DEEP DIVE MIRVAC GROUP ON

ACKNOWLEDGEMENTS

EDITOR

IN CHIEF:

Samuel Yu

AUTHORS: Richard Ly, Will Tsui, David Wang

DESIGNERS: Rama Mahadik, Zachary Ni, Dev Punjabi, Kyan Nikkhah

DISCLAIMER

1 The information in this free guide is provided for the purpose of education and intended to be of a factual and objective nature only. REISA makes no recommendations or opinions about any particular financial product or class thereof.

2. REISA has monitored the quality of the information provided in this guide. However, REISA does not make any representations or warranty about their accuracy, reliability, currency of completeness of any material in this guide.

3 Whilst REISA has made the effort to ensure the information in this guide was accurate and up to date at the time of the publication of this guide, you should exercise your own independent skill, judgement and research before relying on it This guide is not a substitute for independent professional advice and you should obtain any appropriate professional advice relevant to your particular circumstances.

4. References to other organisations are provided for your convenience. REISA makes no endorsements of these organisations or any other associated organisation, product or service

5. In some cases, the information in this guide may incorporate or summarise views, standards or recommendations of third parties or comprise material contributed by third parties (“third party material”). Such third party material is assembled in good faith, but does not necessarily reflect the views of REISA REISA makes no representations or warranties about the accuracy, reliability, currency or completeness of any third party material.

6 REISA takes no responsibility for any loss resulting from any action taken or reliance made by you on any information in this guide (including without limitation, third party material).

01 COMPANYOVERVIEW

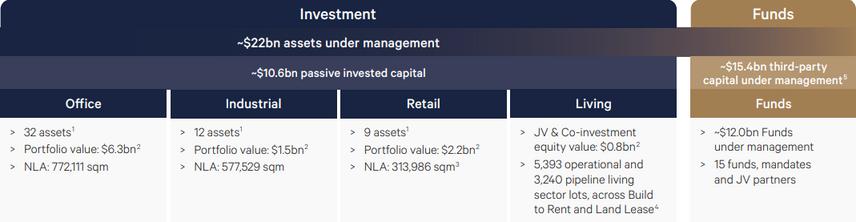

Mirvac Group is an ASX-listed ~$8.4 billion market cap Australian integrated real estate investor, developer and manager with three main operating arms: (1) Investment, (2) Funds and (3) Development Mirvac’s real estate strategy involves investing, developing and managing capital and assets across sectors ranging from living, industrial, premium CBD office, retail, and mixed-use precincts. Mirvac operates domestically with a focus on Australian capital cities.

Source: FY24 Annual Report

Notes: (1) Capital IQ as at 25 March 2025.

INVESTMENTARM

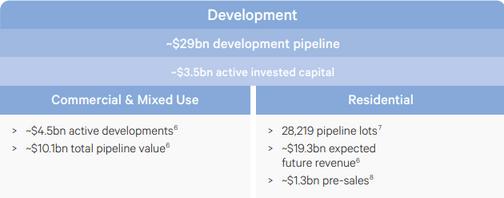

Mirvac’s Investment arm strategically manages a diversified portfolio across office, industrial, retail, and living sectors to deliver long-term financial returns. Investment earnings primarily consist of rental income, coupled with Mirvac’s share of profits from partnerships and co-investments. Key drivers for Mirvac’s investment performance include increasing asset occupancy and rental yields, enhancing asset quality through strategic acquisitions and developments, and actively managing operational efficiencies and financing costs.

As of 1H25, Mirvac manages a ~$10 3 billion investment portfolio, characterised by high occupancy rates averaging 96 2% and a weighted average lease expiry (WALE) of 5.2 years. The portfolio predominantly features premium-grade office spaces, Sydney-based industrial facilities, urban retail assets and rapidly growing presence in the living sector through build-to-rent and land lease assets.

Company Filings

FUNDSARM

Mirvac’s Funds arm includes their Funds Management and Asset Management platforms. The Funds Management platform focuses on raising and managing capital from third-party domestic and international partners where earnings are generated primarily from management fees and performance fees. The Asset Management platform provides operational expertise of the real estate assets within Mirvac’s portfolio where earnings are generated from fees for property management services.

As of 1H25, Mirvac’s Funds Management platform manages ~$16 billion in thirdparty capital, including partnerships, mandates, and joint ventures whilst the Asset Management arm oversees ~$22 billion in assets. Mirvac continues to attract domestic and international partners by leveraging its integrated development capabilities to create high quality assets that meet growing investor demand for sustainable and strategically located properties, highlighted by successful ventures such as the Mirvac Wholesale Office Fund (MWOF), Mirvac Industrial Vehicle (MIV), and the Build to Rent (LIV) Venture

DEVELOPMENTARM

Mirvac’s Development arm strategically focuses on site acquisition, urban planning, and construction within Australia's key urban markets. Development earnings primarily consist of development management fees, performancerelated revenues from joint ventures, gains or losses from project sales, and net income from property revaluations. The primary drivers for development earnings include the level of development projects, effectiveness in managing construction costs, property valuations, and the ongoing availability of third-party capital partnerships to fund development initiatives.

As of 1H25, Mirvac’s Development arm manages a pipeline valued at approximately $29 billion, consisting of commercial and mixed-use (CMU) and residential projects. Notable projects include the Aspect Industrial Estate and 55 Pitt Street in Sydney, LIV Aston in Melbourne, and significant mixed-use ventures such as Harbourside Residences. Mirvac continues to leverage its integrated model and development capabilities to capitalise on rebounding market conditions, particularly in the living and office sectors

02 INVESTMENT HIGHLIGHTS

Increased portfolio resilience achieved through disposals

Successfully executed ~$1 bn in strategic non-core asset sales over the past 18 months, freeing up capital for potential acquisitions for funds, development opportunities and boosting overall portfolio quality.

$29 bn development pipeline with strong pre-leasing commitments

Assets such as Harbourside, Sydney and Aspect Industrial Estate are 80% pre-sold and 67% pre-leased respectively showing strong demand. Looking forward, this presents opportunities for asset disposal if cash is needed given their high occupancy rates and premium positioning.

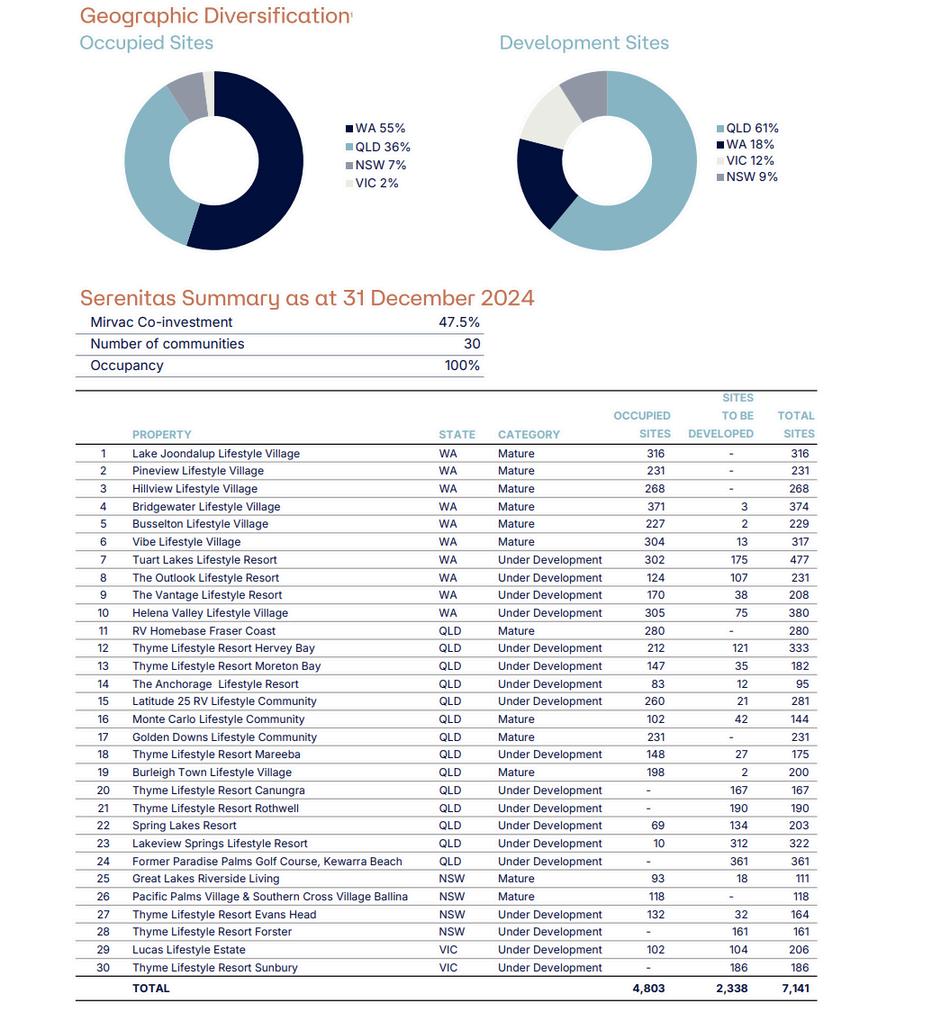

Exposure to living sector plays into Integrated Model strengths

By acquiring a 47.5% interest in Serenitas for ~$1 bn in late 2023, this provided immediate entry and scale in the land lease sector benefiting from Australia’s aging demographics and undersupply in affordable housing solutions tailored for retirees and downsizers.

Robust occupancy driven by desirable location and asset positioning

Maintained a high portfolio occupancy rate of approximately 96.2% as of 1H25, underpinned by robust leasing activity and resilient demand across its premium-grade office, industrial, retail, and living portfolios.

03 REALESTATE PORTFOLIOOVERVIEW

Source: 1H25 Property Compendium

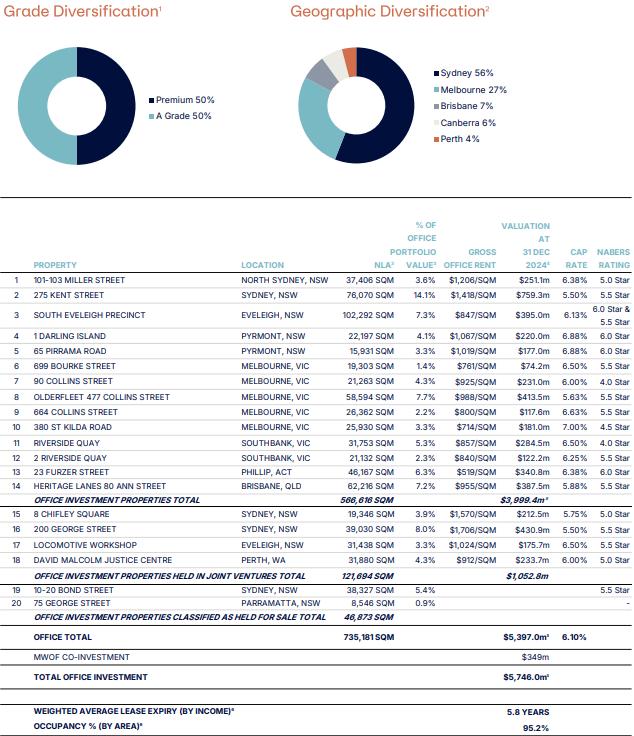

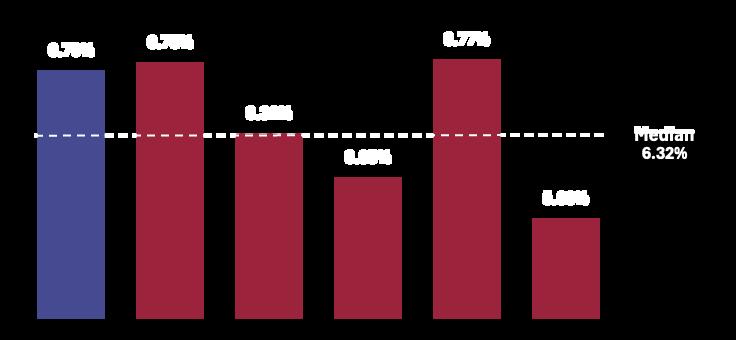

$5.4 billion portfolio; 20 properties; 95% occupancy; 6.10% cap rate

Source: 1H25 Property Compendium

NOTABLEOFFICEASSETS

$5.4 billion portfolio; 20 properties; 95% occupancy; 6.10% cap rate

Address: 275 Kent Street, Sydney, NSW

Size: 76k sqm

Valuation: $759 3 million

Book cap rate: 5 50%

Address: Olderfleet 477 Collins Street, Melbourne, VIC

Size: 59k sqm

Valuation: $413.5 million

Book cap rate: 5.63%

Address: South Eveleigh Precinct, Eveleigh, NSW

Size: 102k sqm

Valuation: $395.0 million

Book cap rate: 6.13%

Address: Heritage Lanes 80 Ann Street, Brisbane, QLD Size: 62k sqm

Valuation: $387.5 million

Book cap rate: 5.88%

INDUSTRIAL

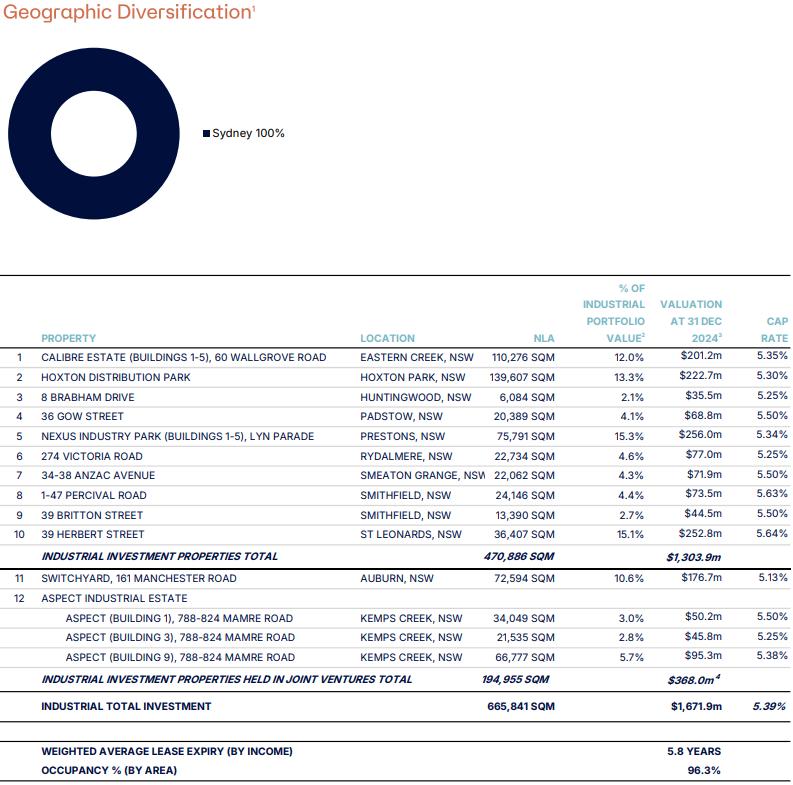

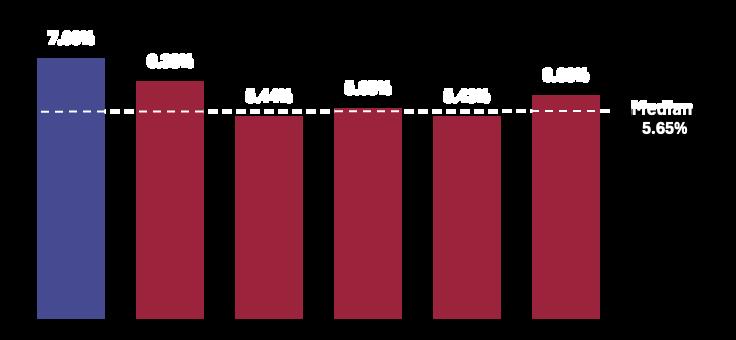

$1.7 billion portfolio; 12 properties; 96% occupancy; 5.39% cap rate

Source: 1H25 Property Compendium

NOTABLEINDUSTRIALASSETS

$1.7 billion portfolio; 12 properties; 96% occupancy; 5.39% cap rate

Address: Nexus Industry Park, Preston, NSW

Size: 76k sqm

Valuation: $256.0 million

Book cap rate: 5.34%

Address: Hoxton Distribution Park, Hoxton Park, NSW

Size: 140k sqm

Valuation: $222 7 million

Book cap rate: 5 30%

Address: 274 Victoria Road, Rydalmere, NSW

Size: 23k sqm

Valuation: $77 0 million

Book cap rate: 5 25%

Address: 39 Herbert Street, St Leonards, NSW

Size: 36k sqm

Valuation: $252 8 million

Book cap rate: 5 64%

Address: Calibre Estate (1-5), Eastern Creek, NSW

Size: 110k sqm

Valuation: $201 2 million

Book cap rate: 5 35%

Address: 1-47 Percival Road, Smithfield, NSW

Size: 24k sqm

Valuation: $73 5 million

Book cap rate: 5 63%

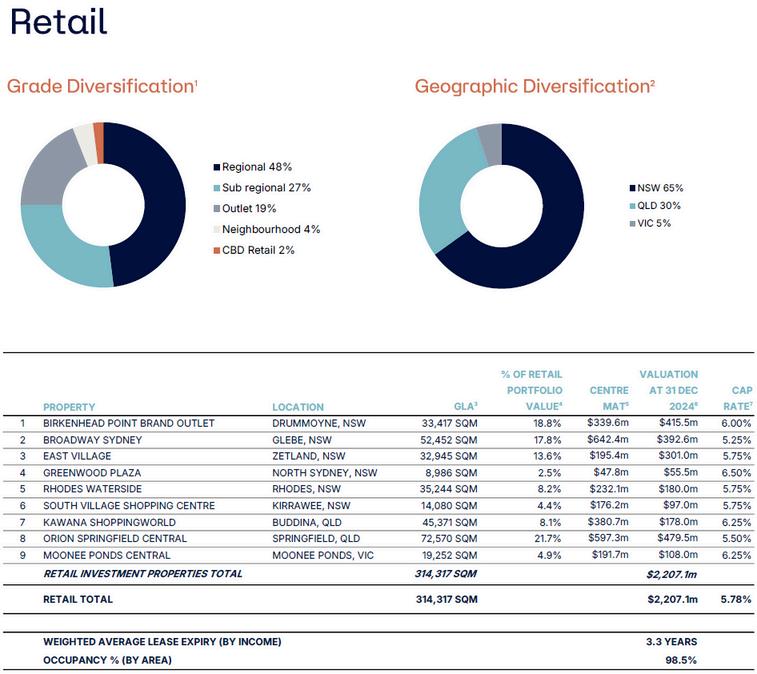

$2.2 billion portfolio; 9 properties; 99% occupancy; 5.78% cap rate

Source: 1H25 Property Compendium

NOTABLERETAILASSETS

$2.2 billion portfolio; 9 properties; 99% occupancy; 5.78% cap rate

Address: Orion Springfield Central, Springfield, QLD

Size: 73k sqm

Valuation: $479.5 million

Book cap rate: 5.50%

Address: Broadway Sydney, Glebe, NSW

Size: 52k sqm

Valuation: $392 6 million

Book cap rate: 5 25%

Address: Birkenhead Point Outlet, Drummoyne, NSW

Size: 33k sqm

Valuation: $415 5 million

Book cap rate: 6 00%

Address: East Village, Zetland, NSW

Size: 33k sqm

Valuation: $301 0 million

Book cap rate: 5 75%

Address: Rhodes Waterside, Rhodes, NSW

Size: 35k sqm

Valuation: $180 0 million

Book cap rate: 5 75%

Address: Kawana Shoppingworld, Buddina, QLD

Size: 45k sqm

Valuation: $178 0 million

Book cap rate: 6 25%

BUILDTORENT

$434 million portfolio; 3 properties; 70% occupancy; 4.25% cap rate

Asset: LIV Indigo, Sydney Olympic Park, NSW

Ownership: 44% Mirvac, 56% Unlisted Partners

Total apartments: 316

Status: Operational

Asset: LIV Munro, Melbourne, VIC

Ownership: 44% Mirvac, 56% Unlisted Partners

Total apartments: 490

Status: Operational

Address: LIV Aston, Melbourne, VIC

Ownership: 44% Mirvac, 56% Unlisted Partners

Total apartments: 474

Status: Operational

Address: LIV Albert, Brunswick, VIC

Ownership: 44% Mirvac, 56% Unlisted Partners

Total apartments: 498

Status: Under Construction

LandLease(Serenitas)

$286 million portfolio; 30 properties; 100% occupancy; 5.40% cap rate

Source: 1H25 Property Compendium

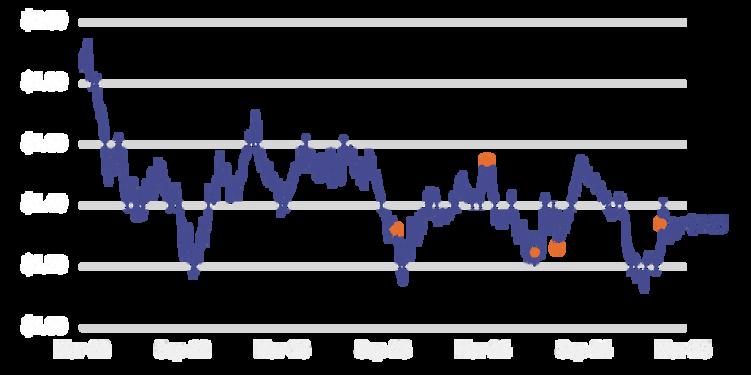

05 TRADING PERFORMANCE

18 Oct 23: Mirvac Group and Pacific Equity Partners and Tasman Capital Partners enter into binding agreement to acquire Serenitas Management. (0.3%) change

02 Apr 24: Keppel REIT agree to acquire 50% stake in 255 George Street, Sydney from Mirvac Wholesale Office Fund I for $360 million. +0.2% change

28 Jun 24: Mitsui Fudosan agree to acquire 66% stake in 55 Pitt Street, Sydney from MGR. +3.8% change

08 Aug 24: MGR reports FY24 results, with earnings at the bottom end of confirmed guidance (14.0cps). (8.8%) change

14 Feb 25: MGR reports 1H25 results, with OEPS guidance of 12.0-12.3cps reaffirmed and improving settlements. +6.5% change

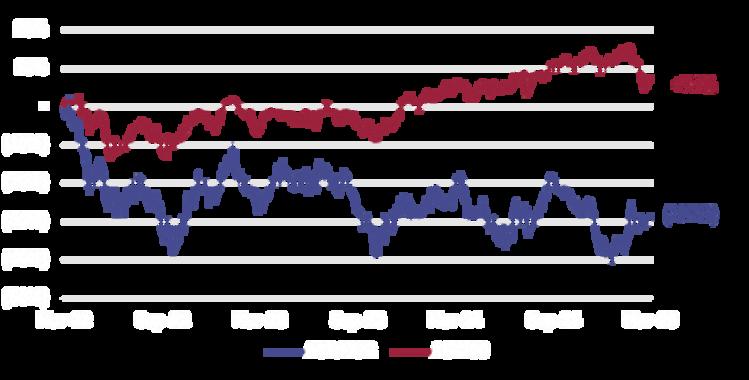

SHAREPRICEVSASX200

3 YEAR TRADING PERFORMANCE ($ PER SHARE)(1)

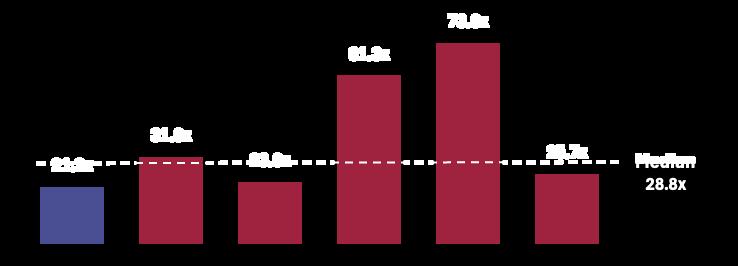

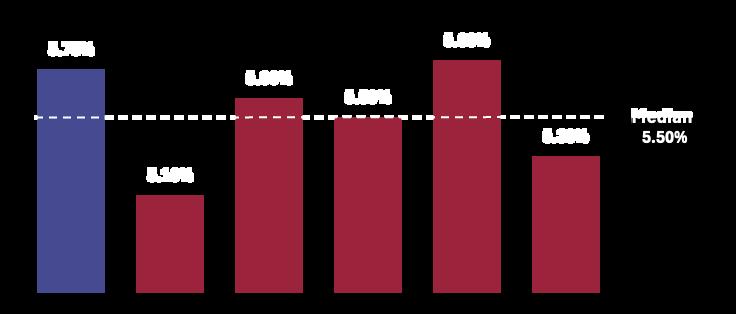

06 TRADINGCOMPS

Trading comparables, or “trading comps”, are a valuation method used to compare the value of a company or part of a company by comparing it to similarly publicly trading companies The idea is similar to how real estate agents determine house prices by looking at recent listings of similar quality homes in the same area. In financial markets, analysts look at key financial ratios or metrics to gauge how a particular company is valued compared to its peers.

FUNDSMANAGEMENTCOMPS

(1) Company filings as at 30 December 2024.

(2) Capital IQ as at 25 March 2025.

(3) Annualised FY25 EBITDA.

07 INVESTMENT RISKS

Asset writedowns

Weighted cap rates across the Mirvac portfolio increased to 5.89% in 1H25 - up from 5.48% in 1H24 - indicating ongoing risks related to capital market volatility and revaluations.

Ballooning construction costs

FY24 residential margins were 17.4%, continued inflationary pressures in the construction industry risk delaying residential settlements and compressing development margins below Mirvac’s through-cycle gross margin target of 18-22%.

Exposure to office sector

Mirvac’s office portfolio remains exposed to structural headwinds from flexible working, evidenced by an 8% decline in office NOI in 1H25. Though its concentration in Premium and A-Grade assets provides partial insulation through strong tenant retention.

Elevated gearing and slower earnings amid asset recycling

FY24 net debt / EBITDA rose to 4.5x and is expected to increase in FY25 amid slower earnings. If the $1bn in asset sales in FY24 (at 11.6% discount to book) is not recycled efficiently this may further dilute earnings.