26 Fuelling a demand

The science and art of good design The bleaching earths of today have evolved from the Pre-Industrial Age into a variety of modern speciallyengineered clays which are blended and treated with acids or chemicals to produce the most efficient product to purify edible oil

Indonesia’s palm oil consumption for biodiesel production has exceeded the volume used in food since 2023. With the country planning to increase its biodiesel blend to 50% by 2026, its exports of palm oil are projected to fall further

Oils & Fats International features a global selection of plant and equipment suppliers to the oils and fats industry, with an A-Z listing plus a company activities guide

House passes bill to extend clean fuel credit

launches new glycerine refinery plant

and consortium to operate at Paranaguá port

Bayer to close Frankfurt factory in restructure plan

VOL 41 NO 5 JUNE 2025

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com +44 1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 1737 855157

ADVERTISING: Mark Winthrop-Wallace markww@quartzltd.com +44 1737 855114

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

SUBSCRIPTION RATES:

Print & digital: Single issue – £45

1 year – £182 (UK), £210 (overseas)

2 years – £328 (UK), £377 (overseas)

3 years – £383 (UK), £440 (overseas)

Digital only: Single issue – £29

1 year – £170

2 years – £272

3 years – £357

© 2025, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 1737 855000

Printed by Pensord Press, Merthyr Tydfil, Wales

Social media, influencers and the views of US Health and Human Services Secretary Robert F Kennedy have brought the health debate over seed oils to the fore.

Seed oils include canola, corn, cottonseed, safflower, soyabean and sunflower oils, which are high in omega-6 polyunsaturated fatty acids (see p6).

They have been described as “toxic” and been blamed for inflammation and chronic diseases, although medical organisations such as the American Heart Association (AHA) support their use as part of a balanced diet.

So what is the evidence behind the debate?

According to Dr Jane Zhao, an expert in global and public health at Harvard University and a nutrition researcher focusing on seed oils, a single meta-analysis published in 2016 found seed oils to be harmful, increasing the risk of some measures of heart disease by 13%. However, dozens of other meta-analyses showed mixed results, ranging from a very mild benefit to heart health and stroke prevention, to having no association with increased risk of either.

The 2016 report analysed data from the Minnesota Coronary Survey in the late 1960s and 1970s and combined it with other studies. It involved over 9,000 people and tested whether swapping out a saturated fat, like butter, for a seed oil high in linoleic acid (an omega-6 fatty acid) would reduce heart disease risk. It found that the swap lowered cholesterol but failed to reduce heart disease, and may have increased deaths and heart attacks.

On the other hand, other studies – like a 2019 meta-analysis – found higher levels of omega-6 in the blood were associated with a lower heart disease and stroke risk, as did an analysis released in 2023, according to Zhao. A report in 2024 found no association between omega-6s and heart disease, while a 2018 systematic Cochrane review of trials found no relationship between omega-6s and heart health.

The controversy over seed oils reflects a wider swing away from the low-fat views of the 1990s and early 2000s – which demonised fats, such as butter, in favour of seed oils –to the more recent embracing of whole foods and saturated fats.

Seed oils are everywhere in the Western diet and, for some critics, they are a symbol of the big-agri industrialised food system, and cheap ultra-processed foods (UPFs), which are linked to poor health outcomes and even the risk of early death (see p8). However, UPFs do not just contain fats and oils, they are also high in salt, sugar and additives.

While it would be much simpler to have black and white messages about what is ‘good’ or ‘bad’ for us to eat, our health is dependent on a range of factors such as overall diet, exercise levels, wider lifestyle and wealth and not on any one single ingredient.

Nutrition science is complex and slow to evolve, with many confounding variables in long-term studies. The evidence is not strong that consuming omega-6 fats from whole foods or oils causes chronic inflammation in typical diets.

But for those still in doubt, the best advice we can all follow is to cook or eat whole, minimally processed, nutritious food in moderation.

Serena Lim, OFI Editor serenalim@quartzltd.com

Transesterification | Enzymatic Biodiesel production | Glycerolisis

Methylester fractional and total distillation

Special Dry degumming & bleaching | Deacidification | Oil washing | Pre-treatment

You choose the feedstock(s), We build your best Biodiesel Plant.

CMB: your trusted partner for your Biodiesel Plants.

CMB S.p.a. Cisterna di Latina, Italy

CMB Malaysia Engineering For Oils And Fats SDN. BHD. Kuala Lumpur, Malaysia

CMB India Engineering For Oils And Fats LTD. Mumbai City, India

CHINA: Global agribusiness COFCO International has started making deliveries from Brazil to China under its certified sustainable soyabean agreement with leading international milk producer Mengniu Group.

COFCO loaded 69,000 tonnes of soyabeans at its new STS11 terminal in Santos on 28 May for delivery to two Mengniu subsidiaries in China. The delivery was part of its agreement with Mengniu, announced in February, to supply 1.5M tonnes of deforestation- and conversion-free soyabeans between 2025 and 2030.

The two subsidiaries –Modern Farming and China Shengmu Organic Milk –manufacture and distribute dairy products in China.

COFCO International is the overseas agriculture business platform for China’s largest food and agriculture company, COFCO Corporation, and is active in grains, oilseeds, sugar and cotton.

INDIA: Edible oil stocks fell to a five-year low of 1.35M tonnes on 1 May due to a sharp drop in palm oil imports in April, which dropped to their lowest level in four years, Business Standard reported on 14 May.

April Indian palm oil imports totalled 321,446 tonnes, a 24.29% fall compared to the previous month, the Solvent Extractors Association of India (SEA) said.

“Stocks and imports have dropped as mustard seed crushing is in full swing, which is why domestic supplies are good,” SEA executive director BV Mehta said. Reduced stock levels could lead to an increase in Indian imports of palm and soyabean oils in the coming months, Reuters wrote.

Meanwhile edible oil prices were soaring, with prices rising by 17.4% in April, the sixth successive month of double-digit inflation, the report said.

The European Commission released its official country risk classifications under the EU Deforestation Regulation (EUDR) on 22 May.

“[The] publication of the country benchmarking is an important milestone ahead of the entry into application of the law on 30 December 2025 for large companies and 30 June 2026 for micro- and small enterprises,” a 22 May Euractiv report quoted the EC as saying.

The regulation aims to ensure that palm oil, soyabean, beef, coffee, cocoa, timber and rubber products sold in the EU do not contribute to deforestation, with four classifcations determining the level of due diligence required for these products.

Four countries – Belarus, Myanmar, North Korea and Russia – have been classified as 'high risk', meaning their imports are subject to the strictest compliance checks, including a 9% inspection rate.

Leading palm oil producers Indonesia and Malaysia have been classified as 'standard risk', along with leading soyabean producer Brazil, and would be subject to a reduced inspection rate of 3%.

The Malaysian Palm Oil Council (MPOC) said the classification was “unfair” as other countries with “weaker” records on forest conservation had been given ‘low risk’ status.

“Of most concern to us is the accompanying documentation that explains the data on which the Commission has based its decision," MPOC CEO Belvinder Sron said, adding that the organisation would request clarification on the full benchmarking methodology used in the assessment.

According to the Euractiv report, all 27 EU countries have been given ‘low risk’ status, along with the USA, China, Australia and Canada. Their imports would be subject to

the least stringent compliance checks, with a 1% inspection rate.

The EUDR requires operators and traders placing the seven relevant commodities and their derived products on the EU market – or exporting them from the EU – to conduct due diligence to ensure they are deforestation-free, legal and traceable. This includes geolocation coordinates where the commodities were produced; production dates proving the product was not sourced from deforested land post-31 December 2020; and evidence of compliance with the producing country's land use rights, forest protection, labour rights and tax laws.

UAE-based global agribusiness Al Dahra has formed a partnership with Getreide AG Ukraine to source Ukrainian grain and oilseeds, World Grain wrote, citing a Khaleej Times report.

Al Dahra would source 100,000-150,000 tonnes of agricultural commodities in Ukraine, with plans to scale operations to more than 500,000 tonnes, the 22 May report said. Operations were expected to be completed before the start of Ukraine’s new crop season in July.

Al Dahra said the partnership would complement its operations in Serbia, Romania, Egypt and the USA while securing supply for its customers across the Middle East and Africa.

“Our exclusive relationship with Getreide AG Ukraine positions us strategically in one of the world’s most vital agricultural regions,” Al Dahra

group CEO Arnoud van den Berg said. Al Dahra’s activities include farming, trading and processing. It has farming and sourcing capabilities across the Black Sea Region comprising wheat, barley, soyabeans, sunflowers and corn from its trading hub in Constanta, Romania.

The company has 16 processing facilities across the world and it sources products from more than 20 countries, with a total capacity of 6M tonnes/year, according to its website.

Getreide AG Ukraine is a subsidiary of Getreide AG, a German company with operations in rapeseed oil, malt and food. Getreide AG Ukraine exports rapeseed and other crops to processing plants in Germany for use in the production of oil, meal and malt.

The world is hungry for premium plant proteins.

Achieve growth targets and profitability by partnering with CPM|Crown.

Bring sustainable plant-based proteins to market with Crown’s technical expertise and Global Innovation Center. From feasibility, trials and toll processing to commercial-sized operations, Crown’s experience, R&D and Lifecycle360™ services provide guidance and support at every step. For dehulling, de-oiling, white flakes and protein concentrates, Crown’s plant protein technologies and custom-engineered solutions allow you to develop and produce consistent products with the highest protein quality. Partner with Crown to turn your plant-based protein ideas into profitable revenue streams.

Premium plant protein is in high demand. Deliver it with CPM|Crown.

Feeding, Fueling and Building a Better World. Human Food | Animal Feed | Aqua Feed

USA: Ongoing uncertainty surrounding US trade policies is impacting sales of new-crop corn and soyabeans, pulling them well below historical averages, according to a new CoBankKnowledge Exchange report.

As of 1 May, US newcrop soyabean export sales totalled 518,100 tonnes, the lowest volume at this point in the season since 2001 and 88% under the historical five-year average, World Grain wrote on 23 May, citing the report. Corn sales of 2.2M tonnes were 27% under their historical five-year average,

Many overseas buyers had reduced forward coverage and were buying in the spot market, complicating the picture for elevators and merchandisers heavily reliant on export demand.

Since US President Donald Trump announced his 'Liberation Day' tariffs on 2 April, China had increased soyabean orders from Brazil, suspended soyabean shipments from three US companies and signed letters of intent with Argentine exporters to purchase soyabeans, corn and vegetable oil, World Grain wrote.

Mexico and Japan, the second and third largest markets for US soyabeans, were also lagging well below historical purchases of newcrop soyabeans, according to the World Grain report.

A US appeals court has ruled that US President Donald Trump’s sweeping tariffs on most of the world’s countries can stay in place, a day after the Court of International Trade found that he did not have the unilateral power to impose them, the BBC reported on 29 May.

On 28 May, the Court of International Trade ruled that the International Emergency Economic Powers Act (IEEPA) invoked by the White House did not give the president unilateral authority to impose tariffs. The court said the US Constitution gave Congress exclusive powers to regulate commerce with other nations, and this was not superseded by the president’s remit to safeguard the economy.

However, President Donald Trump's administration immediately appealed the ruling and, a day later, a federal appeals court granted the White House’s bid to temporarily suspend the lower court’s order while the case is litigated.

In its appeal, the Trump administration said the decision issued by the trade court had improperly second-guessed the president and threatened to undo months of trade negotiations. “The political branches, not courts, make foreign policy and chart economic policy.”

The Court of International Trade ruling was based on two separate cases – one brought by the Liberty Justice Center on behalf of several small businesses that import goods from countries targeted by US tariffs, and the other brought by a coalition of US state governments, the BBC wrote.

Meanwhile, the USA and China had agreed to cut tariffs on each other’s goods by 115% for 90 days in a major de-escalation of their trade war, the BBC wrote on 12 May. Effective from 14 May, US tariffs on Chinese imports fell to 30%, down from 145%, while Chinese tariffs on US goods dropped to 10%, down from 125%.

The Chinese government has published an action plan on edible oil inspections to standardise production and ensure quality and safety, according to a 29 April report by the US Department of Agriculture (USDA).

Partially spurred by domestic food safety contamination incidents in 2024, the 18 April announcement by the State Administration for Market Regulation (SAMR) outlined how officials would step up inspection and enforcement actions from April-December with a focus on adulteration; the use of additives beyond designated limits; false labelling and failure to label genetically modified products as required; and transportation.

On 1 February 2025, China's new national standard for Hygienic Requirements for the Bulk Transportation of Edible Vegetable Oils

also came into force regulating the sanitary requirements for loading, unloading, records management and transportation of bulk edible vegetable oils in the country.

A seed oil ban in the USA would have a devastating impact on US farmers and significantly reduce consumer choice, according to a new study funded by the United Soybean Board and conducted by the World Agricultural Economic and Environmental Services (WAEES).

Seed oils – including soyabean, canola, corn, cottonseed, rapeseed, safflower and sunflower oils – have come under increasing public scrutiny since the appointment of Robert F Kennedy Jr as US Secretary of Health. He claims they cause inflammation and a range of illnesses and has raised the

idea of banning them.

WAEES, identified two possible scenarios from a potential US seed oil ban in study, published in March. The first scenario assumed that US oils and fats consumption would remain steady, with consumers opting for other available fats. However, this did not take into account that many seed oils could not be directly substituted by other fats due to nutritional and chemical differences.

This scenario would see annual 26.3kg/ capita seed oil consumption replaced by imported palm oil, leading to consumers

spending an additional US$7.7bn/year on vegetable oils and fats, a 43% increase.

The second scenario assumed consumers would not be willing to spend more than 8% on fats and oils. This would result in a significant fall in seed oil consumption to 9.5kg/year.

In both scenarios, soyabean prices would fall more than 3%/year while farmer returns would drop by about 7%, the study said.

Farm incomes would decrease by US$2bn/year, while the soyabean planted area would drop by more than 1.1M ha/ year.

The Indonesian government increased the export tax on crude palm oil (CPO) from 7.5% to 10% of the product's reference price on 17 May in a bid to fund its biofuel programme and replanting efforts, Asia News Network wrote on 16 May.

The world’s largest palm oil producer had also increased taxes for outbound shipments of other palm oil products.

The new tariff was published by the finance ministry on 14 May, Indonesian Palm Oil Association (GAPKI) said on 20 May.

ARGENTINA: Canadian grain handling business Viterra was the leading exporter of agricultural commodities to Argentina for the third consecutive season at the end of the 2023/24 marketing year, World Grain reported on 20 May, citing Rosario Grain Exchange data. The exchange said the top 10 companies in terms of volume were:

• Viterra (13.55M tonnes)

• Cargill (11.37M tonnes)

• COFCO (10.35M tonnes)

• Bunge Global SA (8.72M tonnes)

• AGD (8.65M tonnes)

• Louis Dreyfus Co (8.57M tonnes)

• ADM (8.04M tonnes)

• ACA (5.65M tonnes)

• Molinos Agro (5.15M tonnes)

• CHS Inc (1.37M tonnes)

Of the 89.82M tonnes of exports for the main agricultural crops during the 2023/24 cycle ending in March, the top three firms accounted for nearly 39%. By commodity, the top exporters were:

• Soyabeans: Viterra (8.46M tonnes)

• Corn: ADM (6.97M tonnes)

• Wheat: Bunge (760,000 tonnes)

• Barley – Cerveceria y Malteria Quilmes (670,000 tonnes)

• Sunflower: Viterra (990,000 tonnes).

Indonesia was heavily subsidising biodiesel to meet its mandatory 40% palm oil biodiesel (B40) blend target and was using export taxes to fund the programme, Asia News Network said.

The B40 policy introduced in January would require some 15.62M kilolitres of CPO, against a backdrop of reduced CPO production in the country from 50.1M tonnes in 2023 to 47.8M tonnes in 2024, according to GAPKI. B40 implementation could also reduce CPO exports by 2M

tonnes, Asia News Network wrote.

GAPKI chairman Eddy Martono said the increased export tax would make Indonesian palm oil less competitive globally.

“Our palm oil industry has been subjected to three export burdens – the Domestic Market Obligation, export levy and export tax (BK). The total financial burden borne by the palm oil industry has already reached US$221/tonne. With the new tariff, our burden will certainly increase … but we have yet to make a new calculation.”

A diet high in ultra-processed foods (UPF) may be linked to a greater risk of an early death, according to a new study reported by the BBC on 28 April.

Published in the American Journal of Preventive Medicine, the study looked at surveys of people’s diets and data on deaths from in Australia, Brazil, Canada, Chile, Colombia, Mexico, UK and the USA.

The report estimated that in the USA and the UK, where UPFs accounted for more than half of calorie intake, there were 124,000 and 18,000 premature deaths in 2018 due to consumption of UPFs in the USA and the UK respectively.

In countries such as Colombia and Brazil, where UPF intake was much lower (less than

20% of calorie intake), these foods were linked to around 4% of premature deaths. UPFs tend to contain more than five ingredients which are not usually found in home cooked foods – such as additives, sweeteners and chemicals – and include processed

A new report by the Make America Healthy Again (MAHA) Commission says US children would experience fewer childhood chronic diseases if they lowered their intake of ultra processed foods (UPFs) and reduced their exposure to chemicals including pesticides, World Grain wrote on 23 May.

The 22 May report noted that nearly 70% of an American child’s calories came from UPFs, which it defined as “packaged or ready-to-consumeproducts formulated for shelf life and/or palatability but are typically high in added sugars, refined grains, unhealthy fats and sodium, and low in fibre and essential nutrients”. Ultra-processed grains, sugars and fats were highlighted as problematic.

Other ingredients identified as contributing to the poor health of American children included emulsifiers, binders, sweeteners, colourings and preservatives – specifically, titanium dioxide, propylparaben, butylated hydroxytoluene and artificial sweeteners, World Grain wrote.

meats, biscuits, fizzy drinks, ice cream and some cereals.

However, the BBC said the study could not definitively prove UPFs caused premature deaths as the amount of UPFs consumed was also linked to people's overall diet, lifestyle, exercise levels and wealth.

“Additives in processed foods are consumed in complex combinations, where cumulative and synergistic effects may amplify harm beyond individual components,” the report said. “Yet, testing often ignores these interactions."

Increased consumption of UPFs was due to industry consolidation, the corporatisation of the food system and regulations that disadvantaged smaller businesses, the report said.

The commission – established via executive order by US President Donald Trump also said exposure to different chemicals was a problem. Chemicals of concern included perfluoroalkoxy alkanes (PFAs) microplastics, fluoride, phthalates and crop protection products such as glyphosate.

In response to the report, American Soybean Association director Alan Meadows said that by singling out glyphosate and atrazine, activists would advance litigation to take away two tools US farmers used to produce food.

USA: US biofuels production, including SAF, approximately doubled between December 2024-February 2025, according to US Energy Information Administration (EIA) data reported by Biofuels Digest on 11 May.

Although US SAF production capacity was low prior to 2025 at around 2,000 barrels/day (bpd), capacity rose significantly in late 2024 by about 25,000 bpd with projects completed by Phillips 66 and Diamond Green Diesel. Total US SAF capacity was around 30,000 bpd and was expected to drive most of the growth in the country’s biofuels production, the report said.

UK: Greenergy said on 20 May that it had temporarily shut operations at its Immingham biodiesel plant due to adverse market conditions and is reviewing the plant’s commercial viability.

Greenergy sources used cooking oil globally to produce biodiesel. As well as the Immingham plant, it operates a second UK biodiesel plant on Teesside and another in Amsterdam, the Netherlands. Last January, it announced it had expanded its plants in the Netherlands and on Teesside to allow for a wider range of waste oils to be used as feedstocks. The Amsterdam upgrade had increased production capability by 25%.

The US House of Representatives has passed a bill extending the 45Z clean fuel production tax credit, Ethanol Producer reported on 23 May.

The HR1 bill, also known as the “big, beautiful bill”, was passed on 22 May and would now be considered by the US Senate, where it was likely to be amended, the report said.

The draft bill would extend the 45Z credit until 31 December 2031.

“The bill also reinstates crucial tax benefits that will stimulate research, experimentation and innovation across the ethanol supply chain,” Geoff Cooper, president and CEO of the Renewable Fuels Association (RFA), was quoted as saying.

Established by the 2022 Inflation Reduction Act, the existing 45Z tax credit provides

a tax incentive for the production and sale of low-emission transformation fuels. The credit starts at 20¢/gallon for non-aviation fuels and 35¢/gallon for sustainable aviation fuel (SAF). For facilities that meet current wage and apprenticeship requirements, the value of the tax credit is up to US$1/gallon for non-aviation fuels and US$1.75/gallon for SAF. The tax credit is currently in place for 2025, 2026 and 2027.

Section 111112 of HR1 aimed to limit the 45Z credit to fuels produced from feedstocks produced or grown in the USA, Mexico or Canada, Ethanol Producer wrote. It aimed to exclude indirect land use change from being used to calculate the lifecycle greenhouse gas emissions of eligible fuels. Additional changes aimed to restrict access to the credit for certain prohibited foreign entities.

The Canadian International Trade Tribunal (CITT) announced on 5 May that a preliminary investigation launched earlier this year found no evidence that US renewable diesel imports were having a negative effect on the domestic sector.

Conducted under the Special Import Measures Act, the dumping and subsidising investigation was launched by the Canada Border Services Agency (CBSA) following complaints filed by Canadian biofuels producer Tidewater Renewables in late 2024.

“The evidence does not disclose a reasonable indication that the dumping and subsidising of the subject goods have caused injury or retardation or are threating to cause injury,” the CITT said. As a result, the preliminary injury inquiry and the CBSA investigations would end.

The owner of a British Columbia renewable diesel biorefinery, Tidewater alleged that unfairly traded imports of US renewable diesel were significantly undermining the Canadian

industry, Biodiesel Magazine wrote on 7 May. Tidewater claimed it had suffered material injury in the form of lost market share; lost sales; price undercutting; price depression; reduced profitability; and negative cash flow, return on investment and ability to raise capital due to subsidised US renewable diesel imports.

China’s Zhejiang Jiaao Enprotech has exported its first shipment of sustainable aviation fuel (SAF), Reuters wrote on 7 May.

The 13,400-tonne cargo was shipped to Europe by a biofuel plant operated by the company’s east China-based subsidiary, Reuters quoted multiple sources as saying.

According to a stock filing by the company, the shipment came shortly after it was granted an SAF export licence for 2025.

The permit was one of the first Beijing had granted to the country’s emerging low-carbon aviation fuel industry, according to industry officials quoted in a 30 April

Reuters report.

Export licences are among the key policy tools the industry has been waiting for since a group of mostly privately-led biofuel refiners announced a US$1bn investment to build new SAF plants for domestic use or export, according to an earlier Reuters last May.

Zhejiang Jiaao Enprotech’s new subsidiary plant in Lianyungang, in eastern China’s Jiangsu province, would produce 372,400 tonnes of SAF at full operation this year, the stock exchange filing said.

According to an 8 April press release on

Zhejiang Jiaao Enprotech’s website, global energy giant bp invested US$48.54M in acquiring a 15% stake in the SAF plant.

Reuters wrote that some refiners had pushed back the start-up of new plants as the industry was still waiting for Beijing to announce a SAF mandate.

The world’s second-largest aviation fuel market, China launched a pilot scheme in September for the use of SAF in a dozen flights departing from domestic airports in Beijing, Chengdu, Zhengzhou and Ningbo, later expanding the scheme to all domestic flights from those airports, Reuters wrote.

Global agribusiness Louis Dreyfus Co (LDC) has officially launched its new 55,000 tonnes/year glycerine refining plant and a new edible oil packaging line in Lampung, Indonesia, World Grain reported on 27 May.

LDC said the new facilities were strategically located near key export hubs and aligned with its strategic growth plans and ongoing commitment to Indonesia, the world’s largest glycerine producer.

“This inauguration marks an important step in the development of our Food & Feed Solutions business,” said James Zhou,

USA: Speciality chemical producer Pilot Chemical announced a partnership with renewable speciality chemicals firm Novvi on 5 May to produce bio-based surfactants at its Ohio site.

The facility would produce CalCare AOS bio-based alpha olefin sulphonates for the North American household, industrial and institutional (I&I) and personal care markets, with commercial quantities set to be available in the second half of this year.

Pilot said the partnership combined Novvi’s bio alpha olefin technology and commercial-scale feedstock supply with Pilot’s expertise as an alpha olefin sulphonator and anionic surfactant provider.

Novvi produces emollients, speciality waxes, isoalkanes and other personal care ingredients derived from plant oils.

LDC’s global head of Food & Feed Solutions and chief commercial officer.

The new glycerine plant would help meet rising global demand for high-purity, USPgrade glycerine, projected to grow at a 2.5% CAGR for refined glycerine from 2023-40, World Grain reported LDC as saying.

When first announcing the expansion of its Lampung refining complex in 2023, LDC said the plant would complement its existing glycerine refining activities in the USA (Claypool, Indiana) and Germany (Wittenberg).

LDC said the Lampung expansion would strengthen its competitive position as a supplier to the pharmaceutical, personal care and cosmetics industries – key drivers of global refined glycerine demand.

In addition, the new edible oil packaging line – with some 64,800 tonnes/year of packaging capacity – offered various food grade packaging options and would leverage synergies with LDC’s existing Lampung operations to capture domestic and other market opportunities for packaged edible oil exports.

Natural resources and sustainable energy firm Buscar Company has acquired a 50% stake in hemp-based bioplastics company Terramer, PR Newswire reported on 11 April.

Terramer has developed TERBO-100, a hemp-based bioplastic that is 100% biodegradable within 180 days, leaving no microplastic residue.

The company’s production facility in Los Angeles had 136,000 tonnes/year of capacity and it had secured US$6.8M in agreed purchase orders and over US$80M in signed letters of intent from major household brands to date, the report said.

As part of the partnership, Buscar and Terramer would scale up the development and commercialisation of TERBO-1000 to produce scalable, compostable plas-

tics for various industries including the packaging, food service, automotive and construction sectors, PR Newswire wrote.

“By combining Terramer’s bioplastic technology with our financial and operational strengths, we’re positioned to lead the charge in eliminating microplastic pollution,” Buscar

Company CEO and chairman Alexander Dekhtyar was quoted as saying.

Key initiatives of the partnership included the development of custom formulations using AI technology and the exploration of carbon credit opportunities from TERBO-1000’s lifecycle emissions reductions, the report said.

Indonesian palm oil company the Musim Mas Group has agreed to acquire a surfactants manufacturing facility in the Philippines from speciality chemicals manufacturer Stepan Company.

The acquisition of the facility in Bauan, Batangas province, from the Stepan Philippines Quaternaries subsidiary would broaden Musim Mas’ surfactant portfolio, allowing it to meet growing market demand for high-quality surfactants products for personal care, home care and other industrial applications, the com-

pany said on 27 May.

“With a key focus on fabric softeners and other essential surfactants, this new facility allows us to better serve our customers while pursuing our commitment to sustainable growth and partnership,” Musim Mas global business oleochemicals managing director John Hall said.

Musim Mas said the acquisition through its Masurf subsidiary was subject to normal closing conditions.

The company sources raw materials from Malaysia and Indonesia, with the latter

acting as its main operational base.

The food processing company has production plants located across Asia and Europe and has operations in 13 countries.

It also operates palm oil plantations, mills, refineries and palm kernel crushing plants to produce palm oil products and derivatives.

Its main research and development (R&D) centre is based in Singapore and its global marketing activities are undertaken by Inter-Continental Oils and Fats (ICOF), a member of Musim Mas Group.

Optimized fat and meal production The high-quality product specifications you require, and the flexibility to adjust to changing demands.

Dramatically reduced downtime Unsurpassed reliability backed by the rapid response of the largest field service team and parts inventory in the industry.

Complete systems integration Every type of major rendering equipment, including new Dupps-Gratt decanters and centrifuges.

WORLD: The 83rd session of the International Maritime Organization (IMO) Marine Environment Protection Committee (MEPC 83) has approved the use of marine biofuel blends of up to 30% by volume in conventional bunker ships.

The committee meeting on 7-11 April approved the ‘Interim Guidance on the Carriage of Blends of Biofuels and MARPOL Annex I Cargoes by Conventional Bunker Ships’. The guidance allows conventional bunker ships to transport and use fuel blends comprising no more than 30% by volume of biofuels, up from 25%.

According to Lloyd’s Register, most currently used marine biofuels fall in the 20-30% range.

In the approval, biofuels were defined as “fuel oil which is derived from biomass and includes, but is not limited to, processed used cooking oils, fatty acid methyl esters or fatty acid ethyl esters, straight vegetable oils, hydrotreated vegetable oils, glycerol or other biomass-to-liquid type products”.

Additionally, MEPC 83 approved a guidance stating that biofuels blends of up to 30% do not require additional nitrogen oxide emissions testing and can be treated the same as conventional petroleum fuels.

Global agribusiness giant Cargill and a consortium formed by Louis Dreyfus Co and Brazilian grain trader Amaggi (ALDC) were among the winners of a competitive auction to operate three terminals at the Port of Paranaguá in Brazil for 35 years, World Grain reported on 2 May.

Combined bids at the Sáo Paulo Stock Exchange for the PAR 14, 15 and 25 port areas reached BRL855M (US$150.64M), according to port administrator Portos do Paraná.

The successful companies were also expected to invest BRL2.2bn (US$387.62M) in future improvements.

All the areas auctioned at Brazil’s second busiest port have existing facilities and infrastructure and handle solid vegetable bulk, mainly soyabeans, soyabean meal and corn, according to the report.

One of a record six bids for PAR15, Cargill’s

winning bid of BRL411M (US$72.41M) was the highest amount at the auction. The ALDC consortium was one of five bidders for PAR25 and won with a bid of BRL219M (US$38.58M).

PAR14 was won by Brazilian investment bank BTG Pactual Commodities with a bid of BRL225m (US$39.64M).

“I believe that the great competition is due to the fact that we are reaching the last auction areas, which are extremely relevant for agriculture, being one of the main export corridors in the country,” Brazil’s Ministry of Ports and Airports executive secretary Mariana Pescatori was quoted as saying.

Brazil has established itself as the world’s top supplier of soyabeans, with the US Department of Agriculture forecasting that the country will produce 173M tonnes of soyabeans and export a record 112M tonnes in 2025/26.

Canadian grain company Parrish & Heimbecker (P&H) has acquired a deep-water bulk marine export terminal at the Port of Quebec from Societe En Commandite Terminal Grains.

Located in a key eastern shipping corridor, the acquisition for an undisclosed sum “is a strong fit for our long-term growth strategy”, P&H CEO John Heimbecker said on 1 May.

P&H said the acquisition of the terminal (pictured), which had been operated by Sollio Agriculture since 2021, also established a new commercial relationship between P&H and QSL International, which offered stevedoring, marine services, logistics and transport throughout North America.

P&H’s grain asset network comprises 45 grain elevators, rail sidings, inland terminals and specialised export terminals across Canada.

Commodities handled by the company

include canola, corn, feed barley, malt barley, milling wheat, oats and soyabeans. According to Sosland Publishing Co’s 2025 Grain & Milling Annual, P&H is the sixth largest grain handling company in Canada.

US President Donald Trump’s announcement of a ceasefire between the USA and Yemen’s Houthi rebels is not expected to restore freedom of navigation through the Red Sea in the near future, according to a 7 May report by The Soufan Center.

In a statement on 6 May, Trump said the Houthis had told the USA “they don’t want to fight anymore,” and “[the USA] will honour that, and we will stop the bombings”.

Confirming the agreement on behalf of the Houthis, Badr bin Hamad al Busaidi, the Foreign Minister of the Sultanate of Oman, which hosts a Houthi representative office and mediated the truce, posted a

statement on X. “In the future, neither side will target the other – including American vessels – in the Red Sea and Bab al-Mandab Strait, ensuring freedom of navigation and the smooth flow of international commercial shipping,” his post said.

Senior Houthi official Abdul Salam said the deal did not include an end to attacks on Israel, the BBC wrote on 7 May.

While welcoming the pact, global diplomats and experts cast doubts on its benefits as Trump and other senior US leaders had not said if they would consider new Houthi attacks on non-US commercial ships in the Red Sea a violation of the pact.

Due to the ambiguities and uncertainties of the truce, large international shipping companies will not resume using the Red Sea route in the near future, according to an 8 May report by the Wall Street Journal. Representatives of Danish shipping liner AP Moller-Maersk said in the week before The Soufan Center report that they were not ready to send ships through the Red Sea.

Houthi attacks on vessels in the Red Sea since October 2023 have led to a drop in grain and oilseed shipments via the Suez Canal, with shipping companies forced to re-route around the Cape of Good Hope.

USA: German chemical and biotech firm Bayer has unveiled 19 new soyabean varieties ahead of the 2025 planting season, bringing its total Xitavo soyabean seed offering to 46 products, Wyoming Livestock Roundup reported on 16 May.

“Previously, four companies comprised 98% of the soyabean breeding effort for the US market. BASF is now bringing new … germplasm to the market,” the firm said in a press release last July.

BASF US soyabean agronomy lead Marc Hoobler said XO 2625E offered a good tolerance to white mould and iron deficiency chlorosis; XO 2865E contained the Rps1c resistance gene against the phytophthora pathogen causing phytophthora root and stem rot; and XO 3105E featured tolerance to iron deficiency chlorosis, phytophthora and sudden death syndrome.

CHINA: On 7 May, the government approved 11 new food materials and additives, including three genetically modified (GM) microorganisms, the US Department of Agriculture wrote in a 19 May Foreign Agricultural Service Global Agricultural Information Network report.

Two GM enzymes – GM peroxidase and xylanase –were approved for use in the food industry and the GM additive lacto-N-neotetraose was approved in the 'Supplemented Quality Specification Requirements’ category.

German chemical giant Bayer will shut down its herbicide production and development operations at its Frankfurt am Main site by the end of 2028, marking the company's first closure of a German factory in its 161-year history, Biz Community reported on 19 May.

The closure was part of a broader restructuring of Bayer’s Crop Science division, driven by global overcapacity, intense competition from low-cost Asian manufacturers and increasing regulatory constraints in Europe, the report said.

Some operations at the Frankfurt site would be sold while others would be relocated to Dormagen, which would continue as Bayer’s production facility, with the largest portfolio of active ingredients and crop protection products, a 15 May SCI report said.

Production of several generic active ingredients and their associated formulations would be

also discontinued at Dormagen, SCI wrote.

“These steps are urgently needed to counteract the significant overcapacity and … price competition with generics manufacturers from Asia," Bayer Crop Science Division head of strategy and sustainability Frank Terhorst said in a statement on the company’s website on 12 May.

The closure of the Frankfurt site and other restructuring measures are part of Bayer’s strategy to focus on strategic and new technologies in the agriculture sector, according to the report.

On 13 May, Bayer reported a 35% drop in net income in first quarter 2025 to US$1.46bn, Biz Community wrote. The drop was due to a near-tripling of litigation and restructuring costs to US$661M and weakening sales performance. The company was also facing numerous US lawsuits alleging its glyphosate-based herbicide Roundup caused cancer, the report said.

A new study has found that a bioactive compound in olive mill wastewater may potentially be used in the development of biopesticides, Olive Oil Times wrote on 7 May.

Using transgenic Arabidopsis seedlings, researchers from Rome's Sapienza University of Rome and the Italian National Agency for New Technologies, Energy and Sustainable Economic Development confirmed that extracted oligogalacturonides triggered a plant’s immune system and activated defence responses and resistance against some pathogens. This could be used in the development of biopesticides.

This was the first time the molecules had been separated from olive mill wastewater,

Olive Oil Times said.

Olive mills in the Mediterranean basin produce an estimated 30bn litres/year of wastewater, which are considered a significant environmental pollutant, with most countries banning it from being dumped without being treated, according to the report. The waste-

water is very acidic, with high concentrations of recalcitrant compounds including lignins and tannins, which require significant amounts of oxygen to biodegrade. However, the wastewater also contained a wide range of valuable phenolic compounds with proven antimicrobial properties.

German chemical and biotech giant BASF plans to expand its agriculture unit in Asia and the global seed markets as it prepares for a stock market listing in about two years, Reuters reported a senior executive from the company as saying.

The company said its Agricultural Solutions unit should be ready for an initial public offering by 2027 that could involve it selling a minority stake in the business,

the 9 May report said. The unit comprises seeds, traits, seed treatment products, biological and chemical crop protection solutions, and digital farming products.

BASF said it was aiming to increase its revenue from seeds from 22% to 25%. As part of its plans, it was working on hybrid wheat and new soyabean variants resistant to pests such as soil roundworms.

Asia was a region the company was

under-represented in, with interest across products including crop chemicals and digital services, it said.

In 2024, BASF’s agriculture business –among the four largest industry players along with Syngenta, Bayer and Corteva –posted global sales of US$11.1bn, Reuters wrote. Asia accounted for 11.6% of the total, behind North America (39.8%), Europe (24.6%) and South America (24%).

24-25 June 2025

Biofuels International Conference & Expo Brussels, Belgium

https://biofuels-news.com/conference/ about-biofuels-conference-expo/

25-26 June 2025

Argus Biofuels & Feedstocks Latin America Conference São Paulo, Brazil www.argusmedia.com/en/events/ conferences/latin-america-biofuels

29 June-2 July 2025

16th Congress of the International Society for the Study of Fatty Acids & Lipids (ISSFAL) Quebec City, Canada www.issfalcongress.com

28-31 July 2025

Hands on Practical Course on Vegetable Oil/Animal Fats/Products Processing including Biodiesel-Biofuel (VOP-2025) College Station, Texas, USA https://fatsandoilsrnd.com/

25-26 August 2025

Palm, Palm Kernel & Coconut Oil Processing & Food Applications Hotel Estelar La Fontana, Bogotá, Colombia www.smartshortcourses.com/ oilprocess33/index.html

31 August-5 September 2025

FOSFA Introductory & Advanced Courses The University of Greenwich, London, UK www.fosfa.org/education/

4-5 September 2025

12th High Oleic Congress Amsterdam, The Netherlands http://higholeicmarket.com/hoc-2019/

10-12 September 2025

Argus Sustainable Marine Fuels Conference Houston, Texas, USA https://www.argusmedia. com/en/events/conferences/ sustainable-marine-fuels?utm_ source=google&utm_medium=ppc&utm_ campaign=glo-argus-brand-05-24&utm_ content=glo-argus-brand-05-24conferences&utm_term=argus+events

15-19 September 2025

World Congress on Oils & Fats and ISF Lectureship Series 2025

Salon Metropolitano, Rosario Argentina

www.asagaworldcongress2025.com/ acerca.html

18-19 September 2025

International Agro-Industrial Exhibition ‘Oil and Fat Industry’

National Complex Expocentre of Ukraine, Kyiv, Ukraine

https://oil.agroinkom.com.ua/uk/ovystavke/

23 September 2025

Black Sea Oil Trade 2025

InterContinental Athenee Palace Hotel Bucharest, Romania

https://ukragroconsult.com/en/ conference/black-sea-oil-trade-2025/

24 September-26 September 2025

Globoil India 2025

The Westin Mumbai Powai Lake, Mumbai, India

https://www.globoilindia.com/

30 September-1 October 2025

5th International Congress on Mineral Oil Contaminants in Food Berlin, Germany

www.dgfett.de/meetings/aktuell/

1-2 October 2025

14th ICIS World Oleochemicals Conference

The Westin Valencia, Valencia, Spain

https://events.icis.com/website/11650/ home/

12-15 October 2025

Euro Fed Lipid Congress and Expo Leipzig, Germany

https://veranstaltungen.gdch.de/ microsite/index.cfm?l=11649&modus=

14-16 October 2025

Sustainable Aviation Futures North America Congress

Marriot Marquis Houston USA

www.safcongressna.com

For a full events list, visit: www.ofimagazine.com Information subject to change

15-16 October 2025

Oils & Fats Processing Technologies Short Course Leipzig, Germany https://veranstaltungen.gdch.de/ microsite/index.cfm?l=11846&sp_id=2

20-22 October 2025

Argus Biofuels Europe Conference & Exhibition

QEII Centre, London, UK www.argusmedia.com/en/events/ conferences/biofuels-europe-conferenceand-exhibition

21-25 October 2025

North American Renderers Association Annual Convention

Ritz Carlton Bacara, California, USA https://convention.nara.org

29-30 October 2025

7th European Conference Future of Biofuels Gothenburg, Sweden https://fortesmedia.com/future-ofbiofuels-2025,4,en,2,1,111.html

3-5 November 2025

GERLI 20th International Lipid Meeting CCi Campus, Strasbourg, France https://www.gerli.com/congres/welcometo-gerli-20th-lipid-meeting/

6 November 2025

FOSFA Annual Dinner

La Quinta de Jarama, Madrid, Spain www.fosfa.org/news/events/

7-10 November 2025

International Symposium on Lipid Science and Health & AOCS China Section Joint Congress

Wuhan City, Hubei, China www.aocs.org/event/internationalsymposium-on-lipid-science-and-healthaocs-china-section-joint-conference/

13-14 November 2025

11th ICIS Asian Surfactants Conference Kuala Lumpur, Malaysia https://events.icis.com/website/14105/

18-20 November 2025

MPOB International Palm Oil Congress and Exhibition (PIPOC 2025) Kuala Lumpur Convention Centre, Malaysia https://pipoc.mpob.gov.my/

HIGHER PERFORMANCE IN EXTRACTING OILSEEDS AND RENDERING PRODUCTS.

• Process design

• Crude oil processing

• Pressing plants

• Screw presses

• Disc driers

• Sterilizers

• Meat slurry vessels

• Spare parts & Services

GET IN TOUCH WITH US!

Phone +49 40 77179-0

E-Mail service-plt@hf-group.com

hf-press-lipidtech.com

CAPACITY RANGE: 30-130 KG/H

FOR TESTING A WIDE RANGE OF HIGH-QUALITY

MARGARINE PRODUCTS SUCH AS:

• Table margarine

• Industrial margarine

• Puff Pastry

• Shortening

• Low fat spreads

• Recombined butter

The equipment will be sold fully overhauled, and carefully tested before shipment. Mechanically warrantee is granted. Ex works factory in Denmark.

INSPECTION & SALE CONTACT:

Torben From - FH SCANDINOX A/S - DENMARK

Phone head office: +45 7534 3434

Mobile phone/WattsApp: +45 4055 5359

E-mail: TFR@fhscandinox.com www.fhscandinox.com

THE PILOT PLANT IS SKID MOUNTED AND CONSISTS OF THE FOLLOWING MAIN EQUIPMENT:

• Water Phase preparation

• Water Phase pre-heating (Gerstenberg & Agger consistator)

• Emulsion pre-mix and buffer

• Crystallisation (Gerstenberg & Agger) Incl. HP pump, pinmixers, phase inverter

• Resting tube

• NH3 refrigeration unit for Perfector

• Integrated Hot water system

• SCADA automation system

The bleaching earths of today have evolved from the Pre-Industrial Age into a variety of modern speciallyengineered clays which are blended and treated with acids or chemicals to produce the most efficient product to purify edible oil Pat

Howes

The evolution of bleaching earths, from their origins in Fuller’s earth clay to the modern forms we use today, has involved changes in both the type of materials they are made from, and the way they are produced.

From the simple clays used in ancient times for ‘fulling’ or cleaning wool, bleaching earths now encompass a variety of specially-engineered clays which are treated with acids or other chemicals to increase their surface area, porosity and their effectiveness.

Today’s bleaching earths have widespread applications across industries

Source: Dr Pat Howes, Natural Bleach, OFI International 2024

such as pharmaceuticals, cosmetics, fuel, and food, including edible oils.

They must also comply with an increasing focus on sustainability and environmental impact.

Bleaching earths are utilised in edible oil refining to remove impurities that make an oil inedible or unpalatable or cause the oil to spit or froth when frying wet foods. They also improve the shelf life of oils before they turn rancid.

Oils and fats can be chemically or physically refined, the difference being the way in which the free fatty acids are removed from the oil. In chemical refining the free fatty acids are neutralised with alkali such as caustic soda, then the soap formed is washed from the oil.

In physical refining, the neutralisation and washing stages are omitted, and the free fatty acids are removed in a steam distillation (deodorisation) process. Physical refining is preferred because of lower capital costs, due to less processing equipment being required, and also because less effluent is produced.

The bleaching step follows the degumming, neutralisation and washing stages (see Figure 1, left).

In chemical refining, degumming agents such as phosphoric or citric acid are used to remove phospholipids (gums), trace metals and some pigments. Caustic soda is used to neutralise the oil to remove free fatty acids; water is used during the

Note: Finely ground bleacing earth has higher bleaching performance but inferior filterability

• Bulk density – if a bleaching earth has a very low density, it is bulky and it will require bigger silos and pressure leaf filters will fill quicker and need more frequent changes.

• Attrition resistance – the durability of the bleaching earth to withstand wear and tear, particularly how well it can resist being broken down into smaller particles during the refining process, such as when passing through pumps.

• Moisture content – water is needed to maintain the structure of the bleaching earth but customers do not like to feel that they are paying for water.

u

washing stage to remove soaps, waterhydratable gums, some trace metals and pigments; and bleaching earth powder is added to the oil to remove pigments, oxidation products, residual phosphatides, soaps and trace metals.

After the bleaching stage, the oil is filtered to remove the bleaching earth, and deodorisation, steam refining or molecular distillation is utilised to produce a fully refined oil which should be odourless, tasteless, stable to oxidation (have a long shelf-life), not froth or spit when frying wet foodstuffs, and nutritionally wholesome with the desired colour.

For red palm oil, a special bleaching earth is utilised to preserve the beneficial carotene in the oil, and molecular distillation is used to prevent destruction of the carotene in the deodorisation process.

Physical refining was developed during the 1980s with the growth of palm oil volumes in the oils and fats market. Palm oil has a relatively high fatty acid content compared with other edible oils but a lower gums content, which is not very water-soluble. Physical refining was introduced – which cuts out the neutralisation, washing and drying stages – placing higher demands on bleaching.

Bleaching earths are used to remove impurities such as pigments, primary and secondary oxidation products, gums, soaps and trace metals.

Over the years, various additional substances have been added to the list of impurities that need to be reduced or removed during refining. These include

heavy metals; polyaromatic hydrocarbons (PAHs); dioxins and dioxin-like materials; polychlorinated biphenyls (PCBs); pesticides; 3-monochloropropane-1,2diol (3-MCPDs); glycidyl esters (GEs); mineral oil saturated hydrocarbons (MOSH); mineral oil aromatic hydrocarbons (MOAH); chlorinate paraffins; and chlorine-, sulphur- and nitrogen-containing molecules.

A bleaching earth should therefore be an adsorptive material that removes the impurities from the oil being processed, without otherwise altering the beneficial properties or nutritional value of the oil.

Adsorptive bleaching will reduce or remove pigments such as carotenoids, chlorophyll and gossypol; primary oxidation products such as peroxides; secondary oxidation products such as aldehydes and ketones; phospholipids; soaps; and trace metals.

This will improve the colour, flavour, odour and stability of the oil.

With the wide range of impurities that need to be removed at the bleaching stage of edible oil processing, any one adsorbent faces a difficult challenge.

Bleaching earths are therefore often formulated from more than one adsorbent. Some of the general attributes related to all bleaching earths to consider are:

• Bleaching performance or impurity removal – how much bleaching earth is needed to remove the critical impurity.

• Oil filtration properties – once the impurity is removed, how easy is it to remove the bleaching earth from the oil.

• Oil retention – from a cost perspective, how much oil remains in the spent bleaching earth.

Many of the properties of bleaching earths are related to their particle size and particle size distribution, the nature of the adsorbent, and the degree of activation. Designing a good bleaching earth is about optimising these parameters.

Particle size affects bleaching performance, the surface area for adsorption, bulk density, the frequency of spent earth discharges, the breakthrough of fines at filters, and oil retention in spent earth.

If a bleaching earth is ground very fine, it will have a large geometric surface area, which is good for adsorption of surface-blocking impurities such as soaps. However, if it is too fine with no coarse material, it may be very difficult to build the filter bed. Fine grinding will result in lower bulk density, requiring more frequent discharging of the filters. Too much fine material may flow into the filtered oil stream, clog up polishing filters and also result in a higher oil retention losses.

Figure 2 (above left) shows bleaching performance versus particle size. Performance increases with finer grinding, tempting bleaching earth producers to creep up that line to give customers a lower bleaching earth dosage. However, this may lead to problems with reduced throughput in the plant.

Bleaching earths must also be strong enough so they do not break down when handled in a refinery and each type of bleaching earth has its own strengths. Natural bleaching earths have the strongest structures and are the most durable. Acid-activated bleaching earths are less durable as the silica fronds formed during acid activation are brittle. These properties therefore have to be balanced.

With regards to moisture content, bleaching earths generally work better

at a 15-18% moisture content level. At a higher moisture level, the flow properties of the bleaching earth are adversely affected, resulting in caking in pipework.

Refiners may ask for a lower moisture content but below 8%, and particularly below 4%, bleaching earth performance will drop off due to insufficient hydration of interlayer cations, particularly in bentonite-type bleaching earths.

A 8-12% moisture level generally works well performance-wise and for refiners to feel they are not buying excessive water.

Bleaching materials

There are many adsorptive materials that can be utilised at the bleaching stage.

• Natural bleaching earth

• Surface-modified bleaching earths

• Acid-activated bleaching earth

• Activated carbon

• Acid-activated carbon

• Activated carbon blended with bleaching earth

Natural bleaching earths

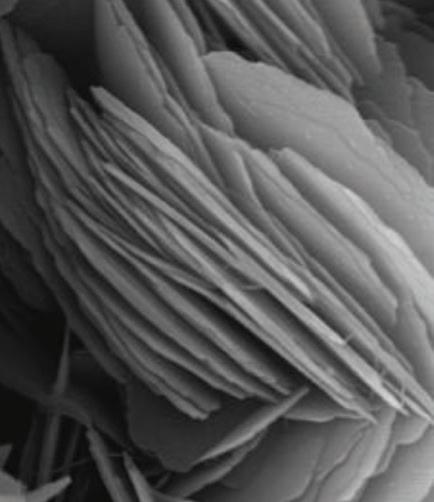

Attapulgite, sepiolite and bentonite are the most common natural bleaching earths (see Figure 3, above right).

They all have similar structures and morphology, in that they are 2:1 structures – they have two layers of tetrahedral sheets on the outside and a middle octahedral sheet (TOT). The sheets are arranged differently or with different spacings in each of the three materials.

Attapulgite and sepiolite are very similar. They have tube-like pores that allow impurities to enter from either end, like a bundle of straws. Both are naturally fibrous, which aids filtration, but they have higher oil retention rates.

Natural bentonite also has a tetrahedral-octahedral-tetrahedral (TOT) structure, with hydrated cations (containing water) to keep the layers apart (see Figure 4, following page).

The main difference with bentonite is that the impurities can come in from the sides, front and back so it has four points of entry, instead of two. Its morphology looks like leaves or a deck of cards.

Natural bentonite has a greater cationexchange capacity (CEC) compared with attapulgite, sepiolite and acidleached bentonite, allowing it to retain and exchange positively charged ions (cations). Its higher CEC means it can adsorb more trace metal contaminants.

An advantage of all natural bleaching earths is that no effluents are generated in their manufacture, and spent natural bleaching earths do no promote autoignition.

Surface modified bleaching earths

Surface modified bleaching earths generally have similar properties to natural bleaching earths. They are typically based on attapulgite, sepiolite or bentonite and have become more popular because no effluents result from their production.

These bleaching earths are typically made by spraying the raw material with acids, such as sulphuric acid. The clay is then dried and milled without washing.

Since they have not been washed during manufacture, surface-modified bleaching earths can contain free acid or sulphate salts.

The free sulphuric acid present can damage processing equipment, such as corroding the bleacher vacuum system.

Iron released from the clay structure of the bleaching earth can react with fatty acids and reduce the oxidative stability of the oil.

Excess sulphate can also react with the refined oil, resulting in an oil with a high sulphate content. The presence of sulphur in refined oils is a growing issue and some refiners are moving away from sulphuric acid-treated clays.

The acidic function of surface modified clays can result in unwanted catalytic reactions – isomerisation, protonation and polymerisation of the oil. Acid-catalytic activity may also promote 3-MCPD formation at the bleaching stage.

Spent surface-modified bleaching earths can also promote auto-ignition. Surface modified bleaching earths may alternatively be made with certain organic acids that do not have the adverse effects of sulphuric acid-treated clays.

Acid-leached bleaching earths

These are the most common bleaching earths used in the last 100 years. Their production includes a washing

process and they should therefore contain less free acid and sulphates than surface-modified bleaching earths, resulting in little or no problems with corrosion at the refinery plant, or with the sulphur content of the fully refined oil. However, the issue of auto-ignition in the spent bleaching earth is still present.

In the acid activation of bentonite –a type of clay composed primarily of montmorillonite, which contains both alumina and silica – the bentonite is treated with a strong mineral acid.

Today, sulphuric acid is mostly used as hydrochloric acid-activated bleaching earths can contain chlorides that could lead to high levels of 3-MCPDs in the oil being processed.

The acid serves to ion-exchange with the interlayer cations (sodium and calcium) and to dissolve part of the octahedral layer of aluminium, magnesium and iron, so as to create new silica surfaces, called silica fronds (see Figure 5, left).

The high surface area of the silica fronds enhances the bleaching earth’s ability to adsorb coloured impurities, oxidation products, gums and other contaminants.

After acid activation, the undesirable residual sulphuric acid – as well as aluminum, magnesium and iron sulphates – need to be washed away.

Activated carbons can have a wide range of pore sizes and surface properties and are capable of removing many impurities such as pigments, odours, dioxins, polychlorinated biphenyls, pesticides, PAHs and heavy metals. Importantly, they remove chlorine, chloride and organochlorine compounds, which are the main compounds related to 3-MCPDs formation.

Activated carbons improve the clarity, flavour and oxidative stability of edible oils, enhancing their shelf life.

Activated carbons can be steam, acid or chemically activated and are a good adsorbent to utilise at the bleaching stage to enhance the removal of impurities that are not so effectively removed by bleaching earths.

They can be highly activated to open the maximum number of pores but the durability of activated carbon reduces with increasing activation. The level of activation therefore needs to balance performance and durability requirements.

Historically, high-performance activated carbons have not been used because of their high price, high oil retention (high cost of oil lost in spent

u

Be the first to know.

e. taikoclaymkt@taikogroup.net

t. +603 7660 7716

w. taikoclaygroup.com

e office@taikogroup.eu

t +31 10 800 5479

The Dallas Group is the leader in edible oil

solutions across several industries Our experts will work with you to develop a strategy that will frying oil and improves product quality

quickly and economically remove naturally occurring and reaction by-product contaminants in a broad range of oleochemicals

MAGNESOL® is the leading adsorbent for removal of residual catalyst and other polar contaminants in the production of the high quality polyols and surfactants

Source: Dr Pat Howes, Natural Bleach, OFI International 2024

activated carbon) and low attrition resistance, leading to fines generation and the breakthrough of fines at filters. These problems are worse when using the highest performance activated carbons.

Activated carbons can be made from a wide range of materials including: Coal – Anthracite, bituminous, lignite Wood – Pine, acacia, eucalyptus Shell – Coconut, palm kernel, hazelnut

Activated carbons can be amorphous (without a clearly defined shape or form) or semi-structured, depending on the material from which they are made.

They may have small micro, mid-size meso- or large macro pores, or pores of all three sizes in a single material (see Figure 6, left).

The surface area of activated carbons can be much higher than for most other absorbents.

Each activated carbon will have its own selectivity and various activated carbons can be blended to give a wider range of adsorption.

To produce activated carbon, heat in the absence of oxygen (pyrolysis) is applied to the base material, which prevents the material from burning (see Figure 7, left).

The charcoal produced may be washed and then activated via steam, acid or chemicals. The level of activation should be to a point where it still retains sufficient mechanical strength to resist breakdown into fines during the bleaching process.

The particle size distribution should be optimised for performance and filterability of the powdered activated carbon (PAC). The largest particles of the PAC which are the least active can be removed, along with the finest particles which could break through.

The different nature of the surfaces in chemically-activated carbons can be advantageous for the adsorption of certain impurities.

Activated carbons can be acidic or alkaline.

H-type activated carbons are hydrophobic (repel water) and tend to absorb more hydrogen (H⁺) ions from water, making the surrounding solution basic (more alkaline).

L-type activated carbons are more likely to absorb hydroxide (OH⁻) ions , making the surrounding solution acidic.

Steam-activated carbons are alkaline and are preferred for many applications as they adsorb impurities without otherwise modifying the oil being processed. Acid-activated carbons

are acidic and can also act as solid acid catalysts, essentially providing an acidic surface on which acid-catalysed reactions can occur.

Taking into account the different types of bleaching clays and activated carbons and their level and type of activation, a comparison can be made on their properties and costs (see Figure 8, opposite page). Properties include N2 BET surface area, pore volume, average pore diameter, oil retention and durability.

Natural bentonite has the lowest cost, followed by bentonite+10% activated carbon, acid-activated bentonite and activated carbon with the highest cost.

Manufacturers of bleaching earths must not only develop a product which optimises operational performance, the product itself must also comply with food safety and environmental requirements.

Bleaching earths are considered a food processing aid and must meeting food safety regulations including:

• FEDIOL standards for fresh bleaching earths.

• Good Manufacturing Practice (GMP)

• HACCP

• Halal

• Kosher (with Passover)

• ISO 9001

• ISO 14000

• FSSC 22000

In terms of environmental regulations, a bleaching earth’s impact relating to raw material extraction, processing and disposal must also be taken into account.

This includes effluent generation in the manufacture of bleaching earths, and the disposal of spent bleaching earth.

In terms of effluents, these are not generated in the manufacture of natural bleaching earths and surface-modified bleaching earths. The manufacture of acid-activated bleaching earths produces some effluents but these can be beneficially utilised in the production of fertilisers, water treatment chemicals and cements.

other building materials.

In addition, spent bleaching earths containing residual oil can be used as a fuel source in cement kilns, brick manufacturing, and other industries requiring high-temperature combustion. The residual oil can also be extracted and used in biodiesel production.

The conversion of woods and shells to activated carbon sequesters the carbon such that bleaching earths with activated carbon can have a carbon negative footprint.

Bleaching earths can be designed to meet the current and future needs of

refiners. The trend is towards natural bleaching earths and steam-activated carbons that remove undesirable impurities without altering the beneficial properties of the oil being processed. They are also preferred as the spent bleaching earth is not prone to autoignition.

The design of bleaching earths generally involves the formulation of several components, to match all the refiner’s requirements, which is both a science and an art. ●

Dr Patrick Howes is the technical and marketing director of Natural Bleach Sdn Bhd, Malaysia

With spent bleaching earth, while landfill disposal is common, several alternative disposal and recycling methods are used to minimise environmental impact and improve sustainability.

Spent bleaching earths can be utilised in salt-lick for cattle or as a plasticiser for tarmac. Some processes also incorporate de-oiled SBE into bricks, concrete or

In a bid to reduce fuel imports and promote the use of domestically-produced palm oil, leading global palm oil producer Indonesia increased its blending mandate from B35 to B40 in January and has plans to increase the blend to 50% by 2026.

Following the move, Indonesia is expected to be the only country among major biodiesel producers where production and consumption will continue to expand, while other regions are likely to experience either stagnation or contraction, according to a 17 March report by the Malaysian Palm Oil Council (MPOC).

According to MPOC forecasts, global biodiesel output is forecast to decline by approximately 500,000 tonnes this year in contrast to annual increases of 3M-6M tonnes from 2021-2024.

Looking at the USA, for example, after the Trump administration took office, US biodiesel and hydrotreated vegetable oil (HVO) production dropped to its lowest level in 22 months in January, while imports almost came to a halt due to unclear biofuel policies, MPOC said.

US biodiesel and HVO production had increased from 10M tonnes in 2022 to 16M tonnes in 2024, a 60% increase over the three years, the report said.

However, it is unlikely that US HVO and biodiesel production will reach 16M tonnes in 2025 due to the country's evolving political framework, according to the report.

Following the implementation of Indonesia’s higher mandatory biodiesel blend, palm oil market participants will be closing watching how increased demand from the domestic energy sector may affect Indonesia’s palm oil exports,

Indonesia's palm oil consumption for biodiesel production has exceeded the volume used in food since 2023. With the country planning to increase its biodiesel blend to 50% by 2026, its exports of palm oil are projected to fall further Gill Langham

according to an 18 March Reuters report. Indonesia's palm biodiesel mandate applies to land transportation, trains, industrial machinery and diesel power plants, says an earlier Reuters report.

Although the Indonesian government made a commitment to increase the country’s mandatory biodiesel blend from B35 to B40 from 1 January 2025, there was a slight delay in implementation and the B40 scheme started in February, Dr Mohamad Fadhil Hasan, head of the Indonesian Palm Oil Association (GAPKI)’s Foreign Affairs division told delegates at Bursa Malaysia’s Palm & Lauric Oils Price Outlook Conference & Exhibition (POC2025).

As of 18 February, domestic distribution of B40 reached 1.47M kilolitres or 9.4% of the total national target volume for biodiesel of 15.616M kilolitres (13.6M tonnes), Hasan said at the event held on 24-26 February in Kuala Lumpur, Malaysia.

Also speaking at POC2025, Glenauk Economics managing director Julian McGill, said: “Indonesia’s B40 biodiesel mandate is progressing.

"Although consumption is below target, it continues to improve and is expected to expand in the second half of the year.”

In his presentation at POC2025, Hasan said the full implementation of B40

would require additional feedstock supply of around 1.7M tonnes (see Figure 1, p28).

The government’s target volume of 13.6M tonnes for biodiesel in 2025 would not be achieved as implementation of the B40 programme started later than initially planned, he added.

With Indonesia planning to increase its biodiesel blend to 50% by 2026, Hasan said the switch in mandatory blending from B35 to B50 would increase domestic crude palm oil (CPO) and palm kernel oil (PKO) consumption by 5.05M tonnes and would also reduce exports by the same amount for 2025.

This would lead to a drop in export value from US$36bn in 2024 to US$27bn in 2029 and a drop in levy revenue from US$3bn to US$2.8bn.

Against a backdrop of rising demand from the domestic biodiesel sector following the mandatory increase to B40, Indonesian palm oil production showed a declining trend in the 2021-2024 period due to a stagnation in productivity and limited expansion of planted area, Hasan said.

“Production of palm oil shows declining trends due to the stagnation of productivity and increasing cost of production.

"In 2024 production also dropped due to

Source: Ministry of ESDM, APROBI (2024)

Source: GAPKI, APROBI, GIMNI, AIMNI, APOLIN (2023)

Source: GAPKI, APROBI, GIMNI, AIMNI, APOLIN (2023)

the El Niño but it will recover next year."

Alongside limited expansion of palm oil planted area and stagnating production, Hasan said yields were declining.

“The key to addressing this is to increase

Source: Fadhil Hasan, GAPKI

Since 2023, palm oil consumption for use in biodiesel production had exceeded the volume used in food, Hasan said (see Figure 2, left).

According to GAPKI data, the trend continued in 2024, with total palm oil consumption for the food sector totalling 10.205M tonnes, 0.90% lower than the previous year’s volume of 10.298M tonnes, while palm oil consumption for biodiesel totalled 11.447M tonnes, 7.51% higher than 10.647M tonnes in 2023.

Total consumption in 2024 reached 23.859M tonnes, which was 2.78% higher than consumption in 2023 at 23.213M tonnes.

“Considering the trend of local production and consumption, especially with regard to the use for biodiesel, and the trend of price and supply and demand of global vegetable oils, Indonesia’s palm oil production [in 2025] is projected to reach 53.6M tonnes, with consumption of 26.1M tonnes, including 13.6M tonnes for biodiesel (B40),” GAPKI said.

“As a result, exports [in 2025] are projected to decrease to 27.5M tonnes, lower than exports in 2024 at 29.5M tonnes.” (See Figure 3, left)

Source: Fadhil Hasan, GAPKI

The Indonesian government started conducting tests in preparation for its plan to increase the palm oil-based biodiesel mandate to 50% last year, according to a VietnamPlus report.

A static test for B50 composition was conducted by the energy ministry and several stakeholders, Eniya Listiani Dewi, director general of Renewable Energy at the energy ministry, was quoted as saying in the 11 August report.

This would be followed by vehicle road tests, a process that usually takes about a year, the report said.

productivity and production.

"Greater efforts are needed to accelerate the replanting of ageing plantations and rehabilitation of unproductive plantations."

Source: Fadhil Hasan, GAPKI

The B50 mandate would require approximately 18M tonnes of CPO, which could impact domestic cooking oil prices, exports and government revenue from exports, VietnamPlus wrote.

According to a 26 August Reuters report, a B50 mandate would cut Indonesia's fuel imports by US$20bn/year.

Looking ahead, Indonesia would need to expand its oil palm plantations to increase palm oil supply needed to implement mandatory biodiesel programmes from 50% to 100% (B50 to B100), a 3 March GAPKI press release quoted deputy minister of Energy and Mineral Resources (ESDM) Yuliot Tanjung as saying during a government hearing in Jakarta.

“Looking forward to the implementation of our mandatory programmes of B50

up to B100, we’ll need additional land areas for palm plantation expansion to provide the necessary additional CPO supply,” Tanjung said.