at the table

At EIC, we champion the interests of the entire supply chain, ensuring our members are heard at the highest levels and supported in accessing global markets

BY REBECCA GROUNDWATER, GLOBAL HEAD OF EXTERNAL AFFAIRS

eopolitics influences every part of the energy sector –from setting the narrative of technologies and picking the winners and runners up, to laying down the trajectory for net zero. Within this complex global landscape, we see the aims of individual nations and internal political will. Tariffs intended to strengthen countries, reindustrialisation to enhance markets, and energy security in the face of escalating global conflict are all pressing concerns. At EIC, we attempt to balance these considerations carefully.

GRepresenting the whole supply chain globally

Our members operate across diverse markets and regions, following opportunities on a global level. We actively enable companies wishing to

export, representing the views of the entire supply chain to politicians who rarely hear from all parts of the value chain. Providing this comprehensive representation is a priority that we consistently uphold.

Our commitment to maintaining continuous dialogue with our members and delivering their perspectives to policymakers remains unwavering

This commitment was front and centre at our flagship Energy Exports Conference (EEC) in June, where we welcomed international delegations from around the world. Delegates from Sarawak, Malaysia highlighted their exciting renewable energy and sustainable infrastructure projects, showcasing their strategic vision for growth and collaboration. Representatives from other dynamic markets, including Brazil, presented significant offshore oil and gas prospects, while delegates from the UAE and Saudi Arabia shared their ambitious energy diversification initiatives, particularly around hydrogen and solar power.

Building connections and opening markets

The global energy supply chain is highly skilled and adaptable – and

increasingly mobile. The active participation and keen interest demonstrated by these delegations, and many others connecting with EIC beyond EEC, underscore how widely recognised our members’ expertise has become. Our ongoing collaborations with governments around the world are facilitating frictionless access to international markets for our members.

Direct

engagement with policymakers

Our roundtables in Aberdeen, Kuala Lumpur, the UAE and other locations facilitate critical dialogue on key issues, including trade, the pace of implementation, turning ambition into reality, and sustainability. Through these events we engage directly with civil servants from different

governments, providing insights into the practical realities faced by the energy supply chain. These discussions play a meaningful role in shaping ministerial conversations and influencing outcomes at major international conferences.

Strengthening influence in key markets

One of EIC’s core functions is to work with our members around the world to respond to consultations and information requests. To that end, we participated recently in one of the UK’s largest consultations, and await its outcomes to guide our strategic direction. We are also involved in the US market, assessing tariff impacts and supporting local members on the ground to foster growth.

Closer to home, Europe’s evolving landscape demands intensified focus and coordination. With our new Regional Director for Continental Europe Claas Helmke now in place, it is crucial to maintain and enhance our interactions with European policymakers. As global blocs form and evolve, ensuring that our members have fair market access and are well-prepared for European legislative developments will necessitate greater strategic collaboration.

A

continuous mission

Energy policy is evolving rapidly in many countries, and our commitment to maintaining continuous dialogue with our members and delivering their perspectives to policymakers remains unwavering. If you would like to become involved or gain further insights into our policy engagement activities, please do get in touch.

EIC Awards ceremonies October-November 2025 Worldwide

www.the-eic.com/Events/ EICAwards

UK & EIC Pavilion at ADIPEC 2025 3-6 November 2025 Abu Dhabi, UAE

internationaltrade@the-eic.com

EIC Connect UK & Ireland Energy 19-20 November 2025 Manchester, UK eventsUK@the-eic.com

Check out our full calendar on the-eic.com/Events/Calendar

Trade delegation to Mozambique 24-27 November 2025 Maputo, Mozambique

internationaltrade@the-eic.com

Latest Reports

EIC Insight Report: South America Offshore Wind

EIC Insight Report: Europe OPEX

EIC Insight Report: APAC Offshore Wind

EIC Insight Report: Survive & Thrive IX

Access is free to EIC members on EICDataStream – visit the-eic.com/Membership

Penta Global Delivering innovative and sustainable solutions

At Penta Global we deliver innovative, sustainable EPC solutions to the ever-evolving energy sector across the Middle East, Southeast Asia and beyond.

Founded in the UK and headquartered in the UAE, Penta Global has two decades of rich experience in construction and fabrication, catering to the rising demand for global energy conversions. Our diverse and highly skilled workforce delivers Engineering, Procurement, Construction, Mechanical, Civil and E&I capabilities across field-based contracts with safety, quality and sustainability at the core.

Headquartered in the UAE with a global reach

4,500+ Global Workforce

Recognised by leading international organisations for our commitment to Safety including RoSPA Silver Award for Health and Safety Performance 2025 and British Safety Council International Safety Award 2025

For more information visit: www.penta-global.com or contact: Enquiries: sales@penta-global.com Supply Chain: procurement@penta-global.com

ADIPEC 2025

From 3–6 November 2025, Abu Dhabi will once again become the centre of the global energy industry as ADIPEC opens its doors. Managed by the EIC International Trade team for more than two decades, the UK Pavilion has grown alongside the event itself, becoming a hub for showcasing UK expertise, technology and capability.

The 2025 edition marks an exciting milestone, with UK Pavilions spannin 1,600sqm across four halls – 8, 12, 15 and 17. This includes the return of the Scotland Pavilion and the Wales Pavilion in Hall 8, hosting 26 and 12 companies respectively. These regional showcases highlight the depth and diversity of innovation coming from across the energy supply chain in the UK – from digital transformation and clean tech to engineering excellence and advanced manufacturing.

Gateway to Middle East energy projects

The significance of ADIPEC for UK businesses is clear. According to

Showcasing UK innovation at ADIPEC’s biggest ever pavilion

The UK Pavilions at ADIPEC 2025 span four halls, showcasing UK innovation and expertise with regional pavilions and advanced solutions shaping the Middle East’s energy transition future

BY CHLOE GONZALES, SENIOR PROJECT AND EVENTS MANAGER, EIC

Prime location, VIP access

The Pavilion’s central location ensures a constant flow of visitors and opportunities. Across the four days, exhibitors will benefit from:

VIP tours

VIP tours for leading national oil companies and international oil companies – past participants have included ADNOC, ARAMCO, SABIC and PDO. These curated walkthroughs offer exhibitors a rare chance to engage with decision-makers and showcase their solutions in a focused setting.

One-to-one meetings

One-to-one meetings with top engineering, procurement and construction contractors including Petrofac, Kent, McDermott, Saipem, TechnipEnergies, Worley and Wood. These strategic interactions help companies position themselves within regional project supply chains.

Networking reception

An exclusive networking reception at the ALOFT Hotel, ensuring industry influencers and buyers from across the Gulf Cooperation Council can network with UK Pavilion exhibitors in an informal environment. These events foster lasting partnerships and open dialogue.

EIC ADIPEC Business

Breakfast

The EIC ADIPEC Business Breakfast at Pearl Rotana Hotel on the first day provides a unique opportunity to hear from industry experts and participate in dynamic discussions, while also connecting with peers over insights and strategies.

growth. This presence at ADIPEC not only reinforces that trust but also enables UK companies to directly contribute to major regional developments in conventional and renewable energy.

Innovation for a net-zero future

ADIPEC EXHIBITION & CONFERENCE

From 3–6 November 2025, Abu Dhabi

EICDataStream, between 2025 and 2030, more than 983 energy projects worth US$1.36tn are planned across the Middle East, keeping the region firmly in focus for UK exporters. As global energy systems continue to transition, there is growing demand for innovative, sustainable and digital solutions – areas in which the UK excels.

The UK’s reputation as a trusted partner to the Gulf Cooperation Council continues to open doors for collaboration and

The significance of ADIPEC for UK businesses is clear. According to EICDataStream, between 2025 and 2030, more than 983 energy projects worth US$1.36tn are planned across the Middle East

The UK Pavilion highlights the country’s legacy in engineering excellence, but it also reflects the dynamic transformation taking place across our energy sector. From carbon capture technologies to AI-powered efficiency tools, UK companies are pushing the boundaries of what’s possible. Visitors to the pavilion will discover innovative clean energy solutions, cuttingedge digital technologies and sustainable engineering practices that support net-zero goals.

Dedicated support for UK exhibitors

The EIC team is also offering enhanced support to ensure UK exhibitors make the most of their participation. This includes tailored market intelligence, on-site business matchmaking and strategic promotion before, during and after the show. Our aim is to help UK businesses gain visibility, build partnerships and secure tangible outcomes from their presence at ADIPEC.

Whether you're a UK-based SME seeking international partners, a global energy player looking for innovative tech, or a policymaker wanting to understand the latest trends, the UK Pavilion is the place to be. We are excited to meet members, partners, and new contacts at ADIPEC 2025, and to demonstrate how UK companies are driving innovation and delivering value to energy projects worldwide.

THE BIG QUESTION

Which green tech provides the opportunities?best

With final investment decision rates low across energy transition projects, three industry leaders share which green technologies currently offer the most promising opportunities and potential for growth in their businesses

Colin Brown

Energy Sector Director at RSK

The energy transition is exactly that: a sector that is in transition around the world, converting from traditional fossil fuels to cleaner alternatives while dealing with sector growth due to energy demand. This means that one generation technology isn’t better than another, and there is an increasingly complicated landscape to navigate when trying to create an appropriate energy mix. Natural resources, technical advances, politics and economics directly affect how countries go about this.

We are involved in some really exciting projects linked to future clean fuels

The big global challenge at present is how we transmit clean energy from producer to consumer and, with increased reliance on renewable generation, how we store that energy. In certain parts of the world this connectivity challenge has slowed progress, but in other parts we are seeing fast clean technology deployment.

RSK has a wide array of projects covering all aspects of energy generation technologies, transmission and consumption. We are involved in some really exciting projects linked to future clean fuels, and, while they may be small scale now, once the technology is proven and becomes bankable, they can be scaled quickly to have a larger, more positive impact as we strive for a better, cleaner future.

About RSK

RSK delivers environmental and engineering solutions. It began in 1989 by providing environmental consultancy services to energy clients, and has expanded to operate across the energy value chain, comprising more than 200 companies and employing over 15,000 people.

Patrick Richardson Head of Business Development Management at AsstrAAssociated Traffi c AG

AsstrA is actively supporting the transition from fossil fuel-based energy systems to sustainable alternatives. In the wind and solar sectors, final investment decision (FID) rates are not posing significant challenges and projects are progressing steadily, reflecting growing global consensus around the viability and importance of conventional renewable energy sources.

However, we are seeing slower progress in newer technologies, such as blue and green hydrogen, carbon capture and storage, and sustainable aviation fuels. These technologies are still in earlier stages of development or market adoption, often leading to delayed investment decisions.

Despite this, AsstrA hopes that the urgency created by global net-zero commitments, which should push alignment between governments, investors and stakeholders, will accelerate FID activity in these emerging sectors over the coming

We are prepared to provide logistics and projects support… and help facilitate the growth of sustainable infrastructure

year. We are fully prepared to provide comprehensive logistics and project support to clients that are involved in such initiatives, and remain committed to facilitating the growth of sustainable infrastructure worldwide.

Robert Tichband

Chief Operating Offi cer at SPP Pumps

We believe hydrogen is not only promising but also a sustainable, longterm revenue stream

The biggest opportunity for SPP Pumps in the energy transition space lies in hydrogen production, which is seeing a surge in development compared to other technologies – signalling strong stakeholder confidence.

We believe hydrogen is not only promising, but also a sustainable, long-term revenue stream for the company. The momentum is driven by both substantial government support and increasing private-sector interest. This global backing aims to accelerate investment in low-carbon hydrogen production as part of broader efforts to reduce fossil fuel dependency, promote the clean energy transition and meet ambitious net-zero emissions targets.

Hydrogen’s role in future energy systems is becoming more credible as the infrastructure for its production, transportation and storage continues to evolve. SPP Pumps is uniquely positioned to contribute to this transition in a meaningful way. We can play a key role by supplying essential equipment for both process applications and fire protection systems across hydrogen facilities. As well as delivering new products, SPP Pumps is also well-placed to provide ongoing maintenance services, ensuring the reliability and efficiency of hydrogen infrastructure as it scales globally.

About AsstrA-Associated Traffic AG

AsstrA-Associated Traffic AG is an international logistics company providing transport and supply chain solutions, supporting clients globally with its project cargo, heavy-lift and multimodal operations expertise while emphasising reliability, safety and continuous improvement.

TFive golden rules for a healthy supply chain

5 4 3 1

he energy sector is booming, with 77% of companies reporting record growth in 2024, averaging 24% revenue jumps. However, beneath the surface, frustration abounds. Policy whiplash, project delays and fragmented strategies are holding back progress. EIC’s ninth Survive & Thrive report, surveying 141 global energy firms, reveals a unified call to action: stability.

Companies are asking for more than just support – they are seeking coherence. From the UK’s plea for “joinedup thinking” to Europe’s fear of deindustrialisation, the message is clear: energy cannot thrive in chaos. So, what does the supply chain need to survive? EIC members have called for:

While the global energy supply chain appears robust on paper, underlying cracks are growing. From policy uncertainty to delayed projects, EIC’s Survive & Thrive 2025 report highlights five critical demands from companies to ensure stability, resilience and sustainable long-term growth

BY MAHMOUD HABBOUSH, COMMUNICATIONS ADVISER, EIC LONDON

1. A consistent pipeline of bankable projects

Projects stuck in approval limbo (for example, UK offshore wind) drain resources and talent. Without a consistent pipeline of projects, “Capability leaks slowly... and when you look up, it’s gone”, says one UK-based respondent.

2. Access to funding

Rising costs and inflation squeeze profit margins. Lack of funding causes an exodus to tax-friendly markets. The UAE, for example, has 0% corporate tax.

3. A role for all technologies

Oil and gas fund 57% of supply chain revenues, and shutting it off “is

energy security suicide”, as one Survive & Thrive respondent puts it.

4. Consistent policy and regulation

About 77% of UK firms cite policy chaos as the top barrier, while Europe fears “deindustrialisation”. Lack of consistent policy risks driving talent away to more stable markets –for example, the Middle East’s 68% revenue growth is a magnet for the supply chain.

5. Drive exports

Only 6% of firms explore new export markets. Europe and the UK lead exports but need state backing. Having said that, local content requirements serve as barriers to entry.

Every sector, every region and every solution has a role – that’s the message from the report

A joined-up energy future will need all five of these asks to work together in sync. Without a consistent pipeline of bankable projects, funding stalls. Without funding, technologies stall. Without all technologies, progress stalls. Without policy consistency, projects stall. And without export momentum, value stalls. Every sector, every region and every solution has a role. That is the message from this year’s EIC Survive & Thrive

report. It is not one answer – it is all of them together. That is why our deep dive begins here — with the need for a consistent pipeline of bankable projects. Without a steady flow of viable opportunities, the rest of the energy transition puzzle simply does not fit together. In this first feature, Jonathan Dyble explores what makes projects investable, why bankability is under strain, and what must change if the UK is to retain its talent, capability, and momentum on the road to net zero.

A

A consistent pipeline of bankable projects

Unlocks investor confidence

Attracts capital

Without a consistent pipeline of bankable projects, funding stalls

Access to funding

Enables delivery of real projects

Supports all energy technologies

Without funding, technologies stall

A role for all technologies

Balances energy mix

Strengthens supply chain capability

Supports more projects entering the pipeline

Without all technologies, progress stalls

Consistent policy and regulation

De-risks investment

Stabilises project development

Encourages long-term planning across sectors

Without policy consistency, projects stall

Drive exports

Increases global market access

Boosts project viability

Attracts further investment into the pipeline

Without export momentum, value stalls

SUSTAINED INVESTMENT NEEDED

NO PROJECT PIPELINE NO PROGRESS

Without a steady pipeline of bankable clean energy projects, the UK’s energy transition could fail, or at least be significantly delayed. So, what is needed to help unlock investment – and what are the consequences if we do not?

BY JONATHAN DYBLE, PARTNER AT WD EDITORIAL

Energy transition is under an ever-brightening spotlight. The stage is set: to ensure global warming remains within 1.5˚C of pre-industrial levels, the world must reach net zero by 2050. Yet achieving those ambitions will rely on serious and sustained investments.

According to the International Energy Agency, annual clean energy spending worldwide will need to more than triple by 2030 to around US$4tn. The UK government’s aim, meanwhile, is to double current investment across frontier clean energy industries to more than £30bn per year by 2035.

Clearly, finances are at the forefront of the conversation. For net zero to be achieved, projects need to be funded. However, to secure that funding, they also need to be financially viable, attractive and bankable.

How can projects earn lenders’ and investors’ confidence? In the eyes of Renny Muslim, Managing Director of EIC member company Sepakat Energy Services, three factors contribute to renewable energy project bankability.

“First is revenue certainty, achieved through long-term offtake agreements such as power purchase agreements,” he says. “Second is credible counterparties or, where possible, sovereign guarantees and stable political and regulatory frameworks. And third is transparent risk allocation, where underlying project risks such as environmental uncertainties are not placed on the project investor.”

Muslim is not the only person to outline these conditions; according to Mahmoud Habboush, Communications Adviser at EIC, similar sentiments were the centre of attention at the EIC Bankable Energies conference earlier this year.

“Bankers and investors were very clear,” he says. “Projects need

financial viability, a clear revenue model such as confirmed offtake or demand, and a robust risk profile that includes reliable regulatory and policy frameworks. If investors and banks believe your numbers add up, the risks are well managed and your market is credible, that’s the foundation of bankability.”

Building this bedrock of bankability conditions cannot be understated in the context of net-zero targets, both in the UK and globally. Without it, Habboush explains, a steady stream of commercially viable, investable projects is less likely to come to fruition – and, in turn, the supply chain will run out of work.

Revenue certainty come from longterm offtake agreements such as power purchase agreements

Renny Muslim, Managing Director, Sepakat Energy Services

“It’s that direct,” he says. “When projects stall or fail to reach financial close, companies can’t plan ahead –they can’t hire, invest or even survive in some cases.”

This can lead to companies pivoting away from cleantech and into conventional energy, or transferring their skills into other sectors entirely, such as defence and aerospace, he adds. Other firms, meanwhile, are relocating to markets that offer more consistent opportunity.

Figures from EIC’s latest Survive & Thrive report confirm this, with UKbased companies increasingly shifting their focus to regions such as the Middle

East, where bankability is stronger and margins are higher.

“In 2024, companies operating in the Middle East reported revenue growth of 68%, compared to just 16% in the UK,” says Habboush. “That tells you everything you need to know. Without a healthy pipeline here at home, we’re not just losing work – we’re losing talent, capability and future investment.”

What needs to change?

Bankability in the UK is under pressure, and it shows. Since 2023, Habboush reveals, only three UK offshore wind projects have moved forward – worth about US$13.8bn in projected CAPEX.

What needs to change? A lot.

In the eyes of Matthew Green, government support and regulatory certainty will be a crucial piece of the puzzle. Citing his own experience as Project Director for EIC member company Flotation Energy, he notes that government support is critical in building a reliable, consistent project pipeline for floating wind.

“Subsidies, Contracts for Difference (CfDs), tax incentives and clear, stable regulatory frameworks provide the financial predictability and investor confidence needed to advance what is still a relatively nascent sector,” says Green. “CfDs, in particular, de-risk revenue streams and help unlock private capital, while regulatory clarity ensures smoother permitting and planning processes.”

Muslim advocates for a broader focus that goes beyond the finances, pointing to the need to develop the overall energy ecosystem, including workforce capacity, technology and capabilities, and overall education and public awareness. A multi-faceted, coordinated strategy will be paramount.

“In our conversations with member companies, the message is

What investors want

Bankers and investors at EIC’s Bankable Energies conference highlighted four essentials for energy project bankability; get these right and the rest will follow:

Financial

VIABILITY WITH A CLEAR REVENUE MODEL

Robust risk

Predictable

loud and clear: we need joinedup thinking across policy, finance and regulation,” says Habboush. “Investors want predictability – clear targets, no U-turns, and frameworks they can trust.”

Of course, these responsibilities do not just sit on the shoulders of governments. Multi-faceted efforts will require multi-faceted contributions from industry players, think tanks and policymakers alike.

Without a healthy pipeline, we lose work, talent, capability and investment

Mahmoud Habboush, Communications Adviser, EIC

PROJECTS WITH CLEAR DEMAND SIGNALS

“Demand signals, for example, are just as important,” says Habboush. “Take clean hydrogen – there is demand, but the purchase price remains a major barrier. Until there’s a mechanism to bridge that gap between willingness to produce and ability to buy, projects will struggle to move forward.”

He flags the issue of scale, explaining that fragmented projects often fail to attract the required capital to make them financially viable. “Bundling or using government-backed guarantees to de-risk the early stages can help bring private finance in. Equally, planning delays are still one of the biggest blockers. It’s not always about money or ambition – it’s the approvals holding things up. So, faster, more joined-up permitting would unlock a lot of momentum.

“Finally, none of this matters without the delivery side. Without

When projects stall or fail to reach financial close, companies can’t hire, invest or even survive

Mahmoud Habboush, Communications Adviser, EIC

skilled people and strong supply chain capacity, even the most bankable project stays stuck on paper.”

Bankability is about more than just financing

In this sense, the success of the energy transition is not just about bankability. Finances are crucial in making projects happen – but to be sustainable, the growth of renewables depends on the sector working for everyone.

For Matthew Taylor, Managing Director at EIC member company Greene Giraffe, that begins with a clear distinction between net-zero and traditional hydrocarbon projects.

“We must recognise that these are fundamentally different asset classes with very different return profiles,” he says. “Net-zero projects are, by and large, much closer to conventional infrastructure. That is not to say the same investor cannot invest in both, but a clear distinction has to be made; we see multiple oil and gas companies making this distinction, for example by allocating their balance sheet accordingly.”

For Habboush, meanwhile, it is about prioritising fair risk and reward. “Right now, too many SMEs are being asked to carry big delivery risks on thin margins,” he says. “That’s just not sustainable. Contracts need to be more balanced, with proper risksharing built in.”

He also argues that tender pricing needs to be more realistic to ensure that UK specialists do not continue to look for more lucrative opportunities in other sectors or regions. “Talent, innovation and investment will follow the opportunity. If we don’t build at pace here, we risk losing capability permanently.”

The key will lie in making renewable energy more attractive

CfDs de-risk revenues and unlock private capital

Matthew Green, Project Director, Flotation Energy

for all stakeholders – through realistic finances, but also through a continuity of work and predictable workloads that enable firms to commit to investing in their people, technologies and innovations. The message is clear: from focusing on local content and building regional supply chains to creating enabling environments that boost investor confidence, bankability is about more than funding. It will require a joinedup approach that focuses on improving sector capabilities, boosting public awareness and creating stable policy frameworks. Get it right and the UK will be well placed to boost investment, maintain jobs and preserve its industrial capacity. Get it wrong, though, and supply chain businesses will be forced to shut down or relocate overseas, weakening UK energy capabilities and hindering the country’s net-zero ambitions.

ince 2023, North America has seen 26 hydrogen and 20 carbon capture projects reach a final investment decision (FID), with a combined CAPEX of US$26.5bn, making it the leading region globally.

US policy drives blue hydrogen

The US accounts for 33 hydrogen and carbon capture projects, bolstered by its respective 45V and 45Q tax credits schemes, which have encouraged the development of the cleantech sector through financial incentives.

US president Donald Trump’s One Big Beautiful Bill confirms that the Section 45V clean hydrogen production tax credit will expire in 2028 instead of 2033, while the Section 45Q tax credit remains at US$85 per tonne for pointsource carbon capture with geological storage, and US$180 per tonne for direct air capture with geological storage.

Blue hydrogen projects will continue under Section 45Q, but the green hydrogen sector faces cancellations as projects must begin construction by 2028 to secure US$3/kg support. The US is poised to remain a global leader in blue hydrogen development.

Europe’s growing momentum

Europe has seen 53 hydrogen and carbon capture projects reach FID, surpassing North America in project count but having a lower combined CAPEX (US$16.6bn). Germany leads

The US is poised to remain a global leader in blue hydrogen development

North America leads hydrogen and carboncapture

North America leads in hydrogen and carbon capture investment, Europe shows growing momentum and Asia Pacific trails behind, highlighting how policy and CAPEX shape the global cleantech race

BY JACK BOGGIS, ENERGY ANALYST, EIC LONDON

in hydrogen with 12 projects reaching FID, while the UK dominates carbon capture with three projects moving forward, accounting for more than half of Europe’s US$6bn FID projects. The hydrogen sector is still in its infancy, with mostly small-scale projects progressing while larger-scale projects lag behind. In contrast, carbon capture commands higher CAPEX, driven by large storage projects such as HyNet’s Liverpool hub, which aims to capture 10m tonnes of CO₂ annually from 2030.

Momentum is slowly building in Europe through the second Hydrogen Bank Auction, although the 15 winning projects must reach FID within two and a half years and begin production within five in order to secure funding; most are still in the planning stage.

Asia Pacific faces hurdles

The Asia Pacific region has seen 18 projects reach FID (total CAPEX US$7.3bn), with just one in the carbon capture sector – Indonesia’s US$4bn Vorwata carbon capture, utilisation and storage project. China leads the region, with three hydrogen projects getting the green light. One of these, the US$4bn 640MW Songyuan Hydrogen Energy Industrial Park, has been operating since 2024.

The region is still heavily reliant on fossil fuels and most of the projects moving forward are in the oil and gas sector. Australia is the most progressive country in terms of introducing hydrogen and carbon capture projects, but has seen various cancellations –including its 3GW Central Queensland green hydrogen project – due to high costs, market uncertainty and regulatory hurdles.

Final investment decisions in hydrogen and carbon capture

Hydrogen projects reaching FID (2020-25)

Top regions by CAPEX on hydrogen projects reaching FID (2023–25)

Top countries by CAPEX on hydrogen projects reaching FID (2023–25) Region

Offshore wind in South America is still in its early stages, but the region holds significant potential to shape the future global pipeline

Push for offshore wind gathers pace after setbacks

Supply chain pressures, policy uncertainty and stalled pipelines have slowed offshore wind. But across Europe, Asia Pacific and South America, fresh reforms and auctions are reviving momentum — though risks remain

BY HAZWANI IZZATI, ENERGY ANALYST, EIC KUALA LUMPUR

The offshore wind industry has faced significant challenges in the last few years, including project cancellations, delays, poor auction interests and developers exiting new markets – driven largely by macroeconomic headwinds and supply chain bottlenecks. Europe has been particularly affected, yet the region, led by the UK, Germany and the Netherlands, continues to hold its position as a global leader in the sector.

Europe: Still leading through reforms

Since 2023, the region has seen 17 projects reach final investment decision (FID), amounting to US$49.32bn. FID activity has doubled in 2025 compared to 2024, supported by policy and auction reforms aimed at addressing the challenges. The UK is expected to add the most capacity,

Finland: Tahkoluoto Offshore Wind Farm Extension

US$1.8BN

Tahkoluoto Offshore Oy

Poland: FEW Baltic II Offshore Wind Farm

US$1BN

Japan: Oga-Katagami-Akita Offshore Wind Farm

US$1BN

South Korea: Dadaepo Offshore Wind Farm

US$500M Busan Offshore Wind Power

2 4 5 3

targeting 29GW of fixed-bottom wind by 2030 and 29.57GW by 2035 for floating technology – but further project delays are anticipated.

So far, three fixed-bottom projects, totalling 5.33GW and worth US$13.84bn, have reached FID. The region is focusing on policy changes to mitigate ongoing challenges. In the UK, eligible fixed-bottom projects can now participate in the 2025 Allocation Round 7 Contracts for Difference (CfD) subsidy auction without prior planning consent – with test and demonstration-scale floating wind projects now allowed to join. The CfD contract has also been extended from 15 years to 20 years for both technologies.

Strong momentum in South Korea and Taiwan

The Asia Pacific region (excluding China) has seen active developments, particularly in South Korea and Taiwan. A total of 13 projects have reached FID, totalling US$23.12bn.

South Korea leads, with 6.79GW of fixed-bottom offshore wind expected to come online by 2030 and 13.25GW of floating wind by 2035 (subject to industry challenges). Four fixed-bottom projects totalling 889MW have reached FID, with a CAPEX of US$2.7bn.

Taiwan follows close behind, with 6.42GW of fixed-bottom offshore wind by 2030 and 12.87GW of floating wind by 2035. Four projects, totalling 2.44GW and worth US$11.8bn, have reached FID.

The region is moving forward with upcoming offshore wind auctions.

South Korea’s H1 2025 auction currently has six bidders participating, while Taiwan has opened consultations for its Round 3.3 auction, proposing up to 3GW of new capacity. Australia, while still emerging, is expected to have one of the largest offshore wind pipelines in

the long term, with its first auction in Victoria in September 2025.

South America: Emerging market, big potential

Offshore wind in South America is still in its early stages, but the region holds significant potential to shape the future global pipeline. Brazil leads the region, with 95 proposed projects, which have a total estimated capacity of 225.82GW.

Progress had been uncertain, as regulatory gaps made it unclear which projects could go ahead. However, this changed with Brazil’s 2025 Offshore Wind Law, which enacted a legal framework for offshore wind development. The country’s first sea use concession auction is expected in Q4 2025, opening the way for developers to obtain environmental licenses and begin feasibility studies. Colombia is also advancing in this area, with its first offshore wind auction underway. The Colombian government has received 69 site nominations for potential development in this auction, focusing on the Caribbean coast. It aims to award 1GW by August 2025, with a minimum project size of 200MW.

Policy uncertainty in North America

Although the US leads the North American region with 5GW having reached FID since 2023, recent policy shifts under Trump have introduced uncertainty. These include cuts to clean energy tax credits and stricter development requirements, casting doubt on the future of its offshore wind pipeline.

Source: EICDataStream, July 2025

Can Asia Pacific’s offshore supply chains keep up?

Asia Pacific’s offshore wind boom is undeniable. But can the supply chains in key markets actually deliver the massive projects planned?

BY REBECCA GROUNDWATER, HEAD OF EXTERNAL AFFAIRS, EIC LONDON

The offshore wind supply chains in the Asia Pacific region present a mixed picture. South Korea is leading in integrated manufacturing, while Taiwan is focusing on service and assembly hubs. Australia and Japan lag critically in turbine component production, relying heavily on imports. Vietnam has transferable industrial skills but needs port upgrades and project momentum. All face the challenge of scaling up rapidly to meet enormous deployment targets.

Australia: Strong services, weak manufacturing Australia excels in operations and maintenance (O&M), with 34 companies active in the sector, 20 of which have proven capabilities. Installation services are supported by 17 providers, and electrical cables have 14 suppliers. However, the country faces a critical shortage in turbine manufacturing.

Proven capability for nacelles and blades is minimal at just two companies each, and that is limited to offices rather than local factories. There is zero proven tower manufacturing. Keppel Prince, the last major onshore tower maker, shut down in 2025, crushed by cheap imports. Port infrastructure is another hurdle, with the planned Port of Hastings hub rejected over environmental concerns. Australia relies heavily on imports for key components.

Japan: Moderate capabilities, component gaps

Japan has a moderate presence in O&M (17 companies, 10 proven) and installation (four companies). It has seven suppliers for electrical cables, three for foundations and four specialising in offshore substations. Like Australia, the country lacks domestic suppliers for nacelles and blades. Global players such as Hitachi Energy and Siemens Gamesa have offices in the country, but Hitachi

stopped its own turbine production in 2019. The company now partners with Enercon for turbines while focusing on grid tech (such as high-voltage direct systems) via its acquisition of ABB. Companies such as Nexans (cables) and JFE Engineering (foundations, new 2024 facility) do have manufacturing sites. Japan aims to boost local content from 60% to 70% by 2040.

Vietnam: Stalled pipeline, transferable skills

Vietnam’s offshore wind supply chain progress mirrors its stalled project pipeline. It has 13 O&M companies, (nine proven) and eight in installation. Notably, it has proven suppliers for electrical cables (10), nacelles (four), foundations (four) and even towers (two), though many are international players. Vietnam’s real potential lies in leveraging its strong oil and gas and onshore wind sectors. Petrovietnam Technical Services Corporation is leading Image: iStock

Across Asia Pacific, countries face a shared challenge: rapidly scaling offshore wind supply chains while balancing local industrial growth with international investment

the charge, using its Vung Tau oil and gas yard to build offshore substations, foundations, and towers. CS Wind also operates a Vung Tau facility, and its major new deal with Dong Tam Group aims to build a US$200m component factory. Having said all this, Vietnam’s ports do need major upgrades for large-scale offshore work.

South Korea: Building momentum with local expertise

South Korea is actively building its supply chain to match its ambitious project pipeline. The country leads the region in O&M capabilities, with 22 companies – 14 proven – supported by strong port infrastructure. Its supplier base includes 10 proven electrical cable manufacturers and nine installation service providers. Importantly, it hosts six key turbine components manufacturing facilities.

Domestic players including Unison (towers, nacelles and blades), Doosan Enerbility (components) and Samkang M&T (foundations) are supported by international companies such as ABB, Nexans and EEW Group. Partnerships are accelerating growth, with Doosan Enerbility having signed a deal with Siemens Gamesa in March 2025 for nacelle assembly, and Unison partnering with China’s Mingyang in September 2024 on a nacelle and blade

factory. Local content incentives, targeting around 50%, encourage further localisation.

Taiwan: Developing hub, local content pressure

Taiwan, which currently leads the region in operational offshore wind capacity, has built a solid foundation in O&M, with 11 companies demonstrating proven capabilities. The installation sector is also active, supported by 10 companies, while four firms specialise in offshore substations. However, domestic production of key turbine components, including nacelles, blades and towers, remains limited. Siemens Gamesa operates a nacelle assembly plant in Taichung, which was expanded in 2024 to boost capacity.

Vestas, in partnership with Tien Li, produces blades locally, sourcing hubs and frames through YCG. Foundations are manufactured nearby by Century Wind Power. The Port of Taichung is being upgraded to serve as a central hub for assembly, logistics and deployment, positioning Taiwan as a strategic node for offshore wind in APAC.

Taiwan’s 60% local content requirement (LCR) has created tension between the need to support domestic suppliers and attract international investment. The upcoming auction round may relax the LCR, which could encourage foreign participation but also impact local manufacturers that have relied on it for contracts. Balancing local industrial growth with competitive investment remains a critical challenge for Taiwan’s offshore wind sector.

TO FIND OUT HOW EICSUPPLYMAP CAN SUPPORT YOUR BUSINESS AND OPEN NEW OPPORTUNITIES WORLDWIDE, CONTACT THE EIC TEAM

Email: info@the-eic.com

he North American oil and gas industry remains a key force in the global energy landscape.

The Permian Basin’s resilience and abundant natural gas reserves are reinforcing the region’s strategic importance, with recent geopolitical shifts pushing the narrative from energy transition goals towards energy security and global dominance. North America is the most active region globally in terms of sanctioned oil and gas project development.

North America: Energy security

sectors have reached final investment decision (FID) in North America, totalling US$175bn in investments. Of these, 36 are already operational. The US alone accounts for 141 of these projects, representing 73% of the total CAPEX.

Regionally, the midstream segment stands out, accounting for most sanctioned projects. Growing global liquefied natural gas (LNG) demand, combined with pro-export energy policies introduced under Trump, has driven midstream investment along the Gulf Coast.

Canada is also seeing renewed upstream investment and progress in LNG export infrastructure, marked rst-ever commercial LNG shipment to Asia from the newly operational LNG Canada project. Despite recent progress, both Canada and Mexico have faced challenges linked to tariff policies introduced under the Trump administration.

In Mexico, the growing LNG export sector is further constrained by pipeline infrastructure bottlenecks, largely due to its dependence on imported gas from e outlook remains positive, driven by LNG growth and rising oil output in the US Gulf of Mexico. Furthermore, it is notable that North America’s role as a stable energy supplier is solidifying amid shifting global supply chains.

In Mexico, the growing LNG export sector is further constrained by pipeline infrastructure bottlenecks

Offshore growth and LNG ambitions in South America

In South America, the oil and gas sector is experiencing increasing activity. Since 2023, 72 projects across the upstream, midstream and downstream segments have reached FID, representing a combined CAPEX of more than US$84bn. Most investment targets exploration and production projects, as the region’s large offshore reserves continue to drive demand for floating, production, storage and offloading (FPSO) units.

By 2030, 20 FPSOs are expected to come online, with key developments in Guyana’s Stabroek block, led by ExxonMobil, as well as Brazil – the region’s leader in project number and investment – and Suriname, following TotalEnergies’ recently sanctioned GranMorgu project. There are 13 FPSOs scheduled in Brazil alone, nine of which will be operated by Petrobras. This momentum is reinforced by successful bid rounds in Brazil and Guyana, and ongoing exploratory activities in

North America is the most active region globally in terms of sanctioned oil and gas project development

both countries as well as Suriname, supported by steadily rising oil and gas demand through to 2050.

In Argentina, vast Vaca Muerta gas reserves are driving the country’s efforts to become a leading LNG exporter, with key projects moving forward. As an example, Southern Energy’s US$670m LNG terminal, approved earlier this year, aims to export 1Bcf/d by 2028 via two floating LNG vessels in the San Matías Gulf. These capital-intensive projects

account for a large share of the US$5bn in investments sanctioned since 2023. While challenges such as political instability, underdeveloped infrastructure and supply bottlenecks persist, South America’s vast reserves and ongoing developments, especially in offshore and LNG, underpin a positive outlook, positioning it as a key player in global energy supply diversification.

Asia Pacific: Exploration and gas-to-power expansion

The Asia Pacific region has been one of the top three most active hubs for sanctioned oil and gas investments in recent years, with around 70 projects across the upstream, midstream and downstream segments accounting for more than US$109bn. Active mega upstream projects, including the Abadi and Kutei North Hub, are progressing steadily, with FID expected in the coming years. Additionally, exploration activity is projected to rise as operators prepare for new drilling campaigns, with several companies across Southeast Asia having already secured drillships.

Licensing rounds throughout 2025 and 2026 across Malaysia, Indonesia, Brunei, Thailand, Pakistan, India, Vietnam and Bangladesh are expected to spur further exploration, feeding into future field development projects. Rising gas demand is fuelling new midstream infrastructure projects, with countries including Vietnam and Indonesia aiming to convert power plants to gas-fired plants. Governments are ramping up incentives for the industry to accelerate this shift.

Other nations have also fast-tracked LNG-to-power targets, though many projects still face investment hurdles. While cost pressures remain a challenge, the region’s robust project pipeline and strong government backing suggest sustained growth ahead.

The growing incorporation of CCS technologies is becoming a trend in the power sector, in line with decarbonisation targets

Power sector shifts for coal, gas and carbon capture

From coal-heavy Asia Pacific to gas-driven North America and Europe’s shift toward carbon capture, regional choices reveal the competing pressures of energy demand, security and decarbonisation goals

BY AIMI TERMIZI, RESEARCH ANALYST, EIC KUALA LUMPUR

The Asia Pacific region remainsthe global leader in new power projects, recording 28 power projects reaching final investment decision (FID) between 2023 to 2025. These developments represent a total CAPEX of US$31.18bn.

Asia Pacific leads the charge India stands out as the single largest contributor globally, with nine projectsworth US$17.94bn. India’s high CAPEX is largely driven by significant investment in large-scale coal-fired power plants.

One example is the 800MW Darlipali Coal Power Plant Stage 2, which secured FID in September 2024 with an investment of US$1.27bn. The country continues to depend heavily on coal, which remains the backbone of its electricity generation. The reliance towards coal is largely due to the

US$2.3BN

U US $ 2.3B N

growing industrial and commercial activity that has significantly increased electricity demand.

To meet the surging demand, the government has instructed power producers to accelerate coal capacity additions, delay retirements and procure US$33bn of additional equipment to maintain and expand coal-based generation until 2030.

The country may increasingly rely on coal plants to offset potential energy deficits, especially during nighttime hours when solar generation drops and during its annual summer monsoon, when wind outputs are lower.

North America’s gas buildout

North America saw 24 projects reach FID between 2023 and 2025, totalling US$14.05bn. The US leads with 18 projects worth US$11.3bn in CAPEX, followed by Mexico with four projects worth US$2.15bn.

Most of these projects are gas-fired developments, particularly combinedcycle gas turbine plants, reflecting both the need for grid flexibility and the gradual retirement of coal units. While gas-fired power plants do not directly qualify for renewable generation tax credits, the Inflation Reduction Act offers indirect benefits that can enhance project viability.

Gas-fired power plants that integrate carbon capture and storage (CCS) can qualify for the 45Q tax credit. Moreover, surging electricity demand from technology sectors including data centres and the abundance of domestic natural gas are expected to sustain the region’s gas buildout in the near term.

Europe focuses on carbon capture Europe has nine power projects moving forward, with a total CAPEX of US$6.04bn. The growing incorporation of CCS technologies is becoming a trend in the power sector, in line with decarbonisation targets. Many new gas-fired power projects are being developed with integrated CCS capabilities, and several existing plants are being retrofitted to reduce emissions while maintaining grid reliability.

Notably, the UK’s Net Zero Teesside Power project, part of the East Coast Cluster, reached FID in December 2024. The project will generate up to 742MW of electricity from natural gas and will have CCS technologies incorporated on site.

While Europe ranks third globally in terms of number of projects reaching FID, the region continues to face hurdles such as complex permitting procedures, high regulatory standards and slower approval timelines that may affect project execution.

US$300M

Source: EICDataStream, July 2025

China leads the way for SMR deployment, with five projects moving forward, three of which are under construction and set to be in operation by 2030

NUCLEAR RENAISSANCE

Powering up: Nuclear on the move

Nuclear power is accelerating worldwide as nations pursue energy security, decarbonisation and rising electricity demand. While the number of projects getting the green light remains modest, growth signals opportunities across regions and technologies

BY JACK BOGGIS, ENERGY ANALYST, EIC LONDON

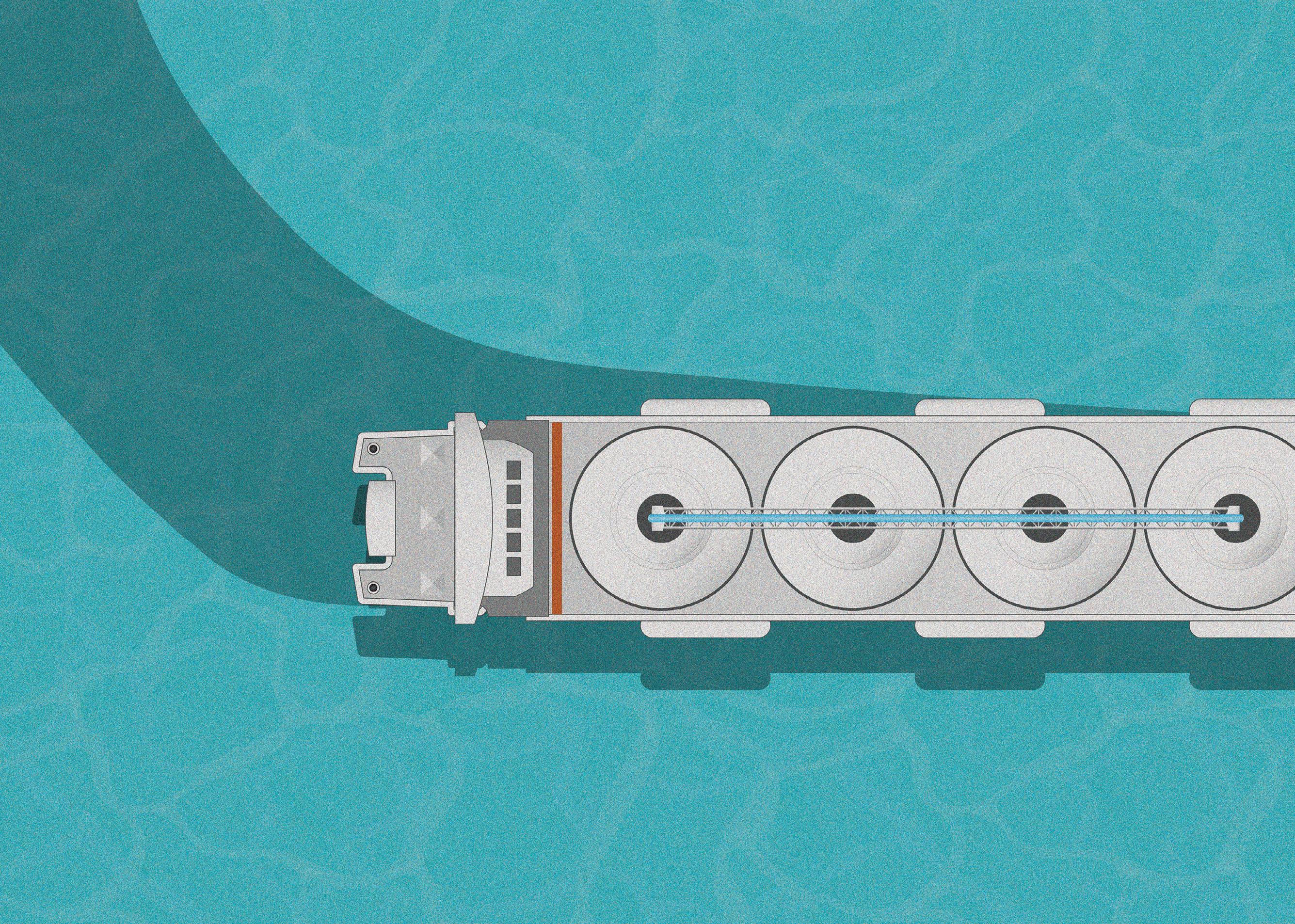

The Asia Pacific region is a major nuclear market, with five projects reaching final investment decision (FID) since 2023. China and India account for two projects each, Pakistan one. These will deliver a combined 8.7GW of power at an estimated US$19.5bn CAPEX, largely as expansions to existing plants. All three countries are looking to expand their nuclear power capacity, with China aiming for 200GW by 2040, India 100GW by 2047 and Pakistan 40GW by 2050.

Asia Pacific leads the charge

The Asia Pacific region is stepping up efforts to deploy nuclear power, with Indonesia, the Philippines and Malaysia all looking at constructing their first nuclear reactors. Malaysia has launched a feasibility study to assess nuclear’s role in its future energy mix. Small modular reactors (SMRs) are gaining traction, with 14 projects under development across the region. China leads the way for SMR deployment, with five projects moving forward, three of which are under construction and set to be in operation by 2030. South Korea follows, with three projects in the early stages of development.

US$8.8BN

US$7.7BN

US$1BN

2 4 5 3

Nuclear power in the Asia Pacific region is poised to grow significantly in the coming decades, driven by surging electricity demand, decarbonisation goals and the pursuit of long-term energy security and resilience.

North America focuses on SMRs

North America has seen one project reach FID since 2023: Canada’s four BWRX-300 units, producing 1.2GW of power, will be developed by Ontario Power Generation at a cost of US$15.1bn.

The region is expanding nuclear power development, with SMRs at the forefront of the growth. Currently 23 SMR projects are proposed: seven in Canada and 16 in the US. President Trump has expressed his fondness for nuclear, signing executive orders to quadruple capacity by 2050 from the current 96GW in operation. However, many experts have said this is highly unlikely to be achieved. The Department of Energy is also working with developers on 11 advanced reactor projects, announced as part of the nation’s Nuclear Reactor Pilot Program, to progress the technologies towards operation.

The growth of AI has seen an unprecedented surge in data centre deployment – and with it, a massive rise in electricity demand. SMRs are touted as a solution to meet this demand due to their smaller scale, flexibility and near-constant power. Companies, including Google and Equinix, a major data centre developer, are already signing power purchase agreements to use electricity generated by various SMR projects in the US.

Europe divided on nuclear’s future Since 2023, Europe has seen two projects reach FID: Türkiye’s 4.8GW Akkuyu nuclear power plant, the nation’s first, and the UK’s 3.2GW Sizewell C nuclear power plant. Together, these projects represent a combined CAPEX of around US$71bn. Unit 1 of Akkuyu is nearing completion, having

entered the commissioning phase, with preparations underway to connect it to Türkiye’s power transmission system.

Europe’s nuclear outlook contrasts with other regions. Several nations – including Italy, Denmark and Germany – have phased it out of their energy mix, and Spain is looking to shut down remaining reactors by 2035, although its nuclear operators are pressing for a rethink. In February 2025, the country’s nuclear industry called for a review of the phaseout plan, and the Iberian Peninsula blackout in April is likely to influence the alteration of this plan. At the same time, new entrants are moving forward. Poland and Estonia, both lacking nuclear infrastructure, are targeting their first nuclear power plants within the next decade. Estonia plans to install two BWRX-300 reactors, while Poland aims to have a 3.75GW nuclear plant and nine SMR projects in operation by 2036.

The road ahead

A nuclear renaissance is underway. While the volume of projects reaching the FID remains low, the trajectory points upwards, with supply chain opportunities growing globally. EIC sees supply chain opportunities in emerging regions such as the Middle East as it starts to make its mark in nuclear – the UAE is looking to construct its second large nuclear power plant, while Saudi Arabia is pursuing 17.6GW by 2040 under its Vision 2030 strategy.

Nuclear power is expected to expand in the coming decades, propelled by the drive to cut carbon emissions and secure reliable, long-term energy supplies. From Asia Pacific’s mega-builds to North America’s SMR drive, Europe’s policy debates and the Middle East’s new entrants, nuclear is reclaiming its place at the centre of the global energy transition.

Can you tell us about Intertek?

Intertek is a leading Total Quality Assurance provider to industries worldwide. We go back more than 130 years, and today we reduce risk for consumers, brands and organisations in every sector around the world. With 45,000 employees across more than 1,000 locations in over 100 countries, we enable global and local companies to overcome the quality, safety and sustainability challenges they face every day.

What does Intertek do?

We go beyond testing, inspection and certification (TIC), providing our ‘ATIC’ advantage – Assurance, Testing, Inspection and Certification. Our assurance solutions help companies identify and mitigate risks, making their businesses stronger, more resilient and more sustainable. My job is to do that in the world of offshore wind,

How is a day in your role?

My role combines customerfacing work, researching new projects and supporting colleagues who want to grow their skills in this industry. We focus on specifi application areas, such as inspection of key components and equipment

MY BUSINESS

on order at a manufacturer or vendor. This is a core service provided by the division in which I work. We work closely with customers’ operations and maintenance teams to inspect critical areas such as offshore wind farm foundations, assessing weld quality, corrosion and marine growth. Our services are wideranging, and assembling expert teams to deliver them makes each day unique.

I run an in-house offshore wind working group, and it’s rewarding to see more colleagues joining to help the company unlock its potential in specialist inspection services. The role involves frequent travel, which I enjoy – especially offshore site work. There’s always something new to learn; lately, I’ve been exploring microbiologically-influenced

Offshore Wind Strategic Development Lead

Richard Sargeant takes Energy Focus behind the scenes at Intertek

corrosion in wind farm foundations.

What’s your favourite part of working at Intertek?

The customers. I’ve worked in offshore wind for years and it’s one of the friendliest, most collaborative industries there is, with common goals and genuine enthusiasm to solve some of the world’s biggest challenges: energy production and environmental conservation.

What is one of Intertek’s strengths?

Our global network of technical personnel. I’m the in-house subject matter expert for offshore wind and am lucky to have exceptionally knowledgeable colleagues to call on around the world. The expertise and experience that our global team have collected is incredible. That translates to peace of mind for our customers.

What makes you excited about your work?

ills in n specific inspection quipment c unpredictabili complexit or subsea ma

Richard Sargeant

r sk on as d eq olleagues scenes at e off cha ity ies ke m as str set on age en my er s to es w on whe ers or b ing is h

Issues such and as involves enviro avifauna mana bottlenecks. I m and I can bett issu I also like de – w p everythi the customer co hic lo op teamsto re y ch I osely perations eamsto