Welcome to Oil & Gas Asia.

It’s always a pleasure to welcome the global energy community to the beautiful city of Kuala Lumpur – a vibrant hub for innovation, collaboration and opportunity in the ASEAN and wider APAC region. Oil & Gas Asia is a highlight in the annual calendar and this year promises to be no exception.

Stuart Broadley

We are proud to once again host the sold-out UK and EIC pavilion at the heart of the action. Our longstanding and lose partnership with the show organisers, Informa Markets, spans many years and we’re excited to be part of this year’s theme: Powering Progress, Shaping Tomorrow –a timely and vital conversation for the future of the industry.

Oil & Gas Asia (OGA) presents an ideal platform for attendees to meet key decision makers from national and international oil and gas companies and the wide network of stakeholders involved in the regions’ diverse energy spectrum of technologies; and at the same time to attain current and relevant information on the trends, energy policies, trading opportunities and net zero targets that are prevalent in the region.

Billed as the region’s number one oil and gas exhibition, last year’s OGA 2024 marked its milestone 20th edition, achieving remarkable success:

• 36,260 attendees representing 70 countries.

• 1,142 participating companies from 40 nations.

• US$52,048,837 in business potential generated.

This three-day event attracted a diverse range of professional visitors, offering unparalleled networking and business opportunities.

Since our founding in 1943, the EIC has proudly supported members across the global energy value chain. APAC remains a vital and strategic market for us, a commitment reinforced by the team of nearly forty professionals we employ here in the region.

We invite you to visit the UK and EIC pavilion to meet our team, connect with our exhibitors and discover how we’re helping companies navigate and thrive in today’s global energy market.

Thank you for being part of Oil & Gas Asia 2025. We hope you have a fantastic and successful show.

Stuart Broadley CEO, EIC stuart.broadley@the-eic.com

Hydrogen Technology Expo Europe | Hamburg, Germany | UK & EIC Pavilion 21 - 23 October 2025

ADIPEC | Abu Dhabi, UAE | UK & EIC Pavilion

3 - 6 November 2025

World Nuclear Exhibition (WNE) | Paris, France | UK & EIC Pavilion

4 - 6 November 2025

Trade Delegation to Mozambique | Delegation 24 - 27 November 2025

Trade Delegation to Guyana | Delegation 8-12 December 2025

World Future Energy Summit (WFES) | Abu Dhabi, UAE | UK & EIC Pavilion 13-15 January 2026

Hyvolution | Paris, France| UK & EIC Pavilion 27-29 January 2026

Trade Delegation to Chile | Delegation 26-30 January 2026

India Energy Week | Goa India | UK Pavilion 27-30 January 2026

Trade Delegation to Angola | Delegation 23-27 February 2026

Wind Expo Japan | Tokyo Japan | UK & EIC Pavilion 17-19 March 2026

CIPPE | Beijing, China | UK & EIC Pavilion 26-28 March 2026

Offshore Technology Conference (OTC) | Houston USA | UK & EIC Pavilion 4-7 May 2026

Trade Delegation to Nigeria | Delegation 11-15 May 2026

OPES | Muscat Oman | UK & EIC Pavilion 18-20 May 2026

ONS | Stavanger, Norway | UK & EIC Pavilion 24-27 August 2026

WindEnergy Hamburg | Hamburg Germany | UK & EIC Pavilion 22-25 September 2026

ROG e | Rio de Janeiro, Brazil | UK & EIC Pavilion September 2026

Please note that the list is not final If you think there are any events we should attend, please contact the team

with Camilla Tew Director, EIC International Trade

September hails the start of a busy season for the International Trade team. We start the month with two shows in one week: Oil & Gas Asia in Kuala Lumpur and Offshore Europe in Aberdeen.

The EIC is delighted to once again be hosting the UK and EIC pavilion at OGA 2025, taking place on 2-4 September in Kuala Lumpur

Organised by the Energy Industries Council (EIC), Oil & Gas Asia (OGA) presents an ideal ground for oil and gas stakeholders to meet key decision makers from national and international oil companies and at the same time attain current and relevant information on the trends, technology and solutions of the industry.

Over the years, Malaysia has strategically strengthened its role in supporting the oil and gas value chain, both domestically and regionally. This aligns with the country’s goal of becoming a regional oil and gas hub. As the secondlargest oil producer in south east Asia and the fifth-largest global LNG exporter, Malaysia plays a key role in the industry. In the APAC region, the oil and gas sector is projected to see US$852bn in investments by 2030.

Alongside this thriving oil and gas industry, the APAC region’s offshore wind market has gained momentum, supported by substantial investments that are expected to reach a CAPEX of US$222bn by 2030. In addition, the APAC region is accelerating its energy transition with investments in carbon capture and hydrogen, with 280 projects planned by 2030 – 71 in carbon capture and 209 in hydrogen.

The EIC and UK pavilion is a launchpad for companies looking to build global relationships, showcase their expertise and tap into new markets. We are pleased to welcome 11 companies into the pavilion this year. To find out more about companies exhibiting within the pavilion see page 6 of this edition of Inside Energy.

Located in Hall 5, the pavilion is a vibrant space for connection and collaboration, offering:

• Guided pavilion tours highlighting key exhibitors.

• Eye-catching branded stands to attract attention.

• Tailored one-to-one meetings with EPC contractors.

• Country-specific meet-ups.

• Access to the private group lounge.

Don’t miss:

Tuesday 2 September 5:30pm-8:30pm DEEPBLUE at THE FACE Suites

Last year, we welcomed over 300 industry professionals, and this year we’re taking it to the next level. With expanded attendance and participation from OGA 2025 exhibitors, delegates and more, enhanced networking opportunities and a truly unforgettable evening in store, this is your opportunity to connect, collaborate and forge lasting relationships with energy leaders and key stakeholders from both the local and global energy sectors – all in one dynamic night.

Invite your colleagues, partners and industry friends – the more connections, the better. Let’s make this third edition the best one yet.

For more details:

Email apac-events@the-eic.com

Tel +601 1 2875 0115 (Nayli, Event Co-ordinator)

We welcome you to come and see us and meet the group in Hall 5 at OGA 2025.

Meet the UK & EIC Pavilion

Exhibitors

SUPPORTING PARTNER

MEDIA PARTNER

Company Name

Air Liquide 5207A

Combilift 5310

Dawson Construction Plant Ltd 5203

E2S WARNING SIGNALS

Fire & Gas Detection

Technologies Inc. 5206

HI-FORCE LIMITED 5204

IK Trax 5201

Offshore Hire & Services (OHS) 5207B

Portwest 5205

Safelift Offshore 5210

Equipment Rental, Equipment Rental/Supply, Industrial gases, Well services contractors

Heavy Lift, Machinery/plant design and manufacture, Warehousing/logistics

Equipment manufacture, Equipment Rental, Marine/ Subsea equipment (Umbilicals, Risers, Manifolds)

Equipment, Equipment Manufacture

Safety Systems, Safety Equipment

Equipment manufacture, Heavy Lift, Equipment Rental/Supply, Training

Equipment manufacture

Equipment Rental/Supply, Well Service Contractors, Cryogenic Equipment Rental

Access, Equipment manufacture, Safety Equipment, Testing, Certifications & Documentation Vulcanic 5209

Compressor design and manufacture, FPSO unit (Vessel, Topside design and manufacture), Equipment manufacture, Static Equipment

Electrical Hetaer

ZOK International Group Ltd 5309

FX PAYMENT PARTNER

www.corpay.com

Drilling and well equipment design and manufacture, Cyber Security, Machinery/plant design and manufacture, Digital Services / Data monitoring, Industrial Ethernet Solutions, Remote access, Data monitoring

Corpay Cross-Border Solutions is a global leader in Global Payments and FX Risk Management solutions, helping companies protect their bottom line whilst managing their FX exposure.

Corpay can help you:

• Make your payment processes more efficient

• Reduce expenses associated with errors on international business payments

• Give you greater visibility and control over your international business payments

Are you up to date on the latest project developments in the energy market?

The EIC’s leading market intelligence database – EICDataStream – contains information on energy projects and associated contracting activity from the inception stage all the way through to construction and commissioning.

• Access details on over 16,000 CAPEX projects across all energy sectors

• Identify business opportunities and inform your business development strategies

• Explore a truly global database, updated daily by an international team of analysts

• Stay up to date with project developments, including information on tenders and awards

• Get insights into what your existing clients are doing and identify potential new clients

• Have a direct interface with analysts for local knowledge and insights

• Access insight and country reports with in-depth data on specific sectors and markets

by Muhammad Ekrahm EIC Energy Analyst, Asia Pacific – Hydrogen and CCS

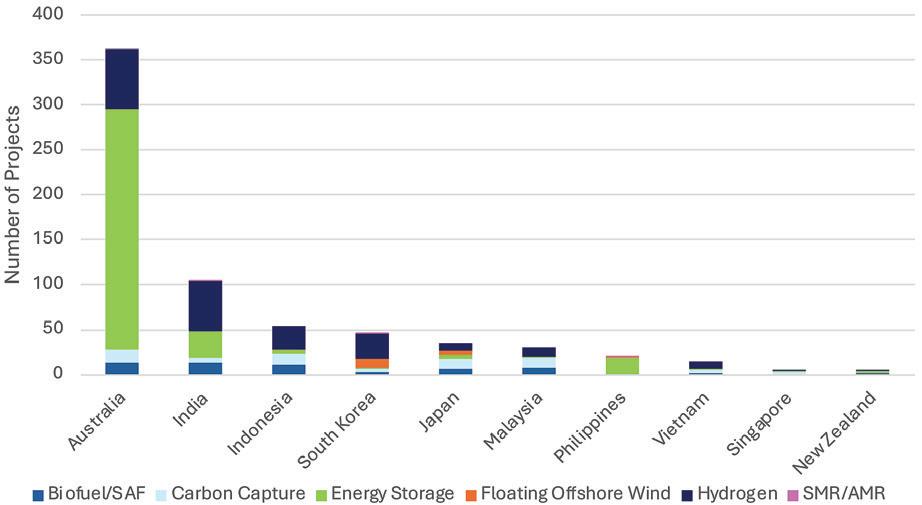

Figure 1: New project announcements since 2020 in Asia Pacific. Source: EICDataStream

EICDataStream tracks over 3,400 projects in the region as of June 2025. Mature renewables and energy transition account for 67%, reflecting a regional pivot towards clean energy such as solar, wind, hydrogen, carbon capture, energy storage and biofuels. Project announcements for the energy transition doubled, rising from 146 in 2023 to 313 in 2024. This growth surpasses the number of projects in the oil and gas sector, signalling growing momentum towards decarbonisation strategies. However, despite the focus on clean energy, conventional power project announcements in the first half of 2025 have nearly matched the total announced in 2024. This trend is largely driven by new projects in China and India, where governments are responding to rising electricity demand from the rapid expansion of data centres and ensuring stable electricity supply. In addition, the oil and gas sector has remained relatively stable. This is due to continued LNG demand and energy security efforts across major producing countries.

The region presents a total of US$2.87tn in potential investment across all energy sectors by 2031. Renewables represent the largest share of CAPEX at 21.6%, driven mainly by solar and wind. This growth is key to support the region’s hydrogen ambitions, as scaling renewables will be essential to achieving green hydrogen production goals. Downstream oil and gas follows closely at 17.3%, driven by investments in refining and petrochemical projects in key markets such as India, China and Indonesia. Nuclear new-builds represent 8.4% of CAPEX, highlighting growing interest in nuclear, particularly in China and India where project pipelines are expanding.

Source: EICDataStream

Figure 3 highlights India and China are leading the capital investments with an estimated CAPEX of over US$600bn each by 2031, followed by Australia (US$533bn) and Indonesia (US$324bn). India, China and Indonesia have some of the highest planned investments in oil and gas and despite the growing interest in clean energy the sector will remain a crucial part of the countries’ energy mix for many years to come. Beyond oil and gas, India is also seeing strong growth in renewables and energy transition, with total CAPEX of nearly US$306bn. China continues to invest in large-scale nuclear with an anticipated CAPEX of US$179bn. In Australia, investment of US$362bn is expected for renewables and energy transition, aligning with its strategy to become a major clean energy exporter. Indonesia has announced plans to reach 87% renewables in its energy mix by 2060. However, progress is being held back by challenges related to finance, policy and infrastructure. This is reflected in the relatively low expected investment in renewables, which stands at US$73bn, 22% of the country’s total CAPEX.

Oil and gas opportunities (2025-2031)

Figure 4: Oil and gas project opportunities in Asia Pacific by 2031. Source: EICDataStream

Figure 4 shows the opportunities in the oil and gas sector for projects that are expected to come online from 2025 until 2031. Overall CAPEX of the sector is US$917.2bn and this includes US$232.7bn in upstream, US$189bn in midstream and US$495bn in downstream. In the upstream sector, field development activities have been gaining momentum with an estimated US$189bn in investment expected by 2031. Major projects such as Indonesia’s Abadi and Malaysia’s Siakap NorthPetai Phase II are progressing, with both projects expected to reach FID. The region is also seeing a number of bid rounds being announced in countries such as Malaysia, Indonesia, Brunei, Thailand, Pakistan, India, Vietnam and Bangladesh. This signals a likely increase in exploration as operators prepare for new drilling campaigns. In addition, governments in the region are stepping up plans to support future gas demand. In Malaysia, Petronas is leading the development of a third regasification terminal in Peninsular Malaysia, while private proposals are being planned in Kedah and Terengganu. Indonesia is rolling out midstream infrastructure to back PT PLN’s shift from diesel to gas-fired power. Vietnam has fast-tracked LNG-to-power timelines, although many projects are still looking for investors.

Value and number of projects that could reach FID in 2025 & 2026

The future looks relatively buoyant for the sector. Based on figure 5, around 50 projects across the sector could reach FID between now and the end of 2026. These projects would see an estimated US$118bn of investment into the sectors, highlighting that the oil and gas sector remains attractive.

Figure 6: Project updates in APAC for oil and gas sector. Source: EICDataStream

Tuban Refinery and Petrochemical Complex (Pertamina): PT Kilang Pertamina Internasional (KPI) has confirmed that Rosneft is currently working to finalise the FID process, which is targeted for completion by Q4 2025. The EPC tender will commence once the FID has been reached. The tendering process will be conducted by KPI.

Abadi LNG Project: INPEX has opened a tender to look for independent project management consultancy (PMC) services to support the FEED phase. The PMC scope may include supervising the FEED activities, reviewing the FEED results and providing recommendations on technical matters such as technology selection, total cost of ownership and scheduling.

Block SK410B – Lang Lebah Gas Discovery:

The FEED tender is expected to be launched by Q4 2025 with the award of FEED tender anticipated by Q2 2026. The FEED work will cover both the onshore and offshore sections and is expected to take approximately four months to complete. A new round of EPC is also expected to be launched in 2026.

Planned energy transition projects (2025-2031)

Figure 7: Top 10 countries with planned energy transition projects to 2031, excluding China. Source: EICDataStream

Australia is leading the clean energy sector with projects announced to come online by end of 2031. Future Made in Australia policy including the Battery Breakthrough Initiative was the driving factor which provides tax breaks and incentives for both hydrogen and energy storage projects.

Figure 8: Project updates in APAC region for ET sector.

Source: EICDataStream

As of June 2025, a total of 362 projects in Australia could potentially enter operations by 2031, with 73% coming from energy storage. While India is more focused on hydrogen (56 projects) despite its aggressive strategy on ramping up solar PV installations, energy storage installations are still low. Adoption of newer technology in the region is marginally slower due to slow policy movements from each country and financial constraints were seen in early Q1 2025 with an increasing number of cancellations of flagship clean hydrogen projects in Australia. The FID rate for hydrogen and carbon capture sectors in Asia Pacific remains low, at 1.3% and 14% respectively. Most of the projects that are advancing are mainly small-scale, pilot, or demonstration projects. These sectors are still in the early stages, with efforts focused on proving the technology before scaling up commercially.

Figure 8 above: Quang Tri Green Hydrogen Project: A JV between Chinese Huadian Group and Minh Quang JSC to build a US$2.4bn hydrogen project in Quang Tri province. The project is currently in feasibility stages with approval from the Vietnam government.

WAH2 Blue Ammonia Project: NH3 Clean Energy has secured funding totalling US$710,000 for the project. The funding will be utilised for progressing early workstreams and contractor engagement for front-end engineering and design (FEED), advance offtake agreements, support project financing initiatives and securing governmental approvals.

Bonaparte CCS Project: The project has been awarded Major Project Status by the Australian government.

SEA Global has been awarded the pre-FEED contract from INPEX. The scope of work will include the shore crossing, subsea CCS export pipeline offshore to the Petrel sub-basin in West Darwin, subsea infield hardware, power and control systems definition, flow assurance, relevant technology studies and scoping for the FEED phase.

Bulli Creek Battery Storage Project: Genex Power has launched a procurement process for the 775MW first stage of its Bulli Creek solar and battery project in Queensland. EPC contractor PCL Construction has finalised the procurement packages and an expression of interest (EOI) is now open for suppliers of goods and construction services.

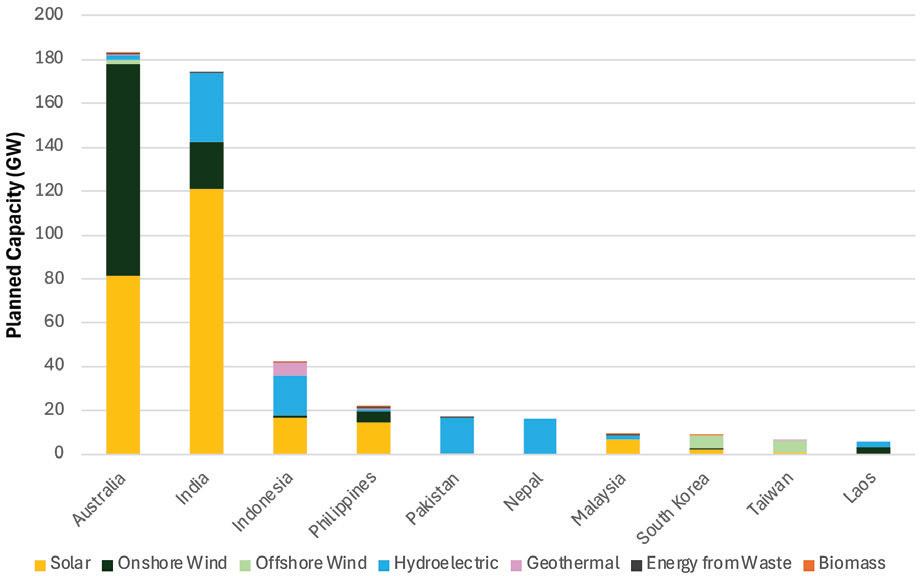

Figure 9: Top 10 countries in planned renewable capacity additions from 2025 to 2031. Source: EICDataStream

The renewable energy market is an ever-growing market and poised to be one of the fastest growing markets in the energy sector for the next decade. As of June 2025, Australia is leading the market with 183GW of planned capacity additions followed by India (173GW). Majority of the projects are solar PV installations accounting for 33.5% of the renewable capacity, followed by onshore wind at 17.3% and hydroelectric at 12.1%.

Figure 10: Project updates in APAC region for renewable sector. Source: EICDataStream

Tennant Creek Solar Farm: The project has been listed as a priority project in both state and federal governments. FID scheduled in 2027.

Dinawan Wind Farm: Dinawan Wind Stage 1 is now open for businesses to register its interest and to view available work contract packages. Power capacity has been revised to 1,200MW.

Bungaban Onshore Wind Farm: The Queensland government has granted approval for the Bungaban wind farm projects. To be developed by Windlab each will contribute 1.4GW of clean energy to the grid.

Laguna Lake Floating Solar PV Projects: SunAsia said the Department of Energy (DOE) has completed granting it the 10 solar energy operating contracts (SEOCs) to develop over 1,000MW of floating solar facilities.

EMEA: Europe, Middle East, Russia, Caspian & Africa

Americas: North, Central and South America

Asia Pacific: East Asia, Australasia, Russia and the Indian sub-continent

Price on request

Worldwide coverage of EIC products, services and facilities

If your company works in the supply chain in the global energy sector and has operations or interests in multiple continents, EIC Global Membership can help you to meet new clients and grow your business.

If your company works in the global renewable energy sector supply chain, EIC Global Renewable Energy or EIC Global Renewable with Energy Transition Memberships can help you to meet new clients and grow your business.

on request

Speak with a dedicated membership manager in what is one of the world’s largest trade associations by emailing membership@the-eic.com or scanning the QR code to find out more about membership and book a demo for our market intelligence databases.