METEC 2023 PREVIEW PROFILE STRUCTURAL STEEL FUTURE STEEL FORUM

We take a look at some of the exhibitors

Carol Jackson, CEO, Harbison Walker Intl

Come to Vienna for the seventh Future Steel Forum

Pinkham examines the situation in the USA

For more info

Hall 1

Booth # C05

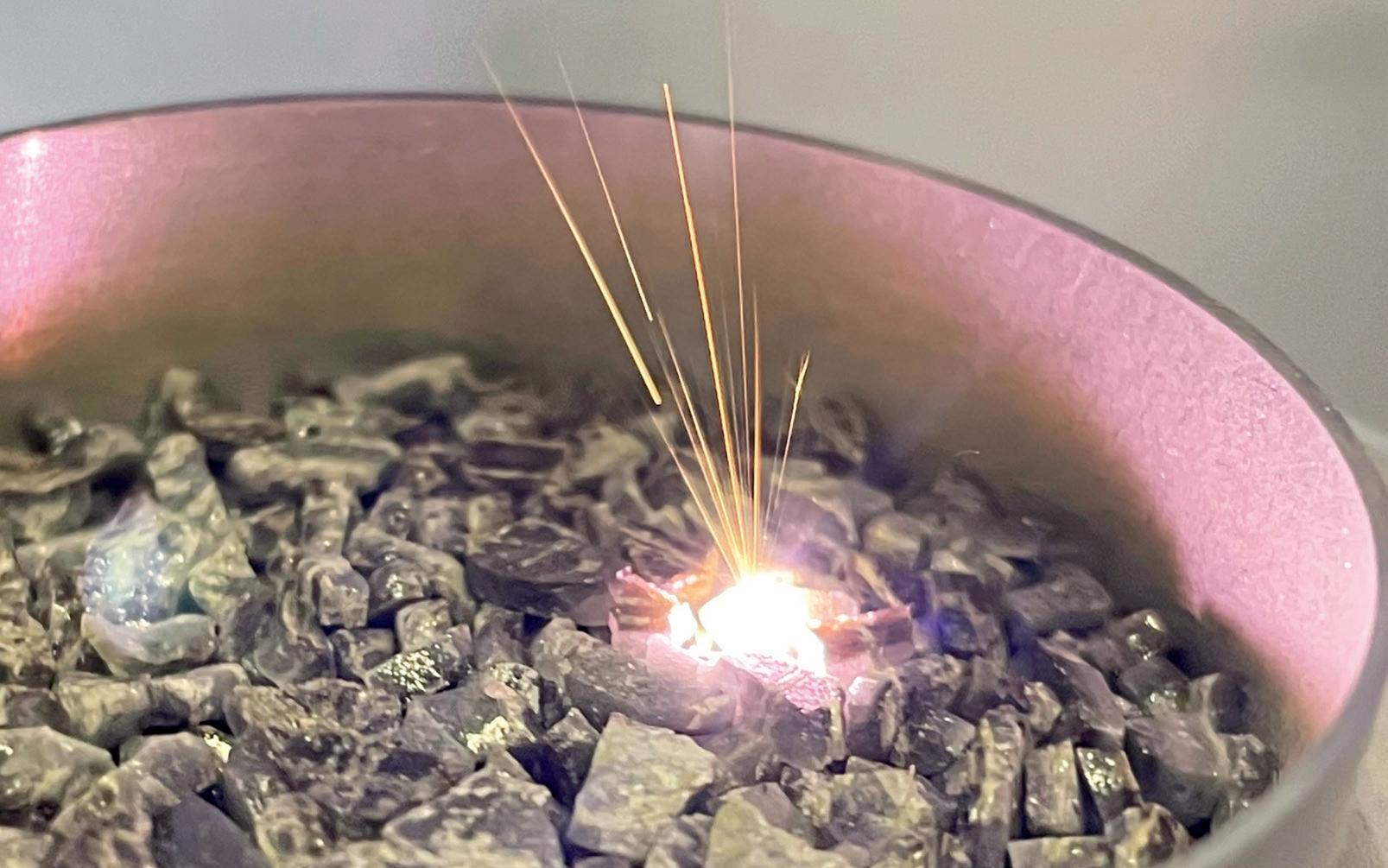

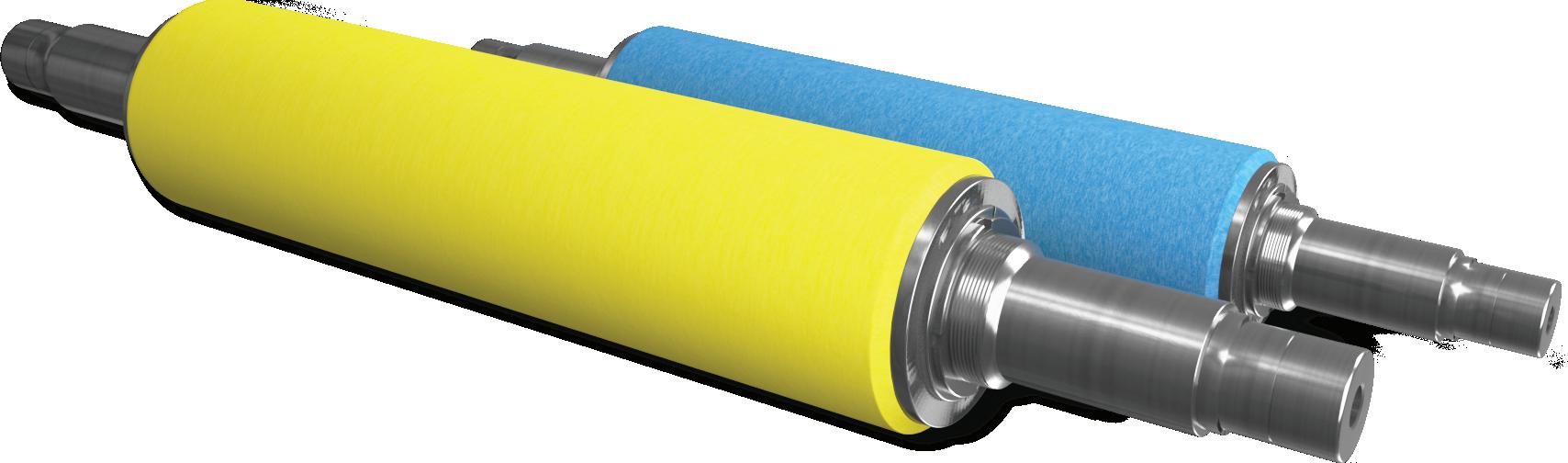

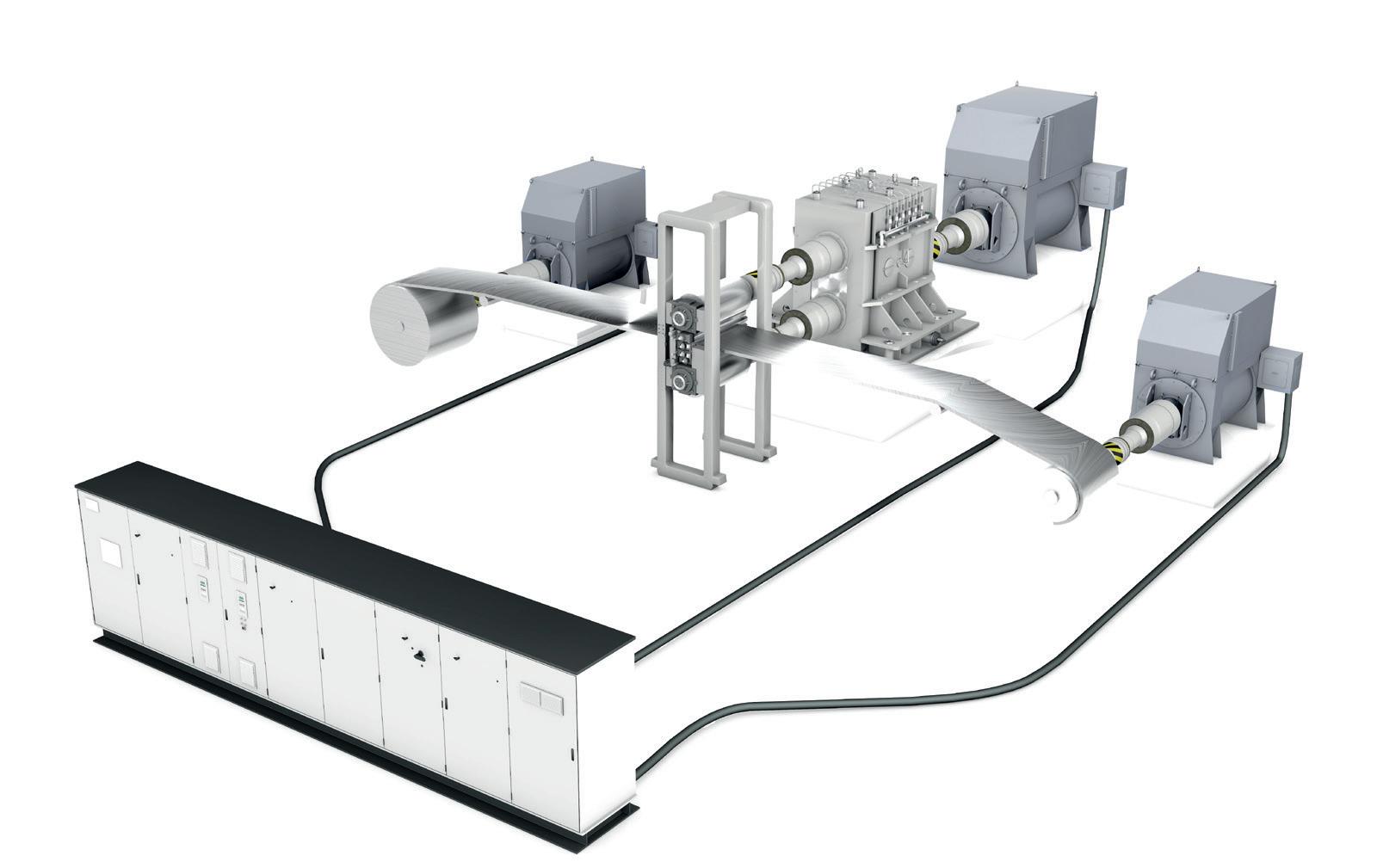

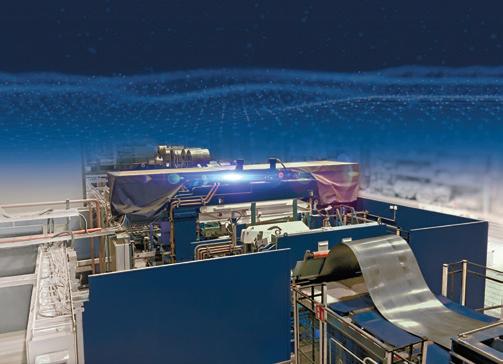

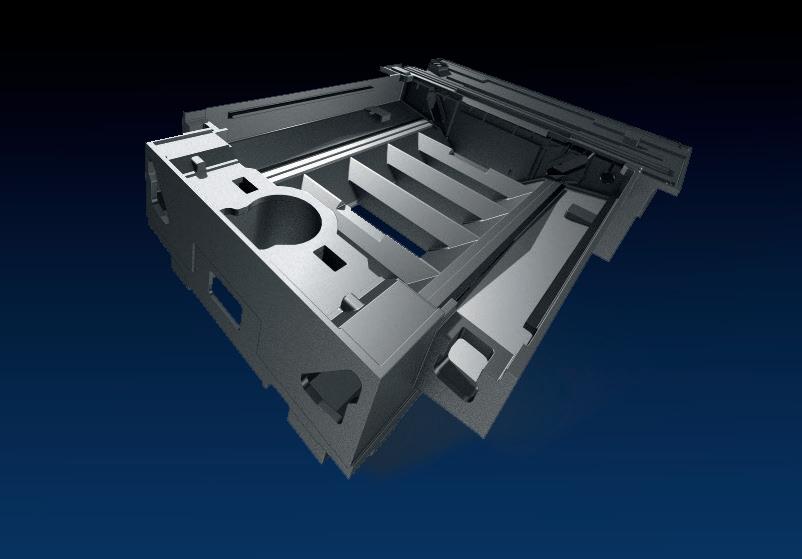

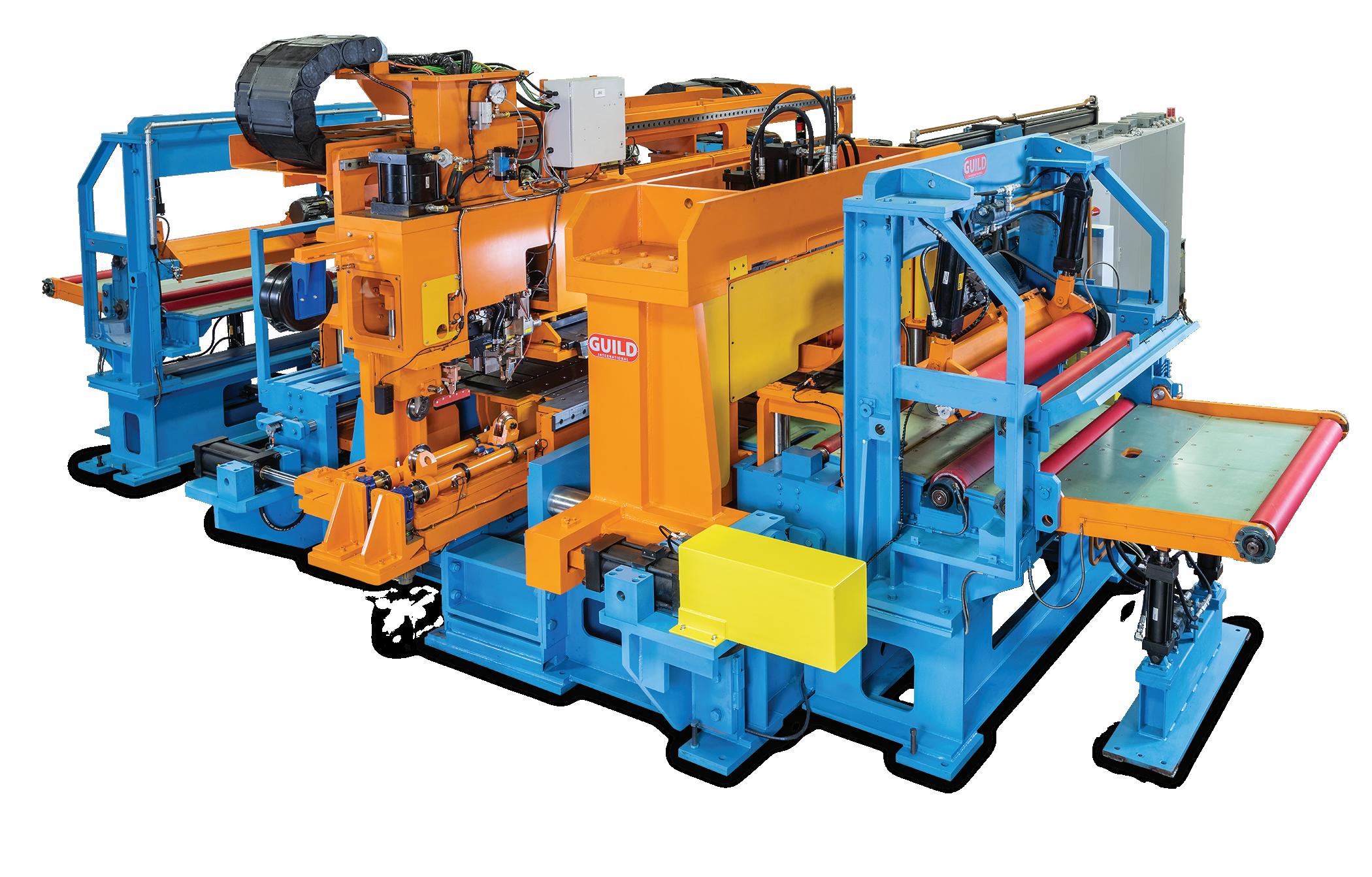

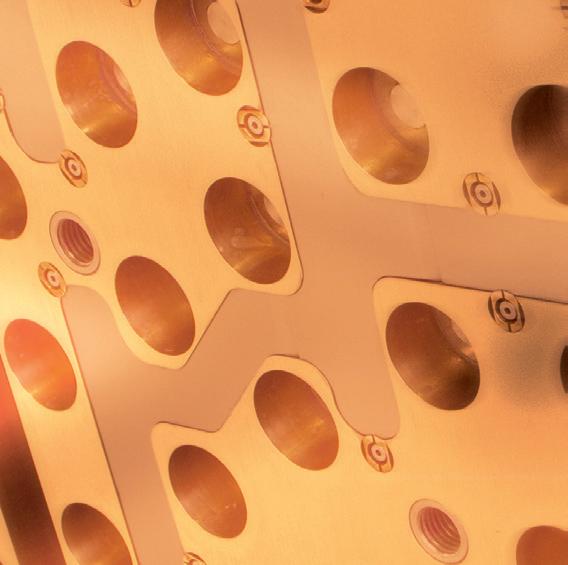

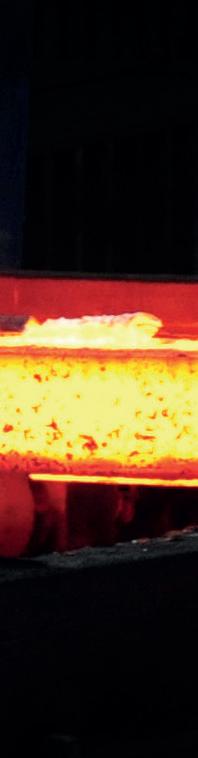

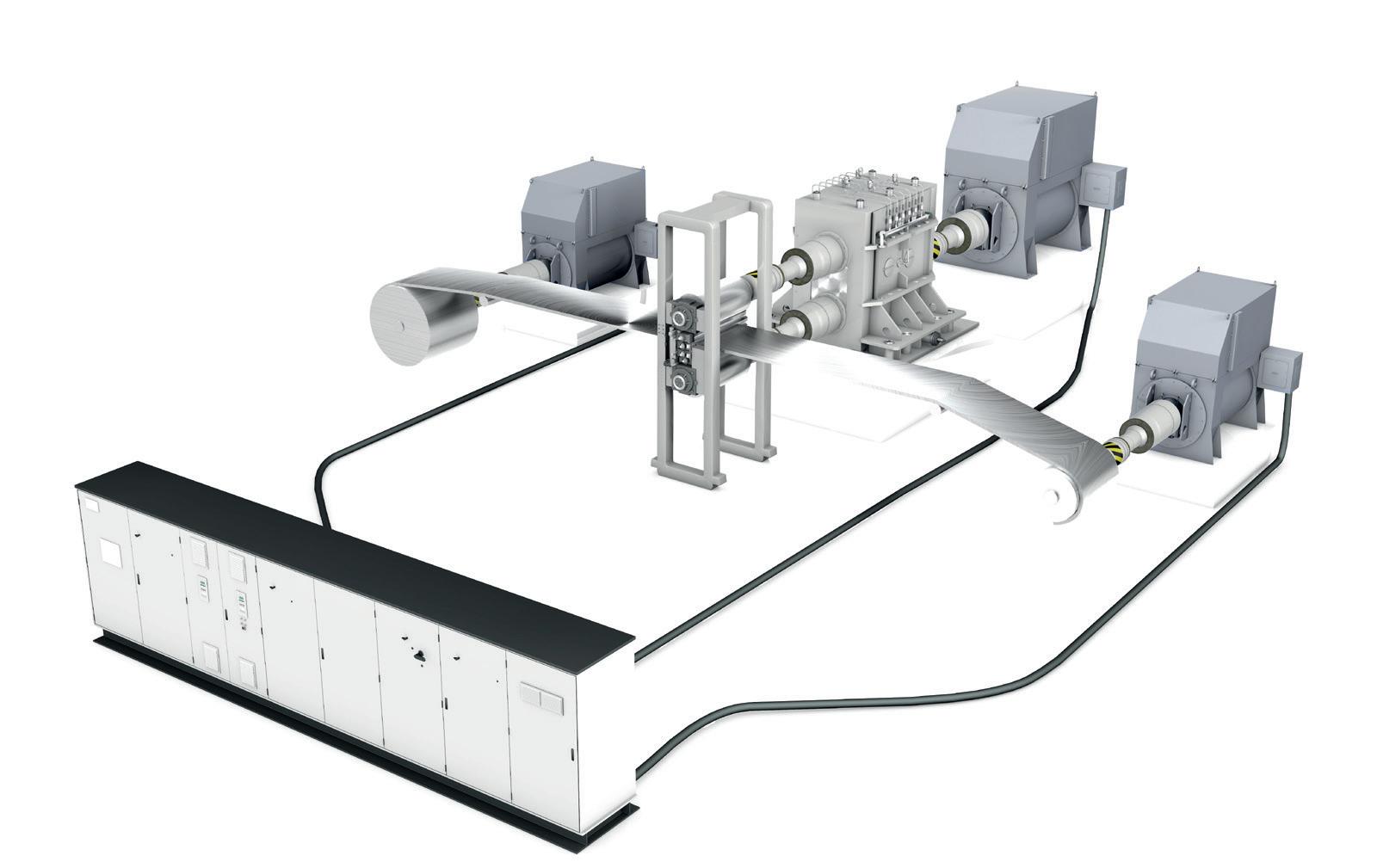

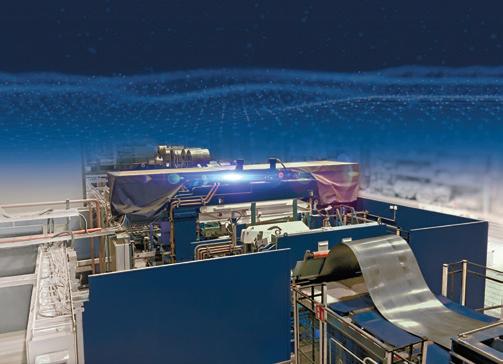

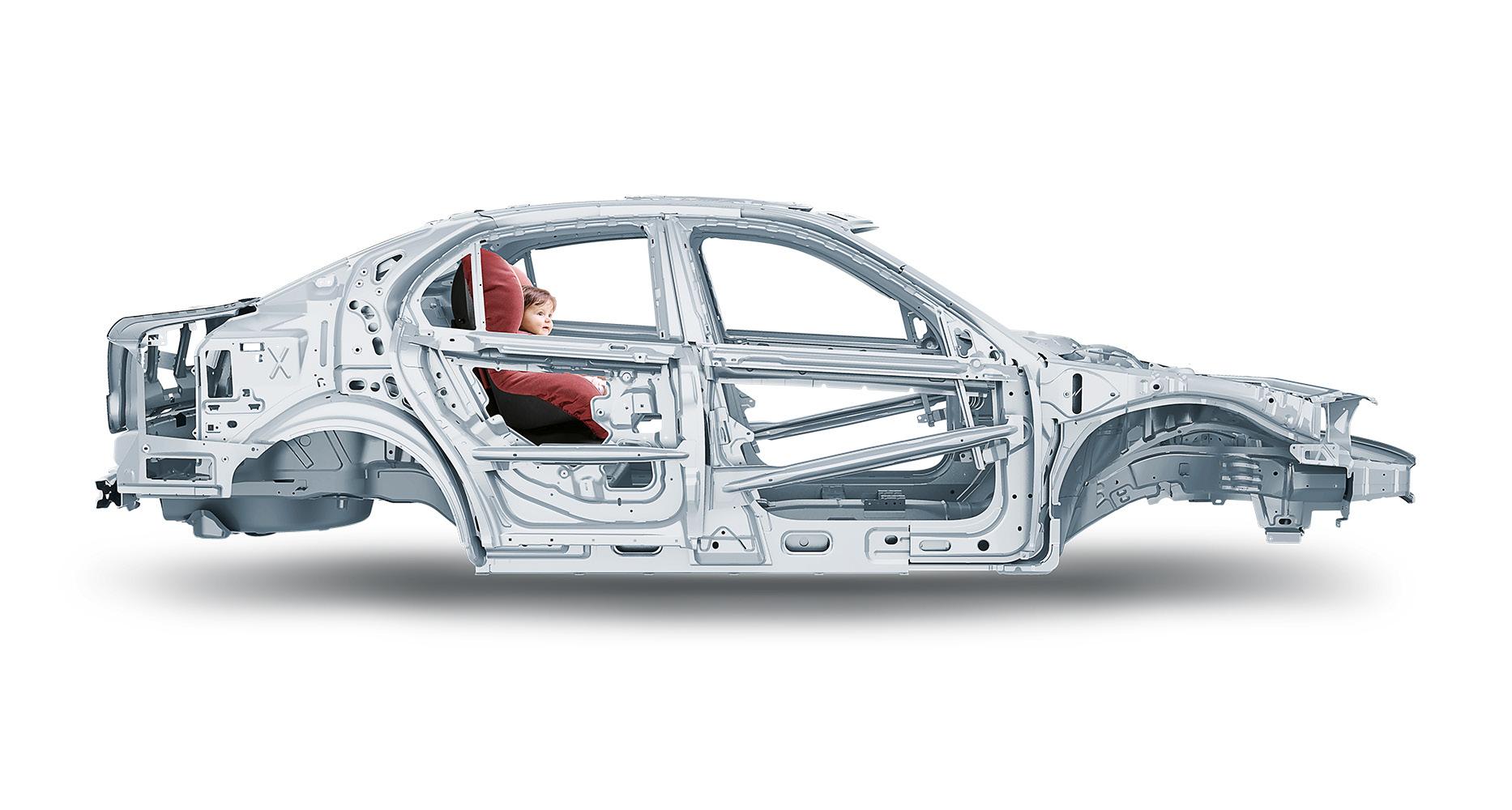

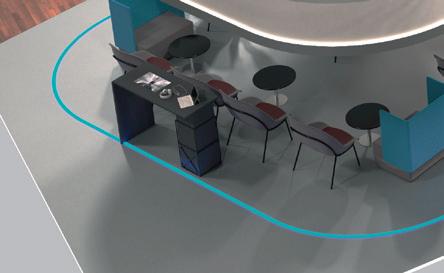

JVD (Jet Vapor Deposition) line

A state-of-the-art solution for the coating of metal strip and a genuine alternative to common steel strip galvanizing owned by ArcelorMittal and commercialized worldwide by John Cockerill

www.steeltimesint.com May/June 2023 - Vol.47 No4

Myra

STEEL TIMES INTERNATIONAL May/June 2023 –Vol.47 No4 ENTER THE ELECTRIC IRON SMELTER...

Since 1866

METEC

Production Management Solutions Today for Generations to Come

Excellence

PSImetals

Software

for Steel and Aluminium Producers

31 Transitioning for growth.

38 Enter the electric iron smelter...

49 Drives to decarbonize. Structural

55 Biding its time.

60 Cutting edge hangar shows its steel.

EDITORIAL

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Editorial assistant

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production

Martin Lawrence

SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

Email subscriptions@quartzltd.com Steel

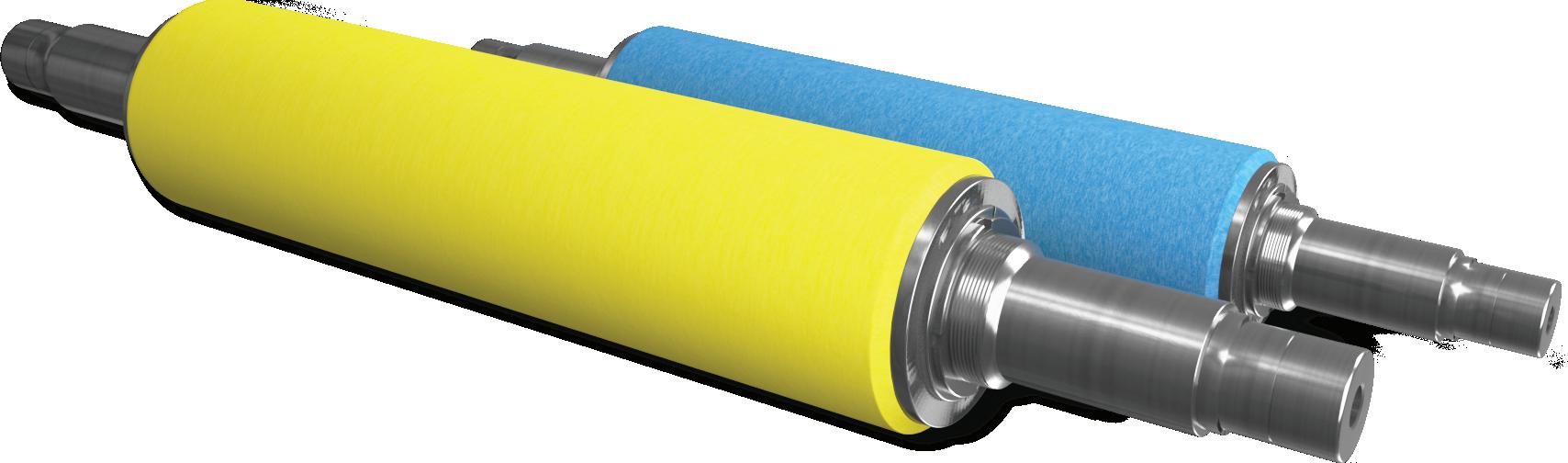

Rolling into the future – we talk to Günther Schnell, managing director, sales and marketing.

79 History

We revisit Romanian steelmaking history with a look at a 19th Century blast furnace at Zimbru, Western Romania

www.steeltimesint.com

Times International is published eight times a year and is available on subscription. Annual subscription: UK £215.00 Other countries: £284.00 2 years subscription: UK £387.00 Other countries: £510.00 3 years subscription: UK £431.00 Other countries: £595.00 Single copy (inc postage): £47.00 Email: steel@quartzltd.com Published by: Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com Steel Times International (USPS No: 020-958) is published monthly except Feb, May, July, Dec by Quartz Business Media Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER send address changes to Steel Times International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in England by: Stephens and George Ltd • Goat Mill Road • Dowlais • Merthyr Tydfil • CF48 3TD. Tel: +44 (0)1685 352063 Web: www.stephensandgeorge.co.uk ©Quartz Business Media Ltd 2023 ISSN0143-7798 Cover courtesy of John Cockerill CONTENTS – MAY/JUNE 1 Decarbonization

steel

63 Refractories

69 Handling Conveying and

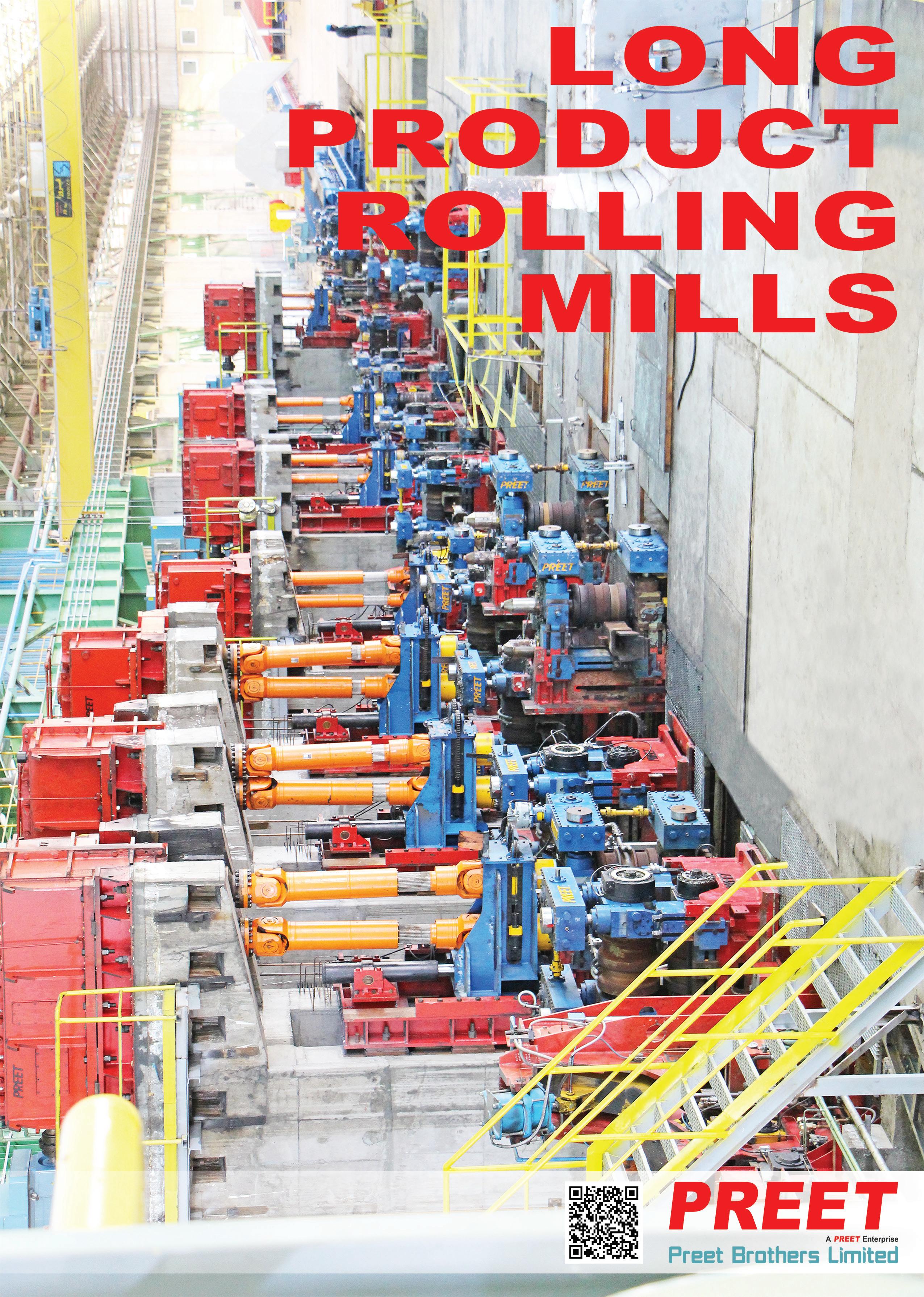

Q&A: Kocks

Maximum longevity.

cooling. 75 Perspectives

2 Leader By Matthew

4 News round-up The latest global steel news. 10 USA update Steel’s price paradox. 15 Latin America update Vallourec’s 70 years in Brazil, Pt.3 18 India update Domestic demand. 22 METEC preview Bringing steel together. 27 Profile: Carol Jackson Making things new. 38

Moggridge.

Net Zero by 2050? What if we don’t achieve that goal?

All over the world, a lot of people are taking more than a passing interest in green steelmaking and, needless to say, doing their bit to save the planet. Millions of dollars are being invested in developing processes to enable makers of the world’s most versatile and infinitely recyclable metal even greener than it is today.

If you want to know where the greenest steel is produced, look no further than North America where over 70% of steel produced comes out of an electric arc furnace. North American steelmakers are rightly proud of their achievements and some of the more vocal stateside steel CEOs are pleased to note that Europe is way behind and may never catch up.

Matthew Moggridge Editor

matthewmoggridge@quartzltd.com

There are, of course, two magical dates that are top-of-mind: 2030 and 2050 – and by the latter date the plan is that everything has to be considerably greener than it is at present. It probably will be, but nobody appears prepared to contemplate words like ‘probably’ as it’s all about ‘definitely’ and not ‘maybe’. That said, there are gathering headwinds. Some observers don’t believe it, and those proffering a more extreme view suggest the current noise is mere posturing. Others

argue that the game is already up and that any hope of mass net zero steelmaking by 2050 is a pipe dream. Steelmakers already know it’s not going to happen on the vast scale envisaged, and that only a minority of manufacturers will wear the slightly smug ‘halo of sustainability’ with pride. For many of the sceptical, the problem is summed up in two words: blast furnaces (BF). Over 70% of steel worldwide is produced in the BF, they’re still being built and there’s more of them to come – particularly in India and China. Blast furnaces are designed to last for decades, a worldwide ban isn’t realistic and some argue that carbon capture – the go-to solution for greener BF steel – sweeps CO2 emissions under the carpet where it lurks ominously.

Others wonder what happens if 2050 doesn’t deliver net zero. The world cannot live without steel, so manufacturers won’t lose any sleep. Steel won’t be banned, mills won’t close and new net zero deadlines will magically appear. There will be heroes among the many zeros, and the steel industry will lurch forwards knowing it is possible to decarbonize and that one day steelmaking will be a carbon-free process.

2 www.steeltimesint.com May/June 2023 LEADER

Norwegian engineering firm Aker Solutions has pledged to buy at least 10% of its steel from low-emissions sources by the end of this decade, by joining the decarbonizing coalition First Movers Coalition (FMC). Led by the World Economic Forum and the US Department of State, the global initiative FMC has been launched by more than 60 companies to establish early markets for clean technologies. Aker Solutions CEO Kjetel Digre said: “Aker Solutions is proud to join the First Movers Coalition to support demand for emerging technologies essential for a net-zero transition.’’

Source: Mining Technology, 30 March 2023

ArcelorMittal SA has announced that AM/NS Luxembourg, the parent company of ArcelorMittal Nippon Steel India (AM/ NS India), has entered into a $5 billion loan deal with a consortium of Japanese lenders. The proceeds will be used to fund the expansion of AM/NS India's annual capacity at its Hazira plant in India to 15Mt from 9Mt, the European steelmaker said in a statement. The expansion will include the development of downstream rolling and finishing facilities for a string of sectors as well as adding 60,000 jobs.

Source: Reuters, 31 March 2023

Staff at Tata Steel’s Corby, UK site handed over 900 Easter eggs to children across the town. The firm holds an annual egg donation scheme which distributes to schools and community groups across Corby. Site communications co-ordinator Marion Dorman commented: “The appeal has been without doubt a phenomenal success and exceeded our wildest expectations. We say this time and time again, but the generosity of our employees never ceases to amaze our community.’’

Source: Northamptonshire Telegraph, 1 April 2023

The former CEO of a collapsed British steel trader was sentenced to six and a half years in jail by a London court for his part in a ‘widespread and systematic’ trade financing fraud. Nasser Alaghband, who was the chief executive of London-based commodities trader Balli Steel, had pleaded guilty to one count of fraudulent trading before the trial. Prosecutors said he helped obtain trade financing for Balli Steel, which involved telling ‘increasingly egregious lies’ to banks as the company's financial position deteriorated in 2012 and 2013.

Source: Reuters, 4 April 2023

ArcelorMittal Europe and Spanish steel producer Bamesa have entered into a memorandum of understanding (MOU) to enhance their joint efforts to decrease CO2 emissions and leverage XCarb solutions. The MOU was signed at Bamesa’s headquarters located in Barcelona, Spain, and centres on the collaboration between the two companies to explore strategies for decreasing scope three emissions, which are linked to purchased steel. It also focuses on ways to advance and assess the utilization of recycled steel in products with low-carbon emissions.

Source: yahoo!news, 4 April 2023

Steel has been cut for the first of the second batch of Type 26 warships, following a £4.2 billion contract awarded to UK aerospace company BAE Systems in November 2022. The UK minister for defence procurement, Alex Chalk, marked the occasion at the steel cutting ceremony, with HMS Birmingham becoming the fourth of eight anti-submarine warships being constructed for the Royal Navy at BAE Systems’ Govan shipyard in Glasgow.

Source: Gov.uk, 4 April 2023

ArcelorMittal has signed a joint venture with energy supplier Vulkan Energiewirtschaft Oderbrücke (VEO) and McPhy Energy, a company that specializes in low-carbon hydrogen production and distribution equipment (electrolyzers and refueling stations), with the goal of building a pilot electrolysis plant and a hydrogen filling station at its Eisenhüttenstadt site.

The State of Brandenburg is funding the project with an investment of €5.1 million as part of a regional innovation cluster. Source: yahoo!finance, 5 April 2023

4 NEWS ROUND-UP

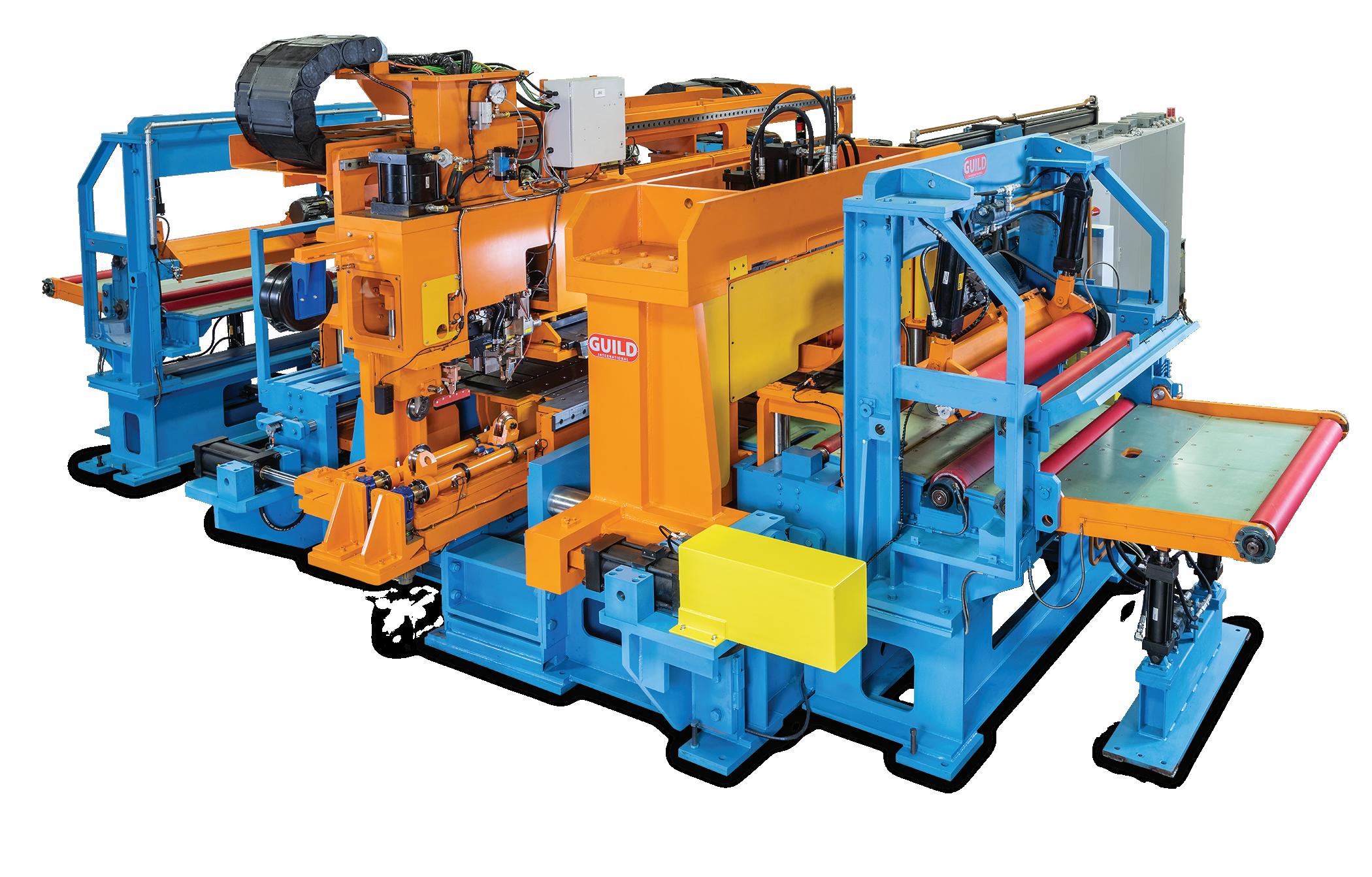

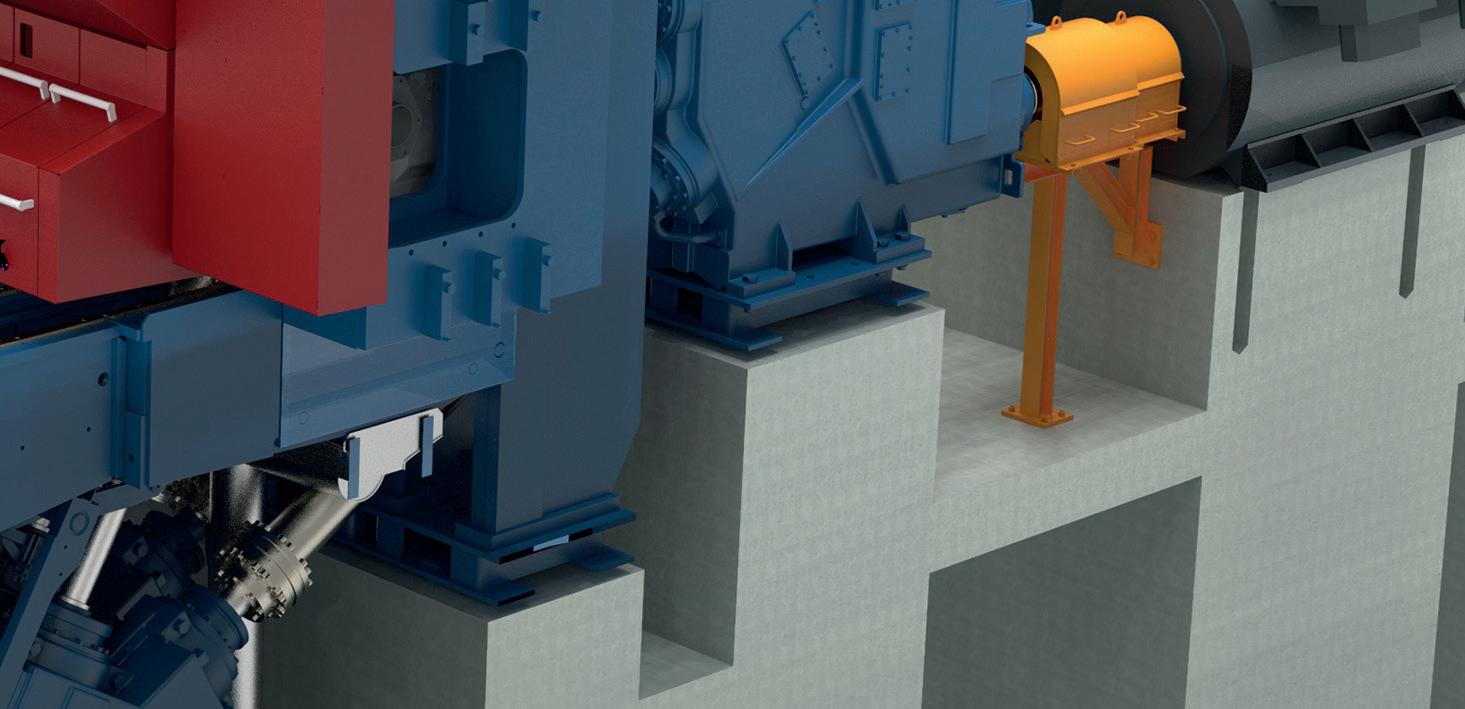

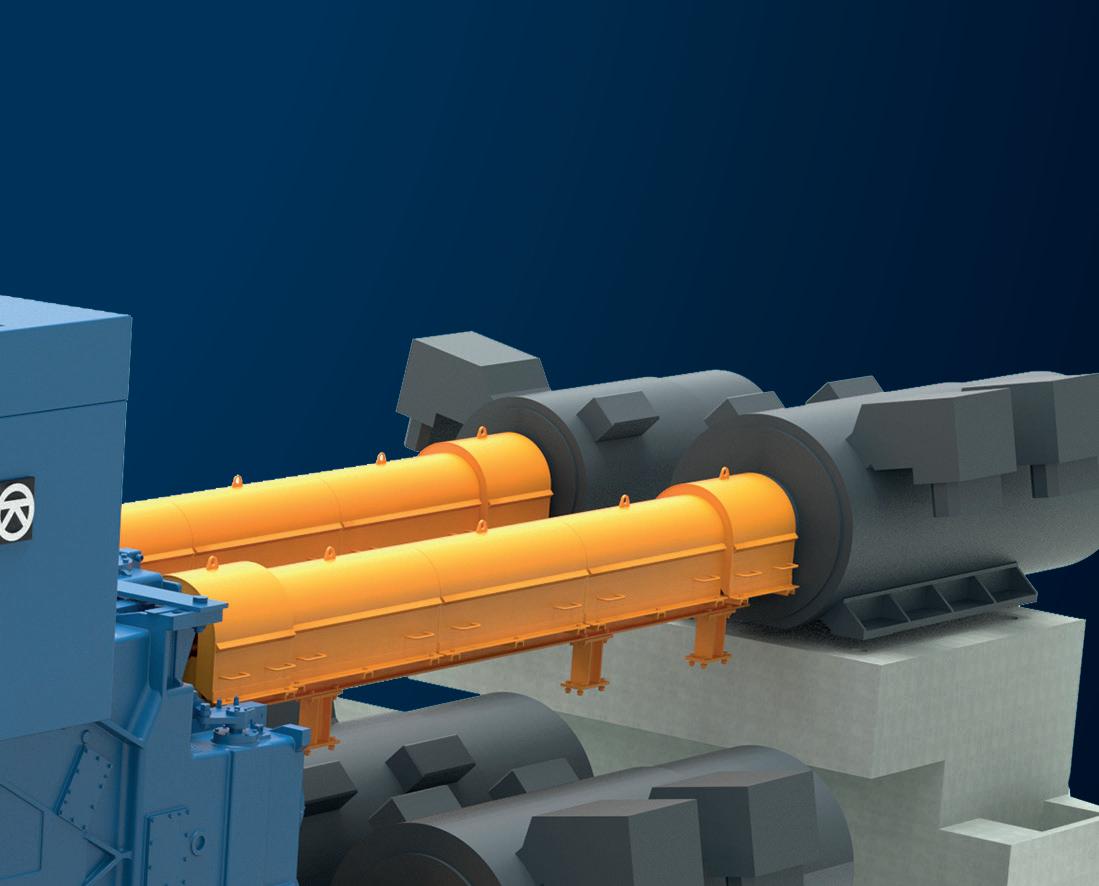

ORANGE IS THE NEW GREEN.

REDEFINING SUSTAINABLE METALS PRODUCTION

As the metals industry transforms in pursuit of green steel, the future of sustainability demands pioneers and leaders with vision, courage, and a willingness to push the boundaries of innovation and eco-friendly metals production. Primetals Technologies is redefining sustainable metals production.

We’re making orange the new green.

LEARN MORE AT METEC 2023

primetals.com

Greenwave Technology Solutions Inc. of Chesapeake, Virginia, has opened a scrap metal facility in Cleveland on a 10-acre site. The property has access to an adjoining railroad to transport processed scrap metal. Hundreds of local businesses and individuals are accustomed to selling their metal scrap to facilities in the vicinity on a regular basis, according to Greenwave Technology. The scrap facility will create 15 to 20 local and offer an opportunity to repurpose ferrous and nonferrous scrap metal from the industrial sector.

Source: Recycling Today, 7 April 2023

Australian steel products manufacturer Molycop and its research partners have commercialised a way of using waste rubber for a cleaner steelmaking process. Molycop produces over 240kt of train wheels, steel bars and other products annually and has worked with recycling scientist Professor Veena Sahajwalla on her breakthrough technology for green steel. Sahajwalla initially worked with OneSteel to develop a process to make green alloys by using waste rubber and plastic. Since then, working with industry partner Molycop for the past decade, millions of tyres have been diverted from landfill.

Source: The West Australian, 6 April 2023

Oman's Public Authority for Special Economic Zones and Free Zones (Opaz) has signed an agreement with Japanese steelmaker Kobe Steel, and investment company Mitsui & Company, for setting up a low CO2 iron metallics project in the special economic zone in Duqm. Under the agreement, the companies will commercialise the manufacture and sale of direct reduced iron (DRI) produced through Kobe Steel’s Midrex Process in co-ordination with Opaz.

Source: Zawya, 11 April 2023

A legal challenge against the Financial Conduct Authority’s (FCA) decision to set up a redress scheme for former British Steel Pension Scheme (BSPS) members has been scrapped. According to press reports, the British Steel Advisor Group (BSAG) has dropped its challenge and paid the FCA £100,000 towards its costs. It had hired legal solicitors to represent its challenge to the redress scheme and the lawyers filed an application on 23 December at the Upper Tribunal Tax and Chancery Chamber.

Sheffield Forgemasters has landed a multi-million-pound US order which is set to keep the plant ‘busy for a year’. The Brightside steelmaker will produce three 147-tonne ’ultra-large steel rolls’ for a new mill near Louisville, Kentucky. Customer Nucor, the largest steel producer and recycler in North America, will use the rolls to produce steel plates used in bridges,

ships and oil rigs. The deal will help safeguard jobs at Forgemasters which employs more than 600, bosses say.

Source: The Star, 12 April 2023

Friends of the Earth and South Lakes Action on Climate Change (SLACC) have asked the UK High Court to reconsider its refusal to hear a legal challenge over the government’s decision to grant planning permission for a new coal mine in Cumbria, UK. Friends of the Earth and SLACC sought permission for a legal challenge after Michael Gove, secretary of state for levelling up, housing and communities, gave planning permission to the controversial coking coal mine in December 2022. The climate organisations were the two main parties opposing the coal mine at the planning inquiry which took place in September 2021.

Source: Friends of the Earth, 12 April 2023

Source: Financial Planning Today, 12 April 2023

ArcelorMittal Brazil has received Responsible SteelTM certification for developing ‘high quality standards for steel production at its Vega plant in Sao Francisco do Sul in Brazil’s Santa Catarina state. Having obtained certification in 2022 for ArcelorMittal Tubarão and ArcelorMittal Monlevade, ArcelorMittal aims to have all the groups’ production units in Brazil certified in the coming years.

Source: Steel Orbis, 12 April 2023

6 NEWS ROUND-UP

#turningmetalsgreen Our mission to create a climate-neutral and digital metals industry Hall 1, booth E40/41 Experience our solutions and technologies for turning this mission into reality. We are looking forward to your visit and excited to discuss your ideas on future technologies. Get your free ticket and register as a #connect member on our website. Join our "Leading Partner Talks" on the booth or in our livestream. www.sms-group.com/metec2023

European steel giant Voestalpine has identified a former container terminal site in Hull, UK, as ‘ideal’ for a new logistics facility, having won a major contract on the highprofile build. The Austrian business’s railway systems subsidiary will supply points and crossings for the first two phases of the project. A total of 20 jobs could be created at the rail-linked location, with an application lodged with Hull city council for a 50m by 20m warehouse, a two-storey modular office building, and a welfare unit.

Source: Business Live, 13 April 2023

India’s Tata Steel Ltd. is in talks to raise as much as $400 million, according to people familiar with the matter, in what could become the company’s first green loan. The debt could have a tenor of about five years and the proceeds would be used for capital expenditure, said the people, who declined to be named. The lenders include Bank of America, HSBC Holdings, JPMorgan Chase & Co. and Mitsubishi UFJ Financial Group Inc.

Source: Bloomberg UK, 18 April 2023

Tata Steel officials, with the help of West Bengal Police, recently conducted a raid on a manufacturing unit situated in Kolkata. The officials together with the police undertook the raid because of citizens having ‘infringed the Tata brand name and allegedly manufactured and sold fake Tata-bearing products illegally’. The products were being manufactured and sold under the registered ‘TATA’ trademark in similar packaging in an attempt to deceive consumers into believing that they were purchasing genuine Tata products. Those responsible have been charged and are awaiting trial.

Source: Goa Chronicle, 14 April 2023

Low-sulphur fuel-grade petroleum coke may gain some support from a recent Indian Supreme Court ruling allowing the country's steelmaking industry to resume coke imports. The court ruled in late March that Indian steelmakers may import petroleum coke for blending with coking coal, subject to a number of conditions. As a result, at least two Panamax cargoes of US west coast sulphur coke have already been sold to an Indian steelmaker, one trader said.

Source: Argus Media, 14 April 2023

South Africa must accelerate its programme to produce decarbonized steel if it is to take advantage of Europe’s scramble to be carbon neutral, according to an industry expert. Speaking at a workshop hosted by Trade and Industrial Policy Strategies (TIPS) and the Leadership Group for Industry Transition (LeadIT), in Johannesburg, independent consultant Hilton Trollip said hydrogen direct reduced iron (H-DRI) – which is produced

Engineering company Siemens Gamesa says its next generation of turbine towers will be built from steel with a 63% lower carbon footprint than before. At 120 metres and taller, the manufacturer says the giant structures’ strength, longevity and other in-service characteristics will be unaffected. Until now the steel used in tower construction has accounted for around a third of a turbine’s lifetime carbon emissions. However, with new production methods employed by the multinational’s suppliers, emissions have been cut to 0.7 tonnes of CO2 per tonne for steel.

The US Justice Department has announced the indictment and arrest of John Can Unsalan, the president of Metalhouse LLC, for engaging in a three-year scheme to violate US sanctions against oligarch Sergey Kurchenko and two of his companies by providing those sanctioned parties with over $150 million in return for steelmaking materials. As alleged in the indictment, between July 2018 and October 2021, Unsalan, acting through his company, Metalhouse, transferred over $150 million to Kurchenko and companies controlled by Kurchenko. In return, Unsalan received metal products used in steelmaking and attempted to collect millions of dollars of funds for undelivered products.

Source: United States Department of Justice, 17 April 2023

using green hydrogen instead of natural gas – is almost certain to be a central component of steelmaking and will need to be adopted by the region’s producers.

Source: Business Day, 19 April 2023

Source: The Energyst, 21 April 2023

8 NEWS ROUND-UP

Solid fuel manufacturer and supplier CPL Industries has commenced construction of what will be a £5 million industrial process plant. The aim of the facility is to provide technology to help clean up steel and other heavy industries in the Port of Immingham, UK. The company is investing after securing a significant grant from the government’s net zero innovation portfolio to ramp up research and development in turning food waste into biochar, a high-carbon material that, if processed further, could be used as a coal replacement.

Source: Business Live, 21 April 2023

A Dorset structural steel firm has resigned its membership of the Confederation of British Industry (CBI) with immediate effect. Christchurch-based John Reid & Sons (Strucsteel) – known as REIDsteel –left the business lobbying group after further serious allegations emerged about misconduct. Simon Boyd, managing director, has resigned his position as a founder member of the CBI’s manufacturing council. The business – which employs 130 people – acted immediately, citing allegations of misconduct at the organisation as completely incompatible with its own company values.

Source: Dorsetbiznews.co.uk, 22 April 2023

North American mine operator Bens Creek Group has completed the delivery of 44kt of coal to an Indian steel producer. The company said the order, which was delivered to a ship at Norfolk, Virginia, using four trains, is part of a larger order made through its offtake partner Integrity Coal Sales Inc, which will be completed by July 2023. Bens Creek said the unnamed steel producer is ‘India's largest’.

Source: Alliance News, 28 May 2023

Tata Steel has inaugurated the JN Tata Vocational Training Institute near its plant at Khopoli, in western India, with a focus on skill development for local youth. The institute aims to empower local students by improving their skills and increasing employment opportunities. Expressing gratitude for the initiative, Subodh Pandey, vice president, operations, Tata Steel Meramandali, said, “As the industrial expansion is rapidly advancing, it is resulting in a demand for a significant number of skilled workforces. I hope the institute [will] contribute to the growth of a skilled manpower pool for the local industry ecosystem and beyond.’’

Source: India CSR, 30 April 2023

carbon neutrality by 2050. The company has also installed electric charging stations at its Mont-Wright and Port-Cartier facilities to support and encourage the electrification of transportation.

ArcelorMittal Mining Canada

GP has become the first mining company in Québec and on the North Shore to use electric buses to transport its employees. The initiative is a part of ArcelorMittal’s sustainable development strategy, which aims to reduce its greenhouse gas emissions by 25% by 2030 and achieve

Source: Energy and Mines, 1 May 2023

China's biggest listed steelmaker, Baoshan Iron and Steel, has signed agreements with natural gas company Saudi Aramco and Saudi Arabia’s sovereign wealth fund, Public Investment Fund (PIF), to build a steel plate manufacturing joint venture. Baosteel will a take 50% stake in the joint venture, while

Saudi Aramco and PIF will take 25% stake each, Baosteel said in a statement. The joint venture will involve the construction of a steelmaking manufacturing base in Saudi Arabia, with the designed annual capacity of 2.5Mt of direct reduced iron and 1.5Mt of steel plate.

Source: Reuters, 2 May 2023

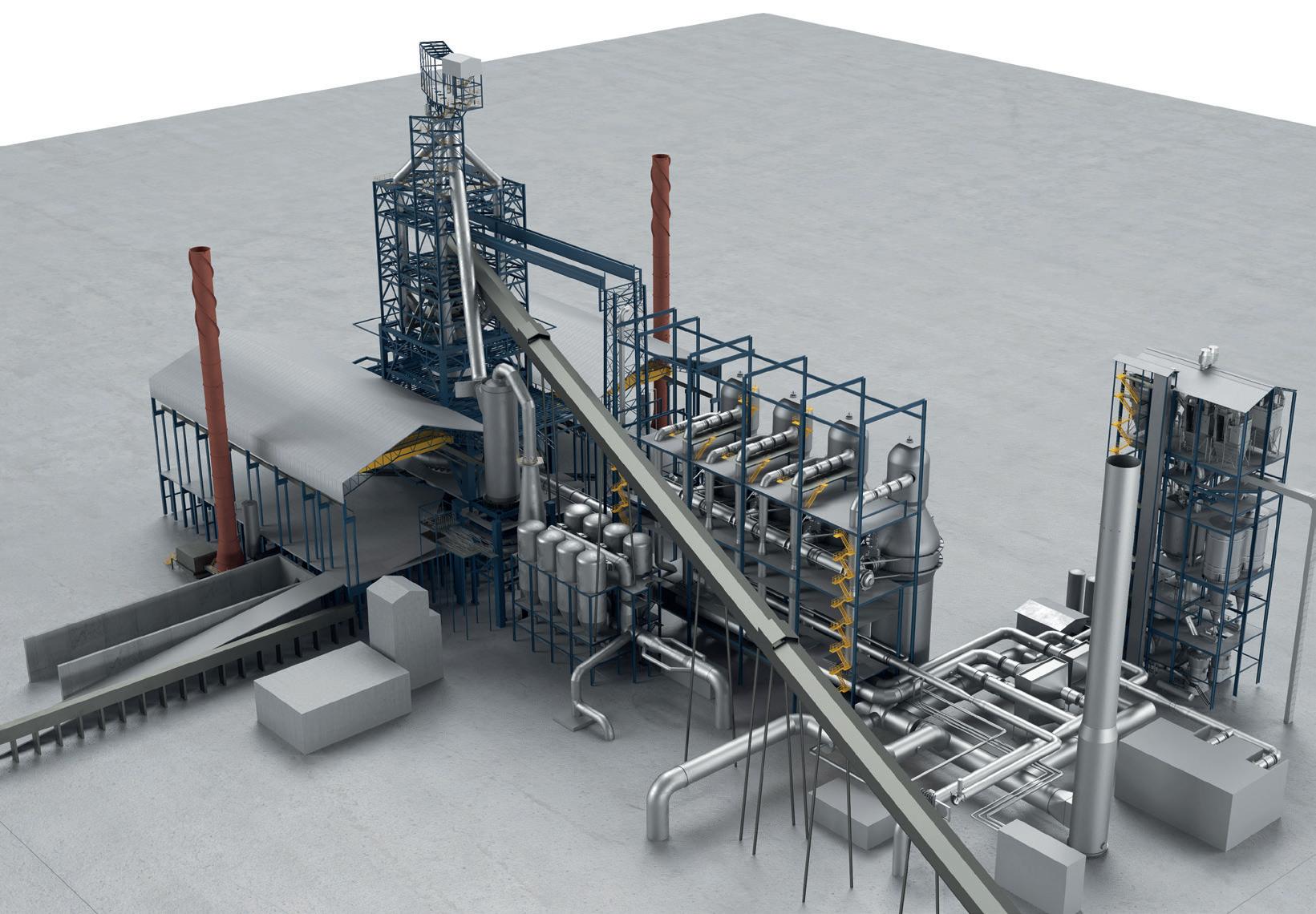

Italian plant supplier Danieli has shipped melt shop cranes and a Q-SYM2 automated scrap yard, featuring automatic cranes, scrap visual-recognition, and automatic scrap sorting and charging equipment, to Canada-based Algoma Steel. Danieli says four additional fully automated cranes are being built for the Algoma scrap yard, and one has been inspected. The cranes will be equipped with scanning technology, which according to the company, makes it possible to check ‘for any undesirable type of material within the scrap before the transfer into the scrap bucket.’ Source: Recycling Today, 2 May 2023.

www.steeltimesint.com 9 NEWS ROUND-UP

Steel’s price paradox

The rise of steel prices is a ‘paradox’ says Manik Mehta*, with demand remaining stable despite prior market predictions.

IT is indeed a paradox of how – or rather why – steel prices have risen in previous months and now seem to be stabilizing, according to market indications. If in 2022 the Ukraine crisis coupled with shortages of vital raw materials led to price increases in the US, the discussion about the heady price surge concentrates on a plurality of issues.

As 2022 ended, US servicing centres had envisaged an abundance of flat steel to be available and, consequently, decided not to engage in purchases at higher prices, amid signs at that time that prices were on the verge of declining.

Nonetheless, demand has remained stable, by and large, repudiating the market expectations. Even before the year 2023 commenced, US facilities had begun to slash their stocks bringing them down to levels that were unprecedented before. They acted out of fear that if demand cooled down, they would have piled stocks purchased at higher prices.

Although there is demand for additional steel, producers with new production facilities, such as Steel Dynamics in Texas and Nucor’s expanded mill in Kentucky, have yet to return to normal production levels. However, they believe that they will fare better in the second quarter of the year.

Notwithstanding the inventory issue, data on steel production in the Great Lakes region, for instance, showed a steady rise for the sixth consecutive week as of early April. Steel production rose by 12kt in the Great Lakes region, rising by 54kt after its sixth straight week of increases, according to the American Iron & Steel Institute (AISI). Steel mills in the Great Lakes region –concentrated mainly along the south shore of Lake Michigan in Northwest Indiana –produced 574kt of the metal in the week ending 8 April, up 562kt from the previous week.

However, steel mills remained well below the 80% capacity which is considered a

*US correspondent, Steel Times International

key threshold determining financial success for the steel sector. On a national basis, steel production in 2023 totalled 23.23Mt, a 4.3% decline from the 24.32Mt of last year’s corresponding period. Capacity utilization had also declined to 74.4% in the week of 8 April, down from 80.3% in the same week of 2022, AISI data suggested.

In a regional comparison, steel production in the southern region, which has many mini-mills and rivals the Great Lakes in output, totalled 677kt in the week under report, up from 671kt the week before. But volume in the rest of the Midwest fell to 206kt, down from 222kt the week prior.

Pittsburgh-based steel producer US Steel has, meanwhile, resumed operations of its No.8 blast furnace at its Gary Works steel mill. US Steel had idled both the No.3 blast furnace at Mon Valley Works in Pennsylvania and the No.8 furnace in Gary, Indiana, last year following the sharp decline from the high levels of 2021 as fears

www.steeltimesint.com May/June 2023 USA UPDATE 10

LEVEL UP GO ELECTRIC

Bring your heating operations to a new level while avoiding emissions. Electric heating technology improves safety, reduces maintenance needs, increases energy efficiency, is quiet to run and enables minimal CO ².

Kanthal will help you get started today.

of a recession had seized the market.

US Steel resumed operations at both blast furnaces as the market recovered with rising demand and improving prices. US steelmakers benefited, particularly, from the auto industry’s production surge after having been hit, in past years, by semiconductor and other supply chain shortages.

US Steel, in a press release, said that the flat-rolled segment’s order book reflected ‘broad improvements across most endmarkets’.

The Gary plant’s blast-furnace, which has a capacity of 1.5Mt/yr of iron, had been idled for a maintenance project last year, with the plan to resume operations in August following construction work of three months duration; however, market conditions did not appear to be favourable for the planned re-start, making US Steel postpone the re-opening until the revival of demand.

US Steel’s spokesperson, Amanda Malkowski, said that the company was monitoring market conditions closely and planned to resume operation of the furnaces when business conditions allowed, adding that there would be no impact on employment at the plant.

Meanwhile, a debate seems to have erupted within the US industry on the overall impact of tariffs imposed on steel and aluminium imports. The latest study by the US International Trade Commission analyzes the impact of tariffs on imports of a number of China-made products.

The USITC studied the effects of Section 232 on steel and aluminium from China as well as Section 301 tariffs on scores of other imports from the country. The added duties date back to 2018, when they were introduced by the Trump Administration which acted against China’s industrial and

trade policies.

The USITC study found that as a result of tariffs between 2018 and 2021, steel imports fell by 24% on average as a result of the tariffs, while US production volume increased 1.9% and prices by 2.4%.

Aluminium imports fell 31.1% on average, while US production volumes increased 3.6% while prices rose 1.6%.

Imports of other China-made products that faced Section 301 tariffs, fell by 13% on average while the value of domestic production rose by an average of 0.4%.

Even as the US steel and aluminium industries benefited from increased production and higher prices, the effects were ‘largely negative’ on downstream manufacturers purchasing the metals as inputs, though the precise effects varied by industry, according to USITC.

Production decline

Overall, production for those industries downstream from steel and aluminium production — which include various machine and tool manufacturers and other producers — fell by nearly 3%, and by as much as $469 million in some industries.

The Biden administration has retained the tariffs imposed by the Trump administration and has signalled it will continue to do so for the foreseeable future.

Based on the Commerce Department’s most recent Steel Import Monitoring and Analysis (SIMA) data, the AISI reported recently that steel import permit applications for the month of March had totalled 2.7Mt (net tons). This was a 23.1% increase from the 2.19Mt (net tons) recorded in February and an 18.2% increase from the February final imports total of 2.28Mt (net tons). Import permit tonnage for finished steel in March was 1.94Mt (net tons), up 11.1% from the final imports total

of 1.74Mt (net tons) in February. For the first three months of 2023 (including March SIMA permits and February final imports), total and finished steel imports were 7.6Mt and 5.6Mt (net tons), down 10.4% and 14.0%, respectively, from the same period in 2022. The estimated finished steel import market share in March was 22% and 23% year-to-date.

In March, the largest steel import permit applications were for Canada (636kt), up 18% from February; Brazil (509kt), up 44%); Mexico (435kt, up 14%), South Korea (179kt), down 21%; and Japan (124kt), up 129%). Through the first three months of 2023, the largest suppliers were Canada (1,76Mt), up 4%; Mexico (1,27Mt), down 18%; and Brazil (1,25Mt), up 27%.

In other news...

The Global Steel Dynamics Forum (GSDF) is scheduled to take place in New York from 26-28 June 2023. The GSDF is being organized by World Steel Dynamics (WSD) and the AIST.

WSD is based in Englewood, New Jersey, while AIST is headquartered in Pittsburgh, Pennsylvania. The GSDF will feature high-profile speakers from the steel sector, including Lourenco Goncalves, chairman/president/CEO of Cleveland Cliffs, Inc., Leon Topalian, chair, president/CEO of Nucor Corp., Jeong Woo Choi, CEO of POSCO Holdings, Mark Millett, cofounder/chairman/CEO of Steel Dynamics, Inc, Yuri Byzhenskov, CEO of Metinvest, Ron Ashburn, executive director of AIST, Philipp Englen, CEO of WSD, Edwin Basson, director general of the World Steel Association, Philip Bell, president of the Steel Manufacturers’ Association, Kevin Dempsey, president/CEO of the AIST, and Alan Kestenbaum, executive chairman/CEO of Stelco. �

www.steeltimesint.com May/June 2023 USA UPDATE 12

DANIELI INTELLIGENT PLANT A NEW CONCEPT FOR PLANT AND PROCESS SUPERVISION Data-driven approach, AI and machine learning for continuous improvement of plant performances, simplifying metals complexity Via Bonaldo Stringher, 4 33042 Buttrio (UD) Italy Phone +39 0432 518 111 www.digi-met.com www.dca.it Follow us on Linkedin

Global greenhouse gas emissions continue to rise despite the global effort to decarbonize. The need for action is now more urgent than ever before.

John Cockerill is committed to help its steelmaking clients enhance product performance and effectively reduce emissions, all while preparing for the needs of tomorrow’s steels.

11th international metallurgical trade fair with congresses June 12-16, 2023 Düsseldorf, Germany Join us booth Hall 1 #C05 Follow us on johncockerill.com/industry

Vallourec’s 70 years in Brazil (Pt. three)

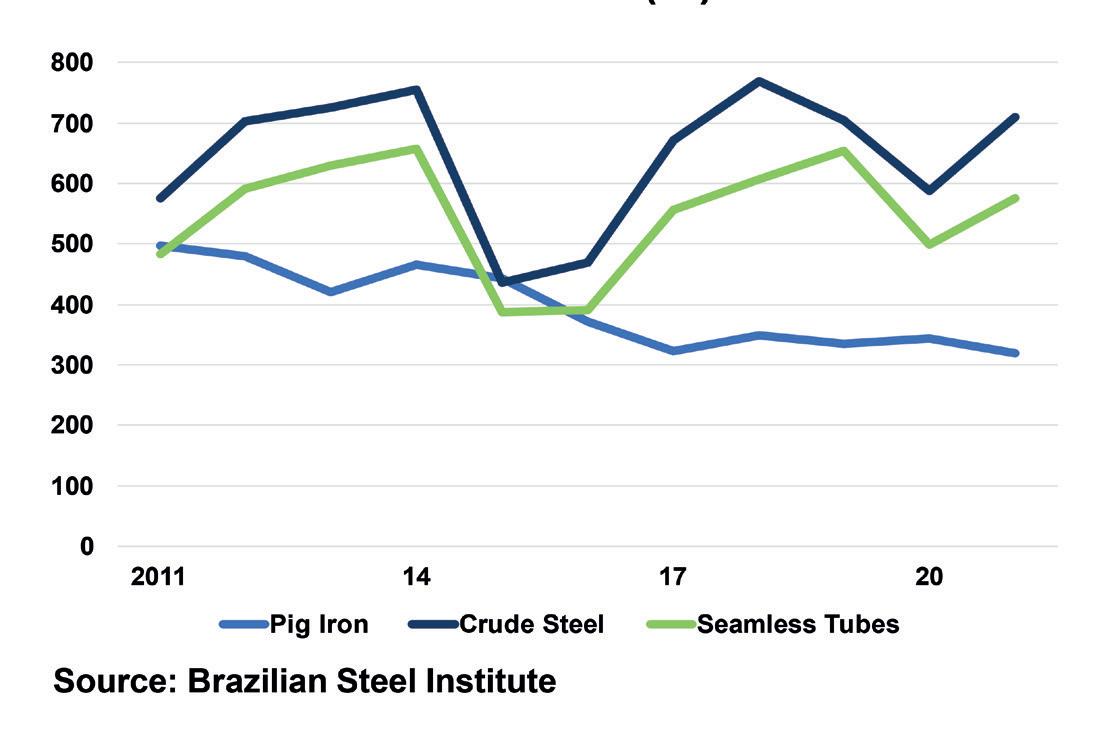

In part three of his series of articles on Vallourec, Germano Mendes de Paula* examines how Brazil’s strong economic recession in the mid-2010s led to the company’s decision to close its Barreiro mill and focus on production at its greenfield Jeceaba mill, which started up in 2001.

AS commented in part two of this article, Jeceaba’s greenfield mill started-up in 2001 and now consists of a 1.5Mt/yr pelletising plant, a 300kt/yr blast furnace, a 1Mt/ yr EAF-based steel shop and a 600kt/yr rolling mill dedicated to seamless tubes. It had a relatively gradual ramp-up, as it amplified its crude steel production from 39kt in 2011 to 352kt in 2014. Meanwhile, seamless tube output jumped from 17kt to 287kt, respectively.

However, Brazil faced a strong economic recession in the mid-2010s when GDP diminished by 3.6% in 2015 and by an additional 3.3% in 2016. The recession generated a strong political crisis, which affected the oil and gas sector – the main customer of Vallourec. Indeed, Brazilian apparent consumption of seamless tubes plummeted from 459kt in 2013 to only 164kt in 2016, with a tiny recovery to 173kt in 2017.

This unsatisfactory environment prompted Vallourec to interrupt the activities of its Barreiro mill. In February 2016, the company announced the imminent shut down (in April 2016) of one blast furnace and the later closure

of the site’s remaining blast furnace and steel shop as of 2018. Consequently, pig iron and crude steel production would take place at the Jeceaba facility. In 2016, according to Exame magazine, Barreiro employed 3,400 people and Jeceaba an additional 2,100. As planned, Barreiro stopped producing pig iron and crude steel in 2018.

In February 2006, the company announced its intention to merge the Barreiro mill with VSB, owner of Jeceaba. Originally, VSB was a joint-venture between Vallourec (56%), SMI (40%) and Sumitomo Corp. (4%). In the merged company, the ownership structure would comprise Vallourec (84.6%), Nippon Steel & Sumitomo Metals Corp. (15%) and Sumitomo Corp. (0.4%). It is important to highlight that, under the merger agreement, the Barreiro mill would maintain its rolling mill and premium finishing facilities. However, the new entity would not include the iron ore mine or the assets of the eucalyptus plantations. The transaction was concluded in October 2016.

According to Vallourec’s statement: “By

creating a single production hub, Vallourec will generate significant industrial synergies, capex avoidance, as well as administrative and tax synergies while resulting in the full consolidation of VSB debt of approximately €200 million”.

The firm explained that a cut of 450 people would be necessary to readjust the staff to the company’s new reality. It stated that it would take two years to minimise the social impacts of these measures with various actions.

In the previous year, 1,100 workers had already been dismissed in Brazil due to the sector’s crisis.

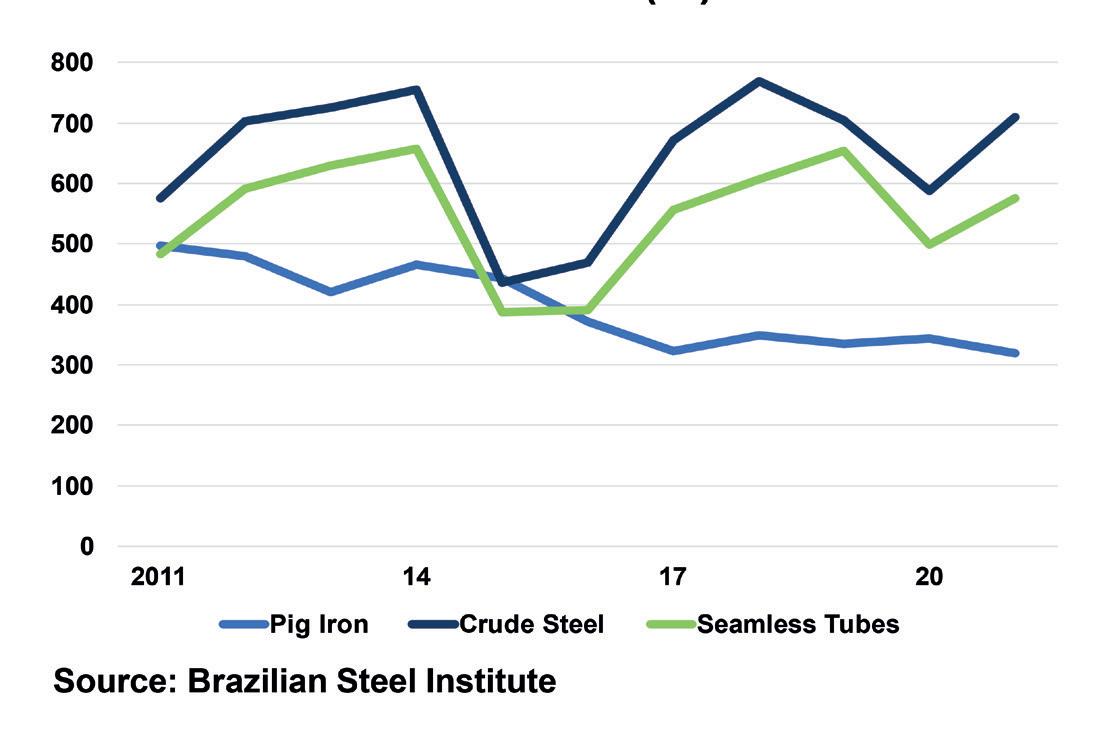

Production performance (2017-2021 period)

Fig 1 shows the evolution of joint production at the Barreiro and Jeceaba mills over the period 2011-2021. Information relating to 2022 was not available. The most remarkable trend was related to the continuously decreasing pig iron output, which diminished from 497kt in 2011 to 320kt in 2021. It should be remembered that Barreiro had two blast furnaces with a combined capacity to 620kt/yr, while

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

LATIN AMERICA UPDATE 15 www.steeltimesint.com May/June 2023

Jeceaba has just one (with a 300kt/yr capacity). It has been operating, therefore, above its nominal capacity.

It is understood that Vallourec is likely to install a second charcoal blast furnace in Jeceaba, aiming to reduce scrap consumption in its melt shop. The company unveiled that the proportion of scrap input to the EAF enlarged from 53% in 2019 to 63% in 2022, mainly due to load limitations at Jeceaba’s blast furnace.

Regarding crude steel production, it can be observed that after the slump between 2015 and 2016, it reached a 690kt/yr plateau during the 2017-2021 period. Similarly, seamless tubes recovered to around the 580kt/yr level. In 2021, Brazilian apparent consumption of seamless tubes was equivalent to 314kt.

In March 2021, Vallourec acquired Nippon Steel’s 15.4% interest in the Brazilian joint-venture VSB. Further to this transaction, Vallourec gained full control of VSB’s capital. Thus, the industrial restructuring in Brazil was followed by a simplification of ownership.

European restructuring

In 2022, Vallourec engaged in a comprehensive industrial restructuring plan. It stated that: “In May 2022, Vallourec announced the initiation of the closure process of its German tube plants and the transfer of the German rolling activity for oil and gas to Brazil. This process will take place over the next two years and will include the sale of land and buildings. The transfer will require approximately €120 million of capex in the Brazil operations to support the transition of premium tubular volume from Europe by end 2023. (…) The closure of the German operations implies further rationalization of other European operations involved in the finishing of tubes rolled in Germany. This rationalization will entail the consolidation of all the European threading activities in a single location in Aulnoye, France. The Group has also launched the closure processes of the heat treatment line at Saint-Saulve (France) and the threading line at Bellshill (Scotland). Elsewhere, Vallourec completed the sale of Vallourec Bearing Tubes. The Aulnoye

Competence Centre will lead the ‘one R&D’ organization”.

Once the restructuring programme is completed, Vallourec will no longer produce tubes in Europe. Reuters reported that the company sees the planned upgrade of its Brazilian capabilities resulting in better competitiveness and enhanced margin and cash flow generation, as well as a positive CO2 impact.

In its latest financial report, Vallourec said it has nearly 3.2Mt/yr of rolled production capacity, which is distributed by four operational regions: Brazil (35%), North America (24%), Europe (23%) and China (18%). In Brazil, the current 1.1Mt/yr rolling mill capacity is effectively limited by steel production of 950kt/yr.

Another key indicator of Brazil’s relevance is the fact that, in 2022, the country’s operations employed 7,231 people, equivalent to 45% of the whole company, against 26% in Europe, 14% in NAFTA, 13% in Asia, and 2% in the Middle East.

In terms of revenues, South America (mainly Brazil, including mine and forests) was responsible for some 21% of the enterprise in 2022. This outcome was negatively affected in January 2022 by an iron mine incident in Brazil after exceptionally heavy rainfall in Minas Gerais State.

Consequently, operations were suspended and then partially restarted in May 2022. When installed capacity, number of employees, and revenues are considered, the importance of Brazil to Vallourec’s present and future is crystal clear. �

www.steeltimesint.com May/June 2023 LATIN AMERICA UPDATE 16

Fig 1

Ceran greases for the Steel Industry

TotalEnergies - your local partner with global solutions

With offices all around the world, TotalEnergies is also present in the Nordic countries. With our unique Ceran greases, we help our customers improve productivity, save overall operating costs (TCO) and reduce their CO2 footprint.

Are you in the steel industry in the Nordic countries? Would you like to implement a unique grease for your heavy operations that enables savings in time, efficiency, and energy – all at once?

Contact us today to learn more about how you can put the pedal to the metal and get way ahead of your competition.

Learn more at nordic.totalenergies.com

TotalEnergies 552 006 454 RCS Nanterre - France. Photos: 123rf - Design: ms.industry@totalenergies.com nordic.totalenergies.com TotalEnergies Industry Solutions

Domestic demand

India’s steel producers have shifted their focus from overseas to domestic markets while production continues to ramp up, offsetting the cost of plunging exports.

By Dilip Kumar Jha*

By Dilip Kumar Jha*

TRIGGERED by a slowdown in global demand in the wake of the ongoing war in Ukraine, steel producers in India have shifted their focus from overseas to the domestic market to ensure future growth. Indian steel producers now feel that the federal government’s unwavering support for infrastructure will lead to higher steel consumption growth in India than in any other country in the world.

As evident from the figures compiled by the country’s leading think tank, the Centre for Monitoring Indian Economy (CMIE), India’s steel consumption reported double-digit growth for the second year in a row, after a year of pandemic-impacted decline. CMIE reported India’s finished steel consumption at 95Mt in the financial year 2020-21, a decline of 5.3% from 100Mt in the previous year. Since the financial year 2020-21, the country’s finished steel consumption has posted double-digit growth by 11.6% to 106Mt in the financial year 2021-22 and 11.4% to 107Mt in the 11-month period ending February 2023.

During the period of April 2022 to February 2023, India’s crude and finished steel production increased by 4% and 6.2%, respectively, on a year-on-year basis. Domestic finished steel production grew by 18% to 114Mt in the financial year 202122, due to the increased pace of execution of infrastructure projects as well as the resumption of real estate and construction activities in the financial year 2020-21.

With robust growth taking place in the economy as well as expectations of a 6% jump in the gross domestic product (GDP)

in the current financial year, India’s steel producers anticipate the local government to continue building new roads, malls, and railway coaches, in addition to modernizing existing infrastructure projects. According to T V Narendran, managing director of Tata Steel, India’s overall steel demand looks positive with money being set aside

for infrastructure development. “All major consumption sectors such as oil and gas, water pipelines, supply chains, and warehousing are looking very strong. We estimate India’s annual steel demand to grow close to the growth rate of GDP i.e. over 6% in the next few years, Narendran said, after announcing the December quarter financial results.

Within India, rural demand has remained slightly fragile in the last six to eight months, but urban demand has witnessed phenomenal growth because of a robust automotive industry that has returned to pre-pandemic levels. Commercial vehicles, which are the most steel-intensive part of the automotive demand, are now back on track. Additionally, the construction sector is reasonably strong but continues to have more room for growth in the future with extended plans such as ‘housing-for-all’.

www.steeltimesint.com May/June 2023 INDIA UPDATE 18

*India correspondent, Steel Times International

Financial

(April-March) Volume (Mts) Growth (%) 2019-2020 100 1.5 2020- 2021 95 (-)5.3 2021-2022 106 11.6 2022- 2023* 107 11.4

Domestic consumption of finished steel

year

Source: Centre for Monitoring Indian Economy; *April 2022 – February 2023 period, growth compared with the same period last year.

Financial

(April-March) Imports Exports 2019-2020 6.8 8.4 2020-2021 4.8 10.8 2021-2022 4.7 13.5 2022-2023^ 5.6 5.9

Overseas trade of finished steel (Mts)

year

Source: Centre for Monitoring Indian Economy; ^ April 2022 - February 2023 period.

Danieli Corus Rooswijkweg 291 1951 ME Velsen–Noord

THE FUTURE IS SUSTAINABLE

As a leading plant builder with decades of track record in all areas of integrated steelmaking as well as the metallurgical processes of the future, we commit to the vision of being a step ahead. We will make the decarbonization of our industry happen as a joint effort along every step of the way: from strategy development to technology implementation.

CO2 emission reduction studies using our proprietary, state–of–the–art software models for plant–wide energy and raw material flow analysis.

Carbon footprint reduction based on top gas recirculation and the injection of alternative reductants such as hydrogen and syngas.

Innovative process technology for the introduction of direct reduction ironmaking while maintaining maximum flexibility with respect to raw material input.

We provide proven, world–class solutions for every step towards a carbon–free steel industry

www.danieli–corus.com 2030 VISION DANIELI CORUS

GREEN TRANSITION A STEP AHEAD

Netherlands E info@danieli–corus.com T +31 (0) 251 500 500

The

Exports plunge

After experiencing an upward trend in exports for three consecutive years i.e. the financial year 2019-20, 2020-21 and 2021-22, India’s steel exports saw a reversal in trend. The country’s steel exports plunged by a massive 52% to 5.9Mt in April 2022 – February 2023 compared to 13.5Mt in the previous financial year. The decline can be attributed to the 15% export duty imposed on steel products between May and November 2022, which made shipments from India less competitive with the world market. Weak international demand, continued geopolitical tensions, and global inflationary headwinds also impacted exports.

From October 2022 to February 2023, India became a net importer of steel, with its import growing by around 56%, totalling 3.03Mt compared to 2.3Mt exported during the same period. In fact, the outbound shipment slumped to 338kt in November 2022, the lowest monthly exports in the last five years. The trend, however, reversed in the steel trade with the removal of the export duty on steel products in November 2022. Since then, exports have rebounded which will get full benefit in the financial year 2023-24. Experts now forecast India’s steel exports to skyrocket once again this year.

Jayanta Roy, senior vice-president of investment agency ICRA, believes that India will witness two significant milestones for the steel sector in the months to come. “Firstly, the central government’s current year capital expenditure is expected to touch the average annual run-rate envisaged in the national infrastructure pipeline for the very first time. Secondly, the sector steel will be witnessing two back-to-back years of double-digit domestic consumption growth rates after a gap of more than a decade. The last time this rate was achieved was in 2010-11.”

Roy further added, “While private sector investments remained generally muted at least for now, the government’s capital expenditure drive has helped maintain the industry’s capacity utilisation rate at an estimated 79% in the financial year 2022-23. With steel consumption expected to witness nearly double-digit growth in the financial year 2023-24, we expect the industry’s capacity utilisation rate to improve to over 80% this year, in addition to the commissioning of some new expansion projects later in the year.”

Conclusion

India’s domestic steel consumption growth rate is expected to remain healthy in the financial year 2023-24, driven by increased infrastructure spending, a surge in real estate and construction activities, and strong auto sales. As India enters its pre-election year in 2023, the government is projected to increase investments in central- and state-driven projects. This was indicated in the last union budget when the government increased budgetary capital expenditure by 33% to INR 10,000 billion for infrastructure, created a capital outlay of INR 240 billion for Indian railways, and announced 100 transport infrastructure projects. These initiatives bode well for domestic steel demand. Additionally, the uptick in construction and real estate activities is driving demand for steel products. The automobile sector, which recorded a 21% yearon-year growth during April 2022-February 2023 period, further indicates the growing domestic demand for steel. �

www.steeltimesint.com INDIA UPDATE 20

GIFA/METEC 2023 June 12–16, 2023

Bringing steel together

METEC 2023, the international industry gathering, promises key insights into the world of metals – with over 1,600 exhibitors, and 78,000 visitors from over 120 countries.

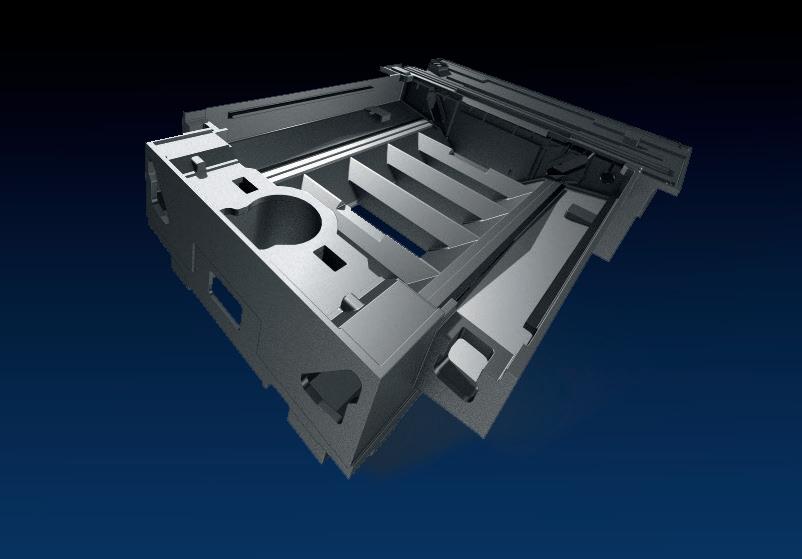

SUSTAINABLE SOLUTIONS FROM DASSAULT SYSTÈMES

French software provider Dassault Systèmes claims it is focused on the belief that ‘virtual universes will be a key enabler for our customers – and the world – to imagine, design, and test the radically new products, materials, and manufacturing processes of tomorrow’s sustainable economy at the fastest possible speed’. With this in mind, the company will be presenting a portfolio of products driven towards sustainable engineering and design and leveraging sustainability and circularity KPIs. These solutions include the DELMIA Quintiq S&OP, which considers all rules, financial constraints and KPIs to model its customers supply chain and create mathematically optimal plans. There is also the DELMIA Quintiq Scheduler, which offers optimized and integrated production scheduling; the CATIA, which integrates sustainability management into core business strategies, and Dassault’s SIMULIA tools, which simulate manufacturing processes such as forming (hot/cold rolling) and casting, and material modelling activities such as material model calibration. Dassault will also be exhibiting its Virtual Twin Experience, which creates an accurate virtual model of operations and supply chain so that users can test and optimize processes and resources before execution.

Dassault Systèmes will be exhibiting in Hall 5, stand B09

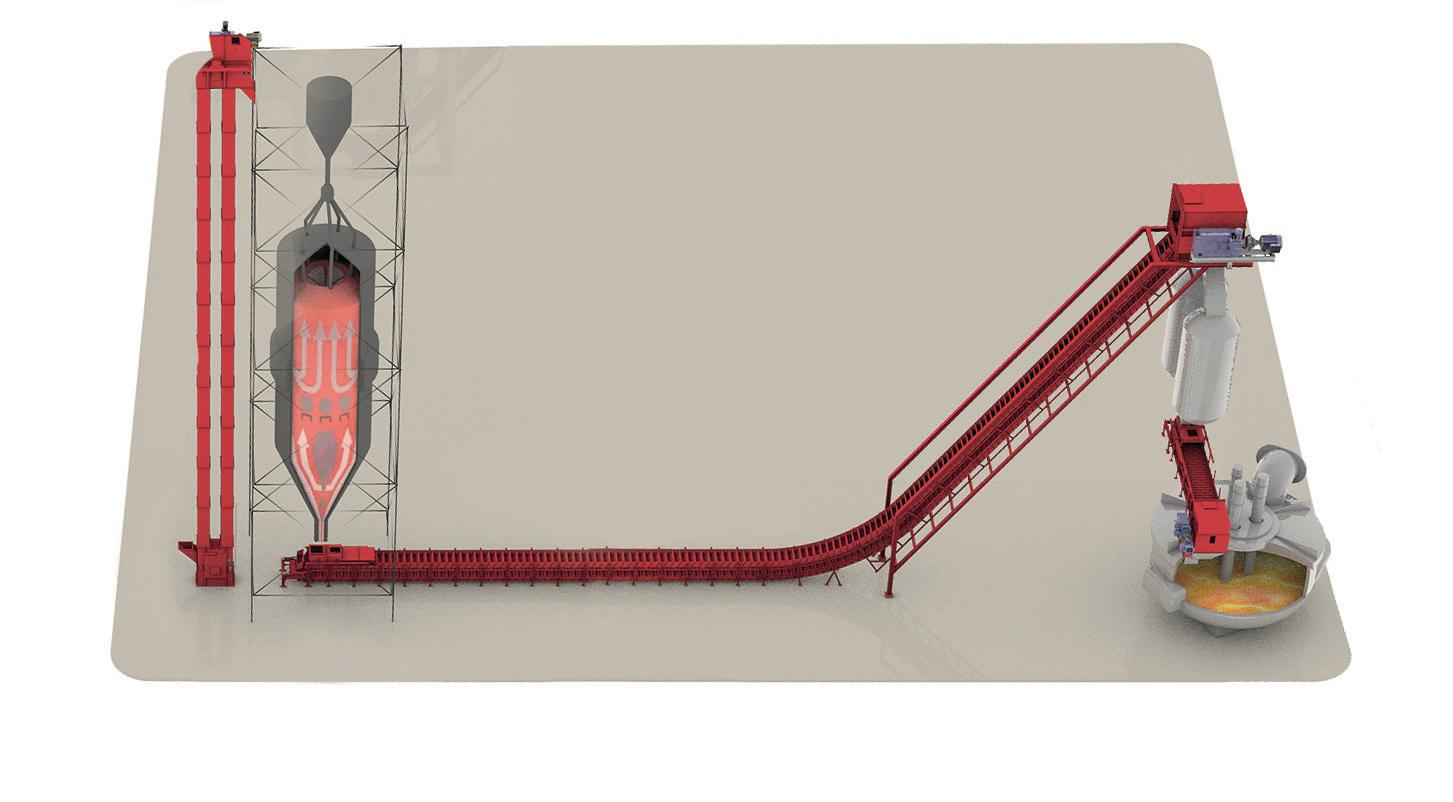

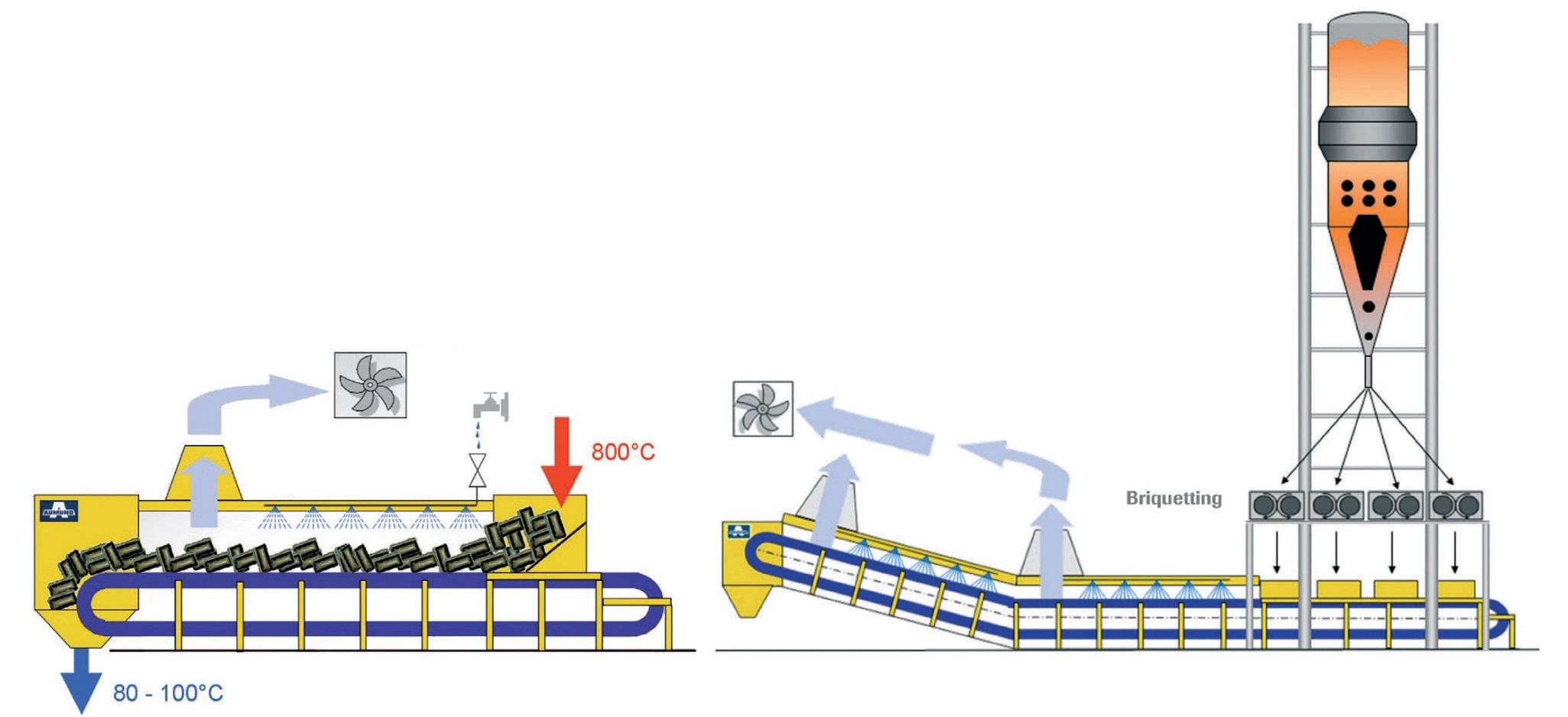

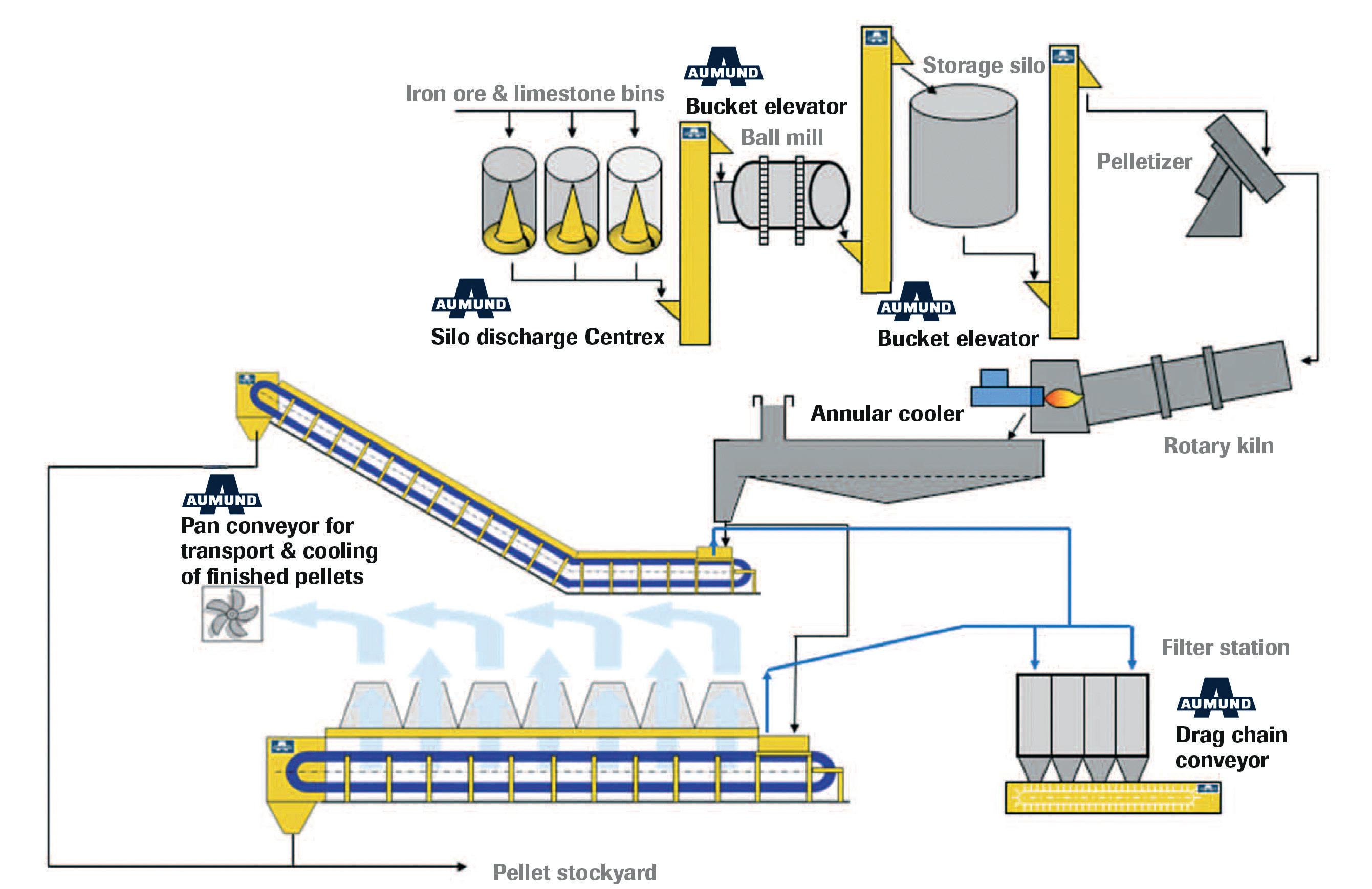

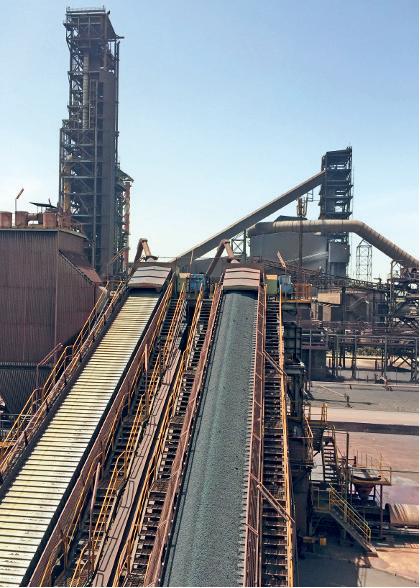

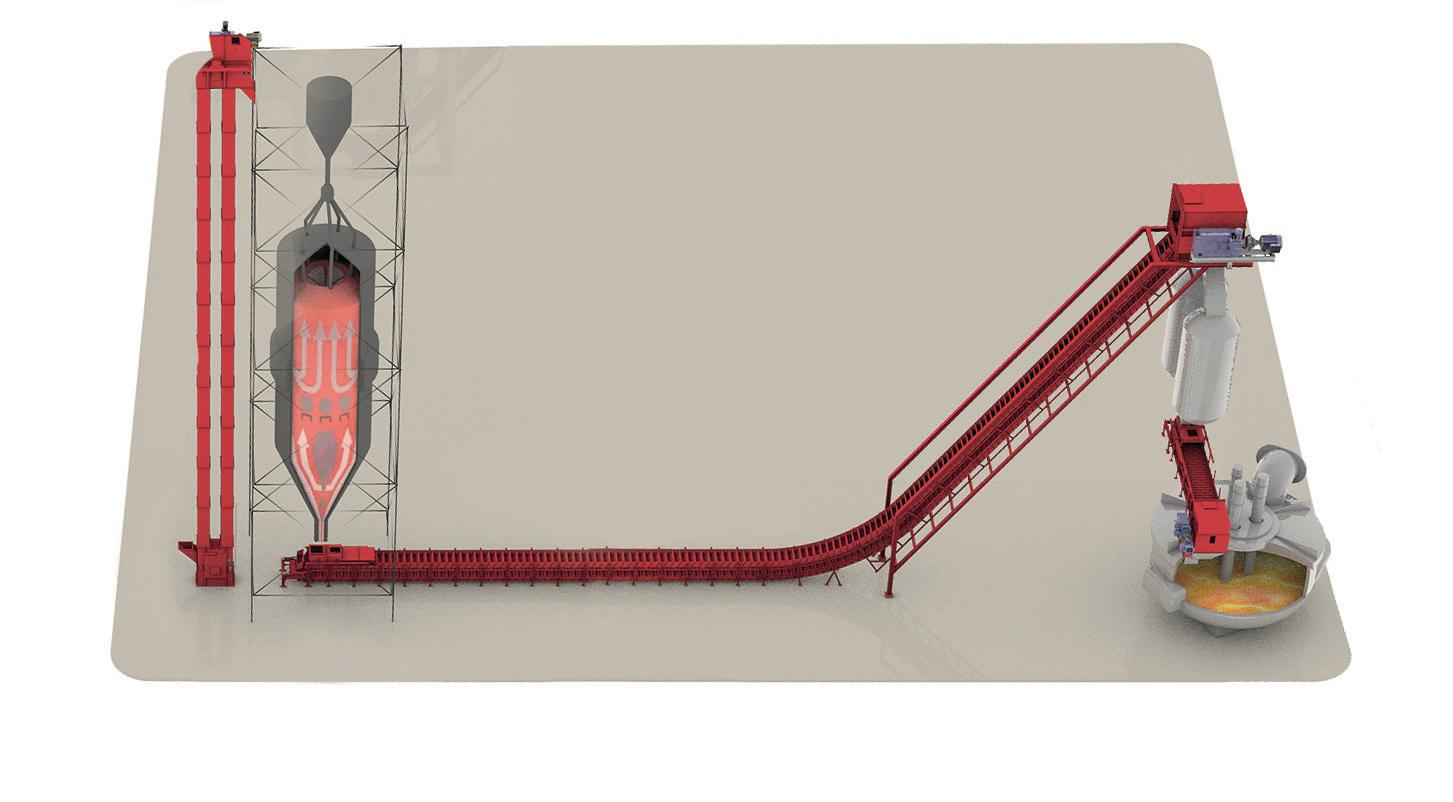

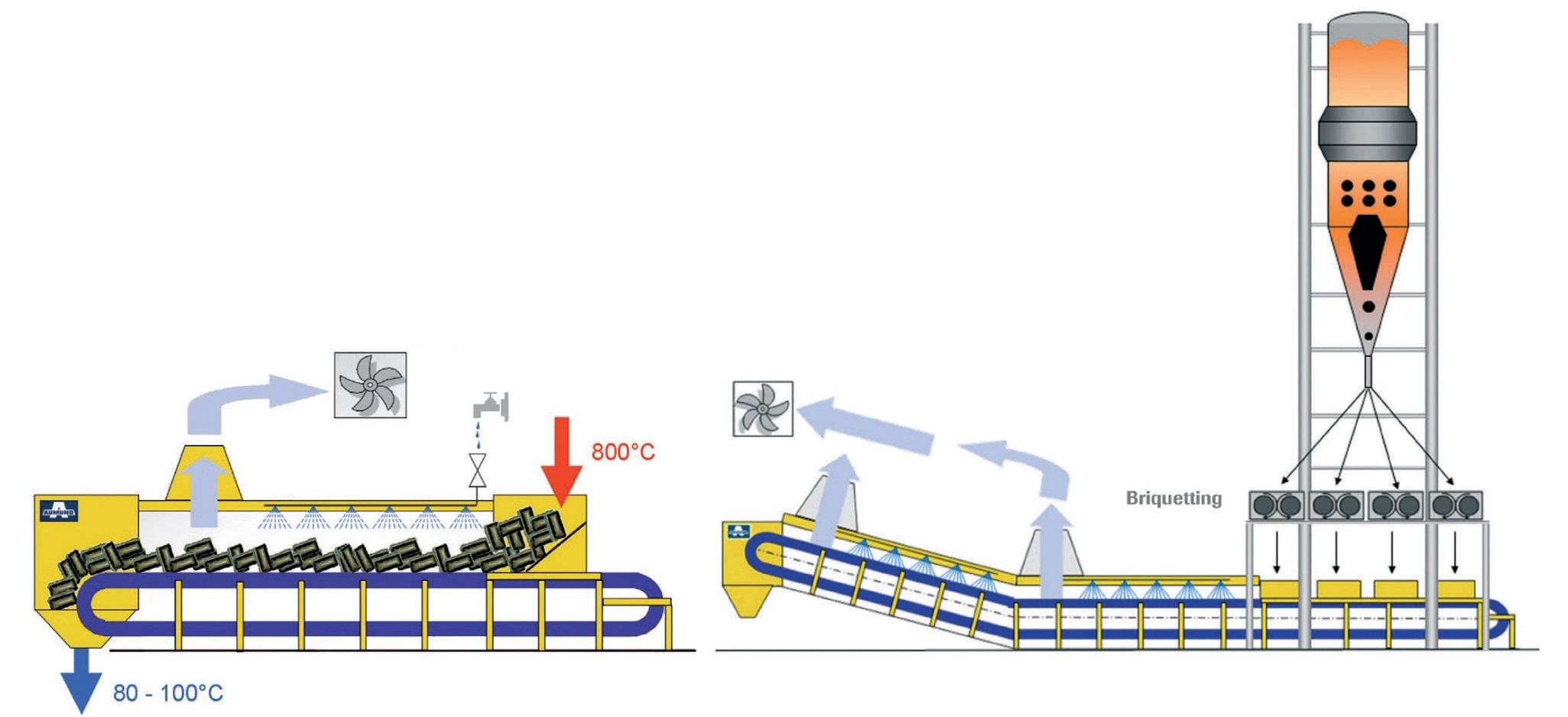

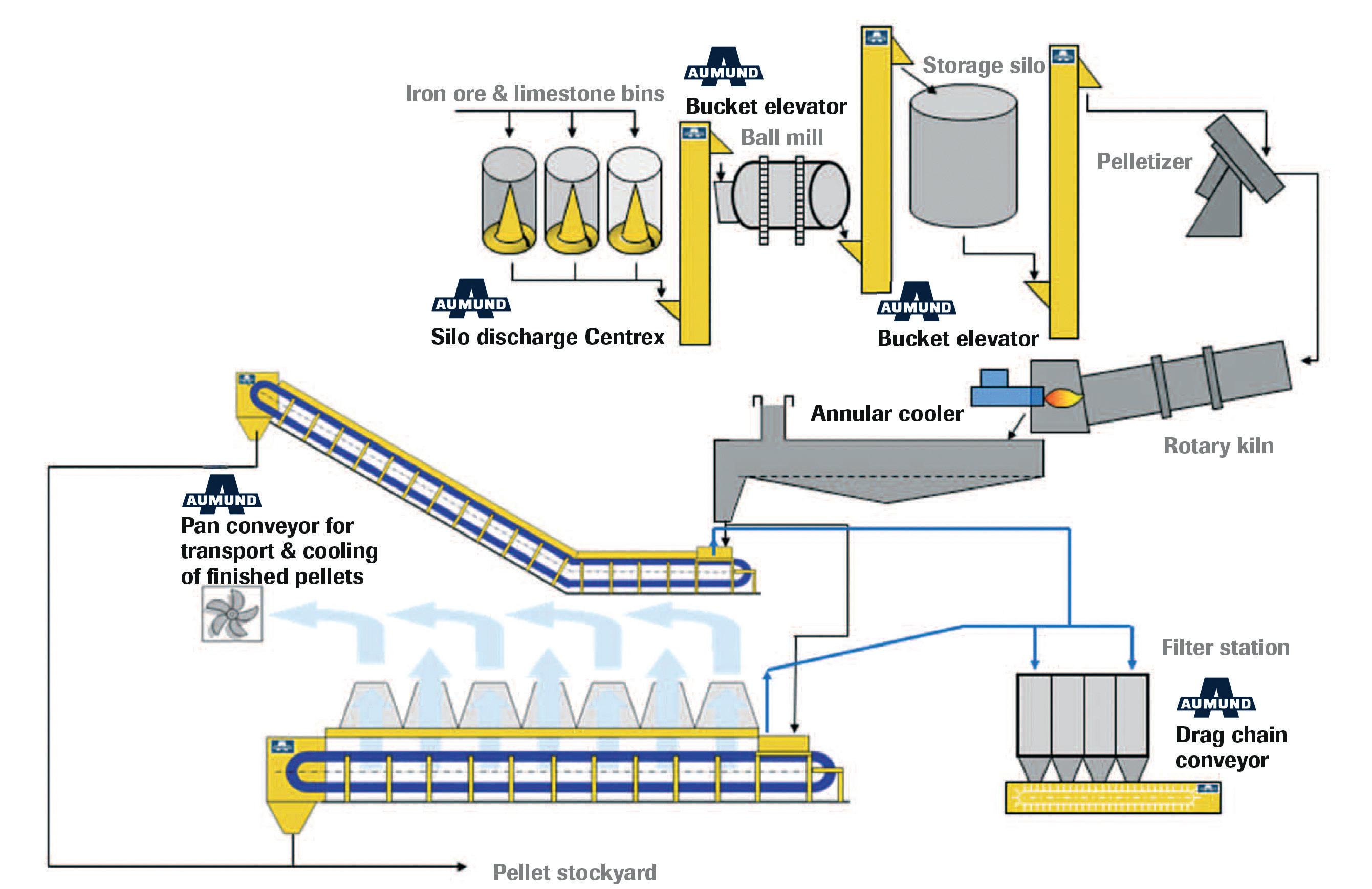

AUMUND TO SHOWCASE PAN CONVEYOR

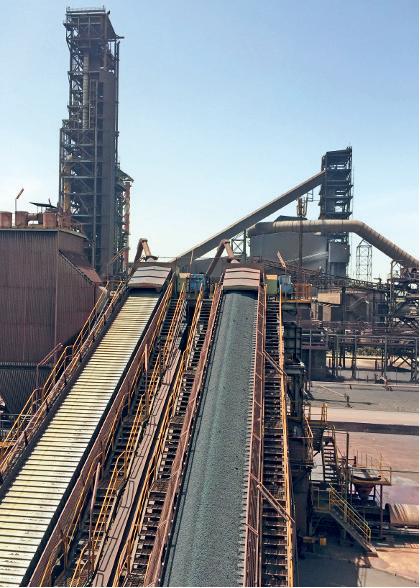

AUMUND Fördertechnik GmbH (AUMUND), an international supplier of specialist conveying solutions for metallurgical processes in the iron and non-iron industries, will be showcasing its product range which includes solutions for handling and discharge of the iron oxide material produced in the agglomeration process of pelletising. A specific solution the company will be focusing on during the event, is the AUMUND Pan Conveyor type KZB-KP, which involves cooling with perforated conveyor sections. The physical principle is based on forced convection, as negative pressure is generated by a powerful radial blower. Air from underneath the conveyor is sucked in through the perforations of the conveyor sections and flows through the layer of pellets on the conveyor. The heat energy is transmitted from the pellets into the medium of the air flowing through them, and discharged via the exhaust hoods. An appropriate dedusting system follows downstream. This cools the product down carefully to below 100°C so that it can be transferred to the onward conveying technology without problems, says AUMUND, and transported to the stockyard. AUMUND has received an order for a 100 m long KZB-KP for a conversion project to increase the capacity of the existing pelleting plant in an Eastern European steelworks. The conveyor will lengthen the existing cooling line and cool the iron ore pellets.

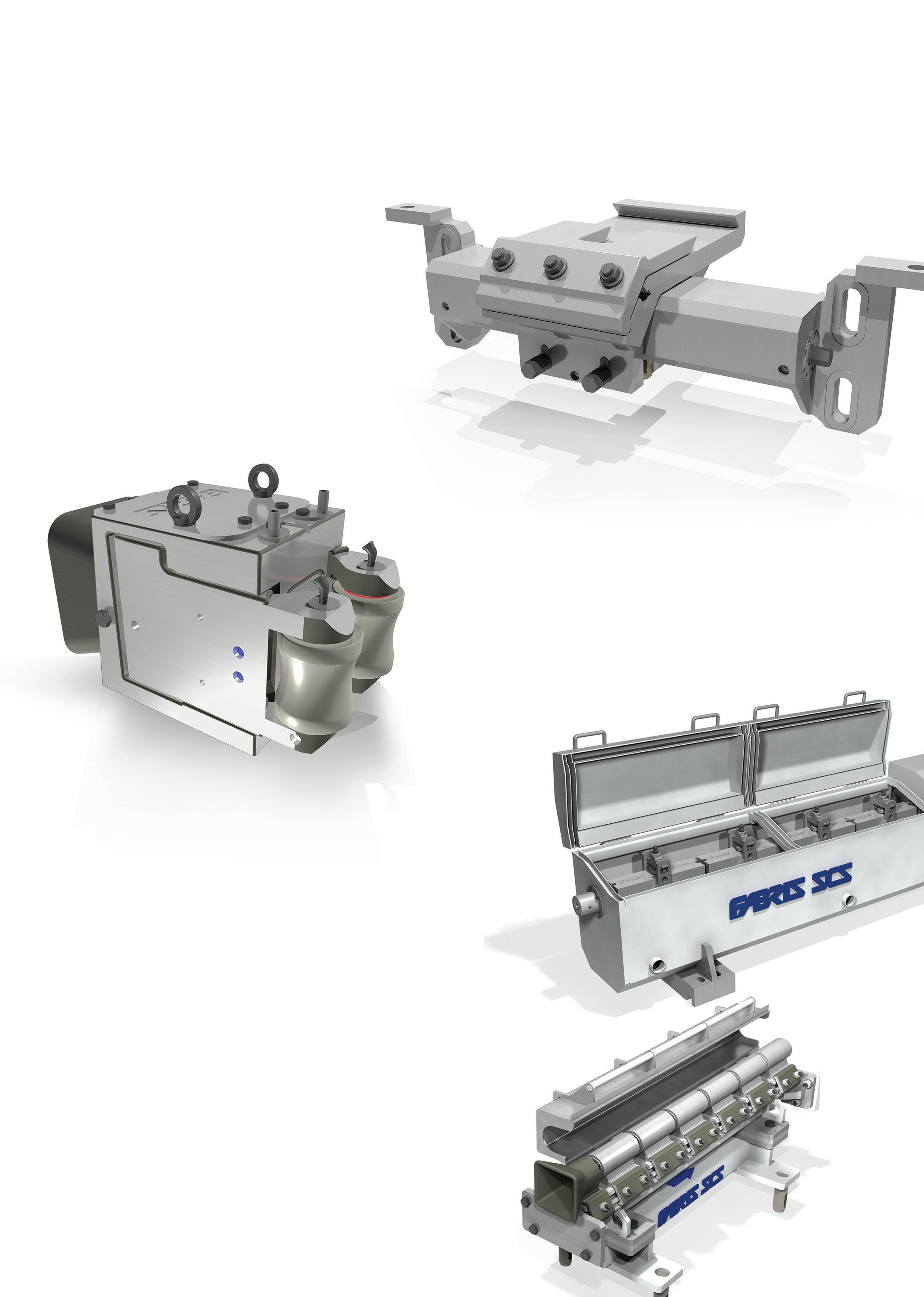

AUMUND will be exhibiting in Hall 04, stand F18

METEC PREVIEW 22 May/June 2023

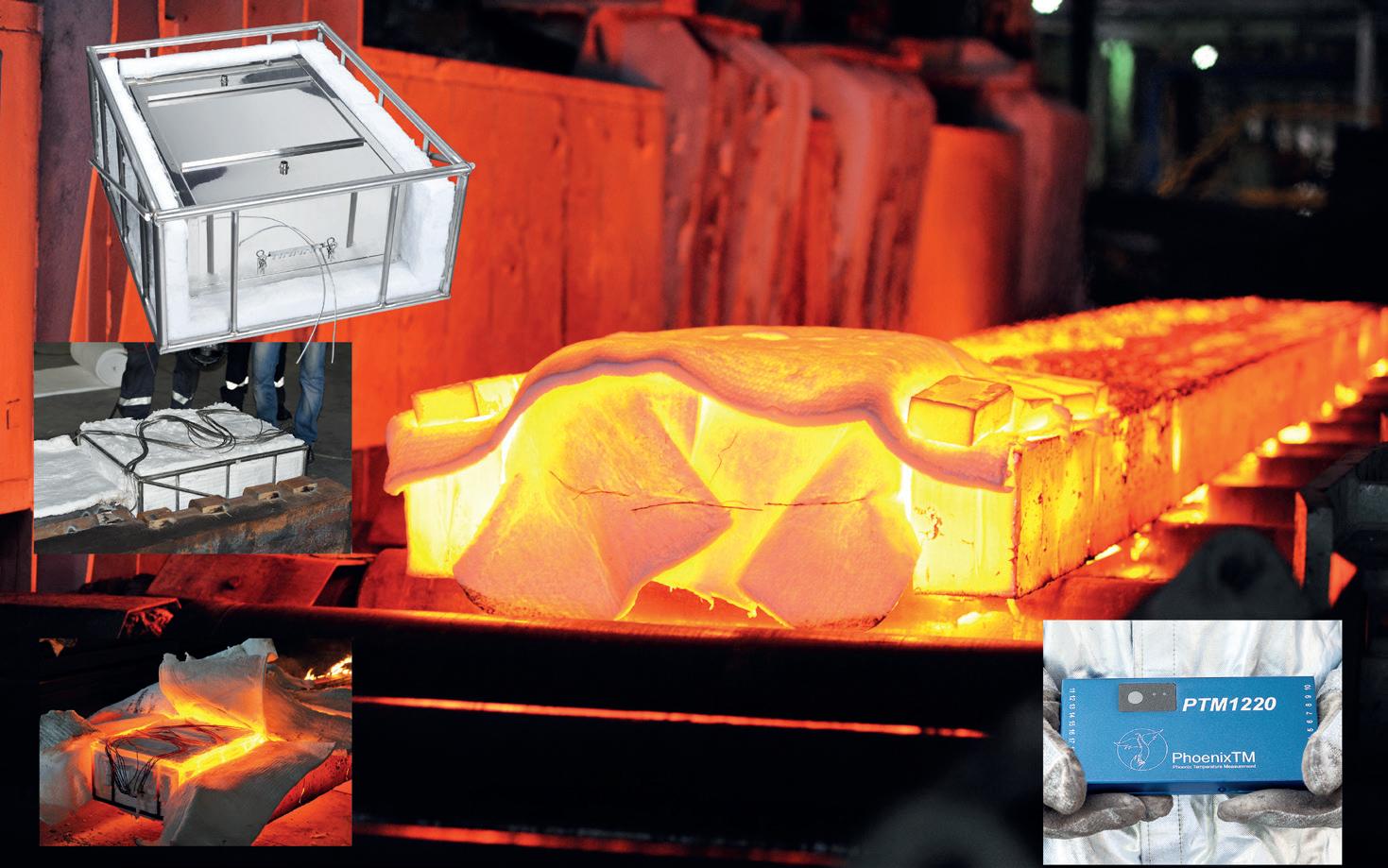

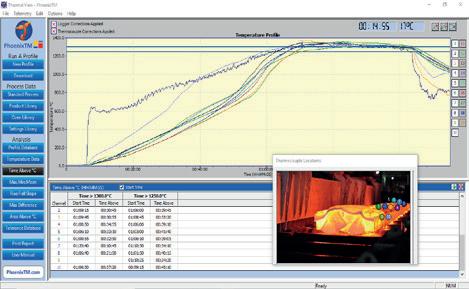

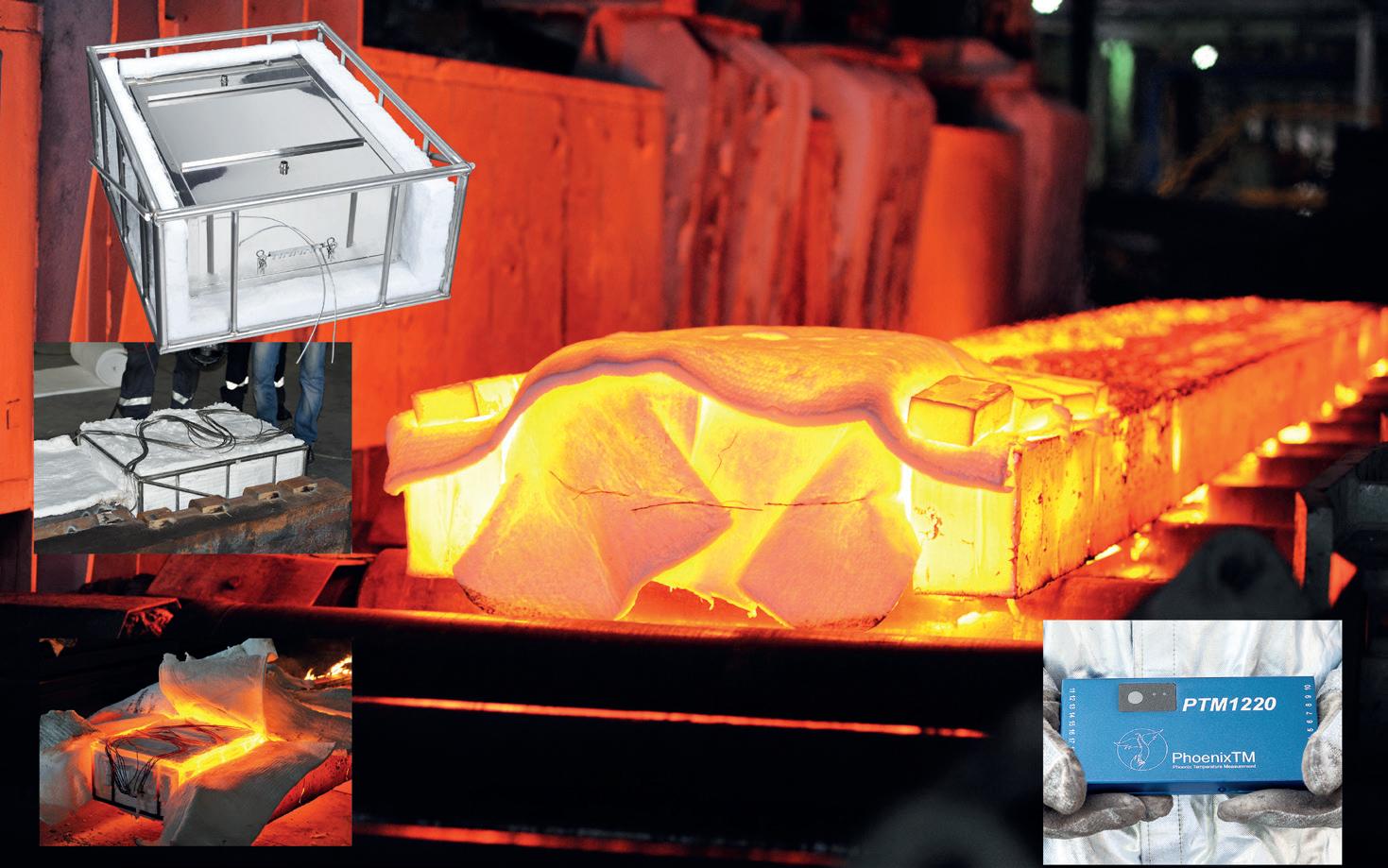

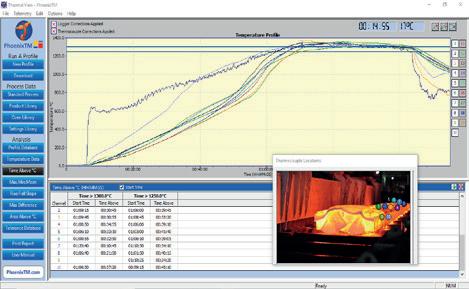

PHOENIXTM TO EXHIBIT TEMPERATURE SYSTEM

Phoenix Temperature Measurement (PhoenixTM), a global provider of temperature measurement systems, will be exhibiting its ‘thru-process’ temperature profiling system which has been designed specifically to allow comprehensive monitoring of the entire slab/billet furnace reheat process. Offering up to 20 thermocouple inputs using the PhoenixTM high temperature PTM1-220-HT data logger, temperatures can be measured at the surface, centre, and base of the product, at various positions along its length. The resulting temperature profile data can be imported directly into the furnace controller model to allow accurate validation.

Passing through the reheat furnace reaching temperatures of up to 1300°C /2372°F, the data logger requires significant thermal protection. The specially designed TS07 thermal barrier is manufactured using graded insulation layers and an evaporative inner water tank, which maintain the logger temperature at a safe 100°C/212°F. The thermal barrier is mounted in a cut-out

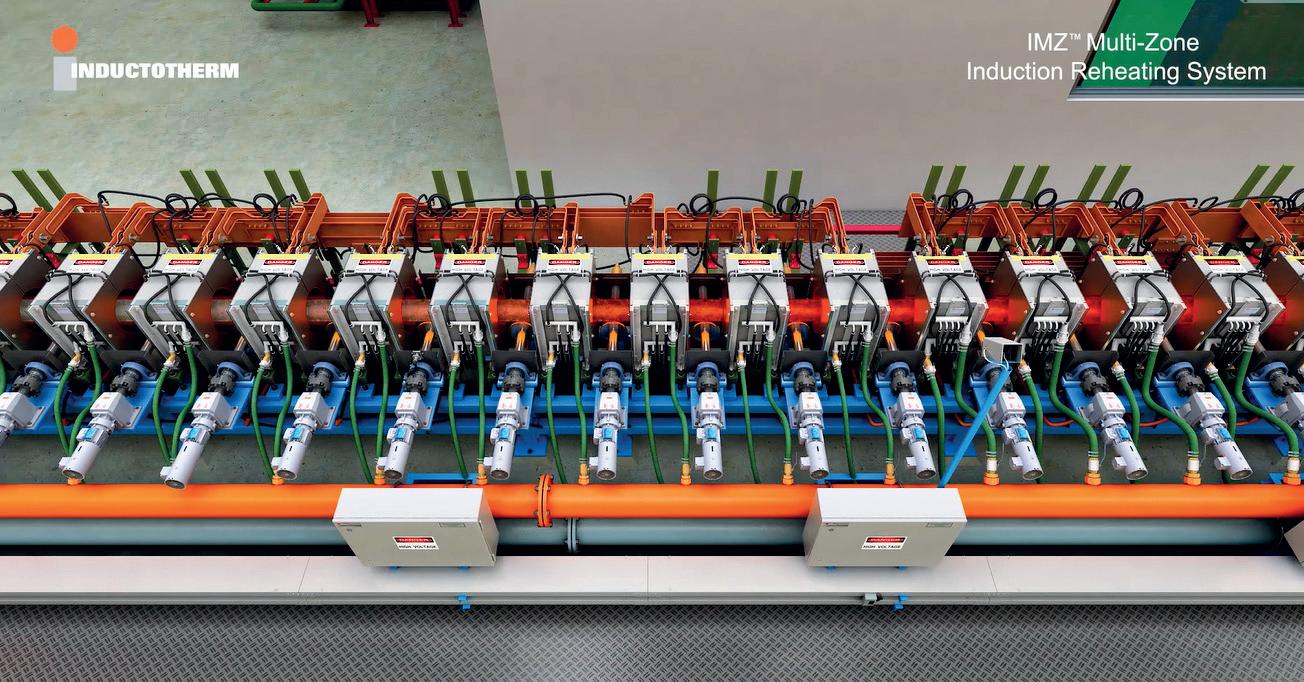

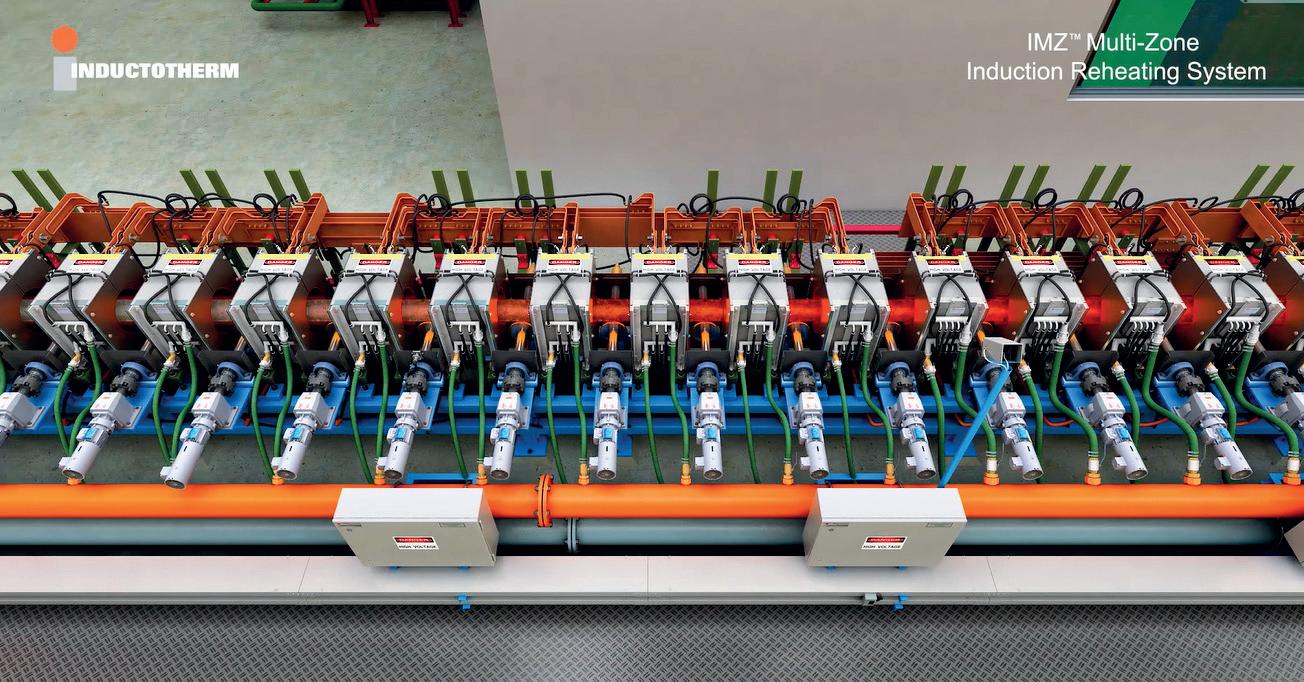

INDUCTION HEATING TECH FROM INDUCTOTHERM

Induction equipment manufacturer Inductotherm Corp. will be presenting its IMZ™ Multi-Zone Technology for induction heating and reheating. This ‘game-changing technology’ for heating and reheating hot-rolled products ensures accurate and repeatable heating results for each combination of size and steel grade required to produce the highest quality products, says Inductotherm. With several coil zones, each individual heating zone can be controlled to provide any desired temperature profile along the workpiece to meet the specific requirements of the rolling mill. According to Inductotherm, since IMZ™ Multi-Zone Technology allows for precise heating, rolling mills have the flexibility to heat a range of material grades and sizes with little to no downtime or loss of production. Rolling mills can reduce their operating costs by using an IMZ™ Multi-Zone induction

within the slab, allowing heavy duty MI thermocouples to be run safely along the slab to where measurement is required. Transfer of the test slab with PhoenixTM’s self-contained monitoring system installed, to and from the furnace, can resultantly be facilitated safely and efficiently.

By applying accurate profile data to mathematical models, targeted roughing mill exit temperatures can be set to obtain a desired furnace drop-out temperature throughout the product thickness. Accurate control of such variables allows a successful rolling operation with minimal scale build-up maximising mill yields, says PhoenixTM, saving significant energy and maximising production throughput. By accurate optimisation and reduction of the furnace operating temperature, furnace life can be extended. At the same time, under-temperature stock can be prevented, further protecting downstream processing machinery.

heating furnace in conjunction with a traditional furnace, claims Inductotherm, as when combustion and walking beam furnaces are used at higher temperatures – up to 1200°C or greater – there is a tremendous amount of on-going maintenance that is needed. Keeping the traditional furnaces at a lower temperature allows them to run smoothly for up to 20 or 30 years with little need for any expensive extraordinary maintenance such as revamping. Additionally, maintaining these furnaces at a lower constant temperature significantly reduces the amount of fuel and energy required for operation.

Inductotherm will be exhibiting in Hall 10, stand B42

METEC PREVIEW 23 May/June 2023

PhoenixTM will be exhibiting in Hall 09, stand B57

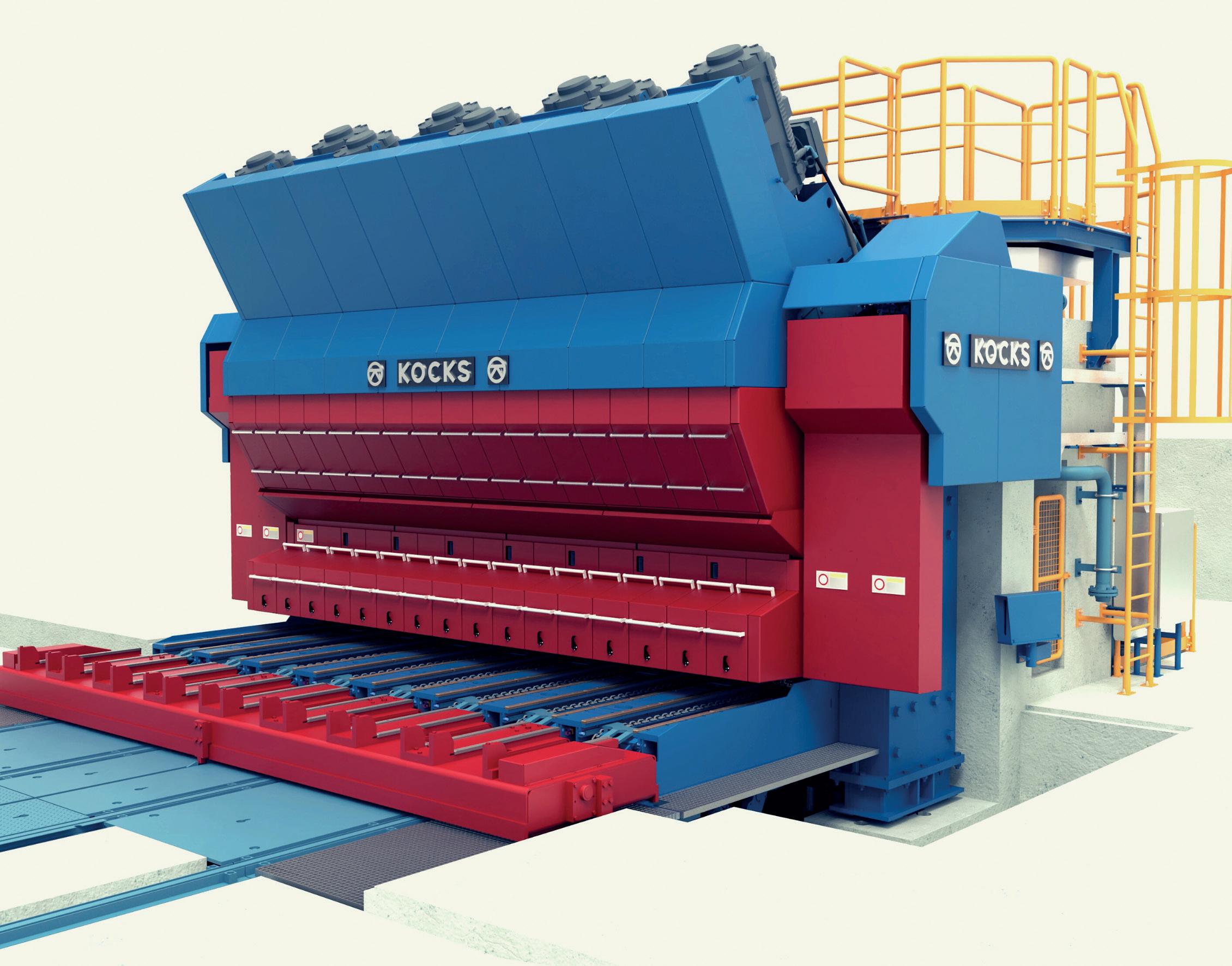

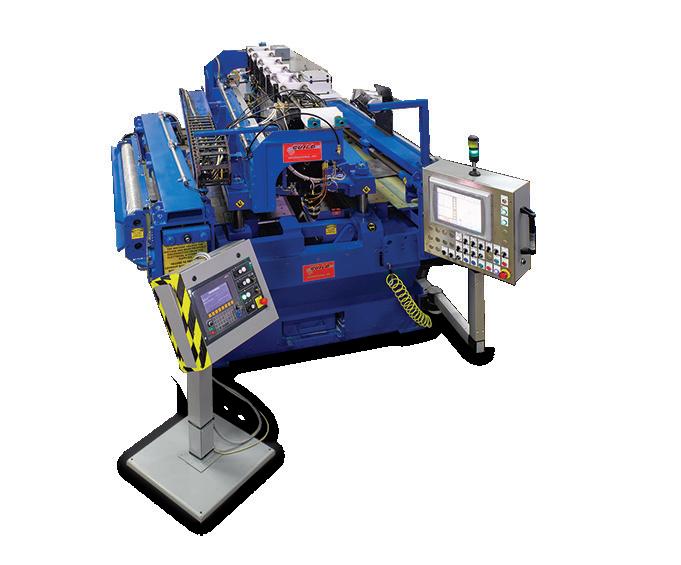

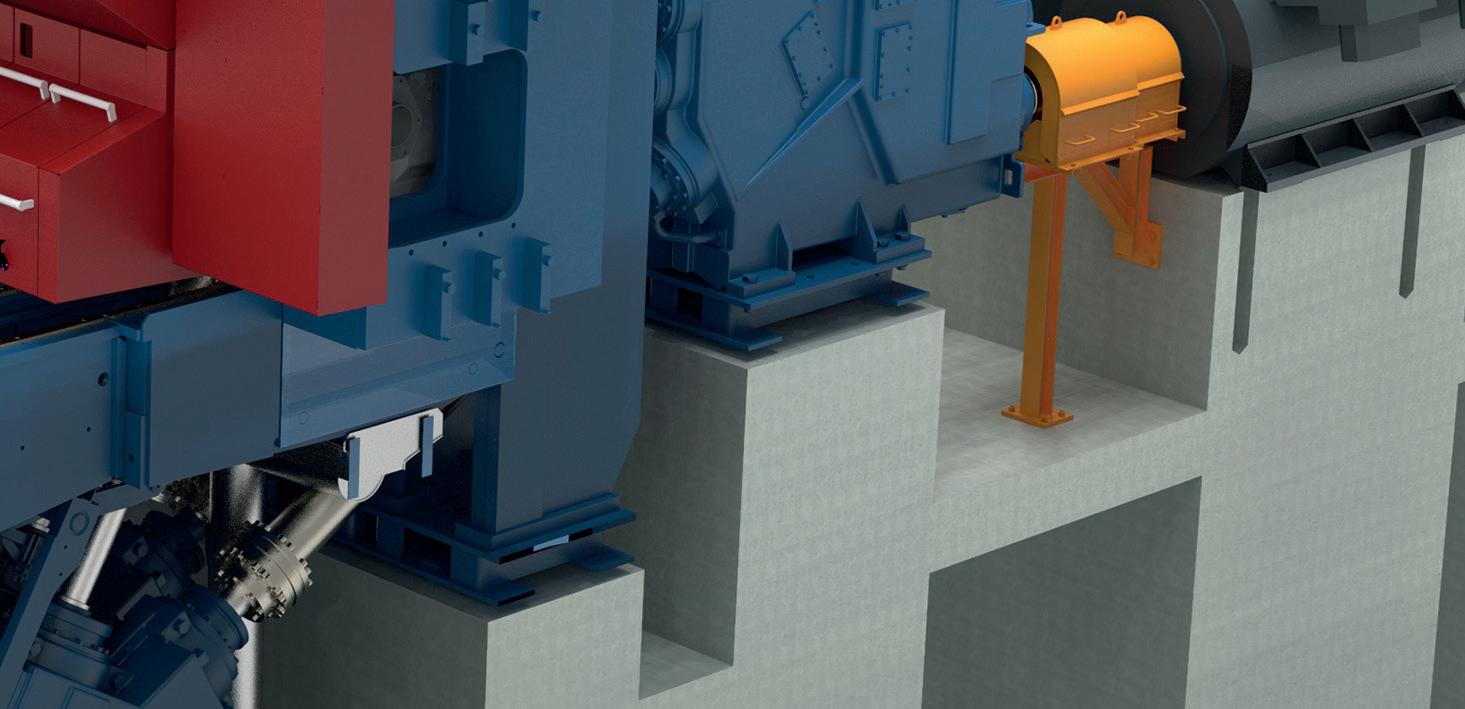

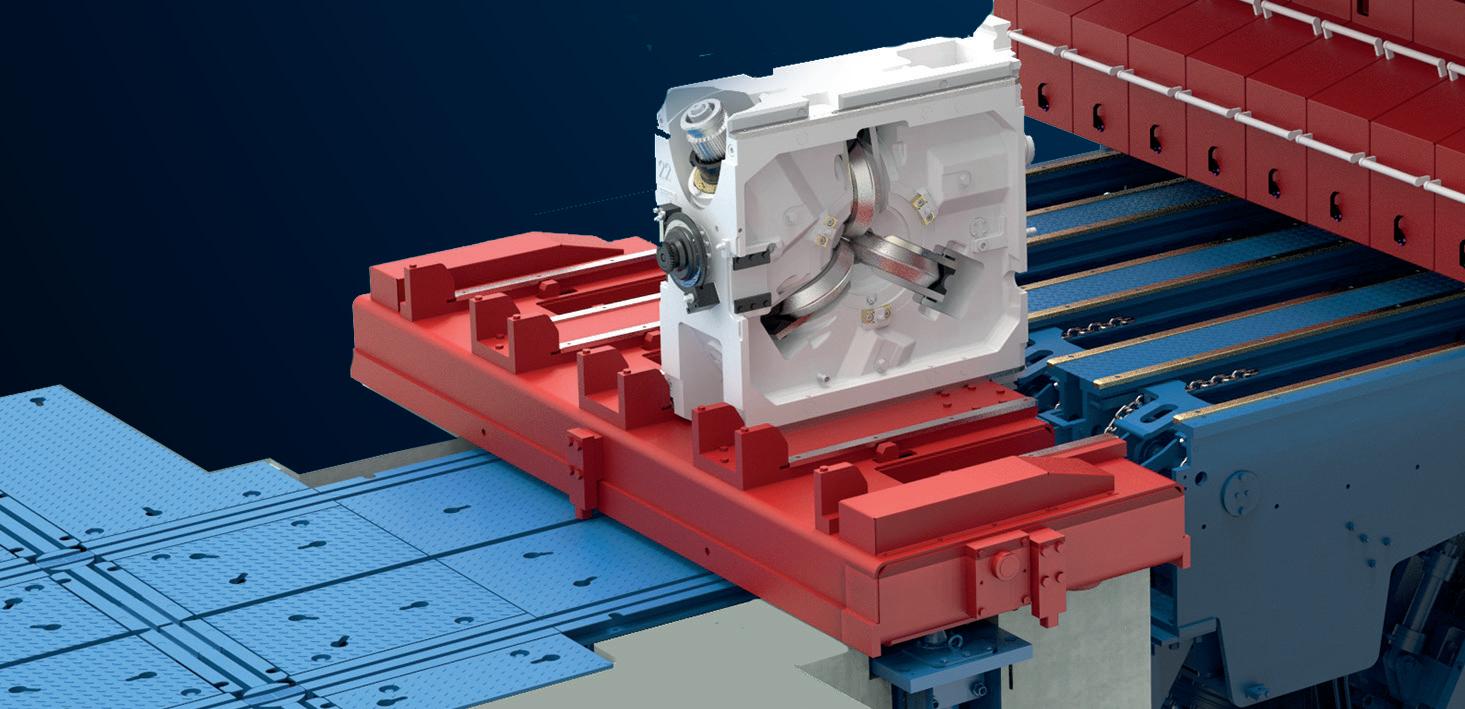

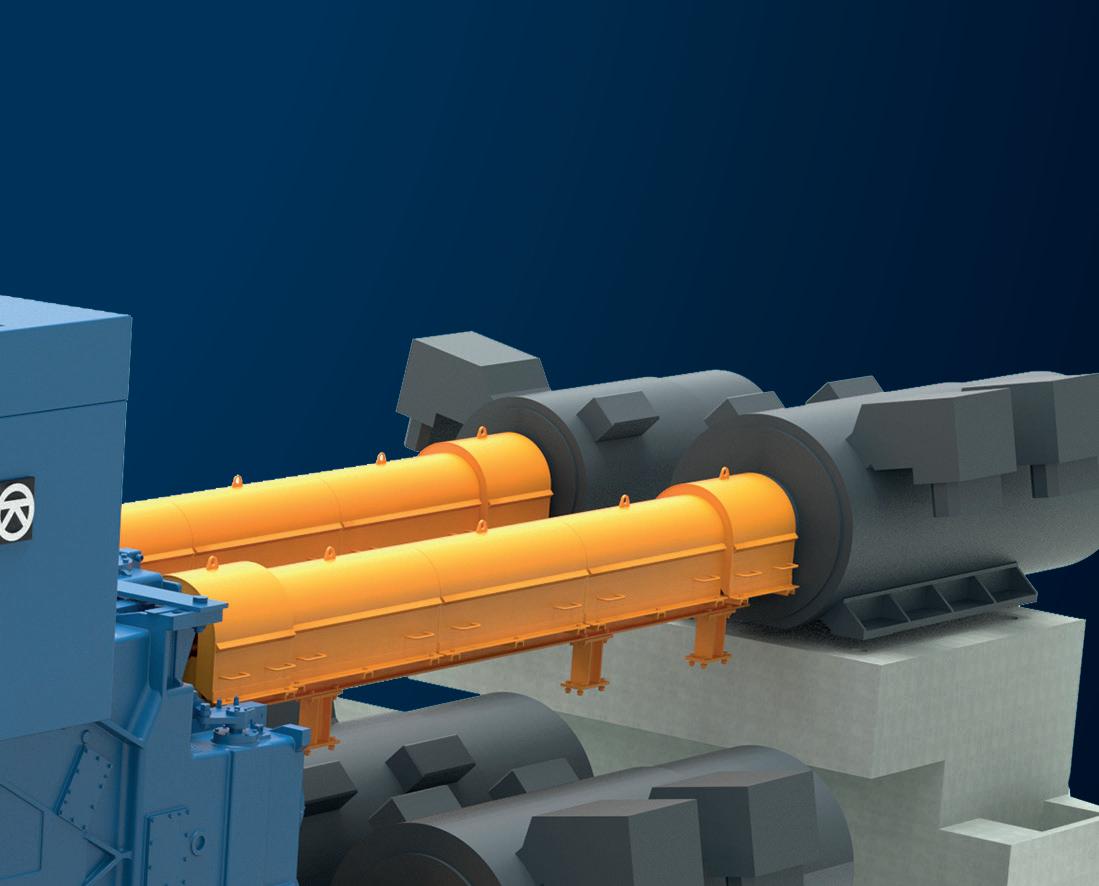

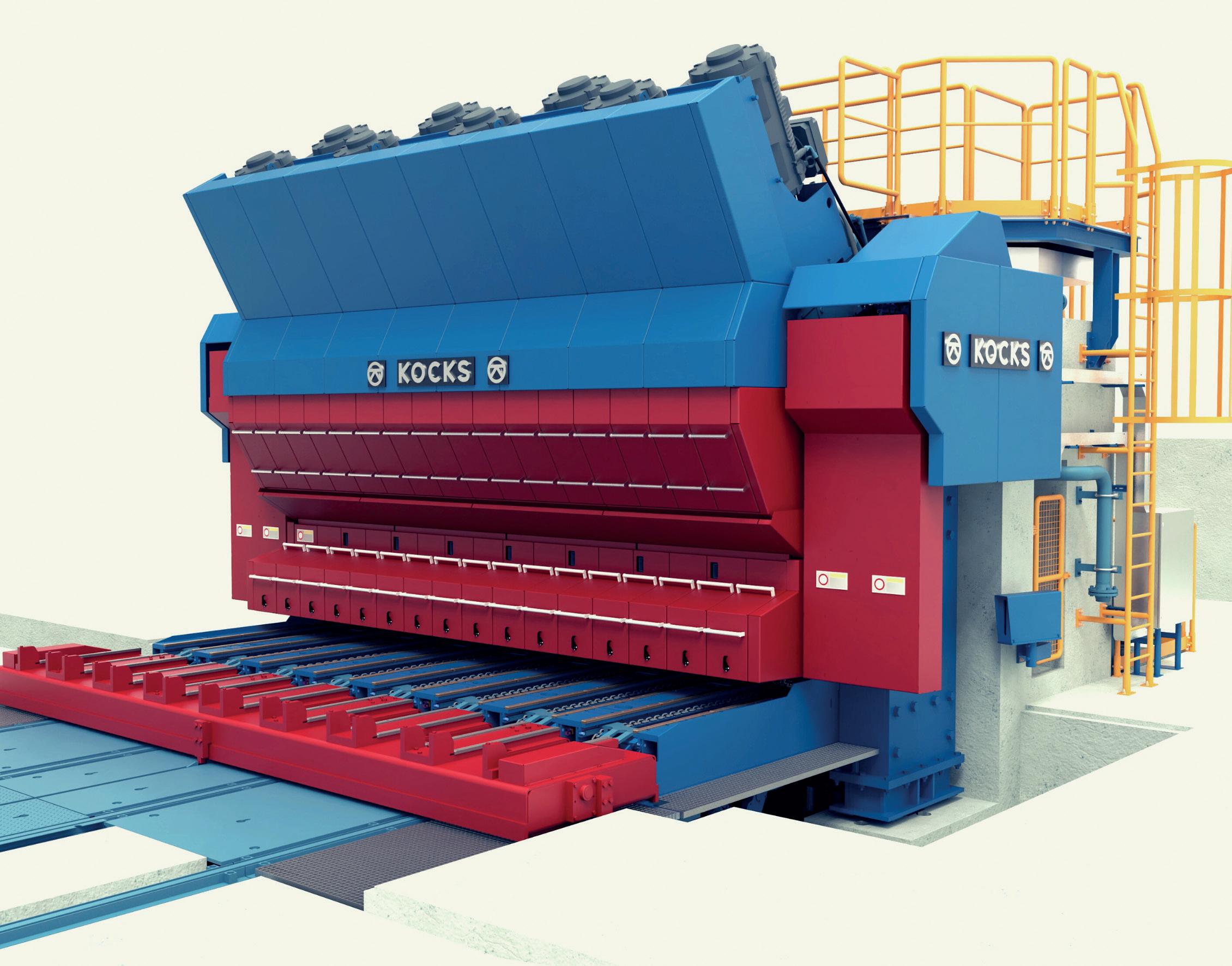

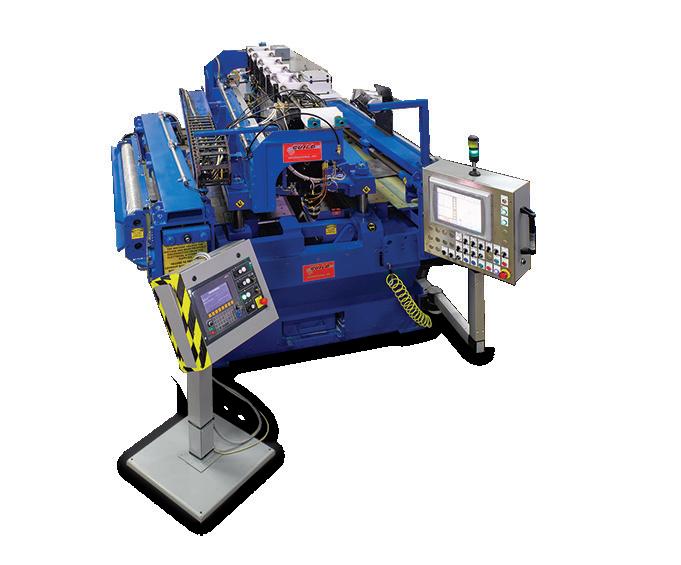

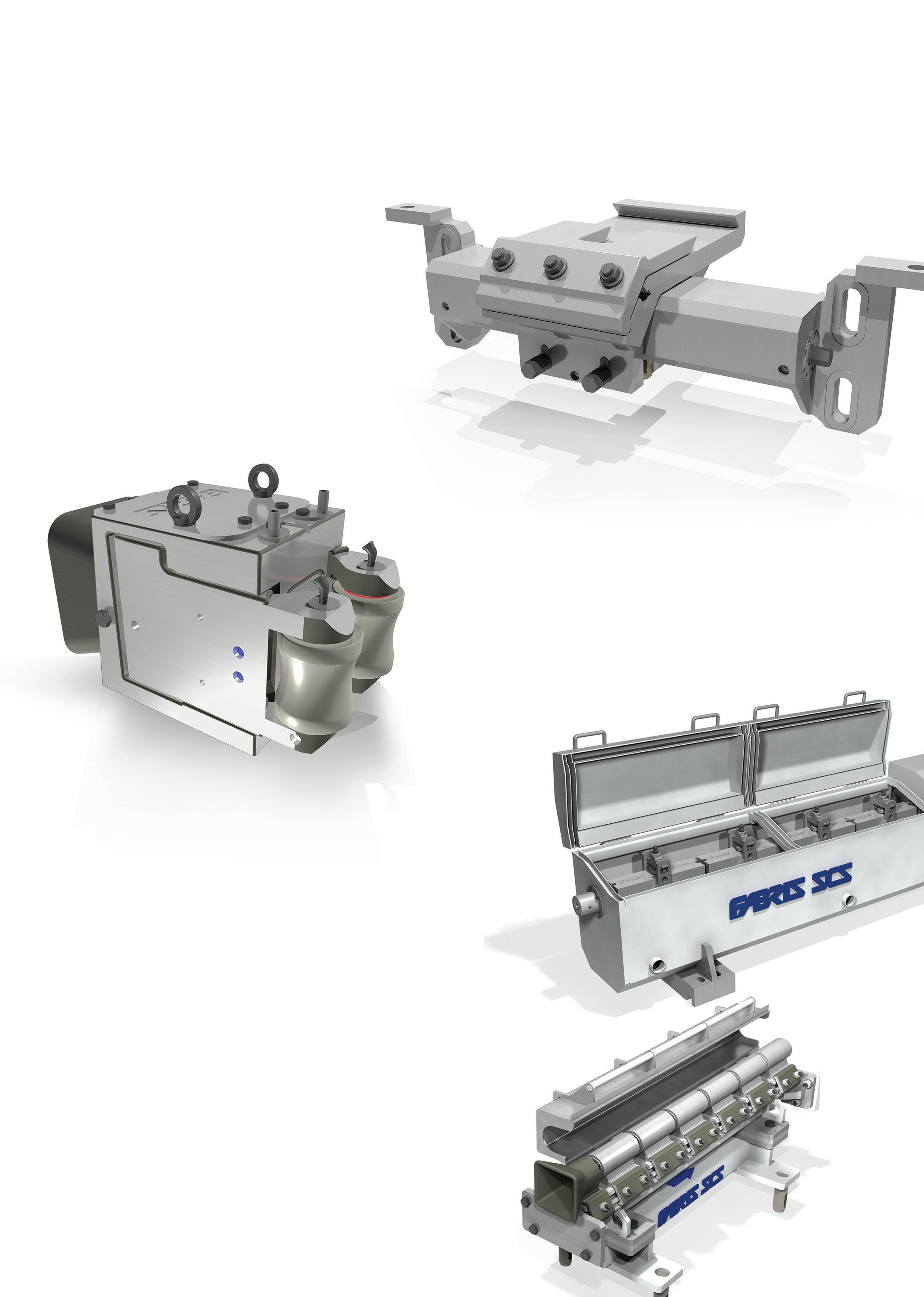

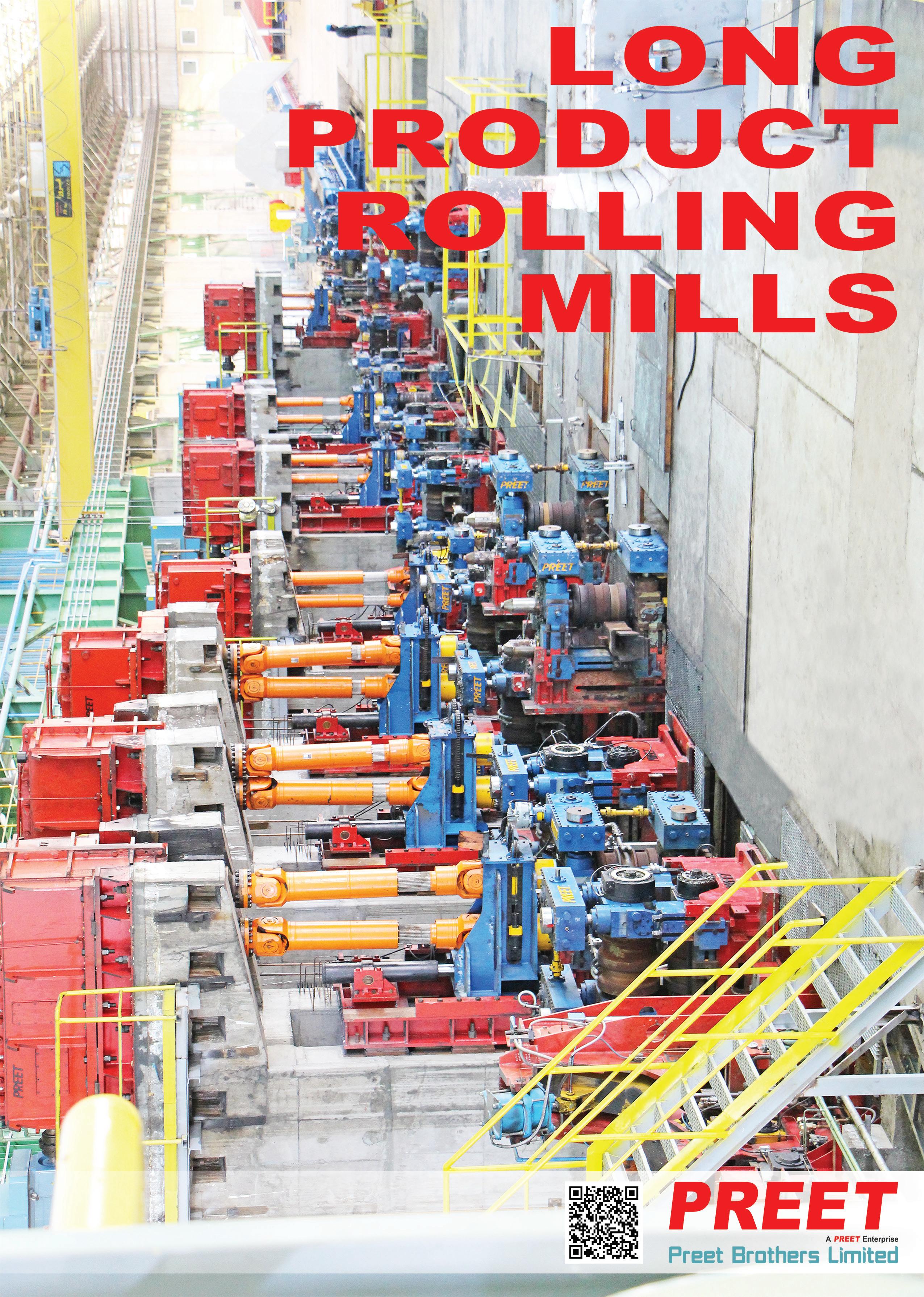

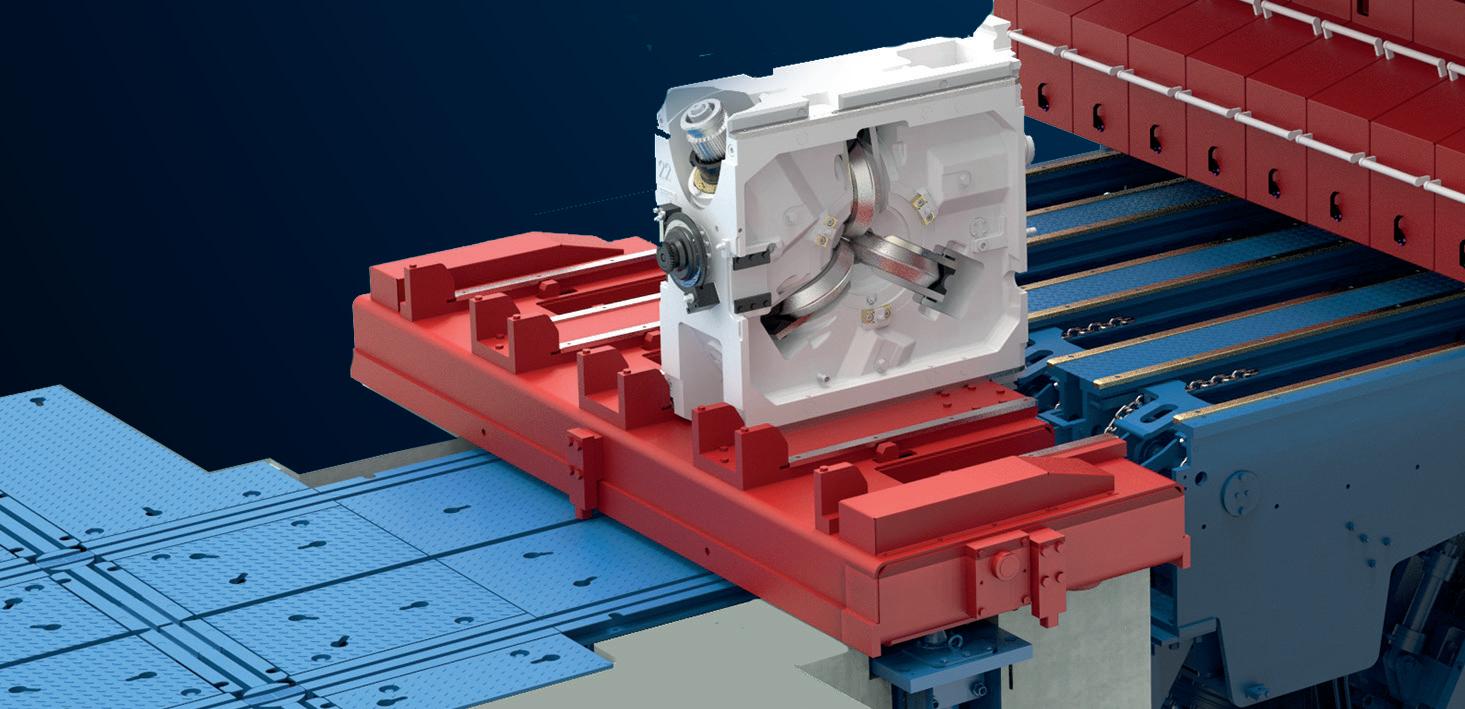

KOCKS TO INTRODUCE 3-ROLL INTERMEDIATE BLOCK

KOCKS, a leading supplier of innovative solutions for long products rolling mills, will be introducing the latest addition to its portfolio; a 3-roll intermediate block. Generally, the company’s flexible Reducing & Sizing Block (RSB®) is used as a finishing unit in highperformance SBQ mills to roll straight bar or bar in coil, or as pre-finisher in high-speed sizing applications for wire rod. Now, KOCKS has adapted its proven 3-roll technology to be integrated as an intermediate mill. The new iRSB® has been developed to replace traditional 2-high stands.

Featuring several advantages, the 3-roll intermediate block gives rolling mill operators more options in terms of flexibility and safety, says KOCKS. Particularly in rolling mills where space is limited, the possibility to add additional reduction capacities provides some crucial advantages. For example, bigger billet sizes can be used, or a different, more fl distribution of the reduction in the stands is feasible – which allows operators to further optimize the quality of the finished product.

KOCKS’ iRSB® 3-roll intermediate block and other advanced rolling mill equipment for the production of bar, wire rod and seamless tubes will be on display at METEC, alongside its holistic portfolio of automation solutions, digital tools and advanced technology.

KOCKS will be exhibiting in Hall 01, stand A79

DR SCHENK TO LAUNCH NEW INSPECTION SYSTEM

Dr. Schenk GmbH will be launching its new AI channel and camera-based surface inspection system, MIDA X, which was developed to mimic the human brain to analyze each defect from multiple, virtual perceptions. A reliable coil grading system requires high confidence in defect detection and classification. Dr. Schenk has developed configurations of advanced cameras and lighting hardware for nearly every metal application at any production speed, usually needing only one set of cameras. MIDA, the physical inspection channel, was developed to detect defects from multiple optical views. Using multiple light sources, this multiplexing technology requires minimal space on the production

light sources, this multiplexing technology

line, says Dr. Schenk. This works by

sending an image to the classifier engine to determine the defect class. MIDA X then gives the system a second chance to view the image, by enhancing and correcting the original physical data in real time. This corrected image is sent to the classifier, resulting in improved classification and grading accuracy. Additionally, setting the detection sensitivity of an inspection system has always been a time-consuming task. The artificial intelligence in MIDA X adjusts detection sensitivity, greatly simplifying the start-up process and decreasing commissioning time by

to view the image, by enhancing and sent

The artificial intelligence in MIDA X simplifying the start-up process and 25%, claims Dr. Schenk.

May/June 2023

flexible

24

Dr. Schenk will be exhibiting in Hall 01, stand E23

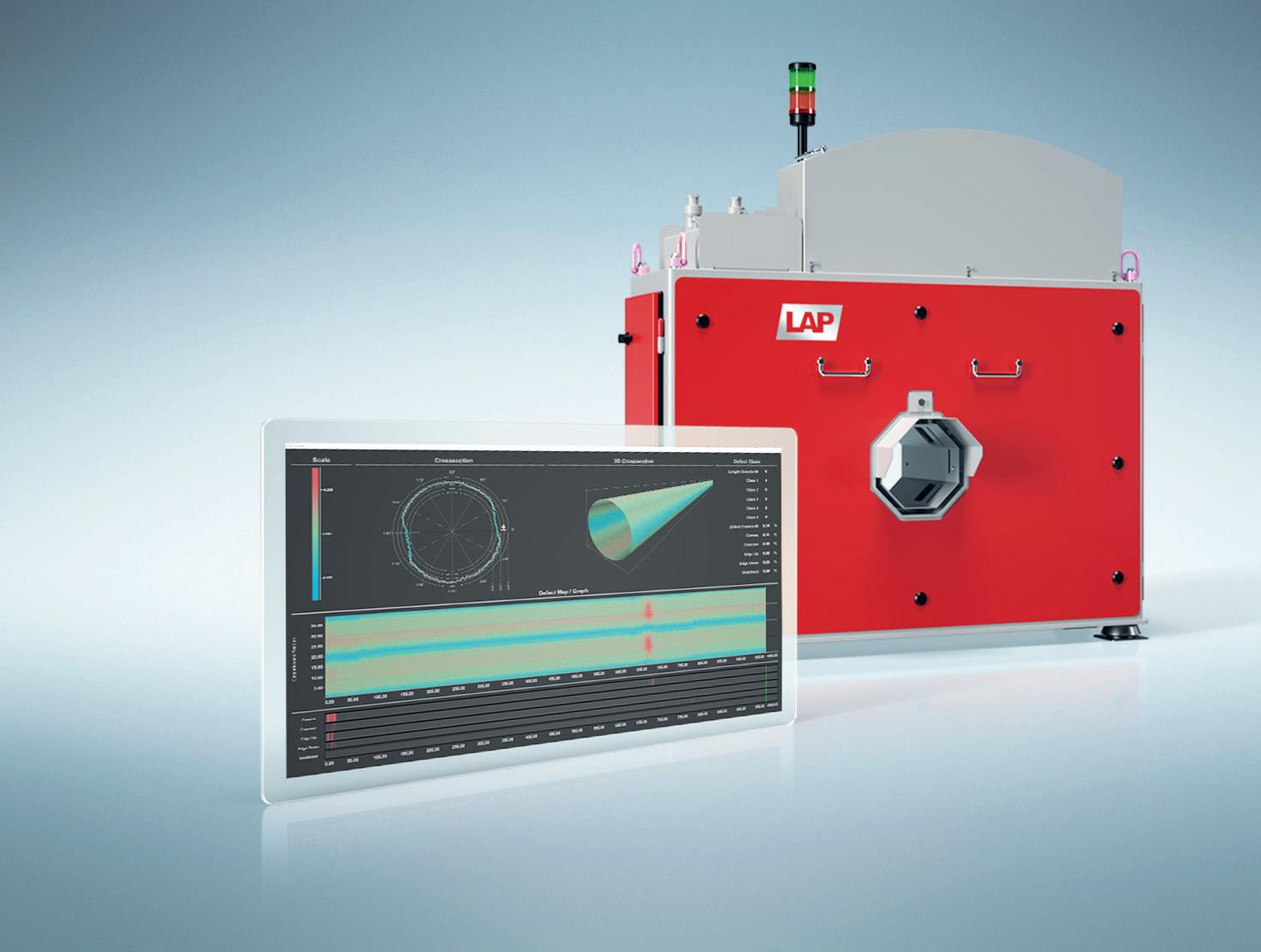

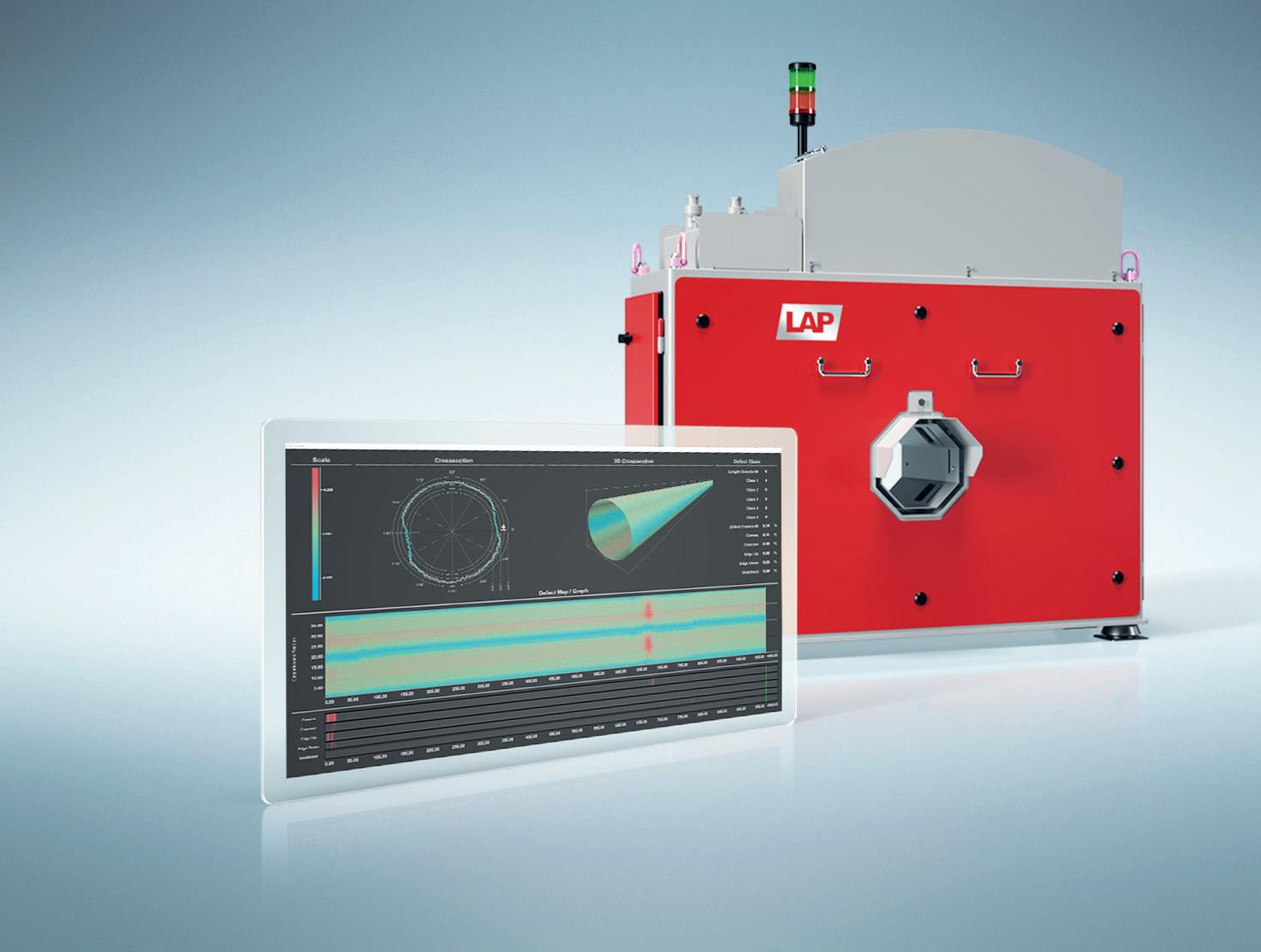

LAP will be highlighting its CONTOUR CHECK family of laser measurement systems and its intelligent evaluation software SMART CORE PRO. CONTOUR CHECK SHAPE is a laser measurement system for the 3D measurement of rolled long products using laser light section sensors. It enables steel manufacturers to improve their manufacturing quality and optimize their production processes by making available real-time, accurate, and reliable data on the shape of steel products, says LAP. SMART CORE PRO software provides users of CONTOUR

MEASUREMENT TECHNOLOGY FROM LAP

CHECK SHAPE systems with geometrical data that can be applied directly in the process line and in the data structures of an Industry 4.0 production environment. CONTOUR CHECK SHAPE integrates seamlessly with SMART CORE PRO, says LAP, providing a complete and robust solution for optical contour capturing and surface defect analysis. According to the company, the solution helps detect the smallest surface defects, such as scale scars, scratches, and roll breaks, immediately during production with high precision and reliability.

LAP will be exhibiting in Hall 01, stand A23

QuantoLux GmbH from Kleve, Germany, will present the QLX9, a high-end laser spectrometer for rapid slag analysis, at METEC this June. A significant advantage over previous analysis methods, says the company, is the sample-preparation-free analysis process – which takes place in less than six seconds. Steel mills can analyse their slag samples within seconds after sampling and thus react in-situ to deviations. Fewer inclusions in the steel, longer refractory life and higher throughput with lower energy consumption are just some of the benefits that lead to annual savings. QLX9 components used for the analyser are non-contact and wear-free, which the company claims reduces costs per analysis by up to 95%. In addition to the new flagship QLX9, QuantoLux is showing other laser OES products that are setting standards. The AlloyChecker, the lightest handheld spectrometer on the market, offers portable metal analysis, and is smaller and lighter than classic spark spectrometers, says QuantoLux. The QLX3 and QLX5 fulfil demanding analytical tasks, virtually crosscontamination-free and with minimal argon consumption.

QuantoLux will be exhibiting in Hall 12, stand D41-1

company

May/June 2023

www.steeltimesint.com

METEC PREVIEW

25

RAPID SLAG ANALYSIS FROM QUANTOLUX

Safety Storage Efficiency

Combilift is the perfect fit for the steel industry. Our multidirectional forklifts, straddle carriers and mobile gantry cranes are perfect for handling long product, allowing you to maximise your storage, efficiency and safety.

• Safer product handling

• Optimised production space

• Improved storage capacity

• Increased productivity & output

• Enhanced profits

combilift.com

MAXIMUM

for new

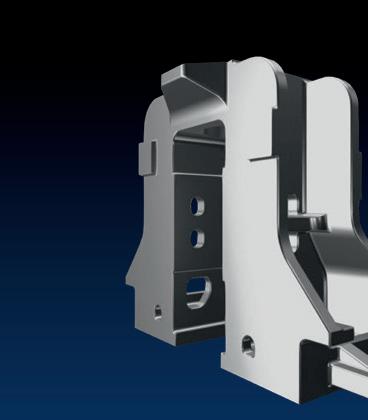

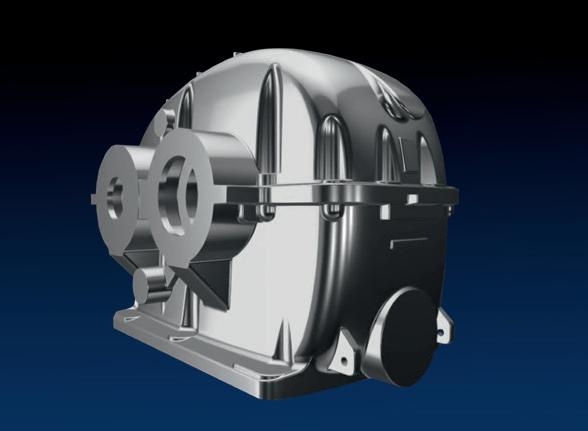

COSWIG means first class roll cast and mould cast products as well as innovative engineering. Since more than 125 years we develop, engineer and produce sophisticated cast parts for various industrial sectors and requirements.

Steel SPI Liz A5 rev 1.1.indd 1 07/03/2023 10:06:57

FLEXIBILITY

www.walze-coswig.com See us at METEC DUSSELDORF HALL1, BOOTH 1C38

ideas.

Making things new

THE word refractory, from the Latin ‘refractarius’, signifies stubbornness. A refractory horse does not wish to be ridden; a refractory toddler refuses to eat their broccoli. In the context of steelmaking, the stubbornness applies to an intrinsic chemical quality in which materials resist the extreme conditions of a furnace, in which temperatures can climb to 3000°F, with workers citing horror stories of 1980s haircuts being singed by a ‘rainfall’ of heat. It’s not an easy environment to cater for by any means – but Harbison Walker International, a company that this year will celebrate its 158th birthday, has been

bred from the beginning to take on the challenge.

Led by Carol Jackson, in her fifth year as president and CEO, the company has gone from the not-so-humble beginnings of designing Andrew Carnegie’s ‘Lucy furnace’– the largest blast furnace ever built at the time – to giant-like status within the industry, shipping over 130 million pounds of materials worldwide in 2020.

Being a part of the refractory industry, Jackson tells me, is all linked to her love of ‘making things’– efforts of creation, design, and functionalization, that initiate a chain ending in products that we use and

encounter everyday. ‘‘I’ve always been in industrial businesses’’, Jackson continues, telling me that from a young age, she was inspired by her father to work in business, and following on from her early career beginnings at PPG industries, a paint and coating manufacturer, she felt the urge to continue in the line of industrial product – that is to say, being a part of a long human heritage of ‘making things’ that are tangible, and influence all levels of experience.

Once Jackson began at HWI, within three years she became the company president and CEO. In a rapid transition to top

PROFILE 27 www.steeltimesint.com May/June 2023

*President, chairman of the board, and CEO, Harbison Walker International **Editorial assistant, Steel Times International

Carol Jackson* sits down with Catherine Hill** to discuss all things refractory, personal inspirations, ignoring bad advice, and her love of quotes.

leadership, Jackson wasn’t jarred by the change in pace, but instead ‘never looked back’– inspired by the fact that the products being made were ‘absolutely essential’, and contributing to a century’s old legacy of heat, chemicals, and fire. All that history, however, drives tricky encounters with ideas of tradition, and progression; ‘the question often is ‘why change it?’ ’’, says Jackson, ‘‘But, we need to pay off for the next generation, and change with the world – our customers are changing, and we have to change in order to be relevant and to sustain ourselves long-term. The reality of refractories is that our products are manufactured from mined raw materials, which are in and of themselves finite – we have a responsibility to be innovative, we have to ensure that we are supporting industry’s ESG initiatives.’’

An example Jackson cites as a way in which HWI is engaging with these initiatives, is its recent reclamation of the company’s fire clay mines, in which, following the effects of mining, through removing and separating unwanted materials, and building dams, land is restored. The key, says Jackson, is ‘working with communities to ensure the land is in a better state than it was before the mining took place’. As a part of a collective agreement between HWI and the surrounding communities impacted by the mining, the onus is to collaborate to deliver environmental sustainability that not only restores the land used, but allows

plant growth to flourish. ‘‘I take no credit for the work’’, Jackson says, adding that as part of her journey as a leader, she has felt the need to give voices to all, both those inside the company, and those that are impacted by its production. HWI’s Focused Intense Rotational Education (FIRE) programme is another way in which the company hopes to drive positive change, in which people from a variety of career backgrounds are able to experience the industry, and receive mentorship and training. ‘‘The more diverse our pool of incoming talent is, the more possibilities are opened up for us as a company. Part of our definition of diversity is diversity of thought, background, and capabilities – and that in itself brings in all kinds of potential that we otherwise wouldn’t have.’’

It’s not always easy for these spaces to even get filled, however, with the ongoing ‘war for talent’ meaning that every company is vying for the attention of incoming potential employees. Jackson used to ‘hate’ the term, but, she stated with a shrug – ‘‘it’s true.’’ ‘‘It’s a war that’s being fought on multiple fronts; we support a wide variety of industries so we’re certainly competing against refractory companies, but also anyone that is hiring talent.’’ As a result, HWI has challenged itself on the criteria written for every given role, and has

resultingly become more ‘open-minded’ regarding qualifications – but it isn’t a case of compromise, Jackson assures me, more a means of modifying the aperture in which talent is viewed. Ultimately, Jackson hopes the fact that ‘you can’t make things without [HWI] is pretty cool to candidates’, but, ‘there must be more’; pertaining to what opportunities the company can create, and how it can appeal to multiple generations of employment.

There are five generations of employees currently working at HWI, which, says Jackson, creates a need for consistent reciprocal communication – with the

company surveying each employee on their work anniversary date, and building the basis of their ESG strategies through a ‘grassroots effort’– asking the employees, ‘‘what are you passionate about?’’ Jackson ‘refuses to greenwash’ sustainability efforts by hiring personnel externally; for her, the most crucial resources lie in the bounds of the company itself, where those with real knowledge of its inner workings can discuss meaningful actions to ensure the company moves forward, rather than stagnates in realms of empty promises.

It hasn’t always been easy for Jackson to make these decisions, however, as she mentions the ‘inconsistent and contradictory feedback’ she received in her early career. ‘‘In the course of the twoyear period when I was in the automotive industry, I went from being perceived as a pushover, to being perceived as a bitch. I was given feedback on both ends of it, and if I had listened, I don’t know what I would have done,’’ she tells me, adding that she was ‘forced to assess’ who she really was, and ultimately came to the conclusion that she had to learn to be comfortable with

PROFILE 28 www.steeltimesint.com May/June 2023

her personality, and its resulting impact on her leadership. ‘‘Over the course of time, I modified my style and embraced an emotional and intuitive style that I was suppressing because it initially seemed like a weakness, when in fact, it’s a strength,’’ Jackson continued, saying that she learned as much from the ‘good bosses’ as the bad, using her experience and self-knowledge to build the trust with employees she enjoys today. She recites a quote that has been in the ‘back of [her] mind for 20 plus years’; ‘‘Become a student of this business: you are smart but you don’t know everything’’. Nothing ever stays the same; much like her love of ‘making things’ her focus is kept on ‘making things new’, challenging viewpoints, seeing the same thing in different shades of light. Being resilient, open minded, and having the ‘gumption’ to remain true to your ideals is a ‘steel thing’, Jackson tells me, saying that industries that see ‘ups and downs’ learn to never give up; to try again, and to learn from failure. There’s another quote she’s reminded of; ‘make better mistakes’;

an attitude that Jackson feels ‘transcends global barriers.’ ‘‘I’ve never known failure’’, she continues, ‘‘hopefully it doesn’t sound arrogant, but it’s about the idea of keeping trying’’. Jackson loves quotes, but to her, words shouldn’t only imply action, but commit to it – unlike the slippery slopes of New Year’s resolutions, making ‘better mistakes’ demands engagement that goes beyond a few erratic months of selfimprovement; it’s a fundamental shift in how we view failure, and how we react to its impacts.

On a more concrete level, however, other changes are taking place at the company this year, with ‘new technologies, new initiatives, and digitalization efforts taking place’, as well as HWI being recently acquired by Platinum Equity, a move that Jackson feels will allow for positive growth to continue while business continues ‘as usual’. ‘As usual’, for HWI, and for Jackson, means many things; acts of making, learning, evolving, and at their core, fulfilling, and even reshaping legacies to fit the future. �

PROFILE 29 www.steeltimesint.com May/June 2023

E xcellence in Ox ygen lancing ww w. beda .com

“Over the course of time, I modified my style and embraced an emotional and intuitive style that I was suppressing because it initially seemed like a weakness, when in fact, it’s a strength”

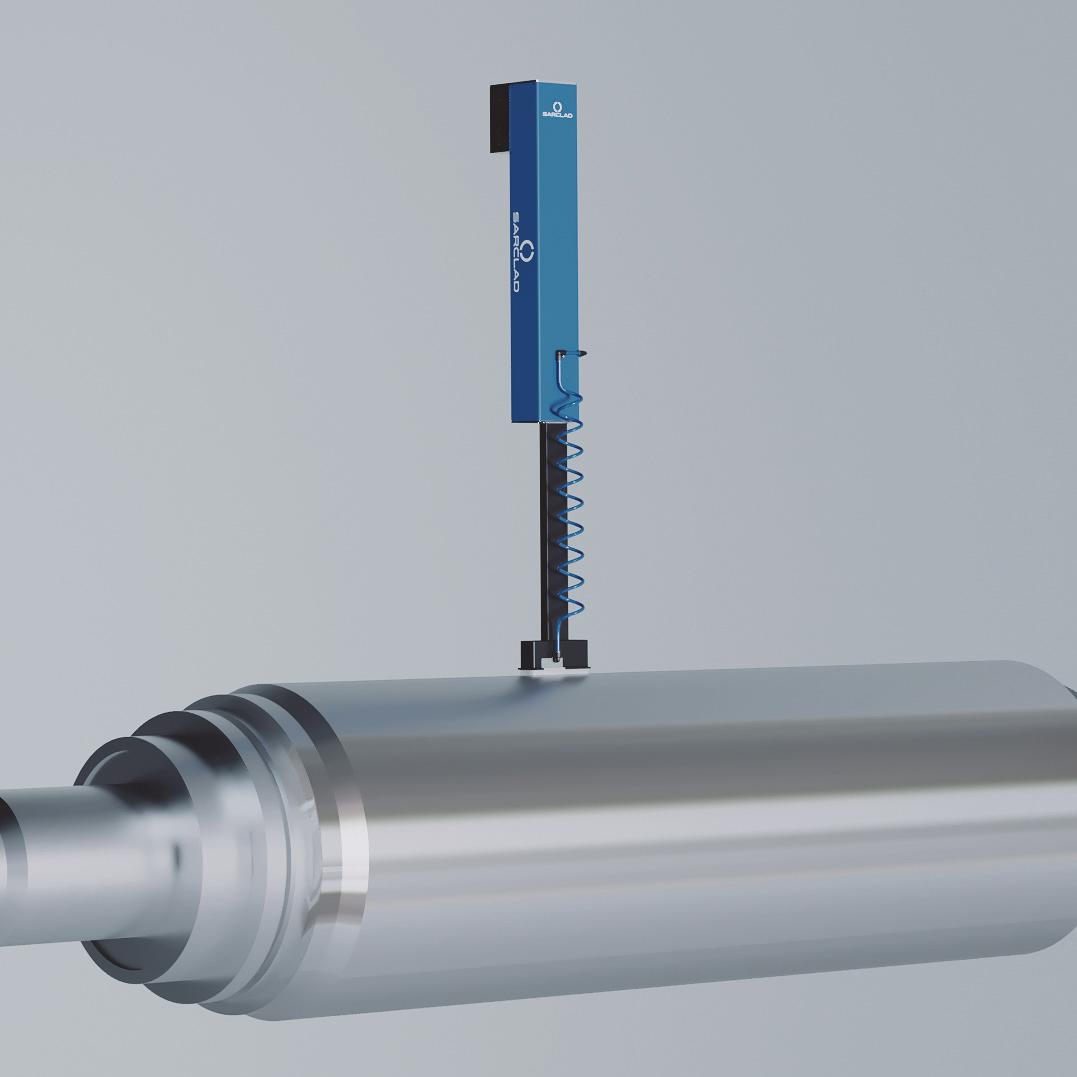

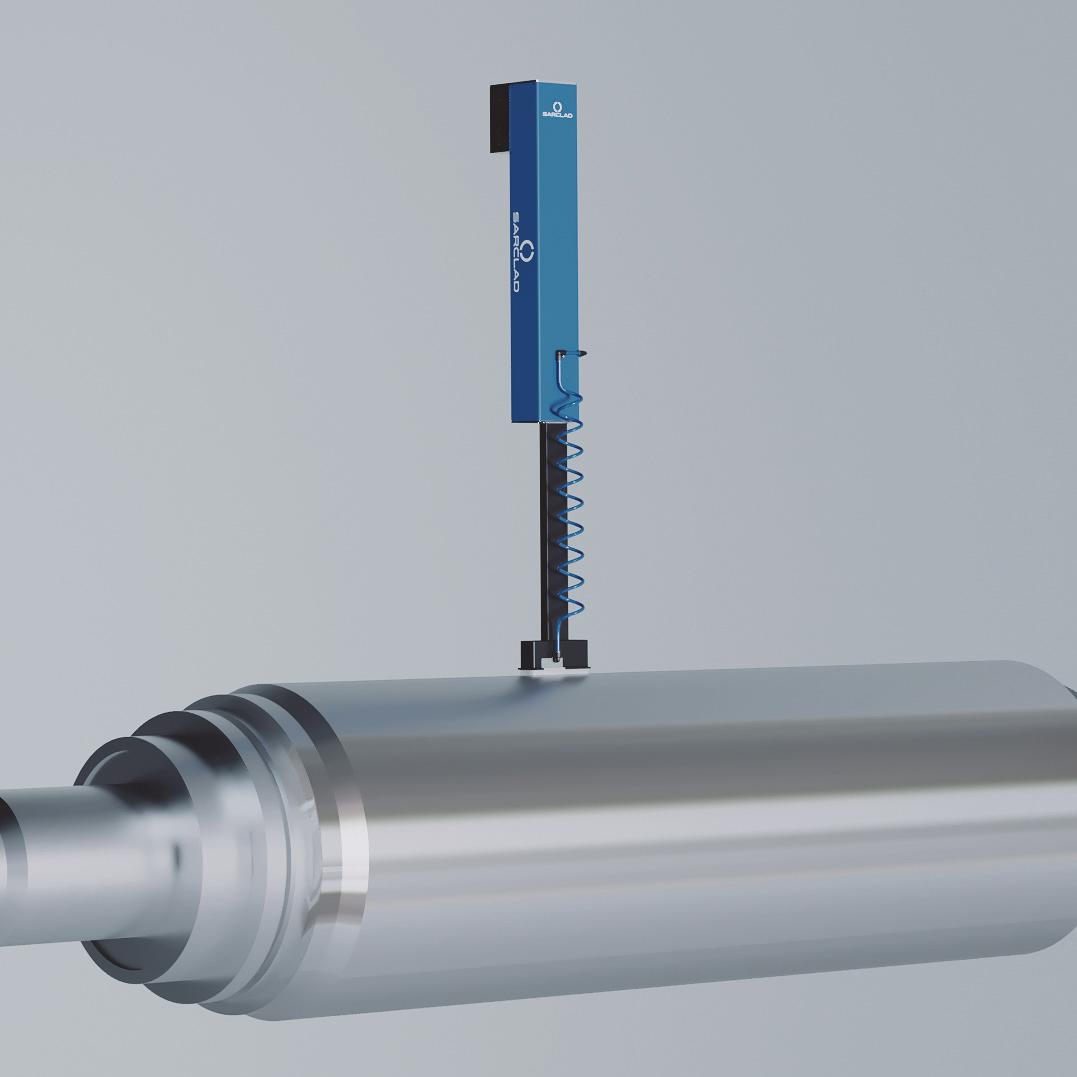

[ State of the art Roll Texturing technology ]

The Multi-Servo Array EDT delivers unrivalled roll texture control and consistency. The informed choice for surface critical strip. First orders secured. Please enquire below for further information.

[ Rollscan Roll Inspection ]

Surface to core roll inspection for back up and working rolls in hot and cold mill applications. A choice of units to meet your needs, backed by local engineering, service and support.

[ Strand Condition Monitors for Continuous Casting ]

sales@sarclad.com

sales@sarcladna.com

sales.china@sarclad.com

sarclad.india@sarclad.com

Sarclad is your proven partner for a bespoke solution for your caster. In-Chain and off-line SCM solutions available. Please enquire below. sarclad.com

RolltexMSA

Transitioning for growth

EU steel producers need to transform to become climate-neutral and less dependent on coal, while ensuring future growth. New opportunities associated with almost climate-neutral ‘green steel’ offer a promising way forward. By Dr. Andrew Zoryk* and Benedikt Meyer-Bretschneider**

DUE to rising EU CO2eq (eq = equivalent) costs and related policy changes aimed at decarbonizing the economy, demand for green steel is set to experience rapid growth, while conventional grey steel demand is expected to see a strong decline. While the costs incurred by steelmakers for CO2eq currently are effectively passed through to the steel consumers, this is unlikely to be the case when these costs rise during the coming years and green steel becomes available.

Direct Reduced Iron with hydrogen

To produce green steel, the use of direct reduction technology with green H2 is the favoured solution of the EU steel industry. In the first part of this article, we highlight

key factors that steel producers should evaluate when considering their pathway to decarbonization. We then derive three key levers that will enable EU steel producers to drive this historical green transformation forward, namely a business operating model, financial drivers, and green steel pricing.

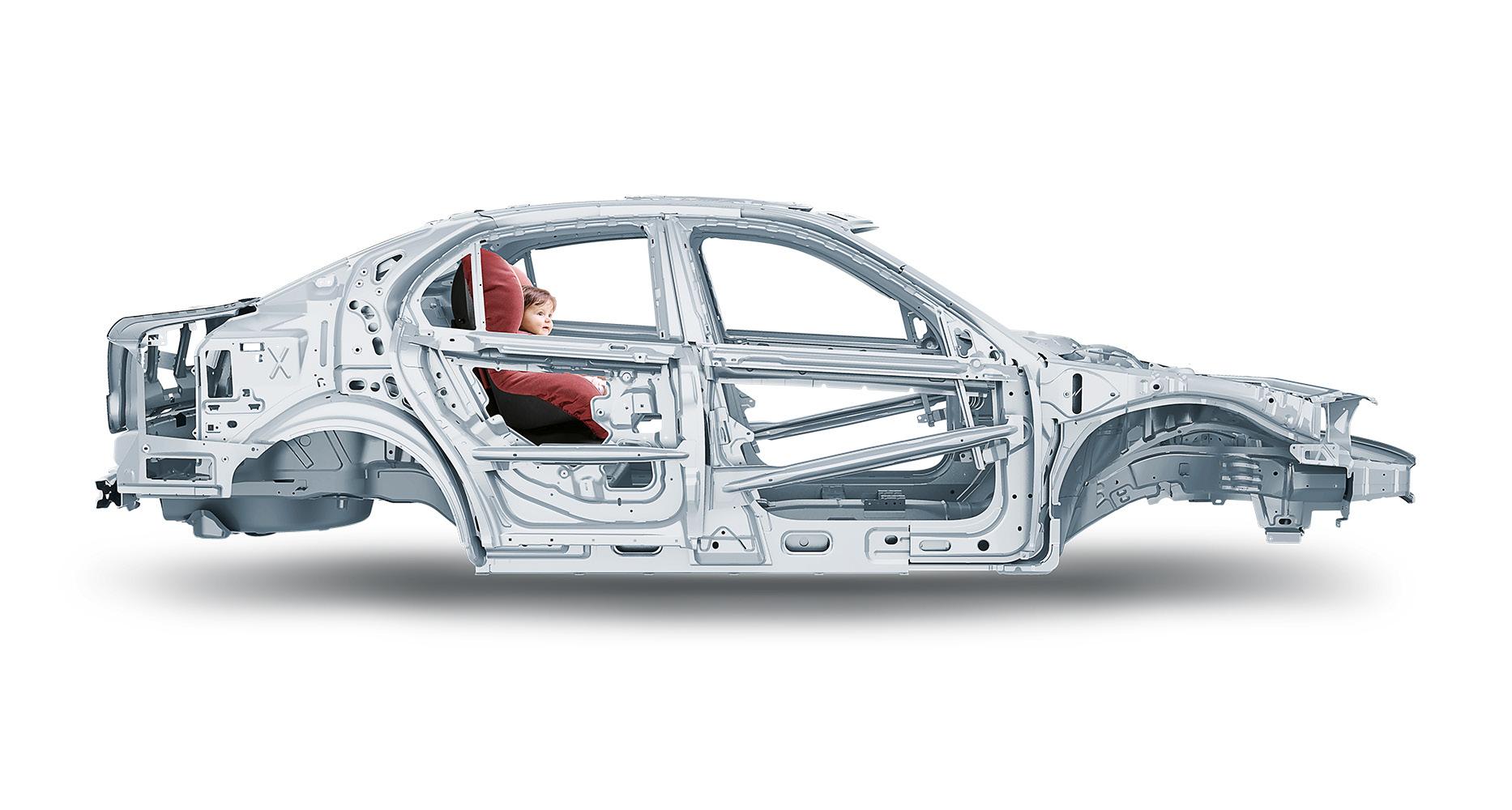

1. EU steel producers need to modernize to become climate-neutral and less dependent on coal, while ensuring future growth: green steel offers a promising way forward EU steel producers face four key challenges: Firstly, the EU steel industry has the ambition to cut CO2eq by at least 30% by 2030 versus 2018 and achieve climate

neutrality by 20501. Similarly, key EU steel customers are increasingly demanding green steel to fulfil their own climate neutrality goals, e.g., in construction, automotive, mechanical engineering, and metalware. Secondly, and as a consequence of increasing green steel demand, EU steel producers need to become less dependent on coal, for which prices are expected to stay significantly above the levels seen before the onset of the Ukrainian war. Thirdly, and coincidentally, EU steel producers will need to replace a significant amount of their key existing iron and steelmaking assets: It is estimated that at least ~70% of existing EU grey steel capacities will reach their end-of-life by 20302. Fourth, EU steel market growth is

DECARBONIZATION 31 www.steeltimesint.com May/June 2023

*Metals sector lead, Deloitte Consulting ** Manager, Monitor Deloitte

expected to continue stagnating until 2050, increasing the pressure to even maintain market shares, as well as to offer the market substantial differentiation.

To master these challenges, EU steel producers are starting to progressively shift their current production towards green steel. Green steel is effectively climate neutral and neither coal nor gas are necessary. It can be produced at the same quality and in the same quantities as grey steel. Overall, it offers a rapidly growing and innovative margin pool in line with key endcustomer ambitions. Of course, such a value chain transformation cannot be tackled alone, but needs multiple stakeholders: producers, customers, suppliers (equipment, raw materials), governments (regulation/industry protection, public funding), investors, as well as other partners along the value chain to join forces and pull together in one direction.

direct emissions), the EU steel industry had to buy allowances on the EU-ETS (Emissions Trading Scheme) for ~60 €/tCO2eq, yielding a total CO2eq cost of ~€2.6 bn in 2021, i.e., ~2% of the EU steel industry revenue of ~€125 bn (the remaining ~76% of direct CO2eq were free allowances).

The business-as-usual situation would be expected to become much worse for grey steel by 2035: assuming no CO2eq decrease in the production process, direct CO2eq would grow in line with the grey steel market to ~200Mt CO2eq. Moreover, free allowances are expected to decline by at least ~2.2% per annum and to end at the latest by around 2035, after phase four of the EU-ETS. Likewise, CO2eq prices are expected to rise to ~100-150 €/tCO2eq by about 2035. This would yield total CO2eq costs to be at least ~€26 bn – about a tenfold increase to 20216

Due to their currently relatively small

transforming, with green steel production capacity in 2030 expected to reach ~20% of the EU steel market, and almost all major EU steel producers are already aiming to participate9. This poses an existential threat for grey steel producers. Over the next years, towards 2030, the forecasted strongly increasing CO2eq costs for grey steel cannot be expected to be passed through to customers sufficiently for steel producers to remain profitable. Most key customers are expected to choose green over grey steel, even at significant price premiums, all else being equal10

In a stagnating steel market, this means predatory competition, as green replaces grey steel step-by-step. If anything, grey steel will only be sold with insufficient or no CO2eq cost pass-through, making it immediately unprofitable. As a result, investments into further grey steel production assets in the EU are not only at risk of becoming stranded assets and consuming capital, but also pose existential risks for a steel producers’ overall business.

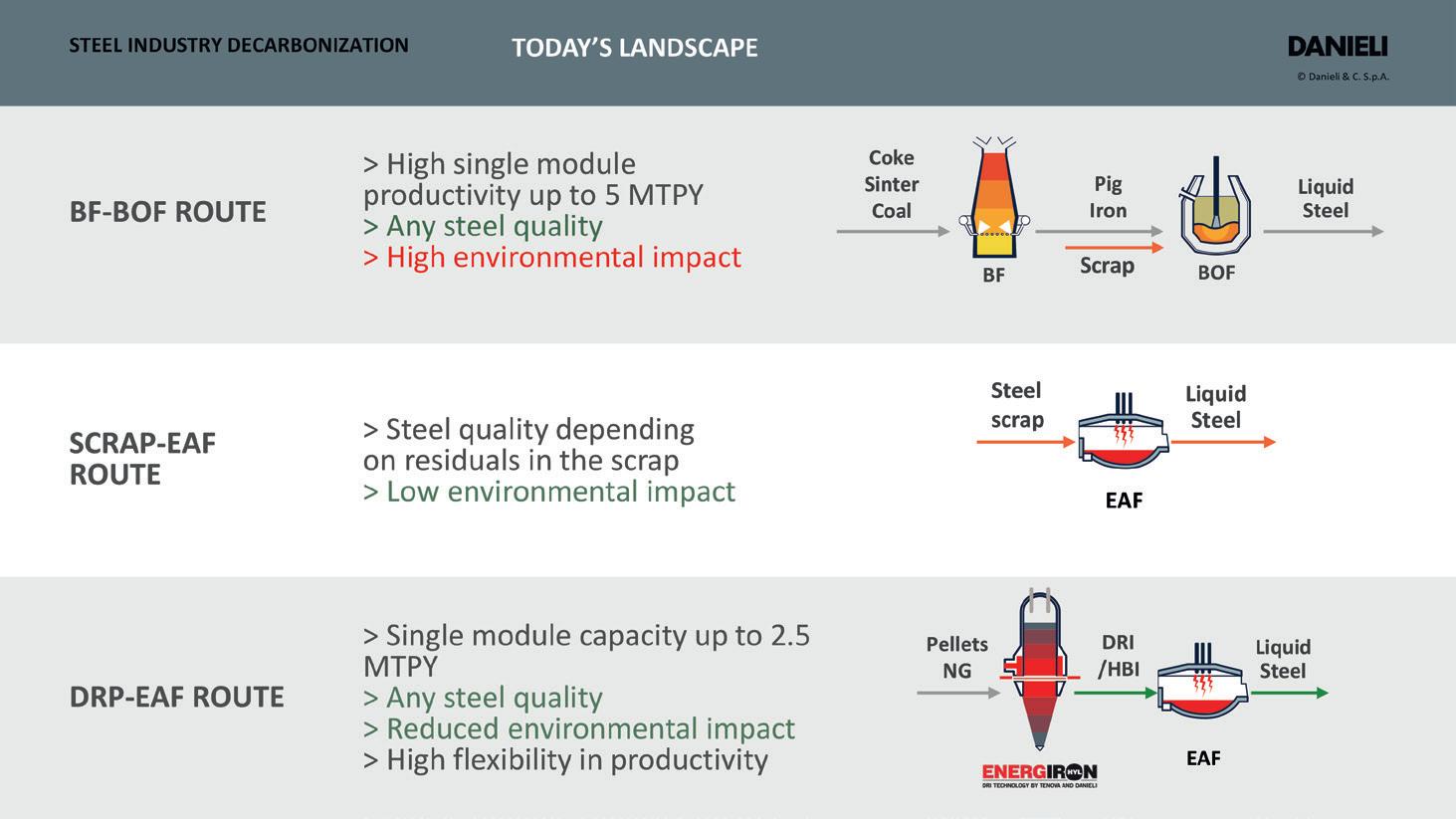

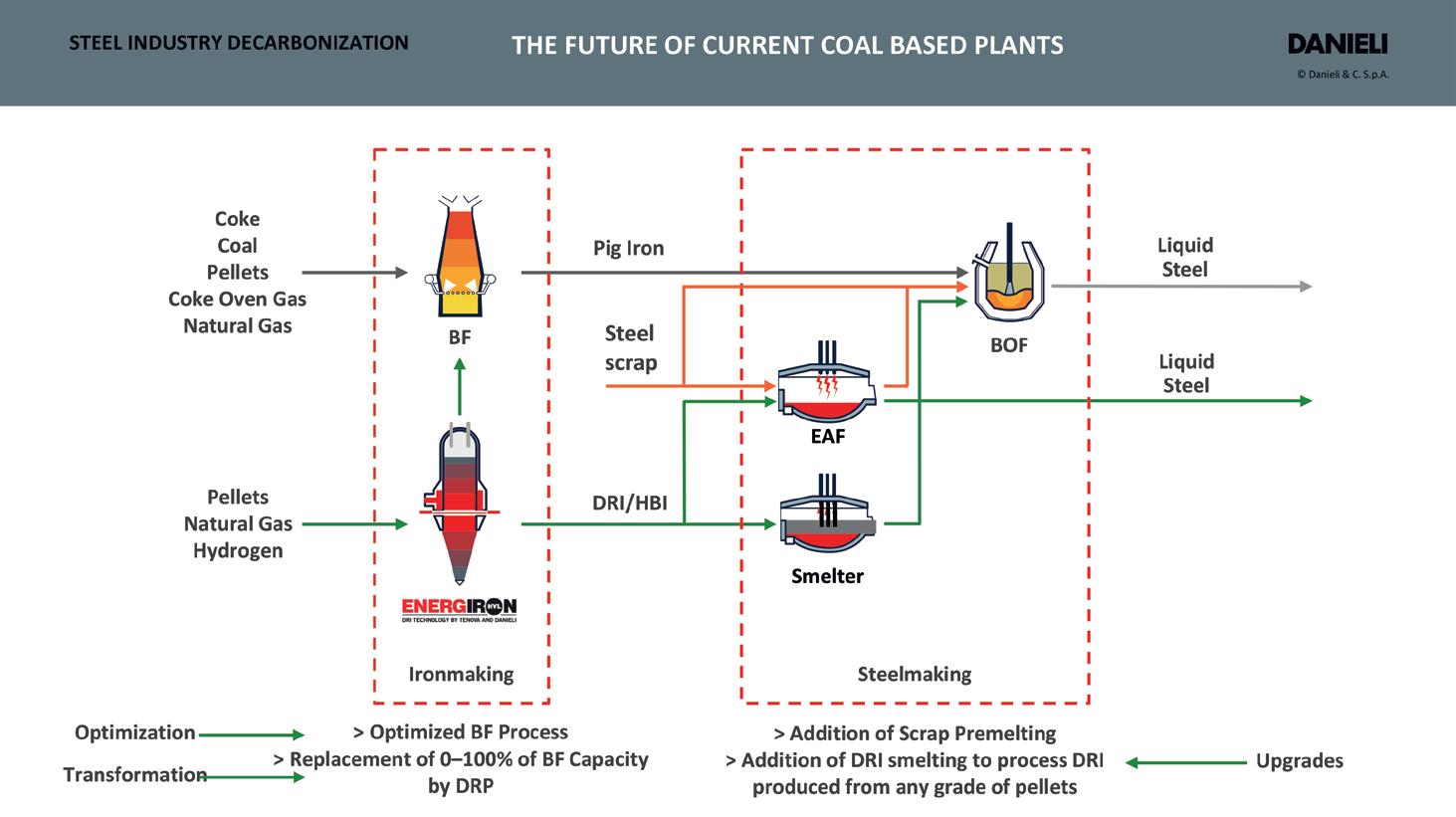

3. Direct reduction with green H2 is the favoured solution of the EU steel industry

2. Rising EU CO2eq costs push green steel demand and erode grey steel business

On the one hand, the EU steel industry produced ~153Mt of crude steel in 20213, supporting ~0.33 million direct and ~2.5 million indirect jobs4. Growth, however, is expected to continue stagnating at about 1%/yr until 2050. The industry is even expected to shrink until at least 2023 due to the Russian invasion of Ukraine. To even maintain market share in such a sharply competitive market, steel producers need to differentiate.

On the other hand, the EU steel industry in 2021 has produced ~228Mt CO2eq, accounting for ~6% of EU CO2eq emissions. This came at a price5: for ~44Mt CO2eq (~24% of ~185Mt CO2eq

levels, CO2eq emission costs have mostly been passed through by steel producers to customers7. As of 2021, ~84% were in four key steel consuming sectors: construction (~37%), automotive and other transport (~18%), mechanical engineering (~15%), and metalware (~14%)8. For these sectors, steel constitutes typically anywhere between ~23% (for construction of a mid-sized steel hall warehouse) and more than ~90% (for metal products) of their CO2eq footprints. Since all steel consuming sectors have at least moderate climate neutrality goals, with many companies having signed up for sciencebased targets that cover Scope 3 emissions, they will require green steel as a key enabler sooner or later.

And the EU steel industry is indeed