DEEP DIVE Lendlease ON

ACKNOWLEDGEMENTS

EDITOR IN CHIEF: William Tsui

AUTHORS: Olivia Luu, Nicola Casaclang, Erin Seo, Fei Fei Gao, Kyan Nikkah, Sanuda Godakandage

DESIGNERS: Olivia Luu, Nicola Casaclang, Erin Seo, Fei Fei Gao, Helen Guo

DISCLAIMER

1. The information in this free guide is provided for the purpose of education and intended to be of a factual and objective nature only. REISA makes no recommendations or opinions about any particular financial product or class thereof

2 REISA has monitored the quality of the information provided in this guide However, REISA does not make any representations or warranty about their accuracy, reliability, currency of completeness of any material in this guide.

3. Whilst REISA has made the effort to ensure the information in this guide was accurate and up to date at the time of the publication of this guide, you should exercise your own independent skill, judgement and research before relying on it. This guide is not a substitute for independent professional advice and you should obtain any appropriate professional advice relevant to your particular circumstances

4 References to other organisations are provided for your convenience REISA makes no endorsements of these organisations or any other associated organisation, product or service.

5 In some cases, the information in this guide may incorporate or summarise views, standards or recommendations of third parties or comprise material contributed by third parties (“third party material”) Such third party material is assembled in good faith, but does not necessarily reflect the views of REISA. REISA makes no representations or warranties about the accuracy, reliability, currency or completeness of any third party material

6. REISA takes no responsibility for any loss resulting from any action taken or reliance made by you on any information in this guide (including without limitation, third party material)

01 COMPANYOVERVIEW

Lendlease Group is an ASX-listed ~A$3.7 billion market cap Australian integrated real estate investor, developer, and manager with three main operating arms: (1) Investment, (2) Development, and (3) Construction. Lendlease’s business model enables it to invest in, develop, and deliver major real estate and infrastructure projects across multiple sectors, including commercial, residential, mixed-use, defence, and social infrastructure. Lendlease operates both domestically and internationally, with a core focus on Australian assets.

INVESTMENTARM

Lendlease’s Investment arm strategically manages a diversified portfolio of highquality real estate assets across office, retail, residential, and mixed-use sectors to deliver sustainable, long-term financial returns. Investment earnings primarily consist of management and performance fees, alongside returns from coinvestments and partnerships Key drivers of Lendlease’s investment performance include enhancing asset quality through active portfolio management, strengthening capital partnerships, and expanding funds under management through selective acquisitions and developments aligned with sustainability objectives.

As of FY25, Lendlease manages $48 9 billion in funds under management and a $3.1 billion co-investment portfolio, comprising both listed and unlisted mandates across Australia, Asia, and select international markets. The portfolio features premium-grade office buildings, retail and residential assets, and data centres, supported by long-term institutional partnerships. Lendlease continues to leverage its integrated investment and development platform to generate stable income and deliver long-term returns

DEVELOPMENTARM

Lendlease’s Development arm strategically focuses on the creation of largescale mixed-use precincts and residential projects across Australia’s key urban markets. Development earnings primarily consist of development management fees, joint venture revenues, gains or losses from project sales, and net income from property revaluations. Key drivers of development performance include the scale and quality of the project pipeline, effective cost management, and the continued access of capital partnerships to fund new opportunities.

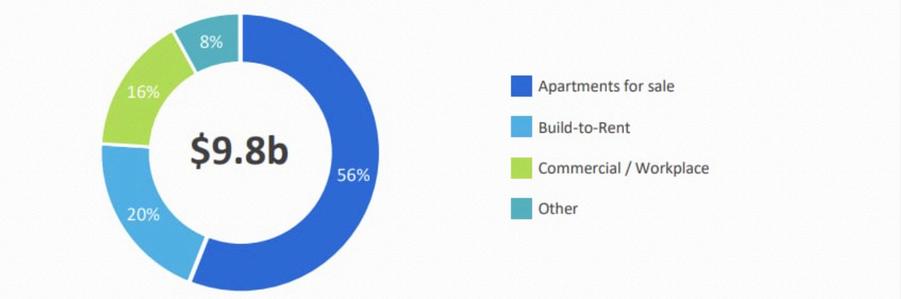

As of FY25, Lendlease’s Development arm manages an Australian development pipeline valued at approximately $9 8 billion, comprising a mix of residential, commercial, and build-to-rent projects. Notable projects in FY25 include Residences One and Watermans Residences at One Sydney Harbour in Sydney, as well as build-to-rent and build-to-sell apartments in Victoria Harbour, Melbourne. Lendlease continues to leverage its integrated investment and construction capabilities, to capitalise on strengthening market conditions, particularly across the residential and mixed-use sectors

Australian Development Pipeline

CONSTRUCTIONARM

Lendlease’s Construction arm provides external project management, design, and construction services. As a tier-one Australian contractor, Lendlease is recognised for delivering large-scale defence, social infrastructure, and commercial projects for government and corporate clients across Australia Construction earnings are generated primarily through management and delivery fees, with performance driven by project execution efficiency, risk management, and returning partnerships.

As of FY25, the Construction arm reported a backlog revenue of $5.9 billion and $8 8 billion in preferred projects Recent completions include the Wyndham Law Courts and Mernda Community Hospital in Victoria, the CIT Woden Campus in the Australian Capital Territory, and the Nambour General Hospital Redevelopment in Queensland, alongside a forward-looking pipeline for FY26 managing approximately $5 billion in new projects for government and corporate partners across key sectors including defence, health and social infrastructure, and data centres

FY25 Backlog Revenue

02 INVESTMENT HIGHLIGHTS

Financial recovery and strengthened balance sheet

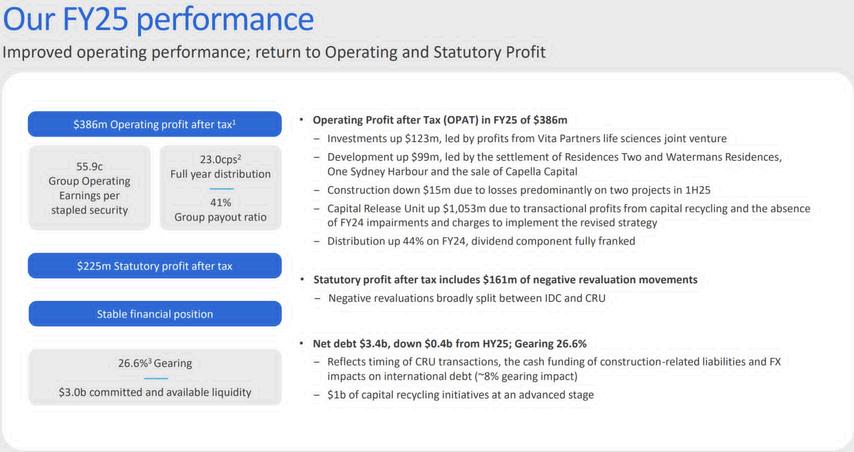

Lendlease has achieved a strong turnaround, with a statutory profit of A$225 million in FY25 after a major loss the previous year Distributions rose 44%, and net debt fell by A$0.4 billion, reducing gearing to ≈26.6%. This balance sheet improvement gives Lendlease room to reinvest while many peers remain financially constrained by high gearing risks.

Strategic refocus through targeted portfolio simplification

Lendlease has streamlined its operations, divesting its UK construction arm and selling the Jem office component in Singapore for S$462 million. These disposals free capital for reinvestment into higher-return domestic projects. Lendlease’s deliberate focused shift to a more Australia centric model enhances efficiency and capital recycling.

Market-leading asset performance and leasing execution

Within its REIT portfolio, Lendlease achieved a 10.7% retail rental reversion and 99.9% retail occupancy (1H25), with office occupancy improving to 86.6%. These results highlight strong active management and design-led appeal, unlike passive REIT peers relying purely on yield stability.

Integrated funds platform reinforcing investor confidence

Lendlease recently retained management of its flagship A$2.8 billion retail fund following a challenge from super funds. Managing ≈A$10 billion in funds with co-investment alignment, Lendlease’s integrated development-investment model provides a diversified and defensible income stream, demonstrating a strategic edge over traditional REITs.

03 REALESTATE PORTFOLIOOVERVIEW

NotableOfficeAssets

$1.1b portfolio, 4.5% gross asset yield, 53% of investment management platform

Address: 21 Moorfields

Country: United Kingdom Interest:Valuation: $155m

Address: Comcentre

Country: Singapore

Interest: 49%

Valuation: $309m

Address: Victoria Cross

Country: Australia

Interest: 75%

Valuation: $369m

Address: IQL Office LP

Country: United Kingdom

Interest: 50% Valuation: $97m

NotableRetailAssets

Address: Paya Lebar Quarter

Country: Singapore Interest: 30% Valuation: $339m

Address: The Exchange TRX

Country: Malaysia Interest: 60% Valuation: $815m

Address: MSG South

Country: Italy

Interest: 50% Valuation: $108m

Address: MSG North Heartbeat

Country: Italy Interest: 17 6%

: $217m

$0.6b portfolio, 4.8% gross asset yield, 8% of investment management platform

Address: Americas Residential Partnership

Country: United States Interest: 50.1% Valuation: $72m

Address: Sydney Harbour R2 Trust

Country: Australia Interest: 75% Valuation: $105m

Address: One Circular Quay Country: Australia

: 33.3%

: $259m

Address: Victoria Drive Wandsworth

Country: United Kingdom

: $15m

NotableMixed-UseAssets

Address: Vita Partners

Country: Singapore Interest: 50%

: $115m

Address: Milano Innovation District

Country: Italy

Address: Podium

Country: Singapore Interest: 53 5%

: $44m

Address: LRIP 2 LP

Country: United Kingdom Interest: 50%

05 TRADING PERFORMANCE

13 Jul 23: Shares lifted as management outlined early restructuring focus and cost discipline ahead of FY23 results +6.23% change

14 Dec

:

27 May 24: Lendlease revealed plan to sell $4.5 bn of offshore assets and refocus on core Australian development; market reacts positively to reset +8.4% change 04 Apr 25: Market reacts to slower asset disposal and weak REIT sentiment. -6.96% change

10 Apr 25: Shares rebounded after

SHAREPRICEVSASX200

3 YEAR TRADING PERFORMANCE

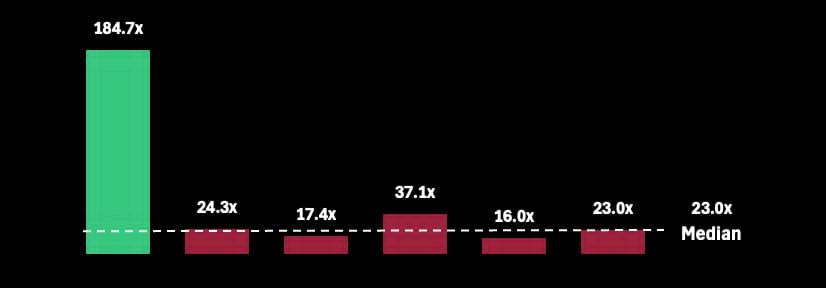

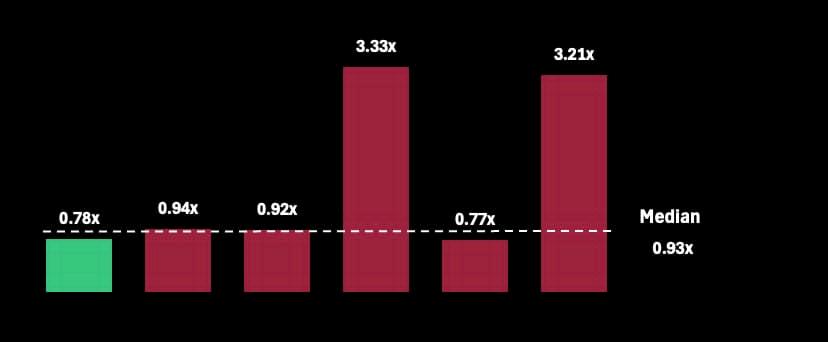

06 TRADINGCOMPS

Trading comparables, or “trading comps” , are a valuation method used to compare the value of a company or part of a company by comparing it to similarly publicly trading companies. The idea is similar to how real estate agents determine house prices by looking at recent listings of similar quality homes in the same area. In financial markets, analysts look at key financial ratios or metrics to gauge how a particular company is valued compared to its peers.

FUNDSMANAGEMENTCOMPS

07 INVESTMENT RISKS

Exposure to global construction and development market volatility

Lendlease operates across multiple international markets, exposing it to fluctuations in construction costs, supply chain instability, and project delivery challenges Despite its recent resilience, supply chain risks remain elevated due to labour shortages, geopolitical disruptions, and natural disasters, all of which increase project timelines and costs while eroding margins.

Balance-sheet and market-rate risk

Lendlease reports explicit exposure to interest rate, liquidity, foreign currency and credit risks, managed within Treasury Policy limits. FY25 Year-end cash was $621 million (down from $1.0 billion in FY24) and borrowing and financing arrangements were $4,054 million Higher rates and refinancing conditions can lift debt costs and pressure valuations and distributions.

Capital-recycling and divestment execution risk

Lendlease created a Capital Release Unit to recycle $4.5 billion and exit international construction In FY25 it announced a completion of $2 3 billion of the program and now targets a further $2.0 billion in FY26. The UK and US construction sales include earn-out arrangements through FY27. If timing or pricing slips, balance-sheet goals and buy-backs could be constrained

Construction margin and delivery risk

FY25 Construction revenue was $3.0 billion (down 13% YoY) with Operating EBITDA $33 million and an EBITDA margin of 1.1% after first-half project losses Although new work secured rose to $5 0 billion and backlog to $5 9 billion, thin margins mean cost overruns or delays (which are currently a risk) can quickly erode earnings.