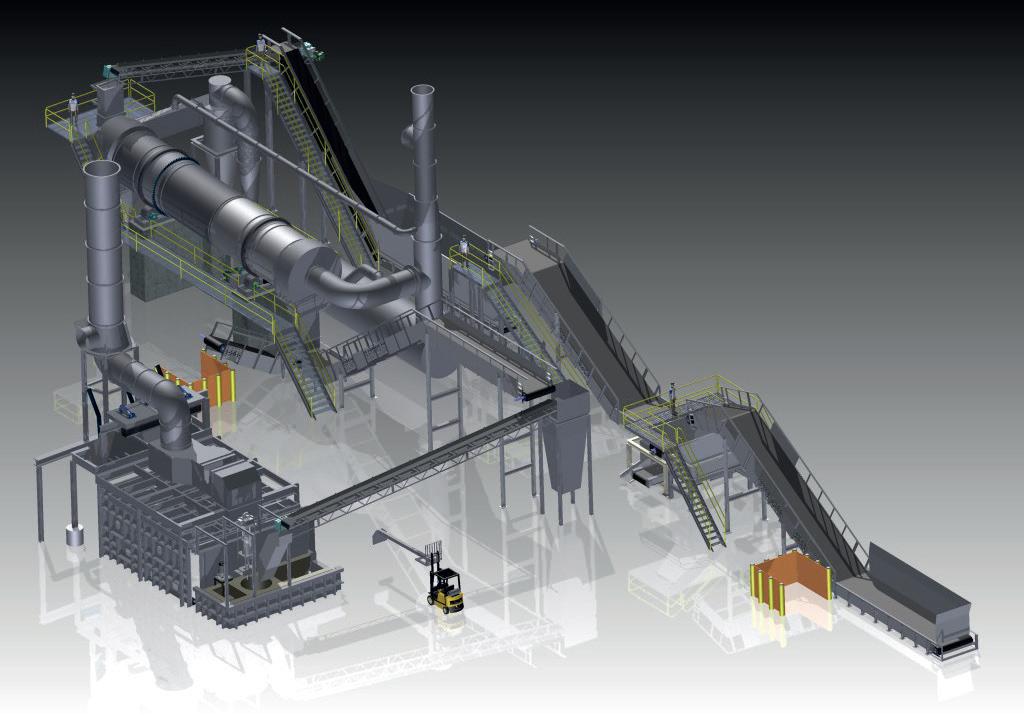

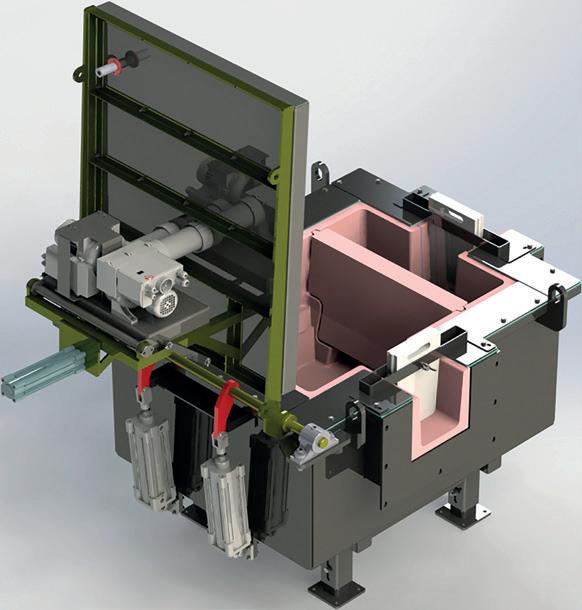

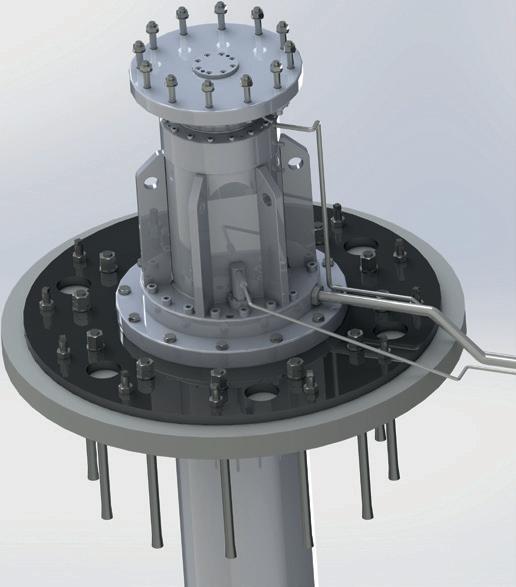

OVER YEARS EXPERIENCE IN THE ALUMINUM MELTING INDUSTRY SINGLE CHAMBER/MULTI CHAMBER FURNACES SCRAP DECOATING SYSTEMS TILTING ROTARY MELTING FURNACES SCRAP CHARGING MACHINES LAUNDER SYSTEMS CASTING/HOLDING FURNACES HOMOGENIZING OVENS COOLERS SOW PRE HEATERS REPAIR & ALTERATIONS www.gillespiepowers.com 314 423 9460 ST. LOUIS, MISSOURI, USA 800 325 7075

Sow Drying Tilting Melter &

Holder

Stationary Melter

Autotapper INDUSTRY NEWS HYDROGEN CBAM UPDATE THE JOURNAL OF ALUMINIUM PRODUCTION AND PROCESSING www.aluminiumtoday.com September/October—Vol.36 No.5 RECYCLING

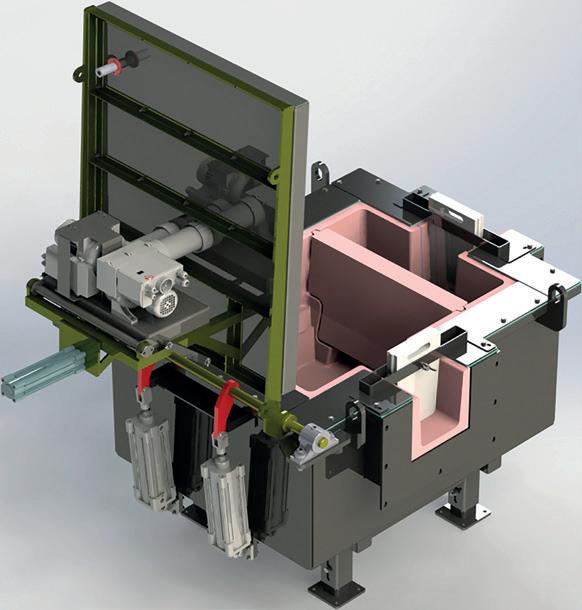

Patented Delacquering System Homogenizing & Cooling

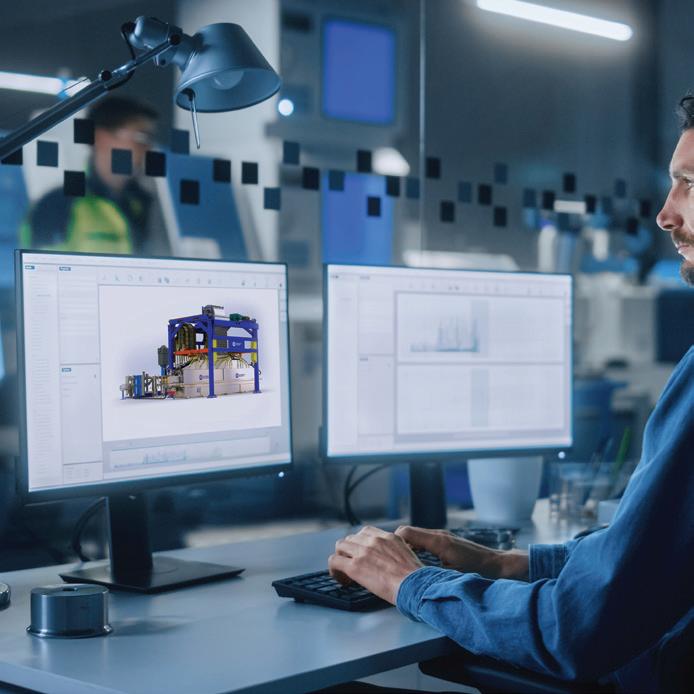

Zero Outsourced Engineering and Service

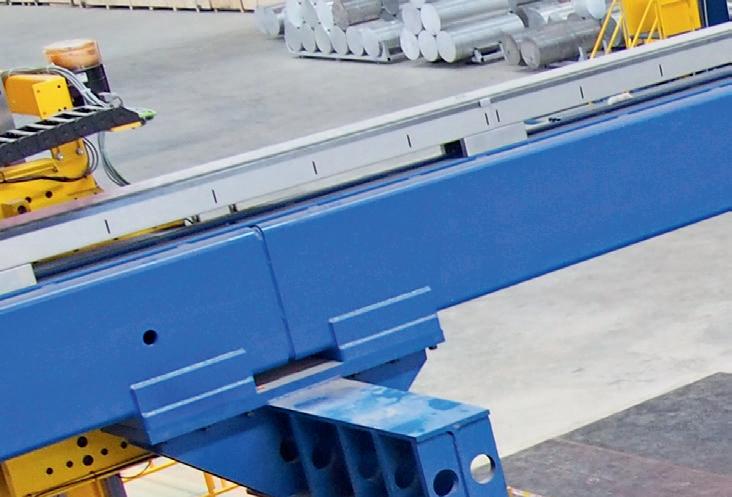

From concept to completion, all mechanical and controls engineering is completed in-house. Our trained service engineers and technicians use the most advanced tools to keep your equipment performing at peak efficiencies.

100% USA Engineered & Manufactured

All Granco Clark equipment comes from our 92,000 square foot modern Michigan facility providing the industry’s most innovative custom equipment built with the exceptional quality you come to expect from Granco Clark. Our repeat customers attest to that.

All-inclusive Turn-key System Supplier.

Granco Clark is your all-inclusive turn-key system supplier. Expect superior performance, industry knowledge, unmatched and proven solutions, onsite commissioning, support, and responsive service technicians.

Our industry knowledge and experience are superior and proven, with our custom-engineered equipment delivering the solutions and performance you expect from Granco Clark.

Being a full-service company means we are with you from the initial planning phase of the project through the start of production and beyond. You will have access to unmatched industry service, support and parts. Our global team of trained service technicians are available to keep your production facility always running smoothly and provide on-site service (in most cases, within 24 hours).

100%

Contact us to discuss your next project. +1-800-918-2600 | www.grancoclark.com We are 100% customer focused. Engineering. Manufacturing. Global Support. Excellence is our standard.

Employee-owned

Volume 36 No. 5 – September/October 2023

Editorial Editor: Nadine Bloxsome Tel: +44 (0) 1737 855115 nadinebloxsome@quartzltd.com

Assistant Editor: Zahra Awan Tel: +44 (0) 1737 855038 zahraawan@quartzltd.com

Production Editor: Annie Baker

Sales

Commercial Sales Director: Nathan Jupp nathanjupp@quartzltd.com

Tel: +44 (0)1737 855027

Sales Director: Ken Clark kenclark@quartzltd.com

Tel: +44 (0)1737 855117

Advertisement Production

Production Executive: Martin Lawrence

Managing Director: Tony Crinion

CEO: Steve Diprose

Circulation/subscriptions

Jack Homewood

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

email subscriptions@quartzltd.com

Annual subscription: UK £270, all other countries £292. For two year subscription: UK £510, all other countries £527. Airmail prices on request.

Single copies £50

7

ALUMINIUM INTERNATIONAL TODAY is published six times a year by Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, UK. Tel: +44 (0) 1737 855000

Fax: +44 (0) 1737 855034

Email: aluminium@quartzltd.com

Aluminium International Today (USO No; 022-344) is published bi-monthly by Quartz Business Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437.

Periodicals postage paid at Emigsville, PA. POSTMASTER: send address changes to Aluminium International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in the UK by:

20

Cover picture courtesy of Gillespie & Powers, Inc

31

CONTENTS 1 www.aluminiumtoday.com Aluminium

Today September/October 2023 2 LEADER 2 NEWS

International

COVER

Stephens and George Ltd, Goat Mill Road, Dowlais, Merthyr Tydfil, CF48 3TD. Tel: +44 (0)1685 352063 www.stephensandgeorge.co.uk © Quartz Business Media Ltd 2023 ISSN1475-455X Supporters of Aluminium International Today SEARCH FOR ALUMINIUM INTERNATIONAL TODAY 20 47 31 38 COMPANY PROFILE 47 Storvik Group takes on the American market EVENT PREVIEW

The stage has been set for the application industries SUSTAINABLE ALUMINIUM 52 Qatalum’s journey: Sustainability and safety in focus 54 Assan Alüminyum invests $90M in sustainable development FURNACE TECHNOLOGY 59 Getting to the true core of the matter! THE ALUMINA CHRONICLES

Aluminium Industry in the USA HYDROGEN

50

11

Worlds first batch of recycled aluminium using Hydrogen USA UPDATE

New North American aluminium capacity RECYCLING

25

Why addressing the PRN system is key to increasing recycling rates EXCLUSIVE

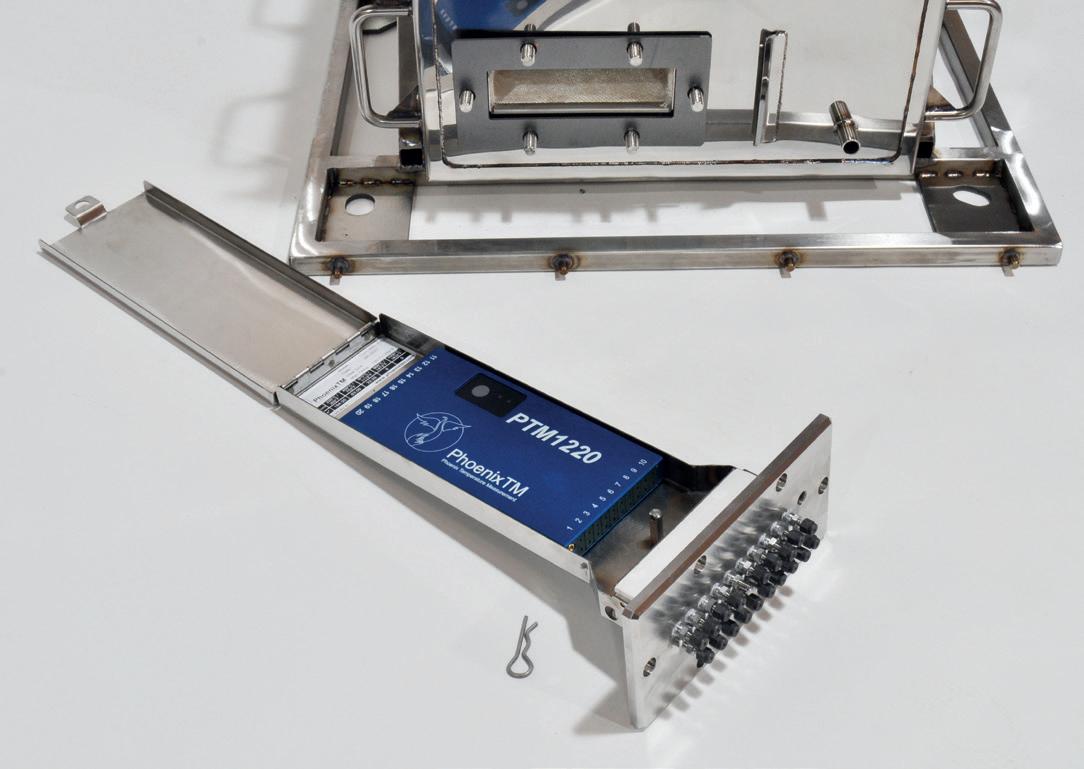

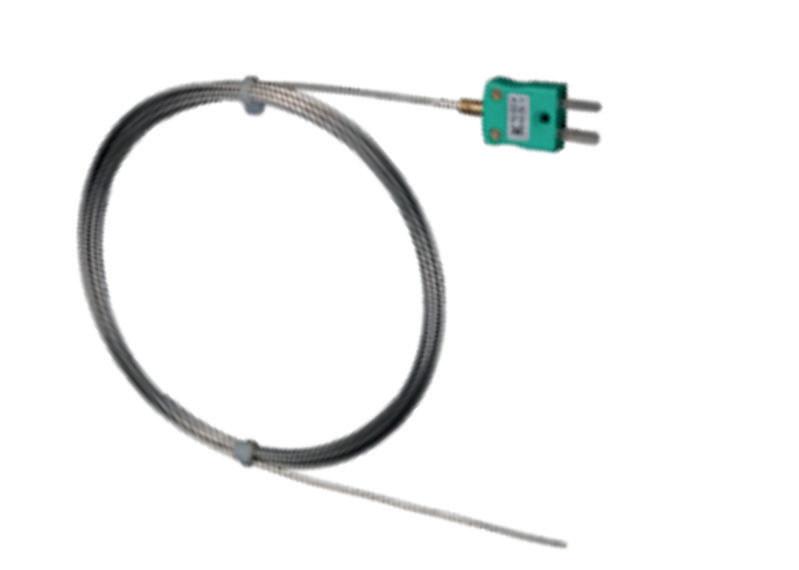

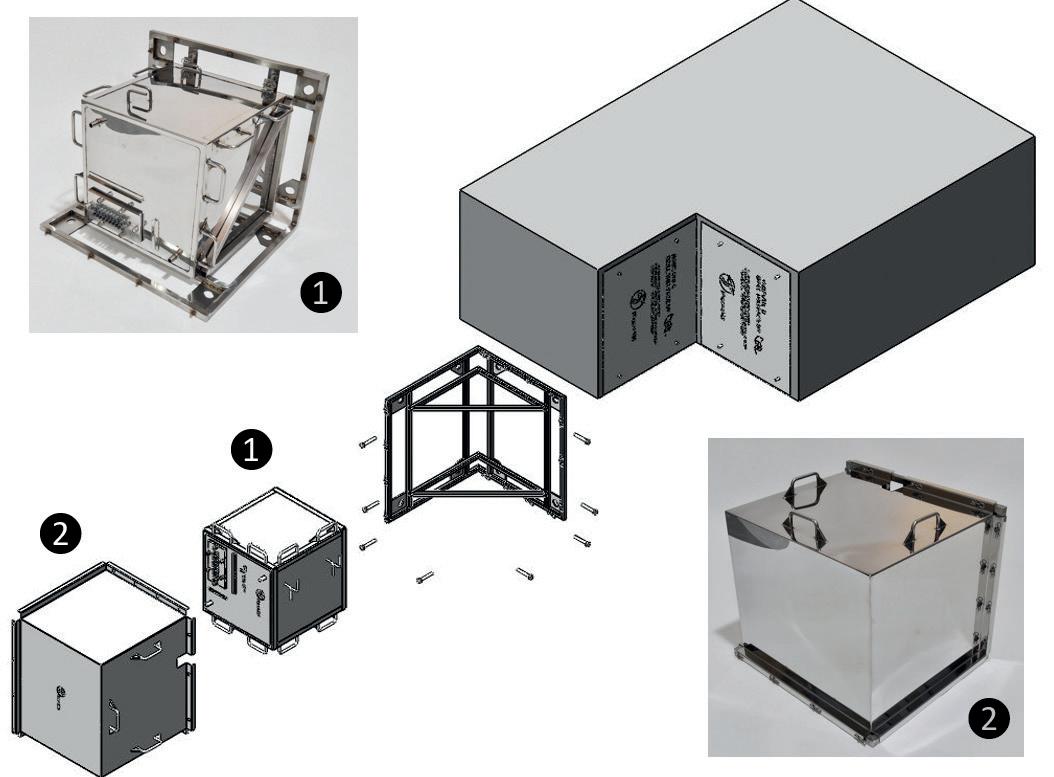

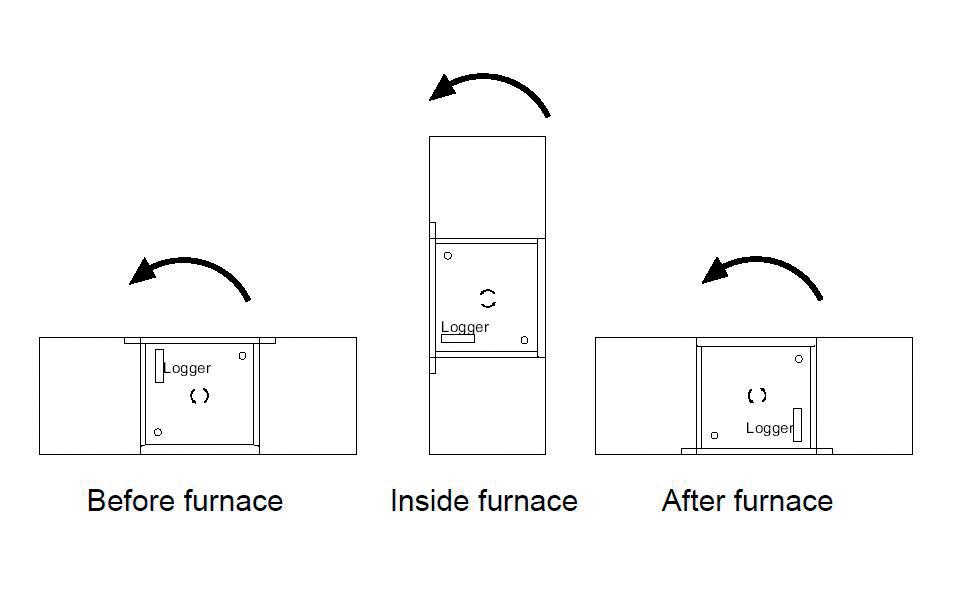

Global lessons for American aluminium security ANNIVERSARY

The people behind the Innovation

35

38

CBAM

Understanding

the Carbon Boarder Adjustment Mechanism

Happy New Year!

No, you’ve not travelled through time to read this issue in 2024..!

I recently read an article that described September as feeling like the start of a new year and it made a lot of sense.

The school year in the UK always starts in September and so, from a young age, we are conditioned into that ‘back to school’ feeling, after a long summer of fun with friends (sometimes not so much fun for the parents!)

It is very much the case in the business world, that everything seems to kick back into gear in September, with facilities and plants back after summer shutdowns and industry events and conferences filling the calendar once again.

While I don’t have a favourite season, I do love the beginning of each season and a crisp autumn morning is hard to beat. Typically, as I am writing this, the UK is looking like it will experience a beautifully warm September, after a slightly average August, so my love of crisp autumn mornings might have to wait for a while!

Hopefully this issue will provide you with everything you need at the start of your ‘new year’ and you can mark off all the events that are planned on your calendar with items from your new pencil case!

We start this issue with an indepth look at what the CBAM regulations mean for non-EU Based aluminium producers and there is a detailed feature, which looks at the significant investments in the aluminium industry across the USA, specifically in rolled and extruded aluminium production.

I hope you enjoy the issue and wish you all a very Happy ‘New’ Year!

nadinebloxsome@quartzltd.com

Rio Tinto and Sumitomo to build Gladstone hydrogen pilot plant

Rio Tinto and Sumitomo Corporation will build a first-of-a-kind hydrogen plant in Gladstone as part of a A$111.1 million program aimed at lowering carbon emissions from the alumina refining process.

The Yarwun Hydrogen Calcination Pilot Demonstration Program received the green light after a A$32.1 million co-funding boost from the federal government’s Australian Renewable Energy Agency (ARENA).

The program is aimed at demonstrating the viability of us-

ing hydrogen in the calcination process, where hydrated alumina is heated to temperatures of up to 1,000 degrees Celsius.

It involves construction of a hydrogen plant at the refinery and the retrofit of refinery processing equipment. If successful, the program could pave the way for adoption of the technology at scale globally.

Rio Tinto Aluminium Pacific Operations Managing Director Armando Torres said “This pilot plant is an important step in testing whether hydrogen can replace

natural gas in Queensland alumina refineries.

“At Rio Tinto we have put the energy transition at the heart of our business strategy, and this is one of the ways we’re working towards decarbonising our operations.

“We are proud to be developing this new technology here in Gladstone, in partnership with Sumitomo Corporation, and with support from ARENA.”

The hydrogen plant and calciner are expected to be in operation by 2025.

South32 collaborates with Fives to reduce HF emissions

In South Africa, South32 is engaged in an ambitious project to limit GTC stack HF emissions at 0,5 mg/Nm³ by April 2025 to comply with new environmental regulation.

Following the implementation of a first Alumina Cascade Feeding System on one Gas Treatment Center at the beginning of the year, the customer has confirmed its intention to deploy the solution on the 4 additional GTCs, but also to convert its VIBRAIR pocket filters

into Extended Surface Bags.

Extended Surface Bag is now a well-known technology, which brings, when applied to GTC, a lot of advantages with regard to filtration surface increase, as increasing the pollutants treatment capacity, or reducing the system pressure drop and HF stack emissions.

his project is part of Hillside’s commitment to implement Fives’ recommendations from previous audits to meet emissions targets,

and thus addressing the challenges of a more virtuous industry.

Alba joins forces with Nasser Artificial Intelligence R&D Centre

Aluminium Bahrain B.S.C. (Alba) underlined its commitment to advance in Artificial Intelligence (AI) within its operations with the successful completion of “Green Anode Density Prediction” -- one of the many joint projects with Nasser Artificial Intelligence Research and Development Centre.

To celebrate this remarkable achievement, an honouring ceremony was held at Alba’s premises where Alba’s Chief Executive Officer, Ali Al Baqali, and Nasser Artificial Intelligence R&D Centre CEO, Dr. Abdulla Naser Al Noaimi, honoured the Centre’s team involved in the project, in the presence of

the Centre’s AI Executive Advisor, Dr. Jassim Haji, as well as other Alba and Nasser Vocational Training Centre (NVTC) officials.

Green Anode Density Prediction is one of many joint projects to be implemented between Alba and Nasser Artificial Intelligence R&D Centre.

COMMENT 2

September/October 2023 TOP STORIES

Back to Business

EXLABESA acquires FLANDRIA ALUMINIUM

LME aapoints new CEO

LME Clear has announced the appointment of Michael Carty as Chief Executive Officer and LME Clear Board Director, effective 2 October 2023.

EXLABESA has announced the acquisition of FLANDRIA ALUMINIUM, a French company who specialises in the extrusion, machining, surface treatment and recycling of aluminium profiles. The recently signed agreement has passed the legal validation process by the competent authorities and has been approved by the French Competition Commission.

This takeover, which is part of EXLABESA’s international expansion strategy, will strengthen its direct presence in France, Belgium, and the Netherlands, allowing the company to offer high value-added products with the highest level of service in these markets.

The two companies, both of family origin, claim they share identical values and the same pas-

sion for the aluminium industry. EXLABESA will bring its entrepreneurial vision and investment capacity to strengthen the French company and drive its long-term growth. At the same time, FLANDRIA will maintain a high degree of autonomy to respond most effectively to the specific needs of its market.

Hydro invests in future of Lucé extrusion plant in France

Hydro has announced it will be investing NOK 67 million (EUR 6 million) in upgrading the equipment, buildings and infrastructure at its aluminium extrusion plant in Lucé, France. The funds will also cover a new employee development program.

The Lucé plant operates two extrusion presses and an anodizing facility, and has been providing customers with custom-made and standard aluminium profiles since its production start in 1959.

“The Lucé plant has the people and the potential to become an industrial leader in the French landscape. The investment is going to

improve the site’s ability to reach its potential,” says Roland Van der Aa, Vice President France for Hydro’s Extrusion Europe business unit.

Hydro employs about 160 peo-

ple in Lucé, which is in the Chartres region, about one hour southwest of Paris.

The new investment will be directed mainly toward technical on-site refurbishments.

Rio Tinto commits $150 million to Centre for Future Materials

Rio Tinto has announced that they have committed $150 million to create a Centre for Future Materials led by Imperial College London to find innovative ways to provide the materials the world needs for the energy transition.

The ‘Rio Tinto Centre for Future Materials’ will fund research programmes to transform the way vital materials are produced, used and recycled, and make them more environmentally, economically and socially sustainable.

Under the partnership, Rio Tinto

and Imperial will together define a set of major global challenges that need to be addressed. These will form the basis of the first research programmes the Centre pursues, in partnership with a selection of international academic institutions.

The Centre will be established in the second half of 2023, with the first research programmes funded in 2024. Rio Tinto will contribute $150 million over 10 years to fund the Centre.

The LME has said that Michael brings with him a wealth of knowledge and experience in financial infrastructure and technology. He joins LME Clear from Euroclear Group, where he has held various senior roles over the last 15 years, including Chief Information Officer and Chief Operations Officer for Euroclear Sweden and Euroclear Finland, CEO of Euroclear Sweden and, most recently, CEO of Euroclear UK and International.

Vedanta appoints John Slaven, former COO of Alcoa, as CEO for Aluminium Business

Announcing the appointment, Anil Agarwal, Chairman, Vedanta Group said, “We welcome John as the CEO for Vedanta’s Aluminium business and look forward to him driving the company’s growth. Aluminium is a ‘Metal of the Future’ and integral to the energy transition. John joins at an exciting time as the world looks at India as the plus one to China in manufacturing. I believe that his global experience and formidable track record in the aluminium sector will be a real asset for the company.”

CRU appoints Chief Information Officer

CRU has announced the appointment of Larry Lorden as Chief Information Officer. Larry, who is based in the United Kingdom, will apply his extensive experience globally to strengthen CRU’s leadership team and support its customers to access the company’s unique, robust data to inform future-proofed business decision making.

3

September/October 2023 NEWS Aluminium International Today

APPOINTMENTS

EGA’s Al Taweelah alumina refinery certified by ASI

Emirates Global Aluminium (EGA) announced that its Al Taweelah alumina refinery has been certified for its environmental, social and governance performance by the Aluminium Stewardship Initiative.

All EGA operational assets around the world are now certified to the Aluminium Stewardship Initiative’s Performance Standard V2 (2017).

The Aluminium Stewardship Initiative is a global, non-profit organisation that brings together aluminium producers, end-users

such as BMW Group and Nespresso, civil society, and the public through consultation, to determine what constitutes good sustainability performance in the aluminium sector.

Al Taweelah alumina refinery has amongst the lowest greenhouse gas emissions in the alumina refining industry, due to highly efficient processes and operations.

The responsible management of bauxite residue, a by-product from the refining process, has been a key priority for Al Taweelah alumina re-

finery since before its construction. EGA’s Research & Development team has made a global breakthrough in the re-use of bauxite residue as a manufactured soil, and is advancing further potential uses including in novel construction materials. Finding viable re-uses for bauxite residue has been a challenge for the alumina refining industry for more than a century.

More broadly, EGA was the first company in the world to make aluminium commercially using solar power.

CRU launches new Sustainability and Emissions Service

CRU have announced that it has launched its new sustainability and emissions service to offer users commodities intelligence through a sustainability lens.

The world’s prioritisation of sustainability has brought a variety of new policies and societal expectations to businesses. However, the current trajectory of emissions reductions is insufficient to adequately address climate change, increasing the likelihood of more severe policies in the near future. Adapting operations to meet new

requirements, laws and policies while remaining economically viable can be a complex task for businesses.

Further, no commodity is untouched by such sustainability factors. Having a centralised view and knowledge base allows clients to make consistent decisions within an informed business strategy and understand the implications of these factors for their operations and markets.

The service gives users a comprehensive, coherent view of how

the transition to a low carbon, sustainable economy will affect different commodities and impact market dynamics.

The service aims to build on CRU’s existing deep commodity market knowledge and sustainability tools, such as the Emissions Analysis Tool. CRU is known and trusted for data excellence, robust data modelling and transparent methodologies and now seeks to apply that expertise through a sustainability lens.

Novelis and thyssenkrupp Materials Services partner to drive circularity

Novelis Inc. and thyssenkrupp

Materials Services have formed a partnership to increase end-of-vehicle-life recycling and availability of valuable secondary materials that can be recovered from automobiles at the end of the consumer-use cycle.

Through the joint development of a digital platform called the Automotive Circularity Platform

(ACP), the companies seek to digitalise the market for secondary materials recovered from end-of-life vehicles and increase its transparency by creating an ecosystem with the common long-term goal to increase the recycling rate of cars and reduce carbon emissions. ACP will be a digital marketplace that connects stakeholders throughout the automotive end-of-life value

chain and empowers automotive suppliers to capture and reuse aluminium and other materials, such as steel, plastics, glass, rubber, and more.

While closed-loop aluminium recycling of production scrap has become a sustainability best practice in the automotive industry in recent years, the loop at the end of a vehicle’s life has yet to be closed. In a market that is thriving with diverse opportunities and on the brink of exciting growth, the partnership between Novelis and thyssenkrupp Materials Services is a major step toward achieving a circular economy for aluminium.

OCTOBER

11th - 13th

Inalco 23

Organised by the Aluminium Cluster AluQuébec and the Aluminium Research Centre

REGAL

Held in Québec City, Canada www.event.fourwaves. com/inalco2023/pages

12th - 14th

ALUEXPO

The 8th International Aluminium Technology, Machinery and Products Trade Fair.

Held in Istanbul, Turkey www.aluexpo.com

18th - 20th

AZ Global Conference Success lies in collaboration and cooperation, and the AZ Global conference is exactly the place to share ideas, learn from others and work together.

Held in Shanghai, China www. conference.azglobalconsulting.com

25th - 26th

ALUMINIUM USA

ALUMINUM USA is an industry event covering the entire value chain from upstream (mining, smelting) via midstream (casting, rolling, extrusions) to downstream (finishing, fabrication).

Music City Center, Nashville, Tennessee www.aluminum-us.com

NOVEMBER

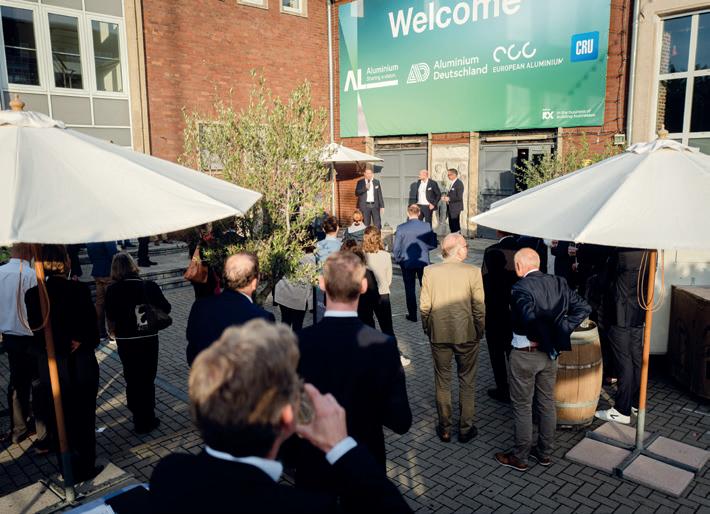

7th - 8th

ALUMINIUM Business Summit

The ALUMINIUM Business Summit will be returning for a second round. The event at Altes Stahlwerk in Düsseldorf will be the best place for the aluminium industry to attend keynotes and panel discussions as well as to network.

Düsseldorf, Germany www.aluminiumexhibition.com/en-gb.html

For a full listing visit www.aluminiumtoday.com/ events

Aluminium International Today www.aluminiumtoday.com

2023 DIARY

4

GREEN NEWS

The best performing grain refiner on the global market. FACT. 50% cost saving 85% less product needed 125% relative efficiency 5:1 125 5:1 125 +44 (0121) 684 0175 info@mqpltd.com mqpltd.com Contact us today to discuss your refinement needs.

Understanding the Carbon Boarder Adjustment Mechanism

How much do non-EU based aluminium producers need to worry about the new CBAM regulation?

By Jonathan Leclercq*

The global aluminium industry has long been an essential pillar for various sectors, including construction, transportation, packaging, and many others. As the world transitions towards a sustainable future, the demand for aluminium is expected to grow steadily, especially as it plays a crucial role in the energy transition. However, challenges lie ahead – particularly for non-EU based aluminium producers who export to the European Union.

CBAM, or the Carbon Border Adjustment Mechanism, is a new regulation introduced by the EU as part of its ‘Fit for 55’ package. Published in the Official Journal of the European Union on 10 May 2023, CBAM aims to tackle carbon leakage and encourage cleaner industrial production worldwide. This regulation will initially impact nonEU based producers in hard-to-abate sectors, including aluminium, iron and steel, cement, fertilisers, hydrogen, and electricity, and it will also affect EU-based importers of these products. Carbon leakage occurs when businesses move their production to countries with less stringent climate policies, or when EU products are replaced by more carbonintensive imports, shifting emissions outside Europe and undermining global climate mitigation efforts. In the aluminium sector this poses a serious threat, with approximately one-third of primary smelting capacity in Europe already closed and replaced by facilities outside the EU.

The essence of CBAM lies in addressing carbon emissions from the manufacturing of goods imported into the EU. Starting from 1 October 2023, non-EU based aluminium producers will be required to provide quarterly reports on the carbon

emitted during the production of their goods, known as GHG (greenhouse gas) embedded emissions. Then, from 2026 onwards, EU importers will have to pay a carbon tax by purchasing carbon certificates equivalent to the carbon price that would have been paid if the goods had been produced under the EU’s Emissions Trading System (ETS).

Challenges and opportunities for aluminium companies

For the aluminium sector, CBAM brings both challenges and opportunities. On one hand, complying with CBAM may increase costs in the short-term, require companies and employees to get to grips with new processes and procedures, and make it necessary to communicate even more with suppliers and buyers than before. However, being well-prepared and ahead of the competition can also provide advantages and potentially increase market share.

This mandatory reporting places a new burden on aluminium producers, necessitating additional resources and efforts to accurately track and measure embedded emissions. Complying with CBAM may also require investments in technology and systems to collect and manage data effectively, further contributing to the increase in operational expenses. Furthermore, the cost of the

Manager – Decarbonisation & Sustainability at DNV

CBAM 7 Aluminium International Today September/October 2023

*Senior

Jonathan Leclercq

carbon tax imposed on EU importers from 2026 onwards will likely be passed on to non-EU producers in the form of higher product prices. As a result, preparing early and before your competitors becomes crucial in mitigating the impact of these increased costs.

One way to gain a competitive advantage, lower costs and increase market share is by looking into ways to actively reduce embedded emissions. Companies that take proactive measures to lower their carbon footprint and transition to more sustainable production practices will be better positioned to comply with CBAM regulations and absorb the associated costs more effectively. Such initiatives might include adopting cleaner energy sources, implementing energy-efficient technologies, and optimising production processes to minimise emissions.

Another crucial aspect of being wellprepared is ensuring a transparent supply chain. Collaborating closely with suppliers to gather accurate data on emissions across the value chain is essential for accurate reporting under CBAM. By establishing strong partnerships with suppliers who share the same commitment

to sustainability, non-EU producers can secure a competitive advantage by providing verified low-carbon products that meet the stringent requirements of the EU market.

Furthermore, companies that embrace transparency and adopt third-party verification for their emissions data can enhance their credibility in the marketplace. Trustworthiness and accountability are becoming vital factors for consumers and investors when making purchasing decisions. By demonstrating a proactive approach to CBAM compliance and sustainability, companies can enhance their brand image and attract customers who are also aiming to become more eco-conscious, leading to an expansion of their market share.

How should aluminium companies get ready for CBAM?

Aluminium producers must take steps to reduce embedded emissions, collaborate with actors along their supply chain to gather accurate data required for CBAM reporting obligations to ensure continued market access to the EU, and continue to focus on sustainability initiatives across

the sector. This is likely only the start of more actions to come from regulators across the world.

To prepare for the start of the CBAM reporting period on 1 October 2023, companies should enter a readiness assessment phase. This involves evaluating existing reporting capabilities – some producers may be more mature than others – and identifying gaps in meeting the regulatory requirements. Establishing a robust data collection system is crucial, as providing accurate and primary data will be more advantageous than relying on default values drawn from secondary data.

CBAM is a significant step towards global climate mitigation, and its implementation will improve transparency and intends to encourage industries worldwide to adopt cleaner production practices. Although non-EU based aluminium producers will face challenges in complying with CBAM, seeking the assistance of expert advisors to help collect, verify and report the data to the EU in the required way will ensure a smoother transition, and pave the way for a more sustainable future for the aluminium industry. �

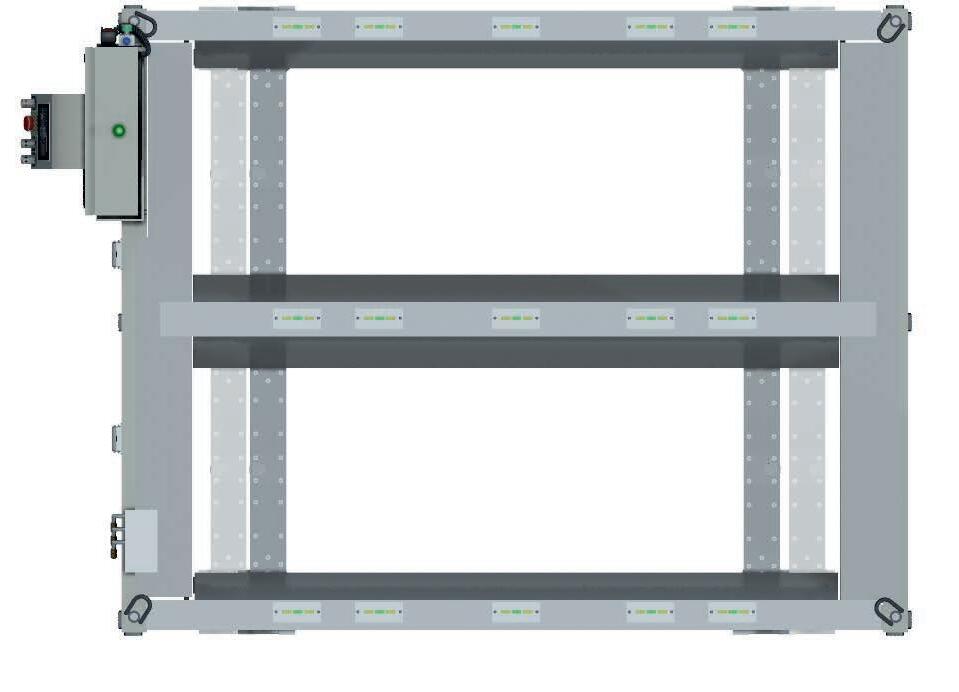

Safety Storage Efficiency

Enhance the Safety, Storage & Efficiency of your logistics with Combilift

The Combilift ethos is helping customers increase storage without the need to expand the size of their facility.

Our range of warehouse and multidirectional forklifts, pedestrian reach trucks, and straddle carriers will allow you to maximize the storage, efficiency and safety of your warehouse facility.

Contact Us Today

CBAM 8

25 To find out how Combilift can help you unlock every inch of your storage space.

combilift.com

TOGETHER TOWARDS PERFORMANCE

NOW IS THE TIME TO ACT REEL is on a journey contributing towards a net-zero Aluminium Industry.

reelinternational.com

REEL Aluminium is a major solution provider dedicated to reduce the carbon footprint in the Aluminium industry. Both internal and external partnership, new ways of understanding and innovative technological investments in the development of net-zero solutions for the Aluminium industry are the best conditions for REEL‘s goals to work together on its path to decarbonization and to green Aluminium future.

Aluminium recycling in the USA

By Richard McDonough*

Aluminium is one of the most frequently recycled products in the United States of America (USA). Along with steel, cardboard, and glass, recycling levels of aluminium have increased during the past few decades, but the percentages of items recycled remain lower than in other nations.

The level of aluminium recycling in the USA is lower than the overall aluminium recycling rates in much of Europe. This is especially true with recycling levels of aluminium beverage cans.

According to the most recent report from The Aluminum Association and the Can Manufacturers Institute (CMI), 45.2% of aluminium cans were recycled in 2020; this joint report was issued in 2021.

“The latest report by Metal Packaging Europe and European Aluminium shows that the overall recycling rate for aluminium beverage cans in the European Union, United Kingdom, Switzerland, Norway and Iceland remained high in 2020 at 73% (72.8%),” a news statement from both organisations issued on 14 December 2022 detailed. “With a 3% points drop compared to 2019 and a growth of 9% cans consumed, the total amount of aluminium recycled from cans reached a record level of 510,000 tonnes, an increase of more than 20,000 tonnes since the previous year.”

This report indicated that recycling rates of aluminium beverage cans were at 99%

in Germany, 98% in Finland, and 94% in Estonia and Switzerland in 2020. Other countries with recycling rates above 90% during that year included Belgium and Norway (each at 93%), Sweden (91%), and Lithuania (90%).

A number of businesses and organisations active in the aluminium industry in the USA are striving to increase the level of aluminium recycling in the country. These entities are moving forward with a number of recycling initiatives, programmes, and developments.

Among the companies investing in enhanced aluminium recycling projects are Ball Corporation, Hydro, and Novelis. The Aluminum Association, the CMI and The Recycling Partnership are among the organisations actively trying to increase the level of aluminium recycling in the USA. Alcoa Foundation, Arconic Foundation, Ardagh Metal Packaging, and Crown Holdings are among the entities supporting civic endeavors in the area of aluminium recycling.

Details on some of these efforts follow.

Recycling As Part Of Strategies To Reach Net-Zero Carbon Emissions

The CMI announced on 20 April 2023 that “leading aluminium beverage can manufacturers and can sheet producers endorse strategy for net-zero, 1.5°C-aligned aluminium industry…These endorsements reflect the aluminium

beverage can industry’s aim to reduce the carbon footprint of the relatively small amount of primary aluminium in beverage cans, thereby contributing toward the needed progress in the fight against climate change.”

In this statement, the CMI reported that “…its aluminium beverage can manufacturer members (Ardagh Metal Packaging, CANPACK, Crown Holdings, and Envases), its aluminium beverage can sheet producer members (Constellium, Kaiser Aluminum, Novelis, and TriArrows Aluminum), as well as its partner and fellow endorser The Aluminum Association, will be working with a variety of stakeholders inside and outside of the industry to catalyse the necessary actions and investments to pursue this transition strategy.”

The CMI describes itself as “…the national trade association of the metal can manufacturing industry and its suppliers in the USA.”

The organisation noted that “transitioning the aluminium industry to net-zero greenhouse gas emissions by 2050 whilst complying with a target of limiting global warming to 1.5°C from preindustrial levels will require a variety of actions including deploying new technologies, decarbonising power supply, and increasing material and product efficiency.”

Increasing the recycling rates of

THE ALUMINA CHRONICLES 11 Aluminium International Today September/October 2023

People gathered as Hydro conducted a traditional Norwegian ceremony called “Kranselag” as the last beam was installed at the company’s new aluminium recycling plant in Cassopolis, Michigan. (The photograph was provided courtesy of Hydro, 17 April 2023.)

* Do you have questions about the aluminium industry?Governmental regulations? Company operations? Your questions may be used in a future news column. Contact Richard McDonough at aluminachronicles@gmail.com. © 2023 Richard McDonough

aluminium cans is a key element of this commitment – an endorsement of the Mission Possible Partnership – by major businesses within the aluminium industry.

The amount of recycled content within a newly-manufactured aluminium can averages 73% today in the USA, according to the CMI.

Through the Mission Possible Partnership, the organisation indicated that “…that number [73%] will increase, decreasing the need for primary aluminium, if the industry is successful in reaching stated aluminium beverage can recycling rate targets. These targets, as set by CMI and its members, entail going from a 45% recycling rate in 2020, which makes it the most recycled beverage container in the United States, to a 70% rate in 2030, 80% rate in 2040, and 90% rate in 2050.”

Scott Breen, Vice President of Sustainability at CMI, said that “our strategy has two parallel paths to further reduce the carbon footprint of the aluminium beverage can – lower the carbon footprint of any primary aluminium incorporated into beverage cans and increase the recovery of used beverage cans so the recycled content in new cans increases. Our members have shown leadership in both of these areas by endorsing Mission Possible Partnership’s strategy to foster a net-zero, 1.5°C-aligned aluminium industry and by committing to ambitious USA aluminium beverage can recycling rate targets.”

Mardi Gras In New Orleans

Special events are one of the activities where beverages in aluminium cans are consumed in large quantities by the public. An effort organised through the CMI helped show how aluminium beverage cans could be recycled at a major event, Mardi Gras in New Orleans. Picture 1

“Instead of going to landfill, many thousands of aluminium beverage cans were sold for revenue that CMI doubled

and went to charity or local residents,” according to a statement from the CMI. “Notably, the aluminium in those beverage cans will now be available to be turned into new cans.”

During Mardi Gras in New Orleans in 2023, a total of 142,974 used beverage cans (UBC) were collected and sold to a local metal recycling facility, the CMI reported. This recycling effort generated (US) $1,927 from the actual recycling plus an additional (US) $1,927 in matching funds from the CMI for local charities and residents.

The CMI explained that the Mardi Gras pilot programme, called “Recycle Dat,” collected UBCs in two ways: recycling hubs staffed by volunteers along the most-used parade route and encouraging people to directly drop off UBCs at a nearby recycling facility.

“UBC collection during the initiative supported local charities and allowed people to earn extra cash,” noted the CMI. “The money raised was split between three local charities – Coalition to Restore Coastal Louisiana, Louisiana Society for the Prevention of Cruelty to Animal, and New Orleans Area Habitat for Humanity. CMI also doubled the market rate payout for UBCs brought directly to EMR [Metal Recycling], and redeemers could either put the money toward the three local charities or keep it. Two-thirds of the cans collected were brought directly to EMR, and the rest were collected along the parade route.”

Mr. Breen of the CMI stated that “in a quest to turn trash into treasure, we are very proud that this pilot effort resulted in nearly 150,000 aluminium beverage cans recycled and sold for revenue instead of going to landfills. We are excited to collaborate with local partners again next year to increase the ability for Mardi Gras partygoers to recycle even more of their used beverage cans, generate more money for charity and local residents, and turn more used beverage cans into new cans.”

Aluminium Recycling Initiative

Investments in equipment have shown to bear fruit in aluminium recycling in the USA.

The Recycling Partnership reported that its Aluminium Recycling Initiative had resulted in a substantial increase in the aluminium being recycled in select areas of the USA. This non-profit organisation has made grants to five entities that serve communities in Florida, Michigan, North Carolina, and Texas.

A news statement issued by The Recycling Partnership on 4 May 2023 indicated that “to date, the grants have captured three times more aluminium than original projections estimated, ultimately resulting in an additional 4.1 million new pounds of aluminium captured annually, equal to more than 18,750 metric tonnes of greenhouse gas emissions avoidance.”

“The Initiative’s efforts have focused on stimulating investment in sorting equipment and process improvements,” this statement continued. “Although materials like aluminium have a long history of recycling and are currently recycled at relatively high recycling rates, there are meaningful opportunities for improvement. To date, the Initiative has received support from the Can Manufacturers Institute (CMI), the Alcoa Foundation, and Arconic Foundation.”

One of the grant recipients highlighted by The Recycling Partnership is Curbside Management in Asheville, North Carolina. The organisation said that funding from the Aluminium Recycling Initiative provided for investments “…in a larger eddy current separator, allowing the facility to capture 1.3 million new pounds of recycled aluminium per year.”

“Through the Aluminium Recycling Initiative grant, we were able to upgrade our aluminium capture process and maximise our annual tonnage,” stated Barry Lawson, President of Curbside Management. “Adding a larger eddy current separator was essential in increasing the capture and improving the quality of aluminium from the container line.”

The news statement noted that other grant recipients increased aluminium capture by transitioning from manual sorting to automated sortation. This switch, according to The Recycling Partnership, decreased the possibilities for aluminium products to be missorted into the plastic container stream.

“There is a growing need to modernise MRFs [material recovery facilities] to enhance sortation, increase capture rates, and improve bale quality,” said Adam Gendell, Director of Materials Advancement at The Recycling Partnership. “These grants prove that investment can

Aluminium International Today September/October 2023

12

Picture 1. Scott Breen of the CMI (to the left) and Brett Davis, Founder of Grounds Krewe, a local organisation in New Orleans, are seen here standing in front of some of the 142,974 aluminium beverage cans collected during Recycle Dat. This pilot project was supported by both organisations, among others, to collect and recycle aluminium beverage cans as part of Mardi Gras in the city known as “The Big Easy.” (The photograph was provided courtesy of the CMI, February of 2023.)

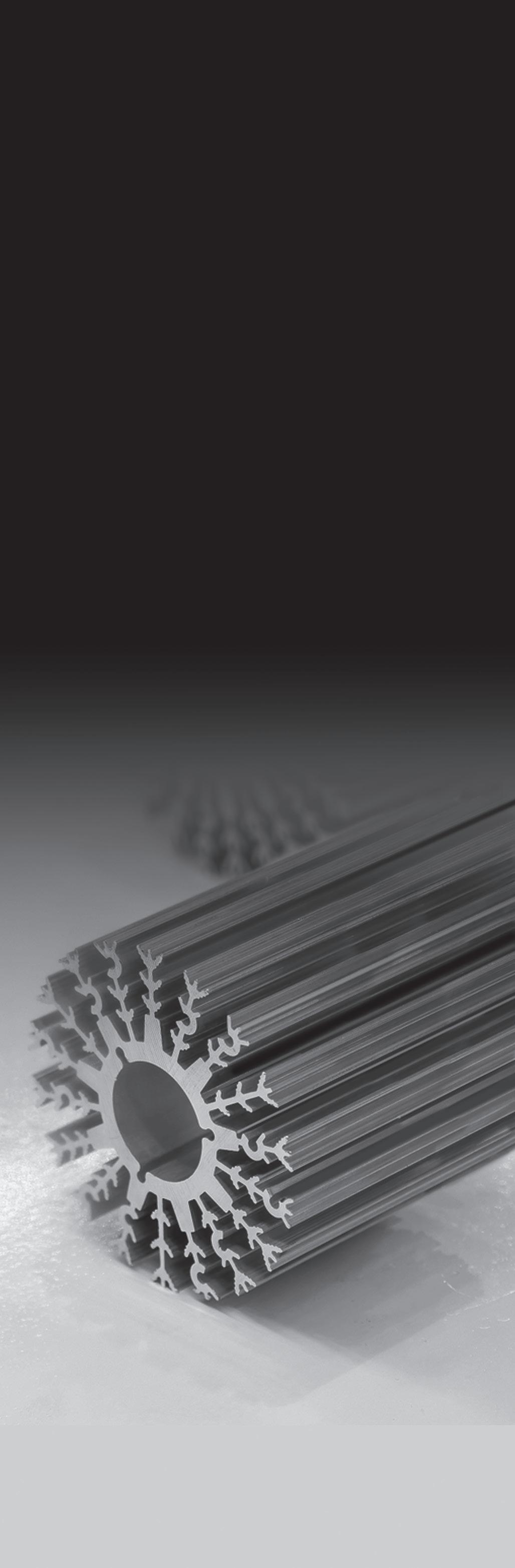

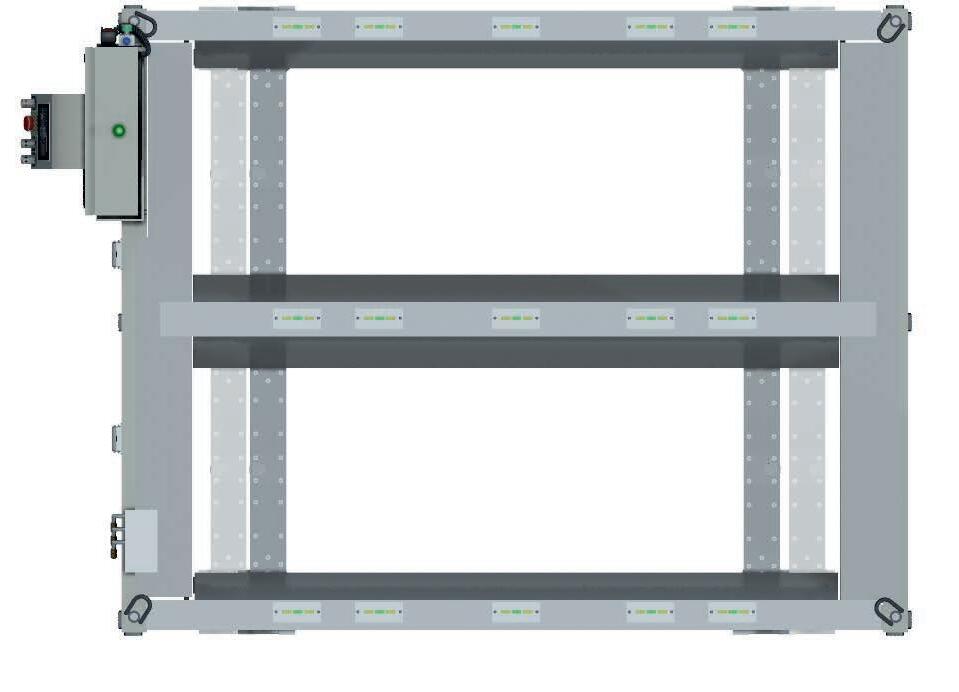

Industry leading air-cooled furnace stirring technology

Increasing productivity, reducing energy and improving operational efficiency

The ALTEK Electro-Magnetic Stirrer (EMS) is the most versatile and advanced air-cooled furnace stirring system available to the industry. Pioneers in this field, Altek’s EMS has been installed around the world on a variety of furnace types and sizes, from reverbatories up to 145T capacity, to curved EMS designs for dome furnaces, and applications for scrap submergence as well.

Benefits include

• Increased furnace productivity

– up to 25%

• Reduced energy consumption

– up to 15%

• Reduced metal loss

– up to 25%

• Guaranteed temperature and chemical homogeneity

• Bottom and side-mounted applications available

• 100% air-cooled inductor

PART

Altek Europe Limited, Lakeside House, Burley Close, Chesterfield, Derbyshire, S40 2UB, UK +44 (0) 1246 383737. © 2023 Harsco Corporation. All Rights Reserved. altsales@harsco.com | www.altek-al.com ALUMINUM USA VISIT US AT STAND 805

OF OUR LEADING END-TO-END DROSS MANAGEMENT SOLUTION

drive meaningful improvement, but we need continued support to achieve fullscale change.”

The organisation explained that “whilst great strides have been made, there is a continued need for this type of impactful investment by all companies and organisations who share the vision of a more circular system for aluminium packaging.”

Aluminium Can Capture Grants for MRFs

The Recycling Partnership is continuing to work with the CMI to lead some of those efforts to increase recycling rates of aluminium products through a new grant programme that is seeking applicants during 2023.

“Aluminium beverage can manufacturers Ardagh Metal Packaging and Crown Holdings are funding a new grant opportunity as part of their continuing support of activities to spur the installation of additional aluminium can capture equipment in material recovery facilities (MRFs), which sort single-stream recyclables,” according to a news statement issued by the CMI on 4 May 2023. “This new grant opportunity builds on the five grants in 2021 that exceeded expectations when nearly 140 million aluminium beverage cans were captured and recycled each year due to the improvements with annual impacts of more than $2 million generated for the recycling system.”

The news statement from the CMI detailed that “making a beverage can from recycled aluminium reduces energy use and greenhouse gas emissions by more than 80% compared to using new aluminium. The beverage can’s existing circular system recycles nearly 46.7 billion cans each year in the USA.”

“That is the equivalent of 11, 12-packs per person and more than 5.4 million cans each hour,” the news statement continued. “This scale and the fact that most recycled cans get turned into new cans is how the average aluminium beverage can in the USA has 73% recycled content.”

Whilst noting that recycled cans, on average, go from recycling bin to store shelf as new cans in about 60 days, the news statement from the CMI concluded by stating that “the aluminium beverage can industry expects to have more cans recycled in the coming years as it executes on its roadmap to achieve its ambitious recycling rate targets.”

Hydro - Cassopolis

One of the major global companies active in the aluminium industry in the USA is Norsk Hydro ASA (Hydro). The firm is in the process of building a new aluminium

recycling plant in Cassopolis, Michigan. Investments in this plant are projected to be (US) $150 million. Seventy jobs are anticipated to be created because of this new plant. Picture 2

Completion is anticipated in the 4th Quarter of 2023.

Hydro indicated that it has ambitions to double the recycling of post-consumer aluminium by 2025.

According to the company, this new plant is projected to produce 120,000 tonnes of recycled aluminium extrusion ingot per year and will be the first large scale producer of Hydro CIRCAL in North America: “…Hydro CIRCAL aluminium extrusion ingot contains at least 75% post-consumer scrap, certified by third party auditors DNV GL, and has a market leading CO2 footprint of just 2.3 kg CO2e/ kg aluminium or less.”

A traditional Norwegian ceremony called “Kranselag” was held by Hydro in Cassopolis on 17 April 2023. Similar to an American tradition called “Topping Out,” the ceremony in Michigan involved placing a wreath on the side of the new recycling plant.

(As an aside, the tradition in the USA –“Topping Out” – usually involves placing an evergreen tree on the top of the last piece of the building’s structure. That tradition reportedly had its origins in Scandinavia.)

“I would like to say thank you to the construction team and local stakeholders for helping us achieve this production milestone,” stated Ingrid Guddal, Head of Recycling in Hydro Aluminium Metal.

“We are grateful for the warm welcome we have received in Cassopolis and look forward to continuing work with the local community to bring stable jobs, career opportunities as well as investing in local education to bring forth the next generation of Hydro employees. Let’s continue the great progress and ensure a safe installation and start-up of the plant.”

A news statement issued by Hydro on 18 April 2023 explained that “applications for

the aluminium produced in Cassopolis will include critical automotive applications as well as other transportation uses, consumer, and building system applications.”

“Aluminium plays a significant role in the light-weighting of electric and hybrid vehicles, as cars need less electricity and fewer or smaller batteries to travel the same distances,” the news statement continued. “With the automotive industry embarking on its biggest transformation since the assembly line, the state of Michigan is fundamental as consumers go electric. To meet this challenge, Hydro is bringing its next generation recycling technology, pioneered in Europe, to the plant in Cassopolis.”

Sustainability through recycling is a critical goal for Hydro and its customers.

“We are seeing increasing interest in terms of low-carbon products and sustainability, where automotive companies look for more low-carbon materials to put into their vehicles and make their cars more sustainable,” said Ms. Guddal. “We are here to serve this growing demand by providing our industry leading proprietary alloys for more critical automotive applications from Cassopolis, Michigan.”

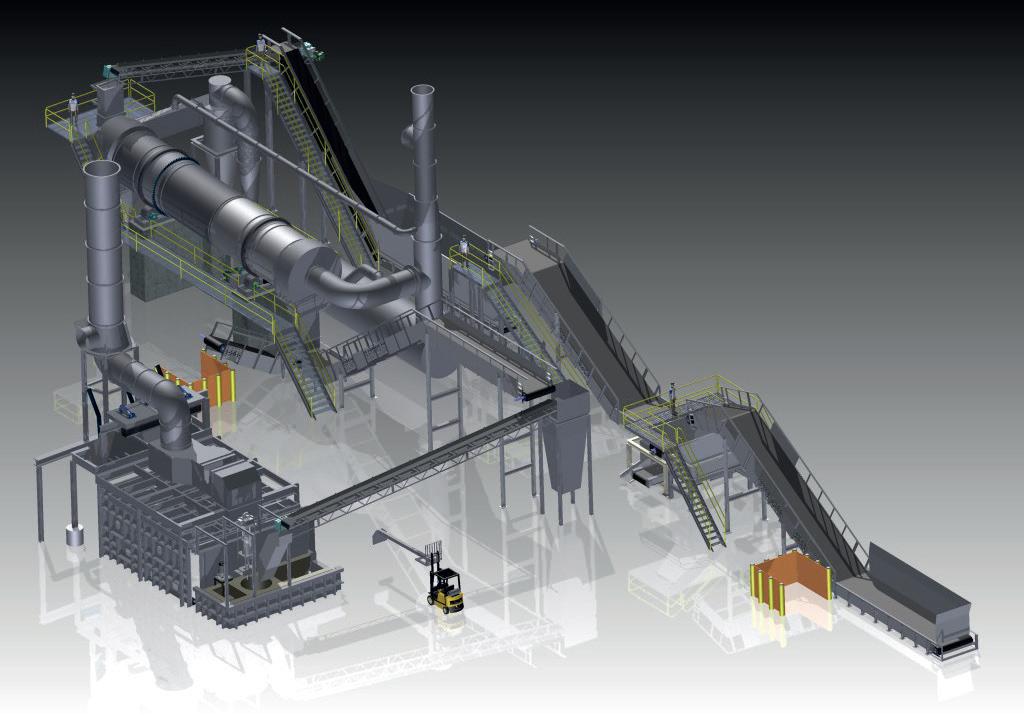

Novelis – Bay Minette

Novelis is the process of building a new, low-carbon facility in Bay Minette, Alabama. According to the company, this is the first fully-integrated aluminium manufacturing and recycling plant built in the USA in nearly 40 years and is expected to create up to 1,000 new jobs in Baldwin County. Picture 3

Kay Ivey, Governor of Alabama, welcomed the decision of Novelis to invest more than $2.5 billion to build this recycling and rolling plant in Baldwin County.

“With this massive investment and these large-scale hiring plans, Novelis will launch a high-tech aluminium mill that will generate significant economic impacts

Aluminium International Today September/October 2023 THE ALUMINA CHRONICLES 14

Picture 2. As part of a traditional Norwegian ceremony called “Kranselag,” a wreath was attached to the side of the new aluminium recycling plant of Hydro in Cassopolis, Michigan. (The photograph was provided courtesy of Hydro, 17 April 2023.)

throughout the region for generations,” said Governor Ivey at the time of the initial announcement on 11 May 2022. “Novelis is a world-class company, and we know that it has selected a prime location in Sweet Home Alabama and specifically Baldwin County as home for its growth plans.”

With an initial capacity of 600,000 tonnes of finished goods for the North American can and automotive markets, this new Alabama facility will be powered by renewable energy, use recycled water and operate as a zero-waste facility, noted a news statement from Novelis; the company stated that it is working toward a goal of achieving net carbon neutrality at Bay Minette.

Groundbreaking took place on 7 October 2022.

“Novelis is making significant progress on the construction of its new recycling, rolling and finishing facility in Bay Minette to serve the North American beverage can and automotive markets,” said a spokesperson of Novelis, Inc. “The building piling and foundation work is well under way.”

“In addition, 100% of the main equipment for the facility has been secured,” the spokesperson continued. “We have committed nearly all the beverage packaging capacity with longterm customer contracts and remain on track to complete the facility in mid2025.”

Novelis describes itself as “a subsidiary of Hindalco Industries Limited, an industry leader in aluminium and copper, and the metals flagship company of the Aditya Birla Group, a multinational conglomerate based in Mumbai, India.”

In a company statement, Novelis is the world’s largest recycler of aluminium – recycling 82 billion aluminium cans globally during FY 2023.

On 1 June 2023, Novelis announced that it had entered into a new long-term contract with Coca-Cola Bottlers’ Sales & Services Company, the contracting agent for The Coca-Cola Company’s authorised North American bottlers (“CCBSS”).

“Under the agreement, Novelis will supply Coca-Cola’s authorised North American bottlers with aluminium can sheet for The Coca-Cola Company’s family of iconic brands,” according to this news statement from Novelis. “This includes supply from Novelis’ plant in Bay Minette, Alabama…The Coca-Cola North American bottlers, through the CCBSS and Novelis agreement, have committed to purchasing a confidential volume of aluminium can sheet over a multi-year period.”

Steve Fisher, President and Chief Executive Officer of Novelis, said that “this new long-term contract builds on a decades-long relationship between Novelis and the Coca-Cola system, and further strengthens Novelis’ position as the leading provider of aluminium for beverage cans. This contract validates our investment in expanding rolling and recycling capacity in North America and solidifies a strong future for sustainable aluminium as the beverage packaging material of choice.”

Sustainability is a key part of this contract which includes closed-loop recycling.

“Through closed-loop recycling programmes, Novelis directly takes back the manufacturing scrap generated during the can making process, recycles it and converts it into new can sheet, which is then made into new beverage cans,” the news statement from the company detailed.

Dan Coe, Chief Procurement Officer of The Coca-Cola Company, stated that “the evolving role on behalf of The Coca-Cola Company and our Bottlers is to build a resilient domestic supply chain, thus

enabling sustainable long-term growth. We recognise Novelis as a leader in sustainability, committed to supporting our 2030 World Without Waste Targets.” Growth in the sustainable aluminium sheet market is anticipated to continue for years to come.

“Novelis expects demand for aluminium beverage can sheet to grow at a 3% compounded annual growth rate from 2022 to 2031,” the company articulated in its news statement dated 1 June 2023. “The demand growth is driven by consumer preference for more sustainable products and size variety, as well as more beverage types being packed in cans, including water, energy drinks, soda, beer, wine, hard seltzers, and ready-to-drink cocktails.”

Ball Corporation

Referencing the recycling rate of 45.2% of aluminium cans in 2020 – the most recent level reported by The Aluminum Association and the CMI – Ball Corporation indicated that the firm is working to increase the aluminium recycling rates in the USA and beyond.

“Whilst higher than the recycling rates of other types of packaging, there is significant room for growth and opportunity to increase real recycling rates even further,” according to a statement from the company. “At Ball Corporation, we work every day to increase not just collection, but real recycling of aluminium cans.”

“A recent report from the [U S] Environmental Protection Agency confirmed that only 25% of waste in the United States is actually being recycled, and most of that is downcycled into lower value products, which ultimately end up in landfills … or worse,” the statement from Ball Corporation continued. “That’s not real recycling. As the world confronts

Aluminium International Today September/October 2023 16

Picture 3. Kay Ivey, Governor of Alabama, spoke at the groundbreaking ceremony for the new manufacturing and recycling plant being built by Novelis in Bay Minette, Alabama. (The photograph was provided courtesy of the Office of the Governor of Alabama, 7 October 2022.)

Kay Ivey, Governor of Alabama, welcomed the decision of Novelis to invest more than $2.5 billion to build this recycling and rolling plant in Baldwin County.

COMMITTED.

We’re pioneering the decarbonization of the aluminum industry.

With nearly $2 billion of completed and announced investments in recycling from 2011 to date, we have achieved an average of 61% recycled aluminum content in our products. But we’re not stopping there. Through continued innovation and partnerships, Novelis is committed to increasing the recycled content of our aluminum even further to reduce carbon emissions across the global value chain.

an overwhelming packaging waste crisis, it’s worth asking, Why aren’t we recycling more?”

Ball Corporation detailed that it is working on several ways to increase recycling, including a focus on five elements: creating products that are designed to be recycled, supporting transparent measurement of the true environmental impact of products when taking into account recycling rates and circularity, supporting Federal and state policies to increase recycling beyond mere collection, investing in green infrastructure to support a more circular system, and educating consumers on the importance of real recycling and the circular economy.

The company describes itself as a firm that “…supplies innovative, sustainable

aluminium packaging solutions for beverage, personal care, and household products customers, as well as aerospace and other technologies and services primarily for the USA government.”

On 19 April 2023, Ball Corporation announced “…that it has received the Aluminium Stewardship Initiative (ASI) certification for the Performance and Chain of Custody Standards for its Global Aerosol Packaging division. Ball’s Aerosol division offers a variety of infinitely recyclable innovative aluminium packaging solutions in the personal care, household, and beverage packaging categories. These include a range of impact extruded single and multi-use aluminium bottles, as well as innovative aerosol containers with primary aluminium content made using low-carbon energy sources.”

This recognition from the ASI is designed to encourage sustainability throughout the aluminium industry.

“Achieving ASI certification demonstrates our commitment to sustainability and is the result of a rigorous

process,” stated Jay Billings, President of Ball Aerosol Packaging. “Infinitely recyclable aluminium packaging is a prime example of material circularity where resources stay in the system, reducing impacts on the environment. Our aluminium aerosol business’ sustainability efforts showcase what can be achieved through material and emissions reduction goal setting, innovation, and, especially, partnership with customers.”

According to the company, “the ASI announcement aligns to Ball’s 2030 sustainability goals, which include ensuring all aluminium is purchased from certified sustainable sources and a commitment to achieving net-zero carbon emissions before 2050 and transitioning to 100% renewable electricity by 2030.” �

Aluminium International Today September/October 2023 THE ALUMINA CHRONICLES 18

Five photographs that show the progress of construction at the site of the new Novelis aluminium manufacturing and recycling plant in Bay Minette, Alabama. (The photographs were provided courtesy of Novelis, July of 2023.)

Don’t Compromise, OPTIMIZE with

Wagstaff ® APEX ™ ingot casting systems have automated, dynamic shape-changing molds that provide unprecedented control, efficiency and casting agility while increasing profits.

AGILE

Cast Ingots with customized profiles optimized to meet exacting customer requirements ACCELERATED

Cast faster and gain weeks of casting profits per year

ADJUSTABLE

Easily and quickly change ingot sizes without changing molds

APEX optimizes butt shape, including elimination of butt swell while allowing faster casting

Conventional ingot butt swell wastes both time and material

Contact

Casting

flexible rolling faces produce custom ingot profiles

TM

Unique design features allow one APEX mold to cast multiple sizes

STARTING HEAD

us today to find out how APEX Ingot

Technology can benefit casthouse operations and rolling mills alike. Visit us at BOOTH #301 Aluminum USA OCT 25-26, Nashville, TN

Worlds first batch of recycled aluminium using Hydrogen

Norsk Hydro announced its first batch of recycled aluminium, using green hydrogen fuels, in June 2023. Zahra Awan* spoke with Per Christian Eriksen** on the achievements and commitments that have been made in the name of sustainable Hydrogen, and what can be expected in the future.

Hydrogen: Named after Greek ‘Hydro’ and ‘genes/ birth’ meaning water forming. The first element in the periodic table, arguably the most abundant element, one of the founding elements of the universe [1]. Hydrogen who presents itself as the modern-day saviour. Havrand: Defined by Per Christian Eriksen, Head of Hydro Havrand as “a Norwegian word that describes the line where the ocean meets the sky – like the horizon, but specifically at sea level. In days gone by, seafarers bravely travelled beyond the limit of what they could see to find better and faster routes – and that is what we will do in the hydrogen market as well.”[2]

HYDRO HAVRAND

“We need to move away from fossil fuels, and green Hydrogen is key to making that happen. Hydro Havrand offers green Hydrogen made from renewable energy to help bring the world to net-zero emissions.” [2]

Aluminium International Today September/October 2023 HYDROGEN 20

* Assistant Editor, Aluminium International Today ** Head of Hydro Havrand, Hydro [1] https://www.rsc.org/periodic-table/element/1/hydrogen [2] https://www.hydro.com/en-GB/energy/hydrogen/ [3] https://www.hydro.com/en-GB/about-hydro/hydro-worldwide/europe/spain/navarra/hydro-extrusions-navarra/

WHY HYDROGEN:

What was the inspiration for using Hydrogen as a fuel, and the start-up of Hydro Havrand?

A few years back Hydro looked at its strategy, where decarbonisation to further reduce the CO2 emissions and lower the carbon content of our aluminium is key. As a part of the strategies and planning Hydrogen came to our attention. Hydro had already electrified many of its plants and sites, but the next goal was to

decarbonise entirely. Hydro is developing proprietary technology, called HalZero, for the electrolysis process, and explore to use carbon capture to remove emissions as well. But hydro needed to also address those processes where it’s difficult to use electrification directly. This typically refers to the high heat processes and calcination process.

Working through this strategy, we considered whether we should buy the

What benefits did you expect to see from Hydrogen beyond sustainability?

We focus on green Hydrogen, the most sustainable form of Hydrogen out there, to decarbonise hydro and help others to decarbonise – and reach their climate targets. We believe that by decreasing the CO2 footprint of Hydro’s aluminium we will create real shareholder value.

How can already low carbon aluminium be improved with the use of Hydrogen?

Green hydrogen can reduce the CO2 footprint of all Hydro products. It can specifically completely remove all emissions from the recycling of aluminium. Hydro has several products containing various degrees of recycled post-consumer scrap. Our CIRCAL 100R product is made from 100 % recycled post-consumer scrap, with emissions around ½ a kilo of CO2 per Kilo of reduced metal. If we in the future can replace natural gas with green hydrogen in this process, we will have a zero carbon aluminium product.

How about primary production?

Looking at the primary production of aluminium value chain, the biggest opportunity to decarbonise through hydrogen is in the calcination process. Also whenever we melt large volumes of metal, we consider the use of Hydrogen, and its role throughout. The location must always be considered to ensure for instance enough access to renewable

power for the hydrogen production, and a competitive levelized cost of hydrogen. There may be instances where other solutions such as biogas or plasma technology is the most sustainable solution, and in others, Hydrogen might be the only option. But Green Hydrogen is a key part of the decarbonisation of the industry.

How was Hydrogen different from natural fuel sources?

Hydrogen has different burning values and behaves very differently to natural gas. It is a lighter gas. It is difficult to store. It is very flammable and explosive.

The main difference in using Hydrogen over natural gas is in the safety measures. This has been a key focus for all parties involved at the Hydro Navarra test.

Our main focus is to make sure that it’s safe and that our people, our operators are familiar with Hydrogen, the protocols and the technology.

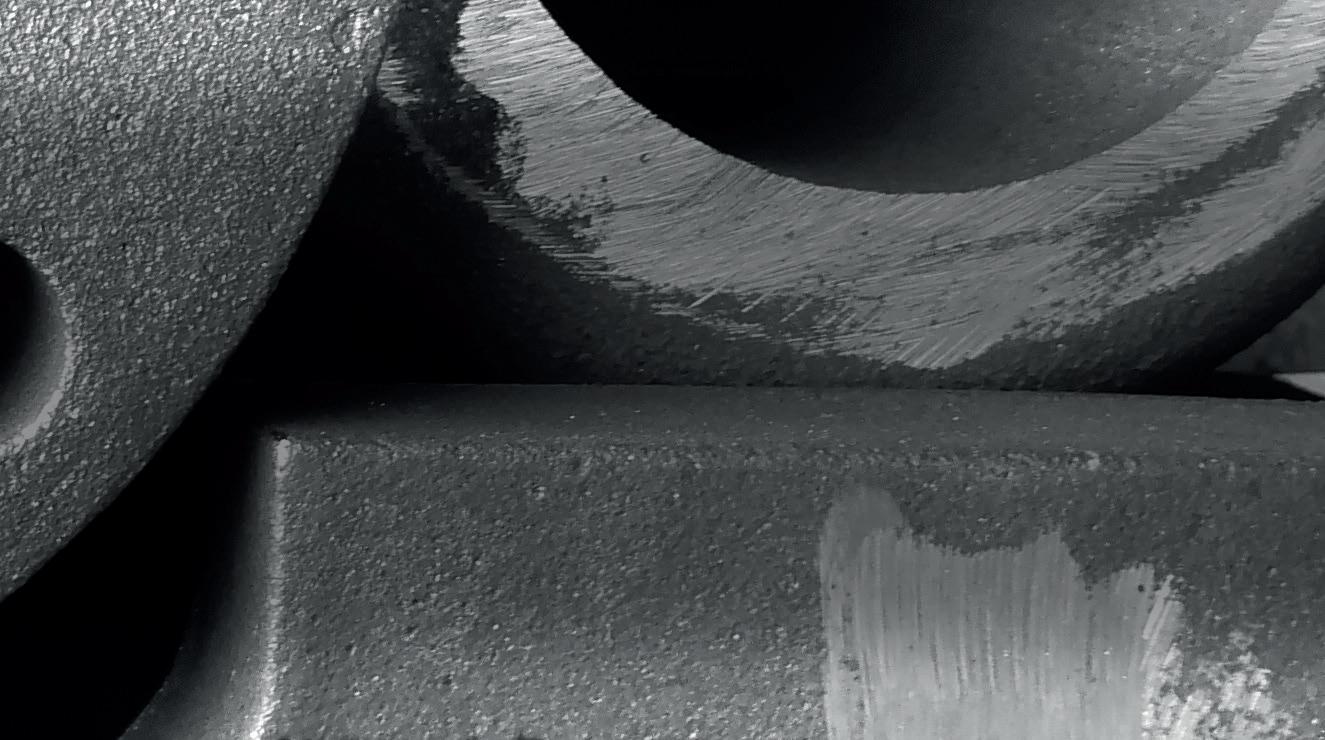

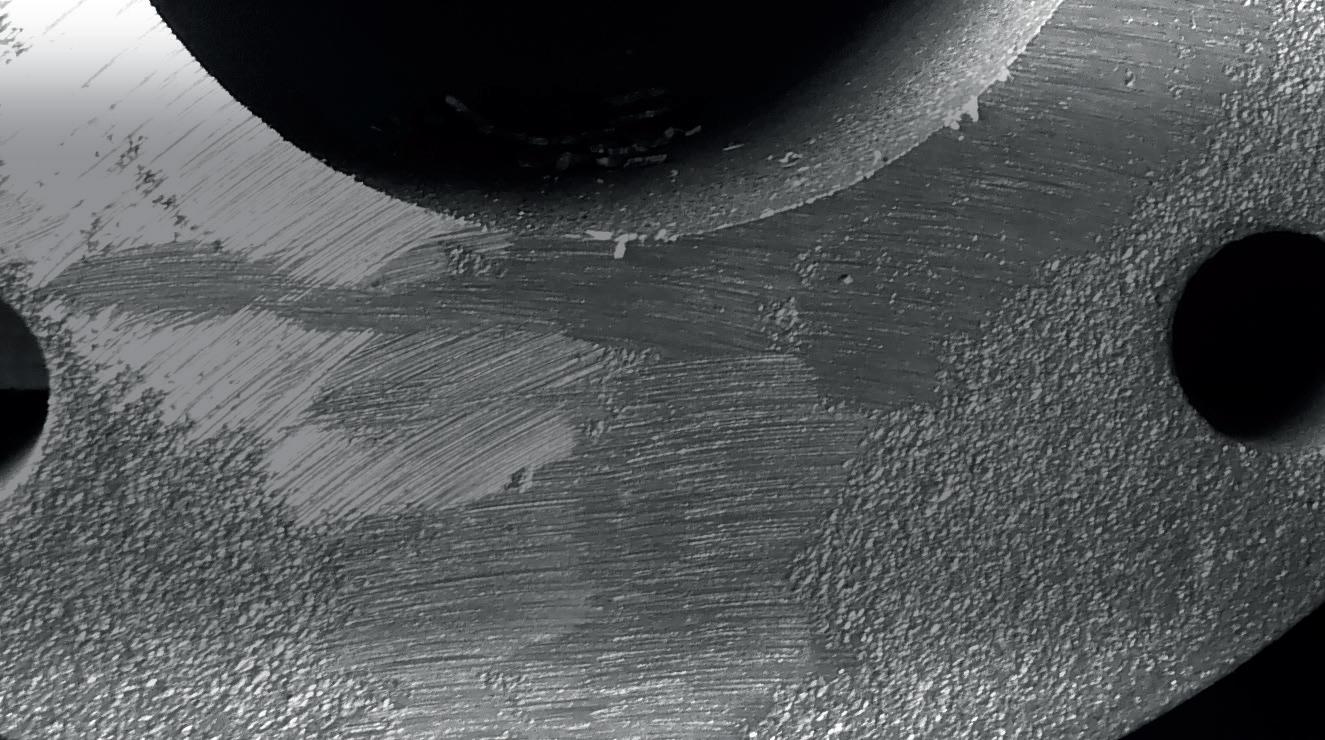

This project is the perfect example of why an industrial scale test is so important. Understanding the production environment first hand; observing the operators and people who are involved working with the volatile gas. It was important to establish a good dialog with the operators and with the people and with the suppliers. We were able to confirm that all the safety features needed were in place and that you can use Hydrogen in safe conditions without any incidents and without any worry. The test were able to document melting efficiency, and no change the metal quality from using hydrogen in our process, and proved that hydrogen can be introduced safely into aluminium production.

Hydrogen available in the market, or whether use the opportunity to build up our own hydrogen business based on the potential internal demand. We created Hydro Havrand, to become an developer, owner and operator of green hydrogen production facilities, to help hydro decarbonise the assets, but also capture future opportunities by helping other industrial players and hard-toabate sectors decarbonise through green hydrogen.

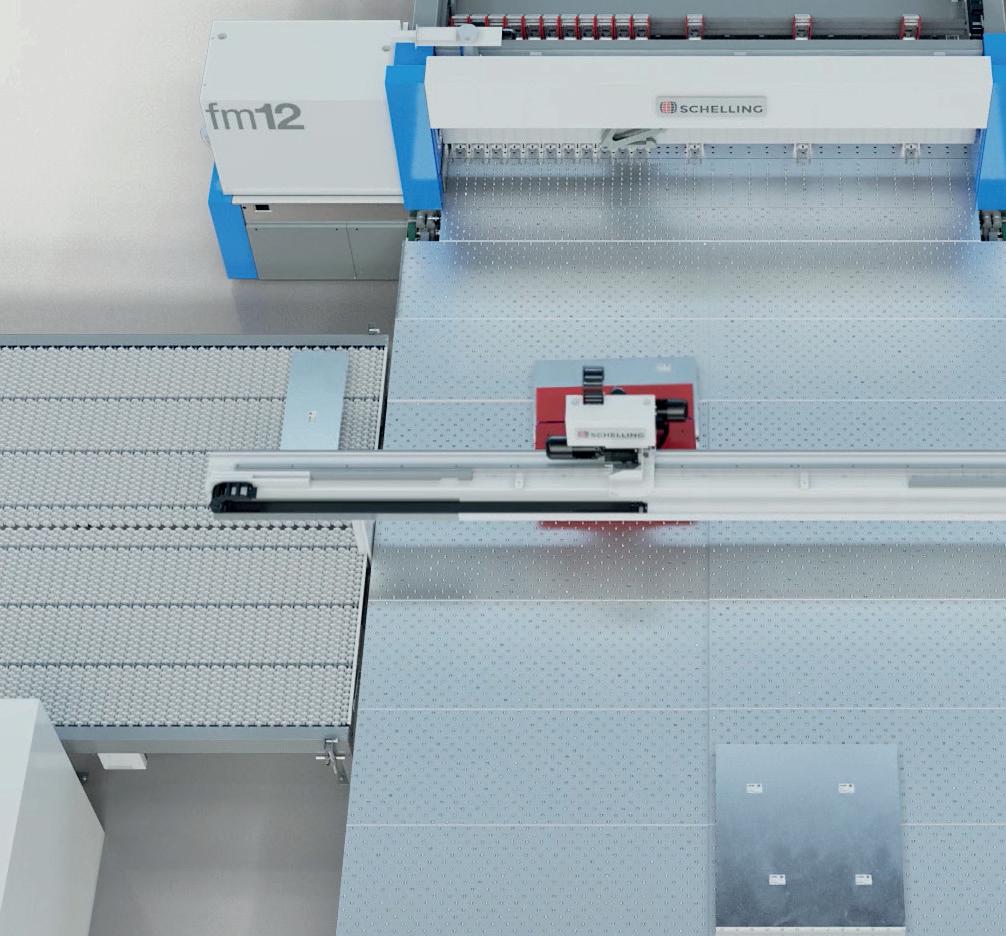

HYDRO EXTRUSION NAVARRA

With more than 65 years of experience in the aluminium sector, Hydro Extrusions Navarra knows how to produce profiles with stable, controlled, and reliable processes.

� 2 Presses (2.000 and 4.000 MT)

� Supply capacity for large profiles, up to 21 kg/m in weight and 15.5 m in length.

� Extrusion of aluminium profiles, precision cutting, machining. Own casthouse for aluminium recycling. Custom alloys.

� IATF 16949 certification for the automotive sector.

� ASI certification, commitment to sustainability.

HYDROGEN 21

[3]

CHALLENGES:

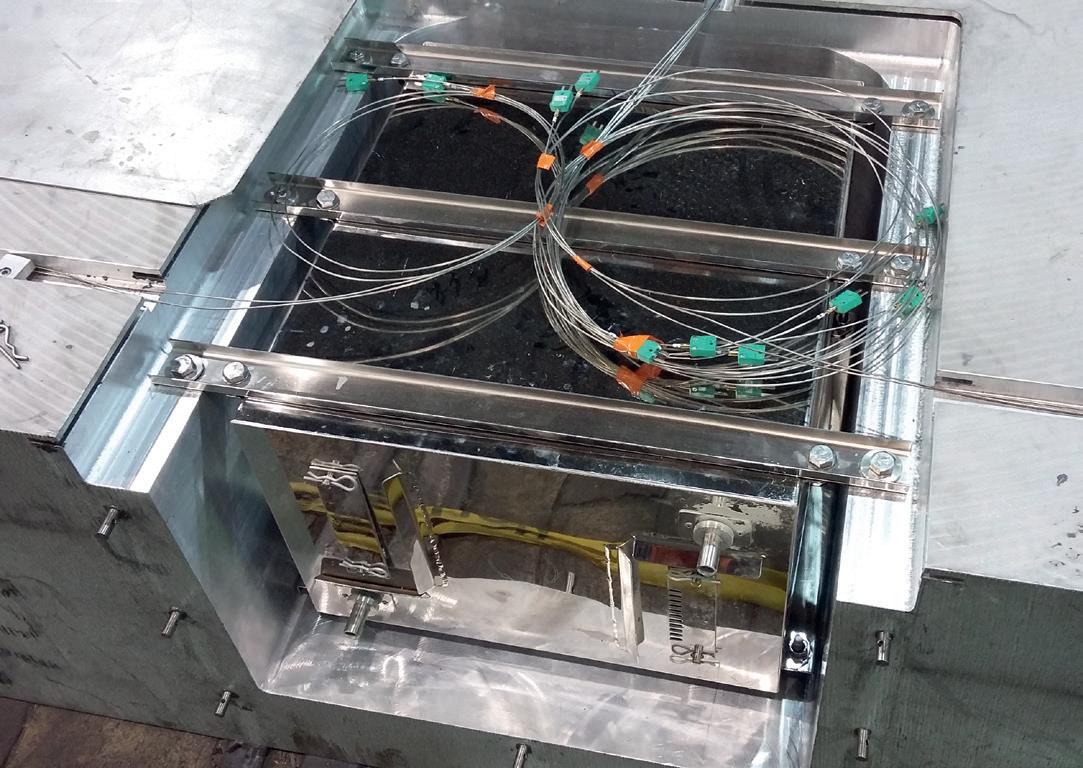

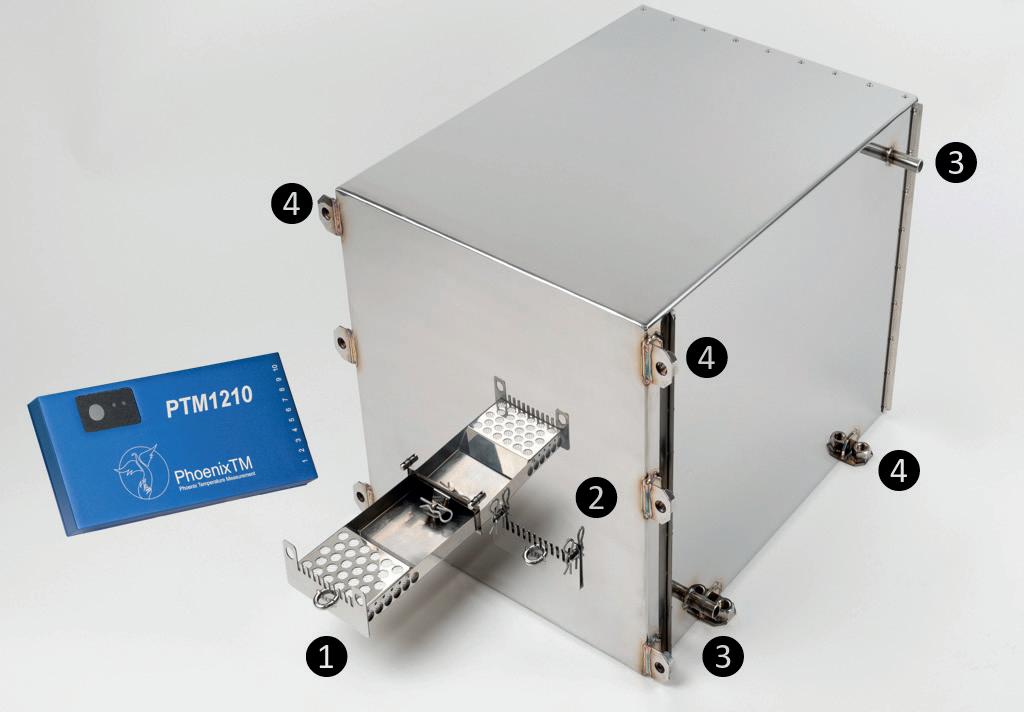

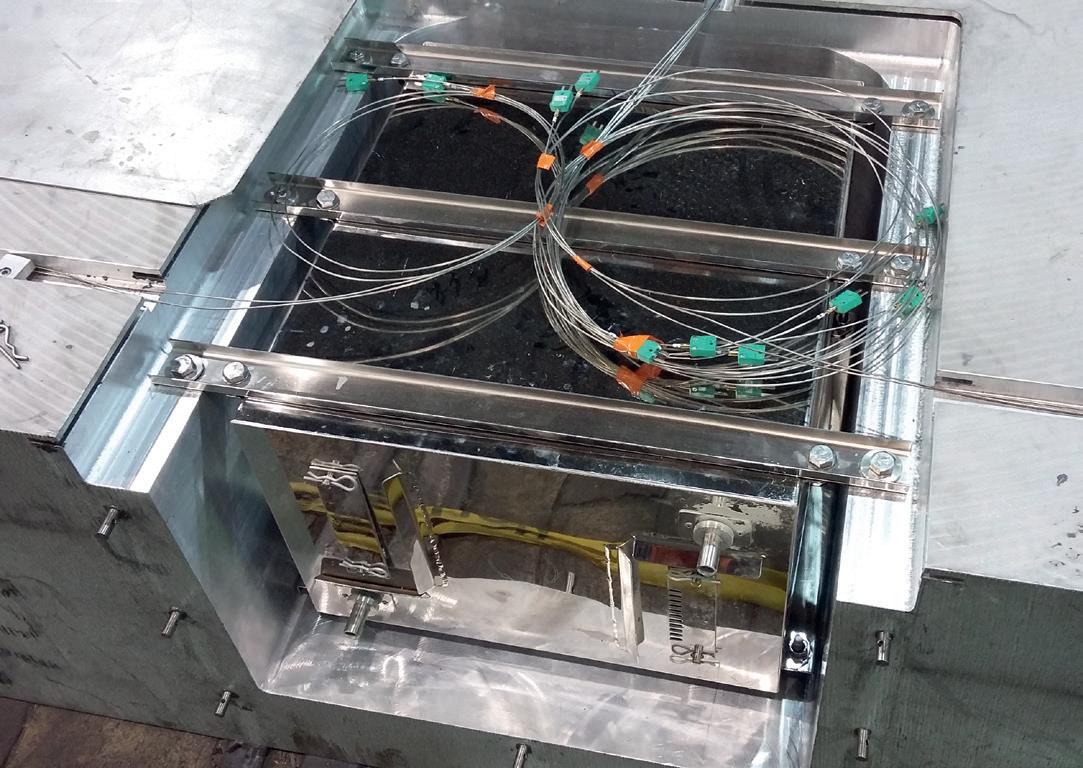

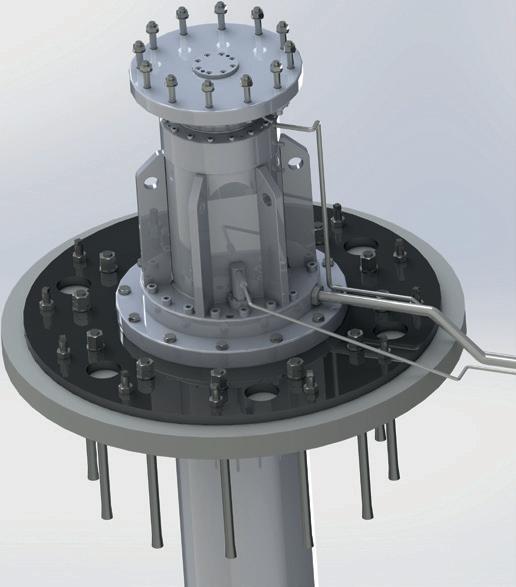

How long has it taken for you to reach this milestone? Did you have to adapt the technology/ machinery you currently use, to accommodate the use of Hydrogen?

We were working towards this project for two years. We took intermediate steps and conducted smaller scale tests with detailed analysis to verify that Hydrogen would work in this industry.

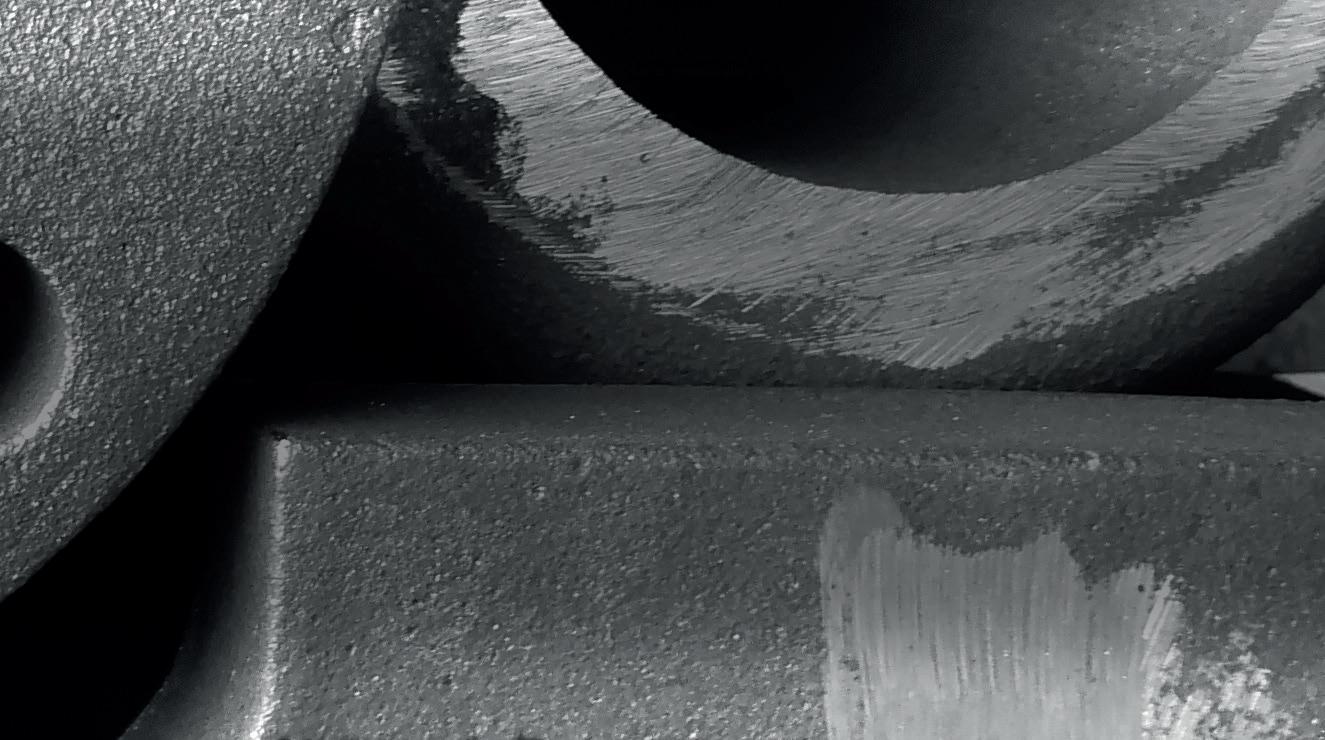

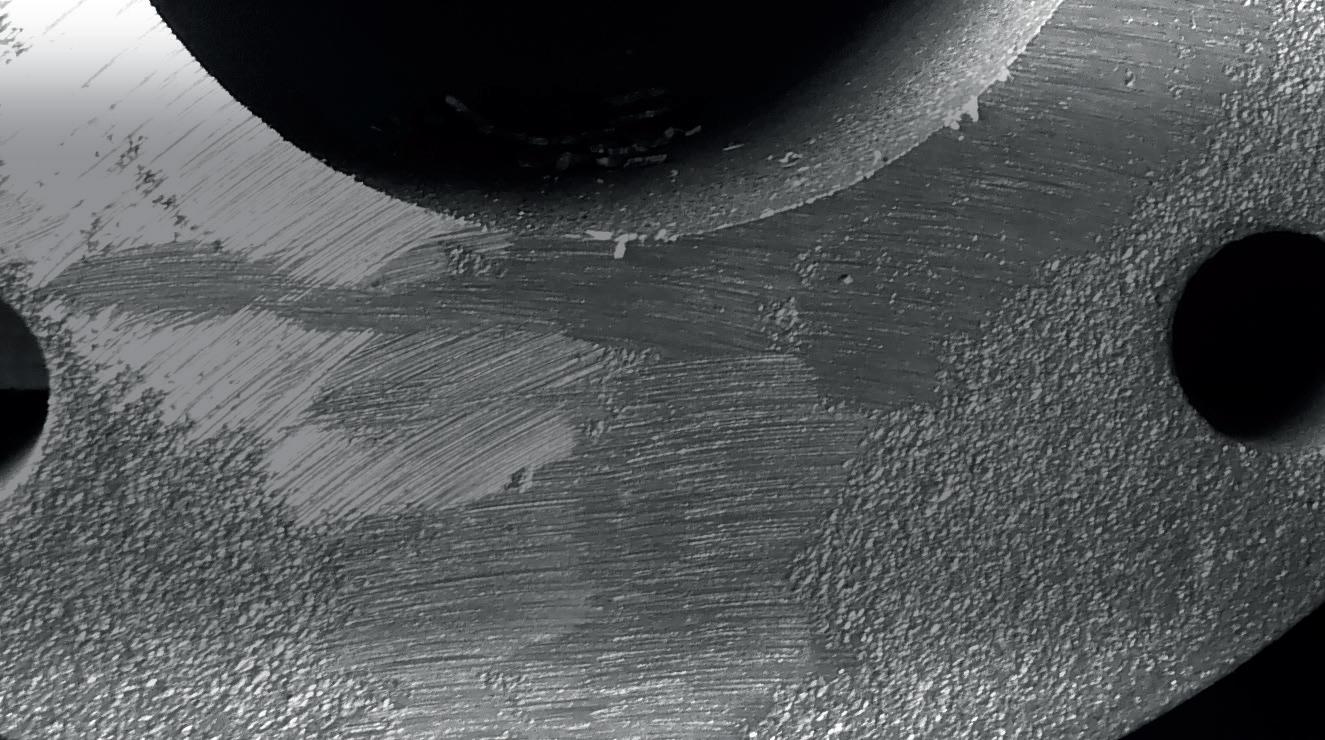

Regarding the furnace, we worked in collaboration with Fives. The furnace in question was due to be a decommissioned. The furnace had been operation, on natural gas, for over 30 years. But after some small adjustments to the burners, it was ready for Hydrogen.

We also had to consider a separate fuel train, controls, and piping. Although we primarily used 100% Hydrogen, we also blended Hydrogen with natural gas to evaluate these different parameters.

THE FUTURE:

Does Hydro plan for any other tests in the future?

The next step is to have a pilot on local production of Hydrogen, with an electrolyser, to produce Hydrogen leading directly into the furnace.

We are aiming for an industrial scale pilot to work on this set up, in Norway. We will be running a pilot project where we fuel furnaces, over a longer period, with Hydrogen.

In this next project we will be implementing a five-megawatt electrolyser and it will have an installed in-house connection to a new recycling furnace. This is scheduled to happen in a year or two from now.

Was getting enough Hydrogen for the Project a challenge?

One of the biggest challenges we faced was getting a hold of the volume of green Hydrogen that we needed to execute these tests. We had two trucks of Hydrogen per day during the nine days of testing.

We ended up burning around three tonnes of Hydrogen during those weeks, and we produced in total around 200 tonnes of aluminium. 150 tonnes of aluminium were produced using only Hydrogen.

Sourcing Hydrogen at a larger scale; do you think that Hydrogen is a feasible global solution?

Definitely. That is one of the motivations for doing these tests. The road map, at this stage, aims to bring up the maturity level of both the technology and the Hydrogen, to later implement these permanently in the processes of producing aluminium. So, this is definitely the plan. The Pilot Project aims to assist this vision, and to bring the fuel switch technology to full maturity. Based on that, we can be ready to start rolling it out across a wider basis. We will have to consider locations with attractive sources of renewable power and other conditions key to produce hydrogen at a competitive levelized cost, and we will continue to find those perfect locations. We are led by the demand from the customers, for green materials. Therefore, this is not something on which we can compromise. We see a positive trend towards green materials, and it fits very well with global decarbonisation agenda. I am a true believer.

What is needed from policy makers, governments, large industries, companies, the public, to make Hydrogen a realistic solution for the future?

Today we are still quite early in the cost curve of green Hydrogen, and especially with the current power situation in Europe; we are seeing a higher cost for green Hydrogen over natural gas. The overall decarbonisation of Europe needs help to stimulate the hydrogen market, and make it easier for forward leaning industries to justify their early investments to decarbonise their processes. There is some regulations coming into play, but it would be great if we could see more rapid speed. In the EU we have an official definition on green hydrogen, but we need it in other markets as well. In addition we need support mechanisms to help kick start the Hydrogen market, and education to the customers, operators, and key players on the implementation of Hydrogen.

Bruno D’hondt, Head of extrusion, Europe, Hydro added: On the definition of ‘Green

CONCLUSION:

Hydrogen’, it is essential that there is a distinction between different types of Hydrogen: Pink, grey, blue, green, brown, turquoise, yellow! Regardless of colour, it’s the same molecule. But from an industrial point of view, you are looking at that green Hydrogen and this has the highest value, and demand because our customers demand the lowest and documented CO2 footprint.

The future of Hydrogen is uncertain. That being said, the element has the full support of the aluminium industry. Hydro has demonstrated its faith in the molecule with investments and testing. Perhaps the future of Hydrogen should be described as hope?

Aluminium International Today September/October 2023 HYDROGEN 22

Don’t play Mikado with your billets. +1 514 687-7678 info@epiqmachinery.com For an organized billet handling, trust branded EPIQ AD’s Billet batch homogenizing system that offers: A touchless aluminium billets gantry system. A fully automated homogenizing sequence on to sawing and batching operations. Only linear motions for increased reliability and better positioning. epiqmachinery.com See the difference, it is

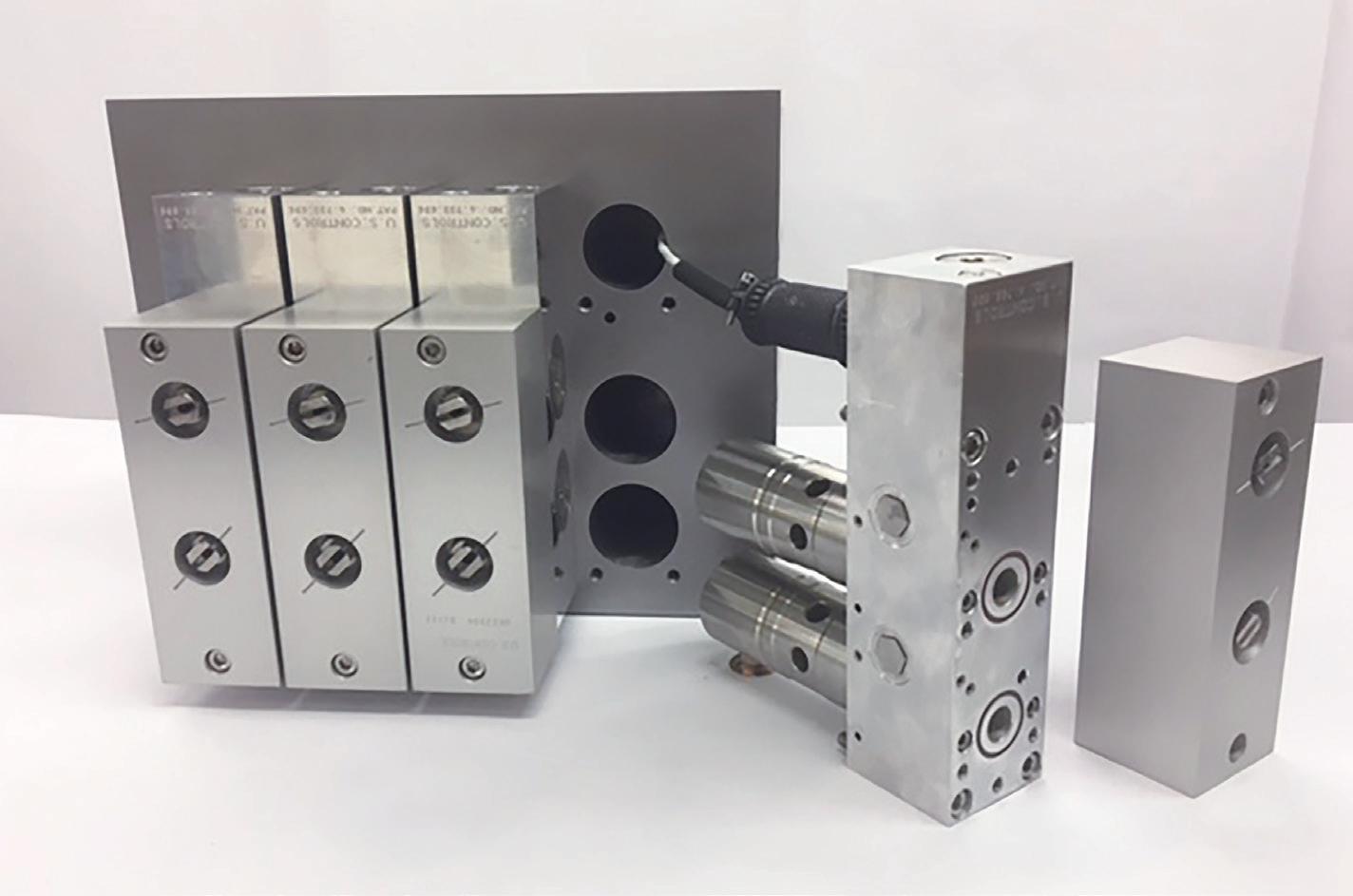

CASTING LAUNDER / CASTING TABLE:

- Automated casting launder (hands-free casting)

- Integrated preheating equipment

- Automatic lids

- Fused silica refractories (low density)

- Cooling system to prevent bending/distorsion

CASTING CONSUMABLES:

- Pin and spouts

- Spout seat

- Heated pin package available

- Ring retainer (FRR Fiber Reinforced Refractory)

- Combo bags (Thermo-Formed & regular version)

SLAB CASTING LINE

. CERAMIC FOAM FILTER SYSTEM:

- CFF lining castridge and insulation kit

- Air based preheating system

- Electrically powered lid

- Safe draining mechanism

- Mechanical lock-out system for safe lter assembly & removal

3

DEGASSING SYSTEM:

- Vessel cartridges and insulation kits

- Heating systems

- Degassing rotor/shaft

- Lid lifting/turning system

METAL FLOW REGULATION:

- Laser sensor technology for metal level control

- Pin position actuators

- Centralized electrical outlet

- Improved control software

CASTING TOOLING:

- Platform & Bottom block support

- Bottom blocks & Plugs machining

- Casting table (tilt-able or powered travel bogie systems)

- Casting molds

- Tooling spare parts

4

CASTING CYLINDER:

- Single acting

- Internal anti-rotation rod guide system

- Integrated torque limiter

- Minimum rod deflection guaranteed

- Long life piston rod coating

- Specially designed hidraulic Power unit control

- Control loop for casting speed regulation

1

- Ceramic Foam Filter available in all sizes and porosity levels

www.rodabell.com

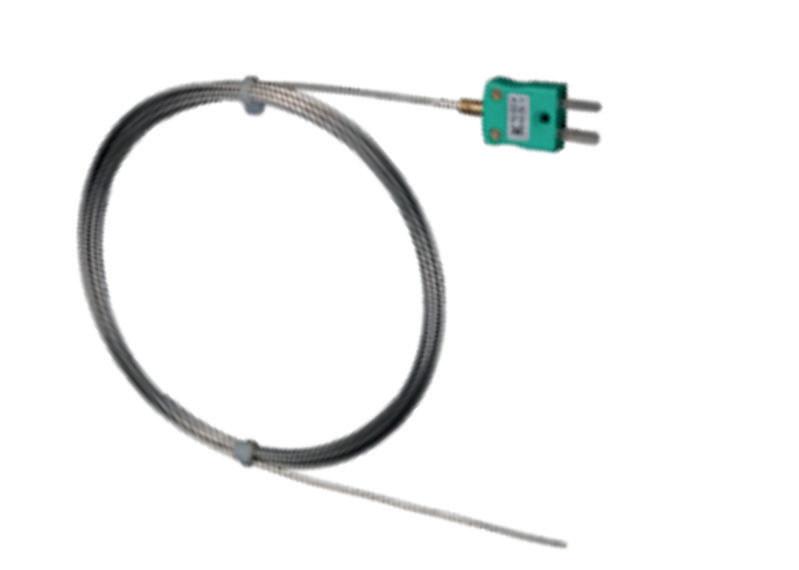

integrated for Temp. monitoring 1 2 2 3 4

- Platform access for drossing operations & rotor replacement

ventas@rodabell.com

- Thermocouples

New North American aluminium capacity

By Myra Pinkham*

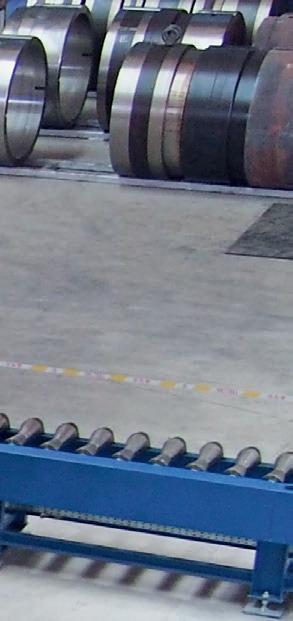

Even with concerns that, in the short term, there will likely be some easing in aluminium demand, the very aggressive plans for new North American rolled and extruded aluminium production, and recycling capacity are still marching along. It is, however, a different story for primary aluminium, where recent idled capacity is yet to come back online.

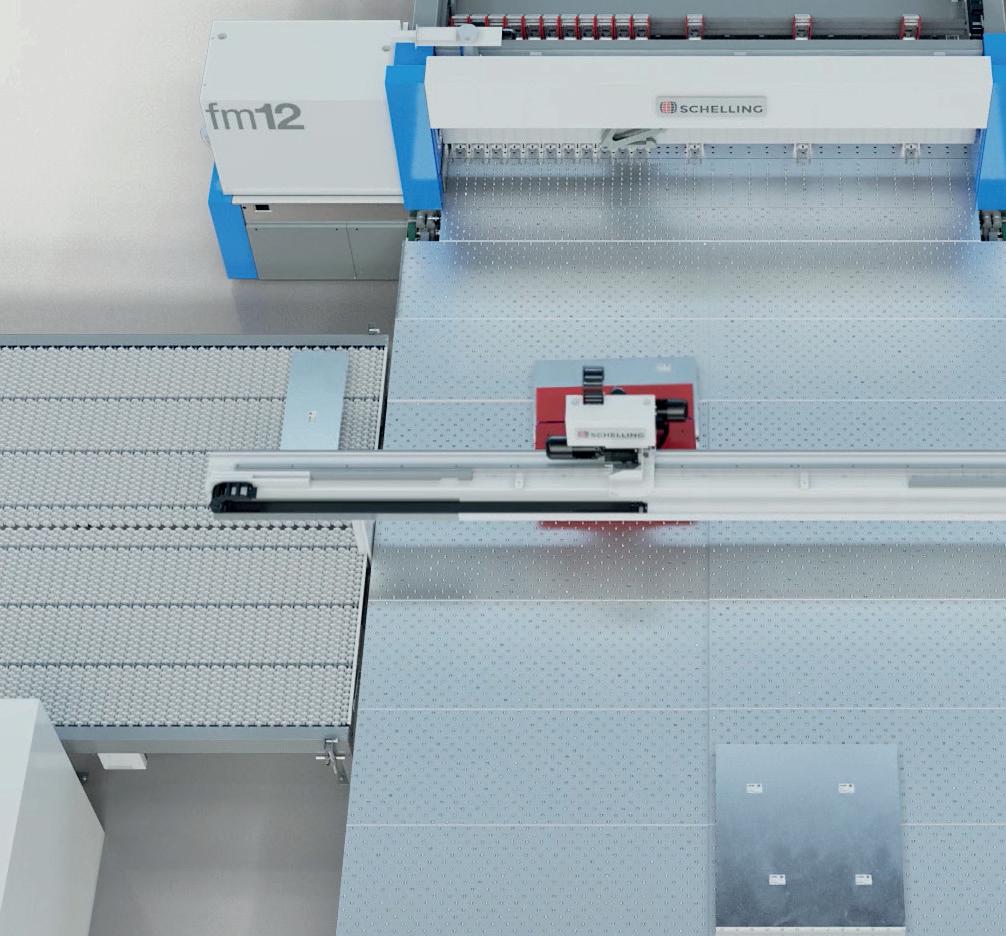

“It hasn’t gotten enough attention as far as just how transformative some of the recent rolled aluminium and extruded aluminium investments announced over the past couple of years have been,” said Matt Meenan, a spokesman for the Aluminum Association, noting that the last time that a US greenfield rolling mill had been built was Logan Aluminum, about 40 years ago. Now there have been four announced over the past year or so. “It is pretty remarkable,” he declared.

At the same time there have been significant investments elsewhere in the aluminium value chain, particularly related to aluminium extrusions. Duncan Pitchford, head of strategy and business development at Hydro Aluminum Metals, observed that in addition to there continuing to be “a steady drumbeat” of new extrusion press announcements, with dozens of new presses expected to come online in North America over the next three to four years, Hydro’s new Cassopolis, MI, recycling plant – the company’s first greenfield mill in almost 15 years – with the capacity to produce 120,000 tonnes of aluminium extrusion ingot, is slated to come online in the fourth quarter.

Also, Matthew Abrams, a CRU

aluminium research analyst, observed that Service Center Metals opened-up new remelt and extrusion plants this year and that Sierra Aluminum broke ground on a new plant in the US Southwest and that Apel Extrusions and ABC Aluminum have also announced their intention to build new facilities.

However, it continues to be somewhat a different story for primary aluminium. CRU’s Simon Large said that US smelter capacity has been shrinking significantly over the past 15 years, and that currently only three companies – Alcoa, Century Aluminum and Magnitude 7 – produce primary aluminium domestically.

In fact, about a year ago the North American primary aluminium market lost a bit of production capacity. Matt Aboud, senior vice president for strategy and business development at Century Aluminum noted that high energy prices made production at the plant uneconomical; his company decided to temporarily close its Hawesville, KY, facility, taking about 220,000 tonnes of primary capacity out of the market.

In July, Alcoa took down one of its potlines at its Warrick smelter in Indiana, reducing US primary aluminium production capacity by another 54,000 tonnes, but Aboud said that wasn’t much about power prices, as far as unstable conditions at that potline and labor issues. CRU’s Large said he believes that Alcoa might keep Warrick closed given that its captive cold-fired power does not necessarily fit with Alcoa’s decarbonisation goals.

Daria Efanova, head of research at Sucden Financial, said these moves by Century and Alcoa have increased the need for the US to import primary aluminium, at least at this time, depending on whether their capacity is restarted and other potential primary capacity changes.

While Century had initially expected to restart Hawesville this year, Aboud said the company is waiting for energy prices to come down and to stay down, as well as for LME aluminium prices to improve. “But it could be turned back on rather quickly,” he said, “It is still being maintained, waiting for the environment to be right to turn it back on.”

Meanwhile, in the longer term, there will be some additional primary aluminium capacity. While it isn’t expected to be commissioned until 2025, in April, Rio Tinto began construction on a project to increase the capacity of its Alma smelter in Québec to cast low carbon billet by 202,000 tonnes, using hydropower. Large said Alcoa had been in negotiations with an investment firm to restart its Intalco smelter in Ferndale, WA, they failed given its inability to get a competitively priced power deal. As such, he doesn’t expect that smelter to be restarted over the next five years.

Sucden’s Efanova said that aluminium smelters, including those in North America are taking are taking active roles in the green energy transition, including through the ownership of recycling assets. For example, in July it was announced that Rio Tinto plans to acquire a 50% equity stake in Giampaolo Group’s Matalco

USA UPDATE 25 Aluminium International Today September/October 2023

*US

Correspondent

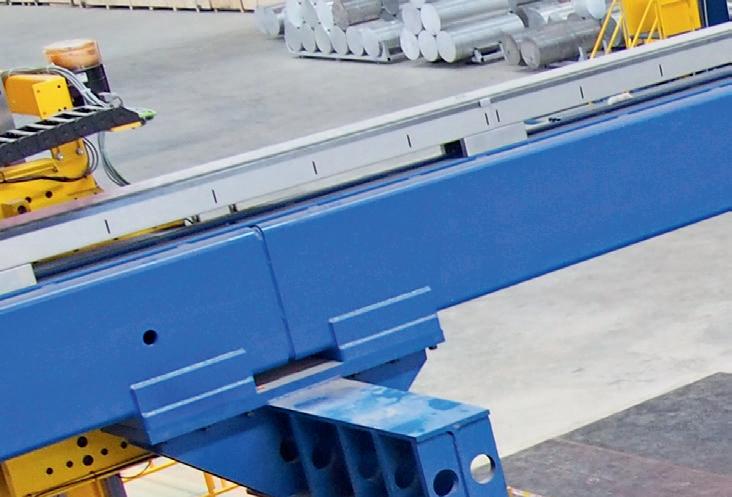

Novelis Bay Minette, Alabama

In April 2023, MetalX announced a $200 million investment to build a greenfield aluminum rolling slab facility in the Midwest. The plant is expected to become fully operational in the first half of 2026 and will employ approximately 100 people.

operation – a leading North American producer of recycled aluminium billet and slab products that gets much of its recyclable feed from Giampaolo’s Triple M Metal subsidiary.

Stephen Williamson, CRU’s aluminium research manager, said that this joint venture partnership further bolster both parties’ presence in the North American primary and secondary aluminium markets.

“Even with the push for green aluminium, the US market still needs primary aluminium,” Aboud said, maintaining that the secondary market isn’t large enough to completely push primary aluminium out. “I don’t see primary aluminium being in competition with secondary aluminium,” he said, “But rather domestic primary aluminium is in competition with imports.”

Regarding the announced US greenfield rolling mill projects, Williamson, CRU’s aluminium research manager, said that at least two of them – an integrated aluminium recycling and rolling facility that Novelis is building in Bay Minette, AL, and the Aluminum Dynamics flat roll mill that Steel Dynamics is building in Columbus, MS, along with two satellite recycled aluminium slab casting centers –are moving ahead as quickly as they can.

Meanwhile, the Manna Capital Partners’ announced in May 2022 that it will partner with Ball Corp to build a aluminium can sheet rolling mill, due to be built in Los Lunas, New Mexico, although it hasn’t broken ground yet. Also, this April Manna announced a strategic partnership with nonferrous scrap recycler MetalX to build a greenfield mill in northeast Indiana, northwest Ohio or southern Michigan, with an annual capacity to produce 100,000 tonnes of ultra-low carbon aluminium rolling slab “with a higher percentage of recycled content than is currently available.” The companies estimated that this new mill be fully operational in the first half of 2026.

There are a number of drivers for these, and some other investments, in US aluminium rolling mill capacity. Ganesh Panneer, vice president of operations at Novelis North America, said that one big driver is the recent increase in domestic demand for beverage cans, and therefore can sheet. He noted that because of this strong demand, the US has been importing about 500,000 tonnes of can sheet per year.

CRU’s Abrams agreed that the biggest

impact of the new US aluminium will be upon can sheet.

He continued that once the capacity comes online, it could flip its market dynamics. While over the past few years can sheet imports have been on the rise, he said that once this new capacity comes online the US could potentially become a net exporter of can sheet.

This is coming at the same time as the growing US demand for aluminium sheet for automotives, including electric vehicle, appliances, and for specialties applications. In fact, Williamson said that CRU is forecasting that from 2023-27 aluminium sheet used by the transportation sector will grow by about 19.5%.

“Broadly there has been a pivot toward

He said that Novelis is in the process of upgrading the hot mill and adding a new coolant room at its Oswego, NY, rolling mill, increasing the hot mill capacity there.

In October 2022, Novelis broke ground on the Bay Minnette mill, which Steve Fisher, its president and chief executive officer, maintained during Novelis’ fiscal first quarter 2024 earnings call in August. The mill aims to be more automated, efficient, and lower carbon emitting than any existing rolling mill. He said that the new mill, which will be largely focused upon the production of can and auto sheet, will have an initial finished goods capacity of about 600,000 tonnes per year, although its site is large enough for a future brownfield expansion to capture growing demand.