Is the blast furnace on the way out or here to stay?

Two articles on the European Union’s CBAM

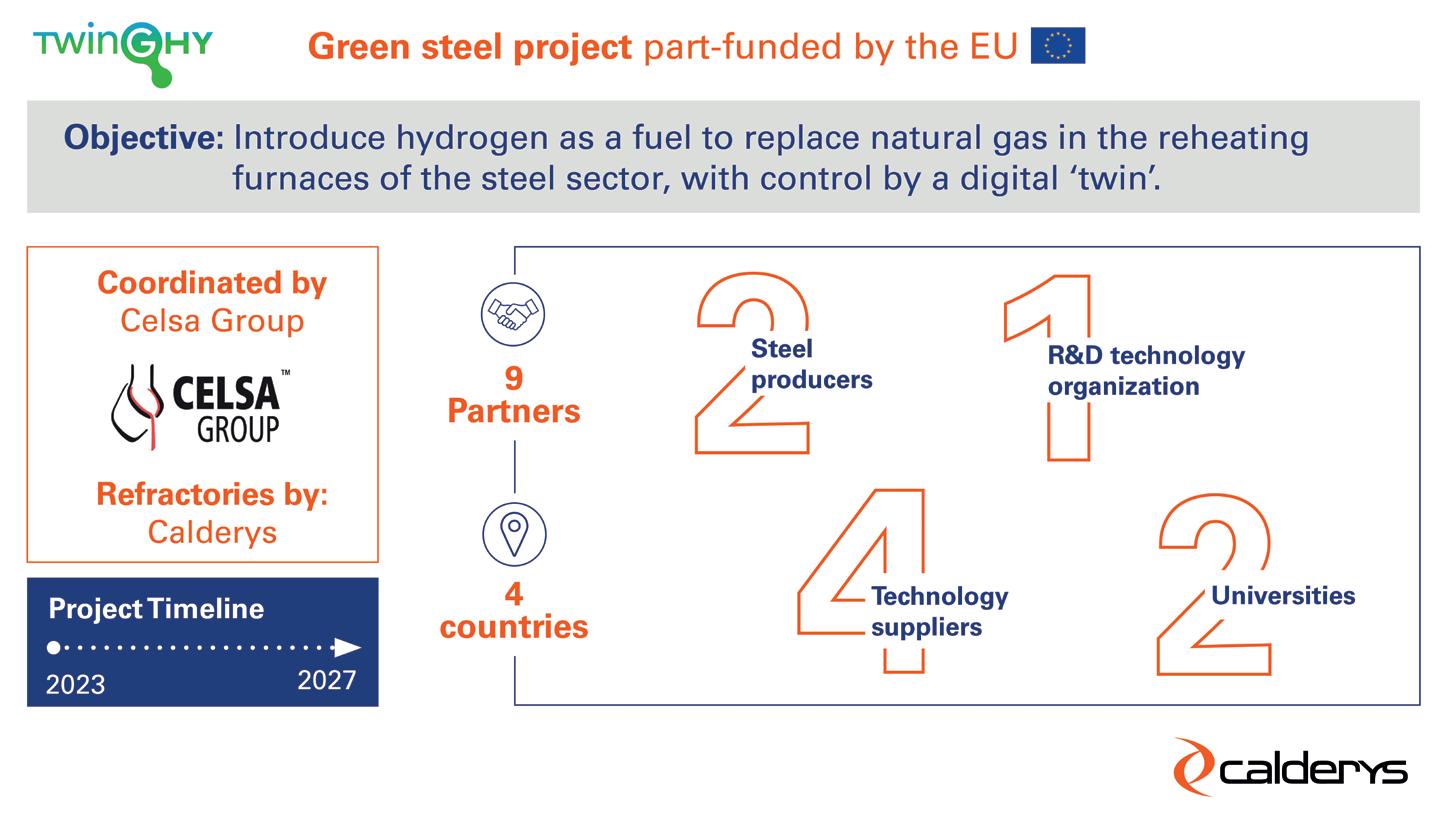

Refractories and the green steel transition

Biden’s bid for industrial decarbonization

www.steeltimesint.com

Is the blast furnace on the way out or here to stay?

Two articles on the European Union’s CBAM

Refractories and the green steel transition

Biden’s bid for industrial decarbonization

www.steeltimesint.com

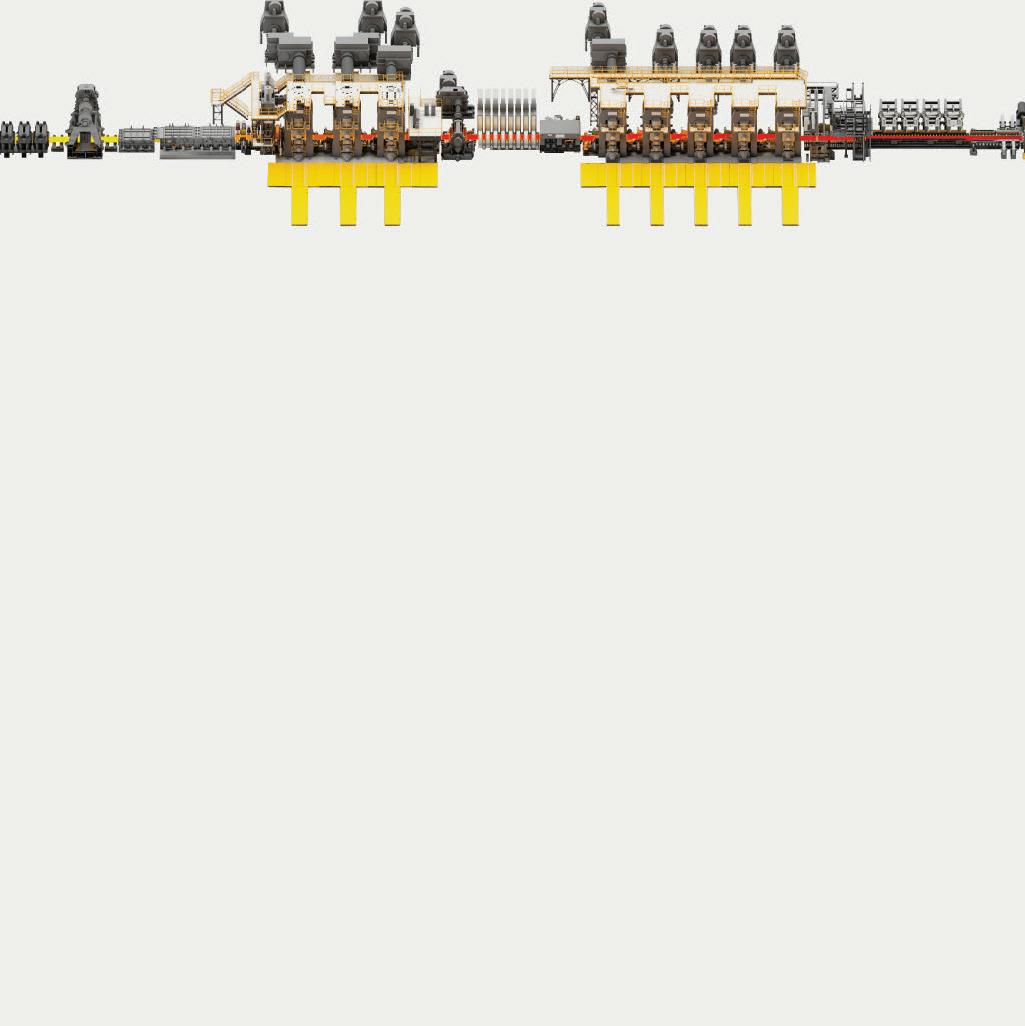

Metals offers the entire steel value chain an exceptional opportunity for curbing their CO2 emissions.

The unique combination of its historic and recently developed product portfolio, make John Cockerill one of the industry’s most relevant suppliers of equipment for both the hot and cold phase of the steelmaking and processing industry.

Our three distinct business segments are addressing todays and tomorrow’s challenges supporting sustainable and green steel production:

Our new upstream offering related to DRI (Direct Reduced Iron), EAF (Electric Arc Furnaces) technologies and the use of hydrogen in steelmaking. Next to offering indirect electrification (DRI-EAF&H2-DRI-EAF),John Cockerill is also working on Volteron®: A first-of-a-kind iron reduction and steel processing route via direct cold electrolysis. This CO2 free steelmaking process, has been co-developed with the world’s leading steelmaker ArcelorMittal.

Regrouping our historical downstream product portfolio, this segment also includes:

¡ the Jet Vapor Deposition (JVD®) technology set to replace today’s hot-dip or electro galvanizing processes. This novel high-productivity vacuum coating technology provides previously unknown coating flexibility and possibilities, all while offering lower CAPEX and OPEX.

¡ our E-Si® equipment & processing lines specifically designed to produce high-quality Non-Grain Oriented (NGO) steel in response to the need for electrical steel meeting precise metallurgical properties, essential to support the shift towards green mobility.

This segment not only embraces all services and after-sales activities but will be strongly focusing on downstream furnace electrification (reheating and processing line furnaces), as well as hydrogen combustion, and the optimization of plant operations, including energy audits and the modernization of steel production equipment and installations.

17 - 19 June 2024

New York Marriott Marquis

EDITORIAL

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Assistant Editor

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor Annie Baker

Advertisement Production Carol Baird

SALES

International Sales Manager

Paul Rossage

paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark

kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion

tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer Steve Diprose

SUBSCRIPTION

Jack Homewood

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034 Email subscriptions@quartzltd.com

(inc

Published by: Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com

Steel Times International (USPS No: 020-958) is published monthly except Feb, May, July, Dec by Quartz Business Media Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER send address changes to Steel Times International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in England by: Stephens and George Ltd • Goat Mill Road • Dowlais • Merthyr Tydfil

2 Leader By Matthew Moggridge.

4

News round-up

The latest global steel news.

10

Innovations

The latest products and contracts.

13

USA update

Biden’s bid for industrial decarbonization.

15

Latin America update SINOBRAS: Doubling its rolling mill capacity (Part 1).

19

India update

Demand falls, exports surge.

21

Decarbonization

Prepare for CBAM compliance.

24

Decarbonization

CBAM: ensure you have your reporting in check by July 2024.

Ironmaking The future of ironmaking.

Blast furnaces Past the tipping point?

Structural steel

Flattening out. 40

Green steel

Calderys refractories and the transition to green steel.

44

Ukrainian steel market Ukrainian steel industry in 2035: green and domestically focused.

46

Raw materials

Coal microlithotypes: coke quality.

48

Perspectives: Weiler Abrasives Wheeling along. 51 History

The Levant Man Engine disaster.

Matthew Moggridge Editor

Matthew Moggridge Editor

matthewmoggridge@quartzltd.com

To tell the truth, I don’t know what it is. Déjà vu? That something doesn’t show up for a while doesn’t mean it ceases to exist. I’ve had a few strange occurences of late, the last one being earlier this week when I reached home and found Dance Moms on the TV. Abby Lee having to contend not only with a bunch of energetic kids but also their demanding ‘moms’ determined to get their female offspring the fame and fortune they think they deserve, plenty of arguments, many kids in leotards and make-up when they should, perhaps, be running wild in the park or riding a bike or making mud pies, but instead they’re upset about something or other; it’s a laugh a minute (or it was). When my daughter was younger it was always on and I was often invited to sit and watch, which I did, but now I was baffled. Why was it on again? My wife was watching it! Why? There was no answer and I’ll admit that I sat there, engrossed again and eager to find out whether they won the dance competition in Arizona. It’s strange how things drift back into my life and I’m sure it’s the same for all of us. But let’s put Dance Moms aside, I must keep with the programme; this is, after all,

an international steel magazine, but when you’re writing leader articles you need a hook and mine was Dance Moms and Déjà vu and you might be wondering why. Well, some years ago, when I started on this magazine, every conference I attended dealt with just one subject: China. And then, it disappeared, replaced by one word: decarbonization. I thought I’d heard the last of the phrase ‘all we want is a level playing field’, but no, it’s back, along with ‘tariffs’ and ‘countervailing duties’ and ‘anti-dumping legislation’. But here’s the thing: it’s never gone away, but now, like Dance Moms, it’s re-appeared, possibly because we’re all suffering from decarb fatigue. It is time to refocus on the problem of overcapacity. It played a role in Máximo Vedoya’s keynote presentation at AISTech’s President’s Award Breakfast earlier this month and – thankfully – the American steel industry and President Joe Biden who is likely up against Donald Trump later this year, are in a combative mood and determined to get to grips with the problem. It’s not just steel in the firing line but also Chinese electric vehicles, solar panels and other goods. The pressure needs to be kept up and I’m sure it will be.

We are your premium partner for refractory solutions for the heat treatment of steel

We offer solutions of the highest performance to meet your most demanding requirements. With RATH you can count on:

• A comprehensive range of premium refractories

• Engineering, production, on-site supervision

• Solutions to reduce your carbon footprint and to save energy

• No compromise on quality, here we remain as tough as steel

To be the leading partner for our customers in this transformation, SMS group bundles all competencies from electrics/automation, digitalization, and technical service. Our goal is to maintain and expand the performance of our customers' plants throughout their entire lifecycle. Together with our customers, we develop integrated solutions speci cally geared to the customer's use case. In doing so, we focus on crucial KPIs such as plant availability, product quality, productivity, or delivery reliability but also on increasingly relevant topics such as sustainability and safety.

UAE-based Green Metal Industries has earmarked $100 million to set up a steel recycling and manufacturing plant located in AD Ports’ Khalifa Economic Zones Abu Dhabi (Kezad), according to a statement released in April. Located in the Kezad industrial area, Kezad Al Ma’mourah, the plant will span 116,000 m2 and is set to commence commercial operations in early 2025. The plant will locally source scrap metal and convert it into high-quality steel materials, according to the statement.

Source: Enterprise, 1 April 2024.

ArcelorMittal Zenica has revealed plans to close its coke plant due to ‘escalating costs and dwindling demand.’ The plant has operated for over 40 years but was inactive from 1992 to 2008. The steelmaker stated that

Tata Steel is investing around $795 million in the equity of its subsidiary Neelachal Ispat Nigam Limited (NINL) to implement its long products expansion plan, according to media reports. The investment is planned to be made over two years, and is subject to shareholder approval. The company is located near Tata Steel’s steel plant in Kalinganagar, Odisha, where a project to increase production capacity by 5Mt/ yr is underway. While the expansion in Kalinganagar is expected to increase the company’s offer in the flat products segment (hot and cold rolled coils), NINL will focus on long products (wire, bars and wire rod).

Source: GMK Center, 1 April 2024.

ongoing maintenance hasn't prolonged its lifespan, and upgrades fail to meet environmental standards. The company's CEO, Nikhil Mehta, expressed the company's commitment of minimizing the impact on the local economy and preserving jobs by facilitating employee transfers to other Zenica plants.

Source: Yieh Corp Steel News, 2 April 2024.

British Steel has won a multimillion-pound contract to supply rail for a new route in north Africa, the company has announced. Approximately 9.5kt of track, produced in Scunthorpe, will be provided for Egypt’s first fully electrified mainline and freight network which stretches from the Red Sea to the Mediterranean. The network is 410 miles long and will carry trains for passengers and goods up to a maximum speed of 155mph.

Source: The Guardian, 2 April 2024.

Producers of renewable hydrogen, green H2-derived iron and steel and green ammonia will shortly be eligible for free allowances under the EU’s carbon trading mechanism, after updated rules were published in the

India’s JSW Vijaynagar Metallics (a subsidiary of JSW Steel) has commissioned a 5Mt/yr hot strip mill at its integrated steel plant in Vijaynagar, Karnataka. The company started trial operation of the equipment in March this year, and after the inspection, it launched commercial production and sales, with the first products already shipped. The hot strip mill can produce plates and coils, and is equipped with digital heating furnaces, evaporative cooling, and waste heat recovery systems.

Source: GMK Center, 2 April 2024.

EU’s official journal. The new rules, agreed after a long legislative passage that began last year, essentially corrects a glitch in the Emissions Trading System (ETS) rules that granted free allowances to producers of fossil fuel-intensive industries, but not their decarbonized equivalents.

Source: Hydrogen Insight, 4 April 2024.

21 workers were admitted to hospital following reports of a gas leak at SAIL’s Bokaro steel plant. Sources claim that maintenance work had been in progress in the mixed gas pipeline, which supplies gas to the re-heating furnace of the hot strip mill. An alarm was initially called due to smoke coming from the pipeline, and a spreading fire. Source: Indian PSU, 6 April 2024.

www.tii-kamag.com

A team of University of Wollongong (UOW) researchers has secured funding worth $4.2 million from the Australian Renewable Energy Agency (ARENA) and industry partner BlueScope Steel to investigate ways of utilising low- and medium-grade iron ore in low-emission steelmaking and further decarbonizing domestic steel production. Project leaders, Dr Xue Feng Dong, Dr Raymond Longbottom, Professor Brian Monaghan, and Dr Paul Zulli, of UOW’s School of Mechanical, Materials, Mechatronic and Biomedical Engineering, will explore the viability of Australia’s abundant, low-to-medium grade Pilbara iron ores in a potential breakthrough, low-emissions, electric smelting furnace (ESF)-based steelmaking route.

Source: University of Wollongong, 10 April 2024.

A steel business in Birmingham, UK, has said it cannot be run effectively, because of fly-tipped rubbish outside. FH Warden (Steel) said deliveries had been blocked and it stood to lose thousands of pounds in trade. Steel firm owner Patricia Hughes said after through traffic was stopped, Adderley Road South ‘effectively became a cul-de-sac’ and it was a ‘fly-tippers paradise’. Birmingham City Council said it investigated incidents and ‘did not hesitate in taking enforcement action’. The council cleared what was there, Hughes said, with the latest rubbish arriving in early April. The authority had responded, but it was ‘not good enough, because [the company] now cannot run business effectively due to fly-tipping impacting on the firm's gates.

Source: BBC. 9 April 2024.

the last mill still operating in what was once the Weirton Steel Works, located about 40 miles west of Pittsburgh. In making the announcement, Cleveland-Cliffs placed blame on the US International Trade Commission (ITC) for failing to impose tariffs on tin products imported from Canada, Germany, China, and South Korea.

Source: WSWS.org, 11 April 2024

Metallus, formerly known as TimkenSteel, a provider of specialty metals, manufactured components and supply chain solutions, has announced its membership of the Global Steel Climate Council (GSCC). This partnership, says the company, underscores its dedication to environmental stewardship and marks another milestone in the company's sustainability journey. The GSCC serves as a platform for industry leaders to collaborate, share best practices, and aims to drive collective action toward reducing greenhouse gas emissions across the steel value chain.

Source: PR Newswire, 10 April 2024.

ArcelorMittal Poland, the Polish division of global steelmaker ArcelorMittal, plans to invest about $25.2 million to modernize and expand the product portfolio of its galvanizing plant in Krakow. The company aims to expand its product range with new coatings based on zinc, magnesium, and aluminium. The new production facilities are scheduled to be commissioned in 2025 and production will begin in 2026 after certification.

Source: GMK Center, 11 April 2024.

A fire broke out at Evraz's steel plant in Pueblo, Colorado. All operations restarted after a brief pause, which affected steelmaking operations. Evraz North America CEO Skip Herald said the fire did not affect the steelmaking facilities, rolling mill, or Palmer project construction. Employees and contractors in the affected areas were evacuated. Emergency crews were able to control the fire, and the US Environmental Protection Agency said that the emergency crews had determined that no hazardous materials were present in the fire and were investigating the cause of the fire.

Source: Yieh Corp Steel News, 11 April 2024

Benteler Steel plans to spend $21 million expanding its facility at the Port of CaddoBossier in northwest Louisiana and create nearly 50 new jobs, US state officials have said. Louisiana Economic Development announced that the company will add a new threading facility for hot rolled seamless steel tubes to its existing operations. Construction was scheduled to begin at the end of April and will be executed in two phases.

Source: AP, 13 April 2024

SSAB has signed a letter of intent for deliveries of its fossil-free steel to Francebased materials handling and earthmoving equipment maker Manitou Group. The SSAB fossil-free product line includes SSAB Zero, a steel made from recycled scrap

According to reports by Kallanish, China’s Baowu Group is taking steps to reduce carbon emissions as the group’s enterprises implement relevant projects.

The Ma’anshan Iron & Steel (Magang) steel plant has started implementing a carbon management system at the end of March 2024, and is the first plant within the Baowu Group to do so. Magang’s carbon management system will cover all relevant activities, including carbon trading and carbon asset management.

Source: GMK Center, 13 April 2024

using fossil-free energy sources, which the company says results in virtually zero emissions from the steelmaking process. The steelmaker already delivers specialized and high-strength steels to Manitou Group, and the companies are now furthering their collaboration by adding future deliveries of the emission-free steels, SSAB Fossil-free and SSAB Zero, to the mix.

Source: Recycling Today, 15 April 2024.

The Liberia National Police (LNP) and ArcelorMittal Liberia (AML) have signed a memorandum of understanding (MOU) aimed at ensuring the secure movement of AML’s equipment from Buchanan, Grand Bassa County, to Tapata, Namba County. Due to logistical constraints, the LNP could only commit to providing one escort vehicle instead of the requested two. In response to the LNP’s request, AML pledged to provide two new vehicles to enhance police operations during the transportation of oversized equipment. The company said this would demonstrate their commitment to safety and cooperation.

Source: GNN Liberia, 14 April 2024

Nippon Steel has suspended production at some of its blast furnaces at the company's Kimitsu plant due to operational issues, said the company, without disclosing further details. The suspension is temporary, a company representative stated, although it remains unclear when the plant will resume production. The firm has not disclosed output volumes at the Kimitsu plant.

Source: Argus Media 15 April 2024.

Russian steelmaker Severstal has acquired a St Petersburg holding company that controls a majority stake in a joint venture previously owned by Spanish firm Windar Renovables. The acquisition of New Solutions and Technologies LLC makes Severstal the sole owner of its former joint venture with Windar, which manufactures towers for wind turbines. Severstal has owned 100% of the holding company since 8 April, a state register has shown.

Source: Reuters, 16 April 2024.

Thyssenkrupp has agreed to sell a stake in its steel business to a group owned by Czech billionaire Daniel Kretinsky, as the German conglomerate seeks to overhaul the ‘long-troubled unit,’ as stated in local media reports. Kretinsky's EP Corporate Group (EPCG) will initially acquire 20% of Thyssenkrupp Steel Europe, in a deal expected to close in the current financial year, the companies said in a statement. Talks are ongoing for EPCG to take a further 30% stake at a later

point with the aim of eventually reaching a 50-50 joint venture. Source: Barrons, 26 April 2024.

The Serious Fraud Office has visited the offices of Sanjeev Gupta’s Liberty Steel. It comes almost a year after the SFO launched an investigation into suspected fraud and money laundering by parent firm GFG Alliance, which has thousands of staff in the UK. The SFO has confirmed that teams from the organisation visited company offices in April to request documents including company balance sheets, annual reports and correspondence related to the investigation.

Source: yahoo!life, 27 April 2024.

ArcelorMittal has warned that one of its divisions may end up leaving the UK if a planning application in a town in south-east England is approved. In a letter seen by Sky News, the Luxembourgbased conglomerate said if a planning application was approved, and part of Chatham Docks in Kent was closed and redeveloped, there would be ‘seismic adverse consequences’ for several important industries and

Chemical company Linde has signed a long-term agreement with H2 Green Steel for the supply of industrial gases to the world's first largescale green steel production plant. Linde will invest approximately $150 million to build, own and operate an on-site air separation unit (ASU) in Boden, northern Sweden. Linde will supply oxygen, nitrogen, and argon to H2 Green Steel's integrated plant, which will use the latest technology to reduce carbon emissions by up to 95% compared to traditional steelmaking.

Source: yahoo!finance, 1 May 2024.

the UK economy as a whole. The redevelopment would necessitate the closure of the docks which Arcelor Mittal uses to supply reinforcement materials for the construction industry.

Source: N Business, 6 May 2024.

UK-based steelmaker and engineering firm, Sheffield Forgemasters, has completed multiple land purchases in the Meadowhall area of the city. The purchases total 21 acres of brownfield land over three plots adjacent to the company’s Brightside Lane site, with the aim of developing additional facilities as its recapitalisation programme gears up. Gareth Barker, chief operating officer at Sheffield Forgemasters, said: “The purchase of these plots of land is a gamechanging venture for the company and will see stateof-the-art manufacturing facilities built in the historic centre of Sheffield’s industrial heartland.’’

Source: Production Engineering Solutions, 2 May 2024.

JFE Steel Corporation has launched a solutions-business brand, JFE Resolus™ to provide solutions to a range of customers, including those outside the steel industry, based on manufacturing and operation technologies that JFE Steel has cultivated over many years in its steelmaking operations. JFE Steel’s recently launched solutions business website showcases diverse

Nippon Steel Corp has postponed the expected closing of its $14.1 billion takeover of US Steel by three months after the US Department of Justice requested more documentation related to the deal. Nippon Steel said the deal, already approved by US Steel's shareholders, is still expected to go through. “Nippon Steel will continue to fully co-operate with the examination of the relevant authorities,” it said in a statement. The sale has drawn opposition from president Joe Biden’s administration on economic and national security grounds, and from former president Donald Trump, the likely Republican presidential candidate in November's election.

Source: Japan Today, 4 May 2024.

products and technologies, including digital technologies, Cyber-Physical Systems (CPS), and robotics, for purposes such as improving production efficiency, increasing labour productivity, manufacturing value-added products and reducing environmental impact.

Source: JFE Steel Corporation, 7 May 2024.

TII SCHEUERLE has launched the fourth generation SCHEUERLE BladeLifter, which the company claims allows all fleet operators to have a high level of investment security as well as economic efficiency, and offers transport safety even when transporting the longest rotor blades. The Steil Kranarbeiten company has used this solution for transports of rotor blades up to 84 metres long to wind farm facilities.

The BladeLifter G4 system has sufficient reserves to accommodate future rotor blades, and the high set-up angle of 60 degrees is designed to ensure the best possible manoeuvrability. The BladeLifter G4 can be operated using two widths,

namely 3 and 3.49 metres. On the one hand, this facilitates a high level of driving stability as well as structural integrity when transporting large rotor blades and, on the other, more compact designs with reduced space requirements.

In addition, the rotor blade adapter from TII SCHEUERLE can also be adapted to suit different root diameters and also features a new height adjustment characteristic to allow it to be driven under bridges when loaded. TII SCHEUERLE has also developed a drawbar coupling element in order to support the self-propelled combination when negotiating extreme gradients or to be pulled quickly with a tractor unit during empty

Tenova, a developer and provider of sustainable solutions for the green transition of the metals industry, is partnering with RINA, a multinational engineering consultancy, inspection, and certification company, on the European Commission-backed Hydra project.

The €88M project is funded by the European

Commission’s NextGenerationEU and backed by the Italian Ministry of Enterprises and Made in Italy. It aims to drive 100% hydrogen-fueled steel production and allow all steelmakers to test it, using the results to drive future investment plans towards sustainable production of steel.

Tenova has been contracted to supply a

runs. Both accelerate the transportation process and save time, it is claimed.

Another advance in the latest generation of the BladeLifter is the optimized remote diagnosis feature and stability monitoring. With the help of remote diagnosis, fleet operators gain access to all status updates of the transport solution. The optimized working lights system, which is activated by means of a remote control, also contributes to user-friendliness and work safety.

For further information, log on to www.tii-group.com

30-metre-tall direct reduction iron ore (DRI) tower which will use hydrogen as a reducing agent, and an electric arc furnace (EAF). The DRI plant, based on the ENERGIRON® Direct Reduction technology, jointly developed by Tenova and Danieli, together with the Tenova EAF will produce up to seven tons per hour at its full production capability within 2025.

“I am very proud of this project with RINA as it provides all European steelmakers the first opensource facility that will enable them to test the process with our pilot plant and drive their future investments to drastically reduce their emissions,” said Roberto Pancaldi, Tenova CEO. “Our co-operation with RINA dates back to the nineties with several projects successfully developed”.

“Hydra aims at decarbonizing the steel production process through hydrogen-based technologies,” added Carlo Luzzatto, CEO, and general manager of RINA. “Thanks to the help of our partners, we will build a pilot plant to experiment with steel production, emitting a marginal fraction of the carbon emissions currently released by the world steel industry. Hydra is available to the entire supply chain for research and development on the production of clean steel”.

For further information, log on to www.tenova.com

Haver & Boecker Niagara, a manufacturer of screening, pelletizing and mineral processing plants and systems for the mining, aggregate and industrial mineral industries, has launched Rhino Hyde liners, which the company claims will enhance the wear life of a full range of equipment. The company’s custom-blend liners are formulated and installed on key wear, material handling and impact areas of chutes, hoppers, vibrating screens and more. Rhino Hyde, constructed from thermoset polyurethane, boasts superior abrasion resistance, says the company, as well as enhanced durability and chemical resistance compared to alternatives like thermoplastic polyurethane, rubber, or metal.

“Haver & Boecker Niagara consistently seeks innovative solutions that elevate our customers’ operations,” said Karen Thompson, president of Haver & Boecker Niagara’s North American and Australian operations. “Offering Rhino Hyde liners underscores our commitment to delivering products and services that go well beyond the ordinary or expected. They aren’t just off-theshelf products; they’re meticulously tailored

solutions developed through collaboration with our partners and customers. It’s this dedication to personalized excellence that sets us apart.”

Rhino Hyde liners are designed for applications such as screening, material handling and hauling. They can be fully customized to the required size and are available in multiple different styles and attachment systems including the classic Rhino

Hyde Blue, magnetic, urethane-backed ceramic, polyurethane blades, belt skirting and weldable liners.

For further information, log on to https://haverniagara.com

Lock Joint Tube, a US steel tube manufacturer, has contracted Fives to supply a completely automatic tube mill to expand its capacity and meet growing demand for renewable energy.

Lock Joint Tube is doubling production at its plant in Temple, Texas to provide solar tubes to key customers who are investing in the solar energy sector. Fives supplied a new OTO tube mill,

equipped with the latest-generation technology that it claims ensures the best performance for a wide range of applications.

“Prior to the installation of the new tube mill, we could only produce small tubes for mechanical and structural applications. We saw a soaring demand from our customers supplying support structures for solar trackers and invested

in new technology. The OTO tube mill is fully automated from the entry line to packaging and flexible enough to produce tubes for all types of applications: solar, mechanical, or structural,” said Michael Donnelly, corporate project manager at Lock Joint Tube.

The tube mill doubled the production capacity up to 4kt per month. It was fully operational in spring 2023 and has produced 3,000 tubes per day in both octagonal and square shapes.

“Automation was our top priority because we wanted to increase safety, reduce heavy work, and speed up production. With the new OTO tube mill, we are doubling our original capacity with a single operator on the line. These exceptional results were only possible because of Fives’ advanced technologies and our successful co-operation,” commented Mark Richner, Temple plant manager at Lock Joint Tube.

The system at Lock Joint Tube consists of a configuration where three robots are synchronized to handle special tube lengths up to 15 metres.

“The Robopack with three robotic arms is one of the main innovations of this project. Its modular design makes it possible to easily adapt the packaging solution to production needs. For short tube lengths, one or two robots can be on standby, which reduces energy consumption,” added Roberto Chiminelli, application engineering manager at Fives OTO, a subsidiary of the Fives Group specialized in tube mill technology.

For further information, log on to www.fives.com

A UK-based stainless-steel manufacturer and stockist has reached an agreement to sell and distribute pipeline and piping packages with products made from the N’GENIUS series of high strength austenitic stainless steels.

Headquartered in St Helens, Project Pipeline Supply (PPS) provide pipes, fittings, flanges, components and specialist equipment to the offshore oil and gas, process, renewables, and defence industries. This agreement will allow PPS to offer customers total packages of products made using the N’GENIUS Series, fulfilling an important step in the supply chain for major projects around the world.

As a complete ‘family’ of grades, N’GENIUS represents a wide selection of new materials, which the company claims are far superior than conventional austenitic stainless steels – commonly known as the 300 Series – and a cost-effective alternative to more expensive nickel alloys and high-alloy stainless steels.

Dr Ces Roscoe, CEO of N’GENIUS Materials Technology, said: “The limitations of many materials utilised on certain projects almost forces engineers to specify completely different alloys that aren’t always compatible with one another. With such a vast range of grades – all of them high strength austenitic – the N’GENIUS Series enables engineers to use the same type of material which meets the requirements of virtually every

pipeline and piping package. It’s the total system material solution.’’

Mr David Toone, managing director at PPS, added: “Many companies are now seeking advanced materials for systems that enable them to be utilised in ultra-deep waters, last longer and operate safely in more extreme environments. Having seen the technical possibilities for N’GENIUS, we believe it will have a big impact with our existing customers and open up new opportunities in other industries. The potential application

• Passes through furnace with Slab

• Get an accurate Slab temperature profile

• Measurement at up to 20 points

• Live 2 way radio communications

of these materials in the hydrogen transport and storage sector will be particularly significant and we are now well-positioned to become a key part of that supply chain. Together, PPS and N’GENIUS can provide expert advice to find the best solution for your projects and this partnership provides the opportunity to source N’GENIUS product packages under one roof.”

For further information, log on to www.ngeniusmaterials.com

• Safe system installation without production delays

• Reliable protection of data logger up to 1300°C

•

•

•

•

•

• Optimise your process accurately

• Validate your furnace mathematical model.

While Joe Biden announced a huge investment sum geared towards greening US energy-intensive industries, tension continues to dominate the domestic steel industry, as Nippon Steel’s planned takeover of US Steel receives criticism from political and industrial representatives. By Manik Mehta*

THE late March announcement by US president Joe Biden’s administration of massive investment aimed at reducing industrial gas emissions and supporting global decarbonization, was welcomed by the nation’s steel industry which applauded the Department of Energy’s $6 billion in projects for decarbonizing energyintensive industries and reducing industrial greenhouse gas emissions.

Under Biden’s Bipartisan Infrastructure Law, and the Inflation Reduction Act, the investment’s focus will be on industries, including steel, that generate high levels of emissions; the projects are designed to help reduce the more conventional carbonintensive steelmaking processes which use coal.

In a statement, Kevin Dempsey, president/ CEO of the American Iron and Steel Institute (AISI) described the DOE announcement as a ‘recognition of the leadership of the American steel industry in reducing greenhouse gas (GHG) emissions and producing the cleanest steel in the world’, adding that the American steel industry and the manufacturing sector as a whole, had made ‘significant investments in cleaner and more sustainable production processes’.

The focus on clean energy is expected to bolster the US steel industry which had, comparatively, appeared to be

falling behind European competitors on this score. Many industry executives say that the nation’s steel plants, which had considerably slowed down their drive for green steel, would now move forward. The $6 billion investment allocated for 33 projects will cover six schemes in the iron and steel industry with an estimated value of $1.5 billion, including projects at Cleveland-Cliffs and SSAB Americas with whom official agencies will hold negotiations on the award of funds.

The much-publicized Bill Gates and Amazon-backed start-up Electra announced on 27 March that it plans to start the first steel production in the US using renewable energy; the Colorado plant will produce clean metallic iron from high-impurity ores. Its green steelmaking process, the company said, was aimed at reducing emissions during steelmaking.

Electra’s CEO/co-founder Sandeep Nijhawan, has been saying that ‘clean iron produced from a wide variety of ore types is the key constraint to decarbonizing the steel industry sustainably’, adding that the pilot project would bring the company ‘closer to our goal of producing millions of tons of clean iron by the end of the decade’.

Meanwhile, the unending discussions over the proposed US Steel acquisition by Nippon Steel for $14.9 billion, has attracted

*US correspondent, Steel

political attention, with some politicians eager to get some mileage in a crucial election year and score some points.

Senator Sherrod Brown (D-Oh) joined the chorus of opposition that includes Lourenco Goncalves, Cleveland-Cliffs’ CEO, and Donnie Blatt, a senior leader in the United Steelworkers, against the sale of US Steel to Nippon Steel.

Brown urged president Biden to stop the proposed acquisition, cautioning that the sale will make it much more difficult for the US to bring trade cases in favour of US steelworkers and take action against any abuses, pointing out that Nippon had not given workers a seat at the table, as guaranteed under the USW’s collective bargaining agreement with US Steel. Brown, commenting after visiting Cleveland Cliffs’ steel plant in Cleveland, said that ‘workers must be treated as partners and that has not been the case with this deal’.

Indeed, Cleveland-Cliffs made a bid to buy out US Steel though its offer fell far below that of Nippon Steel; Cleveland-Cliffs’ takeover bid had given rise to misgivings among steel-consuming industries about concentrating too much of the steel business in one bloated steel group.

John Bozzella, the CEO of the Alliance for Automotive Innovation warned in a letter that a ‘consolidation of the two companies

would also place 65-90% of steel used in vehicles under the control of a single company.’

Goncalves, on his part, also said that steelworkers’ rights should be protected, giving them representation as part of the takeover agreement. He welcomed Brown’s recognition that ‘Nippon’s proposed acquisition is bad for the United States, bad for workers and must be blocked’.

Brown with two other senators – Ohio Republican J.D. Vance and Pennsylvania Democrat Bob Casey – also expressed concern over Nippon Steel’s alleged business ties in China. Brown urged president Biden to investigate Nippon’s business ties in China, with the senator further suggesting that based on a Horizon Advisory report, which was sent to Biden, Nippon had been ‘fundamentally intertwined’ with the Chinese steel industry for four decades, and may have had possible ties to China’s military-civil fusion strategy.

The phantom of China’s overproduction of steel and with it cars, solar panels, and other products that use the metal –

continues to haunt US policymakers, but for some engaged in election campaigns, it is a welcome opportunity to demonstrate their nationalist credentials.

The US and the European Union are the targeted markets, according to American steel pundits. China’s global trade surplus in goods has, meanwhile, increased in 2023 to over $900 billion, rising from some $400 billion in 2019, according to US foreign trade statistics.

It is not unusual for US steel representatives to publicly fret about China

resuming dumping its steel-based products in the US market – the latest being electric vehicles.

The aggressive export of subsidized over-production is the Chinese communist party leadership’s mantra to resuscitate its weakened economy characterized by an ongoing property market slump, declining household spending and a shrinking population, to name some of its woes.

The mood in the US in an election year is not very receptive to China’s aggressive exports, with both the US and Europe keen to reduce their dependence on China, and strengthen their own manufacturing sector and create jobs.

US treasury secretary Janet Yellen, on a recent visit to China, also reportedly conveyed US concerns about China’s overcapacity.

Meanwhile, according to the AISI, the biggest steel suppliers to the US in February 2024 were Canada (537,000 net tons, minus 14% over January), Brazil (506,000 NT, plus 8%), Mexico (328,000 NT, minus 17%), South Korea (185,000 NT, minus 6%), and Taiwan (85,000 NT, plus 38%). �

Sinobras commenced operation at its second long steel rolling mill in December 2023 with a view to providing new types of products to the construction and other industrial markets. The project has cost $204M. In the first part of this two-part feature, Sinobras’ performance prior to the opening of the mill will be analysed, while the second part will focus on the new opportunities provided by the mill.

By Germano Mendes de Paula*SINOBRAS entered the Brazilian long steel industry in 2008. It belongs to Aço Cearense, one of the largest Brazilian importers and distributors of flat steels, and is fully controlled by Vilmar Ferreira. Thus, Sinobras was meant to complement the line of products previously sold by Aço Cearense. Its original configuration consisted of: a) the two charcoal blast furnaces, with a capacity of 175kt/yr and 136kt/yr, which were purchased from Siderúrgica Marabá (Simara) in November 2006. These blast furnaces, installed in Marabá (State of Pará), served as the basis for the construction of the rest of the mill; b) the melt shop, which contains a 40/t EAF, corresponding to a rated capacity of 312kt/yr that was inaugurated in May 2008; c) the 300kt/yr rolling mill started-up in September 2008. The cost of implementing Sinobras was estimated at $350M, including investments in reforestation and working capital (STI, April 2009, p. 17).

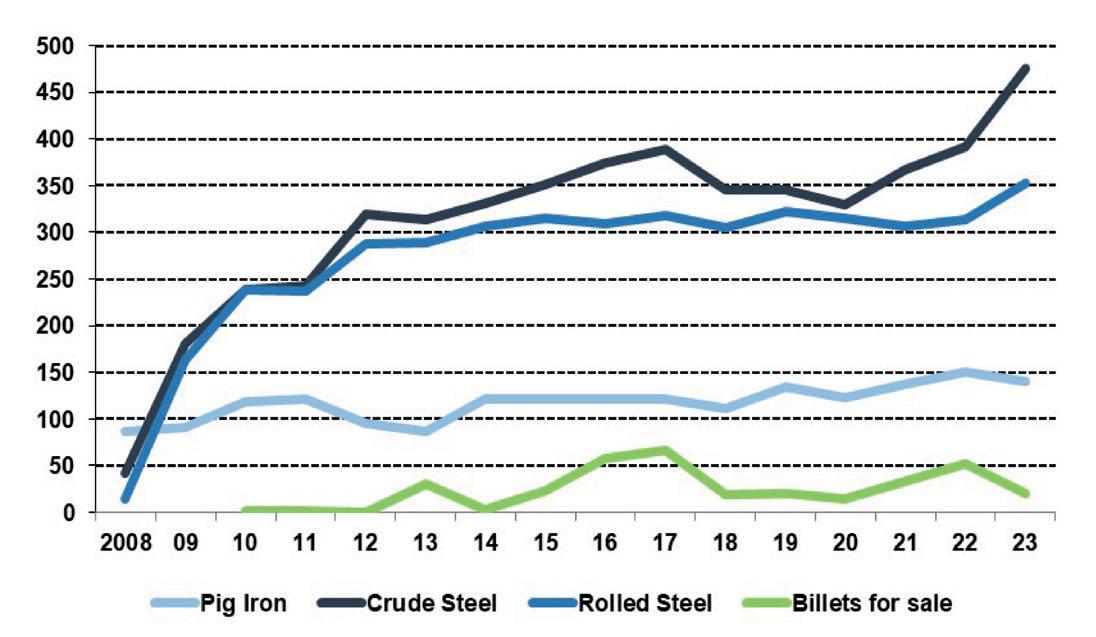

Pig iron production rose from 87kt in 2008 to 118kt in 2010, and has remained roughly at this level since then (Graph 1). Currently, Sinobras operates with just the

largest blast furnace. In its first full year of operations in 2009, the company’s crude steel production reached 181kt, equivalent to 58% of its nominal capacity. In 2012, the respective values were 319kt and 102%. In 2016, with capacity already expanded to 380kt/yr, the volume of crude steel totalled 374kt, which meant full capacity.

Sinobras’ rolled production was equivalent to 164kt in 2009 (or 55% of rated capacity). The following year, this increased to 238kt and 79%. In 2016, the respective figures were 310kt and 103%. Thus, the Sinobras rolling mill was operating above nominal capacity in 2016. This justifies the plant having produced 58kt of billets for sale to the market.

Aço Cearense Industrial, a sister company, inaugurated a drawing plant in 2000 in Fortaleza (State of Ceará), prior to Sinobras’ start-up. Sinobras added a drawing plant in 2010. Their combined capacity increased from 60kt/yr to 132kt/yr in 2014. Aço Cearense Industrial also has a flat steel service centre, including the fabrication of welded tubes.

Having filled its installed capacity relatively

quickly, in 2013, Sinobras announced a $200M investment plan, aiming to increase rolled steel capacity from 300kt/yr to 800kt/ yr. This plan also included a shredder, a new power transmission line (with a substation), improvements to the steel shop (to be compatible with the scale of the rolling mill) and an increase in drawn production. The initial intention was to complete this project by mid-2016.

The creditor protection procedure and recent productive performance

However, given the unsatisfactory performance of the Brazilian long steel market, Sinobras’ expansion project ended up being halted, even with the new rolling mill already stored at the mill. More importantly, in May 2017, Aço Cearense group filed a request for judicial reorganisation, due to $545M liabilities. In 2016, the holding company had $483M net revenues and $24M net losses. In December 2016, Sinobras’ net sales reached $326M, with minor $3M net losses, but with $212M liabilities. Therefore, Sinobras finished up being more affected by the financial

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

The steel manufacturing assets were purchased in 2007 from POSCO to extend the seller’s existing manufacturing capability. The order comprised of 10,200 cases weighing over 53,000 tons.

The assets for sale arrived after the financial crisis of 2008 and plans for installation where delayed due to market uncertainty. Future plans to expand were further halted with the economic shockwave caused by the COVID-19 pandemic in 2020.

The owners subsequently decided not to expand production and the mainly unused assets, crated and stored as per the OEMs recommendation, are now available for sale.

Two A/C climate-controlled warehouses contain those assets that require a temperature-controlled environment with the remaining assets catalogued and mapped in secure paved outdoor storage.

The available assets include but are not limited to:

• STS 4-strand billet caster (2008)

• Rokop 5-strand billet caster (1995)

• Mannesmann DEMAG 2-strand thin slab caster

• Mitsubishi 5-stand 4-high hot strip mill (1998)

• UBE Industries 700,000 TPA hot skin-pass mill (1998)

• 3 Inductotherm 30T induction furnace (2008)

• 2 VAI Fuchs 80T electric arc furnace (2000)

• Nippon Steel Corporation 150T ladle refining furnace (1998)

• 6 Wärtsilä 10.51 MW diesel generator sets (1997)

• 5 Sulzer 10.56 MW diesel generator sets (1994)

• 10 overhead cranes by Hyundai, Samjung and Bando ranging from 12T – 110T

Gordon Brothers is currently accepting offers on the 2 million TPA Flat & Long Steel Production Plant, as well as on individual assets.

performance of its parent company. It is important to highlight that the creditor protection procedure was finished in October 2022.

As it can be observed in Graph 1, along the period 2017-2023, Sinobras’ pig iron output oscillated around a 130kt/yr plateau, as it had been operating with just one of its blast furnaces. Regarding crude steel production, it diminished from 389kt in 2017 to 345kt in 2018-2019 and even to 330kt in 2020, as a consequence of Covid.

Nevertheless, it increased to 367kt in 2021, 392kt in 2022 and 475kt in 2023, when it produced substantially more billets in order to accumulate some semis for the newcoming rolling mill. It is understood that Sinobras’ melt shop is operating with 75% scrap and 25% liquid pig iron.

Sinobras fabricated roughly 310kt/yr of long products during the period 20172022, which was equivalent to its nominal capacity. Last year, however, it achieved 352kt. This can be considered a good

performance, taking into consideration that Brazilian long steel output (including seamless tubes) decreased from 9.8Mt in 2022 to 9.1Mt in 2021, showing a 7% drop. In addition, Sinobras sold on average 34kt/yr of billets between 2017-2022 and 21kt in 2023.

With the start-up of the rolling mill, Sinobras began a new development phase, as will be examined in the second part of the article, which will appear in the July/ August print edition of the magazine. �

Enhance the Safety, Storage & Efficiency of your logistics with Combilift

Combilift’s range of multidirectional forklifts, pedestrian reach trucks, straddle carriers and container loaders will allow you to maximize the capacity, improve efficiency and enhance the safety of your facility. Contact Us Today

To find out how Combilift can help you unlock every inch of your storage space.

INDIAN producers have been facing tremendous margin pressure due to a slowdown in steel demand since December 2023, as the caretaker government abruptly halted fund releases following the Parliamentary election-led Aachar Sanhita (Moral Code of Conduct). The central government requires permission from the Election Commission of India (ECI) to release funds from the date of announcement of the Parliamentary election (this year on 16 March 2024) to the Oath Taking Ceremony of the next Council of Ministers (by end-June this year). Therefore, the caretaker government avoids releasing funds for any private or public sector projects, resulting in an abnormal delay in stalled projects, including those in the infrastructure or housing sector. Consequently, Indian steel producers estimate the slowdown in domestic steel demand to continue at least until June-end. Domestic steel producers strongly rely on the government’s infrastructure spending and plan their capital outlay accordingly.

Domestic infrastructure projects gain significance as the sector cumulative consumes approximately two-thirds of the overall steel demand, thus exerting a multiplier effect on the country’s economic growth and employment creation.

Announcing the interim Union Budget in February this year, India’s Finance Minister, Nirmala Sitharaman, increased capital expenditure by 11% to INR 11.11 trillion, which is approximately 3.4% of gross domestic product (GDP).

According to the Joint Plant Committee, part of the Indian government, the country’s steel exports rose by 12.7% to reach 6.65Mt from April 2023 to February 2024, compared to 5.9Mt reported in the corresponding period last year. In February alone, India’s outbound shipments of steel surged to 1.03Mt, a 21.2% increase from 850kt reported in January 2024. Domestic steel shipments have skyrocketed since December 2023, following a slackening

Source: Joint Plant Committee, Indian government, *CPLY = Corresponding period last year

*India correspondent, Steel Times International

in local demand. Therefore, overall steel exports recorded a staggering jump of 77.6% since December 2023. However, increasing domestic demand has prompted steel mills to boost supply to local mills between April and November 2023. Not only did exports surge, but also imports witnessed stellar growth during the April 2023 to February 2024 period. A Joint Plant Committee analysis shows India’s steel imports surging by 28.8% since December 2023 but softening to 760kt in February 2024. Despite contracting by 1.3% in February 2024, steel imports recorded a jump of 35.6% to 7.58Mt during the April 2024 to February 2024 period, compared to 5.59Mt reported during the corresponding period last year. Supporting the ‘Aatmanirbhar’ (self-reliance) vision, India’s net steel trade contracted by 930kt during the April 2023 to February 2024 period.

However, analysts called India’s rising exports ‘opportunistic’, which may ease once domestic demand resumes post-

Source:

election. The ongoing slowdown in domestic steel demand may have a longterm impact as projected by the Indian Steel Association (ISA). The Association estimates that overall domestic steel demand will grow by 6.3% to reach 136.97Mt in the financial year (FY)2024-25 (April-March), compared to the 7.5% growth projected at 128.85Mt for the recently ended FY 202324 (April-March) and 119.86Mt reported in FY 2022-23 (April-March).

Domestic steel demand has already been

slowing since December 2023, growing just 6.5% after six months of approximately 16% growth. “While these are early trends, these numbers nonetheless hint at demand remaining soft over the next two quarters as government spending moderates around the election period,” stated Jayant Roy, senior vice president and group head of corporate sector ratings at Icra Ltd. The rating agency estimated that domestic steel consumption growth will slide to 7-8% in FY 2024-25 after three years of double-digit growth, down from approximately 12-13% in FY 2023-24. Concurrently, higher input

costs and soft steel prices will squeeze operating profit margins for producers by 1.10-1.15% in FY 2024-25. Crisil Ltd said in its analysis that about 12-13Mt of new capacity were expected to come on stream between October 2024 and March 2025, aligning production with demand and reducing import dependence.

Major Indian steel producers such as Tata Steel Ltd, Jindal Steel and Power Ltd, JSW Ltd, among private producers, are planning to commence project work on 22Mt of capacity additions in FY 2024-25. Although Jindal Steel and Power is expected to add 6Mt to the existing capacity of around 9.6Mt, Tata Steel is adding 5Mt to 21Mt of its existing capacity. India’s largest steelmaker JSW Steel aims to increase its capacity to 38.5Mt by 2024-25, up from 27.5Mt of domestic capacity currently.

ISA forecasts India’s steel demand to expand by 8-9Mt/yr at least in the next couple of years due to robust capital expenditure on infrastructure development. Infrastructure spending is expected to accelerate, and growth in urban consumption is projected to sustain at least for now. The rising share of investment in the economy, backed by strong capital expenditure outlay by the government and improving private investments is likely to drive India’s steel demand in the future. The stellar growth can be estimated through a 33% acceleration in the budgeted capital expenditure to INR 10 trillion, of which 50% has been allocated for road and railway infrastructure. �

The European Union’s (EU) Clean Border Adjustment Mechanism (CBAM) is a landmark regulatory framework aimed at curbing emissions embedded in imported goods, including steel. By 2026, it will require steel importers to fully measure, report, and pay for these greenhouse gas (GHG) emissions, aligning imported goods with the stringency of the EU’s climate policies. By Urszula Szalkowska*

IN anticipation of CBAM’s full implementation, the first reporting phase has already commenced, with a grace period allowing the use of default emission values until June 2024. Nevertheless, steel producers are urged to prepare for more rigorous emissions reporting in compliance with EU methodology to maintain competitiveness in the EU market. From 2026 onward, importers must procure CBAM certificates at prices reflecting the EU Emissions Trading System (ETS), further incentivizing accurate emissions declarations.

Non-EU importers held to standard CBAM’s inception is a strategic move to address carbon emissions by ensuring that non-EU manufacturers are held to similar GHG-reduction standards as those within the EU. It attempts to level the playing field between domestic and foreign producers and reinforces the EU’s commitment to becoming a carbon-neutral continent by 2050. This mechanism marks a shift from negotiated international environmental regulations towards the EU leveraging its market power to project its climate policies globally. As such, it signifies the maturing and globalization of carbon markets, requiring producers worldwide to adapt to these comprehensive standards.

Prepare now for EU methodology Currently, importers can use the EU

calculation methodology or emissions calculations accepted in countries of origin or default values listed by the European Commission to report embedded emissions. Based on CBAM reports received in January 2024, most importers used the last easiest option, ie, default values. However, as mentioned previously, this type of reporting will no longer be accepted after June 2024.

After a transition period in 2025, the EU calculation methodology and its emissions factors will be required for CBAM reporting in 2026. This means that importers and producers should be already preparing for actual life cycle GHG emissions reporting following the EU methodology to remain competitive in the European market.

Additionally, importers in 2026 will be required to purchase CBAM certificates corresponding to the declared emissions. The price of CBAM certificates will be based on the weekly average price of the EU ETS allowance and expressed in EUR/tonne of CO2 emitted. An independent accredited verifier will need to verify the declaration’s accuracy. Each year, by 31 May, starting in 2026, declarants will surrender CBAM certificates equivalent to their declared and verified embedded emissions. CBAM certificates will not be tradable, but they can be re-purchased by a regulator that issued them.

New importers of iron and steel can register at any time they decide to bring goods covered by CBAM to the EU

*Managing director, European markets, EcoEngineers.

market. Depending on when they become importers, they need to follow the rules applicable in this specific period. For example, until the end of 2025, they need to follow transitional rules; starting in 2026, they must follow full compliance rules.

Importers can claim emissions reductions if a carbon price was paid in the country of origin and deduct this price from the CBAM cost. Details on how the EU will incorporate foreign climate policies into CBAM calculations will be finalized before a definitive rule is entered into force. The European Commission claims that it will consider the position of its international partners. In the meantime, some countries are already deliberating how to accommodate CBAM. For example, China is contemplating including CBAM sectors in its own cap-and-trade scheme, and India is discussing a CO2 tax.

As the CBAM enters into force, foreign companies must navigate the complexity of the system and its timeline to ensure compliance. Understanding these key requirements and the depth of the regulation is crucial for exporters looking to participate in the European markets. �

For more information about CBAM or other EU climate policies and programmes, please contact Urszula Szalkowska at uszalkowska@ ecoengineers.us

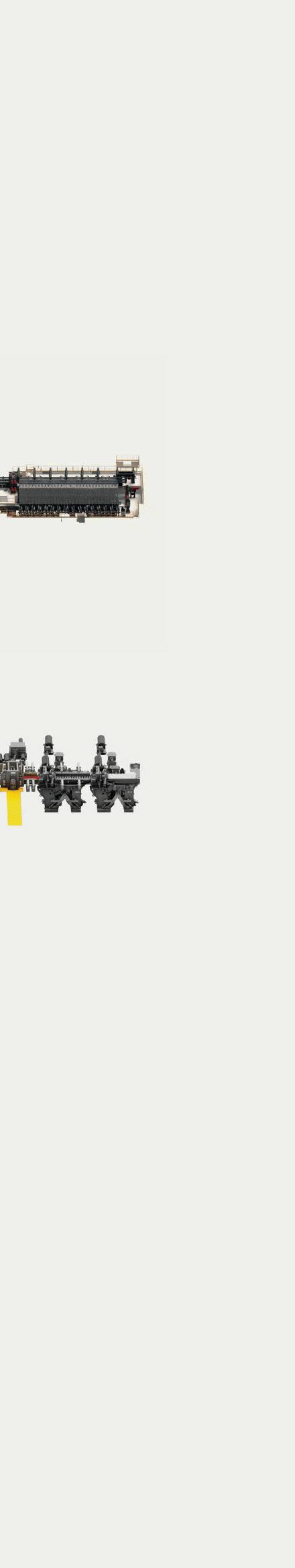

and QSP–DUE are the winning Danieli direct-rolling technologies for the most competitive production of long and flat green-steel products.

They are the result of the research and continuous improvement profused over 20 years, along with multi-million dollars of investment.

Their unmatched performances have fueled their success worldwide, thanks to lower resource consumption and carbon emissions, unbeaten OpEx, and outstanding product quality.

So, top technology becomes copied technology, the shortest route for competitors that, abandoning their solutions, now try to imitate MIDA–QLP and QSP–DUE

Equipment and layout may be copied, but experts know that details make the difference. Automation and process solutions are not easy to copy, and this will be the experience of anyone trusting in those imitations.

The competitive advantage for our customers, obtained by field results, is the best defense for our technology – more than court rulings protecting our patents.

Danieli offers the best guarantees for speedy learning curves, steady performances, and now Digital Plants with no men on the floor. Buy the Original.

GIANPIETRO BENEDETTI CHAIRMAN OF THE BOARD OF DIRECTORS

With the EU’s CBAM coming into play this month, importers must ensure that their data is accurate in order to ensure alignment. By

Jonathan Leclercq*ENTERED into force in May 2023, CBAM (Carbon Border Adjustment Mechanism) is a regulation that will initially impact nonEU-based producers of certain industrial materials that export to the EU (iron and steel, aluminium, cement, fertilizers, hydrogen and electricity), and also EUbased importers of these products. CBAM forms part of the Fit for 55 package, the EU’s plan to reduce greenhouse gas (GHG) emissions by at least 55% by 2030 compared to 1990 levels, and become carbon neutral by 2050.

The transitional phase of CBAM began on 1 October 2023. This meant that EU importers of steel, aluminium, cement, fertilizer, hydrogen and electricity had to submit the first required quarterly report detailing the embedded carbon emissions of their imports on 31 January 2024.

received from the operators

• The third-country operators hadn’t taken necessary steps to determine actual emissions

• They opted for the simplest way of reporting (default values were pre-filled in the CBAM transitional registry).

What happens now?

EU importers of products impacted by the EU’s Carbon Border Adjustment Mechanism (CBAM) who have not yet submitted CBAM reports have until 31 July 2024 to do so, otherwise they will face the risk of being fined (€10-50 per tonne of unreported carbon emissions).

What steps do importers need to take to ensure the emissions data they provide to the EU is accurate?

EU importers should perform a screening on the emissions data they received from third-country operators to ensure that it is the actual data determined according to the CBAM greenhouse gas (GHG) accounting principles.

This screening can consist of asking third-country operators for relevant documentation, such as the calculation template and supporting evidence, to ensure its alignment with the CBAM methodology.

There are also other steps that can be taken to ensure quality control for accurate carbon accounting, which include:

However, as the Financial Times recently reported in March, fewer than 10% of 20,000 German companies reported by the deadline earlier this year, according to data collected by Germany’s emissions trading authority. Through our discussions with companies across Europe who are required to report, there are a number of difficulties that importers have experienced with sourcing, and therefore submitting, the actual emissions data corresponding to their imports of products manufactured outside of the EU, which include:

• They’ve had difficulty tracing back to the third-country operator who manufactured the goods

• The third-country operators had difficulties determining the actual emissions according to the new CBAM methodology

• They were not confident in the credibility of emission information they

For those who did submit CBAM reports, the EU made it possible to submit emissions data using default values for the first three quarterly reports. However, for the remaining transitional period – from 1 July 2024 to 31 December 2025 – importers will have to provide actual values (estimated values may still be used with a quantitative limit of up to 20% of the total embedded emissions).

• Verifying data by cross-checking against multiple sources to ensure consistency and accuracy

• Performing audit to assess data quality and identify potential discrepancies

• Validating the accuracy of calculations and measurements.

From 2026 (after the transitional period has ended, and when companies will start having to pay the carbon tax based on the emissions of their imports), the emissions data of imported goods will need to be verified by a third-party before being submitted to the European Commission. However, there are many benefits to ensuring that you procure accurate emissions data before this. This would:

• Ensure that third-country operators are ready for the definitive period so the risk of non-compliance (and therefore, fines) is minimized

*Senior manager, decarbonization and sustainability, DNV

• Provide an accurate estimation of financial exposure when the tax will apply – precise emissions data will allow this

• Enable companies to take informed decisions regarding business and supply chain decarbonization strategies.

In general, what work needs to be undertaken to ensure your CBAM compliance strategy works for your business and its supply chain?

CBAM reporting can add workload and costs to importers and manufacturers. However, ensuring that you are on top of emissions reporting and other sustainability measures that are increasingly being required to track and report on throughout the value chain, is a worthy investment in the long run.

In particular, to ensure that CBAM reporting requirements are met, EU-based steel importers can seek the help of an adviser to:

• Map suppliers and source accurate emissions information

• Assist in the collection of emissions data at the installation level

• Assess the quality of emissions data received from suppliers

• Provide an accurate evaluation of the financial impact of CBAM.

In turn, producers impacted by CBAM that are based outside of the EU can benefit from external advice to:

• Support their CBAM readiness and the determination of the actual embedded emissions

• Build and manage elements of a wider decarbonization strategy and lowcarbon initiatives. �

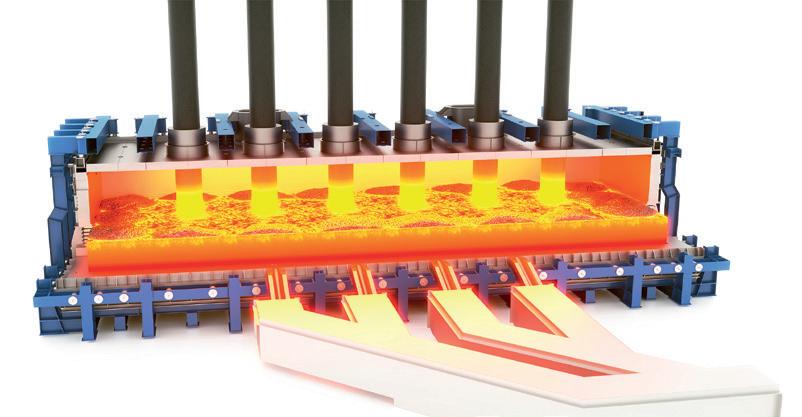

Blast furnace steelmaking is on the way out. Fact. But it’s not going to go quietly and it won’t happen overnight. Taking its place will be the electric arc furnace combined with direct reduction technology and, of course, scrap; but with 85% of the world’s iron ore either low or medium grade, and EAFs more at home with high grade raw materials, things might get messy. In the second of three ad-libbed interviews with senior executives from Primetals Technologies, Matthew Moggridge* talks to Gerald Wimmer** about the electric smelter and its place in the steel industry of tomorrow.

A few weeks ago I sat down in front of the television with a view to watching (all the way through) The Fugitive, a movie starring Tommy Lee Jones and Harrison Ford about a man – Dr Bruce Kimble, played by Ford – who is on the run having been found guilty of a murder he didn’t commit. Oddly, perhaps, it got me thinking about blast furnaces. I know, I’m weird, I’ll accept that, but I found myself thinking that the humble BF (as it is known in steelmaking circles) is on the run. After decades of good service in integrated steel mills around the world, the blast furnace is suddenly the bad

guy, the rabbit caught in the headlights, the cause of all environmental ills, and now they’re being hunted down and dismantled. Well, not quite and not yet. As we all know, the blast furnace will be around for some time to come and they’re still being built in China, India, parts of South East Asia and elsewhere; some are being relined at great cost and there are plenty of new technologies being developed, such as CCUS, designed to make the BF more environmentally friendly than is currently the case.

Odder still, perhaps, is that people as

* Editor, Steel Times International

clued up as Philip Bell, head of the Steel Manufacturers Association (SMA) in the USA – an association representing North American EAF manufacturers – has said that there will always be room for the blast furnace in modern steelmaking. Is he right? Only time will tell, but there are plenty of people around, like Caroline Ashley, director of the UK-based climate watchdog SteelWatch, who would fundamentally disagree.

While the media perception is that blast furnaces are well and truly on the way out and are not only being hunted into

** Vice president, converter steelmaking and a member of Primetals Technologies’ Green Steel Team

extinction, but also replaced by EAFs, the truth is yes, they are on a back foot but are far from finished.

New technologies

Gerald Wimmer, who is responsible for converter steelmaking at Primetals Technologies, based in Linz, Austria, believes that while we will see less and less blast furnaces as steelmakers continue with the challenge of tackling the climate emergency head on with a variety of new technologies designed to reduce carbon emissions, there will still be plenty of Basic oxygen furnaces – or BOFs – in circulation as the steel industry continues with the serious work of reducing CO2 emissions.

“The bad guy in the room is the blast furnace,” Wimmer told me, explaining how they use only carbon to make the full reduction, “so we definitely have to do something” but he disputes the need to do away with the BOF. “I think it is too simple that the BOF has to go away,” he said.

These are interesting times for the global steel industry. The blast furnace is on a back foot, so is the use of coking coal and

sinter in iron making as it has now been proved – not that there was any doubt –that hydrogen can be used instead, thanks first and foremost to Swedish ingenuity and companies such as SSAB who pioneered the successful HYBRIT process; and, more recently, H2 Green Steel, also from Sweden, who is pushing ahead with the development of a dedicated, purpose-built, greenfield hydrogen steelmaking facility in Boden, northern Sweden, which will go live in 2025.

What about blast oxygen furnaces? “I agree there will not be big growth for BOF, but I am convinced that we will still see BOFs in the next decades; but to understand this we must go a step back and look at total CO2 emissions. I am happy to see that our steel industry is serious about reducing emissions and when we go into a bit of detail as to where the emissions come from, we see they come mainly from the blast furnace.” Wimmer explained.

“Without the blast furnace today, there is no hot metal to feed the BOF converters,” said Wimmer. “But in the future we see two things, one is that we have different iron ores and that mother nature provides the resources we have, but she doesn’t care too much which process we have in mind, Looking now into green steelmaking using hydrogen for reduction – like H2GS for example – an electric arc furnace is needed for melting because direct reduction is never doing the melting or the separation of metal and slag – the blast furnace does, direct reduction will not; so this is done in the electric arc furnace and it works, but only if you have the right iron ore. High grade iron ores as we call them, meaning iron ores with a low mineral fraction and a high iron content, result in low slag volume in the EAF. Operation with such material is fun, fast, and profitable. But Australian iron ore is not high grade, it is low grade and further beneficiation is difficult and expensive; the blast furnace is taking this iron ore and is happy to melt and separate the slag and – also very important – it’s going to create slag that is suitable for the cement industry, avoiding any landfilling of by-products.”

Wimmer asserts that if you think the steel industry is the bad guy in terms of CO2 emissions, wait until you meet the ‘cement guys’ – they’re even worse! “If we are, CO2wise, as the iron and steel industry, the bad

guys in the room, then the cement guys are even worse, as the cement industry is the largest industrial emitter of CO2 in the world with even larger emissions than the steel industry,” he said and it needs this CO2-free secondary material to reduce its emissions. “Also, in future, if we shut down the blast furnace how will we process this iron ore, there is not enough high grade iron ore to switch all the blast furnaces to electric arc furnaces.”

Turning the global steel industry into an EAF-centric environment – which, ultimately, is the plan – would, on the face of it, be bad news for Australian mining companies because EAFs need a higher grade of iron ore, which rules out the stuff coming out of antipodean mines. In other words, simply getting rid of all blast furnaces will turn the spotlight on the availability of the right raw materials in terms of grade.

In Australia, these are worrying times because if – or when – the big shift to EAFs happens then there will be a noticeable shift in purchasing patterns as steelmakers look to buy the highergrade ores demanded by EAF operators. This would leave the Aussies with the Chinese as their main customer and such a scenario has prompted industry observers to question whether it is possible to make green steel down under, offering more value generation instead of simply shipping iron ore out to where the processing takes place.

“We all know that scrap is the most sustainable material and scrap recycling, luckily, in the Western world is already as high as 90%, so you can only increase the amount of scrap from recycling maybe by three or four per cent. Basically, we must accept that scrap availability is limited,” Wimmer said.

“So think wisely what you do with steel: make smaller cars, make less cars, make a smaller bridge, build a house out of wood, because we do not have enough steel, we’re simply not ready for this; so we’ll still make steel out of iron ore in the future and there are basically two ways: either we keep the blast furnace and combine it with carbon capture and storage (CCS) technology – which is not ideal for steel at the moment – or we switch to direct reduction using natural gas or, in the long term, hydrogen, the latter being

With over 50 years in the Steel Industry, we have a wide variety of solutions to keep your mill rolling.

allow for quick and accurate pass changes

· Honours existing mill attachment points and guide base, no machining on your stands required

· Made from stainless steel and speci cally tailored to your mill ensuring perfect t, operation and longevity

Our roller entry guides keep your product on the pass

· Single point, centralized adjustment during operation

· 2, 3 and 4 roller con gurations

· Rigid, stainless steel construction

· Broad size range

Maximize your mill speed while meeting your quenching requirements on all bar sizes. Not just controlled cooling, but correct cooling

· Fewer surface defects and better scale control

· Available in Box, Trough and Restbar-mounted con gurations

the dominant strategy at the moment,” Wimmer said.

Green steelmaking – the ‘gold standard’

And when we talk about hydrogen steelmaking we are talking about the likes of SSAB/HYBRIT, H2 Green Steel and SALCOS, and are in the process of developing production technologies that rely upon hydrogen as a reductant, not coal, and, therefore, are regarded as the ‘gold standard’ of green steelmaking. But when we consider the raw materials, in particular Australian iron ore, then clearly direct reduction is the solution; but, says Wimmer, the EAF will not fit. Why? Because EAFs demand higher grade iron ore and not the lower grades mined in Australia. “You can build an electric arc furnace technically, you can run it with an incredible amount of slag, but it’s not fun, it’s very slow, it’s very expensive, and the metallurgical process is difficult to handle,” he said.

With the blast furnace on the way out, Wimmer firmly believes that there are two process options available to steelmakers. One is the electric arc furnace (fine if you have access to high grade iron ore). The second is a two-step process based on a new piece of equipment known as the Smelter. The existence of the electric smelter means that the basic oxygen furnace (BOF) can detach itself from the mother ship (the blast furnace) and continue its good work refining hot metal into crude steel. The smelter, therefore, would breathe new life not only into BOFs but also low-grade iron ores.

Looking at it in the cold light of day, then, blast furnaces are fine with low grade and high-grade iron ores. The blast furnace is really the best option for steelmaking and would continue to be blasting away if there was no such thing as a climate emergency. The BF represents the best way to make steel and if other methods are on the table, then operators are going to have to change their raw material. Electric arc furnaces require higher grade iron ore to operate efficiently and the cost equation is too high for some existing integrated steelmakers. Enter the electric smelter! An alternative to the blast furnace that offers users a twostep process in collaboration with the BOF. In short, it will keep the BOF process alive. Wimmer says that raw materials decide the process route. When it comes to electric steelmaking, operators pay the premium

for high grade pellets because they need them. Integrated mills on the other hand often claim that their strength is based on smart purchasing, they buy low-grade raw materials but it’s super cheap. The key takeaway here is that the electric smelter will allow integrated mills to continue purchasing low-grade ores…and all from a piece of equipment that could be described as a ‘simple EAF’ but with the added bonus of enabling sophisticated metallurgy to continue in the BOF, hence the twostep process. In essence, the smelter is a dedicated furnace which is simply melting the iron, reducing and adjusting the slag and separating metal from slag and then straight to the BOF. Wimmer says that the chief advantage for existing operators is they can keep their steel plant largely intact with all the quality certification and ‘the well-aligned processes where the BOF and the secondary metallurgy and the caster fit perfectly to each other’. “That’s a big advantage of this route and that’s why it is especially of interest for existing integrated plants with big BOFs and a big investment in secondary metallurgy and casting equipment,” he said.

The big question, of course, is how long before the electric smelter becomes reality? The answer? Not long. “We have announced that we have signed contracts with voestalpine and with Australian mining company FMG to build a demo plant here in Linz, Austria, for our new green ironmaking process – an innovative combination of our HYFOR direct reduction technology and a smelter.

HYFOR stands for hydrogen-based fineore reduction and uses 100% hydrogen to reliably reduce iron ore fines. The project’s partners for the first HYFOR demonstration plant were Primetals Technologies, K1-MET, Montanuniversität Leoben and voestalpine Stahl Donawitz all of whom, it is claimed, have gained valuable experience from operating a pilot plant at the voestalpine Donawitz site. This plant produces several hundred kg of DRI in discontinuous operation mode since two years ago.

This new ironmaking process is claimed to take things a ‘major step further’ and on an industrial scale. DRI fines leave the HYFOR plant and head directly into the smelter where a product similar to pig iron is produced and can be further processed in the traditional converter process. The plan is to build a demonstration plant in Linz that will produce up to three tonnes of pig iron per hour in a continuous process, all fully based on green hydrogen.

The fact that low-grade and mediumgrade ores account for around 85% of the world’s iron ore supply gives you some idea of the importance of developing the electric smelter especially where CO2-free reduction is concerned, offering clear advantages in terms of global competition for raw material, says Thomas Buergler, CEO of K1MET’s metallurgical competence centre and partner of the HYFOR-Smelter project.

Primetals is also working with South Korean steel giant POSCO with whom it has a long history using its FINEX technology. FINEX is fluidized bed technology and, says Wimmer, direct reduction, which ‘is already quite modern’. However, FINEX uses a coal-fired furnace to melt the raw material

BIGGER.

Superior Machine has joined the Woodings’ group creating the most capable hot metal equipment supplier group in North America. Offering the combined knowledge, engineering, manufacturing, and construction expertise for all your equipment needs.

Wherever hot metal is produced, you will find equipment from Woodings, Superior Machine, and

Munroe operating at the highest level in the most demanding conditions. Our products and professional installation services reduce downtime and extend campaign cycles.

We are better together. Let us show you. woodings.com