OILS & FATS INTERNATIONAL

FEATURES

Soyabeans

OILS & FATS INTERNATIONAL

Soyabeans

Plant & Technology

28 Global round-up of news

20 Brazil vs USA

Brazil has overtaken the USA to become the world leader in soyabean output and exports, with record production projected for 2023/24

Oleochemicals

24 The next decade

Stricter regulations on sustainability, high energy costs and renewable demand for tallow will all impact the oleochemicals market in the future

China

OFI reports on some of the latest projects, technology and process news and developments around the worle

30 Exports drive biodiesel, HVO

China’s domestic biodiesel and renewable diesel sectors are largely unsupported and mainly exportorientated

Argentina

33 Hope in new reforms

Policies to tackle Argentina’s strangled economy and soaring inflation promised by new president Javier Milei could help the country’s oils and fats sector

Comment

2 Eliminating industrial trans fatty acids

News

4 Polish farmers protesting over Ukrainian imports

Biofuel News

10 Construction of Cepsa and Bio-Oils plant starts

Renewable News

12 Neste reports higher HVO and SAF production

Transport News

14 Nibulon restructures elevator operations

Show Preview

15 OFI launches new event in Rotterdam

International Market Review

16 Have prices bottomed out?

Diary of Events

35 International events listing

Statistics

36 World statistical data

OILS &

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com

+44 (0)1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com

+44 (0)1737 855157

SALES:

Sales Manager: Mark Winthrop-Wallace markww@quartzltd.com

+44 (0)1737 855114

Sales Consultant: Anita Revis anitarevis@quartzltd.com

+44 (0)1737 855068

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com

+44 (0)1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com

+44 (0)1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

© 2024, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020-747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA.

POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com

+44 (0)1737 855000

Printed by Pensord Press, Merthyr Tydfil, Wales

The end of 2023 was the date in which the World Health Organization (WHO) had hoped to achieve global elimination of industrially-produced trans fatty acids (iTFAs).

And while this ambitious target has not been met, the organisation says remarkable progress has been made towards the goal it set in 2018 in every region of the world.

When awarding best practice certificates to Denmark, Lithuania, Poland, Saudi Arabia and Thailand in January for the monitoring and enforcement of their trans fats policies, WHO said 53 countries now have measures in place to tackle iTFAs in food, vastly improving the food environment for 3.7bn people, or 46% of the world’s population, compared with 6% just five years ago.

“These policies are expected to save approximately 183,000 lives a year,” it says.

iTFAs – as opposed to naturally-occurring TFAs from the meat and milk fat of ruminant animals – are created by partial hydrogenation of oils to turn them into semi-solid or solid fats, which have increased resistance to oxidation and a longer shelf-life. They can be found in margarine, vegetable shortening, vanaspati ghee, fried foods and baked goods, and it is estimated that excess TFA intake leads to up to 500,000 deaths/year from coronary heart disease, due to their effect in raising low density lipoprotein (‘bad’) cholesterol in blood, while lowering levels of high density lipoprotein (‘good’) cholesterol.

WHO reported on the progress of 11 global food and beverage companies – Coca-Cola, Danone, Ferrero, General Mills, Grupo Bimbo, Kellogg’s, Mars, Mondelēz, Nestlé, PepsiCo and Unilever – which in 2019 had committed to WHO’s recommendations not to exceed 2g of iTFAS/100g of fats and oils in their global products by 2023.

WHO said while Kellogg’s and Mars had achieved the iTFA target, progress was uneven across companies, food categories and markets, with packaged baked goods continuing to be a risk category for iTFAs. The WHO report looked at the companies’ products in Australia, China, Germany, Hong Kong, India, Italy, Mexico, New Zealand, Nigeria, Pakistan, Ukraine, UK, USA and Vietnam in eight food categories (baked goods; confectionery; dairy, ice cream and frozen desserts; ready meals; savoury snacks; sweet biscuits, snack bars and fruit snacks; and sweet spreads) representing 10% of products with potential TFAs in the global market.

To accelerate progress, WHO has called for a broader range of companies to act and for firms to provide comprehensive and consistent data; and for multinationals to implement the same portfolio across different markets, regardless of a country’s TFA policies.

WHO says that despite the recent successes in eliminating iTFAs from food globally, over half of the world’s population remain unprotected from its harmful impacts. It says there are two best practice policy options which can be implemented – a mandatory national limit of 2g iTFA/100g of total fat in all foods; and a mandatory national ban on the production or use of partially hydrogenated oils as a food ingredient. It has proposed a new target for virtual elimination of iTFAs globally by 2025.

According to Dr Tom Frieden, CEO of Resolve to Save Lives – a not-for-profit organisation working with WHO to ban iTFAs –accelerating efforts in just five countries (China, Pakistan, Russia, Indonesia and Iran) would eliminate about 85% of the global iTFA burden.

“Global elimination would prevent about 17.5M deaths over 25 years. The progress of reducing trans fat globally shows that non-communicable diseases can be beaten,” he says. Serena Lim, serenalim@quartzltd.com

Oleochemicals

Glycerine Distillation & Refining

CMB S.p.A.

IIG/Enzymatic Biodiesel & Methylester Fractionation

Oil Refining & Fat Modification

Oilseed Preparation & Solvent Extraction

Via Appia Km 55,900 – 04012 Cisterna di Latina (LT), Italy

CMB MALAYSIA ENGINEERING FOR OILS AND FATS SDN. BHD. D-23A-03, Menara Suezcap Tower 1 KL Gateway, Jalan Kerinchi 59200 Kuala Lumpur W.P. Kuala Lumpur Malaysia

CMB INDIA ENGINEERING FOR OILS AND FATS Pvt. Ltd. 501, A Pinnacle Corporate Park 5th Floor, Near Trade mark Center, BKC Bandra East, Mumbai, Mumbai City, Maharashtra, India

In-house workshop cmb.it

CONTACT US scan the qr-code

UKRAINE: Crushing margins for sunflower oil and meal have been falling and are at the bare minimum in some regions, according to trade sources reported by AgriCensus on 23 February.

In the month prior to the report, sunflower oil prices fell by an average of US$60US$70/tonne or 7% to reach US$835-US$840/tonne CIF Mersin for spot delivery, against buyers’ expectations of US$825-US$830/ tonne CIF Mersin. Sunflower meal prices fell by 24% in Ukrainian ports to US$155US$165/tonne CPT port and were down by 17.5%-18% to US$225-US$235/tonne CIF Marmara, according to buying levels for March delivery.

Some crushers in the central and western parts of Ukraine were reporting minimum margins with purchase prices of US$363/ tonne CPT crush plant, or zero once increased costs for logistics were factored in. However, some southern crushers reported sufficient margins of some US$50/ tonne due to their proximity to export ports and lower logistics costs.

Farmers in Poland have been disrupting traffic with nationwide blockades as part of their ongoing protests against Ukrainian grain and oilseed imports, which they claim are affecting their profits, World Grain reported on 20 February.

Protesters at the Medyka border crossing were seen opening railway carriages to allow grain to pour onto the tracks in a video shared on the Telegram messaging app, the report said.

Farmers across Europe have been demonstrating over

several issues, including rising costs and what they say is unfair competition from imports.

Since Russia’s invasion of Ukraine on 22 February 2022, Ukrainian farmers have faced difficulty in producing and exporting grain and oilseeds and attempts have been made to export more via rail and truck to counter transport difficulties via the Black Sea.

In June 2022, as part of its efforts to help Ukraine, the EU waived import duties on Ukrainian grain. However, until mid-September last year, the

EU had allowed five countries – Bulgaria, Hungary, Poland, Romania and Slovakia – to ban domestic sales of Ukrainian wheat, maize, rapeseed and sunflowerseeds, while allowing their transit.

A spokesman for Poland’s Solidarity farmers’ union was quoted as saying that while military aid for Ukraine would be allowed through, all passenger traffic on the border would be blocked, not just trucks. In addition, ports and motorways would also be blockaded.

Ukrainian haulers also started their own round-the-clock counter-demonstrations –planned to last until 15 March – at three crossings.

Ukraine said its agricultural shipments through Eastern Europe had not affected markets, World Grain wrote.

Polish Agriculture Minister Czeslaw Siekierski was previously quoted as saying he was negotiating with Ukraine and that a deal limiting imports could be reached by the end of March, the report said.

Black Sea sunflower oil traders are looking for new export markets as demand from Asia falters due to high stocks, national holidays and increased competition, AgriCensus wrote on 9 February.

Leading importer China had reported high stocks of sunflower oil while India had increased imports from Argentina in a bid to minimise supply risk disruption, the report said. In addition to maritime war risk in the Black Sea, Russia and Ukraine – the two largest sunflower oil producers and exporters in the world – now faced disruption from Houthi attacks on vessels in the Red Sea, AgriCensus wrote. Any ship passing through the Suez Canal, which is the quickest sea route between Asia and Europe, has to travel via the Red Sea. The disruption had made Black Sea sun-

flower oil uncompetitive on price and with complicated logistics, the report said.

India imported 119,432 tonnes of Argentine sunflower oil from 1 November 2023 to 31 January 2024 – more than 70% higher than in the same period of the previous year, according to the Solvent Extractors’ Association of India (SEA).

On average, the cost of freight from Argentina to India is 20% lower than freight from the Black Sea region and, at the time of the report, was US$83-90 CIF India compared with US$100-US$120 CIF India from the Black Sea, according to estimates from trade sources.

Argentine sunflower oil was trading at US$910/tonne CIF India for delivery in February and US$900/tonne for delivery in March-April, while sunflower oil

from the Black Sea region was trading at US$920-US$940/tonne CIF India, depending on the month supplied, AgriCensus wrote.

Meanwhile, soyabean oil – which Indian importers would turn to as an alternative product when prices allowed – was becoming more popular, the report said. Soyabean oil for delivery in April was trading at US$920/tonne CNF India, while sunflower oil for delivery in February-March was trading at US$940/tonne CIF India, the report said.

At the time of the report, Chinese buyers had not been active for more than a month, as sunflower oil stocks in the country remained high, and were estimated by Chinese sources at 340,000 tonnes at the end of January.

Develop, scale and commercialize with Crown – the proven, single-source partner for product and process optimization.

Bring new products to market faster and more sustainably with Crown. As a leader in oilseed extraction for 70 years, Crown’s technical expertise, guidance, proven technologies and Global Innovation Center transform your ideas for protein concentrates, food/beverage, botanicals and other new product segments into pro table realities. With Crown’s full-scale, state-of-the art pilot plant, analytical lab and training facilities, you can test product and process feasibility, run benchtop scale to custom processing and commercialize with ef cient, continuous operations backed by Crown’s aftermarket support and eld services. Accelerate your market opportunity — partner with Crown for a full lifecycle solution. Start up, scale up and expand with CPM and Crown’s expertise.

Protein Concentrates

Contact CPM and Crown today 1-651-894-6029 or visit our website at www.crowniron.com

A class action has been filed against Nestlé Health Sciences – a business unit of Swiss food and drink giant Nestlé – and its Nature’s Bounty fish oil supplement brand, Top Class Actions reported on 19 February.

Filed by Anthony Fasce in a New York federal court, the lawsuit claimed that Nature’s Bounty fish oil supplements were falsely advertised as being beneficial for cardiovascular health despite randomised trials showing fish oil had no heart-related benefits.

“Scientists and consumer health advo-

GREECE: Olive oil production this year is expected to be half of last year’s record crop according to European Commission estimates reported by Olive Oil Times on 19 February.

Greece’s olive oil crop would be around 175,000 tonnes this year – the lowest volume in the last six years – compared to last year’s record harvest of around 340,000 tonnes.

Earlier estimates had forecast a harvest of around 200,000 tonnes this year, with the difference in estimates due to erratic weather patterns at the time of harvesting, Olive Oil Times wrote. “This has been one of the worst harvests in the last 30 years,” Periklis Tsoukalas, a producer and miller from the Ilia region in the Peloponnese, was quoted as saying.

cates have warned that fish oil labels are misleading and that consumers are wasting their money,” the class action stated.

Fasce was looking to represent a nationwide class and New York subclass of consumers who had purchased one or more of Nature’s Bounty fish oil supplements within the applicable statute of limitations period, Top Class Actions wrote.

Fasce’s claims against Nestlé Health Sciences included intentional and negligent misrepresentation; breach of express and implied warranties; and violation of an im-

plied contract, the Magnuson-Moss Warranty Act, New York General Business Law and consumer protection acts in six states.

A separate class action lawsuit filed in September 2021 against Nature’s Bounty and The Bountiful Co claimed they had sold fish oil tablets which did not contain fish oil or any other essential omega-3 fatty acids, Top Class Actions wrote.

Nature's Bounty was among the core brands of The Bountiful County which Nestlé Health Science acquired in August 2021.

The Lebanese olive harvest has been hit by the Israel-Hamas conflict and extreme weather patterns, Olive Oil Times wrote on 19 February. Adverse weather conditions heightened by climate change had led many local producers to estimate a considerably lower final olive oil volume for the current crop year than the International Olive Council (IOC) estimates of 18,000 tonnes. According to local media outlet Murr Television, yields have dropped from 120 litres/m² to less than 20 litres/m² in certain regions of the country.

The escalation of tensions along Lebanon's southern border with Israel had compounded the challenges faced by olive oil producers, Olive Oil Times wrote. Since the 7 October attack by Hamas on Israel, there had been near-daily exchanges of fire between the Israeli Defence Force and Hezbollah, a Shiite militant organisation that controls southern Lebanon which opposes the state of Israel.

The conflict had severely disrupted the Lebanese olive harvest, an earlier Olive Oil Times report in December said.

Figures from Lebanon’s Ministry of Agriculture showed that at least 386 fires caused by Israeli bombings had destroyed 50,000 olive trees. Save the Children estimated that some 86,000 people had been displaced from southern Lebanon due to the conflict, leaving olive trees unharvested. Around 20-30% of national production comes from souther Lebanon, according to the country’s farmers’ union.

Ministry of Agriculture’s figures showed that the country’s olive sector comprises more than 110,000 growers and about 200,000 plots with 12M trees. The olive sector was important in Lebanon, not only economically but culturally, with more than half the trees over 500 years old, Olive Oil Times wrote.

South American soyabean producers Brazil and Argentina are set to maintain their shares in the global market this crop year, according to United States Department of Agriculture (USDA) data reported by Germany’s Union for the Promotion of Oil and Protein Plants (UFOP).

While Brazil's harvest was likely to fall just short of the previous year’s bumper crop, Argentina was expected to double its

production, the 16 February report said.

Brazil, Argentina and the USA accounted for 80% of global soyabean output, the report said. Brazil was set to harvest around 156M tonnes of soyabeans in the current crop year, compared with the previous year's record volume of 162M tonnes.

The forecast meant Brazil would maintain its leading position ahead of the USA based on a 1.3M ha expansion in soyabean

planted area to 45.9M ha (see p20).

In the USA, the soyabean harvest would total around 113.3M tonnes for 2023/24, a decline of around 2.9M tonnes from the previous year.

At some 50M tonnes, Argentina’s output was likely to be double the previous year’s drought-stricken volume, according to research by Agrarmarkt Informations-Gesellschaft (see p33).

Global agribusiness giant Cargill’s complete edible oils portfolio now complies to the World Health Organization’s (WHO’s) best practice on industrially-produced trans fatty acids (iTFAs), the firm said on 1 February.

Cargill committed to complying with WHO’s recommended standard of a maximum of 2g iTFA/100g fats and oils in 2021.

“Taking this … step, even in countries without current iTFA legislation, helps ensure consistency in our supply chain for larger food manufacturers, while offering Cargill’s … experience to smaller manufacturers,” said Natasha Orlova, Cargill vice

Global agribusiness giant Cargill has launched a programme in Australia to help meet rising demand for sustainable canola and to help farmers connect with new and emerging markets.

The aim of the SustainConnect programme was to develop new revenue streams for canola producers in Australia while helping the company meet rising demand from domestic and international customer, Cargill said on 12 February.

The Australian programme built on Cargill’s global efforts to introduce sustainable farming programmes across its global supply chains, including its RegenConnect program in North America and Europe, the company said.

As part of the new programme, Australian canola growers could choose from a range of sustainable agriculture practices including nutrient management interventions, reduced or no-tillage and crop residue retention.

Cargill said it had partnered with carbon measurement business Regrow to measure, report and verify (MRV) carbon outcomes using infield data, remote sensing and crop and soil health modelling.

Growers would receive a guaranteed A$25/ha, subject to practices introduced in compliance with a one-year agreement, with total compensation based on the total hectares the farmer had enrolled in the programme, the company said.

president for edible oils and managing director for North America.

iTFAs are created by partial hydrogenation of oils to turn them into semi-solid or solid fats, which have increased resistance to oxidation and a longer shelf-life. They can be found in margarine, vegetable shortening, vanaspati ghee, fried foods and baked goods.

As part of its commitment to remove iTFAs from its edible oil portfolio, Cargill said it had invested an additional US$8.5M to upgrade facilities to reduce the amount of trans fat produced during oil process-

ing, while working with more than 100 additional customers in 24 countries to reformulate new product solutions.

To ensure compliance, Cargill said it had added iTFAs to its food safety and quality assurance programme, which included multiple layers of monitoring, compliance and auditing.

In addition, Cargill said it had taken steps to help advance industry-wide reformulation during the past two years, particularly in countries that did not have iTFA regulation at the time of the company’s commitment.

9-11 September 2024

Rotterdam Ahoy Convention Centre

The Netherlands

SUPPORTED BY:

ORGANISED BY:

USA: The US soyabean industry’s carbon footprint has decreased significantly due to improved land management and soil health; increased land efficiency and yields; reduced pesticide application and energy consumption; and the introduction of advanced technologies in manufacturing, according to new research by the United Soybean Board (USB) reported by SeedWorld on 22 February.

Commissioned by the USB and the National Oilseed Processors Association, and conducted by Sustainable Solutions Corporation (SSC), the study analysed 2020 and 2021 data from 454 farms in 16 US states and 2021 operations data from 52 soyabean processors and 27 soyabean oil refiners in 18 states.

The life cycle assessment (LCA) study found falls in the US industry's carbon footprint in 2021 compared to 2015 for soyabeans (–19%); soyabean meal (–6%); crude soyabean oil (–22%); and refined soya oil (–8%); due to processors committing to efficiencies across plant operations, manufacturing and transportation.

The USA is the world's second largest soyabean exporter (see p20) and the crop accounts for about 90% of US oilseed production.

Australia’s tallow exports reached a record value of more than A$1bn in the 2022/23 financial year, the first time they had exceeded the A$1bn mark, the country’s Department of Agriculture was quoted as saying by ABC News

Tallow production had reached record levels in Australia – now the world’s leading exporter of the animal by-product – with demand being driven by the biofuels industry rather than the food sector, the 3 February report said.

According to Australian Renderers Association (ARA) figures, the country produced 550,000 tonnes of tallow last year, 450,000 tonnes of which were exported.

The US and Singapore biofuels industries

received 90% of Australian tallow exports, with China and South Korea also taking a small percentage, the report said.

“In the USA, there’s been a growing industry converting tallow into petrol, diesel and jet fuel substances,” Australia meat and livestock analyst Tim Jackson was quoted as saying.

Prices were also surging, reflecting high demand, Jackson added. After peaking at US$2,500/tonne in the 2022/23 financial year, international tallow prices remained above historical averages at US$2,000/tonne at the time of the report. Domestic tallow prices were currently “double or triple the historic norm” at US$1,900/tonne, Jackson added.

Leading coffee chain Starbucks has expanded its extra virgin olive oil-infused coffee line to all its stores in the USA.

Alongside the national rollout of Oleato drinks in the USA, Starbucks had introduced the new Oleato Golden

Foam, Iced Shaken Espresso with Toffeenut and Oleato Caffè Latte with Oatmilk, the company said on 29 January.

The inspiration for the range followed a trip to Sicily in 2022 by Starbucks chief executive Howard Schultz, who took a

spoonful of Partanna extra virgin olive oil as part of his daily ritual in addition to his morning coffee after being introduced to the Mediterranean custom of taking a spoonful of olive oil each day. He then had the idea to combine the two ingredients. The company’s Oleato range, which combines arabica coffee infused with Partanna cold-pressed, extra virgin olive oil, was launched in Italy in February 2023.

A month after its Italian debut, Starbucks launched the olive oil-infused coffee drinks across 550 locations in Chicago, New York City and Seattle and the line is also available in nine countries in Asia, Europe and North America.

A research team in South Korea has developed a hybrid type of beef rice containing cow muscle and fat cells inside the rice grains, CNN reported on 15 February.

The pink coloured rice could offer a more environmentally sustainable source of protein with a much lower carbon footprint than beef, according to the researchers.

Published in the Matter journal, the project involved coating the rice in fish gelatine to improve the meat cells’ ability to attach

to the grains. Cow muscle and fat stem cells were then inserted into the rice grains, which were placed in a petri dish to culture.

Meat cells then grew on the surface of the rice grain and inside the grain itself and, after about nine to 11 days, the final product was produced.

Similar in taste to micro-beef sushi, the final product has a different texture, nutritional profile and flavour to traditional rice grains, according to the study. The beef

rice was firmer and more brittle than the typically sticky, soft texture of regular rice and was also higher in protein and fat.

According to Neil Ward, an agri-food and climate specialist and professor at the University of East Anglia, the data looks “very positive,” with potential for helping develop “healthier and more climate-friendly diets in future”. However, he was quoted as saying the critical test “is around public appetite for these sorts of lab-developed foods”.

WORLD: Global multi-energy company TotalEnergies has formed a sustainable aviation fuel (SAF) partnership with European aircraft manufacturer Airbus in which it would supply Airbus with SAF for more than half of its needs in Europe.

The partnership would also involve a research and innovation programme aimed at developing 100% sustainable fuels, tailored to the design of current and future aircraft, TotalEnergies said on 21 February.

The impact of SAF composition on the reduction of CO2 emissions and non-CO2 effects, such as contrails, would also be studied.

“Accelerating the deployment of sustainable aviation fuels is essential if we are to meet our targets for reducing carbon emissions from aviation by 2030. This partnership … demonstrates the willingness of aerospace manufacturers and major energy producers and suppliers to work together to meet this challenge,” Airbus CEO Guillaume Faury said.

TotalEnergies had set itself a SAF production target of 1.5M tonnes/year by 2030, CEO Patrick Pouyanné said. The firm had been supplying Airbus with SAF used for its aircraft deliveries in Toulouse since 2016.

Spanish multinational oil and gas firm Cepsa and Bio-Oils have started construction of a sustainable aviation fuel (SAF)/hydro-treated vegetable oil (HVO) plant in Huelva, Spain.

The new US$1.07bn (€1bn) second generation (2G) biofuel plant at Cepsa’s La Rábida Energy Park facility in Palos de la Frontera would have two pre-treatment units and the capacity for flexible production of 500,000 tonnes/year of SAF and renewable diesel, Cepsa said on 23 February.

Due to become operational in 2026, Cepsa said the new plant would source most of its feedstock – organic waste such as agricultural residues or used cooking oils) – through a global, long-term agreement with Bio-Oils’ parent company Apical.

The new plant – with existing facilities operated

by Cepsa and Bio-Oils in Huelva – would form the second largest renewable fuel complex in Europe, with a total production capacity of 1M tonnes/year, Cepsa said. Once operational, the new 2G biofuels plant would be the largest SAF processing facility in southern Europe, according to the companies.

“The global production of SAF is expected to triple in 2024, compared to 2023 levels, reaching 1.5M tonnes. Yet, the availability of sustainably available feedstock remains a challenge for many countries,” Apical executive director Pratheepan Karunagaran said.

“As we continue to expand Apical’s global footprint and capacities, the availability of waste and residue is set to grow in tandem, enabling value-added partnerships to be forged.”

The EU renewable ethanol association ePURE said on 31 January that it had launched a legal challenge to the FuelEU Maritime Regulation for excluding EU Renewable Energy Directive (RED)-compliant crop-based biofuels from the maritime sector’s decarbonisation objectives.

Filed with the General Court of the EU on 18 December by ePURE and Hungarian biofuels company Pannonia Bio, the aim of the legal application was to annul a section of the legislation that classed crop-based biofuels as having the same emission factors as the least favourable fossil fuel pathway, ePURE said.

“The EU’s patchwork approach to crop-based renewable ethanol – confirming its sustainability and importance in the RED but sidelining it in FuelEU Maritime and RefuelEU Aviation – is more than just discriminatory. It also jeopardises the EU’s ability to meet ambitious decarbonisation targets,” ePURE director general David Carpintero said.

The challenge also claimed that the European Parliament and Council’s assessment had not been based on scientific and technical data.

Renewable diesel or hydrotreated vegetable oil (HVO) production in the USA is expected to grow by 30%/year in 2024 and 2025, Biodiesel magazine reported from US Energy Information Administration (EIA) data.

In its Short-Term Energy Outlook report published on 6 February, EIA forecast renewable diesel production to average approximately 230,000 bpd (barrels/day) in 2024, increasing to 290,000 bpd in 2025. At the end of 2023, production averaged

approximately 200,000 bpd.

The EIA also reduced its US crude oil refining capacity forecast by 120,000 bpd following reports that Phillips 66 planned to permanently stop processing crude oil at its Rodeo refinery in California in March, Biodiesel magazine wrote on 7 February.

Phillips 66 is converting the facility to produce renewable diesel which – once completed – is expected to have the capacity to produce around 50,000 bpd of renewable diesel, according to the report.

US renewable diesel production capacity had expanded significantly in recent years.

Meanwhile, the Western Producer wrote on 2 February that US biomass-based diesel production (comprising biodiesel, renewable diesel, sustainable aviation fuel and heating oil) totalled 4bn gallons (15.14bn litres) last year, according to Environmental Protection Agency figures. The volume exceeded EPA targets set in June last year for 2023, 2024 and 2025 under the US Renewable Fuel Standard.

Photo: Adobe Stock

Finnish renewable fuels producer Neste reported that its production of renewable diesel in 2023 had increased by more than 15% while sustainable aviation fuel (SAF) production had risen by almost 59% compared with 2022, SAF magazine wrote on 21 February. The company produced almost 3.27M tonnes of renewable diesel last year, up from 2.83M tonnes in 2022, while SAF production totalled 251,000 tonnes, up from 158,000 tonnes.

“The sales volume of renewable diesel

INDONESIA: German chemical firm BASF said it had provided technical support and training to more than 1,000 independent palm oil smallholders since the launch of Project Lampung in 2018, in collaboration with international civil society organisation Solidaridad, leading cosmetics chain Estée Lauder Companies and the Roundtable on Sustainable Palm Oil (RSPO), with the support of the Indonesian government.

The programme had also helped 313 farmers in the Way Kanan Regency achieve RSPO certification, the first certified smallholder group in the state, the company said on 20 November.

“[It marks] the achievement of one of the primary objectives of Project Lampung, to have nearly one-third of the supported smallholder farmers achieve certification according to the RSPO Smallholder Standard within three years,” BASF Care Chemicals senior vice president Marcelo Lu said.

As part of the project, farmers were given access to certified seedlings to improve productivity; social and environmental impact assessments were conducted; and farmers’ fields were mapped and all relevant data uploaded to the RSPO database.

and SAF in third quarter 2023 amounted to 843,000 tonnes in line with our target,” Neste president and CEO Matti Lehmus said on 8 February when announcing the company’s fourth quarter and full year results. Sales of renewable diesel and SAF, which totalled 3.3M tonnes in 2023, were impacted by the delayed ramp-up of Neste’s Singapore expansion and its Martinez joint operation, Lehmus said.

In fourth quarter 2023, the utilisation rate in Singapore had increased to around 75%

while the Californian Martinez facility was operating at slightly below 50% capacity following a fire late last year, Neste said.

Lehmus also noted that the share of waste and residue feedstocks remained high throughout 2023, averaging 92% of total renewable material inputs, down slightly from 95% the previous year.

For 2024, Neste expects total sales volumes in Renewable Products to reach around 4.4M tonnes, with SAF volumes in a range of 500,000 tonnes to 1M tonnes.

Chemical firm LG Chem announced on 15 February that it had signed a joint venture deal with food conglomerate CJ CheilJedang to produce bio-nylon in South Korea from pentamethylenediamine

(PMDA), a raw material produced by fermenting corn, sugarcane and other crops.

As part of the deal, CJ CheilJedang would produce PMDA using microbial fermentation technology and joint devel-

opment technology between the two firms, while LG Chem would polymerise it to produce and sell bio-nylon.

The bio-nylon offered the same heat resistance and durability as petroleum-based nylon and was suitable for use in sectors including textiles, cars and electronic devices, LG Chem said.

Global bio-nylon market demand was expected to grow by 29%/year, expanding from 400,000 tonnes in 2023 to 1.4M tonnes by 2028, said LG Chem, which is active in the petrochemicals, advanced materials and life sciences sectors; and produces a variety of plastics synthesised using alcohol, acid and amine compounds.

US oleochemical producers will continue to switch operations from tallow to palm-based fatty acids this year, according to an Argus Media report.

With US buyers looking for plant-based alternatives for their personal care and cleaning products, producers with the capability had switched their operations to palm oil products while others were planning to shift production methods, the report said. In addition, US red meat consumption had declined due to changing food habits in the USA, impacting supplies of rendered fats, according to US Department of Agriculture data.

Tallow consumption continued to grow in the US biofuels industry, with prices remaining higher than those for palm oil, which remained the most economical option for oleochemicals producers.

Manufacturers who used purely tallow-based

fatty acids risk being priced out of the market.

Palm-based fatty acids imports into the USA were expected to increase, with levels rising since the introduction of EU anti-dumping duties on Indonesian fatty acids imports in 2023, the 20 December report said.

Global Trade Tracker data showed fatty acid exports – excluding tall oil fatty acids – from Indonesia to the USA totalled 101,000 tonnes in the first six months of 2023, a rise of 17% on the 86,000 tonnes shipped during the same period in the previous year and almost double the 53,000 tonnes exported in the same 2021 period. The USA remained one of the few markets open to shipments of palm-based fatty acids, leading to expectations that imports would continue increasing this year, Argus Media wrote.

Leading Ukrainian agribusiness Nibulon has announced plans to restructure operations at its Ukrainian grain elevators in a bid to increase efficiency, World Grain reported.

The company would divide its 22 elevators into six groups:

• Mykolayivska is the largest and includes the trans-shipment terminal, Kolosivsky elevator, Vradiivskyi JSC, Novoodeska and Voznesenska branches

• Kremenchutska including Kremenchutska, Globynska and Hradizk

• Poltava including Romodan, Reshetylivska, Skorokhodivska and Maryanivska

• Cherkassy including Zolotoniska, Pereyaslavska and Vitove

• Zahidna currently unites Teteriv, Smotrych

SINGAPORE: Global tank storage company Vopak has commissioned 40,000m³ of capacity for bio-bunkering at its Sebarok Terminal.

Located close to the eastern part of Singapore – where a large amount of bunkering activity takes place – the terminal’s additional capacity would be used for blending biofuels into marine fuels, the company said on 26 February.

Vopak said its existing pipeline system had also been converted to a dedicated biofuel blending service.

“Our vision for Sebarok Terminal is to be a sustainable multi-fuels hub to strengthen Singapore’s position as the top bunkering hub,” Vopak president of business unit Singapore Rob Boudestijn said. “This development can facilitate the entry of more biofuels companies to diversify the supply chain for marine biofuels and accelerate the decarbonisation of the shipping industry.”

Headquartered in Rotterdam, Vopak stores and handles biofuels, vegetable oils, chemicals, gases and crude oil.

and Denihivska. Khmelnyk will join this group later after expansion of containers and installation of a dryer, planned for later this year

• Zaporizhzhia-Dnipro including Ternivska, Khortytsia and Zelenodolska

Bessarabska would continue to work independently due to its location away from other elevator groups and its focus on transshipment of grain, rather than accumulation and finishing, Nibulon said on 13 February. The development of Mykolaivska was at the final stage while the others facilities were in place, the company said.

Other plans included the automation of all elevators with sensors to transmit operat-

ing data to a single service centre.

Nibulon said it expected the automation of operations to increase the efficiency of elevator operations and reduce costs.

According to its website, Nibulon operates throughout most regions of Ukraine and its activities include grain and oilseed processing, logistics, storage and shipment.

It runs its own fleet, has a total grain storage capacity of 2.25M tonnes and operates a network of 27 trans-shipment terminals and grain and oilseeds complexes in the country.

One of the country’s largest grain growers and traders, Nibulon produces more than 320,000 tonnes/year of grain and oil mostly for export.

G3 Canada announced on 6 February that its long-term partnership with the Port of Québec would continue for another 30 years, continuing

a 50-year collaboration between the company and the port.

G3 Canada operates a network of grain elevators in western Canada and port terminals in eastern Canada.

Its terminal at the Port of Québec has a storage capacity of over 225,000 tonnes and handles grain and oilseeds before they are shipped to Africa, Europe, the Middle East and South America.

G3 Canada is part of Canadian grain company G3, which purchases, imports and exports grains and oilseeds such as canola, corn, soyabeans and wheat.

G3’s operating companies also include G3 Terminal Vancouver, which operates a grain export terminal on Canada’s west coast.

The International Chamber of Shipping (ICS) has submitted a proposal to shipping’s global regulator – the United Nations (UN) International Maritime Organization (IMO) – for a Zero Emission Shipping Fund (ZESF).

Submitted with the Commonwealth of The Bahamas and the Republic of Liberia, the fund aimed to accelerate the shipping sector’s transition to net zero by 2050, the ICS said on 1 February.

As part of the proposal, governments would be urged to approve fit-for-purpose proposals to meet their commitment to adopt a maritime greenhouse (GHG) emissions pricing mechanism in 2025.

Governments had already unanimously com-

mitted to developing a GHG pricing mechanism for international shipping by 2025, the ICS said. If governments agreed, the ZESF would be approved next year to help achieve net zero GHG emissions from shipping by, or close to, 2050, in line with the GHG reduction targets adopted by IMO member states.

Under the proposal, contributions from ships per tonne of CO2 emitted would be used to reduce the significant cost gap between zero GHG fuels and conventional fuel oil. The proposal would include support for the production of zero/ near-zero marine fuels and the roll-out of new bunkering infrastructure in developing countries’ ports worldwide, as well as supporting training in the safe use of new fuels.

9-11 September 2024

Brought to you from the same team behind the global magazine, Oils & Fats International (OFI) is delighted to announce the launch of OFI International 2024, featuring the 3rd Sustainable Vegetable Oil Conference, to be held at the Rotterdam Ahoy Convention Centre on 9-11 September 2024.

OFI International 2024 will bring together major players across the Dutch, Asian and global oils and fats community under one roof, with a focus on ‘Solutions for Sustainability, Processing & Trade’.

The three-day event will feature:

9 September

Site visits to major companies in the Port of Rotterdam and an evening Welcome Reception. The Port of Rotterdam is one of the world’s key trading hubs, housing six vegetable oil refining complexes, four biofuel manufacturers, and four oils and fats storage terminals. As part of OFI International 2024, site visits will be organised to some of the major companies located in the port.

10 September

The 3rd Sustainable Vegetable Oil Conference (SVOC) – this annual event organised by the Council of Palm Oil Producing Countries (CPOPC) is a crucial platform aimed at facilitating a comprehensive dialogue among international stakeholders of the vegetable oil industry. This year’s theme of ‘Sustainability Transformation Beyond Borders’ is centred around implementation of the EU Deforestation Regulation (EUDR), food & energy security, and the role of vegetable oil in meeting rapid growth of the global population. The event is organised in partnership with the Netherlands Oils and Fats Industry association (MVO) and the Indonesian Palm Oil Association (GAPKI).

10-11 September

• A two-day exhibition of major suppliers to the oils and fats industry.

• A two-day Technical Commercial Conference organised by OFI with the theme, ‘Innovations in Processing & Refining – Addressing Sustainablility and Traceability Challenges in the Supply Chain’. With oils and fats processors facing increasing pressure to maximise www.ofimagazine.com

yields in the most competitive and environmental way, this conference will focus on the latest refining and processing technologies, focusing on sustainable processing and contaminants such as MCPDEs, GEs, MOSH/MOAH, chlorinated paraffins and other POPs.

11 September

The OFI Trade Outlook & Logistics Conference - ‘Managing risks and addressing sustainability in the supply chain’. This one-day conference will focus on current and future price trends impacting the world’s major vegetable oils including war and climate impacts on shipping; and what traders and producers must do to meet sustainability regulations such as the EU Deforestation Regulation and the EU’s Union Database Biofuels.

The Dutch oils and fats industry is one of the major players in the production and refining of oils and fats in Europe. Leading global producers such as ADM, Bunge, Cargill, Neste, Olenex, Sime Darby and Wilmar all have operations in the Netherlands, with production chiefly centred around the ports of Rotterdam and Amsterdam. More than 20% of European oilseeds, oils and fats imports and exports run through the Netherlands.

For further information, go to www.ofimagazine.com/ofievent Organisers

Oils & Fats International specialises in the global oil crops and animal fats industry, with a flagship magazine, newsletter and worldwide conferences and exhibitions.

The Council of Palm Oil Producing Countries (CPOPC) is an intergovernmental organisation established in November 2015 to strengthen mutual cooperation between palm oil-producing countries and represent their interests, with Indonesia and Malaysia as founding members.

MVO – the Netherlands Oils and Fats Industry – represents 95% of companies in the Netherlands active in the production, processing and trade of vegetable oils and animal fats, through contacts with the government, politics, social organisations, science and media.

The Indonesian Palm Oil Association (IPOA) –locally known as Gabungan Pengusaha Kelapa Sawit Indonesia (GAPKI) – works with the country’s central and regional governments to formulate policies for a sustainable palm oil industry and to develop Indonesia’s competitiveness in the global palm oil market.

Supporting organisations

Supporters of OFI International 2024 include:

Euro Fed Lipid is a federation of 11 scientific associations working to further lipid science and technology at a European level.

FOSFA International is a trade federation providing supporting services and standard contracts for fair and transparent free trade and shipping in oils, oilseeds and fats.

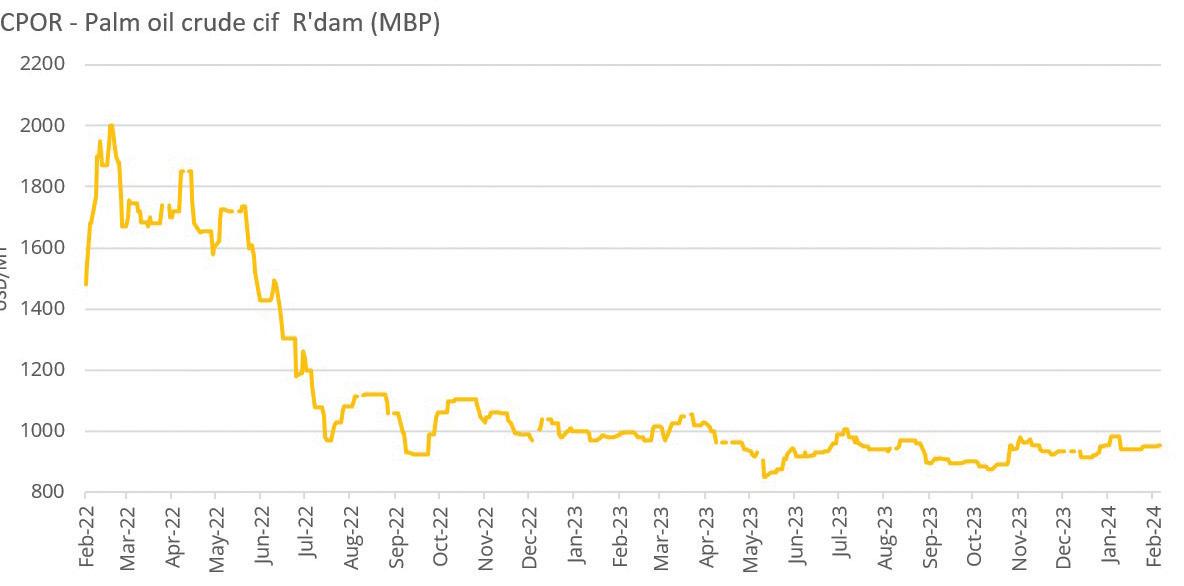

Prices for soyabean, rapeseed and sunflower oils have been falling but a bounceback for palm oil has created a new discount for soft oils, prompting a significant shift in demand among top buyers such as India John Buckley

Welcome as it has been for consumers, the reversal of global vegetable oil prices from their record 2022 peaks has been a challenge for producers still facing higher energy and transport costs. Recent data suggests prices may have bottomed out but, amid mixed supply/demand pointers, are hopes for stability premature?

While the latest United Nations Foreign Agriculture Organization (FAO) index showed food prices continuing to weaken in January, the vegetable oil component edged up to 122.5 points, staying above the October 2023 low of 120. However, it was still down by 12.7% compared with January 2023.

Chicago soyabean prices have been trading recently at their lowest level in over three years. Rapeseed’s benchmark Winnipeg futures – driven by improving supply – has also been at their cheapest since December 2020, below C$600/ tonne. Improved shipping from the Black Sea region has also helped sunflower oil prices join the weaker trend in ‘soft’ oils.

The exception has been palm oil, with Bursa Malaysia futures bouncing back by over US$100/tonne or 15% from its mid2023 and late-2022 lows to more than

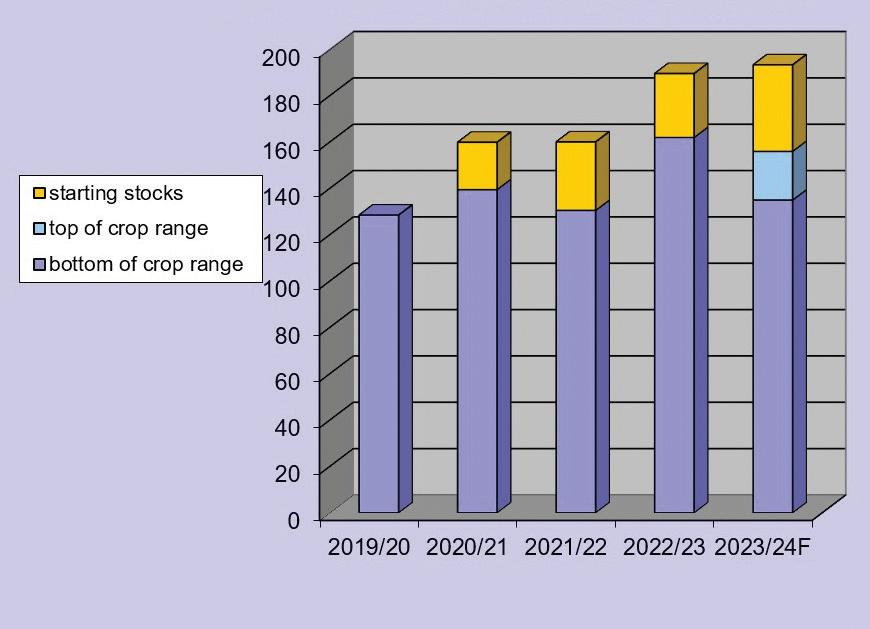

Stocks raise 2023/24 supply, even at low-end crop range (shown for 2023/24)

US$800/tonne (see Figure 1, above). The soft oils’ resultant new discount to palm oil has prompted a significant shift in demand among some major price-sensitive buyers, especially India, away from normally cheaper palm oil.

Supply factors that could extend the decline in vegetable oil prices may be led by soyabeans. Until recently, the Latin American crops appeared to have shrugged off an unpromising start amid extremes of heat, drought and too much rain in parts of Brazil and dryness in Argentina.

Brazilian estimates seem most at risk of heavy trimming. While the US Department of Agriculture (USDA) recently estimated the country’s soyabean production at 157M tonnes, some local analysts have been talking it down to 145-150M tonnes (see Figure 2, above). A rapidly progressing harvest should soon show whether the low estimates have been alarmist. Brazil’s 2022 crop has been revised up by 2M tonnes to 162M tonnes – a 32M tonnes gain on 2021 – which is still heavily influencing the 2023/24 market.The Brazilian 2023/24 shortfall is also heavily offset by a dramatic improvement in Argentina, which is set to produce 50M tonnes – double its 2022/23 drought-ravaged soyabean crop.

The soyabean market also took another bearish hit in February, with the USDA Annual Outlook Forum projecting a large increase in US 2024 planted area, up 4.6% to 87.5M acres (35.4M ha). Assuming trend yields of 52 bu/acres (versus last year’s 50.6 bu/acres), that suggests a crop potential of 122.5M tonnes against 2023’s rather disappointing 113M tonnes. In the best-case scenario for 2023/24,

soyabean customers are promised a second season of steeply rising world output – from 375M tonnes to 399M tonnes tonnes. It is also likely to be more than the market needs, raising carry-out stocks by as much as 10-12M tonnes.

While its domestic crush remains strong, the once-dominant USA is losing export market share (forecast to drop below 30%) to rising Latin American competition. If that continues into 2024/25 season, US carryout stocks could grow to their highest level since 2019/20. The USDA expects that to drive down the 2024/25 seasonal average price of US soyabeans to around US$11.20/ bu – about US$1.45 cheaper than this season and well below the average of recent years. The forward Chicago futures market is less bearish, though, suggesting prices a year hence similar to current levels for soyabeans, meal and oil.

Less welcome for soyabean’s food customers has been news that Brazil intends to use more of the oil in its biodiesel programme, increasing its blend from 12% to 14% from March 2024 and 15% next year. It could mean less crop for export. At the same time, a new Argentine government is talking of raising export taxes on soya products (see p33).

Rapeseed/canola supplies look less likely to increase in 2024. Agriculture and AgriFood Canada (AAFC) recently forecast the country’s planted area easing by 1.5% to 21.74M acres (8.8M ha) but said yield could edge up to around 37.6 bu/acre for a crop of about 18.37M tonnes, similar to last year’s. It also saw crush reaching 10.5M tonnes but exports staying low at 7M tonnes, resulting in ending stocks u

rising to 2M tonnes from this season’s 1.4M tonnes. The seasonal average price for Canadian canola in 2024/25 is, meanwhile, expected to drop C$40/tonne on the year to C$680, about C$177 below the 2022/23 average.

Some estimates suggest Canada’s crushing capacity could increase by 60% from the current 11.1M tonnes by 2025, while rapeseed oil production could rise from 2022/23’s 4.15M tonnes to as much as 7M tonnes within five years.

Across the border, the US rapeseed crop was also estimated to have risen 9% to a new record high of 1.88M tonnes, as planting rose in response to growing biodiesel demand. US consumption of rapeseed oil for biodiesel soared in the 2022/23 season by 1.6bn lbs to 2.9bn lbs, providing 10% of all US feedstock, according to recent Energy Information Administration (EIA) data.

The increase was heavily fed by Canadian exports, which jumped to 2.6M tonnes. However, of the total 30bn lbs of vegetable oils, waste oils, fats and greases used for US biofuel, soyabean oil still leads, supplying 41% of feedstocks.

Can this pace continue? Further growth in US renewable diesel capacity (already up 1.49bn gallons to 3.7bn gallons in 2022/23) is expected as state/federal targets rise, alongside biomass-based diesel tax credits.

However, US farm economist Scott Irwin of the University of Illinois believes the boom may have already peaked. He told the Purdue Top Farmer conference in January that total US renewable diesel capacity was already outstripping government mandates, threatening to deter growth in 2024. He cited higher production costs versus traditional diesel, typically US$1-$2 and sometimes as much as US$5/gallon, leaving the industry reliant on government blending mandates (demanding 4-4.5bn gallons by 2025 against projected capacity of 5.5bn gallons by the end 2024 and 7.5bn gallons beyond 2025). Irwin estimates that the renewable diesel boom has added about US$2.50/bu to the soyabean price in the last three crop years. Lacking an increase in mandates or exports may eventually force a cut in production capacity for new and existing plants. However, he acknowledges potential growth in sustainable aviation fuel, although that may take years to fully develop.

In Europe, the bloc’s rapeseed crop revival appears to be slowing down for the year ahead. Planted area jumped almost 6% last year, to gain almost 17% on 2022, resulting in an output 2.7M tonnes higher than two years ago. The jump was

largely in response to the threat of supply shortages and/or higher costs resulting in the Black Sea region. However, top grower France was recently estimated to be sowing 0.6% less for 2024, although that is still almost 16% more than the fiveyear average.

Ukraine’s crop turned out far larger than the expected 3-3.5M tonnes for the 2023/24 season while Russia’s was again larger than usual at 4.1M tonnes.

Finally, Australia’s crop, arriving halfway through the Northern Hemisphere season, was recently estimated by the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) at 5.5M tonnes, 300,000 tonnes more than earlier estimates but still well down on the record 8.3M tonnes grown last season and the 6.8M tonnes produced in 2021/22.

Among the major oils, palm oil crop forecasts for 2023/4 (up 2.4%) have appeared at the greatest risk of trimming by El Niño-linked weather events in Asia. Output has been well down in the last few months but much of this is seasonal. A larger than usual yield drop on dry weather issues (which may not be fully apparent for 10-12 months) could be offset somewhat by improved supply of immigrant plantation labour, curbed in the past two to three years by COVID restrictions. A Reuters poll of analysts recently resulted in an average forecast of Malaysian output up 1% in 2024 to 18.75M tonnes, with Indonesia up 0.6% to 48.87M tonnes. The USDA has seasonal (Oct/Sep) 2023/24 output up 3.3% for Malaysia at 19M tonnes and 1% higher for Indonesia at 47M tonnes.

Palm oil demand seems to have taken a tumble recently, partly due to seasonal factors, with consumers tending to use less in the cold winter months when the oil takes on a more solid consistency.

However, import purchases by countries

like India have also been curbed by palm’s oil’s unusual price premium over the soft oils. Against that, markets also have to continue close monitoring of the ‘fuel versus food’ factor. Leading palm producer Indonesia is now using a 35% palm oil blend in biodiesel this year in response to a sharp narrowing of the spread between palm and crude mineral oil (the so-called POGO spread). Crude oil’s fortunes will clearly remain a driver. Although its price has recently been jumpy over events in the Red Sea – with Houthi attacks on commercial vessels – it has dropped by about 10% in the past year after three years on the up.

To confuse matters further, leading palm oil importer India recently cut its import taxes on all vegetable oils (led by palm oil) in a bid to build stocks and woo food oil consumers with cheaper prices ahead of looming national elections. Markets have also been worrying that China’s economic slowdown could curb its palm imports.

While frequently a follower of the main vegetable oil price trend, sunflower’s outlook will depend heavily on spring planting in Europe, weather, the RussiaUkraine war and how effectively Ukraine can ship out what it produces.

While the world sunflowerseed planted area is down from its high of 28.5M hectares in 2021/22 (see Figure 3, above), the crop had a much better than expected harvest in 2023/24, especially in Ukraine and Europe, keeping oil supplies flowing and prices on a downward trajectory.

The EU may be encouraged to plant another large crop for 2024 while Ukraine, after its initial drop in output when Russia’s invasion began, has so far shown it can meet most global demand. Hopefully, along with an improved Black Sea export corridor, that may keep Ukrainian farmers growing enough sunflowerseed, although its ocean freight remains at risk of military disruption.

Overall, the demand outlook for the oils and fats sector is currently being influenced by factors such as China’s economic woes and whether it will cut imports of palm, soyabean and crude mineral oils. Buyers generally are also being influenced by the shifting price relationships between the oils, especially palm oil’s lost discount. India meanwhile wants to grow more of its own oilseeds to reduce oil imports although history suggests this will not happen quickly. Fuel demand is another wild card as vegetable oils try to establish an ‘equilibrium’ value after the extreme volatility of recent years.

● John Buckley is OFI’s market correspondent

Improvements to Brazil’s transport infrastructure and the devaluation of its currency in the past decade have propelled the country to become the world leader in soya output and exports, with record production projected for 2023/24 Constanza Valdes, Jeffrey Gillespie, Erik Dohlman

Soyabean – and its meal and oil – is the most traded agricultural commodity, accounting for nearly 9% of the total value of global agricultural trade, according to a US Department of Agriculture (USDA) Economic Research Service Information Bulletin published last December.

Brazil and the USA jointly supplied 89% of worldwide soyabean exports in the 2021/22 marketing year (MY) and are major export competitors, says the ‘Soyabean Production, Marketing Costs, and Export Competitiveness in Brazil and the United States’ bulletin.

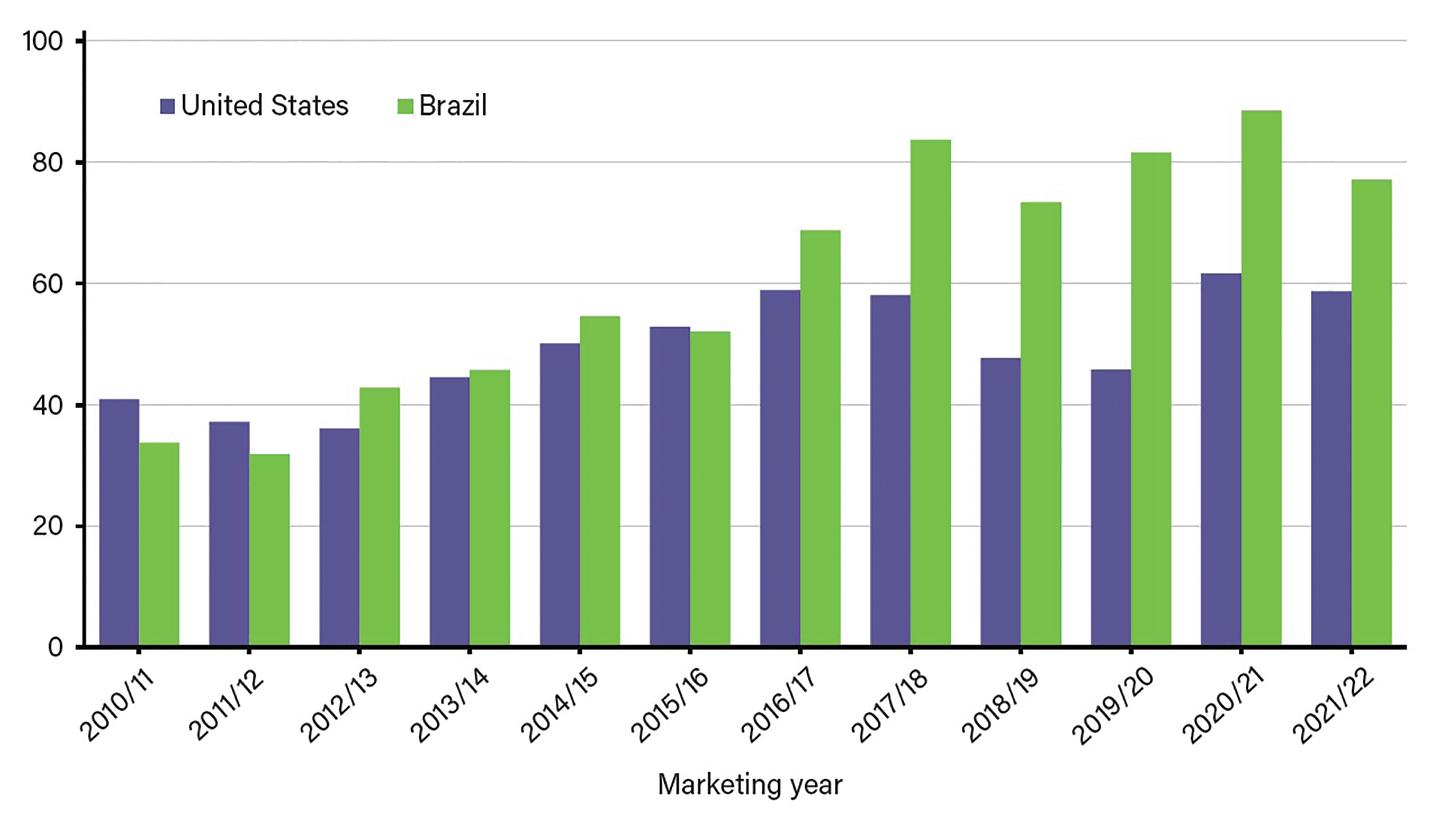

Historically, the USA was the world’s largest soyabean exporter but since 2012/13, Brazil has overtaken the country, with projections indicating that the Brazilian share of global soyabean trade could increase from 51.6% to 60.6% between *2021/22 and 2032/33.

Brazil is the world’s largest soyabean producer and exporter, according to the USDA report. The country exports more than 60% of the soyabeans it grows and the crop is Brazil’s main agricultural commodity export by volume.

National food supply agency Companhia Nacional de Abastecimento (CONAB) forecasts Brazil producing an all-time high of 154.8M tonnes in 2022/23, harvested from a record 43.8M ha. Exports are projected by the USDA to rise to more than 130.4M tonnes by 2032/33.

“Brazil’s strong soyabean performance is based on area expansion and changes in technology and farming practices over the past 25 years,” the USDA report says.

Brazil initially began growing soyabeans during the 1960s by double-cropping them with wheat in traditional production regions such as Rio Grande do Sul state in the far south. As part of agricultural diversification efforts during the early 1960s, soyabeans were also introduced as an alternative to coffee in Paraná state, north of Rio Grande do Sul.

The growth in the soyabean sector accelerated after 2008, with the devaluation of the Brazilian Real brought on by the country’s financial crisis in early 1999 strengthening the competitiveness of exporters.

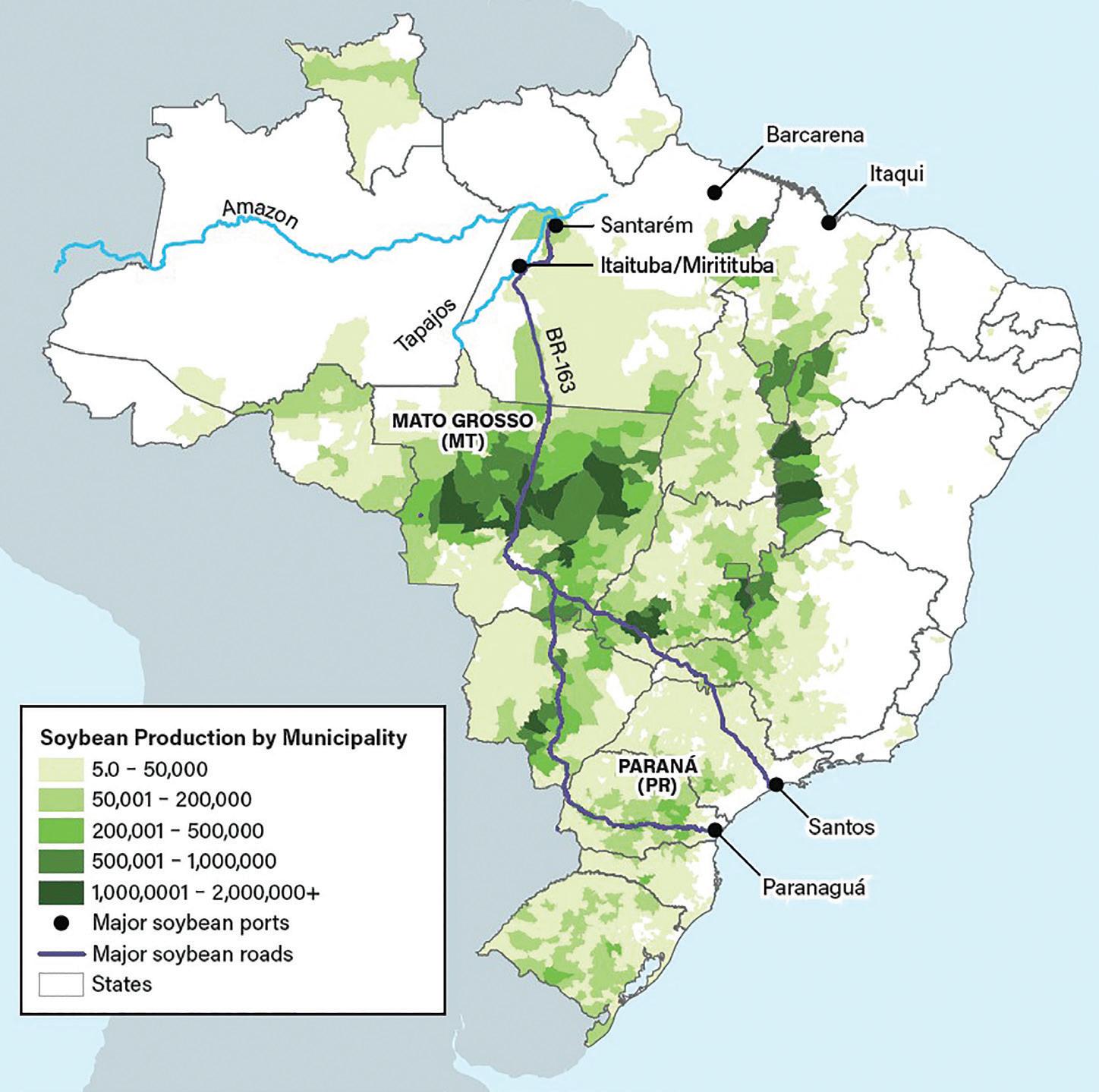

Today, soyabean production is highest in Brazil’s Central-West region, particularly in Mato Grosso state, which grows about 27% of Brazil’s soyabeans and accounts for almost 30% of its soya exports.

At the centre of large-scale soyabean production is the long-term strategy of

cultivating the Cerrado, an extensive tropical savannah covering central Brazil and comprising 11 states, including some parts of the southeastern and northeastern regions. The Cerrado biome has seen great expansion of grain and oilseed production, with farmers adopting new crop varieties suited to the biome’s climate and soil conditions, and the development of transport and port infrastructure.

China’s increasing demand for soyabeans has played a key role in stimulating growth in Brazil’s soyabean exports. Brazilian soyabean exports to China increased from 5.7M tonnes in 2004/05 to 60.5M tonnes in 2021/22, aided by the substantial depreciation of the Real. International trade in soyabeans began growing when China liberalised imports to meet demand for protein in animal feed and edible oils, which coincided with Brazil’s expansion of output in the Cerrado region. China imported even more Brazilian soyabeans after imposing a 25% retaliatory tariff on US soyabeans in 2018 as Brazil was the only exporter capable of replacing large US volumes.

The international market is crucial to the US agricultural economy, with combined exports of soyabeans and products worth more than US$41.5bn in 2022.

The USA was the world’s largest soyabean exporter until 2012/13, when Brazil exported more of the crop than the USA for the first time. US share of global soyabean trade is projected to drop from 38% to 28% between 2021/22 and 2032/33.

STATE-OF-THE ART OILSEEDS AND OIL PROCESSING TECHNOLOGIES

● Horizontal agriculture

● Local mechanical processing

● Patented system of energy recovery

● Complex approach

● Unique combination of extruders and screw presses

www.farmet.eu

The effective technology and complex services

In 2021/22, Brazil exported 77.1M tonnes of soyabeans while the USA exported 58.7M tonnes (see Figure 1, above). Argentina, the world’s next largest soyabean trader, exported just 5.6M tonnes. In that year, China was the main export destination for US soyabeans (52% of total exports), followed by other Asian countries (19%).

Soyabeans comprise about 90% of US oilseed production with more than 92% of soyabeans produced in 15 states, including the Heartland region encompassing parts or all of Illinois, Indiana, Iowa, Kentucky, Minnesota, Missouri, Nebraska, Ohio and South Dakota states. More soyabeans are produced in the Heartland than in any other part of the USA because of the region’s moderate climate and fertile and well-drained soil.

In 2000, almost 30.3M ha were planted with soyabeans in the USA, making it second only to corn in terms of planted area. Soyabean hectarage has increased

steadily since then, reaching 35.3M ha in 2021/22.

A series of currency devaluations during Brazil’s 2014–16 economic recession, and in 2020 during the COVID-19 related recession, increased revenues for farmers in domestic currency, outweighing the increased costs of imported inputs.

Devaluation of the Real encouraged Brazil’s farmers to put more land into production and increase double cropping. Soyabean land use increased by 38% between 2014 and 2022, with the increase in planted area and higher production contributing to an 84% increase in soyabean exports by volume. Since 2022, the Brazilian Real has been relatively stable against the US dollar.

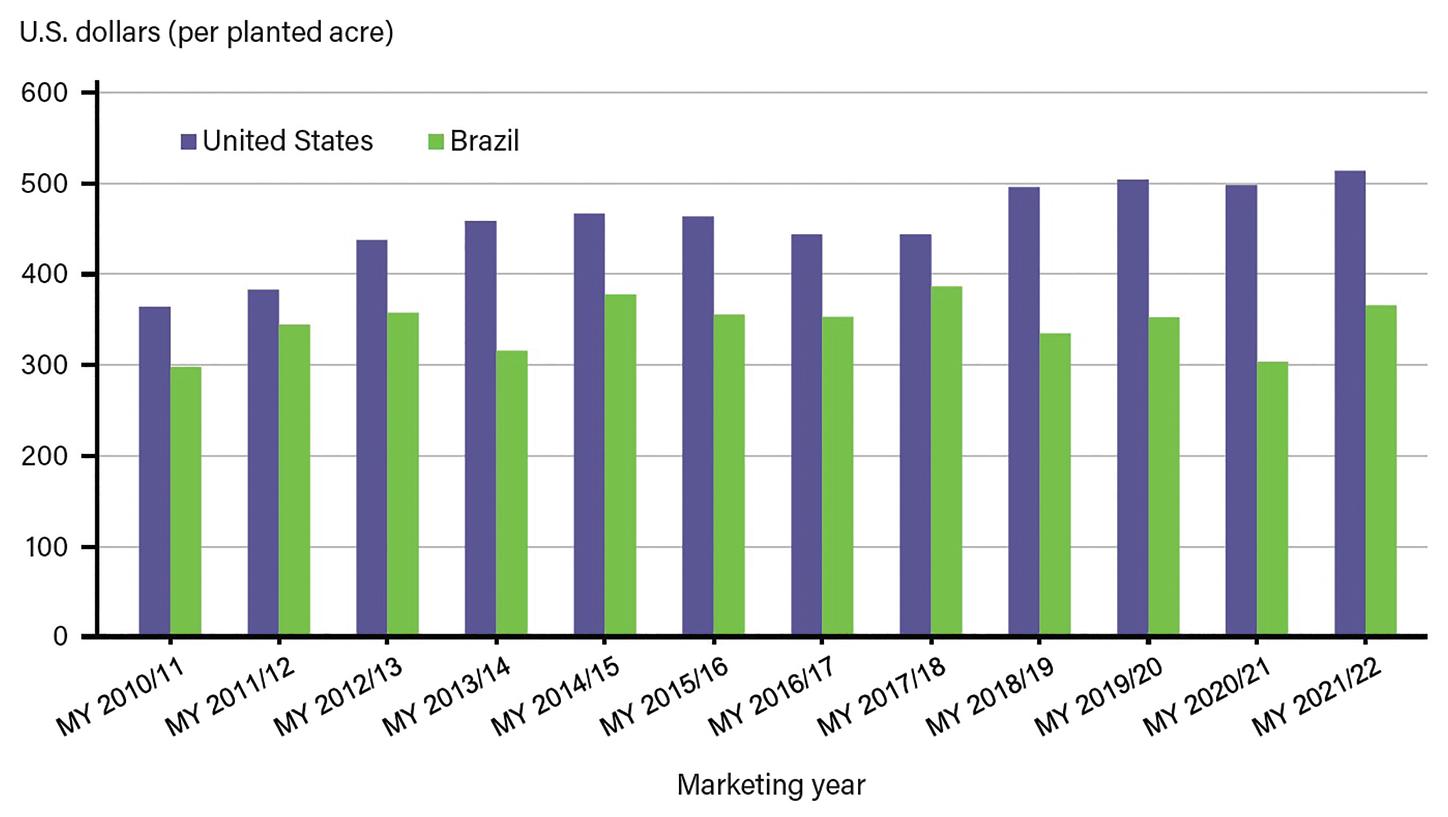

At the farm level, export competitiveness can be affected by production and marketing costs, including for seed, fertiliser, land, fuel, chemicals, credit, transportation, handling and storage.

While there is not a large difference in total production costs between Brazil and the USA, their variable and fixed costs differ.

In 2021/22, Brazil’s soyabean producers spent far more on fertilisers and chemicals per acre than producers in the USA, a reflection of the traditionally lownutrient soils in the Central-West, high pest prevalence in tropical weather, and trucking costs to move imported fertilisers and chemicals.

Seed costs were the largest operating expense per acre in the USA at US$63 in 2021/22, compared with US$43 for Brazil. Both countries plant genetically modified (GM) varieties but, most notably, Brazilian farmers are legally allowed to produce their own seeds, precluding the need to purchase new seeds every year.

Total economic costs per acre to produce soyabeans in the USA and Brazil increased by 2.6% and 0.5% annually, respectively, over 2010/11 to 2021/22, not adjusted for inflation (see Figure 2, left).

In the USA, the main factors for the rise were higher fertiliser, pesticides, machinery, repairs and land costs. For Brazil, fertiliser costs rose by 16.8% and pesticide costs increased. However, Brazil had considerably lower land costs, with its vast supply of arable land. Land costs averaged US$61/acre in Brazil, compared with about US$155/acre in the USA.

However, the USA has higher yields per acre than Brazil, particularly in the US Heartland region, helping to offset its higher per acre costs.

Historically, the USA has held the competitive edge in international freight costs compared with Brazil. Transport costs – including for internal freight, marketing and ocean shipping –represented about 23.2% of landed costs for the US Heartland between 2017/18 and 2021/22. However, the US advantage diminished in 2021/22 as logistics constraints arising from the COVID-19 pandemic, particularly on sea cargo, led to higher US shipping costs compared with sea cargo shipping costs for Brazil.

In Brazil, 60% of soyabeans are transported by road, 33% by rail and 7% by waterway (see Figure 3, p23). The country’s history of under-investment in transportation infrastructure and port terminals had long been seen as a key bottleneck for its export competitiveness.

However, in 2013, the government enacted a framework for private investments in ports and the paving of 850km of the BR-163 highway in the centre of the country’s grain belt. It also accelerated development of the Arco

Norte (Northern Arc), an area comprising river and ocean ports in the north and northeast regions of Brazil. These ports are located along the Amazon River, the Tapajós River, and the northern Atlantic Coast of Brazil (Porto Velho in Roraima state; Miritituba, Santarém and Barbacena in Pará state; Itacoatiara and Manaus in Amapá state; and Itaqui in Maranhão state).

Between 2010 and 2022, soyabean exports through the Arco Norte expanded from 6M tonnes/year to 35M tonnes/ year, doubling its share of total Brazilian exports from 14% to 28%.

The paving of BR-163, the main highway through landlocked Mato Grosso, was also seen as crucial to providing soyabean farmers more efficient access to northern ports on the Atlantic Ocean and the Panama Canal, increasing the country’s export competitiveness to North America, the EU, Africa and Asia.

The development of the northern corridor brought new barging operations in the inland river port of Santarém, linking the river ports of Barcarena and Miritituba on the Tapajós-Amazon waterway in Pará state. These ports are operated by Amaggi, Bunge, Cargill, Louis Dreyfus and COFCO.

With the completion of the BR-163 in 2019, the cost of hauling soyabeans 1,067km from Mato Grosso to Miritituba port in northern Pará state fell significantly, leading to lower trucking costs and savings compared with soyabean exports via southern ports. The export FOB price for soyabeans grown in Mato Grosso became lower at northern ports, and the share of soyabeans exported through northern ports expanded, accounting for a third of Brazil’s soyabean exports in 2021.

China has played a large role in Brazil’s transport and infrastructure landscape.

In 2013, China’s Development Bank provided US$1.2bn to Chinese global agribusiness COFCO to expand the soyabean supply chain, including the construction of a processing plant in Mato Grosso and 19 storage facilities throughout the country. In 2022, COFCO was awarded a 25-year terminal concession for the southern Port of Santos. Under China’s Belt and Road Initiative, various infrastructure projects are also being developed, including the US$4bn China Railway Bureau Group partnership in the Ferrogrão project (EF170 Railway) to move soyabeans and corn from Mato Grosso to Pará state.

Brazil’s improved transport infrastructure over the past decade has led to substantial falls in its internal transport and marketing costs. Its estimated five-year average for shipping soyabeans during 2017/18–2021/22 was

US$77/tonne. This represents a US$21/ tonne cost saving.

The USDA report says the US Heartland is the lowest-cost soyabean exporter. Paraná state is the next lowest-cost exporter, mainly due to its location close to large ports and low internal transport costs. Mato Grosso is competitive with the USA despite higher inland transport costs due to its lower soyabean production costs.

Despite substantial growth in US soyabean production and exports in the past 25 years, the US share of global exports has steadily diminished and Brazilian output now exceeds that of the USA. The US share of global soyabean exports is projected to decline from 38.1% in 2021/22 to 28% by 2032/33, while Brazil is expected to remain the world’s largest soyabean exporter.

Soyabean production in Brazil is set to rise from 127M tonnes in 2021/22 to 214M tonnes in 2032/33, and its exports are expected to reach 130M tonnes by 2032/33.

China will account for about 72% of the projected rise in global soyabean imports, while transport will remain a major factor in export competitiveness.

In the USA, more agricultural

commodities are moved to ports using lower-cost barge and rail transport, while 60% of Brazilian soyabeans are moved to ports using higher-cost truck transport.

Improvements over the past decade to Brazilian transportation infrastructure – including roads, railways, waterways and ports – have enhanced the country’s competitive position. However, despite the progress achieved, infrastructure and ports still face challenges when it comes to increasing efficiency, reducing operating costs, and effectively attracting investment to sustain the projected expansion of the agricultural sector.

Overall, Brazil is likely to remain the world leader in soyabean production and exports, followed by the USA, with US exports influenced in the longer term by the continued presence of Brazil as a major competitor. ●

*All periods in this report refer to marketing years (1 September-31 August)

Constanza Valdes (International Trade and Development Branch), Jeffrey Gillespie (Animal Products and Cost of Production Branch), and Erik Dohlman (Agricultural Policy and Models Branch) are research agricultural economists with the Market and Trade Economics Division, Economic Research Service, USDA

Stricter regulations on sustainability including the EU Deforestation Regulation, high energy costs, and renewable diesel demand for tallow will all impact the oleochemicals market in the future

Serena LimThe oleochemicals industry faces both a range of challenges and opportunities as it heads into the next decade, Wilmar Europe basic oleochemicals business unit head Claire van Seumeren told the 13th ICIS World Oleochemicals Conference in Prague on 24-25 October.

An increasing focus on sustainability would lead to the use of more bio-based products such as vegetable oils and fats. Sustainability growth would drive product innovation, and there would be growing demand from end-use industries – such as the personal care market – for renewable and sustainable products to minimise environmental impacts.

Demand for new applications and speciality oleochemicals such as silicone replacers was expected to grow further, along with the adoption of green chemistry to result in less polluting or hazardous substances.

Challenges facing the oleochemicals industry included stricter regulations and standards; re-globalisation; financing; competitiveness factors and energy costs, Seumeren said.

Energy was a significant component in

operational costs and Europe, in particular, had to compete against regions with lower or subsided energy costs, affecting its competitiveness. While relocating energy-intensive production to lower cost regions was possible, interest rates were expected to remain high, affecting the financing of operations and any expansion of production facilities, she said.

Complying with stricter regulations on environmental impacts, product safety and sustainability was another challenge facing the industry.

“This can be complex and costly, especially for small- and medium-sized companies.”

The European Chemicals Agency (ECHA), for example, was looking into restrictions on 1,4-dioxane, a byproduct of sodium laureth sulfate (SLES) processing, due to its potential health and environmental risk. This could result in restrictions on the manufacture of 1,4-dioxane in surfactants due to the potential risk it could pose in drinking water sources.

SLES is found in many personal care products such as shampoos, detergents and cosmetics and can be derived from petroleum or plant-based sources such as palm kernel or coconut oils.

The availability of palm oil products complying with the new EU Deforestation Regulation (EUDR) could also be a challenge this year, with potential price rises if there was not enough compliant feedstock, Seumeren said.

The EUDR requires documented proof that palm oil products and their derivatives are deforestation-free when imported into or exported from the EU.

“This will affect the availability of

compliant raw materials and their derivatives.”

While the EUDR, along with weather and geopolitical factors, could affect feedstock prices and availability, reliance on palm and palm kernel oil (PKO) feedstock was also increasing, presenting an opportunity, Seumeren said.

“Oleochemical manufacturers need to ensure their raw materials are sourced responsibly and EUDR compliance will guarantee access to European markets.”

The utilisation of waste was also gaining traction, opening up potential for raw materials such as rice bran oil, for example.

Meanwhile, increasing populations and disposable incomes in emerging markets in Asia-Pacific, Africa and Latin America, were bringing new demand.

The expansion of traditional applications, such as lubricants in metal working fluids, was leading to new products for these applications.

Technology advancement with new catalysts and enzymes, along with digitisation, automation, advanced analytics and AI, would also be a feature of the next decade, Seumeren added.

Focusing on the European fatty acids market, ICIS senior editor manager Eashani Chavda said 2023 had been dominated by low demand and falling prices for most grades; with healthy supply despite Europe imposing antidumping duties on Indonesia.

Europe had been plagued by inflation, recession and poor consumer confidence, with low demand for personal care products such as make-up and perfumes

due to hybrid working and less officebased work.

Detergents and cleaners accounted for almost half of fatty acids demand (48%), followed by intermediates (16%) and plastics (14%), with a move away from big brands to private labels.

Demand erosion was shifting buying trends, with producers moving from quarterly to monthly buying to take advantage of falling prices and a higher incentive to keep stocks.

Chavda said supply had outpaced demand and while Europe had imposed anti-dumping duties on Indonesia fatty acid imports in January 2023, it did not have a major effect on the market, with limited impact on palm stearic acid and only some constraints on palm oleic acid.

Indonesian exports to Europe had been replaced by Malaysia (see Figure 1, right) and low EU demand had mitigated some of the impact from reduced imports.

Palm oil prices were very volatile last year, but the preference for vegetablebased feedstock against animal-based products, such as tallow, was expected to continue, Chavda said.

“The tallow fatty acids market is shrinking in Europe and the market wasn’t affected by the KLK Oleo Düsseldorf site closure in August.”

The fatty acids market was expected to experience continued low demand, with a potential palm oil supply crunch due to El Niño-related rainfall deficits affecting production.

“The EUDR is also a topic of high importance and we may see impacts on palm and soya supply, with the potential for price increases because of this.”

Caroline Midgley, director of biofuels and oleochemicals at GlobalData (formerly

UK-based LMC International), also spoke on the EUDR at the ICIS conference.

“The oleochemical industry is still struggling to understand how they can apply the regulation,” she said. “It applies to all oleochemicals products, including glycerine and soap, when these issues had previously been ignored.

“The legislation requires buyers to carry out due diligence to identify the exact geo-location of where palm oil has come from. This implies total traceability, which then requires segregation rather than mass balance, which is the current industry standard.”

Another issue concerned smallholders, who accounted for around 40% of the palm oil produced in Southeast Asia. The definition of smallholders was not aligned, with the EU having different definitions compared with Indonesia or Malaysia.

There was also a lack of digitalisation of transaction information between smallholders and small and medium-sized enterprises (SMEs).

“Technology solutions are required to collect and store the supply chain data that will be needed to demonstrate compliance,” Midgley said. “Some market participants have suggested that it can be compatible with current certification criteria like the Roundtable on Sustainable Palm Oil (RSPO) if everyone employs compatible IT systems and they use block chain, but this would require considerable industry investment.”

A final concern was that while all countries would start on a level playing field, the EU planned to risk assess, then grade and differentiate them after 18 months, with concerns that countries like Indonesia would get a poor rating, putting it at a disadvantage.

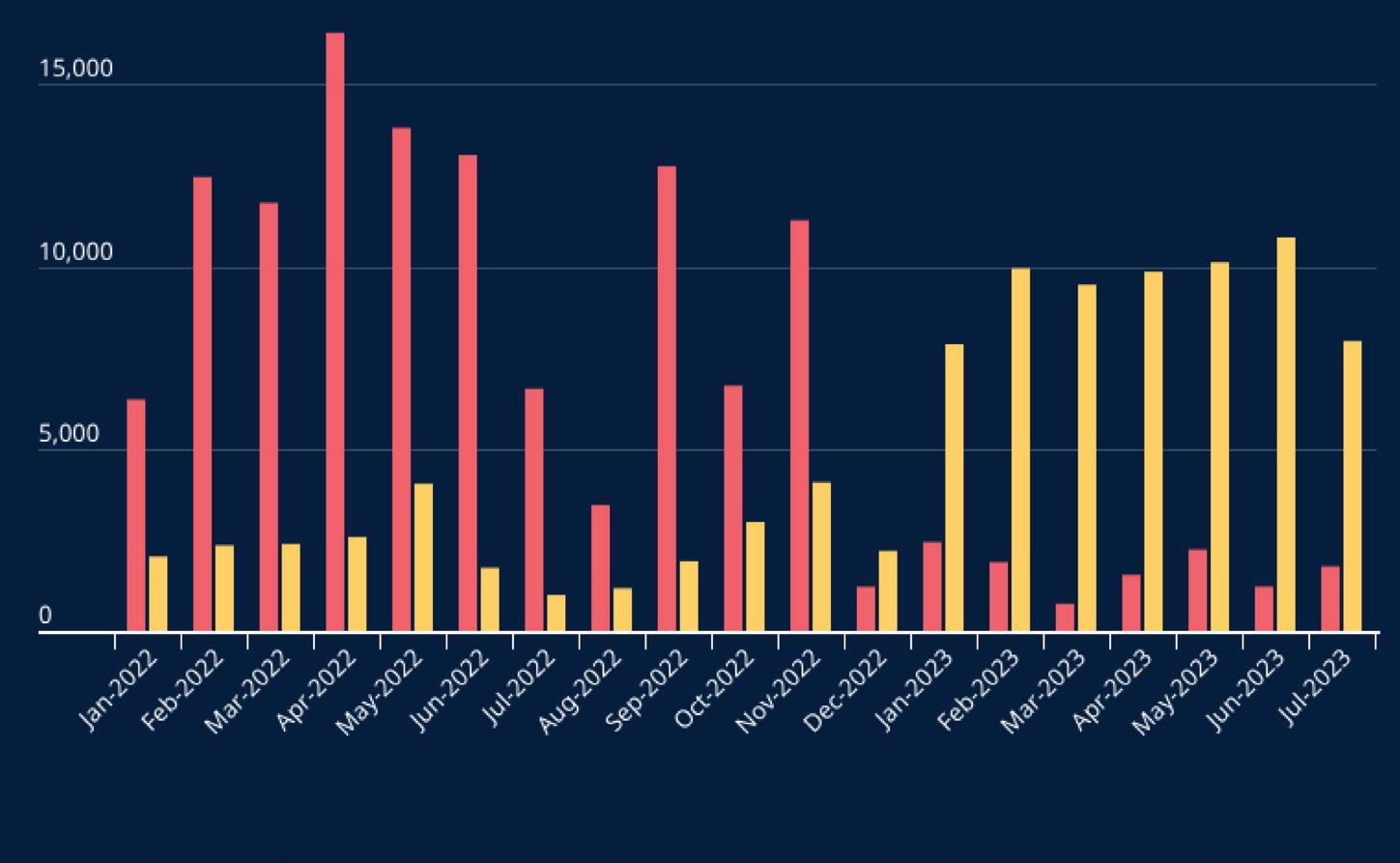

Apart from the EUDR, slowing palm oil supply growth would also pose a challenge for oleochemical producers, who required palm stearin and PKO, Midgley said.