Oilseeds/Oleochemicals

28 Sourcing erucic acid from crambe

An initiative by the G7 group of

Lecithin’s role in food and feed

Soya lecithin is widely used as an emulsifier, dispersant, antioxidant and humectant in various industries including food and feed. As a major global producer of soyabeans, South America is also a key supplier of soya lecithin

Although most erucic acid for olechemical use is derived from high erucic acid rapeseed (HEAR), crambe is another potential source for this fatty acid

Transport & Logistics

31 Black Sea waters still turbulent Ukraine’s sunflower oil exports have reached pre-war levels while Russian shipments have grown but sea mines and high insurance costs continue to challenge Black Sea logistics

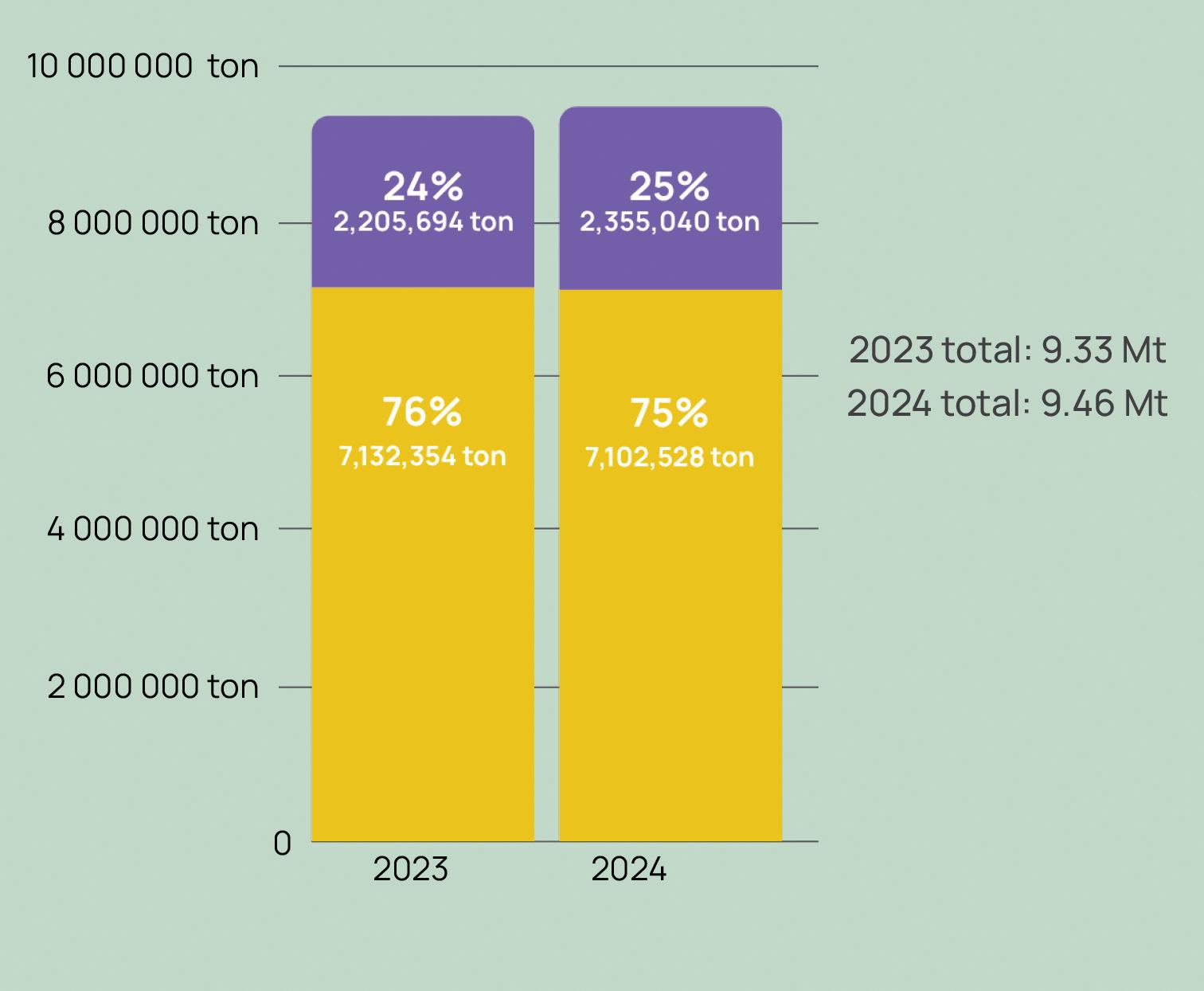

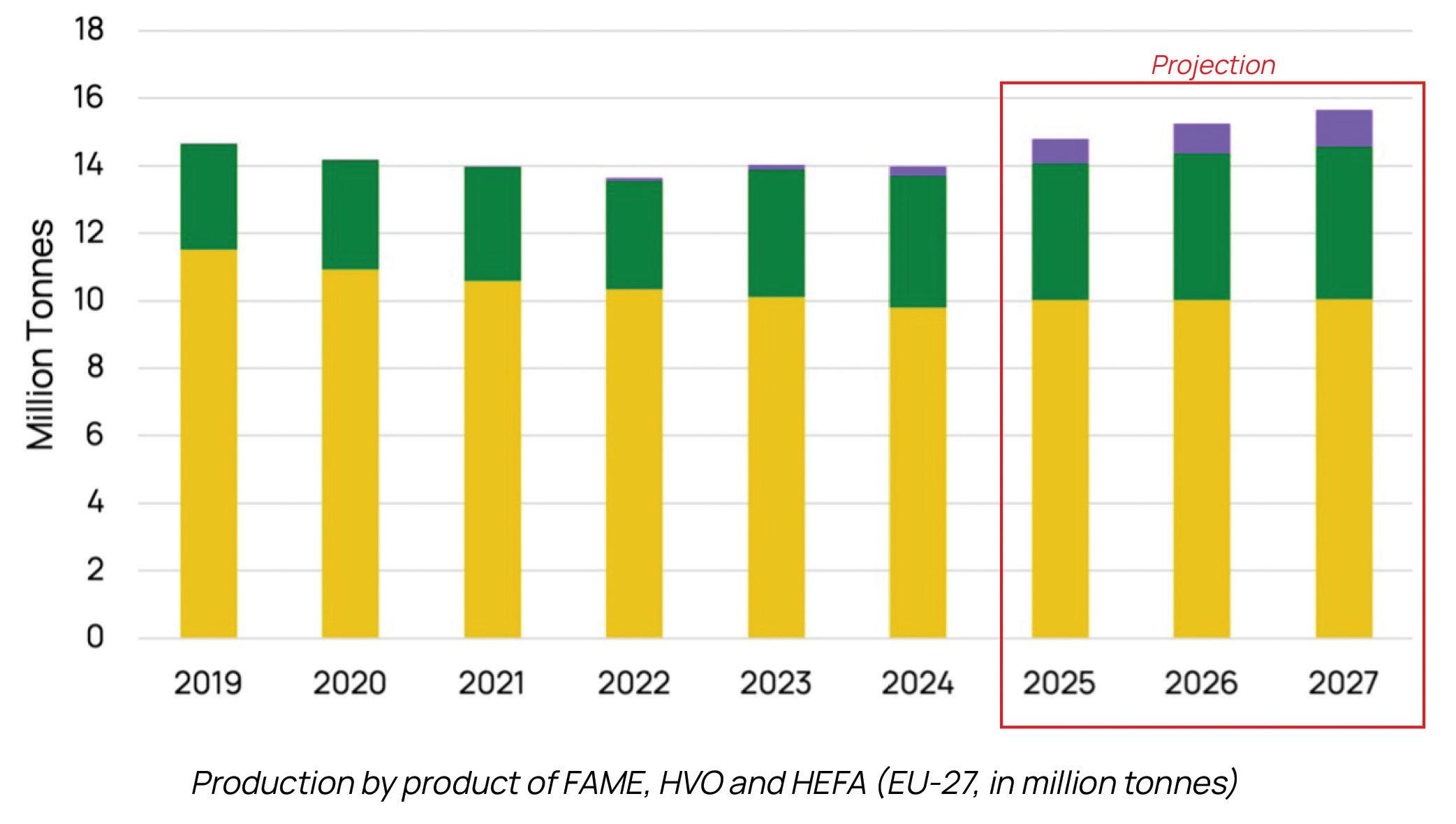

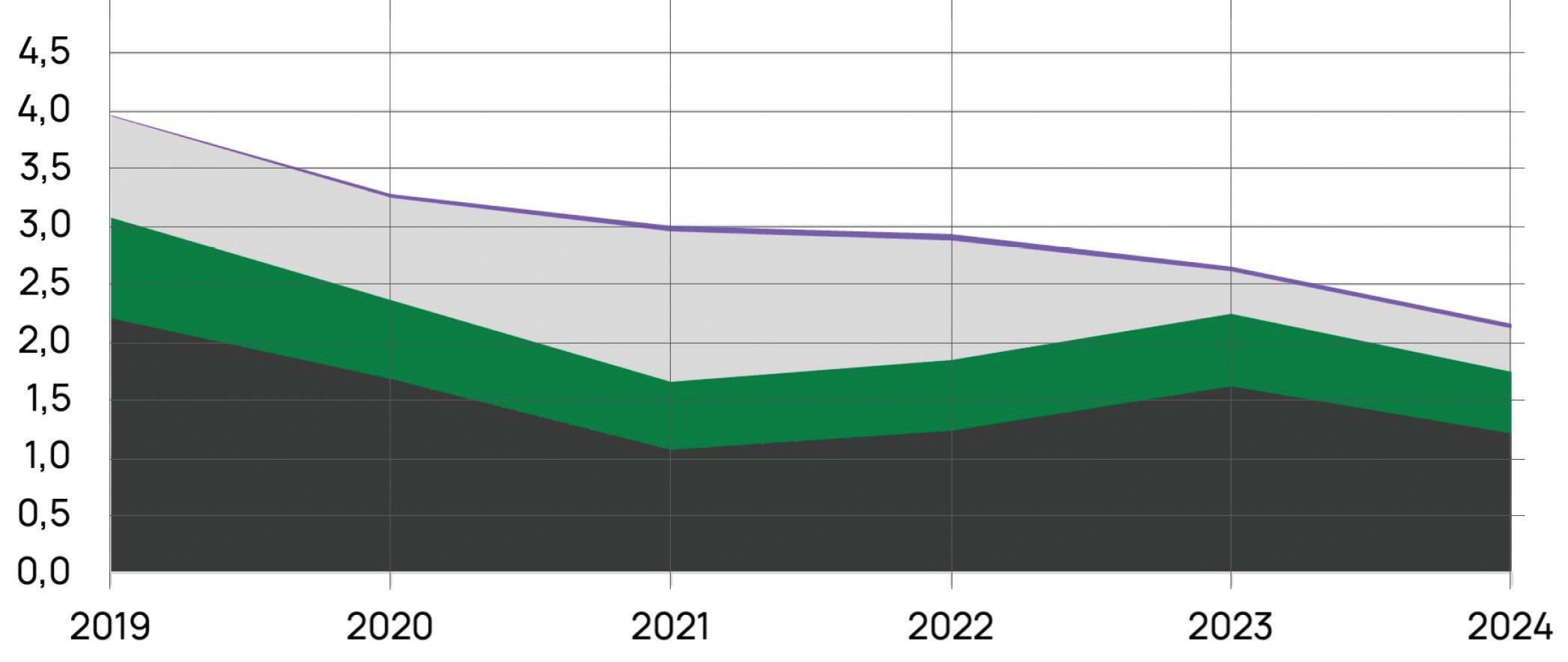

33 Biodiesel output stagnates

EU biodiesel is stagnating, with fatty acid methyl ester (FAME) still dominating the market. While rapeseed oil is still the main feedstock overall, it has been overtaken by waste-based feedstocks

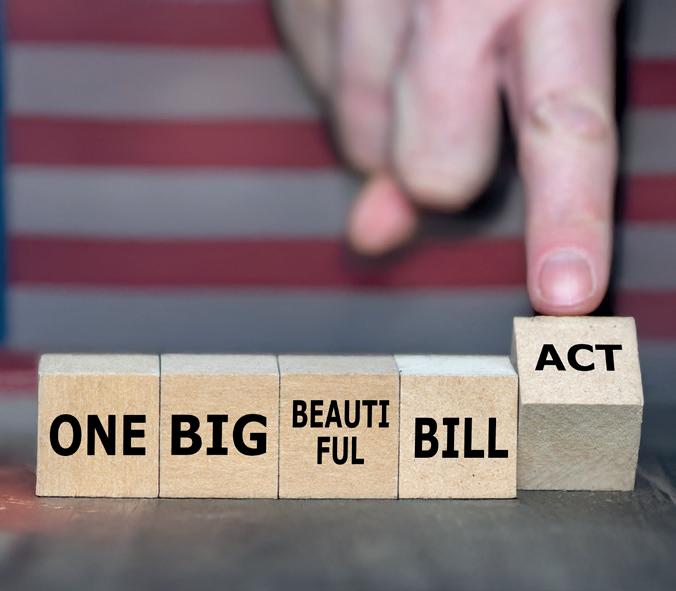

2 Big, beautiful move

4 Bunge Global completes US$8.2bn Viterra merger

Biofuel News

10 Trump’s ‘Big Beautiful Act’ supports US biofuels sector

Renewable News

12 EU rules to make detergents more sustainable Transport

14 Chornomorsk port to transship products for Nibulon Biotech

16 Russia to allow GM soya imports for feed exports Diary of Events

17 International events listing International Market Review 18 Energy market back on radar

36 World statistical data

VOL 41 NO 6

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com +44 1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 1737 855157

ADVERTISING: Mark Winthrop-Wallace markww@quartzltd.com +44 1737 855114

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

SUBSCRIPTION RATES:

Print & digital: Single issue – £45

1 year – £182 (UK), £210 (overseas)

2 years – £328 (UK), £377 (overseas)

3 years – £383 (UK), £440 (overseas)

Digital only: Single issue – £29

1 year – £170

2 years – £272

3 years – £357

© 2025, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020747)is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 1737 855000

Printed by Pensord Press, Merthyr Tydfil, Wales

The passing of US President Donald Trump’s ‘Big Beautiful Bill Act’ on 4 July has come at a pivotal time for American biofuel and soyabean producers.

Included in the act is the extension of the 45Z Clean Fuel Production Tax Credit by two years, the limiting of the credit to US, Canadian and Mexican feedstocks only, and the removal of indirect land use change (ILUC) penalties (see p10).

Industry groups say the legislation gives the most significant boost in years after “months of uncertainty, stalled production and investment hesitation”, according to Iowa Biodiesel Board executive director Grant Kimberley.

Alongside the 45Z measures, the US Environmental Protection Agency has proposed its highest mandated biomass-based diesel volumes in the history of the Renewable Fuel Standard (RFS) for 2026 and 2027 (see p10). Foreign-sourced biofuels and feedstocks will also be limited, generating only 50% of tracking renewable identification numbers (RINs) compared to their domestic equivalent.

The 45Z measures clearly tilts the biofuels feedstock mix firmly towards North American crop oils, boosting demand and farmgate prices for soyabeans and canola. More than 620,000 bushels/day (bu/day) of new soyabean and canola crush capacity are on track to come online in North America, according to Argus Media. This includes a 96,000 bu/d multi-seed crush facility in South Dakota scheduled to start up in October; a new Ag Processing 137,000 bu/d soyabean crush plant in Nebraska; and Cargill’s 121,000 bu/d canola processing plant in Saskatchewan, also due to open this year. In the first half of next year, Louis Dreyfus says it plans to open a 151,000 bu/d soyabean crush plant in Ohio, and double capacity to more than 240,000 bu/d at a canola crush facility in Saskatchewan.

Soyabeans and canola will also benefit from the removal of the indirect land use change (ILUC) penalties in the 45Z credit’s carbon intensity (CI) calculations. Only direct emissions – such as from cultivation, processing and transport – will now count toward the CI score, narrowing the gap with waste-based feedstocks.

Overall, biofuel demand is expected to absorb more than half of US soyabean oil production in the 2025/26 marketing year, starting on 1 October, to a record 15.5bn pounds (some 7M tonnes), 26.5% higher than the current marketing year, according to the US Department of Agriculture.

For foreign suppliers of waste-based feedstocks, such as Chinese used cooking oil (UCO), new markets will need to be found. The used cooking oil (UCO) market hit record volumes in 2024, with China alone exporting 1.36M tonnes to the USA in just the first 11 months of that year, according to Henri-Jean Bardon, writing for Globalbiodiesel. With imported waste oils declining sharply in relevance for the USA, likely straining their supply chains and depressing prices globally. Europe appears the natural destination for displaced Asian UCO volumes. However, traders will worry about potential restrictions, with the EU industry increasingly concerned about potentially fraudulent imports.

Meanwhile, there will be increasing competition for US UCO supply, estimated at just around 700–900,000 tonnes/year.

The One Big Beautiful Bill Act has given the US farming and biofuel sectors “much-needed certainty for the near future”, according to Kimberley.

Of course, the perennial risk for any company is that policy, especially around biofuels, often swings unexpectedly, Argus Media writes.

Serena Lim, OFI Editor, serenalim@quartzltd.com

CMB TECHNOLOGIES

Transesterification | Enzymatic Biodiesel production | Glycerolisis

Special Dry degumming & bleaching | Deacidification | Oil washing | Pre-treatment Methylester fractional and total distillation

You choose the feedstock(s), We build your best Biodiesel Plant.

CMB S.p.a. Headquarter Cisterna di Latina, Italy

CMB Malaysia Engineering For Oils And Fats SDN. BHD. Selangor, Malaysia

CMB (Shanghai) Engineering Co., LTD. Shanghai, China

CMB India Engineering For Oils And Fats LTD. Mumbai City, India

CMB: your trusted partner for your Biodiesel Plants.

BRAZIL: Soyabean production is expected to reach 176M tonnes in 2025/2026 driven by an expansion in the soyabean planted area, stable weather and increased productivity, says the US Department of Agriculture (USDA) Foreign Agricultural Service 'Brazil: Oilseeds and Products Update'.

From a total planted area of 49.1M ha, the output was almost 2% higher than 169.5M tonnes in 2024/25, the 1 July report said.

According to sources within Brazil, various stakeholders had called for the termination or relaxation of the country's Soy Moratorium, which could lead to a significant expansion in soyabean plantings in 2026. Established in 2006, the moratorium is an agreement by major soyabean traders, environmental organisations and the Brazilian government to prevent the sale of soyabeans grown on land deforested in the Amazon biome after July 2008.

The USDA said exports would rise to 114M tonnes in 2025/26, supported by expanded port capacity and growing demand from China.

Expanded operations at Terminal STS11 were expected to start in 2026. The terminal, operated by China's COFCO International, was set to be one of the largest in the Port of Santos, which currently accounted for nearly 30% of Brazil's total soyabean exports.

Data from the Brazilian Ministry of Development, Industry, and Trade showed that Brazil exported 16.9M tonnes of soyabeans to China in the first quarter of 2025, an increase of nearly 7% compared to the same period the previous year.

In the same period, Beijing lowered its soyabean imports from the USA by 8% compared to first quarter 2024, the USDA said.

Bunge Global SA announced on 2 July that it had successfully completed its merger with Viterra Limited, creating a food, feed and fuel firm closer in size and scope to global agribusiness giants Cargill and ADM.

“The merger brings together two significant players in the food products industry, with Bunge currently valued at US$10.93bn and generating over US$51bn in annual revenue,” according to an Investing. com report on 2 July.

The deal had taken more than two years to complete, with Chinese regulatory approval on 16 June being the last hurdle to clear following conditional approvals in Canada, the EU and other markets, World Grain wrote on 3 July.

Bunge said that the combined company would offer a broad portfolio of plant-based oils, fats and proteins while continuing to focus on grain origination, storage, distribution and oilseed processing. It would own and operate

more than 300 grain storage facilities, over 40 port terminals and more than 155 processing, refining and packaging facilities, according to a Bunge fact sheet about the merger. Viterra operates more than 300 grain and oilseed processing facilities in more than 40 countries, while Bunge runs 56 oilseed crushing plants with 57M tonnes of capacity, 26 port terminals, 47 oil refineries and 17 grain processing facilities, according to the World Grain report.

The merger would increase Bunge’s already leading position as a soyabean and corn exporter in South America as Viterra currently ranked among the largest exporters of those crops in Brazil, Bunge said. Already controlling around 90% of the global grain and oilseed trade before the merger, the so-called ABCD companies of agribusiness (ADM, Bunge, Cargill and Louis Dreyfus), would now increase their market share even more, World Grain wrote.

Some plantation firms may scale back or exit their operations over the longer term following a wave of large-scale land seizures in Indonesia, New Straits Times reported Malaysia-based Public Investment Bank (PublicInvest) as saying.

In the week before the 16 July report, Indonesian authorities had confiscated 394,547ha of plantation land in Central Kalimantan on the island of Borneo, as well as in Riau, North and South Sumatra provinces.

Previously controlled by 232 companies, the land had been transferred to Agrinas, a stateowned company established in early 2025 under the administration of President Prabowo Subianto, New Straits Times wrote.

The government's forestry task force had set a target to reclaim up to 3M ha of plantations believed to be illegally operating within forest areas by August, the report said.

Defence Minister Sjafrie Sjamsoeddin, who heads the forestry task force, said authorities had so far seized more than 2M ha of plantations in forest areas that were allegedly operating illegally across the country.

Following the latest seizures, Agrinas controlled approximately 833,000ha of plantation land, making it one of the largest oil palm plantation operators globally.

Agrinas chief executive Agus Sutomo said of the 484,000ha Agrinas had inventorised, around 271,000ha were productive.

PublicInvest said the seizures could lead to firms being more cautious about replanting.

“This development raises regulatory risks for industry players with significant exposure in Indonesia, which could weigh on their valuations over the long term,” In addition, PublicInvest said it was also concerned the military-led enforcement in plantations could exacerbate the declining trend in Indonesian palm oil production, as there were doubts over the state’s ability to manage these plantations effectively.

“Based on our rough forecast, if 50% of the entire seized 833,000ha plantation remains unproductive, annual palm oil production could decline by about 4% or 1.7M tonnes,” it said.

CPM offers end-to-end processing solutions for the oilseed market.

We are the preferred partner for the oilseed processing industry, offering complete preparation solutions. CPM offers the lowest total operating cost solution in the industry, everything from maximizing your extraction process to minimizing energy consumption.

Discover all the benefits of our solutions at OneCPM.com/Markets/Oilseed-Processing

CRACKING FLAKING GRINDING PELLETING PARTS & SERVICE

UKRAINE: The EU has granted equivalence to sunflower and soyabean seed imports from Ukraine, allowing EU-based companies to diversify their seed production areas and maintain a continuous supply of high-quality seeds, according to a European Council press release on 12 June.

Seed outside the EU could only be marketed within the bloc if it offered the same guarantees as officially-certified EU seed, the press release said. NonEU countries exporting to the EU must meet the same criteria for seed characteristics, examination, identification, marking, control and packaging as seed harvested and controlled in the EU.

The EU decision grants equivalence for sunflowerseed and soyabeans produced and certified in Ukraine and for seed of fodder plants from Moldova.

MALAYSIA: Palm oil production in 2025/26 will reach 19.4M tonnes due to expectations for normal weather and an expansion in planted area, according to the US Department of Agriculture (USDA)'s 10 July Foreign Agricultural Service's Malaysia: Oilseeds and Products Update

Palm kernel oil production in 2024/25 is forecast at 2.10M tonnes, rising to 2.11M tonnes in 2025/26.

US President Donald Trump announced on his Truth Social platform that he will impose a 35% tariff on Canadian goods starting on 1 August, the BBC reported on 11 July.

The 35% tariff was an increase from the current 25% rate that Trump had assigned to Canada, a 10 July Reuters report said.

An exclusion for goods covered by the United States-Mexico-Canada Agreement (USMCA) was expected to stay in place, and 10% tariffs on energy and fertiliser were also not set to change, although Trump had not made a final decision on those issues, an administration official was quoted as saying by Reuters

Canada is the USA’s second-largest trading partner after Mexico, and the largest buyer of US exports, according to Reuters. The USA is also Canada’s top market for canola products, although canola oil and meal are currently exempt

from additional US tariffs under the exclusion for USMCA goods.

At the time of the reports, Trump had sent more than 20 letters outlining his tariff plans to other US partners and had also said he would soon announce new tariffs on the EU.

As with the Canada letter, Trump has vowed to implement those tariffs by 1 August, giving countries around the world until then to strike a deal with the USA, the BBC wrote.

Trump has also said the USA would impose a 50% tariff from 1 August on all imports from Brazil, Reuters wrote on 10 July. Trump linked the tariffs to Brazil’s treatment of former President Jair Bolsonaro who was on trial over charges of plotting a coup, the report said. The USA is Brazil’s second largest trading partner after China and the tariffs were a major increase on the 10% rate announced in April, Reuters wrote.

Leading international coffee chain Starbucks is exploring how to remove canola oil from its food menu in the USA, Straits Times reported on 8 July, citing a Bloomberg News article.

As one example, the company was considering making its egg white and roasted red pepper bites without canola oil, a spokesman said.

Starbucks’ US menu had several items containing canola oil including potato bakes and a bacon, gouda and egg sandwich, the report.said.

The new initiative was part of a wider brand revamp aimed at reversing declining sales, with a focus on testing products that appealed to more health-conscious consumers, Straits Times wrote.

In June, Starbucks chief executive Brian Niccol had pledged in a meeting with US Health and Human Services Secretary Robert Kennedy Jr to further align the chain’s menu with the Trump administration’s health priorities, the report said.

impact on inflammation or the risk of dying from cardiovascular disease.

Brazil and China are in the initial stages of developing a dedicated soyabean supply chain to meet Chinese sustainability and quality standards, according to the 23 June 'Assessment of Soy China Initiative in Brazil' report by the US Department of Agriculture (USDA).

Known as “Soy China”, the initiative was inspired by the “Boi China” (“China Beef”) model of Brazilian cattle and beef produced specifically to meet Chinese import standards, the USDA report said.

Sustainability standards under negotiation for the soyabean initiative were

likely to mirror those imposed by the EU Deforestation Regulation (EUDR) but with less strict policies.

The USDA said it expected sustainability efforts for “Soy China” would mainly focus on defining and monitoring land expansion, as well as strengthening enforcement of Brazil’s low-carbon agriculture policy, with exporters required to submit emissions data. New restrictions could also be imposed on certain pesticides currently permitted in Brazil but banned in other major soyabean-producing countries, helping Brazil align with Chinese maximum residue limits.

In 2024, 71% of China’s soyabean imports came from Brazil, according to Trade Data Monitor.

“Should Brazil produce a soyabean variety specifically tailored to Chinese standards, this share would likely increase, leading to a reduction in soyabean imports by China from other major suppliers, including the USA,” the USDA said. “Other exporting nations such as Argentina, Uruguay and Canada may also experience marginal impacts. In addition, Brazilian farmers who did not adhere to the new production standards could face reduced demand.

Argentina has re-introduced higher export taxes on soyabeans, sunflowerseed and corn, effective 1 July, the Buenos Aires Herald (BAH) reported on 27 June.

Export duties on some agricultural commodities had been cut in January to help farmers recover from low crop prices and bad weather but the Economy Ministry’s decree had dashed the hopes of producers wishing for a last-minute change of heart, BAH wrote.

Duties would increase from 26% to

WORLD: Global oilseed production is forecast to continue growing, potentially reaching a new record of 695.9M tonnes, mainly due to an expected increase in soyabean output, according to the United Nations Food and Agriculture Organization (FAO)'s bi-annual Food Outlook report on 12 June.

Global soyabean production in 2024/25 was forecast to increase for the third successive season, up 6.1% year-on-year and marking a new high of 422.5M tonnes, largely driven by forecasts of an all-time high crop in Brazil, the report said.

However, protracted dryness across main producing regions in the southern part of South America could lead to stagnating output in Argentina and a reduced crop in Paraguay.

World rapeseed production fell by 5.4% in 2024/25, largely due to smaller harvests in Canada and the EU due to adverse weather conditions.

In Asia, rapeseed production in China reached an alltime high due to continued area expansion, while India harvested a near-record crop, the report said.

Global sunflowerseed production was expected to decline in 2024/25, largely reflecting lower harvests in the Black Sea Region following persistent dryness across main producing areas.

33% for soyabeans; 9.5% to 12% for corn and sorghum; and from 5.5% to 7% for sunflowerseed. Export duties on wheat and barley would remain at 9.5% until 31 March 2026.

According to a 28 June Rio Times report, the temporary tax cut in January had helped boost sales and production but the government was re-instating the duties to build up its reserves of foreign currency and meet its obligations with the International Monetary Fund.

Argentina is one of the world’s largest exporters of soyabeans, soyabean oil and corn. In 2024, exports taxes earned the government US$5.3bn, with soyabeans accounting for most of that amount, the Rio Times wrote.

The earlier tax cuts had made Argentine crops cheaper and more competitive but the new increases could slow exports and lead to a drop in farmer income of about US$30/tonne less for soyabeans, the report said.

Philippine President Ferdinand R Marcos has ordered coconut planting to be doubled to 50M trees next year, The Philippine Star reported on 20 June.

Agriculture Secretary Francisco Tiu Laurel Jr said Marcos had approved a budget of more than PHP7bn (US$122.5M) for next year’s tree planting programme.

The ambitious strategy was part of a five-year programme to plant 100M coconut trees by 2028, The Star wrote.

More than 8.5M trees were planted in 2024, with at least 15M more targeted for planting before the end of this year, the report said.

The Department of Agriculture (DA) said the replanting effort was critical for the

growth of the coconut sector as many of the 340M trees nationwide were already ageing, leading to reduced yields.

According to DA data, Indonesia produced 17.13M tonnes of coconuts in 2024, compared to the Philippines’ output of 14.77M tonnes.

Global demand for coconut oil was rising, driven in part by EU Deforestation Regulation requirements that all imported palm oil must be verified as deforestation-free, the DA said. Palm kernel oil can be substituted with coconut oil, which is not covered by the regulation.

A new study conducted by the non-profit Fatty Acid Research Institute (FARI) has found no link between omega 6 and increased inflammation, News Medical reported on 30 June.

The study’s publication in Nutrients journal comes against a backdrop of heightened interest in seed oils, such as canola, many of which are rich in omega-6 linoleic acid (LA). Some have claimed that western diets contain “too much” LA and that many modern diseases stem from the increased intake of LA over the last century.

The study used data from the Framingham Offspring Study, an initiative following the children of participants in an earlier Framingham Heart Study investigating genetic and lifestyle factors influencing cardiovascular and metabolic health.

The new study measured LA and arachidonic acid (AA) levels in the same blood samples as 10 inflammation-related biomarkers in 2,700 individuals. After adjusting for factors such as

age, race, sex, smoking, blood lipid levels, blood pressure and body weight, the researchers found that higher LA levels were associated with statistically significantly lower levels of five of the 10 biomarkers. The team found no case of higher LA related to higher levels of any biomarker.

For AA, higher levels were linked with lower concentrations of four markers and, as with LA, there were no statistically significant associations with higher levels of inflammation/oxidation.

“The new data shows clearly that people who have the highest levels of LA (and AA) in their blood are in a less inflammatory state than people with lower levels,” said Dr William Harris, FARI president and professor in the Department of Internal Medicine at the Sanford School of Medicine, University of South Dakota.

The study was partly funded by a grant from the Soy Nutrition Institute Global, with support from the United Soybean Board.

USA: Amendments to California’s Low Carbon Fuel Standard (LCFS) took effect on 1 July, Biodiesel magazine reported on 8 July.

The updates aimed to reduce the carbon intensity of the state’s transportation fuel by 30% by 2030 and by 90% by 2045, the report said.

Other changes included a requirement for fuel producers to track cropbased and forestry-based feedstocks to their point of origin; independent feedstock certification to ensure biomass-based diesel and sustainable aviation fuel (SAF) feedstocks are not undermining natural carbon stocks; a halt to palm-derived fuels receiving credits; and a cap on the use of soyabean oil, canola oil and sunflower oil in the production of LCFS-compliant biodiesel diesel fuels.

California consumes most of the renewable diesel produced in the USA.

In November 2024, renewable diesel production on the US West Coast (including California, Oregon and Washington) exceeded 90,000 barrels/day, nearly four times the volume in 2023, with refiners such as Marathon Martinez and Phillips 66 Rodel significantly expanding capacity, Mansfield Energy wrote on 3 March.

The US biofuels industry has welcomed the signing into law of US President Donald Trump’s ‘One Big Beautiful Bill Act’ on 4 July.

“The reforms in this legislation represent a major win for the US oilseed processing industry and the American farmers and rural communities it supports,” the National Oilseed Processors Association (NOPA) and the American Soybean Association (ASA) said on 3 July.

The act limits eligibility for the 45Z Clean Fuel Production Credit to feedstocks grown and produced in the USA, Mexico or Canada.

“This critical provision disqualifies imports such as Chinese used cooking oil (UCO) and foreign tallow from receiving US clean fuel tax incentives,” NOPA and ASA said.

The legislation extends the 45Z credit through the end of 2029, two years beyond its current

expiration date of 31 December 2027.

It also revises how lifecycle greenhouse gas (GHG) emissions are calculated by excluding emissions from indirect land use change (ILUC).

Additionally, it includes provisions to support small-scale biodiesel producers by increasing the Small Biodiesel Producer Credit to 20 cents/ gallon from 10 cents/gallon, and extending the credit – which had expired at the end of 2024 –to the end of 2026, according to an 8 July Ethanol Producer Magazine report. The credit applied to the first 15M gallons/year of agri-biodiesel made by small producers (those with capacities of less than 60M gallons/year).

However, the act eliminated the special 45Z credit rate for sustainable aviation fuel, capping it at US$1/gallon rather than US$1.75/gallon, as established by the 2022 Inflation Reduction Act.

The Brazilian government has announced an increase in its biodiesel blending mandate to B15 (15% biodiesel) from B14, effective 1 August, Biodiesel Magazine reported on 26 June.

The transition to B15 – announced on 25 June by the National Energy Policy Council (CNPE) – was expected to generate more than BRL$5bn (US$900M) in investments in new soyabean mills and crushing units, while creating more than 4,000 jobs, the report said.

CNPE was looking into the feasibility of raising biodiesel blends to a 13%-25% range, Mines and Energy Ministry’s biofuels department director Marlon Arraes was quoted as saying in a 25 June Argus Media report.

The government also announced an increase in the blending of ethanol in gasoline from 27% to 30% in a bid to eliminate gasoline imports while reducing emissions and fuel prices.

Despite the increased mandates, cost

competitiveness, feedstock supply risks and regulatory instability remained hurdles to a wider biofuel framework in Brazil, Arraes told delegates at Argus’ Biofuels & Feedstocks Latin America Conference, in São Paulo, Brazil.

The US Environmental Protection Agency (EPA) has raised Renewable Fuel Standard (RFS) renewable volume obligations (RVOs) for 2026 and 2027, Biodiesel Magazine wrote on 13 June.

The proposal – published on 13 June –sets the total 2026 RVO at 24.02bn renewable identification numbers (RINs), an almost 8% rise compared to 2025, with the 2027 RVO set at 24.46bn RINs, an increase of almost 2%. RINs are serial numbers used to track the production, use and trading of renwable fuels in the USA.

The proposed 2026 RVO included targets

of 7.12bn biobased-diesel RINs and 9.02bn advanced biofuel RINs. The agency projected that 5.61bn gallons (21.2bn litres) of biobased diesel would be needed to comply with the 2026 RVO.

The proposed 2027 RVO included targets of 7.5bn biomass-based diesel RINs and 9.46bn advanced biofuel RINs.

The EPA estimated that 5.86bn gallons (22.18bn litres) of biobased diesel would be needed to meet the 2027 RVO.

The EPA proposal also included provisions aimed at boosting domestic biofuel production by only allowing foreign biofu-

els and feedstocks to generate 50% of the RIN value relative to domestic biofuels and feedstocks, Biodiesel Magazine wrote.

To ensure renewable fuel producers generated the required RINs, the EPA proposed that all domestic producers should keep and report records of feedstock purchases and transfers identifying the point of origin for each feedstock. The feedstock origin would generally be defined as the location where a feedstock was grown, produced, generated, extracted, collected or harvested.

A public comment period on the EPA proposal was open until 8 August.

The European Council and European Parliament provisionally agreed on 14 June to update the EU’s Regulation on Detergents and Surfactants to make detergents and surfactants safer and more sustainable, EuChemS magazine reported on 16 June.

The agreement would allow the European Commission (EC) to tighten rules on biodegradability, particularly for water-soluble films encapsulating detergents, which had become a widespread source of microplastic pollution, the report said.

It maintained the EU’s ban on animal

UAE: Dubai-based Emirates Biotech has signed a deal for Swiss fluid engineering company Sulzer to provide the equipment for its new bioplastics plant in the UAE.

Sulzer would manufacture and supply equipment –including lactide formation, purification and polymerisation technology – to produce polylactic acid (PLA) from lactic acid, Emirates Biotech said on 27 May.

The new facility would be located in the KEZAD free zone in Abu Dhabi, with access to the deep seaport of Khalifa. It would be constructed in two phases, each with 80,000 tonnes/year capacity, the company said when first announcing the project in December.

Construction was expected to start in the fourth quarter of this year, with the plant scheduled to become operational by early 2028.

testing, with rare exceptions granted under strict and essential conditions.

To ensure flexibility and higher compliance, the new rule would simplify how detergents, ranging from capsules to microbial products, were marketed across the EU.

The regulation mandated digital and clearer labelling to make key information –such as the presence of fragrance allergens –more transparent for consumers.

The changes aimed to address concerns about the safety of imported products, requiring non-EU manufacturers to appoint

authorised representatives to ensure compliance with EU standards, EuChemS wrote.

The EC was also tasked with assessing if new limits on phosphorus content in detergents were feasible without compromising product performance or inadvertently increasing environmental impact, such as more intensive cleaning cycles or higher water temperatures.

The provisional agreement was now subject to formal approval by both the European Council and Parliament.

Belgian start-up AmphiStar is partnering with US surfactants producer Kensing to bring its biosurfactants to the North American market.

AmphiStar’s biosurfactants are produced via microbial fermentation of agri-food waste and side-steams, such as supermarket food waste.

As part of their collaboration, the companies would work together to develop regionally-sourced circular feedstocks with a near-term plan for full US domestic production, AmphiStar said on 17 June.

The biosurfactants could be used as emulsifiers and co-surfactants in body lotions, creams, shampoos, body wash, and other products.

The companies said they would also co-develop AmphiStar’s biosurfactant platform technology to develop and commercialise products in the personal care, agrochemical

and household and industrial and institutional (HI&I) sectors.

According to its website, AmphiStar’s biosurfactant technology platform is based on the yeast organism Starmerella bombicola, which is used to produce over 25 specific variants of glycolipid biosurfactants. Both conventional first-generation biomass feedstocks, such as glucose

French vegetable oil and biodiesel group Avril has acquired a rapeseed crushing, refining and biodiesel production plant in Baleycourt, France, from speciality chemicals and additives company Valtris.

Located in one of the main rapeseed-growing regions of France, the plant processes some 400,000 tonnes/year of oilseeds.

Valtris Speciality Chemicals would continue to operate its speciality chemical production facility co-located at the same site, Avril said on 4 July.

and fatty acids derived from locally-sourced plant oil, and second generation biomass feedstocks, such as crude glycerine and food waste, could be used in the process.

Kensing produces a range of speciality ingredients derived from vegetable oils, including plant sterols, natural vitamin E, anionic and amphoteric surfactants, and speciality esters.

“This acquisition has the potential to give us new capabilities to better address today’s challenges around food, decarbonisation and sovereignty, while continuing to fulfil our original mission of adding value to French agricultural production,” Avril CEO Jean-Philippe Puig said.

Valtris CEO Simon Medley said the agreement would allow the company to focus on its portfolio of speciality performance additives.

The project remained subject to consultation with relevant employee representa-

tive bodies and approval by competition authorities.

Avril crushes oilseeds and producers refined oils, meals and biodiesel through Saipol in France and Expur in Romania.

Valtris’ products include bio-based plasticisers, epoxidised natural oils, heat stabilisers, biocides, lubricants, functional fluids, biodiesel and rapeseed derivatives for the industrial; building and construction; packaging; pharmaceutical; cleaning, coatings and adhesives; food processing; and biodiesel sectors.

ITALY: Enilive marine hydrotreated vegetable oil (HVO) will be available at the ports of Ravenna and Venice in the second half of this year, Bunkerspot reports.

In an email sent to Bunkerspot on 27 May, Eni said the marine HVO would be available “through barge deliveries in those ports and through truck deliveries in the north of Italy”.

A subsidiary of Italian energy multinational Eni, Enilive is a leading HVO producer in Europe and globally and runs two biorefineries in Venice and Gela, with a third in Livorno scheduled for conversion by the end of 2026. The company is also a 50% co-owner of the St Bernard Renewables biorefinery in Louisiana, USA, and has two biorefineries under construction in Malaysia and South Korea.

Enilive HVO is produced from renewable raw materials such as vegetable oils and animal waste.

ARGENTINA: The government has approved the use of pure biofuels in the shipping sector, Latin American news agency BNamericas reported on 11 June. Under an update to Argentina’s 2021 biofuels law, No 27,640, biofuels could now be used neat or blended with fossil fuels in river and ocean vessels, the report said.

Leading Ukrainian agribusiness Nibulon has signed a contract with the Port of Chornomorsk for the trans-shipment of up to 1M tonnes of agricultural products for an undiclosed sum in preparation for the 2025/26 marketing year.

The contract was a significant step in shaping a logistics model that would allow Nibulon to maintain continuity of exports despite the blockade of its own terminal hub, the company said on 13 June.

Before Russia invaded Ukraine in 2022, the ports of Mykolaiv and Kherson were used to transport a significant portion of Ukrainian agricultural exports. Nibulon said earlier this year that the blockade of the ports had paralysed maritime trade in southern Ukraine and prevented recovery in regional areas.

Nibulon director of logistics Serhii Kalkutin said the company worked with over 3,000 small-

and medium-sized agricultural producers, helping them to plan under challenging conditions.

The Port of Chornomorsk is one of Ukraine’s largest ports and is located on the Sukhoi Estuary, 19km west of Odessa on the Black Sea.

Nibulon said negotiations with other port operators were ongoing and it was open to new partnerships. The company is one of Ukraine’s largest grain and oilseed growers, traders and processors and is active in wheat, corn, barley, sunflower, soyabean, rapeseed and sorghum. It runs its own fleet, has a total grain storage capacity of 2.04M tonnes and operates a network of trans-shipment terminals and complexes.

Prior to Russia’s invasion of Ukraine in February 2022, Nibulon was exporting nearly 4M tonnes/year. Exports plummeted in the early stages of the war but rebounded to 3.1M tonnes in 2024, World Grain wrote on 17 June.

The Ports of Indiana announced on 23 June that it had selected global agribusiness group Louis Dreyfus Company (LDC) to reopen its Burns Harbor grain export facility on Lake Michigan, Portage, Indiana, USA.

LDC said it expected to begin operating the terminal (pictured) in early 2026.

During the period it was open between1979 and 2023, the Burns Harbor terminal enabled exports of more than 500M bushels of corn and soyabeans, according to Ports of Indiana.

Northern Indiana has the largest US port with access to the Great Lakes, St Lawrence Seaway and US Inland River System, and also provides multimodal connections to 16 railroads in the Greater Chicago market. The port’s grain operation includes storage capacity for 7.2M bushels of grain, 200 railcars and 20 barges.

“This terminal is one of the leading export

facilities in the Midwest, with the capacity to load up to 90,000 bushels/hour into an ocean vessel or laker and unload 30,000 bushels/ hour from a unit train,” Burns Harbor Port Director Ryan McCoy said.

Brazilian rail operator Rumo SA has cancelled the sale of its 50% stake in a grain terminal at the Port of Santos, Brazil, to Bunge Global and Zen-Noh Group, according to a 5 June securities filing by the company reported by World Grain.

When first announcing the deal last May, Rumo said the agreement was valued at BRL600M (US$107.8M).

Rumo said certain conditions for the sale of its equity interest in Terminal XXXIX “were not fully satisfied” before the established deadline.

The deal would have been delivered through a joint venture between US-based

Bunge and Zen-Noh Grain Corp, the US subsidiary of Japan’s Zen-Noh Group, with each of the partners holding an equal stake, the 10 June World Grain report said.

Terminal XXXIX has the capacity to store 135,000 tonnes of grain, with Brazilian food and fuel processor Caramuru Alimentos holding the remaining 50% stake in the terminal, according to World Grain

The Port of Santos acts as a key export hub for Brazilian soyabeans and is Latin America’s largest port.

Rumo operates around 14,000km of railway lines with direct connections to the ports of Santos, Paranaguá, São Francisco

do Sul and Rio Grande, its website says. It operates several terminals at the Port of Santos, including the T-GRÃO terminal at Wharf 26, which is specifically designed for the storage and shipment of soyabeans and maize, according to Brazilian ship brokers Cargo Chartering. This terminal had a storage capacity of 114,000 tonnes and could handle up to 15,000 tonnes/day, with a loading rate of 1,000 tonnes/hour.

Rumo primarily transports agricultural commodities such as soyabeans, soyabean meal and corn, complemented by sugar, fertilisers and industrial products such as fuels and pulp, according to its website.

SOUTH AMERICA: German chemical and biotech giant BASF has started the registration process for a new fungicide to tackle Asian soyabean rust (ASR) in South America.

The company said it had submitted the regulatory dossiers to register Adapzo Active (Flufenoxadiazam) to the relevant authorities in Brazil and Paraguay, with a further submission planned in Bolivia.

Specifically developed for the soyabean crop rotation in South America and adapted to growers’ needs, the new active ingredient was the industry’s first histone deacetylase (HDAC) inhibitor, the company said on 2 June.

Pending regulatory approvals, BASF said it expected the first Adapzo Active-based formulations to be available in 2029.

Farmers in Brazil, Paraguay and Bolivia produce 44% of the world’s soyabeans, but faced challenges from ASR, which could severely impact soyabean cultivation and cause substantial yield loss of up to 90% if not controlled, BASF said.

“[Adapzo Active]'s novel mode of action ensures full control of mutated fungal strains, which are currently a major and growing challenge for farmers,” said Ulf Groeger, vice president of fungicides research at BASF agricultural solutions.

The Russian government has agreed to allow imports of genetically modified (GM) soyabeans on condition that resulting feed products are exported, APK-Inform wrote on 17 June, citing a report by Russian news agency Interfax.

Signed on 12 June, the resolution took effect immediately and would remain in force for one year, the APK-Inform report said.

According to accompanying documents, the move “will allow Russian enterprises to import and process soyabeans containing genetically engineered organisms registered for food purposes on the territory of the Russian Federation, while maintaining the ban on the use of finished feed for domestic consumption”. Processing would be allowed exclusively for export shipments.

The Ministry of Agriculture, which prepared the draft resolution, said “the inability to import [GM] soyabeans negatively affects the utilisation

of oilseed processing capacities and the export volumes of processed products”.

The move was expected to more fully utilise processing capacities, such as in the Kaliningrad region, where facilities capable of handling over 2M tonnes/year of soyabeans were operating at less than 5% capacity due to limited domestic production, according to an UkAgroConsult report.

Russia had registered six GM soyabean lines for food purposes, which could be used for feed production, the 17 June report said.

The cultivation, planting and circulation of GMOs remained banned in Russia and imported soyabeans were intended solely for processing and subsequent export of finished products. Despite increasing domestic production, Russia requires over 1M tonnes/year of imported soyabeans, according to oilseed market experts quoted by UkAgroConsult.

A group of firms in the soyabean supply chain has invested C$2.4M (US$1.75M) in a new programme to breed high-protein, non-genetically modified (GM) soyabeans adapted for Canada’s climate, World Grain wrote on 25 June.

Led by NRGene Canada, Pulse Genetics, Hensall Co-op and Yumasoy Foods, with the support of Protein Industries Canada, the group was working to develop a novel, soya-based plant protein product.

New soyabean varieties would be specifically bred for improved yield, resistance to soyabean cyst nematode (SCN), and better adaptation to a range of environmental

conditions, the report said.

Extruded non-GM soyabeans would be used to create high-protein meat-like shreds that retained the bean’s full range of nutrients.

Although the speciality soyabean market was growing,

particularly in Asia where they are used in products such as soya milk and tofu, Canadian farmers faced increasing challenges in maintaining their share of this export market, due to fewer, non-GM seed options, the report said.

German chemical giant Bayer is lobbying to secure immunity from Roundup cancer liability, according to a ZeroHedge report.

The company has faced a series of lawsuits linked to its Roundup weedkiller brand, which came with its US$63bn acquisition of US agrochemical company Monsanto in 2018, the 6 June report said. To date, Bayer had paid out US$11bn in settlements and was now pushing state legislatures to pass bills that would block “failure-to-warn” claims tied to glyphosate. In Missouri, where Bayer’s North Ameri-

can Crop Science headquarters is located, the company increased its lobbyists from four to nine directly before the introduction of Senate Bill 14 and its companion House Bill 544, ZeroHedge wrote.

Both bills were aimed at shielding Monsanto/Bayer from lawsuits claiming Roundup caused non-Hodgkin’s lymphoma.

With 40,000 cases still pending in Missouri alone, Bayer’s strategy is to convince lawmakers that Environmental Protection Agency (EPA)-approved labels, which omit cancer warnings, should pre-empt state

litigation, according to the report.

Against this backdrop, Bayer has indicated it might exit the glyphosate business, according to a 10 June AgNet West report.

Company executives have told investors that the ongoing litigation linked to Roundup could force a major strategic retreat, the report said. Bayer had removed glyphosate from consumer herbicide products sold in the USA but said litigation could undermine its ability to provide glyphosate-based products to farmers and other professional users.

9 August 2025

PORAM 50th Anniversary Gala Dinner

Mandarin Oriental Hotel, Kuala Lumpur, Malaysia

https://poram.org/poram-gala-dinner

21 August 2025

East Malaysia Palm Oil Forum (EMPOF)

Kota Kinabalu Marriott Hotel, Sabah, Malaysia www.mpoc.org.my/event/east-malaysiapalm-oil-forum-2025/

25-26 August 2025

Palm, Palm Kernel & Coconut Oil Processing & Food Applications

Hotel Estelar La Fontana, Bogotá, Colombia www.smartshortcourses.com/ oilprocess33/index.html

31 August-5 September 2025

FOSFA Introductory & Advanced Courses

The University of Greenwich, London, UK www.fosfa.org/education/

4-5 September 2025

12th High Oleic Congress

Amsterdam, The Netherlands http://higholeicmarket.com/hoc-2019/

15-19 September 2025

World Congress on Oils & Fats and ISF Lectureship Series 2025

Salon Metropolitano, Rosario, Argentina www.asagaworldcongress2025.com/ acerca.html

23 September 2025

Black Sea Oil Trade 2025

InterContinental Athénée Palace Hotel Bucharest, Romania https://ukragroconsult.com/en/ conference/black-sea-oil-trade-2025/

24-26 September 2025

Globoil India 2025

Westin Mumbai Powai Lake, Mumbai, India https://www.globoilindia.com/

30 September-1 October 2025

5th International Congress on Mineral Oil Contaminants in Food Berlin, Germany

https://dgfett.de/veranstaltungen/ tagungen-kongresse/

The Malaysian Palm Oil Board’s International Palm Oil Congress and Exhibition (PIPOC) will be held on 18-20 November at the Kuala Lumpur Convention Centre in Malaysia.

The event features four concurrent conferences on Agriculture, Biotechnology & Sustainability; Downstream & Value Addition; Milling, Processing & Biorefinery; and Global Economics & Marketing. It also includes a palm oil exhibition with a total floor area of more than 3,600m2 and over 400 booths.

In addition, PIPOC 2025 includes:

• The PIPOC Golf Challenge Trophy on 16 November.

• Technical tours on 17 November to the SD Guthrie Plantation and Tun Razak Agricultural Research and Development Centre; or the Edenor Oleochemicals Group; or the Felda Global Venture Innovation Centre.

• A congress dinner on 18 November

1-2 October 2025

ICIS World Oleochemicals Conference

The Westin Valencia, Valencia, Spain https://events.icis.com/website/11650/ home/

12-15 October 2025

Euro Fed Lipid Congress and Expo Leipzig, Germany https://veranstaltungen.gdch.de/ microsite/index.cfm?l=11649&modus=

14-16 October 2025

Sustainable Aviation Futures North America Congress

Marriot Marquis Houston, USA www.safcongressna.com

20-22 October 2025

Argus Biofuels Europe

QEII Centre, London, UK www.argusmedia.com/en/events/ conferences/biofuels-europe-conferenceand-exhibition

21-24 October 2025

North American Renderers Association (NRA) Annual Convention

Ritz Carlton Bacara, California, USA https://convention.nara.org

For a full events list, visit: www.ofimagazine.com Information subject to change

www.ofimagazine.com

featuring live entertainment and the multicultural heritage of Malaysia.

PIPOC 2025 caters to all stakeholders in the oil palm industry including R&D personnel, scientists, planters, millers, traders, processors, manufacturers, economists, policymakers and academics. Its line-up of world-renowned speakers will share their latest information and research advances with the industry. For registration and enquiries, contact: Rafidah Abd Hamid/ Nurul Aishah Musa/Noor Asmawati Abd Samad E-mail: rafidah@ mpob.gov.my; pipoc@mpob.gov.my Tel: +603 8769 4567/ 4568/3942

30 October 2025

Grain Academy 2025

Varna, Bulgaria

https://grain-academy.com/

3-5 November 2025

Roundtable Conference on Sustainable Palm Oil (RT2025)

Shangri-La Hotel, Kuala Lumpur, Malaysia https://rt.rspo.org/

6 November 2025

FOSFA Annual Dinner

La Quinta de Jarama, Madrid, Spain www.fosfa.org/news/events/

12-14 November 2025

21st Indonesian Palm Oil Conference and 2026 Price Outlook (IPOC 2025)

Bali International Convention Centre Indonesia www.gapkiconference.org/

13-14 November 2025

11th ICIS Asian Surfactants Conference

Kuala Lumpur, Malaysia https://events.icis.com/website/14105/

18-20 November 2025

MPOB International Palm Oil Congress and Exhibition (PIPOC 2025)

Kuala Lumpur Convention Centre, Malaysia https://pipoc.mpob.gov.my/

Instability in the Middle East region and its effect on crude petroleum oil prices, as well as other factors relating to the global energy market, will be a key factor in vegetable oil values in the months ahead John Buckley

Vegetable oil markets rapidly shifted focus in the second quarter of 2025. Initially it was rising global production, South American export competition and the USA’s self-inflicted handicap on its soyabean trade with top customer China.

For much of the period since, attention has been drawn to Middle East instability and its threat to reversing easing crude petroleum oil costs and reinvigorating the use of vegetable oils as biofuel.

The waters have been muddied by shifting US policy in the biofuel sector and the broader trade arena, frequently wrong-footing market analysts.

Yet the distant futures markets for many of the key commodities appear to be staying relatively calm.

supply prospects

Rising supply prospects have helped keep markets under control. Global oilseed production for 2025/26 (beginning on 1 September) was recently forecast by the US Department of Agriculture (USDA) to grow by about 2.1% or 14M tonnes to some 693M tonnes.

Gains are again expected to be led by soyabeans (up around 6M tonnes) but, unlike last year, supply growth is also expected from rapeseed and sunflowerseed, rising by around 4M tonnes each.

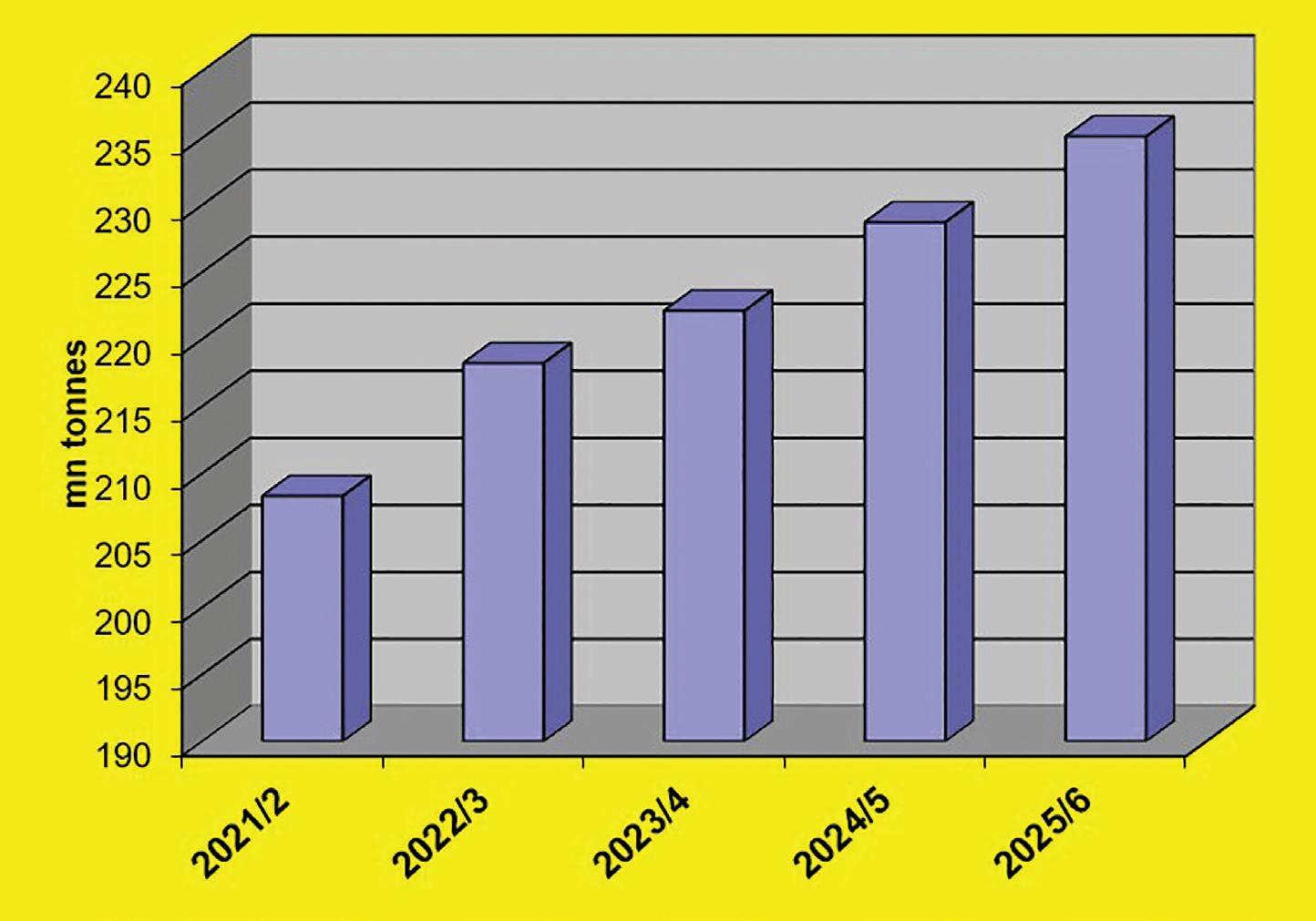

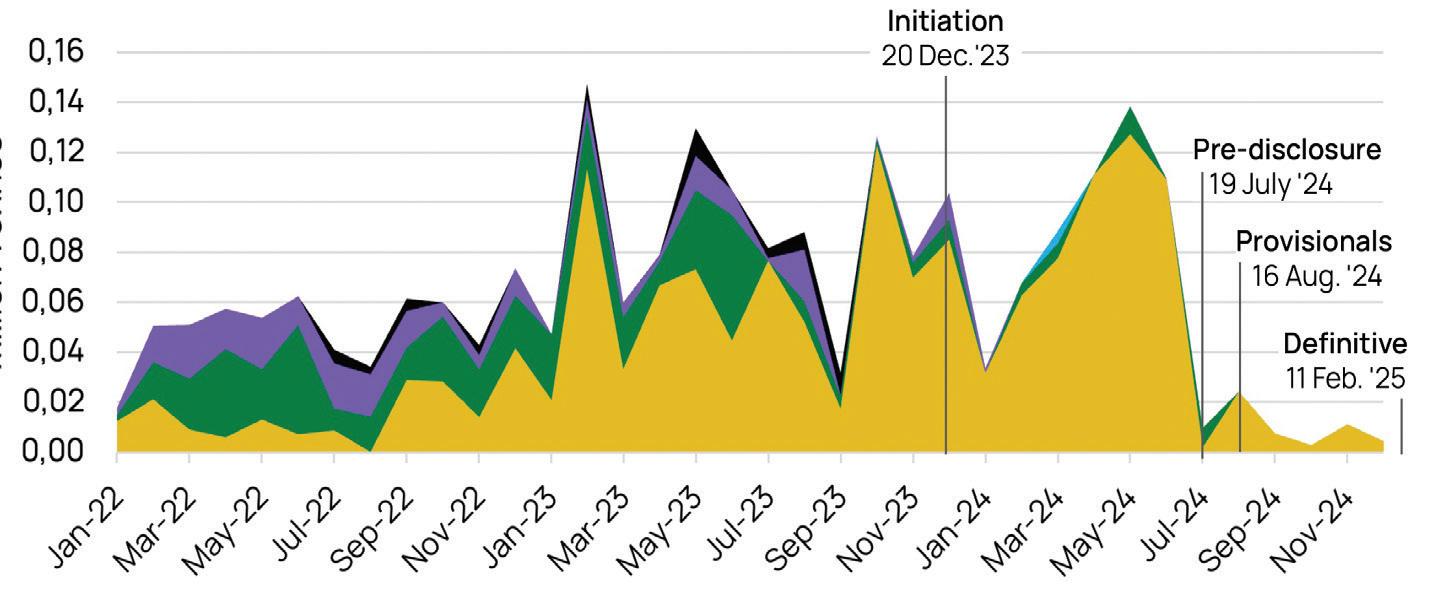

For vegetable oil production in total, growth is expected to expand by 6.4M tonnes or 2.8% (see Figure 1, above), thanks also to an expected continued recovery in output of palm oil, stymied in the 2022-2024 period by weather and other issues.

At the start of third quarter 2025, the focus edged back to China’s ‘revenge’ tariffs, blocking US soyabean exports and switching its business to expanding Latin American supply.

The USDA has been shaving its

seasonal forecasts for total US soyabean exports, half of which normally go to China. They are now running about 3M tonnes under 2024/25’s 50M tonnes. The relatively moderate reduction seems to suggest some optimism about a resolution to the tariff conflict rescuing a reasonable US share of the Chinese market.

However, the latest monthly data – and some of the commentary by the Chinese trade – has so far offered little cheer on that front. The more hopeful view (not apparently shared by so many US farmers) may also have been encouraged by the revival that took place in the past season’s total US soyabean exports (from 46M tonnes in 2023/24), although that may have been more a reflection of this season’s later arriving Latin American crop.

With China still blanking out US soyabean imports for new crop delivery, US farmers have sown over 4% less soyabean acres.

However, with very favourable weather so far, the USDA still expects better yields to return another good crop for 2025/26, not so far off last year’s bumper 118.8M tonnes.

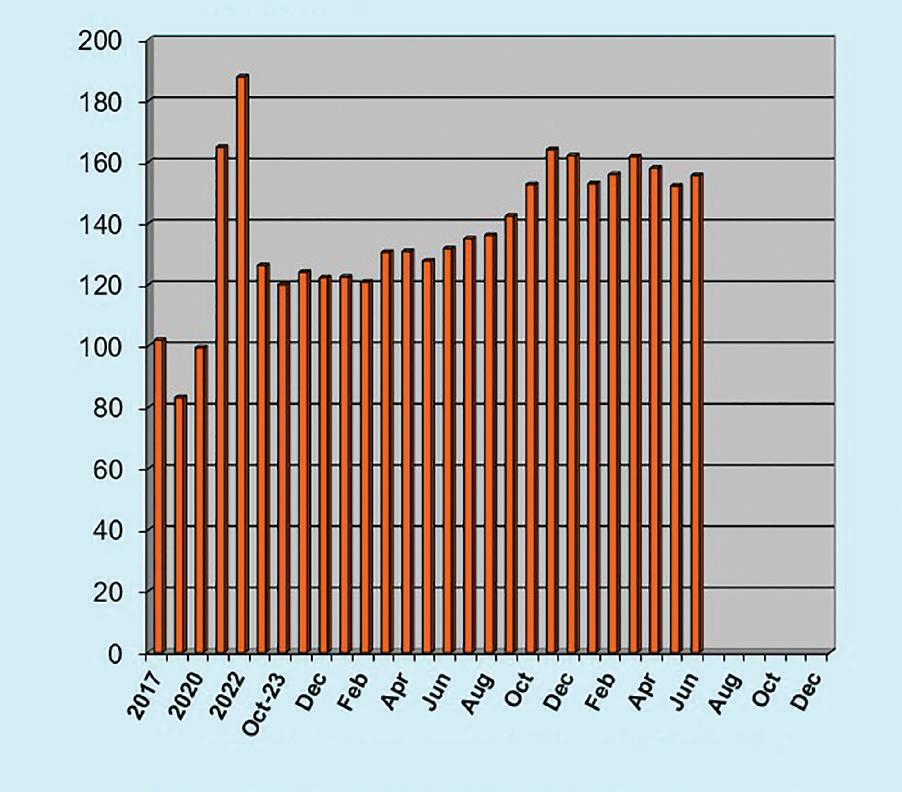

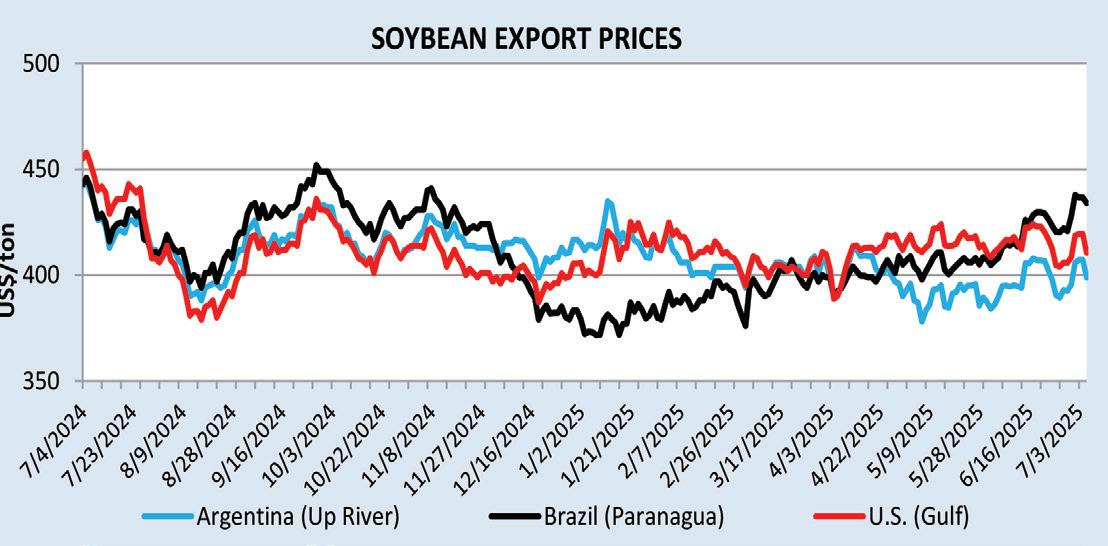

What has helped stave off bearish thoughts across the Chicago Board of Trade (CBOT) soyabean complex has been the sudden revival in the value of soyabean from under 46c/lb (basis CBOT futures) at the start of June to as much as 55c/lb as OFI went to press (see Figure 3,

p20). Two factors led to the rise. One has been the US Environmental Protection Agency proposing new biofuel blending requirements that exceeded market expectations, especially under the current climate sceptic administration of US President Donald Trump.

The EPA suggested raising the limit for biomass diesel to 5.61bn gallons (21.24bn litres) in 2026 and 5.86bn gallons (22.18bn litres) in 2027.

It also proposed total biofuel blend volumes of 24.02bn gallons (90.93bn litres) in 2026 and 24.46bn gallons (92.59bn litres) in 2027, compared with 22.33bn gallons (84.53 bn litres) in 2025.

Not surprisingly, CBOT soyabean oil futures initially went up on the news. The gains were enhanced by the accompanying geopolitical backdrop of President Trump attacking Iran’s nuclear processing facilities, risking broadening an already volatile regional conflict.

This prompted a sharp response from the crude oil and other energy markets which, in hindsight, might have been somewhat over-stated.

Yet readers will remember that just a

few months ago, the World Bank was predicting yet more declines in the cost of crude petroleum oil, led by rising global supplies and China’s accelerated switch to electric cars from fossil-fuel driven vehicles.

Where energy goes in the months ahead will clearly be a key factor in vegetable oil values.

Other markets that will be directly affected by the energy market include palm and rapeseed oils.

Rapeseed oil

Canada’s rapeseed and rapseed product sales to the USA’s growing biofuels sector –a major bullish factor this season –appears to have experienced a reprieve from the immediate threat of a prohibitive US tariff, letting Canada off the hook of the EPA’s proposal to cut credits on imported feedstocks.

Confusion re-surfaced at the end of June as President Trump said he was ending trade discussions with Canada amid a dispute over Canada’s digital services tax, only for things to settle down again as Canada backed away from the tax.

Optimism was swiftly dispelled again by China’s response to Canada imposing a 100% tax on Chinese imports of electric vehicles. A 100% levy on imports of Canadian canola quickly sent prices of the key oilseed crop into a fresh spin, raising farmer talk about a potential wipeout of any profit from the crop.

Amid that hubbub, consumers at least had the comfort of knowing the crop was in the ground. However, not all was well there either with a dry spell across the Prairies starting to threaten yield potential.

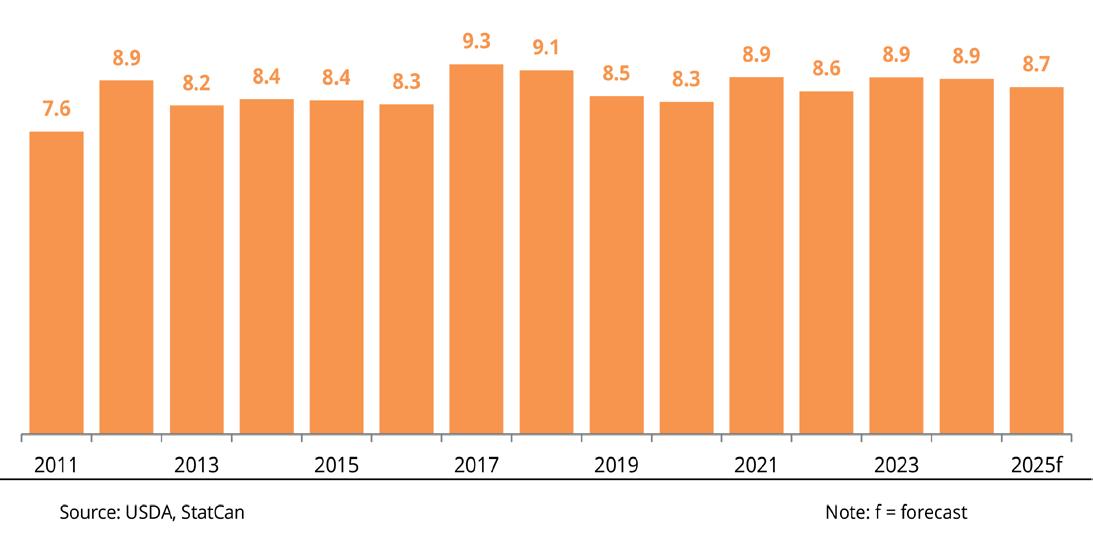

On top of that, Statistics Canada came out with a slightly lower estimate of planted area than last year’s. The USDA is currently looking for a potential 19.5M tonnes crop against last year’s 18.8M tonnes.

If forecasts of some beneficial rain are accurate as OFI went to press, something in the 19M tonnes area still looks possible. Demand issues notwithstanding, Canada needs a decent 2025 crop as it closes the 2024/25 marketing year with is lowest stocks in 12 years.

Official body AgCanada said stocks stood at just 1.15M tonnes, 58% less than a year ago. On that basis, it expected seasonal average Canadian rapeseed prices to stay around C$700 (US$510)/

tonne compared with the past season’s C$680 (US$495)/ tonne.

The USDA projects Europe’s next rapeseed crop at 19.35M against last year’s poor 16.86M tonnes, based on a 4% increase in harvest area and a 7% rise in yields from last season’s unusually poor average of under 3 tonnes/ha.

The European Commission has a slightly more conservative yield forecast but, at the time of going to press still expected a significant crop recovery.

The USDA has also estimated Ukraine’s rapeseed crop at just under last year’s 3.8M tonnes, Russia up at 5.3M tonnes against last year’s 4.65M tonnes, and

Australia steady at 6.15M tonnes, against 6.1M tonnes last year.

Alongside slightly better Chinese and Indian crop forecasts, the USDA suggested world rapeseed output of just under 90M tonnes against last year’s disappointing 85.3M tonnes.

The USDA also forecasts 2025/26 global rapeseed oil production rising from under 34M tonnes to about 34.6M tonnes.

However, if all the crops come through as forecast, implied oil output gain from higher crush could, in theory, be significantly more than that, perhaps well over 1M tonnes.

TONSIL™ your solution for oils, fats, and renewable fuels. Enhance your refining process with state-of-the-art purification and targeted impurity removal, safeguarding your catalyst for advanced protection and optimal efficiency in your operations.

Palm oil prices have been volatile in recent months, responding to swings in origin production trends and the need to price competitively against other edible oils.

Bursa Malaysia futures’ near-month position had, at one stage, lost about 20% off its peak February value, reaching an eight-month low of just over MYR3,700 (US$871.36)/tonne in May 2025 before bouncing back to MYR4075-4125 (US$959-$971)/tonne recently.

Top customer India was a major factor in pulling prices off their earlier highs, cutting its April imports to a four-year low. It also took some of the credit for the subsequent bounce, raising its May imports by a hefty 84%, partly to take advantage of lower prices but also due to the pressing need to restore its low stocks of vegetable oils in general, showing just how important a role palm oil plays in this.

If palm oil prices stay competitive, India is forecast to raise its 2025/26 seasonal imports from the past season’s relatively low 7.8M tonnes to as much as 8.7M tonnes, although that would still be way under the 2022/23 peak, which was in excess of 10M tonnes.

Second largest buyer China has also been forecast to buy more palm oil in coming months. In 2022/23, it took as much as 6.2M tonnes but, in recent seasons, has averaged about 4.5M tonnes.

Less promising is the third largest buyer, the EU, which took in over 5M tonnes in 2021/22 but has recently averaged around 4M tonnes or less, a number expected to erode further in 2025/26.

Adverse publicity over deforestation in origin countries and palm oil’s nutritional profile has played a part in the decline, although this has been offset by palm’s legion of medium/smaller customers who are likely to continue responding to palm’s

Source: John Buckley

harvest area, the expected recovery is based on yields returning to a healthy 2.11 tonnes/ha against last year’s 1.75 tonnes/ha. However, this is dependent on whether recent dry weather will persist, or a wet harvest.

Other major sunflower producers, Russia and Ukraine are also expected to turn out bigger crops of 18M tonnes (up 1.1M tonnes) and 14M tonnes (up 1M tonnes), respectively.

Sunflower oil prices were softening in second quarter 2025, with recent futures trading at around US$1,240/tonne, their lowest level in eight months, under forecasts of a global supply glut and lower prices for some rival oils, especially palm.

traditional reputation as a value oil.

Depending on how production pans out over the coming months of seasonally higher yields, global palm oil supply could expand by about 1.5M tonnes to as much as 80.7M tonnes.

The potential for more biofuel use also remains a possible bullish factor for palm oil, particularly with top supplier Indonesia. Although the USDA currently sees a relatively modest expansion in Indonesia’s total palm oil consumption to some 23.5M tonnes (an increase of 6M tonnes in just four years), government plans to raise the palm oil biodiesel blend could require a larger increase. The catch here might be finance, as planned higher export levies to fund the scheme could reduce palm oil’s competitiveness and put importers off.

Europe is expected to lead a resurgence in global sunflowerseed production in 2025/26, with current crop forecasts ranging to around 10M tonnes against last year’s poor crop of 8.5M tonnes.

With little change in the estimated

Traders noted key customer India was being lured away by palm oil’s US$200/ tonne discount against sunflower oil, raising its June imports of the lauric oil to its highest level in 11 months.

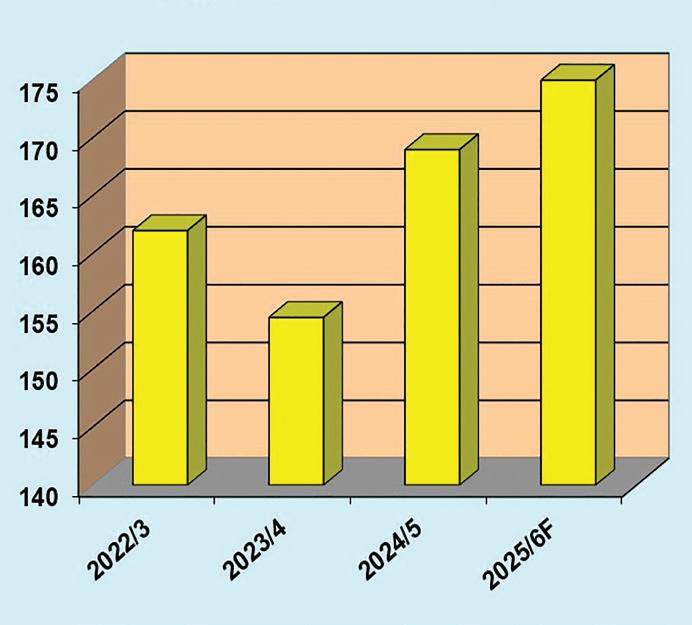

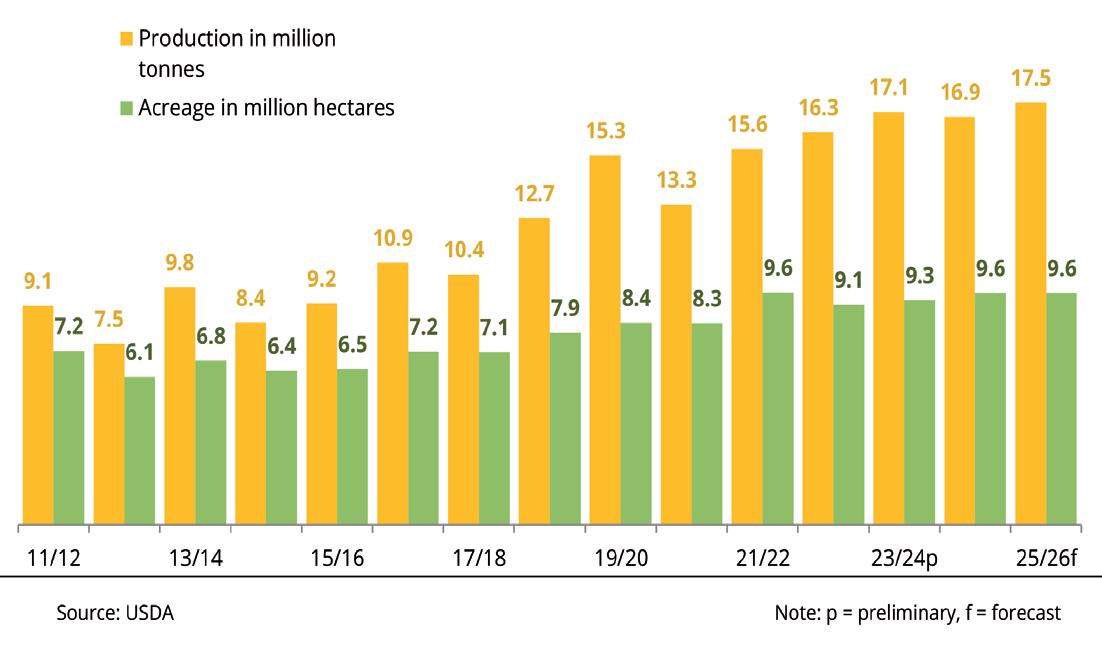

Rising output of Brazilian soyabeans (see Figure 5, above) and EU rapeseed was also said to be squeezing sunflower oil’s market share.

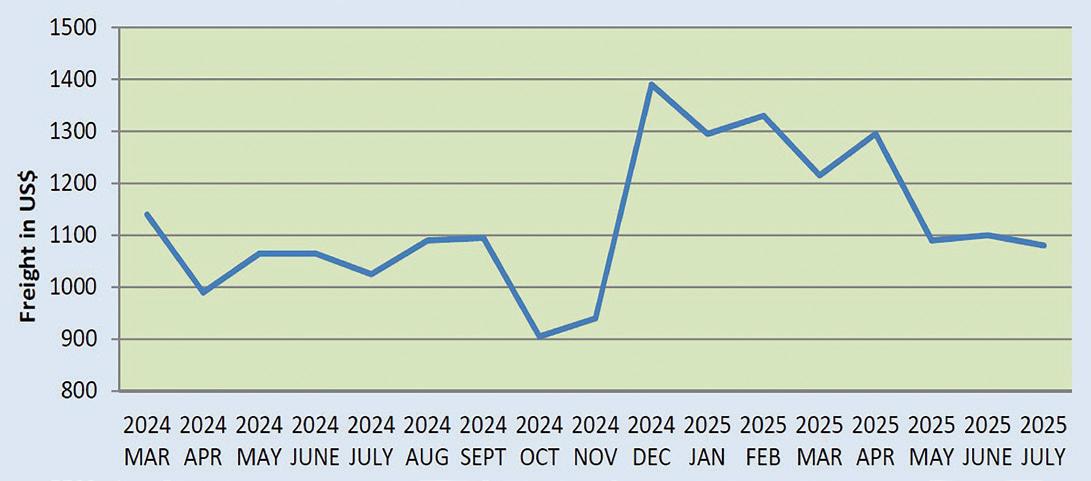

Ukraine and Russia, which account for more than 60% of global sunflower oil exports, were recently offering FOB terms at US$1,100-1,110/tonne amid robust Black Sea shipments and Russia’s 30%+ cut to its July export duty to Rb4,739 (US$60.66)/tonne.

The United Nations (UN) Food & Agriculture’s monthly food price index showed global vegetable oil prices rising by another 2.3% in June, putting them 18.2% higher than in the same month last year (see Figure 4, above). It cited higher palm, rapeseed and soyabean oil prices, palm gaining near 5% on strong import demand and soyabean oil boosted by Brazilian and US policies favouring more biofuel demand. ● John Buckley is OFI’s market correspondent

The OLCC high-performance cracking mill is Bühler’s latest innovation for the efficient processing of oilseeds and a range of feed milling applications. Designed for maximum throughput, seamless automation, and exceptional ease of maintenance, the OLCC sets a new standard in cracking technology.

The future of Oilseed Cracking starts here. Scan the QR code to learn more.

An initiative by the G7 group of nations and the OECD aims to boost

The poor quality of seeds used in Africa has long been a brake on the continent’s oilseeds production but an initiative by the G7 group of nations and the Organisation for Economic Cooperation & Development (OECD) launched last September aims to boost African seed yields.

As part of the initiative, a capacity building exercise was launched last September to enable 14 African countries over the next five years to join the OECD Seed Schemes, which encourage the agricultural sectors of participating countries to use certified quality seeds.

Initially, eight countries will be selected to take part in the scheme, Csaba Gaspar, head of OECD agricultural codes and schemes, says.

The OECD helps partner governments to set up seed certification schemes to improve farmers’ confidence in buying quality seed, including for oilseed crops such as mustard, oilseed rape, peanut, safflower, cotton, sunflower, flax, soyabean and others.

According to the OECD, the G7-OECD

‘Strengthening seed certification in Africa’ joint initiative will “improve seed quality, boost yields and farmer incomes, and strengthen agricultural productivity across the continent”.

It will also facilitate African farmer access to quality seeds; improve trade and access to new markets; build inclusive seed supply systems; and boost resilience to climate change.

Largely funded by the Italian government, the G7 initiative will run alongside the OECD’s existing Seed Schemes programmes, which are being increasingly adopted in Africa.

“We’ve seen a huge increase of applications and pro-activity from the African countries,” Gaspar tells OFI

The increase in interest has been sparked by supply chain vulnerabilities highlighted by COVID-19 and the impact of recent military conflicts, according to Gaspar.

At present, the only African countries using the scheme are Burkina Faso, Egypt, Kenya, Nigeria, Morocco, Senegal, South Africa, Tanzania, Tunisia, Uganda, Zambia and Zimbabwe. Of these, only Egypt, Kenya, Morocco, South Africa, Uganda and Zimbabwe are members of the ‘Crucifer Seed and Other Oil or Fibre Species’ Seed Scheme.

Worldwide, there are 64 countries that operate and work with the schemes, which have special sections for different kinds of plants.

The system involves variety registration, inspection and traceability of the seed production chain and trade, to ensure high quality seed is supplied to participants.

Certified quality seeds are sold in specially-marked packs. There are also some detailed technical rules to follow, such as 90% minimum varietal purity for hybrid oilseed varieties and 85% at post control stage for hybrid varieties of spring oilseed rape.

Rules are also in place on seed lot size – for wheat-sized seeds and larger, one seed lot should not exceed 20,000kg; for smaller seeds, one seed lot should not exceed 10,000kg.

Participating countries must ensure that the seed crops of cross-pollinating species are isolated from any possible source of contaminating pollen by keeping them at minimum distances from other crops that can cross-pollinate, and from crops for seed production fields. For example, 200m and 100m for basic rapeseed and certified rapeseed respectively.

Rules also specify that fields that have had below-standard yields for specific crops should be not sown with seeds of the same crop for a set period of time, with a five-year period for crucifer species (which include many oilseeds).

African seed distributors and producers are not following these rules, according to the Nairobi, Kenya-based African Agricultural Technology Foundation (AATF).

“We found that over 80% of the independent seed companies that service Africa’s smallholder markets have difficulties with production and maintenance of quality foundation seed, resulting in low and inconsistent supply, which has a knock-on impact on the production of certified seed.

“This, in turn, is costing farmers and seed companies the opportunity to fully benefit from new improved varieties that are critical to raising farm productivity,” the AATF said in a note last March.

According to analysis in 2022 by data service Our World in Data, average yields for cereal seeds in Africa were half that of India and one-fifth of US yields.

The use of quality seed alongside solid agricultural techniques – such as irrigation, soil protection, pest and disease protection – can increase agricultural yield and ensure consistent crop performance and healthier crops, Gaspar explains.

Alongside participating governments, the OECD has worked with key partner organisations to achieve success in its seed programmes and assist in developing the national seed sectors in Africa. These partners include the African Union and its development agency AUDA-NEPAD, and an informal initiative called the World Seed Partnership which includes organisations such as the International Seed Testing Association (ISTA), the International Union for the Protection of New Varieties of Plants (UPOV), the International Seed Federation and the World Farmers’ Organisation.

The G7 project will also include a training component to help other African countries develop their seed certification capacity, Gaspar says.

As the whole seed sector needs to be developed to achieve results, he says the general approach is a holistic one.

The OECD scheme is involved in the international regulatory framework for seed production and trade which could be a complementary option besides the local and informal seed sector, he adds.

Applying an enabling regulatory environment can attract investments to the national seed sector, boosting local breeding programmes, providing a livelihood for local seed companies and better food security and self-sufficiency, Gaspar says.

The key is giving more choice to farmers, so they can choose certified seed varieties that give them a crop adapted to local farming conditions, for example, being heat or disease resistant.

‘Over 80% of independent seed companies servicing Africa’s smallholder markets have difficulties with production and maintenance of quality foundation seed, which impacts the production of certified seed’

“The traceability system provided by the OECD – together with an enabling legal framework, efficient law enforcement and education of stakeholders – can also reduce fraud,” Gaspar says.

In addition, creating a viable local seed sector could potentially see oilseeds being exported within and across Africa, he adds.

Looking ahead, expanding Nigeria’s participation in the OECD Seed Schemes to include soyabean and other oilseeds could replicate the impressive yield improvements already achieved in the rice sector through certified varieties, according to Mayowa Ilebami, a manager at Farmwell Agricultural Seeds, Kano.

In the past, Nigerian farmers often unknowingly purchased mixed or substandard seeds, leading to disappointing harvests, he tells OFI

Certification helps farmers know the right place to access the seed, reducing the risk of fraud and ensuring they plant only high-performing varieties, Mayowa adds.

The impact of such access is clear with rice, he explains.

“If you plant 25kg of Faro 44, you might get 70 bags, but with Gawara 1, you can get around 100kg plus.”

This leap in productivity is due to the availability of high-quality, certified seed, and could also apply to oilseeds if Nigeria joins the OECD scheme, he adds.

Tanzania is another participant country. The major sunflower producer’s output of the crop is expected to reach 1.1M tonnes in 2028, up from 1.08M tonnes in 2023, according to French business data platform ReportLinker.

The commodity is mainly produced by about 1M smallholder farmers, explains Tumaini Elibariki, sunflower programme manager for Farm Africa, a non-governmental organisation that helps farmers in Tanzania boost their productivity, resilience to climate change and conserve biodiversity.

According to the Bank of Tanzania’s May 2024 Monthly Economic Review, Tanzanian oilseed exports rose by 67.4% from US$181.8M in 2023 to US$304.3M last year.

The success of Tanzania’s sunflower sector is due to the use of improved and international sunflowerseeds, Gaspar tells OFI

“For two decades now, Tanzania has been a member of the OECD Seed Schemes that certifies and ensures the quality and purity of seed varieties, including those used for sunflower production.”

Patrick Ngwediagi, the director general of the Tanzania Official Seed Certification Institute, says his organisation has been working to increase the availability of improved seed varieties, including hybrid seeds, and is also addressing counterfeit seeds and low productivity problems.

“To ensure that only quality seeds are in the market, we are setting up a new genetic reference library in Morogoro [eastern Tanzania].

“This will serve as an information centre for all genetic materials in the seed industry, including sunflower, to lock out low quality and counterfeit seeds,” Ngwediagi adds.

According to Felister Tibamanya, an assistant lecturer of agricultural economics at Tanzania’s Mzumbe University, sunflower production in Tanzania is also affected by the high cost of inputs, diseases, weather and birds that eat the crop.

In a report co-written with University of Copenhagen researchers, ‘The Rise of Sunflower Oil: A Reliable Cooking Oil in Tanzania’, Tibamanya says the quality of Tanzania’s sunflower product is diminished by farmers’ and traders’ deception in seed admixtures (the intentional mixing of different types of seeds), the addition of sand, moisture, broken and dead seeds. ● Keith Nuthall in Ottawa; Wachira Kigotho in Nairobi and Samuel Okocha in Abuja write for International News Services, UK

CANTRELL WORLDWIDE ( INDIA ) PVT. LTD. WORLD STANDARD FOR PROCESSING An Affiliate Company of Cantrell Worldwide Inc. Dallas, Texas, U.S.A. Turnkey Projects & Equipments for Cottonseed Delinting & Dehulling Sunflowerseed Cleaning & Dehulling Soyabeanseed Cleaning & Dehulling

Rotary Pre Cleaner, Model 398 & 399 New Seed Cleaner, Delinter, Gummer, Seven Stage Lint Cleaner, Press, Huller, Beater Separator, Density Separator, Hull Beater, Hammer Mill, Expander, Flaker, Cracker etc. Manufactured in USA & India 460 LARGE CAPACITY TWIN ROLL HULLER

CANTRELL WORLDWIDE ( INDIA ) PVT. LTD. Mumbai - 400059, India +91-22-6828 4201/2/3 • Bharatt: +91 98201 93098 cantrellindia@gmail.com • bharatt@cantrellworldwide.com www.cantrellworldwide.net Aubrey, Dallas, Texas 76227, USA • +1-972-302-2557 • Justin: +1 (469) 314 4117 justin@cantrellworldwide.com • ayush@cantrellworldwide.com • www.cantrellworldwide.com Plant Capacity 100 TPD to 2000 TPD

Soya lecithin is widely used as an emulsifier, dispersant, antioxidant and humectant in various industries, including food and feed. As a major global producer of soyabeans, South America is also a key supplier of soya lecithin

Renan Fernandes

Soya lecithin is a natural phospholipid complex derived from crude soyabean oil.

Rich in bioactive components, soya lecithin functions as an emulsifier, dispersing agent, stabiliser, antioxidant and humectant. It is effective in dispersing powders into liquids and enhancing mixture homogeneity by preventing clumping.

In agribusiness, lecithin is either a byproduct or versatile ingredient used across several industries, including food and feed, paints, pharmaceuticals and resins.

Lecithins are produced through various processes, which may include filtration, standardisation and deoiling. Their molecular structure can be modified enzymatically or chemically to obtain customised properties tailored to the specific needs of each customer.

Soya lecithin is one of the most widely used emulsifiers due to its ability to blend ingredients that do not naturally mix, such as oil and water. Consequently, there are numerous practical applications in the food industry. Lecithin is valued for its nutritional benefits (choline, phospholipids), aligning with the growing demand for functional foods and dietary supplements. Additionally, the tocopherols present in lecithin help delay fat oxidation, thereby extending product shelf life.

In chocolate and confectionery production, lecithin reduces the viscosity of molten chocolate, prevents fat bloom, and improves moldability. As a result, it enhances texture and gloss while reducing the need for cocoa butter, generating cost savings during manufacturing.

In margarine production, lecithin acts as an emulsifier and stabiliser, helping to maintain uniformity between water and oil phases and improving texture, consistency, and plasticity. In baked goods, lecithin improves dough handling, enhances moisture retention and results in softer bread and cakes with increased volume and extended shelf life.

In cookies and crackers, lecithin serves

as a release agent and lubricant, facilitating demoulding and improving texture and crunchiness. Another, perhaps lesserknown, application is in mayonnaise and sauces, where lecithin acts as a primary emulsifier, preventing phase separation and contributing to a smooth, uniform texture. It can also be used in ice cream and plantbased beverages to prevent crystallisation and enhance creaminess.

Lecithin’s outstanding ability to act as an emulsifier, dispersant and stabiliser underscore its role in optimising production processes and final product quality. Its versatility not only elevates the consumer experience but delivers significant efficiencies and cost savings for manufacturers.

In the animal nutrition sector, lecithin is an excellent source of essential fatty acids, enhancing the absorption of water-soluble nutrients such as vitamins and minerals. It is thus an effective solution for healthier and more efficient production.

With its natural emulsifying properties, lecithin improves the flavour and texture of animal feed, boosting performance and productivity. Key applications include feed formulation for poultry, calves, ruminants, swine, fish and crustaceans.

In poultry and swine feed production,

lecithin acts as a fat emulsifier in the diet, improving digestion and the absorption of fat-soluble vitamins and essential fatty acids. This results in better feed conversion and weight gain. In aquaculture, lecithin plays an essential role in feeds for salmon, shrimp, tropical fish and lobsters, particularly during early growth stages.

In South America, Chile and Ecuador stand out in soya lecithin consumption for aquaculture. Ecuador is a major global player, recognised as the world’s leading producer and exporter of farmed shrimp.

Lecithin is one of the most strategic by-products of soyabean processing. Consequently, global lecithin supply is concentrated in the world’s main soyabean-producing countries.

As well as the USA, South America leads global soyabean production and exports, with Brazil, Argentina and Paraguay accounting for over 50% of total global supply. The soyabean harvest volumes in Brazil and Argentina illustrate the strategic importance of the region in supplying the broader soyabean complex.

Argentina and Brazil are key players in global soya lecithin supply, providing product not only within the Mercosur economic bloc but also to European and Asian markets.