Hyundai must align ops with sustainability claims.

South Korean giant clings to coal dependence.

Foreign steel suppliers starting to feel uneasy. Since 1866

Fuel for decarbonized steel, says SAP’s Stefan Koch.

Hyundai must align ops with sustainability claims.

South Korean giant clings to coal dependence.

Foreign steel suppliers starting to feel uneasy. Since 1866

Fuel for decarbonized steel, says SAP’s Stefan Koch.

Metals offers the entire steel value chain an exceptional opportunity for curbing their CO2 emissions.

The unique combination of its historic and recently developed product portfolio, make John Cockerill one of the industry’s most relevant suppliers of equipment for both the hot and cold phase of the steelmaking and processing industry.

Our three distinct business segments are addressing todays and tomorrow’s challenges supporting sustainable and green steel production:

Our new upstream offering related to DRI (Direct Reduced Iron), EAF (Electric Arc Furnaces) technologies and the use of hydrogen in steelmaking. Next to offering indirect electrification (DRI-EAF&H2-DRI-EAF),John Cockerill is also working on Volteron®: A first-of-a-kind iron reduction and steel processing route via direct cold electrolysis. This CO2 free steelmaking process, has been co-developed with the world’s leading steelmaker ArcelorMittal.

Regrouping our historical downstream product portfolio, this segment also includes:

¡ the Jet Vapor Deposition (JVD®) technology set to replace today’s hot-dip or electro galvanizing processes. This novel high-productivity vacuum coating technology provides previously unknown coating flexibility and possibilities, all while offering lower CAPEX and OPEX.

¡ our E-Si® equipment & processing lines specifically designed to produce high-quality Non-Grain Oriented (NGO) steel in response to the need for electrical steel meeting precise metallurgical properties, essential to support the shift towards green mobility.

This segment not only embraces all services and after-sales activities but will be strongly focusing on downstream furnace electrification (reheating and processing line furnaces), as well as hydrogen combustion, and the optimization of plant operations, including energy audits and the modernization of steel production equipment and installations.

EDITORIAL

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Assistant Editor

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor Annie Baker

Advertisement Production Carol Baird

SALES

International Sales Manager

Paul Rossage

paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark

kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion

tonycrinion@quartzltd.com / Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

Tel +44 (0) 1737 855028 / Fax +44 (0) 1737 855034 Email subscriptions@quartzltd.com

Steel Times International is published eight times a year and is available on

subscription. Annual subscription: UK £226.00 Other countries: £299.00

2 years subscription: UK £407.00 Other countries: £536.00

3 years subscription: UK £453.00 Other countries: £625.00 Single copy (inc postage): £50.00 Email: steel@quartzltd.com

Digital subscription: (8 times a year) - 1 year: £215.00 - 2 years: £344.00 3 years: £442.00. Singe issue: £34.00

Published by: Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com

Steel Times International (USPS No: 020-958) is published monthly except Feb, May, July, Dec by Quartz Business Media Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER send address changes to Steel Times International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in England by: Stephens and George Ltd • Goat Mill Road • Dowlais • Merthyr Tydfil • CF48 3TD. Tel: +44 (0)1685 352063

Web: www.stephensandgeorge.co.uk ©Quartz Business Media Ltd 2024

www.steeltimesint.com

2 Leader By Matthew

Moggridge.

4 News round-up

The latest global steel news.

The latest products and contracts.

USA update Fork in the road ahead.

Latin America update From Acesita to Aperam.

India update

Special boost for specialty steel.

Climate crisis

Co(al)-dependent: POSCO dragging its feet

Decarbonization CELSA’s TWINGHY project.

Climate crisis

Hyundai’s tainted steel.

Tube and pipe

New pipes, new prospects.

Digitalization

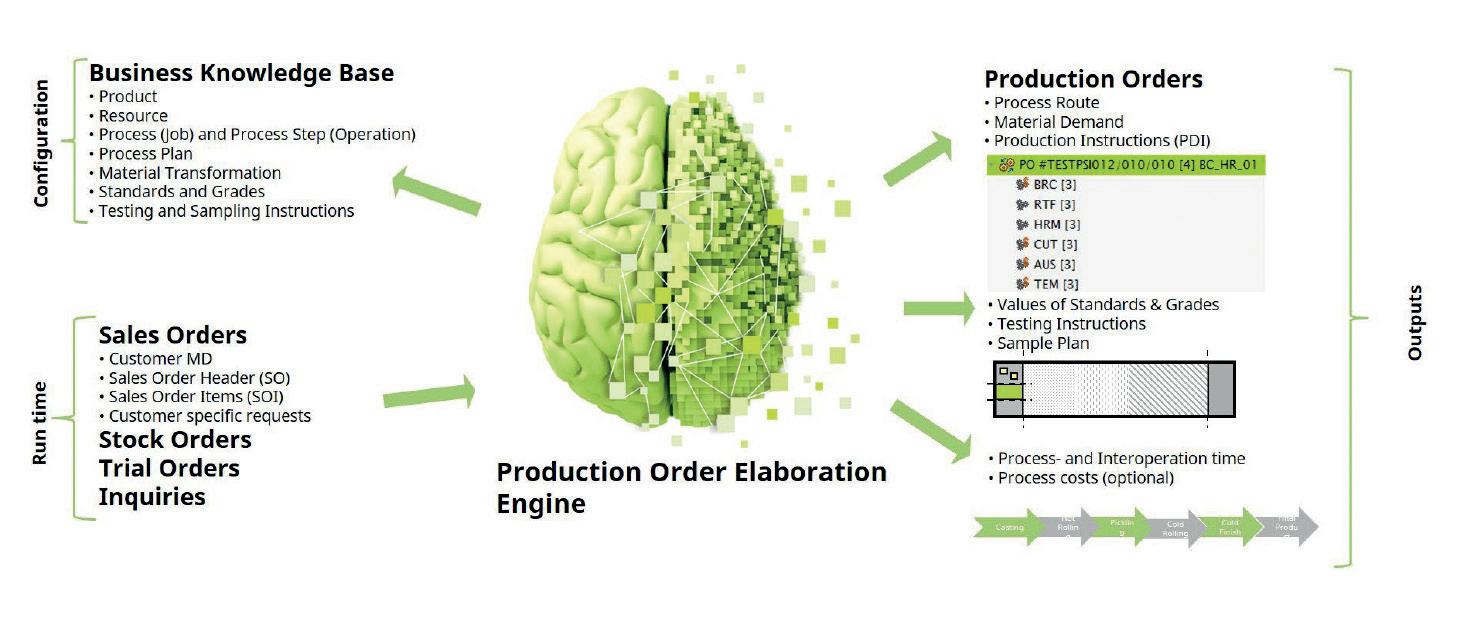

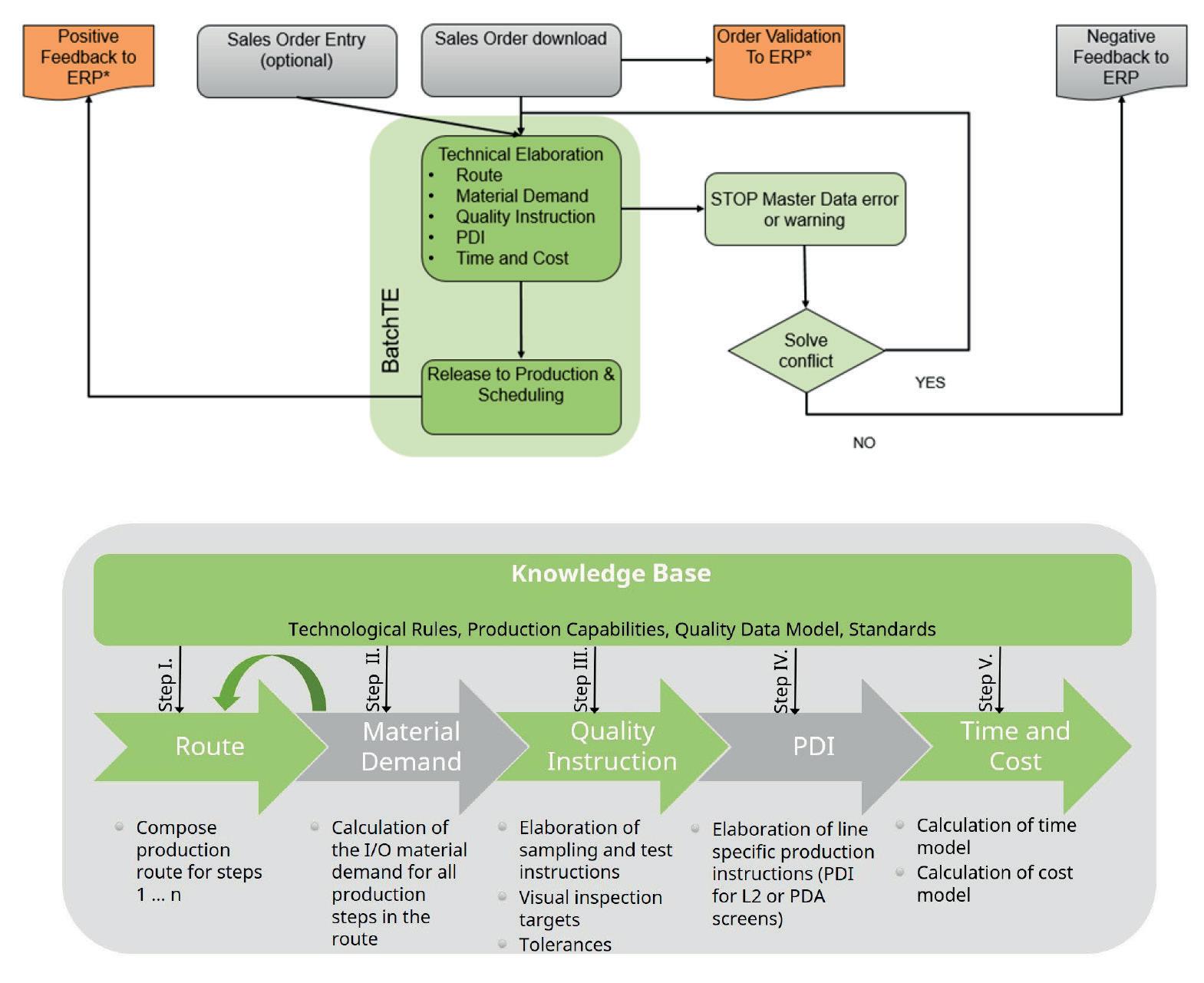

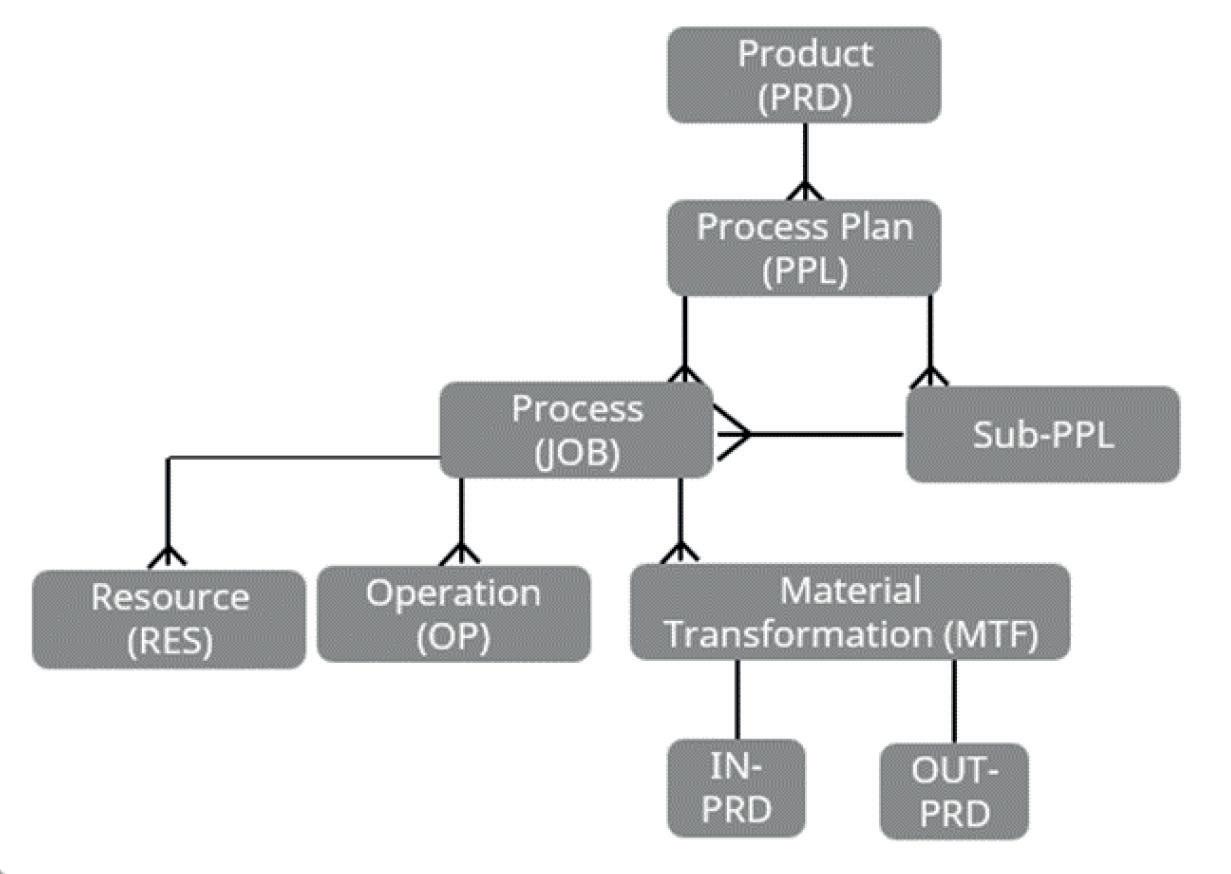

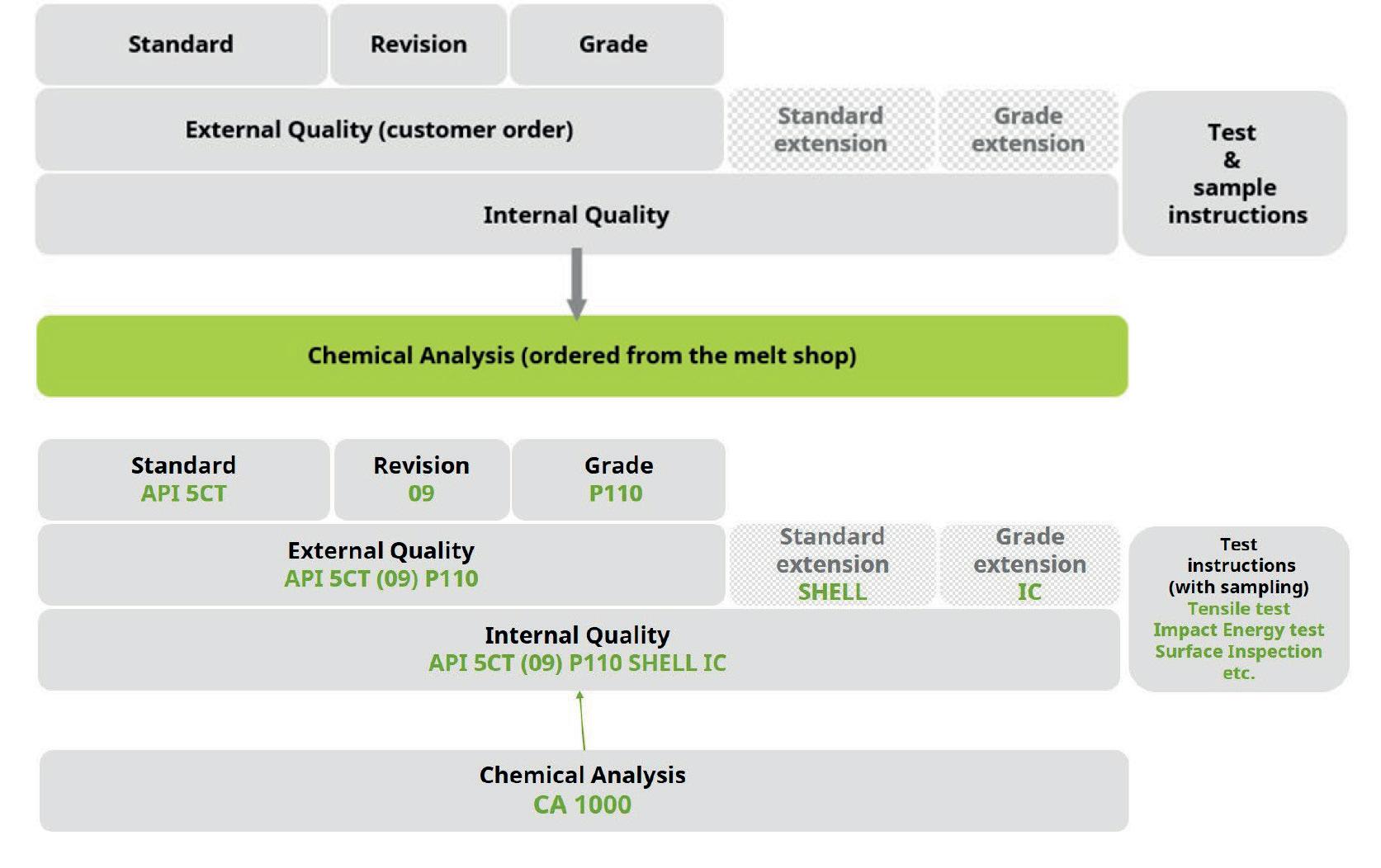

Smart order dressing explained.

Digitalization

People and technology: fuel for decarbonized steel. 48

Perspectives: Resonac Graphite Radical innovation. 51

History Pioneers of coke smelting part 3: William Chettle and Zachary Downing.

Matthew Moggridge Editor

matthewmoggridge@quartzltd.com

I wonder what Sir Keir Starmer, the UK’s Prime Minister, is thinking right now having publicly brown-nosed President Donald Trump in the White House, touching him here, there and everywhere after his winter greens salad and sea bass and grovellingly handing him a letter from King Charles inviting him on a second state visit. Seriously, I was frantically looking around for a sick bag as I watched such chronic obsequiousness unfold in front of me, knowing full well that tariffs would be applied to UK steel regardless of Starmer’s beggarly behaviour in front of a man the Daily Star, a UK-based tabloid, has labelled the ‘orange man-baby’. I bet King Charles is, at this very moment, standing in front of an ornate mirror practising (with great difficulty) a smile he is hoping will convince Trump that he is welcomed in the UK after publicly humiliating President Zelenskyy of Ukraine (who got to shake hands with our King first!) and then trashing the so-called ‘special relationship’ between the UK and the USA by slapping 25% tariffs on our steel. I just hope that we are as tough with Trump as he has been with us. Let’s hope we respond in kind rather than do nothing in the hope that Trump will see sense and

back track. Let’s face it, he’s not going to, not yet at any rate. Who needs Harley Davidsons and bourbon whisky anyway? Not that we haven’t been here before, it’s like an horrendous Groundhog Day without the humour.

In a BBC News report on the day of the announcement, Gareth Stace, directorgeneral of UK Steel, called the Trump decision ‘hugely disappointing’, adding that some steel company contracts had already been cancelled or put on hold and that customers in the USA will have to pay £100 million per year extra in tax. Stace believes that tariffs will hit the UK hard at a time of rising imports and punitive energy prices.

Oddly, the US only accounts for around 8% of UK exports, according to the International Steel Statistics Bureau, quoted in the BBC report, which rather makes a nonsense of imposing punitive tariffs but, as I’ve said a lot of late, ‘it is what it is’, a phrase that implies a sorry inevitability to a situation I can do little about.

As they used to say in Thunderbirds, ‘anything can happen in the next half hour’ – and it probably will.

Just as athletes rely on their teammates, we know that partnering with our customers brings the same level of support and dependability in the area of manufacturing productivity. Together, we can overcome challenges and achieve a shared goal, optimizing processes with regards to economic efficiency, safety, and environmental protection. Let’s improve together. Do you want to learn more? www.endress.com

www.fivesgroup.com/steel

Norway’s Blastr Green Steel has successfully completed the second round of partnership financing, the company said in a statement. This round involved three of Blastr’s founding investors and three new investors based in Finland. The initial investors who provided additional capital and increased their stake in Blastr are Cargill Metals, the Finnish stateowned venture capital and private equity company Tesi, and Blastr founder Vanir Green Industries.

Source: GMK Center, 4 February 2025

A steel company has announced it could close its only UK plant, putting about 180 jobs at risk. Union Electric Steel has launched a consultation on ending

Tempest Minerals has signed a memorandum of understanding with GreenSteel of WA, a company focused on creating a sustainable steel manufacturing industry for Western Australia. The MOU establishes a framework for Tempest and GreenSteel to explore potential development opportunities for the former’s Remorse magnetite deposit within the Yalgoo project in WA. The collaboration aims to leverage GreenSteel’s production expertise and Tempest’s Remorse deposit to produce high-grade magnetite concentrate for use in green steelmaking processes.

Source: Australian Mining, 7 February 2025

production at its site in Gateshead, which has been making steel for more than 150 years. Bosses said the business had been losing money for the past three years, due to lack of demand for products manufactured in the UK, high energy costs, and the ongoing effects of Brexit.

Source: BBC, 12 February 2025

Indian industrialist Naveen Jindal has submitted a bid exceeding $1 billion to acquire Italian steel manufacturer Acciaierie d’Italia (ADI). The offer, made through his privately held overseas companies, focuses on transforming ADI’s traditional blast furnaces into energyefficient electric arc furnaces, aligning with modern environmental standards.

ADI, with an annual steel production capacity of approximately 10Mt, employs around 10,000 workers, a quarter of whom are currently under a layoff scheme.

Source: Manufacturing Today, 9 February 2025

ArcelorMittal is considering moving some of its European business processes to India as part of its cost optimization strategy. The

Tata Steel UK has selected construction company Skanska to oversee the design and project management of its £1.25 billion new electric arc furnace project, a move aimed at advancing low carbon steelmaking in South Wales. The electric arc furnace initiative is part of a broader strategy to secure the long-term viability of steel production in the region.

Source: New Civil Engineer, 11 February 2025

company emphasized that this decision does not affect production facilities in Europe but is aimed at improving operational efficiency. According to Reuters, citing the company’s official statement, the European steel industry is facing a number of challenges that affect its competitiveness. In response to these challenges, ArcelorMittal is analyzing the possibility of centralizing business functions by expanding its existing service centre in India.

Source: GMK Center, 13 February 2025

SeAH Wind has confirmed it will commence commercial production at its £900 million monopile manufacturing facility at Teesworks in the UK from next month. The company, which rolled the first 7.5-metre diameter steel can in pre-production trials at the factory late last year, said trial production activities and final installations are now fully underway.

Source: ReNews.biz, 13 February 2025

Liberty Steel Georgetown has been hit with a $7 million lawsuit by the South Carolina Public Service Authority for allegedly failing to fulfil an electricity service agreement. According to the lawsuit, Liberty Steel ‘entered into a South Carolina Public Service Authority Service Agreement for Large Power Electric Service’ with Santee Cooper on 1 May 2023. The agreement states Santee Cooper was to sell electricity to the mill for five years, which was to be paid monthly. The filing states Liberty Steel failed to pay for November 2024 service charges of $167,280.50 and December 2024 service charges of $166,942.56, for a total past due balance of $334,233.06.

Source: GAB News, 17 February 2025

South African officials are working with the government to prevent the closure of ArcelorMittal’s Newcastle steel plant, which threatens 1,500 jobs. Acting Newcastle mayor Lihle Mthembu said that the municipality is working with the provincial government to find a way to prevent what local media is referring to as an ‘economic disaster.’ “As the district and our sister municipalities, we will be directly affected by this closure and we are committed in finding more ways of supporting the affected workers and their families,” said Mthembu.

Source: Scrolla, 17 February 2025

Brazilian steelmaker Gerdau may opt to increase its output capacity in the US instead of building a new plant in Mexico, its CEO has said, as tariffs implemented by President Donald Trump shake up global trade. Gerdau announced last year it was considering installing a new special steel mill in Mexico, which would have an annual capacity of around 600kt and require investment of $500$600 million.

Source: Reuters, 20 February 2025

The German Steel Federation is urging the new government to act to sustain the country's steel production, the largest in Europe and seventh worldwide, with a position

British Steel should get an extra £200 million from the government to support it in keeping the UK’s two remaining blast furnaces open until electric replacements are built, according to a proposal put forward by unions.

Chinese-owned British Steel has said it will replace its blast furnaces at Scunthorpe with electric arc furnaces, which can be used to make much cleaner, recycled steel. However, unions are concerned that a rapid closure of the blast furnaces will result in the loss of nearly 2,000 jobs within months.

Source: The Guardian, 20 February 2025

paper aimed at ensuring the sector's competitiveness and sustainability, a WV Stahl spokesperson told Platts, part of S&P Global Commodity Insights. According to the Federation, addressing electricity costs – which account for 20-40% of steelmakers' expenses – is crucial. Source: S&P Global, 24 February 2025

In a recent review published in the Journal of Energy and Climate Change, researchers from IIT Bombay have collated the advances made in the field of hydrogen generation for the steel industry and put forward the best way to decarbonize the steel industry using ‘green’ hydrogen. A team of researchers, Arnab Dutta, Sukanta Saha, Suhana Karim and Santanu Ghorai, from the Chemistry Department at the Indian Institute of Technology Bombay (IIT Bombay) have come up with a set of sustainable catalysts for generating green hydrogen that can be utilised in the steel making process via hydrogen-based direct reduction of iron (H-DRI) method. Source: The Hindu, 25 February 2025

The Trade Remedies Authority (TRA) has published initial findings, proposing that antidumping and countervailing measures on organic coated steel imported from China be maintained for an additional five years, until 4 May 2029. In its Statements of Essential Facts (SEF), the TRA found that dumping and subsidisation would likely recur if the measures were removed, potentially causing injury to UK industry.

Source: GOV.UK, 25 February 2025

Petronas, a Malaysian oil and gas company, has formalized an agreement with Sabah Energy Corporation Sdn Bhd (SEC) for supplying additional natural gas to support Sabah’s industrial and energy needs. SEC will allocate a portion of this to Esteel Enterprise Sabah Sdn Bhd, supporting its steel production operations and efforts to adopt greener and more sustainable practices.

Source: Egypt Oil & Gas Group, 2 March 2025

TOSYALI SULB Steel Industries, which was formed by TOSYALI and Libya United Steel Company, has awarded an order to Midrex and SMS group for a new DRI complex. The company intends to immediately commence the first phase of the project, with the construction of a 2.5Mt cold DRI (CDRI) plant. The Libyan plant will supply CDRI to meet the needs of the nearby region.

Source: Construction World, 26 February 2025

Korean steel giant POSCO has been sued over the climate impact of a blast furnace expansion plan. Youth activists are arguing that POSCO’s plan to extend the life of its Gwangyang coal-based blast furnace violates a human right to a healthy environment. It is the first lawsuit to challenge a company on its climate impact since a constitutional ruling recognised the state’s obligation to protect citizens from climate change.

Source: Eco Business, 2 March 2025

Swedish steelmaker SSAB and Italian crane manufacturer Fassi have reportedly signed an agreement to supply steel with almost zero fossil carbon emissions in the future. Under this agreement, SSAB will provide Fassi with steel made from iron ore and recycled scrap steel. Fassi produces self-propelled hydraulic cranes and crane trucks.

Source: Yieh Corp Steel News, 28 February 2025

ArcelorMittal has announced the appointment of Everton Negresiolo as CEO of its South American long products and mining business and a member of the group management committee, effective 1 April 2025. Everton will report to Aditya Mittal, CEO of ArcelorMittal. Everton succeeds Jefferson de Paula, who is retiring, also effective on 1 April 2025.

Source: Global Newswire, 3 March 2025

HYBRIT, a joint venture between steelmaker SSAB, mining company LKAB, and energy company Vattenfall, has completed a pilot hydrogen storage project, as reported to the Swedish Energy Agency. According to the company, the results of the project show the technical feasibility of storing hydrogen for metallurgical production without fossil fuels on an industrial scale.

Source: GMK Center, 2 March 2025

The Washington-based Steel Manufacturers Association (SMA) is citing a study prepared by a French consulting firm that backs the notion that enough domestically generated ferrous scrap is in the United States for recycled-content electric arc furnace (EAF) mills to supply nearly all of the country's steel needs. The 18-page report, titled A Transition towards Scrapbased EAFs Accelerates the Competitiveness and Decarbonization of the American Steel Industry, has been prepared by French consulting firm Laplace Conseil. According to the SMA, the study helps confirm that EAFs in the US already produce the same high-quality steel as blast furnaces and basic oxygen furnaces.

Source: Recycling Today, 3 March 2025

Liberty Steel Galati has initiated a preventive composition process, designed to stabilise the company, optimise resource allocation, and unlock new investment opportunities. The business claims that its actions will build a sustainable business, protect the company’s future and restart the production operations in Galati, which shuttered in May last year.

Source: BR Magazine, 4 March 2025

Liberty Steel UK’s pipes division in Hartlepool has now started work on creating pipelines for the Net Zero Teesside project after securing work on the bp-led scheme last year. The company will produce 105km of offshore pipeline infrastructure which will be used to transport CO2 to the Endurance carbon capture storage facility in the North Sea – 1,000 metres below the seabed.

Source: Tees Business, 7 March 2025

Rails manufactured by British Steel in Scunthorpe, UK, for Egypt’s first fully electrified mainline and freight network have recently passed inspection and been dispatched from the port of Immingham. The UK-based steelmaker recently hosted representatives from the Egyptian companies F.A.T. and Orascom, who are managing the project, to deliver Egypt’s landmark new rail route. They inspected, and approved rails from a batch of over 4,500 18-metre lengths which were ready for dispatch at both the Scunthorpe site and the Immingham port.

Source: British Steel, 4 March 2025

The UK’s only plate steel mill needs investment to allow it to become a ‘world-leading producer’ of a key component for offshore wind turbines, trade union leaders have said. A new report from the

The European Recycling Industries' Confederation and the Bureau of International Recycling, both based in Brussels, are ‘profoundly concerned’ about the conclusions reached during the Summit on the Future of the European Steel Industry in Paris, particularly with the intention expressed by representatives of Belgium, Italy, France, Luxembourg, Romania, Slovakia and Spain to ‘secure access to raw materials while retaining steel scrap within the EU’ and the proposal to ‘restrict or ban exports to third countries that do not adopt environmental and production legislation similar to that of Europe.’

Source: Recycling Today, 4 March 2025

Ukraine still maintains steel production growth in the first two months of 2025 despite the loss of the sector's key coking coal mine in Pokrovsk in the eastern part of the country, data from the Ukrainian steel producers' union showed earlier this

Fujian Kebao Metal Products, a Chinese silicon steel producer and subsidiary of Sanbao Group, has placed an order with Primetals Technologies for a continuous tandem cold mill (CTCM) at its steel plant in Zhangzhou. According to a press release, the 6-stand CTCM will be used to produce high-quality silicon steel and associated services in China. The machine will be designed to achieve precise thickness and flatness tolerances with high accuracy. It will be equipped with chamfered shiftable work rolls and a multichannel edge drop thickness gauge.

Source: Primetals Technologies, 6 March 2025

month. Ukrainian steelmaker Metinvest has suspended operations at Ukraine's only coking coal mine, citing a deteriorating security situation as Russian forces advanced.

Source: yahoo!finance, 8 March 2025

Community trade union made the case for investment in the Dalzell steelworks in Motherwell, which is currently the UK’s only plate mill.

Source: The Standard, 9 March 2025

DYSENCASTER®

HYDROGEN-READY AND ELECTRIC TUNNEL FURNACES

Performances, operational reliability and quick startups are the result of 30 years of continuous R&D activities, carried out at the Danieli research center and onsite together with partnering customers.

QSP-DUE can make use of more than 20 Danieli patents covering technological layouts, production equipment and Danieli Automation solutions, such as power, instrumentation and intelligent digital controls.

— The most efficient, digitally controlled electric steelmaking with no impact on the power grid.

— 6 m/min casting speed, allowing up to 4.5-Mtpy productivity on a single strand, with dynamic adjustment of slab thickness and width at any speed. In-mould fluidodynamic control with MultiMode Electromagnetic Mould Brake (MM-EMB) for no quality limitation.

— Hydro-MAB burners ready for 100% hydrogen operations and electric tunnel furnaces for carbon-free slab reheating.

— Split mill layout, intensive cooling and dynamic transfer bar reheating for true thermomechanical rolling and endless operation of ultra-thin gauges.

— Danieli Automation robotics and artificial intelligence for zero-men on the floor.

— Least power-consuming process with the lowest carbon footprint.

— The most competitive plant in terms of CapEx and OpEx.

— The highest production flexibility due to three rolling modes available in a single line.

QSP-DUE® ENDLESS CASTING-ROLLING PLANTS

SGJT and Yukun are enjoing their QSP-DUE plants operating in coil-to-coil, semi-endless and endless mode, based on HRC market requests. The Nucor Steel QSP-DUE plant is under construction.

15 QSP PLANTS

The TII Group has ‘set the course for ensuring continued future success’ through the appointment of Filippo Baldassari as managing director of TII GmbH. Together with CEO Dr. Gerald Karch, he has been tasked to strategically develop the group and sustainably strengthen its market position.

Filippo Baldassari has been managing director of TII SCHEUERLE and TII KAMAG since 2020, contributing to the successful development of the group of companies during this time. In his new role as managing director of TII GmbH, he will continue to assume his previous responsibilities as well as working closely with Dr. Karch. Together, they will maintain the TII Group’s course, drive innovation forward, and strengthen customer orientation.

“With the new management structure, we are focusing on continuity and future security and reliability. Dr. Karch and Filippo Baldassari bring extensive experience and strategic foresight to optimally position the TII Group for facing future challenges. In this way, we can ensure that we

For further information, log on to www. tii-group.com

AMADA WELD TECH EUROPE has announced the launching of its IS-Q Series Inverter Resistance Welding Power Supply. With a compact design for optimal system integration, the IS-Q series is designed to be used in combination with mechanical, pneumatical, or motorised weld heads. This technology was created for a variety of applications, including stranded wire to coil, motor fusing, and stranded wire to terminal welds.

The IS-Q Series offers control monitoring with the MG3 and OP-AWS3-A Active Welding Systems. The OP-AWS3-A integrates the process control of all mechanical and electrical parameters. It also integrates static and dynamic process monitoring, as well as quality analysis with an advanced SPC feature and data logging capability.

The integrated process monitoring offered by this series allows for rigorous quality control, says AMADA. With a high output current, the system also leads to short cycle times, it is claimed. With up to 20kHz of feedback, it enables fast

reaction to fluctuations in the weld process, says AMADA WELD TECH EUROPE. The ISQ-Series also offers additional force control via a proportional pneumatic valve and comes in a variety of different versions, each with a different performance range, weld current type, and various other fea-

tures. These versions include the IS-Q3000A, the IS-Q6000A, the IS-Q40A, and the IS-Q500A.

For further information, log on to www.amadaweldtech.eu

Wheatland Tube, a division of Zekelman Industries, has announced a new name for its proprietary, five-step galvanization process. The newly dubbed HDZ Coat™ is used in the company’s standard and fire sprinkler pipe for fluid, water, and gas applications. The hot dip zinc process is completed fully in-house at Wheatland Tube, so that engineers and contractors who specify HDZ

Coat will have full traceability and compliance with updated ASTM standards.

“With HDZ Coat, Wheatland Tube goes the extra mile to eliminate the pain that engineers and contactors feel with every piece of returned inventory or project claims,” said Kevin Kelly, president of standard pipe, Wheatland Tube. “By controlling the entire process for HDZ Coat in-

house, we eliminate those pain points with fully compliant pipe that also prevents early rust and eliminates microbial contamination.”

For further details, log on to https://www.wheatland.com/.

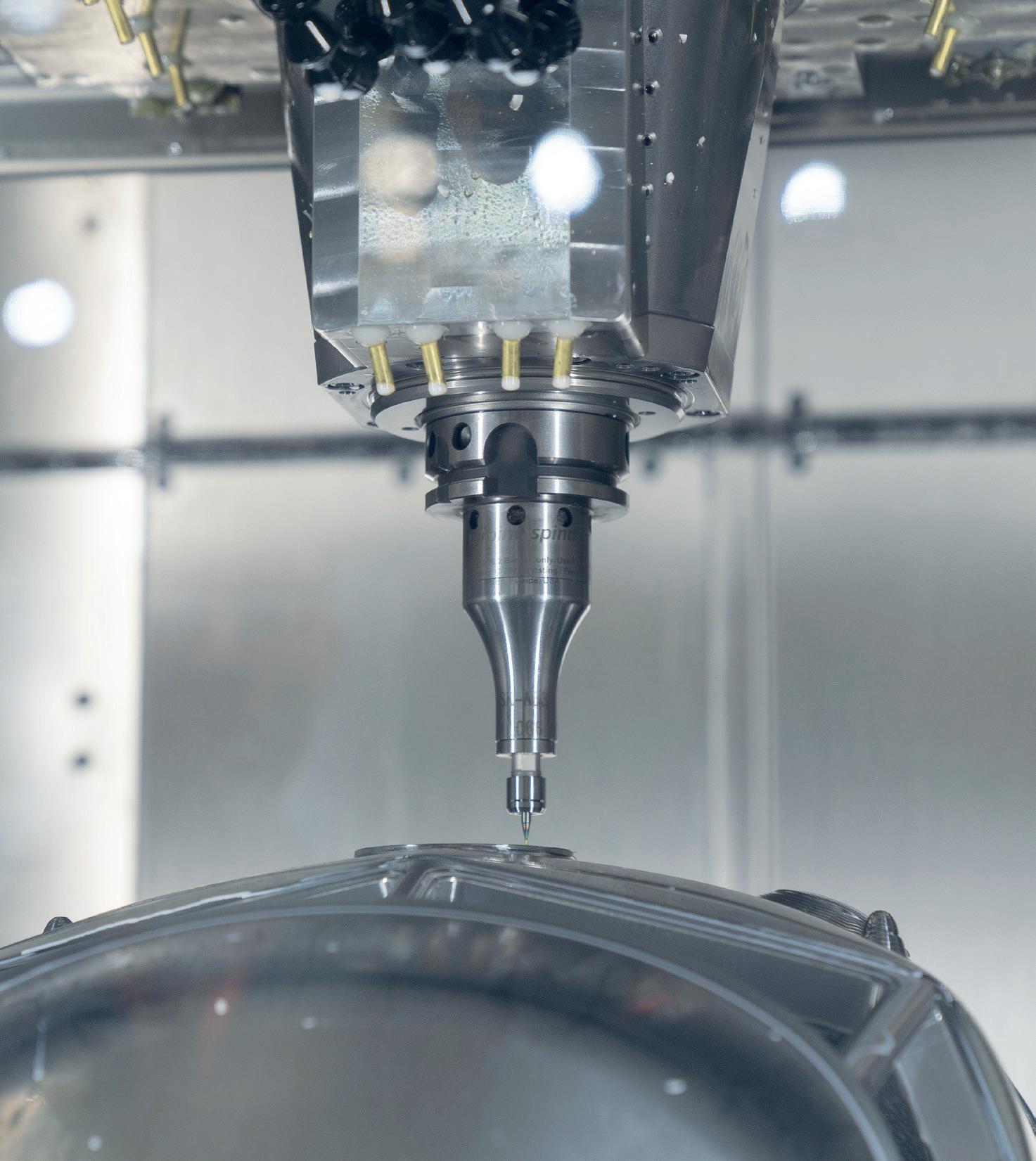

Air Turbine Technology Inc., a manufacturer of high-speed turbine products, has launched its new Air Turbine Spindles® 601 Series Spindle. The spindle combines constant high-speed in cut, energy efficiency and a user-friendly design, says the company.

The compact 601 Series Spindle incorporates Air Turbine Technology Inc.’s patented governor technology, which increases CFM airflow on demand to maintain constant speeds of 40,000 to 90,000 RPM under cutting load on the toolpath through the program. The 601 Series Spindle provides up to 0.2 HP (0.15 kW) power, delivering power for micro-machining applications – although Air Turbine Technology Inc.’s range includes spindles with power to 1.4HP (1kW) for larger tools and hard materials.

This governed turbine maintains the required surface feet per minute (SFM) and chip load for micro and small tools by sustaining high RPM on the toolpath. Air Turbine Technology Inc.’s direct drive 601 spindle generates no heat, delivering accuracy with no thermal growth in the spindle.

Fully automated loading is available using air supply through the machine spindle, a collar and stop block or manual connection through the side air inlet. Easy installation minimizes downtime, claims the company, allowing manufacturers to quickly adapt to changing production demands.

For further information, log on to https://www.airturbinetools.com/products/spindles/ spindle-series/601-series/

Eudmarco S/A Serviços e Comércio Internacional has added two more customized Konecranes reach stackers to its fleet at the Port of Santos terminal in Brazil. The Konecranes SMV 4638 TC6H and Konecranes Liftace 4532 TC5 were ordered in early 2024 and delivered later in the year in November.

Both of the new reach stackers are fitted with the latest driveline or transmission technology, enabling up to 10% fuel savings compared to older models, claims Konecranes. Load-sensing pumps and an automatic acceleration feature for hydraulic movements aim to reduce the need for engine revving – helping to cut carbon emissions. ‘Eco mode’ is designed to further enhance fuel efficiency and extend the lifespan of the equipment.

Built with the same chassis as the top-selling Konecranes SMV 4632 TC6 model, the two new reach stackers come with the addition of power-damping capability. This allows operators to lock the tilt of the spreader, which is useful when the ground is not flat or when loading containers onto a train.

With the new Konecranes SMV 4638 TC6H, Eudmarco’s operators can stack up to six 9’6’’ containers in the 1st row and up to five 9’6’’containers in the 2nd row – significantly increasing

capacity and operational efficiency at the terminal. To increase stability and safety, this crane model comes with larger 18.33 tyres.

“We really appreciate the quality of Konecranes equipment, and the support provided by the company, so we decided to take this next step together. We’re very happy to make our operations more eco-efficient with Konecranes’ new fuel-saving technology,” said José Wenes, administrative manager from Eudmarco’s parent company, ABA Infraestrutura e Logística.

Konecranes TRUCONNECT® telematic solution is also included, so Eudmarco can remotely monitor the performance of the reach stackers through the yourKONECRANES.com customer portal and the Konecranes CheckApp for inspections.

“We are very pleased that Eudmarco is taking Konecranes advanced features and digital tools into use. The powerful technology package we’ve customized for the Port of Santos terminal will enable higher productivity and efficiency, with lower fuel consumption and fewer emissions,” added Andres Ramirez, sales manager, lift trucks, Konecranes.

For further information, log on to www.konecranes.com

Thermo Fisher Scientific has introduced the Thermo Scientific™ Elescan™ XRF-100 Online Multi-Stream Elemental Slurry Analyzer. The analyzer supplies real-time elemental analysis of multiple slurry streams in a centralized multiplexed system configuration by employing the latest Energy Dispersive X-Ray Fluorescence (EDXRF) technology, including low-power, air-cooled X-ray tube. The modular design allows for optimization of the sampling strategy for online analysis, says the company, and incorporates the latest iteration of proven XRF technology, ensuring longevity and serviceability for the years to come.

In base metal and polymetallic ore plants, the analyzer helps enhance recovery rates while increasing product quality. Because the measure-

ments are taken in real-time, the analyzer gives plant operators immediate notification of process upsets, facilitating rapid response and remediation to minimize losses. Additional benefits include optimization of reagent usage, reduction in product grade variability, control of product contaminant levels, and rapid experimentation of operational strategies.

The Elescan XRF-100 features a modular design that allows flexible integration into a wide range of plant set-ups. Its scalability ensures it can adapt to both small and large operations.

For further information log on to: https://www.thermofisher.com/Elescan

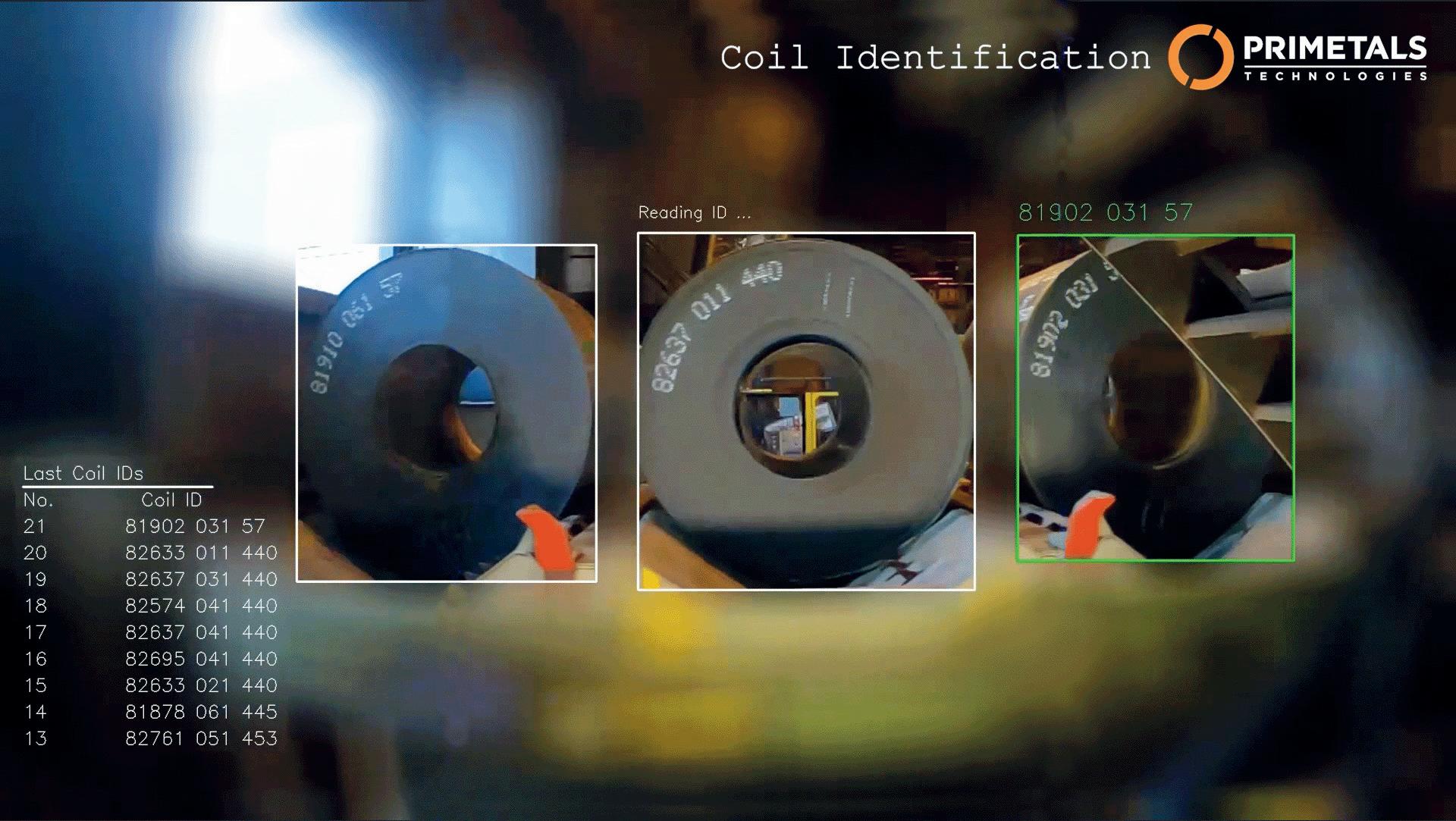

Primetals Technologies has recently received the final acceptance certificate (FAC) for digital assistant systems at SSAB’s Hämeenlinna plant in Finland. These systems mark the first-ever implementation of Primetals Technologies’ digitalization solutions for coil identification and pickling defect detection. The AI-powered systems identify surface quality issues, reducing production interruptions caused by strip breakage and other defects, says Primetals.

For producers in the metals industry, pro-

cessing coils out of sequence or with undetected pickling defects can result in production delays and equipment damage. To address this, Primetals Technologies has developed AI-driven computer vision solutions for automated coil identification and strip surface monitoring. These assistant systems aim to enhance operational efficiency by minimizing downtime and eliminating the risk of processing coils that do not meet end-customer specifications. The solutions are designed to prevent coil mismatches and reduce

scrap, with real-time results visualized through augmented video streams.

A key objective of the assistant systems is to identify coils at an early stage to ensure correct storage in the coil yard. A strategically placed camera detects coil and saddle numbers while the hot-rolled coils are still located on the delivery train, before storage.

The data is transmitted to a coil yard management system to streamline and optimize crane operations. As the coils are loaded onto the entry walking beam, the coil identification number is detected and cross-checked with the production schedule. If a mismatch is identified, the operator is immediately notified to correct the coil sequence, ensuring smooth and accurate processing.

The insights gained from the assistant systems are transmitted to the automation systems for further processing, analysis, and documentation. The results are communicated to subsequent downstream processes, enabling real-time adjustments such as modifying rolling speeds or adapting cutting plans.

At SSAB Hämeenlinna, the system will be continuously optimized, as it can be trained to detect new types of coil marking and pickling defects.

For further information, log on to www.primetals.com

While President Trump’s inauguration speech did not mention tariffs, foreign steel suppliers feel trepidations. By Manik Mehta*

FOLLOWING the inauguration of President Donald Trump on 20 January, many steel pundits are wondering if and when he would impose new tariffs against imports, as he vowed to during his election campaign, since his inauguration speech did not provide any indications of tariffs.

Prior to his inauguration, Trump had vowed to impose more tariffs on imports of Chinese products; imports of Chinese steel products are already subject to 25% tariffs imposed in 2018 under Section 232. However, it remains to be seen if Trump will continue with the existing level of tariffs on Chinese steel imports or if he would impose further tariffs on Chinese steel imports.

Steel industry experts are also wondering about the future of the United StatesMexico-Canada (USMCA) free-trade pact, since Trump had threatened to impose 25% tariffs on exports from Canada and Mexico. Such a move would, invariably, affect trade relations with both these trading partners who are very likely to retaliate by imposing tariffs on US products. Trump is very likely to call for a comprehensive review of the USMCA agreement, a step leading towards imposing tariffs against Canada and Mexico which, so far, enjoyed tariff exemption.

But China exports far less steel to the US – about 32.555kt or 1.67% of the total US imports in November – than the volumes exported by Canada and Mexico. Trump has threatened to impose an additional 10% tariff on all imports from China if the latter did not curb ‘the flow of illegal drugs into

The US domestic steel industry could benefit from tariffs on imports from Mexico and Canada; this was the case when Trump imposed Section 232 tariffs in 2018 which brought US steel companies higher steel prices and margins.

In the six years since the imposition of tariffs in 2018, the average margin for hot-rolled coil production, for example, jumped to over $630 per tonne compared to the average margin of $405 per tonne prevalent in the five years prior to the tariff introduction.

“Keep your fingers crossed,” was the response I got from a New York-based analyst when asked to give his view on when the tariffs could be imposed. But the analyst, preferring to remain anonymous, commented that there was a procedure that would have to be followed, including a review of the industry and market situation as well as studying the implications (by which he meant the possible retaliatory measures from those facing the tariffs) for the US.

Former US President Joe Biden decided to officially block the US Steel/Nippon Steel merger but executives of the Japanese steelmaker are now hoping that President Trump will find a way to accommodate the deal. Japan’s prime minister Shigeru Ishiba had directly expressed his concerns to Biden

*US correspondent, Steel Times International.

during a video conference on 13 January about Biden’s action against Nippon Steel’s planned acquisition of US Steel.

Besides being opposed by domestic steel companies and steelworkers, the $14.9 billion merger deal was also opposed by politicians; during the campaign, both Biden and Trump had opposed the deal but Trump has, lately, maintained silence over the issue, leading some to believe that this could lead to a gradual acquiescing to the merger deal.

American industrialists, steelworkers, and politicians generally disapprove of the idea of the control of a one-time iconic steel business falling into the hands of a foreign company. But Nippon Steel already has operations in the US. Indeed, a large number of Japanese and American automobile manufacturers source their requirements from Japanese steelmakers in the US.

Nippon Steel and US Steel have, meanwhile, initiated a lawsuit against the Biden administration’s decision to block their merger, and also moved a federal court to set aside the review of the Committee on Foreign Investment in the US (CFIUS); the two merger partners argue that the deal would enhance, not threaten, US national security.

Supporters of the merger, including a number of politicians and senior officials, point out that Japan is a staunch ally of the US in East Asia and an effective counterweight to China’s growing

influence. Indeed, the Biden administration had cleared a $3 billion air missile sale to Japan just a day before the merger deal was blocked.

US Steel/Nippon Steel merger has other rival suitors

Somewhat coinciding with Trump’s inauguration, Lourenco Goncalves, CEO of Ohio-based steelmaker Cleveland-Cliffs, was brazenly critical at a press conference of Japan, even making incredulous references to the US bombing of Hiroshima and Nagasaki and harping on the need to save the industry in the Mon Valley.

Despite President Biden blocking the merger, the CFIUS has, meanwhile, extended its own deadline to 18 June for delivering its final assessment. Many see in this date extension a sign that CFIUS will reconsider its original review which

may have been done under pressure from the administration. Besides the lawsuits challenging the CFIUS review and questioning whether due process was followed, the time would also allow President Trump to find a way to reverse his predecessor’s decision.

With his outburst, Goncalves was trying, as many believe, to catch attention of the new administration by toeing the nationalist line, in keeping with Trump’s much-touted MAGA (Make America Great Again) slogan, though many felt that his expression of anti-Japan sentiments were uncalled for. The Cleveland-Cliffs CEO’s remarks did shock Japan and its industry, creating the impression that the US did not welcome foreign investors. Goncalves had been interested in acquiring US Steel which

spurned his first takeover bid. If US Steel had acquiesced in Goncalves’ takeover bid, it would face anti-trust issues whereas in Nippon Steel’s case, the anti-trust question would not arise. US laws encourage competition and discourage any entity from having a monopoly in the industry.

At the press conference, Goncalves also announced his company’s renewed bid to acquire US Steel which had once rejected the former’s bid and accepted Nippon’s offer. Without revealing many details, Goncalves spoke of offering an ‘all-American solution’ to save US Steel by relocating Cleveland-Cliffs to Pittsburgh, retaining the US Steel brand name, and making Cleveland-Cliffs part of US Steel.

Goncalves is also trying to partner with electric arc furnaces (EAF) steelmaker Nucor Corp. of Charlotte, North Carolina, to make a joint bid to acquire US Steel, with Cleveland-Cliffs acquiring most of US Steel and Nucor taking its mini-mill EAF assets, which are based in Arkansas and operate under the Big River Steel brand.

It remains to be seen if the joint bid would materialize and succeed with the acquisition. �

Main advantages:

• Reduces downtime;

• Forms tidier packs;

• Requires rare and limited maintenance;

• Achieves 30 tons per hour with cycle times under 10 seconds per layer;

• Saves energy while producing at peak performance.

The Robotic Stacker is AIC’s new system that automates the process of piling flat and angular profiles.

The system is designed to handle up to 6 bars from 4,5 to 13 m in legth, and the profiles can be picked in a mixed way (straight or reverse).

It integrates perfectly with no mechanical modification to the existing machine.

The system is very flexible and allows to change profile in just 7 minutes.

In the third part of a series of articles analysing the development of Acesita/Aperam, Germano Mendes de Paula* examines the 1990s and the 2000s and the company’s transition from Acesita to Aperam Group.

IN October 1992 Acesita was privatised for $465 million, using Brazilian pension funds and, to a lesser extent, banks as the primary buyers. In the years that followed, the company underwent significant shifts in corporate strategy (STI, Jul-Aug 2002, p. 50).

In 1994-1995, Acesita made several acquisitions, primarily in the special steel and forging sectors. In 1994, it acquired Eletrometal, a small long specialty steel producer specializing in high-alloy steels. In 1995, Acesita purchased a 31% stake in Aços Villares, Brazil’s largest producer of special long steel. The following year, Eletrometal was integrated into Aços Villares, resulting in the formation of Villares Metals. Additionally, Acesita took over Sifco in 1994, the second-largest forging producer in Brazil, which focused on the automotive industry and held around 25% market share. Before this acquisition, Acesita’s forging division had a mere 6% share of the Brazilian market.

In a more significant move in 1996, Acesita acquired a 34% strategic stake in Companhia Siderúrgica de Tubarão (CST) for $518 million. The deal saw Companhia Vale do Rio Doce (CVRD) and Kawasaki Steel, both existing shareholders of CST, purchase additional shares. Two Brazilian banks and the Italian steel company Ilva (part of the Riva group) divested their total shareholdings in this transaction.

However, Acesita’s consolidator strategy was short-lived, as the company’s financial conditions deteriorated. By late 1997,

rumours of a potential sale surfaced, with Usiminas initially seen as the likely buyer, due to logistical synergies. By 1998, competition for Acesita narrowed down to Companhia Siderúrgica Nacional (CSN) and France-based Usinor, with the latter ultimately acquiring 28% of Acesita’s total capital and 39% of its voting capital for approximately $610 million. This agreement also granted Usinor a 49.9% stake in a new special-purpose company that took over Acesita’s interest in CST, making them a stakeholder in CST through two indirect means.

Following Usinor’s acquisition, Acesita underwent another radical shift in corporate strategy, refocusing on the flat stainless steel market. Between 1998 and 1999, Acesita divested several assets:

a) Forjas Acesita (forging producer) to Krupp;

b) a hydroelectric mill;

c) its stake in Atlas, a leading Brazilian lift manufacturer; and

d) various forest holdings.

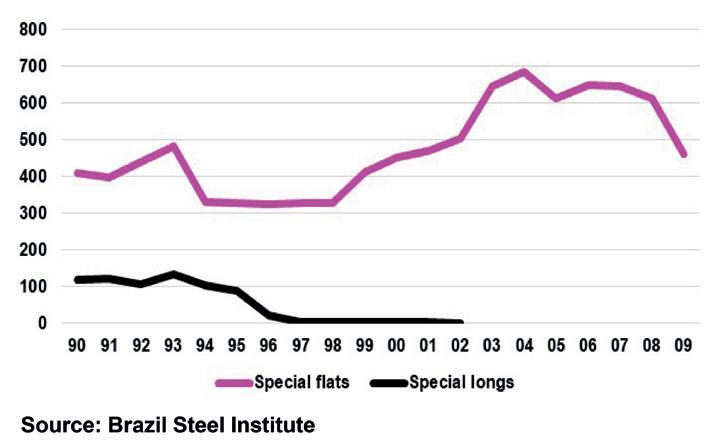

Regarding production capabilities, Acesita commissioned a new Sendzimir cold rolling mill with a capacity of 160kt/yr in 1998 at a cost of $215 million. Pig iron production increased from 545kt in 1990 to 623kt in 1999 (a 14% growth), while crude steel output rose from 673kt to 786kt (17% increase) (Graph 1). Production of special flats grew only slightly from 410kt to 413kt, while special longs drastically decreased from 118kt to 3kt, indicating a near-total exit from that segment (Graph 2). Notably,

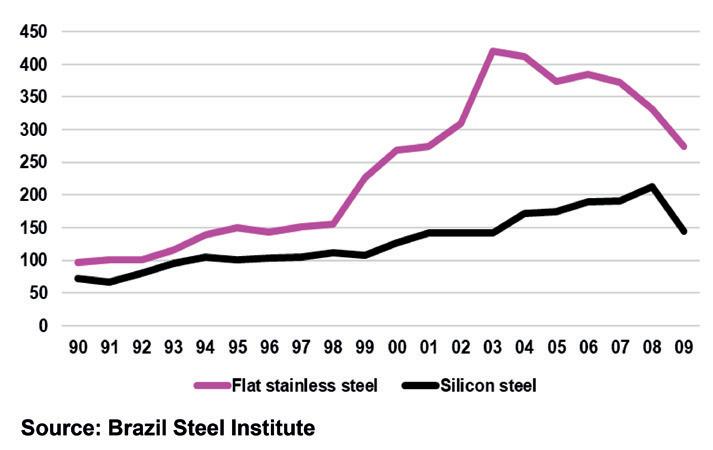

high-value-added products saw significant gains, with flat stainless steel production rising from 97kt in 1990 to 226kt in 1999, and silicon steel output increasing from 72kt to 107kt (Graph 3).

The ‘noughties’

The first decade of the 21st century witnessed a continued focus on flat stainless and silicon steels from an operational standpoint, along with complete ownership by ArcelorMittal from a corporate perspective, as explained below.

In 2000, the Spanish steelmaker Sidenor acquired a majority stake in Aços Villares, diluting previous shareholders’ stakes. Eventually, Acesita divested its remaining interest in Aços Villares. In 2002, Acesita finalised an agreement to sell Sifco, its autoparts forging subsidiary, to welded tubemaker Metalúrgica de Tubos de Precisão (MTP), for a nominal amount.

In 2002, a merger led to the formation of Arcelor, which combined the former companies Usinor (France), Arbed (Luxembourg), and Aceralia (Spain).

As a result, Arcelor inherited Usinor’s shareholding in Acesita. At that time, the controlling shareholders included Arcelor with 38.9% of the voting capital and Brazilian pension funds with 39.3%. The largest investors decided to delegate operational management to Arcelor.

ArcelorMittal was formed in 2006, and by the following year, it held a 57% stake in Acesita. In April 2008, just months before the Lehman Brothers’ bankruptcy,

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

ArcelorMittal made a public offering to acquire the remaining 43% of Acesita’s shares that it didn’t already own. The offer culminated in ArcelorMittal purchasing 94% of the shares it sought for approximately $1.66bn. Following this acquisition, the company was rebranded as ArcelorMittal Inox Brasil.

On the operational front, Acesita completed a $100M investment project in 2002, aimed at increasing the capacity of its Steckel rolling mill from 600 to 800kt/ yr. Additionally, the capacity for stainless

steel production was expanded from 350 to 500kt/yr. That same year marked the complete cessation of long steel product manufacturing, allowing Acesita to concentrate entirely on flat steel products.

Throughout the 2000-2008 period, Acesita’s pig iron production varied around a 636kt/yr plateau, but fell to 478kt in 2009 due to the global financial crisis. Crude steel output reflected this downward trend, with figures of 785kt/yr dropping to 607kt (Graph 1). Production of flat steel products averaged 586kt/yr in the first nine years

of the decade but decreased to 461kt in 2009 (Graph 2). For stainless flat steel, the respective production figures were 350kt/ yr, subsequently dropping to 274kt, while silicon steel production saw a decline from 166kt/yr to 144kt (Graph 3).

In 2011, Acesita transitioned into the Aperam group and underwent another rebranding as Aperam South America. However, the evolution of the company from 2010 onward will be explored further in the next and concluding part of this article. �

Dilip Kumar Jha*

FOLLOWING the success of its first edition, the Indian government has reintroduced its popular Production-Linked Incentive (PLI) scheme for specific categories of importoriented specialty-grade steel. This initiative aims to replace imports with domestic production, save foreign exchange, and make India’s steel sector self-reliant within a

specified timeframe.

India has achieved the distinction of being the world’s second-largest steel producer, with a cumulative steel production capacity of 180Mt and actual crude steel production of 144.30Mt, trailing only China. This is against a total steel consumption of 136.29Mt in the financial year (FY) 2023–24 (April–March).

Source: Joint Plant Committee, Ministry of Steel, Indian government; *April-September

imported steel continues to make inroads

Joint Plant Committee (JPC) under the

Despite this significant achievement, imported steel continues to make inroads into the Indian markets. According to the Joint Plant Committee (JPC) under the Ministry of Steel, India’s total steel imports stood at 8.32Mt in FY 2023–24, compared to 6.02Mt in the previous year.

Source: Ministry

The revised PLI Scheme 1.1 targets coldrolled grain-oriented (CRGO) steel, a high-value material used in the production of power transformers for high-tension (HT) electricity distribution. Recognizing the strategic importance of achieving selfreliance in CRGO, the Indian government has consistently engaged with the industry to promote domestic production. However, Indian steel manufacturers have struggled to find a solution due to the unavailability of the required technology to support local manufacturing. High capital expenditure, coupled with a lack of government support, has rendered previous attempts unsuccessful.

Although the earlier PLI scheme covered a wide range of specialized steel products, CRGO steel for HT power distribution remained an untouched area, with no steelmakers showing interest in setting up greenfield projects or modernizing existing facilities to begin domestic production. To address this, the government has reduced the investment and capacity creation thresholds in the revised PLI scheme – from INR 50 billion ($588 million) and 200kt to INR 30 billion ($360 million) and 50kt respectively. The Ministry of Steel hopes that these changes will encourage industry participation. India’s total consumption of electrical steel is estimated at approximately 400kt/yr.

According to Sandeep Poundrik, secretary at the Ministry of Steel, the revised PLI

scheme 1.1 will be implemented during the production period from FY 2025–26 to FY 2029–30. He noted, “There were no participants in eight sub-categories during the previous round, but we hope for wider participation this time. Certain changes have been incorporated in consultation with the industry to make the scheme more investor-friendly. These include reducing the threshold investment and capacity requirements for CRGO product sub-categories, allowing the carry-forward of excess production to the immediately following year for incentive claims, and lowering the threshold investment under the capacity augmentation mode.”

The steel industry previously perceived the large thresholds for capital investment and capacity creation as unworkable, necessitating a revision. Not all companies need to install new mills. Recognizing the importance of producing high-quality steel, improving energy efficiency, and enhancing other processes, the revised scheme allows companies investing in capacity augmentation to participate. In such cases, the required investment will be 50% of the threshold mentioned in Annexure-III of the guidelines, which were uploaded on the web portal launched by the honourable minister.

HD Kumaraswamy, union minister of steel, stated, “The PLI Scheme 1.1 spans five product categories of specialty steel, consistent with the existing scheme. The revised version aims to encourage further

participation, addressing requests from industry stakeholders for relaxation. Indian steelmakers are expected to actively participate, invest, and contribute to strengthening Brand India, reducing imports, and positioning India as a global steel powerhouse. The changes in the PLI scheme for specialty steel reflect the government’s commitment to bolstering domestic production, fostering innovation, and minimizing imports.”

Under the revised scheme, steelmakers can carry forward excess production to the subsequent year for incentive claims. If a company’s production in a given subcategory exceeds its committed target for the year, the excess can be carried forward to offset shortfalls in meeting the committed production for the immediate next year. This ensures that incentives are distributed optimally and that no company is denied benefits if it falls short of incremental production targets following a strong performance year.

Originally conceived and notified in July 2021 with a budgetary outlay of INR 63.22 billion ($743 million), the first round of the PLI scheme aimed to promote the manufacturing of value-added steel grades within the country. It sought to help the Indian steel industry advance technologically and move up the value chain.

According to the Ministry of Steel, 26 Indian companies proposed setting up 44 projects with a committed investment of approximately INR 2,710.6 billion ($3.19 billion) and a downstream capacity creation of 24Mt. Of these, the investment reached so far is around INR 1,830 billion ($2.15 billion), resulting in the direct generation of approximately 8,300 jobs. The government’s incentive payout under the first PLI scheme is estimated at INR 20 billion ($235.29 million).

The PLI Scheme for specialty steel has highlighted the importance of developing self-reliance in the production of specialty steel.

The country will benefit from a reduction in imports and, it is hoped, will achieve selfreliance through capacity creation, ensuring investments that lead to job creation, and moving up the value chain in the steel business. �

The world’s biggest integrated steel production hub, the POSCO Gwangyang Steelworks, continues to cling to its coal dependence, with the relining of one of the facility’s blast furnaces expected to extend the lifeline of dirty coal-based steelmaking while depleting the global carbon budget. By Yeongmin Kweon*

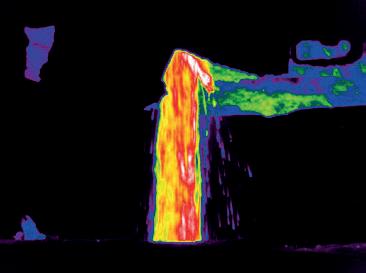

THE climate crisis is accelerating faster than ever, yet some of the world’s biggest polluters remain locked into coal dependency. According to the World Meteorological Organization (WMO), 2024 is projected to be the first year that global temperatures exceed 1.5°C above preindustrial levels, underscoring the urgency of immediate emissions reduction. This intensifies the pressure on carbon-intensive industries, such as steel, to accelerate their decarbonization efforts. However, POSCO, South Korea’s largest steel producer, continues to extend the lifespans of its coalbased steelmaking facilities, undermining global efforts to limit temperature rise. The steel industry has long been a significant source of carbon emissions due to its conventional production methods. Blast furnaces, the dominant method of steel production both globally and in South Korea, are heavily reliant on coal. In particular, POSCO produces over 97% of its steel through this emissions-intensive process, consistently ranking as the nation’s top industrial emitter for the past decade. In response to growing climate concerns, POSCO has announced its commitment to achieving carbon neutrality by 2050 and reducing carbon emissions by 10% from its baseline (average emissions between 20172019) by 2030.

Despite these commitments, POSCO recently began relining one of the largest blast furnaces at its Gwangyang steelworks. Relining is not a short-term measure – it

is a significant financial commitment to maintain carbon-intensive steelmaking for decades.

Just last year, POSCO completed a similar relining at its Pohang steelworks, spending approximately $360 million to extend operations. The blast furnace can now produce 5.3Mt/yr of steel, which is over 80% of the total annual capacity of US Steel’s Gary Works. Given the scale of these investments, the blast furnaces are likely to operate for as long as possible after relining, meaning the decision to reline effectively commits to massive carbon emissions for another 15 to 20 years. In essence, POSCO continues to pour vast sums into coal-based steelmaking, despite their tremendous cumulative emissions.

These continued relinings are seriously concerning, as they risk accelerating the depletion of the global carbon budget. The carbon budget represents the maximum allowable carbon dioxide emissions required to limit global temperature rise. The United Nations Intergovernmental Panel on Climate Change (IPCC) calculates carbon budgets under various scenarios, offering guidance for setting fair and effective greenhouse gas reduction targets. If the carbon budget were allocated to South Korea’s steel industry, these relinings would rapidly consume a significant share. According to recent research by Solutions for Our Climate (SFOC), the estimated remaining carbon budget allocated to Korean steelmakers as of 2024 is only 550MtCO2e, and to

*Policy analyst, Solutions for Our Climate

align this carbon budget, at least four blast furnaces in South Korea should be shut down by 2030. In other words, the blast furnaces should be shut down as soon as possible rather than having their operational lifespans expanded, given the cumulative emissions from blast furnaces and their ongoing contribution to global warming.

The situation appears even more alarming when the emissions are quantified. Given the scale of annual production and the carbon intensity of steel produced from blast furnaces, the ongoing relining is comparable to building a new facility that would emit approximately 137Mt of carbon emissions over the next 15 years. This is roughly equivalent to the lifetime emissions of 3.68 million passenger vehicles, exceeding the total number of registered cars in Seoul. This decision is a clear contradiction to the urgent need to cut carbon emissions.

Rather than extending the life of coalbased blast furnaces, POSCO has viable alternatives, such as hydrogen-based direct reduced iron (H2-DRI) technology, which has already demonstrated its potential to significantly reduce carbon emissions. POSCO has been developing its own innovative hydrogen-based steelmaking technology, HyREX, but progress on its development and commercialization has been slower than expected. Rather than investing further in carbon-intensive steelmaking, POSCO should prioritize a

more sustainable future by aggressively accelerating the commercialization of H2-DRI technology. This would not only align with the growing global demand for greener steel but also ensure POSCO remains competitive in a rapidly changing market.

Financial considerations also favour a transition toward greener steel production. As carbon pricing mechanisms and trade regulations tighten globally, continued reliance on coal-based steel production exposes companies like POSCO to rising operational costs and regulatory risks. A proactive shift toward low-carbon technologies, rather than sticking to the traditional carbon-intensive methods, could mitigate these risks and secure long-term profitability.

The climate crisis demands bold action from industries responsible for the highest emissions. As a leading steel producer, POSCO is uniquely positioned to drive transformative change in the sector. The company has both an opportunity and a responsibility to lead the way toward low-carbon steel production. By focusing

on innovative, low-emission technologies, POSCO can help accelerate the industry’s shift toward sustainability, and influence global practices.

A commitment to phase out coalbased steel production not only aligns with scientific urgency but also secures a competitive advantage in the evolving global market for green steel. However, POSCO continues to invest in conventional carbon-intensive steelmaking facilities

without any plans to phase them out or explain how carbon emissions could be reduced while continuing to operate the blast furnaces. The ongoing relining of blast furnace no.2 at its Gwangyang steelworks is a prime example of this.

The decisions made today will determine whether POSCO remains competitive in a decarbonizing global market or faces escalating environmental and economic risks. �

• Production Capacity: 600,000 Tons/year

• Input Materials: Billets, Blooms, or Beam Blanks

• Product Range: Beams, Channels, Angles & Flat

Steel Times International travelled to Barcelona to discuss the TWINGHY decarbonization project with Spanish steelmaker Celsa Group and Fives, supplier of a walking beam furnace at the centre of the project. By Matthew Moggridge*

ACRONYMS are funny things. They’re fine if they work, like NATO, meaning North Atlantic Treaty Organization, or ASAP being short for As Soon As Possible, but sometimes, like personalized licence plates, they simply don’t add up. Or rather they do, but you need to be a little flexible in your thinking. Take TWINGHY, for example. Yes, I know it sounds like the name of a new children’s television programme – the Twinghys – but in reality, it means Digital Twins For Green Hydrogen Production. So, where’s the ‘D’ for digital? Call me a pedant, but it matters. Or perhaps it doesn’t.

Despite its rather cute name, TWINGHY is a serious project, as, indeed, is green hydrogen production in the quest for zero-

carbon steelmaking.

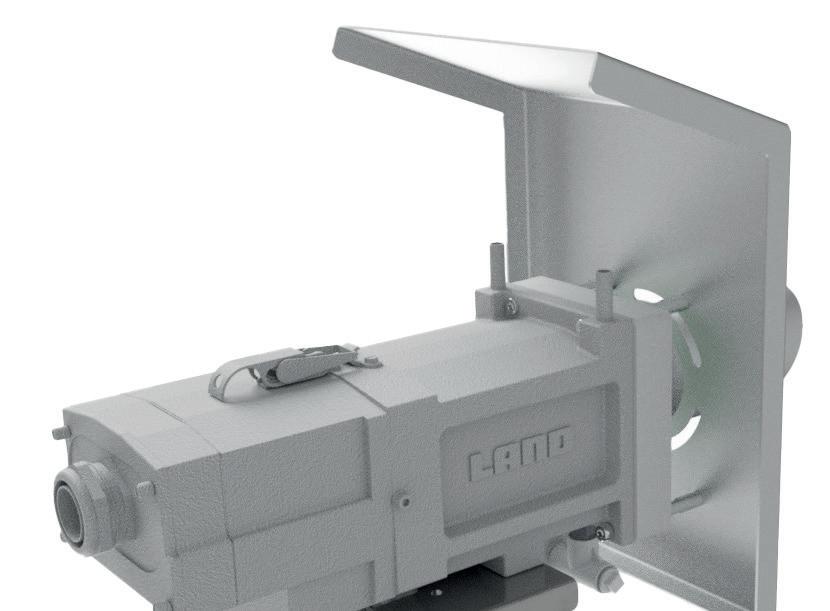

One of the project’s industrial partners is Fives Group. The company is developing a new reheating burner capable of injecting a blend of hydrogen and natural gas in a range from 0 to 100% hydrogen. The burner will be tested at leading Spanish steelmaker CELSA’s furnace number three in Barcelona, Spain.

Replacing traditional burners with hybrid technology is a big challenge as the quality of the final products must be guaranteed and NOx emissions reduced while maintaining the same productivity.

The TWINGHY consortium consists of nine partners – Celsa Group in Barcelona (Spain); Swedish steelmaker SSAB; Fives Stein, a Fives Group subsidiary (France);

Nippon Gases Espana (Spain); Barcelona Supercomputing Centre (Spain); RWTH Aachen (Germany); Oulun Yliopisto – Uoulu (Finland); Calderys Iberica Refractarios SA (Spain); and Swerim (Sweden).

The TWINGHY project was started in early 2023 and is one of many initiatives led by Celsa Group that form an important part of the Spanish steelmaker’s decarbonization strategy and will contribute to its ambition of becoming net positive by 2050.

“Which means we need to be at least zero carbon and fully circular by then,” said Celsa Group’s head of innovation, Anna Domenech.

Steel Times International had been planning to visit Celsa to discuss TWINGHY for some time and embarked upon a

natural gas’, said Domenech.

Celsa is a recycler so most of its energy is generated by electricity used to melt the steel.

profiles, wire rod and rebar.

A great deal of research has gone into energy efficiency, ‘which is a critical first step’, says Domenech, ‘and then we will move forward in order to prove that it’s possible to make the switch towards hydrogen’. The timelines are simple: this year [2025] will see the installation of the required pipes and instrumentation, which can only be done after the plant has been shut down – the facility runs 24/7 all year round but closes for maintenance for three weeks in the summer and two weeks in winter. In 2026, the trials with hydrogen will begin.

train journey from London to Barcelona in early December 2024. Editor Matthew Moggridge sat down with Celsa Group’s Anna Domenech, the rolling mill plant manager Ramon Garriga and Gustavo Guzman, CEO of Fives Steel Spain, another subsidiary of Fives Group, involved in this project.

“When it comes to zero carbon, one of the most important things we need to do is to replace natural gas and to do that we currently consider three alternatives,” said Domenech. The options are biofuels, hydrogen and ‘not combusting for induction’, the latter meaning electrification.

“We are not the ones that are going to select which one is happening in the future, what we are doing is trying to keep all doors open. So, we are investing into knowing a bit more about every one of these possibilities,” she said, adding that there are no innovation projects concerning biofuels because their composition is similar to natural gas, but more sustainable. The third option involves electrifying the process of beam reheating ‘because that is the main part of the process where we consume

TWINGHY is a hydrogen project, started in early 2023 and, therefore, almost two years in development. Celsa uses natural gas for reheating and currently has many hydrogen-focused projects underway for reheating furnaces across the group. Domenech highlighted other planned Celsa projects testing the consumption of hydrogen in EAFs and ladle furnaces.

In Spain, however, the challenge is to make the reheating furnace in Barcelona ‘hydrogen ready’ and, according the plant manager, Ramon Garriga, that means making many improvements to the company’s existing reheating furnace, supplied by Fives.

The aim of TWINGHY, according to RWTH Aachen, one of the project consortium’s nine participants, is to ‘demonstrate an optimized heat transfer process based on hybrid burners in reheating furnaces, progressively decarbonizing the reheating process through the increase of H2 in combination with O2 and by monitoring and controlling it through a digital twin’.

Celsa’s Barcelona facilities constitute a true steelmaking hub. It has two electric arc furnaces (EAFs) in the melt shop, three rolling mills and several final transformation plants. The TWINGHY project is focused solely on one of the plant’s rolling mills and a Fives walking beam reheating furnace. “We have three rolling mills in Barcelona,” said Domenech, but only one of them is being used for the project producing merchant bars. The others produce big

Domenech said that energy efficiency was crucial. “You cannot use hydrogen in a process that is not efficient,” she explained, stating that hydrogen will need a lot of energy to be created. “And that’s also the power of the digital twins as they allow us to not only simulate the situations that we will have in the future, but also to find the most optimal situation for every specific moment or scenario”.

The plant will be shut down for around three weeks during the coming summer to install the special burners, which are bigger than the existing ones and, therefore, require new holes to be made. The summer is the only season when it is possible to completely stop the furnace. The rest of the installation procedure (pipes and instrumentation) can be carried out during plant operation. The new burners can run with 100% natural gas and that’s good because when the plant restarts there won’t be any hydrogen available.

The reheating furnace has 24 burners in total, 10 of which will be repurposed for use with hydrogen.

There are also two burners from Nippon Gases, a consortium partner, and these are capable of working in hybrid mode, i.e. natural gas and hydrogen, but they are located in the less efficient soaking zone of the furnace, which comes after the heating zone. Oxy-combustion is generally more efficient since there are no additional air particles to be heated during the combustion process. This is why CELSA is interested in exploring this solution further. However, the furnace was not originally designed for this technology, and when combined with H2 combustion, it could create an imbalance in air pressure. This imbalance may allow cold air to enter the furnace, potentially reducing the overall efficiency of the process, therefore Nippon’s

oxy burners are located in the less efficient soaking zone of the furnace, which comes after the heating zone. The eight burners from Fives are inside the heating zone, which is the most important part of the reheating furnace. In total, including the Nippon burners, there are 10 out of 24 burners being repurposed. All 10 (including the two from Nippon Gases) can handle hydrogen and will not have an adverse effect on the function of the reheating furnace.

Fives Steel Spain’s Gustavo Guzman said that the company’s contribution to the TWINGHY project was the development of the new burners which, he claimed, were fully compatible with all blends of hydrogen from zero to 100%. Fives was brought into the project by Celsa with the express purpose of developing the burners, said Domenech, as they are also the suppliers of the furnace. The two companies have enjoyed a long and fruitful working relationship for many years, she added, and Fives was very much interested in participating in the project.

Fives has up to eight furnaces working within the Celsa Group of companies, the last installation being at Celsa Atlantic’s new rolling mill in Bayonne, France. He said that Fives was working on increasing the efficiency of other furnaces in operation at Celsa, not just the TWINGHY furnace in Barcelona. From Celsa’s perspective, having a trustworthy furnace supplier is important when dealing with a new, disruptive and risky product such as hydrogen. “You need guarantees,” asserted Domenech.

Celsa’s Ramon Garriga said that, when operational, the burners will be the first

industrial-scale hydrogen burners in Europe on a reheating furnace, with a capacity of 180 tons/hr. Each burner will have a capacity of 4MW or 32MW in total across the eight burners developed by Fives. Guzman believes the total useful power of the furnace is around 55MW.

The burners are currently 100% natural gas, but it can be 100% hydrogen or a combination such as 20% hydrogen, 80% natural gas. The burners can be set to work with whatever blend combination is applicable at the time.

The overarching challenge, of course, is hydrogen supply and that, says Domenech, is why the digital twin approach is so good. “Because it will allow us to adapt to different market situations in terms of availability.”

Challenges presented by hydrogen supply issues have been a constant concern prompting Celsa to consider installing its own electrolyser or to partner with a hydrogen supplier. A third option was to buy hydrogen from the network. “We were in discussions with many stakeholders, we are part of networks in different regions of Europe that are promoting hydrogen including one in Catalonia. We are doing everything we can to push for hydrogen production,” said Domenech. It looks likely that buying from the network will be pursued. “So, we keep being part of these networks at European and national level,” she said. “We expect this to happen at some point, I don’t know when, but it looks like the availability of hydrogen, or the feasibility of producing it, will depend on the geographical location of your plant. Spain seems to be a good country to

produce hydrogen in terms of renewable energy capacity because we can install a lot of it, but I don’t think we considered the issue of water enough. We tend to treat it like an infinite resource and it’s not,” she explained.

Domenech spoke of water shortages in Catalonia and how, at times, Celsa was almost pushed to stop production. There are now, however, many projects funded by the European Commission that are focused on water circularity. Celsa is involved with two projects related to developing membrane technologies for water cleaning.

Where TWINGHY is concerned, however, the premise is simple: is it or is it not valid to reheat billets with hydrogen? Answering that question is the project’s aim, its end game. It’s then a case of being ready for the right market conditions to prevail.

“We need time to make all the trials,” said Ramon Garriga.

Domenech says it’s not so much about what is there, but for plants to invest further into energy infrastructure. “At the end, Celsa is guided by the politicians. Everything is about politics, but the European Commission says we should get ready for hydrogen because they will make it a reality, so we say okay, let’s get ready. Even if hydrogen is not available in the future, TWINGHY will have been a useful project because it has increased the energy efficiency of our furnaces and opened the door to using new fuels,” she explained.

The relationship between the participants of the TWINGHY project is good, says Domenech. “It doesn’t always happen in European projects, but when you have good personal connections, you just learn

more and want to do more,” she said.

Fives is confident about its new burners which have already been tested, qualified in mid-2024 and are ready to go. “We want to be ready for the opportunity that may come,” said Guzman. “There will be other potential clients interested in having these burners when hydrogen becomes available.”

Celsa’s Domenech cites Fives’ burners as one of the two main achievements of TWINGHY so far. “They have developed the burner and proved it in the lab, that’s the first thing. Second, we have the first high-resolution simulations of combustion in this type of furnace in Europe, albeit with natural gas, and we will do the same with hydrogen,” she said.

So, what’s next? This year the burners will be installed and next year trials will be conducted. “The most important thing is that, at the end of the journey, we will know if our furnace can work with hydrogen and for us it’s already a goal which can be applied to other furnaces. Here in Barcelona, we have three reheating furnaces and one of these is the same

[as the TWINGHY furnace] in terms of capacity,” said Ramon Garriga.

Where hydrogen availability is concerned right now, it’s uncertain how things will unfold going forward, says Celsa’s Domenech and Fives’ Guzman, but one thing is certain: the nine participants in the TWINGHY project are working well together. According to Guzman, “The

starting up of such a programme is always a challenge, bringing people together, signing NDAs between us, it’s difficult to put these people together and work for the same objective, but it’s working pretty well,” he said.

Domenech agrees, stating that ‘every partner has a clear role and a clear reason why they are there’. She believes in small consortiums like TWINGHY as opposed to some of the increasingly larger ones being funded by the European Commission.

Celsa’s Ramon Garriga extolls the virtues of the consortium, agreeing with Domenech’s point about exploiting synergies between the partners. “To use the knowledge of all the people in a collaborative team is good, it’s best to be with a group rather than going it alone,” he said.

“It’s been a good experience for us,” said Fives’ Guzman. “Learning from each other and reaching for a target that we set together. I think what will happen will happen. We don’t know the future for hydrogen, but what we agreed to be done with this project is done.” �

Metal is the backbone of our society. It’s in the structures we ride, work and live on every day. That’s why you’ve trusted the detection technology inside every Thermo Scientific™ ARL™ iSpark Plus OES Metal Analyzer for over 80 years to ensure every piece of steel and metal you produce is safe. With so much riding on that, why would you choose anything else?

Find out more at thermofisher.com/isparkplus

As Hyundai expands its global footprint, the company faces a stark choice: stay on cruise control and maintain the status quo or take real action to align its operations with its sustainability rhetoric, says Matthew Groch*

THE steel industry is one of the world’s largest contributors to climate change, responsible for approximately 7% of global greenhouse gas emissions and 11% of carbon dioxide emissions. The vast majority of these emissions come from coal-fired blast furnaces used in primary steel production, a process that remains deeply entrenched in the industry. Automakers, as the third-largest consumers of steel globally, have an opportunity to drive the steel industry to cleaner alternatives. To accomplish this, automakers need to map out their supply chains and ensure that their suppliers and partners are engaged in clean and ethical practices.

Hyundai Motor Company is uniquely positioned to lead the transition to sustainable steel and cleaner supply chains. In addition to being the world’s thirdlargest automaker, Hyundai is the only automaker in the world with its own steel company, Hyundai Steel. In fact, Hyundai Motor Company seems to understand this opportunity by positioning itself as a leader in sustainability, promoting its commitment to carbon neutrality and ethical supply chains.

However, investigations into Hyundai’s steel supply chain suggest a stark contrast between Hyundai’s marketing and reality, revealing significant under-reporting of

emissions, continued reliance on fossil fuels, and serious human rights concerns along its supply chain. A new report published by Mighty Earth, Tainted Steel: The Deadly Consequences of Hyundai’s Dirty Steel Supply Chain, offers a unique look into the automaker’s steel supply chain and the suppliers who have left a trail of environmental destruction and human rights abuses in their wake.

The report maps Hyundai’s supply chain from coal and iron ore mining to steel production. It identifies a range of projects and facilities across many countries (including Brazil, Colombia, South Korea, the USA, Mexico, Vietnam, Australia, Canada, and Russia) producing materials and components within the Hyundai steel supply chain that have been tied to negative impacts on the environment, climate, and human rights. To identify these suppliers, projects, and facilities, Mighty Earth and Sunrise Project commissioned Empower LLC to analyze 57,402 shipments made between January 2018 and October 2024 by 196 companies in Hyundai’s steel supply chain.

Mighty Earth also collaborated with local organizations and CSOs to validate findings, conduct interviews, and review additional

: *Senior director of the Decarbonization Campaign.