DEEP DIVE

Vicinity Centres ON

ACKNOWLEDGEMENTS

EDITOR IN CHIEF: William Tsui

AUTHORS: Vincent Bui, Rose Sabu, Justin Qin, Hannah Hsu, Dev Punjabi, Aman Madhyastha, Kyan Nikkah

DESIGNERS: Vincent Bui, Rose Sabu, Justin Qin, Hannah Hsu, Dev Punjabi, Helen Guo

DISCLAIMER

1. The information in this free guide is provided for the purpose of education and intended to be of a factual and objective nature only. REISA makes no recommendations or opinions about any particular financial product or class thereof

2 REISA has monitored the quality of the information provided in this guide However, REISA does not make any representations or warranty about their accuracy, reliability, currency of completeness of any material in this guide.

3. Whilst REISA has made the effort to ensure the information in this guide was accurate and up to date at the time of the publication of this guide, you should exercise your own independent skill, judgement and research before relying on it. This guide is not a substitute for independent professional advice and you should obtain any appropriate professional advice relevant to your particular circumstances

4 References to other organisations are provided for your convenience REISA makes no endorsements of these organisations or any other associated organisation, product or service.

5 In some cases, the information in this guide may incorporate or summarise views, standards or recommendations of third parties or comprise material contributed by third parties (“third party material”) Such third party material is assembled in good faith, but does not necessarily reflect the views of REISA. REISA makes no representations or warranties about the accuracy, reliability, currency or completeness of any third party material

6. REISA takes no responsibility for any loss resulting from any action taken or reliance made by you on any information in this guide (including without limitation, third party material)

01 COMPANYOVERVIEW

Vicinity Centres (ASX:VCX) is an ASX-listed A$11.9 billion market cap diversified and established retail property group, with two core divisions: (1) Investment and (2) Development. The group manages retail destinations across key metropolitan markets with Vicinity being formed in 2015 following the merger of Novion Property Group and Federation Centres This combined leading retail assets to strategically redefine and develop the retail landscape across Australia. Vicinity combines direct property ownership with co-investment funds and strategic partnerships, generating income from leases and management fees. With strong occupancy and efficiency in leasing and operations, it aims for reliable, stable returns.

INVESTMENTARM

Vicinity Centres’ core investment strategy focuses on curating a premium, fortress-style asset portfolio in high-performing trade areas, whilst recycling capital through forward-looking acquisitions and divestments. Earnings are driven by base and turnover rents, outgoings recovery, and ancillary income streams, with additional uplift from developments, revaluations, and joint venture management. Vicinity’s strategy depicts a proactive, risk-adjusted approach to investing, evidenced by recent divestments of non-strategic assets to free up $1.0 billion of capital.

As of FY25, Vicinity Centres manages a $24 billion asset portfolio including 52 shopping centres across Australia, generating 380 million customer visits annually. Their portfolio is predominantly positioned in urban areas to maximise foot traffic, supported by increasing YoY retail occupancy rates of 99.5%. This underpins retailers’ willingness to commit despite macroeconomic and sector uncertainty and shows a stabilisation of rental income through reducing the downside risk of unoccupied GLA. Additionally, Vicinity has driven superior longterm growth through strategic divestments and the reallocation of capital toward premium retail assets, leveraging experiential shopping headwinds and contributing to $18 billion in annual retailer sales. Holistically, through a deepening concentration in fortress assets, active management, divestment strategies and conservative leverage, Vicinity is positioned to generate stable income streams with minimal risk.

DEVELOPMENTARM

Vicinity Group’s Development arm strategically focuses on renewal, expansion and reposition of premium retail and mix-use assets. Development earnings consist of development management fees, joint venture performance revenues, rental growth from redeveloped assets, and third-party partnerships Additionally Vicinity is able to overcome inflationary pressures, supply chain disruptions, and other regulatory complexities through rigorous pre-project due diligence, early market engagement, specialised teams, tailored procurement, strong governance oversight, and a robust health, safety, and wellbeing management system.

As at 30 June 2025, Vicinity manages a $2.9 billion near-term development pipeline, in conjunction with longer term mix-use opportunities. The pipeline is both expansive and diversified incorporating luxury retail expansion, entertainment and experiential repositioning, and integrating mixed-use precincts leveraging synergies to drive financial growth. Examples of projects include recently completed Market Pavillion in Chadstone, a $485 million 26,500 square metre development accommodating 60 retailers. Alternatively, Chatswood Chase further shows Vicinity's shift to premium retail as 12 iconic brands such as LVMH arising from a strategic partnership seeks to transform Chatswood Chase into northern Sydney’s fashion capital. Despite ongoing projects and elevated lost rent from developments, in FY25 Vicinity Group is still able to sustain a $918 1 million net property income, a 3 3% upside from FY24 showcasing the company’s resilience and financial discipline.

Pipeline

Development

02 INVESTMENT HIGHLIGHTS

Retail benefits from economic tailwinds and productivity growth

Retail sales, such as from jewellery and fresh food, were driven up 2.8% gathering momentum from healthier population growth, employment and income tax reductions fuelling consumption. This reflected higher sales productivity to $13,037, benefitting from stronger asset quality and strategic diversification into retail remixing and divestments.

Investment traction, value adding of $300m Bankstown Central stake

Branching into mixed-retail usage, Vicinity Centres’ development pipelines unveil their multistage scheme to value-add 1300 apartments, a hotel, childcare facilities to the 11.4ha complex to leverage prime asset positioning in the Bankstown CBD

Healthy occupancy rates outpace cost of living pressures

Benefitting from their $420m acquisition of Lake Joondalup, the conglomerate’s portfolio repositioning from suburban to mixed-use assets have improved footing for long-term leases with a total 99.5% occupancy rate.

Asset re-development opportunity reignites market exposure

Seeking to buy out the other 75% stake in Uptown Brisbane, the company’s development pipeline offers a $400m market redevelopment to address particular retail undersupplies in the area and sustain long-term leasing activity.

03 REALESTATE PORTFOLIOOVERVIEW

NotableRetailAssets

Address: Chadstone Shopping Centre, NSW

Lettable Area: 230,442 sqm Valuation: $6,926m

Rate: 4.25%

Address: Northland Shopping Centre, Preston, VIC

Lettable Area: 98,097 sqm

Valuation: $820 0m Cap Rate: 6%

Address: Queen Victoria Building, Sydney, NSW

Lettable Area: 14,242 sqm Valuation: $532 0 Cap Rate: 5 50%

Address: Queens Plaza, Brisbane, QLD

Lettable Area: 39,373 sqm Valuation: $715 0m

Rate: 5 13%

NotableRetailAssets

Address: Chatswood Chase, Chatswood, NSW (Under Redevelopment) Lettable Area: 67,557 sqm

Address: DFO Homebush, Homebush, NSW

Lettable Area: 28,035 sqm

04 FINANCIAL SUMMARY

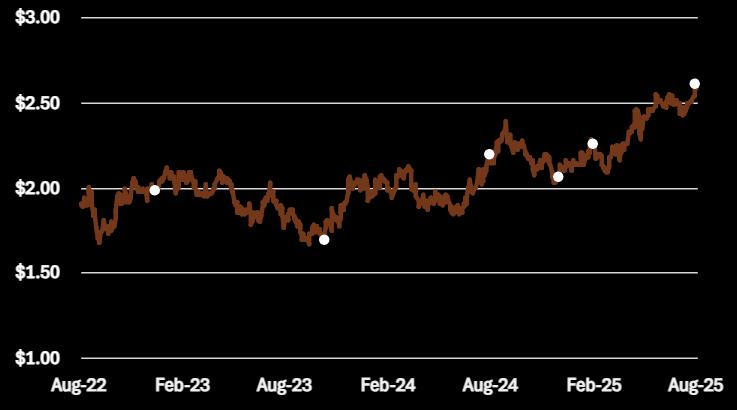

SHAREPRICEVSASX200

06 TRADINGCOMPS

Trading comparables, or “trading comps” , are a valuation method used to compare the value of a company or part of a company by comparing it to similarly publicly trading companies. The idea is similar to how real estate agents determine house prices by looking at recent listings of similar quality homes in the same area. In financial markets, analysts look at key financial ratios or metrics to gauge how a particular company is valued compared to its peers.

FUNDSMANAGEMENTCOMPS

07 INVESTMENT RISKS

Development execution risk

Vicinity has $700 in capital commitments for projects like Chadstone and Chatswood Chase, creating risk in development execution and delivery. In FY25, development related rent loss was c $34m, however this is expected to decline to c.$25m in FY26 and c.$15m in FY27.

Rising construction costs

Challenges in the construction sector include labour shortages, rising material costs, regulatory red tape and worsening labour productivity in construction, which declined by 17% over past decade. This poses significant risk to Vicinity, who has a near-term development pipeline of $2.9 billion.

E-commerce headwinds

E-commerce penetration is expected to continue to rise from 14% in 2025 to 17% by 2029. This reduces foot traffic and demand for retail space. However, this is addressed through increased capital investment into mixed use precincts and experiential retail, underpinning foot traffic and encouraging cross-spend.

Consumer spending risks

Over 75% of Vicinity’s tenants are discretionary retailers, a segment pressured by higher living costs and consumer sentiment still 15% below prepandemic levels. Structural consumer spending issues, such as high household debt in Australia, continue to dampen discretionary spending despite RBA rate cuts Elevated debt levels limit households’ capacity to increase consumption, particularly on non-essential items, and this is expected to weigh on retail sales growth over the medium term.