DEEP DIVE Abacus Group ON

ACKNOWLEDGEMENTS

EDITOR IN CHIEF: William Tsui

AUTHORS: Stephanie La, Sanuda Godakandage, Dev Punjabi, Rose Sabu, Jonathan Chen, Kobe Choy

DESIGNERS: Stephanie La, Rama Mahadik

DISCLAIMER

1. The information in this free guide is provided for the purpose of education and intended to be of a factual and objective nature only. REISA makes no recommendations or opinions about any particular financial product or class thereof

2 REISA has monitored the quality of the information provided in this guide However, REISA does not make any representations or warranty about their accuracy, reliability, currency of completeness of any material in this guide.

3. Whilst REISA has made the effort to ensure the information in this guide was accurate and up to date at the time of the publication of this guide, you should exercise your own independent skill, judgement and research before relying on it. This guide is not a substitute for independent professional advice and you should obtain any appropriate professional advice relevant to your particular circumstances

4 References to other organisations are provided for your convenience REISA makes no endorsements of these organisations or any other associated organisation, product or service.

5 In some cases, the information in this guide may incorporate or summarise views, standards or recommendations of third parties or comprise material contributed by third parties (“third party material”) Such third party material is assembled in good faith, but does not necessarily reflect the views of REISA. REISA makes no representations or warranties about the accuracy, reliability, currency or completeness of any third party material

6. REISA takes no responsibility for any loss resulting from any action taken or reliance made by you on any information in this guide (including without limitation, third party material)

01 COMPANYOVERVIEW

The ASX-listed Abacus Group (ASX:ABG) is a diversified real estate conglomerate with a $1.1 billion market cap and principal divisions: (1) industrial, (2) commercial, (3) residential and (4) retail. Spanning office and industrial assets, Abacus hosts one of Australia’s largest self-storage sectors in managing a $3.4 billion self-storage portfolio, alongside a social value creation approach through long-term ESG strategies Abacus’ bilateral presence with primary operations in Australia and presence in New Zealand is underpinned by its focus on densegrowth commercial assets in urbanising geographic areas.

INVESTMENTARM

, coupled with Abacus’ share of profits from capital partnerships and extensive investment networks. Primary drivers for Abacus’ investment performance involve collecting rental yield through enhancing occupancy and asset quality, conducive through strategic acquisitions and the active management of operational efficiencies and continual improvement in financing costs.

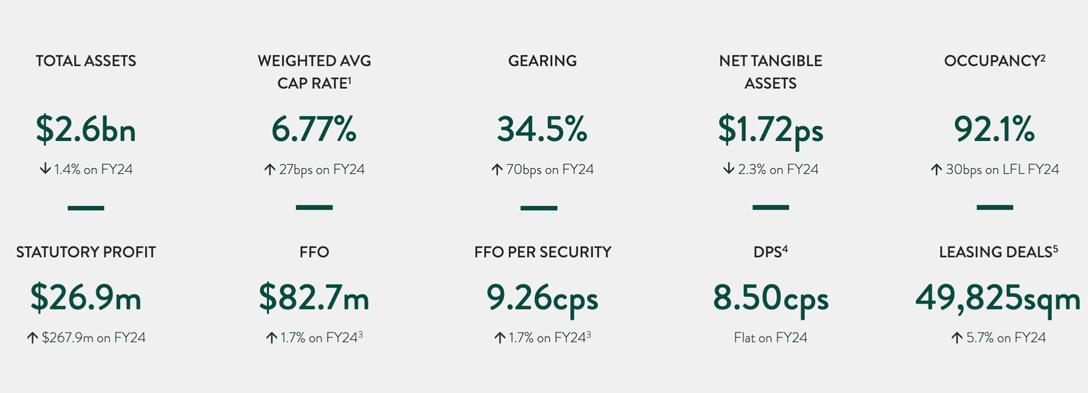

As of FY25, Abacus’ investment portfolio stands at $2.6 billion, primarily led by 56% diversification in office spaces Whilst occupancy rates are relatively high at 92.1%, coupled with a weighted average lease expiry (WALE) of 4.0 years, $1 billion worth of Abacus’s office spaces are channelled into high-growth corridors in geographic areas of Sydney and Brisbane to leverage commercial density. Abacus' long-term strategy is supported by tailwinds, including a return to office spaces and increased retail foot traffic, which are sustained by improving leasing outcomes and serve as a driver for cost control

FUNDSARM

The funds arm of Abacus includes its Funds Management and Asset Management platforms. Whilst a Funds Management platform is steered by cultivating third-party local and global capital, earnings are primarily sourced from management and performance fees Conversely, the asset management platform highlights the logistical and operational proficiency of the company’s real estate assets, with earnings generated from property management service fees.

As of FY25, Abacus’ capital partnerships and joint ventures spanning the past five years have been precise in harvesting sustainable, long-term growth and value creation across the business. Particularly, the conglomerate has crafted strategic third-party partnerships to specialise in alternative asset investment, management and social and real estate ideation crucial to the development of industrial growth. Whilst several of these Assets Under Management (AUM) are working to capitalise development margins, Abacus’ funds arm is geared towards enriching diversification in capital recycling and split strategic asset acquisition

DEVELOPMENTARM

Abacus’ development arm is closely aligned with ideation on strategic acquisition, construction and planning in urban corridors to yield growth in Australia’s chief dense markets. Particularly, development management fees, performance-related revenues from joint ventures, net project sale outcomes and net income from revaluations comprise the entirety of development earnings The key motivators of these can be attributed to the status of development projects, construction cost and management efficiencies, valuations and the accessibility of external capital to fund such development initiatives.

Since the development arm is rooted in tactical-term projects and value creation, Abacus taps into the self-storage sector - notably through their establishment of a self-storage real estate investment trust (REIT), Abacus Storage King (ASX:ASK), hosts nearly 15% of assets already funnelled into their development pipeline. Such a significant stride by Abacus not only demonstrates a shift from core plus investments to high-quality location and asset spread. In doing so, Abacus continues to capitalise on valuations rising off the back of improved rents, re-funnelled into developmental strategies

02 INVESTMENT HIGHLIGHTS

Abacus Storage Continues to Deliver Returns Post-Destapling

In 2023, Abacus streamlined its portfolio by destapling its self-storage business (Abacus Storage King) into a separate REIT, while retaining a 19.8% interest. This strategic stake contributed $16.8 million in earnings, accounting for 18% of the group’s operating earnings.

Continued Growth of the Retail Sector

Abacus Group’s retail portfolio has outperformed expectations, with operating earnings growth of $16.8 million, reflecting an 8.8% increase compared to FY24. This was driven by strong average rents of $373/sqm (up 4.1% from FY24) and maintained occupancy of 91.2%, up from 90.8% in FY24.

Strong Capital Management Focus

In FY25, Abacus maintained a gearing ratio of 34.5%, comfortably below the ceiling target of 40%. Management has indicated a future focus on balance sheet strength, with plans for potential non-core divestments, repositioning, and value-accretive leasing.

Resilient Office Portfolio with Strong Leasing Activity

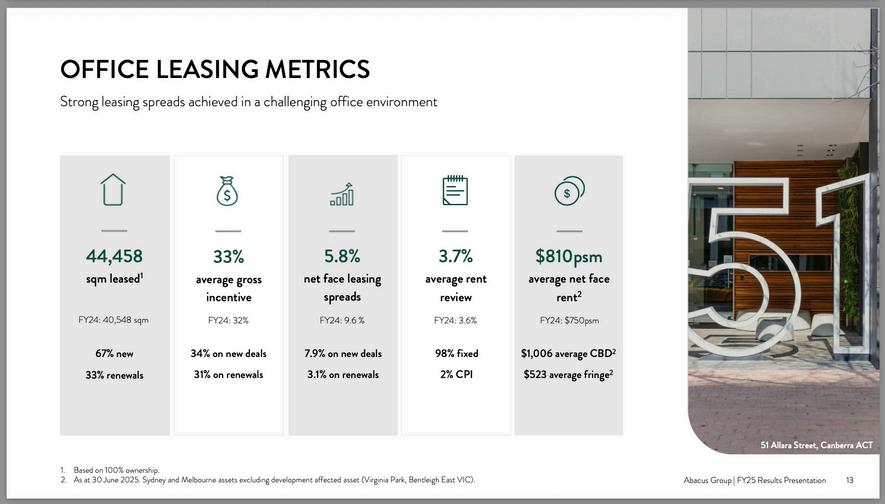

In FY25, Abacus’ office portfolio delivered 9.8% earnings growth, underpinned by strong leasing momentum with over 44,000 sqm leased at healthy net face spreads of 5.8%. Like-for-like rent growth of 4.3% further reinforced the portfolio’s resilience amidst a challenging market.

03 REALESTATE PORTFOLIOOVERVIEW

NotableOfficeAssets

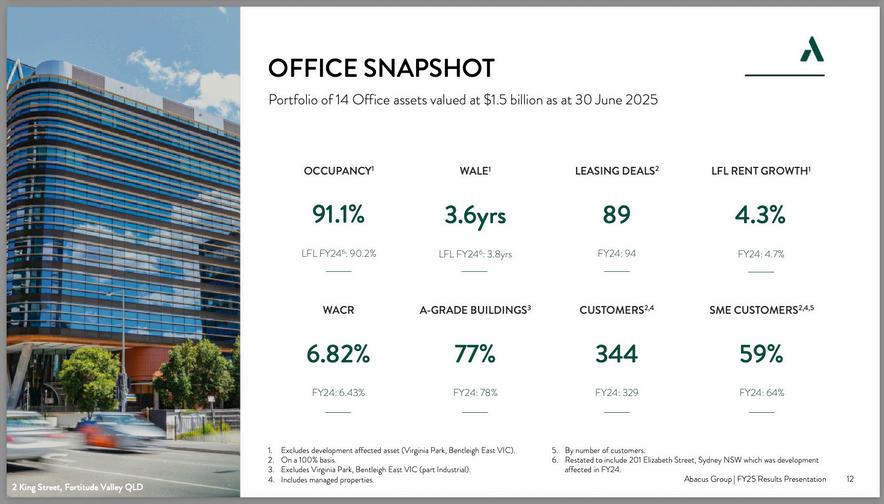

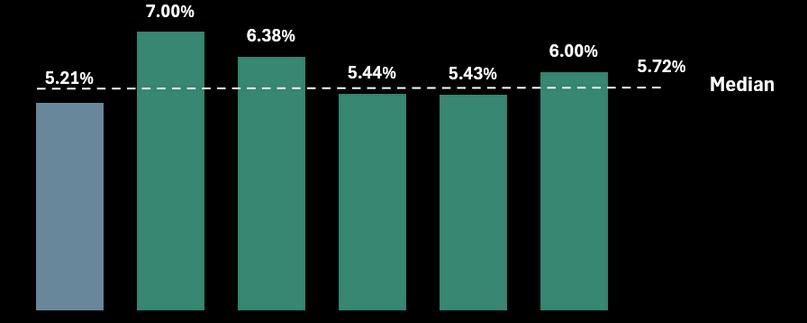

$ 1.5 billion portfolio, 14 assets, 91.1% Occupancy Rate, 6.82% WACR

Address: 201 Elizabeth Street, Sydney, NSW

Lettable Area: 37,954 sqm

Valuation: $197m

Cap Rate: 6.38%

Address: 14 Martin Place, Sydney, NSW

Lettable Area: 13,154 sqm

Valuation: $110m Cap Rate: 5 88%

Address: 324 Queen Street, Brisbane, QLD

Lettable Area: 19,292 sqm

Valuation: $141m

Cap Rate: 7 75%

Address: 459-471 Church Street, Melbourne, VIC

Lettable Area: 19,542 sqm

Valuation: $90m

Cap Rate: 6 25%

NotableOfficeAssets

Address: 99 Walker Street, North Sydney, NSW Lettable Area: 18,861

Address: 77 Castlereagh Street, Sydney, NSW

Lettable Area: 13,104 sqm Valuation: $206m

NotableRetailAssets

Address: The Oasis Broadbeach, Gold Coast, QLD

Lettable Area: 25,627 sqm Valuation: $194m

Rate: 7.00%

Address: Myer Bourke Street, Melbourne, VIC

Lettable Area: 39,923 sqm

Valuation: $225m

Rate: 6.5%% $ 0.4

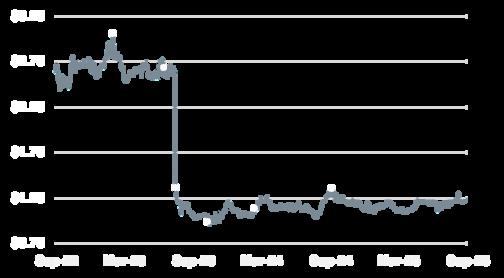

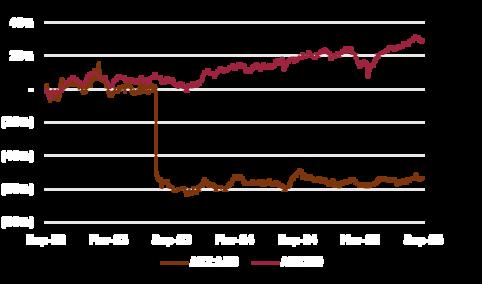

SHAREPRICEVSASX200

06 TRADINGCOMPS

Trading comparables, or “trading comps” , are a valuation method used to compare the value of a company or part of a company by comparing it to similarly publicly trading companies. The idea is similar to how real estate agents determine house prices by looking at recent listings of similar quality homes in the same area. In financial markets, analysts look at key financial ratios or metrics to gauge how a particular company is valued compared to its peers.

FUNDSMANAGEMENTCOMPS

07 INVESTMENT RISKS

Exposure to Office Sector

Abacus Group’s $1 5 billion, 14-location office holdings represent 69% of their $2.1 billion property portfolio by value and 78% by asset count. Despite demonstrably strong short-term growth, the lack of diversification amplifies structural headwinds in the office sector, particularly regarding flexible working environments.

Short Lease Expiry Risk

The relatively short WALE of 4.0 years, down from 4.3 years in FY24, is underpinned by a 3.6-year WALE in their primary office portfolio. Further, 55% of leases are set to expire before FY28, including a 9% current vacancy rate, exposing the group to more frequent re-leasing events during a period of office market uncertainty.

Elevated Financing Costs

Despite the current gearing of 34%, which sits below the ceiling target of 40%, Abacus Group’s average cost of drawn debt increased from 4.4% in FY24 to 5.1% in FY25. Other leverage metrics, such as total debt drawn and look-through gearing, also increased from FY24 baselines.

Uncertainty of Storage King Ownership

The group relies on its 19.8% strategic interest in Storage King to provide earnings of $16.8 million, equivalent to 18% of operating earnings. A recent $2.17 billion bid from Nathan Kirsh’s Ki Corporation was rejected, coinciding with a 9% share price drop in Abacus Storage King (ASX:ASK) and a 5% drop in Abacus Group (ASX:ABG).