26 Tariff disruption

18 UDB: Mired in red tape

Originally due to come into force in November 2024, the EU Union Database for Biofuels aimed at tracking the sustainability and traceabililty of biofuels has been criticised for being overly complex

Oilseeds

22 Positive shifts in Central Asia

As the largest country in Central Asia, Kazakhstan has seen its production of oils and fats boom in recent years, while other countries are focused on self-sufficiency

Major oils and fats trading nations have had to contend with disruptive tariffs since US President Donald Trump took office in January

Instrumentation/Process Control

30 From theory to results

Data-driven modelling and computer simulation can be used to help improve process control performance, leading to more efficient and sustainable operations in oilseed crushing plants and edible oil refineries

Transport & Shipping

33 Red Sea impact

Houthi attacks on western shipping in the Red Sea caused seaborne trade to fall by 70% through the Suez Canal, althought the crisis has not had a major impact on Black Sea sunflower oil exports

4 EC plans to delay EUDR for small operators only

11 Corteva Agriscience may split into two companies

News 12 EU appeals WTO decision on Indonesian duties

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com +44 1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 1737 855157

ADVERTISING: Mark Winthrop-Wallace markww@quartzltd.com +44 1737 855114

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

SUBSCRIPTION RATES:

Print & digital: Single issue – £45

1 year – £182 (UK), £210 (overseas)

2 years – £328 (UK), £377 (overseas)

3 years – £383 (UK), £440 (overseas)

Digital only: Single issue – £29

1 year – £170

2 years – £272

3 years – £357

© 2025, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 1737 855000

Printed by Stephens & George Print Group, Merthyr Tydfil, Wales

It’s all a shake-up for some of the world’s largest fast-moving consumer goods (FMCG) companies.

Italian chocolate giant Ferrero’s US$3.1bn acquisition of WK Kellogg closed on 26 September, giving it a dominant position in the US breakfast cereal market (see p6). The private Ferrero group has been actively expanding through acquisitions over the years – focusing on chocolate, biscuits and snacks to diversify beyond its traditional brands like Nutella spread, and Kinder and Ferrero Rocher chocolates. It has also had its eye on North American expansion, buying Nestlé’s US confectionery business in 2018.

Ferrero says it plans to grow Kellogg’s iconic breakfast brands such as Frosted Flakes and Special K, although it will need to contend with declining breakfast cereal sales due to consumer concerns over sugar and ultra-processed foods, and changing eating habits as more people skip breakfast or eat on the go. However, its experience in snack bars is expected to drive innovation – we may see portable cereal bars or functional breakfast bites like high-fibre Raisin Bran snacks.

WK Kellogg resulted from the split of the old Kellogg Company, completed in October 2023. It has been struggling financially since, with declining revenues and sales volumes. Kellogg’s split also resulted in a global snacking business, Kellanova, which Mars is now aiming to acquire for US$36bn (see p6).

The deal was given the all-clear by the US Federal Trade Commission in June but the EU opened a full-scale investigation that month, concerned that Mars’ increased portfolio and bargaining power with retailers might lead to higher prices for consumers or reduce competition. The deal would bring some of the largest snack and breakfast brands under one roof, including Mars’ M&M’s and Snickers, and Kellanova’s Pringles crisps and Pop-Tarts. In September, EU anti-trust regulators resumed their investigation into the deal, after a pause to receive more information, and have set a 19 December for their decision.

Rather than expanding, Kraft Heinz announced a split in September into two separate companies, a decade after the mega merger of Kraft and Heinz in 2015. The split into one business focused on sauces and spreads, and the other on groceries and ready-toeat meals, is scheduled for completion next year. It will allow the companies to give “the right level of attention and resources to unlock the potential of each brand”, says Kraft Heinz executive chair Miguel Patricio.

The packaged foods industry has been facing pressure on many sides, with higher commodity costs, tariffs squeezing margins, and regulatory and consumer concerns.

The snacks, chocolates, confectionery, crisps, sauces and spreads subject to the latest company moves all use oils and fats either as whole or functional ingredients for frying, baking, coating, texture, shelf life or melting behaviour. Potential changes in the companies’ operations, sourcing, scale and supplier relations could ripple through to our sector.

Chocolate and confectionery saw huge spikes in cocoa and cocoa butter prices in 2024 and volatility is expected in continue in the future due to climate change and weather affecting production. Consumer demand for healthier products may lead to more R&D and reformulation or substitutions towards low-fat, low-sugar or plant-based ingredients. Users of palm and soyabean oils, meanwhile, have to grapple with sustainability pressures and the changing deadlines of the EU Deforestation Regulation coming into force, affecting the import of these oils into the EU.

The FMCGs will be hoping to use their size, scale and focus to tackle these challenges.

Serena Lim, OFI Editor, serenalim@quartzltd.com

CMB TECHNOLOGIES

Transesterification | Enzymatic Biodiesel production | Glycerolisis

Special Dry degumming & bleaching | Deacidification | Oil washing | Pre-treatment Methylester fractional and total distillation

You choose the feedstock(s), We build your best Biodiesel Plant.

CMB: your trusted partner for your Biodiesel Plants.

CMB S.p.A. Cisterna di Latina, ITALY

CMB MALAYSIA ENGINEERING FOR OILS AND FATS SDN. BHD Selangor, MALAYSIA

CMB SHANGHAI ENGINEERING CO. LTD. Shanghai, CHINA

CMB INDIA ENGINEERING FOR OILS AND FATS PVT. LTD. Mumbai City, Maharashtra, INDIA

MALAYSIA: The EU has recognised Malaysian Sustainable Palm Oil (MSPO) certification as a credible standard that can facilitate compliance with its EU Deforestation Regulation (EUDR), Reuters wrote on 10 September.

The MSPO scheme of Malaysia – the world’s second largest palm oil producer and exporter – had been mandatory for its palm oil industry since January 2020, with audits conducted by independent third-party certification bodies to ensure compliance and credibility.

The EU's acknowledgement reinforced MSPO’s role as Malaysia’s national framework for sustainable palm oil, said the Malaysian Palm Oil Certification Council, which administers the MSPO.

BRAZIL: Global agribusiness giant Bunge is working in partnership with Bangkok Produce Merchandising (BKP) – a subsidiary of Charoen Pokphand Group (CP Group) – to advance soya traceability from Brazil. Following successful testing of a blockchain platform for soya traceability, the companies would adopt this system for soya and soya meal sourced by Bunge in Brazil and supplied to Bangkok Produce Merchandising (BKP) and CP Group for food and animal feed production in Thailand and other Southeast Asian countries, Bunge said on 15 September.

Bunge and CP have been collaborating on technical, operational and commercial feasibility studies for sustainable and digitally integrated supply chains since 2023. Last year, the partnership validated traceability in a pilot involving a shipment of approximately 375,000 tonnes of soya meal. Following the latest agreement, the solution would be adopted at scale, Bunge said.

The European Commission (EC) has proposed delaying its EU Deforestation Regulation (EUDR) for small operators only, and simplying its due diligence system.

On 23 September, EU Environment Commissioner Jessika Roswall proposed a one-year delay of the EUDR's implementation, set to come into force on 30 December 2025, citing concerns about the IT system supporting the law.

This would have been the second delay of the EUDR covering seven deforestation-linked commodities –cattle, cocoa, coffee, palm oil, soyabean, wood and rubber.

However, on 21 October, the EC proposed a delay until 30 December 2026 for micro and small operators from lowrisk countries who sell their goods directly on the European market. It also proposed that downstream operators and traders would no longer need to submit regular due diligence statements (DDSs).

Instead, "only one submission in the EUDR IT system at the entry point in the market will be required for the entire supply chain," the EC said on 21 October. "The reporting obligations would be focused on the operators first placing the products on the market. For example, cocoa beans would need only one DDS to be submitted by the importer placing them on the EU market, but downstream manufacturers of chocolate products will not be required to submit a DDS."

Small operators only needed

to submit a one-off declaration in the EUDR IT system. When the information was already available, for instance in a member state database, the operators did not have to take any action in the IT System themselves, the EC said.

The EUDR would still come into force for large and medium companies on 30 December but they would have a six-month grace period for checks and enforcement.

The EC's proposal would need to be adopted by the European Parliament and Council.

Indonesia and the EU have agreed a trade agreement after almost a decade of negotiations, The Star reported on 23 September.

The landmark Indonesia-European Union Comprehensive Economic Partnership Agreement (CEPA) would eliminate tariffs on approximately 80% of Indonesian exports to the EU, including palm oil, according to Palm Oil Monitor.

The deal would open investment in strategic sectors such as electric vehicles, electronic and pharmaceuticals, The Star wrote.

In relation to palm oil, Palm Oil Monitor wrote on 23 September that the CEPA deal would eliminate duties and create a competitive advantages for Indonesian suppliers.

“The EU’s current tariff structure for palm oil is complex. Rates vary based on end-use and processing. Under the 2025 Common Customs Tariff, crude palm oil for industrial uses already enters duty-free. But crude palm oil (CPO) for food manufacturing faces a 3.8% tariff.

“Importantly, refined fractions - the products that directly compete with European vegetable

oils in food applications - currently face duties ranging from 9% to 12.8%. On refined palm oil fractions, Indonesian exporters will enjoy a landed-cost advantage of €90-128 per €1,000 of value compared to competitors still paying most favoured nation (MFN) rates.

Palm Oil Monitor said the immediate loser was Malaysia, Indonesia’s main palm oil competitor, which would continue facing the full MFN tariff.

For crude palm oil destined for food uses, Indonesian suppliers would hold a 3.8 percentage point price advantage. For refined products, the gap widened to 9-12.8 percentage points.

“These aren’t marginal differences. They’re sufficient to redirect trade flows across Southeast Asia. Malaysian palm oil will increasingly be diverted to other markets while Indonesia captures a growing share of EU imports,” Palm Oil Monitor said.

Malaysia was now under pressure to conclude its own EU trade agreement while European producers would need to compete on a more level playing field.

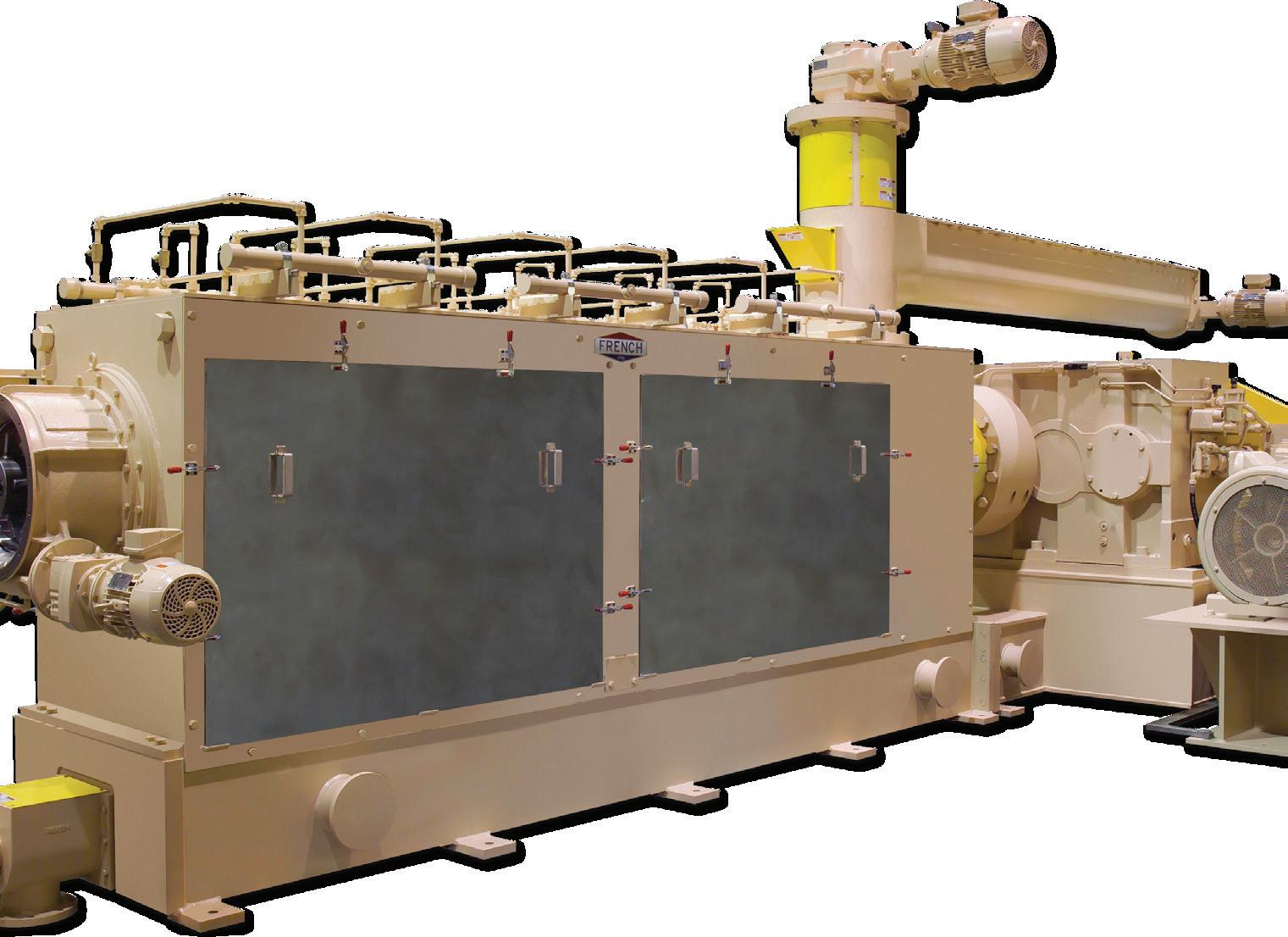

CPM offers end-to-end processing solutions for the oilseed market.

We are the preferred partner for the oilseed processing industry, offering complete preparation solutions. CPM offers the lowest total operating cost solution in the industry, everything from maximizing your extraction process to minimizing energy consumption.

Discover all the benefits of our solutions at OneCPM.com/Markets/Oilseed-Processing

CRACKING FLAKING GRINDING PELLETING PARTS & SERVICE

GERMANY: Global agribusiness giant Louis Dreyfus Company (LDC) has completed its acquisition of German chemical and biotech company BASF’s food and health performance ingredients business, previously part of BASF’s Nutrition & Health division.

First announced last December, the transaction for an undisclosed sum included BASF’s production site in Illertissen, Germany, and three application labs outside of Germany, the companies said in a joint statement on 30 September.

Business activities involved in the transaction included: food performance ingredients, such as whipping agents, emulsifiers and fat powders; health ingredients, including plant sterol esters, conjugated linoleic acid (CLA) and omega-3 oils for human nutrition, and some smaller product lines.

“By focusing on vitamins and carotenoids, we are reinforcing our strategic direction towards … nutrition ingredients for human and animal nutrition,” said Daniela Calleri, BASF senior vice president, Nutrition Ingredients.

LDC's CCO and head of Food & Feed Solutions James Zhou said the move was a “significant milestone” in its growth in the plantbased ingredients sector.

Italian chocolate and confectionery giant Ferrero has announced the completion of its US$3.1bn acquisition of leading cereal producer WK Kellogg.

The move marked a new milestone in Ferrero’s North American growth strategy, the company said on 29 September. “The acquisition ... supports Ferrero’s plan for strategic growth in North America. Ferrero plans to invest in and grow WK Kellogg Co’s iconic portfolio of brands across the USA, Canada and the Caribbean.”

Ferrero is one of the world’s largest chocolate and confectionery companies, purchasing ingredients such as palm oil, cocoa and sugar on a global scale, and with iconic brands including Nutella spread and Kinder and Ferrero Rocher chocolates.

The acquisition was announced in July and approved by WK Kellog Co shareholders in Sep-

tember. WK Kellogg Co, which separated from the Kellogg Company in 2023, has now been delisted from the New York Stock Exchange and becomes a wholly-owned subsidiary of Ferrero.

The 2023 Kellogg split also resulted in a global snacking business, Kellanova, which Mars is aiming to acquire for US$36bn (see below).

Established in 1946, the Ferrero group entered the US market in 1969 and its portfolio comprises 35 brands in over 170 countries. Its acquisition of WK Kellogg brings a range of well-known cereals under its ownership including Corn Flakes, Rice Krispies, Special K and Raisin Bran.

Ferrero’s experience in snack bars is expected to drive innovation in new products such as cereal bars or functional breakfast bites such as high-fibre Raisin Bran snacks.

Global agribusiness giant Cargill is using a robot powered by artificial intelligence (AI) to monitor safety and operational reliability through a pilot programme at its multi-seed crushing and refinery facility in Amsterdam, the Netherlands.

Developed by US-based Boston Dynamics,

“Spot”, the four-legged robot, uses advanced sensors and real-time data collection to detect equipment and safety risks.

The robot conducted around 10,000 inspections/week, collecting thermal, acoustic and visual data across rapeseed and sunflower processing lines, Cargill said on 1 October. It could also identify maintenance issues such as overheating equipment, product leaks and ventilation faults; and scan for hazards such as open doors, misplaced equipment or obstructed walkways.

“It’s more than just a robot; it’s an early warning system that helps keep production safe and smooth,” said Martin Blommestijn, plant superintendent at Cargill Amsterdam.

For example, Cargill said the robot detected a decanter running above safe operating limits. Maintenance teams made immediate adjustments, preventing equipment failure and avoiding significant downtime.

Confectionery and snack giant Mars’ US$36bn bid to acquire global snacking business Kellanova looks set to win unconditional EU antitrust approval, according to three sources quoted in a 7 October Reuters report.

Kellanova resulted from the split of the old Kellogg Company, completed in October 2023.

Kellogg’s split also resulted in the formation of North American cereal business WK Kellogg, which Italian chocolate and confectionery giant Ferrero has just acquired for US$3.1bn.

Mars’ acquisition of Kellanova would

bring some of the largest snack and breakfast brands under one roof, including Mars’ M&M’s and Snickers and Kellanova’s Pringles crisps, Pop Tarts and Eggo.

The deal was given the all-clear by the US Federal Trade Commission in June but the EU opened a full-scale investigation that month, concerned that Mars’ increased portfolio and bargaining power with retailers might lead to higher prices for consumers or reduce competition.

The European Commission (EC) had found insufficient legal grounds to demand concessions, the sources in Reuters report said.

An EU decision on the deal was expected by 19 December.

A combined Mars and Kellanova would account for roughly 12% of the US snacking and confectionery industry, according to market share data from NielsenIQ.

In announcing the split last summer, Kellogg’s said the move would drive growth for both companies and this was likely to include the acquisition of new brands.

At that time, Kellogg’s said it expected two distinct corporate cultures to emerge, with decisions at Kellanova driven by the fact that it was an international snacks business.

• INTERESTERIFICATION/HYDROGENATION • DRY FRACTIONATION FOR STANDARD & SPECIAL PRODUCTS • VACUUM DISTILLATION FOR MOSH/ MOA REDUCTION

Swiss conglomerate Nestlé has said it would cut 16,000 jobs over the next two years, the BBC reported on 16 October.

The company had to “change faster” to keep pace with a changing world and adopt a “performance mindset” that did not accept losing market share to rivals, Nestlé’s new CEO Philipp Navratil was quoted as saying.

Nestlé announced the job cuts on 16 October after reporting better sales figures

RUSSIA/CHILE: Russian agribusiness Miratorg has delivered its first trial shipment of soyabean oil totalling 44 tonnes to Chile after signing a one-year supply contract, according to a report by state agricultural export agency Agroexport on 30 September.

Miratorg’s oil extraction plant in the Kromsky district of the Oryol region processed oilseeds such as soyabean, rapeseed and sunflowerseed. It also offered compound animal feed for export and was also involved in grain and meat production and the manufacture of frozen and convenience food.

Agroexport said the delivery to Chile laid the foundation for long-term cooperation with the country, as well as opening up new opportunities for Miratorg's presence in Latin America.

According to Chilean customs service data, imports of soyabean oil were worth US$216M in 2024, sunflower oil (US$151M), rapeseed oil (US$83M), palm oil (US$37M), and corn and flaxseed oils (US$23M).

In Chile, oils are used not only in the food industry, but also in the feed industry, mainly in the production of feed for salmonids, according to the report.

The country was the second largest producer of farmed salmon in the world after Norway, Agroexport said.

in the first nine months of 2025, selling more products across its major categories, including coffee and sweets, the report said.

The world’s largest packaged food and drink company, Nestlé owns hundreds of brands, including Nescafé, KitKat and Maggi.

Nestlé said in a statement that it planned to get rid of 12,000 white collar jobs on

top of 4,000 other roles across the board within the next two years.

The job cuts would save the food giant around CHF1bn (US$1.26bn)/year as part of an ongoing cost-savings effort, it said.

Navratil’s predecessor Laurent Freixe was sacked in early September after an investigation into whistleblower allegations that he did not disclose a romantic relationship with a direct subordinate, the BBC wrote.

World leading sunflower oil producer Russia is planning to increase exports to India in a bid to replace Ukrainian supplies that are being redirected to Europe, Reuters wrote on 26 September, quoting state agricultural export agency Agroexport.

India was a major buyer of Russian energy and the two countries had maintained close ties, the report said.

“Russia may strengthen its position in sunflower oil exports to the Indian market in the 2025/26 season ... as Ukrainian suppliers shift their focus from Asia to Europe,” Agroexport said.

Russia is set to export a record 5M tonnes of sunflower oil in 2025/26 and India is the biggest buyer, accounting for a third of total exports, according to Dmitry Rylko, the head of consultancy IKAR.

Meanwhile, forecasts for the Russian sunflower oil crop have declined, according to a 15 October Vesper report. Initially expected to reach 17.9M tonnes this season (compared to 16.6M tonnes last year) – excluding occupied territories – the forecast had now been reduced to 17.75M tonnes, the report said.

Vesper also wrote that sunflower oil prices at Ukrainian ports were climbing due to lower

crop forecasts. Crude sunflower oil prices at Ukraine’s ports for November-December delivery had increased by US$10/tonne to US$1,360/tonnes, the report said.

APK-Inform had reduced its forecast for the Ukrainian sunflower crop to 12.45M tonnes in October – down from 12.68M tonnes in the same period the previous year, due to bad weather and slow harvesting.

Processing activity in Ukraine had also declined significantly in September, totalling around 560,000 tonnes, the lowest level since July 2022, Vesper wrote.

Soyabeans are likely to be covered in a potential US-China trade deal to be discussed when US President Donald Trump and Chinese President Xi Jinping meet on 30 October, as OFI goes to press.

US treasury secretary Scott Bassent said the two countries had "reached a substantial framework for the two leaders", and hinted that China's boycott of US soyabeans could soon be over, the BBC wrote on 26 October. "I believe when the announcement of the deal with China is made public that our soyabean farmers will feel really good about what's going on for this season and the coming seasons for several years."

China – usually the largest buyer of US soyabeans – has made no purchases from the USA since the start of the 2025/2026 marketing year on 1 September, according to data from China’s General Administration of Customs. This com-

pared with 1.7M tonnes in September 2024. China traditionally bought most of its soyabeans from the USA in the September-November window, which coincided with the US harvest, but had turned to Brazil and other South American countries for most of its soyabean supply in recent months due to its trade war with the USA, World Grain wrote on 21 October.

“Typically, by 11 September, China would buy about 30% of its annual purchases of US soyabeans,” said Zaner Ag Hedge chief market analyst Karen Braun, during her keynote address at the Women in Agribusiness Summit on 22-24 September. “By the end of October, that number is usually at 60%.”

In 2024, the USA shipped nearly 985M bushels of soyabeans to China, 51% of the nation’s total soyabean exports, World Grain wrote.

WORLD: Prices for cocoa and cocoa butter have been declining since the end of August due to strong prospects for the 2025/26 West African harvest, according to a report by Spanish vegetable oil company Lipsa.

The International Cocoa Organization had forecast a potential surplus after last season’s deficit, the 8 October report said. However, despite the decline, prices remained historically high and global supply chain pressures were ongoing.

“Producers are looking to cut costs by reformulating products, particularly in chocolate, with shea butter – a cheaper partial substitute for cocoa butter – seeing rising demand in niche markets despite climate and logistical uncertainties.”

“If cocoa butter prices keep on declining, they will soon reach the same level as shea stearin prices and make shea stearin less attractive.”

At the time of the report, most shea-producing countries (Nigeria, Burkina Faso, Mali, Côte d’Ivoire and Togo) had export bans in place on the commodity. These bans were largely unsustainable, as none of the countries – except Ghana – had the facilities to process all of their nuts, the report said.

“Overall, the shea price trend remains upward as demand is strong."

Chinese state trading firm COFCO has bought up to nine 60,000 tonne shipments of Australian canola amid China's ongoing trade dispute with Canada, Reuters wrote on 19 September.

The purchases totalled around 540,000 tonnes, equivalent to about 8% of China’s total canola imports last year, the news agency quoted three trade sources as saying.

Alongside an anti-dumping probe into Canadian canola expected to last until March, Beijing had imposed preliminary duties of 75.8% on imports of the oilseed from the country in August, bringing shipments to a virtual standstill, Reuters said.

For the past few years, Canada had been China’s main canola supplier and the Australian

imports demonstrated Beijing could find alternative sources of the oilseed, the report said.

However, as Australia was a smaller producer than Canada, it could struggle to match Canadian volumes.

All the Australian shipments were scheduled to be loaded between November and January, an Australia-based broker for agricultural products with direct knowledge of the deals said.

China is the world’s leading canola importer, with 6.4M tonnes of purchases worth US$3.4bn last year, almost all of it from Canada, according to Chinese customs data.

Canada is the world’s biggest canola exporter and Australia is the second leading shipper.

The European Parliament (EP) voted on 8 October to ban the use of the term “veggie-burger” and limit food descriptions such as steak, escalope and sausage to products containing meat, as part of a proposed EU law to protect farmers, Reuters reported on the same day.

The EP voted in favour of an amendment to a regulation aimed at giving farmers a stronger negotiating position so that powerful companies in the food supply chain did not impose unfavourable conditions, the report said.

The text of the final regulation would follow negotiations between representatives of the EP, EU governments and the European Commission, with the EP backing a ban of terms such as “veggie burger” or “vegan sausage” (pictured), according to the report. Its meat-only list also included “hamburger”, “egg yolk” and “egg white”.

The EU had already defined dairy items such as milk, butter, cream and cheese as “products secreted by mammary glands”, disallowing the use of terms such as 'oat milk', Reuters wrote.

“Europe is the biggest consumer market globally for plant-based meat alternatives, a market from which EU farmers will benefit hugely as it creates higher-value markets for pulses, soya, wheat, fungi and vegetables, many of which are already grown in Europe.”

US start-up California Cultured has filed a patent covering the production of cocoa butter in plant cell culture, AgFunderNews (AFN) reported on 16 September.

The company, which has a 10-year offtake deal with Japanese chocolate company Meiji, announced plans in May to build a pilot plant in Sacramento, California, with commercial production of cocoa flavanols and powder using callus cells expected to start in the second or third quarter of 2026, the report said. In addition, the company had been working on the production of cocoa butter using somatic embryos, formed by re-program-

ming somatic cells (non-reproductive cells) from cacao plant tissue into an embryo-like structure, AFN wrote.

California Cultured’s head of strategy and business development Steve Stearns said that with volatile cocoa prices, food companies had been exploring a range of alternatives for cocoa powder but replacing cocoa butter was more challenging.

“There are a tonne of microbes that can produce triglycerides, but they can’t produce them in the right ratios."

Somatic embryos naturally produced high levels of fat and the critical triglycerides that make cocoa butter solid at room tempera-

ture but quick to melt in the mouth, he said. While these somatic embryos had been used for clonal propagation of whole cacao plants, they had not been used in the production of fats in plant cell culture.

California Cultured patent referred to somatic cells that produce at least 10% lipids.

“We took a broad approach with our patent. It covers all methods of processing chocolate that rely on somatic embryos,” Stearns said. “We need to get to at least 30% cocoa butter moving forward, but we’re also planning to use this particular cell line for multiple applications, of which cocoa butter is one.”

Biotech seed producer Corteva Agriscience could be looking to split its seed and pesticide businesses into separate companies, Progressive Farmer reported from a Wall Street Journal (WSJ) article.

Quoting “people familiar with the matter”, the WSJ said Corteva had a market value of around US$50bn “and could unveil its plans soon, assuming the talks don't hit any last-minute snags”.

Corteva was created as part of the 2017 merger between DuPont and Dow Chemical, becoming a standalone, publicly traded company in 2019. It is among the largest US crop protection producers, competing with Switzerland's Syngenta and German firms BASF and Bayer.

While Corteva and its competitors had closely teamed their seed businesses and biotech traits with their pesticide offerings, the WSJ article on 12 September suggested one reason for a split would be to “help shield its seeds from any future

liabilities associated with its pest and weed-killing chemicals”.

Bayer has faced years of legal liability and payouts over its weedkiller product Roundup, although the WSJ noted that Corteva “isn’t involved in that litigation”.

Corteva is the owner of the Pioneer seed brand, with products including genetically modified corn and soyabeans. It also owns the Enlist herbicide-tolerant trait system which can be found in Pioneer seeds. Its seed business generated about 56.5% of total net sales of US$16.90bn last year, while its crop protection segment – which included herbicides, fungicides, insecticides and seed treatments – accounted for 43.5%, Reuters wrote on 15 September. According to a company fact sheet, Corteva sells seed for more than 100 crops and has more than 400 seed and crop protection products.

The Argentine government has approved the commercialisation of a genetically modified (GM) soyabean with resistance to lepidopteran insects and tolerance to glufosinate ammonium, local newspaper Economis reported on 8 September.

The DBN-Ø82Ø5-8 GM soyabean seed could be marketed and planted throughout the country following submission of an Insect Resistance Management Plan and registration in the National Registry of Cultivars, the report said.

Soyabeans were Argentina’s main export commodity, generating more than 25% of

the country's foreign exchange, and approval of the new seed would boost competitiveness with other soyabean-producing countries such as Brazil and the USA, Economis wrote. Argentina already had more

than 60 events approved in soyabeans, corn and cotton.

The new seed's adoption would be subject to approval in main buying destinations such as China and the EU, the report said.

CANADA: Food tech company Burcon NutraScience Corporation has made the first commercial sale of its non-genetically modified (GM) canola protein isolate.

Extracted from non-GM canola seeds grown in North America, the Puratein C isolate contained all nine essential amino acids and delivered a protein digestibility-corrected amino acid score (PDCAAS) of 1.0, the highest score possible used to evaluate the quality of a protein based on its amino acid profile and digestibility, the company said on 10 September.

The canola protein isolate had high solubility, a light cream colour and a mild flavour profile, according to the Vancouver-based company. Potential applications included baked foods, dairy alternatives, ready-to-drink beverages, meat analogues and sauces.

Burcon’s portfolio also includes Peazazz, a pea protein isolate, and FavaPro, a fava bean protein isolate.

“By leveraging our technology platform, we are creating sustainable, high-quality proteins that drive new opportunities for customers,” said Burcon CEO Kip Underwood.

Aimed at the food and drink sector, Burcon’s patent portfolio comprises plantbased proteins derived from pea, canola, soyabean, hemp, sunflowerseed and other plant sources.

The Make America Healthy Again (MAHA) Commission has pulled back on restricting pesticides such as glyphosate in its second report, Civil Eats wrote on 9 September.

Published in May, the first MAHA Commission included an assessment of possible drivers of childhood chronic disease – including “chemical exposure” – and included details of health concerns tied to US agriculture’s use of specific pesticides, like glyphosate. After the first report drew criticism from agriculture groups for its mention of pesticide use as harmful, the

White House held meetings with many representatives of the sector.

The second report outlined how the US Environmental Protection Agency (EPA) planned to work to reform the approval process for chemical and biologic products to protect against weeds, pests and disease, World Grain wrote on 11 September. The EPA also planned to work “to ensure that the public has awareness and confidence in EPA’s pesticide robust review procedures”.

The focus of the commission, led by Health and Human Services Secretary

Robert F Kennedy Jr, was now largely on “reducing” the use of crop protection chemicals rather than taking a hardline restrictive approach, Ag Daily wrote on 9 September.

The second MAHA report was welcomed by several US agricultural groups.

“CropLife America (CLA) appreciates the commission for inviting feedback ... and recognising that pesticides are important tools that help farmers grow healthy, affordable and abundant food for American families,” CLA president and CEO Alexandra Dunn said.

INDONESIA: Indonesia has moved closer to launching 50% palm oil-based biodiesel (B50) after concluding laboratory tests, as the country aims for implementation next year, Reuters quoted the Energy Ministry’s bioenergy director Edi Wibowo as saying.

Indonesia’s blend rate was currently mandated at 40% (B40), and the country would now move to carry out B50 road tests, the 7 October report said.

Adopting B50 would require 20.1M kilolitres/ year of palm-oil based biofuel for mixing with regular petrol, compared to 15.6M kilolitres with B40, energy ministry data showed.

A 10 October VOI report quoted Indonesia’s Minister of Agriculture Andi Amran Sulaiman as saying that the government would reduce crude palm oil (CPO) exports by 5.3M tonnes in 2026 to support the mandatory B50 biodiesel programme. Indonesia currently exports 26M tonnes/year of CPO from total national production of approximately 46M tonnes/year, according to the report.

CANADA: The government has introduced a new biofuel production incentive to assist the country’s canola and other agricultural producers in response to trade disruptions and tariffs, Biodiesel Magazine wrote.

Announced on 5 September, the amendment to the country’s Clean Fuel Regulations would support the domestic biofuels industry, the 9 September report said.

In response to the challenges, the government said it would immediately introduce new biofuel production incentives providing more than C$370M (US$267M) over two years to help domestic producers and restructure their value chains.

The European Union (EU) has appealed the World Trade Organization (WTO)’s decision supporting Indonesia’s complaints against EU duties imposed on its biodiesel exports.

On 22 August, the WTO dispute panel had assessed that Indonesia’s export duty and export levy on palm oil could not be categorised as a subsidy, and that the European Commission (EC) had failed to prove a threat of material harm to European biodiesel producers, the Edge Malaysia reported.

Welcoming the EU’s decision, Xavier Noyon, secretary general of the European Biodiesel Board (EBB) said: “It demonstrates the EU’s commitment to defending compliance and maintaining fair trade rules in the biofuels sector, especially as global competition intensifies.

“Without decisive follow-through, the risk is

that anti-dumping and countervailing measures could be overturned or weakened, undermining the integrity of European biofuels and placing compliant producers at a disadvantage.”

The WTO decision followed a 2023 complaint by Indonesia contending that EU duties imposed on its biodiesel exports to the bloc broke WTO rules.

The EC imposed provisional countervailing duties of 8%-18% on Indonesian biodiesel in 2019 following a probe initiated in December 2018 into Indonesian biodiesel imports. This resulted in Indonesia’s exports of palm oil-based biodiesel to the EU dropping from 1.32M kilolitres in 2019 to 27,000 kilolitres in 2024, according to Reuters

Indonesia regretted the EU’s decision to appeal the panel’s findings, the WTO said.

Italian oil and gas company Eni is set to launch a new hydrotreated vegetable oil (HVO)/sustainable aviation fuel (SAF) project in Sannazzaro de’ Burgondi, Italy (pictured).

The company announced the plans after receiving approval from the Italian Ministry of the Ministry of the Environment and Energy Security to convert selected units at the Sannazzaro de’ Burgondi refinery in Pavia into a biorefinery.

Eni had now started the authorisation process and had filed an application for an environmental impact assessment, the company said on 23 September.

The project would involve the conversion of the existing hydrocracker (HDC2) unit using Ecofining technology and the construction of a pre-treatment unit for waste and residues, the main feedstocks used by Eni’s subsidiary and biofuels arm Enilive to produce HVO biofuels.

HVO/SAF production was expected to begin

in 2028, Eni said. Once operational, the biorefinery would have a processing capacity of 550,000 tonnes/year of feedstock – mainly waste and residues – with flexibility to produce SAF and HVO and would boost the site’s ability to supply traditional jet fuel and SAF to north-west Italian airports.

Global energy giant bp has announced plans to halt work on its Rotterdam biofuels plant, Biofuels International wrote.

The oil and gas major’s move made it the latest company to halt biofuel production in Rotterdam due to weak global demand, the 24 September report said.

In an internal message on 22 September, bp said that the project had become too expensive to continue.

The plant had been scheduled to produce 10,000 barrels/day (bpd) of sustainable aviation fuel (SAF), Biofuels International wrote.

“We will continue to evaluate biofuels options at our refining sites,” a spokesperson was quoted as saying in a 22 September Reuters report.

The company had invested millions of euros in preparing the Rotterdam site, a 23 September Dutch News report said.

In September, global oil giant Shell said it was halting construction of a partly built biofuels plant in Rotterdam following an in-depth commercial and technical evaluation.

Shell has said it expected to take a US$600M hit in the third quarter after halting the project, Reuters wrote on 7 October.

t

e.

t.

w.

e

British start-up Clean Food Group (CFG)’s fermentation-derived oil has been approved for cosmetic use in Europe, the UK, and USA, the firm said on 12 September.

The approval marked a major milestone in the commercialisation of the company’s CLEAN OilCell technology platform, unlocking access to the global personal care and cosmetics sector, CFG said.

According to a report on the sector by Grand View Research, the industry is projected to grow from US$295.95bn in 2023 to more than US$445.98bn by 2030.

CFG’s technology is a microbial/

SINGAPORE: Biotech firm Terra Oleo announced on 18 September that it had raised US$3.1M in funding to support its yeast-based fermentation platform producing tailored lipids from agro-industrial waste.

The firm said its cocoa butter equivalent products had a smooth, butter-like texture, remaining solid at room temperature, with a melting point above 350C. Its oleochemicals could be used as emulsifiers, excipients, lubricants and surfactants.

“We currently co-manufacture in Thailand and Singapore and plan to scale up our first products through a mix of larger-scale co-manufacturing and potentially a joint venture with a manufacturing partner,” co-founder Shen Ming Lee said.

AUSTRALIA: Biodegradable plastics company EcoPHA has developed a dual-output process to produce polyhydroxyalkanoate (PHA) bioplastic and biofuels from pongamia oil, medianet reported on 18 September.

Pongamia oil is derived from the seeds of the pongamia tree, which grows on marginal land and EcoPHA was looking into making initial investments of up to US$65.8M to develop plantations in Queensland and the Northern Territory.

fermentation based platform that uses non-genetically modified (GM) oleaginous yeast grown on food waste as the carbon/ nutrient source. After the yeast is grown in tanks, the yeast cells’ lipids are extracted, which have a fatty acid profile equivalent to palm and other functional oils used in food, cosmetics and other products, the firm said.

In other news, CFG also announced on 25 September that it acquired omega-3 oil manufacturer and supplier Algal Omega 3 (AO3), providing it with access to 1M litres of fermentation capacity.

AO3 entered administration in May and

operated a manufacturing site in Liverpool, UK, producing crude algal oil from microalgae using fermentation technology.

CFG said it had conducted commercial-scale production at the Liverpool facility, producing 2,000 litres of oil in a fermentation run. Following the acquisition, the firm said it would be able to produce microbial oils at commercial scale for use in the food, cosmetics and pet food sectors.

“With this acquisition, we have fasttracked our route to market ... ready to capitalise on the US$20bn market opportunity ahead,” said CFG CEO Alex Neves.

Carbon recycling company LanzaTech has developed a process to turn waste CO2 gases into a fat for use in cosmetics and sustainable aviation fuel (SAF).

The first step of the dual fermentation technology is similar to brewing beer, with the grain replaced by CO2 as the raw material.

In the second step, developed primarily by the Fraunhofer Institute for Interfacial Engineering and Biotechnology IGB, the alcohol produced from CO2 is transformed into specific fats by specialised oil yeasts. Both fermentation stages used naturally occurring, non-genetically modified micro-organisms, the companies said on 2 September.

Following successful laboratory trials at Fraunhofer IGB and application tests in the Mibelle Group’s laboratories, the partners said they were

moving into kilogram-scale production of the fat blend.

The new process could also be used in the Hydroprocessed Esters and Fatty Acids (HEFA) pathway, used by the aviation industry but currently dependent on crops and waste oils as

feedstocks, Interesting Engineering wrote on 4 September. By transforming ethanol into synthetic oils that could be used as HEFA feedstocks, the technology could boost SAF production, the firms said.

Sasol International Chemicals – a division of global chemicals and energy company Sasol –has launched a bio-circular insect oil surfactant for the care chemical sector.

The C12-14 alcohol (mid-cut alcohol) ethoxylate was palm oil- and deforestation-free and could be used as a drop-in replacement for conventional synthetic-based alcohol ethoxylates, the company said on 7 October.

The non-ionic LIVINEX IO 7 surfactant was derived from oil from black soldier fly larvae, which was rich in fatty acids used to produce detergent-grade alcohols, Sasol added. The product

was suitable for use in the fabric, home care, industrial and institutional cleaning sectors.

Sasol said it planned to expand its portfolio to include insect oil-based products for the personal care industry.

“As global demand for sustainable products increases … we remain committed to offering our customers a … suite of solutions that includes both high-performing synthetic feedstocks and novel renewable options,” said Louis Snyders, Sasol vice president of care chemicals.

LIVINEX IO 7 is currently available in European markets.

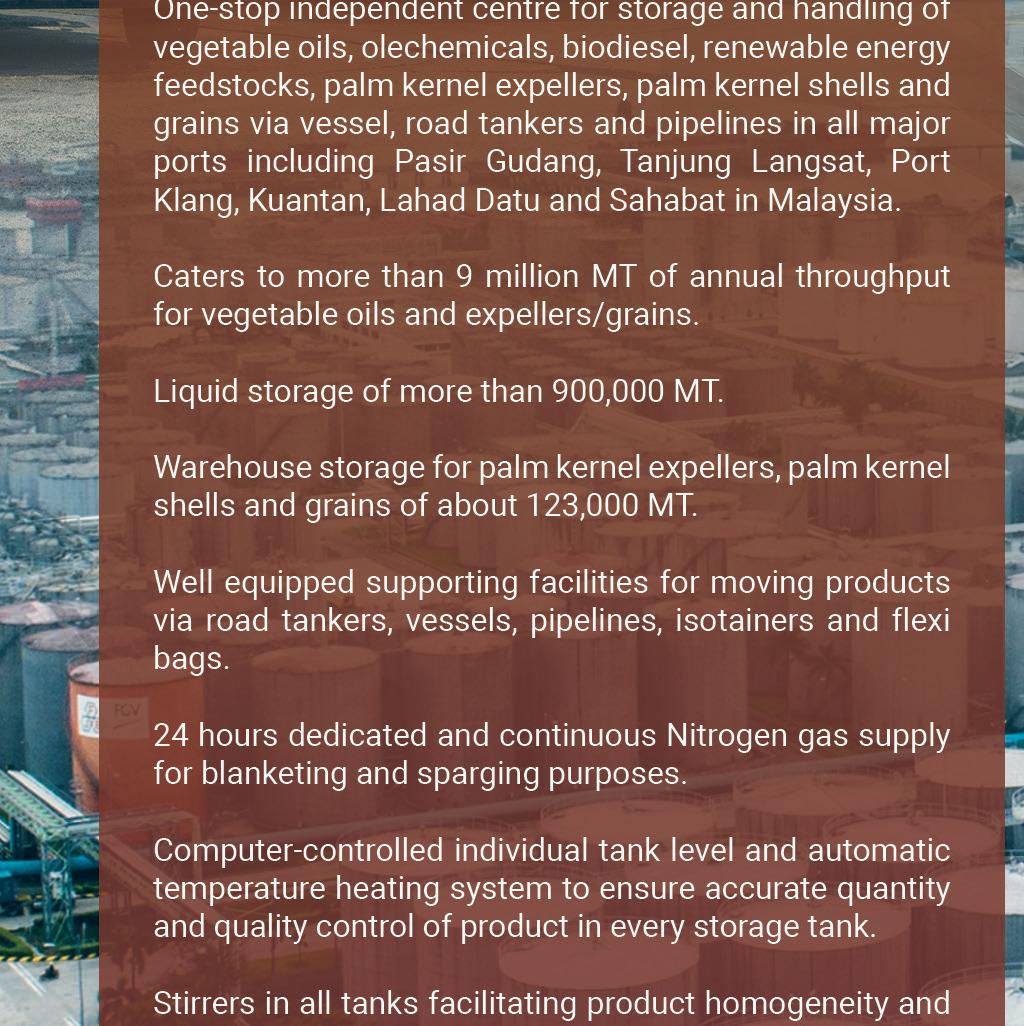

Chane is a liquid bulk storage partner, specialising in end-to-end services for storage, processing and logistics. Collaborating closely with our customers, we provide reliable services that help their businesses run smoothly, as well as creating the infrastructure that facilitates their growth. We make storage active by connecting supply and demand in new ways and thinking ahead towards the future.

Chane offers storage facilities at strategic locations across the Netherlands, France, the United Kingdom, Spain, Portugal and Poland. With a total capacity of over 5,6 million cubic metres (CBM), our terminals handle a highly diversified base of liquid bulk products and offer excellent integrated and innovative service solutions.

21 terminals in 6 European countries

With a total storage capacity of 5,6 million CBM

Creating a sustainable future together

WORLD: Inspection and maintenance software provider Falcker and global tank storage company Vopak have signed an agreement for worldwide distribution of Falcker’s advanced tank inspection platform.

Developed in collaboration with Vopak, the platform comprises a site explorer, condition monitoring and a life cycle planner.

Falcker said its integrated platform used cloudbased technologies, digital twinning and automated inspection tools to enable predictive maintenance and extend asset lifecycles for industrial operators worldwide.

Scheduled to be deployed at Vopak’s terminals over the next few years, the platform would allow Vopak to optimise its maintenance programme by providing long-term predictions based on tank maintenance, Falcker said on 8 October.

Falcker’s site explorer feature links direct users to specific on-site locations or external systems like maintenance management systems.

The condition monitoring feature provides 3D digital twinning, time-based and risk-based inspections and automated drone flights. The lifecycle planner helps schedule maintenance and plan inspections.

The Chinese government has introduced fees on US ships calling at its ports in retaliation to US port fees against China, which came into force on 14 October, FreightWaves wrote on 10 October.

The tonnage fees announced by China’s Ministry of Transportation mirror US levies set in April following a US Trade Representative (USTR) investigation into Chinese shipping and shipbuilding, which found that China had allegedly used unfair trade advantages to attain dominance in the sectors.

China’s fees, also effective on 14 October, apply to US-flagged, built and operated vessels –including vessel operators with 25% or greater US ownership – which had resulted in the departure of US-based directors from three shipowners, according to a 16 October FreightWaves report.

The Chinese fees start at US$56/tonne at current exchange rates compared to the US$50/ tonne USTR fee, increasing to per tonne rates of US$90 (versus the US$80 USTR fee) as of 17 April 2026; US$123 (vs the US$110 USTR fee) as of 17 April 2027; and US$157 (vs US$140 USTR fee) from 17 April 2028. As with the USTR charges, the Chinese fees only apply to the first call at a port on a trip with multiple calls, and a maximum of five times/year.

The retaliatory port fees are expected to have a greater impact on China. The US-flagged fleet accounts for 0.6% of global deadweight tonnes, while vessels flagged in China and Hong Kong combined account for 13.9%, according to the United Nation (UN)’s 2025 Review of Maritime Transport, reported by FreightWaves.

The Hamilton-Oshawa Port Authority (HOPA Ports) has secured the future operation of a biodiesel facility in Hamilton, Ontario, previously operated by Canada-based renewable energy company Biox Corporation.

The 67M litres/year Biox facility had been operating at the port for more than two decades, processing used cooking oil (UCO), animal fats and seed oils into biodiesel, HOPA Ports said on 22 September. Since being built in 2005, more than US$70M had been invested in the plant.

HOPA Ports had finalised an agreement with Biox on 15 August, securing the plant’s assets, preventing the liquidation of essential equipment and maintaining the plant’s ability to re-start operations.

The port authority said it was also actively engaging with industry partners to identify a suitable operator capable of maintaining

biodiesel production at the facility. Regulatory progress had also boosted the outlook for domestic biodiesel, with Canada introducing a new amendement to support the domestic biofuels industry (see p12).

A landmark agreement to cut global shipping emissions has been blocked for a year after pressure from Saudi Arabia and the USA, the BBC wrote on 17 October.

More than 100 countries had gathered at the International Maritime Organization (IMO) in London from 14-17 October to approve a long-awaited deal to make ships start paying for their more than 1bn tonnes/year of greenhouse gas emissions.

However, US President Donald Trump called the plan a “green scam” and threatened countries with tariffs if they voted in favour of it, the report said.

On the day of the BBC report – when

countries should have been voting to approve the deal – Saudi Arabia tabled a motion to adjourn the talks for a year, which was narrowly approved.

The deal had generally been supported by the shipping industry as it offered consistent global standards, the BBC said.

Speaking after the talks ended, Thomas Kazakos, secretary-general of the International Chamber of Shipping, was quoted as saying: “We are disappointed that member states have not been able to agree a way forward at this meeting. Industry needs clarity to be able to make the investments.”

First agreed in April after 10 years of ne-

gotiations, the deal was considered historic as it meant shipping was set to become the first industry in the world with internationally-mandated targets to reduce emissions.

The agreement would have meant that from 2028, shipowners would have had to use increasingly cleaner fuels or face fines. With talks now delayed, the carefully planned timeline to get the regulation in place for 2028 did not appear feasible, the report said.

Shipping currently makes up 3% of global emissions, the BBC wrote, with 90% of goods currently transported via the sea and levels increasing in line with global trade.

Originally due to come into force in November 2024, the EU Union Database for Biofuels aimed at tracking the sustainability and traceability of biofuels has been criticised for being overly complex

Keith Nuthall, Liz Newmark

The contrasting focus of the two European Commissions led by its current and past president Ursula von der Leyen – the first with a keen environmentalist edge and the second more concerned about business impact – have been underlined by Brussels’ plans for its Union Database for Biofuels (UDB).

The UDB – part of the latest version of the EU Renewable Energy Directive (RED III) passed in 2019 and updated in 2023 – is designed to help regulators monitor if biofuels and biogases are legitimate and environment-friendly.

The directive requires companies in EU member states “to enter in a timely manner” accurate data on sales and purchases “and the sustainability characteristics of the fuels ... including their life-cycle greenhouse gas emissions”, from production to sale in the EU.

This data can be entered directly into an EU database (UDB), which was operational by January 2024, or via national EU databases, which would feed information into the UDB.

Under RED III, this information should include data from feedstock suppliers –including farmers and growers – alongside the fuel manufacturers, traders, importers and suppliers covered by the initial version

of the database. Rules governing how the database operates, including mandatory requirements for logging biofuel details –including sustainability certification – were meant to be enforced by November 2024.

However, while detailed database links and extensive guidance advice via EC Public Wiki have been released, a draft delegated EU regulation on how the system will work and what legal liability is incurred by biofuel companies was only released last October.

It was then subject to a four-week consultation and has not been approved by EU ministers so far, or taken forward by the new European Commission (EC), elected in 2024.

With the pause, the von der Leyen II Commission seems to have listened to the significant amounts of criticism levelled at the UDB system by the EU biofuels and associated sectors.

An EC statement said it had been “trying to populate the UDB with the raw materials data” so there would be “no immediate sanctions” for companies failing to log data after the November 2024 deadline.

Meanwhile, talks with EU member states on when to make database filing mandatory were to be staged in future.

These discussions are ongoing, says Nathalie Lecocq, director general of FEDIOL – the European association representing the vegetable oil and protein meal industry.

“Member states have been discussing technicalities and a new timeline for implementation. We are still waiting to get formal confirmation about when the use of the UDB will be mandatory and how it will ensure that the rules do not lead to unnecessary and excessive administrative burden.

“Together with other biofuels chain players, we asked for all technical and practical problems with the UDB to be resolved, before setting a mandatory deadline for economic operators to register transactions in the UDB,” she says.

“We also requested a phase-in period, during which an ad-hoc working group involving DG ENER [Directorate-General for Energy]’s UDB team, experts from member states, voluntary schemes and industry representatives would collaborate to address and resolve the identified issues.”

In consultation on the draft regulation, EU farmers and growers federation Copa-Cogeca called for the regulation to be suspended pending an assessment on its utility – a request that appears to have been granted. “We fear the lack of workability of the UDB’s implementation, the efficiency of the database to check physically whether a certificate is legitimately issued, the use of data from farmers and the data protection...” said Copa-Cogeca.

Ethanol producers’ association ePURE had similar concerns, highlighting “too many flaws in the UDB design”. It warned of the incompatibilities between national databases and the UDB, which it said could “result in chaos and uncertainty for economic operators in the end, undermining the objective to have more renewables in transport”.

It also warned that extending the UDB requirements to upstream transactions for raw materials “would create an extra heavy administrative burden that will appear unjustified to farmers and first collectors in the EU”, maybe causing protests.

Speaking to OFI, European renewable ethanol association ePURE communications director Craig Winneker advocates a one-year phase-in period for the new rules, once they are agreed.

He also warns that industry representatives remain excluded from the ad-hoc working group and so fears “that this group might not address the administrative burden issue”.

“While issues remain, the delegated regulation extending the UDB’s scope to raw materials should be temporarily put on hold until the working group’s work is complete and industry inputs should be fully considered during the drafting process,” he tells OFI.

ePURE also advises integrating existing national databases with the UDB through bi-directional interfaces.

“This approach would avoid duplication, reduce administrative effort and facilitate seamless data sharing in line with the member states’ recommendations.

In its note to the EC, FEDIOL said the UDB’s requirements had been

“elaborated without appropriate consultation of the concerned parties, and their implementation would lead to unnecessarily complex and burdensome administrative procedures”.

It called for pilot projects to test the procedures before making the database mandatory.

Speaking to OFI, FEDIOL’s Lecocq says: “Earlier this year we called on the EC to improve the UDB because it was leading to unnecessary and disproportionate administrative burdens and presented a number of criticalities and malfunctions.

“It was highlighted multiple times by the industry and also by the majority of

your solution for oils, fats, and renewable fuels. Enhance your refining process with state-of-the-art purification and targeted impurity removal, safeguarding your catalyst for advanced protection and optimal efficiency in your operations.

member states that such critical problems undermines the UDB’s usability itself, its effectiveness in supporting traceability, as well as the competitiveness of the whole biofuel chain.”

The European Federation for Waste Management and Environmental Services (FEAD) warned in its formal comments to the Commission that the proposal will “apply excessive regulatory burdens on biowaste traders, biofuel producers and users...” And it added that EU waste regulation already insists on waste origins being documented “with sufficient traceability as well as a system of proof for sustainability criteria”, making the “new proposal onerous”.

The European Biodiesel Board (EBB), while supporting the idea in principle as “key to ensure full traceability along the whole value chain and thus to facilitate robust verification” highlighted the regulation’s increasing complexity over using the database, calling for an 18-month phase-in period.

That said, EBB secretary general Xavier Noyon tells OFI that the UDB was something the EBB had pushed regulators for since 2012, and is a major asset in fighting fraud. “Once fully functional, it will fundamentally improve prevention of biofuels fraud.”

With a year passed since the EC proposed this regulation, Noyon says changes to improve the UDB’s operation, “beyond the core data… should include supporting documents like customs records to verify the origin of both the product and its sustainability certificates”.

“Linking this with national systems that track production capacity and feedstock use would make irregularities much easier to detect and investigate,” he says.

Noyon agrees with other industry experts that it is essential to get the Commission to share a clear implementation plan, whereby everybody is on board.

The EBB sees the UDB as an “interface between producers, traders, regulators and verification schemes”, he adds. In short, “We need a system that works. Overall, a centralised database dramatically improves traceability and transparency. But it needs to be comprehensive and easily crossreferenced to fulfil its potential as a fraudbusting tool.”

Other responses to the EC highlighted the potential complexity in policing such a detailed database. For instance, industry body FuelsEurope highlighted the risk of suppliers being suspended from the database (impacting their sales) if they did not certify data in time.

It stressed that the database regulators

“A centralised database dramatically improves traceability and transparency. But it needs to be comprehensive and easily crossreferenced to fulfil its potential as a fraud-busting tool”

should be flexible in cases where certification bodies are late in undertaking their work, for example.

Finland-based renewable leader Neste said a proposed three-day reporting and review window imposed undue administrative burdens, “potentially deterring companies away to less demanding markets”.

It recommended an “extended reporting period and removing automatic cancellation of transactions” by regulators – with buyers being able to send back transactions for corrections to the seller if errors are spotted post approval.

The European Waste & Advanced Biofuels Association (EWABA) said there needed to be a year’s delay in implementing the database to iron out operational issues which, if left unaddressed, could “cause a huge negative impact on the industry”.

Europe’s eFuel Alliance warned that the “anticipated data requirements and complex submission processes may quickly become overwhelming, especially when they don’t align with practical, real-world operational practices. Smaller companies, which often lack the extensive administrative resources of larger organisations, will likely struggle to meet these new demands, diverting resources away from core activities.”

But there remain supporters of the system, for preserving fair competition in the EU biofuel market. The European Fat Processors and Renderers Association (EFPRA) stressed it backed “any initiative

to avoid biofuel fraud risks within or from outside the EU”, as long as EU and nonEU companies and their suppliers had the same reporting obligations.

It noted how European renderers and other waste and residue collectors had witnessed a “dramatic price decline due to fraudulent used cooking oil [UCO] imports from China over years...”

A 2024 report from the EU Working Group on Monitoring Methodologies of CO2-Neutral Fuels (WGMM), representing the automotive industry, its suppliers and distributors, stressed how the database would have real value in aiding compliance with the RED.

It said under this law, fuel suppliers must prove that a certain amount of renewable energy is brought to the transport market:

“It doesn’t matter which gas filling station (in national borders) is supplied or which vehicle uses the fuel. A certification scheme along the value-chain from the producer to the filling station verifies that all production and sustainability criteria are met,” which the UDB will aid by boosting the traceability of these fuels. If its information is linked to vehicle regulations and national registration, RED compliance could be passed down to the driver level, maybe shifting consumer behaviour through incentives:

“Otherwise, it is impossible to show which CO2 tailpipe emissions have been compensated using [CO2-neutral fuels] CNFs,” says the WGMM report.

Writing in the ERA Forum journal, focusing on the European Research Area (ERA), Professor Kim Talus of Finland’s Centre of Climate Change, Energy and Environmental Law (CCEEL), stressed that the UDB could help the EU and its member states assess the appropriate level of state aid subsidies to promote biofuel production and use.

Prof Talus stresses that an efficient market requires the avoidance of doublesubsidisation and overcompensation, which in Europe would be better serviced by a comprehensive EU-wide state aid scheme, even if political support for such an idea is currently lacking.

The UDB could help cross-border trade in biofuels, argued Prof Talus, by aiding the traceability of such products within the EU.

He added the database may complement existing information and “provide a transparent, systematic and reliable source” to help the EU and its member states reliably monitor and control subsidies, so they aid sustainable growth of biofuels.

● Keith Nuthall and Liz Newmark in Brussels write for International News Service, UK

As the largest country in Central Asia, Kazakhstan has seen its production of oils and fats boom in recent years, while other countries are focused on self-sufficiency Vladislav Vorotnikov

For decades, most of Central Asia was terra incognita on the global oil and fats industry map, but new technologies and smart policy have propelled profound changes that have already made Kazakhstan a leading exporter and promise to improve self-sufficiency in some other parts of the region.

Central Asia comprises five countries – Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan – which were part of the former Soviet Union and is bordered by the Caspian Sea to the west, China to the east and Afghanistan to the south.

Kazakhstan, the leading oil and fats producer in the region, has seen domestic production booming in the last few years – a trend largely driven by soaring export sales.

In 2024, Kazakhstan exported over 1M tonnes of oil and fats, nearly doubling this figure compared with the previous year, according to the Kazakhstan National

(NOPA).

Sunflower oil is the key driver of the trend. In 2024, Kazakhstan saw an 18.3% rise in production to 632,200 tonnes and growth is also picking up pace this year.

In 2024, Kazakhstan exported 476,000 tonnes of sunflower oil, of which 200,000 tonnes landed in Uzbekistan, 171,000 tonnes in China and 64,200 tonnes in Tajikistan.

In the 2024/2025 marketing year, Kazakhstan already exported over 1M tonnes of oil and fats during the first nine months of the year, NOPA says. Sales to overseas customers generated US$612M, 46% up compared with 2023/24.

The growth, which was secured in previous years by rising sales to Asian customers, is now primarily fuelled by surging exports to the EU. For example, sales of oil and fat products to Denmark skyrocketed by 1,240%, by 165% to Germany, and by 14% to Latvia during the first nine months of the 2024/2025 marketing year. Eastern expansion has also grown, with deliveries to China

surging by 41% and to Afghanistan by 30%.

The Kazakhstan oils and fats industry growth potential is far from exhausted yet, as acknowledged by the Kazakh government.

In May 2025, the Development Bank of Kazakhstan and the Export Credit Agency of Kazakhstan signed an agreement with a group of leading oil and fats manufacturers, providing state support to oils and fats exports.

Under the terms of the agreement, the businesses will be eligible for pre-export financing – secured lending provided to an exporter to help fund the costs of producing goods or commodities for a specific, confirmed export contract.

The tool is expected to facilitate further growth in oil and fat exports from Kazakhstan, government officials say.

“Our oil and fat producers have enormous potential, and we fully recognise their key role in expanding the country’s export portfolio,” says Allen Chaizhunussov, chairman of the board of the Export Credit Agency of Kazakhstan.

u and Iran – import around 43M tonnes/ year of vegetable oil. Kazakhstan has an opportunity to meet a part of this demand.

“This [state support] will minimise production and market risks, stabilise supply chains and, as a result, significantly increase export volumes of finished oils and fat products,” Chaizhunussov added.

A new era in Kazakhstan

Several factors have contributed to the ongoing industry boom in Kazakhstan, market players believe.

In 2024, oilseed planting in the country reached a record high of 2.9M tonnes, a feat that seemed unreachable not long ago. Several years back, oilseed planting in Kazakhstan was limited to only a few regions in the eastern part of the country, where climate conditions were the most favourable, says Tatyana Derevyanko, a local analyst.

However, the emergence of new hybrids and planting technologies have enabled farmers to start planting oilseeds in the Pavlodar, Kostanai and West Kazakhstan regions in central and western parts of the country, dramatically expanding production.

Rapid growth of oilseed production led to occasional processing capacity shortages in the early 2020s and this is sometimes still a problem, Derevyanko says. Farmers in Pavlodar, Akmola and Abay regions still have to transport their products to neighbouring regions for processing, bearing substantial logistics costs.

According to the Kazakhstan Agricultural Ministry, the oilseed sown area in 2025 will reach 3.4M ha as more farmers switch to producing sunflowers and rapeseed due to the high profitability of these crops.

By 2030, the oilseed sown area will reach 3.9M ha which, coupled with the construction of new crushing and processing capacities, will make Kazakhstan one of the world’s top three leading sunflower oil exporters, the ministry forecasts.

An export duty on oilseeds imposed by the government in 2023 was also a game changer for the industry, NOPA chairman Yadykar Ibragimov says.

The 20% duty, set at a minimum €100/ tonne, has triggered a massive inflow of investments into new processing capacities in Kazakhstan.

“By the end of this year, we plan to launch two refining projects with a combined capacity of 231,000 tonnes/year. [New] refineries will allow Kazakhstan to produce more refined bottled oil, which is a good export commodity,” Ibragimov says.

According to NOPA, the markets where Kazakhstan exporters are already present – including the EU, China, Central Asia

“We have colossal export potential,” Ibragimov says.

Other countries in Central Asia have also seen minor positive shifts in oil and fats production. For example, oil, fats and oilseeds exports from Uzbekistan have been on a steady growth trajectory in the last few years, according to Alisher Makhmudov, a Tashkent-based agricultural analyst.

Sales to overseas customers reached US$45M, rising two-fold compared to 2021, Makhmudov says. The preliminary forecast for this year is US$56.8M.

“These dynamics are evidencing a growing competitiveness of Uzbek [oil and fats] manufacturers on foreign markets,” Makhmudov says.

However, the country has limited potential to boost exports due to a lack of domestic oilseed production.

Uzbekistan’s climate is much harsher than Kazakhstan’s, with deserts covering some 75-80% of the country’s territory.

Around 70% of Uzbek annual consumption of vegetable oils, estimated at 491,000 tonnes, is met by local processors. However, nearly a third of oilseeds used by local processing plants – around 100,000 tonnes/year is imported.

Uzbekistan also imports around 142,000 tonnes of vegetable oil to bridge the gap between supply and demand, Makhmudov notes.

On top of that, Uzbek investors are now pumping their money into new projects in Kazakhstan and this trend is projected to gain momentum, Makhmudov says.

One of the key trends in the oil and fats industry of Central Asia is that competition for investments among the leading economies is becoming increasingly fierce.

As revealed during the Asia Grains & Oils Conference in Tashkent in September, the oil and fats industry in Uzbekistan is braced for a mass consolidation. By 2030, only 25 processing plants will be in operation in the country compared to 85 in 2024.

Uzbek investors will continue to move their production capacities overseas and open between 8-10 modern processing plants in Kazakhstan and Russia, local analysts reported during the event.

Other Central Asian countries are primarily focused on improving their selfsufficiency in oil and fats production.

In 2024, the Kyrgyzstan Agricultural and

Water Ministry rolled out plans to expand vegetable oil production to meet domestic demand.

The country consumes some 60,00070,000 tonnes/year of vegetable oil and local capacities can only meet 8% of that demand, the ministry says.

New capacities are being established in the country. For example, the first plant in Kyrgyzstan for soyabean processing with a nameplate capacity of 10,000 tonnes/year of soyabean meal was launched in the Chui region in July.

However, growth potential remains limited as domestic oilseed production last year stood at only 18,400 tonnes.

The picture is similar in Tajikistan. Only 30% of annual vegetable oil consumption – estimated at 150,000 tonnes – is met by local plants.

Tajikistan spends around US$200M/ year on purchasing vegetable oil in Russia and Kazakhstan, the Agricultural Ministry calculates. Growth potential remains limited due to a lack of oilseeds. In 2025, the planting area under oilseeds in the country was only 1,200ha.

A threat to the future of oilseed production across Central Asia is the looming impact of climate change and growing water scarcity.

According to a 2019 World Bank study, Kazakhstan’s grain production may drop by 37% by 2030 due to the impact of climate change. The report warned that the republics of Central Asia would be among the most climate-vulnerable regions in the next decades, forecasting significant temperature increases in that part of the world.

This could affect oilseed production, with some impact already felt in the industry.

Changing temperatures have turned grain production in Kazakhstan into a lottery, says Yevgeniy Karabanov, head of the analytical department of the Kazakhstan Grain Union, pointing to fluctuations in yearly grain production that have grown wider in recent years.

Additionally, Central Asia is facing a severe water crisis that threatens economic development, including agriculture, says Climate Action Network, a local environmental protection NGO.

Substantial efforts are being made in Kazakhstan, Kyrgyzstan and Uzbekistan to safeguard agriculture, which includes sustainable land management, improving water efficiency through better irrigation and drainage, and promoting climatesmart agricultural practices such as agroforestry and hydroponics. ● Vladislav Vorotnikov is a freelance journalist

Major oils and fats trading nations have had to contend with disruptive tariffs since US President Donal Trump took office in January. Ahmad Pathoni, Iman Muttaqin, Wang Fangqing, Liz Newmark, Andreia Nogueira, Keith Nuthall

The global oils and fats industry has had to manage significant levels of trade disruption through the turbulent policies of the US administration under President Donald Trump.

Since Trump took office in January for his second term as president, the predictability of past American trade policy that generally favours freer trade has been abandoned. Uncertainty is now the name of the game, with the administration imposing, increasing and sometimes decreasing tariffs.

Brazil is a case in point – the USA bought US$57.1M’s worth of soyabeans from Brazil in 2024, according to the

Observatory of Economic Complexity. However, on 30 July, the USA imposed an additional 40% tariffs on all Brazilian imports, bringing the total tariff amount to 50%. Trump’s executive order announcing the move cited unhappiness with the prosecution of former Brazilian President Jair Bolsonaro, a Trump ally, as grounds for increasing the tariffs.

How long the 50% rate will last remains to be seen. Trump met Brazil’s centreleft President Luiz Inácio Lula da Silva in September during the UN General Assembly session and they have agreed to meet in future.

Changeable American protectionism has certainly been the experience of Indonesia, with the Trump administration imposing a ‘reciprocal’ 19% tariff within a July trade deal, having earlier threatened a 32% levy.

The cost was Jakarta eliminating tariff barriers on over 99% of US products exported to Indonesia.

The USA is hoping to export more goods to Indonesia under the trade deal. US exports to Indonesia in 2024 were worth around US$10.2bn, with soyabeans and related agricultural

products accounting for US$1.2bn of that total, the second largest product category, according to Trading Economics.

However, the USA imported around US$28.1bn worth of goods from Indonesia in the same year, including electronics, clothing, rubber and palm oil.

Indonesian Palm Oil Association (GAPKI) chairman Eddy Martono says Indonesia shipped 2.5M tonnes of palm oil to the USA in 2023 and 2.2M tonnes in 2024. With an 85% market share in the USA, Indonesia remains the dominant supplier despite the new 19% tariff, ahead of rival Malaysia.

Indeed, he told OFI that the real victims of the trade policy will be US shoppers.

“Given the US food industry’s dependence on palm oil, the real impact of a 19% tariff will be higher costs for American consumers.”

He notes that the Indonesian government is negotiating a possible review, hoping that the Trump administration will agree that duties on commodities not produced in the USA be restored to earlier levels of 0%–5%.

GAPKI’s foreign affairs division head Fadhil Hasan says the tariff is unlikely to weaken Indonesia’s competitiveness in American palm oil markets.

“The US cannot substitute palm oil in its food processing sector. Since Malaysia faces the same tariff and Indonesia still controls about 85% of the market, our position remains strong,” he says.

Hasan adds that while south and central American suppliers face lower tariffs of around 10%, Indonesia’s supply scale secures its advantage.