TOWARDS GREEN STEEL

The world’s largest & most eco-friendly Acid Regeneration Plant is up and running in China

The world’s largest & most eco-friendly Acid Regeneration Plant is up and running in China

Editor Matthew Moggridge Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Editorial assistant Catherine Hill Tel:+44 (0) 1737855021

Consultant Editor Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production Martin Lawrence

SALES

International Sales Manager Paul Rossage paulrossage@quartzltd.com Tel: +44 (0) 1737 855116

Sales Director Ken Clark kenclark@quartzltd.com Tel: +44 (0) 1737 855117

Managing Director Tony Crinion tonycrinion@quartzltd.com Tel: +44 (0) 1737 855164

Chief Executive Officer Steve Diprose

SUBSCRIPTION Jack Homewood Tel +44 (0) 1737 855028 Fax +44 (0) 1737 855034

Email subscriptions@quartzltd.com

2 Leader By Matthew Moggridge.The latest global steel news.

New products and contracts.

Dark clouds on the horizon.

18 Latin America update Pecém, Vale, and ArcelorMittal.

21 India update Demand rebounds. 24 Iron ore Gabon intensifies iron ore ambitions.

After the rain, comes the drought.

Building a better America.

In between strength and beauty.

SIP technology and BF operation.

Increasing refractory lifetime 52

Positioned for sustainability

The early days of ironmaking at Scunthorpe Part 2. 1919-1939.

In recent weeks I’ve had the incredible good fortune of being out of the country – twice! Once in Stockholm in Sweden, and then in Buttrio in Northern Italy. On both occasions the relief of not being in the UK – where the current Conservative government under Liz Truss is in freefall and making a mockery of British politics –was palpable. I was in the Swedish capital to meet and interview the great Mark Bula who is the chief commercial officer of H2 Green Steel. Mark and I first met in October 2017 in Osceola, Arkansas, USA. He was working at Big River Steel with Dave Stickler and then, like now, Mark was at the cutting edge of steel manufacturing, working at a facility rammed with hightech manufacturing and digital capability. Today, he commands a leading role in what is arguably THE most important steel project in the world. Mark is the chief commercial officer at H2 Green Steel; he’s relocated from the USA to live the life of an ‘empty nester’ in Stockholm with his wife. While he has travelled further north –to Boden where the hydrogen steelmaking facility is to be located – he’s yet to see the Northern Lights, or rather he has seen them, but, as he put it, ‘not enough to go

wow!’ Well, I’m sure his time will come.

While there are many different decarbonization projects under way around the world, the two most prominent ventures at present are HYBRIT (SSAB, LKAB and Vattenfall) and H2 Green Steel. The former has proved it possible to make green steel using hydrogen and, says Mark, ‘I think they’re making 100kt/ yr’. H2 Green Steel is planning to make an initial 2.5Mt/yr when the Boden facility starts producing green steel in 2025. The key difference between the two projects? ‘We’re skipping the pilot plant,’ says Mark.

Americans are blessed with a good turn of phrase and Mark’s no exception. He refers to Sweden – where both HYBRIT and H2 Green Steel are based – as the ‘Goldilocks location’ for such projects, thanks to an abundance of important natural resources.

Mark and I chatted for around two hours and when I later transcribed the notes back in the UK they ran to 12,000 words. I could have written a dissertation on H2 Green Steel! In the end, however, I settled for around 4,000 words running over six pages in this issue of Steel Times International Go to page 26.

One worker was killed, and five others injured when hot liquid from a furnace spilled on them at a factory manufacturing steel products in the Wada area of Maharashtra's Palghar district in India. The local police registered an offence under relevant sections of the Indian Penal Code against the company for the incident. The accident occurred at Surya Company around 10pm on 22 August, when hot melted steel from a furnace spilled on the workers.

Source: NDTV, 10 September 2022

Tata Power has said that its subsidiary, Tata Power Renewable Energy (TPREL), has collaborated with Mumbai-based stainless steel manufacturer, Viraj Profile, to set up a 100-MW captive solar plant to provide power to its Tarapur plant. According to the official press release, the plant will be located at Tata Power’s Nasik site and will be commissioned by July 2023. It added that the plant would generate about 200 million units of energy and offset 170 million kg of carbon dioxide annually.

Source: ET Energy World, 8 September 2022.

ArcelorMittal, Europe's largest steel maker, has further cut its production in Europe after its Polish subsidiary said that it would idle one of its two blast furnaces. The company will temporarily suspend production at its number 3 furnace at its Dabrowa Gornicza plant in southern Poland. The furnace has a production capacity of 2.2Mt of crude steel. The decision to reduce production is the latest by the Luxembourg-based steel maker as it faces deteriorating market conditions marked by increasing prices for carbon, gas and electricity.

Source: Market Watch, 8 September 2022

POSCO Holdings Inc., the holding company of South Korea’s largest steelmaker, has restarted its blast furnaces at its main plant in Pohang, North Gyeongsang Province, which were idled following damage by Typhoon Hinnamnor. Furnace 3 resumed operations first, while the other two – furnaces 2 and 4 – were restarted afterwards, according to company officials. POSCO’s furnaces at its Pohang plant manufacture heavy plates, hot-rolled steel, cold-rolled steel, iron rods, electrical steel and stainless steel.

Source: The Korea Economic Daily, 12 September 2022

Multinational steelmaker ArcelorMittal and quarried materials group SigmaRoc have entered into a strategic joint venture agreement to create a new company. The company will produce lime, an essential purifying additive used in steel production as well as numerous other industrial applications. The partners will leverage their manufacturing experience to produce 900kt/yr of the material. The operations will be located close to Dunkirk’s harbour and the ArcelorMittal steelworks – which will be the main consumer of the lime produced – allowing for shorter transportation of the finished product.

Source: AggNet, 12 September

British Steel has hiked the prices for some of its structural steel products by a further £150 a tonne, putting more stress on contractors. The Chineseowned steel producer had already increased the price of its steel by £100 per tonne on 15 August. This has followed from a period of relative price stability through the summer following March’s record £250 a tonne rise, which pushed sections towards £1,000 a tonne.

Source: Construction News, 12 September 2022

ArcelorMittal SA has announced it has paid the first tranche of its outstanding penalty set by the Competition Commission six years ago, saying it will settle the full amount by 2028. The steelmaker, which admitted to having been involved in steel and scrap metal cartels, was fined R1.5bn in 2016 for engaging in collusion by fixing prices and discounts, allocating customers and sharing commercially sensitive information.

Source: Business Day, 12 September 2022

Klöckner & Co, the German steel and metal distributor, has launched the new Nexigen® brand bringing together its entire portfolio of sustainable products and services. Under the Nexigen® brand, the company will now provide carbon-reduced solutions in the three categories of materials, processing and logistics. The first quantity of green steel under the Nexigen® brand has been secured by Mercedes-Benz AG.

Source: EQS News, 13 September 2022

Japan's biggest steelmaker Nippon Steel Corp has said that it will start selling steel products next year that are certified as reducing CO2 emissions from the steel manufacturing process. The steelmaker plans to adopt a so-called mass balance method in which the total amount of CO2 emissions that the company has actually reduced by improving manufacturing processes is determined and allocated to any given steel product.

Source: Reuters, 14 September 2022

Prosecutors in the UK say executives of a sincecollapsed steel company falsified documents and created fake trades to defraud five trade finance banks out of $150 million in order to keep the struggling trader afloat. A prosecutor representing the UK’s Serious Fraud Office (SFO) stated on the first day of a criminal trial at Southwark Crown Court in London on 11 September that five executives of Balli Steel Plc told ‘increasingly egregious’ lies throughout 2012 and early 2013 as part of a ‘widespread and systemic fraud’ against trade finance lenders in Europe and Asia.

Source: Global Trade Review, 14 September 2022

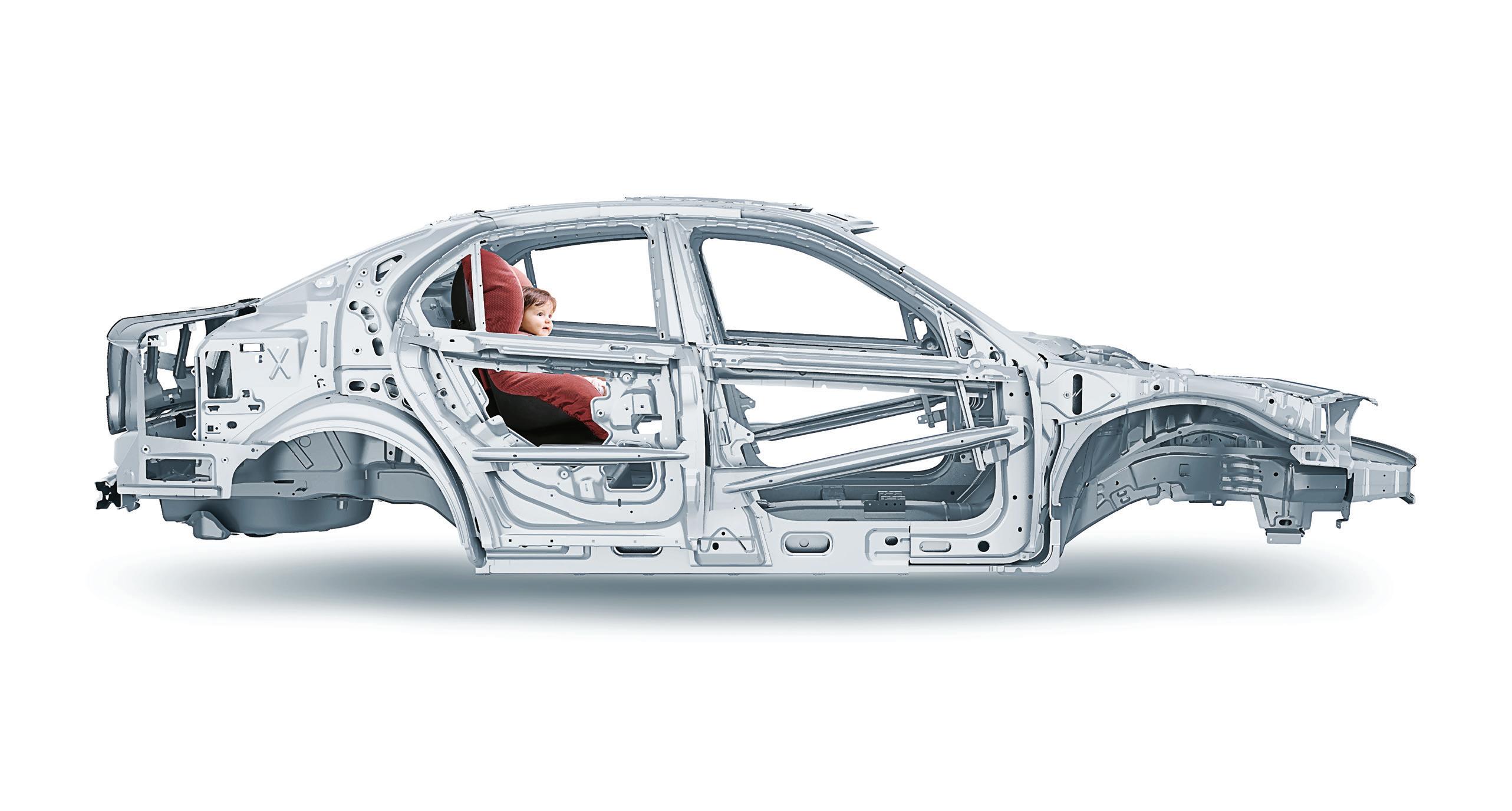

Hyundai Steel Co. has announced that it succeeded in the pilot manufacturing of advanced auto steel sheets using an electric furnace. According to the company, thanks to the electric arc furnace, carbon emissions were reduced by more than 30% when compared to a conventional method that used iron ore and coal in furnaces. The steelmaking arm of Hyundai Motor Group is headquartered in Incheon and Seoul and manufactures a range of products – including H-beams, rails, and stainless cold-rolled sheets.

Source: The Korea Economic Daily, 14 September 2022

A steel worker passed away while working at a Tata Steel UK plant, prompting police to launch an investigation. Gwent Police officers were called to a medical emergency at Tata Steel in Newport, Wales on 14 September. The man, 50, from Cwmbran, Torfaen, was pronounced dead at the scene. Tata Steel said it was ‘incredibly sad’ that one of its employees had died. A spokesman added: "The health and safety of our employees, contractor partners and visitors has always been, and will remain, our most important priority. Our thoughts are with our colleague's family, friends and workmates at this distressing time."

Source: BBC, 14 September 2022

The auditor of many of the companies in Sanjeev Gupta’s network of metals companies, which includes UK steelmaker Liberty Steel, has resigned from at least five of them, amid an investigation of its work by UK regulators. London-based King & King has resigned as auditor of the companies in Gupta’s GFG Alliance, a sprawling group of firms under his control. The accountant is under investigation by the accounting regulator, the Financial Reporting Council, for its audits of four GFG companies.

Source: The Guardian, 15 September 2022

NLMK, Russia’s largest steelmaker, has reached an agreement with NLMK Belgium Holdings (NBH), the Belgium-based joint venture with SOGEPA (a Belgian investment fund) to integrate NLMK Dansteel (Dansteel) into NBH. According to NLMK, the consolidation of Dansteel within the NBH perimeter will further optimize European assets' management structure and provide additional strategic flexibility and synergies. The transaction has been submitted for EU merger control approval.

Source: Market Screener, 15 September 2022

Researchers at Imperial College London have developed a new materials design strategy that produces copper-based metal oxides that perform efficiently under high temperatures. Metal oxides are key to greener manufacturing, carbon capture, energy storage and gas purification. These compounds are commonly used in carbon capture, utilization and storage (CCUS), for purifying and recycling inert gases in solar panel manufacturing, thermochemical energy storage, and producing hydrogen for energy.

Source: Mining.com, 16 September 2022

Liberty Galati, the Romanian steelworks, has launched its first GREENSTEEL learning module for Romanian students, in partnership with Dunarea de Jos University of Galati. Starting in October 2022, the

Scania, the Swedish vehicle manufacturer, has announced vast measures in a bid to see its supply chain decarbonized by 2030, with hydrogen looking set to play a key role. As part of its strategy to clean up its materials, Scania has set the target of using 100% green steel, which it has said could be met by replacing coal with green hydrogen in the production of flat steel.

Source: H2 View, 16 September 2022

US Steel Corporation, one of the largest steel producers in the United States, has shut down BF8 at the Gary Works steel plant in Indiana. The blast furnace, with a capacity of 1.5Mt of steel per year, has been idle since 7 September 2022. The date of the units’ restart is not yet known. This is the first closure of rolling plant in the United States in recent times. Local producers point to the constant oversupply of products on the market and the lack of reduction in steel production.

Source: GMK Center, 18 September 2022

Seah Gulf Special Steel has said it has sealed two agreements for its new steel pipe factory in Dammam being built at an investment

University will integrate the GREENSTEEL module, which allows students to learn about climate change and cutting-edge steelmaking technologies, within its academic programme. The initiative is part of the ‘LIBERTY GREENSTEEL Academy project’ that also targets other elite universities, aiming at strengthening the company’s collaboration with the educational and scientific research communities.

Source: The Diplomat, 16 September 2022 worth more than $266.3 million – an EPC contract with Saudi-based Sendan International Company for its construction and a land lease agreement with King Salman Energy City (Spark). Seah Gulf Special Steel is a joint venture between Saudi industrial investments company Dussur and Korean group SeAH Changwon Integrated Special Steel Corporation.

Source: Zawya, 17 September 2022

Asbestos has been found in Tata Steel mills on 35 different times over the past five years, confirms a report by Dutch newspaper, Nordhollands Dagblad. In total, Tata made 1,825 records of factory workers potentially exposed to asbestos at those times. “Asbestos is something that requires our constant attention,” the company stated.

Source: Taylor Daily Press, 17 September 2022

Circular Maritime Technologies International (CMT) has introduced a circular process for the ship breaking industry, aiming to provide a solution to the problem of dangerous ship scrapping. Following a business model, CMT will set up yards with international partners and attract business from shipowners by matching the price paid by South Asian competitors. The CMT yard will run on its own power and produce clean steel, related to green steel production. The yard will reduce the size of the vessel step by step through various automated tools, up to the point where each part of the ship’s steel structure is reduced to many small pieces.

Source: Safety4Sea, 19 September 2022

Dunaferr steel plant, one of Hungary’s largest industrial manufacturing companies, has been forced to shut production, the company said on 18 September. The company said that the immediate reason for the shutdown is the unexpected refusal of Austria-based Donau Brennstoffkontor GmbH, their partner for decades, to supply the essential raw coke. “The forced shutdown now means that there is currently no possibility for pig iron and steel production at Dunaferr,” the company stated.

Source: Euractiv, 19 September 2022

H2 Green Steel and GreenIron H2 have agreed to collaborate to achieve further emission reduction and increased circularity in H2 Green Steel's plant in Boden in Northern Sweden. GreenIron H2 is a Swedish start-up focused on cost efficient CO2-free reduction of metal oxides to pure metals. Its hydrogenbased CO2 reduction process will be used to recycle iron residuals and waste from H2 Green Steel's operations.

Source: Cision, 23 September 2022

Tata group has announced the amalgamation of all metal companies within Tata group into Tata Steel. The company board approved merging its seven metal companies with its parent metal company Tata Steel Limited. The seven metal companies of Tata group that will be merged with Tata Steel are Tata Steel Long Products Limited, The Tinplate Company of India Limited, Tata Metaliks Limited, TRF Limited, Indian Steel & Wire Products Limited, Tata Steel Mining Limited and S & T Mining Company Limited.

Source: Mint, 23 September 2022

The Ethiopian Ministry of Finance has announced that a decision has been made to sell scrap metal and outof-service vehicles to steel manufacturing industries without resorting to a bidding process. The scrap metal and out-of-service vehicles will be collected from federal offices, public development organizations, and state-owned universities, then allocated to companies according to the manufacturing capacity of the factory of each company. The selling price will be set according to market conditions and the type of items.

Redcar's former blast furnace, part of the Teesside Steelworks in northern England, has been demolished. The 365ft structure dominated the skyline for decades, but the decision was made to clear the site for regeneration. The site has been dormant since 2015 when its owner, Sahaviriya Steel Industries, went into liquidation with the loss of more than 2,000 jobs. It is hoped the 4,500-acre site will become home to a range of new industries .

Source: BBC, 20 September 2022

A 100-year-old woman from the UK has been given an honorary degree for her input during World War II to keep an entire steel industry from collapsing. Kathleen Roberts and her female coworkers kept Sheffield’s steel industry afloat with months of ‘gruelling work’ during the outbreak of World War II. Kathleen worked 72-hour weeks with the other women while being paid less than men. For their exemplary determination and hard work,

the group came to be known as 'Women of Steel'. Today, Kathleen is the only surviving member of the group.

Source: Times Now, 25 September 2022

Source: 2Merkato.com, 23 September 2022

Arabian Pipes Company has been awarded a contract worth around SAR 155 million to supply the Saudi Arabian Oil Company (Aramco) with steel pipes. The financial impact of the 15-month contract will reflect on Arabian Pipes’ financials in the second and third quarters of 2023, according to a stock exchange statement. Currently, Arabian Pipes’ existing projects total more than SAR 800 million. Source: Zawya, 25 September 2022

50 local farmland owners near Yekepa, Nimba County, Liberia received $138,188 in resettlement compensations from ArcelorMittal Liberia (AML), due to crops being affected by mining. The ‘Resettlement Programme’ which has been an ongoing focus for the company, focuses on evaluating assets and compensating affected farmers in areas where ArcelorMittal Liberia operates. The AML Community Relations department confirmed that including the recent transaction, the company has now paid more than $18 million in resettlement compensation to farmers and it is expected that the amount will further increase.

Source: GNN Liberia, 25 September 2022

Czech Republic-based steelmaker Liberty Ostrava, a subsidiary of UK-based Liberty Steel, has announced that it will invest $3.45 million to install a new exhaust pipeline at its sinter plant to reduce dust emissions by around 46%. The project on the sinter conveyor paths, which will be completed later this year, is a further sign of progress in Liberty Ostrava’s green steel transformation programme, the company said.

Source: Steel Orbis, 26 September 2022

Rachel Reeves, the shadow chancellor of the UK Labour party, announced that the party would set up a ‘National Wealth Fund’ for the state to invest directly in projects like steel to create a return for taxpayers and rebuild industrial areas. This includes £3 billion of investment for six clean steel plants which would benefit Sheffield, Rotherham and Scunthorpe, to help strengthen the industry.

Source: The Yorkshire Post, 26 September 2022

Tata Steel Europe, a subsidiary of Indian steel producer Tata Steel, has announced that it has signed a contract

with the Netherlands-based transportation service company Hardt Hyperloop for the delivery of Zeremis

Carbon Lite, steel with an allocated carbon reduction of up to 100%. In July this year, Tata Steel delivered the first batch of the new steel product tailor-made for the Hardt Hyperloop.

Source: Steel Orbis, 26 September 2022

ArcelorMittal Poland, a subsidiary of global steel producer ArcelorMittal, has announced that it has received ResponsibleSteel certification, a sustainability certification, as the business fulfilled the criteria required to earn certification against the ResponsibleSteel Standard. The company is the first to be certified in eastern Europe by ResponsibleSteel, the steel industry’s first global standard and certification initiative for sustainability.

Source: Steel Orbis, 26 September 2022

According to the participants of the First British Steel Forum, British steelmakers are pushing for stronger sanctions against imports of Russian origin steel that may have been processed in third countries. The UK imposed sanctions on the import of steel products and semifinished products from the Russian Federation due to the invasion of Ukraine. There is a total ban on steel, while semifinished products are subject to a 35% duty.

Source: GMK Center, 26 September 2022

As part of reducing carbon footprint throughout the equipment supply chain, Swedish sustainable solutions provider Alfa Laval, and Nordic and US-based steel

company SSAB have signed an agreement to collaborate on the development and commercialization of the world’s first plate heat exchanger to be made using fossil-free steel. The goal is to have the first unit made with hydrogen-reduced steel ready for 2023. SSAB is part of the HYBRIT initiative alongside mining company LKAB and power provider Vattenfall.

Source: Offshore Energy, 27 September 2022

Outokumpu, the largest producer of stainless steel in Europe, has launched a new sustainable stainless steel line, Circle Green, with a carbon dioxide footprint 92% lower than the global industry average and 64% lower than Outokumpu’s regular production of stainless steel, the company has stated. The new product line achieves significant carbon reduction by relying on biobased materials — biogas, biodiesel and bio-coke — to produce stainless steel and by purchasing electricity from low-carbon sources.

Source: Fastmarkets, 27 September 2022

Russian vertically-integrated steel producer Severstal will supply large-diameter pipe (LDP) to leading Russian gas producer and supplier Gazprom, the company has said. The 63kt consignment will contain pipes in diameters of 1,0201,420mm, which have have an external anti-corrosion coating and wall thickness of 12-37mm. The product will be manufactured at the company's LDP dedicated Izhora Pipe Plant near St. Petersburg from K52-K65 strength grade steel.

Source: Kallanish Commodities, 28 September 2022

A steel shipment has arrived on Teesside, UK, – marking the first activity of a freeport, anywhere in the UK. The area's freeport is expected to create 18,000 jobs and drive billions into the local economy in five years. Around 100 tonnes of steel were delivered to the South Bank area of Teesworks, designated as part of the freeport. Tees Valley Mayor Ben Houchen said: “Whether it’s pioneering the industries of tomorrow, or innovative initiatives, Teesside is leading the way –and this is yet another UK first as we become the first area to accept goods through our freeport."

Source: Teesside Live, 28 September 2022

ArcelorMittal has submitted an expression of interest (EOI) to acquire Srei Equipment Finance and Srei Infra Finance, which are both undergoing a resolution process under the Insolvency and Bankruptcy Code (IBC). Srei lenders have invited a fresh round of bids for these companies after a dispute with earlier bidders over earnest money deposits (EMDs). The creditors are yet to decide whether they can allow the entry of a new bidder, say various sources.

Source: BQ Prime, 29 September 2022

Immersive digital experience specialist Animmersion has created ‘Steelmaking of the Future’ for the Materials Processing Institute. The app enables users to scan QR codes placed around a purpose-built scale model of a steel plant and enables the Institute to showcase its advances in research and innovation in the steel industry on the road to Net Zero. Chris McDonald, CEO of the Materials Processing Institute, said: “This hi-tech model allows us to explain in an engaging and informative way just what steelmaking will look like in 2050, the year the government has pledged to meet its net zero targets’’.

Source: The Yorkshire Post, 30 September 2022

US-based Latrobe Specialty Steel has seen its workers at odds with their union after a hastily ratified contract. After the United Steelworkers rejected a new contract, employees began to collect signatures for a decertification petition to vote out the union. When union officials heard about the petition, they signed the contract on 28 July. Then, a second vote on the contract was held on 1 August. Workers were unaware the contract had been signed, but the vote was irrelevant to the contract negotiations. The situation ‘is another example of how union bosses put their own power and interests ahead of those they claim to ‘represent,'’ National Right to Work Foundation vice president Patrick Semmens said.

Source: Broad + Liberty, 28 September 2022

India has applied to the World Trade Organization (WTO) for permission to impose additional import tariffs of 15% on 22 British goods. According to a report, this step was taken by the Indian government in response to restrictions on shipping steel products to the UK. The government told the WTO that the safeguard measures taken by the UK on steel products led to a reduction in Indian exports of 2.19Mt.

Source: GMK Center, 29 September 2022

The Global Innovation Lab for Climate Finance, a publicprivate partnership to scale up climate finance, has launched seven innovative financial instruments for climate-related projects in emerging economies. Combined, the new deals seek over $1 billion from commercial, concessional, and philanthropic investors for climate adaptation, food systems, zero-carbon buildings, sustainable energy, and green steel.

Source: Eco Business, 3 October 2022

Tata Steel Mining Limited (TSML) has received the prestigious Responsible Chromium recognition, awarded by the International Chromium Development Association (ICDA) based in Paris. TSML is the first Indian mining company to receive this international recognition. The Responsible Chromium recognition was awarded to the company after a rigorous sustainability assessment, combined with a verified rating from the independent sustainability rating agency Ecovadis.

Source: The Pioneer, 3 October 2022

BHP Group, the Australian multinational mining company, has lifted its long-term demand forecast for steel based on what it describeds as a global shift towards the decarbonization of power generation that will increase the need for steel. The company forecasts surging demand for wind and solar farm equipment to boost steel demand by 2% in 2030 and by 4% in 2050. It expects global steel consumption to increase by 42Mt and 76Mt in 2030 and 2050, respectively, with a sizeable chunk due to demand for solar and wind power equipment.

Source: Reuters, 3 October 2022

Italy-based plantmaker Danieli has announced that it will supply a new rolling mill and reheating furnace to Brazilian steelmaker ArcelorMittal Brazil for the production of profiles including flats, angles, rounds, and squares. The new rolling mill and reheating furnace will be installed at the company's Barra Mansa Works to produce 400Mt/yr of quality bars and medium sections, increasing the production capacity of the plant. The rolling mill and reheating furnace are expected to start operation by mid-2024. This will be the 48th Danieli rolling mill in Latin America.

Source: Steel Orbis, 3 October 2022

ArcelorMittal has announced that it has invested a further $17.5 million in Form Energy Inc. (Form) via its XCarb® Innovation fund. The investment, which is part of Form’s oversubscribed $450 million Series E financing

round, is the second investment ArcelorMittal has made in the company, following its initial investment of $25 million announced in July 2021. Form Energy was founded in 2017 and is developing, manufacturing, and commercialising a new class of cost-effective, multiday energy storage systems that aim to enable a reliable and fully renewable electric grid year-round.

Source: ArcelorMittal, 4 October 2022

Steel Dynamics Inc, the US-based steelmaker, has announced the completion of its acquisition of Mexican recycler ROCA ACERO (ROCA), as part of its North American raw material procurement strategy. The transaction was funded with available cash. ROCA, headquartered in Monterrey, Mexico, operates a ferrous and non-ferrous scrap metals recycling business comprised of five

scrap processing facilities strategically positioned near high-volume industrial scrap sources located throughout Central and Northern Mexico.

Source: Cision, 4 October 2022

The Indian government has set up two advisory committees to iron out the challenges in the steel industry to achieve the target of 300Mt of production capacity by 2030. Members of the steel industry, associations, academia, and senior retired government officials comprise the two separate committees formed for integrated steel plants (ISPs) and the secondary steel sector, according to a steel ministry document. Source: Moneycontrol, 5 October 2022

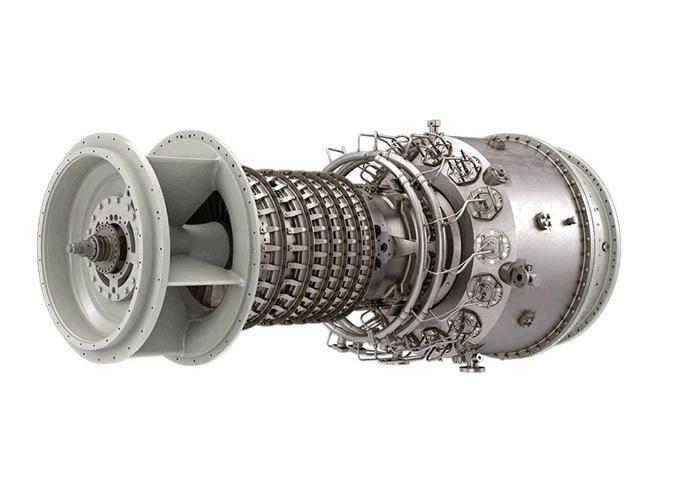

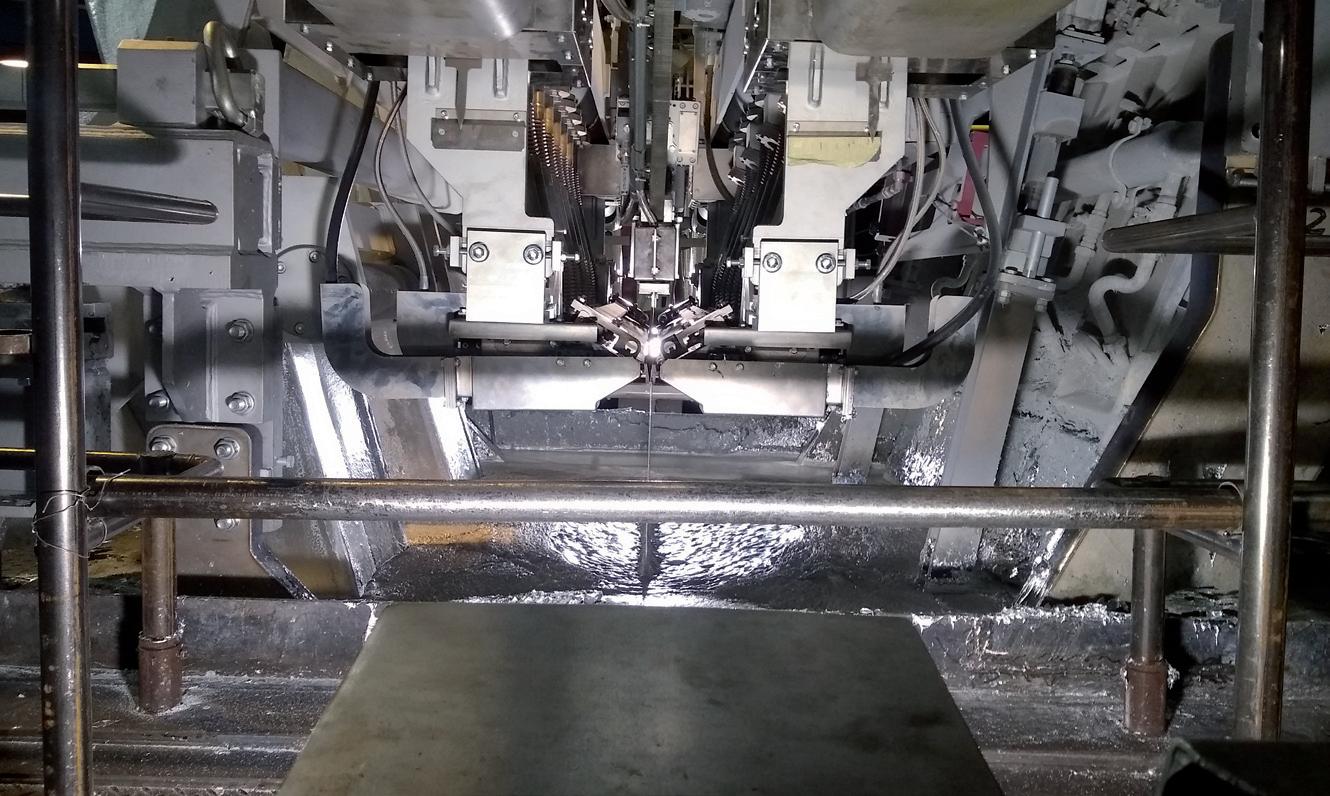

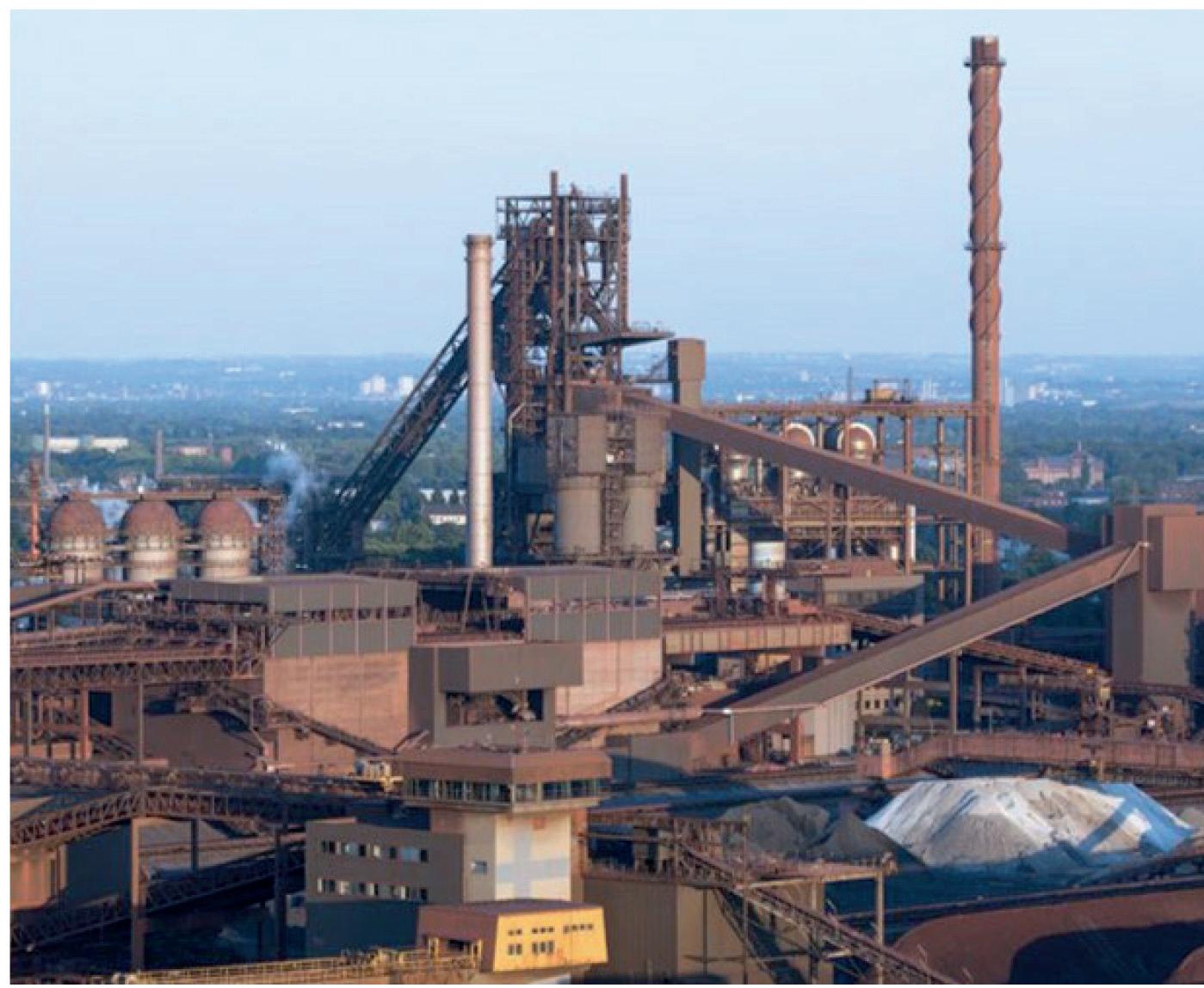

The official inauguration of the world’s largest acid regeneration installation has taken place at the Chinese BAOWU Steel Group’s Shang hai-based subsidiary, Baoshan Iron and Steel, supplied by mechanical engineering group, John Cockerill Industry.

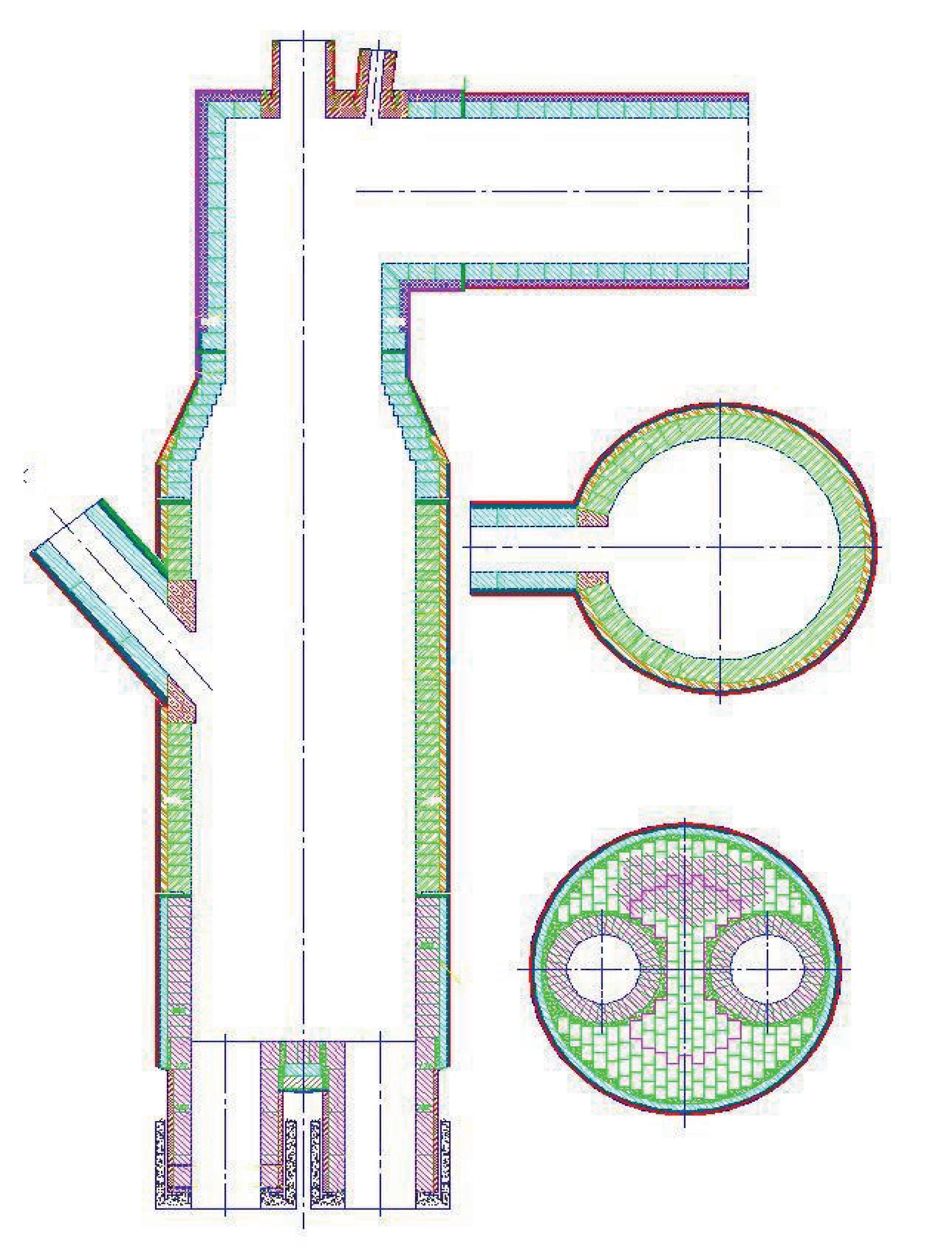

The world`s largest capacity twin acid regener ation plant (ARP) purifies 2 x 20 litres per hour of spent hydrochloric acid (HCl) that is led back into the client’s manufacturing process. According to the latest monitoring data recorded by John Cockerill, it will reduce the plants carbon foot print by 4.8kt per year, and its dust emissions by 25 tons, all while either reducing or eliminating other waste streams, including wastewater and solid hazardous waste.

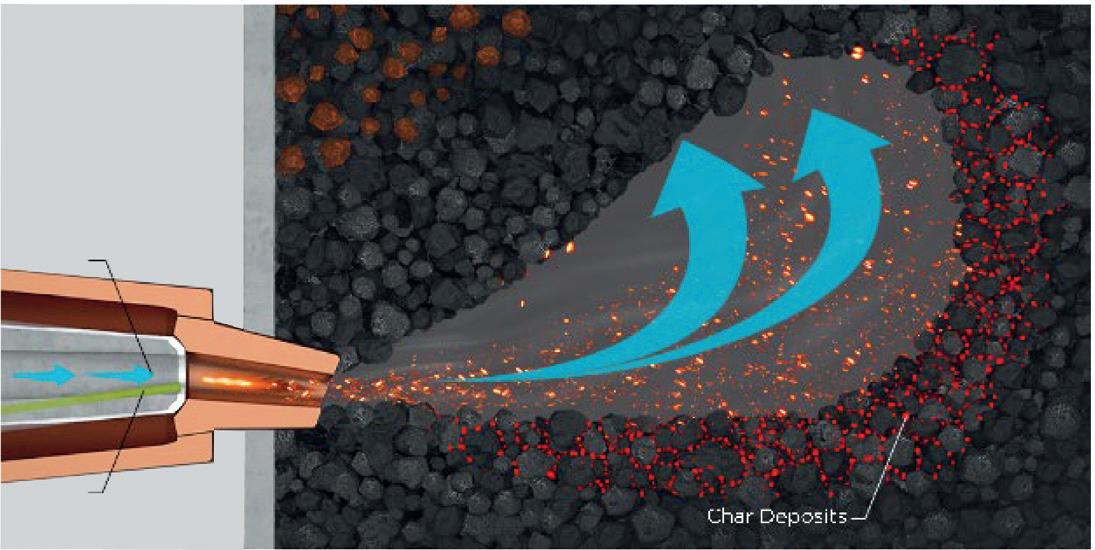

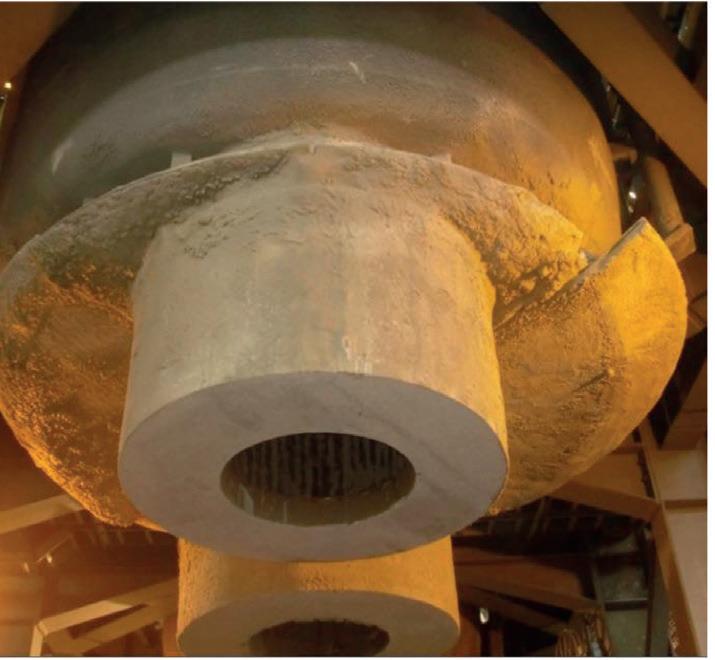

Located in the client’s flat steel complex in Shanghai, the two ARPs are based on John Cock erill’s fluidized bed (FB) technology, for highest throughput and plant availability, which the company claims provides operator friendliness, as well as a small footprint and easy oxide handling.

According to the company press release, John Cockerill’s acid regeneration plants allow the re cycling of close to 100% of the generated spent pickling liquor. Additionally, the tank farm guar antees the management of consumable process chemicals and maximizes operating efficiency, but also minimizes the environmental impact.

“There are many ways towards circular econo my in the steel sector, but the fundamental solu tion lies in technology.” said Mr. Gu, Baoshan Iron and Steel’s project manager, adding: “This new installation is yet another element to help

our Group towards circular economy and tackle climate change. One of the strengths of the acid regeneration process provided by John Cockerill is the environmentally friendly design of the twin plant. Thus, the two highly efficient ARPs allow the recycling of close to 100% of the used hydro chloric acid for reuse in our hot-rolled steel strip manufacturing process.”

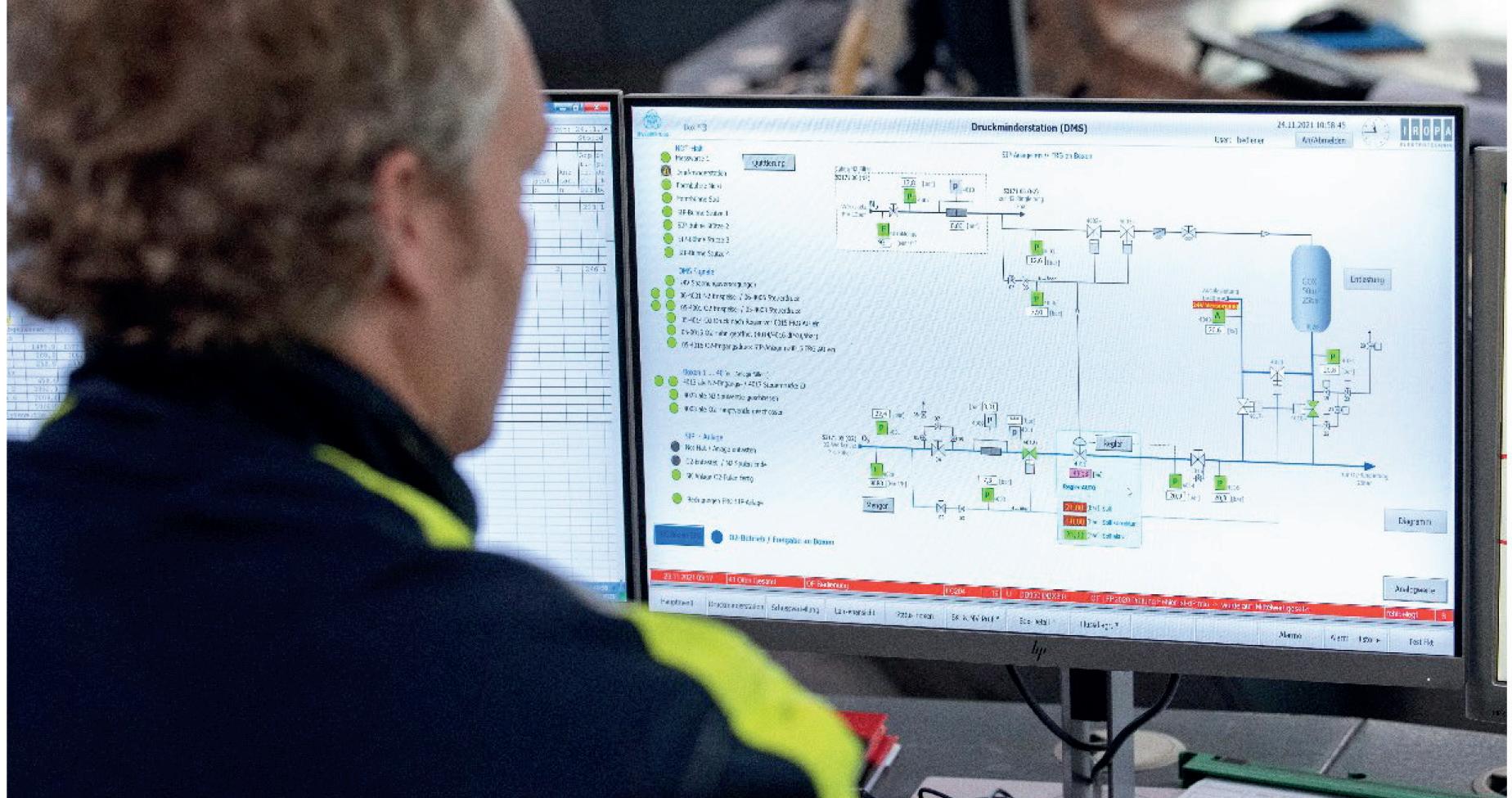

“John Cockerill’s latest generation of ARPs come with an innovative and environmen tally friendly concept, particularly in terms of emissions and waste energy recovery, combined

with smart manufacturing and Industry 4.0 technologies. We are proud being able to assist premium steel suppliers like BAOWU to face the ever more stringent environmental policies in their country and to deliver a cleaner and more sustainable steel industry by providing future-ori ented high-performance equipment like this Twin ARP installation,” commented Isabelle Widmer, managing director of John Cockerill UVK.

For more information, log on to www.johncockerill.com

The Chinese producer of special bar quality prod ucts, Fujian Sangang Minguang Group Co., Ltd. (Sanming), has successfully modernized its bar mill line and rolled the first bar on its new KOCKS 3-roll Reducing & Sizing Block (RSB).

The government-owned enterprise was found ed in 1958. Today, it is one of the largest steel producers in the Fujian province on the south eastern coast of China, producing around 11Mt of steel every year. As part of a major moderni zation project, the decision was made to invest into an upgrade of the existing mill, including the integration of a KOCKS RSB®

The commissioned RSB® 370++/4 is located as part of a finishing unit after 21 stands in H/V rolling mill arrangement, and will produce bar in coil within a dimension of Ø 16 to 48 mm and

straight bars within a dimension of Ø 20 to 90 mm in a 800kt/yr mill line.

The large-scale modernization through a Chinese EPC contractor required the purchase of additional rolling mill equipment. As well as the KOCKS RSB, the project included the supply of H/V stands, shears, a new bar in coil line with finishing facilities, and the upgrade of the inspection line.

In addition to the mechanical equipment, electrical and automation components have been modernized to ensure minimum down times, maximum transparency and the highest efficiency.

For further information, log on to www.kocks.de

Amid declining steel production the US steel industry braces itself to cope with the climate change challenge. By Manik Mehta*

ONE had been hearing for some time the Cassandra cries about soaring inflation, job cuts and, indeed, a recession ahead of us, though such forebodings were dismissed in the past by some experts as ‘unrealistic’ and divorced from the economic realities. America, they said, had fared not badly despite the Covid slowdown, compared to other developed countries where the confidence level in the steel industry had sunk to a low point. America had jobs for the asking, with employers stretching their hands with a carrot for enticing workers.

But the upbeat mood is increasingly becoming a thing of the past, and many have revised their outlook for the economy but also for specific industries, including the steel sector.

US raw steel production declined by 0.6% to 1.683Mt (net tons) in the week ended 24 September while the capability utilization rate slipped to 76.4%, the lowest since 20 months, according to the weekly data of the American Iron and Steel Institute (AISI) the steel industry’s ‘voice’.

Year-to-date (YTD) raw steel production until 23 September dropped to 66.4Mt (net tons) at a capacity utilization of 79.6%, down from 69.2Mt (net tons) the year earlier at a capacity utilization rate of 81.0%.

The AISI, quoting Census Bureau’s preliminary data, reported that US imports amounted to 2.51Mt (net tons) in August 2022, including 2.08Mt (net

tons) of finished steel (down 6.2% and 8.4% respectively compared to July 2022).

Imports of total and finished steel were up 8.8% and 28.7% respectively, year-to-date compared to 2021 levels.

In August, the largest supplying countries were Canada (589kt NT, up 8% versus July), Mexico (485kt NT, up 5%), South Korea (177kt NT, down 37%), Brazil (176kt NT, down 30%) and Vietnam (107kt NT, up 110%). For the 12-month period September 2021 to August 2022, the largest suppliers were Canada (7.00Mt NT, up 9% compared to the previous 12-months), Mexico (5.77Mt NT, up 50%), Brazil (2.98Mt NT, down 16%), South Korea (2.90Mt NT, up 21%) and Vietnam (1.29Mt NT, up 160%).

Aside from the drop in production and imports, the pundits predict a weakening of the US steel industry accompanied by dark clouds on the horizon that could result in a recession.

The US steel industry has faced a steady decline in demand since the third quarter of 2021 when prices had crossed the highest

mark of $2,000 per ton. This was quite a departure from the previous year’s so-called ‘less pessimistic mood’ prevalent in the market, even as buyers then had begun to experience the low after a cautious return to their business in the aftermath of the Covid lockdowns and restrictions.

In general, one can say that the mood is not exactly upbeat right now, particularly among flat-rolled producers who have faced a number of production challenges and shipment issues, with some not ruling out a major drop in demand in the remainder of the year.

Meanwhile, there have been calls for repealing Section 232 tariffs with the argument that this would generate economic growth and other benefits. A report from the Tax Foundation suggests that the nation’s GDP would gain by $ 3.3 billion and create some 4,000 jobs.

The tariffs of 25% and 10% were imposed on steel and aluminium imports respectively by former President Donald Trump in March 2018, in an effort to support the domestic steel and aluminium industries using national security interests to justify the tariffs. The US also signed agreements with Canada, the European Union and others, replacing tariffs with other restrictions such as quotas.

While the US steel industry supported the tariffs, the opponents have been questioning the relevance of the national security argument for imposing the tariffs; besides, they argue, the benefits to domestic steel producers did not take into account the heavy price paid by the national economy. The Tax Foundation’s

representatives said that several independent studies had concluded that each of the estimated 8,700 jobs protected in the steel industry cost an estimated $650,000; indeed, the tariffs had led to some 75,000 job losses in the general manufacturing sector. The Foundation further concluded that the evidence suggested that the cost of tariffs had been borne, mainly, by the nation’s consumers and companies.

Reacting to the call to revoke the tariffs on steel imports, US Commerce Secretary Gina Raimondo said that the government is considering repealing tariffs on certain goods to curb the highest inflation Americans have had in 40 years.

However, Raimondo was not specific about steel and aluminium tariffs.

“I know the president is looking at that,” Raimondo noted in an interview on CNN’s State of the Nation. “There are … products – such as household goods and bicycles –[where] it may make sense.”

“Steel and aluminium – we’ve decided to keep some of those tariffs because we need to protect American workers and we need to protect our steel industry; it’s a matter of national security,” said Raimondo who had in the past supported Trump’s tariffs on China.

However, the steel industry’s big challenge lies in overcoming the pollution emitted in the course of production. Though US steel production is considered to have the lowest carbon level, the industry is also taking measures to curb carbonization. The Biden administration announced in September new measures to be included in the so-called Federal

Buy Clean Initiative aimed at pushing the development of low-carbon construction materials made in America and, in effect, supporting good paying jobs.

While visiting the direct reduction steel plant of Cleveland Cliffs, Transportation Secretary Pete Buttigieg and some senior officials remarked that the administration would prioritize the purchases of steel, concrete, asphalt and flat glass with reduced emissions.

The US steel industry welcomed the measures. In his reaction, AISI’s president/ CEO Kevin Dempsey said that the announcement was a recognition of the innovation and advancement made by American steel producers, offering to work with government agencies to ensure the use of clean American steel.

As the emphasis on ‘clean and green steel’ grows, the industry is turning, increasingly, to recycling. According to estimates by industry groups, US steelmaking furnaces consume about 70Mt of domestic steel scrap for producing new steel. This is also in sync with the industry’s commitment to sustainability, as the steel industry conserves energy, emissions and resources.

Demand for steel scrap directly sustains and enhances recycling of many products such as cans, cars, appliances and construction materials that consume steel. The physical characteristic of steel allows it to be recycled numerous times without affecting its quality or strength. Indeed, more than 80% of the co-products from the steelmaking process are recycled or used again.

While the fear of cheap imports hangs like the proverbial sword of Damocles over the domestic steel industry, the latter also faces the challenge of drastically cutting down decarbonization.

According to a report by the research firm Wood Mackenzie, decarbonizing the iron ore and steel industries by the 2050 target year, in line with the Paris Climate Agreement, would require a whopping $1.4 trillion in terms of investment and upgrading across every stage of the value chain, creating challenges for the industry but also for the institutions charged with funding.

The US steel industry has its job cut out for it – it must eventually play not only to international public opinion, but may also come under the scrutiny of environmentallyconscious US politicians. �

With ArcelorMittal having recently disclosed its acquisition of Brazilian steelmaker Companhia Siderúrgica do Pecém (CSP), opportunities and impacts from this investment are heading to the surface. It is yet to be seen what strategy ArcelorMittal will utilize to expand to the company, but, says Germano Mendes de Paula*, the effect on the global market in both the short and long-term will be considerable.

ARCELORMITTAL has announced the acquisition of a 100% stake of the Brazilian steelmaker CSP, for a consideration of $2.2bn, in late July 2022. The seller was a consortium formed by Vale (50%) and the South Korean steel producers Dongkuk (30%) and Posco (20%). CSP, the new Brazilian integrated coke mill, started-up in 2016. CSP’s productive and financial performance in its initial years of operations was theme of the article published in STI, Nov-Dec 2021, pp. 20-21.

Vale’s disposal of its stake in CSP cannot be seen as a surprise. In 2016, we discussed the company’s strategy regarding investments in the Brazilian steel industry. It was identified as having three different stages: a) investments for the implementation of coke integrated steel mills during the 1950s and 1970s, aiming to boost iron ore sales; b) participation in the privatised companies, during the period 1991-2009, not only for commercial purposes, but also due to a financial goal: to convert a large amount of Siderbrás’ (a governmental holding for steel assets) debentures, an illiquid financial asset, into steel enterprises’ shares; c) investments in

greenfield projects, from 2004 onward, including ThyssenKrupp CSA and CSP.

It was verified that “Vale’s investments in CSA and CSP share similar characteristics, because they are: a) greenfield coke integrated mills; b) joint ventures with international steelmakers; c) specialised on slab production; d) located on the coast. In this way, the third phase can be considered as almost a reproduction of the first one”. Moreover, “Nowadays, Vale’s participation in Brazilian steel companies is restricted to CSP, prompting one final question: When will it sell its stake in CSP?” (STI, Nov-Dec 2016, p. 12). The answer finally came over five years later. Now, it is the first time in six decades that Vale does not have any stake in a Brazilian steel company.

According to a report released by the Brazilian investment bank Itaú BBA, concerning Vale’s corporate strategy: “Last decade’s diversification strategy comes to an end. CSP was one of the last relatively significant assets that remained to be sold by Vale. In 2022 they had previously concluded the sale of their coal operations. In 2021, they divested from: i) nickel assets in [Vale New Caledonia] VNC; ii) a stake in fertilizer assets at Mosaic; and iii) a 50% stake in CSI’s steel operations in California”.

It is worth noting that a 40% stake in Mineração Rio do Norte, a bauxite mining located in the Amazon Forest, is the only asset that falls in a non-core category that remains to be sold. Indeed, for Vale, CSP was a non-core asset, both in terms of strategy and finance. It sold its participation in CSP for $1.1bn, while its market capitalisation reached $63.3bn, when the transaction was announced.

ArcelorMittal has extensive operations in Brazil, both for flat steel products (Tubarão and Vega do Sul) and long steel products (Monlevade, Juiz de Fora, Piracicaba, Barra Mansa, Resende, and 50% of Sitrel, as well as in the downstream activities through its partnership with Bekaert). In 2021, it produced 11.2Mt of crude steel, which was equivalent to 31% of the country’s output. Consequently, it has substantial expertise in operating in Brazil, and in producing and exporting slabs (in Tubarão).

It should be stressed that from a financial perspective for ArcelorMittal, the acquisition of CSP is more relevant than for Vale, not only because it needs to pay $2.2bn, but also due to its lower market capitalisation ($25.9bn). Thus, the deal was equivalent to

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

8.5% of ArcelorMittal’s market capitalisation, whilst only 1.7% for Vale. It should be highlighted that the CSP’s purchase still needs to be approved by the Brazilian antitrust authority, which is expected to happen by the end of this year.

ArcelorMittal justified its considerable investment to purchase CSP by the following reasons. Firstly, it is a first-class 3.0Mt/yr slab producer, installed in a deep-water port. It is capable of producing high quality slab, and its steel shop is already prepared for doubling its installed capacity.

Secondly, it is located relatively close to Carajás iron ore mine, which allows lower logistic costs. In addition, CSP is installed inside an Export Processing Zone and benefits from a special tax regime on the sale of products and purchasing of raw materials. The asset will face a 15% tax rate and has $1.2bn of tax credits to be utilised to offset profits in other operations and to reduce expansion costs.

Thirdly, CSP’s 5-year average EBITDA has been $320M. ArcelorMittal expected to gain $50M of synergies, including selling, general, and administrative expenses (SG&A), procurement, debottlenecking, and improved productivity. In addition, it planned to achieve a normalised EBITDA of $330M, implying that it is paying a 6.7x Enterprise Value (EV)/EBITDA, in the post synergies scenario. As CSP is quite modern, a small maintenance capex (lower than $50M annually) is projected.

Fourthly, CSP’s output can be used to supply slab to other groups, such as for Lazaro Cardenas mill, in Mexico, which is ramping up a 2.5Mt/yr hot strip mill, Calvert mill, in the USA (a 50:50 joint venture with Nippon Steel), and other plants in Europe. It can also serve third parties in the USA, which currently is short of slabs, and in Latin America.

Finally, ArcelorMittal is considering expanding CSP. Two main options have already been mentioned by the company. The first refers to amplifying crude steel capacity, by adding BF/BOF or even DRI/EAF, and the latter is related to higher vertical integration. Despite the fact that Mr Aditya Mittal declared that there are lots of downstream options, on flat and long steel products, no additional information was provided. Considering that many investments were announced for long steel products in Brazil recently and there is just one flat steel amplification project under construction in the country nowadays (an expansion in ArcelorMittal Vega do Sul), there is likely to be more space downstream for flat steel products. In this case, CSP will need to address this investment opportunity with Tubarão.

In any case, CSP’s transaction might have considerable impacts for the global and Brazilian slab market in the short-term- and even for the country’s finished steel market in the medium and long-term. �

With the demand season round the corner, Indian steel mills are preparing to witness a sharp improvement in their operating margin in the second half (October 2022 - March 2023) of the current financial year, after a lacklustre performance reported in the first half (April – September 2022).

By Dilip Kumar Jha*INDIAN steel mills are desperately waiting for the commencement of construction activity which normally begins following the end of the monsoon rainfalls in September. This restores steel demand after nearly four months of drawdown during the monsoon season, between June and September. The second half brings in a lot of optimism, which not only compensates for the weak demand trend of the first half but also sets the tone for the next year.

During the April – June quarter, the operating margin of India’s steel producers slumped on a sharp decline in steel prices despite high input costs pressure. While input prices have started correcting since July, its impact will be felt towards September-end, when the existing pipeline steel inventory exhausts. This inventory was built on expectation of a further price increase.

While the most developed economies talk of economic recession, India is looking to an emphatic 7% GDP growth, with

focus on a consumption-led economy. Meanwhile, the government’s attention is being paid toward the infrastructure development of road and housing construction projects which are set to support India’s steel demand going forward. The upsurge in demand is bound to elevate the operating margin of India’s steel producers which is estimated to report at 25% in the second half, after falling to 14-15% in the first half between April and September 2022. In the previous financial year, the operating margin of Indian steel mills had set a decadal high record at 30%.

Indian steel mills reported a pressure on their operating margin on account of high

* India correspondentinput cost, lower realizations and a 15% export duty levy on finished steel products that impacted overall business sentiment in the first half. Above all, the high input cost emanated after supply disruptions from Russia following Moscow’s invasion of Ukraine and western sanctions on the Kremlin thereafter, hit the global economy, with India’s steel sector not being immune.

According to Seshagiri Rao, joint managing director, JSW Steel, the entire Indian steel industry suffered after 15% of export duty was levied by the government earlier this year. “India’s steel exports declined by 50% in the first half of the current financial year to around

3-3.5Mt from around 7Mt reported in the corresponding half of the previous year because of a slowdown in overseas orders. Indian steel became uncompetitive in the world market after the introduction of a 15% export duty levy. In July this year, the Indian steel industry, in fact, became a net importer. Presently, India’s steel output is higher than demand which translates to lower realization, and eventually a squeeze in profit margins. We have submitted a written memorandum to the government, seeking immediate withdrawal of the export levy, and are now waiting for the decision,” Rao added.

Indian steel producers are losing the opportunity to dispatch more product, even though the market is less competitive due to the sanctions Russia faces, and the Covid cases and lockdowns in China. In 2021-22, India’s steel exports jumped by over 25% to 13.49Mt from 10.78Mt reported in the previous year.

In the second half of this year, the margin pressure is expected to ease and improve as production costs have declined on account of a sharp decrease in raw material prices amid expectations of robust domestic demand. For the full financial year April 2022March 2023, therefore, operating margins are forecast to average at 22-24%, with a decline of 7-8% from the previous year, but an increase from the pre-pandemic average of around 20% logged between financial years 2017 and 2020.

Coking coal is a key raw material comprising around 40% of the production cost and is usually imported by Indian steel manufacturers. Prices, however, dipped from a historical high of around $600 a tonne in March to around $250 a tonne in August due to improved supply from Australian mines and weakening demand from global steel producers. Coking coal prices are expected to remain benign as supply improves. The global demand outlook is forecast to remain weak.

“Iron ore sourced domestically and accounting for 15-20% of the production cost, has also shed more than 50% in price since May 2022 on account of increased domestic supply following the imposition of export duty of 50% on iron ore and 45% on pellets. The lower raw material prices, mainly global coking coal and domestic iron ore, may reduce production costs for Indian steelmakers by around 30% in the second half of this fiscal,” said Ankit Hakhu, director, Crisil Ratings.

Indian steel mills are estimated to have expanded their cumulative installed capacity to 155Mt, for the financial year 2021-22 against 142.91Mt reported the previous year. JSW Steel alone added 5Mt of new capacity at its Dolvi plant in Maharashtra. However, weak demand coupled with high raw material prices in the first half yielded an average total capacity utilization of 77% for the financial year 2021-22. With demand weakened further in the first half, the average capacity utilization of Indian steel mills is projected to have declined to below 70% during the April – September 2022 period.

Strong economic growth coupled with governmental focus on consumption-led demand drivers is set to brighten the outlook for Indian steel producers in the second half of the current financial year, between October 2022 and March 2023.

ARL iSpark. The trusted standard.

Metal is the backbone of our society. It’s in the structures we ride, work and live on every day. That’s why you’ve trusted the detection technology inside every ARL iSpark for over 80 years to ensure every piece of steel and metal you produce is safe. With so much riding on that, why would you choose anything else?

Find out more at thermofisher.com/ispark

*Based on a data comparison, completed by Thermo Fisher Scientific in 2021, of detection limits for OES systems using data published in specifications and applications notes for ARL iSpark and competitors.

©2022 Thermo Fisher Scientific Inc. All rights reserved. All trademarks are the property of Thermo Fisher Scientific and its subsidiaries unless otherwise specified. AD41408 0922

Following STI’s recent review of Genmin’s iron ore activities in Gabon, Fortescue Metals Group Ltd (FMG) has outlined its preliminary investigations of further iron ore activities in that country. This development reflects Gabon’s drive to become a major high-grade iron ore producer.

By Michael Schwartz*FMG has entered into an agreement with the Gabonese Government to study the potential development of the country’s Belinga iron ore project. The company’s CEO Elizabeth Gaines outlined the background to STI: “In December 2021, Fortescue announced it had entered into a binding preliminary agreement with the Government of the Republic of Gabon to study the opportunity to develop the Belinga iron ore project in Gabon, West Africa. If successful, the project would complement Fortescue’s existing product mix by providing a high-grade iron ore.”

Three years will be specifically set aside under the agreement to study and negotiate a mining convention for the development of the Belinga project, which stretches over 5,500 km². A separate Gabonese mining company will be established to enter into the mining convention and to hold the mining tenure over the Belinga project.

In turn, the mining company will be established by an incorporated joint venture which will be owned 80% by Fortescue and 20% by the Africa Transformation and Industrialisation Fund, an Africafocused investment fund incorporated in

Abu Dhabi. The joint venture will initially focus on exploration works to determine the potential size and grade of the Belinga deposit and logistics solutions during the 36-month exclusivity period.

commonly host banded iron formations and itabirites found in other parts of West Africa such as the Simandou project. The Belinga Iron Ore Project has been progressively assessed by Fortescue since 2018.

Elizabeth Gaines stressed that discussions with the Gabon Government on final documentation are progressing and that a technical review recently commenced to assess infrastructure and local geology in Gabon, as well as to conduct community engagement.

In addition, Gabonese president Ali Bongo Ondimba said that ‘following successful completion of the initial exploration and due diligence work with Fortescue, our aim is to put the Belinga project back on track, building the mining sector’s contribution to our economy and delivering training, jobs and skills.’

The Belinga iron ore project is located in the northeast of Gabon. The deposit was initially discovered in 1955, and subsequent exploration in the 1970s identified high iron and low contaminant mineralisation. The deposit sits in Archean aged rocks of the Congo Craton. The lithology and structure are typical of other greenstone belts that

*Iron ore correspondentThe last words are those of Elizabeth Gaines: “Fortescue is committed to its strategic pillars of investing in the long-term sustainability of the iron ore business and investing in growth…We look forward to working with all key stakeholders on this project as we continue to invest in assets to optimise growth and returns in our iron ore business.” �

Ready to invest in carbon capture? Munters has the expertise and equipment to support your project. We have decades of experience in Mass Transfer and Mist Elimination – Clean technologies that are essential to any successful carbon capture project, no matter the industry. You can count on Munters proven solutions to support your carbon capture project.

Clean technologies by Munters

more at www.munters.com/cleantechnologies

SOME people say that if you want to get ahead get a hat. Mark Bula, chief commercial officer of H2 Green Steel based in Sweden, would probably beg to differ. He would argue that if you want to move on up, work for somebody who is tough, demanding, and opinionated. There are many people in Mark’s world who have fitted the bill and when he mentions them it’s like a roll call of the US steel industry’s great and good.

“You learn in this industry in general that you’ve got to have a strong backbone and a tough skin,” said Bula, sitting in a bright meeting room in H2 Green Steel’s Stockholm offices. Bula looks the part, he always has, he’s one of two people I know who looks good in a pair of jeans and can carry off ‘smart casual’ with aplomb.

He had emailed explaining how the guys at H2 Green Steel are pretty relaxed and, therefore, there was no need to dress formally, which set alarm bells ringing. Unfortunately, when it comes to sartorial elegance, I have but two settings: smart and utterly derelict, so I opted for a suit. I couldn’t very well arrive in my unpressed ‘I bring nothing to the table’ tee-shirt, which I always pack for emergencies.

I’d been up early figuring out how to get across town from my hotel in the south of the city to where H2 Green Steel was located. I arrived early, very early, 0730hrs early – my appointment wasn’t until 0900hrs – and decamped to a small bakery where cappuccino and almond croissants prepared me for my first meeting with Mark since June, when he kindly

*Editor, Steel Times Internationalpresented the opening keynote at Steel Times International’s Future Steel Forum in Prague. Prior to that I hadn’t seen him for almost five years when he was working for Dave Stickler at Big River Steel in Osceola, Arkansas, USA.

That strong backbone, Mark admitted, had eluded him for many years. “I had to work when I was 14 just to have money to help the family,” he said, referencing humble beginnings. “I was picked on a lot as a kid. I was raised a Catholic, I used to get stuck in trash cans, I was the skinny, scrawny kid with no sports, I wasn’t super smart, I didn’t fit in anywhere and I was an easy target.”

Workplace advice was blunt: “You need to get a tougher skin.” It was one of many ‘valuable lessons’ he learned from the likes

Hydrogen steelmaking has been a big talking point in the global steel industry for many months – and for good reason. Two leading businesses involved in the development of such C02 reduction technology – HYBRIT and H2 Green Steel – are both based in Sweden which is viewed as a ‘Goldilocks location’ in terms of its renewable energy resources. While the former has kept its progress fairly close to its chest – but has proved that it’s possible to produce green steel using hydrogen – the latter has been open enough to offer Steel Times International an exclusive interview. Matthew

Moggridge* flew to Stockholm to meet Mark Bula, the company’s chief commercial officer

Stockholm where they are now looking to buy a place.

Mark described those early days in the US steel industry working for National Steel (which was eventually absorbed into US Steel) as a ‘grunt role’ in sales as opposed to a place on the management training programme, but eventually Nucor came calling and while he was advised that working for what is now the biggest US steelmaker was ‘a little cult-like’ he was assured that if he fitted in, it was a great company. And fit in he did. “I thought Nucor was the greatest thing ever,” he said, explaining how his career path was sales-driven, he was sent to problem territories where profitability wasn’t high enough, there were difficult customers, or the business needed to be expanded. “I was identified as the guy sent in to fix things,” he said, adding that when boredom eventually crept in, he was moved. And when he was bored of moving – and not wishing to jeopardize his second marriage – he resigned despite protestations from one John Ferriola who wanted him to stay. “I think maybe I could have been one of John’s guys,” he said, but not in a Brandolike On the Waterfront manner as Bula would soon be a contender in his own right.

January 2021 when he was working as chief strategy officer for the US-based AI start-up Everguard where he still sits on the board of advisors. The journey started with a random Linkedin message from Harald Mix, chairman and co-founder of H2 Green Steel and subsequent chats with him and his business partner Carl-Erik Lagercantz of Northvolt, a leading manufacturer of lithium-ion batteries. “I’m not here to be the front and centre guy. I’m here to mentor for the first time in my life,” he said. “I am in a role that yes, I have to deliver results, but this is more about me helping build behind the scenes…and that’s a role that I’ve never played before.”

And so he moved to Sweden with his wife and son, his daughter Kathleen had already begun college at the Citadel military college in Charleston, South Carolina, and currently plays Division 1 volleyball for them. His son, Tim, is also back home studying economics at Purdue, leaving Mark and his wife to learn Swedish and live the Scandinavian life. Does he miss his kids?

“The kids don’t miss us right now, they’re in college working out who they are; it’s easy not to miss them when they want to be on their own,” he said.

of National Steel’s Jim Bender – ‘the first one to toughen my skin a little’ – and then from Dave Stickler at one of the start-ups they both worked on, probably Severcor, he said.

Why was he constantly advised to toughen up? “I think probably I took a lot of things personal, and I think it’s pride,” he said, wondering whether he could have done things differently and accepting that he’s always wanted to be liked and recognized as somebody who worked hard and delivered results.

During his early career he was expected to move around a lot and it cost him his first marriage. “I was too focused on myself, and my career and it was my fault,” he confessed, but has since remarried and now has two grown-up kids both of whom remain in the USA, leaving Mark and his wife as ‘empty nesters’ enjoying life in

Joining the late, great John Correnti and Dave Stickler at Big River Steel in Osceola, Arkansas, proved a turning point as it took Bula out of, if you like, ‘traditional’ steelmaking circles and into the world of Industry 4.0, digital manufacturing, artificial intelligence and, strangely, perhaps, the premise that steel as a material wasn’t the beginning, middle and end of what he was doing. Big River Steel, for example, liked to stress that it was a technology company that ‘just happened to make steel’.

Correnti put Mark out front, but when he suddenly (and tragically) passed away while on a business trip to Chicago with Mark, Dave Stickler took centre stage, taking on the role of raising money for the business. But not before Mark had established himself as a man who could develop an excellent rapport with the banks, a rare quality that would soon appeal to those in the early stages of setting up a groundbreaking hydrogen steelmaking business, something Mark described as ‘transitional in our industry’.

He was approached by the founders of the H2 Green Steel Project on, of all things, social media. It happened on 2nd

H2GS AB consists of three operating divisions – hydrogen, DRI/HBI and virgin iron – and ultimately, it’s all about flexibility. “We could just build a hydrogen plant somewhere, we could just build a DRI tower somewhere, we could just build a steel plant somewhere,” said Mark using repetition to drive home his point. “We don’t necessarily want to be in the steel business,” he said referring to the company’s tagline (or mission statement): ‘we decarbonize hard-to-abate industries’, meaning the technology could reduce the carbon footprint of other industries, like cement and fertilizer. “We’re very particular in that; there is a way to decarbonize those industries and to be the leader that takes the risk,” he said, adding that the risk can be ‘de-risked’ by having the hydrogen know-how. He spoke of the three different hydrogen processes that will be married into one hydrogen facility.

According to Mark, the amount of energy needed is enormous and that alone will be a limiting factor for the growth of hydrogen steelmaking generally, particularly for hydrogen to feed DRI and steel plants.

“If we can figure out how to manage all three [hydrogen production technologies] together and use computer learning, that’s

“H2 Green Steel’s purpose is to decarbonize hard-to-abate industries, starting with steel.” The company aims to build a large-scale green steel plant, with production up and running as early as 2025.

GIGA-SCALE ELECTROLYSIS: decomposing water into hydrogen using electricity, the starting point. Using fossil-free electricity to produce enough hydrogen to bring 5Mt of highquality steel to the market by 2030.

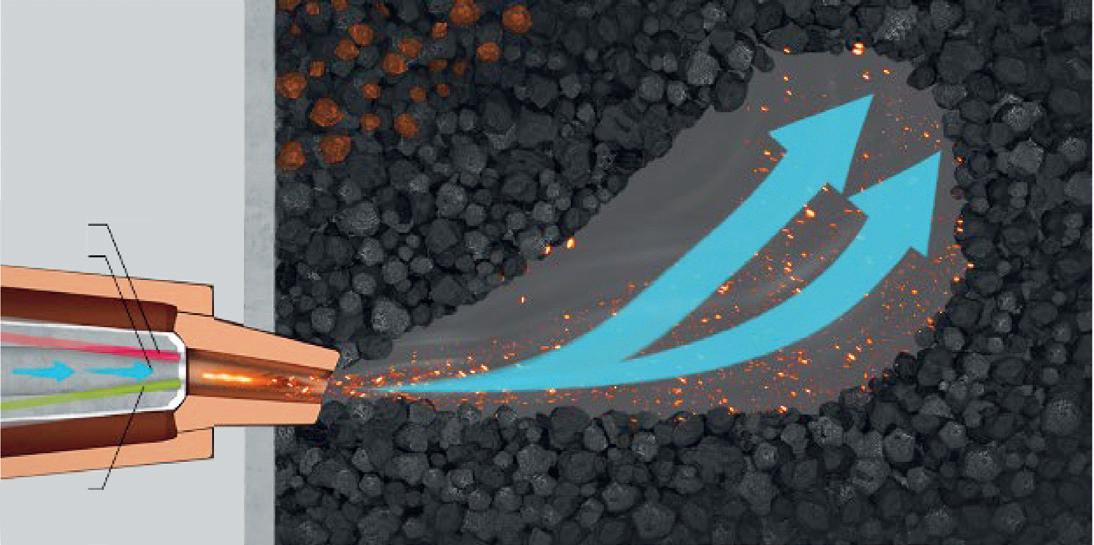

THE DR REACTOR: this equipment refines iron ore to direct reduced iron or DRI: iron ore exposed to hydrogen, which reacts with oxygen in the ore to form steam as a residual. Green hydrogen produced through electrolysis is used to reduce the ore instead of coal, reducing CO2 emissions by more than 95%.

ELECTRIC ARC FURNACE: fossil-free electricity used to heat the DRI and steel scrap to a homogenous melt of liquid steel. In the melting process, carbon plays an important role in lowering electricity consumption, forming the protective properties of the slag on top of the melt and enabling the transformation of iron to steel.

where our intellectual property resides,” he said, adding that patents have been filed and suddenly ‘you’re talking about H2GS AB as a parent company with an energy division’.

When I brought up the complex subject of how to define green steel, Mark admitted it was not a topic he or anybody else at H2 Green Steel had considered in any great detail – yet. “We’re still a project, we’re not a company,” he said, telling me that the World Steel Association has said that green steel doesn’t exist, again

prompting the use that word ‘yet’. But there is an official H2 Green Steel definition which reads as follows: ‘Green steel must be produced from a combination of a significant amount of green virgin iron and scrap in a production process which uses electricity from renewable energy sources. The total C02 emissions in such a process must be more than 90% lower than that of traditional steelmaking in a blast furnace process.’

“We’ve defined it less from a marketing and messaging standpoint and don’t

tout it a lot. I think it will evolve into something and maybe it will become the gold standard. The reason we have that definition [above] is we have commercial agreements that we’re closing to help us get finance and when you have a commercial agreement to provide ‘green steel’ or decarbonized steel you need a definition,” he explained.

“We don’t use the words ‘zero carbon’, we don’t use the phrase fossil-free steel because we know that carbon steel inherently has carbon in it, so I don’t

“I think a lot of people believe it’s too complex to get done, particularly for an inexperienced steel team. We have some good people involved, but we need to add more, and I hope this article gets people to realise that we need more experienced, start-up, minimill, DRI, EAF people. We have a really strong DRI team from the Middle East.”

CONTINUOUS CASTING AND ROLLING: Integrated process enables H22 Green Steel to reduce energy consumption by 70% and replace natural gas used in the traditional process.

LINES: for cold rolling to change thickness, annealing (to create the right mechanical properties); hot dip galvanizing: for desired corrosion resistance.

product just like other people, but for now that has not been a primary focus,” Mark said, stressing that the definition is there purely for commercial purposes. And then things took a complicated turn, or perhaps it was just me. Mark said that hydrogen was needed to make ‘green steel’ because natural gas was a fossil fuel. So hydrogen is an essential ingredient to reduce the iron ore to make a virgin iron product. In other words, you need a certain percentage of virgin iron in your EAF along with scrap, to make some of these high-quality steel products, but if the scrap does not have any C02 attached to it, it’s a lower footprint than if virgin iron from a hydrogen facility is added. For Mark, therefore, the ‘funny thing’ is that the automotive sector is leading the charge for ‘green steel’ but automotive grades cannot be made without virgin iron products so there must be a balance. “That intellectual property of the balance of the charge mix that goes into the EAF (and what happens afterwards) that’s what we will retain,” he said, bringing up the possibility of a C02 accounting system. “So, when you have a financial invoice, you should also have a C02 invoice, that’s what creates the value and so in my simple mind it comes down to the C02 footprint of that coil and I don’t think the industry is complex or good enough to know exactly how to put a value on that yet.

“It’s one thing to do these agreements today. I believe that what we’re charging for a green premium now will be considerably higher in the future. The difficult part is that higher grades will have a higher C02 footprint than scrap-based lower grades and that will be a commercial decision.

know that you can make a carbon-free steel but what you can do is decarbonize a significant portion of the traditional C02 intensity footprint of a coil which is 90-99% accomplished by this plant,” asserted Mark.

Mark says that the technology for the three hydrogen-making methods to be employed by H2 Green Steel exist and have been proven, the DRI towers are proven technology – Midrex was recently announced as the DRI partner in the project – and the steel mill, says Mark, is largely a duplicate of the last SMS mill that was

built, so all the technologies are used, but nobody has put them together and that’s what H2 Green Steel is doing. Mark believes H2 Green Steel will be able to achieve a 90-95% reduction in scope one and two emissions. Beyond that, he said, you consider things like carbon storage, carbon capture, bio-diesel. “All those things are incremental to try and get you as close to zero as you can,” he said.

“We’ll figure out how to market it and how we position it and I’m sure we’ll have a trademark name for our green steel

Series A funding was completed a year ago and while it looked as if the facility could be built for 2.5 billion Euros, it now looks as if the final figure will be close to double that, thanks to geo-political headwinds, notably Russia’s illegal invasion of Ukraine, which has increased opex and capex, but Mark believes it can still be financed. The ‘first close’ of series B funding was announced on 29 August 2022 with a ‘selected group of investors’ showing strong support for the company.

H2 Green Steel, says Mark, is one of the biggest projects in Europe but it’s going to take longer than originally anticipated. “Everybody wants to build a new green steel mill so to lock in the DRI tower, the

three different hydrogen processes and the steel plant equipment you need to put money down, so the series B round [of financing] allows for us to do that,” he said.

When it comes to the supply of steel

production equipment, it was recently announced that SMS group has been selected to provide a broad range of technology and equipment for H2 Green Steel’s Boden production facility and that

H2 Green Steel equipment operators will be trained by the German plant builder. But to start talking about equipment now would be premature, Mark suggested. “We’re a long way from that, we don’t have all our

“H2 Green Steel, is one of the biggest projects in Europe but it’s going to take longer than originally anticipated. ”Mark Bula with Maria Persson Gulda, CTO

20 years of experience and over 40 installed plants make Steuler the Refractory Technology Partner for tomorrows DRI Processes.

finance yet,” he said.

In total, across all three business units, there is likely to be between 1,200 to 1,400 employees at the Boden facility in Northern Sweden to deal with the planned initial capacity of 2.5Mt/yr (metric tonnes) – ‘and then we’re going to 5Mt’.

It goes without saying that there’s going to be a lot of eyes on this project. According to Mark it’s becoming a big topic at steel conferences where it comes up a lot in ‘sidebar conversations’.

“I think a lot of people believe it’s too complex to get done, particularly for an inexperienced steel team. We have some good people involved, but we need to add more, and I hope this article gets people to realise that we need more experienced, start-up, minimill, DRI, EAF people. We have a really strong DRI team from the Middle East,” he said.

Cost is a big issue as the plan is to electrify the whole process. “We’re using induction heating and green electricity, and this is the Goldilocks location to try it. I’m not sure you could do this project anywhere else in the world today and we’re going

to prove it can be done, we’re going to do it on a large scale,” said Mark, adding that there are lots of hurdles. He said it wasn’t going to be easy but having all the ingredients – iron ore and renewable energy – in one spot – made it a no brainer.

There will be winners and losers, according to Mark. “The people who can do it and the places where there’s no way you’ll ever be able to do it,” he said. In continental Europe there is limited fossilfree or renewable energy and, therefore, the cost is two or three times that of the Nordic countries. “When your energy rates are that high and you need 800-850MW, it’s a massive project,” Mark said.

There is an abundance of iron ore in the region surrounding H2 Green Steel’s Boden facility and Mark is keen to point out that the company found itself ‘in a little bit of trouble’ when it claimed a supply agreement was in place with LKAB, one of the founding partners of rival hydrogen initiative HYBRIT. “We don’t have an agreement yet,” he said but negotiations are taking place and if they fall through there are plenty of other places around the

world, such as Brazil, where the company could source its key ingredient even if sourcing raw materials from the other side of the world isn’t considered particularly ‘green’. “That is absolutely a concern for us and that is the complexity of Scope 3 upstream for any steel mill, right? We have done it in our modelling where we would have a certain percentage of direct reduction iron from Brazil, Australia and Canada. The real issue is where are the direct reduction pelletizers because you’ve got to have the pellets. We want to buy the pellets, so it makes sense for us to be in Sweden.”

Mark introduced the phrase ‘a rising tide raises all boats’ in relation to Sweden’s natural resources. “Sweden could be the leader, it’s the lighthouse. We’re not talking about SSAB or H2 Green Steel, it should be about Sweden. We think there are ample natural resources for us all to be successful and be the leader of it,” he said.

Jumping the gun a little I wondered what the expansion potential was for a concept such as H2 Green Steel. Are we likely to see more Bodens cropping up?

It was a naïve question as development of such a massive project depends on the availability of renewable resources which, as discussed above, not every country possesses, but Mark believes that elements of what is being built in Northern Sweden can be duplicated elsewhere, certainly in collaboration with like-minded businesses such as the Spanish renewable energy business Iberdrola, which has an established partnership with H2 Green Steel.