Since 1866

Since 1866

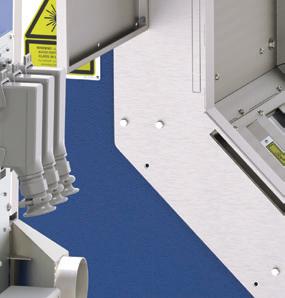

The rst continuous monitor of strip cleanliness providing real-time data with unprecedented precision that distinguishes between oil and iron nes contamination.

The only system to differentiate between Oil and Iron Fines

Real-time cleanliness monitor for strip processing lines

Utilising Laser Induced Breakdown Spectroscopy (LIBS)

sales@sarclad.com

sales@sarcladna.com

sarclad.com

sales.china@sarclad.com

sarclad.india@sarclad.com

Non-contact sampling

20Hz sample rate

Eliminates need for ‘tape test’

EDITORIAL

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Assistant Editor

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production

Carol Baird

SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark

kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

subscriptions@quartzltd.com

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

Steel

2 Leader by Catherine Hill.

4 News round-up

Two pages of global steel news.

6 Innovations

New products and contracts.

17 USA update

The saga continues: Nippon’s bid for US Steel.

21

Latin America update Brazilian and Mexican electrical steel markets.

25

India update

India aims for self-reliance.

28

China

China’s hydrogen strategy: national versus regional plans.

32

Hydrogen reduction

Hydrogen unleashed: opportunities and challenges.

38

Green hydrogen

Green hydrogen for the steel industry – requirements for success.

42

Sustainability leaders

GravitHy: dragging emissions down.

48

North American markets

‘Hydrogen is the future’

52 Perspectives Q&A: Kanthal Heating steel, cooling the planet.

54 History

Coalport Bridge – a later cousin to Iron Bridge.

42

Catherine Hill Assistant editor catherinehill@quartzltd.com

Catherine Hill Assistant editor catherinehill@quartzltd.com

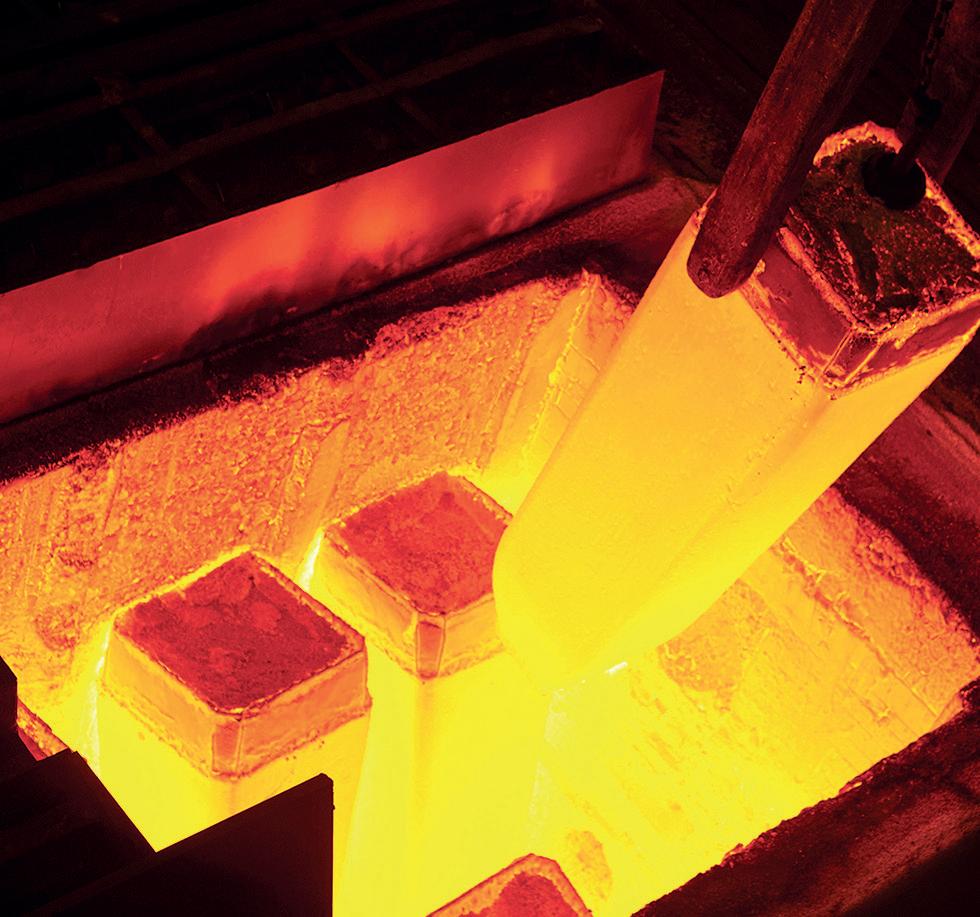

In 1671, the Irish scientist Robert Boyle discovered and described the reaction between iron filings and dilute acids, which results in the production of hydrogen gas; ‘’So inflammable it was, that upon the approach of a lighted candle to it, it would readily enough take fire, and burn with a blewish flame with little light, yet with more strength than one would easily suspect.’’

Hydrogen, part of a planetary makeup that sustains stars and planets, is instilled in public imagination in its many forms; a complex sustainability saviour for heavy industries, galactic swirlings captured in the sky, flames licking the Hindenburg as it collapsed over New Jersey in 1937. The mythos that surrounds hydrogen is much what Boyle appeared to predict; a chemical with the capacity to overspill, and to set alight. In the three centuries that have passed since Boyle’s discovery, scientific advances have wrought an alternative, and nuanced language to understand the periodic table. Hydrogen’s capacity to produce the intense heat required for industrial production has led it to become somewhat of a paraded

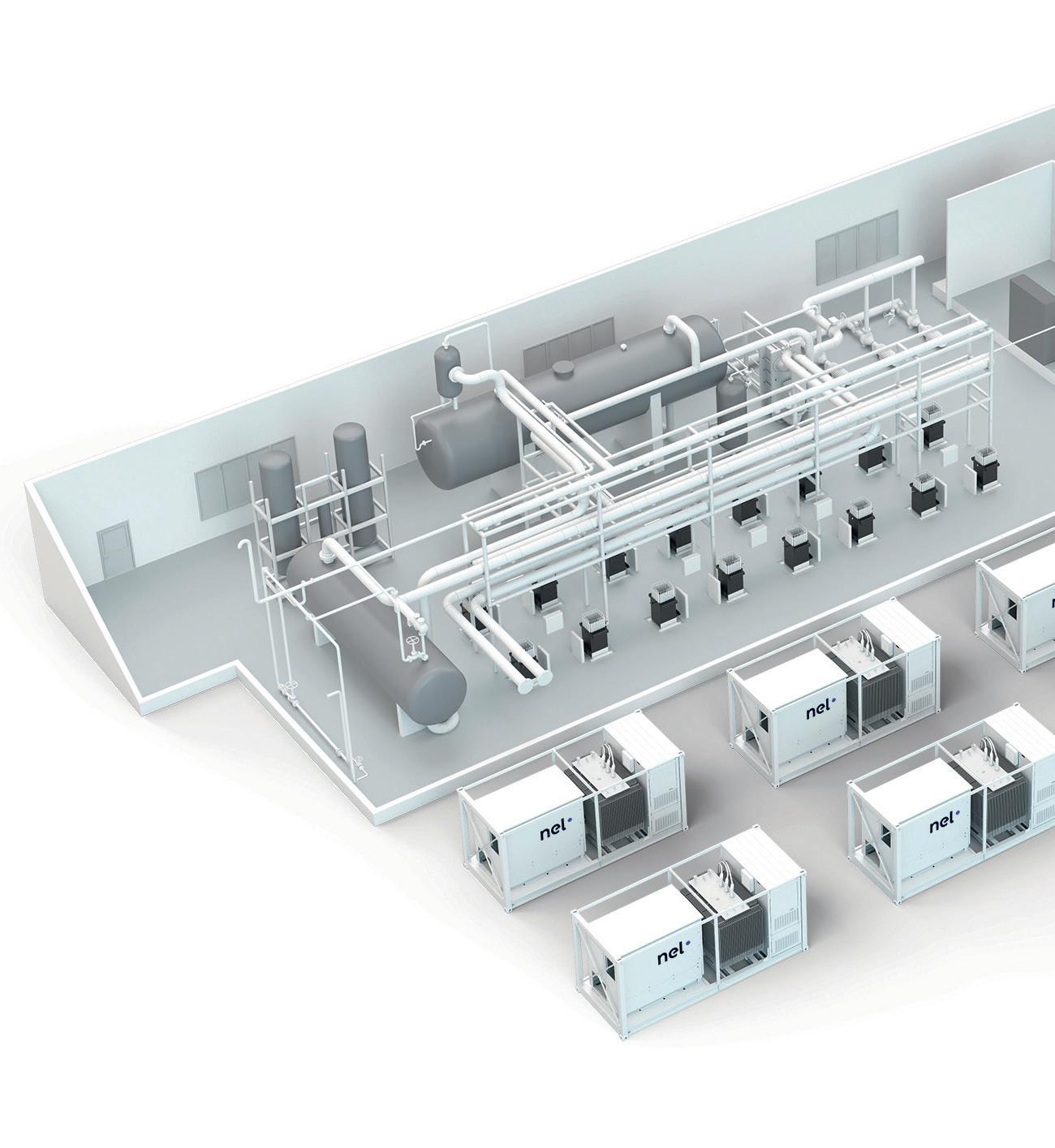

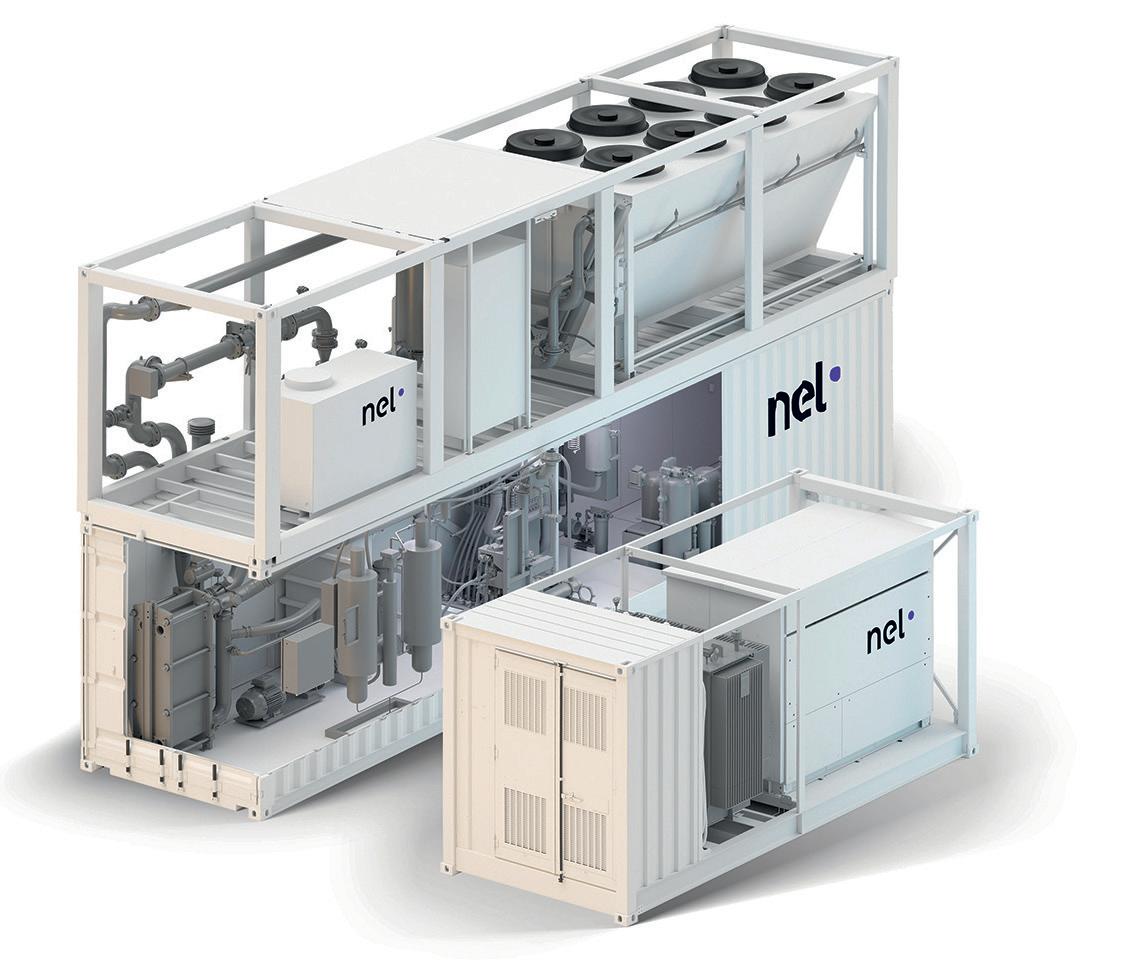

new technology in the context of steel decarbonization; the movement away from carbon-rich fossil fuels into a clean industrial feedstock which powers furnaces, without the planet-killing smoke. That’s not to say that the adoption of hydrogen technology will be an easy feat; alongside its touted high performance as a fuel source are logistical challenges, such as its storage, transportation, and its fickleness, or tendency to explode. Such are the complexities of working with an element that contains ‘more strength’ than expected; the expectation belies its faculty to perform and adhere to no will other than its chemical potential. As Soroush Basirat states on p.32, ‘green hydrogen comes at a high cost’, yet projects like Nel Hydrogen’s electrolysis plant at Ovako’s steel facility in Sweden (p.38) are shedding light on its inherent sustainable capabilities. As said by Roald Dahl; ‘‘My candle burns at both ends/it will not last the night/but ah my friends and oh my foes/ it gives a lovely light”. The industry cannot solely rely on hydrogen as an omnipotent saviour, but what is burned, will burn bright.

Scientists at the Max-PlanckInstitut für Eisenforschung, a centre for iron research, have shown how green steel can be produced from aluminium production waste. In an electric arc furnace similar to those used in the steel industry for decades, they convert the iron oxide contained in the red mud into iron using hydrogen plasma. With this process, almost 700Mt of CO2-free steel could be produced from the 4 billion tons of red mud that have accumulated worldwide to date – which corresponds to around a third of annual steel production worldwide.

Source: Phys Org, 4 February 2024

Tata Steel's Kalinganagar and Meramandali plants in Odisha have received the Responsible Steel certification, a company statement said. Responsible Steel is a global multi-stakeholder standard and certification initiative that works with

South Korea's POSCO Group and the United Arab Emirates' Abu Dhabi National Oil Company (ADNOC) will collaborate on blue hydrogen production facilities in Gwangyang to supply steelmaking, according to a report by Kallanish. The two companies signed a strategic collaboration agreement this month at ADNOC's headquarters in Abu Dhabi. Under the agreement, they will build blue hydrogen production facilities at POSCO’s liquefied natural gas terminal in Gwangyang.

Source: Kallanish, 6 February 2024

steel producers, consumers, and intermediaries towards building a sustainable steel industry by addressing challenges including climate change, diversity, and human rights. Tata Steel CEO and MD TV Narendran said, "The Responsible Steel certification for our sites is a testament to Tata Steel's unwavering commitment to sustainability. It reflects our proactive approach towards addressing the evolving challenges of the steel industry and shaping a better tomorrow.’’

Source: The Economic Times, 11 February 2024

ArcelorMittal has indicated to investors that additional capital expenditure projects in the United States could be on its near-term agenda. In a presentation accompanying its 2023 year-end and fourth quarter results, the Luxembourg-based company indicated that its 1.5Mt/yr electric arc furnace (EAF) mill under construction in Calvert, Alabama, is expected to be complete in the second half of this year. Additionally, ArcelorMittal says it is studying an option to add a second 1.5Mt EAF at a lower capex intensity.

Source: Recycling Today, 8 February 2024

Tata Steel has said that it has taken a significant step towards promoting inclusivity by inviting applications from transgender candidates for various positions across multiple locations. "Transgender candidates with any of the following qualifications can apply:

The UK government’s anti-dumping body has recommended that measures limiting the import of certain steel products be lifted after the decision to close the blast furnaces at Port Talbot. The Trade Remedies Authority, which is charged with protecting UK industry from dumped or subsidised imports, said its preliminary view was to advise the UK government’s business secretary, Kemi Badenoch, to suspend safeguarding measures on imports of hotrolled flat and coil steel for a temporary period of nine months.

Source: The Guardian, 9 February 2024

Matriculation in English or ITI or graduation in any discipline or diploma in engineering in any discipline from any institute recognized by AICTE or UGC or Degree in B.E./B. Tech in any discipline from any institute, recognized by AICTE or UGC," the company stated in its job listings.

Source: Outlook India, 13 February 2024

UK-based British Steel has submitted a planning application to the North Lincolnshire Council for its proposed electric arc furnace (EAF) mill in Scunthorpe, which is in the East Midlands region of the UK. The application follows an earlier one submitted to the Redcar and Cleveland Borough Council in northern England in December 2023 to build an EAF at the company’s steel beam mill in that jurisdiction.

Source: Recycling Today, 13 February 2024

Artom Steel

is investing over €6 million to modernize production processes and significantly reduce carbon emissions and fuel consumption. The company is collaborating with metallurgical suppliers, such

Celsa, Spain’s largest private industrial group, is considering the sale of its steel plants in Poland, Norway and the UK. The total market value of the assets reaches €1.3 billion. Celsa’s Polish unit Huta Ostrowiec is likely to attract the most interest from potential buyers and could be worth up to €800 million. The Norwegian plant can be valued at around €300 million, while the British Celsa Steel UK is estimated at around €200 million.

According to the report, Celsa is working with Citi to analyze the triple deal with its foreign subsidiaries.

Source: GMK Center, 14 February 2024

as SMS Spa and Badische Stahl Engineering, to upgrade its facilities in Romania. With around 2,350 people employed at the Resita steelworks, the move towards greener production processes will not only secure jobs but ensure a healthier planet for future generations, the company claims.

Source: BNN Breaking, 15 February 2024

signed a memorandum of understanding (MOU) with Port Pirie Regional Council, a local government area in South Australia, to develop Port Pirie into a future hub for green iron production. This initiative aligns with the global steel industry’s shift towards decarbonization and the anticipated ‘Green Iron & Steel Strategy’ by the South Australian government. The MOU outlines a collaborative effort to engage with state and federal governments, plan for green iron production, and involve the community and First Nations in the process.

Source: Mining Technology, 14 February 2024

Brazilian steel producer Gerdau and local renewable power producer and trader Newave Energia have broken ground on a 420-MWp solar park project in Brazil’s Minas Gerais state. The Arinos Solar

Liberty Galati, a Romanian steel plant that is part of the GFG Alliance group of companies owned by metal magnate Sanjeev Gupta, has announced the restarting of blast furnace No. 5 after it was suspended in January this year.

The company is currently increasing the furnace’s capacity. After reaching the planned capacity of the unit, Liberty plans to resume the operation of rolling lines, including at plants in the Czech Republic and Hungary.

Source: GMK Center, 15 February 2024

Park, as it is named, will require an investment of $302 million, Gerdau said. Arinos' construction is scheduled to be completed by the end of the year. Once the solar farm is up and running, 30% of the output will be used to feed Gerdau's steel manufacturing. The asset's full capacity is equivalent to 7% of Gerdau's total energy consumption in Brazil.

Source: Renewables Now, 16 February 2024

Engineering company Fluor Corporation has been selected by H2 Green Steel to lead the construction of the world's inaugural renewable hydrogen-based 'green steel' mill in Boden, Sweden. Fluor's engagement in the project will involve engineering, procurement, and construction management services for the plant. The plant will feature a melt shop, casting, rolling, and finishing facilities, all designed to operate with renewable hydrogen.

Source: BNN Breaking, 16 February 2024

Jari A. Koskinen, sales manager, Konecranes Industrial Service & Equipment,

modernization of the two ageing cranes

“We leveraged advanced technologies such as our Crane Reliability Study and RailQ to assess

“The heritage protection status of our facility meant there were significant restrictions on how to carry out the project. Konecranes played an

active role in planning the modernization so the historical integrity of the power plant was preserved,” said Petra Väisänen, project manager, Fortum Power & Heat.

Konecranes used a variety of advanced Consultation Services, such as a Crane Reliability Study and RailQ, coupled with a steel structure analysis to take a deeper look at the crane and its components. This analysis formed the basis

for the modernization plan, addressing specific challenges posed by the ageing cranes. The modernization includes the installation of two 87-ton hoists (SMT1925) and two 10-ton (CXT6022) auxiliary hoists, along with the replacement of electrical cubicles, cables and wiring.

A strong focus on customers and commitment to business growth and continuous improvement make Konecranes a lifting industry leader. This is

underpinned by investments in digitalization and technology, plus the company’s work to make material flows more efficient with solutions that decarbonize the economy and advance circularity and safety.

For further information, log on to www.konecranes.com

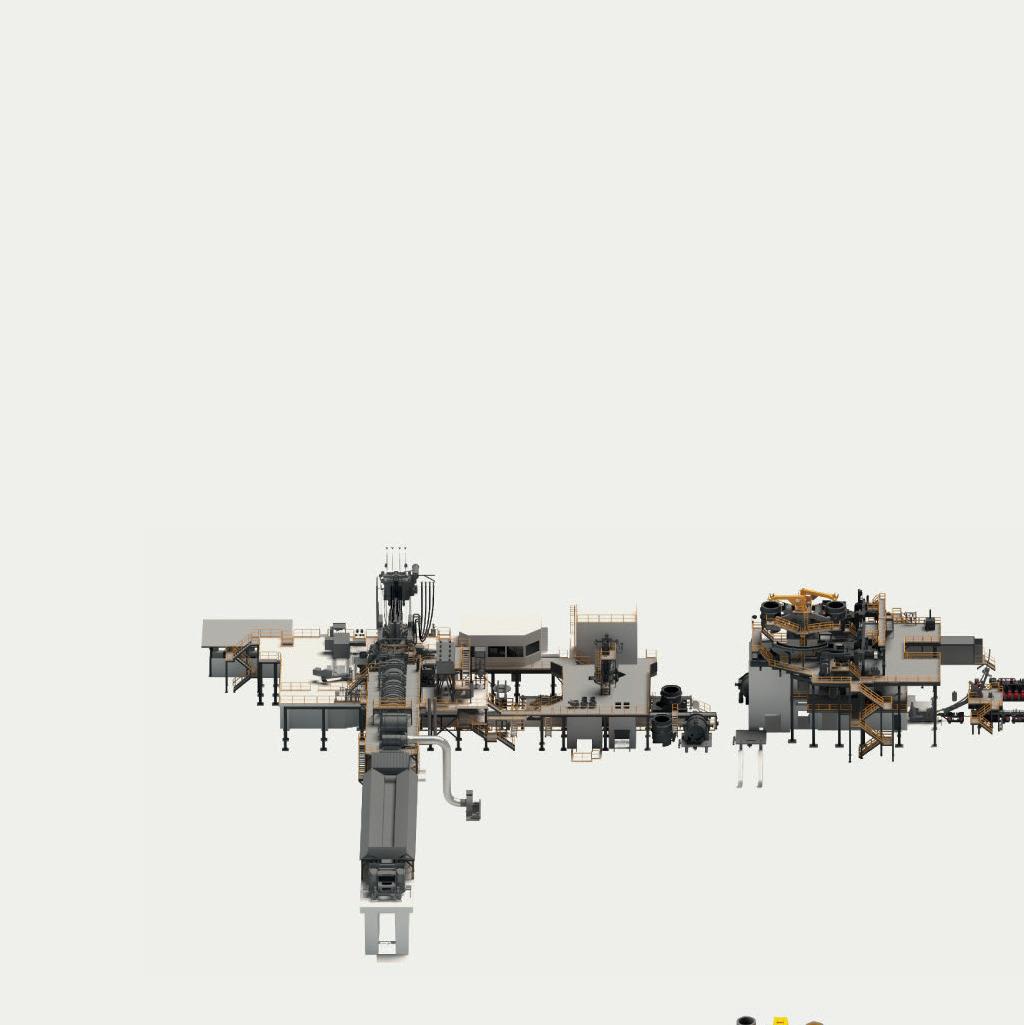

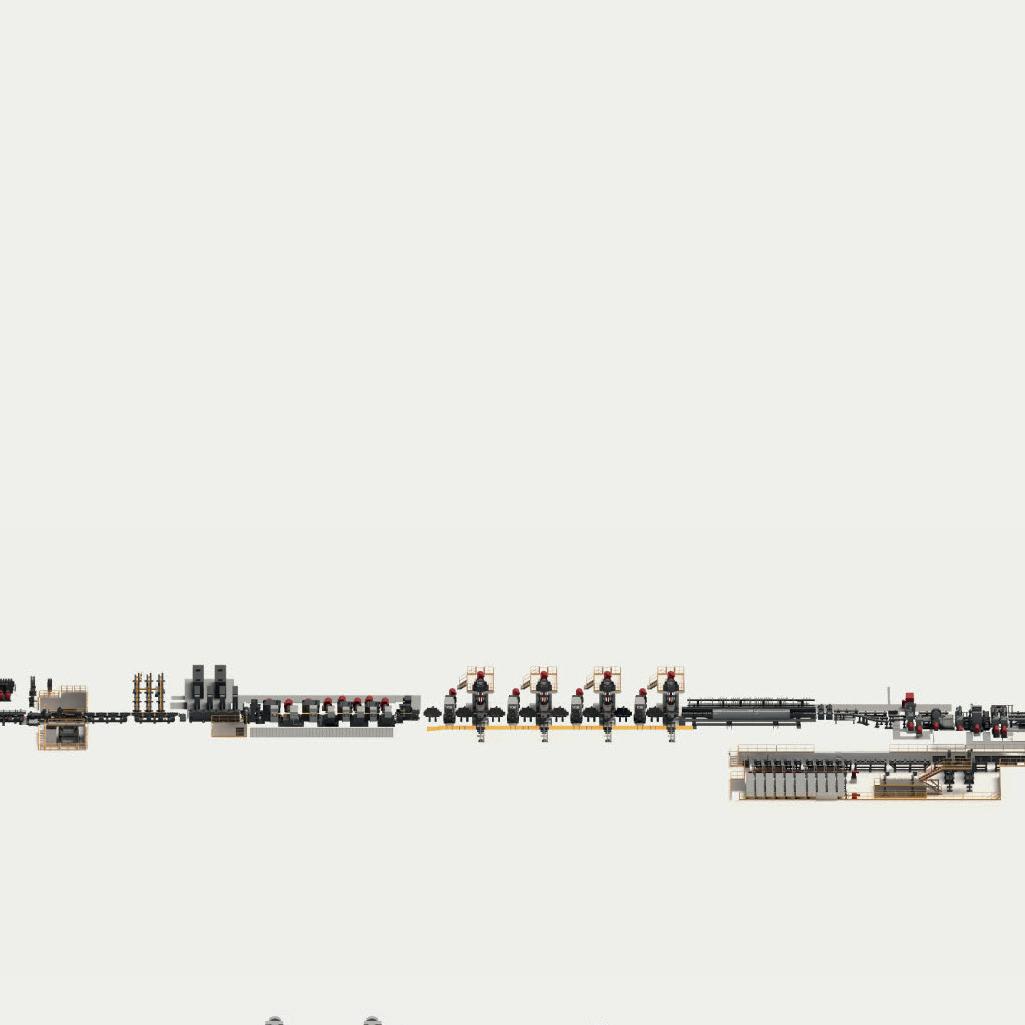

Primetals Technologies operates three service workshops in China, and recently, the facility located in Changxing, Huzhou City, Zhejiang Province, entered Phase 2 in a strategically planned extension that the supplier says will further enhance the capabilities of Primetals Technologies’ Metallurgical Services organization.

On 29 November, Primetals held a ceremony to celebrate the expansion of the Changxing workshop. Guests from the Changxing government, customer representatives, and members of Primetals’ global executive management team participated in the opening festivities.

“Thanks to the start-up of the Phase 2 facilities, Primetals Technologies will further expand its local service competences,” said Tomislav Koledic, CEO of Primetals Technologies China. “We are now able to provide a wider range of services to meet the ever-changing customer and market requirements, including manufacturing of core equipment, repair, and long-term maintenance work. The range of these services covers the complete production chain, including steelmaking, casting, ESP plants, long rolling, flat rolling, and processing.”

“As an OEM, Primetals Technologies is in a unique position,” said Karl Purkarthofer, global

head of metallurgical services at Primetals. “With the combination of our expertise in processes, technology, electrics and automation and maintenance, as well as upgrading and revamping, we are not only able to improve maintenance results, but also support our customers in their ambition to improve overall plant performance. All this goes hand-in-hand with our motto ‘Next level services now’.”

Established in 2019, the Changxing branch measures close to 13,000 square metres including the approximate 5,900 square metres added in phase 2. The scope of services now includes long rolling and flat rolling mills, continuous casters, the EAF Quantum, and Arvedi ESP lines. Additionally, the workshop now also acts as a platform for advanced condition monitoring and predictive maintenance services.

Thanks to the expanded facilities, Primetals Technologies now aims to expand its Metallurgical Services business across China, with a focus on further developing top-class services for upstream technologies.

New equipment and wider range of competencies allow Primetals Technologies to extend the range of services at the workshop in Changxing. The facility now offers services for

Refurbishment and key component manufacturing for long rolling and flat rolling mills are also part of the scope of services at the Changxing workshop. Morgoil oil-film bearings, which have an excellent reputation in China for their high quality and long lifetime, are an example of rolling equipment being refurbished at the workshop. Equipment from Arvedi ESP lines is regularly maintained at the Changxing location.

For further information, log on to www.primetals.com

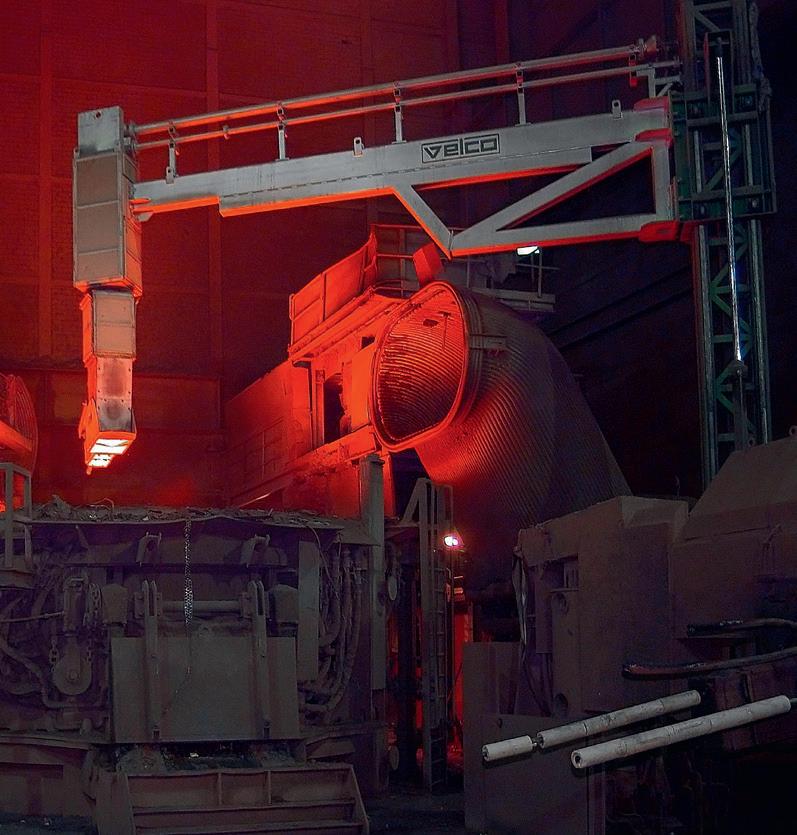

the growing numbers of EAF Quantum plants in China – for example, the location executes maintenance work for key components in Primetals Technologies’ scrap preheating system, as well as the EAF Quantum lance tip, an important part of the oxygen blowing and carbon injection processes. This part of the electric steelmaking plant is welded using different materials, which ensures high temperature resistance.

The Changxing service workshop is characterized by lean operations, the concept of smart manufacturing, and the implementation of energy-saving measures. Photovoltaic cells are installed on the roof and will provide 60% of the power required to run the facility.

use on an electric arc furnace (EAF) at the SeAH Changwon

The plant produces 1.2Mt of steel and 1Mt of steel products annually, putting SeAH in the global top 10 of special steel manufacturers. Its

stainless-steel rods and wires made from special steel have end-uses with customers in the automotive, energy and shipbuilding industries.

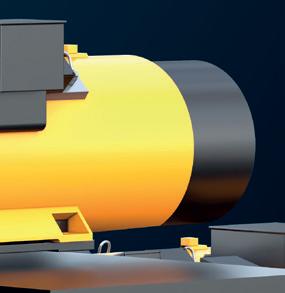

ABB ArcSave will be installed on an EAF that produces carbon and stainless steel and has a steelmaking capacity of 100 tons. The technology is expected to improve furnace efficiency, reduce energy consumption and overall operating costs on the continuously operated EAF at Changwon. Steelmakers have typically reported yield improvements of up to 1%, productivity increases of 5-7%, and electrical energy savings of 3-5% when deploying the equipment.

The customer will be able to improve metallurgical conditions in the EAF melt using the ABB technology. The stirring solution has optimized the operation of some of the world’s largest arc furnaces and can help reduce the carbon footprint at both existing steelmaking lines and greenfield projects.

“We have experienced the benefits of the ABB

ArcSave first-hand and look forward to further improving the efficiency of our electric arc furnace steelmaking operations with a second installation,” said Eung-Sou Lee, director, production division, SeAH Changwon Special Steel.

“We are very pleased that SeAH Changwon Special Steel has once again chosen ABB to provide this unique technology,” said Zaeim Mehraban, global head of sales, ABB Metallurgy. “It underlines the positive effect that ABB ArcSave has for high-alloy steel producers, including overcoming the challenge of bottom skull formation which can impact steel yield, furnace volume capacity, maintenance costs and downtime.”

The new order, which will be commissioned in late 2024, is the second from SeAH Steel and follows the installation of an ABB ArcSave electromagnetic stirrer on an EAF with a 70-tons production capacity in 2018. By introducing electromagnetic stirring and replacing an existing bottom gas stirring installation, SeAH was able

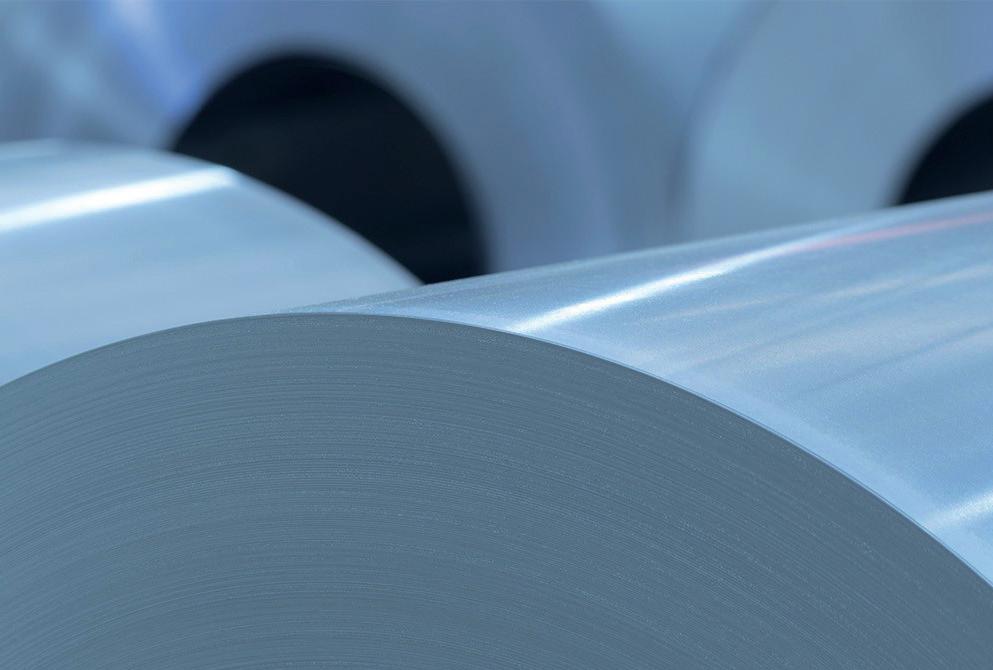

The installation of IMS’ radar width measuring at steelmaker Salzgitter’s roughing stand has led to a more stable rolling process despite the harsh conditions with high occurrence of splashing water, steam and scale, the company claims.

The radar width measuring system enables stable width measurement at the roughing stand, fulfilling a key prerequisite for improving width performance

The harsh conditions that prevail in the area of the roughing stand, including the high occurrence of splashing water, steam and scale, make it difficult to use optical measuring systems. Optical measuring methods require complex cooling and suction devices as well as extensive maintenance to be able to reliably measure the width through the view of the camera. These are factors that make the use of this method during operation and maintenance very costly. A radar-based measuring method offers a technically and economically attractive alternative.

Several years ago, IMS Messsysteme GmbH, together with Fraunhofer FHR and Salzgitter Flachstahl GmbH, developed a measurement system based on radar technology which for the first time enabled stable, precise width measurement at the roughing stand.

The final installation of the radar width measuring system took place at Salzgitter Flachstahl GmbH between the upsetting press and the blooming train, immediately before the roughing stand – a position that allowed the complete measurement of the width along the entire slab length before each upsetting pass. SMS group GmbH then integrated the radar width measuring system into the automation system. The measuring results obtained during real operations made it clear just how much potential the radar width measuring system has for the optimisation of width performance.

The use of the radar-based width measurement system reliably solved several problems at once, contributing to a considerable improvement in the width of the pre-strip and thereby

to reduce bottom skull thickness from up to 1,000mm to less than 200mm. EAF productivity was improved by between 5-7%, scrap handling costs were reduced by 70-80%, electrical energy savings were at between 3-4%, and there were 40% savings on furnace refractory repairs. Other improvements included easier scrap bucket charging and better melt bath level control and tap weight hit ratio.

Requiring no physical contact with the bottom of the EAF, ABB ArcSave enhances metallurgical performance during the melting of large scrap items, reducing stratification via forced convection. This improves EAF operation by homogenizing temperature distribution and chemical composition, while speeding up scrap and ferroalloy melting compared with natural convection alone.

For further information, log on to https://global.abb/group/en

also the finished strip.

‘‘After we increased the availability of the radar width measurement system together with IMS and SZFG and then integrated it in our automation system as a measuring device, we have been able to achieve significant improvements in process stability. This was only possible thanks to the high reliability of the radar width measurement, even in the harsh conditions in the entry of the blooming train,‘‘said Dr Olaf Jepsen, head of research and development at SMS group GmbH.

The radar width measuring system was commissioned at Salzgitter Flachstahl GmbH back in 2017. Before the newly developed system was commissioned, its measuring accuracy and stability was first verified at the exit of the roughing stand by comparing the results with an optical width measurement system. Once it was moved to its final position right at the entry of the roughing stand, it was ultimately possible to achieve 99% availability of the radar width measuring system despite the challenging conditions there. The maintenance requirements are primarily limited to the cleaning of the measurement window in the scope of regular maintenance downtime. Readjustment and calibration is only rarely necessary, for instance after retrofitting or conversion work in the measurement area.

‘‘Various measuring methods have already been investigated in this challenging environment. However, they all required so much maintenance and had such a high rate of error that permanent availability could not be ensured. Only radar width measuring offers excellent availability alongside minimal maintenance effort,’’said Ingo Leckel, production measuring technology employee for wide-strip hot mills at Salzgitter Flachstahl GmbH, confirming the benefits of the radar width measuring system.

For further information, log on to www.ims-gmbh.de

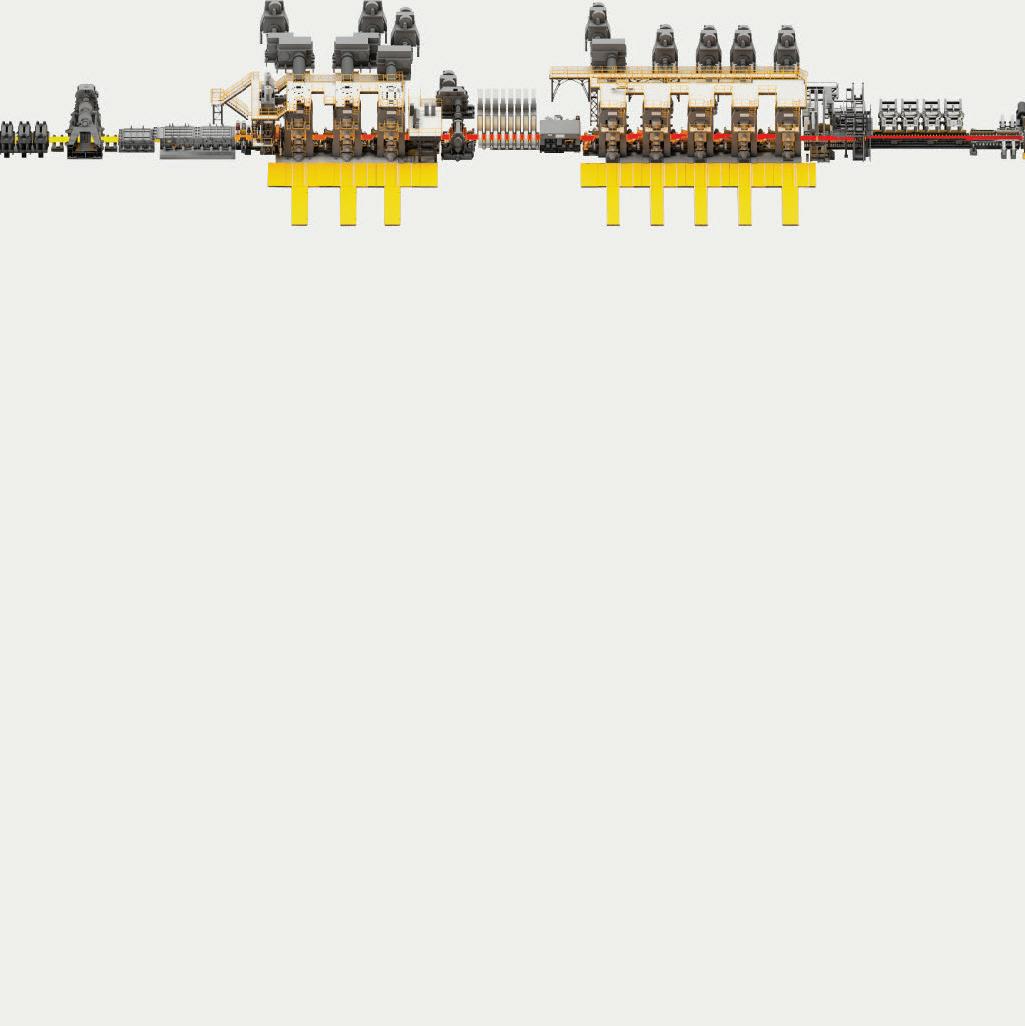

MIDA–QLP

are the winning Danieli direct-rolling technologies for the most competitive production of long and flat green-steel products.

They are the result of the research and continuous improvement profused over 20 years, along with multi-million dollars of investment.

Their unmatched performances have fueled their success worldwide, thanks to lower resource consumption and carbon emissions, unbeaten OpEx, and outstanding product quality.

So, top technology becomes copied technology, the shortest route for competitors that, abandoning their solutions, now try to imitate MIDA–QLP and QSP–DUE Equipment and layout may be copied, but experts know that details make the difference.

Automation and process solutions are not easy to copy, and this will be the experience of anyone trusting in those imitations.

The competitive advantage for our customers, obtained by field results, is the best defense for our technology – more than court rulings protecting our patents.

Danieli offers the best guarantees for speedy learning curves, steady performances, and now Digital Plants with no men on the floor. Buy the Original.

GIANPIETRO BENEDETTI CHAIRMAN OF THE BOARD OF DIRECTORS

Arvedi AST (Acciai Speciali Terni), a European stainless steelmaker, has chosen plant supplier Fives to take a digital step forward to transform its production management.

Eyeron®, an intelligent quality management system developed by Fives, was installed across the entire integrated plant of Arvedi AST with the aim of streamlining the production process and taking quality management to a higher level.

“We had, on one hand, a huge amount of process data handled by different systems across several steel manufacturing workshops, and, on the other hand, demanding requirements regarding coil quality from individual customers. Therefore, our primary goal was to find a digital solution that would allow us to consolidate process and quality-related information on a single device, increasing efficiency and significantly

improving quality control,” said Gian Piero Ruello, coil intelligent processing project manager at Arvedi AST.

“Eyeron® fundamentally transformed our company’s work philosophy, enabling proactive quality control and production issue prevention. Fives played a key role in this process, demonstrating a high level of professionalism and expertise throughout the entire journey, offering customized solutions and constant assistance and guidance,” added Gian Piero Ruello.

The project consisted of several key stages, including data collection, rule enforcement, and dashboard customization. Each stage had its challenges that pushed the joint project team to find appropriate solutions.

The first milestone – data collection – was the most crucial as it required an upgrade of the

internal system and infrastructure to handle the massive data that Eyeron® required.

The second phase concerned the management of quality rules to effectively manage the collected data: the quality rules applied by the quality managers were first rationalized before being implemented in Eyeron® thanks to its user-friendly rule editor.

The final stage encompassed dynamic scheduling with product reallocation module and a machine learning algorithms application for process control improvement. This last phase also provided an opportunity to adapt dashboards and reports to the needs of each user.

For further information, log on to www.fives.com

Tenova LOI Thermprocess, part of Tenova and one of the leading companies supplying industrial furnace systems for the heat treatment of metals, has once again proven that CO2-neutral heat treatment can go together with low nitrogen oxide (NOx) emissions in a project with thyssenkrupp Hohenlimburg GmbH.

In a campaign involving several annealing cycles, a further step has been taken towards decarbonizing steel production as part of the joint project. In production trials, the fuel gas supply for the heat treatment of hot-rolled narrow strip was gradually converted from natural gas to up to 100% hydrogen. For the first time in the world, 70 tons of steel strip were heat-treated in a bell-type annealing plant with Tenova LOI’s HPH®-flameless technology in a CO2 neutral

process, the company claims.

For the flexible delivery of natural gas/H2 mixtures, a specially developed mobile natural gas/hydrogen mixing station was used during the annealing process in order to assess the influence of increased hydrogen admixtures on the overall system. The increased hydrogen requirements for the annealing cycles due to the approximately one-third lower calorific value were supplied by a special trailer and fed directly into the pipework systems of the bell-type annealing plant.

“The project is part of thyssenkrupp Steel Europe’s long-term decarbonisation strategy and includes the goal of achieving climate neutrality in all downstream production processes by 2045 at the latest, in addition to iron and steel production,” said Jan Bernhofen, team co-ordi-

nator, processing, at thyssenkrupp Hohenlimburg GmbH.

“The combustion of hydrogen is technically more complex than the direct use of electricity or the combustion of natural gas. This project has provided us with further insights into the decarbonization of the bell-type annealing process and is helping us on our joint path towards the transformation to climate-neutral steel production. Tenova LOI Thermprocess supplies the suitable technologies for a wide variety of plant types,” commented Dr. Gökhan Gula, project manager and process engineer at Tenova LOI Thermprocess.

For more information, visit www.loi.tenova.com

Technologies turning steelmakers’ decarbonization goals into reality.

Jet

The JVD line introduces a technological breakthrough in the steel coating of advanced high resistant steel grades difficult to galvanize by hot dipping. This genuine alternative to Electro-Galvanizing and Hot-Dip-Galvanizing considerably reduces the cost of galvanized steel and provides multiple advantages when it comes to quality, speed and OPEX. Developed for ArcelorMittal with the help of our experts, John Cockerill is in charge of commercializing this unique technology worldwide.

Electrical

Our E-SiTM equipment and processing lines are designed for the production of strong, ultrathin, lightweight, and highquality Non-Grain Oriented (NGO) steel grades essential for the future of e-mobility.

Other developments & technologies aiming at decarbonizing the steel industry:

VolteronTM: CO2-free Steel Production Process

Furnace Electrification

Carbon Capture Heat Recovery

Plants

High-performance

John Cockerill Industry’s ARPs come with smart plant control systems, provide waste energy recovery and drastically reduce pickling process plants’ fresh acid demands and waste streams in general. What is more, they are providing the lowest emissions in the market.

Steelworkers oppose while politicians question Nippon’s takeover bid, but the Japanese steelmaker remains confident that it will complete the purchase. By

WHILE the initial hullabaloo over Nippon Steel’s takeover of US Steel has diminished, the takeover saga seems to continue with new twists and turns.

Firstly, there is the reaction of the steelworkers who are rattled by the opaqueness surrounding the deal and, secondly, there are also murmurs of opposition from politicians who are unsure about a ‘prized jewel’ of the American steel landscape slipping into foreign hands, even though Japan is a staunch US ally.

Steelworkers, banded under the trade union United Steelworkers (USW), have filed what they describe as ‘grievances’ against the deal, claiming that proper information

Manik Mehta*about the sale was not provided, nor was the union ‘consulted, nor reassured, that its collective bargaining agreement would be honoured’, according to various media reports.

However, US Steel denied the allegation and said that it had already met its obligation under the basic labour agreement (BLA), and was looking to ‘quickly and favourably’ resolve the union’s grievance. The company stated that it was hoping to finalize the nearly $15 billion acquisition in the second or third quarters of this this year.

The acquisition was largely ‘sprung’ on the union, the USW contended, saying that

*US correspondent, Steel Times International

its support was for a bid from rival steel producer Cleveland-Cliffs, Inc. whose July purchase offer at $7.3 billion for US Steel was rejected; thereafter, US Steel received offers from other companies.

In its letter to US Steel ‘s CEO David Burritt, the USW referred to the BLA provisions which, the union contends, were violated during the review process, and called for resolving the dispute. The violations, the USW said, included the company’s failure to provide the union with any information about the sale process that its board of directors had started in August, including important deadlines or timetables, and the bids it had received; the

USW said it was entitled to the information under the BLA, when US Steel agreed with Nippon’s Houston-based holding company on the acquisition.

The USW referred to certain sections of the BLA with US Steel which has a validity until September 2026.

The USW also emphasized the successorship factor to ensure that whoever takes over US Steel will be bound by the labour agreements between the USW and the company.

The USW said it was not consulted nor taken into confidence that its collective bargaining agreements would be respected.

Both US Steel and Nippon Steel stated that ‘represented members’ would continue to receive their paychecks, profit-sharing and benefits from US Steel which, after the takeover, would retain its name. However, the USW did not seem to be convinced, telling its members that ‘talk is cheap, coming from greedy corporations’ and this was the reason why it insisted on including successorship rights in the BLA to protect the workers’ contracts and their interests.

To reassure its workers, US Steel emphasized, in a posting on its website, that Nippon Steel had the ‘financial wherewithal and desire’ to honour all the agreements existing with the USW.

However, the USW said, after its meeting with Hiroshi Ono, Nippon Steel North America’s president at the union’s headquarters, that ‘simply saying Nippon Steel North America (the US office of Japan’s Nippon Steel) will accept our labour agreements’ did not satisfy the BLA

conditions.

The USW also cast doubts on the question of profit sharing which it considers as an employee benefit under the BLA, and said in a statement that it was prepared to continue the grievance process right till the end, contending that it held the management accountable for trying to cash in by selling out American steelworkers and ignoring the contracts and the dedicated workers.

While the USW/US Steel wrangling is expected to continue until it is finally resolved, the acquisition deal is also subject to close scrutiny by the Committee on Foreign Investment in the US (CFIUS), under the treasury department, vested with powers to approve, block, or amend the deal on national security grounds and even forward the deal to the highest authority, the US president, for a decision.

supply chain reliability’.

Biden’s reaction – and also that of other leaders of the two parties – has, so far, been restrained, compared with the sharp criticism from lawmakers of the two parties. Indeed, former President Donald Trump, who is running again for the President’s office, has been silent so far.

Steel industry sources say that Nippon Steel/US Steel lawyers had held talks with treasury department officials on the deal’s announcement in December 2023, concentrating on the process for filing with the CFIUS.

President Joe Biden had expressed doubts on US Steel’s sale to Nippon Steel, apparently fearing that this could become an issue in an election year.

White House national economic adviser Lael Brainard noted that the president believed that the ‘purchase of this iconic American-owned company by a foreign entity – even one from a close ally – appears to deserve serious scrutiny in terms of its potential impact on national security and

Nippon Steel has been sounding confident about completing the US Steel deal, with the company’s president, Eiji Hashimoto recently telling reporters, after the Japan Iron and Steel Federation’s New Year party, that the deal posed ‘no harm to America’ as Nippon Steel would invest in line with the economic security strategies of the US and other Western countries. He added that Nippon Steel’s substantial investment and its advanced steel-manufacturing technology would be advantageous to the US, adding that the current labour agreement would be maintained, and that taking good care of the employees and labour union ‘is our specialty’. His company had anticipated challenges in the form of different opinions, objections, and government scrutiny.

Meanwhile, the American Iron and Steel Institute (AISI) reported a 0.1% increase in the nation’s weekly steel output to 1.699Mt and capacity utilization of 76.5% during the week ending January 13, 2024, compared with 1.697Mt and 75.9% capacity utilization in the year-earlier week and a steel output of 1.707Mt in the previous week.

The top steel-producing regions were the Southern region with 769kt, and the Great Lakes region with 553kt during the week. �

The PROFILEMASTER® SPS is a light section measuring device for measuring contours and dimensions on profiles of all kinds in cold and hot steel applications.

Benefits:

Maximum measuring accuracy thanks to temperature-stabilized measuring systems

Shape fault detection (SFD) thanks to high sampling rate

High-precision measurements

Detects process problems at an early stage

Fast maintenance and easy cleaning

While electrical steels are estimated to account for only 1% of the global steel market, its supply is being considered as an increasingly critical input to Original Equipment Manufacturers (OEMs)’ electrification plans as well as various energy transition initiatives. By Germano Mendes de Paula*

THE commercial electrical steel market is divided in two major categories: the non-grain oriented electrical steels (NOES) and grain-oriented electrical steels (GOES). NOES’ main applications are: hydroelectric plant generators, electric motors, fluorescent lamp ballasts, and hermetic compressors for refrigerators, freezers and air conditioning. Each electric vehicle motor requires around 68kg of NOES, according

to Cleveland Cliffs. GOES are used in the manufacturing of transformer cores, power reactors, hydro generators and turbo generators. As transformers are the only major consumer of GOES, the market is significantly smaller for that product rather than for NOES, at around one third of the demand. Cold Rolled Motor Lamination (CRML), which is known as semi-processed electrical steels because it requires

annealing after stamping and a product little seen outside of North America, is not examined in this article.

Unsurprisingly, during the age of energy transition, there are new projects dedicated to producing electrical steels (also known as silicon steels and magnetic steels). For instance, in 2022, ArcelorMittal announced investments of €300 million in Mardyck, France, for this purpose. It will have a

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

200kt/yr capacity and it is expected to startup in 2024.

US Steel commissioned the new 180kt/ yr NOES line at its Big River Steel mill in Osceola, Arkansas, in October 2023, at a cost of $450M. Cleveland Cliffs (formerly AK Steel) has also deployed $30M as capital expenditure into its Zanesville, Ohio, facility to enlarge production capacity of NOES by another 70kt annualized. Considering that electrical steels gained momentum worldwide, it seems interesting to compare the two largest Latin American markets: Brazil and Mexico.

Brazil is the only producer of electrical steels in the region. Aperam South America, formerly known as Acesita – a state-owned Enterprise (SOE) – began to produce NOES in 1979 and GOES in 1981. The company also initiated the fabrication of High Grain-oriented (HGO), a high-permeability product, which allows increased efficiency and reduced size of electrical generation and distribution transformers, as of 2017. HGO requires investments in modern equipment, which is supported by dedicated research and development efforts.

Aperam’s electrical steels are produced in its Timoteo steelworks, located in the state of Minas Gerais. Aperam’s NOES installed capacity reached 194kt/yr in 2022, while the GOES capacity achieved 56kt/yr. Taking data from the consultancy company Steel-Insights into consideration, they were equivalent respectively to 1.4% and 2.2% of global figures. Bearing both products combined in mind, the company’s capacity equals 250kt/yr (or 1.5% of the world).

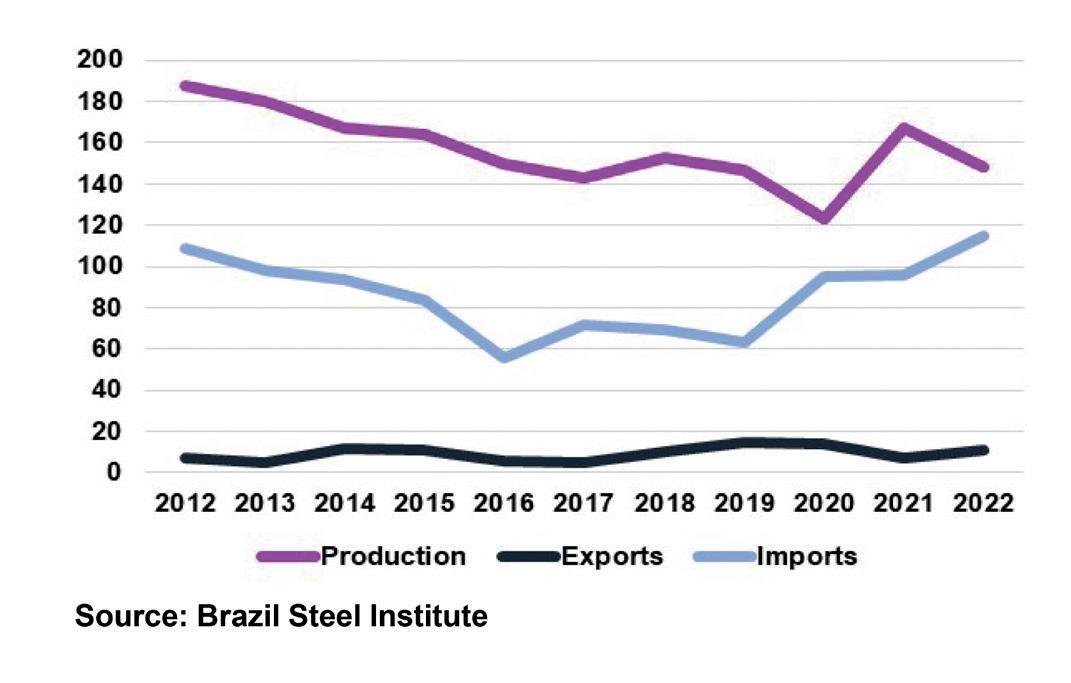

Graph 1 shows that Brazilian electrical steel output plummeted from 188kt in

2012 to 143kt in 2017, largely due to a severe domestic macroeconomic crisis. It partially recovered to a plateau of 150kt/yr in 2018-2019 and then faced a temporary additional drop to 123kt in 2020, as a consequence of Covid-19. Since then, it has stabilized at around 160kt/yr.

The country’s exports were relatively low during the examined period. On average, it reached 10kt/yr. On the other side of the spectrum, imports diminished from 109kt in 2012 to 56kt in 2016, following the trajectory of domestic production. Afterwards, it was around 70kt/yr in 20172019 and 100kt/yr in 2020-2022. More importantly, imports as a proportion of domestic production increased from 58% in 2012 to 78% in 2022.

The Mexican experience was totally different from the Brazilian one, as the market is fully served by imports. During the 2012-2016 period, imports reached 200kt/yr. Since 2017, it has expanded, with imports more than doubling to 455kt in 2022. Despite

the fact that Mexico does not produce electric steels, it exported roughly 8kt/yr between 2012-2022.

The German distributor Klöckner acquired National Material of Mexico (NMM) in August 2023, a service centre and materials supplier serving automotive end markets, with 10 facilities throughout Mexico. NMM operates a service centre model, as opposed to a purely distributory model. The acquisition allows Klöckner to enter the Mexican electrical steel market. Mexican steelmakers have also announced various investment projects recently, to some extent motivated by nearshoring, but no new line of electrical steels have been added so far. Electrical steels remain a niche market. There is a quite reduced number of producing countries, headed by China and other Asian players. Indeed, Steel-Insight estimates that Asian nations control 90% of NOES capacity and 67% of GOES capacity in 2022. Latin America has played a minor role regarding production, but Mexican demand has been showing a remarkable trend in the last six years. �

GLAMA Maschinenbau GmbH

Headquarters:

Hornstraße 19 D-45964 Gladbeck / Germany

Fon: +49 (0) 2043 9738 0

Fax: +49 (0) 2043 9738 50

Email: info@glama.de

GLAMA USA Inc.

60 Helwig St., Berea, Ohio 44017

Fon: +1 877 452 6266

GSM 200 to capacity and GFM 100 to capacity in operation at NAF, New Castle / PA

GIR-P 1 to capacity in operation at Standard Steel, Burnham / PA

GSM 200 to capacity and GFM 100 to capacity in operation at NAF, New Castle / PA

GIR-P 1 to capacity in operation at Standard Steel, Burnham / PA

Liquiline CM44 and CPS11E:

Versatile transmitter and Memosens pH sensors ensure reliable measurement

FieldPort SWA50:

Intelligent Bluetooth or WirelessHART adapter for the easy connection of all HART field devices to the Netilion Cloud via Edge Devices.

Cerabar PMC71B:

Absolute and gauge pressure transmitter combining measurement accuracy with IIoT functionalities.

With the introduction of the ‘Production-Linked Incentive booster 2.0’, India’s speciality steel sector is hoping to go from strength to strength. By

Dilip Kumar Jha*

INDIA aims to achieve self-reliance in speciality steel production and become a net exporter following the successful implementation of the second round of the Production-Linked Incentive (PLI) booster.

Currently under consideration, the second PLI booster is expected to prompt steel mills to establish at least 25Mt of additional production capacity by the end of the proposed three-year tenure of the scheme.

India presently imports between 5-6Mt/yr of specialised steel mainly from China, Japan, and South Korea, among other countries, to bridge the supply-demand deficit.

Speciality steel is a value-added product where normal finished steel undergoes processes such as coating, plating or heat treatment, making it suitable for applications that require specific properties such as defence, space, power, automotive, and specialized capital goods. Additional production of speciality steel is required for the domestic steel sector to scale up to the global value chain. Key features of the scheme include three incentives; participation limited to companies registered in India, commitment to investment thresholds, and incremental

*India correspondent, Steel Times International

production as outlined in the scheme guidelines.

Restricted to the premium steelmaking sector across high-value categories, the second PLI scheme is expected to have a capital outlay of INR 40 billion (~$480 million), nearly double the total disbursement made under the original programme. Segments to be covered under the PLI 2.0 scheme include coated and plated steel, speciality rails, high-strength and wear-resistant offerings, and alloys such as electrical steel, and wires and tubes, among others. The government is currently

Source: Ministry of Steel, Government of India; FY = Financial Year (April-March)

A= Incremental sales in current year with reference to previous year or the base year whichever is higher

B= Weighted Average sale price (net of taxes) in current year

C= Weighted Average sales price (net of taxes) in the base year (2019-20)

Source: Ministry of Steel, Government of India; FY = Financial Year (April-March); INR=Indian rupee

recommendations made by concerned stakeholders for the smooth transition of PLI 2.0, which aims to promote high-end steel or speciality steel manufacturing, thereby reducing India’s dependence on imports. The draft guidelines indicate that the usage of coated plated steel across user industries requires an investment of INR 5 billion (~$60 million) towards capacity addition. Eligible products are widely used in the automotive industry. Furthermore, the speciality rails segment, mostly used in head-hardened rails, is likely to draw an investment of INR 2 billion (~$24 million), alloy steel (wires and tubes in segments like tool and die, valve steel and automotive power tool) to the tune of INR1 billion (~$12 million), and tyre beads and metallic coated wires may attract an investment of INR 800 million (~$10 million). Products such as zinc/aluminium/copper-coated wires, carbon steel, high-strength rebars, and CRGOs would also be eligible for PLI 2.0. Faggan Singh Kulaste, India’s minister of state for steel, indicated the government’s overall outlay for PLI 2.0 at INR 40 billion (~$480 million).

PLI 1.0

Since 2018, India has emerged as the world’s second-largest crude steel producer and the second-largest consumer of finished steel since 2019. However, the country has remained import-dependent for value-added steels in specialised applications. With an objective of making India self-reliant in speciality steel, the government approved a PLI scheme for this sector with a financial outlay of INR 63.22 billion (~$759 million) on 22 July, 2021. The present specialized steel production capacity in India is estimated at 25Mt/yr.

finalizing the draft in consultation with the major consuming sectors of specialized steel such as roads, the Department of Atomic Research, commerce, defence, and others, to assess its impact on various industries, and plans to launch the scheme soon.

T V Narendran, managing director of Tata Steel Ltd, one of India’s the largest integrated primary steel producers, highlighted the need for massive

investment in the speciality steel sector to counter increasing imports from China.

Speaking on the company’s New Year plan at its factory in Jamshedpur, Jharkhand, Narendran expressed optimism about the government’s increasing focus on infrastructure development, which he believes will be the key driver for the industry’s growth in the future .

The government is current reviewing

The first version of the PLI scheme (PLI 1.0) attracted a total investment of INR290 billion (~$3.48 billion) with a guarantee to install 25Mt/yr of additional capacity additions. The application window for PLI 1.0 closed on 15 September 2022, with the government receiving 79 applications from 35 companies.

Companies participating in the PLI 1.0 scheme have committed to downstream capacity additions of 24.78Mt/yr. Some of the categories covered by that PLI 1.0 include coated steel in the non-alloyed category, wires, water and weatherresistant steel, asymmetric rails with forgings, metallic, coated wires, among others. �

due to a lack of media attention, China’s ‘substantial market size’ and extensive electrolyser capacity foreshadows its future influence and leadership in the hydrogen sector.

By Anne-Sophie Corbeau*media focuses largely on low-carbon hydrogen developments in the US and Europe. However, China is also the country with the largest installed electrolyser capacity and the largest electrolyser manufacturer capacity. The country’s substantial market size and extensive industrial infrastructure not only facilitate fast technological advancements in the hydrogen space, but also offer the potential to achieve economies of scale which could

significantly influence the global hydrogen landscape.

To realize China’s potential as a clean hydrogen leader, it is crucial to understand its hydrogen strategy. Indeed, China’s strategies are plural given the multiplicity of hydrogen strategies at the provincial level. These give a very different perspective than the national hydrogen strategy, with a more bullish view on renewable hydrogen development. It appears that provincial strategies may, in fact, give a more accurate view of China’s potential than the national one.

*

An overview of China’s hydrogen landscape

China represents roughly one-third of global hydrogen output at around 33Mt (2020). This production heavily relies on fossil fuels (79%), while about 21% of it originates as industrial by-product. Meanwhile, the contribution of renewable hydrogen remains marginal, accounting for less than 0.1% of production.

Hydrogen production and consumption in China are concentrated in the northwest and northeast, with the highest outputs in the Autonomous Region of Inner Mongolia (‘Inner Mongolia’) and Shandong, each of which exceeded 4Mt in 2020, followed

by Xinjiang, Shaanxi, and Shanxi with over 3Mt. These regions’ coal abundance fuels hydrogen production, mainly serving local petrochemical and chemical industries. The northwest, rich in renewable energy resources (wind and solar), is also positioned to become a renewable hydrogen hub.

However, anticipated surging demand in eastern and southeastern China highlights a growing supply-demand geographic mismatch. With only 400 km of existing hydrogen pipelines, China lacks the infrastructure to transport hydrogen from distant renewable-rich regions to emerging consumption hubs. Recent initiatives to develop infrastructure such as shortdistance hydrogen pipelines, hydrogen refueling stations, and liquid hydrogen storage facilities are primarily concentrated in four major industrial clusters: the Beijing-Tianjin-Hebei Region, the Yangtze River Delta, the Pearl River Delta, and the Ningdong Energy and Chemical Industry Base. Consequently, they may not be able to connect renewable hydrogen supplies with primary demand centres.

China’s national and regional hydrogen development strategies compared

A notable feature of China’s hydrogen strategy is that it is not, in fact, singular, but instead is comprised of a national strategy and a multitude of regional strategies. China released its medium and long-term strategy for the development of the hydrogen energy industry (2021–2035) (‘the National Plan’) in March 2022. It strategically positions hydrogen as

(1) an important part of China’s future energy system; (2) an important carrier for achieving China’s low-carbon energy transition; and (3) a key emerging industry and development direction of future industries in China. The National Plan aims to establish a hydrogen supply system using both industrial by-product hydrogen and renewable hydrogen. However, its targets for renewable hydrogen production may appear relatively conservative with a range of 100-200kt/yr by 2025 (or 0.3 to 0.6% of current Chinese hydrogen consumption).

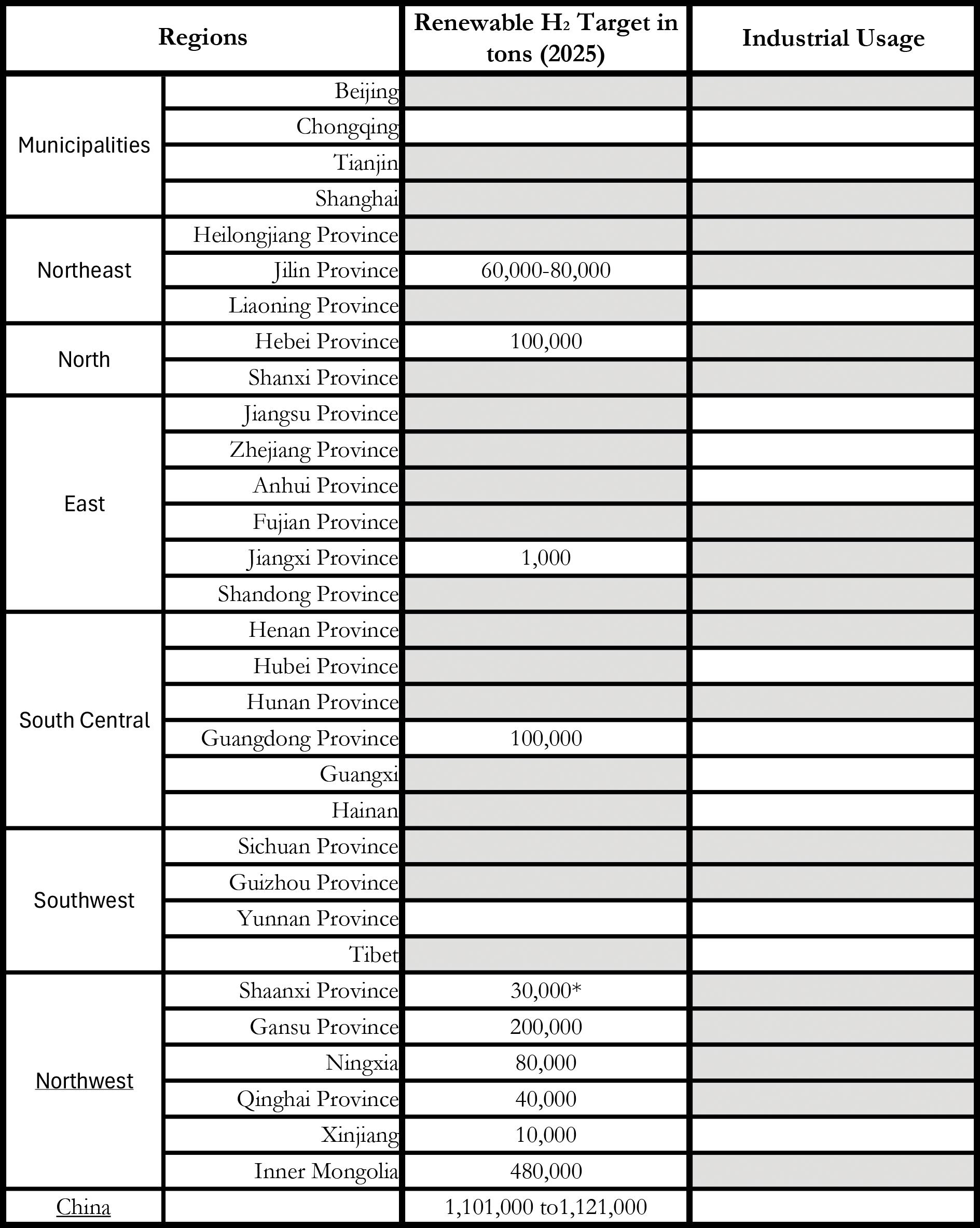

By contrast, provinces, cities, and municipalities across China have introduced their own hydrogen development plans that establish far more ambitious renewable hydrogen goals. Out of the 34 regions that make up mainland China, 18 have

independently introduced their hydrogen industry’s 14th Five-Year Plan, while the others have incorporated hydrogen into broader industrial strategies. These local strategies are setting targets far beyond those of the National Plan. The regions’ cumulative targets for renewable hydrogen amount to 1.1 to 1.2 Mt by 2025, or five to 12 times the conservative national target. For instance, Inner Mongolia has an ambitious objective of 480kt of renewable hydrogen by 2025, more than twice the national target.

Localized hydrogen strategies are tailored to leverage regional advantages and infrastructure, leading to varied approaches across provinces. Regions with abundant renewable resources, such as Sichuan with its hydropower potential, prioritize renewable hydrogen production. In contrast, coal-rich regions, such as Shanxi, primarily focus on industrial by-product hydrogen from coal-chemical production. Regions with an abundance of both renewable and coal resources, such as Inner Mongolia, adopt a diversified approach.

Regions also prioritize different applications according to their unique needs. Inner Mongolia, Shanxi, and Shaanxi aim to deploy hydrogen fuel cell forklifts and trucks for mining operations. Zhejiang focuses on leveraging hydrogen for combined power and heating as well as fuel cell electric vehicles (FCEVs). In fact, all regions emphasize establishing hydrogen refueling stations and deploying FCEVs, with some having identified targets, aligning with China’s longstanding policy support in these areas. Some regional plans state the adoption of renewable hydrogen for industrial decarbonization without explicit targets, with the exception of Jilin’s 250-350kt capacity goal for green chemicals and refining.

Still, these strategies underscore the vital role of local governments in the initial phase of China’s hydrogen development, acting as a testing ground for the central government. Local officials and leaders of state-owned enterprises are collaborating with central ministries to implement hydrogen policies, motivated by the prospect of career advancement to align with the national development objectives Table 1.

Inner Mongolia’s hydrogen leadership

Inner Mongolia’s 14th Five-Year Plan on hydrogen development, announced in

Note: Highlighted cell indicates the plan mentions the target/application without a quantified target. Industrial usage covers steel, refining, chemicals; highlights do not imply all applications are covered. Some plans offer post-2025 visions/targets, but this table only shows 2025 targets. Abbreviations: Guangxi – Guangxi Zhuang Autonomous Region; Tibet – Tibet Autonomous

Ningxia

2022, sets the most ambitious renewable hydrogen production target by far at 480kt/ yr by 2025. The region has undergone rapid expansion in terms of installed renewable hydrogen production capacity, often developed by major state-owned enterprises (SOEs), and will host one of the world’s largest renewable hydrogen projects, currently under construction.

Several factors contribute to Inner Mongolia’s ability to assume a leadership role in hydrogen development in China. The region:

• possesses substantial solar and wind

potential, with technically exploitable wind and solar energy resources of around 57% and 21% of China’s potential, respectively.

• has a pre-existing local hydrogen demand, such as ammonia production, and oil refining and future demand from steel manufacturing.

• benefits from its proximity to the eastern economic hub (Beijing-TianjinHebei region). The 400-km Ulanqab-Beijing pipeline is China’s first long-distance hydrogen pipeline. It has an initial capacity of 0.1Mt/yr and the potential to expand to 0.5Mt/yr.

To determine whether local renewable hydrogen targets are a better benchmark than the national target, it is crucial to estimate whether Inner Mongolia could potentially achieve its 2025 target.

Based on publicly available statistics, Inner Mongolia hosts 50 renewable hydrogen projects, of which three, yielding a combined 10.884kt/yr hydrogen production capacity, are operational. Moreover, 21 projects with a cumulative capacity of over 300kt/yr are under construction and are expected to be online by 2025. This represents 63% of the province’s goal. Another 26 projects with an aggregate production potential of 1Mt/yr are planned, with around 460kt expected to be online by 2025.

Inner Mongolia may still fall short of its ambitious 2025 target since there is uncertainty about whether planned projects will actually materialize. The region’s ability to reach its ambitious target depends on projects currently under construction as well as additional planned projects that are supposed to begin construction soon. Based solely on projects operational and under construction, Inner Mongolia’s anticipated annual hydrogen output would surpass the national target of 100–200kt/ yr. With planned projects included, Inner Mongolia’s potential annual renewable hydrogen production capacity could reach 1.4Mt, exceeding the aggregated renewable hydrogen production targets announced across all regions. Most projects are located within the industrial zone adjacent to the petrochemical plants in which they could replace gray hydrogen. These projects also reflect the heavy statedriven involvement of China’s hydrogen market–32 of the 50 existing projects are spearheaded by SOEs, and an additional six involve collaborative efforts between SOEs and private enterprises.

Similarly to other parts of the world, there might be questions about whether the hydrogen produced from these electrolysers will truly be ‘renewable’. In 2021, the China Hydrogen Alliance proposed the Standard and Evaluation of Low-Carbon Hydrogen, Clean Hydrogen, and Renewable Hydrogen. However, this framework sets a relatively unambitious threshold of 14.51 kgCO2e/ kgH2 for low-carbon hydrogen (which is above the current carbon intensity of hydrogen from steam methane reforming)

and 4.9 kgCO2e/kgH2 for renewable hydrogen (above the EU’s threshold of 3.38 kgCO2e/kgH2).

Moreover, the differentiation between hydrogen produced from renewable sources and other variants remains ambiguously addressed in official Chinese government documents. Both the central government and local governments refer to ‘hydrogen’ and ‘green hydrogen’ without providing explicit definitions. Even the PRC Energy Law (Draft) does not differentiate between various hydrogen production approaches. Consequently, China’s current hydrogen policy lacks mechanisms to regulate the sources and carbon intensity of hydrogen (e.g., by requiring that ‘renewable

hydrogen’ be produced exclusively from renewable electricity).

This lack of a precise definition is not so surprising given that many regions and countries are still in the process of considering how to precisely define renewable hydrogen. The EU approved a definition in a Delegated Act only in June 2023, while the US finally published the hydrogen tax credit guidance in late 2023. However, on the provincial level in China, there does seem to be an attempt to articulate a definition for renewable hydrogen. In 2023, Inner Mongolia, and several other provinces, began to distinguish between grid-connected and off-grid hydrogen production projects (relying solely on wind and solar plants).

One notice published by the Inner Mongolia Bureau of Energy states that ‘grid-connected projects, in principle, should not purchase electricity from the grid.’ ‘In principle’ is a unique Chinese term that indicates the clause has room for manoeuvre based on regulations, which implies this rule might not be strictly enforced. However, if ‘grid-connected’ projects do not use grid electricity, these

projects would satisfy the European definition of ‘temporal correlation’ which emphasizes that hydrogen producers must ensure that renewable electricity generation and hydrogen production coincide temporally. This rule in Inner Mongolia indicates an attempt to produce electrolytic hydrogen solely from renewable energy.

Local policy and industry developments on renewable hydrogen in China are already exceeding the national strategy and its conservative targets, making them a better indicator of China’s ambitions. In particular, Inner Mongolia’s renewable hydrogen production target is more than twice the national target and seems potentially within reach based on projects currently under construction.

China’s hydrogen strategy, unlike the

EU and US, leans more towards economic growth than immediate climate action, as evidenced by the limited emphasis placed on measuring hydrogen’s carbon intensity. Despite several regions having suggested restrictions on fossil-based hydrogen, national policies still lack a strong push against it. Still, climate mitigation does exert influence: hydrogen is integral to China’s low-carbon transition, while provinces promote renewable hydrogen to replace gray hydrogen. China’s hydrogen development landscape presents a complex mix of challenges and opportunities. As the global community navigates the intricacies of the hydrogen economy, understanding China’s unique approach, characterized by a blend of centralized directives and regional initiatives, is paramount, providing insights into the future trajectory of the world’s largest hydrogen market. �

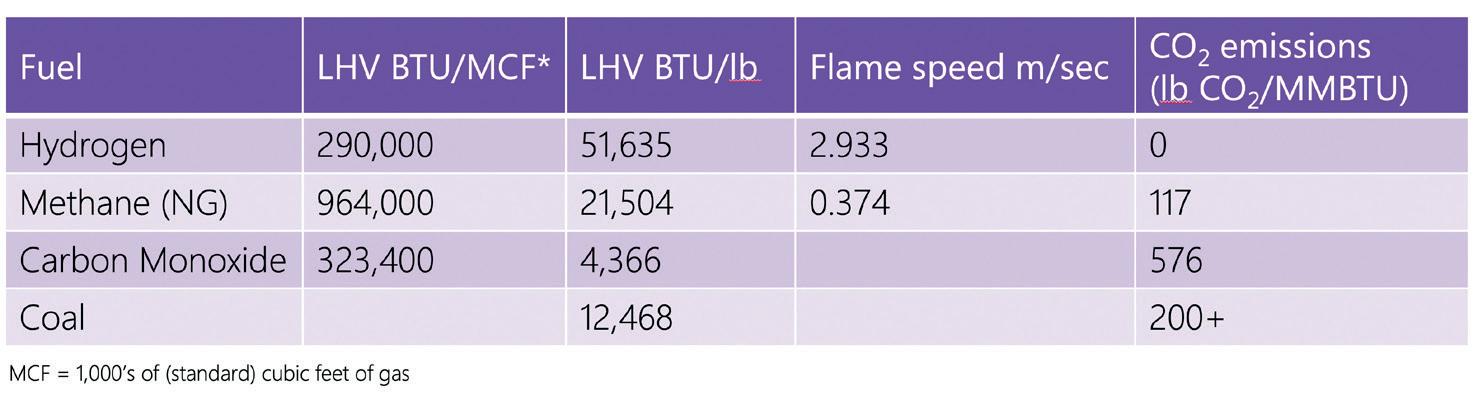

The H2-DRI-EAF process shows significant promise in decarbonizing the steel sector, but challenges must be addressed to achieve genuinely green steel through hydrogen reduction. By Soroush Basirat*

GREEN hydrogen is set to transform the steel industry. Hydrogen-based direct reduction (DR) technology is already leaving behind other decarbonization solutions for primary steelmaking such as carbon capture and storage (CCS).

H2-DRI-EAF involves the use of hydrogen (H2) to produce direct reduced iron (DRI), which is then processed in an electric arc furnace (EAF) to produce steel. In the BloombergNEF net-zero outlook, 64% of the total primary steel production projected for 2050 is associated with H2-DRI-EAF, followed at 25% by DRI-EAF equipped with CCS technology. The remaining share is allocated to blast furnace-basic oxygen furnace (BF-BOF) steelmaking and other technologies.

In its revised net-zero roadmap 2023, the International Energy Agency (IEA) envisions that 44% of iron production will be derived from hydrogen-based processes by 2050, followed by other technologies including CCS and direct iron ore electrolysis.

While hydrogen use in ironmaking based on the DR process makes sense to produce low-emissions steel, there are specific hurdles that must be overcome to facilitate this shift. The foremost challenges include ensuring an adequate supply of DR-grade iron ore, and establishing a sustainable green hydrogen value chain for steel production.

The iron ore mining industry has been a major sector with established corporate entities for many years. To

*Energy finance analyst – global steel, IEEFA

cater to emerging demand for green iron, companies are adopting diverse strategies, including opening new iron ore mines with high-grade ores such as Iron Bridge, Australia, and Simandou, Guinea. Furthermore, inventive methods are being explored such as microwave and biocarbon technologies for producing low-emission pure iron, along with the use of smelting reduction with lower-grade ores.

Compared to the iron ore sector, green hydrogen is relatively new. However, it will play a pivotal role in effectively decarbonizing the steel industry, which demands closer examination.

The challenge of creating a green hydrogen value chain for steel

The decarbonization of the steel sector will necessitate additional and more dedicated gigaWatt-scale green hydrogen projects. Green hydrogen is still in its early stages of development, and increased investment is crucial for its integration into the steel industry. In the H2-DRI-EAF process, one tonne of steel requires nearly 300 megaWatts (MW) of electrolyser capacity operating around the clock.

Currently, among the commercial-scale green steel projects, only H2 Green Steel has outlined a comprehensive plan, proposing an electrolyser capacity above 700MW for steel production and aiming to transition directly to hydrogen instead of gas as an alternative reducing gas. Thyssenkrupp is exploring the possibility of outsourcing hydrogen supply for its plant in Duisburg, Germany, opting not to invest directly in

the hydrogen value chain. This will entail considering long-term supply contracts for both green and ‘blue’ hydrogen from domestic and international sources.

The hydrogen economy faces constraints such as limited electrolyser manufacturing capacity, and entails significant electricity consumption, posing challenges for renewable energy supply.

To sustain the operation of largescale green hydrogen-based DR plant, a consistent supply of renewable electricity must be guaranteed throughout the year. The variability of renewable energy sources, such as solar and wind, necessitates oversizing of capacity and the implementation of energy storage solutions to ensure a continuous energy supply. This necessity contributes to an escalation in the initial investment costs for renewables that can dwarf the CAPEX needed for the steelmaking facilities.

As per the US government’s updated Inflation Reduction Act (IRA), tax credits are available exclusively for hydrogen projects meeting specific criteria covering three key factors. First, the project must involve dedicated renewables constructed no more than 36 months before the commencement of electrolyser production (Additionality). Second, the renewables and electrolysers should operate within the same grid (Grid Access). Third, the project must align precisely with renewable power generation in terms of production time (Time Matching). The new requirements push developers to build their hydrogen plants with dedicated renewables nearby.

As of December 2023, the Hydrogen Council reported that despite a substantial number of projects announced, amounting to 305 gigaWatts (GW) in total pipeline capacity, the combined electrolyser capacity for green hydrogen has only surpassed 1GW. This capacity is sufficient to decarbonize just one steel mill with a capacity close to 3Mt/yr. The hydrogen development sector is also grappling with challenges such as cost inflation and rising financing expenses that push up the price of the hydrogen. The estimated levelised cost of producing renewable hydrogen (LCOH) is about USD4.5/kg to USD6.5/kg if built today. It is expected to decline to USD2.5/kg to USD4.0/kg towards 2030. Chinese electrolysers present an opportunity as they are two to five times more cost-effective than their Western counterparts; however, their performance

lags behind that of Western models.

Owing to inflation and uncertainty regarding government support, some projects are deferring their final investment decisions (FIDs). Lenders are anticipating support from off-takers for green hydrogen projects, but the price gap between production costs and off-takers’ desired rate remains substantial. End users are hopeful for more supportive regulations to facilitate a smoother transition, potentially resulting in an uptick in project finance approvals in 2024.

With all of these challenges facing green hydrogen production, it is crucial to prioritise the available capacities for sectors that can yield a substantial reduction in carbon emissions, such as the steel industry.

German think tank Agora Industry has underscored that steel stands out as the sector with the greatest potential for carbon reduction among various hydrogen applications. Interestingly, even in sectors where direct electrification is not feasible, shifting from coal to hydrogen – as seen in the steel sector – yields more benefits compared with transitioning from other fossil fuels, including oil and gas, to hydrogen.

In addition to distributing valuable green hydrogen across various sectors according to priority and carbon reduction potential, developers should reconsider exporting hydrogen for long distances. Particularly for projects under development in regions like MENA, hydrogen transportation is not an optimal solution, with inefficiencies and energy losses that add costs to the hydrogen value chain. Instead, using hydrogen domestically for producing hydrogen-reduced iron is strongly recommended as a preferable approach.

As an alternative, some steelmakers are opting to shift the ironmaking process to locations with access to more affordable and reliable energy sources, importing pure iron as a feedstock in the form of hot briquetted iron (HBI). The concept that is emerging sees a decoupling of ironmaking from steelmaking processes.

To bring this into reality, some steel producers are focusing their efforts on Australia, Brazil, the Middle East and Africa, all of which are positioned to establish themselves as green hubs for steel raw materials. POSCO is in the process of outlining a USD12 billion investment for green HBI in Australia. Plans for the development of 2Mt/yr of HBI and 0.7Mt/

#itsmorethanjustamachine

3-ROLL TECHNOLOGY FOR SBQ SIZING.

A Reducing & Sizing Block for long products keeping its promises.

Achieve your goals with KOCKS RSB®

up to 160mm

finishing size in round or hexagonal dimensions

up to 20%

increase in production

up to 10% energy savings in the mill line

yr of iron ore pellets were submitted for environmental approval in October 2023

Gas is only an intermediary solution The growth of the green hydrogen value chain is a process that will extend over several years. This is reflected in the basic design of numerous newly announced green iron and steel projects, which are strategically planned to be hydrogen-ready. Most of these projects are set to commence operations initially utilising natural gas (NG) – the exception being the Nordic countries. Continuous access to affordable renewable energy derived from hydro power frees the Nordic nations from any reliance on gas at the outset.

Midrex, the largest manufacturer of DR

plants, offers flexibility in its process, which can function with varying hydrogen ratios in the reducing gas mix. This allows for a gradual transition from gas to hydrogen whenever green hydrogen production becomes cost-competitive.

Tenova and Danieli, the joint developers of the Energiron DR technology, claim that all Energiron DRI plants are hydrogen-ready by design and can start using hydrogen as reduction gas without equipment modifications.

Experiments such as elevating the hydrogen share to 60%, in a trial conducted by HBIS, validate the potential of utilising a gas mixture in Energiron shafts to decrease carbon emissions in the ironmaking process. In May 2022, ArcelorMittal Long Products

Canada, equipped with two Midrex shafts, successfully conducted tests replacing gas with hydrogen partially. Table 1

The concluding remarks of COP28 highlighted the imperative to shift away from fossil fuels in energy systems, signalling the commencement of a pivotal phase. This underscores the collective responsibility of all nations to swiftly phase out fossil-based industrial operations, ensuring alignment with the goals of the Paris Agreement.

Despite the current high price of hydrogen, it is anticipated that the cost will become increasingly economical as electrolyser technology matures in the near future, prompting a shift towards hydrogen. Conversely, as the energy system moves away from fossil fuels, a global glut of gas supply is expected by the end of this decade. Investing in new capacity development is likely to result in stranded assets.

Even in regions with access to gas reserves, like Western Australia (WA), where projects such as POSCO’s new HBI plant have been announced, securing gas is challenging due to the extremely tight supply, as most gas produced in WA is exported as liquefied natural gas (LNG). Conversely, regions such as the Middle East boast plentiful and affordable gas resources that have historically been employed in iron production.

The first wave of green steel initiatives is emerging in Europe. Following the Ukraine war, Europe aims to replace Russian pipeline gas partially with increased LNG imports, mainly from the US. Introducing new gas demand from steelmakers could strain the overall supply, necessitating reconsideration in studies for transitioning to the NG-DRI pathway even as a bridging solution to true green steel. It’s crucial to note that utilising LNG as a feedstock may raise the final steel cost, given the additional expenses incurred during liquefaction, transportation and regasification processes for LNG compared with delivering gas via pipeline.

Europe is decreasing its reliance on gas, as renewable sources are claiming a larger share of the energy mix on the continent. The EU aims to fulfill 42.5% of its energy demand from renewable sources by 2030.

Given the transformations in the energy sector, the concept of utilising ‘blue’ hydrogen – made using gas, with the emissions captured with CCS – in steelmaking is irrational. CCS remains an

unproven technology with a track record of underperformance and low capture rates.

According to a report from the US Department of Energy (DOE), the majority of blue hydrogen projects are not deemed clean due to their high upstream emissions and do not qualify for tax credits. The EU also does not provide extensive subsidies for blue hydrogen. Moreover, in line with the EU’s revised Renewable Energy Directive (RED III), industries such as steel are mandated to have at least 42% of their hydrogen use sourced from renewable energy by 2030, with a further increase to 60% by 2035. This updated directive effectively excludes the possibility of blue hydrogen development for steelmaking in the EU. The utilisation of gas-based DRI is not a definitive solution for achieving steel decarbonization due to its significant carbon emissions. Green steel producers should have a clear strategy to transition towards green hydrogen or, at the very least, plan to incrementally incorporate hydrogen to curtail their reliance on gas.

H2-DRI-EAF represents a narrative of allocating limited resources to create

valuable products. Currently, green hydrogen comes at a high cost, and there is a scarcity of DR-grade iron ore. By judiciously allocating these two resources to

green steel facilities, and with the backing of supportive yet rigorous regulations, the transition to green steel can continue to gain momentum in 2024. �

THE

GROUP GROUP

Global Sponsors

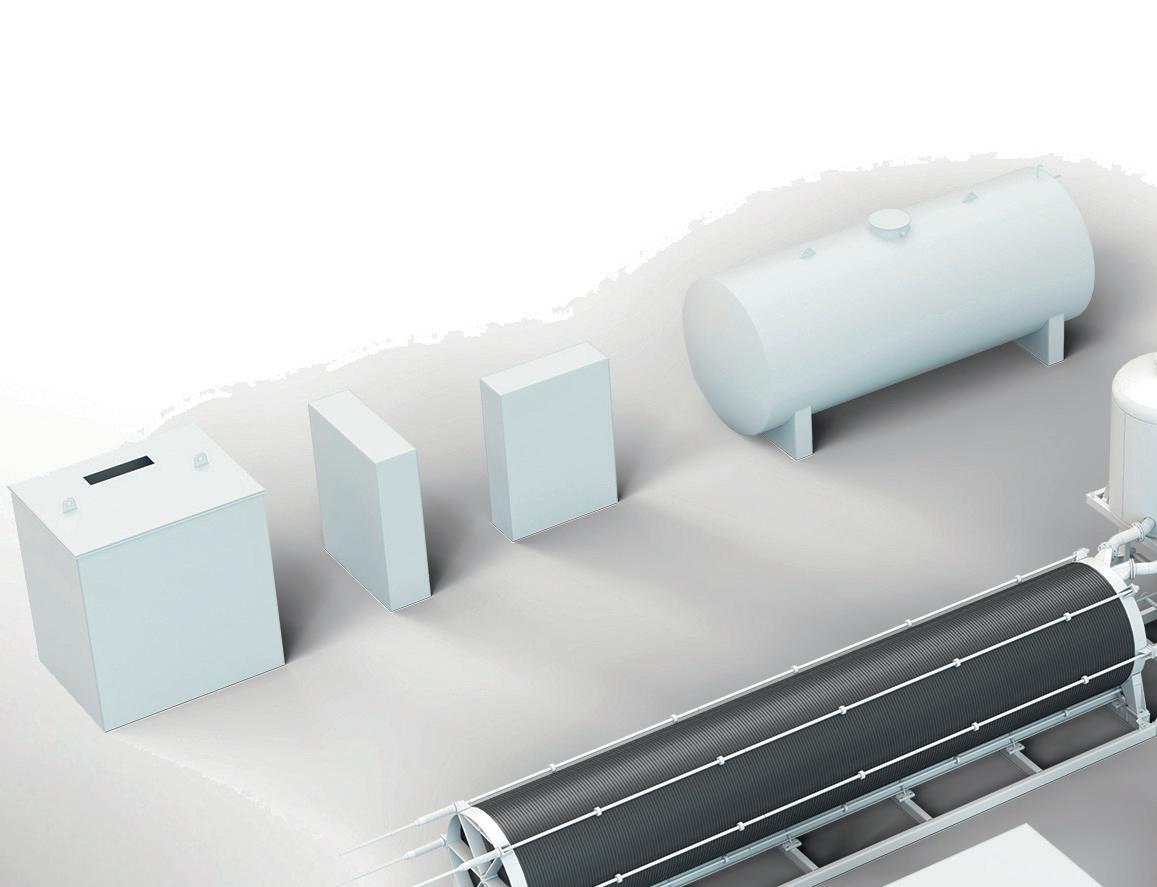

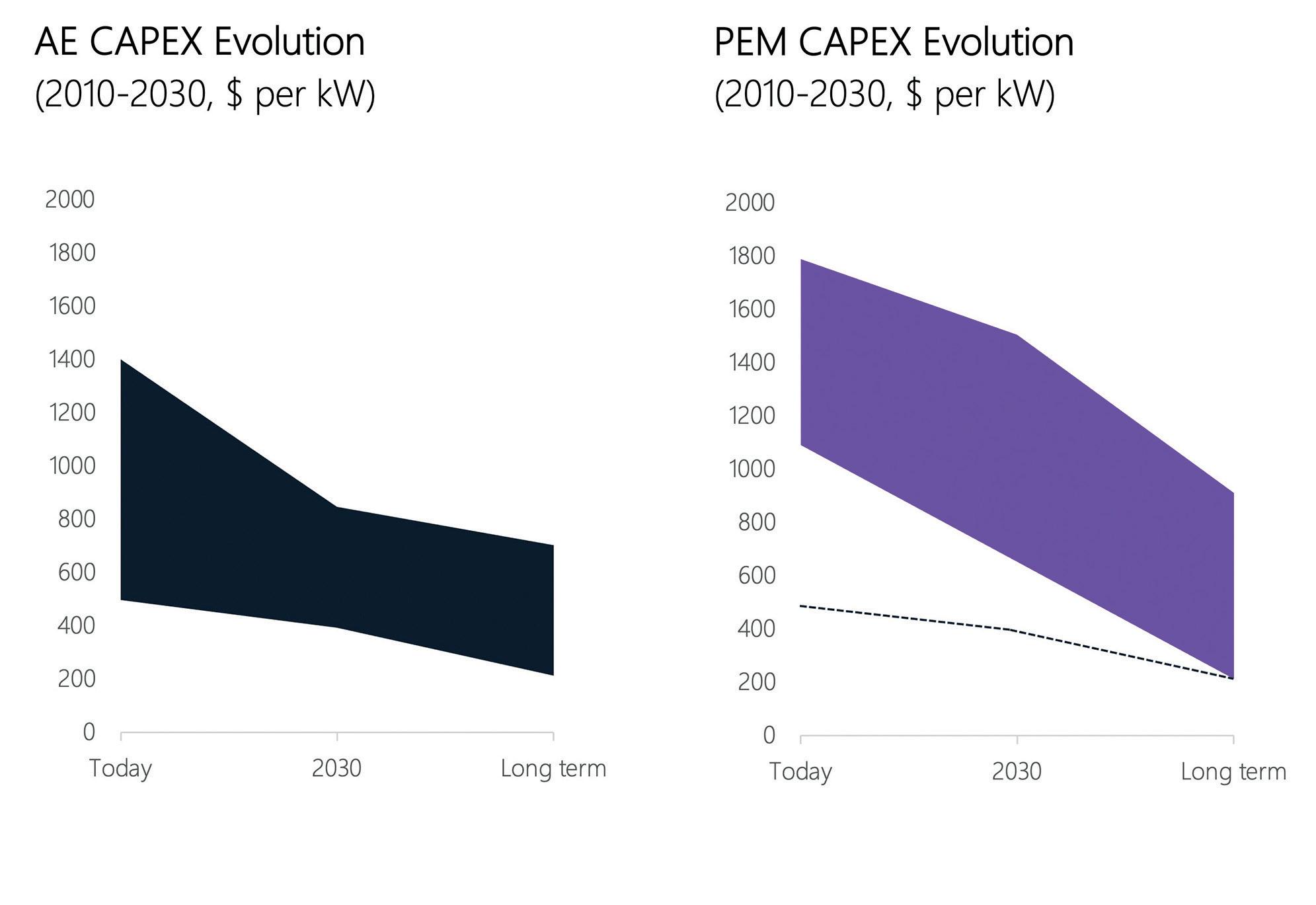

Slowly but surely, momentum is building to upscale H2 production via electrolysis, with goals to increase renewable energy sources, and reduce costs.

By Lynn Gorman*

THE steel industry is realigning future investment from the legacy steelmaking technologies of the BF and the BOF to the current preferred technology of the EAF. As such, steelmaking is on track to become significantly greener, and the plants will become smaller, cleaner, and consume less energy. Today, the steel industry releases 7% of the world’s CO2. According to a report by Wood Mackenzie, the steel industry’s carbon emissions are expected to fall by 30% by 2050 compared to 2021 levels. The European steel industry has already cut its CO2 emissions and energy use by half since 1960, and aims to achieve further cuts of 80-95% by 2050 compared to 1990 levels. Because of the enormous installed equipment base and the long life of steel production plants, the evolution to a greener steel industry may be a slower one compared to some other industries such as power generation, semiconductor, and

automotive. However, the steel industry is indeed positioning itself for a cleaner future and has demonstrated notable efforts on the decarbonization journey.

The iron and steel industry knows where

*Freelance writer

the technology gaps are, what the market realities are, and what the cost inhibitors are, enabling stakeholders to turn the stumbling blocks into practical solutions. There are pilot projects well underway

worldwide, and demonstration facilities in northern Europe that serve as teaching models for the optimal systems to employ, strategic partnerships to nurture, and are providing the data the steel industry has been seeking.

Steel is the most recycled manufactured

product in the world. EAF steel plants primarily use scrap steel to make new steel, yet they must add additional iron molecules to the process, such as DRI (direct reduced iron), sponge iron, or HBI (hot briquetted iron), to augment recycled steel in EAF production. EAF iron

feedstock produced in a shaft furnace to complement scrap steel made from ore is using a CO (carbon monoxide)-hydrogen blend currently made from natural gas or coal. The near-term solution for a greener steel industry is replacing natural gas and/ or coal used for producing iron units with zero carbon hydrogen as the reducing gas for EAF feedstock preparation. Clean steelmaking may ultimately use hydrogenderived DRI and hydrogen-enhanced electric arc furnaces with near-zero CO2 emissions per ton of steel. However, to reach that level requires massive production of green hydrogen at a cost that’s acceptable to steelmakers.