What is President Donald Trump’s agenda?

Will US Steel pivot to greener fields, asks Akira Kanno.

IDOM Consulting examines the available technologies.

Tenova’s and Ori Martin’s Lighthouse Project.

What is President Donald Trump’s agenda?

Will US Steel pivot to greener fields, asks Akira Kanno.

IDOM Consulting examines the available technologies.

Tenova’s and Ori Martin’s Lighthouse Project.

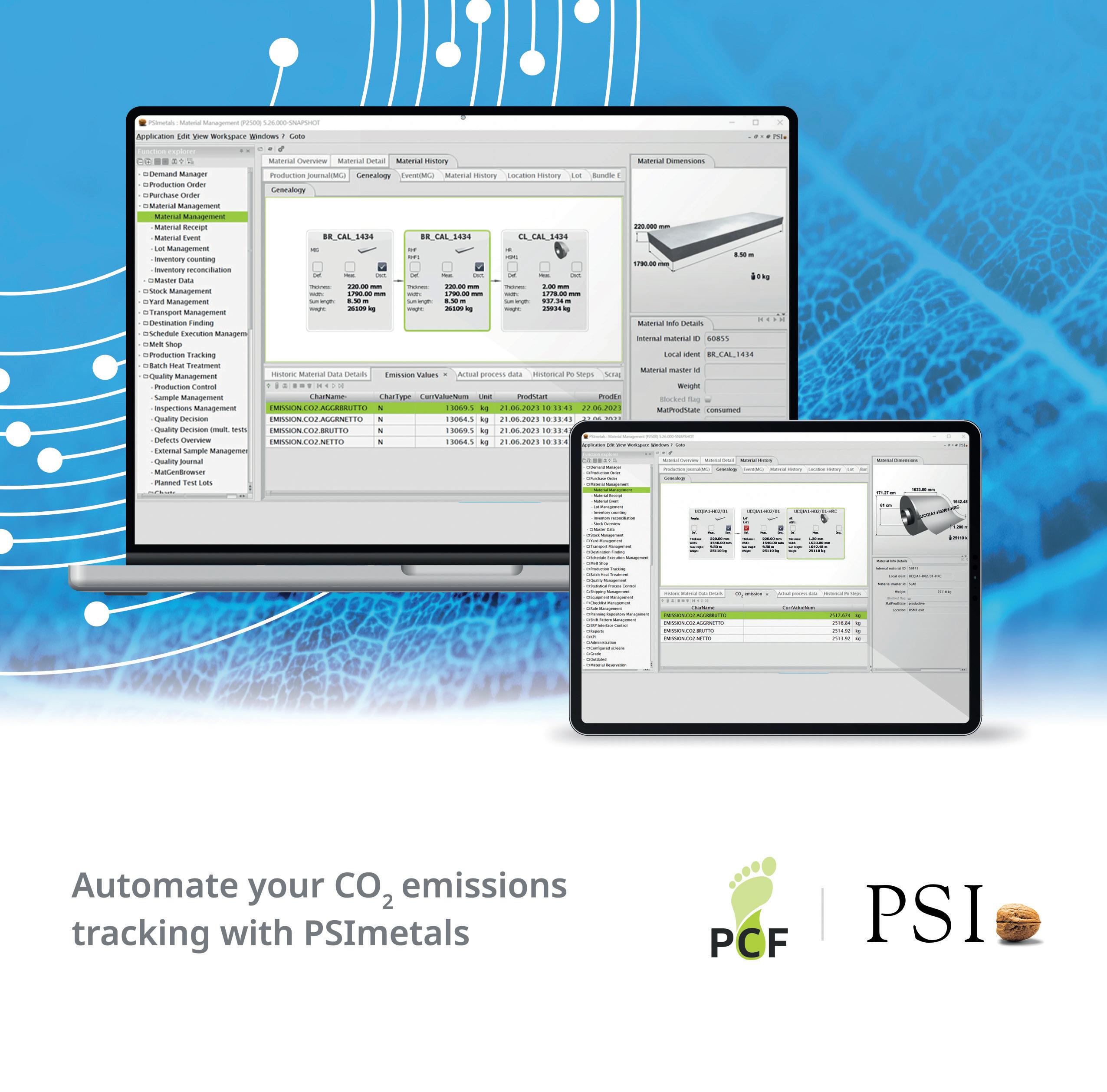

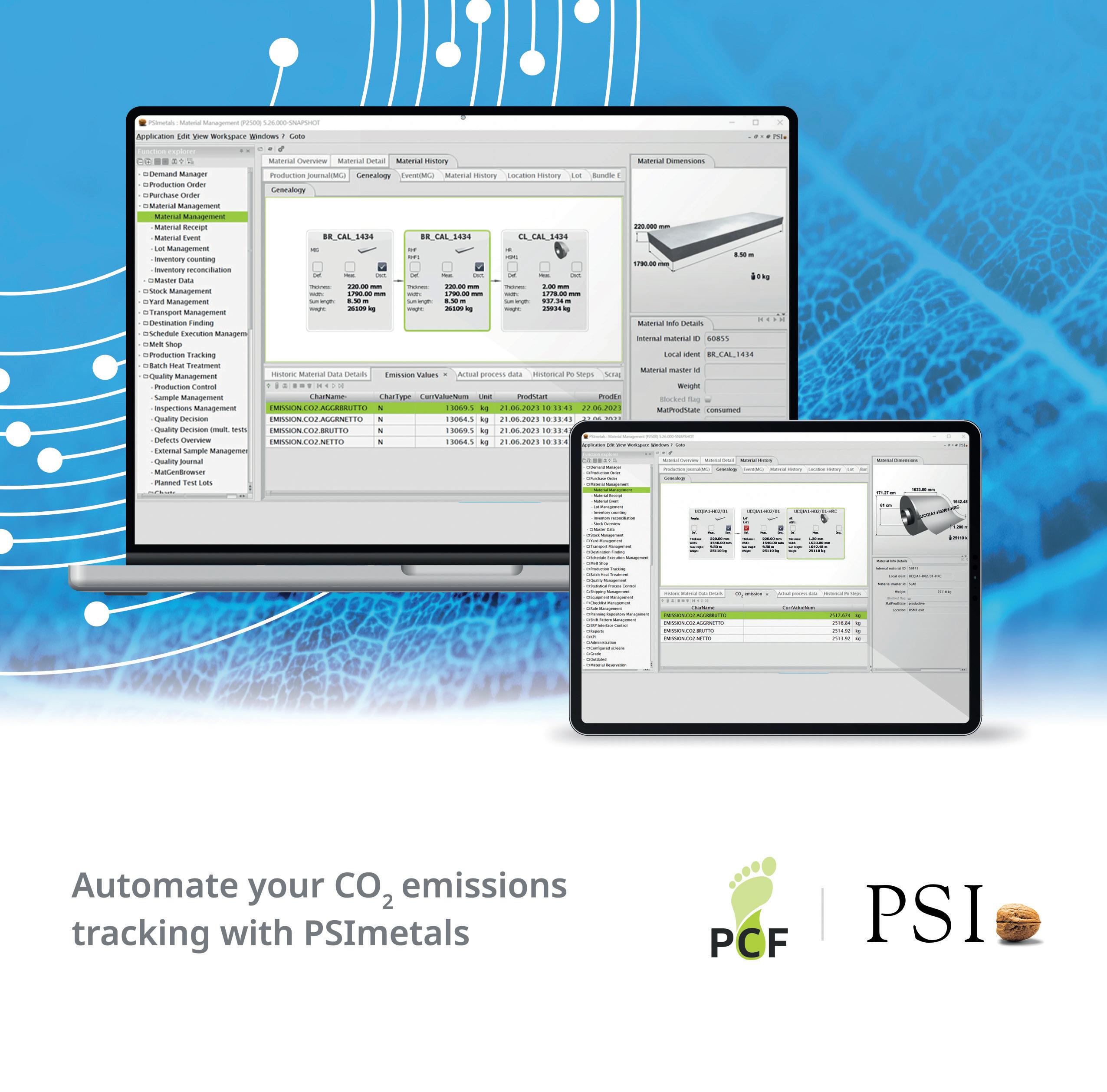

Metals offers the entire steel value chain an exceptional opportunity for curbing their CO2 emissions.

The unique combination of its historic and recently developed product portfolio, make John Cockerill one of the industry’s most relevant suppliers of equipment for both the hot and cold phase of the steelmaking and processing industry.

Our three distinct business segments are addressing todays and tomorrow’s challenges supporting sustainable and green steel production:

Our new upstream offering related to DRI (Direct Reduced Iron), EAF (Electric Arc Furnaces) technologies and the use of hydrogen in steelmaking. Next to offering indirect electrification (DRI-EAF&H2-DRI-EAF),John Cockerill is also working on Volteron®: A first-of-a-kind iron reduction and steel processing route via direct cold electrolysis. This CO2 free steelmaking process, has been co-developed with the world’s leading steelmaker ArcelorMittal.

Regrouping our historical downstream product portfolio, this segment also includes:

¡ the Jet Vapor Deposition (JVD®) technology set to replace today’s hot-dip or electro galvanizing processes. This novel high-productivity vacuum coating technology provides previously unknown coating flexibility and possibilities, all while offering lower CAPEX and OPEX.

¡ our E-Si® equipment & processing lines specifically designed to produce high-quality Non-Grain Oriented (NGO) steel in response to the need for electrical steel meeting precise metallurgical properties, essential to support the shift towards green mobility.

This segment not only embraces all services and after-sales activities but will be strongly focusing on downstream furnace electrification (reheating and processing line furnaces), as well as hydrogen combustion, and the optimization of plant operations, including energy audits and the modernization of steel production equipment and installations.

EDITORIAL

Editor Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Assistant Editor

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor Annie Baker

Advertisement Production Carol Baird

SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark

kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion

tonycrinion@quartzltd.com / Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

Tel +44 (0) 1737 855028 / Fax +44 (0) 1737 855034 Email subscriptions@quartzltd.com

Steel Times International is published eight times a year and is available on

subscription. Annual subscription: UK £226.00 Other countries: £299.00

2 years subscription: UK £407.00 Other countries: £536.00

3 years subscription: UK £453.00 Other countries: £625.00 Single copy (inc postage): £50.00 Email: steel@quartzltd.com

Digital subscription: (8 times a year) - 1 year: £215.00 - 2 years: £344.00

3 years: £442.00. Singe issue: £34.00

Published by: Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com

Steel Times International (USPS No: 020-958) is published monthly except Feb, May, July, Dec by Quartz Business Media Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER send address changes to Steel Times International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in England by: Stephens and George

Ltd • Goat Mill Road • Dowlais • Merthyr Tydfil • CF48 3TD. Tel: +44 (0)1685 352063

Web:

www.steeltimesint.com

Latin America update 80 years of Acesita/Aperam, Pt.4.

India update Floodgates are opened.

AIStech 2025 (5-8 May)

We examine a few of the new products to be found in Nashville, TN.

Steelmaking in the hydrogen era.

North American markets

Trump’s environmental agenda.

Vacuum-tank degassing offers better performances.

Nippon’s US Steel acquisition.

Decarbonization

Chinese steel – urgent reform needed.

Increasing the recyling of scrap and scrap processing residues.

Mimimising vibration to increase output

Perspectives: Emisshield From space to steel.

Pioneers of coke smelting, Pt.4 Abraham Darby 1st.

Matthew Moggridge Editor

matthewmoggridge@quartzltd.com

Last month I was highly critical of US President Donald Trump for his imposition of tariffs on UK steel. What do you expect, I’m British! I’ll be honest, I can’t see a time when I won’t be critical of Trump, I just don’t view him as a political statesman to be in any way admired or, indeed, believed. He’s an isolationist who thinks it’s his way or the highway and, to be honest, other nations should be giving it back to him with both barrels. If he wants a global trade war, let him have it, because there are no winners and that’s what he needs to learn. In fact, I’m rather hoping that King Charles uses some kind of flimsy excuse to postpone Trump’s state visit as I don’t see why we should be throwing down the red carpet for this man.

News this week that British Steel is consulting on the closure of its two Scunthorpe, UK-based blast furnaces, at the risk of losing 2,700 jobs, intensifies my dislike of President Trump, I’m not keen on having to put the word ‘president’ in front of his name.

One of the reasons given for British Steel’s highly probable demise is the imposition of tariffs – imposed by Trump – although there is a certain irony at play

inasmuch as British Steel is owned by Jingye Group, a Chinese company, and it is Chinese overcapacity that is putting a lot of pressure on steel companies globally. It is also at the root of Trump’s tariffs.

Trade unions have been highly critical of Jingye’s decision, but can you imagine losing £700,000 per day on top of everything else? Yes, it is devastating that almost 3,000 UK jobs could be lost as a result of the possible closure of the two blast furnaces, but what else is there?

UK Steel’s Gareth Stace has called the loss of Jingye’s blast furnace facilities ‘an irreparable break in the armour of national security’ – a comment similar to Trump’s reasoning behind the introduction of Section 232 tariffs the last time he was in power.

There’s never been a dull moment in the global steel industry and a common thread has always been Chinese overcapacity. I remember attending a conference somewhere in Europe when one speaker’s answer to virtually any question fired at him was ‘it’s all about China’. Now it’s also about decarbonization, digitalization and, of course, that crusty old chestnut, President Donald Trump and his tariffs.

Just as athletes rely on their teammates, we know that partnering with our customers brings the same level of support and dependability in the area of manufacturing productivity. Together, we can overcome challenges and achieve a shared goal, optimizing processes with regards to economic efficiency, safety, and environmental protection. Let’s improve together. Do you want to learn more? www.endress.com

India's ArcelorMittal Nippon Steel Limited (AMNS) has warned that it may have to drastically cut back its steel output in the country and delay capacity expansion plans owing to the Indian government's restrictions on imports of key steelmaking raw materials, government sources said on 6 March, citing internal communications. The checks have been imposed by the government over the last few months.

Source: Steel Orbis, 6 March 2025.

Indian steel manufacturer

ArcelorMittal's South African unit ArcelorMittal South Africa is seeking a 3.1 billion rand (US$167 million) rescue package to stop the closure of its steel mills in the country. The company is seeking funds from Industrial Development Corp, a national finance institution with a 6.4% stake in ArcelorMittal. The rescue package would prevent the complete shutdown of the company's long-steel Vereeniging and Newcastle facilities.

Source: Hindustan Times, 16 March 2025.

Whyalla Steelworks administrators have appointed BlueScope as a steelmaking advisor, the company announced. “This is a difficult time for the steel industry in the Asia Pacific region, but we are in a position to help. Accordingly, we will provide a team of experts from Port Kembla Steelworks to assist the administrators work through their process,” said Mark Vassella, managing director and chief executive officer of BlueScope.

Source: BlueScope, 6 March 2025.

DB Cargo UK and its sister company DB Cargo Polska are breathing new life into 60 BAA wagons for Tata Steel. The refurbished wagons, which will be capable of carrying steel slab and/or coil, are essential to support Tata Steel’s £1.25 billion transition in the UK from traditional iron and steel production to the use of cleaner and greener electric arc furnace technology. DB Polska is currently manufacturing new 40-foot wagon frames for the BAAs at its engineering facility

Bashundhara Multi Steel Industries (BMSIL), which has set a target to establish the world's largest single-strand minimill project for long steel products, is expected to commence operations by mid-next year, at the National Special Economic Zone in Mirsarai of Chattogram, according to company officials. BMSIL will be the first company in Bangladesh to produce rebar coil and wire rods. Furthermore, modern, environmentally friendly technology will be used in steel production, claims the company, reducing the cost per tonne of rod.

Source: TBS News, 12 March 2025.

Armenian prime minister Nikol Pashinyan attended the opening ceremony of the Armenian-American GTB Steel rebar plant located in Ararat, with $31 million invested

The San Diego-based Pacific Steel Group has selected Danieli & C. S.p.A. of Italy as the lead supplier of equipment for its new electric arc furnace (EAF) micromill. Danieli says the recycled-content EAF mill in Mojave, California, will make use of solar energy to produce up to 380kt /yr of steel rebar. The technology vendor says the contract it has been awarded by Pacific Steel involves supplying a continuous charge system through which recycled steel will be converted into new steel by Danieli Digimelter and LF digital melting and refining equipment.

Source: Construction and Demolition Recycling, 13 March 2025.

in the plant. The plant's production capacity is 112.8kt/ yr. It currently employs 240 people, but the number is planned to be increased to 500 within three years. Two 250-ton induction furnaces, a rolling mill, and a flow line for rebar production were purchased.

Source: ARKA News Agency, 17 March 2025.

in Rybnik, Poland, which are then being sent to the UK for final fitting, assembly and testing at DB Cargo UK’s

wagon maintenance facility in Stoke.

Source: Rail UK, 17 March 2025.

Toyota Tsusho, part of the Toyota Group, has announced that it is acquiring Radius Recycling, an industrial metals recycler based in Portland, Oregon. Radius, formerly known as Schnitzer Steel, operates more than 100 sites across 25 US states, Puerto Rico and parts of Western Canada. The purchase price for the deal is roughly $907 million, according to a release from Toyota Tsusho. The buyer expects to complete the deal in the third quarter of this year.

Source: Waste Dive, 17 March 2025.

Cleveland-Cliffs Inc. is laying off more than 600 workers at iron ore operations in Minnesota, according to reports. According to the Minneapolis Star Tribune, the action affects workers at Hibbing Taconite Co. and at its Minorca mine. “These temporary idles are necessary to rebalance working capital needs and consume excess pellet inventory produced in 2024,” the company said in a statement, according to

Japanese stainless steel producer Nippon Yakin Kogyo has successfully produced the first coil on its new HZMill at the Kawasaki plant, engineered and supplied by Primetals Technologies. Primetals Technologies said the HZ-Mill is its advanced split-housing 20-high mill featuring a large gap opening for easy strip threading and a double AS-U shape control system for stable rolling and improved productivity. It is the first ever HZ-Mill to be used for stainless steel production and has replaced two monoblock cold rolling mills.

Source: Primetals Technologies, 20 March 2025.

the newspaper. “We remain committed to supporting our employees and communities while monitoring market conditions.”

Source: Minneapolis Star Tribune, 21 March 2025.

International technology group ANDRITZ has received an order from ArcelorMittal Calvert to supply an annealing and coating line and a cold rolling mill for its new wholly owned, electrical steel production facility in Calvert, Alabama. The facility will be able to produce up to 150kt of non-grain oriented electrical steel per year, supporting the automotive and other industries’ journey toward more sustainable transportation and industrial/ commercial applications.

Source: Metal Center News, 21 March 2025.

Hyundai has revealed plans for a $5.8 billion investment in American manufacturing, announcing the construction of its first-ever steel mill in

Düsseldorf-based Hoberg & Driesch Röhrengruppe, one of Europe’s steel pipe distributors, has reached an agreement with Salzgitter Mannesmann Stahlhandel GmbH to acquire part of the latter’s pipe business in Germany. The agreement covers seamless heavy-wall pipes and precision steel pipes, according to a press release. The deal aims to allow Hoberg & Driesch to strengthen its market position and expand its product range.

Source: GMK Center, 21 March 2025

the United States. Located in Louisiana, the new facility will produce over 2.7 million metric tons of steel annually and create more than 1,400 American jobs. This major development is aimed at supplying steel directly to Hyundai's auto plants in Alabama and Georgia, projected to produce over one million American-made vehicles each year.

Source: Business Today, 25 March 2025.

Some Chinese steel mills have begun to cut production as the industry is pressured by oversupply and low profitability, Bloomberg has reported. According to a new release by consultancy Mysteel, four steelmakers in Xinjiang have announced a 10% cut in production since the beginning of this week. This news comes after the government announced in early March that it would restructure the steel industry by cutting production in the sector at the annual legislative meeting. Source: GMK Center, 25 March 2025.

While supporting domestic steel manufacturing, US President Donald Trump’s tariffs also risk fuelling inflation and making steel-consuming industries less competitive

PRESIDENT Donald Trump has gone on what some industry experts describe as a ‘tariff spree’– a reference to the perceived notion of using tariffs as a weapon aimed at stopping or restricting imports of not only steel but also a number of other products.

The 25% tariff imposition on all steel imports, purported to reduce dependency on imports and protect domestic steel producers from unfair foreign competition, has indeed helped stabilize and even raise prices for domestic steel.

The tariffs did benefit the domestic steel companies which, before that, were losing their foothold in a market inundated by cheap steel imports. US steel companies such as Nucor, Steel Dynamics, ClevelandCliffs, and US Steel, can benefit from higher domestic prices, reduced competition from foreign suppliers and a growing demand for US-produced steel.

While China, a leading steel supplier to the US, was exporting steel at prices much lower than the actual production costs – American experts alleged that this was because of the massive state subsidy given to its suppliers – its steel shipments had shown a downward trend after the 25% tariffs which were imposed first by Trump and retained by the Biden administration.

Tariffs also drive domestic steel companies to re-invest in expanding and modernizing their manufacturing

By Manik Mehta*

capabilities, besides restarting idled plants and also creating jobs. The US steel industry could well be on the verge of a new steel era.

The downside of tariffs

However, tariffs can produce retaliatory action from the trading nations hit by tariffs. Canada, for instance, announced 25% tariffs on more than $20 billion worth of US goods, including steel and aluminium. The European Union has also threatened tariffs on some $28 billion worth of US goods. Counter-tariffs will impact US export industries, including agriculture and automotive, thus almost nullifying the overall benefits for the US steel industry. US steel-consuming industries, relying on imported steel, will invariably pass down the higher import costs they have to bear, onto their customers and thereby fuel inflation.

This could possibly unleash a global trade war, thus affecting the smooth flow of trade, and resulting in slowing down economic growth.

President Trump, who had temporarily suspended the 25% steel tariffs under Section 232 against Canada, decided to re-impose them – and even threatened to double the tariffs on Canadian imports –after Ontario’s premier Doug Ford vowed to implement a 25% surcharge on electricity exports to the US.

*US correspondent, Steel Times International

According to data from the American Iron and Steel Institute (AISI), imports account for 23% of US finished steel consumption. Imports from Canada and Mexico – two US trade partners in the USMCA free-trade pact – accounted for some 8.6% of US consumption in 2024. Indeed, Canada is the largest steel exporter to the US, and a top supplier of hot-dipped galvanized sheet and cold-rolled sheet, representing 34% and 38% of the total US imports of these products respectively.

According to Kevin Dempsey, the AISI president/CEO, the AISI supports President Trump’s actions to implement tariffs on imported steel. “The comprehensive programme of national security tariffs and other measures on steel imports put in place in 2018 allowed the American steel industry to restart idled mills, rehire laid-off workers and begin investing tens of billions of dollars in new and upgraded plants. Unfortunately, the effectiveness of those measures has been eroded in recent years and foreign steel overproduction has led to increased dumping of excess foreign steel production onto world markets, as well as widespread transshipment and diversion of steel from third countries,” he said.

Dempsey added that the AISI ‘applauds’ the president’s actions to restore the

integrity of the tariffs on steel, and implement a robust and reinvigorated programme to address unfair trade practices. America must have a ‘sustainable, commercially viable steel industry to meet its national security needs’, he concluded.

Similar sentiments were voiced by the Steel Manufacturers Association (SMA), the largest US steel industry trade association, whose president Philip K. Bell, in a statement, described the tariffs as ‘another major step forward’ by President Trump to defend ‘our national, economic and energy security and create more American jobs’. He emphasized that the domestic steel industry had seen a revival after President Trump imposed tariffs on imported steel. But over time, the impact of those tariffs had lessened because of exemptions and exclusions that chipped away their effectiveness. ‘‘With a revised steel tariff, President Trump is boldly declaring that America is no longer a dumping ground for cheap, subsidized foreign steel’’, Bell summarised.

Bell said that by closing ‘loopholes in the tariff that have been exploited for years’,

President Trump would again ‘supercharge a steel industry that stands ready to rebuild America’. “Robust domestic steel production is essential for building new infrastructure that connects our country, building a fleet of ships capable of defending America’s interests around the world and building new manufacturing facilities that restore America’s manufacturing leadership.”

After the Biden administration’s negative reaction to the US Steel/Nippon Steel

merger, the Trump administration recently filed a motion to extend two deadlines in the US Steel and Nippon Steel’s lawsuit against a US national security panel to grant the government more time to make a conclusive decision on the merger; some experts interpreted this as the ‘clearest indication’ of President Trump’s inclination to allow the deal which had been blocked by President Biden.

President Trump said he would not object to Nippon Steel taking a minority stake in US Steel.

US Steel and Nippon Steel filed a lawsuit in January against the Committee on Foreign Investment in the US which examined foreign investments from a national security angle.

In their lawsuit against the CFIUS, US Steel and Nippon Steel said that President Biden was instrumental in prejudicing the committee’s decision, arguing that Biden’s rejection was aimed at getting support from the steelworkers union in Pennsylvania for his re-election bid. Nippon Steel said that it was going to make a change in the merger model after Trump’s comments. �

Weld breaks – and the related downtime – are the enemy of every finishing line. With the rising cost of raw materials and labor, downtime is getting more expensive. That is why steel producers are turning to advanced technology & machine automation o ered by Taylor-Winfield. Our coil joining welders are equipped with the most advanced features in the world, all of which work together to virtually eliminate weld breaks in the line. The question isn’t if you can a ord to upgrade or replace your coil joining welder, but if you can a ord not to.

This is the fourth and final part of the article highlighting Acesita’s journey, focusing on the years from 2010 onwards. By Germano Mendes de Paula*

THE year 2010 marked a significant rebound for the Brazilian economy, driven by a robust fiscal policy aimed at offsetting the effects of the global financial crisis. As a result, the country’s GDP grew by 7.5%, steel consumption surged by 40.5%, and demand for special flat steels increased by 52.9%. However, considering 2009 as a negative outlier, steel consumption in 2010 compared to 2008 showed a more modest rise of 8.5% overall and 12.7% for special flat steels. Unfortunately, this economic boom was not sustained, and Brazil’s economy proved to be highly volatile throughout the decade, leading some to refer to it as a ‘lost decade,’ similarly to what had happened in the 1980s.

Given this context of economic instability, it is not surprising that the production output of the company, which rebranded as Aperam South America in 2011 following its spin-off from ArcelorMittal, did not experienced positive growth. Specifically, pig iron production fell from 609kt in 2010 to 454kt in 2019, while crude steel production decreased from 771kt to 688kt (Fig 1). Special flat steel production saw a slight decline from 598kt to 578kt (Fig 2). Concerning high-value products, flat stainless steel output dropped from 328kt to 292kt, while silicon steel production plummeted from 199kt to 147kt (Fig 3). Nonetheless, besides non-grain oriented electrical steels (NOES) and grain-oriented electrical steels (GOES), Aperam South America began producing High GrainOriented (HGO) steel – an advanced highpermeability product – starting in 2017, which enhances efficiency and reduces the size of electrical transformers. The development of HGO required significant

investments in modern equipment and supported dedicated R&D efforts (STI Digital, Feb 2024, p. 22).

In May 2022, Aperam South America announced a $117 million investment plan aimed primarily at modernising the Steckel mill. This initiative was intended to diversify the product range starting in 2024, introducing special steels with enhanced complexity and resilience, such as Endur, described as the world’s first highly corrosion-resistant stainless steel, launched by Aperam in 2019. The plan included improvements to the Steckel mill’s finishing operations, updates to the roughing mill and cooling system, and advancements in process control and automation.

The second priority of the investment package was focused on Aperam BioEnergia, to sustain the production of charcoal, seedlings, and seeds through advanced forestry technology. However, by December 2023, Aperam South America opted to suspend the investment plan due to increased imports from China, which also impacted other proposed and not yet approved projects, such as a new cold rolling mill set for 2024-2025. During the first half of 2023, imports of flat stainless and electrical steels rose by 17% year-onyear, leading the company to place its investments on hold.

Throughout this decade, pig iron production rose from 479kt in 2020 to 503kt in 2023 (the latest available information), while crude steel production figures were 696kt and 726kt, respectively (Fig 1). The latter figure is 5.8% below the peak observed in 2010. Special flat steel

production remained relatively stable, with a slight decrease from 424kt in 2020 to 423kt in 2023 (Graph 2), but reflecting a 33% decline compared to 2018. In terms of flat stainless steel, production numbers rose from 261kt in 2020 to 301kt in 2023, with a 14.2% drop from the maximum achieved in 2016. Silicon steel production remained stagnant, averaging around 140kt during the 2020-2023 period, but saw a decrease of 43% compared to 2011 levels (Fig 3).

In 2023, Aperam South America’s revenue distribution was as follows: 69% from stainless steel, 14% from carbon steels, 10% from GOES, and 8% from NOES. The market segments for stainless steel were led by general industry (24%), followed by energy and chemicals (23%), catering and appliances (21%), automotive (19%), building and construction (9%), and transport (4%).

Notably, the Brazilian subsidiary accounted for 40% of crude steel production and 37% of total shipments in the stainless and electrical steel segment in 2023, employing 4,651 workers, which constituted 40.5% of the group’s total workforce.

It is essential to note that since 2011, Aperam South America has utilized only charcoal in its blast furnaces. To provide raw materials for charcoal production, the company manages 150k hectares of eucalyptus forest reserves, including over 60k hectares of natural vegetation preserves and wildlife corridors. There are plans to expand this forestry area by 24% by 2030 compared to 2022 levels, with an anticipated annual planting area 18%

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

Steel manufacturing that’s both decarbonized and profitable? Transform your operations through unified electrification, automation, and digitalization solutions and meet your goals.

Be an #ImpactMaker. Learn more.

se.com/metals

larger in the period 2023-2030 than that established between 2015 and 2022.

In May 2022, Aperam South America proclaimed itself the world’s first carbonneutral company in the special flat steel sector, based on scope 1 and 2 emissions. Assessments demonstrated that the integrated operations of Aperam South America and Aperam BioEnergia resulted in the removal of more greenhouse gases from the atmosphere than were emitted throughout the steel and charcoal production processes during the 20202021 period. After neutralising its total greenhouse gas emissions, the company

managed to remove an additional 33kt of carbon emissions from the atmosphere.

In March 2025, International Finance Corporation (IFC), a member of the World Bank Group, announced a €250 million financing package to Aperam BioEnergia. The investment will support the acquisition of complementary eucalyptus plantations and the modernisation of Aperam South America’s charcoal-producing kilns with cleaner and more efficient technology, further enhancing the sustainability of Aperam BioEnergia’s operations.

As Acesita/Aperam South America celebrated its 80th anniversary in

2024, it stood out as a resilient player, having navigated numerous periods of macroeconomic instability while significantly transforming its production structure. Today, it is recognised as a strategic asset within the Aperam group, crucial for their decarbonization initiatives, particularly with its unique charcoalintegrated mill technological route, which is exclusively used in Brazil.

This innovative approach not only enhances operational sustainability but also underlines the company’s commitment to addressing environmental challenges in the steel sector. �

%

%

< 1 min

Schedule generation time

Comprehensive supply chain planning solution. Raw materials supply, production planning, what-if scenarios.

Most advanced scheduling software. Automated generation of casting and rolling programs. Expert filtering, editing, scripting. Covers all constraints, KPIs

Centralized planning system for slot-based production. Covers diverse steel grades, profiles, cutting optimization.

Automatic reallocation of slabs, coils. Ranks according to grade, geometry, processing steps. Maximizes revenue.

THE import duty, announced by Trump, has enabled Chinese and South Korean steel producers to capture a larger share of the Indian steel market, the fastest-growing consumer market in the world.

With an estimated export volume of less than 100kt/yr , valued at $3 billion, India remains a minor player in the US steel industry compared to Canada and Brazil, which together account for approximately 30% of US steel imports. Consequently, President Trump’s tariff imposition is unlikely to have a significant direct impact on the Indian steel industry.

India’s steel secretary, Sandeep Poundrik, commented, “The US import tariff on global steel will not have much impact on Indian metal companies, as a 15% duty already existed well before the recent announcement. However, this duty was partially waived through certain agreements and bilateral business partnerships. The recent tariff imposition is merely a change in approach, so it is not new for Indian steelmakers.”

Indirect impact

However, the US tariff levy is expected to weaken the pricing power of Indian steel mills, directly impacting their sales and revenue due to global oversupply, lack of competitiveness, and the re-direction of global shipments toward India. When the US implemented a similar tariff during President Trump’s previous term, which ended four years ago, it triggered a wave of protectionist measures from countries worldwide, and India was not immune to it.

The 25% import duty imposed by the Trump administration in the United States has opened the floodgates for global steel producers, especially from China and South Korea, to dump their output into Indian markets at prices lower than the cost of production for Indian steelmakers. By Dilip Kumar Jha*

Source: Joint Plant Committee, *April-December period

Source: Joint Plant Committee under Ministry of Steel; * India Bureau of Mines

For example, the European Union faced a surge in re-directed Chinese steel exports from the United States and responded by imposing its own restrictions. This had a direct negative impact on India’s steel exports to Europe as those markets tightened. Meanwhile, China, with limited options to offload its steel elsewhere, turned its focus to India, leading to an increase in steel imports from the Chinese market. This shift resulted in a higher volume of steel flooding into Indian markets, putting significant pressure on domestic steelmakers.

Hui Ting Sim, assistant vice president at Moody’s Ratings, stated, “The US tariffs on steel will increase competition and exacerbate oversupply in other steelproducing markets. Indian steel producers

will face heightened challenges in exporting their products. Over the past year, high steel imports into India have already dampened prices and earnings for Indian steel producers.”

Imports up, exports down

According to the Joint Plant Committee (JPC) under the Union Ministry of Steel, India’s imports of finished steel have registered a significant increase in recent months. In December 2024 alone, finished steel imports rose to 0.761Mt, up from 0.745Mt in the preceding month. However, this represents a 15.7% decline from the 0.903Mt recorded in December 2023. For the April–December 2024 period, India’s finished steel imports increased by 20.3% to 7.27Mt , compared to 6.049Mt reported

during the same period last year.

On the other hand, India’s finished steel exports climbed by 11.5% to 0.446Mt in December 2024, up from 0.400Mt in the previous month. However, this reflects a 30.8% decline from the 0.644 Mt recorded in December 2023. For the April–December 2024 period, cumulative export volumes dropped by 24.6% to 3.6Mt, compared to 4.773Mt reported during the same period last year.

Protectionism

While India is not a major steel exporter to the US, previous tariffs led to protectionist measures that negatively impacted Indian exports, particularly to the European Union. India’s steel imports from China jumped to approximately 1.75Mt during AprilDecember 2024, compared to around 1.2Mt recorded during the corresponding period last year. The government is considering safeguard duties to protect local producers as global trade dynamics shift in response to Trump’s policies.

Leading credit rating agency India Ratings and Research anticipates domestic steel

demand to grow by 9–11% year-on-year in the fiscal year 2024–25. This demand growth is likely to be supported by the government’s continued investment in infrastructure projects, such as roads, railways, and ports, along with stable growth in end-user industries. However, the

imposition of duties and tariffs by various countries on steel imports poses a persistent threat of high import volumes into India, where demand growth remains relatively strong. This could lead to a reorganization

of supply chains and keep domestic steel prices in check.

Meanwhile, India’s Directorate General of Trade Remedies (DGTR) has initiated anti-dumping investigations based on a substantiated application filed by the domestic industry, alleging that the dumping of goods into the country is causing injury to local producers. To address concerns about increased steel dumping from other countries, Anti-Dumping Duty (ADD) measures are already in place for certain steel products.

These include seamless tubes, pipes, and hollow profiles of iron, alloy, or non-alloy steel (excluding cast iron and stainless steel) from China; electro-galvanized steel from Korea, Japan, and Singapore; stainless-steel seamless tubes and pipes from China; and welded stainless steel pipes and tubes from Vietnam and Thailand.

Rising steel imports, coupled with Trump’s 25% tariff, could pose additional challenges for Indian steelmakers, even as domestic demand for steel remains high. �

Combilift’s range of multidirectional forklifts, pedestrian reach trucks, straddle carriers and container loaders will allow you to maximize the capacity, improve efficiency and enhance the safety of your facility.

Contact Us Today

To find out how Combilift can help you unlock every inch of your storage space.

It might seem like only a few weeks since the AISTech conference and exposition took place in Columbus, Ohio, but it’s a year on and this year’s event in Nashville, TN takes place 5-8 May at the Music City Centre. Here’s just a little taster of what some of the exhibitors will be showing. This is a great event and should not be missed by any self-respecting steel industry professional.

The AUMUND Group, supplier of solutions for conveying and storing bulk materials, will be presenting its Bucket Apron Conveyors for transporting hot DRI, which is to be supplied by AUMUND Fördertechnik for the ThyssenKrupp Steel direct reduction plant at Duisburg in Germany. In the hydrogen-based production process the two Hot Material Conveyors will be the connecting point between the direct reduction plant and the smelting furnace.

Both conveyors will be installed beneath the shaft furnace of the direct reduction plant, and their function is to feed the smelting furnace directly with hot DRI. The direct reduction shaft furnace designed by Midrex Technologies, USA, is the core technology of the plant. “The order for ThyssenKrupp Steel is not only a very significant project for us, but will play a leading role in the transformation of green steel in Germany,” said Alberto Lalia, head of the metallurgy business unit at AUMUND

Fördertechnik. He added: “Thanks to a large extent to the success of our joint projects with MIDREX, we are very proud of our proven experience in conveying technology for direct reduction plants.”

The patented AUMUND Hot Material Conveyors are a closed system for continuous material feed. They transport the DRI in an inert atmosphere which prevents it coming into contact with the air, so that avoidance of re-oxidation is assured.

One of the advantages of this mechanical enclosed system is its significantly lower energy consumption in comparison with pneumatic conveying concepts. Unlike with pneumatic conveying, on a mechanical conveyor there is no relative movement between the equipment and the transported material on the conveying route. This prevents any additional fines being generated during transportation.

The AUMUND equipment is automated, with sensors monitoring the temperature and the condition of the material on the conveyor. The concept of the transport system is that inert gas protects the conveyed material from contact with outside air, and dust remains inside the system.

AUMUND will be exhibiting at booth #1056.

cunova, a provider of products and solutions made from copper and copper alloys, will be showcasing the WAVE® Mould Tube, which has specifically been designed for continuous billet casting. This technology aims to address issues, such as poor billet quality (rhomboidity, cracks, snaking) or low lifetime. With its unique design, the WAVE® Mould Tube improves both the shape and quality of the billet, while simultaneously extending the lifetime of the mould, says cunova.

The WAVE® Mould Tube features a special geometry, where a series of wave patterns are applied to the hot face of the mould. These waves create a mirrored pattern on the billet surface as it begins to solidify. The mould wall and the billet surface interlock and guide the shell through the length of the mould, ensuring more uniform heat extraction and, consequently, more uniform shell formation. This results in improved billet shaping and a more stable billet structure during the critical solidification process, claims cunova.

BSE, a sister company of Badische Stahlwerke GmbH (BSW), an electric arc furnace steel plant, provides services that aim to increase the safety, efficiency and productivity in the electric steel industry worldwide. Exhibiting at this year’s AISTech, BSE will be highlighting its BSE DoorMan®, the latest addition to the company’s Safe Steel product family, designed to optimize slag management and eliminate manual furnace door cleaning.

The DoorMan® is the newest innovation in BSE’s comprehensive safety and automation line-up, which includes EBT SandMan®, Ladle SandMan®, and Tap Hole Manipulator (THM). The DoorMan® is a new furnace door concept with an automatic slag cleaning function,

designed to ensure a safe, standardized process while minimizing human intervention. It is fully compatible with existing EAF set-ups, requiring no major modifications to the upper shell, lower shell, or furnace platform.

With increasing automation, stricter safety regulations, and labour shortages affecting steelmakers, the DoorMan® provides a cost-effective, future-ready solution for boosting productivity while enhancing workplace safety, says BSE.

BSE will be exhibiting at booth #1506.

The WAVE® Mould Tube is compatible with various mould coatings and can be used with all standard copper alloys. It is available for both round and rectangular moulds and is suitable for a wide range of applications, including casting medium-carbon steels.

cunova will be exhibiting at booth #2545.

Dassault Systèmes, a provider of collaborative 3D virtual environments to imagine sustainable innovations, will be exhibiting its product, DELMIA, which delivers solutions for metals manufacturing.

DELMIA’s solution for metals manufacturers leverages Industry 4.0 technologies like IoT, AI, and data analytics to enhance real-time monitoring, predictive maintenance, and operational efficiency. Its tools, including manufacturing operations management, advanced scheduling, and sales and operations planning, streamline processes, reduce waste, and enable precise demandsupply alignment, says the company.

The solutions also support sustainability initiatives by integrating virtual twins and green practices to lower the carbon footprint and foster a circular economy. By adopting DELMIA, metals manufacturers can gain a competitive edge, improve efficiency, and align with global sustainability goals.

Dassault Systèmes will be exhibiting

at booth #951.

Linde, a global industrial gases and engineering company, has developed the Three-in-One Injector to be used as an oxygen lance, a carbon injector and an oxyfuel burner. This injector has the capability to replace existing fixed-wall oxygen injectors, entraining carbon into the primary oxygen stream and then accelerating it to supersonic velocities, generating a coherent jet of fluidized carbon in oxygen that is able to traverse the distance from the wall of the furnace to the bath/slag interface.

The injector can accomplish supersonic carbon injection without the need to modify the existing infrastructure. Delivering the carbon

at high momentum, has the advantages of increasing carbon utilization, reducing power consumption by increasing chemical energy input into the bath, reducing electrode consumption and allowing the use of lighter carbon material, (e.g. petcoke, biocarbon, and lower cost coals) says Linde.

The Linde Three-in-One Injector is designed for the harsh EAF environment, featuring key design elements that enable it to function for extended periods with limited wear or maintenance issues. This includes a modular design that allows the inner carbon conveying assembly to be replaced in-situ, meaning that the inner nozzle can be replaced in between heats

Guild International offers a complete line of coil joining and end welding

machines for almost any steel processing, tube producing or stamping application. At AISTech, the company will be highlighting its Guild QM Quicklap Seam Welder, a product that is ideally suited to join coils for various flat metal processing

without having to remove the whole injector. The injector also works with existing oxygen, natural gas and carbon conveying systems and does not require any additional compressed air lines, pressure, skid upgrade, controls, or equipment.

Linde will be exhibiting at booth #2936.

lines by resistance welding two slightly overlapped strip ends. The weld created by the QM series seam welder is an overlapped resistance weld that is generally as strong as the parent material. Any weldable material can be joined on these machines. The two coil ends are slightly overlapped, and the upper and lower weld wheels roll across the overlapped ends while passing current through the material to forge the weld. Hardened planish rolls,

one upper and one lower, follow the weld wheels, and the result is a fast, flat, and strong weld. An optional induction annealer can also be included on the QM to post-anneal the weld during the same pass as welding and planishing. The QMT and QMM can shear, weld, and planish material ranging from about 0.1mm (0.004“) up to about 3.5mm (0.137“) thick, and as wide as necessary, all in under a minute. Recent machines have been used for strip up to 1900mm (76“) wide.

Guild International will be exhibiting at booth #1361.

Gradall Industries, a supplier of equipment for infrastructure maintenance, agriculture and other applications, will be showcasing its XL Series V featuring an innovative boom design, which the company claims provides exceptional reach and movement. With a continuous 360-degree boom tilt, the machines can work in hard-to-reach places, telescoping into position with minimal overhead clearance. Attachments – hammers, rippers, buckets and drills – can be precisely directed to the job at hand, whether desculling and cleaning hot metal ladles, removing bricks, cleaning distribution channels, or placing tap

holes. Heavy-duty boom rollers reinforce optimum strength for the exceptionally rugged boom, and the boom tilt motor is at the rear of the cradle protecting it from damage.

Gradall industrial maintenance machines feature cabs designed for operator comfort and safety, with plenty of windows for excellent visibility in all directions. Gradall, Deere or SAE boom control joysticks are built into the adjustable seat, and foot pedals allow the operator exacting control to position the carrier. For operator comfort, heaters, air conditioning and more are all standard.

Gradall will be exhibiting at booth #2013.

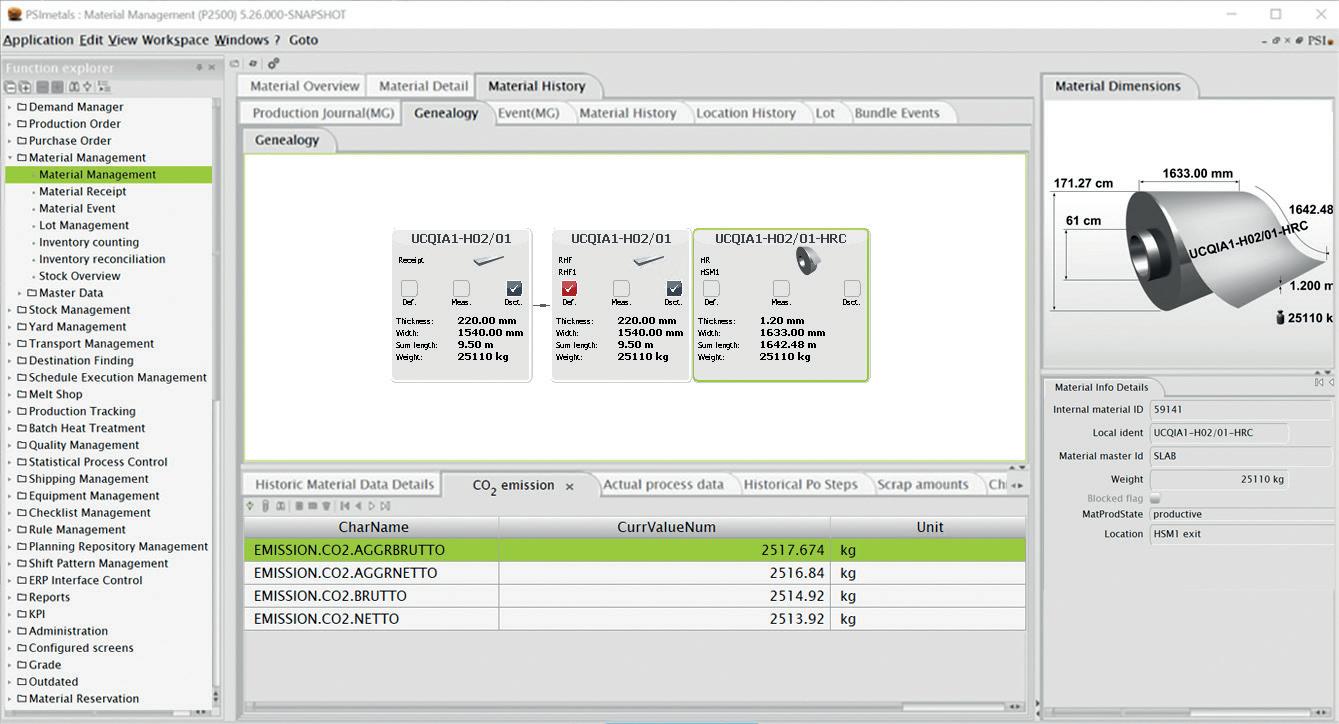

Take the next step towards transparent calculation and tracking of your emissions at piece and product level.

PRODUCT CARBON FOOTPRINT TRACKING:

PRODUCT ID: CL CAL 1434

NIPPON Steel is set to pay $979 per ton of US Steel’s crude steel production – a price about 1.4 to 1.5 times higher than the market capitalisation per ton for both US Steel ($689) and Nippon Steel ($638) as of the end of FY2023, suggesting a substantial M&A premium. By contrast, market capitalisations per ton for comparable USbased electric arc furnace (EAF) companies are significantly higher, with Nucor Corporation $2,018 and Steel Dynamics at $1,852 at the end of FY20231,2. While Nippon Steel’s willingness to pay such a premium demonstrates its high expectations for US Steel, which operates using BFs, the market currently places a much higher valuation on EAF companies. This raises a critical question: could US Steel’s reliance on BFs make it a less attractive investment when stacked against EAF-based competitors? This commentary explores the missed opportunities and potential strategic gaps in Nippon Steel’s approach.

The two EAF operators, Nucor and Steel Dynamics, have better margins and over the past five years, they have consistently achieved superior EBITDA levels. In 2023, US Steel’s EBITDA per ton was $124, compared to $295 for Nucor and $195 for Steel Dynamics – both more than 1.5 times higher than US Steel’s figure3,4,5. In other words, these EAF mills are maintaining higher profitability than a blast furnacebased competitor. Fig 1

One key factor driving these margins is the flexible cost structure of EAF mills, characterised by a smaller share of fixed costs. This allows them to quickly adjust production to meet demand and maintain more stable margins over time – unlike BFs, which must operate continuously for prolonged periods6,7,8. This highlights the potential profitability advantage of EAF producers over traditional BF-BOF producers like US Steel – also implying that BF-BOF producers face greater sensitivity to price

fluctuations.

In particular, we feel that the medium-tolong-term risk of carbon pricing and other decarbonization measures in the mediumto-long-term is likely to significantly impact US Steel’s BF-BOF steel production. The company – with already low industry margins – faces greater sensitivity to commodity price fluctuations, an additional financial headwind would be unwelcome to its new owners.

The high market caps of US Steel’s domestic competitors likely rules out an M&A strategy for American EAF mills, but perhaps M&A is a strategy that doesn’t need to be pursued where there is greenfield opportunity in the country9. It is true that the US market is to some extent saturated, however there is still demand and opportunity to produce steel with fair margins. Building EAF-based steel mills could navigate the challenges associated with US Steel’s BF-BOF technology, *ESG research fellow, Transition Asia

remaining flexible, resilient and able to produce the low-carbon products demanded by customers.

Nippon Steel has already partnered with ArcelorMittal to build a new EAF in Calvert, Alabama. For Nippon Steel, greenfield investments in the US are not unfamiliar territory. EAFs are the most costeffective investment to decarbonize steel production and the average investment per ton for newly constructed or planned EAFs in the US in recent years stands at $676, a significant discount to the US Steel acquisition price10,11,12

Should Nippon Steel seek to pursue a strategy based on primary iron production there is the opportunity to build H2-DRI facilities. Admittedly, these facilities will cost substantial amounts. The total investment that Swedish start-up Stegra, formerly known as H2 Green Steel, has allocated for their H2-DRI-EAF green steel plant is approximately $6 billion. However, through the Industrial Demonstrations Programme, funded by the Bipartisan Infrastructure Law and the Inflation Reduction Act, up to $500 million in funding can be secured for the construction of H2-DRI-EAF facilities in the

US, helping to mitigate initial investment risks13. Attractive tax relief is also available to green hydrogen producers, further derisking green investments.

Production from green steel projects can additionally be hedged through take or pay contracts as seen in the Swedish green steel projects.

Nippon Steel has already publicly expressed its intentions to make largescale investments in US Steel post-2027,

company, disruptive to the market and attractive to shareholders.

With President-elect Trump already signalling that the US Steel deal will be blocked and premiums for pure-play EAF mills seemingly too high, Nippon Steel should remain open to greenfield investments within the US.

Investing in EAF steel processes rather than maintaining and re-investing into BFBOF technology would not only contribute

Source: Annual Reports, TA analysis

and given that the last BF relining at the Edgar Thomson Plant took place in 2001, there are indications that large CAPEX investments will be required soon14 Instead of investing heavily in renewing US Steel’s ageing plants, the construction of greenfield H2-DRI-EAF or EAF facilities in the US could prove beneficial for the

1. https://worldsteel.org/data/top-producers/

2. https://companiesmarketcap.com/

3. https://d1io3yog0oux5.cloudfront.

4. https://www.fitchratings.com/research/corporatefinance/fitch-affirms-nucor-idr-at-a-outlookstable-26-02-2024

5. https://www.forbes.com/sites/ greatspeculations/2023/10/17/nucor-steel-titan-rising/

6. https://rtpatterson.com/revitalizing-the-steel-industrythe-transformative-role-of-electric-arc-furnaces-insustainable-steelmaking/?form=MG0AV3

7. If Nucor and Steel Dynamics were each acquired at the same percentage premium as U.S. Steel, their acquisition costs would be $60.8 billion for Nucor and $27.2 billion for Steel Dynamics. Nucor’s cost would be about 3.9 times that of acquiring U.S. Steel, while Steel Dynamics, despite producing only 65% as much crude steel as U.S. Steel, would still cost 1.7 times more.

to reducing corporate emissions but also support the company in strengthening its presence in the strategically important US market. Through maintaining exposure to BF-BOF technologies and the challenges they attract, Nippon Steel risks missing a critical opportunity to invest in the rapidly expanding green steel market. �

net/_871a703ad34e43f8f0477a06ba2d66bd/ussteel/ db/3222/30221/segment_and_financial_operational_ data/U.+S.+Steel+-+Segment+and+Financial+Operat ional+Data+-+Q4+2023+20240201.pdf

8. https://icrm.indigotools.com/IR/ IAC/?Ticker=NUE&Exchange=NYSE#

9. https://ir.steeldynamics.com/annual-reports/

10. https://www.nipponsteel.com/en/ news/20201222_100.html

11. https://buildsteel.org/news/steel-dynamics-sintontexas/

12. https://www.recyclingtoday.com/news/big-river-steelexpansion-arkansas-ferrous-scrap/

13. https://www.energy.gov/oced/industrialdemonstrations-program-selections-award-negotiationsiron-and-steel

14. https://rmi.org/wp-content/uploads/dlm_ uploads/2024/02/PA_steel_memo.pdf

How China’s blast furnace overcapacity erodes profitability and impedes the green steel transition.

By Xinyi Shen*

CHINA’S steel industry, the largest in the world, plays a pivotal role in the country’s carbon emissions. Responsible for around 17% of China’s total emissions, the sector is a critical focus in the country’s pursuit of carbon neutrality by 2060. However, the industry’s reliance on coal-based blast furnaces (BF) and its overcapacity present significant challenges. Despite the government’s ambitious decarbonisation goals, including increasing the share of electric arc furnace (EAF) steelmaking, the industry struggles to transition due to continued overcapacity and weak profitability.

In 2024, China’s crude steel production surpassed 1 billion tonnes for the fifth consecutive year, underscoring the sector’s dominance. However, consumption has stagnated, exacerbating the oversupply problem. This article explores the challenges facing China’s steel sector, the path to decarbonization, and the urgent reforms needed to align the industry with China’s climate targets.

China’s steel production reached 1 billion tonnes in 2024, maintaining its position as the global leader in steel output (Fig 1). However, production declined by 5.6%

compared to the record high in 2020, while consumption plummeted by 15.6% over the past four years. The downturn in key industries such as real estate, traditionally a major consumer of steel, has further dampened domestic demand.

As a result, overcapacity has become a pervasive issue. While China continues to produce large quantities of steel, excess supply has led to near-zero profit margins for producers. In 2024, profits for the entire steel sector fell to an historic low of 29 billion yuan, marking the third consecutive year of declining profitability. The situation is unsustainable and demands urgent policy interventions to address overproduction and accelerate the industry’s transition to lowcarbon technologies.

The green steel challenge

China’s carbon neutrality ambitions hinge on transforming its steel industry, which relies heavily on the carbon-intensive BFBOF process. This method, which uses iron ore and coke, produces substantial CO2 emissions. The steel industry must shift towards more sustainable practices to align with the country’s climate goals. Electric arc furnaces (EAF), which utilise scrap steel and are significantly less carbon-intensive, offer a promising solution. However, EAF

*Researcher, Centre for Research on Energy and Clean Air

adoption has been slow due to limited scrap supply and economic barriers.

EAF accounts for just 10% of China’s crude steel production, far below the government’s 15% target for 2025. Despite the urgency of decarbonization, progress in increasing the EAF share has stagnated over the past five years. A crucial challenge is the higher operational cost of EAF steelmaking compared to BF-BOF, which has disincentivised the adoption of EAF technology.

The government’s 2020 carbon neutrality pledge set ambitious targets for the steel industry, including raising the share of EAF production to 15% by 2025 and 20% by 2030. However, these targets are unlikely to be met without substantial policy support and incentives.

The overcapacity crisis in China’s steel industry has increased exports, as manufacturers seek to offset declining domestic demand. In 2024, steel exports surged to 111Mt, the highest in nearly a decade, exacerbating global oversupply. This export increase has sparked trade frictions, with several countries imposing tariffs on Chinese steel imports.

For instance, Brazil introduced a 25%

tariff on Chinese steel, and the United States reinstated a blanket 25% tariff on all Chinese steel and aluminium products. These trade barriers are hurting Chinese producers and complicating the global steel market. Furthermore, the European Union has raised concerns about Chinese steel entering the EU through third countries. These tensions further highlight the need for China to address its overcapacity problem and focus on reducing carbon emissions within its domestic industry.

The path forward: deeper cuts in coal-based steelmaking capacity

To address both overcapacity and carbon emissions, China must drastically reduce its reliance on coal-based BF-BOF technology. The government has already introduced production cuts, but these measures have been insufficient. A study by researchers from Tsinghua University has shown that a net reduction of at least 200Mt/yr of BF capacity is required by 2025 (Fig 2) –about 15% of China’s total steelmaking capacity and equal to the current total EU steelmaking capacity. A further 150Mt/yr reduction is needed from 2026 to 2030. These cuts are critical for decarbonization and improving profitability within the industry. Reducing BF capacity will help alleviate overcapacity and allow producers to focus on manufacturing higher-value, lower-carbon steel products.

In 2024, local governments approved 11.04Mt/yr of new BF capacity, which, if built, will contribute to China’s overcapacity problem. The newly approved coal-based BF projects risk becoming stranded assets, with potential losses estimated at 140 billion

yuan. This reinforces the need for stricter policies to halt the approval of new coalbased projects and focus on supporting low-carbon alternatives.

Scaling up zero-emission technologies

To meet the 2060 carbon neutrality target, China’s steel sector must significantly scale up its use of zero-emission technologies, such as hydrogen-based metallurgy.

Hydrogen metallurgy, which relies on hydrogen produced through renewable energy, holds the potential to reduce emissions by up to 90% compared to traditional BF-BOF methods. However, only a small fraction of steelmaking capacity has been dedicated to hydrogen-based processes. Between 2021 and 2024, only 2.3Mt/yr of hydrogen-based metallurgy projects were approved, far below the pace needed to meet long-term targets.

One potential solution lies in redirecting

investments away from coal-based projects and towards hydrogen metallurgy. Leading steelmaker Baowu Steel has already begun pioneering hydrogen-based steel production in Zhanjiang, with an investment of 2.15 billion yuan in a 1Mt/ yr hydrogen metallurgy project. By 2060, China will need 150Mt/yr of hydrogenbased metallurgy capacity – equivalent to 150 projects of Baowu’s Zhanjiang scale.

To achieve this, one hydrogen plant must be commissioned every quarter starting in 2023.

‘Steel Reform 2.0’: a new era of structural change

According to a January 2025 Morgan

Stanley research report, a new round of supply-side reform, ‘Steel Reform 2.0,’ could begin as early as 2025. Unlike previous rounds of reform, this phase is expected to be more cautious and focused on gradual changes, emphasising consolidation and stricter production controls based on producers’ environmental performance.

Action plan for energy conservation

Key policy developments, such as the National Development and Reform Commission’s 2024 action plan for energy conservation and carbon reduction, signal a shift towards prioritising low-carbon steelmaking methods. The Ministry of Ecology and Environment has also proposed including the steel sector in the national carbon market by the end of 2024, with the first compliance cycle due in 2025. These policies ensure the steel sector meets its emissions reduction targets and aligns with China’s broader climate goals.

Policy recommendations

To address the challenges outlined above and facilitate a smooth transition to a lowcarbon steel sector, the following policy recommendations are made:

1. Accelerate low-carbon technology adoption: Promote using EAF and hydrogen-based metallurgy technologies through targeted financial incentives and innovation-driven policies.

2. Reduce coal-based steelmaking capacity: Implement a phase-out plan for coal-based BF and BOF capacity, focusing on cutting back existing capacity and halting new projects to avoid stranded assets.

3. Foster technological innovation: Support research into alternative steelmaking methods and encourage international collaboration to enhance competitiveness and sustainability.

4. Leverage renewable energy: Capitalise on China’s expanding renewable energy capacity to drive synergies between the decarbonisation of electricity generation and industrial processes.

5. Strengthen the carbon market: Expand the carbon market to include steel, cement, and aluminium industries, transitioning from an intensity-based approach to a cap-and-trade system to ensure meaningful emissions reductions.

China’s steel sector faces critical challenges balancing production growth with environmental sustainability. Urgent reforms are needed to tackle overcapacity, reduce emissions, and accelerate the adoption of low-carbon technologies. The success of these reforms will determine whether China can meet its carbon neutrality goals and ensure the long-term competitiveness of its steel industry. �

Performances, operational reliability and quick startups are the result of 20 years of continuous research and development activities, carried out at the Danieli research center and onsite together with partnering customers. Depending on plant configuration, MIDA QLP can make use of more than 30 Danieli patents covering technological layouts, production equipment and Danieli Automation solutions, such as power, instrumentation and intelligent digital controls.

— The most efficient, digitally controlled electric steelmaking with no impact on the power grid.

— 10 m/min casting speed, allowing up to 1.5-Mtpy productivity on one casting strand, 23.5 hours out of 24 of continuous endless-casting operation.

— No gas-reheating furnace, and no induction heating during casting.

— Danieli Automation robotics and artificial intelligence for zero-men on the floor.

— Least power-consuming process with the lowest carbon footprint.

— The most competitive plant in terms of CapEx and OpEx.

With the order placed by CMC Steel for its fourth new, MIDA QLP hybrid-ready minimill, the Danieli scorecard hits 26 plants for long-product endless casting-rolling, out of 115 total minimills.

PLANTS

Dust and fines escaping from transfer points in steel production create a triple threat: compromising worker safety, triggering regulatory violations, and eroding operational efficiency. Martin's engineered solutions eliminate these hazards at their source.

Our modular Transfer Point Kits feature strategically configured loading, settling, and stilling zones that manage airflow at critical junctures. This primary defense is reinforced by field-proven components—including ApronSeal™dual-seal skirting, specialized impact belt cradles, dust curtains, and internal and external wear liners. This integrated containment approach creates a sealed conveyor environment that prevents dust from becoming airborne while extending equipment service life with minimal maintenance requirements.

Martin Engineering. Good thinking.

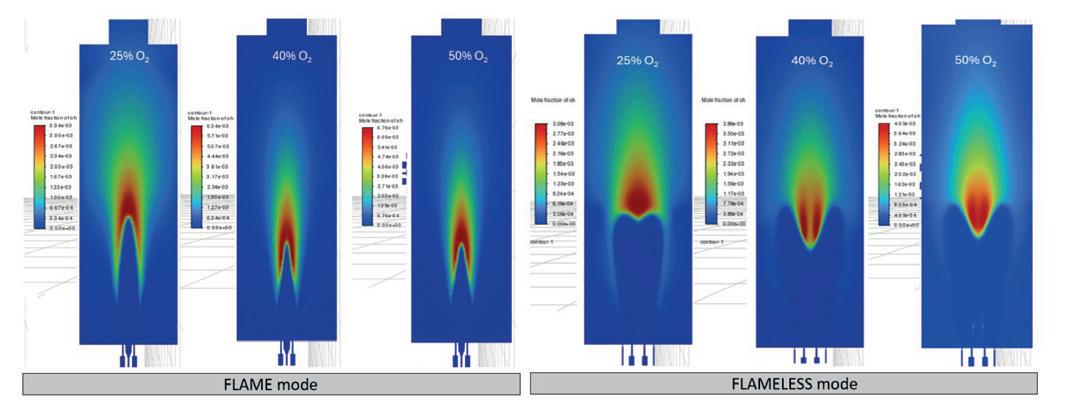

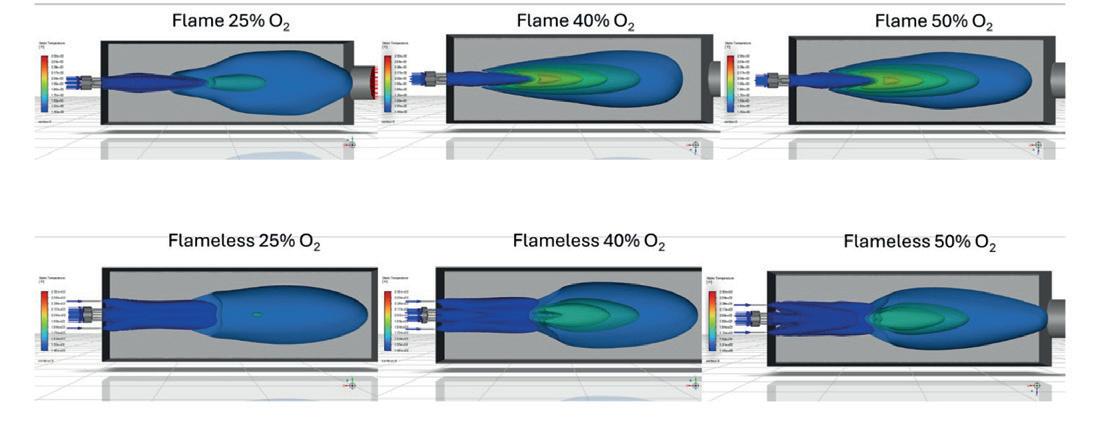

Meeting decarbonization goals will require a nuanced engagement with all the potential hydrogen usage offers, alongside consideration of the challenges faced in its adoption. By Almudena Casado1, Ricardo Baños2, and Eduardo Bilbao1

DECARBONIZING the steel industry is essential to meet global climate change targets, as it accounts for 7% of total global GHG emissions. The sector faces significant challenges due to its global competitiveness, reliance on carbon in production, and high energy consumption. The push for decarbonization is driving innovation, with solutions like renewable energy, fuels, and CO2 capture being developed. Hydrogen is emerging as a key player in this transformation.

However, the widespread adoption of hydrogen faces several obstacles. Developing low-carbon technologies, such as electrolysis, is crucial for sustainable hydrogen production. Despite its potential, hydrogen must compete with more accessible alternatives, and overcome challenges related to infrastructure, cost, and social acceptance, which is vital for its success.

The agreements from COP 28 emphasize the urgent need to triple renewable energy generation capacity and double energy efficiency by 2030. Adopting lowemission hydrogen is not just an option but a strategic necessity to meet climate goals and ensure a just and sustainable transition. Integrating hydrogen into the energy mix is crucial for achieving these targets and driving the global energy transition, particularly in decarbonizing steel production.

Currently, 70Mt of hydrogen (H2) are produced directly: 76% from natural gas primarily through Steam Methane Reforming (SMR), 23% from coal, and 1-2% from electrolysis. Additionally, 48Mt of H2 are produced as a byproduct. The annual production of H2, which is almost entirely derived from fossil fuels, results in the

IDOM Consulting, Engineering, Architecure, S.A.U.

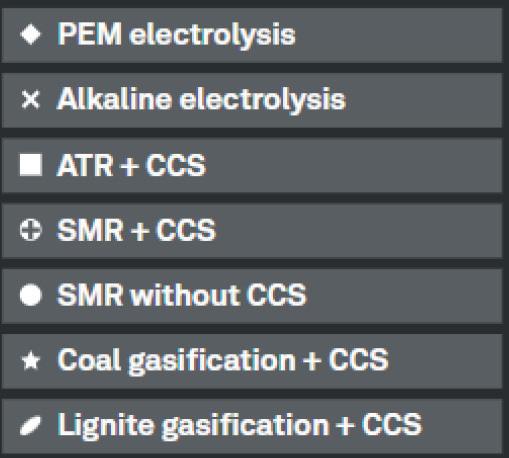

emission of approximately 830Mt of CO2 per year. There are four main technologies: SMR; Alkaline, PEM, and SOEC, with the latter being the least mature:

• Steam Methane Reforming (SMR): Methane reacts with steam at high temperatures and pressures, producing hydrogen and carbon monoxide. A common method for large-scale hydrogen production but it generates CO2 emissions.

• Alkaline Electrolysis: A simple and cost-effective process, but less efficient, which splits water into hydrogen and oxygen using an alkaline solution.

• Proton Exchange Membrane (PEM): A more efficient method with high purity, where water is split into oxygen, protons, and electrons using a special membrane that only allows protons to pass through.

• Solid Oxide Electrolysis Cells (SOEC): Uses a ceramic electrolyte at high

1. Avenida Zarandoa, 23, Bilbao, España, 48015 2. 1375 Peachtree St. NE, Atlanta, GA, U.S.A., 30309

Phone: +34 944797600 Email: metals-minerals@idom.com

Fig 1a. Hydrogen facilities regarding their origin; Figure 1b.implementation phase.

Source https://www.spglobal.com/commodity-insights/en/news-research/special-reports/ energy-transition/atlas-of-energy-transition

Fig 2.Hydrogen prices based on the production method in EEUU

current electrolyzers, 1 MWh can produce 220 Nm³ or 20 kg of H2. A significant portion of the cost of H2 produced from electrolyzers is electrical consumption. It is estimated that around 70% of the cost is related to electricity, while the remaining 30% is associated with CAPEX amortization and maintenance.

Fig 2 shows the differences in hydrogen prices based on the production method. Competition is emerging between technologies and regions to produce the cheapest low-carbon hydrogen (blue or green). The prices reflect monthly average production costs, including capital expenditures.

Challenges for the widespread adoption of H2 in steelmaking

Source :https://www.spglobal.com/commodityinsights/PlattsContent/_assets/_files/en/specialreports/energy-transition/ platts-hydrogen-price-wall/index.html

temperature, improving efficiency, and can be integrated with external heat sources.

As an alternative to producing H2 by breaking down water molecules, some projects are starting to look at the feasibility of extracting hydrogen buried under the Earth’s crust, similar to natural gas.

Hydrogen classification by production method:

• Grey hydrogen: Produced from fossil fuels without carbon capture and storage (CCS), resulting in CO2 emissions.

• Blue hydrogen: Produced from fossil fuels with CCS or through electrolysis using non-renewable electricity. This method

incurs high capital costs for CCS and hydrogen generation equipment.

• Green hydrogen: Produced through water electrolysis using renewable electricity. This method faces challenges related to the cost and scale of current commercial plants.

Since 2020, there has been a proliferation of clean hydrogen project proposals. Fig 1 illustrates the different hydrogen facilities based on their origin and implementation phase.

Electrolysis is recognized as a promising option for generating hydrogen from renewable sources. As a reference value for

To meet the goal of limiting global warming to +1.5ºC, it is estimated that hydrogen must account for 12% of global energy demand by 2050, with 66% being green hydrogen. This requires an electrolyzer capacity of 5,000 GW, compared to the 10 GW installed in 2023. The production of green hydrogen will require 20,800 TWh of electricity, which is equivalent to 80% of current global electricity generation.

The transition to green hydrogen in the steel industry faces several challenges. Producing green hydrogen through electrolysis is more expensive than fossil energy sources, which could lead steel plants to relocate to countries with cheaper renewable energy. Optimal locations must meet certain critical parameters, such as:

• Abundant and cheap renewable energy, as the cost of green hydrogen depends on electricity prices.

• Efficient production, storage and transportation infrastructure. Hydrogen

transportation via pipeline is cost-effective up to 3,000 km; beyond that distance, shipping hydrogen by sea is more economical.

• Favourable government and regulatory policies, with clear incentives and regulatory frameworks that encourage investment in green hydrogen.

• Access to international markets, with trade agreements and efficient port infrastructure for hydrogen import/export. Competitive production costs, where production efficiency, renewable electricity cost, and the scale of projects are key to reducing costs.

• Technological innovation, through investment in R&D to improve hydrogen production, storage and transportation.

• Political and economic stability, which attracts foreign investments and ensures the continuity of long-term projects.

Another significant challenge is the lack of large-scale electricity transmission infrastructure required to power

electrolyzers. Possible solutions include the development of high-capacity transmission networks or energy storage, either batteries or in the form of green hydrogen, to overcome the variability of renewable energy sources. Fig 3

The US is one of the few regions worldwide where both ‘blue’ and ‘green’ hydrogen can play a significant role as competitive low-carbon solutions. This is due to the country’s relatively low-cost natural gas and onshore CO2 storage capabilities, as well as affordable renewable energy sources in key regions, both essential for producing blue and green hydrogen.

2. Use of hydrogen in the steelmaking industry

Hydrogen can replace carbon as a reducing agent and in combustion processes in the steel industry. Here are some detailed applications:

As a reducing agent:

Traditionally, coal has been used as a

reducing agent in steelmaking, leading to significant carbon emissions. Hydrogen offers a cleaner alternative, as it can reduce iron ore to iron while producing water vapour instead of carbon dioxide.

Use of hydrogen in blast furnaces:

Hydrogen can serve as a substitute for coke in blast furnaces by injecting hydrogenrich streams, thereby reducing coke consumption. However, the endothermic nature of hydrogen necessitates additional energy to sustain high temperatures, posing challenges to the heat balance. Moreover, hydrogen must deliver the same consistency as coke to maintain furnace stability and efficiency.

� Ongoing projects:

• COURSE50: This project aims to reduce blast furnace CO2 emissions by using hydrogen reduction technology combined with CO2 separation and recovery. It has achieved a 10% reduction of CO2 emissions in experimental settings and is working on scalable solutions.

• H2Stahl: This project focuses on integrating hydrogen into the blast furnace process to explore the technical and economic feasibility of using hydrogen as the primary reducing agent, with the goal of significantly lowering the carbon footprint of steel production.

Use of hydrogen in direct reduction plants:

Hydrogen and carbon are both suitable reductants for iron ore, but they differ significantly in their by-products. Hydrogen emits water vapour instead of CO2, making

it a cleaner alternative. However, additional energy is required, given the endothermic nature of the reaction with hydrogen. It is estimated that for every cubic metre of natural gas replaced, three cubic metres of hydrogen are needed.

Advantages:

Hydrogen can be used up to 100% as a reducing gas in the direct reduction process without major modifications, offering a seamless transition to a cleaner alternative. The CO2 mitigation potential is 100%, significantly reducing the carbon footprint of steel production. This makes hydrogen

reduced sponge iron production and a pilot hydrogen storage facility. HYBRIT has the potential to cut Sweden’s CO2 emissions by 10% and Finland’s by 7% when fully implemented.

• The SALCOS® project by Salzgitter AG focuses on producing climate-neutral steel using hydrogen-based direct reduction methods. It includes constructing a 100 MW electrolysis plant to generate around 9kt of green hydrogen annually from 2026, aiming for over 95% reduction in CO2 emissions and setting a benchmark for sustainable steel production.

an attractive option for industries aiming to meet stringent environmental regulations and sustainability goals.

Disadvantages: As hydrogen usage increases, the carbon content in direct reduced iron (DRI) decreases. Carbon is essential in electric arc furnaces (EAF) because it combines with oxygen to provide energy for melting. Producing DRI with 0% carbon would impact the subsequent EAF steelmaking step, requiring changes to the process, with alternative (and sustainable) carbon addition sources, such as biocharge and alternative additives for foaming, potentially increasing the EAF process costs. OEMs recommend a minimum practical carbon content of 1-1.3% for EAF.

Projects:

• The HYBRIT project, launched by SSAB, LKAB, and Vattenfall, aims to produce fossil-free steel using hydrogenbased processes, achieving milestones like the world’s first pilot-scale hydrogen-

• Chemical energy injectors in EAFs: Hydrogen can be used as fuel in electric arc furnaces (EAFs) to improve combustion efficiency and reduce carbon emissions. This technology is adaptable for low, medium, and high-pressure applications.

• Ladle and tundish drying and preheating: Hydrogen combustion provides a clean and efficient heat source for ladle drying and preheating, crucial for maintaining efficiency and quality in steel production.

• Oxyhydrogen cutting torch: Combines hydrogen and oxygen to produce a hot flame for cutting and welding steel with precision. This method is safer and more environmentally friendly than traditional acetylene torches.

• Reheating furnaces: Hydrogen combustion in reheating furnaces heats semi-finished products before rolling, reducing CO2 emissions and improving thermal efficiency and temperature uniformity.

Green steel projects aim to produce steel with significantly lower carbon emissions by using renewable energy sources and innovative technologies. These initiatives are essential for achieving climate goals and transitioning to a more sustainable industry. Stegra project: The Stegra project, formerly known as H2 Green Steel, is a groundbreaking initiative to decarbonize the steel industry. Located in Boden, Sweden, this project includes a 2.1Mt/ yr direct reduction iron (DRI) production facility powered by a 760 MW hydrogen production plant. The project also features a 2.5Mt/yr steelmaking and continuous strip production (CSP) facility, various cold finishing facilities, a plant power distribution grid, and comprehensive plant infrastructure and water systems. Stegra aims to set a new industry standard by producing near-zero emission steel and significantly reducing steel emissions by over 7Mt/yr.

GravitHy project: The GravitHy project, backed by a consortium of industrial leaders, plans to build, own, and operate its first green iron and steel plant in Fossur-Mer, Southern France. This project includes a 650 MW electrolyzing plant for green hydrogen production, which will feed a 2Mt/yr DRI production facility. The DRI produced will be used either on-site as feedstock for green steel or traded globally as hot-briquetted iron (HBI). The project also encompasses plant infrastructure, port, and logistics facilities. GravitHy aims to support the decarbonization of the steel industry and contribute to Europe’s ‘Fit for 55’ ambitions.

4. Conclusion:

Decarbonizing the steel industry is essential to meet climate targets, with hydrogen playing a crucial role despite challenges in cost, infrastructure, and social acceptance. Since 2020, clean hydrogen projects have surged, focusing on hydrogen production from renewable resources via electrolysis. Hydrogen can replace carbon at every stage of the steelmaking process, significantly reducing CO2 emissions. Green steel plants, such as Stegra and GravitHy, are being built to produce near-zero emission steel. IDOM leads steel industry decarbonization and digitalization, supporting clients to reduce emissions, improve efficiency, and maintain quality. �

www.HilcoIndustrial.com

‘DANIELI’ 600,000 TPY FLEXIBLE SECTION ROLLING MILL (2011)