SUSTAINABILITY

EU palm oil rules take effect

EU palm oil rules take effect

RENDERING

Meeting fuel and pet food demand

Meeting fuel and pet food demand

EU palm oil rules take effect

EU palm oil rules take effect

RENDERING

Meeting fuel and pet food demand

Meeting fuel and pet food demand

Rendering

Consumer demand for more ‘natural’ products is driving the growth of bio-based surfactants based on palm kernel and coconut oils, as well as biosurfactants produced via fermentation

Projects & Engineering

34 Global round-up of news

OFI reports on some of the latest projects, technology and process news and developments around the world

Instrumentation

18 Meeting fuel and pet food demand

Increasing quantities of EU rendered fats are going into producing biodiesel and renewable diesel, as well as pet food, at the expense of oleochemicals and animal feed

Chlorinated paraffins

22 Emerging contaminant

Chlorinated paraffins are found in a wide range of everyday products and are a health concern due to their persistent and toxic properties with food, including oils and fats, posing a potential exposure route

Surfactants

26 Taking the green route

38 News and developments

The latest instrumentation and testing news

Sustainability

41 Tightening rules on deforestation

Tougher EU deforestation regulations are having an increasing impact on palm oil producers, who say they are being targeted unfairly

Comment

2 Weather alarm

Ukraine/Russia News

4 Russia continues port attacks News

6 Lowest deforestation loss in Indonesia, Malaysia

Biofuel News

10 EU launches probe into Indonesian biodiesel

Renewable News

12 Firms to produce plastics from waste oils

Transport News

14 Mississippi barge rates rise as water levels fall further

Biotech News

16 Amyris selling brands and files for bankruptcy

Statistics

44 World statistical data

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com

+44 (0)1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com

+44 (0)1737 855157

SALES:

Sales Manager: Mark Winthrop-Wallace markww@quartzltd.com

+44 (0)1737 855114

Sales Consultant: Anita Revis anitarevis@quartzltd.com

+44 (0)1737 855068

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com

+44 (0)1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com

+44 (0)1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

© 2023, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020-747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA.

POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com

+44 (0)1737 855000 Printed

The first week of July was the hottest week ever recorded globally, following on from the hottest June on record, according to preliminary data released by the World Meteorological Organization (WMO). Across the world this year, weeks-long heatwaves, deadly wildfires and severe flooding have struck North America, Europe and Asia, killing people and destroying homes.

Our industry has not been immune to the effects of these extreme weather events either – leading soyabean producer Argentina’s production will halve due to its most severe drought in 60 years, while top olive oil producer Spain’s output is also likely to fall sharply and its stocks to reach near zero following its second bad harvest year in a row. This comes as near historic low water levels in the Mississippi drive up barge rates for soyabean exports; and restrictions at the Panama Canal due to shallow waters reduce the throughput and capacity of vessels (see p14).

“The extreme weather which has affected many millions of people in July is unfortunately the harsh reality of climate change and a foretaste of the future,” WMO secretary-general Professor Petteri Taalas says.

Climate change is likely to contribute to food insecurity in the future, by reducing food production and increasing prices. Water may become more scarce due to drought and increased irrigation. Competition for land may increase as certain areas become unsuitable to grow crops.

This year’s unprecedented climatic events as a result of fossil fuel emissions should be raising the alarm. And yet a recent Greenpeace press release has accused 12 of Europe’s leading fossil fuel companies of ‘greenwashing’, saying that only 0.3% of their combined energy production came from renewable power last year, and just 7.3% of their investments went towards green energy, while they use a “deliberate cocktail of greenwashing jargon and promote dangerous distractions like carbon capture & storage and carbon offsetting”.

Along with the world’s lack of progress in curbing emissions, the tropical forests which remove carbon dioxide from the air continue to be cut down. Global Forest Watch (GFW) has reported that the deforestation rate in the tropics actually rose 10% in 2022 compared with 2021, with Brazil accounting for 43% of the total under the administration of former Brazilian president Jair Bolsonaro (see p6). This trend is reversing under new president Luiz Inácio Lula da Silva, who has pledged to end deforestation in Brazil by 2030.

Palm oil giants Indonesia and Malaysia should also be commended for slowing deforestation, with Indonesia seeing deforestation fall by 64% between 2015-2017 and 2020-2022, the steepest drop of any tropical country. Over the same time frame, Malaysian deforestation fell by 57%, the fourth steepest drop in the tropics, GFW said.

Their success has been attributed to tougher government policies and corporate commitments, along with wet weather in recent years minimising forest fires. No Deforestation, No Peat and No Exploitation (NDPE) commitments now cover the majority of the two countries’ palm oil sector, and mining is now Indonesia’s biggest deforesting sector, overtaking palm oil.

The efforts of Indonesia’s and Malaysia’s palm oil sectors demonstrate that government and industry can do something about deforestation. But the danger is that the world is still nowhere near the scale and pace of emission reductions needed to put us on track towards limiting the global temperature rise to 1.50C by the end of the century in order to save lives and livelihoods.

Serena Lim, serenalim@quartzltd.com

Russia has continued its attack on Ukrainian grain and oilseed assets with drone strikes at the Danube River port of Izmail on 23 August, Reuters reported on the same day.

Quoting a message from Ukrainian Deputy Prime Minister Oleksandr Kubrakov on the Telegram messaging app, Reuters said Russia had destroyed 13,000 tonnes of grain — about 15% of total storage capacity — at the port.

Nibulon said one of its grain warehouses near Odessa was also damaged by a Russian drone attack on 23 August.

In just over a month since Russia's 17 July withdrawal from the Black Sea Initiative (BSGI) facilitating safe passage of Ukrainian agricultural exports, Moscow had destroyed 270,000 tonnes of grain at Ukraine's Black Sea and Danube ports, the Reuters report said.

Trade had already been switching towards the Danube ports even prior to Russia leaving the BSGI as exporters considered it a safer option, AgriCensus wrote on 17 August.

UKRAINE: The Ukrainian Grain Association (UGA) has improved its 2023/24 harvest outlook by 7.8M tonnes to 76.8M tonnes of grain and oilseed crops, 3M tonnes more than the country harvested in 2022/23, Interfax wrote on 3 August.

"The increase is due to favourable weather conditions and better crop yields than expected, although the planted area is 2.2M ha less than last year," the UGA said.

The sunflower harvest was forecast at 13.9M tonnes with 1.1M tonnes of exports; the rapeseed harvest at 3.9M tonnes with 3.7M tonnes of exports; and the soyabean outlook was 4.8M tonnes with potential expoerts of 3.3M tonnes.

However, rates for the Danube were now increasing amid increased risks with freight for coaster vessels increasing by almost US$25/tonne to US$65/ tonne since the second half of July, AgriCensus said.

In addition, waiting times at the entrance and exit of the Sulina canal at the mouth of the Danube were long, with up to 90 vessels waiting at the entrance and up to 40 vessels in the queue to exit at the time of the report.

Russian President Vladimir Putin said he would only rejoin the BSGI if the West stopped restricting Russia’s exports from

global markets, the Associated Press wrote on 5 September.

Putin was speaking following talks with Turkish President Recep Tayyip Erdogan on 4 September to discuss the BSGI.

Putin also said that Russia was close to finalising an agreement to provide free grain to six African countries, saying the country would ship 1M tonnes of cheap grain to Turkey for processing and delivery to poor countries.

Meanwhile, the Ukrainian government confirmed that the first vessel stuck in a Black Sea port since the beginning of the conflict with Russia last Feb-

ruary had been able to leave under a new humanitarian corridor opened by the country’s navy on 10 August, AgriCensus reported on 16 August.

The Hong Kong-flagged Joseph Schulte had left carrying up to 30,000 tonnes of cargo, including food, according to the Ministry of Infrastructure.

Ukrainian naval forces said vessels would only be allowed to use the corridor if their owners or captains confirmed their willingness to ship in the current conditions or were prepared to accept the risk.

Despite the move, trade sources said the primary concern about who would provide insurance for such shipments remained, AgriCensus wrote.

In July, Ukrainian officials said that they had made an insurance fund of around US$544M available to cover any potential damage for such shipments. However, the decision on whether to cover any damage would be analysed and taken by the Ukrainian government and it was not fully clear how it would work, AgriCensus wrote.

Romania could double its monthly transit of Ukrainian grain to its Black Sea port of Constanta to 4M tonnes in the coming months Reuters reported on 15 August.

The increased capacity could be achieved by hiring extra staff to ease the passage of vessels into the Danube’s Sulina canal and by finalising connecting infrastructure projects — many of them EU-funded, Romanian Transport Minister Sorin Grindeanu said.

Before Russia’s withdrawal from the Black Sea Grain Initiative facilitating Ukrainian grain exports, Ukraine's inland Danube ports of Reni and Izmail had accounted for about 25% of Ukraine’s grain exports, Reuters said. Grain was loaded onto barges, shipped downriver through the territorial waters of the EU and NATO-member Romania, and onwards to Constanta.

Grindeanu said Romania’s Danube administration agency would have 60 pilots to take

ships in and out of the Sulina canal by the end of August.

In addition, an EU-funded project to make sailing possible at night on Sulina was expected to be completed in October.

Following the investments and increased staffing levels, the Romanian ports of Galati and Braila would be used alongside Reni and Izmail, Grindeanu added.

Against this backdrop, Ukraine exported 3.39M tonnes of agricultural products in July 2023 – the first month of the 2023/24 season – according to preliminary data quoted in a 15 August report by UkrAgroConsult.

This was 31% lower than the 4.86M tonnes exported in June 2023 – the last month of the previous season, the 15 August report said.

UkrAgroConsult wrote that the termination of the BSGI on 17 July had reduced Ukraine’s export volumes to the lowest monthly level since last July, when 2.8M tonnes were exported.

Bring new products to market faster and more sustainably with Crown. As a leader in oilseed extraction for 70 years, Crown’s technical expertise, guidance, proven technologies and Global Innovation Center transform your ideas for protein concentrates, food/beverage, botanicals and other new product segments into pro table realities. With Crown’s full-scale, state-of-the art pilot plant, analytical lab and training facilities, you can test product and process feasibility, run benchtop scale to custom processing and commercialize with ef cient, continuous operations backed by Crown’s aftermarket support and eld services. Accelerate your market opportunity — partner with Crown for a full lifecycle solution. Start up, scale up and expand with CPM and Crown’s expertise.

CHINA: Soyabean imports are expected to reach a record 100M tonnes in the 2022/23 marketing year, according to the US Department of Agriculture (USDA) Foreign Agricultural Service (FAS) Oilseeds: World Markets and Trade August report.

In the first 10 months of the current marketing year – which runs from October 2022-September 2023 –China had already imported almost 84.5M tonnes of soyabeans, with just under 30M tonnes sourced from the USA. Total arrivals to date were 10% higher compared to the same period last year.

“Shipments from the USA trailed off in April as Chinese buyers took advantage of a bumper Brazilian soyabean crop and attractive prices. Smaller suppliers of soyabeans to China have also increased their exports,” the USDA said.

“The ‘soya dollar’ programme in Argentina contributed to recovery in shipments in the first half of 2022/23. Canada and Russia also increased exports to China this year on higher soyabean production and relatively flat crush.”

In 2023/24, China was projected to remain the world’s largest soyabean buyer with imports forecast at 99M tonnes.

“China is likely to continue buying larger volumes of soyabeans from Brazil and potentially less from the USA. Prices of the new US crop have been rising on lower supply expectations, while Brazil output prospects remain robust.”

The world’s two biggest palm oil producers, Indonesia and Malaysia, have kept deforestation to near record-low levels, according to non-profit organisation Global Forest Watch (GFW).

In Indonesia, deforestation dropped by 64% from 2015-2017 and 2020-2022 – the steepest decline of any tropical country – while forest loss in Malaysia fell by 57%, the fourth biggest drop in the tropics, the research showed.

“I think Indonesia and Malaysia should be included as success stories," Liz Goldman, senior geographic information system research manager for GFW, was quoted as saying in a 7 August Guardian report. "They have been for a number of years now, ever since the 2015 fires [linked to El Niño]. We’re really seeing government and corporate actions coming together there.”

However, tropical deforestation was accelerating overall despite the progress being made in some countries, Eco-Business wrote on 3 July.

Ghana had the highest increase in tropical deforestation, a rise of 71% year-on-year in 2022.

A total of 4.1M ha of tropical primary forest was lost overall last year – a 10% increase compared to 2021 – with the highest rate reported in Brazil under former President Jair Bolsonaro's administration, GFW said. Forest loss in Brazil accounted for 43% of total global deforestation in 2022.

However, newly-elected Luiz Inácio Lula da Silva had pledged to restore protections for the Brazilian Amazon and achieve zero deforestation in Brazil by 2030, the Eco-Business report said. Against this backdrop, a joint statement was made on 8 August by eight countries belonging to the Amazon Cooperation Treaty Organisation following a summit in Belém, saying the new alliance would aim to “prevent the Amazon from reaching a point of no return”, while leaving each country to pursue its own conservation goals, the BBC reported.

new version would not have a fixed and differential exchange rate. In the new scheme, 75% of the countervalue of the export of goods would have to be brought in via foreign currency and negotiated through the Free Exchange Market, while the remaining 25% would be “freely available” to exporters.

The Argentine government confirmed the introduction of a fifth 'soya dollar' scheme on 5 September to boost exports and foreign currency earnings, the Buenos Aires Times reported on the same day.

The Economy Ministry said it was acting amid a lack of foreign currency and an imbal-

The fifth scheme was aimed at soyabean producers, specifically exporters who had shipped crops overseas in the last 18 months, the report said. Producers would be rewarded if they completed sales before 30 September.

Unlike previous schemes, the

In this way, producers would be able to buy a tonne of soyabeans by paying 75% of an official exchange rate – 365 pesos/US$ currently – while the remaining 25% could be bought via a free exchange rate such as the MEP or CCL dollar, currently at 672 peso/US$ and 769 pesos/US$, respectively.

The previous scheme had offered an exchange rate of 340 pesos/$US and its target to raise around US$2bn had been exceeded in a few days.

Global vegetable oil prices were up by 12.1% in July compared with June – the first increase after seven months of consecutive declines, according to the United Nations Food and Agriculture Organization Food Price Index published on 8 August.

“International sunflower oil prices

rebounded by more than 15% month-onmonth, primarily underpinned by renewed uncertainties surrounding the exportable supplies out of the Black Sea region after the decision by the Russian Federation to terminate the implementation of the Black Sea Grain Initiative. World palm oil prices

also rose markedly, reflecting prospects of subdued production growth in leading producing countries," the FAO said.

International prices for soyabean and rapeseed oils also rose due to concerns over the production outlooks of US soyabeans and rapeseed in Canada.

The US Food and Drug Administration (FDA) issued its final rule on the use of partially hydrogenated oils (PHOs) in the food supply on 8 August, which it said reflected its June 2015 determination that PHOs in food was no longer generally recognised as safe (GRAS).

Industrial trans fatty acids (TFAs) are produced when oils are partially hydrogenated to make them solid or semi-solid, increasing their stability and improving their shelf life. They were used widely in margarines, vegetable shortenings, commercial baked

The Turkish government has re-introduced olive oil export restrictions, a US Department of Agriculture (USDA) Foreign Agricultural Service Global Agricultural Information Network report said on 22 August.

A three-month export ban on olive oil in bulk and in barrels was introduced by the Ministry of Trade on 1 August due to a olive oil production shortage in Mediterranean countries and subsequent domestic price rises in Turkey.

This was the third time in three years that Turkey had banned olive oil exports in a bid to stabilise local market conditions, the report said. The export ban would stay in place until the beginning of the next olive oil harvest period on 1 November 2023, the ministry said.

Turkey’s packaged olive oil exports increased by 3% in volume in the 2022/23 marketing year, while bulk olive oil exports increased by 5.5 times and barrel exports increased by four times, the USDA said. Total exports of bulk and barrel olive oil increased from 42% to 83% compared to the previous year.

In July, the Turkish government introduced a fee of US$0.20/kg for all bulk and barrelled olive oil exports in a bid to increase the export of value-added products, such as consumer-ready packaged olive oil, and to discourage the export of olive oil in bulk and barrels.

goods and in fast-food restaurant deep fryers until scientists discovered they had a ‘double whammy’ effect of increasing ‘bad’ or low density lipoprotein (LDL) cholesterol, while lowering ‘good’ high density lipoprotein (HDL) cholesterol. Trans fats increase the risk of developing heart disease and stroke.

The FDA has set 1 January 2021 as the final compliance date to remove PHOs from the food supply to allow manufacturers time to reformulate foods but it added that “trans fat will not be completely

removed from the food supply because it occurs naturally in meat and dairy products and is present at very low levels in other edible oils”.

The final rule revoked the regulation for partially hydrogenated fish oil as an indirect food substance and revised GRAS affirmation regulations to no longer include partially hydrogenated forms of menhaden and rapeseed oils.

It also revoked the pre-1958 authorisation for using PHOs in margarine, bread, rolls, buns and shortening.

AUSTRALIA: Alternative fats start-up Nourish Ingredients has secured A$5.8M (US$3.9M) in funding and grants from the government to help with its launch late next year, AgFunder News reported on 25 July.

By tailoring the DNA of its yeasts and growing them in specially calibrated environments, the company said it could create customised fats to suit specific products.

Nourish said it was now in discussion with potential commercial partners to build a large-scale [fermentation] facility in the USA or Singapore. It was also in the process of applying for approval from the US Food and Drug Administration and Singapore Food Agency.

ARGENTINA: Argentina’s production of soyabeans and corn is expected to increase sharply in the 2023/24 marketing year, according to latest forecasts from the Buenos Aires-based Rosario Grain Exchange (BCR) reported by World Grain on 10 August.

With recent rainfall providing relief from the leading soyabean producer's worst drought in almost 60 years, the grain exchange forecast soyabean production to reach 48M tonnes, up from 20M tonnes in 2022/23.

The country was also expected to increase its soyabean planted area by 6% to 17M ha, according to the BCR.

Leading Asian agribusiness Wilmar International has acquired Cosumar SA’s 45% stake in Moroccan vegetable fats business Wilmaco for US$8.7bn.

Following the deal, Wilmaco would become a wholly-owned subsidiary of Wilmar, the latter said on 30 July.

Wilmaco is involved in the production, development, processing, import, export and marketing of vegetable fats and their by-products.

The construction of Wilmaco’s speciality fats facility in Morocco was due to be completed in

the fourth quarter of this year, Wilmar said.

The acquisition was subject to terms due to be agreed and finalised by September and to Cosumar board approval.

As part of the same transaction, Singapore-based Wilmar said it had agreed to dispose of its 30.05% equity shareholding in Cosumar –Morocco's top sugar producer and refiner.

In addition, Wilmar said it would acquire Cosumar’s 43.275% stake in Durrah Advanced Development, a Saudi Arabian refiner of white sugar for the retail and industrial sectors.

and texture to new meat alternatives, according to a report by The Independent.

Coconut oil is used extensively in the plant-based protein market and Impossible’s range of pig-free pork combines soya with sunflower and coconut oil and the soya-derived heme protein.

However, after several years of rapid expansion, sales of meat substitutes have fallen, with UK sales dropping by 6% last year, according to a Guardian report on 9 August.

US plant-based company Beyond Meat has seen its sales drop by almost a third, saying it had been affected by “softer demand in the plant-based meat category, high inflation, rising interest rates and ongoing concerns about the likelihood of a recession”, the BBC reported on 8 August.

The company, which co-developed McDonald’s McPlant vegan burger, reported a

drop in sales of 30.5% for the three months to the end of June, compared to the previous year. It now expected annual revenue of between US$360M-US$380m, down from earlier estimates of as much as US$415M.

The global rise in consumer demand for plant-based foods has opened up new markets for oils and fats which are used to add flavour, moisture

Vegan food firm Meatless Farm said the alternative meat market had become crowded and stopped trading in June, while sausage producer Heck recently reduced its vegan range due to lack of consumer demand, the BBC wrote.

Beyond Meat’s chief executive said demand had also been hit by increased scrutiny of the health benefits of vegan products.

Olive oil stocks in Spain – the world’s largest producer – could reach near zero levels, a consultant in the sector told Olive Oil Times.

Stocks had fallen to 455,000 tonnes at the end of June compared with 809,000 tonnes at the same time the previous year, the 31 July report said.

“There has never been a situation like this one where, off the back of a histor-

ically poor harvest, another one is also expected," Juan Vilar, strategic consultant in the sector, was quoted as saying. “We are going to arrive in October [the start of the next harvest] with almost zero stock.”

Fears of an olive oil shortage had led to continuing price rises, with extra virgin olive oil selling for €7.625/kg (US$8.29/kg) – an increase of almost 125% compared to last July – according to data by the Spanish

Federation of Olive Oil producers Infaoliva.

Prices for virgin olive oil and lampante olive oil at origin were also at record highs but had not increased as sharply as extra virgin prices due to higher levels of availability relative to demand, the report said.

Going forward, olive oil prices depended mainly on the likelihood of rainfall in Andalusian olive groves in September, October and early November, Olive Oil Times wrote.

INGREDIENTS.

We provide HydrogenationCIE - Dry Fractionation plants for specialty fats products.

BRAZIL: Leading food and fuel processor Caramuru Alimentos has started selling soyabean-based ethanol at one of its plants, AGWeb reported on 18 August.

Caramuru was one of the first companies in the world to produce at scale and sell hydrous ethanol made from soyabean molasses – a soya by-product, the report said.

The soyabean-based ethanol was being produced at Caramuru’s 9.5M litres/ year plant in Sorriso.

The company said it expected to sell 72% of that volume in the domestic market, with the remainder used to make soyabean protein concentrate.

Caramuru is one of Brazil’s main soyabean, corn, sunflower and canola processing companies.

ARGENTINA: Biodiesel production in 2023 will be the lowest in 15 years at 1bn litres, says the US Department of Agriculture (USDA)’s Foreign Agricultural Service Argentina: Biofuels Annual published on 26 August.

This was down to slower exports, due to the uncompetitive price of Argentine biodiesel entering EU; and lower domestic demand, due to reduced overall diesel demand and lower mandated blending rates. The average biodiesel blending rate in 2022 was 5.9% and was forecast at 5.6% this year.

According to the report, the Argentine biodiesel industry comprises companies operating small and medium-sized plants supplying the domestic market; and firms operating large plants – generally associated with large soya crushing facilities – which export their production. Biodiesel plants of all sizes used soyabean oil feedstock almost exclusively.

Biodiesel exports are forecast at 280M litres this year, the second lowest volume on record.

The European Union (EU) has launched an investigation into allegations of Indonesian biodiesel avoiding EU duties by going via China and Britain, Reuters reported on 18 August.

The EU is Indonesia’s third-largest destination for palm oil products including palm-based biodiesel, according to the report.

The probe followed an initial request from the European Biodiesel Board (EBB), Reuters wrote.

“The request contains sufficient evidence that the existing countervailing measures on imports of the product concerned are being circumvented by imports of the product under investigation,” the European Commission (EC) was quoted as saying in the EU’s official journal.

“A change in the pattern of trade involving exports from Indonesia and the People’s Republic of China and the UK to the EU has taken place following the imposition of the existing counter-

vailing measures,” it added.

The Indonesian government would monitor the investigation and take steps if there were things that did not comply with World Trade Organization (WTO) rules, said Djatmiko Bris Witjaksono, director general of international trade negotiations at Indonesia’s trade ministry. Earlier in August, Indonesia had requested WTO dispute consultations with the EU over the EU’s imposition of countervailing duties on its biodiesel exports, the report said.

Trade relations between the EU and Indonesia have been strained by the bloc’s move to limit imports of commodities linked to deforestation, which is expected to curb EU imports of palm oil, according to the report.

The EBB said it estimated that Indonesian biodiesel imports circumventing duties could have cost the EU around US$241M last year.

Spanish energy company Repsol plans to invest US$133M to transform a unit at its plant in Puertollano (Ciudad Real) to become its second advanced sustainable fuels plant, alongside its Cartagena complex, where production started earlier this year, Servimedia wrote on 27 July.

Repsol CEO Josu Jon Imaz announced the investment while presenting the company’s first half results.

Repsol planed to produce 200,000 tonnes/year of biofuels in Puertollano to be sold at its service stations.

The firm currently produced 700,000 tonnes/year of biofuels and aimed to increase this to 2M tonnes/year in 2030, the report said.

In Cartagena, Repsol would

be investing US$219M with the aim of producing 250,000 tonnes/year of advanced biofuels including biodiesel, bio-naphtha, sustainable aviation fuel and bio-propane.

Biodiesel imports into the EU are forecast to increase by about 14% this year mainly due to rising shipments from China, the US Department of Agriculture (USDA) wrote on 14 August.

China’s exports of biodiesel to the EU jumped by 86% from January-April 2023, with the highest increases going to the Netherlands, Spain, Malta, Bulgaria and Germany, according to Trade Data Monitor (TDM) quoted in the Biofuels Annual Country: European Union report.

“However, in the EU there is growing concern over potential fraud associated with imports

from China as the country does not allow witness audits of their sustainability certification,” the USDA said. “In contrast, imports from Argentina are forecast to decline in 2023, as the minimum import price is too high to be able to compete with Chinese product.”

In 2022, the leading suppliers of biodiesel to the EU were Argentina, China, the UK, Malaysia, South Korea, and Indonesia, accounting for 36%, 22%, 14%, 12%, 4.98% and 4.79% of EU biodiesel imports respectively, the USDA report said.

Malaysian publicly-owned government company Sirim Berhad, Japanese packaging producer Fujimori Kogyo Co (Zacros) and the Universiti Sains Malaysia (USM) are working together on a project to produce biodegradable plastics from waste vegetable cooking oil.

Sirim said the institutions aimed to establish optimal processes for producing polyhydroxy alkanoates (PHA) using local microbial strains, the New Straits Times

JAPAN: Finnish oil and gas and renewable fuels supplier Neste announced on 21 August that it had agreed to supply its Neste RE feedstock for polymers production to Suntory, ENEOS and Mitsubishi Corp of Japan to enable production of polyethylene terephthalate (PET) resin on a commercial scale.

Japanese petroleum firm ENEOS would use bio-intermediates based on Neste RE to produce bio-paraxylene at its Mizushima refinery in Okayama, which would be converted to purified terephthalic acid and subsequently to PET resin for beverage firm Suntory to produce bottles, starting in 2024.

Neste RE is made from 100% bio-based raw materials such as waste and residues, including used cooking oil, the company said.

SPAIN: An experimental asphalt made with semi-hot bitumen (a by-product of petroleum refining), olive oil refining by-products and recycled vegetable oil is being trialled in Castile and León region, Olive Oil Times wrote on 10 August.

Local authorities said the asphalt could be produced at temperatures 400C cooler than traditional asphalts, reducing energy usage, and emitted less smoke and odour while being poured, as well as creating value from olive oil waste.

(NST) reported on 24 July.

The locally-developed organism was capable of producing high yields of poly(3-hydroxybutyrate-co-3-hydroxyvalerate) [PHBV], a microbial biopolymer with biocompatible and biodegradable properties that made it a potential candidate for substituting petroleum-derived polymers, the NST wrote.

As part of the project, the companies had completed construction of a pilot plant

located at Sirim’s facility, Zacros said on 24 July. With a current production capacity of five tonnes/year, Zacros said it expected commercial operations to start at the plant in 2025, with production increasing to 5,000 tonnes/year by 2030.

The bioplastics produced would be used to make single-use plastic products – such as cutlery and food packaging – in Southeast Asian countries, said Zacros, which has plants in three Southeast Asian countries.

roll off their bodies, Intelligent Living wrote.

The Kao researchers focused on creating a surfactant – a substance that can decrease the surface tension of fluids – that could dampen the insects’ body and wings.

Researchers at Kao Corporation’s Personal Health Care Products Research and Material Science Research laboratories have developed a surfactant spray for mosquito control without the use of insecticides, Intelligent Living reported on 16 July.

Mosquitos are carriers of diseases such as malaria,

dengue fever, Zika virus and Japanese encephalitis.

However, traditional insecticides could pose health risks to humans, the report said.

The bodies and wings of mosquitoes were covered in micro- and nano-scale structures that repelled water, along with a wax-like covering allowing water droplets to

While water droplets could roll off mosquitoes’ bodies due to their water-repellent (hydrophobic) physiology, the surfactant solution spray wetted the mosquitoes, causing them to fall. The spray also blocked the mosquitoes’ spiracles –small openings for respiration. Without oxygen, the mosquitoes died.

An additional benefit was that mosquitoes were unlikely to develop resistance to the surfactant solution, the Kao researchers said.

Their findings were published in Scientific Reports journal earlier this year.

Global bio-polymer producer Braskem and leading Asian petrochemical company SCG Chemicals have formed a joint venture – Braskem Siam Company – to produce bio-ethylene in Thailand.

The project would be located in Map Ta Phut, Rayong, and produce bio-ethylene from ethanol dehydration, commercialising ‘I’m green’ biobased polyethylene (PE) using EtE EverGreen technology, Braskem said on 17 August.

As part of the joint venture – which was subject to regulatory approval and final investment decisions by the partners – Braskem said it would provide technology it had developed in partnership with Lummus Technology, combining its experience in the bio-based plastics sector

with SCG Chemicals’ expertise in high-quality PE for different applications, operational experience in PE manufacturing and market reach in Southeast Asia.

“SCGC aims to develop … environmentally-friendly polymers … to reach 1M tonnes annually by 2030 … satisfying soaring demand for environmentally-friendly plastic which has a robust growth rate, especially in Asia and Europe,” SCGC CEO Tanawong Areeratchakul said.

The ‘I’m green’ brand was a bio-plastic made from ethanol which could be used in a range of products, from food and drink packaging to personal and home care products, toys, houseware and plastic bags, Braskem said.

ROMANIA: Farming investment company Holde Agri Invest has built a new 10,000 tonnes US$1.7M silo at Frumusani farm, in Calarasi county, increasing its total storage capacity to 25,000 tonnes, the company said on 31 August.

Holde said the investment was the first phase of its project to develop storage capacities at the farm. The second stage would involve building five new 500 tonne cells, installing a seed selection and treatment station, along with storage halls.

According to Holde’s 2022 annual report, the company operates a total land area of 12,300ha divided into four core farms – Rosiori, Frumusani, Videle and Contest – of which 700ha is owned and 11,600ha leased. Holde also owns a 15,000 tonne silo at Rosiori farm. In 2022, Holde farmed conventional wheat, rapeseed, sunflower, corn, peas and soyabeans, as well as organic wheat and sunflower.

In the 2021/2022 agricultural year, total harvests reached 48,062 tonnes, comprising 2,319 tonnes from organic crops (sunflower, wheat, peas) and the remainder from conventional crops (rapeseed, wheat, corn, sunflower, soyabeans).

Barge rates on the Mississippi River are rising as water levels on key sections of the waterway continue to fall, according to the US Department of Agriculture (USDA)’s 31 August weekly Grain Transportation Report.

“Restrictions – which have grown increasingly stringent since June – lower the amount of grain allowed to be loaded on a barge,” the USDA said. “As a result, barge supply has tightened, because more barges than normal are required to ship the same amount of grain.”

Spot rates for barge shipments out of St Louis were US$23.34/tonne – a 49% increase compared to the week prior to the report and 42% higher than the previous year. It was also an 85% increase compared to the three-year average.

Longer-term rates out of St Louis were also higher, with the one-month rate up 53% compared to the five-year average, the report said.

“If these conditions persist, the tight barge supply could be especially problematic as the corn

and soyabean harvests progress,” the USDA said.

Shipping company American Commercial Barge Line said loading drafts out of St Louis were about 15% below capacity, with a similar size reduction on the entire Illinois and Mid-Mississippi section of the river system, Freight Waves wrote on 1 September.

Water levels on the Mississippi system had been falling since June and were likely to continue falling in the coming weeks, with lower-than-normal precipitation forecast, the USDA said.

Mike Steenhoek, the executive director of the Soy Transportation Coalition, said the the current low water conditions were a cause for concern.

“Harvest and the concomitant export season is ‘game time’ for farmers and the entire agricultural industry,” Freight Waves quoted Steenhoek as writing in a note sent to members and the media on 1 September. “During this period, we need our supply chain, including the Mississippi River, to be operating at full capacity.”

China’s largest food and agricultural company COFCO International has started work on the expansion of the Port of Santos terminal in Brazil which would expand the company’s port capacity in the country from 3M to 14M tonnes, COFCO said on 14 August.

The new terminal was scheduled to become operational in phases between 2025 and 2026.

Located on São Paulo state’s coastline, the Port of Santos is the largest in Latin America connecting more than 600 ports in 125 countries. It is also the most important foreign trade

route in Brazil with almost 27% of the country’s trade balance (US$112.3bn) passing through, according to Santos Port Authority.

Last March, COFCO announced that its Brazilian branch had secured a 25-year lease for a new bulk terminal at Santos Port. As part of the deal, the Brazilian branch would invest in modernising and expanding the terminal facilities.

At the time of the March announcement, COFCO said its Brazilian branch sourced agriculture commodities from more than 7,000 farmers.

Restrictions at the Panama Canal imposed because of falling water levels could continue for another 10 months, AgriCensus wrote on 1 September.

In late July, the Panama Canal Authority (ACP) reduced the daily number of vessels passing through the canal from 36 to 32 – 22 through its Panamax locks and 10 through the Neo-Panamax locks, with restrictions on ships’ depth.

This had led to an increasing backlog of vessels waiting to pass through the canal, with 116 vessels waiting to transit as of 1 September, the report said.

Sources told AgriCensus that current waiting times were around 20 to 21 days and the PCA was quoted as saying the restrictions could remain in place for another 10 months.

With only one or two daily

slots available for vessels without bookings, LPG company Avance Gas said in a second quarter earnings report that the ACP was holding auctions for ships waiting to pass, with one bidder paying US$2.4M for a

one-way northbound transit, on top of the US$400,000 toll fee.

The situation could also impact US crop exports to Asia, which had already become less competitive compared to Brazil, AgriCensus wrote.

USA: US agricultural bioscience company Yield10 Bioscience has filed a request for a regulatory status review of its camelina varieties containing genes to produce the eicosapentaenoic acid (EPA) component of omega-3 oil.

The request was filed with the US Department of Agriculture’s Animal and Plant Health Inspection Service Biotechnology Regulatory Service under the SECURE Rule, the firm said. The rule exempts plants modified by genetic engineering where the modification could otherwise have been made through conventional breeding, reducing the regulatory obligation for organisms unlikely to pose plant pest risks.

SRI LANKA: Foods which contain or have genetically engineered (GE) materials of less than 0.9% will be exempt from requiring the Chief Food Authority’s approval for import or mandatory labelling under amendments to the Food (Control of Import, Labelling and Sale of GM Foods) Regulations, according to a 16 August report by the US Department of Agriculture.

Previously, food and agricultural products with a GE content higher than 0.5% needed approval for import and mandatory labelling of the GE content on packaging.

The USDA said the change would facilitate exports of US non-GM soyabeans and corn.

US synthetic biotechnology ingredients firm Amyris – along with some of its US subsidiaries – has filed for bankruptcy and plans to sell its consumer brands to improve its liquidity, Reuters reported on 10 August.

Amyris specialises in modifying the DNA of yeast to produce cosmetic and health ingredients such as its sugarcane-derived alternative to shark liver oil squalene, Neossance Squalane emollient.

“Restructuring is intended to improve the company’s cost structure, capital structure and liquidity position while streamlining its business portfolio to focus on its core competencies in R&D,” Reuters quoted Amyris as saying. The company’s interests outside the USA were not included in the bankruptcy proceedings, the report said.

Amyris would continue operating its consumer

brands while marketing them, Happi wrote on 11 August.

The company’s products include ingredients for cosmetics and flavours and its range of consumer brands includes the Biossance skin care and Pipette baby care ranges.

To date, Amyris said it had developed and commercialised a total of 13 sustainable ingredients for use in products made by more than 3,000 top global brands. It has worked in partnership with companies including French cosmetics company L’Oréal and Japanese personal care firm Shiseido.

In May, Amyris completed a deal to license cosmetic ingredients, including Neossance Squalane, Neossance Hemisqualane and CleanScreen, to Swiss flavour, fragrance and cosmetic ingredients manufacturer Givaudan, the report said.

Around 55% of total cropland in the USA was planted with varieties having at least one genetically modified (GM) trait in 2020, according to US Department of Agriculture (USDA) data reported by World Grain on 23 August.

Corn, soyabeans and cotton dominated the area planted with GM crops, which were adopted widely by US farmers in the 1990s, the Economic Research Service report said.

GM varieties were beginning to spread in alfalfa and had been planted on a small commercial scale in potato, papaya, squash and apples, the ERS said. The most common GM traits were herbicide tolerance and insect resistance.

According to the USDA’s

Acreage report, biotech varieties were planted this year on 93% of corn area (37.6Mha), 97% of soyabean area (33.4M ha) and 95% of cotton area (3.8M ha).

Wheat, rice, barley, oats, sorghum, peanuts, sunflower, flax, beans, potatoes, vegetables, fruit and nuts continued to be grown mainly using nonGM planting material.

Researchers from the Delhi-based National Institute of Plant Genome Research of the Department of Biotechnology have developed a rapeseed mustard variety to yield a bland oil with insect-repelling compounds BQ Prime wrote on 18 August.

The research team developed a mustard with a low level of glucosinolate compound in its seeds but not in the rest of the plant using genome editing (GE) technology.

Glucosinolates defended brassica plants

against predatory pests and pathogens but mustard oil had a pungent taste and deoiled mustard meal was repellent to cows, pigs and poultry, the report said.

Working on a popular mustard variety called Varuna, the researchers focused on two genes – GTR2 and GTR2 – that transported glucosinolates from their source in leaves and pod walls to the seeds.

The resulting low glucosinolates-in-seed variety produced a non-pungent oil.

The next stage was seed multiplication and would be conducted later in the year, with nationwide trials in late 2024/25, the report said.

Last year, the Indian government approved the mustard hybrid DMH-11 for commercial cultivation – the country’s first permitted GM food crop, BQ Prime wrote.

However, commercialisation had been held back by litigation in the Supreme Court filed by anti-GM activists.

The European rendering industry has come into the spotlight due to recognition of its important role in energy production and in meeting the multiple challenges of creating a more sustainable Europe, according to European Fat Processors and Renderers Association (EFPRA) president Sjors Beerondonk.

However, being in the spotlight also means dealing with matters such as criticism over the use of animal fats in biofuel production and continued scepticism about the safety of rendered products, Beerondonk told the EFPRA 2023 Congress earlier this year in June.

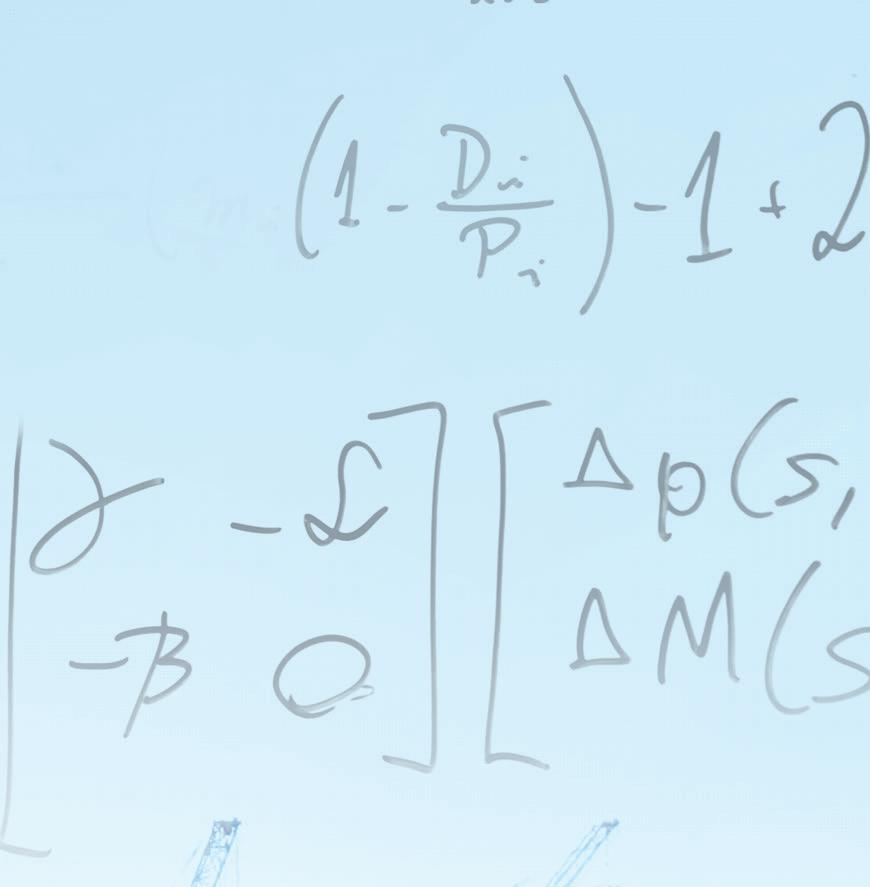

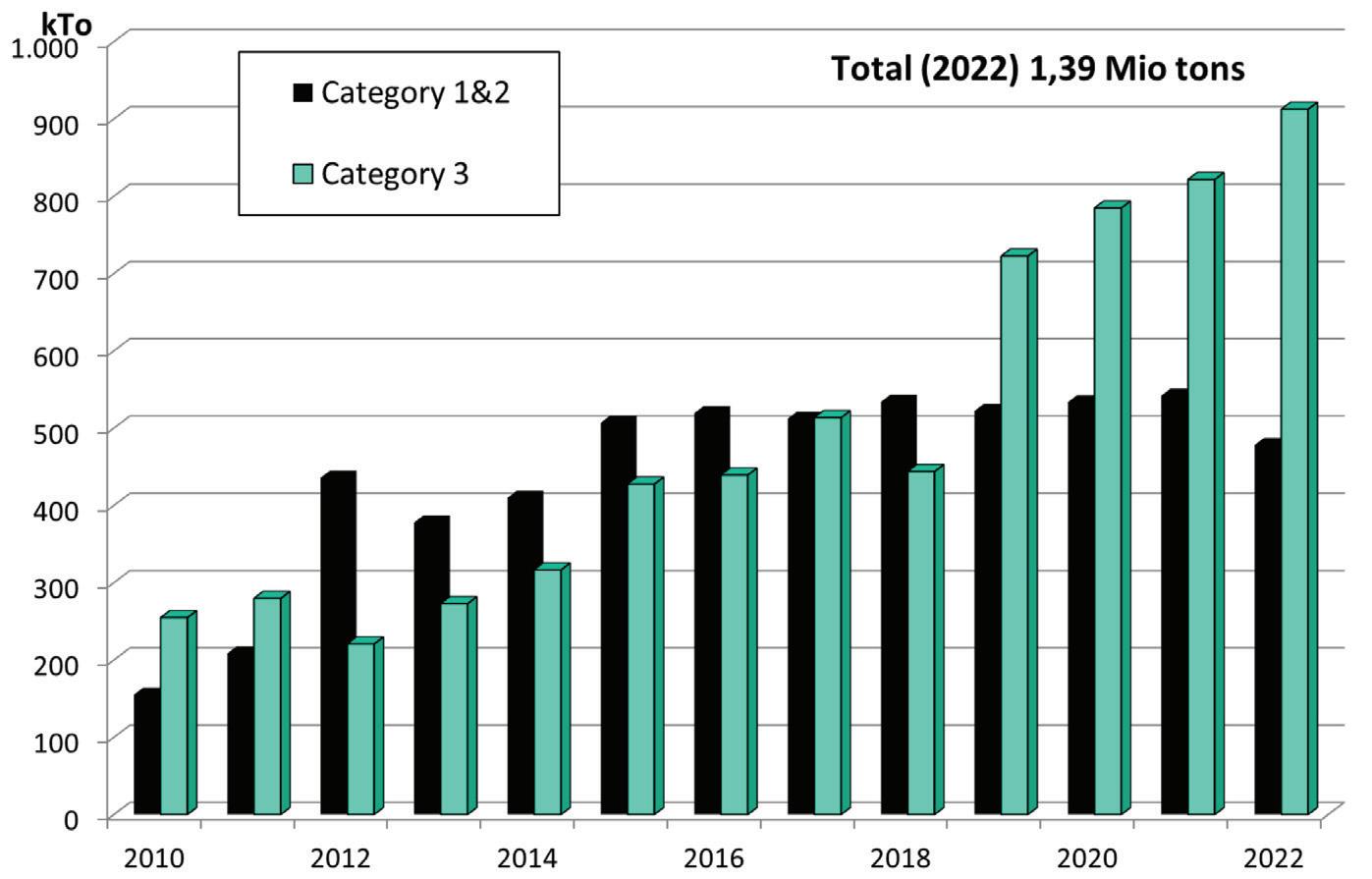

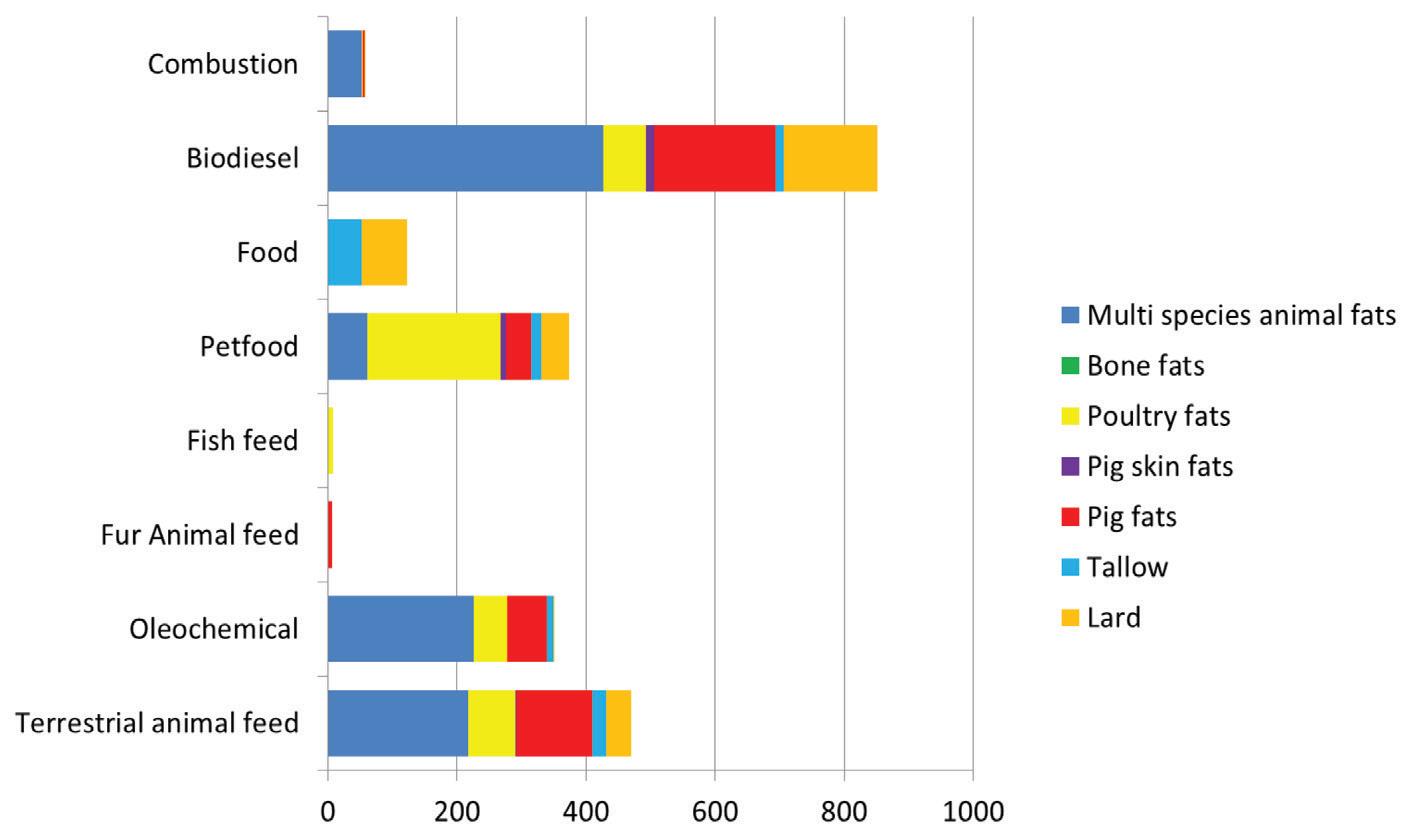

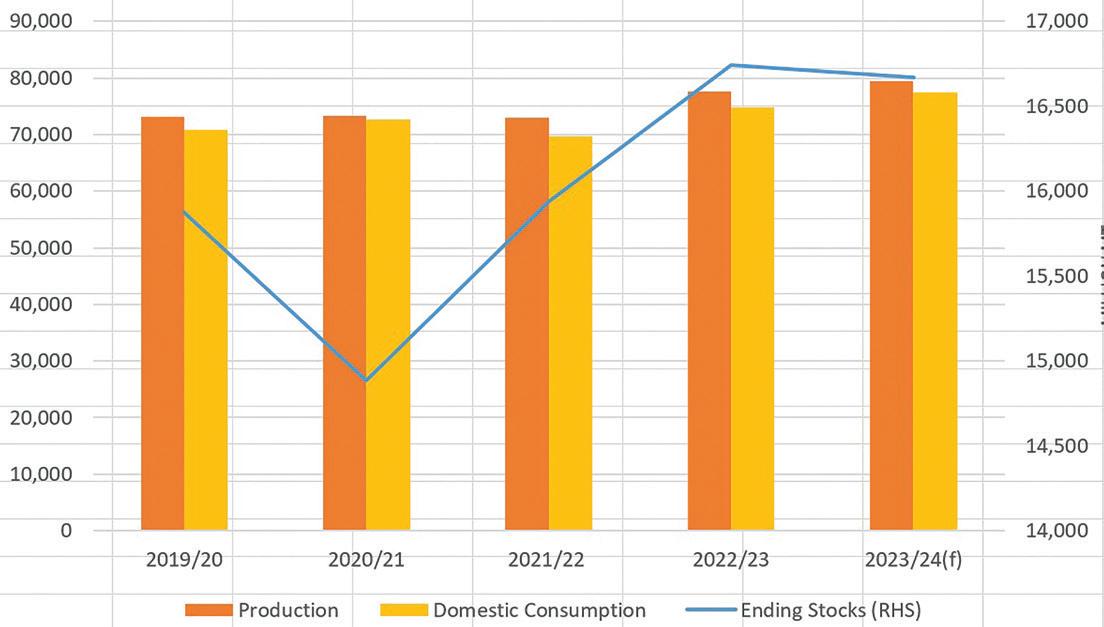

EFPRA secretary general Dirk Dobbelaere told the congress in Italy that 2.3M tonnes of Category 3 fats were produced in the EU last year (see Figure 1, below). Of this total, the largest amount went into biodiesel and renewable diesel, accounting for 39% of fats usage, an increase of 11% in 2022 compared with 2021 (see Figure 2, following page).

However, the pet food sector is still also

a major user of rendered fats (see Figure 2, following page), with amounts going into this sector up by 4% in 2022 compared with the previous year.

In contrast, rendered fats going into oleochemical and animal feed use were down by 18% and 17% respectively.

A surprising amount of food and feed grade fats were combusted last year –60,000 tonnes. Even if that was 14% down from 2021, it was still a big number, Ross Gordon Consultants managing director Bruce Ross reported Dobbelaere as saying.

In total, 1.39M tonnes of EU Category 1, 2 and 3 products went into biodiesel production last year, with continued

2022 total: 2.3M tonnes

In the European Union (EU), animal byproducts (ABPs) are divided into three categories based on the risks they pose.

Category 1 materials have the highest risk of spreading diseases such as bovine spongiform encephalopathy (BSE).

Category 2 materials are classed as high risk.

Category 3 materials are classed as low risk and include processed animal proteins (PAP).

increased use of Category 3 products since 2018 (see Figure 3, following page).

EFPRA’s 30 members in 25 European countries and its associate members processed 18.1M tonnes of raw material into 2.9M tonnes of animal fat and nearly 4M tonnes of animal proteins last year, Dobbelaere said.

Currently, 18 EU and four non-EU countries in Europe ran 49 rendering production lines (from food to Category 1 products) in 257 processing plants and 186 intermediate collection plants.

Overall, processing of animal byproducts was slightly lower in 2022 than in 2021, Dobbelaere said. Beef production, for example, was down 2.6%.

This long-term downward trend was unlikely to be reversed, not least because dairy cow numbers were forecast to fall in the coming years, Ross wrote in the August issue of Render magazine.

Per capita beef consumption was also predicted to continue its declining trend, partly because of its high price relative to other foodstuffs.

The congress heard that the global pig breeding herd had fallen as well – by 2% in 2022 – and was expected to decline by another 5% this year due to several factors, including African swine fever in several EU countries and stricter animal

Increasing quantities of EU rendered fats are going into producing biodiesel and renewable diesel, as well as pet food, at the expense of oleochemicals and animal feed

Source: Dirk Dobbelaera, EFPRA Congress, June 2023

welfare rules for sows and fattening pigs.

One consequence was record prices for pig meat, resulting in the EU being less competitive in export markets, Ross reported Dobbelaere as saying.

Poultry production also decreased last year, although at a slower rate than in 2021, driven by falls in major producing countries such as France. Avian influenza had played a role in this.

However, Dobbelaere said poultry production was likely to grow by 1.1% this year, and demand for poultry meat was strong in the current inflationary times, with consumption potentially rising by 2.5% in 2023.

Last year, 2.78M tonnes of PAP and food grade protein was produced in the EU, almost half of which was multi-species PAPs, the largest proportion, Dobbelaere said. Pet food was, by far, the largest user of PAP and food grade protein (75% share), amounting to 2.13M tonnes.

Source: Dirk Dobbelaere, EFPRA 2022 Congress

Other uses were for fertilisers, incineration, animal feed, fish feed, fur animal feed and food.

Around a third of all PAPs were exported from the EU last year, up from 29% in 2021.

However, the congress heard that there was a large gap in EU official statistics on trade in rendered products and the European Commission (EC) had now agreed to collect statistics on imports and exports of these materials, Ross wrote.

Beerondonk said feed compounders were rediscovering the advantages of using processed animal proteins (PAP)s as ingredients to meet sustainability targets.

PAPs can be used to feed non-ruminant farmed animals such as pigs and poultry in the EU, following an EC decision in August 2021.

Source: Dirk Dobbelaere, EFPRA 2022 Congress

The next move could be to allow less stringent processing methods for the use of pig PAPs in non-ruminant feed following an expected favourable opinion from the European Food Safety Authority, Ross reported Francisco Gordejo, head of the European Commission’s health and food safety department unit that manages transmissible spongiform encephalopathies (TSEs) and animal byproducts, as saying. This should reduce costs, align EU standards with the rest of the world and facilitate exports.

In conclusion, Dobbelaere, said that the pet food’s industry position as a major market for both rendered proteins and fats continues. However, the importance of the renewable energy market continues to grow on the fats side, with the regulatory environment likely to reinforce that trend.

Continuous Rendering Systems

Cookers and Dryers

Screw Presses

Decanters and Centrifuges

Size Reduction Equipment

Process Control Systems

Material Handling Equipment

Total Service and Support

• Optimized fat and meal production

The high product quality specifications you require, and the flexibility to adjust to changing demands.

• Dramatically reduced downtime

Unsurpassed reliability backed up by the rapid response of the largest field service team and parts inventory in the industry

• Complete systems integration

Every type of major equipment — including new Dupps-Gratt horizontal bowl decanters and disctype vertical centrifuges — as well as unsurpassed engineering expertise in creating better ways to recycle protein by-products into profitable fats and meals.

Chlorinated paraffins (CPs) are used in a wide range of industrial and everyday products and are a health concern due to their persistent and toxic properties. Food is a main exposure route to CPs, including fat-containing products and oils and fats

themselves Kerstin KrätschmerChlorinated paraffins (CPs) are persistent organic pollutants (POPs) – chemical substances that break down slowly and enter the food chain as a result – which are of concern to human health.

CPs are mixtures of several thousand compounds that are produced by the chlorination of alkane feedstock. They are ubiquitous and are found even in the Antarctic and remote Pacific islands.

They have been produced since the 1930s for a wide range of applications such as metalworking fluids, lubricants and additives (flame retardants, softeners, water- and mildew-proofing) in consumer goods (paints, coatings, sealants, adhesives, rubber, plastic, polyvinyl chloride [PVC] and flooring).

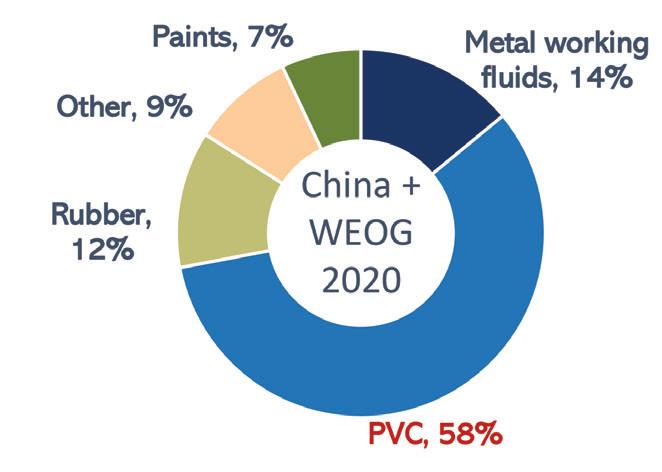

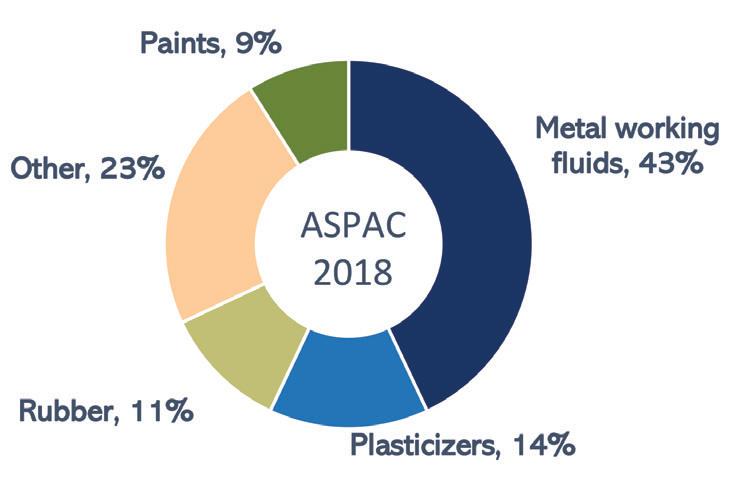

While metal working fluids (high pressure lubricants) accounted for a 43% share of CP applications in 2018, shares in PVC and plastic production (as a plasticiser) is rising, accounting for a 58% share in 2020 (see Figure 3, below).

Commercial production of CPs began in the 1930s, with global production

increasingly considerably at the end of the 1970s to now total more than 1M tonnes/year.

This volume almost equals the total production over six decades of polychlorinated biphenyls (PCBs) – highly carcinogenic chemical compounds

formerly used in industrial and consumer products – the production of which was banned internationally in 2001 (see Figure 1, above).

The total volume of CPs produced to date is some 20-30M tonnes. The main producing country is China, followed by India and other Southeast Asian countries (see Figure 2, above). The annual production volume of CP is more than the sum of all other halogenated flame retardants.

Based on the length of their alkane chains, CPs are commonly divided into:

● Short chain CPs (SCCPs): C10-C13

● Medium chain CPs (MCCPs): C14-C17

● Long chain CPs (LCCPs): C18+

SCCPs have been under scrutiny for more than a decade for their bioaccumulative, persistent and toxic properties, and

their production and use wordwide were severely restricted under the Stockholm Convention on POPs in 2017. The convention is an international environmental treaty signed in 2001 that aims to eliminate or restrict the production and use of POPs.

The long preparatory work leading to the restriction on SCCPs in 2017 has resulted in a shift in production to other CP groups, particularly MCCPs and LCCPs.

Human milk presents a non-invasive way to monitor POPs in the population and the World Health Organisation and United Nations Environment Programme (UNEP) have organised representative global human milk studies since 1987.

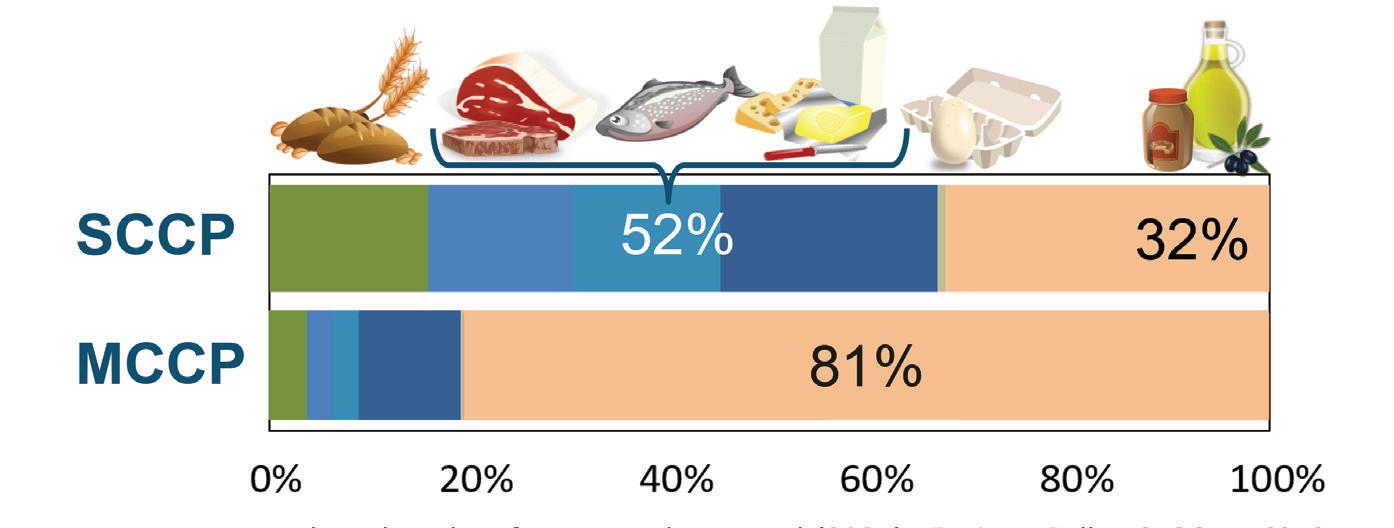

In pooled human milk samples collected between 2012-2019 from five continents, CPs were found in all samples, with the highest levels seen in Asia, Africa and Oceania. Although pesticides accounted for around half of POPs found in Europe, Asia and Africa, SCCPs and MCCPs were always among the Top 4 of analysed POPs in human milk (see Figure 4, right).

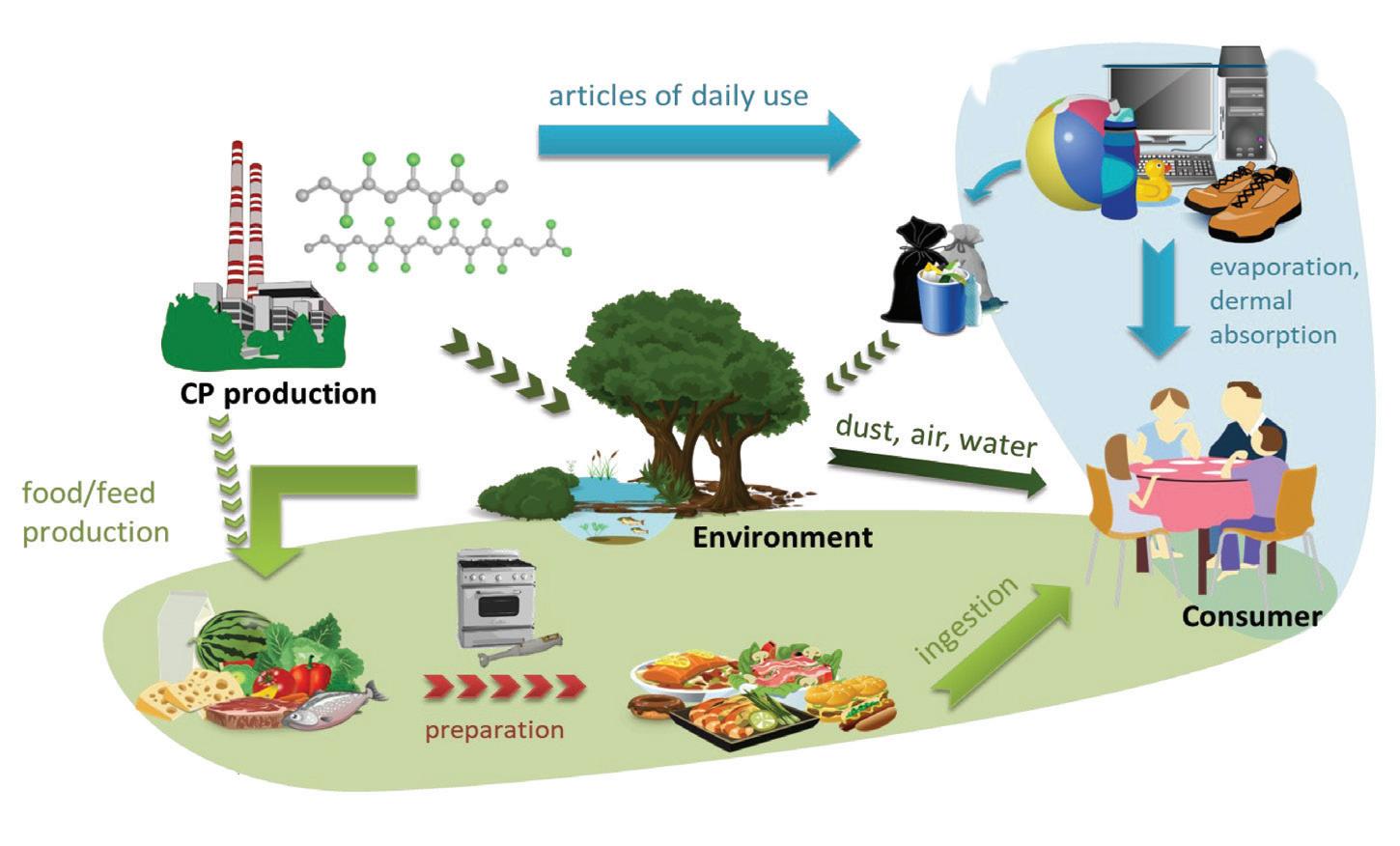

There are many pathways to CP exposure including via everyday products in daily use; dust, air and water; and through eating and preparing food (see Figure 5, following page).

The kitchen environment has multiple potential sources of CP contamination, such as during food preparation and storage, or from industrial fats/greases in hinges or sealings. Little is known about the sources or mitigation pathways.

However, foodstuffs are viewed as a main CP exposure route for the consumer and a study published in 2021 in Environmental Pollution reported fats and oils as the dominant contributor to SCCP and MCCP uptake in Germany (see Figure 6, following page). Vegetables and fruits were not analysed in the study.

CPs may occur during edible oil processing, such as pressing and milling, from the presses used during extraction. Coldpressed extra virgin olive oils often have a higher CP content. However, oil refining can partially remove more volatile CPs.

In a study published in Food Control journal in November 2023, SCCPs and MCCPs were analysed in vegetable oils from the Dutch market. CPs were widespread in various categories of vegetable oils available in supermarkets.

MCCPs were detected at higher frequency and concentrations than SCCPs, with MCCPs dominant in 88% of oil samples.

A marked decrease in concentrations of both SCCPs and MCCPs in refined oil

u

The study – published in Environment International journal in July 2019 – said that CPs most likely originated from vitamin E enrichment of contaminated palm oil.

Another study published in Food Control in March 2023 analysed nut-nougat and chocolate spread samples for the occurence of SCCPs and MCCPs.

MCCPs were found in higher levels in chocolate spreads containing palm oil, compared with spreads not containing palm oil (see Figure 7, below left).

A preliminary risk assessment of the detected levels gave MoEs to CPs from consumption of chocolate and nut-nougat spreads ranging from 16,000 to 48,000. Since health concerns are expected at an MoE of <1,000, this indicated no risk from CP consumption of these products, based on current knowledge.

SCCPs are considered a POP under the Stockholm Convention, with the aim that their production should be eliminated.

Note: Vegetables and fruits were not analysed

compared with their corresponding crude oil was noted, with an average reduction rate of 82% and 69% for SCCPs and MCCPs, respectively.

Although the estimated margins of exposure (MoEs) due to oil consumption alone were all higher than 1,000, this did not indicate any current health concern for the Dutch population.

In another study on dietary sup-

plements – with a focus on Vitamin E products – CPs were detected in 12 of 25 supplements bought on the German online market.

Very high CP levels (>35 μg/g fat) occurred in six vitamin E products containing palm oil (see Figure 7, above). Daily CP intake from these capsules was some 100-fold higher than the tolerable daily intake (TDI) of PCBs.

However, MCCPs are not subject to any international conventions, although they have been listed as an unregulated, candidate substance of very high concern in the EU since 2022 by the European Chemical Agency (ECHA). This means companies are responsible for managing the risks of these chemicals and giving customers and consumers information on their safe use.

In addition, MCCPs have been given the label – “may cause harm to breast-fed children” – under the EU Classification, Labelling and Packaging Regulation.

The European Food Safety Authority Panel on Contaminants in the Food Chain (CONTAM Panel) concluded in 2020 that it could not assign a benchmark dose level for harmful effects in the EU for LCCPs due to lack of occurrence and toxicological data, while the US Environmental Protection Agency has characterised LCCPs as low risk in the USA.

The measurement of CPs in itself is very involved and challenging due to the complexity of CP mixtures.

However, more data and toxicology studies are needed to identify CP contamination sources and pathways into food.

A working group of the European Union Reference Laboratory for Halogenated Persistent Organic Pollutants in Feed and Food (EURL POPs) is investigating comparable and more easily implementable CP analysis and is trying to identify homologue groups of interest for toxicological studies. ●

Taiko’s state-of-the-art adsorbents are specially engineered to pre-treat a variety of feedstocks, ensuring your top-quality end products.

• Excellent Impurity Adsorption for Your Product Quality and Stability

• Optimized Refining Performance for Production and Cost Efficiency

• Tailored Solutions for Your Diverse Feedstock and Requirements

• Our Eco-friendly Process for Your Sustainable Future

STATE-OF-THE ART OILSEEDS AND OIL PROCESSING TECHNOLOGIES

● Horizontal agriculture

● Local mechanical processing

● Patented system of energy recovery

● Complex approach

● Unique combination of extruders and screw presses

The effective technology and complex services

Consumer demand for more ‘natural’ products, along with sustainability and environment concerns, are driving the growth of biobased surfactants based on palm kernel and coconut oils, as well as biosurfactants produced via fermentation

Serena Lim, Gill LanghamSurfactants may appear completely invisible to us but they benefit our lives in many different ways.

They are found in many everyday products such as laundry detergents, shampoos, soaps, cleaners, cosmetics, sunscreens, pharmaceuticals, paints and adhesives.

“What makes surfactants special is their ability to mobilise and combine materials – typically water, oils, fats and solvents –that otherwise would not mix due to their incompatible molecular properties,” says the European Committee of Organic Surfactants and their Intermediates (CESIO).

Surfactants decrease the surface tension between two liquids, a liquid and a gas, or a liquid and a solid. This allows incompatible substances to be mixed and aids cleaning by releasing dirt (oil or fat) and keeping it suspended in water so that it can be rinsed away.

Surfactants also have other useful prop-

erties such as wetting, emulsifying, foaming, dispersal and stabilisation powers.

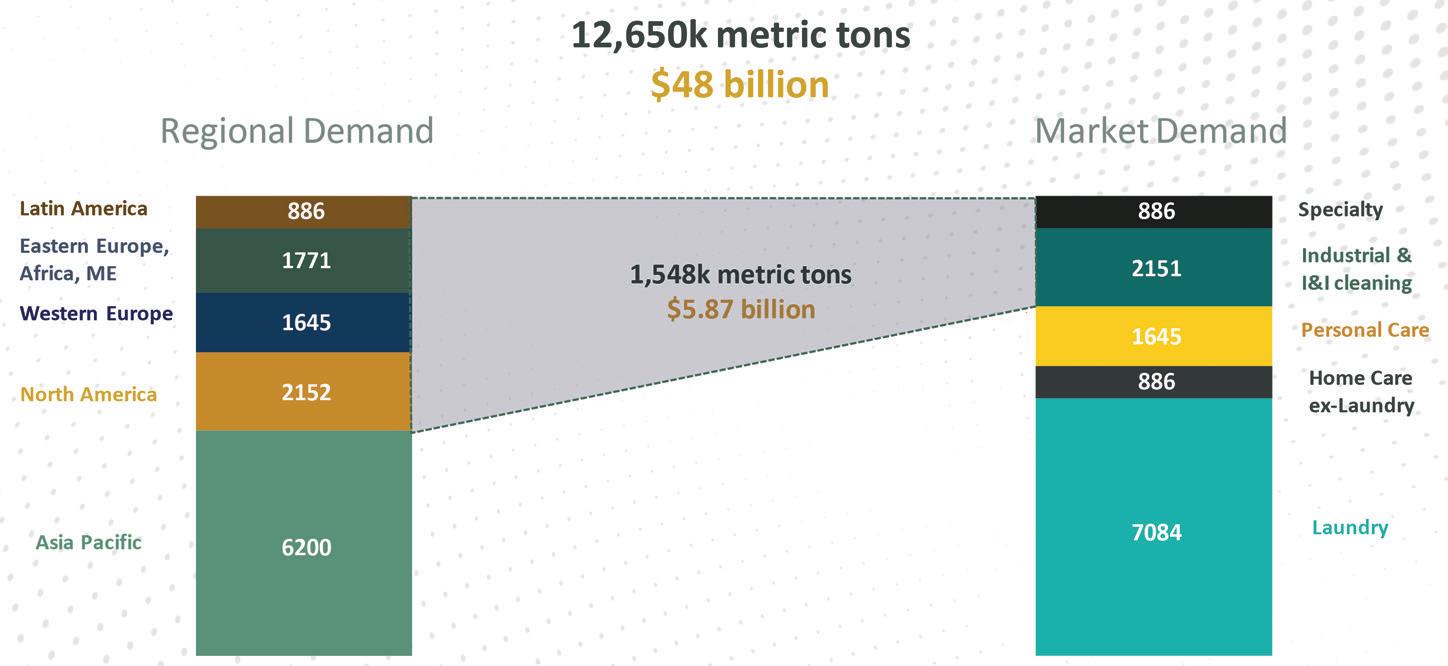

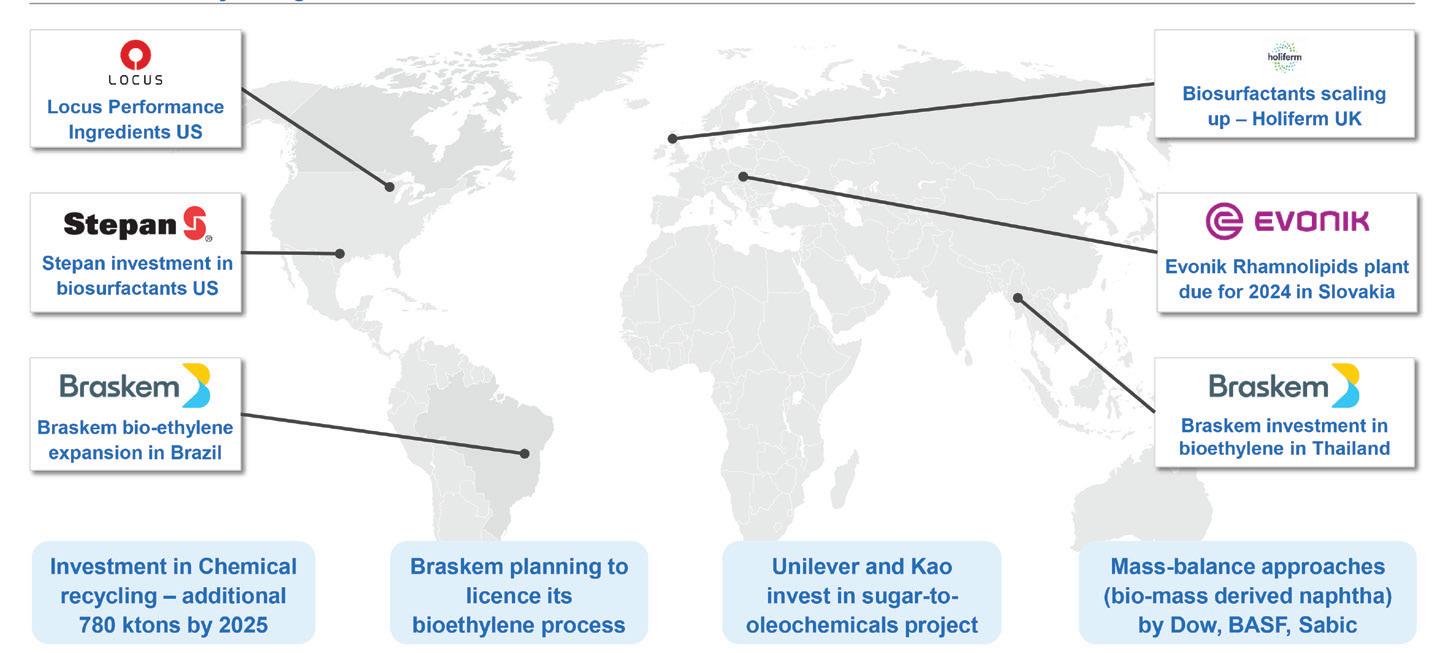

Today, the global surfactants market is worth some US$48bn, or 1.26M tonnes in volume, Locus Performance Ingredients global business development director Tim Kraemer told the ACI Future of Surfactants Conference in London in May (see Figure 1, below).

Asia Pacific has the largest regional demand, while the laundry sector accounts for more than half of global demand, followed by industrial and institutional cleaning, personal care, home care and speciality demand (see Figure 1, below).

Surfactants can be produced from both petrochemical feedstocks (ethylene), or fatty alcohols originating from coconut and palm kernel (PKO) oils (see Figure 2, following page).

Crude oil and PKO prices are subject to different cost pressures and their relative pricing will affect a formulator’s demand, alongside consumer pressures, Eric Hudson of NexantECA said at the conference (see Figure 3, following page).

The Russia-Ukraine war which began in 2022 led to gas and crude oil prices shooting up on the synthetic side.

For PKO, politics, weather patterns, planting cycles, processing capacities, and food and biodiesel usage affect supply, Rob Hogan of Nexant added.

However, despite economic constraints, there was ongoing investment in bionaptha, bioethylene, chemical and biosurfactants operations, Hogan said (see Figure 4, following page).

FOR 2022, OUR GLOBAL SUPPLY CHAIN ACHIEVED

TRACEABILITY

TRACING EVERY DROP OF OIL DOWN TO ITS SOURCE

CROSS-CHECK

AN OPEN ACCESS ONLINE CHECKING TOOL, FREE FOR ANYONE TO USE

TRANSPARENCY

FORGING STAKEHOLDER TRUST WITH OUR TRANSPARENT PRACTICES

73% TRACEABLE TO PLANTATION

WE UPGRADED THE PLATFORM TO CROSSCHECK 2.0

WE ACHIEVED

97% TTP FOR OUR INTERNAL MILLS

A DIGITAL TOOL THAT TRACKS THE ORIGIN OF FFB & CPO

IN OUR SUPPLY CHAIN

EMPLOYING

TRANSPARENT

PRACTICES POSITIONS US TOWARDS A DEFORESTATION-FREE SUPPLY CHAIN

BEING TRANSPARENT MEANS WE CAN EFFECTIVELY DIAGNOSE IN OUR SUPPLY CHAIN RISK

Source: NexantECA

This was because while many consumers had less to spend, they still had sustainability and environmental goals.

“Consumers prefer eco-friendly products and consider the chemical industry to be the least concerned about the environment,” Dorothee Arns, director general of the European Association of Chemical Distributors (FECC), said at the ACI conference.

Green demand is also driving interest in biosurfactants, which are produced via a fermentation process from feedstocks such as vegetable oils or sugar (see Figure 5, below).

The two most commercially-advanced biosurfactants today are rhamnolipids and sophorolipids, but production amounts to just a few thousand tonnes per year currently, the conference heard.

Rhamnolipids and sophorolipids consist of one or two rhamnose or sophorose sugar groups, respectively, attached to one or two fatty acid chains.

Source: NexantECA

Companies active in the biosurfactants sphere include Germany’s Evonik Industries, which is building a rhamnolipid plant in Slovakia, due to begin production in 2024, with Unilever already on board as a customer.

UK-based Holiferm opened a commercial plant in Liverpool this year, producing 1,100+ tonnes/year of sophorolipids, with most production going to chemical firm Sasol. It plans to expand production to 3,000 tonnes/year in a year, and to bring two new biosurfactants – rhamonolipids & MELs – to market in 2024. By 2026, it hopes to achieve 80,000 tonnes/year of production with a third plant.

Source: NexantECA

Locus Performance Ingredients, USA, which started up in 2020, signed a deal with Dow in 2021 to supply it with sophorolipids for the personal and home care market and is expanding into the European market with EU REACH approval for some of its products granted last August. It has a plant in the USA and is looking to expand into Europe.

Source: Locus Performance Ingredients

Belgian firm AmphiStar, a spin-off from Ghent University, had its first commercial launch in May with a multi-surface cleaning product for eco-cleaning brand Ecover which is 97% food waste-derived.

Biosurfactants have the advantage of being a 100% biological product, free of harmful trace chemicals, with minimal processing and no solvent usage, said Kraemer. “They are mild, rapidly biodegrade and provide a low carbon footprint.”

They can also be palm oil free, and non-genetically modified (GM), depending on their feedstocks.

However, this emerging sector also faces challenges.

“Surfactants have been around for a long time. Nowadays, they are a commodity that industry uses in a variety of applications, from our detergents to eye injections for macular degeneration at a price between US$500-$3,000 a pop,” said Arxada business development director Jordan Petkov at the ACI conference.

“Being a commodity, the appetite to invest more time, resources and money into further deepening our understanding has almost disappeared.”

The cost of investing in R&D and building facilities is high, while the price of biosurfactants themselves – some US$50/kg 10 years ago – makes them an unattractive feedstock. Dealing with a living organism also means different limitations on production capabilities, the conference heard.

“The fundamental problem is that surfactants are available at large scale. From a speciality chemical point of view, they’re commodities and they don’t have attractive margins,” Peter Schwab, R&D manager at Evonik Industries said at the conference. “Speciality chemical companies won’t look at something that gives them a lower return than they currently have. We have to give a reason to customers to make that switch.”

While the current low production volume means there is no impact on feedstocks, there could be an issue in the future if vegetable oils and sugars are used on a large scale.

Some microbe strains used in the fermentation process are also genetically modified to optimise their performance.

From a legislative/labelling point of view, the product is GM-derived and not genetically modified, but consumers may not make that differentiation. In personal care, the challenge is even greater as the organic and natural cosmetics COSMO certification does not accept GM-derived materials.

Schwab of Evonik believes biosurfactants will not replace current surfactants.

“The key is finding attractive applications where they have a clear benefit. We are still finding out about their properties and there will be applications where biosurfactants have tangible benefits,” he said at the ACI conference.

Scaling up needed a change in thinking between producers and soapers.

“Soapers are used to having raw material producers supply a material at a certain price per kg. In future, we have to talk about sharing the investment.” ●

UK-based biotech company Holiferm has grown from a small spin-off from research work conducted at the University of Manchester to become a producer and supplier of sophorolipids used to produce sustainable cleaning products worldwide.

Holiferm operates a dedicated plant in Liverpool using fermentation technology to produce 1,100 tonnes/year of sophorolipids, and plans to scale up production to 3,000 tonnes/year, as well as beginning producing rhamnolipids and mannosylerythritol lipids (MELs).

Established in May 2018, Holiferm focused its first few years of operation on proving the technology developed during Dr Ben Dolman’s PhD studies at Manchester University could be scaled up and replicated at pilot scale. This involved a series of trials around the world, including in India.

Following investment from ICOS Capital in 2019, Holiferm opened the company’s first dedicated laboratory facilities, which allowed the technology to be further tested and refined. At that stage, Holiferm had six employees.

By 2021, the company had grown to around 20 employees and further investment from Rhapsody Ventures and Clean Growth Fund led to the opening of a pilot plant facility to demonstrate the technology worked at scale.

These investments also allowed the company to start designing and building a commercial scale plant and to begin developing processes for manufacturing other biosurfactants, including rhamnolipids and MELs.

By 2023, the company had grown to 45 employees and it opened a dedicated sophorolipids plant in February. Next year Holiferm says it will begin manufacturing rhamnolipids and MELs at commercial scale.

“This will coincide with our commercial plant being scaled up to 3,000 tonnes a year, with a target to scale up to 80,000 tonnes a year capacity by 2030 through the opening of further plants,” Holiferm managing director Richard Lock says.

As part of that expansion, the company says it is planning to base new plants in countries close to the source of raw materials to minimise the environmental footprint of feedstocks used. The company is also actively looking into a number of industries where its products might have beneficial properties, including the paint sector.

Holiferm says it only uses natural raw ingredients, including rapeseed oil, glucose and yeast naturally found in honey, in its production process.

“Our biosurfactants are produced using natural raw ingredients in a fermentation

u

process. This means that no harmful petrochemicals are used, which makes the products more sustainable and environmentally friendly,” Holiferm chief technical officer Vicky De Groof says.

“There is also a significant reduction in the amount of carbon dioxide produced when compared to petrochemical based surfactants. Using a fermentation process also means the biosurfactants can be produced using a continuous method, rather than the more costly batch production method widely in use.”

The company currently sources all its raw materials from the European Union (EU).

“We saw a shortage in the supply of a couple of our commodities at the start of 2022 due to the COVID pandemic, which led to huge price increases. Today the markets are in a much better place, with more availability and better prices,” De Groof adds.

The production process used by Holiferm is based on the technology developed by Dr Dolman – co-founder and CEO of the company – during his PhD studies.

He designed a fermentation process with integrated gravity separation technology, which has since been patented, for manufacturing sophorolipids. The basic process sees the raw ingredients fed into a bioreactor where they mix together and produce the sophorolipids (See Figure 1, above)

Using a system similar to brewing beer, the process uses a yeast called starmerella bombicola. The use of non-genetically modified (non-GMO) rapeseed oil and sugar forces a fermentation that creates a crude sophorolipid solution.

The sophorolipids are then drawn off using the gravity separation technology and enter a downstream process where they are sent through a series of wash tanks and converted to either low-foaming or high-foaming products.

These are then packed into vessels for transport to customers while the by-product of the process becomes animal feed.

Holiferm offers a range of sophorolipids biosurfactant products – in low foaming (LF) and high foaming (HF) versions – for use in a variety of application areas.

“Holiferm’s products have a wide range of applications including personal care such as shampoos and shower gels, home care such as surface cleaners and cosmetics such as moisturisers. They also have uses in agricultural and textile industries amongst others,” De Groof says.

Directly obtained from the fermentation process without further modifications, the LF product is suitable for a range of applications including washing up liquids, facial cleansers, shampoos and shower gels.

For the personal care sector, the company’s HoliSurf product promotes a healthy scalp by moisturising and restoring scalp microbiota. The HF product has undergone a mild chemical transformation to allow the generation and stabilisation of larger volumes of foam and can be used for a range of applications from detergents to car washing products.

For the homecare sector, the company’s HoneySurf product is designed for optimum grease removal.

Holiferm sells its products worldwide, including in France, Germany, Italy, the

Nordic region, the DACH-region, Australia and New Zealand. It sells directly to customers such as Mix Clean Green and An’du, off-takers such as Sasol, and global distributors, such as Biesterfeld, Ingretech and Azelis.

The company is also actively involved in working in collaboration with other firms from local independent businesses to multinationals.

For example, it has worked with Fibenol, Sasol and Peel Pioneers, while in the UK, it has partnered with small family-run London-based company An’du, which is using Holiferm’s HoneySurf sophorolipid to produce a shampoo bar.

The 100g bar is environmentally friendly, biodegradable and comes in compostable packaging.

Holiferm said increased demand for its products was being driven by societal changes.

“Consumers are more aware than ever about the products they are using and where they come from.

“Traditional petrochemical-based companies are seeing the need to integrate these technologies with their own and so are engaging green chemistry companies to work with them to diversify their product lines,” Lock says.

Looking ahead, Holiferm sees further expansion for the company and increasing demand for its products.

“The biosurfactant sector is only going to grow. We are seeing a great deal of interest in our technology from traditional petro-chemical based companies,” Lock adds. ●

International reports on some of the latest projects, technology and process news and developments around the world

MALAYSIA: Poly polyethylene and uPVC producer Resintech Sdn Bhd signed an agreement on 16 June with Malaysia’s Sarawak Economic Development Corporation (SEDC) to develop and produce sustainable aviation fuel (SAF) from algae, the New Straits Times reported.

As part of the memorandum of understanding signed between subsidiaries Resintech Plastics and SEDC Energy, Resintech would provide the infrastructure needed to cultivate algae, the report said.

DENMARK: Danish process technology specialist

Topsoe has signed a deal with global chemicals and energy company Sasol to set up a 50/50 joint venture to develop, build and operate sustainable aviation fuel (SAF) plants and market SAF derived primarily from non-fossil feedstock, the companies said on 21 June.

Sasol’s Fischer Tropsch and Topsoe’s related technologies would be used in the project.

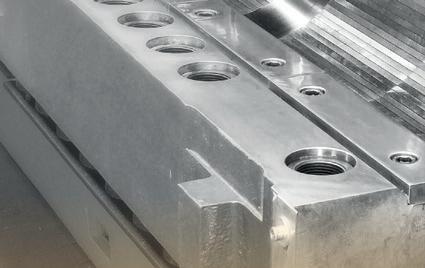

US refining companies Marathon Petroleum Corp and CVR Energy are set to bring their new feedstock pre-treatment facilities online later this year, Biodiesel Magazine reported on 1 August.

During an announcement of its second quarter earnings on 1 August, Marathon said it expected feedstock pre-treatment facilities at the Martinez Renewable Fuels facility in California to come online during the second half of this year. The new facility would have 2.7bn litres/ year of capacity by the end of 2023.