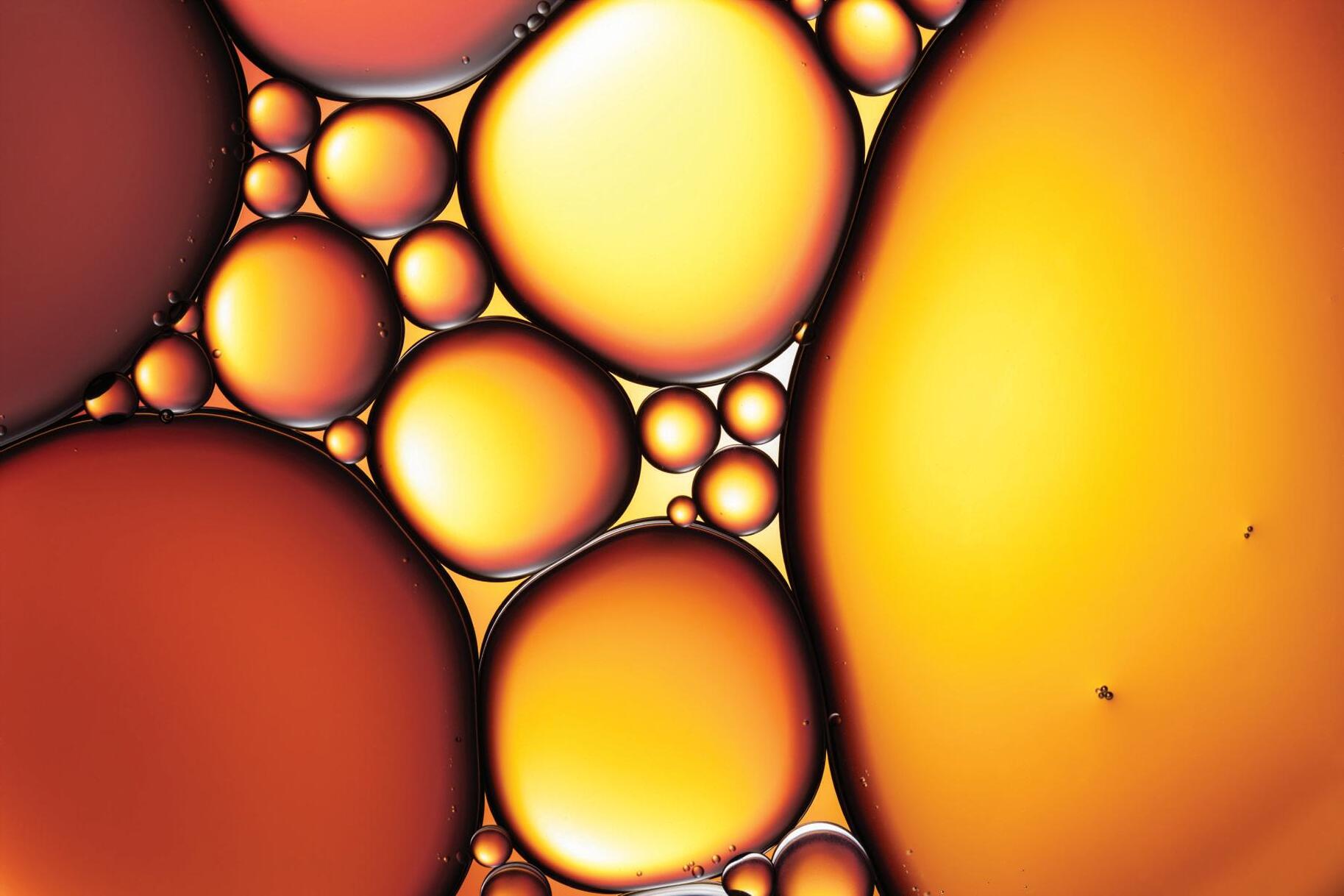

Fish Oil & Meal

32 Scale of an industry

A new proposal to eliminate overly rigid EU animal by-product rules could pave the way for Europe to use and export more processed

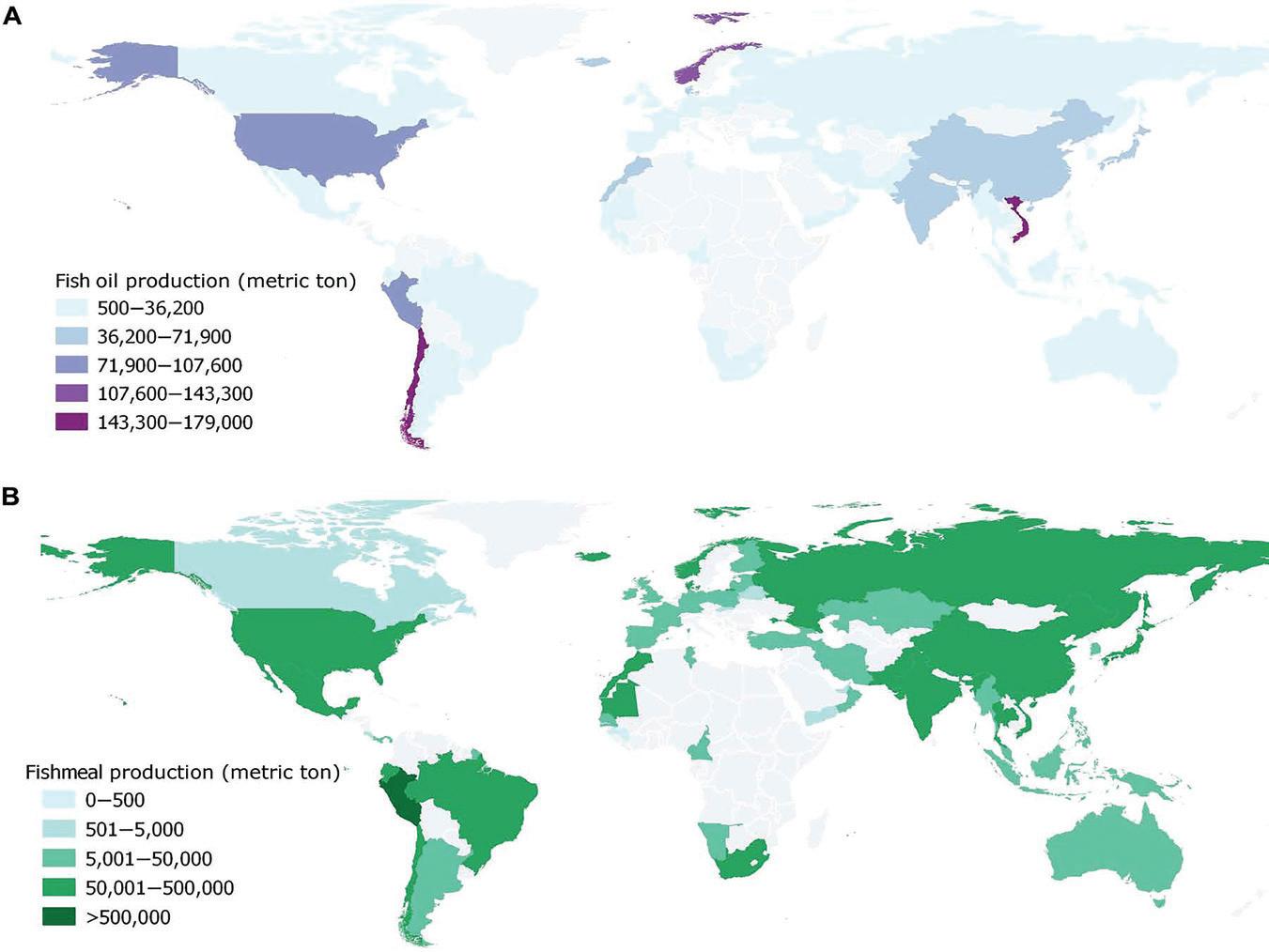

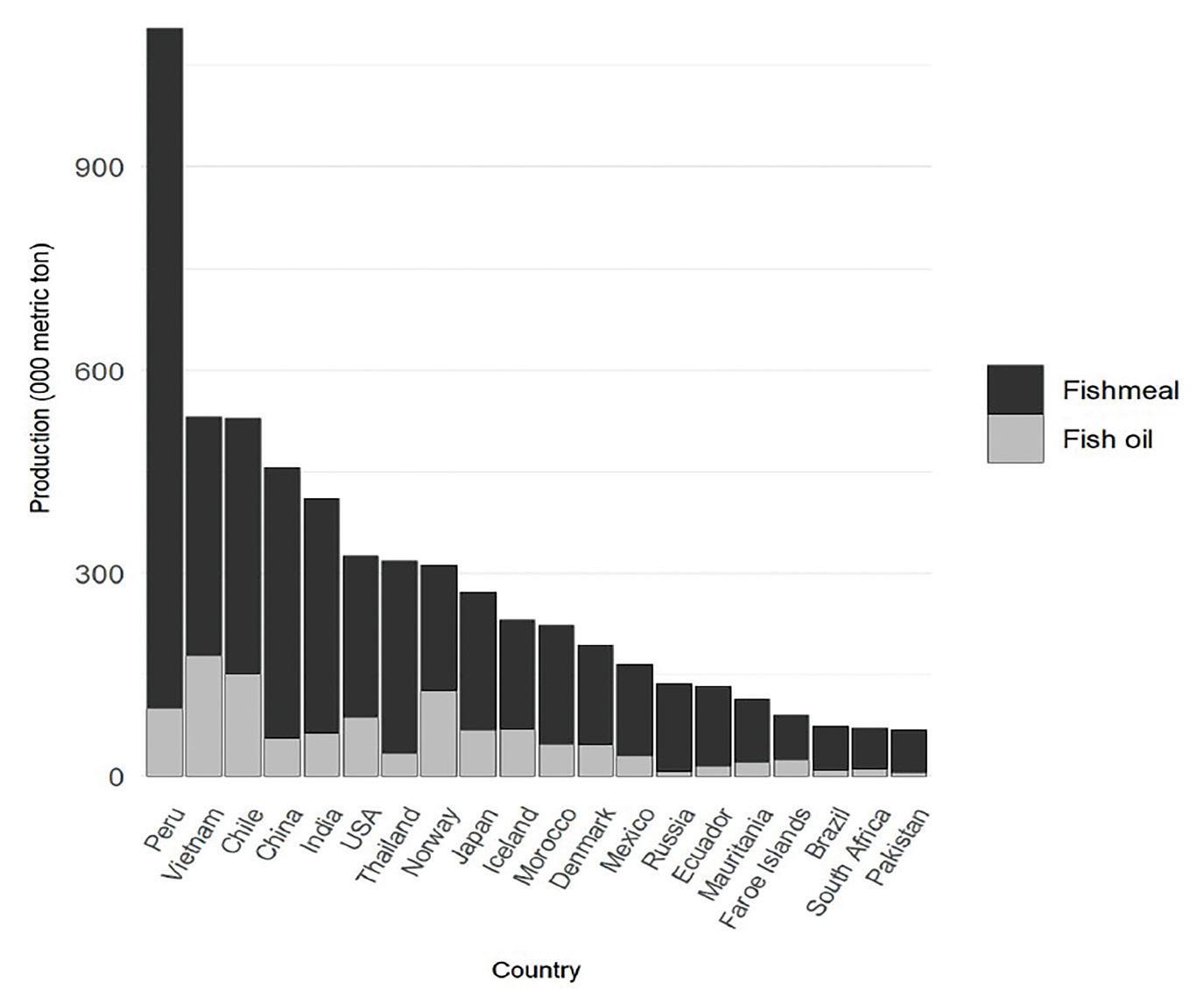

A new study by US researchers maps out fish oil and meal production locations around the world, highlighting a critical area of the acquaculture supply chain Plant & Technology 36 Global round-up of news OFI reports on some of the latest projects, technology and process news and developments globally

Feedstocks

LDC completes purchase of Bunge Polish, Hungarian assets

Rotterdam plant halted after cost review

New laws and calls by agribusiness groups could put Brazil’s Soy Moratorium at risk, which could lead to a significant expansion in plantings

Increasing instability in used cooking oil traceability is leading biofuel producers to focus on alternative feedstocks such as acid oils and fatty acids

News 12 Unilever uses palm-based biomethane at UOI

News

LDC opens new terminal in Santa Elena, Argentina

of Events

events listing

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com +44 1737 855066

VOL 41 NO 7

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 1737 855157

ADVERTISING: Mark Winthrop-Wallace markww@quartzltd.com +44 1737 855114

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

SUBSCRIPTION RATES:

Print & digital: Single issue – £45

1 year – £182 (UK), £210 (overseas)

2 years – £328 (UK), £377 (overseas)

3 years – £383 (UK), £440 (overseas)

Digital only: Single issue – £29

1 year – £170

2 years – £272

3 years – £357

© 2025, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 1737 855000

Printed by Pensord Press, Merthyr Tydfil, Wales

The 30 December deadline for the EU Deforestation Regulation (EUDR) to come into force for large and medium companies is fast approaching.

Originally due to take effect a year earlier, the regulation was delayed to give operators around the world more time to prepare for the ban on deforestation-linked products being sold in the EU – the seven affected commodities are palm oil, soyabean, timber, rubber, coffee, cocoa and cattle.

However, with just months to go, pressure is mounting on the European Commission (EC) to water down the law or delay implemention even further, with speculation that special deals favouring the EU’s major trading partners could be reached, according to Food Navigator.

The EU released its risk classifications for countries in May, giving ‘standard’ risk status to palm oil leaders Indonesia and Malaysia, and leading soyabean producer Brazil. They will have the heavy administrative burden of proving their commodities are deforestation-free, traceable and legal, by submiting Due Diligence Statement (DDSs) that includes geolocation coordinates of production land plots; risk assessment results; descriptions of the supply chain; and confirmation that the product complies with the EUDR. The mind boggles with all the data that needs to be collected, verified, updated, stored, formatted and loaded onto an EU digital system that only accepts file sizes of up to 25MB, which critics say is not large enough for large-scale or multi-farm supply chains. This burden particularly impacts smallholders on the ground.

Pressure is now growing for the EC to add a fourth ‘negligible’ risk category for countries, with the European Parliament’s Committee on Environment, Public Heath and Food Safety adopting a motion to add this category in June, and the EC releasing a guidance in August defining ‘negligible’ risk. The EU and USA have already agreed that US commodities pose negligible deforesation risk in their August framework agreement on trade (see p6). Is this one step on the slippery slope of the EUDR straying into politics?

The EU insists its benchmarking is based on science and data but Malaysia and Indonesia have long criticised the EUDR as a politically motivated form of green protectionism, with a system that lacks transparency or a formal appeal process.

Malaysia claims its classification as ‘standard’ risk is based on outdated 2020 Food and Agriculture Organization (FAO) data. Indonesia is calling for further postponement to 2028 because small-scale farmers still lack the infrastructure to meet requirements like geolocation tracing.

Adding to the calls for delay are some cocoa producers and users. Speaking at the European Parliament in July, Massimiliano Di Domenico, European vice president of corporate and government affairs of Mondelēz – the producer of Cadbury – urged a 12-month delay, citing soaring prices, declining production, and origin countries still scaling up digital capacity as critical barriers to compliance.

Cocoa futures prices more than quadrupled to US$12,000/tonne in December 2024 (see p8), with floods, droughts and disease hitting yields last year in West Africa, which accounts for around 60% of global production. The International Cocoa Organisation says smallholders are particularly at risk of being barred form the EU market.

With the EUDR deadline looming, multinationals, companies and smallholders will be in different stages of preparedness for its final implementation. The million dollar question is whether there will be another delay or change?

Serena Lim, OFI Editor, serenalim@quartzltd.com

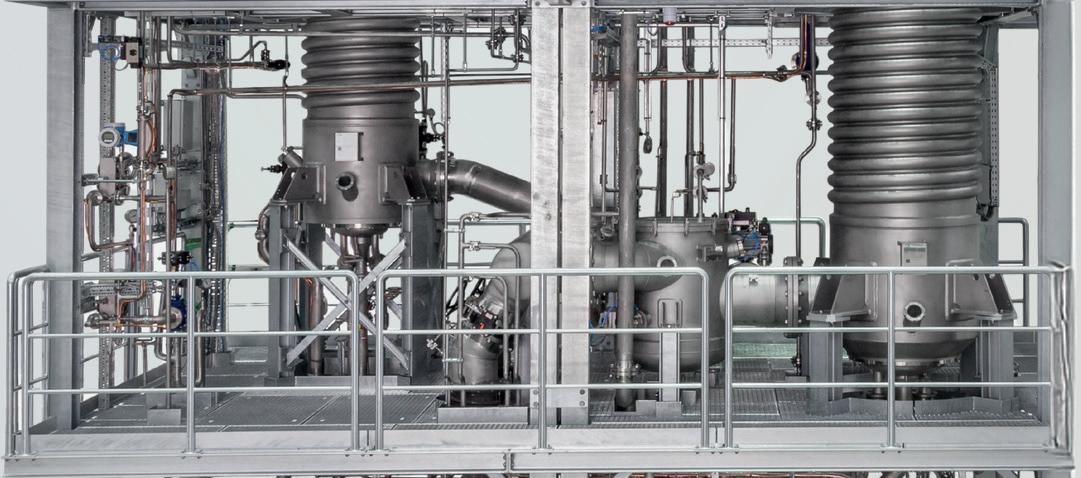

CMB TECHNOLOGIES

Transesterification | Enzymatic Biodiesel production | Glycerolisis

Special Dry degumming & bleaching | Deacidification | Oil washing | Pre-treatment Methylester fractional and total distillation

You choose the feedstock(s), We build your best Biodiesel Plant.

CMB: your trusted partner for your Biodiesel Plants.

CMB S.p.A. Cisterna di Latina, ITALY

CMB MALAYSIA ENGINEERING FOR OILS AND FATS SDN. BHD Selangor, MALAYSIA

CMB SHANGHAI ENGINEERING CO. LTD. Shanghai, CHINA

CMB INDIA ENGINEERING FOR OILS AND FATS PVT. LTD. Mumbai City, Maharashtra, INDIA

UKRAINE: The government's new 10% export duty on rapeseed and soyabeans, introduced to promote domestic processing, took effect on 2 September, World Grain wrote on 3 September, citing a US Department of Agriculture (USDA) report.

The duty had faced strong opposition from farmers and agricultural associations, who claimed it would reduce planted areas and impact farmers’ livelihoods,

The bill had been drafted by Dmytro Kysylevsky, deputy chairman of the parliamentary Committee on Economic Development, who said Ukrainian oilseed processing plants were underutilised by 35%, and fully engaged, could generate an additional US$176.8M to finance Ukraine’s armed forces, Interfax-Ukraine wrote on 3 September.

“These duties would mostly fall on international traders, as the bill exempts farmers and cooperatives from the tax,” the USDA said.

WORLD: The butter market is facing a significant downturn due to price drops across all major regions, with European butter leading the decline due to a supply surplus of 56,500 tonnes compared to the first half of 2024, commodity platform Vesper wrote on 28 August.

European butter prices had dropped to €6,700 (US$7,793)/tonne on the Vesper Price Index.

The report said the European supply surplus was due to 37,500 tonnes of increased production; 6,500 tonnes from reduced exports; and 12,500 tonnes from higher imports.

“The current environment of sellers facing pressure to move inventory while buyers experience no urgency to purchase creates challenging conditions for price recovery in the near term,” Vesper wrote.

Global agribusiness giant Louis Dreyfus Co (LDC) announced on 1 September that it had completed its acquisition of Viterra’s former grains and oilseeds businesses in Hungary and Poland from Bunge Global for an undisclosed sum.

As part of the European Commission (EC)’s approval of Bunge’s US$8.2bn merger with Viterra on 2 July, LDC was required to divest the entirety of Viterra’s oilseed businesses in Hungary and Poland and logistical assets linked to those operations, World Grain wrote on 2 September.

The deal includes standalone grain and oilseed trading and origination teams in Budapest and Gdansk.

In Hungary, the transaction comprises:

• A multi-seed (sunflowerseed, rapeseed and soyabean) crushing and refining plant in Foktő that is one of Europe’s largest sunflowerseed crushing facilities.

The site also produces sun-

flower-based lecithin.

• Three grain and oilseed storage and logistic sites in Debrecen, Gyomaendrőd and Berettyóújfalu, with a combined storage capacity of around 150,000 tonnes.

In Poland, the transaction includes:

• A multi-seed (rapeseed, sunflowerseed and soyabean) crushing and refining plant in Bodaczów, specialised in rapeseed processing and accounting for around 15% of Poland’s total rapeseed crush

volume. The plant refines rapeseed oil for the food and biodiesel industries, while rapeseed meal is sold mostly locally to feed compounders and animal protein producers.

• Four grain and oilseed storage and logistic sites in Kętrzyn, Szamotuły, Trawniki and Werbkowice, with a combined storage capacity of some 170,000 tonnes. The silos are equipped to support origination and distribution programmes for crops such as wheat, corn and rapeseed.

Global agribusiness giant Bunge Global has reached an agreement with international soya ingredients supplier Solae to acquire most of the assets related to the lecithin, soya protein concentrate and crush businesses of its subsidiary International Flavors and Fragrances (IFF).

The acquisition of US-based IFF – a global flavours, fragrances, food ingredients, health and biosciences supplier – included operations that generated approximately US$240M in revenue in 2024, IFF said on 5 August.

Subject to closing adjustments and conditions, the deal was expected to close by the end of this year, IFF said. Financial terms of the agreement were not disclosed.

“The sale aligns with IFF’s strategy to strengthen its portfolio and supports the ongoing evaluation of strategic alternatives for its Food Ingredients segment, with a focus on maximising shareholder value,” the company said.

During a conference call with analysts following IFF’s 6 August earnings report, the

company’s CEO and director J Erik Fyrwald was reported as saying in a 12 August World Grain report that the soya crush, soya protein concentrate and lecithin products were a “better fit with Bunge”.

“They were low single-digit EBITDA margins for us, and they were distracting from our very differentiated isolated soya protein business, which we can now focus on and drive application development … that’s going to improve our margins in the Food Ingredients business significantly and allow us to focus where we need to focus,” Fyrwald said.

Within its agribusiness segment, Bunge processes oilseeds – mainly soyabeans, rapeseed, canola and sunflowerseed – into vegetable oils and protein meals, principally for the food, animal feed and biofuel industries.

The company, which completed an $8.2bn merger with Viterra on 2 July, had a particularly strong local presence in the three largest soyabean producing countries in the world: Argentina, Brazil and the USA, World Grain wrote.

Test, develop, scale and commercialize with a trusted company at a facility like no other.

The only facility of its kind, CPM|Crown’s Innovation Center is a world-class, fully functional pilot plant, analytical lab and training center for preparation, extraction, desolventizing, drying, deodorizing, refining, fat-splitting and specialty extraction (including plant-based proteins). The Innovation Center offers piloting capabilities from benchtop lab scale to multiple tons per day of continuous production, simulating real life and enabling customers to develop and test new product concepts in a confidential, controlled environment. Crown’s Innovation Center also features the Liquids Pilot Plant, which offers customers access to a state-of-the-art continuous-process environment for testing, validating, scaling and commercializing renewable diesel/HVO, SAF, edible oils, oleochemicals and specialty products. Crown’s technical expertise, R&D and Lifecycle360™ support services provide guidance at every step from feasibility, trials, training and custom processing to commercial-sized operations and aftermarket.

Feeding, Fueling and Building a Better World.

USA/CHINA: The USA and China have extended a pause on higher reciprocal tariffs for 90 days until 9 November, The Guardian reported on 12 August.

The pause means the USA will hold its levy on Chinese imports at 30%, while China will keep a 10% baseline tariff on US products, according to a 12 August FreightWaves report.

Trump had previously threatened to put tariffs as high as 245% on China, while China had threatened retaliatory tariffs of 125%, The Guardian wrote in a separate report on 13 August.

While announcing the pause, Trump urged China to quadruple its soyabean orders. "This is also a way of substantially reducing China’s trade deficit with the USA,” he wrote on social media platform Truth Social.

China is the world’s largest consumer and importer of soyabeans and will import 106M tonnes of soyabeans in 2025/26 to meet demand of 124.4M tonnes, according to the US Department of Agriculture.

The American Soybean Association said retaliatory tariffs now made US soyabeans 20% more expensive than South American supplies and China had not bought any US soyabeans for the months ahead, making a a trade deal urgent.

The US Court of Appeals ruled on 29 August that most of US President Donald Trump’s global tariffs are illegal.

However, in a petition filed on 3 September, the US administration asked the US Supreme Court to overturn the decision, the BBC reported on 4 September.

At stake are Trump’s wide-ranging reciprocal tariffs announced on 2 April, as well as tariffs on China, Canada and Mexico aimed at putting pressure on those countries to curb shipments of fentanyl into the USA, FreightWaves wrote on 29 August.

The appeals court found that Trump had exceeded his authority in imposing tariffs under the International Emergency Economic Powers Act (IEEPA), which grants a US president significant

authority to respond to a national emergency or a major threat from overseas.

It upheld a May ruling from the US Court of International Trade, which had rejected Trump’s argument that his global tariffs were permitted under the IEEPA, the BBC wrote on 30 August.

While the appeals court had ruled against the president, it postponed its decision from taking effect until 14 October to allow the Trump administration time to file an appeal.

The rulings came in response to lawsuits filed by small businesses and a coalition of US states opposing the tariffs, the BBC wrote.

They do not apply to some other US duties, like those imposed on steel and aluminium, which were brought in under a different presidential authority.

The Indonesian government has announced plans to prioritise wheat and soyabean imports from the USA as part of a trade agreement aimed at reducing tariffs and establishing new agricultural trade channels, UkrAgroConsult wrote on 31 July.

Tied to a US$4.5bn agricultural import commitment, the initiative was linked to a wider reciprocal deal comprising energy purchases and aircraft acquisitions.

Agriculture Minister Andi Amran Sulaiman was quoted as saying that wheat and soyabeans were the primary focus of the import strategy, citing domestic supply shortages and the need to stabilise food prices.

As part of the deal, Indonesia would eliminate several non-tariff barriers and recognise US Food and Drug Administration certifications for specific goods, while the USA would reduce tariffs on Indonesian exports to 19% from a

previously proposed 32%, the report said. According to Indonesia’s Central Statistics Agency (BPS), the country imported 2.68M tonnes of soyabeans in 2024, up nearly 18% compared to the previous year, with the majority sourced from the USA.

The USA and the EU agreed details on 21 August on their trade deal struck at the end of July, with EU agricultural trade organisation Copa Cogeca saying they deliver “nothing for the EU agriculture sector”.

In an official joint statement, the USA and the EU said the deal was the first step in a process that could be expanded over time to cover additional areas and continue to improve market access.

The EU would remove tariffs on all US industrial goods and provide preferential market access for a wide range of US seafood and agricultural goods, including soyabean oil, planting seeds, processed foods, tree

nuts, dairy products, fresh and processed fruits and vegetables, and pork and bison meat, Reuters wrote on 21 August.

Almost all EU goods entering the USA from 1 September would be subject to a 15% baseline tariff.

The deal also included updated tariffs on cars, pharmaceuticals and semiconductors, and other sectors.

In addition, the EU said it would work to address the concerns of US producers regarding the EU Deforestation Law (EUDR) to avoid undue impact on trade, as production in the USA posed “negligible risk” to global deforestation, the report said.

Copa Cogeca said the deal “grants improved market access for US agri-food products, while EU producers are left facing higher tariffs on key export products”.

“This one-sided outcome is not only unjustified – it is deeply damaging to a sector already under pressure from rising costs, regulatory constraints and increasing global competition,” a 22 August Agriland report quoted the agricultural group as saying.

“Competitor countries, for example Australia and Argentina, will continue to benefit from lower 10% tariffs, meaning EU producers are now at an even greater disadvantage in a key market.”

US multinational food company Kraft Heinz announced plans on 2 September to split into two separate companies – one focused on sauces and spreads and the other on grocery staples and ready-to-eat meals.

The move was aimed at maximising the company’s capabilities and brands while reducing complexity, Kraft Heinz said.

Formed by the merger of Kraft Foods Group and the HJ Heinz Company in 2015, Kraft Heinz’s portfolio includes leading brands such as Heinz ketchup and Philadelphia cream cheese.

According to Britannica Money, the company’s portfolio of more than 200 brands are produced and sold in more than 40 countries. Its main product categories can

be broken down into five segments:

• Condiments and sauces

• Cheese and dairy products

• Meals, snacks and meat products

• Drinks

• Other grocery items

Many Kraft Heinz products contain oils and fats, either as core ingredients or for texture, flavour and shelf stability. These products include cheese and dairy-based products; condiments, sauces and dressings; plantbased brands; and snacks and meals kits.

Kraft Heinz products can include vegetable oils, cocoa butter, dairy fats and emulsifiers derived from oils and fats.

Kraft Heinz said the two new companies,

whose names would be decided at a later date, would temporarily be called Global Taste Elevation Co and North American Grocery Co.

Global Taste Elevation Co would include a range of brands including, Heinz, Philadelphia and Kraft Mac & Cheese – with approximately 75% of its net sales from sauces, spreads and seasonings. North American Grocery Co’s portfolio would include the Oscar Mayer, Kraft Singles and Lunchables brands.

“By separating into two companies, we can allocate the right level of attention and resources to unlock the potential of each brand,” said Miguel Patricio, executive chair of the Kraft Heinz board.

Swiss conglomerate Nestlé has developed a new process to increase cocoa yields amid a global cocoa crisis.

Cocoa futures prices peaked above US$12,000/tonne in December 2024, more than quadruple the levels seen in previous years, according to the IG online trading platform. Cocoa butter prices also peaked that month at $14,300/tonne, a 137% surge compared to US$6,044/ tonne the previous year, a Claight Corporation 28 July market report said.

The April IG report said West Africa – particularly Ivory Coast and Ghana – accounted for around 60% of global cocoa production and these regions faced droughts and erratic rainfall last year, hitting yields and exacerbating the spread of diseases like the cacao swollen shoot virus. Smuggling and underinvestment in ageing plantations further reduced output,

while hedge funds and other investors engaged in aggressive trading, contributing to price volatility. While cocoa prices had fallen close to 30% from their peak, they remained significantly elevated.

Against this background, Nestlé announced on 20 August that it had

patented a new technique that utilised up to 30% more cocoa fruit by processing previously unused cocoa pulp, placenta and pod husk, as well as the traditional cocoa beans.

With soaring cocoa butter prices, some companies had also been redeveloping their white chocolate brands, Food Navigator wrote on 20 August.

For example, all cocoa butter was removed from McVities’ white chocolate digestives in March and replaced with palm, shea and sal oils.

As UK legislation required that chocolate must contain a minimum of 20% cocoa butter, McVities’ owner Pladis removed the word “chocolate” from its packaging.

Palm and shea fats was also used to make the white coating on Nestlé’s Kit Kat Chunky White, the report said.

The Chinese government announced provisional 75.8% anti-dumping duties on Canadian canola seed imports effective from 14 August, World Grain reported on 13 August.

Canola is Canada’s second largest crop by planted area, covering 8.5Mha/year, and the country's highest value field crop, earning US$12.9bn in farm cash receipts in 2024, according to the government.

China is Canada's largest export market for canola seed, representing 67% of total canola seed exports, totalling 5.9M tonnes in 2024 and worth approximately US$4bn, according to World Grain.

China’s move was the latest step in a trade dispute which began with Canada’s

imposition of tariffs on Chinese electric vehicle imports in August 2024, the report said. On 8 March, the Chinese government announced new tariffs on several Canadian agricultural products, with canola oil and canola meal targeted with tariffs of 100%.

Canada also imposed tariffs on Chinese steel and aluminium.

China’s Ministry of Commerce said its anti-dumping probe launched in September 2024 had found that Canada’s agricultural sector, particularly the canola industry, had benefited from substantial government subsidies and preferential policies.

The Canola Council of Canada and Canadian Canola Growers Association said China's ruling would create uncertainty

and volatility in the global marketplace and have an immediate and substantive impact on farmers’ marketing opportunities for the 2025 canola crop.

With Canada looking to redirect exports to the EU, its shipments to the bloc could face a certification bottleneck, according to a 3 September report by commodity platform Vesper.

The constraint was due to certification requirements that restricted Canadian canola exports to biodiesel applications only within the EU market, Vesper wrote.

As not all Canadian canola carried the necessary certification for this specific use, this had created a significant bottleneck for exporters, the report said.

UK: The Trade Remedies Authority (TRA) has proposed introducing anti-dumping duties on Chinese imports of fatty acid methyl esters (FAME) and hydrotreated vegetable oils (HVO) following its investigation into biodiesel shipments from the country.

The TRA – the UK’s independent body that investigates whether trade remedy measures are needed to counter unfair import practices – launched a probe in June 2024 following an application by the Renewable Transport Fuels Association (RTFA) on behalf of UK biodiesel producers.

Products covered in the TRA probe included were FAME and HVO used pure or blended and commonly supplied for use as road transport fuel in the UK.

The TRA’s Statement of Essential Facts on 22 August found that Chinese biodiesel was being dumped in the UK at unfairly low prices, causing material injury to UK producers, and recommended anti-dumping measures, including duties of:

• 15.68% for the Zhuoyue Group and non-sampled co-operating exporters

• 54.64% for all other exporters

The TRA has invited comments by 22 September before making a final recommendation.

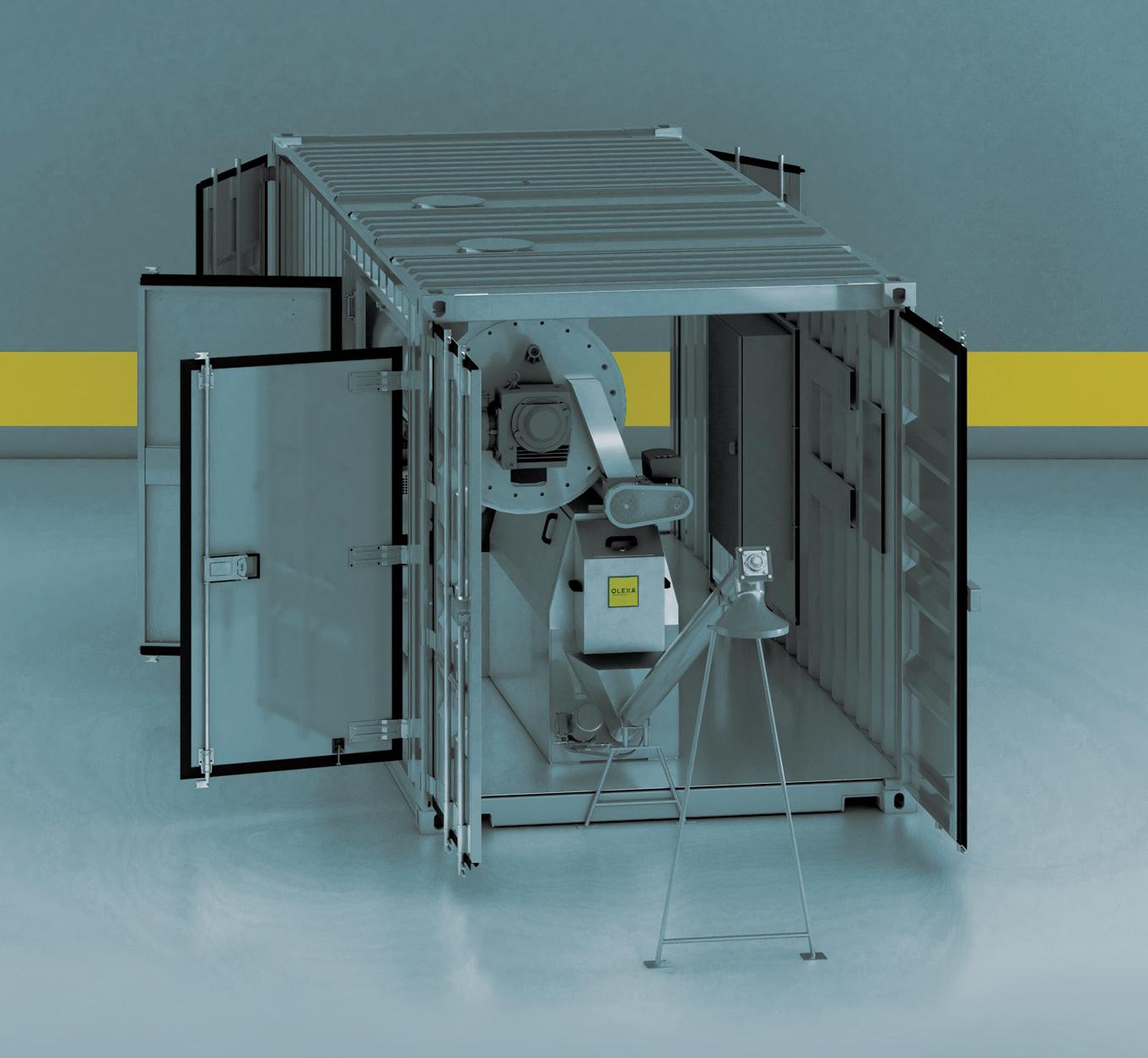

Global oil giant Shell has halted the construction of its planned 820,000 tonnes/year biofuels plant in Rotterdam, the Netherlands.

Given the go-ahead by Shell in September 2021, construction at the Shell Energy and Chemicals Park in Rotterdam began in 2022 but was paused last July to “address project delivery and ensure future competitiveness given current market conditions”.

About half of the biofuels from the Rotterdam plant was expected to be used for sustainable aviation fuel (SAF) produced from used cooking oil (UCO) and animal fat, The Guardian worte on 4 September.

In its latest decision on 3 September, Shell subsidiary Shell Nederland said it had decided not to restart building at the site following an in-depth commercial and technical evaluation to

reassess the project’s competitiveness.

“As we evaluated market dynamics and the cost of completion, it became clear that the project would be insufficiently competitive to meet our customers’ need for affordable, low carbon products,” Shell’s downstream, renewables and energy solutions president Machteld de Haan said.

Shell’s move follows Finnish forestry/paper mill company UPM’s announcement in May to halt plans for the development of a biofuels refinery at the Port of Rotterdam due to “technical, commercial and strategic evaluations” (see p37).

De Haan said that despite Shell’s decision, the company was still “one of the world’s largest traders and suppliers of biofuels, including SAF”. In 2024, Shell was one of the world’s largest traders and suppliers of SAF, with close to 20% of total sales in North America and Europe, she added.

The World Trade Organization (WTO) dispute panel has backed several of Indonesia’s claims against the EU in a 22 August ruling on Indonesia’s biodiesel exports to the bloc.

The WTO decision followed a 2023 complaint by Indonesia contending that EU duties against Indonesian biodiesel imports broke WTO rules, Reuters wrote on 25 August.

The WTO panel had assessed that Indonesia’s export duty and export levy on palm oil could not be categorised as a subsidy, and that the European Commission (EC) had failed to prove a threat of material harm to European biodiesel producers, a 25 August The Edge Malaysia report cited the Indonesian trade ministry as saying.

Indonesian Palm Oil Association (GAPKI) chairman Eddy Martono said the EU’s ‘threat of injury’ claim was based on assumptions rather than evidence. “Without proving real harm, the EU had no valid reason to impose duties.”

The EC imposed provisional countervailing duties of 8%–18% on Indonesian biodiesel in 2019 following a probe initiated in December 2018 into Indonesian biodiesel imports. This resulted in Indonesia’s exports of palm oil-based biodiesel to the EU plunging from 1.32M kilolitres in 2019 to 27,000 kilolitres in 2024, according to Reuters

The European Commission (EC) has found no evidence of fraud involving biodiesel imports from China but has identified some systemic weaknesses in the way certification audits are conducted, the EU Directorate-General for Energy said on the EU’s official website on 18 July.

The EC launched an investigation into alleged fraud after obtaining a notification from the German authorities in March 2023 of alleged fraud in imports of biodiesel from China.

In cooperation with the German authorities, the EC collected input from stakehold-

ers and reviewed audit reports from the voluntary certification scheme that certified the economic operators concerned.

Commenting on the EC’s decision, Germany’s Union for the Promotion of Oil and Protein Plants (UFOP) said the EC “could and must exert more pressure on the approved certification systems to ensure that, as part of the annual re-certification process in the supply chain, initial collectors, waste oil collectors, raw material processors and, in particular, biofuel producers are subject to stricter certification requirements”.

To tackle the risk of fraud in the biofuels

market, the EC said it would be taking a range of actions, particularly in areas where the Implementing Regulation on sustainability certification (EU/2022/996) could be strengthened.

A working group with EU countries had been set up under the Committee on the Sustainability of Biofuels, Bioliquids and Biomass Fuels to look into a revision of the legal text, planned to be finalised in early 2026. In addition, the EC said it was in talks with EU countries on a timeline for the full mandatory deployment of the EU Union Database for Biofuels.

Consumer goods giant Unilever is using biomethane from palm oil mill effluent (POME) to provide power at its palm oil refinery in Indonesia.

Unilever said on 21 August that in its bid to make its palm oil supply chain more transparent and traceable, it was working directly with producers and mills to bring much of its palm oil refining in-house, bypassing traditional intermediaries.

As part of that drive, the company had expanded Unilever Oleochemical Indonesia (UOI), its palm oil processing facility in Sei Mangkei, North Sumatra.

WORLD: The global bioplastics market is forecast to surge from US$6.3bn in 2025 to US$15.6bn by 2035, according to new research by Future Markets Insights (FMI).

With a compound annual growth rate (CAGR) of 9.5%, the increase would be driven by global environmental priorities, regulatory changes such as the EU Single-Use Plastics Directive and rising demand for sustainable materials across industries, FMI said on a 19 August blog.

Bio-based biodegradable plastics were becoming more affordable due to increased investment in R&D and scaled production capacities, with large companies choosing bio-based polymers made from renewable resources, such as sugarcane and vegetable oils, the report said.

However, the facility became Unilever’s largest greenhouse gas (GHG) emitting site following the expansion.

To meet its target of reducing the company’s global Scope 1 and 2 emissions by 100% by 2030 (compared to 2015), Unilever said it had taken steps to shift towards thermal renewable energy and had started replacing the natural gas used at UOI with POME-based biomethane, sourced from two nearby mills.

The compressed biomethane (bioCNG) was transported by Asian biogas provider KIS Group.

Unilever said it would be expanding its partnership with KIS to a third mill by the end of 2025 and had plans in place to source biomethane from six additional mills over the next two years.

The company said it expected to source over 800,000 MMBtu/annum of biomethane at UOI, to meet almost a quarter of its energy needs by 2030.

There are sufficient POME supplies in Indonesia to produce biomethane equivalent to over 5% of Indonesia’s natural gas consumption in 2024, according to a 2021 report, ‘Biomethane Utilisation from POME’.

Estonian biotech start-up ÄIO has secured US$1.17M in public funding to develop fermentation-derived lipids for personal care products.

The funding would support a three-year research and development (R&D) project focused on microbial fermentation-derived lipids and their derivatives, specifically for use in cosmetic and personal care ingredients, the company said on 22 July.

Using specialised yeast fermentation, ÄIO utilises locally available by-products and side streams from the food, agricultural and wood industry to produce ingredients rich in omega-3 fatty acids, antioxidants and pigments.

“Our aim is to reduce the use of palm and coconut oil, mineral oils and substitute animal-based lipid products,” the company said.

“The grant’s timing aligns

perfectly with major regulatory shifts, particularly the EU’s deforestation regulation that will significantly impact palm oil sourcing.”

ÄIO said its ingredients were suitable for use in a range of cosmetics applications, from soap to facial moisturisers and serums, and makeup formulations with specialised pigments.

At the time of the report, the company said it was in discussion with cosmetics manufacturers and aimed to secure additional funding by the third quarter of 2026 to support the company’s expansion.

According to the company, the alternative fats market is “projected to grow by 6% annually, reaching US$4.5bn by 2032”.

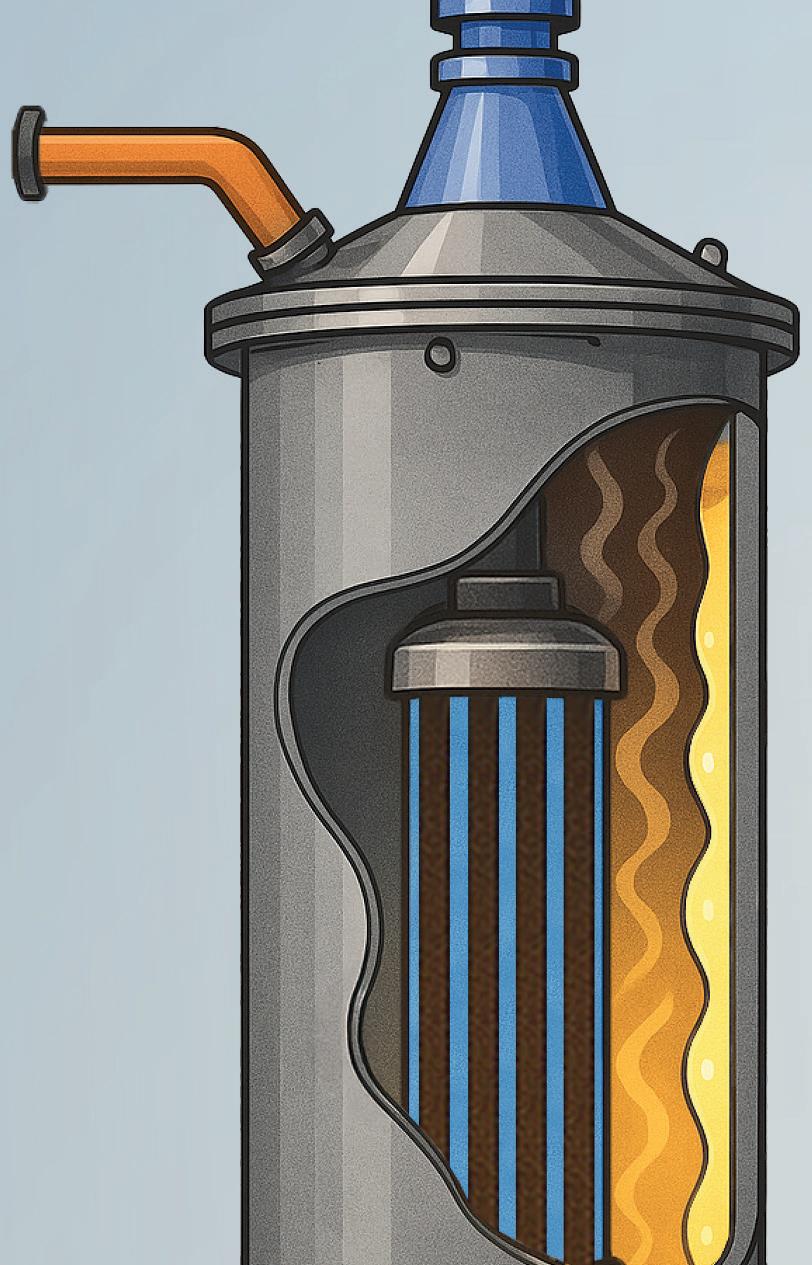

A research team at Aston University, UK, have developed a process to make renewable hydrogen and propane from glycerol.

Glycerol or glycerine is produced mainly from fats and oils via hydrolysis in traditional soap-making, or transesterification for biodiesel production, and is often used in health and beauty products.

The HYDROGAS project explored glycerol’s potential as a raw material to make hydrogen and propane, led by Dr Jude Onwudili from Aston University’s Energy

and Bioproducts Research Institute.

With crude glycerol from biodiesel production plants available in large volumes and at low cost, the research could benefit the environment and reduce reliance on fuel imports, Dr Onwudili said.

Although previous studies had shown that hydrogen could react with glycerol to produce propane, the use of external hydrogen could be expensive, the research team said. However, HYDROGAS’s method involved using some of the glycerol itself to

produce the hydrogen needed to transform glycerol into bio-propane.

The first aim of developing a process to generate sufficient hydrogen to convert glycerol to biopropane was successful and its second objective of obtaining high yields of biopropane was still being investigated.

“We discovered that second-stage reactions can work in different conditions to those that make the hydrogen, so will explore this alternative route,” Dr Onwudili added.

oilRoq GmbH is a highly specialized engineering company with an experience of 40 years. We design and deliver enre process plants in oleochemical, food, edible oil and fat modificaon industry like:

Interesficaon oilRoq GmbH—Willy-Brandt-Str. 59—D 06110 Halle/Saale—Germany—Phone:

www.oilRoq.eu

Globally Preferred Bleaching Earths

UKRAINE: Kernel Holding’s trans-shipment volumes rose 36% from 6.7M tonnes last year to 9.13M tonnes in 2025 despite stable export volumes, World Grain wrote on 5 August.

“The overall growth in trans-shipment volumes was driven by higher edible oil exports handled through the group’s vegetable oil trans-shipment terminal, which became operational in January 2024, as well as by increased volumes transshipped for third parties,” the company said.

Kernel processed 952,000 tonnes of oilseeds in the fourth quarter, flat year-on-year but a 13% increase from the third quarter, driven by a surge in farmers selling previously withheld inventories.

The processed volume included 852,000 tonnes of sunflowerseeds, 71,000 tonnes of soyabeans and 29,000 tonnes of rapeseed.

Total oilseed processing for 2025 reached 3.5M tonnes, an 8% increase from the previous year.

According to its website, Kernel is Ukraine’s largest producer and exporter of sunflower oil, and a major supplier of agricultural products from the Black Sea region to international markets, accounting for about 8% of the world’s sunflower oil exports.

Global agribusiness giant Louis Dreyfus Company (LDC) has opened a new port terminal in Argentina as part of its overall investment plan to enhance its oilseed and grain operations in the country.

Since acquiring the Santa Elena facility in March, the company said upgrades it had made to the warehouse and port infrastructure included river dredging to support barge loading.

The improvements at the site in Entre Ríos state provided better connectivity, linking grain and oilseed production in Entre Ríos and southern Corrientes to LDC’s crushing plants in Santa Fe, LDC said on 5 August.

Other investments LDC had made to support its grains and oilseeds interests in Argentina included the expansion of its warehouse in Campo

Largo, El Chaco, which had increased the site’s storage capacity from 3,000 to 13,000 tonnes following the addition of two new silos. The warehouse’s connection to the Belgrano Cargas railway would help northern production reach LDC’s ports, the company said.

LDC said its facility in Quimilí, Santiago del Estero, had also been officially authorised to operate as a grains and oilseeds warehouse and now had static storage capacity for up to 50,000 tonnes in silo bags and was set to receive wheat in October, followed by sunflowerseed in December.

In General Paz, Córdoba, a new warehouse with capacity to store 3,000 tonnes of products and direct access to the Belgrano Cargas rail network was scheduled for completion in the first half of 2026, the company said.

Leading US railway companies Union Pacific and Norfolk Southern have agreed a US$85bn deal to merge their networks and create the first US transcontinental railroad.

As a combined company valued at more than US$250bn, the merged Union Pacific company would operate more than 80,467km of track across 43 states from the East Coast to the West Coast, serving around 100 ports, the companies said on 29 July.

The merger would create US$2.75bn in annual synergies and deliver a faster, more comprehensive freight service to US shippers by eliminating interchange delays, opening new routes, expanding intermodal services, and reducing distance and transit time on key rail corridors, the firms said.

Both companies are major grain and soyabean shippers, according to a 25 July World Grain report.

Grain shippers could benefit from the merger, which would provide a single-line service on the US Class I rail network, which was currently divided so that no single railroad reaches from the US East Coast to the West Coast, according to the US Department of Agriculture.

Ukrainian agribusiness the Epicentr Group and the family of Ukrainian MP Anatoliy Urbansky plan to build a grain terminal at Pivdenny Port in the Odessa region with a handling capacity of 5M tonnes/year and total silo storage capacity of 250,000 tonnes, Ukrainian news agency Interfax-Ukraine wrote on 20 August.

The project will cost around US$160MUS$270M, according to Latifundist.com.

Scheduled for completion in 2026, plans included a dedicated railway station with a throughput capacity of up to 3M tonnes/ year, a 2,000 tonnes/hour railcar unloading station and a 1,000 tonnes/hour truck

unloading station, Interfax-Ukraine wrote.

Epicentr Group’s agricultural arm, Epicentr Agro, is one of the largest grain and oilseed producers in Ukraine, according to its website.

Established in 2015 in the Khmelnytskyi region, the company has expanded into regions such as Vinnytsia, Kyiv, and Cherkasy. Its activities include crop cultivation, dairy production, grain storage and seed processing.

The company produces and handles oilseeds such as sunflower and soyabeans, oilseed products, grains like wheat and corn, and niche crops, including sugar beet,

buckwheat and berries.

Its agricultural infrastructure includes 16 grain elevators with a total storage capacity of 1.8M tonnes, 11 dairy farms, a certified seed plant and an agrochemical laboratory.

The company manages over 167,000ha of land across six regions of Ukraine and operates a fleet of over 1,000 vehicles, including 133 grain trucks and 50 oil trucks.

Investments in grain storage have been a core part of Epicentr’s growth strategy, with significant expansions such as the Vapnyarskyi, Wendychanskyi and Shepetivskyi elevators, according to the company.

Dutch bulk storage and handling company HES International has completed the second phase of expansion work at its Port of Gdynia bulk terminal in Poland, World Grain wrote on 28 August.

The grain handling and storage facility at Slaskie Quay now had a total capacity of 240,000 tonnes.

In May, HES Gydnia opened Warehouse No 32 – a flat grain storage facility with a capacity of 64,000 tonnes – and had also commissioned three new grain silos with a combined storage capacity of 21,000 tonnes, World Grain wrote.

Alongside its existing infrastructure, the

expansion had created a fully integrated and automated grain logistics hub on the Gulf of Gdansk serving the Baltic region, Rotterdam, HES International said.

“This investment boosts our grain export storage capacity by 150% and annual grain throughput by up to 1.5M tonnes,” the company said.

HES Gdynia’s new facility features:

• 85,000 tonnes of automated grain intake and dispatch capacity.

• An integrated conveyor system connecting storage, handling and vessel loading.

• Modern truck and railcar loading/discharge points stations.

• Panamax and Capesize vessel handling capability.

HES International operates terminals across 16 sites in Europe, including five at the Port of Rotterdam.

The HES Gdynia Bulk Terminal handles and stores dry bulk cargo such as coal, coke, ore, biomass, fertilisers, cereals and feed, including soyabean meal, according to the Port of Gdynia. In March 2024, the terminal received a record shipment of over 88,000 tonnes of soyabean meal from Santos, Brazil, Dry Cargo International wrote on 13 March that year.

UK-based biodiesel supplier Greenergy has announced a 10-year extension to its lease with the Port of Amsterdam.

Since acquiring the Amsterdam biodiesel plant in 2018, the company said it had made significant investments to convert it to produce waste oils, and most recently, to expand production capacity.

Expansion works completed in 2024 had increased production by 25% and enabled the plant to process a wider range of waste oils, Greenergy said on 14 August.

“Our extended lease agreement with the Port of Amsterdam demonstrates our commitment to the

production of biodiesel in the Netherlands, where there is support for the industry and clear long-term policies for use of biofuels,” said Greenergy CEO Adam Traeger.

Greenergy (pictured) sources used cooking oil (UCO) globally

and converts it to biodiesel.

As well as the Amsterdam plant, the company operates two UK biodiesels – one in Teesside and one in Immingham, on which it has begun a consultation to cease production.

CHINA: The Chinese government could block Hong Kong-based CK Hutchison’s sale of its global port facilities to US-based investor BlackRock and Mediterranean Shipping Company (MSC) unless Chinese state-owned shipping company Cosco is included, FreightWaves wrote, citing a 17 July Wall Street Journal (WSJ) report.

The US$22.8bn sale, announced in March, included two ports at the Panama Canal and over 40 others globally. The move would be made by CK Hutchison selling its 80% share of port terminals through subsidiary Hutchison Port Holdings.

Lavanda Spectrum has acquired the former Olimpex Coupe Grain Terminal in Ukraine’s Port of Odessa and renamed it Lavanda Terminal, World Grain wrote on 15 July.

The acquisition followed efforts by creditors in international and Ukrainian courts to reverse alleged asset stripping by the terminal’s former owners, the report said.

Lavanda said it had assumed physical control of Lavanda Terminal in the week of the report and had appointed Swedish entrepreneur Carl Sturen as CEO.

The acquisition followed the successful enforcement of mortgages granted to Madison Pacific as security trustee under loans that GN Terminal Enterprises (GNT) had received from Argentem Creek Partners (ACP), World Grain wrote.

Ukrainian courts had also reversed sev-

eral allegedly fraudulent transfers through which the former owners of GNT, Sergiy Groza and Volodomyr Naumenko, had sought to strip assets from GNT.

The enforcement followed a multi-level legal battle between Groza and Naumenko and their creditors – ACP and co-lenders Innovatus Capital Partners (ICP). Both long-standing investors in the Ukrainian market, ACP and ICP provided US$95M to finance the terminal, the report said.

In June 2024, a Ukrainian court found that Groza and Naumenko had leased the former Olimpex Coupe and MetalsUkraine terminals to Agiros Ltd, an entity sanctioned by the Ukrainian government and linked to a smuggler for the storage, transshipment and export of “black” grain.

Groza and Naumenko were sentenced to

21 months in prison in October 2024 by an English High Court judge for breaching asset disclosure orders made in connection with a Worldwide Freezing Order obtained by Madison Pacific in January 2023.

In January 2025, the London Court of International Arbitration Tribunal ordered Groza and Naumenko to pay around US$150M in respect of outstanding debts owed to ACP, interest and costs.

Naumenko was also arrested in May 2025 on suspicion of fraud and forgery related to the unexplained disappearance of more than 100,000 tonnes of grain pledged as collateral for the ICP loan.

ACP and ICP said they welcomed the launch of Lavanda Terminal while they continued enforcement action to protect their position.

30 September-1 October 2025

5th International Congress on Mineral Oil Contaminants in Food Berlin, Germany

https://veranstaltungen.gdch.de/ microsite/index.cfm?l=11848&sp_id=2

1-2 October 2025

ICIS World Oleochemicals Conference

The Westin Valencia Valencia, Spain

https://events.icis.com/website/11650/ home/

12-15 October 2025

Euro Fed Lipid Congress and Expo Leipzig, Germany

https://veranstaltungen.gdch.de/ microsite/index.cfm?l=11649&modus=

20-22 October 2025

Argus Biofuels Europe

QEII Centre, London, UK www.argusmedia.com/en/events/ conferences/biofuels-europe-conferenceand-exhibition

21-24 October 2025

North American Renderers Association (NRA) Annual Convention

Ritz Carlton Bacara California, USA https://convention.nara.org

30 October 2025

Grain Academy 2025 Varna, Bulgaria

https://grain-academy.com/

3-5 November 2025

Roundtable Conference on Sustainable Palm Oil (RT2025)

Shangri-La Hotel, Kuala Lumpur, Malaysia https://rt.rspo.org/

6 November 2025

FOSFA Annual Dinner

La Quinta de Jarama, Madrid, Spain www.fosfa.org/news/events/

7-10 November 2025

Internationial Symposium on Lipid Science and Health & AOCS China

Section Joint Congress Wuham, Hubei, China

www.aocs.org/event/internationalsymposium-on-lipid-science-and-healthaocs-china-section-joint-conference/

www.ofimagazine.com

10-12 November 2025

AAOCS - Fats & Oils: Food, Health, Industry & Innovation

Rendezvous Hotel

Melbourne, Victoria Australia

www.aocs.org/event/aaocs-2025-fatsoils-food-health-industry-innovation/

12-14 November 2025

21st Indonesian Palm Oil Conference and 2026 Price Outlook (IPOC 2025)

Bali International Convention Centre

Indonesia www.gapkiconference.org/

13-14 November 2025

11th ICIS Asian Surfactants Conference

Kuala Lumpur, Malaysia https://events.icis.com/website/14105/

18-20 November 2025

MPOB International Palm Oil Congress and Exhibition (PIPOC 2025)

Kuala Lumpur Convention Centre, Malaysia https://pipoc.mpob.gov.my/

24-26 November 2025

Sustainable Aviation Futures Congress

Marina Bay Sands, Singapore https://www.safcongressapac.com/

TONSIL™ your solution for oils, fats, and renewable fuels. Enhance your refining process with state-of-the-art purification and targeted impurity removal, safeguarding your catalyst for advanced protection and optimal efficiency in your operations.

A European Commission (EC) proposal in April 2025 to align Europe’s animal byproduct rules with world standards could signal a new era for the region’s rendering industry.

The aim of the proposal is to bring EU rules more in line with World Organisation for Animal Health (WOAH) standards, putting the region on a level playing field with the rest of the world, according to European Fat Processors and Renderers Association (EFPRA) president Robert Figgener.

Europe’s rendering industry has the strictest regulations in the world, introduced following the region’s bovine spongiform encephalopathy (BSE or ‘mad cow disease’) crisis in the 1990s.

Stringent rendering and animal byproduct regulations were introduced to prevent the spread of transmissible spongiform encephalopathies (TSEs), a group of rare, fatal brain diseases that affect humans and animals caused by abnormal prion proteins that lead to progressive degeneration of the brain and nervous system.

A total ban on meat and bone meal (MBM) in feed for ruminants was introduced in 1994, which was extended in 2001 to feed for all farmed animals.

‘Species-to-species’ recycling was prohibited, such as feeding pigs with porcine-derived proteins.

Fish meal was only allowed for nonruminants under strict conditions.

In 2002, the Animal By-Products Regulation (EC) No 1774/2002 was also introduced – now replaced by Regulation

(EC) No 1069/2009 – classifying animal by-products into three risk categories:

Category 1: Highest risk materials –including specified risk materials (SRMs) such as the brain, spinal cord, eyes, tonsils and intestines of ruminants (animals with four-chambered stomachs such as cows, goats and sheep). This category includes fallen stock or animals that die on farm which have not been slaughtered for human consumption which are suspected of being infected with TSEs or includes SRMs.

Category 2: Medium risk materials –including manure, digestive tract contents; and fallen stock. These materials must be sterilised if processed and can be used in biogas plants or technical products – such as oleochemicals, biodiesel and fertilisers – but not for feed.

Category 3: Lowest risk materials – parts of animals fit for human consumption but not used, such as hides, hooves, feathers and some offal; former foodstuffs no longer for human consumption; and byproducts from healthy slaughtered animals like bones and skins.

fertilisers; and technical products such as oleochemicals, biodiesel and cosmetics.

Dr Francisco Reviriego Gordejo, head of animal health at the European Commission’s Directorate-General for Health and Food Safety (DG SANTE) told the annual EFPRA Congress in June that classical BSE associated with contaminated animal feed had not been identified in Europe recently, although atypical BSE not linked to feed contamination was still detected occasionally.

Figgener said that the most remarkable part of the EC’s proposal was that in countries with ‘negligible BSE risk status’, “no tissues shall be considered as SRM any more”.

“By deciding that there is no longer any need to remove SRM, we would finally acknowledge the practical absence of BSE in Europe and, as a consequence, the practical absence of the respective risk. And if there is practically no risk, why would we any longer need the strictest precautions in the world?”

“The envisaged alignment with WOAH rules will have a significant impact on operations and markets for our industry.

A European Commission proposal to eliminate overly rigid EU animal by-product rules to align more closely with global standards could pave the way for Europe to use and export more processed proteins in different feed categories Serena Lim u

These materials can be used in pet food and PAP for non-ruminant feed;

“It seems that – many years after the BSE crisis – a new era is dawning.

This is the moment to think the so far unthinkable and to get aligned with the world standards.

“Let’s allow more circularity in the use of our animal by-products, also in Europe.”

Figgener said it was time for Europe to allow the use of ruminant PAPs in animal feed (except for cattle) and aquaculture, like the rest of the world.

“These valuable proteins are currently limited to serving as a sustainable protein source in animal farming and aquaculture in third countries only.”

Lifting the ban would be a signal to countries, like Vietnam, not to mistrust the product.

Vietnam has ranked among the top 10 feed-producing countries in the world in recent years, according to the Alltech Global Feed Survey.

Figgener said that, unlike the rest of the world, Category 2 meals are not allowed for feed use in the EU.

He said the EC should consider a relaxation of the export rules for these valuable proteins.

“These pressure-sterilised meals meet the highest biosecurity standards worldwide. That is why their export should not only be allowed as fertiliser but for all legal purposes in the country of destination, including the use as feed.”

Figgener said that if the EU does not export these meals, feed producers outside of Europe might instead choose genetically modified soyabean meal (which is not allowed in the EU); proteins from animals that receive growth promoters and hormones; or non-sustainably sourced fish meal.

“We should not forget that 70% of the farmed fish consumed in Europe is imported – most probably fed with similar types of meals like Category 2 meals, but sourced from countries outside of Europe. And we have no problem in eating these fish.”

This issue would be even more important in the future as, under a new SRM regime, significantly higher volumes of category 2 meals would be available on the market, due to the shift of fallen stock from category 1 towards category 2.

Another area the EU should examine is over intraspecies recycling – the feeding of animal by-products from one species back to the same species, Figgener told the EFPRA congress.

“While we finally feed pork PAP to poultry, and poultry PAP to pork [in 2021], intraspecies recycling is still not allowed

in Europe. In fact, intraspecies recycling is totally in line with the natural behaviour of these animals and the amino acid profile of these proteins perfectly matches the need of the animals and leads to better health.”

Figgener said Europe was the only region in the world ignoring these facts.

All countries around the world ban ruminant-to-ruminant feed. However, countries such as the USA, Canada, Australia, New Zealand and Brazil allow poultry-to-poultry and pig-to-pig feed.

Dr Gordejo of DG SANTE said that the EU TSE regulatory framework had been a

huge success in eliminating BSE in Europe and the risk was now negligible in most EU member states.

“We have a regulatory framework that is stricter than the rest of the world.”

The EC was aiming to eliminate outdated or overly rigid provisions in its review of TSE Regulation (EC) No 999/2001, which lays down rules for the prevention, control and eradication of TSEs in animals.

The goal was to preserve animal and human health and ensure a risk-based approach to BSE management, while implementing proportionate, science-based measures, and align with international

The EU’s three-category risk system is specific to the region and is not used elsewhere in the world.

In the USA, for example, rendering is regulated by the Food and Drug Administration (FDA) for feed and food safety, and by the US Department of Agriculture (USDA) for animal health and meat inspection. The country distinguishes between:

• Edible rendering (for food production)

• Inedible rendering (for uses such as animal feed, pet food and biofuels)

Certain high-risk materials, such as SRMs in cattle over 30 months old, are excluded from feed use but are not placed into numbered categories.

Global standards

The WOAH (formerly the OIE – World Organisation for Animal Health) does not regulate rendering directly, but provides international standards and guidelines related to animal by-products, animal disease prevention and safe trade. While WOAH issues guidance, it is up to individual countries to incorporate WOAH standards into national laws. WOAH guidelines intersect with rendering in several key areas:

Risk mitigation for transmissible diseases

The WOAH Terrestrial Animal Health Code specifies that SRMs must be removed, segregated and destroyed, often by incineration or high-temperature rendering. Rendering alone is not considered sufficient to inactivate the prions agents of BSE. Countries must demonstrate:

• Effective SRM controls.

• Surveillance and traceability.

• Controls on feeding animal protein to ruminants.

Inactivation of pathogens during processing

• WOAH recommends that rendering (or alternative treatments) must effectively inactivate pathogens of concern.

• Heat treatment is key: Typically: 133°C for 20 minutes at 3 bar pressure (known as ‘Method 1’ in EU rules).

Use of animal by-products in feed

• The WOAH warns against feeding ruminant-derived protein to ruminants, due to BSE risk.

• For non-ruminants such as pigs, poultry and fish, the use of rendered material is allowed if the material is from healthy animals, properly processed and is traceable and not contaminated.

Safe trade of rendered products

• WOAH provides sanitary measures for international trade in products like MBMs and tallow.

• Countries exporting such materials must certify the absence of SRMs, ensure materials are heat-treated and processed safely, and meet BSE risk status requirements.

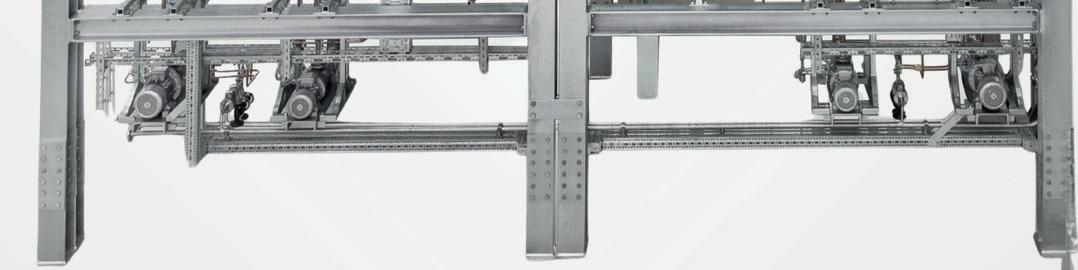

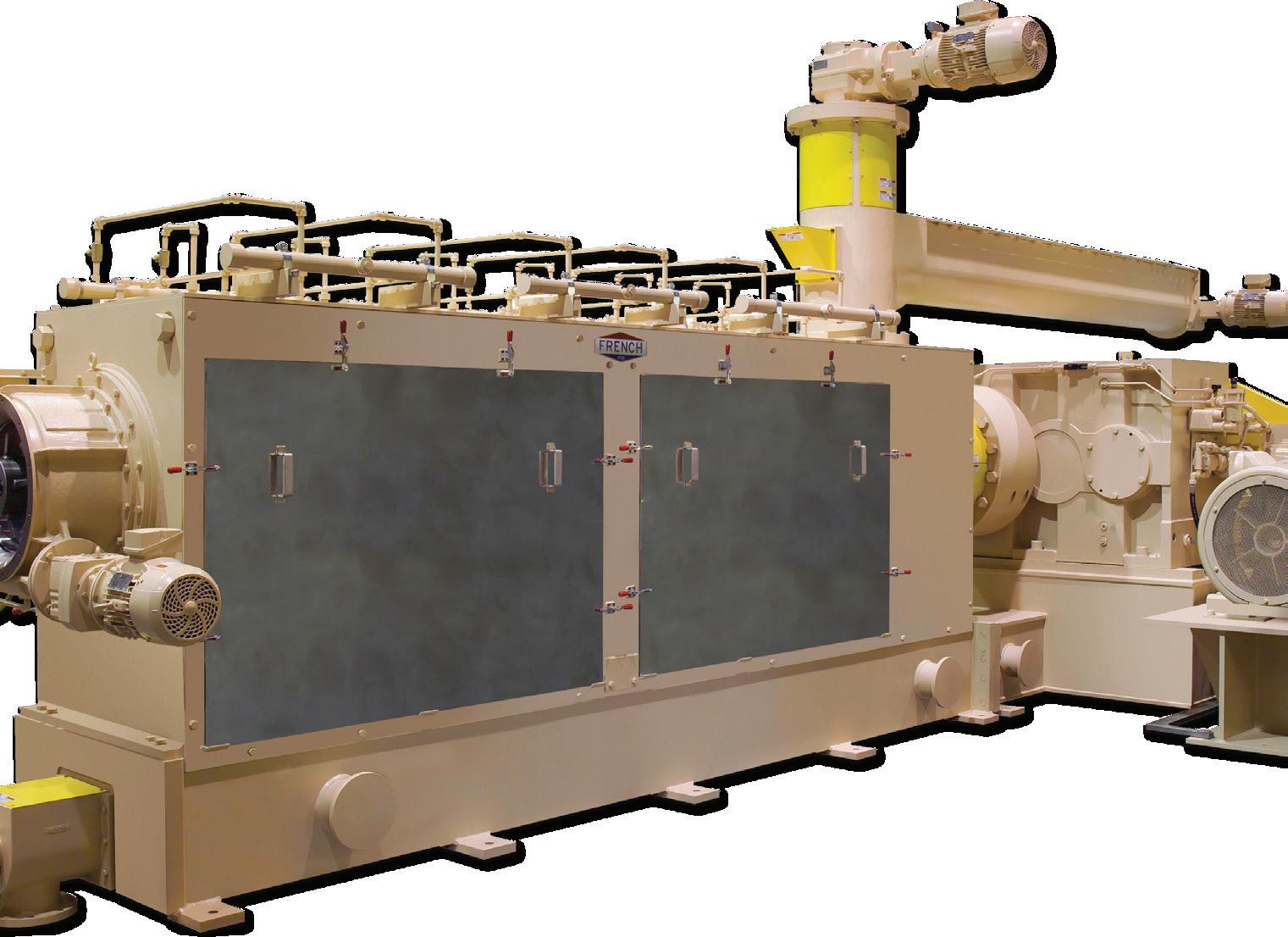

Continuous Rendering Systems

Cookers and Dryers

Screw Presses

Decanters and Centrifuges

Size Reduction Equipment

Process Control Systems

Material Handling Equipment

Total Service and Support

• Optimized fat and meal production

The high product quality specifications you require, and the flexibility to adjust to changing demands.

• Dramatically reduced downtime

Unsurpassed reliability backed up by the rapid response of the largest field service team and parts inventory in the industry

• Complete systems integration

Every type of major equipment — including horizontal bowl decanters and disc-type vertical centrifuges — as well as unsurpassed engineering expertise in creating better ways to recycle protein by-products into profitable fats and meals.

standards in the areas of risk-based surveillance, removing trade restrictions for certain commodities, updating the BSE risk determination status, and updating the list of SRMs for removal.

Any revision to the EU regulation should be scientifically sound, proportionate to the risk, and practically enforceable – there would not just be automatic alignment, Dr Gordejo said.

Practical steps in place included working groups discussions with member states on what to update and how, regular exchanges with other stakeholders; and scientific opinions from the European Food Safety Agency (EFSA) to strengthen legislative updates.

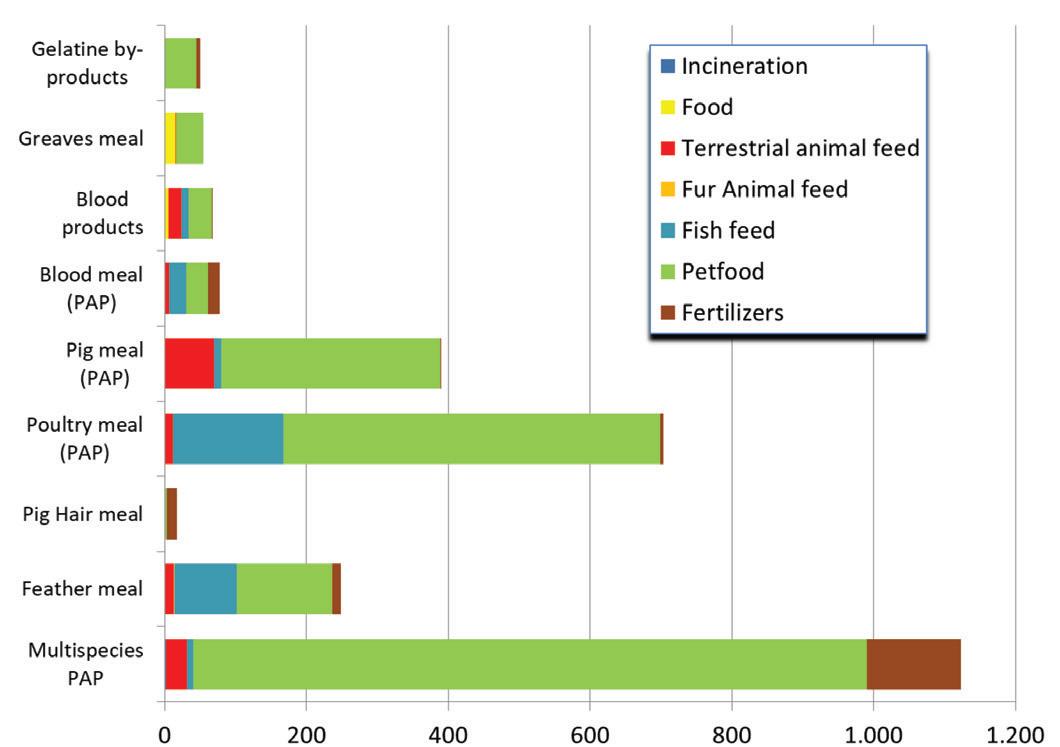

Dirk Dobbelaere, secretary general of EFPRA, looked at the production and use of rendered products among the association’s members, which process around 17M tonnes of raw material into

2.7M tonnes of animal fat and nearly 3.7M tonnes of animal proteins in Europe.

EFPRA’s 30 members have 446 different lines (from food to category 1) in 251 processing plants and 236 collection plants in 22 European countries.

Dobbelaere said the processing of animal by-products in Europe remained stable overall in 2024, with Category 1 and 2 processing falling 18%, and category 3 and edible fats processing rising by 6%.

The majority of the Category 1 (3.2M tonnes) and Category 2 (0.7M tonnes) of material products was combusted last year (752,000 tonnes of MBM and 18,000 tonnes of fat).

The next highest usage was in biodiesel, totalling 391,000 tonnes in 2024 compared with 440,000 tonnes in 2023. Category 1, 2 and 3 biofuels usage remained stable at 1.45M tonnes last year (see Figure 1, above) compared with 1.46M tonnes in 2023.

The 2024 production of Category 3 materials and edible fats was 2.28M tonnes (a rise of 6% compared with 2023), with the majority going into biodiesel (more than 1M tonnes), followed by terrestrial animal feed (over 400,000 tonnes), oleochemicals and pet food (see Figure 2, below left).

Dobbelaere said all fat markets were up in 2024: oleochemical usage rising by 9% compared with 2023, feed up by 5%, pet food higher by 7%, and fish feed rising by 136%.

Dirk

In the protein sector. 2.74M tonnes of PAP and food grade protein was produced in 2024, a rise of 3% against 2023, with large markets in fertiliser and pet food.

The largest proportion of protein (roughly 75% or 2.07M tonnes) went into pet food (see Figure 3, below), followed by the aqua feed sector (296,000 tonnes), which rose by 60% in 2024.

EFPRA members exported 30% of the PAPs they produced last year, while fat exports nearly tripled from 3% to 8%.

In 2024, biodiesel was the largest market for food and feed grade fats, with a 46% market share and the sector rising by 4% against 2023. Pet food use rose by 7% but 33,000 tonnes of food and feed grade fats was still combusted last year, a rise of 29%.

Meanwhile, although animal fats and other category materials are eligible to be sustainable aviation fuel (SAF) feedstocks under the ReFuel EU Aviation regulation that came into force on 1 January, “this market has not really taken off for the time being”, according to Figgener.

As for the reason why, he told OFI “we can only speculate or report what the market says – too much imports and too low biofuel inclusion targets for aviation”. ●

Serena Lim is the editor of Oils & Fats International (OFI)

While satellite technology and AI are valuable tools in complying with sustainable standards, they must be backed with high-quality data and experts on the ground who understand the specific commodity and its local cultural, legislative and supply chain context Priscillia Moulin

The push for supply chain sustainability in edible oils has entered a new era, with satellite monitoring and AI driving much of the progress in transparency and traceability across palm oil and soyabeans. While tech platforms are extremely useful tools, they are no silver bullet, and organisations that rely too heavily on them for compliance or to support their own sustainability goals face real risks.

It is important to recognise the tremendous value that technology provides, and the positive forces driving adoption of satellite monitoring and AI in palm oil and soyabean supply chains.

Consumers are demanding deforestation-free and sustainable products, and organisations across the

supply chain are making No Deforestation, No Peat, and No Exploitation (NDPE) commitments.

Legislation like the EU Deforestation Regulation (EUDR) is pushing companies from voluntary commitments to mandatory standards.

Although deforestation is still happening across the world, there has been a lot of progress. In palm oil, the broad trends over the past decade on deforestation and sustainability in Southeast Asia have been positive, with deforestation levels slowing down significantly in Malaysia and Indonesia. In Brazil, deforestation in the Amazon fell 50% in 2023 compared to the previous year.

Satellite data platforms, in particular, are empowering businesses and NGOs to track deforestation in near real-time, giving them greater visibility and control than ever before.

However, there is a lot that technology alone cannot do, despite the claims of the growing number of tech platform providers.

The promise that many satellite data and AI platforms are making is that anyone can now track forest loss in the palm and soya landscapes of Southeast Asia and South America from a desk. They can monitor everything from carbon emissions and land change to biodiversity loss and wildfires without ever visiting the areas in question. While companies such as MosaiX offer a tech platform and

recognises its potential, the idea that any platform can do all the above is a pipe dream. An over-reliance on these tools, especially for complex forest risk oil crops like palm and soyabean, comes with critical limitations and serious risks.

Technology platforms and AI insights are only as good as the data they use, and this is the first big issue.

Sourcing high-quality, accurate data for high-risk deforestation areas is notoriously difficult. Many platforms depend on open-source and government data, which can be inaccurate, out of date, and fragmented.

Critical information regarding land tenure, intricate supply chain relationships, and verified corporate ownership is often of particularly poor quality. Then there is governmental reluctance or legislative restrictions on the sharing of essential geospatial data in cases in Malaysia and Indonesia.

In May 2019, for example, the Indonesian government issued a letter advising members of the country’s palm oil industry not to share plantation data with external parties, including NGOs, consultants and foreign agencies. While cultivation land titles (Hak Guna Usaha - HGU) are sometimes made available, the data is often fragmented and not combined with actionable information.

In both Indonesia and Malaysia, obtaining concession maps typically

requires going through multiple government agencies, securing various approvals and, in many cases, paying significant fees. Access to such data is neither straightforward nor affordable.

One Indonesian company MosaiX previously worked with had published its concession maps online to demonstrate transparency. However, the company later received an official letter from the government instructing it to remove the maps from its website.

Put poor data in, and you will inevitably get poor insights out. An AI-powered satellite data platform may be able to alert a customer to every single bit of deforestation in an area, but if the customer does not know if it’s on land that’s relevant to its supply chain, it has no real value in terms of compliance.

The result is that users often get an illusion of supply chain visibility, not the real picture, making it impossible to draw meaningful insights or take meaningful action.

In addition to data deficits, there is also the ‘interpretation gap’. Even when all the satellite data is correct, and land plotting is accurate, raw data cannot provide a full picture of what is happening on the ground.

An alert for tree cover loss does not tell a company who was responsible, or what caused the deforestation, and whether it was deforestation intentionally conducted by a supplier, or an illegal encroachment.

To draw accurate conclusions, that data must be filtered through a complex web of local context, including social dynamics, customary land rights and specific legal frameworks.

No tech platform can do this. It requires experts on the ground who understand the specific commodity and regional cultural and legislative landscape to verify and contextualise the data.

There is no one-size-fits-all solution when it comes to deforestation and sustainability issues in oil crops.

Different commodities and regions of the world require different approaches. Palm oil and soyabeans are great examples –the regional differences, certification challenges and level of supply chain transparency are completely different.

Tackling deforestation and social sustainability issues in Indonesia for palm oil is completely different to addressing issues with palm oil in Nigeria, and a world away from stopping deforestation and protecting indigenous rights in

Priscillia Moulin:

“The true value of tech platforms depends on who is using them and how”

the Amazon. Each different region and commodity varies massively in terms of data quality, cultural norms, local legislation and supply chain models. Tech platforms simply cannot filter data through all the necessary lenses.

Assuming a company receives a perfectly accurate deforestation alert, the next move is knowing what to do with it. Many companies come to MosaiX because they have lots of information but struggle to turn it into meaningful action on the ground. A technology platform is not going to call the right decision-maker at an oil palm plantation in Malaysia to help stop deforestation.

Failing to respond effectively can mean that destructive practices continue unchecked, causing environmental and reputational damage. The other side of the coin is reacting to false alerts. Acting on misinterpreted data risks the unnecessary exclusion of a supplier, potentially damaging livelihoods, disrupting supply chains and severing valuable relationships.

To intervene effectively, a company needs more than an alert – it needs relationships, expertise and a deep understanding of how to engage constructively with suppliers in the relevant regions.

Regulations like the EUDR, the Corporate Sustainability Due Diligence Directive (CSDDD) and the Corporate Sustainability Reporting Directive (CSRD) are changing the legislative landscape. The need for accurate data and due diligence has

never been greater. Under the EUDR, businesses must provide verifiable proof that relevant oil commodities (palm and soyabean oils) are deforestation-free, backed by precise geolocation data.

The right technology platforms make compliance much easier, gathering and providing all the data needed from a centralised system. However, superficial reliance on technology and automated assessments is not sufficient for compliance – companies need traceable, defensible data and auditable processes to back them up.

The risk here is the illusion of compliance, creating a false sense of security for organisations that depend entirely on tech. They may be answering all the questions and providing the data needed but should this be audited or examined in any detail by activists or NGOs, the illusion will invariably be exposed.

This does not just mean consequences in terms of non-compliance, like fines or exclusion from trading – it also means reputational damage that can affect consumer perceptions of products, and cause backlash from investors. This is a real risk for the growing number of businesses peppering sustainability policies with phrases like “AI-powered” and “satellite-monitored”.

When these claims are not backed by robust processes, deep expertise or genuine accountability, companies risk accusations of greenwashing, or perhaps “tech-washing”, should the reality of their due diligence be exposed.

The true value of satellite technology and AI depends entirely on who is using them and how. To be effective, technology must be integrated thoughtfully with human expertise.

Businesses should use technology to help with compliance and to support their own sustainability goals. The message is that they need to have the right people in place – both in-house and at their technology provider.

The best practice is to choose those that have real expertise in the relevant commodities they use, and their technology is backed by accurate land data and local teams on the ground in those regions.

Priscillia Moulin is the co-founder and director of strategy at MosaiX, a Netherlands-based company that provides data-driven, real-world solutions for sustainability, compliance and responsible sourcing, and its own NDPE and EUDR compliance platforms

●

MOSH & MOAH Removal by

VTA & UIC are leading German companies specialized in thermal separation processes such as Short Path Distillation (SPD)

SPD can be used to remove MOSH and MOAH, along with other contaminants, from various edible oils

Short Path Distillation is a continuous high-vacuum distillation process

With successfully commissioned SPD units operating worldwide in the edible oil and fish oil industries, VTA & UIC are your trusted partners in meeting upcoming stricter MOSH and MOAH regulations.

For more information, read our case study featuring an example project (QR code below)

Short Path Dist

hort Distillation Unit

dible Oil

MOSH & MOAH Contaminated

Examples for

Brazil’s Soy Moratorium has led to a significant reduction in deforestation linked to soyabeans but new laws and calls by agribusiness groups to relax or terminate it could put the moratorium at risk, which could lead to a significant expansion of soyabean plantings

The future of Brazil’s Soy Moratorium, which bans the sale of soyabeans grown on land deforested in the Amazon biome after July 2008, could be at risk due to new state laws and the growing influence of some agribusiness associations.

The end of, or more flexibility in, the Soy Moratorium, could lead to a significant expansion of soyabean planted area in 2026, according to sources quoted in a US Department of Agriculture (USDA) report, ‘Brazil’s Soy MoratoriumBalancing Economic Interests and Regulatory Measures’, published on 6 June.

Brazilian soyabean production is already forecast to rise to 176M tonnes

in 2025/2026 due to favourable weather and technological advances.

The latest projection from a total planted area of 49.1M ha is up from 169.5M tonnes in 2024/25, the USDA Foreign Agricultural Service (FAS)’s 1 July ‘Brazil: Oilseeds and Products Update’ says.

“This increase is mainly driven by the expansion of soyabean planted area, supported by high global demand, stable weather with an El Niño season, and an increase in productivity compared to the prior and current years.”

Established in 2006, the Soy Moratorium is an agreement by major soyabean traders, environmental organisations and the Brazilian government to prevent the sale of soyabeans grown on land deforested in the Amazon biome after July 2008. The goal is to control deforestation driven by soyabean expansion.

The moratorium:

• Covers only the Amazon biome (not the Cerrado or other regions).

• Prevents major traders from purchasing soyabean from areas that have been deforested after 2008.

• Is monitored by satellite imagery and field verification to track deforestation linked to soya expansion.

• Does not apply to legally deforested

areas, indigenous lands or small-scale producers under certain conditions.

The moratorium has led to a significant reduction in deforestation linked to soyabeans, the USDA report says. While newly planted fields in deforestation areas totalled 30% before the legislation was introduced, this fell to 1.5% after the moratorium came into force.

Soyabean production continued to grow after the moratorium, but this was mostly through increased productivity and expansion into already cleared lands, the USDA report says.

The legislation has also led to the implementation of other environmental policies, including discussions about expanding similar restrictions to other ecosystems, such as the Cerrado, where soyabean-driven deforestation remains a major concern,

The moratorium is still supported by several major traders due to demands from international markets, according to the USDA.

“The European Union’s antideforestation law, which bans imports of products linked to deforestation, has further highlighted the need for such policies, making it more difficult for Brazil to justify ending the moratorium without risking trade restrictions.”

However, several groups are pushing for the termination or relaxation of the Soy Moratorium, claiming it hampers economic growth and land-use rights, the 6 June USDA report says.

The groups include some soyabean producers, agribusiness associations, Brazilian agribusiness-linked politicians, state governments (particularly in Mato Grosso and Pará), as well as some trading companies.

The groups are pushing for increased flexibility or the moratorium’s complete termination and new state laws –particularly in Mato Grosso, Brazil’s largest soyabean producing state.

They claim the moratorium gives too much power to European and US companies, limiting Brazil’s ability to control its own agricultural policies.

The groups also say the moratorium impacts economic growth and land rights by blocking the use of private land, even if deforestation is legal under Brazil’s Forest Code (Código Florestal). They say the Forest Code should replace the moratorium, rather than using voluntary agreements influenced by international companies.

In Brazil, the Forest Code establishes how much native vegetation must be preserved on private rural properties.

One key element is the Legal Reserve Requirement (Reserva Legal). For properties in the Legal Amazon region, if located in forested areas, at least 80% of the property must be preserved as native vegetation.

In savannah areas (Cerrado), and in grassland areas (campinaranas), the required levels are 35% and 20%, respectively.

For all other regions of the country, regardless of the type of vegetation and biome, the Forest Code stipulates that the minimum preserved area must be 20%.

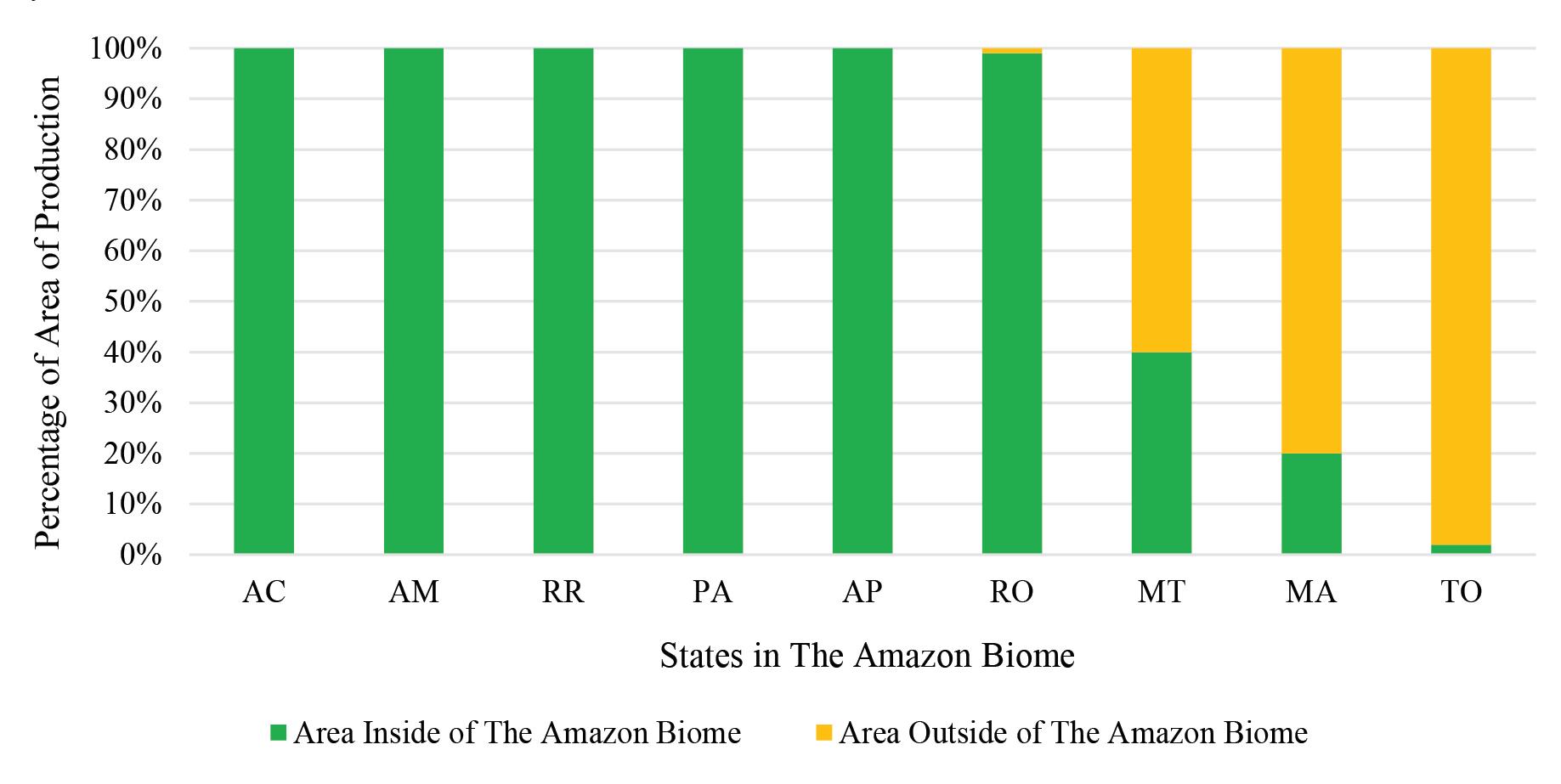

It is estimated that Brazil has over 47.3M ha of soyabean planted area, with nearly 8M ha located within the Amazon biome (see Figure 1, following page).

Although the Legal Amazon region covers approximately 502M ha in Brazil, the Amazon biome accounts for only 84% of this region, equivalent to 418.3M ha. Within the biome, 301.2M ha remains as preserved natural forest, while