DEEP DIVE Stockland ON

ACKNOWLEDGEMENTS

EDITOR IN CHIEF: William Tsui

AUTHORS: Aman Madhyastha, Sanuda Godakandage, Jonathan Chen, Hannah Hsu, Samuel Hui, Olivia Luu, Annabelle Zhang

DESIGNERS: Anneka Cai, Sanuda Godakandage, Jonathan Chen, Annabelle Zhang

DISCLAIMER

1. The information in this free guide is provided for the purpose of education and intended to be of a factual and objective nature only. REISA makes no recommendations or opinions about any particular financial product or class thereof

2 REISA has monitored the quality of the information provided in this guide However, REISA does not make any representations or warranty about their accuracy, reliability, currency of completeness of any material in this guide.

3. Whilst REISA has made the effort to ensure the information in this guide was accurate and up to date at the time of the publication of this guide, you should exercise your own independent skill, judgement and research before relying on it. This guide is not a substitute for independent professional advice and you should obtain any appropriate professional advice relevant to your particular circumstances

4 References to other organisations are provided for your convenience REISA makes no endorsements of these organisations or any other associated organisation, product or service.

5 In some cases, the information in this guide may incorporate or summarise views, standards or recommendations of third parties or comprise material contributed by third parties (“third party material”) Such third party material is assembled in good faith, but does not necessarily reflect the views of REISA. REISA makes no representations or warranties about the accuracy, reliability, currency or completeness of any third party material

6. REISA takes no responsibility for any loss resulting from any action taken or reliance made by you on any information in this guide (including without limitation, third party material)

01 COMPANYOVERVIEW

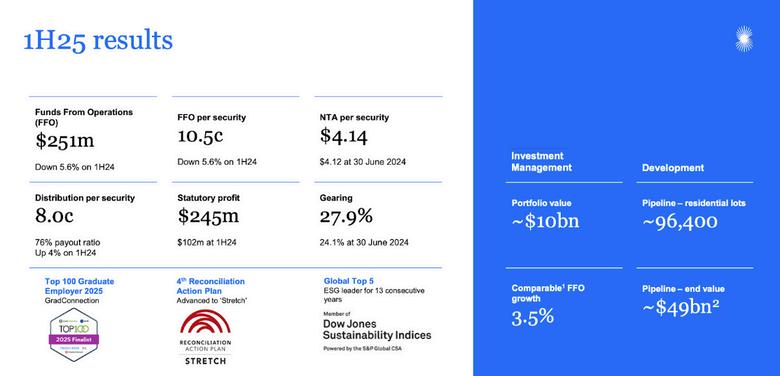

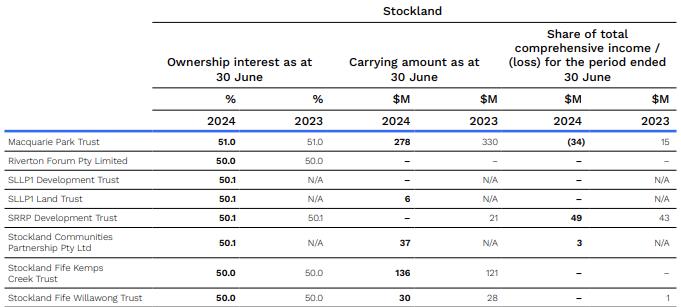

Stockland Corporation is an ASX-listed A$13 billion market cap diversified real estate investor and developer with two core divisions: (1) Investment management, and (2) Development. Stockland’s real estate strategy involves owning, managing and developing assets ranging across logistics, workplaces, town centres, masterplanned communities and land lease communities Specifically, they aim to leverage major trends such as urbanisation, ESG and increased adoption of technology changing the future of real estate.

Stockland’s reported ‘Investment Management’ arm comprises investments and asset management across all asset classes, property management, leasing, and funds management of their capital partnership platform. Thus, Investment earnings primarily consist of rental income, complemented by Stockland’s share of profits from co-investments and partnerships Furthermore, their Funds segment enables Stockland to earn management fees, performance fees, and income from co-investments. This further involves Stockland’s Asset Management platform, delivering operational expertise across Stockland’s portfolio of logistics, workplace, town centres, and communities, generating revenue through property management, leasing, and development services.

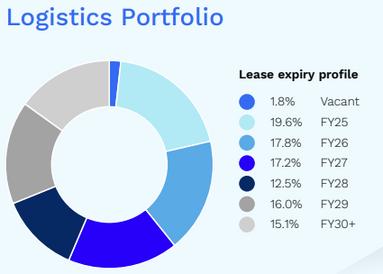

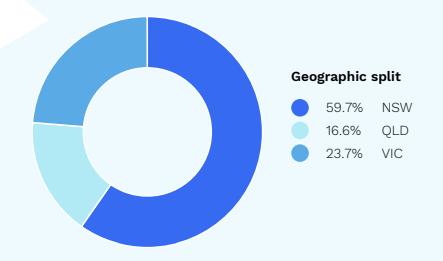

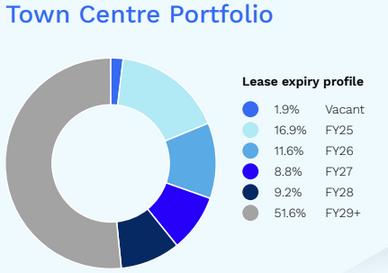

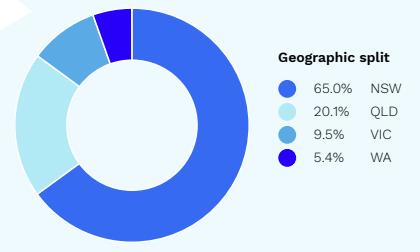

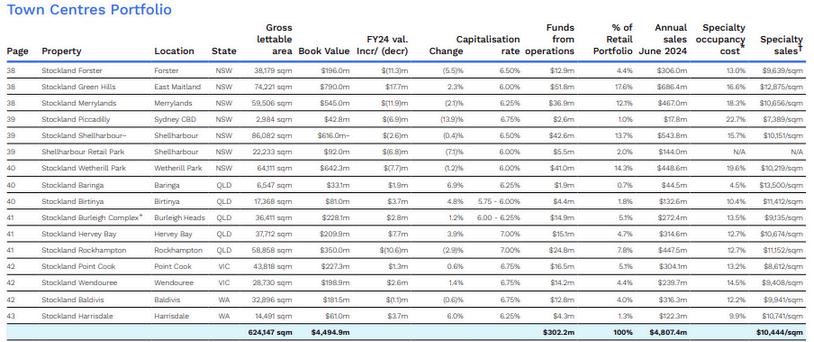

As of 1H25, Stockland manages an investment portfolio of approximately $10 billion, primarily allocated across logistics, workplace, town centres, and land lease communities. Stockland’s portfolio remains focused on high-growth urban areas, underpinned by strong population growth and ongoing infrastructure projects. Town centre occupancy stands at a solid 99.1%, highlighting sustained demand for well-located and convenient retail centres Furthermore, its logistics portfolio occupancy of 97.3% demonstrates a sustained benefit from the ecommerce boom and demand for urban infill. Moreover, with a portfolio of over 3,000 homes, Stockland’s land lease communities continue to provide steady, stable income.

DEVELOPMENTARM

Stockland’s Development arm focuses on site acquisition, planning, and construction in Australia’s key urban and growth markets. Earnings stem from development management fees, performance revenues from joint ventures, project sales, valuation uplifts, and income from revaluations and capital partnerships. Key drivers include project scale and timing, cost management, property valuations, and institutional capital flows

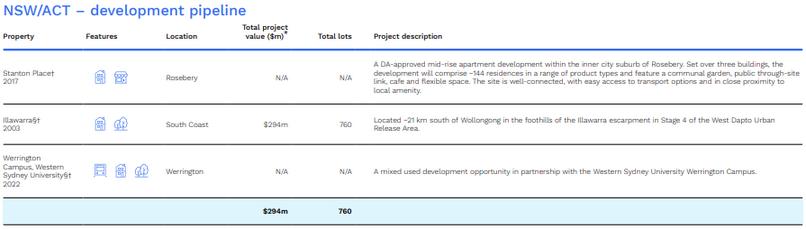

As of 1H25, Stockland has an approximate A$49 billion pipeline spanning across master-planned communities, logistics and workplace hubs, and town centres with mixed uses. Specifically, the company acquired 12 active MPC projects through its Supalai partnership, adding about 28,000 future lots. Logistics development is accelerating, with A$500 million in projects under way, including 145,000 m² of pre-released space at Yennora and Kemps Creek Key upcoming projects include the Aura Town Centre and the Waterloo Renewal Project in Sydney in collaboration with Link Wentworth, City West and Birribee Housing.

02 INVESTMENT HIGHLIGHTS

03 REALESTATE PORTFOLIOOVERVIEW

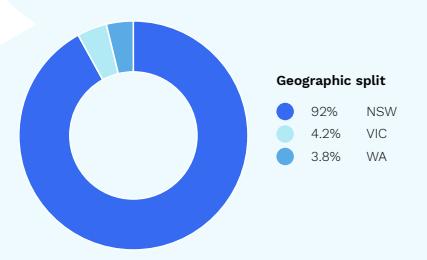

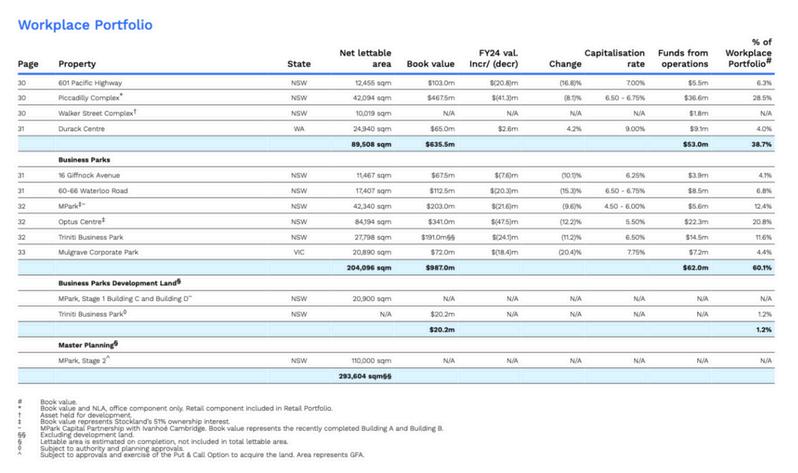

NotableWorkplaceAssets

Address: 1110–122 Walker Street, North Sydney, NSW

Lettable Area: 42,340 sqm Valuation: $$203.0m

Rate: 4.50 - 6.00%

Address: 1 Lyonpark Road, Macquarie Park NSW 2113

Lettable Area: 84,194 sqm

Valuation: $340 7m Cap Rate: 5 50%

Address: 263 Adelaide Terrace, Perth WA 6004

Lettable Area: 24,940 sqm

Valuation: $65 0m Cap Rate: 9 00%

Address: 210 Pitt St, Sydney NSW 2000

Lettable Area: 42,094 sqm

Valuation: $467 5m

Rate: 6 50 - 6 75%

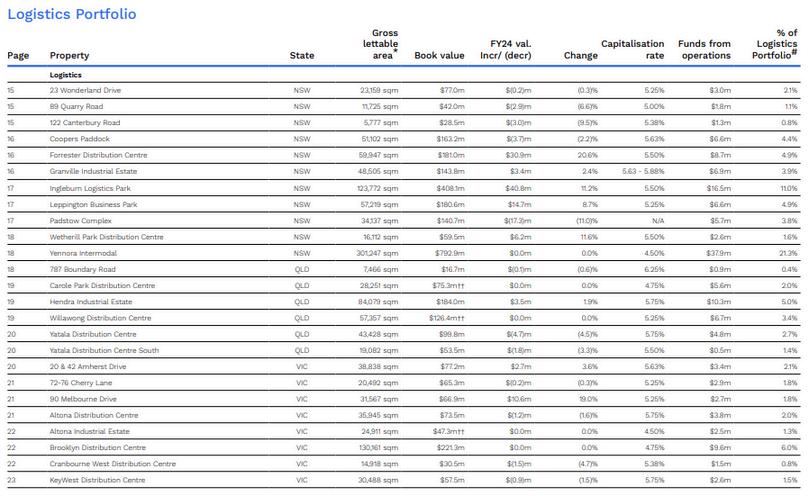

LOGISTICS

NOTABLELOGISTICSASSETS

Address: 35–47 Stennett Road, Ingleburn, NSW 2565 Size: 123,772 sqm

Address: 77 Darlington Drive, Yatala, QLD

$22.2 billion portfolio (end market value), 43 communities

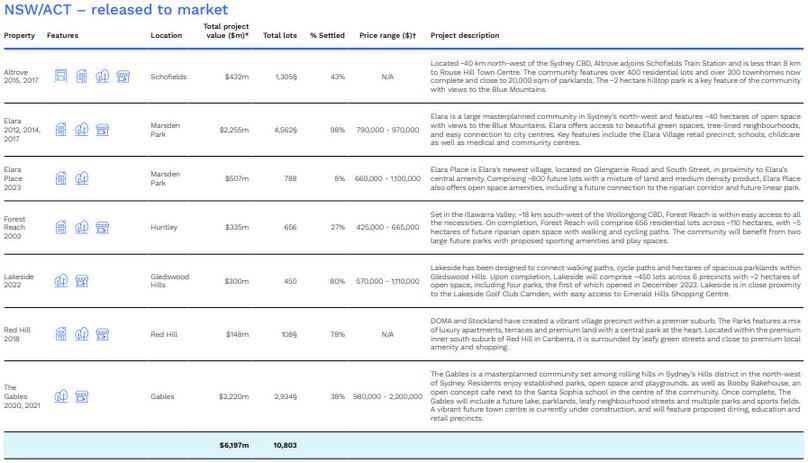

NOTABLEMPCASSETS

$22.2 billion portfolio (end market value), 43 communities

Adddress: 1 Elara Boulevard, Marsden, NSW 2765

Total Project Value: $507m

Total Lots: 788

% Settled: 8%

Address: 121 Old Pitt Town Rd, Box Hill NSW 2765

Total project value: $2,200m

Total lots: 2934

% Settled: 38%

Address: Elara Bvd, Marsden Park NSW 2765

Total project value: $507m

Total lots: 788

% Settled: 8%

Address: Hoy St, Schofields NSW 2762

Total project value: $432m

Total lots: 1305

% Settled: 43%

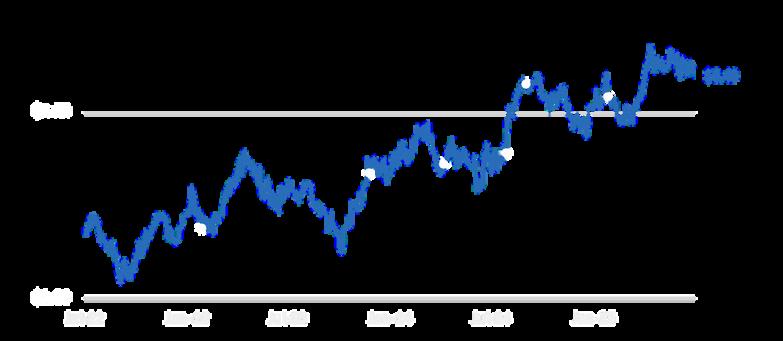

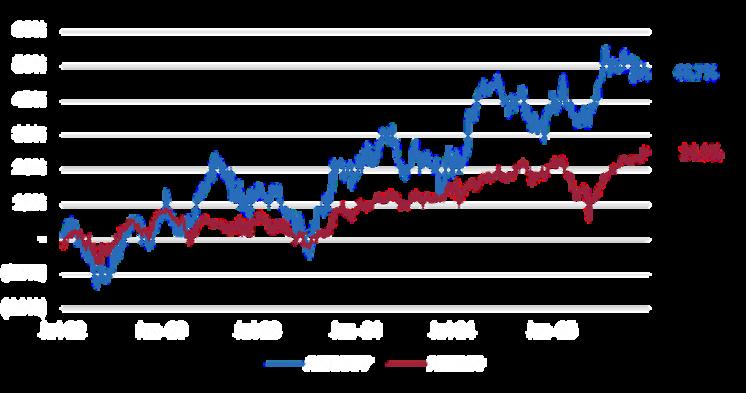

SHAREPRICEVSASX200

3 YEAR TRADING PERFORMANCE

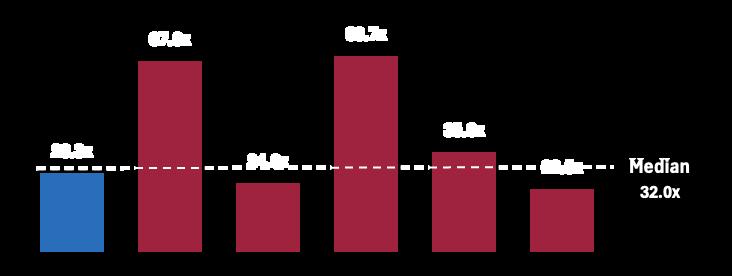

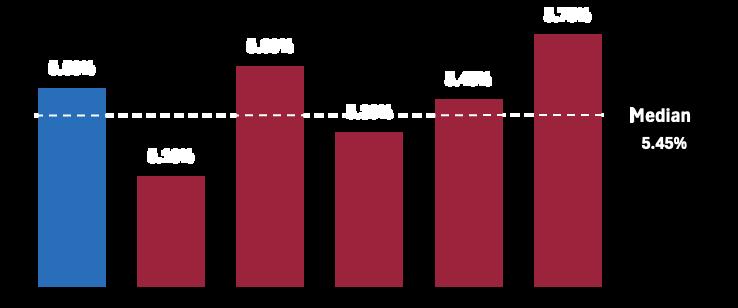

06 TRADINGCOMPS

Trading comparables, or “trading comps” , are a valuation method used to compare the value of a company or part of a company by comparing it to similarly publicly trading companies. The idea is similar to how real estate agents determine house prices by looking at recent listings of similar quality homes in the same area. In financial markets, analysts look at key financial ratios or metrics to gauge how a particular company is valued compared to its peers.

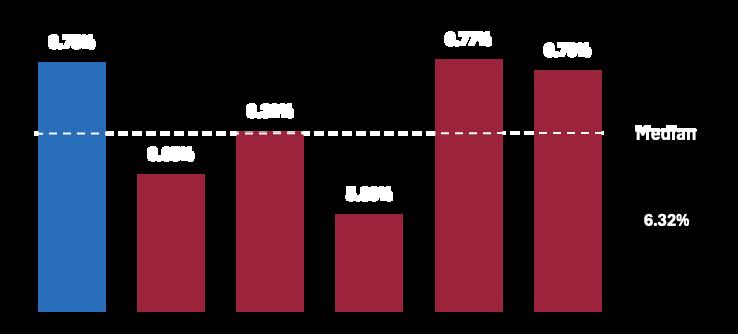

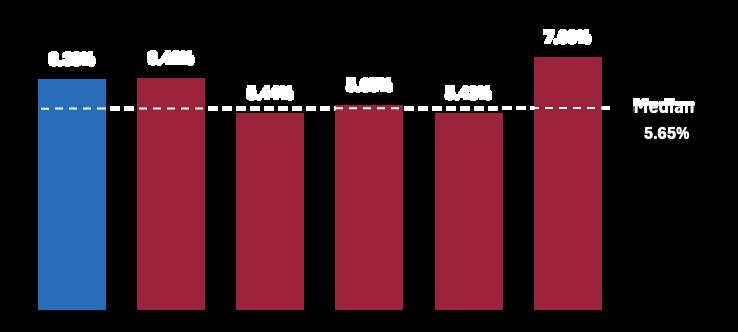

FUNDSMANAGEMENTCOMPS

07 INVESTMENT RISKS

Exposure to geographic disparities in residential market conditions

Although residential market conditions have improved, further improvements in conversion rates and sales volumes of Stockland’s masterplanned communities will depend on the pace of market recovery in Victoria. This comes amidst demand and prices in the state lagging compared to the rest of the Eastern seaboard to date.

Retail portfolio sensitivity to consumer behaviour

Stemming from the rise of e-commerce and broader economic uncertainty, this poses ongoing risks from shifts in consumer behaviour Reflecting these headwinds, Stockland recorded a $46 million valuation decrease in its retail assets in FY24.

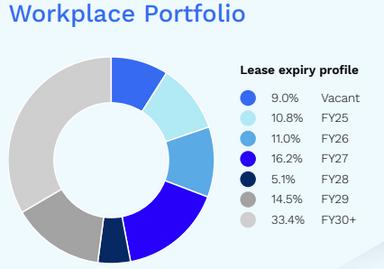

Exposure to office sector headwinds

Enduring structural headwinds of hybrid work models and persistently elvated vacancy rates is reflected in Stockland’s workplace portfolio experienced a significant $334 million valuation decline in FY24, driven by a 46 basis point expansion in cap rates and softening rental prospects These factors diminish asset values and rental income, undermining portfolio diversification benefits.

Interest rate risk

Stockland’s weighted average cost of debt increased from approximately 4.5% in FY23 to 5 3% in FY24, contributing to a 4 5% year-on-year decline in pre-tax FFO per security. Thus, increased debt servicing costs may induce margin compression, whilst applying downward pressure on property valuations due to higher discount rates