DEEP DIVE Dexus ON

ACKNOWLEDGEMENTS

EDITOR IN CHIEF: William Tsui

AUTHORS: Kyan Nikkhah, Stephanie La, Zachary Ni, Sanuda Godakandage, Nicola Casaclang, Helen Guo, Martin Zhu

DESIGNERS: Rama Mahadik, Zachary Ni, Sanuda Godakandage, Nicola Casaclang

DISCLAIMER

1 The information in this free guide is provided for the purpose of education and intended to be of a factual and objective nature only. REISA makes no recommendations or opinions about any particular financial product or class thereof.

2. REISA has monitored the quality of the information provided in this guide. However, REISA does not make any representations or warranty about their accuracy, reliability, currency of completeness of any material in this guide.

3 Whilst REISA has made the effort to ensure the information in this guide was accurate and up to date at the time of the publication of this guide, you should exercise your own independent skill, judgement and research before relying on it This guide is not a substitute for independent professional advice and you should obtain any appropriate professional advice relevant to your particular circumstances.

4. References to other organisations are provided for your convenience. REISA makes no endorsements of these organisations or any other associated organisation, product or service

5. In some cases, the information in this guide may incorporate or summarise views, standards or recommendations of third parties or comprise material contributed by third parties (“third party material”). Such third party material is assembled in good faith, but does not necessarily reflect the views of REISA REISA makes no representations or warranties about the accuracy, reliability, currency or completeness of any third party material.

6 REISA takes no responsibility for any loss resulting from any action taken or reliance made by you on any information in this guide (including without limitation, third party material).

Dexus is an ASX-listed ~$7.5 billion market cap Australian integrated real estate investor and manager with three main operating arms: (1) Investment, (2) Funds and (3) Development Dexus’ real estate strategy involves investing, managing and developing assets across sectors ranging from office, industrial, retail, healthcare, infrastructure, and alternatives. Dexus operates in both Australia and New Zealand, with a strong focus on Australian capital cities. (1)

INVESTMENTARM

Dexus’ Investment arm strategically manages a diversified portfolio across primarily office and industrial sectors to deliver long-term financial returns

Investment earnings consist of rental income, coupled with Dexus’ share of profits from partnerships and co-investments. Key drivers for Dexus’ investment performance include increasing asset occupancy and rental yields, enhancing asset quality through strategic acquisitions and developments, and actively managing operational efficiencies and financing costs.

As of 1H25, Dexus manages a ~$14.5 billion investment portfolio predominantly composed of office and industrial properties, with smaller allocations to retail, healthcare, infrastructure, and alternative assets through investment vehicles such as the Dexus Industria REIT (ASX: DXI). Specifically, this ranges from premium office towers to logistics and warehousing facilities, convenience retail centres, and specialised healthcare properties across key Australian markets Dexus’ assets are characterised by high occupancy rates signalling strong performance, averaging 95.7% and 93.5% across its industrial and office assets respectively.

Source: Company Filings

(

Source: Company Filings

FUNDSARM

Dexus’ Funds arm includes its Funds Management and Property Management platforms The Funds Management platform focuses on raising and managing capital from third-party domestic and international partners, with earnings primarily derived from management fees and performance fees. The Property Management platform provides operational expertise of the real estate assets within Dexus’ portfolio, generating earnings from fees for property management services

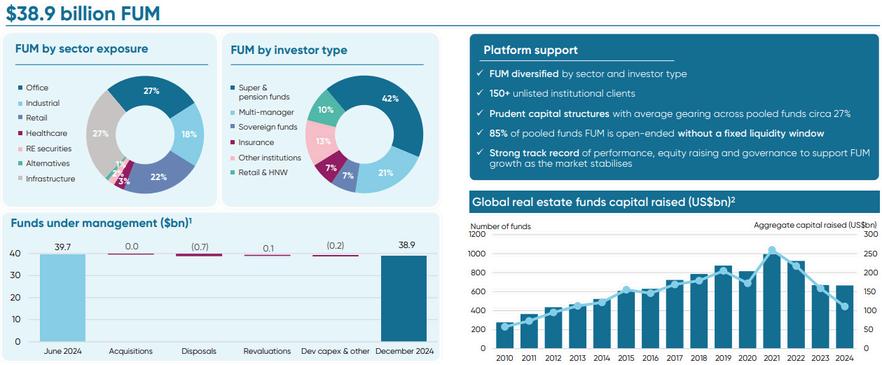

As of 1H25, Dexus’ Funds Management platform manages $38.9 billion in thirdparty capital across a diverse mix of partnerships, mandates, and joint ventures, while the Property Management platform oversees a broad range of asset types, primarily comprised of office and industrial assets. Dexus continues to attract both domestic and global capital partners through flagship vehicles, such as the Dexus Wholesale Property Fund (DWPF) and the Dexus Australian Property Fund (DAPF), supported by a reputation for high-quality, sustainable real assets in prime locations.

: Company Filings

Source: 1H25 Presentation

Source

DEVELOPMENTARM

Dexus’ Development arm strategically focuses on site acquisition, urban planning, and construction within Australia's key urban markets. Development earnings primarily derive from development management fees, performancerelated revenues from joint ventures, gains or losses from project sales, and unrealised gains or losses from property revaluations. Key drivers for development earnings include the scale of development projects, effective construction cost management, changes in property valuations, and the continued access to third-party capital partnerships to support development initiatives

As of 1H25, Dexus’ development arm oversees a pipeline valued at approximately $15.6 billion, comprising primarily industrial and office projects, alongside mixed-use and healthcare properties. Notable projects include Atlassian Central, Horizon 3023 in Melbourne’s west, and the Waterfront Brisbane precinct. Across these developments, Dexus is delivering high-quality, sustainable assets across Australia’s major urban centres

02 INVESTMENT HIGHLIGHTS

Strong

financial position through strategic

divestments

Dexus has divested $7.4 billion of assets since FY20. A further ~$2 billion are expected to be divested over the next 3 years, with $665 million in property sales across 1H25 Proceeds have reduced pro forma gearing to 31.3%.

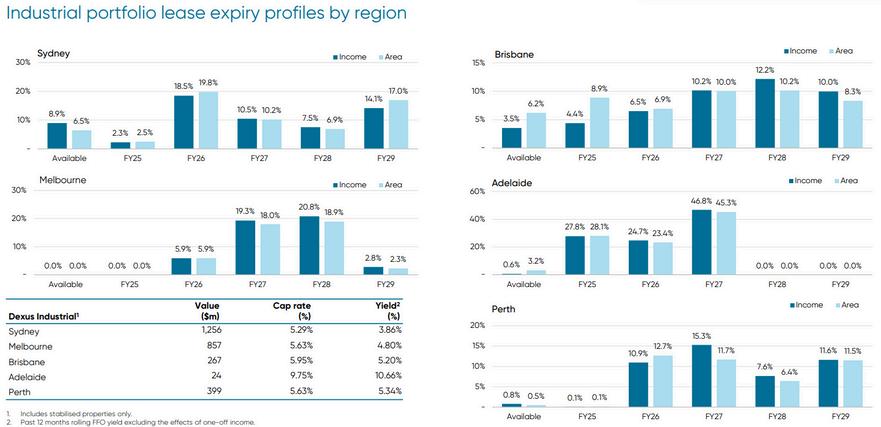

Robust industrial portfolio driven by logistics demand

Dexus’s industrial portfolio displays strong performance, with 95.7% occupancy and valuation declines of 1.4% in FY24 compared to a 3.2% decrease in the office sector. These assets are strategically located with strong tenant demand, supporting premium rents and longer WALEs

Capital recycling to capitalise on the ‘flight to quality’ trend

Since FY19, Dexus’ proportion of Prime grade assets in its office portfolio has lifted from 88% to 95%. This repositioning enhances Dexus’ appeal to blue-chip tenants seeking premium space, supporting occupancy and rental resilience amidst a challenging office market

Capital expansion despite challenging market

Dexus’s opportunistic real estate vehicle, Dexus Real Estate Partnership 2 (DREP2), has grown to around $470 million, following a $160 million raise in 1H25, indicating continued support from global institutional investors for Dexus’s active management model

03 REALESTATE PORTFOLIOOVERVIEW

Source: 1H25 Presentation

Source: 1H25 Presentation

NOTABLEOFFICEASSETS

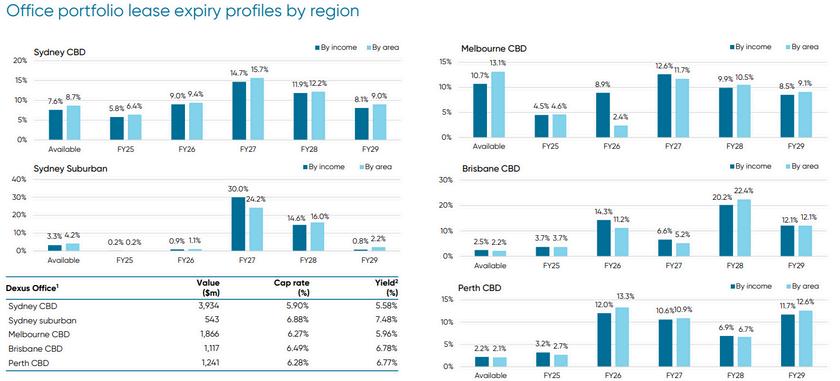

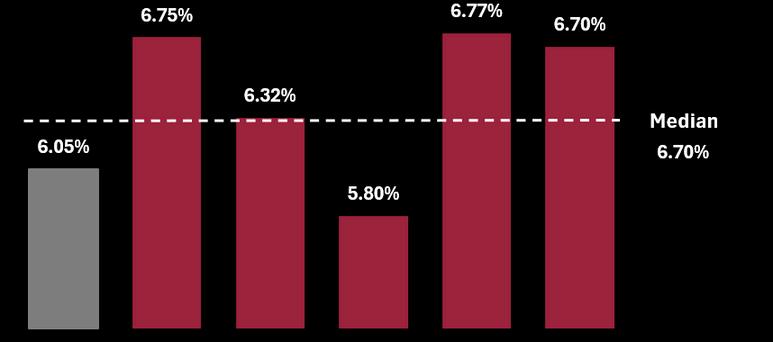

$9.6 billion portfolio; 36 properties; 93.5% occupancy; 6.17% cap rate

Address: 1 Bligh Street, Sydney

Lettable Area: 42k sqm

Valuation: $369 6million

Cap Rate: 5 50%

Address: 25 Martin Place, Sydney

Lettable Area: 79k sqm

Valuation: $836 0 million

Cap Rate: 5.94%

Address: 80 Collins Street, Melbourne

Lettable Area: 104k sqm

Valuation: $953.3 million

Cap Rate: 6.11%

Address: 240 St. Georges Terrace, Perth

Lettable Area: 47k sqm

Valuation: $538 0 million

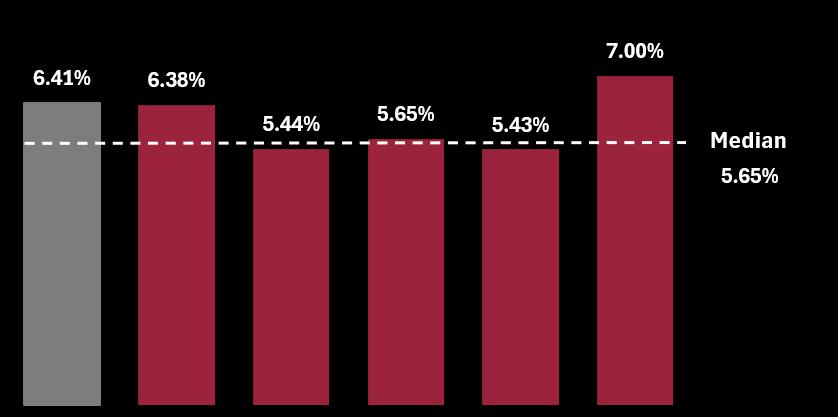

Cap Rate: 6.38%

Source: 1H25 Presentation

NOTABLEINDUSTRIALASSETS

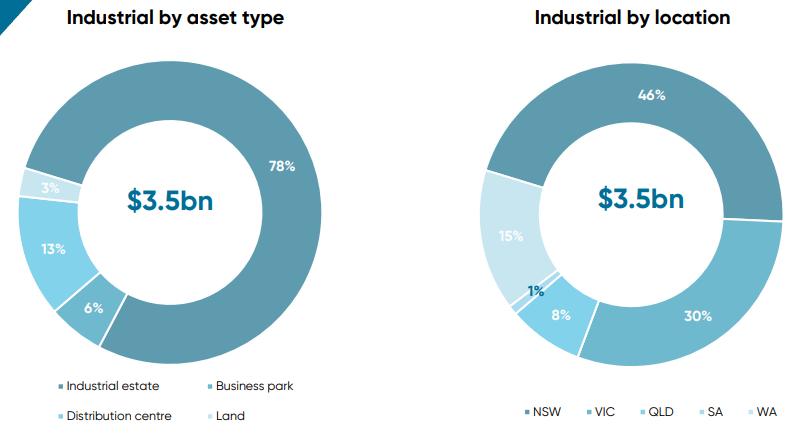

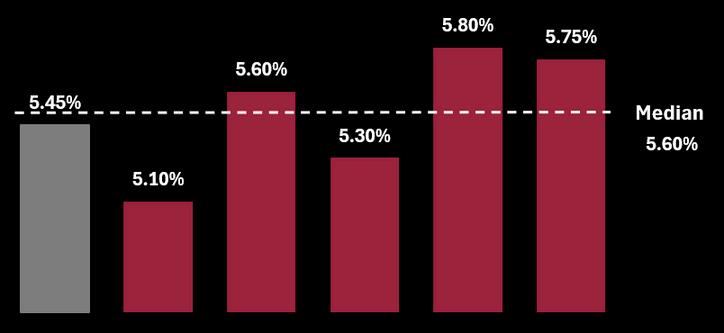

$3.5 billion portfolio; 140 properties; 95.7% occupancy; 5.54% cap rate

Address: Jandakot Airport

Size: 470k sqm

Valuation: $400 0 million

Book Cap Rate: 5 63%

Address: 62 Ferndell Street, South Granville

Size: 57k sqm

Valuation: $143 0 million

Book Cap Rate: 5 00%

Address: Kings Park Industrial Estate, Marayong

Size: 69k sqm

Valuation: $113.7 million

Book Cap Rate: 5.75%

Address: Dexus Industrial Estate, Dandenong South

Size: 79k sqm

Valuation: $93.4 million

Book Cap Rate: 5.58%

NOTABLERETAILASSETS

$9.2 billion FUM; 123 properties; 1.5 million sqm retail space

Address: Casula Mall, Casula, NSW

Size: 20k sqm

Valuation: $203 5 million

Book Cap Rate: 6 00%

Address: The Mill, Alexandria, NSW

Size: 3k sqm

Valuation: $181 0 million

Book Cap Rate: 5 63%

Address: Brickworks Ferry Road, Southport, QLD

Size: 16k sqm

Valuation: $145 0 million

Book Cap Rate: 6 00%

Address: Stud Park Shopping Centre, Rowville, VIC

Size: 25k sqm

Valuation: $141 5 million

Book Cap Rate: 6 50%

$10.9 billion FUM; 27 investments

Address: ANU Student Accommodation Size: N/A

Address: Sydney University Village

Size: N/A

Valuation

Book

Address: Macarthur Wind Farm Size: N/A

Valuation

Address: Auckland South Corrections Facility

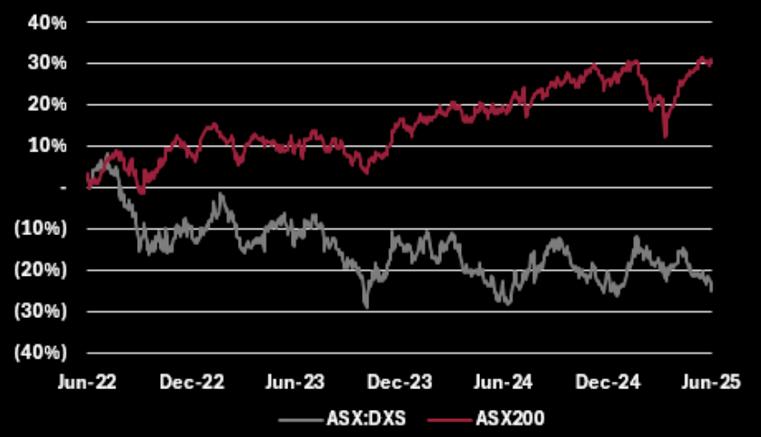

SHAREPRICEVSASX200

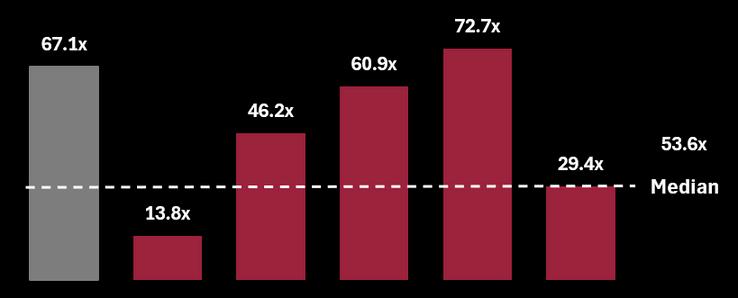

06 TRADINGCOMPS

Trading comparables, or “trading comps” , are a valuation method used to compare the value of a company or part of a company by comparing it to similarly publicly trading companies. The idea is similar to how real estate agents determine house prices by looking at recent listings of similar quality homes in the same area. In financial markets, analysts look at key financial ratios or metrics to gauge how a particular company is valued compared to its peers.

FUNDSMANAGEMENTCOMPS

07 INVESTMENT RISKS

Funding cost pressure

Higher rates have seen net finance costs increase by $16.8 million in 1H25, and management cautions that “higher funding costs are expected to impact in FY26” , compressing EBITDA and limiting distributional growth unless earnings rebound.

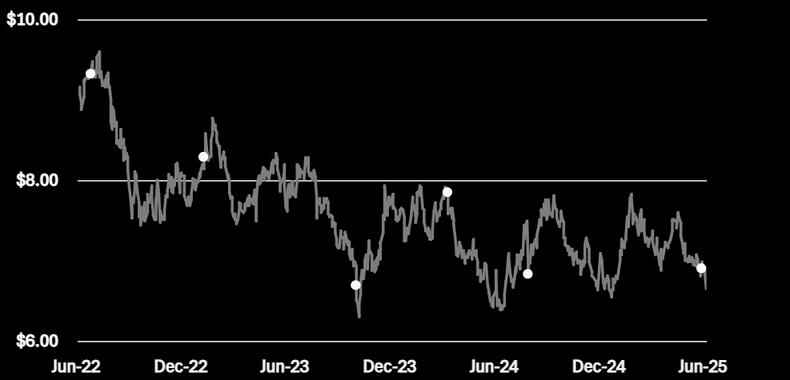

Fair-value write-downs dragging NTA

External valuations in 1H24 decreased book values by A$687 million (-4.7%), with weighted average cap rates softening +32 bp (office) / +42 bp (industrial). The slide continued in 1H25, with a further 1.6% fall in portfolio value (cap-rates +12 bp office / +9 bp industrial), dampening NTA to A$8.81.

Development pipeline execution risk

Dexus is carrying a $15.6 billion group development pipeline (1H25), with about $1 billion of committed cap-ex still to be spent before FY26 Although having entered pre-lease arrangements, any construction-cost escalation or labour shortages would compress target development yields.

Volatile fees and trading income

Group FFO fell -6.2 % YoY in 1H24, largely because lower trading profits and softer performance fees outweighed a 4.5% lift in “management operations” FFO With transaction markets subdued and performance fee hurdles harder to clear amid valuation pressure, this is likely to amplify EBITDA volatility.

REISA Sydney

REISA REISA Sydney